Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CVR Refining, LP | cvrr8-kxq12014earningspres.htm |

1st Quarter 2014 Earnings Report May 1, 2014

Forward Looking Statements 1 This presentation should be reviewed in conjunction with CVR Refining, LP’s First Quarter earnings conference call held on May 1, 2014. The following information contains forward-looking statements based on management’s current expectations and beliefs, as well as a number of assumptions concerning future events. These statements are subject to risks, uncertainties, assumptions and other important factors. You are cautioned not to put undue reliance on such forward-looking statements (including forecasts and projections regarding our future performance) because actual results may vary materially from those expressed or implied as a result of various factors, including, but not limited those set forth under “Risk Factors” in CVR Refining, LP’s Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and any other filings CVR Refining, LP makes with the Securities and Exchange Commission. CVR Refining, LP assumes no obligation to, and expressly disclaims any obligation to, update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

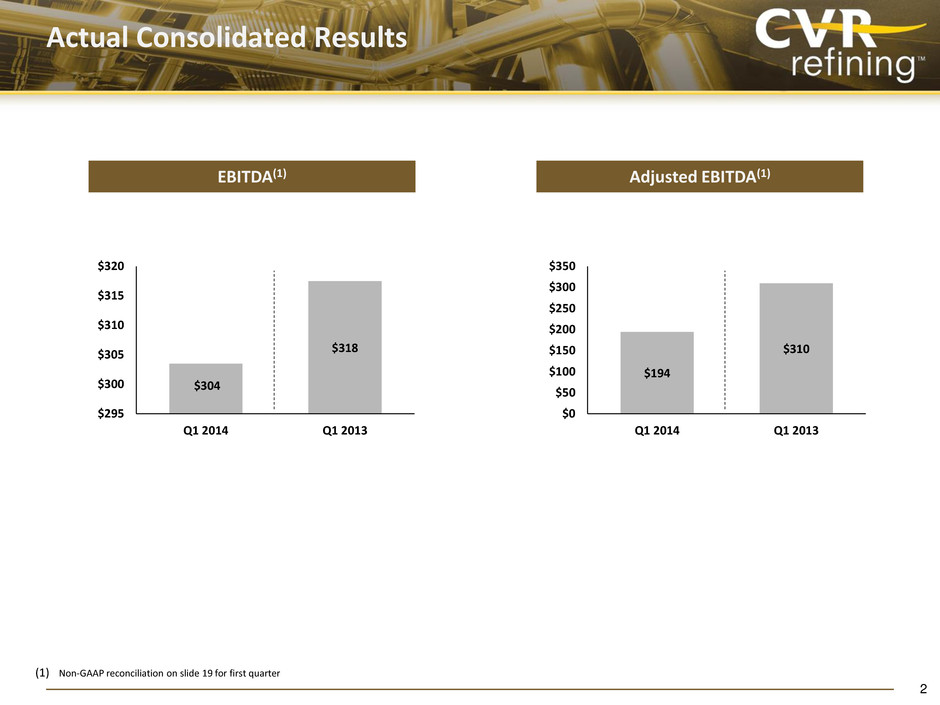

$304 $318 $295 $300 $305 $310 $315 $320 Q1 2014 Q1 2013 $194 $310 $0 $50 $100 $150 $200 $250 $300 $350 Q1 2014 Q1 2013 Actual Consolidated Results (1) Non-GAAP reconciliation on slide 19 for first quarter 2 EBITDA(1) Adjusted EBITDA(1)

Crude Differentials Source: ProphetX (1) As of 4/28/2014 First Quarter Q1 Average Q1 High Current(1) WTI vs. WCS $ (21.56) $ (26.93) $ (19.73) WTI vs. Brent $ 9.55 $ 15.56 $ 7.76 WTI vs. WTS $ (5.50) $ (17.22) $ (7.16) WTI vs. LSB $ (9.11) $ (12.87) $ (7.43) 3

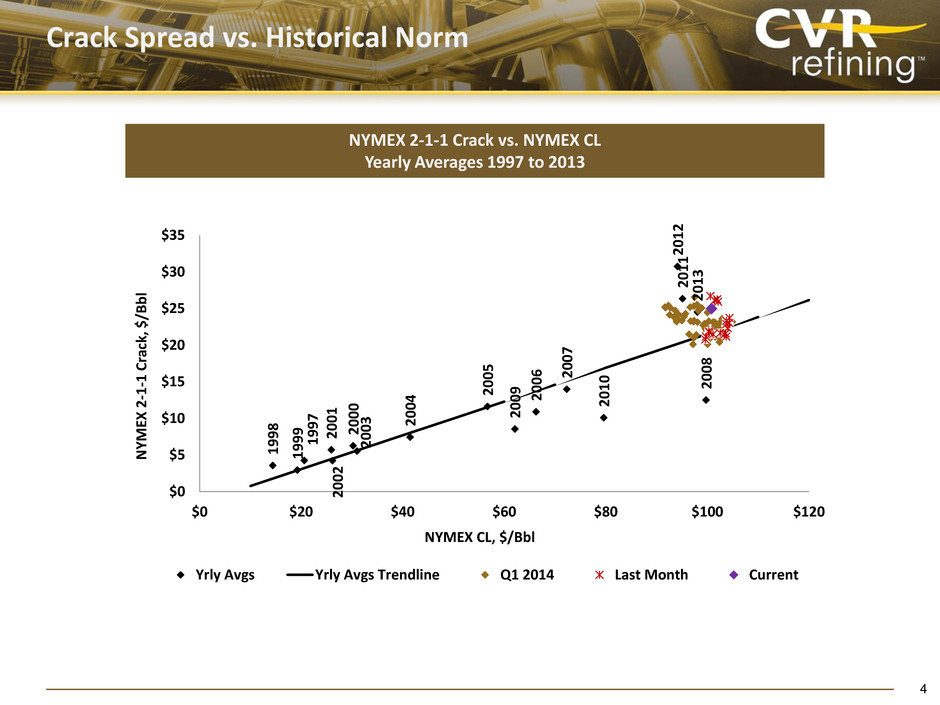

19 97 19 98 19 99 2 00 0 20 01 20 02 20 03 2 00 4 2 00 5 20 06 2 00 7 20 08 20 09 20 10 20 11 20 12 20 13 $0 $5 $10 $15 $20 $25 $30 $35 $0 $20 $40 $60 $80 $100 $120 NY M EX 2- 1- 1 C ra ck , $/B bl NYMEX CL, $/Bbl Yrly Avgs Yrly Avgs Trendline Q1 2014 Last Month Current Crack Spread vs. Historical Norm 4 NYMEX 2-1-1 Crack vs. NYMEX CL Yearly Averages 1997 to 2013

Hedging Position(1) (1) As of March 31, 2014 (2) Weighted-average price of all positions for period indicated Commodity Swaps Barrels Fixed Price(2) Second Quarter 2014 5,175,000 $28.39 Third Quarter 2014 6,000,000 26.78 Fourth Quarter 2014 5,100,000 27.25 First Quarter 2015 525,000 32.09 Second Quarter 2015 975,000 30.20 Third Quarter 2015 150,000 29.83 Fourth Quarter 2015 150,000 29.83 Total 18,075,000 $27.76 5

Financial

Consolidated Results (1) Non-GAAP reconciliation on slide 19 (2) Non-GAAP reconciliation on slide 20 (3) Available cash for distribution per common unit for three months ended March 31, 2013 of $1.58 reflects available cash for distribution per common unit since the closing of the Partnership’s initial public offering on January 23, 2013. On a full quarter basis, available cash for distribution per common unit would have been $1.76. (In millions, except for EPU/Distributions) First Quarter Q1 2014 Q1 2013 Percent Change EBITDA(1) $ 303.5 $ 317.5 -4% Adjusted EBITDA(1) $ 194.1 $ 309.9 -37% Available Cash for Distribution, per unit(2) (3) $ 0.98 $ 1.58 -38% 7

Quarterly Coffeyville Refinery Petroleum Segment (In millions except for barrels sold data) Q1 2014 Q1 2013 Net Sales $ 1,572.3 $ 1,492.6 Gross Profit (1) $ 142.2 $ 227.8 Crude Oil Throughput (barrels per day) 123,953 123,639 Barrels Sold (barrels per day) 139,016 133,746 Refining margin (per crude oil throughput barrel) (2)(3) $ 17.65 $ 26.12 Direct Operating Expenses (per crude oil throughput barrel) $ 4.78 $ 4.69 (1) Calculation on slide 15 (2) Adjusted for FIFO impact (3) Definition on slide 14 8

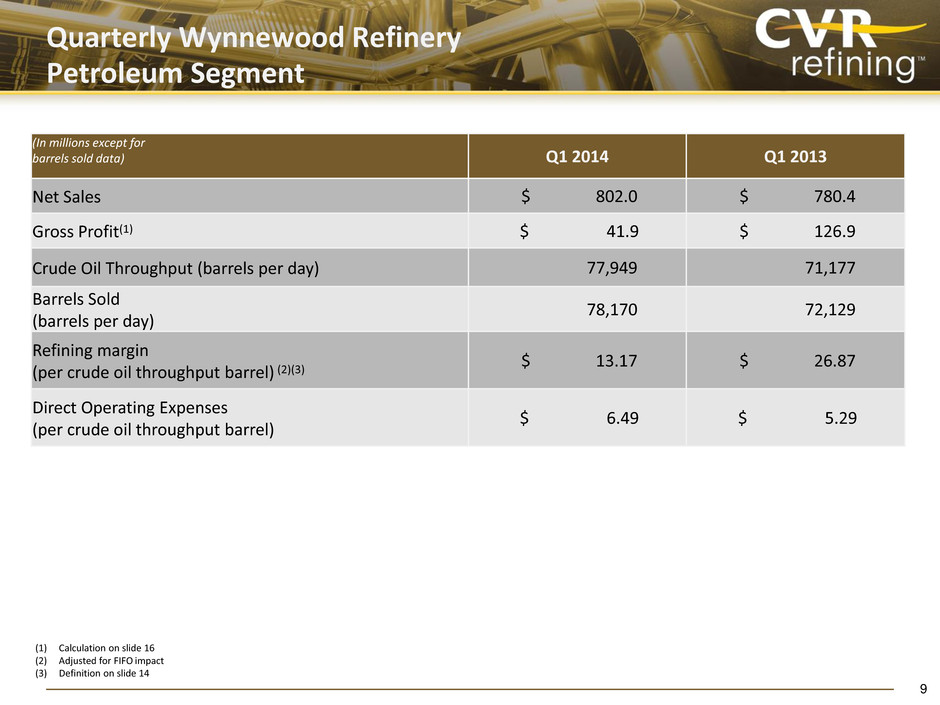

Quarterly Wynnewood Refinery Petroleum Segment (1) Calculation on slide 16 (2) Adjusted for FIFO impact (3) Definition on slide 14 9 (In millions except for barrels sold data) Q1 2014 Q1 2013 Net Sales $ 802.0 $ 780.4 Gross Profit(1) $ 41.9 $ 126.9 Crude Oil Throughput (barrels per day) 77,949 71,177 Barrels Sold (barrels per day) 78,170 72,129 Refining margin (per crude oil throughput barrel) (2)(3) $ 13.17 $ 26.87 Direct Operating Expenses (per crude oil throughput barrel) $ 6.49 $ 5.29

Debt Metrics Note: Refer to slide 17 for metrics used in calculations Financial Metrics 2010 2011 2012 2013 Q1 2014 LTM Debt to Capital 53% 42% 44% 28% 25% Debt to Adj. EBITDA 3.1 1.3 0.7 0.8 1.0 10 Net Debt (Cash) ($ in millions) 466.7 727.2 620.1 302.9 169.0 $0 $100 $200 $300 $400 $500 $600 $700 $800 2010 2011 2012 2013 2014

Appendix

Non-GAAP Financials Measures 12 To supplement the actual results in accordance with GAAP for the applicable periods, the Company also uses non- GAAP measures as discussed below, which are reconciled to GAAP-based results. These non-GAAP financial measures should not be considered an alternative for GAAP results. The adjustments are provided to enhance an overall understanding of the Partnership’s financial performance for the applicable periods and are indicators management believes are relevant and useful for planning and forecasting future periods. Gross profit is calculated as the difference between net sales, cost of product sold (exclusive of depreciation and amortization), direct operating expenses (exclusive of depreciation and amortization), major scheduled turnaround expenses and depreciation and amortization. Gross profit per crude throughput barrel is calculated as gross profit as derived above divided by our refineries’ crude oil throughput volumes for the respective periods presented. Gross profit is a non-GAAP measure that should not be substituted for operating income. Management believes it is important to investors in evaluating our refineries’ performance and our ongoing operating results. Our calculation of gross profit may differ from similar calculations of other companies in our industry, thereby limiting its usefulness as a comparative measure.

Non-GAAP Financials Measures EBITDA and Adjusted EBITDA. EBITDA represents net income before (i) interest expense and other financing costs, net of interest income, (ii) income tax expense and (iii) depreciation and amortization. Adjusted EBITDA represents EBITDA adjusted for FIFO impacts (favorable) unfavorable; share-based compensation, non-cash; major scheduled turnaround expenses; loss on extinguishment of debt; loss on disposition of fixed assets; (gain) loss on derivatives, net; current period settlements on derivative contracts; and expenses associated with the acquisition of Gary- Williams. We present Adjusted EBITDA because it is the starting point for calculation of our available cash for distribution. EBITDA and Adjusted EBITDA are not recognized terms under GAAP and should not be substituted for net income or cash flow from operations. Management believes that EBITDA and Adjusted EBITDA enable investors to better understand our ability to make distributions to our common unitholders, help investors evaluate our ongoing operating results and allow for greater transparency in reviewing our overall financial, operational and economic performance. EBTIDA and Adjusted EBITDA presented by other companies may not be comparable to our presentation, since each company may define these terms differently. 13 Available cash for distribution is not a recognized term under GAAP. Available cash for distribution should not be considered in isolation or as an alternative to net income or operating income as a measure of operating performance. In addition, available cash for distribution is not presented as, and should not be considered an alternative to, cash flows from operations or as a measure of liquidity. Available cash for distribution as reported by the Partnership may not be comparable to similarly title measures of other entities; thereby limiting its usefulness as a comparative measure.

Non-GAAP Financials Measures 14 Refining margin per crude oil throughput barrel is a measurement calculated as the difference between net sales and cost of product sold (exclusive of depreciation and amortization). Refining margin is a non-GAAP measure that we believe is important to investors in evaluating our refineries' performance as a general indication of the amount above our cost of product sold at which we are able to sell refined products. Each of the components used in this calculation (net sales and cost of product sold exclusive of depreciation and amortization) can be taken directly from our Statement of Operations. Our calculation of refining margin may differ from similar calculations of other companies in our industry, thereby limiting its usefulness as a comparative measure. In order to derive the refining margin per crude oil throughput barrel, we utilize the total dollar figures for refining margin as derived above and divide by the applicable number of crude oil throughput barrels for the period. We believe that refining margin is important to enable investors to better understand and evaluate our ongoing operating results and allow for greater transparency in the review of our overall financial, operational and economic performance. Refining margin per crude oil throughput barrel adjusted for FIFO impact is a measurement calculated as the difference between net sales and cost of product sold (exclusive of depreciation and amortization) adjusted for FIFO impacts. Refining margin adjusted for FIFO impact is a non-GAAP measure that we believe is important to investors in evaluating our refineries’ performance as a general indication of the amount above our cost of product sold (taking into account the impact of our utilization of FIFO) at which we are able to sell refined products. Our calculation of refining margin adjusted for FIFO impact may differ from calculations of other companies in our industry, thereby limiting its usefulness as a comparative measure. Under our FIFO accounting method, changes in crude oil prices can cause fluctuations in the inventory valuation of our crude oil, work in process and finished goods, thereby resulting in favorable FIFO impacts when crude oil prices increase and unfavorable FIFO impacts when crude oil prices decrease.

Coffeyville Refinery Calculation of Gross Profit First Quarter 3/31/2014 3/31/2013 Net sales $ 1,572.3 $ 1,492.6 Cost of product sold 1,358.8 1,195.1 Refining margin 213.5 297.5 Direct operating expenses 53.3 52.2 Depreciation and amortization 18.0 17.5 Gross profit $ 142.2 $ 227.8 15

Wynnewood Refinery Calculation of Gross Profit First Quarter 3/31/2014 3/31/2013 Net sales $ 802.0 $ 780.4 Cost of product sold 704.5 610.4 Refining margin 97.5 170.0 Direct operating expenses 45.6 33.8 Depreciation and amortization 10.0 9.3 Gross profit $ 41.9 $ 126.9 16

Capital Structure Note: 2011 includes debt related to acquisition of Gary-Williams but only 16 days of EBITDA contribution (1) Adjusted for FIFO, turnaround expenses, non-cash share based compensation, financing costs, gains/losses on derivatives, net, current period settlements on derivative contracts, asset dispositions, loss on extinguishment of debt, Gary-Williams acquisition and integration costs, and bridge loan expenses (2) Non-GAAP reconciliation on slide 18 Financials ($ in millions) Full Year LTM 2010 2011 2012 2013 Q1 2014 Cash $ 2.3 $ 2.7 $ 153.1 $ 279.8 $ 413.4 Total debt, including current portion 469.0 729.9 773.2 582.7 582.4 Net Debt 466.7 727.2 620.1 302.9 169.0 Partners capital/divisional equity 418.8 1,018.6 980.8 1,522.1 1,721.6 Adjusted EBITDA(1)(2) $ 152.6 $ 577.3 $ 1,176.2 $ 712.0 $ 596.1 17

Consolidated Non-GAAP Financial Measures (1) Represents the portion of gain (loss) on derivatives, net related to contracts that matured during the respective periods and settled with counterparties. There are no premiums paid or received at inception of the derivative contracts and upon settlement, there is no cost recovery associated with these contracts. Financials ($ in millions) Full Year LTM 2010 2011 2012 2013 Q1 2014 Net Income $ 38.2 $ 480.3 $ 595.3 $ 590.4 $ 580.4 Interest expense and other financing costs, net of interest income 49.7 53.0 76.2 43.7 38.2 Depreciation and amortization 66.4 69.8 107.6 114.3 115.8 EBITDA $ 154.3 $ 603.1 $ 779.1 $ 748.4 $ 734.4 FIFO impacts (favorable) unfavorable (31.7) (25.6) 58.4 (21.3) (38.1) Share-based compensation, non-cash 11.5 8.9 18.5 9.5 6.3 Loss on disposition of assets 1.3 2.5 - - - Loss on extinguishment of debt 16.6 2.1 37.5 26.1 - Expenses associated with the acquisition of Gary-Williams - 5.2 11.0 - - Major scheduled turnaround expenses 1.2 66.4 123.7 - - (Gain) loss on derivatives, net 1.5 (78.1) 285.6 (57.1) (186.5) Current period settlements on derivative contracts(1) (2.1) (7.2) (137.6) 6.4 80.0 Adjusted EBITDA $ 152.6 $ 577.3 $ 1,176.2 $ 712.0 $ 596.1 18

Consolidated Non-GAAP Financial Measures Financials ($ in millions) First Quarter 3/31/2014 3/31/2013 Net Income $ 265.4 $ 275.4 Interest expense and other financing costs, net of interest income 8.6 14.1 Depreciation and amortization 29.5 28.0 EBITDA 303.5 317.5 FIFO impacts (favorable) unfavorable (21.6) (4.7) Share-based compensation, non-cash 0.5 3.5 Loss on extinguishment of debt - 26.1 (Gain) loss on derivatives, net (109.4) 20.0 Current period settlements on derivative contracts(1) 21.1 (52.5) Adjusted EBITDA $ 194.1 $ 309.9 19 (1) Represents the portion of gain (loss) on derivatives, net related to contracts that matured during the respective periods and settled with counterparties. There are no premiums paid or received at inception of the derivative contracts and upon settlement, there is no cost recovery associated with these contracts.

Consolidated Non-GAAP Financial Measures Financials ($ in millions, except for per unit data) First Quarter 3/31/2014 Adjusted EBITDA $ 194.1 Less: Cash needs for debt service (10.0) Reserves for environmental and maintenance capital expenditures (31.3) Reserves for future turnarounds (8.8) Available cash for distribution $ 144.0 Available cash for distribution, per unit $ 0.98 Common units outstanding (in thousands) 147,600 20