Attached files

| file | filename |

|---|---|

| EX-31.1 - EX-31.1 - WILLIS TOWERS WATSON PLC | d717031dex311.htm |

| EX-31.2 - EX-31.2 - WILLIS TOWERS WATSON PLC | d717031dex312.htm |

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

Amendment No. 1

(Mark One)

| ¨ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2013

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number: 001-16503

WILLIS GROUP HOLDINGS PUBLIC

LIMITED COMPANY

(Exact name of Registrant as specified in its charter)

| Ireland | 98-0352587 | |

| (Jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

c/o Willis Group Limited

51 Lime Street, London EC3M 7DQ, England

(Address of principal executive offices)

(011) 44-20-3124-6000

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each Class |

Name of each exchange on which registered | |

| Ordinary Shares, nominal value $0.000115 per share | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the Registrant’s knowledge, in definite proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definition of ‘large accelerated filer’, ‘accelerated filer’ and ‘smaller reporting company’ in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | x | Accelerated filer | ¨ | |||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

The aggregate market value of the voting common equity held by non-affiliates of the Registrant, computed by reference to the last reported price at which the Registrant’s common equity was sold on June 28, 2013 (the last day of the Registrant’s most recently completed second quarter) was $5,757,806,783.

As of April 23, 2014, there were outstanding 179,008,836 ordinary shares, nominal value $0.000115 per share, of the Registrant.

DOCUMENTS INCORPORATED BY REFERENCE

None.

Table of Contents

| Explanatory Note | 2 | |||||

| PART III | ||||||

| Item 10 |

3 | |||||

| Item 11 |

16 | |||||

| Item 12 |

—Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

58 | ||||

| Item 13 |

—Certain Relationships and Related Transactions, and Director Independence |

62 | ||||

| Item 14 |

63 | |||||

| PART IV | ||||||

| Item 15 |

66 | |||||

| Signatures | 73 | |||||

Table of Contents

Willis Group Holdings plc (“Willis Group Holdings,” the “Registrant” or the “Company” and, together with our subsidiaries, “we,” “us” or “our”) is filing this Amendment No. 1 to the Annual Report on Form 10-K (this “Amendment”) to our Annual Report on Form 10-K for the fiscal year ended December 31, 2013 (the “Original Form 10-K”) that was originally filed with the Securities and Exchange Commission (the “SEC”) on February 27, 2014.

This Amendment is being filed solely to include the information required in Part III (Items 10, 11, 12, 13 and 14) of Form 10-K that was previously omitted from the Original Form 10-K in reliance on General Instruction G(3) to Form 10-K. General Instruction G(3) to Form 10-K allows such omitted information to be filed as an amendment to the Original Form 10-K or incorporated by reference from the Company’s definitive proxy statement which involves the election of directors not later than 120 days after the end of the fiscal year covered by the Original Form 10-K. As of the date of this Amendment, the Company does not intend to file a definitive proxy statement containing the information required in Part III within such 120-day period. Accordingly, the Company is filing this Amendment to include such omitted information as part of the Original Form 10-K.

Except as expressly set forth herein, this Amendment does not reflect events that occurred after the date of the Original Form 10-K and does not modify or update any of the other disclosures contained therein in any way. This Amendment No. 1 should be read in conjunction with the Original Form 10-K and the Company’s other filings with the SEC. This Amendment consists solely of the preceding cover page, this explanatory note, Part III (Items 10, 11, 12, 13 and 14), the signature page and the certifications required to be filed as exhibits to this Amendment.

2

Table of Contents

Item 10—Directors, Executive Officers and Corporate Governance

Directors

The following table sets forth, as of April 23, 2014, the name, age and summary background of each of our current directors and director nominees. Directors are elected by our shareholders at our annual meeting of shareholders and serve until the next annual meeting of shareholders or until his or her earlier resignation or removal. The Nominating and Corporate Governance Committee (the “Governance Committee”) has reviewed the needs of the Board and the qualities, experience and performance of each director. At the Committee’s recommendation, the Board has renominated all current directors.

| Director and Director Nominees |

Age |

Director |

Summary Background | |||

| Dominic Casserley |

56 | 2013 | CEO of Willis Group Holdings plc | |||

| Anna C. Catalano |

54 | 2006 | Former Group Vice President, Marketing for BP plc | |||

| Sir Roy Gardner |

68 | 2006 | Chairman of Compass Group, PLC | |||

| The Rt. Hon. Sir Jeremy Hanley, KCMG |

68 | 2006 | Former Member of Parliament for Richmond and Barnes | |||

| Robyn S. Kravit |

62 | 2008 | Chief Executive Officer of Tethys Research, LLC | |||

| Wendy E. Lane |

62 | 2004 | Chairman of Lane Holdings, Inc. | |||

| Francisco Luzón |

66 | 2013 | Former Executive Board Member and General Manager of the Latin American Division of Banco Santander, S.A. | |||

| James F. McCann |

62 | 2004 | Chairman and CEO of 1-800-Flowers | |||

| Jaymin Patel |

46 | 2013 | President and CEO of GTECH Americas | |||

| Douglas B. Roberts |

66 | 2003 | Professor and the Director for Institute of Public Policy and Social Research - Michigan State University | |||

| Dr. Michael J. Somers |

71 | 2010 | Former CEO of Irish National Treasury Management Agency | |||

| Jeffrey W. Ubben |

52 | 2013 | Founder, CEO and Chief Investment Officer of ValueAct Capital | |||

Nominees for Election

Willis Group Holdings plc is a leading global risk advisor, insurance and reinsurance broker. Through its subsidiaries, Willis develops and delivers professional insurance, reinsurance, risk management, financial and human resources consulting

3

Table of Contents

and actuarial services to corporations, public entities and institutions around the world. We have approximately 21,700 employees around the world (including approximately 3,700 at our associate companies) and a network of in excess of 400 offices in approximately 120 countries.

Directors are responsible for overseeing the Company’s business around the globe consistent with their fiduciary duties. This requires highly-skilled individuals with various qualities, attributes and professional experience. The Governance Committee believes that the slate of nominees as a whole reflects the collective knowledge, integrity, reputation, and leadership abilities, and, as discussed more below, the diversity of skills and experience with respect to accounting and financial services, government and regulation, marketing and operations and global markets that the governance of the Company requires.

Qualifications

When recommending a person for new or continued membership on the Board, the Governance Committee considers each nominee’s individual qualifications in light of the overall mix of attributes represented on the Board and the Company’s current and future needs. In its assessment of each nominee, the Governance Committee considers the person’s integrity, experience, reputation, independence and when the person is a current director of the Company, his or her performance as a director. The Governance Committee considers each director’s ability to devote the time and effort necessary to fulfill responsibilities to the Company and, for current directors, whether each director has attended at least 75% of the aggregate of the total number of meetings held by the Board and any committee on which he or she served. In 2013, each director satisfied this requirement. The Governance Committee believes service on other public or private boards (including international companies) also enhances a director’s knowledge and board experience. It considers the experience of a director on other boards and board committees in both this nomination decision and in recommending the membership slate for each of the Company’s Board Committees.

The Governance Committee believes that including directors having current and previous leadership positions is important to the Board’s ability to oversee management. Extensive knowledge of the Company’s business and the industry is an important quality for directors. Additionally, because of the Company’s global reach, international experience or knowledge of a key geographic area is also important. As the Company’s business also requires continuous compliance with regulatory requirements and agencies, it is imperative for some directors to have legal, governmental, political or diplomatic expertise. If a person has served or currently serves in the public arena (whether through political service, employment as a CEO of a public company or membership on a board of a public company), then his or her integrity and reputation is also a matter of public record on which Company and its shareholders may rely. The Governance Committee also believes that the Company distinguishes itself from its competitors through marketing and, as a result, a strong marketing perspective should be represented. In light of its public and global nature (including conducting business in different countries and currencies), the Company also seeks international experience and a high level of financial literacy and experience on the Board and Audit Committee.

Diversity

The Company is committed to maintaining diversity on the Board as provided in the Company’s Corporate Governance Guidelines. The Board and the Governance Committee believe that diversity on the Board is important to ensuring a rounded perspective. Diversity is broadly interpreted by the Board to include viewpoints, background, experience, industry knowledge, and geography, as well as more traditional characteristics of diversity, such as race and gender. We believe that our commitment is demonstrated by the current structure of our Board and the varied backgrounds and skill sets of our current directors and nominees, which include three women, two persons of Asian descent and a mix of American, British, Irish and Spanish citizens.

Set forth below each biographical information is a summary of some of the key qualifications, attributes, skills and experiences discussed above that were considered by the Governance Committee for each person nominated for election at our 2014 Annual General Meeting of Shareholders. (The absence of a particular bullet-point for a director does not mean that the director does not possess other qualifications or skills in that area).

4

Table of Contents

Biographical Information

The following sets forth information about our directors and director nominees:

Dominic Casserley — Mr. Casserley, age 56, joined the Company as CEO and as a director on January 7, 2013 and currently serves as a member of the Company’s Executive Committee. Before joining the Company, he served as a senior partner of McKinsey & Company, which he joined in New York in 1983. During his 29 years at McKinsey & Company, Mr. Casserley was based in the U.S. for 12 years, Asia for five years, and, from 2000 until 2012, he worked across Europe while based in the London office. During his time at McKinsey & Company, Mr. Casserley led McKinsey’s Greater China Practice and its UK and Ireland Practice. Mr. Casserley was a member of McKinsey’s Shareholder Council, the firm’s global board, from 1999 to 2012 and for four years served as the Chairman of its Finance Committee. Mr. Casserley is a graduate of Cambridge University.

| • | International Business Experience — Mr. Casserley’s expertise in the global financial services industry, including experience with insurance companies, and the skill of capitalizing on the opportunities of expanding into new markets, was obtained during his 29-year tenure at McKinsey where he spent 17 years working in Asia, Europe and London and, during which time, he led the firm’s Greater China Practice and its UK and Ireland Practice. |

| • | CEO/Management Experience — Mr. Casserley has served as the Company’s current Chief Executive Officer since January 7, 2013. In addition to serving as a senior partner at McKinsey & Company he served on the company’s global board for over 10 years and served as Chairman of the Finance Committee of that board for four years. |

Anna C. Catalano — Ms. Catalano, age 54, joined the Board on July 21, 2006 and currently serves as a member of the Company’s Governance Committee and Compensation Committee. She was Group Vice President, Marketing for BP plc from 2001 to 2003. Prior to that she held various executive positions at BP and Amoco, including Group Vice President, Emerging Markets at BP; Senior Vice President, Sales and Operations at Amoco; and President of Amoco Orient Oil Company. She currently serves on the Board and the Governance Committee of Mead Johnson Nutrition and Chemtura Corporation and the Compensation Committees of Mead Johnson Nutrition, Chemtura Corporation and Kraton Performance Polymers. She serves on the Executive Committee of the Houston Chapter of the Alzheimer’s Association and serves as a director on the National Board of the Alzheimer’s Association. Ms. Catalano formerly served on the boards of SSL International plc, Hercules Incorporated, Aviva plc and U.S. Dataworks and as an advisory board member of BT Global Services. Ms. Catalano holds a BS degree in Business Administration from the University of Illinois, Champaign-Urbana.

| • | International Business — Ms. Catalano has significant executive experience in international business operations through her roles as: Group Vice President, Marketing at BP plc; Group Vice President, Emerging Markets at BP; Senior Vice President, Sales and Operations at Amoco; and President of Amoco Orient Oil Company. In 2001, Ms. Catalano was recognized by Fortune Magazine as being among the “Most Powerful Women in International Business.” |

| • | Marketing Experience — Ms. Catalano has over 25 years of experience in global marketing and operations. During her tenure as the head of marketing for BP plc, she was instrumental in the internal and external repositioning of the BP brand and was a primary voice behind the campaign to establish BP’s “Beyond Petroleum” positioning. She is also a frequent speaker on strategic and global branding. |

| • | Board and Committee Experience — Ms. Catalano has significant experience as a director and committee member from her service on other public company boards including her current service as a member of the Governance Committee of Mead Johnson Nutrition and Chemtura Corporation, the Compensation Committees of Mead Johnson Nutrition, Chemtura Corporation and Kraton Performance Polymers as well as her former service on the international company boards of SSL International plc and Aviva plc. |

Sir Roy Gardner — Sir Roy Gardner, age 68, joined the Board on April 26, 2006 and currently serves as the Chairman of the Company’s Risk Committee and a member of the Executive Committee. He is a Chartered Certified Accountant and served as Chairman of Compass Group PLC, a food and support services company, until his retirement from the position in February 2014. He also served as Chairman of the Nominating Committee of Compass Group PLC. He is a Senior Advisor to Credit Suisse and also a Director and Chairman of the Nominating Committee of Mainstream Renewable Power Limited, Chairman of the Advisory Board of the Energy Futures Lab of Imperial College London, President of Carers UK, Chairman of the Apprenticeship Ambassadors Network and Chairman and member of several board committees of

5

Table of Contents

Enserve Group Ltd. In addition, he was Chairman of Connaught plc between May and September 2010. He previously held positions as Chief Executive of Centrica plc, Chairman of Manchester United plc, Chairman of Plymouth Argyle Football Club, Finance Director of British Gas plc, Managing Director of GEC-Marconi Ltd, Director of GEC plc and Director of Laporte plc.

| • | International Business and Board Experience — The United Kingdom is an important market for the Company. Sir Roy Gardner is a well-respected British businessman who began his career in 1963 and has held leadership positions at or held director positions on the boards of a number of UK and other European companies. |

| • | CEO/Management Experience — Sir Roy Gardner’s senior leadership roles include his position as former Chief Executive of Centrica plc for 9 1/2 years. Centrica plc is a large multinational utility company that is based in the United Kingdom but also has interests in North America. It is listed on the London Stock Exchange and is a constituent of the FTSE 100 Index. |

| • | Extensive Knowledge of the Company’s Business — Sir Roy Gardner’s experience on the Board, his financial background as a UK-Chartered Certified Accountant and his former service as the Chairman of the Company’s Compensation Committee provides him with an extensive knowledge of the Company’s business and allows him to serve as an effective Chairman of the Company’s Risk Committee. |

The Rt. Hon. Sir Jeremy Hanley, KCMG — Sir Jeremy Hanley, age 68, joined the Board on April 26, 2006 and currently serves as a member of the Company’s Audit Committee. He is a Chartered Accountant and a director of Willis Limited, a subsidiary of the Company, and a director and member of the Audit and Remuneration Committees of Langbar International Limited and of London Asia Capital plc. He also serves on the International Advisory Committee for GTECH S.p.A Sir Jeremy was a Member of Parliament for Richmond and Barnes from 1983 to 1997 and held a number of ministerial position in the U.K. government, including Under Secretary of State for Northern Ireland, Minister of State for the Armed Forces, Cabinet Minister without Portfolio at the same time as being Chairman of the Conservative Party and Minister of State for Foreign & Commonwealth Affairs. He retired from politics in 1998. He also served on the Boards of Lottomatica S.p.A., Onslow Suffolk Limited, Mountfield Group Limited, Nymex London Limited and ITE Group plc. and the Audit Committee of the Joint Arab British Chamber of Commerce.

| • | Legal, Governmental, Political or Diplomatic Expertise — Sir Jeremy Hanley has a deep understanding of UK governmental and regulatory affairs and public policy based on his 14 years as a member of Parliament and significant ministerial positions in the UK government. Sir Jeremy Hanley’s background is important for his role as a director of Willis Limited, a subsidiary of the Company regulated by the Financial Control Authority, the regulator of the financial services industry in the UK. |

| • | Financial Background — Sir Jeremy Hanley, a member of the Company’s Audit Committee, is a UK-Chartered accountant which qualifies him as an audit committee financial expert. |

| • | International Board and Committee Experience — Sir Jeremy Hanley also brings experience from his service on numerous international boards, including his former service on the Board and Audit Committee of Lottomatica S.p.A., an Italian company. |

Robyn S. Kravit — Ms. Kravit, age 62, joined the Board on April 23, 2008 and currently serves as a member of the Company’s Risk Committee. She is an international business executive with almost 30 years of experience in establishing and directing significant China-based operations engaged in the international trading of industrial raw materials. Ms. Kravit co-founded Tethys Research LLC, a biotechnology company, and has acted as its Chief Executive Officer since 2000. From 2001 through 2010, Ms. Kravit was a Director of FONZ, the organization which manages commercial and educational activities for Smithsonian’s National Zoological Park, serving two terms as President and later chairing its Audit Committee. On January 1, 2012, she was appointed to a two-year term on the Standing Advisory Group of the Public Company Accounting Oversight Board (PCAOB), established by Congress to oversee the audits of public companies. She currently serves on the Advisory Council of Johns Hopkins University’s Whiting School of Engineering and the Board of Governors of the Washington Foreign Law Society. She previously served on the Board of InovaChem Inc. Ms. Kravit holds a BA in East Asian Studies from Vassar College, and a MA in East Asian Studies from Harvard University.

| • | International Experience — China is an emerging market for the Company and Ms. Kravit’s almost 30 years of experience in international business, focusing on the Far East markets, provides the Company with an |

6

Table of Contents

| extensive knowledge base. She is fluent in Mandarin Chinese. She has established and directed significant China-based operations engaged in the international trading of industrial raw materials and has experience in devising marketing plans that adapt to evolving political and economic environments. She also has extensive experience in the management of foreign trade transactions and international risk management. |

| • | CEO/Management Experience — Ms. Kravit founded and since 2000 has been the Chief Executive Officer of Tethys Research LLC, a biotechnology company, and is responsible for contract, administrative and financial operations. Prior to Tethys, as Managing Director for Asian operations, Ms. Kravit functioned as CEO of a major business unit within a complex multinational corporation. |

| • | Financial Background — Ms. Kravit previously served on the Company’s Audit Committee and was appointed to a two-year term on the Standing Advisory Group of the PCAOB. The Standing Advisory Group advises the PCAOB on issues relating to the development of auditing standards. |

Wendy E. Lane — Ms. Lane, age 62, joined the Board on April 21, 2004 and currently serves as the Chairman of the Company’s Compensation Committee and as a member of the Audit Committee and Executive Committee. She was a member of the CEO Search Committee as well as other ad hoc Board Committees convened from time to time. She has been Chairman of Lane Holdings, Inc., an investment firm, since 1992. Prior to forming Lane Holdings, Inc., Ms. Lane was a Principal and Managing Director of Donaldson, Lufkin and Jenrette Securities Corporation, an investment banking firm, serving in these and other positions from 1981 to 1992. Ms. Lane is also a director and Audit Committee member of UPM-Kymmene Corporation, a Finnish publicly-held corporation and, until May 13, 2014, will serve as a member of the board, Nominating and Corporate Governance and Audit Committees of Laboratory Corporation of America. Ms. Lane holds a BA from Wellesley College and a MBA from Harvard Business School.

| • | Financial Background — Ms. Lane has more than 15 years of experience in investment banking, including financings, mergers and acquisitions and advisory projects. Prior to forming her own investment firm in 1992, Ms. Lane was a Principal and Managing Director of Donaldson, Lufkin and Jenrette Securities Corporation, an investment banking firm, serving in these and other positions from 1981 to 1992. From 1977 to 1980, she was an investment banker at Goldman Sachs. Ms. Lane’s financial background qualifies her as an audit committee financial expert. |

| • | Extensive Knowledge of the Company’s Business — Ms. Lane’s service as a director, financial expertise, current dual service as the Chairman of the Company’s Compensation Committee and member of the Audit Committee and former service as a member of the Company’s Nominating and Corporate Governance Committee have provided Ms. Lane with an invaluable knowledge base of the Company and a deep understanding of the interrelationships of issues and decisions between the Committees. She was also part of the Search Committee formed by the Board in connection with appointing a new CEO. |

| • | International Board Experience — Ms. Lane has served for seven years on the board of UPM-Kymmene Corporation, a Finnish publicly held corporation with worldwide operations and revenues exceeding $11.5 billion. |

| • | Board and Committee Experience — As well as serving on almost all of Willis’ Committees, Ms. Lane serves on the Audit Committee of UPM-Kymmene Corporation, has chaired the Audit and Compensation Committees of Laboratory Corporation of America and has extensive committee experience on all of her current and past boards. |

Francisco Luzón — Mr. Luzón, age 66, joined the Board on July 23, 2013 and currently serves as a member of the Governance Committee. From 1996 until January 2012, Mr. Luzón served in several capacities at Banco Santander, S.A. (a public company organized under the laws of Spain), most recently as Executive Board Member and General Manager of the Latin American Division, from 1996 until 1998, as Executive Director and Deputy to the Chairman and Head of Strategy, Communication and Investor Relations, and in 1998, as Head of Human Resources and Information Technology. Prior to that, Mr. Luzón held executive positions at several other banks, including Argentaria, S.A., Banco Exterior de Espana, S.A., Banco Bilbao Vizcaya and Banco Vizcaya. Within the last five years, Mr. Luzón has served as a Director of Banco Santander, S.A. and Inditex-Zara, the international fashion retail company. Mr. Luzón currently is a director of Latam Airlines Group, the

7

Table of Contents

international airline, and Member of its Finance Committee and its Strategy Committee. He also serves on the boards and advisory councils of numerous academic institutions, non-profit organizations and think tanks. He is also a consultant of the Interamerican Development Bank. Mr. Luzón has a Degree in business and economics from Bilbao University and, in 2010, received an Honorary Degree in economics from University Castilla La Mancha.

| • | International Business and Management Experience — Mr. Luzón has significant international financial services experience, having served in executive roles most recently at Banco Santander, the Spanish financial institution, and other international banks over the last 30 years, and having worked in London, New York, Tokyo, the Middle East, North Africa and 12 countries in Latin America. |

| • | Financial Background — Mr. Luzón has over 40 years of experience working in mergers and acquisitions, the restructuring of numerous private and state-owned banks, insurance companies and financial institutions in Spain and throughout numerous countries in Latin America. |

| • | International Board Experience — Mr. Luzón also brings experience from his service on international boards, including his former service as a director of Banco Santander and Inditex-Zara, the international fashion retailer, and his current service as a director of Latam Airlines Group, the international airline. He has also served on the boards and advisory councils of numerous companies, academic institutions, not-for-profit organizations and think tanks. |

James F. McCann — Mr. McCann, age 62, joined the Board on April 21, 2004 and currently serves as the Board’s non-executive Chairman of the Board, the Chairman of the Company’s Governance Committee, and as a member of the Executive Committee. Prior to serving as the non-executive Chairman of the Board, Mr. McCann served as the Company’s Presiding Independent Director. Mr. McCann was a member of the CEO Search Committee as well as other ad hoc Board Committees convened from time to time. He has served since 1976 as Chairman and Chief Executive Officer of 1-800-Flowers.Com, Inc., a florist and gift shop company. He also serves as a director for Scott’s Miracle-Gro, Dearborn National and JPMorgan Chase Regional Advisory Board. He previously served as a director and Compensation Committee member of Lottomatica S.p.A. and a director of Gateway, Inc. and The Boyds Collection, Ltd.

| • | CEO/Management Experience — Mr. McCann has substantial management, strategic and operational experience as Chairman and CEO of 1-800-Flowers.com, Inc. The knowledge and experience he has gained through his leadership of a consumer-product and service-based public company for over 30 years continues to benefit the Company both in his role as a director, Chairman of the Board, the Chairman of the Governance Committee, Presiding Independent Director, and a member of the Executive Committee. |

| • | Extensive Knowledge of the Company’s Business — Mr. McCann’s service as a director of the Company, service as the Board’s non-executive Chairman of the Board, Presiding Independent Director, Chairman of the Governance Committee, member of the Executive Committee and former member of the Company’s Compensation Committee has provided him with an in-depth knowledge of the Company’s business and structure. He was also part of the Search Committee formed by the Board in connection with appointing a new CEO. |

| • | Board and Committee Experience — Mr. McCann has benefited from his service as a former director and member of the Compensation Committee of Lottomatica S.p.A., an Italian headquartered company and his experience as Chairman of 1-800-Flowers.com. |

Jaymin Patel — Mr. Patel, age 46, joined the Board on July 23, 2013 and currently serves as a member of the Compensation Committee. Mr. Patel is currently the President and Chief Executive Officer of GTECH Americas, a division of GTECH S.p.A. (formerly named Lottomatica S.p.A.), a leading commercial operator and provider of technology in regulated worldwide gaming markets. Before becoming CEO of GTECH Corporation, then a subsidiary of Lottomatica Group S.p.A. in 2008, Mr. Patel held various executive positions at GTECH, including President and Chief Operating Officer (2007), Senior Vice President and Chief Financial Officer (2000-2007), Vice President, Financial Planning and Business Evaluation (1998-2000) and Finance Director, European and African Operations (1995-1997). From August 2006 until April 2007, Mr. Patel also served as Chief Financial Officer of Lottomatica S.p.A. (now GTECH S.p.A.). Prior to joining GTECH, Mr. Patel worked at PricewaterhouseCoopers in London. Mr. Patel serves as a member of the Board and the Executive Management Committee of GTECH S.p.A. Mr. Patel holds a B.A. with honors from Birmingham Polytechnic in the United Kingdom and qualified as a Chartered Accountant with PricewaterhouseCoopers in London.

| • | CEO/Management Experience — Mr. Patel has approximately twenty years of experience as an executive of GTECH and is currently the President and Chief Executive Officer of GTECH Americas. |

8

Table of Contents

| • | International Experience — As CEO of GTECH Americas, an international business that operates in over 55 countries, Mr. Patel has international business experience, especially growing GTECH in developing countries, including Latin America, Eastern Europe and Asia Pacific regions. |

| • | International Board Experience — Mr. Patel has served for six years on the Board and Executive Management Committee of Lottomatica Group S.p.A. (now GTECH S.p.A.), an Italian publicly held corporation with worldwide operations. |

Douglas B. Roberts — Mr. Roberts, age 66, joined the Board on February 13, 2003 and currently serves as the Chairman of the Company’s Audit Committee and a member of the Executive Committee. He is the former Treasurer for the State of Michigan, a position held from April 2001 to December 2002 and from January 1991 to November 1998. From January 1999 to March 2001 he was Vice President of Business Development and Best Practices at Lockheed Martin IMS. Prior to January 1991, Mr. Roberts worked in the Michigan Senate as Director, Senate Fiscal Agency from April 1988 to December 1990 and as Deputy Superintendent of Public Instruction for the Department of Education. Mr. Roberts holds a doctorate in Economics from Michigan State University. Currently, Mr. Roberts is both a Professor and the Director for the Institute for Public Policy and Social Research at Michigan State University.

| • | Legal, Governmental, Political or Diplomatic Experience — Mr. Roberts has a deep understanding of public finance and other public policy matters from his 28-year tenure in state government, including his years as a Michigan state treasurer and his current academic position. As Michigan state treasurer, he oversaw the state’s revenue and cash positions during a period of rebirth in Michigan’s finances and economy which included five ratings upgrades. In addition, the state Treasurer is the sole fiduciary of the state’s pension systems valued at approximately $50 billion. |

| • | Financial Background and Extensive Knowledge of the Company’s Business — Mr. Roberts’ business experience and education also qualify him as an audit committee financial expert and have positioned him well to serve as a Company’s director and as the Chairman of our Audit Committee. |

Dr. Michael J. Somers — Dr. Somers, age 71, joined the Board on April 21, 2010 and currently serves as a member of the Company’s Audit Committee. He was Chief Executive Officer of the Irish National Treasury Management Agency from 1990, when it was established, until the end of 2009. The Agency, which is a commercial entity outside the civil service, was initially set up to arrange Ireland’s borrowing and manage its national debt. Its remit was extended to establish and manage the National Pensions Reserve Fund, of which Dr. Somers was a Commissioner, and the National Development Agency, of which he was Chairman. It also incorporated the State Claims Agency, which handles claims against the State and against hospitals and other medical institutions. Dr. Somers previously worked in the Irish Department of Finance and the Central Bank and served as Secretary General of the Department of Defense from 1985 to 1987. He was the Irish member of the EU Monetary Committee from 1987 to 1990 and chaired the EU group that established the European Bank for Reconstruction and Development. He served on the board of the Irish Stock Exchange until the end of 2009. He was the Irish Director on the Board of the European Investment Bank up to May 2013. He serves on the Boards of Allied Irish Banks plc, St. Vincent’s Healthcare Group Ltd., the Institute of Directors, Hewlett Packard International Bank plc, Fexco Holdings Ltd., and as Chairman of Goodbody Stockbrokers, a subsidiary of Fexco. He also serves as Chairman of the Audit Committees of Hewlett Packard International Bank plc and St. Vincent’s Healthcare Group and Chairman of the Risk Committee of the AIB Bank. He was awarded the honor of Chevalier of the Légion d’Honneur by the President of France. He previously served as a Council Member of the Dublin Chamber of Commerce and Ulysses Securitization plc, a government established special purpose entity whose purpose has expired and assets have been liquidated. He holds various degrees, including a master’s degree in economic science and a doctorate from University College Dublin. He is President of the Ireland Chapter of the Ireland-U.S. Council.

| • | Financial Background — Dr. Somers has an extensive finance background as a result of his experience relating to Ireland’s borrowing and managing its national debt as well as his experience as the Irish member of the EU Monetary Committee. |

9

Table of Contents

| • | International Business and Board Experience — Dr. Somers has extensive knowledge and experience in serving the Irish and European financial, business and governmental communities, including through his service on a number of Irish Boards. The Irish market is important to the Company which completed its redomicile to Ireland, in part, to facilitate business expansion. Dr. Somers also brings his experience on the Audit Committee and Risk Committee of various entities. |

Jeffrey W. Ubben — Mr. Ubben, age 52, joined the Board on July 23, 2013 and is a member of the Company’s Risk Committee. Mr. Ubben is a Founder, Chief Executive Officer and the Chief Investment Officer of ValueAct Capital. Prior to founding ValueAct Capital in 2000, Mr. Ubben was a Managing Partner at Blum Capital Partners for more than five years. Previously, Mr. Ubben spent eight years at Fidelity Investments where he managed the Fidelity Value Fund. Mr. Ubben is a former director and member of the Compensation Committee of Acxiom Corp., a former director and member of the Compensation Committee of Gartner Group, Inc., a former director and member of the Audit and Finance Committee of Misys, plc, a former director and member of the Nomination and Governance Committee of Omnicare, Inc., a former director and member of the Audit and Finance Committee of Sara Lee Corp. and a former director of several other public and private companies. In addition, Mr. Ubben serves as chairman of the national board of the Posse Foundation, is on the board of trustees of Northwestern University, and is also on the board of the American Conservatory Theater. He has a B.A. from Duke University and an M.B.A. from the J. L. Kellogg Graduate School of Management at Northwestern University.

| • | Financial Background — Mr. Ubben has more than 20 years of experience in the investment management business. |

| • | CEO/Management Experience — Mr. Ubben’s leadership roles include serving as Chief Executive Officer and Chief Investment Officer of ValueAct Capital since 2000 and as Managing Partner at Blum Capital Partners for more than five years prior to joining ValueAct. |

| • | Board and Committee Experience — Mr. Ubben also brings experience from his prior service as a director and board committee member of numerous global public companies. |

On April 25, 2013, the Company entered into a Nomination Agreement with ValueAct pursuant to which the Company’s Board of Directors agreed to nominate Mr. Ubben for election at the 2013 Annual General Meeting of Shareholders. In addition, ValueAct agreed, subject to exceptions, not to engage in certain transactions regarding the Company and its securities until a date specified in the Nomination Agreement. This agreement expires at the 2014 Annual General Meeting of Shareholders.

Executive Officers

The following table sets forth, as of April 23, 2014, the name, age and position of each of our executive officers. Executive officers are elected by, and serve at the pleasure of, our Board of Directors.

| Name |

Age |

Position | ||

| Celia Brown |

59 | Willis Group Human Resources Director | ||

| Dominic Casserley |

56 | Chief Executive Officer of Willis Group Holdings plc; Director | ||

| Stephen Hearn |

47 | Deputy CEO; Chairman and CEO of Willis Global | ||

| Todd Jones |

49 | CEO of Willis North America | ||

| Michael K. Neborak* |

57 | Group Chief Financial Officer | ||

| Adam L. Rosman |

48 | Group General Counsel | ||

| David Shalders |

47 | Group Operations & Technology Director | ||

| Timothy D. Wright |

52 | CEO of Willis International | ||

| * | As previously announced by the Company, John Greene, 48, was appointed to serve as the next Group Chief Financial Officer, succeeding Mr. Neborak, effective June 2, 2014 or such earlier date as may be mutually agreed by the Company and Mr. Greene. |

10

Table of Contents

Biographical Information

The following sets forth information about our current executive officers other than Dominic Casserley, the Company’s CEO, whose qualifications are set forth above:

Celia Brown — Ms. Brown, age 59, was appointed an executive officer on January 23, 2012. Ms. Brown joined the Willis Group in 2010 and serves as the Willis Group Human Resources Director. Prior to joining the Willis Group, Ms. Brown spent over 20 years at XL Group plc where she held a number of senior roles. Ms. Brown served from 2006 to 2009 as the Executive Vice President, Head of Global HR and Corporate Relations at XL Group plc. Following XL Group plc, Ms. Brown formed an independent management consultancy, providing human resources services to not-for-profit, corporate and individual clients.

Stephen Hearn — Mr. Hearn, age 47, was appointed an executive officer on January 1, 2012. Mr. Hearn joined the Willis Group in 2008 and was named Chairman and CEO of Willis Global in 2011, CEO of Willis Limited in 2012 and Group Deputy CEO in 2013. Since joining the Willis Group, Mr. Hearn has served as Chairman of Special Contingency Risk, Chairman of Willis Facultative and Chairman and CEO of Glencairn Limited. From 2009 until 2011 he led Faber & Dumas, Global Markets International and Willis Facultative. Prior to joining the Willis Group, Mr. Hearn served as Chairman and CEO of the Glencairn Group Limited and as President and CEO of Marsh Affinity Europe.

Todd Jones — Mr. Jones, age 49, was appointed an executive officer and CEO of Willis North America on July 1, 2013. Mr. Jones joined Willis in 2003 as the North American Practice Leader for Willis’s Executive Risks Practice and served as the President of Willis North America from 2010 to 2013. Mr. Jones also served as a National Partner for the Northeast Region. Prior to joining Willis, Mr. Jones held various leadership roles in the insurance brokerage industry. Before entering the brokerage industry, he was a financial analyst and corporate banker for a regional bank that is now part of Wells Fargo, focusing on the telecommunications industry.

Michael K. Neborak — Mr. Neborak, age 57, was appointed an executive officer and Group Chief Financial Officer on July 6, 2010 and will continue to serve in this capacity until Mr. Greene succeeds him as Group Chief Financial Officer, effective June 2, 2014 or such earlier date as may be mutually agreed upon by the Company and Mr. Greene. Mr. Neborak joined Willis from MSCI Inc., a NYSE listed company, where he was Chief Financial Officer. With more than 30 years of experience in finance and accounting, Mr. Neborak also held senior positions with Citigroup, including divisional CFO and co-head of Corporate Strategy & Business Development, from 2000 to 2006, and prior to that, in the investment banking group at Salomon Smith Barney from 1982 to 2000. He began his career as an accountant with Arthur Andersen & Co.

Adam L. Rosman — Mr. Rosman, age 48, was appointed Group General Counsel on May 7, 2012 and is responsible for legal, corporate secretary, compliance, audit and risk management. He joined Willis in 2009 and served for three years as the company’s Deputy Group General Counsel, responsible for Willis’ worldwide legal operations. Before joining Willis, Adam was Senior Vice President and Associate General Counsel at Cablevision Systems Corporation in Bethpage, NY, and before that he was a partner at the Washington D.C.-based law firm of Zuckerman Spaeder LLP, where he advised public companies and senior executives on a range of topics, including Sarbanes-Oxley. Between 1997 and 2003, Adam was an Assistant United States Attorney in Washington, D.C., where he prosecuted a wide range of matters. He also worked in 2000 and 2001 as Deputy Assistant to the President and Deputy Staff Secretary for President Clinton.

David Shalders — Mr. Shalders, age 47, was appointed an executive officer and Group Operations & Technology Director on November 4, 2013. Prior to joining Willis, Mr. Shalders spent over a decade in senior operations and IT roles at the Royal Bank of Scotland Group, most recently as Global COO for Global Banking and Markets. Mr. Shalders also held roles as Head of London & Asia Operations and Head of Derivative Operations for NatWest at RBS.

Timothy D. Wright — Mr. Wright, age 52, was appointed an executive officer in 2008 and in 2012 was appointed CEO of Willis International. Mr. Wright served as Group Chief Operating Officer from 2008 to 2012. Prior to joining the Willis Group, he was a Partner of Bain & Company where he led their Financial Services practice in London. Mr. Wright was previously UK Managing Partner of Booz Allen & Hamilton and led their insurance work globally. He has more than 20 years of experience in the insurance and financial service industries internationally.

11

Table of Contents

Corporate Governance

The Board’s Committees

The Committees and its members, as of April 23, 2014 are described in further detail below.

| Audit Committee |

Compensation Committee |

Governance Committee |

Risk Committee |

Executive Committee | ||||||

| Dominic Casserley |

X | |||||||||

| Anna C. Catalano |

X | X | ||||||||

| Sir Roy Gardner |

C | X | ||||||||

| Sir Jeremy Hanley |

X, F | |||||||||

| Robyn S. Kravit |

X | |||||||||

| Wendy E. Lane |

X, F | C | X | |||||||

| Francisco Luzón |

X | |||||||||

| James F. McCann |

C, CB | C | ||||||||

| Jaymin Patel |

X | |||||||||

| Douglas B. Roberts |

C, F | X | ||||||||

| Michael J. Somers |

X, F | |||||||||

| Jeffrey W. Ubben |

X |

| C | Committee Chairman |

| CB | Chairman of the Board |

| F | Financial Expert |

| X | Committee Member |

The Executive Committee has the full powers, authorities and discretions of the Board of the Directors, when it is not in session, in the management of the business and affairs of the Company, except as otherwise provided in the resolutions of the Board and under applicable law. The Executive Committee is currently composed of the Chairman of the Board, the CEO, the Presiding Independent Director (if any) and the Chairman of each Board Committee (James F. McCann, Dominic Casserley, Sir Roy Gardner, Wendy E. Lane and Douglas B. Roberts).

The Audit Committee assists the Board in fulfilling its oversight responsibilities with respect to:

| • | The integrity of the Company’s financial statements; |

| • | The selection and oversight of the independent auditors; |

| • | The Company’s compliance with legal and regulatory requirements; |

| • | The independent auditors’ qualifications and independence; |

| • | The performance of the independent auditors and the Company’s internal audit function; |

| • | The establishment and maintenance of proper internal accounting controls and procedures; and |

| • | The treatment of employees’ concerns regarding accounting or auditing matters as reported under the Company’s whistleblower policy. |

12

Table of Contents

In addition, the Audit Committee provides an avenue for communication among internal audit, the independent auditors, management and the Board. The Audit Committee also focuses on major financial risk exposures, the steps management has taken to monitor and control such exposures, and, if appropriate, discusses with the independent auditor the guidelines and policies governing the process by which senior management and the relevant departments of the Company assess and manage the Company’s financial risk exposure. The Audit Committee operates under a charter, a copy of which can be found in the Investor Relations — Corporate Governance section of the Company’s website at www.willis.com. The Audit Committee is currently composed of Douglas B. Roberts (Chairman), Sir Jeremy Hanley, Wendy E. Lane and Michael J. Somers and met formally five times during 2013. In addition to holding formal meetings, the Audit Committee members met informally during the course of the year to discuss and review financial matters related to the Company as well as the Company’s filings with the SEC. After regularly scheduled meetings, the Committee also meets in executive session, which includes separate meetings with management, the internal auditors and external auditors. Mr. Roberts, Sir Jeremy Hanley, Ms. Lane and Mr. Somers are considered to be Audit Committee Financial Experts in light of their financial experience described in their biographies above.

The Compensation Committee determines and approves the Company’s CEO’s compensation and recommends to the Board the compensation of other executive officers and non-employee directors. In addition, the Compensation Committee oversees the administration of the Company’s share-based award plans and, in consultation with senior management, establishes the Company’s general compensation philosophy and oversees the development and implementation of the Company’s compensation programs. In connection with those objectives, the Compensation Committee is also responsible for:

| • | Reviewing and approving annually performance goals and objectives relevant to the compensation of the CEO and other executive officers and evaluating their performance in light of those goals and objectives; |

| • | Reviewing and approving compensation policies applicable to the senior management of the Company; |

| • | Making recommendations to the Board on the Company’s existing and proposed incentive compensation plans and equity-based plans and overseeing the administration of these plans; |

| • | In consultation with senior management, overseeing regulatory compliance with respect to compensation matters; |

| • | Reviewing and discussing with senior management the Compensation Discussion and Analysis and approving its inclusion in the Company’s Proxy Statement and Annual Report on Form 10-K; |

| • | Reviewing the results of the “say-on-pay” proposals included in the Proxy Statement and the appropriate response; |

| • | Annually evaluating the independence of its compensation consultants, legal counsel or other advisors taking into consideration the factors enumerated in the NYSE listing standards and evaluating whether any conflict of interest exists with respect to its Compensation Consultant; |

| • | Reviewing an assessment of compensation risk to determine whether any material risks were deemed to be likely to arise from the Company’s compensation policies and programs, what mitigating factors are in place, and whether these risks would be reasonably likely to have a material adverse effect on its business; and |

| • | Providing input and advice on the implementation of the Company’s talent strategy, including recruiting and development strategies, and the development of senior leaders. |

The Compensation Committee operates under a charter, a copy of which can be found in the Investor Relations — Corporate Governance section of the Company’s website at www.willis.com. The Compensation Committee is currently composed of Wendy E. Lane (Chairman), Anna C. Catalano and Jaymin Patel and met formally four times during 2013. In addition to holding formal meetings, the Compensation Committee members met informally during the course of the year to discuss compensation related matters and acted from time to time by unanimous written consent. After regularly scheduled meetings, the Committee also meets in executive session, which includes meetings with its Compensation Consultant.

13

Table of Contents

The Risk Committee is responsible for assisting the Board in:

| • | Monitoring oversight of the Company’s enterprise risk management; |

| • | Overseeing, on the basis of proposals from management, the creation, and subsequent assessment, of a framework, for approval by the Board, in relation to the management of risk; |

| • | Reviewing the adequacy of the Company’s resources to perform its risk management responsibilities; |

| • | Reviewing the activities of the Company’s Enterprise Risk Management Committee (“ERMC”), as well as reviewing and approving annually the Company’s Enterprise Risk Management Policy; |

| • | Meeting with the chairman and/or other members of the Company’s ERMC and Audit Committee, as needed or advisable, to discuss the Company’s corporate risk management framework and/or related areas; and |

| • | Reviewing and recommending any major transactions or decisions affecting the Company’s risk profile or exposure. |

The Risk Committee operates under a charter, a copy of which can be found in the Investor Relations — Corporate Governance section of the Company’s website at www.willis.com. The Risk Committee is currently composed of Sir Roy Gardner (Chairman), Robyn S. Kravit and Jeffrey W. Ubben and met formally four times in 2013. After regularly scheduled meetings, the Committee also meets in executive session.

The Corporate Governance and Nominating Committee is responsible for assisting the Board in:

| • | Developing and recommending director independence standards to the Board and periodically reviewing those standards; |

| • | Developing and recommending to the Board the director selection process for identifying, considering and recommending candidates to the Board and director qualification standards for use in selecting new nominees and periodically reviewing the process and standards; |

| • | Recommending to the Board the nominees to stand for election as directors at the next annual shareholder meeting and in the event of director vacancies; |

| • | Recommending to the Board, from time to time, changes the Committee believes is desirable to the size of the Board or any Committee thereof; |

| • | Recommending to the independent and non-management directors a nominee for Presiding Independent Director and recommending to the Board nominees and chairman for each Board Committee; |

| • | Reviewing periodically and recommending changes to the Board, from time to time, to the Company’s Corporate Governance Guidelines; |

| • | Reviewing the appropriateness of continued service on the Board of members whose circumstances have changed or who contemplate accepting a directorship to another company or an appointment to an audit committee of another company; |

| • | Administering and overseeing, on behalf of the Board, the evaluation process for the overall effectiveness of the Board (including the effectiveness of the Committees and the Board’s performance of its governance responsibilities); and |

| • | Assisting the Board in reviewing succession plans prepared by management for all senior management. |

14

Table of Contents

The Governance Committee identifies potential director nominees by preparing a candidate profile based upon the current Board’s strengths and needs and from a variety of sources, including engaging search firms or utilizing business contacts of the Board and senior management. Nominees must meet minimum qualification standards with respect to a variety of criteria including integrity, reputation, judgment, knowledge, experience, maturity, skills and personality, commitment and independence. The Governance Committee may also take into consideration additional factors it deems appropriate, which may include diversity, experience with business and other organizations, the interplay of the candidate’s experience with the experience of other Board members and the extent to which the candidate would be a desirable addition to the Board and any committee thereof.

With feedback from the Board members, members of the Governance Committee initiate contact with preferred candidates and, following feedback from interviews conducted by Governance Committee and Board members, recommend candidates to join the Board. The Governance Committee has the authority to retain a search firm to assist with this process. The Governance Committee considers candidates nominated by shareholders and ensures that such nominees are given appropriate consideration in the same manner as other candidates.

The Governance Committee operates under a charter, a copy of which can be found in the Investor Relations — Corporate Governance section of the Company’s website at www.willis.com. The Governance Committee currently consists of James F. McCann (Chairman), Anna C. Catalano and Francisco Luzón met formally six times during 2013. After regularly scheduled meetings, the Committee also meets in executive session.

Highlights of the Company’s Corporate Governance Guidelines

Based on the Governance Committee’s recommendation, Company’s Corporate Governance Guidelines include, among other things, the following policies:

| • | Requiring the CEO to seek approval of the Governance Committee before serving on any other public company board; |

| • | Restricting directors (other than the CEO who is further restricted as noted above) from serving on the boards of more than 3 publicly-traded companies in addition to the Company’s Board; |

| • | Requiring a director who experiences materially changed circumstances to offer his or her resignation from the Board; and |

| • | Prohibiting directors and executive officers from having margin accounts and pledging Company shares. |

Our Corporate Governance Guidelines and all Board Committee Charters can be found in the Investor Relations — Corporate Governance section of our website at www.willis.com. Copies are also available free of charge on request from the Company Secretary, Willis Group Holdings Public Limited Company, c/o Office of General Counsel, 200 Liberty Street, New York, NY 10281-1033.

Ethical Code

The Company has adopted an Ethical Code applicable to all our directors, officers and employees, including our CEO, the Group Chief Financial Officer, the Group Financial Controller and all those involved in the Company’s accounting functions. Our Ethical Code can be found in the Investor Relations — Corporate Governance section of our website at www.willis.com. A copy is also available free of charge on request from the Company Secretary, c/o Office of the General Counsel, Willis Group Holdings Public Limited Company, One World Financial Center, 200 Liberty Street, New York, NY 10281-1033. The Company intends to post on its website any amendments to, or waivers of, a provision of its Ethical Code in accordance with Item 406 of Regulation S-K.

Section 16 Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires the Company’s executive officers and directors, and persons who own more than 10% of a registered class of the Company’s equity securities, to file reports of ownership and changes in ownership (Forms 3, 4 and 5) with the SEC and the NYSE. Executive officers, directors and such security holders are required by SEC regulation to furnish the Company with copies of all such forms which they file. To the Company’s knowledge, based solely on a review of the copies of such reports furnished to the Company and information provided by the reporting persons, all of its directors and executive officers made all required filings on time during 2013.

15

Table of Contents

Item 11 — Executive Compensation

Compensation Discussion and Analysis

The following is an overview of the Compensation Committee’s philosophy and objectives in designing compensation programs for the Group CEO, the Group CFO, and the Company’s three other most highly compensated executive officers, collectively our “named executive officers.” For the fiscal year ended December 31, 2013, our named executive officers were:

| • | Dominic Casserley (Group CEO); |

| • | Michael Neborak (Group CFO); |

| • | Stephen Hearn (Deputy CEO; CEO and Chairman, Willis Global); |

| • | Timothy Wright (CEO, Willis International); |

| • | Todd Jones (CEO, Willis North America); |

| • | Joseph Plumeri (Former Chairman and Group CEO); and |

| • | Victor Krauze (Chairman and former CEO, Willis North America). |

Typically, there are five named executives officers, but we have seven because the SEC rules require us to include (i) Joseph Plumeri who served as the Group CEO in 2013 from January 1st to January 6th and (ii) Victor Krauze who ceased to be CEO of Willis North America on July 1, 2013.

On March 25, 2014, we announced that John Greene will succeed Michael Neborak as Group CFO on or before June 2, 2014. Michael Neborak will continue to serve as Group CFO during the transition period.

| 1.0 | Executive Summary of our Named Executive Officer 2013 Compensation |

| 1.1 | Background |

The Compensation Committee establishes, implements, and monitors the Company’s compensation programs, philosophy, and objectives. The Committee has two primary objectives: (1) to attract and retain highly qualified executives in the competitive marketplace in which the Company operates; and (2) to create appropriate incentives for our executives to improve their individual performance and Company performance. To achieve these objectives, the Compensation Committee evaluates and sets the total compensation for each of our named executive officers – base salary, annual incentive compensation, and long-term incentive compensation – considering the scope of the named executive officer’s role, level of expertise, individual performance, business or functional unit performance, Company performance, and compensation paid to similarly-situated executives in peer group companies from which we compete for talent. To assist the Compensation Committee in all aspects of the named executive officer and the Company’s compensation program, the Compensation Committee has retained Towers Watson as its independent compensation consultant.

The Compensation Committee spent significant time in 2012 and 2013 reviewing, evaluating, and re-designing our named executive officer compensation program, including a comprehensive shareholder outreach program to understand shareholder concerns. The Committee and Board considered the various viewpoints expressed by our shareholders and market factors, and adopted several changes to Company policies and our named executive officer compensation program, including:

| • | Revising the Company’s financial metrics for its 2013 annual incentive compensation awards and performance-based long-term incentive awards to emphasize both short-term and long-term financial performance. The annual and long-term incentive awards will have different metrics, all of which are key drivers to increase cash flow and, therefore, important constituents of shareholder value enhancement. |

16

Table of Contents

| • | Confirming our philosophy that incentive pay should be performance driven and not guaranteed. Accordingly, unless there are compelling circumstances (i.e., on a limited basis, in connection with new hires), the Compensation Committee will not approve guaranteed incentive awards. |

| • | Lowering our new CEO’s total target pay package by over 25% compared to Mr. Plumeri and lowering his amount of fixed pay by almost 45%. |

| 1.2 | The Company’s 2013 Financial Performance and Named Executive Officer Compensation |

The macroeconomic environment in 2013, while better than 2012, remained challenging globally but especially in three of our key geographic markets, the United Kingdom, Western Europe and North America. Adjusted EBITDA, a key financial metric in calculating named executive officer compensation in 2013, was $874 million in 2013. That is down $16 million from $890 million in 2012. However, a like-for-like basis, assuming we expensed bonuses in 2012 the way we did in 2013, adjusted EBITDA in 2012 would have been $48 million lower, or $842 million. On that basis, adjusted EBITDA improved $32 million, or 3.8%, in 2013. Organic commissions and fees growth and adjusted EBITDA figures are non-GAAP figures. A reconciliation of the non-GAAP to GAAP figures are located on Exhibit A.

On the top line, Willis saw solid improvement in its revenues, with reported commissions and fees growth of 5.1% over 2012 and organic commissions and fees growth of 4.9%. That revenue growth breaks out by segment as follows:

| • | North America reported commissions and fees growth of 5.4% and organic commissions and fees growth of 4.9%; |

| • | International reported commissions and fees growth of 3.9% and organic commissions and fees growth of 4.1%; and |

| • | Global reported commissions and fees growth of 5.7% and organic commissions and fees growth of 5.6%. |

Additionally, in 2013, the Company:

| • | Generated 2013 cash flow from operating activities of $561 million, up $36 million from the prior year; |

| • | Maintained cash on hand of $796 million at December 31, 2013, up almost $300 million from year end 2012; |

| • | Refinanced over $500 million of debt, pushing out maturities 10 and 30 years, effectively increasing the weighted average maturity of our debt while mildly decreasing the overall cost of debt; and |

| • | Made substantive progress on key strategic initiatives centered around how and where we will compete, including executing and announcing a number of organizational structure changes, invested in markets where we see growth opportunities and divesting in markets where we don’t see the strategic advantage or growth opportunities. |

The annual incentive compensation awards for our named executive officers (other than Joseph Plumeri) were based on a combination of the Company’s performance (80% for Dominic Casserley and 60% for Michael Neborak, Stephen Hearn, Timothy Wright, Todd Jones and Victor Krauze) and individual and business unit or corporate function performance (20% for Dominic Casserley and 40% for Michael Neborak, Stephen Hearn, Timothy Wright, Todd Jones and Victor Krauze). The Company performance portion was calculated measuring organic commissions and fees growth against a target of 5.8% and adjusted EBITDA against a target of $902 million. The Compensation Committee set challenging targets to incent the Company and the named executive officers to deliver strong financial performance. Because the Company’s actual performance was close to but did not reach these targets, the portion of the annual incentive compensation awards based on Company performance produced a blended payout percentage of 89.5% of the targets. The Compensation Committee similarly set demanding individual and business unit performance goals.

17

Table of Contents

After taking into account both Company performance and individual and business unit performance based on the formula above, the annual incentive compensation awards to our named executive officers were as follows:

| • | Dominic Casserley was awarded $2,061,000, representing approximately 92% of his target payout. |

| • | Michael Neborak was awarded $540,000, representing 90% of his target payout. |

| • | Stephen Hearn was awarded £975,200 (or $1,525,213), representing 92% of his target payout. |

| • | Timothy Wright was awarded £810,950 (or $1,268,326), representing approximately 93% of his target payout. |

| • | Todd Jones was awarded $708,600, representing approximately 94% of his target payout. |

| • | Victor Krauze was awarded $826,875, representing 90% of his target payout (pro-rated to reflect change in job responsibilities). |

Joseph Plumeri’s 2013 pro-rated annual incentive compensation award was based 100% on Group financial performance. As a result, he was awarded $1,678,125, representing approximately 90% of his target payout. Mr. Plumeri resigned as Group CEO on January 6, 2013 and as Chairman of the Board on July 7, 2013.

Our current named executive officers also received time-based restricted stock units (“RSUs”), performance-based RSUs and time-based options as long-term incentive awards. The performance-based RSUs are based on three-year performance period targets in lieu of the previous one-year performance targets, designed to encourage sustained financial performance. The value of these awards cannot be fully calculated until the requisite time periods are reached, the three-year performance period has ended and performance against the targets is calculated. The grant date fair value of the awards are below, however, the named executive officer will not realize the full value of such awards if the three-year performance targets are not reached:

| • | Dominic Casserley: $5,250,000; |

| • | Michael Neborak: $1,000,000; |

| • | Stephen Hearn: $2,200,000; |

| • | Timothy Wright: $1,200,000; and |

| • | Todd Jones: $750,000. |

| 2.0 | The Company’s Named Executive Officer Compensation Program |

The Compensation Committee is responsible for establishing, implementing, and monitoring the Company’s compensation programs, philosophy, and objectives. The Company has two primary objectives in designing compensation programs for our named executive officers: (1) to attract and retain highly qualified and talented executives and professionals in the highly competitive marketplace in which the Company operates (which includes large financial services companies); and (2) to create appropriate incentives for our executives to improve their individual performance with the objective of improving the Company’s long-term performance, thereby creating value and wealth for our shareholders. We want to incent executives to make the right investments, take appropriate risks, and execute on plans to drive shareholder value. Against those objectives, we consider each named executive officer’s total compensation in the context of compensation paid to similarly-situated executives in peer group companies from which we compete for talent, the scope of the role, the individual’s level of expertise and other market factors, and the performance of the individual, his or her business unit and the Company.

18

Table of Contents

| 2.1 | Compensation Committee Consultant |

The Compensation Committee has the independent authority to hire external consultants and, accordingly, has retained Towers Watson since April 2011 to provide advice to the Compensation Committee on all matters related to the senior executives’ compensation and compensation programs. The Compensation Committee has the independent authority to terminate Towers Watson’s services at its discretion. Representatives from Towers Watson attended all of the Compensation Committee’s regularly scheduled meetings in 2013.

Towers Watson reports directly to the Compensation Committee and provides data on U.S. and U.K. executive compensation trends in the sectors in which the Company competes for senior executive talent as well as the broader market. In 2012 and 2013, Towers Watson advised the Compensation Committee on the redesign of the named executive officer compensation program and, in particular, the compensation package of Mr. Casserley, the Company’s new CEO, and certain changes to the compensation packages for the Company’s other executive officers. Towers Watson also assists with selecting appropriate peer companies and assessing non-employee director compensation. The fees paid to Towers Watson in 2013 for these services totaled $200,572.

The Compensation Committee uses the data and analysis provided by Towers Watson to better ensure that the Company’s compensation practices are consistent with the Company’s compensation philosophy and objectives for both the amount and composition of executive compensation, including that of the CEO. Based on the data and analysis provided by Towers Watson as well as information from management and outside counsel, the Compensation Committee applies business judgment in recommending compensation awards, taking into account the dynamic nature of the insurance sector internationally and the adaptability and response required by the Company’s leadership to manage significant changes that arise during the course of a year.

Before its appointment as the consultant to the Compensation Committee in 2011, Towers Watson had been providing investment advisory services for the Company’s UK pension plan and was engaged directly by the fiduciary trustees of the plan. These trustees operate independently of the Company’s management. In addition, Towers Watson also provides human resource consulting services to certain of the Company’s subsidiaries (the majority of services is provided to international subsidiaries where Towers Watson was hired by local management). The additional services provided to the Company’s significant subsidiaries totaled $1,455,928 for 2013, of which $1,210,029 related to the services provided for UK pension plan and $245,899 related to the human resource consulting services. The decision to engage Towers Watson for the human resource consulting services before 2011 was originally approved by management and since that time the Compensation Committee has reviewed and approved such services. None of the Towers Watson representatives that advise the Compensation Committee provide any other services to the Company’s subsidiaries. The Compensation Committee determined that those services, in addition to the other factors specified in the NYSE listing rules, produced no conflicts of interest.

| 2.2 | Peer Group and Market Data |

As providers of insurance brokerage and risk consultancy services, we have no direct competitors of comparable financial size in our marketplace. However, we compete for talent with brokers of all sizes, with insurance carriers, and with companies in other financial services sectors. Accordingly, to assist the Compensation Committee in judging the reasonableness of its compensation recommendations, we typically use data related to a group of peer companies in the insurance sector, some of whom do not directly operate as insurance brokers.

19

Table of Contents

The Compensation Committee reviews its peer group on an annual basis to ensure that it remains reasonable and justifiable. It seeks to avoid changes unless there is some significant rationale. In 2013, following a review by Towers Watson and subsequent discussions between the Compensation Committee, Towers Watson, and management, the Compensation Committee approved a change to its peer group. The Compensation Committee approved removing Ace Limited and The Chubb Corporation due to their significantly larger revenue and market cap size and adding (i) Allied World Assurance Company, (ii) CNA Financial Corporation, (iii) Markel Corp, (iv) PartnerRe Ltd., and (v) Towers Watson & Co. based on similar size and other business comparability criteria. Making these changes increases the peer group size to 13 companies, and positions Willis at the 50th percentile in revenue and 61st percentile in market capitalization.

The current peer group is listed below and consists of a combination of large and small insurance brokers, insurance carriers and a human resources and consulting services company:

| Insurance Brokers |

Insurance Carriers |

Human Resources and Consulting Services Company | ||

| AON plc | Allied World Assurance Company Holdings | Towers Watson & Co. | ||

| Arthur J. Gallagher & Co. | Arch Capital Group Limited | |||

| Brown & Brown Inc. | Axis Capital Holdings Limited | |||

| Jardine Lloyd Thompson Group plc | CNA Financial Corporation | |||

| Marsh & McLennan Companies, Inc. | Markel Corporation | |||

| PartnerRe Ltd. | ||||

| XL Group plc | ||||

Our executive officers are based in both the United States and the United Kingdom. The country of each executive officer’s primary location is taken into account when reviewing and determining his or her annual base salary and, particularly, benefits.

In order to attract and retain exceptional senior executives, the Compensation Committee generally sets the executive officer’s base salary at the median but evaluates the executive officer’s total compensation (defined as base salary, annual incentive compensation and long-term incentive compensation) in the context of compensation paid to similarly-situated executives in our peer group companies, considering the performance of the individual, business/functional unit, and the Company as well as the scope of the role, the individual’s level of expertise and other market factors.

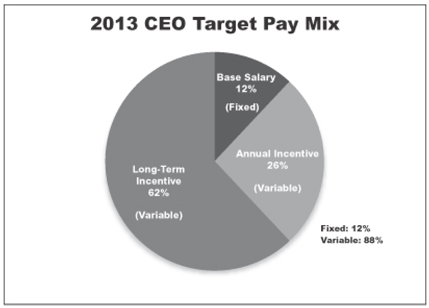

The Compensation Committee reviews each element of compensation separately, as well as the total compensation of named executive officers. Compensation differences among the named executive officers reflect their different roles, their contributions, and the different market pay relating to those roles.