Attached files

| file | filename |

|---|---|

| 8-K/A - 8-K/A - CIMPRESS plc | d720343d8ka.htm |

| EX-99.3 - EX-99.3 - CIMPRESS plc | d720343dex993.htm |

Q3

Fiscal Year 2014 Earnings Presentation, Commentary

& Financial Results Supplement

April 29, 2014

Exhibit 99.2 |

Safe

Harbor Statement 2

This presentation and the accompanying notes contain statements about our future

expectations, plans and prospects of our business that constitute

forward-looking statements for purposes of the safe harbor provisions under the Private

Securities Litigation Reform Act of 1995, including but not limited to our

financial guidance, outlook, expectations, and investment areas for the

fiscal year 2014; the anticipated effects on our business of our strategy, including our pricing

strategy, and investments; and the anticipated development of our business,

markets, and financial results in fiscal 2014 and beyond, including the

performance of the businesses we acquire or invest in. Forward-looking projections and

expectations are inherently uncertain, are based on assumptions and judgments by

management, and may turn out to be wrong. Our actual results may differ

materially from those indicated by these forward-looking statements as a result of

various important factors, including but not limited to flaws in

the assumptions and judgments upon which our projections

and guidance are based; our failure to execute our strategy; our

failure to make the investments in our business that we

plan to make or the failure of those investments to have the effects that we

expect; our failure to identify and address the causes of our revenue

weakness; our failure to acquire new customers and enter new markets, retain our current

customers, and sell more products to current and new customers; our failure to

manage the growth, changes, and complexity of our business and expand our

operations; costs and disruptions caused by acquisitions and strategic

investments; the failure of the businesses we acquire or invest in to perform as

expected; the willingness of purchasers of marketing services and products

to shop online; currency fluctuations that affect our revenues and costs, including the

impact of our currency hedging strategies; unanticipated changes

in our market, customers or business; our failure to

promote and strengthen our brand; the failure of our current and

new marketing channels to attract customers;

competitive pressures; our failure to maintain compliance with the financial

covenants in our revolving credit facility or to pay our debts when due;

costs and judgments resulting from litigation; changes in the laws and regulations or in the

interpretations of laws or regulations to which we are subject, including tax laws,

or the institution of new laws or regulations that affect our business; and

general economic conditions. You can also find other factors described in our

Form

10-Q for the fiscal quarter ended December 31, 2013 and the other documents we

periodically file with the U.S. Securities and Exchange Commission.

|

Presentation Organization & Call Details

3

Presentation Organization:

•

Q3 FY14 overview

•

Q3 FY14 operating and

financial results

•

FY14 outlook

•

Supplementary information

•

Reconciliation of GAAP to

Non-GAAP results

Live Q&A Session:

•

5:15 p.m. Eastern

•

Link from the IR section of

www.vistaprint.com

•

Hosted by:

Robert Keane

President & CEO

Ernst Teunissen

EVP & CFO |

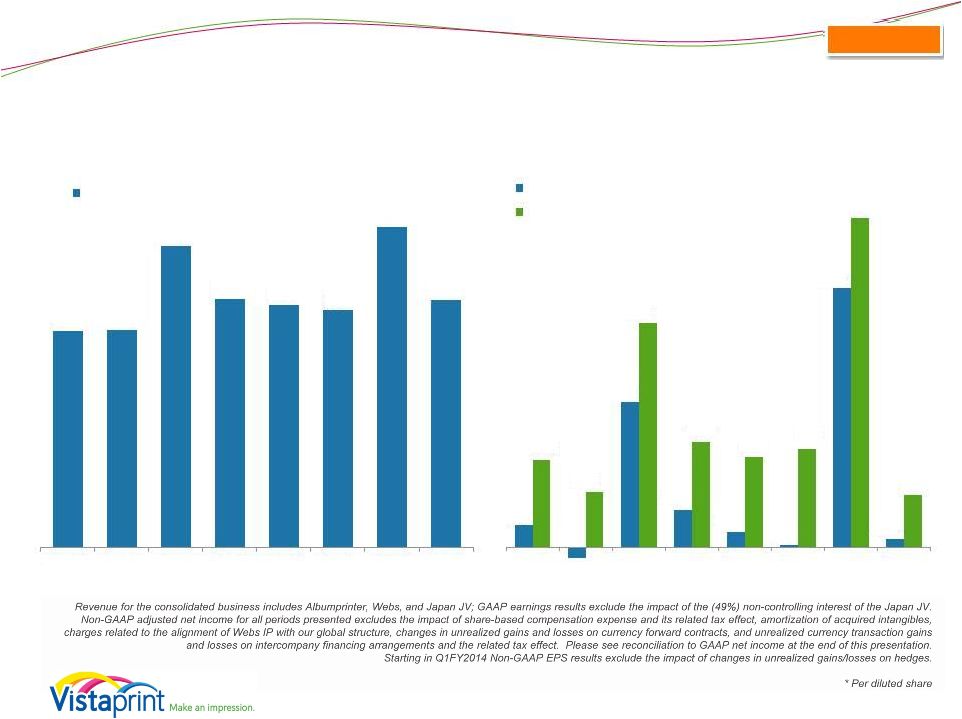

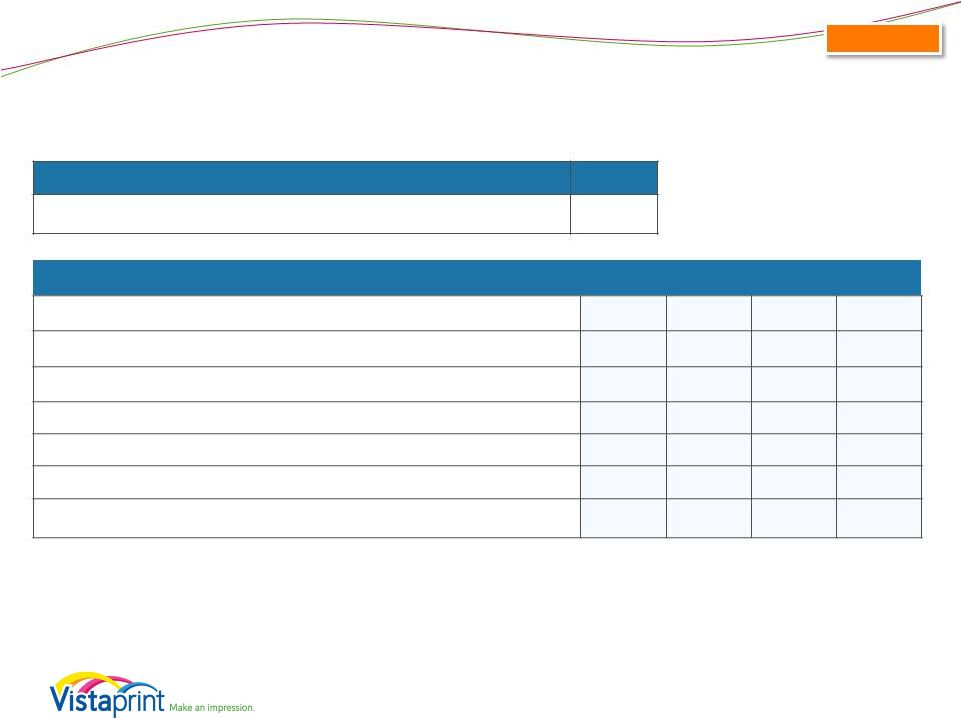

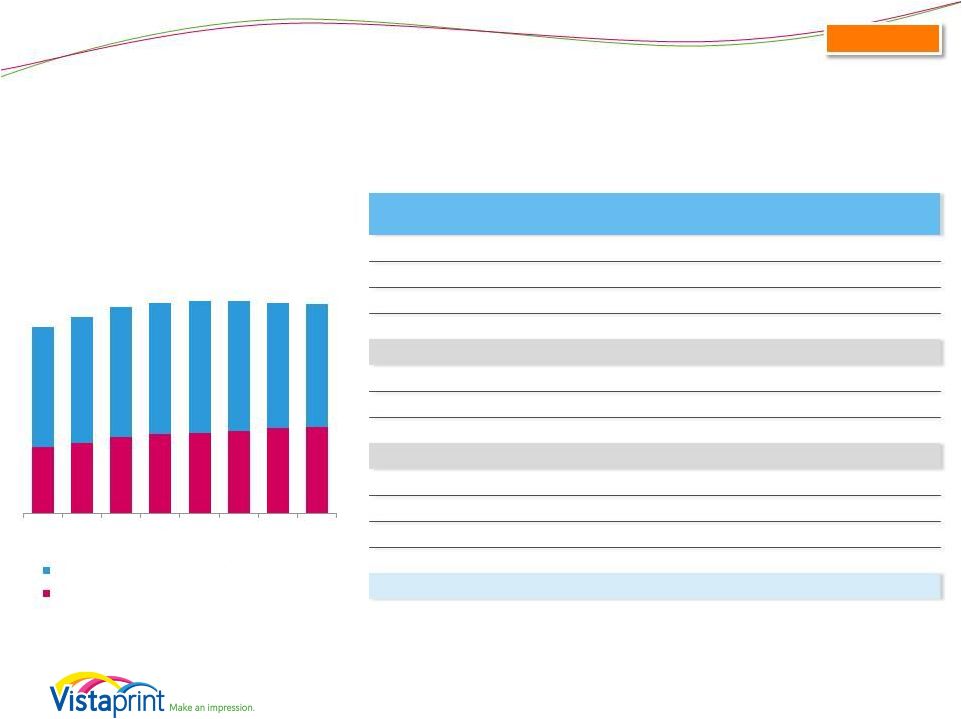

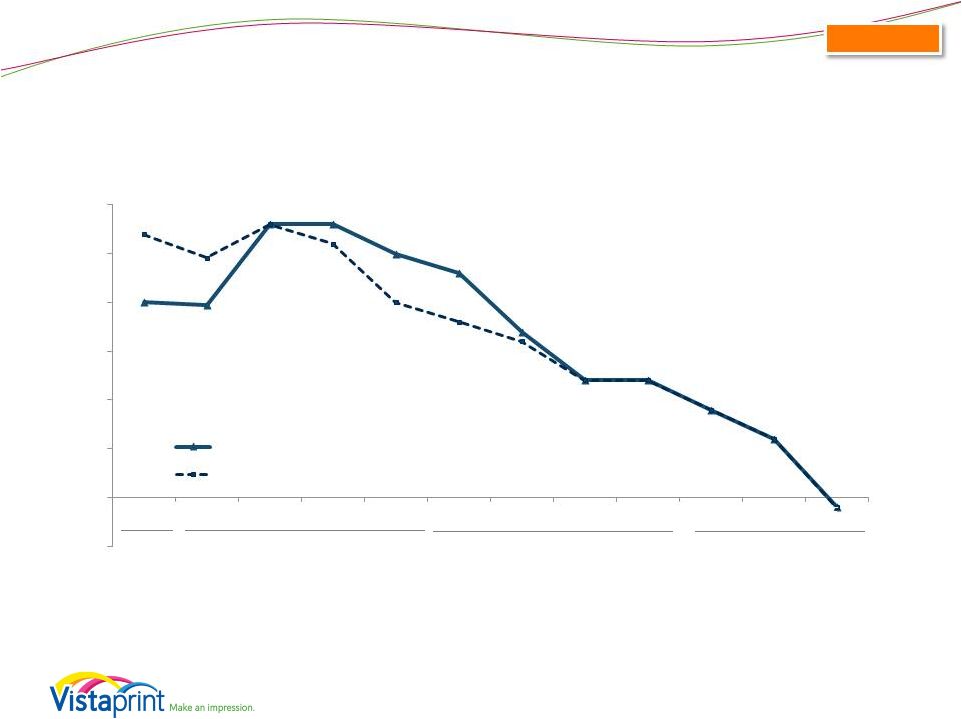

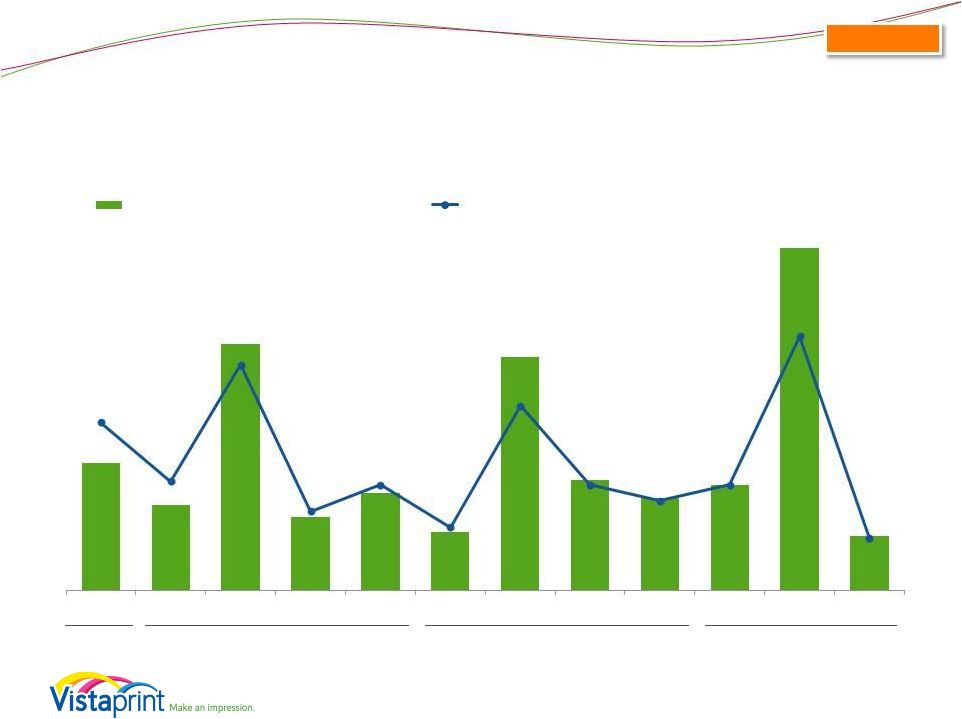

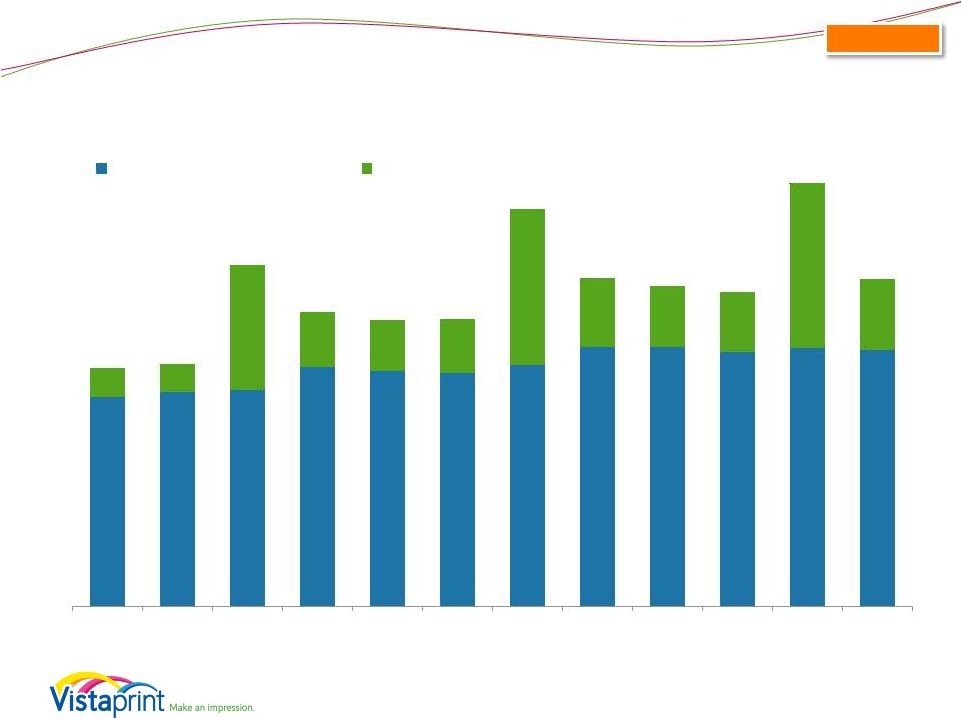

Quarterly Financial Results

$250

$251

$348

$288

$280

$275

$371

$286

Q4 FY12

Q1 FY13

Q2 FY13

Q3 FY13

Q4 FY13

Q1 FY14

Q2 FY14

Q3 FY14

Consolidated Revenue

$0.10

$(0.05)

$0.66

$0.17

$0.07

$0.01

$1.18

$0.04

$0.40

$0.25

$1.02

$0.48

$0.41

$0.45

$1.50

$0.24

Q4 FY12

Q1 FY13

Q2 FY13

Q3 FY13

Q4 FY13

Q1 FY14

Q2 FY14

Q3 FY14

GAAP EPS*

Consolidated

4

Non-GAAP EPS* |

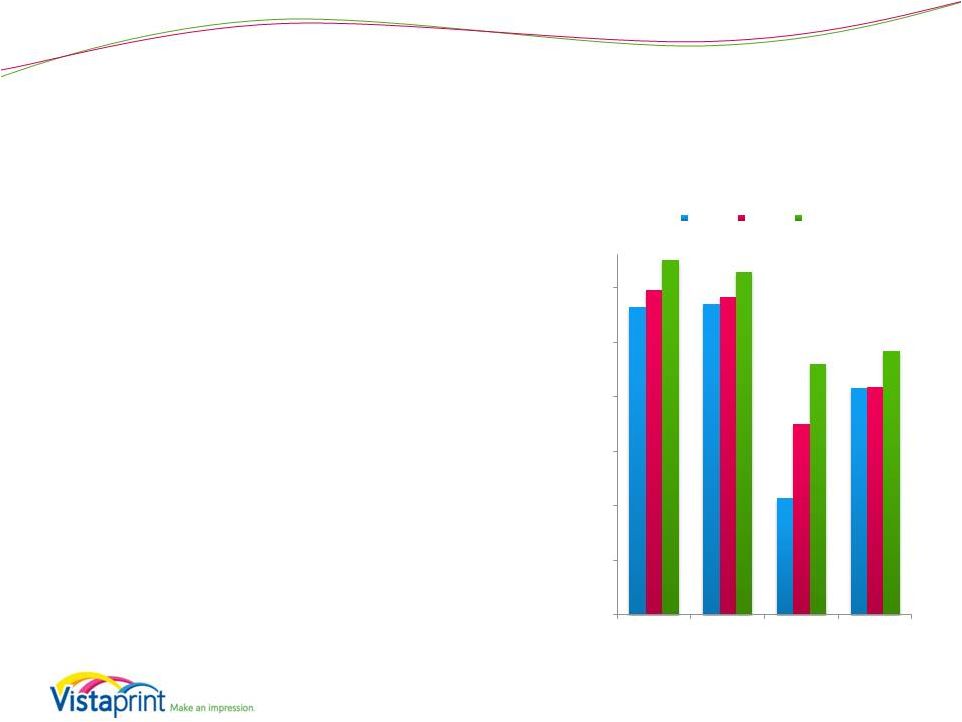

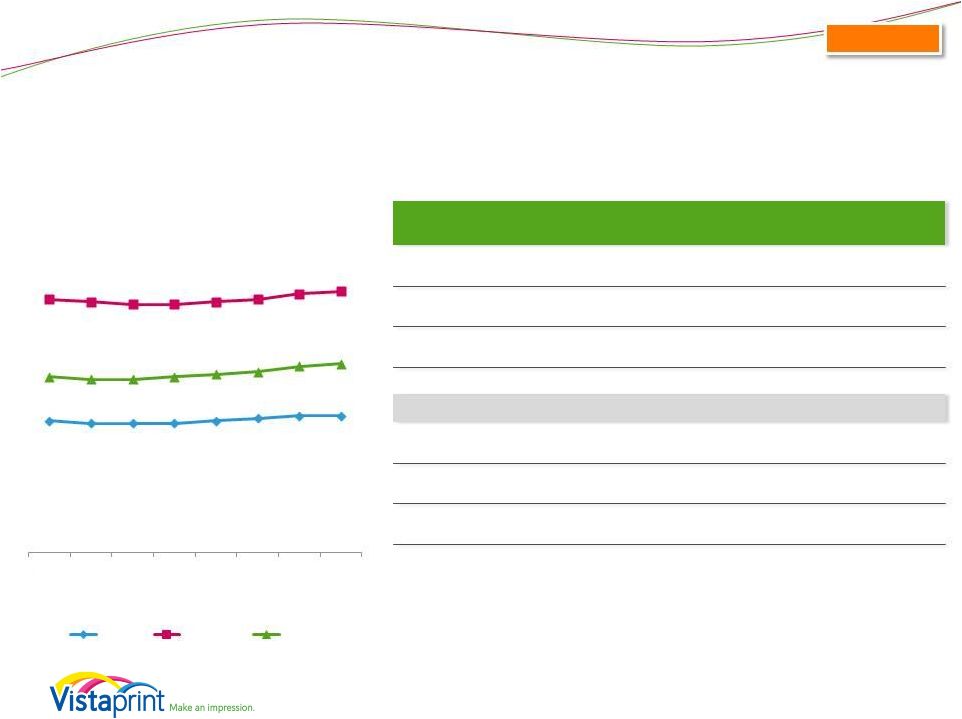

Performance Commentary

5

•

Continue to roll out significant

changes to offers and pricing:

o

US and Germany overhaul

launched early in the quarter

•

Impact was deeper than expected,

particularly in the US

o

Very weak first month, improved

trends in subsequent months

•

Achieving strong NPS improvements

o

Believe this will support a stronger

brand longer term

0%

10%

20%

30%

40%

50%

60%

Canada

USA

Germany

UK

Q3 Net Promoter Score

FY12

FY13

FY14 |

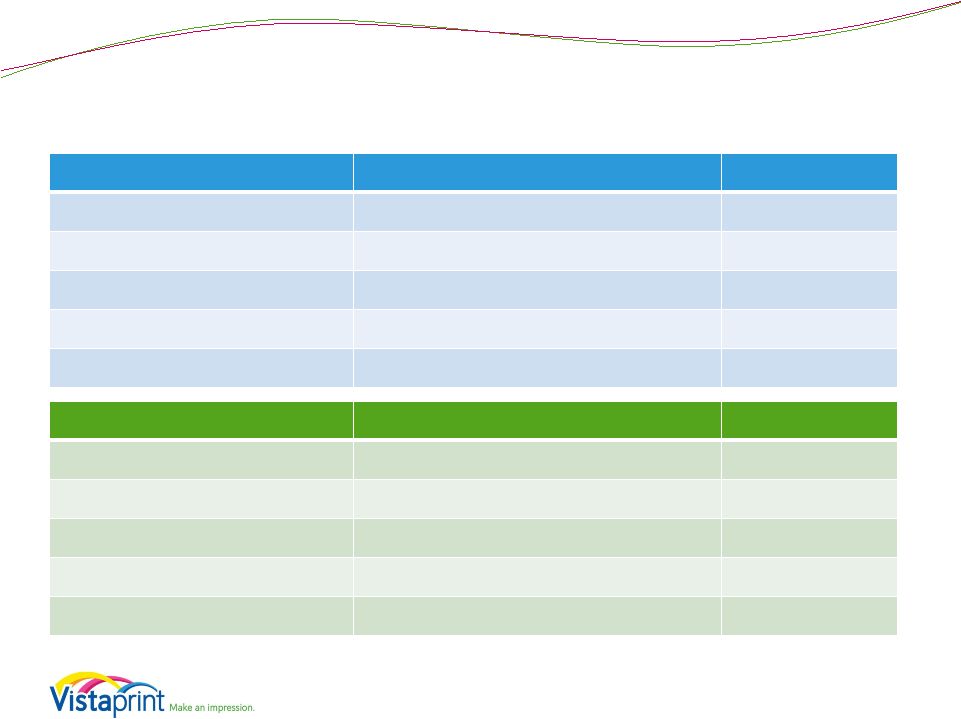

Pricing & Channel Coordination Actions

6

Action

Why do it?

Short-Term Impact

Lower list prices while lowering

discounting

•

Meet higher expectations

desire for consistent

pricing

•

Makes sales and

promotions more

authentic when they do

happen

•

Drives lower engagement in

long-standing discount

channels: users are no longer

enticed by slashed prices or

constant flash sales

•

Attracts fewer new customers

albeit with higher potential LTV

•

Higher percentage of revenue

attributable to base product

Lower and more transparent

shipping prices

•

Clarity for customers

•

Brings practices inline

with e-commerce norms

•

Lower percentage of revenue

attributable to shipping

Elimination of many fees and

upsells (e.g. uploads, proofs)

•

Reduces customer

frustration

•

Lower revenue of high margin

items

More consistent promotions

•

More consistent

experience across

channels and customer

touch points

•

Lower revenues from those

channels where deep discounts

drove volume |

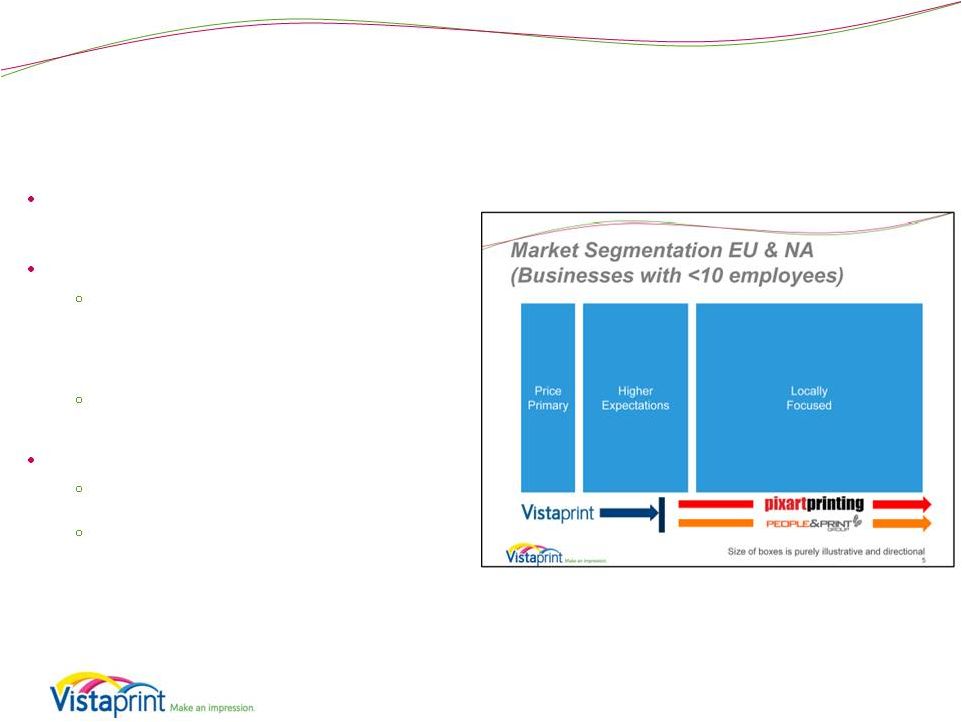

Recent Acquisitions

People & Print Group, Pixartprinting

7

Attractive standalone cash flow return

projections

Distinct front end brands

Target: graphic professionals and local

printers who in turn serve small

businesses via high touch, locally

focused service offering

Will keep customer value proposition

differentiated vs. the Vistaprint brand

Shared back-end advantages

Large scale in small quantities

Anticipate long-term cash flow

improvements due to integration into a

common, software-driven, high-

efficiency manufacturing & supply

chain system |

Geographic Expansion: Asia

8

India

•

Strong development and growth

Japan

•

Finalized joint venture

•

Own 51% of venture

o

Plus approximately 17% of the equity of

our partner Plaza Create

•

China

•

Remain committed to the market

•

o

Q4 charge of up to $14M write down of

equity investment

Next 18 months will be focused on building

local manufacturing, service and value

proposition

However, decided to dispose of our

minority investment |

Q3

FY 2014 Financial and Operating Metrics

9 |

Q3

FY 2014: Key Financial Metrics 10

*

**

Quarter Ended 03/31/2014

Nine Months Ended 03/31/2014

Revenue

•

$286.2 million

-1% y/y growth

-1% y/y constant currency growth

•

$932.1 million

5% y/y growth

5% y/y constant currency growth

GAAP Net

Income*

•

$1.4 million

•

$0.04 Diluted EPS

decrease of 77% y/y

•

$42.6 million

4.6% net margin vs. 3.1% last year

increase of 57% y/y

•

$1.24 Diluted EPS

increase of 59% y/y

Non-GAAP

Adjusted Net

Income**

•

$8.3 million

•

$0.24 Non-GAAP Diluted EPS

decrease of 50% y/y

•

$77.0 million

8.3% net margin vs. 7.0% last year

increase of 25% y/y

•

$2.20 Non-GAAP Diluted EPS

increase of 26% y/y

Consolidated

0.5% net margin vs. 2.0% last year

decrease of 77% y/y

2.9% net margin vs. 5.9% last year

decrease of 51% y/y

GAAP net income attributable to Vistaprint N.V.

Non-GAAP adjusted net income and non-GAAP adjusted EPS exclude share-based compensation

expense and its related tax effect, amortization of acquired intangible assets, charges

related to the alignment of Webs IP with our global operations, changes in unrealized gains

and losses on currency forward contracts, and unrealized currency transaction gains and losses on intercompany

financing arrangements and the related tax effect. Please see reconciliation to GAAP net income

(loss) and EPS at the end of this presentation.

|

Cash Flow & ROIC Highlights

Quarterly cash flows and investments (in millions)

Q3FY14

Q3FY13

YTD FY14

YTD FY13

Cash flow from operations

$3.1

$8.1

$98.0

$103.3

Free cash flow*

$(11.7)

$(5.5)

$36.5

$30.8

Capital expenditures

$11.8

$11.2

$54.0M

$66.5

as % of revenue

4.1%

3.9%

5.8%

7.5%

Trailing Twelve Month Return on Invested Capital** (GAAP)

14%

8%

NA

NA

Trailing Twelve Month Return on Invested Capital** (Non-GAAP)

23%

18%

NA

NA

*

**

ROIC = NOPAT / (Debt + Equity –

Excess Cash)

Net operating profit after taxes (NOPAT)

Excess cash is cash and investments of 5% of last twelve month revenues

Operating leases have not been converted to debt

Non-GAAP TTM ROIC excludes share-based compensation expense and its

related tax effect, amortization of acquired intangibles, charges related to

the alignment of Webs IP with our global operations, changes in unrealized gains

and losses on currency forward contracts, and unrealized currency

transaction gains and losses on intercompany financing arrangements and the

related tax effect Excess cash definition updated in period ending

03/31/2013 and for prior periods. 11

Consolidated

Balance sheet (in millions, as of March 31, 2014)

Cash and cash equivalents

$46.5

FCF = Cash Flow from Operations – Capital Expenditures – Purchases of Intangible assets not

related to acquisitions – Capitalized Software Expenses |

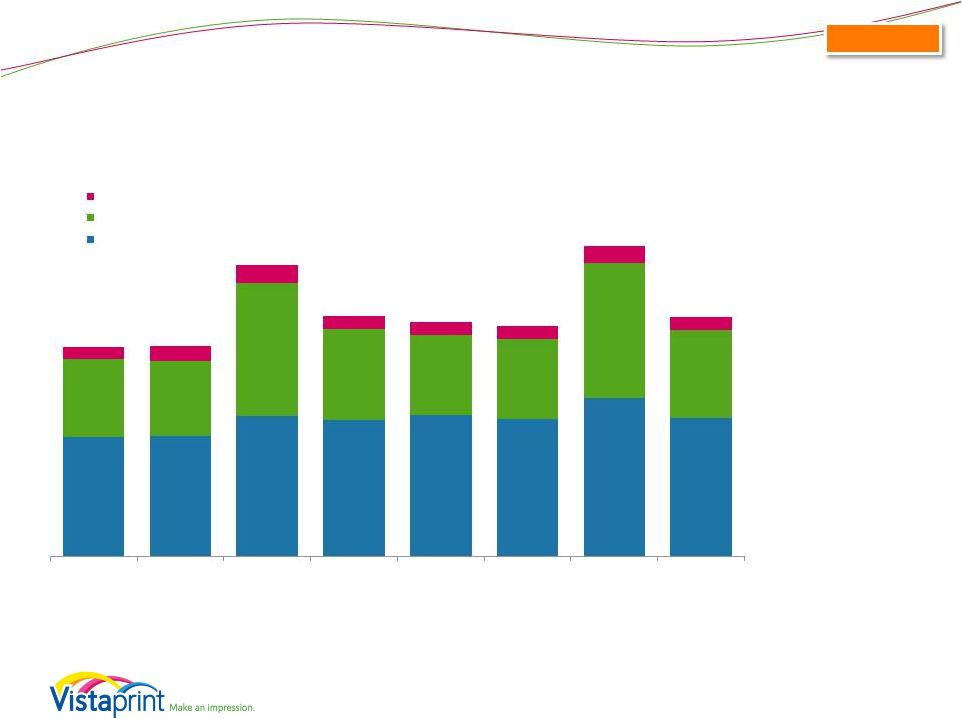

Geographic Segment Revenue -

Quarterly

(millions)

North America:

58% of total revenue

2% y/y growth

3% y/y constant currency

growth

Europe:

36% of total revenue

-4% y/y growth

-7% y/y constant currency

growth

Asia Pacific:

6% of total revenue

-3% y/y growth

10% y/y constant currency

growth

Q3 FY2014

12

Consolidated

$143.4

$144.2

$167.5

$163.0

$169.6

$164.8

$189.4

$166.1

$92.0

$89.7

$159.3

$108.3

$94.9

$94.7

$161.0

$104.2

$15.1

$17.5

$21.5

$16.4

$15.6

$15.6

$20.3

$15.9

Q4 FY12

Q1 FY13

Q2 FY13

Q3 FY13

Q4 FY13

Q1 FY14

Q2 FY14

Q3 FY14

Asia

-Pacific

Europe

North America

Revenue results for the consolidated business, including Albumprinter and Webs results since

respective acquisition dates. All Albumprinter revenue included in European segment. All

Webs revenue included in North American segment. All Japan JV revenue included in Asia-Pacific.

Constant-currency revenue growth is estimated by translating all non-U.S. dollar denominated

revenue generated in the current period using the prior year period’s average exchange

rate for each currency to the U.S. dollar and excludes the impact of gains and losses on effective currency hedges

recognized in revenue for applicable periods.

Please see reconciliation to reported revenue growth rates at the end of this presentation.

|

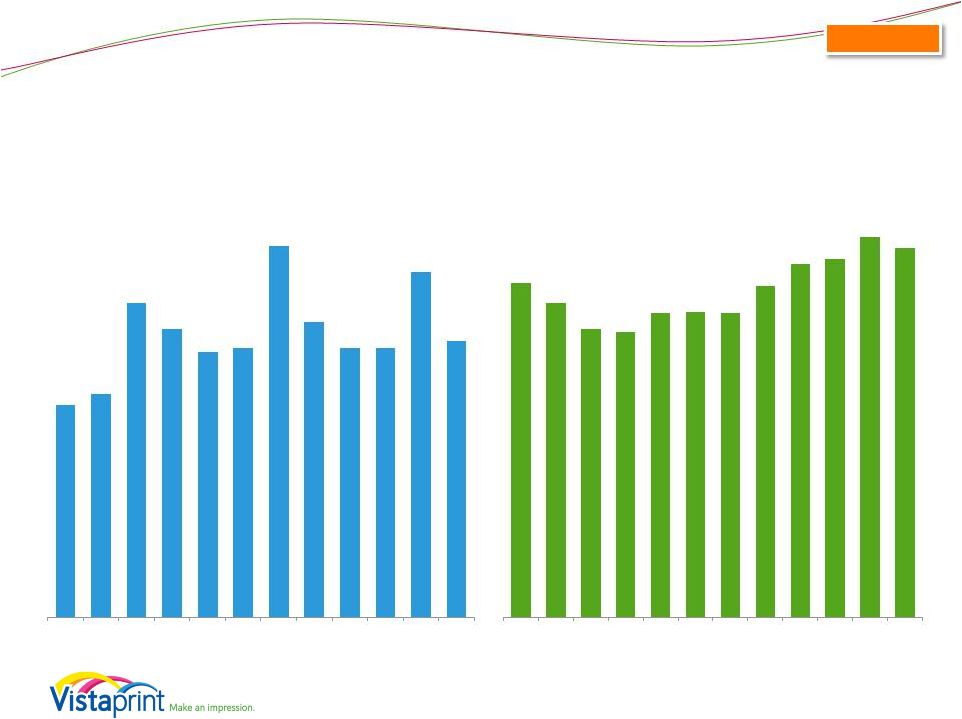

Operational Metrics

(Includes Albumprinter and Webs)

13

Consolidated

*Albumprinter and Webs included starting Q3FY12

Also starting in the same period, a minor calculation methodology change was made

in order to accommodate the consolidation of metrics.

5.6

5.9

8.3

7.6

7.0

7.1

9.8

7.8

7.1

7.1

9.1

7.3

Orders (M)

Q4

FY11

Q1

FY12

Q2

FY12

Q3

FY12*

Q4

FY12

Q1

FY13

Q2

FY13

Q3

FY13

Q4

FY13

Q1

FY14

Q2

FY14

Q3

FY14

$37.75

$36.38

$34.61

$34.43

$35.69

$35.79

$35.72

$37.56

$39.08

$39.40

$40.92

$40.14

Q4

FY11

Q1

FY12

Q2

FY12

Q3

FY12*

Q4

FY12

Q1

FY13

Q2

FY13

Q3

FY13

Q4

FY13

Q1

FY14

Q2

FY14

Q3

FY14

Average Order Value |

Operational Metrics

(Includes Albumprinter and Webs)

14

*Albumprinter and Webs included starting Q3FY12

Also starting in the same period, a minor calculation methodology change was made

in order to accommodate the consolidation of metrics.

New Customers

(million)

Implied COCA

Advertising as

% of Revenue

1.8

1.9

2.9

2.6

2.3

2.3

3.3

2.6

2.3

2.2

2.9

2.4

0.0

0.5

1.0

1.5

2.0

2.5

3.0

3.5

$26

$27

$26

$25

$25

$28

$28

$27

$26

$29

$28

$27

0 $

5 $

10 $

15 $

20 $

25 $

30 $

35 $

23%

24%

26%

25%

23%

26%

27%

24%

21%

23%

22%

23%

0%

5%

10%

15%

20%

25%

30%

35%

Consolidated |

Historical Revenue Driver Metrics

(Includes Albumprinter and Webs)

15

16.9

*trailing twelve month at period end

16.8

15.0

15.8

16.6

17.0

17.1

16.9

5.4

5.7

6.1

6.4

6.5

6.7

6.9

7.0

9.6

10.1

10.5

10.5

10.5

10.4

10.0

9.8

Q4

FY12

Q1

FY13

Q2

FY13

Q3

FY13

Q4

FY13

Q1

FY14

Q2

FY14

Q3

FY14

TTM* Unique Customers (M)

New Customers Aquired in Period

Customers Repeating from Prior Periods

Q4

FY12

Q1

FY13

Q2

FY13

Q3

FY13

Q4

FY13

Q1

FY14

Q2

FY14

Q3

FY14

TTM Unique Customers (M)

15.0

15.8

16.6

16.9

17.0

17.1

16.9

16.8

TTM New

Customers (M)

9.6

10.1

10.5

10.5

10.5

10.4

10.0

9.8

TTM Repeating Customers (M)

5.4

5.7

6.1

6.4

6.5

6.7

6.9

7.0

As % of Unique Customers

TTM New Customers

64%

64%

63%

62%

62%

61%

59%

58%

TTM Repeating Customers

36%

36%

37%

38%

38%

39%

41%

42%

Y/Y

Growth

TTM Unique Customers

32%

33%

29%

19%

13%

8%

2%

-1%

TTM New

Customers

30%

31%

25%

15%

9%

3%

-5%

-7%

TTM Repeating Customers

34%

35%

37%

25%

20%

18%

13%

9%

Implied

Retention**

47%

48%

48%

45%

43%

42%

42%

41%

**TTM repeating customers as % of year-ago unique customers

Starting in

Q3

FY12, impact of Albumprinter and Webs has been included.

Consolidated |

Historical Revenue Driver Metrics

(Includes Albumprinter and Webs)

16

Average Customer Bookings:

*trailing twelve month at period end

$51

$50

$50

$50

$51

$52

$53

$53

$98

$97

$96

$96

$97

$98

$100

$101

$68

$67

$67

$68

$69

$70

$72

$73

Q4

FY12

Q1

FY13

Q2

FY13

Q3

FY13

Q4

FY13

Q1

FY14

Q2

FY14

Q3

FY14

Average TTM* Bookings Per Unique

Customer (USD)

New

Repeat

Total

Q4

FY12

Q1

FY13

Q2

FY13

Q3

FY13

Q4

FY13

Q1

FY14

Q2

FY14

Q3

FY14

Average

TTM Bookings per

Unique Customer

$68

$67

$67

$68

$69

$70

$72

$73

Average TTM Bookings per

New Customer

$51

$50

$50

$50

$51

$52

$53

$53

Average TTM Bookings per

Repeat

Customer

$98

$97

$96

$96

$97

$98

$100

$101

Y/Y

Growth

Average

TTM Bookings per

Unique

Customer

-6%

-8%

-6%

-1%

1%

4%

7%

7%

Average TTM Bookings per

New Customer

-7%

-9%

-6%

-2%

0%

4%

6%

6%

Average TTM Bookings per

Repeat Customer

-2%

-5%

-4%

-3%

-1%

1%

4%

5%

Starting in

Q3

FY12, impact of Albumprinter and Webs has been included.

Consolidated |

Looking Ahead

17 |

FY

2014 Outlook Commentary (Revenue) 18

Revenue

Reason for Change

Amount

Prior Guidance Midpoint

-

$1250M

Operational outlook lowered

~($27)M +/-

Currency impact

negligible

Revenue from acquisitions

~$37M +/-

New Guidance Midpoint

$1260M |

FY

2014 Outlook Commentary (EPS) 19

GAAP EPS

Reason for Change

Amount

Prior Guidance Midpoint

-

$1.68

Operational outlook change

~($0.03) +/-

Dilution from acquisitions

~($0.16) +/-

Write-off of minority investment

~($0.41) +/-

New Guidance Midpoint

$1.08

Non-GAAP EPS

Reason for Change

Amount

Prior Guidance Midpoint

-

$2.81

Operational outlook change

~($0.03) +/-

Dilution from acquisitions

negligible

Write-off of minority investment

excluded

New Guidance Midpoint

$2.78 |

Revenue and EPS Guidance*

(as of January 29, 2014)

FY14

ending 06/30/2014

Revenue

$1,250 -

$1,270

Revenue growth from FY 2013 period

7% -

9%

Constant currency revenue growth estimate

7% -

9%

Constant currency revenue growth estimate excluding acquisitions

4% -

6%

GAAP EPS

$1.00 -

$1.15

EPS growth from FY 2013 period

18% -

35%

GAAP share count

34.5 million

FY14

ending 06/30/2014

Non-GAAP adjusted EPS

$2.70 -

$2.85

EPS growth from FY 2013 period

26% –

33%

Non-GAAP share count

35.0 million

Non-GAAP exclusions

$59.4

* Millions, except share and per share amounts and as noted

20

Consolidated

The Company is providing the following assumptions to facilitate non-GAAP adjusted net income per

diluted share comparisons that exclude share-based compensation related expenses,

amortization of acquired intangible assets, tax charges related to the alignment of IP with our global operations, changes in

unrealized gains and losses on currency forward contracts, unrealized currency transaction gains and

losses on intercompany financing arrangements, and the expected charge for the disposal of our

minority investment in China: |

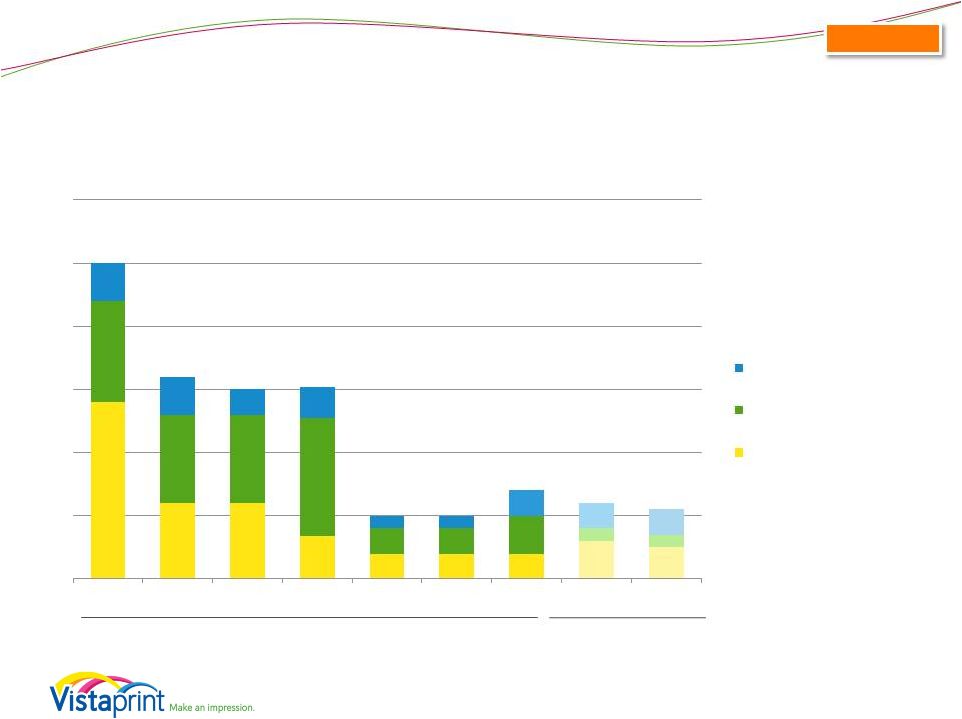

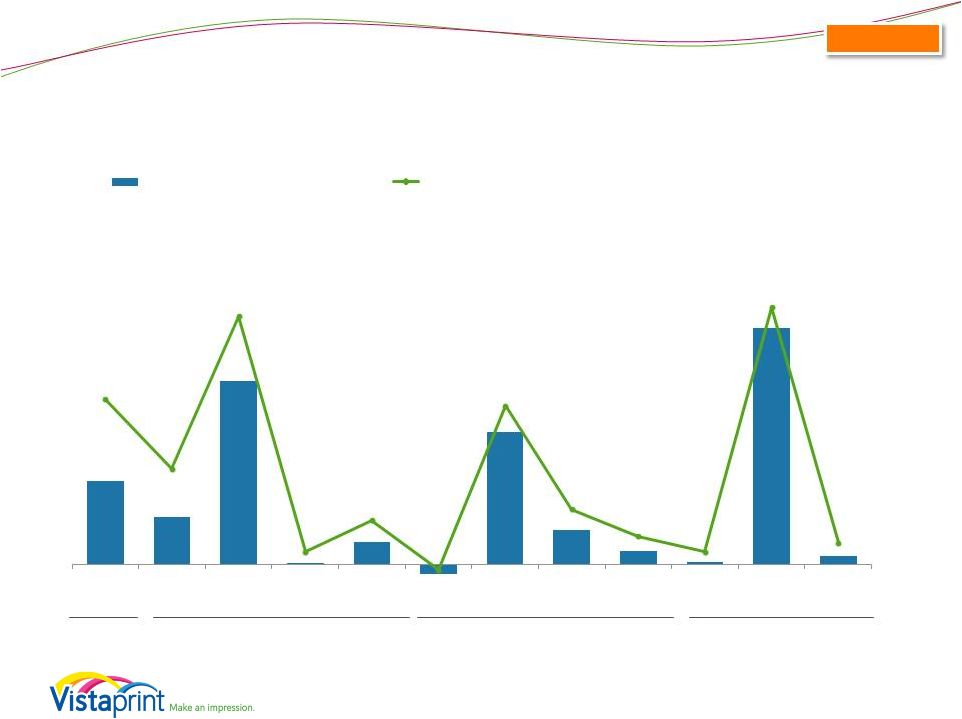

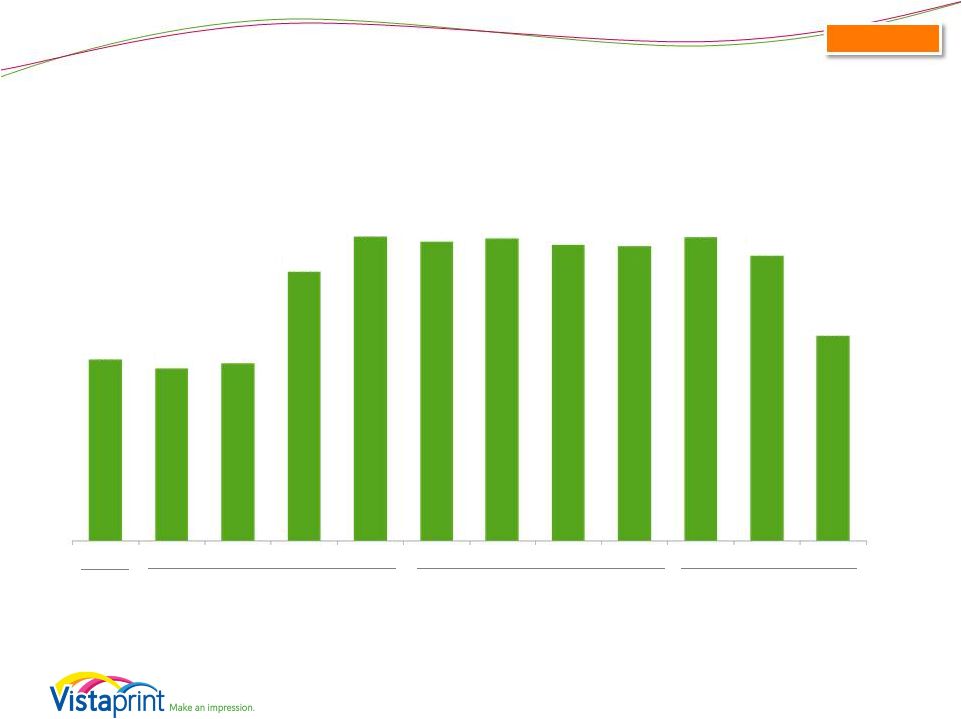

Capital Expenditures Guidance

(as of April 29, 2014)

Expressed as percent of revenue

FY 2014 Guidance:

•

$70M -

$80M

•

Actuals

Guidance

21

Consolidated

$63M

$63M

$76M

$80M

$70M

$101M

$37M

$46M

$79M

14%

6%

6%

3%

2%

2%

2%

3%

3%

8%

7%

7%

9%

2%

2%

3%

1%

1%

3%

3%

2%

3%

1%

1%

2%

2%

2%

FY 07

FY 08

FY 09

FY 10

FY 11

FY 12

FY 13

FY 14-High

FY 14-Low

25%

16%

15%

5%

6%

15%

5%

6%

7%

Other

Land and Facilities

Manufacturing &

Automation Equipment

~6% of revenue

guidance midpoint |

Summary

•

Focus: strategic initiatives and operational implementation

•

Patient with our slower revenue growth

•

Commitment to:

o

Cash flow return-based investment decisions

o

Investing for long term competitive advantage

o

Belief in the opportunity for

•

Organic growth of revenue

•

Cash flow per share

22 |

Q&A Session

Please go to the

Investor Relations section of www.vistaprint.com

for the live Q&A call at

5:15 pm EDT on April 29, 2014 |

Q3

Fiscal Year 2014 Financial and Operating Results Supplement

|

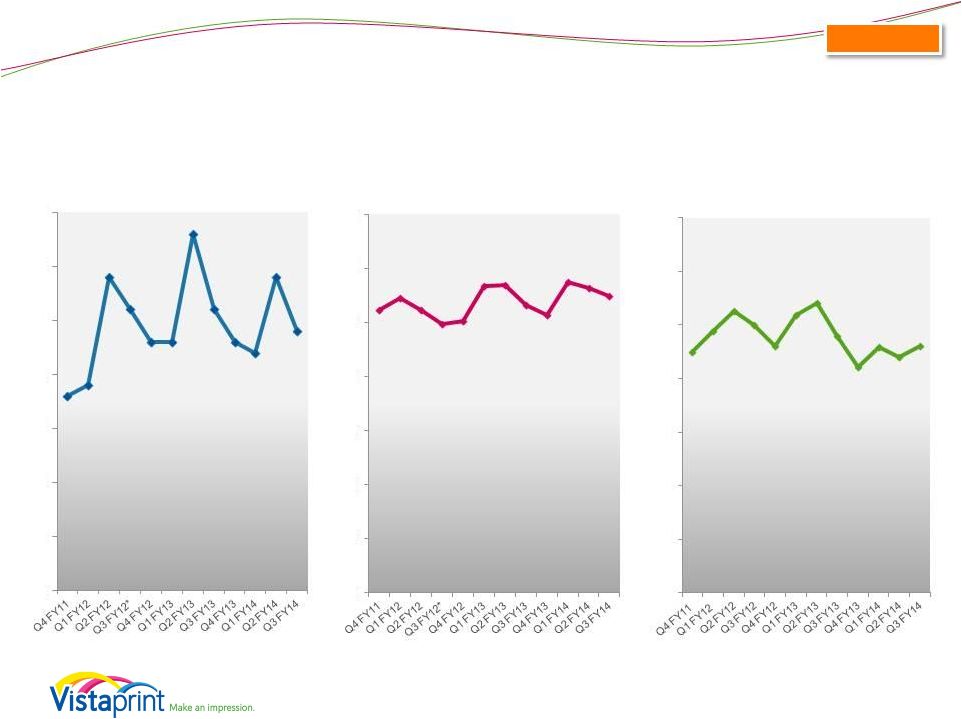

Total Company Growth Rates*

*Starting in Q2FY2012, revenue from acquired companies included.

Please see reconciliation to reported revenue growth rates at the end of this

presentation. -1%

reported

-1%

constant-

currency

25

22% constant-

currency growth

FY11

FY12

25% constant-currency growth

FY13

16% constant-currency growth

Consolidated

YTD FY14

5% constant-currency growth

-5%

0%

5%

10%

15%

20%

25%

30%

Q4 FY11

Q1 FY12

Q2 FY12*

Q3 FY12

Q4 FY12

Q1 FY13

Q2 FY13

Q3 FY13

Q4 FY13

Q1 FY14

Q2 FY14

Q3 FY14

Constant-Currency

Reported

Note: Constant-currency revenue growth is estimated by translating all non-U.S. dollar

denominated revenue generated in the current period using the prior year period’s average

exchange rate for each currency to the U.S. dollar and excludes the impact of gains and losses

on effective currency hedges recognized in revenue for applicable periods. |

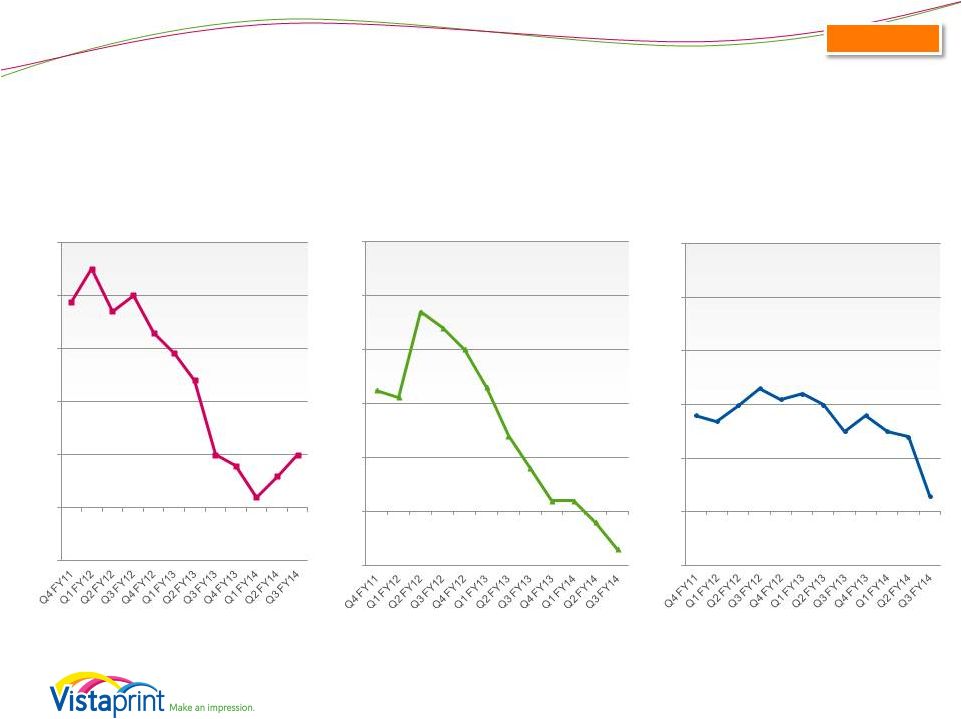

Segment Revenue Growth Rates*

Constant Currency

26

*Starting in Q2FY2012, revenue from acquired companies included.

Please see reconciliation to reported revenue growth rates at the end of this

presentation. Consolidated

Note: Constant-currency revenue growth is estimated by translating all non-U.S. dollar

denominated revenue generated in the current period using the prior year period’s

average exchange rate for each currency to the U.S. dollar and excludes the impact of gains and

losses on effective currency hedges recognized in revenue for applicable periods. 39%

45%

37%

40%

33%

29%

24%

10%

8%

2%

6%

10%

-10%

0%

10%

20%

30%

40%

50%

APAC

22%

21%

37%

34%

30%

23%

14%

8%

2%

2%

-2%

-7%

-10%

0%

10%

20%

30%

40%

50%

Europe

18%

17%

20%

23%

21%

22%

20%

15%

18%

15%

14%

3%

-10%

0%

10%

20%

30%

40%

50%

North America |

Gross Margin and Gross Profit

27

FY11 64.8%

FY12 65.2%

Consolidated

FY13 65.7%

YTD FY14 65.9%

$133

$134

$200

$169

$162

$163

$234

$189

$181

$179

$250

$185

63.9%

63.2%

66.8%

65.5%

64.6%

65.0%

67.2%

65.5%

64.6%

65.2%

67.4%

64.7%

Q4 FY11

Q1 FY12

Q2 FY12

Q3 FY12

Q4 FY12

Q1 FY13

Q2 FY13

Q3 FY13

Q4 FY13

Q1 FY14

Q2 FY14

Q3 FY14

Gross Profit (millions)

GM % |

GAAP Net Income (Loss) and Net Margin

28

FY12 $44

Consolidated

FY13 $29

YTD FY14 $43

FY11 $82

$14

$8

$32

$(2)

$23

$6

3.8%

10.6%

0.1%

1.5%

-0.7%

6.6%

2.0%

0.8%

0.1%

11.0%

0.5%

-

Q4 FY11

Q1 FY12

Q2 FY12

Q3 FY12

Q1 FY13

Q2 FY13

Q3 FY13

Q1 FY14

Q2 FY14

GAAP Net Income (loss), in millions

GAAP Net Margin

6.9%

$41

$4

$1

$0

$2

$0

Q4 FY12

Q4 FY13

Q3 FY14 |

Non-GAAP Adjusted Net Income*

and Non-GAAP Adjusted Net Margin

*Non-GAAP adjusted net income for all periods presented excludes the impact of

share-based compensation expense and its related tax effect,

amortization of acquired intangibles, charges related to the alignment of Webs IP with our global structure,

changes in unrealized gains and losses on currency forward contracts, and

unrealized currency transaction gains and losses on intercompany financing

arrangements and the related tax effect. Please see reconciliation to GAAP net income at the end of this

presentation.

29

FY11 $105

FY12 $77

FY13 $76

YTD FY14 $77

$20

$13

$38

$11

$15

$9

$36

$17

$14

$16

$53

$8

9.4%

6.1%

12.6%

4.4%

5.9%

3.5%

10.3%

5.9%

5.9%

14.2%

2.9%

Q4 FY11

Q1 FY12

Q2 FY12

Q3 FY12

Q4 FY12

Q1 FY13

Q2 FY13

Q3 FY13

Q4 FY13

Q1 FY14

Q2 FY14

Q3 FY14

Non-GAAP Adjusted Net Income (millions)

Non-GAAP Adjusted Net Margin

5.0%

Consolidated |

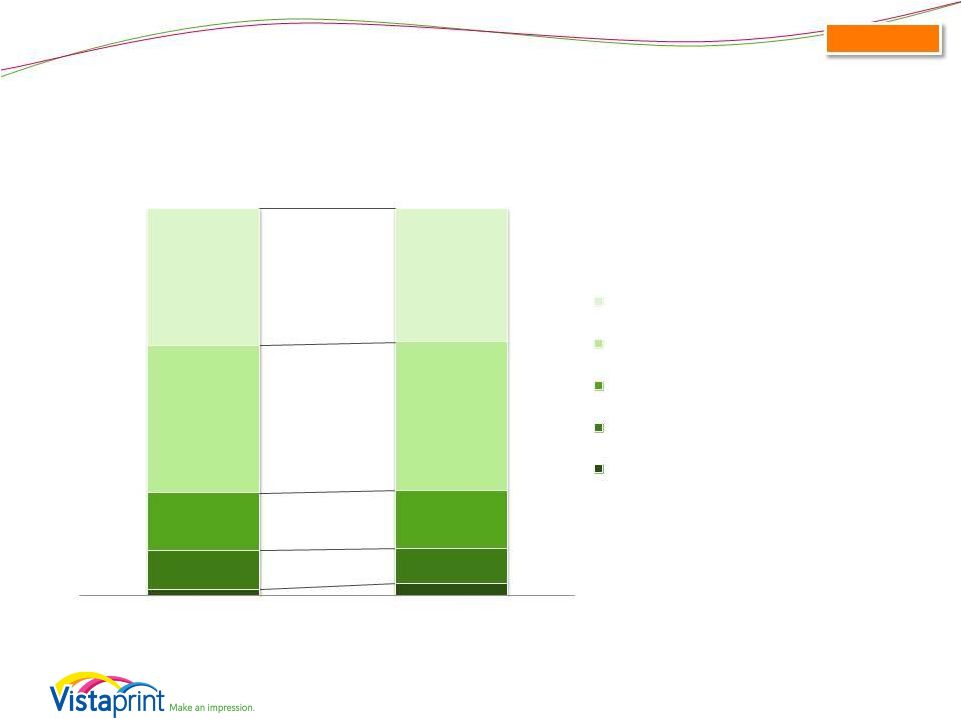

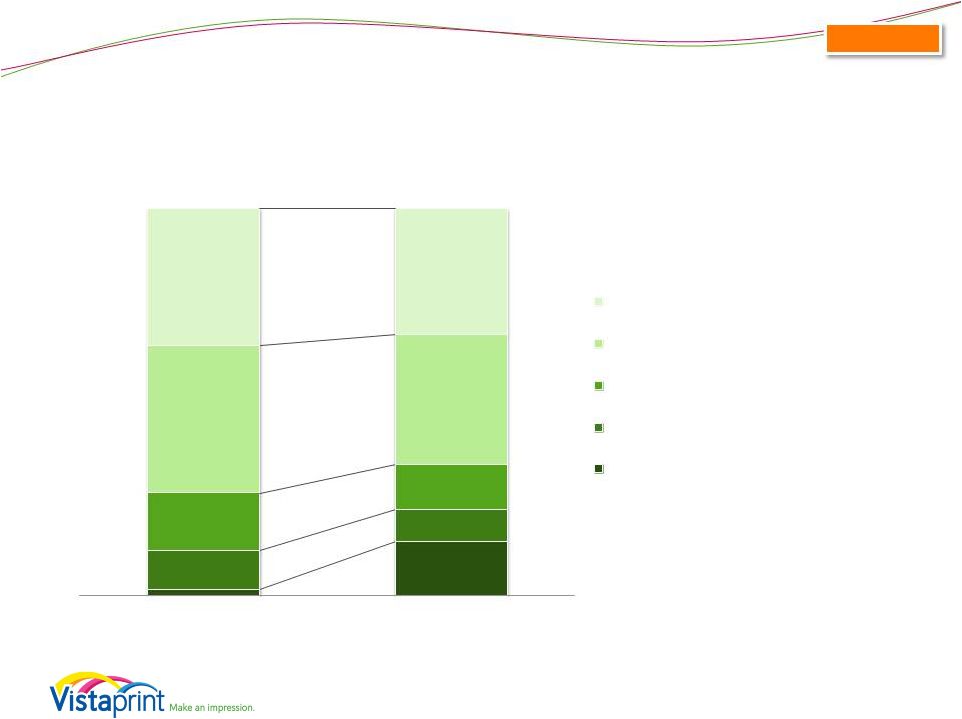

Q3

Income Statement Comparison to Prior Year (as a percentage of revenue)

30

Consolidated

1.8%

3.4%

10.0%

9.0%

14.8%

14.9%

38.1%

38.2%

35.3%

34.5%

Q3 FY2014

Q3 FY2013

Cost of revenue

Marketing and selling

Technology and development

General and administrative

Income from operations |

Q3

Income Statement Comparison to Prior Quarter (as a percentage of

revenue) 31

Consolidated

1.8%

14.2%

10.0%

8.2%

14.8%

11.5%

38.1%

33.5%

35.3%

32.6%

Q3 FY2014

Q2 FY2014

Cost of revenue

Marketing and selling

Technology and development

General and administrative

Income from operations |

Share-Based Compensation* (millions)

* Share-based compensation (SBC) expense includes SBC-related tax

adjustment. 32

FY11 $22.4

FY12 $26.1

Consolidated

FY13 $33.7

YTD FY14 $22.5

$5.1

$4.9

$5.0

$7.6

$8.6

$8.4

$8.5

$8.4

$8.3

$8.6

$8.1

$5.8

Q4 FY11

Q1 FY12

Q2 FY12

Q3 FY12

Q4 FY12

Q1 FY13

Q2 FY13

Q3 FY13

Q4 FY13

Q1 FY14

Q2 FY14

Q3 FY14 |

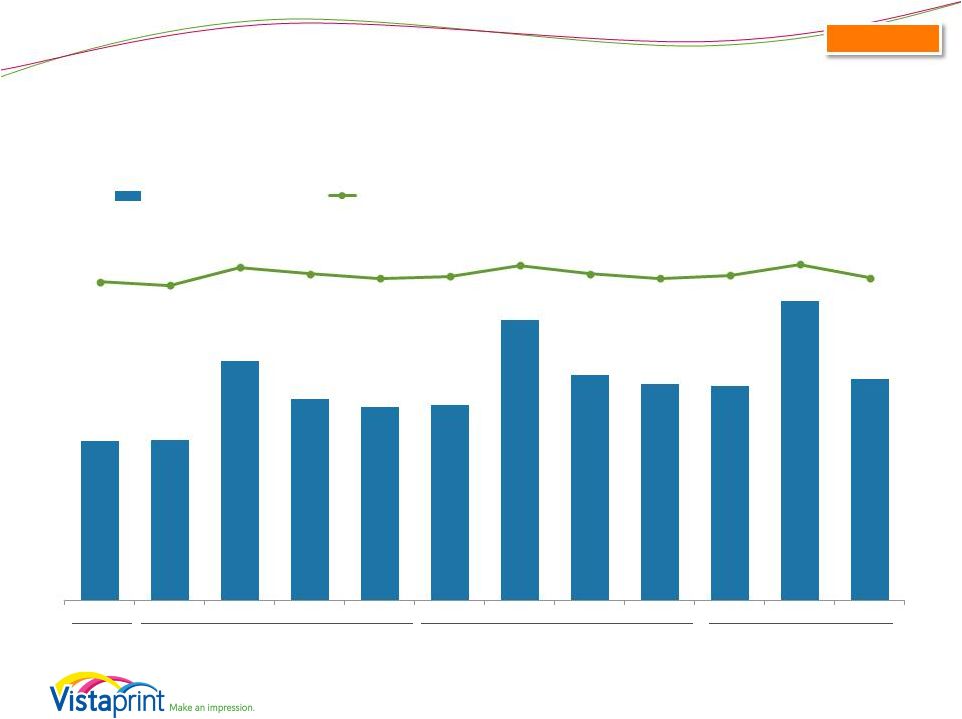

Revenue Seasonality

(Includes Albumprinter and Webs as of the dates of acquisition)

* Home and family revenue is calculated using a product format-based approach;

all Albumprinter revenue is included in home and family and all Webs

revenue is included in Small business marketing 33

Consolidated

$209

$212

$300

$258

$250

$251

$348

$288

$280

$275

$371

$286

Q4 FY11

Q1 FY12

Q2 FY12

Q3 FY12

Q4 FY12

Q1 FY13

Q2 FY13

Q3 FY13

Q4 FY13

Q1 FY14

Q2 FY14

Q3 FY14

Small Business Marketing*

Home and Family* |

Balance Sheet Highlights

Balance Sheet highlights, in millions, at period end

03/31/2014

12/31/13

09/30/2013

06/30/13

03/31/13

Total assets

$672.0

$674.6

$638.7

$601.6

$616.4

Cash and cash equivalents

$46.5

$62.3

$64.7

$50.1

$51.3

Total current assets

$126.0

$135.5

$121.8

$100.2

$104.4

Goodwill and intangible assets

$169.2

$171.6

$171.5

$171.2

$174.3

Total liabilities

$393.9

$414.4

$432.0

$412.0

$414.7

Current liabilities

$177.4

$197.9

$144.3

$155.0

$154.0

Long-term debt

$185.6

$189.3

$262.5

$230.0

$229.0

Shareholders’

Equity

$272.4

$260.3

$206.7

$189.6

$201.7

Treasury shares (in millions)

10.8

10.9

11.0

11.3

10.9

34

Consolidated |

Total Debt as of March 31, 2014

Availability under our credit facility ($ millions)*

03/31/14

Pro Forma for

Acquisitions

(approximate)

Aggregate loan commitments

798.0

798.0

Outstanding borrowings

(202.0)

(434.8)

Remaining amount

596.0

363.2

Limitations to borrowing due to debt covenants and other

obligations*

(294.6)

(213.2)

Amount available for borrowing as of March 31, 2014

301.4

150.0

35

* Our borrowing ability can be limited by our debt covenants each quarter. These

covenants may limit our borrowing capacity depending on our leverage, other

indebtedness, such as installment obligations and letters of credit, and other factors that are outlined in our credit

agreement filed as an exhibit in our Form 8-Ks filed on February 13, 2013 and

January 22, 2014. Consolidated

•

Aggregate loan commitments of $798.0M •

Interest rate of LIBOR plus 1.50% - 2.0%, depending on leverage •

Currently in compliance with all covenants. Key financial covenants are: o Total leverage ratio not to exceed 3.25x TTM EBITDA (reducing

to 3.0x on 3/31/15).

o

Interest coverage ratio of at least 3.0x TTM EBITDA.

•

Purchases of our ordinary shares, payments of dividends, and mergers and acquisitions are subject to

more restrictive consolidated leverage ratio thresholds than those listed above when calculated

on a proforma basis in certain scenarios. Also our credit agreement limits the amount of

purchases of our ordinary shares, payments of dividends, mergers and acquisitions, investments

in joint ventures or minority interests, and consolidated capital expenditures that we may make.

These limitations can include annual limits that vary from year-to-year and aggregate limits

over the term of the credit facility. Therefore, our ability to make desired investments may be

limited during the term of our revolving credit facility.

|

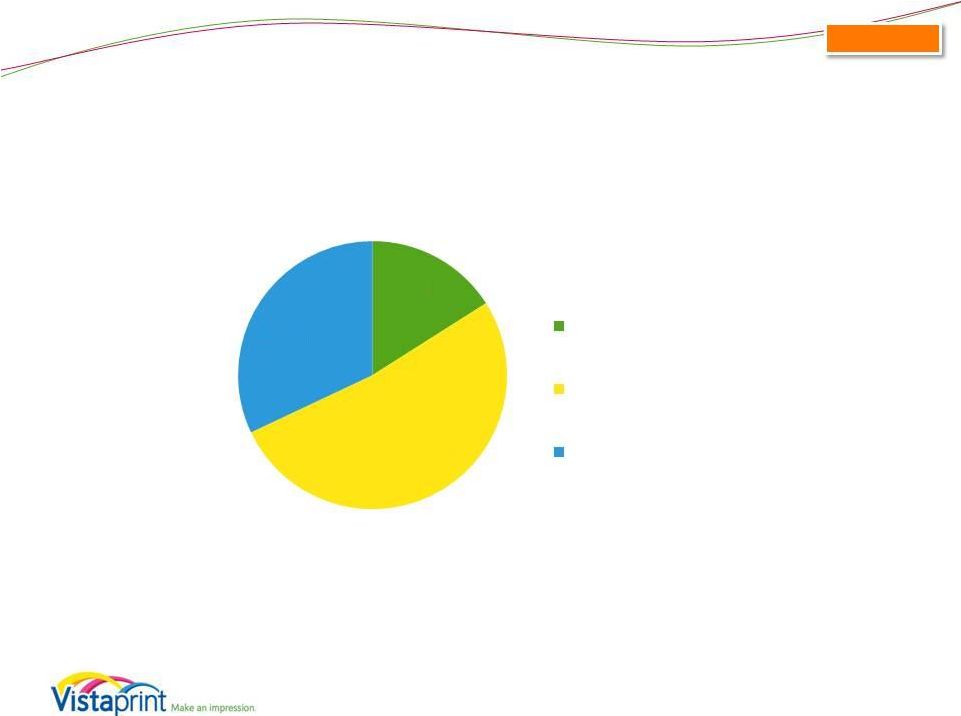

Q3

FY14 Capital Expenditure Breakdown 36

Q3 FY14 CapEx: $11.8M

16%

52%

32%

Land/Facilities

Mfg & Automation

Equipment

Other

1

2

3

Consolidated

1

2

3

Land, building and construction, leasehold improvements, and furniture and fixtures

All manufacturing and automation equipment, including offset and digital print lines, other

printing equipment, pre-press and post-press equipment such as cutters, and

automation equipment IT infrastructure, software and office equipment |

Appendix

Including a Reconciliation of

GAAP to Non-GAAP Financial

Measures |

About

non-GAAP financial measures

To supplement Vistaprint’s consolidated financial statements presented in

accordance with U.S. generally accepted

accounting principles, or GAAP, Vistaprint has used the following measures defined

as non-GAAP financial measures by Securities and Exchange Commission, or

SEC, rules: non-GAAP adjusted net income, non-GAAP adjusted net income

per diluted share, free cash flow and constant-currency revenue growth. The

items excluded from the non-GAAP adjusted net income measurements are

share-based compensation expense and its related tax effect, amortization of

acquisition-related intangibles, tax charges related to the alignment of

acquisition-related intellectual property with global operations,

changes in unrealized gains and losses on currency forward contracts, unrealized currency transaction gains

and losses on intercompany financing arrangements and the related tax effect, and

the expected charge for the disposal of our minority investment in

China. Free cash flow is defined as net cash provided by operating activities less

purchases of property, plant and equipment, purchases of intangible assets not

related to acquisitions, and capitalization of software and website

development costs. Constant-currency revenue growth is estimated by translating all non-U.S.

dollar denominated revenue generated in the current period using

the prior year period’s average exchange rate for each

currency to the U.S. dollar and excludes the impact of gains and

losses on effective currency hedges recognized in

revenue in the prior year periods.

The presentation of non-GAAP financial information is not intended to be

considered in isolation or as a substitute for the financial information

prepared and presented in accordance with GAAP. For more information on these non-GAAP

financial

measures,

please

see

the

tables

captioned

“Reconciliations

of

Non-GAAP

Financial

Measures”

included

at

the

end of this release. The tables have more details on the GAAP financial measures

that are most directly comparable to non-GAAP financial measures and the

related reconciliation between these financial measures. Vistaprint’s

management believes that these non-GAAP financial measures provide meaningful supplemental

information in assessing our performance and liquidity by excluding certain items

that may not be indicative of our recurring core business operating results,

which could be non-cash charges or discrete cash charges that are infrequent

in nature. These non-GAAP financial measures also have facilitated

management’s internal comparisons to Vistaprint’s historical

performance and our competitors’ operating results.

38 |

Reconciliation: GAAP to Non-GAAP Results

FY 2003

FY 2004

FY 2005*

FY 2006

FY 2007

FY 2008

FY 2009

FY2010

FY2011

FY2012

FY2013

GAAP Net Income

$473

$3,440

($16,218)

$19,234

$27,143

$39,831

$55,686

$67,741

$82,109

$43,994

$29,435

Share-based

compensation and

related tax effect

$0

$0

$0

$4,850

$8,765

$15,275

$20,177

$23,156

$22,400

$26,060

$33,662

Amortization of

acquired intangible

assets

-

-

-

-

-

-

-

-

-

$5,754

$10,361

Tax Impact of Webs

IP transfer

-

-

-

-

-

-

-

-

-

$1,235

$2,387

Non-GAAP

Adjusted Net Income

$473

$3,440

$4,782

$23,146

$35,908

$55,106

$75,863

$90,897

$104,509

$77,043

$75,845

Net Income (Loss) –

Annual

($ in thousands)

*Fiscal 2005 non-GAAP results exclude a contract termination payment of

$21mm 39 |

Reconciliation: GAAP to Non-GAAP Results

($ in thousands)

.

Fiscal

Year 2011

Fiscal Year 2012

Fiscal Year 2013

FY2014

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

GAAP Net Income*

$14,397

$8,172

$31,697

$274

$3,851

$(1,696)

$22,960

$5,866

$2,305

$412

$40,875

$1,376

Share-based

compensation and

related tax effect

$5,129

$4,876

$5,021

$7,566

$8,596

$8,445

$8,540

$8,353

$8,324

$8,576

$8,062

$5,773

Amortization of

acquired intangible

assets

-

-

$1,148

$2,381

$2,225

$2,178

$2,243

$2,275

$3,665

$2,200

$2,249

$2,228

Tax Impact of

Webs IP Transfer

-

-

-

$1,017

$218

-

$2,164

$431

($208)

$63

$1,468

$312

Changes in

unrealized (gain)

loss on currency

forward contracts

included in net

income

$4,856

$(1,155)

$(1,131)

Unrealized

currency

transaction loss

(gain) on

intercompany loan

and the related tax

effect

-

$1,163

$(283)

Non-GAAP

Adjusted Net

Income

$19,526

$13,048

$37,866

$11,238

$14,890

$8,927

$35,907

$16,925

$14,086

$16,107

$52,662

$8,274

40

* GAAP net income attributable to Vistaprint N.V.

Net Income (Loss) – Quarterly

|

Reconciliation: GAAP to Non-GAAP Results

Diluted

Earnings

Per

Share

-

Annual

41

FY 2006

FY 2007

FY 2008

FY 2009

FY2010

FY2011

FY2012

FY2013

GAAP Net Income per share

$0.45

$0.60

$0.87

$1.25

$1.49

$1.83

$1.13

$0.85

Share-based Compensation and

related tax effect per share

$0.09

$0.18

$0.31

$0.43

$0.49

$0.47

$0.65

$0.95

Amortization of acquired

intangible assets per share

-

-

-

-

-

-

$0.14

$0.29

Tax Impact of Webs IP Transfer

per share

-

-

-

-

-

-

$0.03

$0.06

Non-GAAP Adjusted Net

Income per share

$0.54

$0.78

$1.18

$1.68

$1.98

$2.30

$1.95

$2.15

Weighted average shares used

in computing Non-

GAAP EPS

42.651

45.825

46.780

45.099

45.989

45.448

39.426

35.201

(millions) |

Reconciliation: GAAP to Non-GAAP Results

Earnings

Per

Diluted

Share

-

Quarterly

.

Fiscal

Year 2011

Fiscal Year 2012

Fiscal Year 2013

FY2014

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

GAAP Net Income per

share

$0.32

$0.19

$0.82

$0.01

$0.10

$(0.05)

$0.66

$0.17

$0.07

$0.01

$1.18

$0.04

Share-based Compensation

and related tax effect per

share

$0.11

$0.12

$0.12

$0.20

$0.23

$0.24

$0.24

$0.24

$0.24

$0.25

$0.22

$0.17

Amortization of acquired

intangible assets per share

-

-

$0.03

$0.06

$0.06

$0.06

$0.06

$0.06

$0.11

$0.06

$0.06

$0.06

Tax impact of Webs IP

Transfer per share

-

-

-

$0.02

$0.01

-

$0.06

$0.01

$(0.01)

$0.00

$0.04

$0.01

Changes in unrealized

(gain) loss on currency

forward contracts included

in net income per share

$0.13

$(0.03)

$(0.03)

Unrealized currency

transaction loss (gain) on

intercompany loan and the

related tax effect per share

$0.00

$0.03

$(0.01)

Non-GAAP Adjusted Net

Income per share

$0.43

$0.31

$0.97

$0.29

$0.40

$0.25

$1.02

$0.48

$0.41

$0.45

$1.50

$0.24

Weighted average shares

used in computing Non-

GAAP EPS

(millions)

45.156

42.569

39.041

38.346

37.620

35.793

35.156

35.217

34.633

35.005

35.118

34.857

42 |

Reconciliation: Free Cash Flow

(in thousands)

43

Three Months Ended

Nine Months Ended

March 31,

March 31,

2014

2013

2014

2013

Net cash provided by operating activities

$ 3,142

$ 8,135

$ 98,046

$ 103,318

Purchases of property, plant and

equipment

(11,830)

(11,155)

(53,999)

(66,523)

Purchases of intangibles assets

(83)

(82)

(202)

(452)

Capitalization of software and website

development costs

(2,920)

(2,439)

(7,339)

(5,579)

Free cash flow

$ (11,691)

$ (5,541)

$

36,506

$ 30,764

|

Reconciliation:

Constant-Currency Revenue Growth Rates

Quarterly

44

ASIA-PACIFIC

Q4 FY11

Q1 FY12

Q2 FY12

Q3 FY12

Q4 FY12

Q1 FY13

Q2 FY13

Q3 FY13

Q4 FY13

Q1 FY14

Q2 FY14

Q3 FY14

Reported revenue growth

65%

67%

41%

47%

28%

28%

26%

6%

4%

(11%)

(5%)

(3%)

Currency impact

(26%)

(22%)

(4%)

(7%)

5%

2%

(3%)

4%

4%

13%

11%

13%

Revenue growth in constant

currency

39%

45%

37%

40%

33%

29%

24%

10%

8%

2%

6%

10%

Note: Constant-currency revenue growth is estimated by translating all

non-U.S. dollar denominated revenue generated in the current period using the prior year period’s

average exchange rate for each currency to the U.S. dollar and excludes the impact

of gains and losses on effective currency hedges recognized in revenue for applicable

periods.

EUROPE

Q4 FY11

Q1 FY12

Q2 FY12

Q3 FY12

Q4 FY12

Q1 FY13

Q2 FY13

Q3 FY13

Q4 FY13

Q1 FY14

Q2 FY14

Q3 FY14

Reported revenue growth

38%

31%

36%

29%

18%

12%

11%

8%

3%

6%

1%

(4%)

Currency impact

(15%)

(10%)

1%

5%

12%

11%

2%

0%

(1%)

(4%)

(3%)

(3%)

Revenue growth in constant

currency

22%

21%

37%

34%

30%

23%

14%

8%

2%

2%

(2%)

(7%) |

Reconciliation:

Constant-Currency Revenue Growth Rates

Quarterly

45

NORTH AMERICA

Q4 FY11

Q1 FY12

Q2 FY12

Q3 FY12

Q4 FY12

Q1 FY13

Q2 FY13

Q3 FY13

Q4 FY13

Q1 FY14

Q2 FY14

Q3 FY14

Reported revenue growth

18%

17%

20%

23%

20%

22%

20%

15%

18%

14%

13%

2%

Currency impact

0%

0%

0%

0%

0%

0%

0%

0%

0%

1%

1%

1%

Revenue growth in constant

currency

18%

17%

20%

23%

21%

22%

20%

15%

18%

15%

14%

3%

Note: Constant-currency revenue growth is estimated by translating all

non-U.S. dollar denominated revenue generated in the current period using the prior year period’s

average exchange rate for each currency to the U.S. dollar and excludes the impact

of gains and losses on effective currency hedges recognized in revenue for applicable

periods.

TOTAL COMPANY

Q4 FY11

Q1 FY12

Q2 FY12

Q3 FY12

Q4 FY12

Q1 FY13

Q2 FY13

Q3 FY13

Q4 FY13

Q1 FY14

Q2 FY14

Q3 FY14

Reported revenue growth

27%

25%

28%

26%

20%

18%

16%

12%

12%

9%

6%

(1%)

Currency impact

(7%)

(5%)

0%

2%

5%

5%

1%

0%

0%

0%

0%

0%

Revenue growth in constant

currency

20%

20%

28%

28%

25%

23%

17%

12%

12%

9%

6%

(1%) |