Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - SEALED AIR CORP/DE | d716125d8k.htm |

| EX-99.1 - EX-99.1 - SEALED AIR CORP/DE | d716125dex991.htm |

| Exhibit 99.2

|

Sealed Air

Re-imagine TM

First Quarter 2014

Earnings Conference Call Supplement

(Unaudited Results)

|

|

Safe Harbor and Regulation G Statement

This presentation contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of

1995. Forward-looking statements can be identified by such words as “anticipates,” “believes,” “plan,” “assumes,” “could,”

“estimates,” “expects,” “intends,” “may,” “plans to,” “will” and similar expressions. These statements reflect our beliefs and

expectations as to future events and trends affecting our business, our consolidated financial position and our results of

operations. Examples of these forward-looking statements include expectations regarding our anticipated effective income

tax rate, the potential cash tax benefits associated with the W. R. Grace & Co. Settlement agreement (as defined in the

Company’s Annual Report on Form 10-K), potential volume, revenue and operating growth for future periods, expectations

and assumptions associated with our restructuring programs, availability and pricing of raw materials, success of our growth

initiatives, economic conditions, and the success of pricing actions. A variety of factors may cause actual results to differ

materially from these expectations, including general domestic and international economic and political conditions, changes in

our raw material and energy costs, credit ratings, the success of restructuring plans, currency translation and devaluation

effects, the competitive environment, the effects of animal and food-related health issues, environmental matters, and

regulatory actions and legal matters. For more extensive information, see “Risk Factors” and “Cautionary Notice Regarding

Forward-Looking Statements,” which appear in our most recent Annual Report on Form 10-K, as filed with the Securities and

Exchange Commission, and as revised and updated by our Quarterly Reports on Form 10-Q and Current Reports on Form 8-

K. While we may elect to update these forward-looking statements at some point in the future, we specifically disclaim any

obligation to do so, whether as a result of new information, future events, or otherwise.

Our management uses non-U.S. GAAP financial measures to evaluate the Company’s performance, which exclude items we

consider unusual or special items. We believe the use of such financial measures and information may be useful to investors.

We believe that the use of non-U.S. GAAP measures helps investors to gain a better understanding of core operating results

and future prospects, consistent with how management measures and forecasts the Company’s performance, especially

when comparing such results to previous periods or forecasts. Please see Sealed Air’s April 30, 2014 earnings press release

for important information about the use of non-U.S. GAAP financial measures relevant to this presentation, including

applicable reconciliations to U.S. GAAP financial measures.

2

|

|

Sealed Air

Re-imagine TM

FIRST QUARTER 2014

Key Takeaways

We are executing on our “Get Fit” and “Change the Game” strategy with a focus on creating value for our customers and improving our quality of earnings.

Constant currency net sales growth of 2.8% year-over-year (YoY) with growth in all regions except for a decline in Europe; Sales from developing regions increased 7.9% and accounted for 25% of net sales

Favorable product price/mix across all divisions and all regions

Adjusted gross profit margin increased 160 basis points and Adjusted EBITDA increased 110 basis points with margin expansion in each of our three core divisions

Adjusted EBITDA increased 8.9% to $252 million or 13.8% of net sales as compared to first quarter 2013 Adjusted EBITDA of $231 million or 12.7% of net sales

Reported U.S. GAAP Measures, Continuing Operations

Q1-14 Net Sales: $1.8B; Operating Profit: $155M; Net Income: $72M Q1-13 Net Sales: $1.8B; Operating Profit: $127M; Net Income: $1M

3

|

|

Sealed Air

Re-imagine TM

FIRST QUARTER 2014

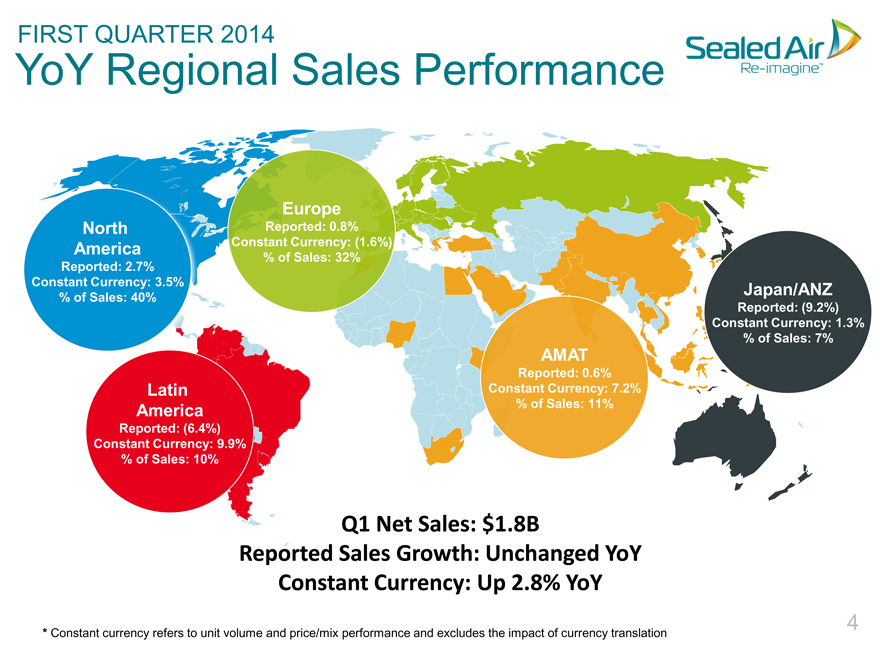

YoY Regional Sales Performance

Europe

North Reported: 0.8%

America Constant Currency: (1.6%)

% of Sales: 32%

Reported: 2.7%

Constant Currency: 3.5% Japan/ANZ

% of Sales: 40%

Reported: (9.2%)

Constant Currency: 1.3%

% of Sales: 7%

AMAT

Reported: 0.6%

Latin Constant Currency: 7.2%

America% of Sales: 11%

Reported: (6.4%)

Constant Currency: 9.9%

% of Sales: 10%

Q1 Net Sales: $1.8B

Reported Sales Growth: Unchanged YoY

Constant Currency: Up 2.8% YoY

* Constant currency refers to unit volume and price/mix performance and excludes the impact of currency translation 4

|

|

Sealed Air

Re-imagine TM

FIRST QUARTER 2014

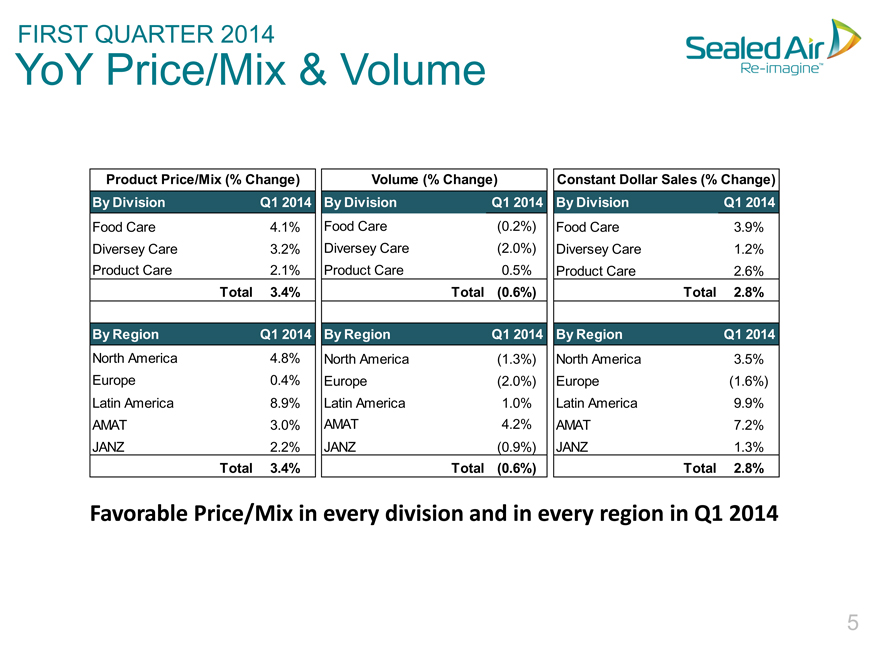

YoY Price/Mix & Volume

Product Price/Mix (% Change) Volume (% Change) Constant Dollar Sales (% Change)

By Division Q1 2014 By Division Q1 2014 By Division Q1 2014

Food Care 4.1% Food Care(0.2%) Food Care 3.9%

Diversey Care 3.2% Diversey Care(2.0%) Diversey Care 1.2%

Product Care 2.1% Product Care 0.5% Product Care 2.6%

Total 3.4% Total(0.6%) Total 2.8%

By Region Q1 2014 By Region Q1 2014 By Region Q1 2014

North America 4.8% North America(1.3%) North America 3.5%

Europe 0.4% Europe(2.0%) Europe(1.6%)

Latin America 8.9% Latin America 1.0% Latin America 9.9%

AMAT 3.0% AMAT 4.2% AMAT 7.2%

JANZ 2.2% JANZ(0.9%) JANZ 1.3%

Total 3.4% Total(0.6%) Total 2.8%

Favorable Price/Mix in every division and in every region in Q1 2014

5

|

|

Sealed Air

Re-imagine TM

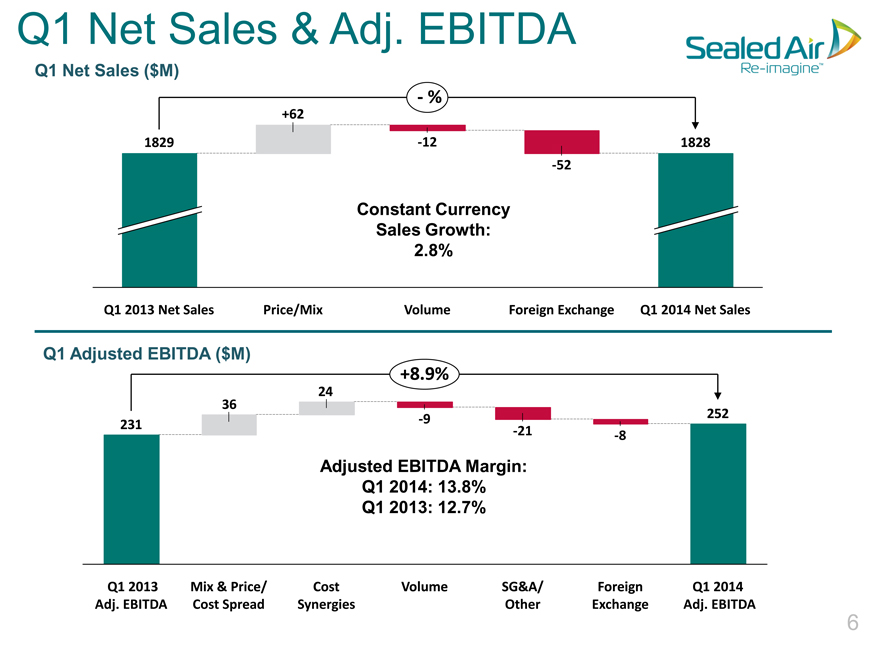

Q1 Net Sales & Adj. EBITDA

Q1 Net Sales ($M)

—%

+62

1829 -12 1828

-52

Constant Currency

Sales Growth:

2.8%

Q1 2013 Net Sales Price/Mix Volume Foreign Exchange Q1 2014 Net Sales

Q1 Adjusted EBITDA ($M)

+8.9%

24

36

-9 252

231

-21 -8

Adjusted EBITDA Margin:

Q1 2014: 13.8%

Q1 2013: 12.7%

Q1 2013 Mix & Price/ Cost Volume SG&A/ Foreign Q1 2014

Adj. EBITDA Cost Spread Synergies Other Exchange Adj. EBITDA

6

|

|

Sealed Air

Re-imagine TM

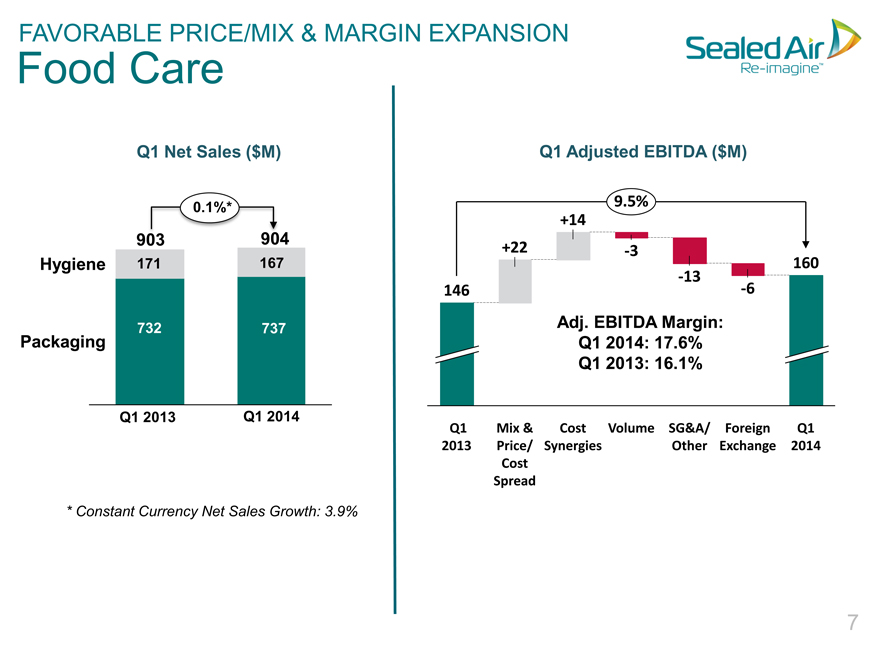

FAVORABLE PRICE/MIX & MARGIN EXPANSION

Food Care

Q1 Net Sales ($M)

0.1%*

Hygiene 171 167

732 737

Packaging

Q1 2013 Q1 2014

* Constant Currency Net Sales Growth: 3.9%

Q1 Adjusted EBITDA ($M)

9.5%

+14

+22 -3

160

-13

146 -6

Adj. EBITDA Margin:

Q1 2014: 17.6%

Q1 2013: 16.1%

Q1 Mix & Cost Volume SG&A/ Foreign Q1

2013 Price/ Synergies Other Exchange 2014

Cost

Spread

7

|

|

Sealed Air

Re-imagine TM

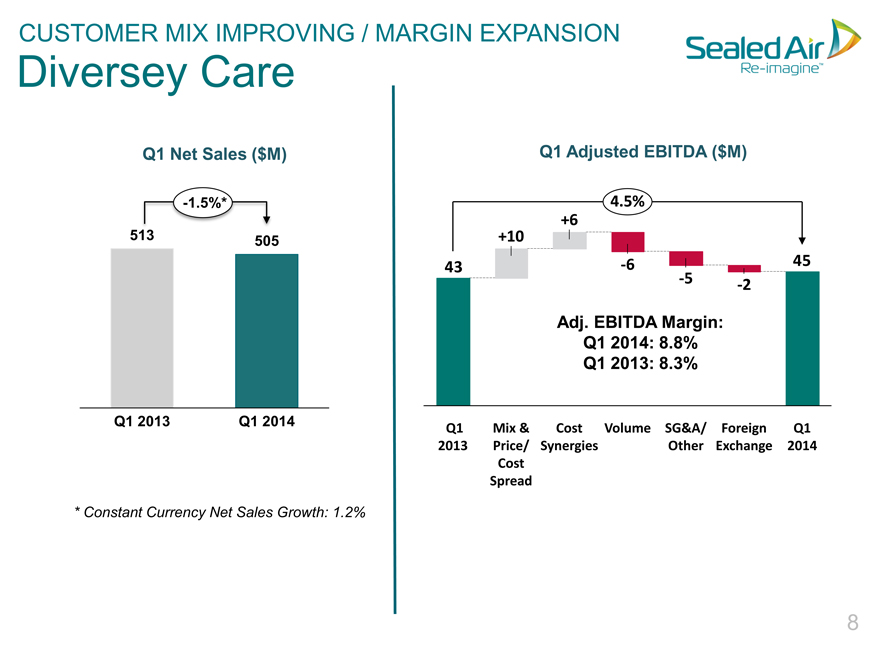

CUSTOMER MIX IMPROVING / MARGIN EXPANSION

Diversey Care

Q1 Net Sales ($M)

-1.5%*

513 505

Q1 2013 Q1 2014

* Constant Currency Net Sales Growth: 1.2%

Q1 Adjusted EBITDA ($M)

4.5%

+6

+10

43 -6 45

-5 -2

Adj. EBITDA Margin:

Q1 2014: 8.8%

Q1 2013: 8.3%

Q1 Mix & Cost Volume SG&A/ Foreign Q1

2013 Price/ Synergies Other Exchange 2014

Cost

Spread

8

|

|

Sealed Air

Re-imagine TM

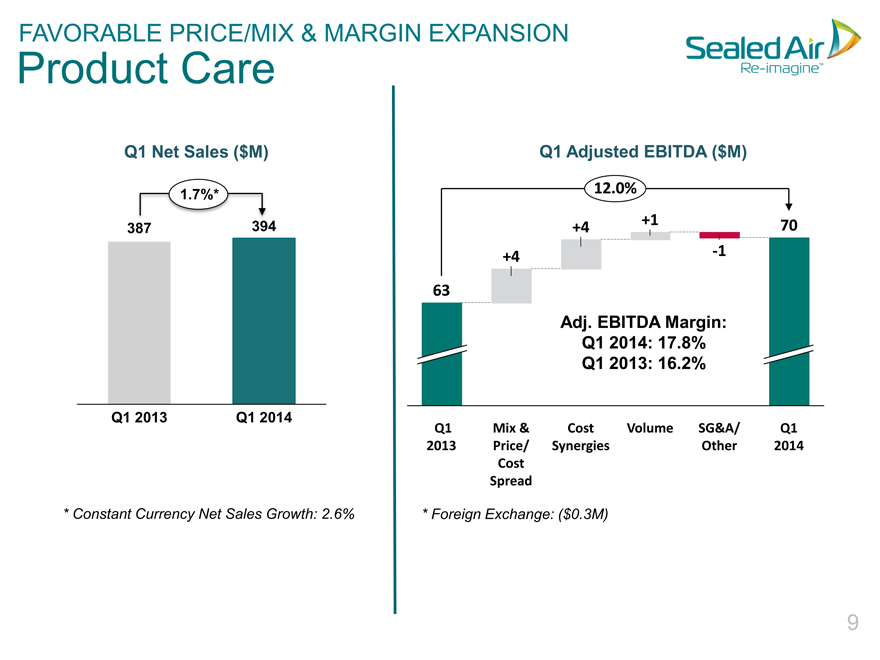

FAVORABLE PRICE/MIX & MARGIN EXPANSION

Product Care

Q1 Net Sales ($M)

1.7%*

387

Q1 2013 Q1 2014

* Constant Currency Net Sales Growth: 2.6%

Q1 Adjusted EBITDA ($M)

12.0%

+4 +1 70

+4 -1

63

Adj. EBITDA Margin:

Q1 2014: 17.8%

Q1 2013: 16.2%

Q1 Mix & Cost Volume SG&A/ Q1

2013 Price/ Synergies Other 2014

Cost

Spread

* Foreign Exchange: ($0.3M)

9

|

|

Sealed Air

Re-imagine TM

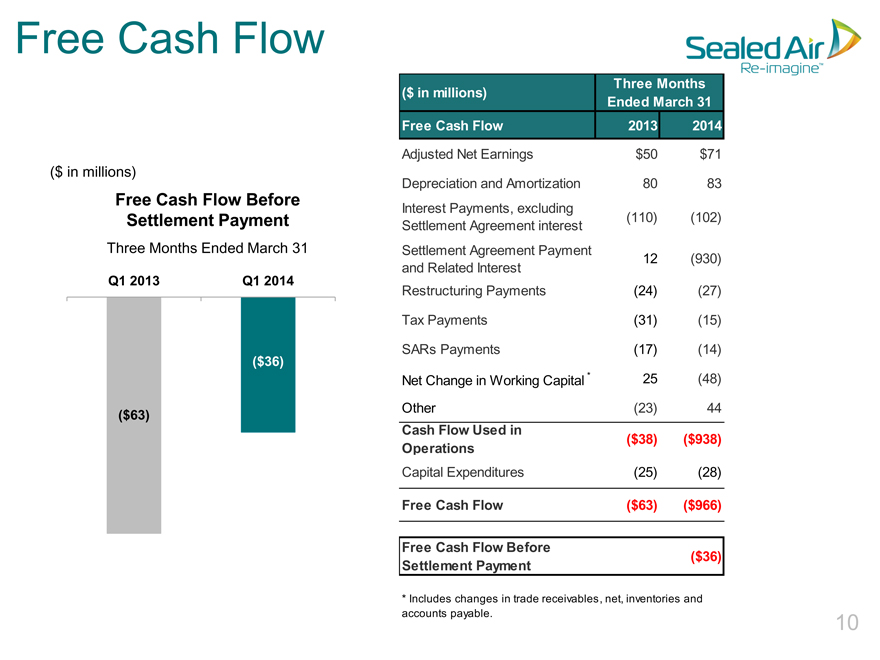

Free Cash Flow

($ in millions)

Free Cash Flow Before

Settlement Payment

Three Months Ended March 31

Q1 2013 Q1 2014

($36)

($63)

Three Months

($ in millions)

Ended March 31

Free Cash Flow 2013 2014

Adjusted Net Earnings $50 $71

Depreciation and Amortization 80 83

Interest Payments, excluding

Settlement Agreement interest(110)(102)

Settlement Agreement Payment 12(930)

and Related Interest

Restructuring Payments(24)(27)

Tax Payments(31)(15)

SARs Payments(17)(14)

Net Change in Working Capital * 25(48)

Other(23) 44

Cash Flow Used in

($38)($938)

Operations

Capital Expenditures(25)(28)

Free Cash Flow($63)($966)

Free Cash Flow Before

($36)

Settlement Payment

* Includes changes in trade receivables, net, inventories and

accounts payable. 10

|

|

Sealed Air

Re-imagine TM

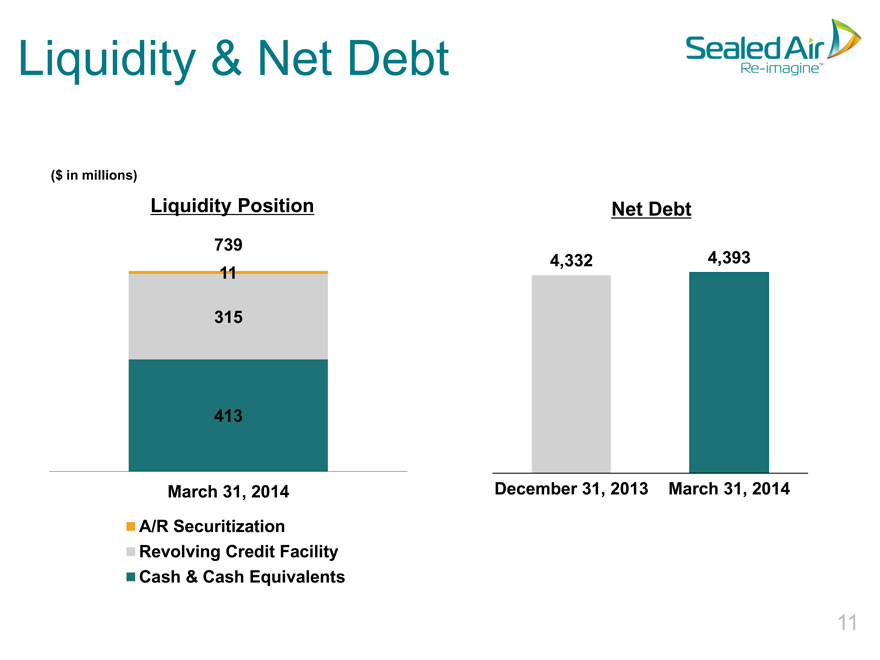

Liquidity & Net Debt

($ in millions)

Liquidity Position Net Debt

739

4,332 4,393

| 11 |

|

315

413

March 31, 2014 December 31, 2013 March 31, 2014

A/R Securitization

Revolving Credit Facility

Cash & Cash Equivalents

| 11 |

|

|

|

Sealed Air

Re-imagine TM

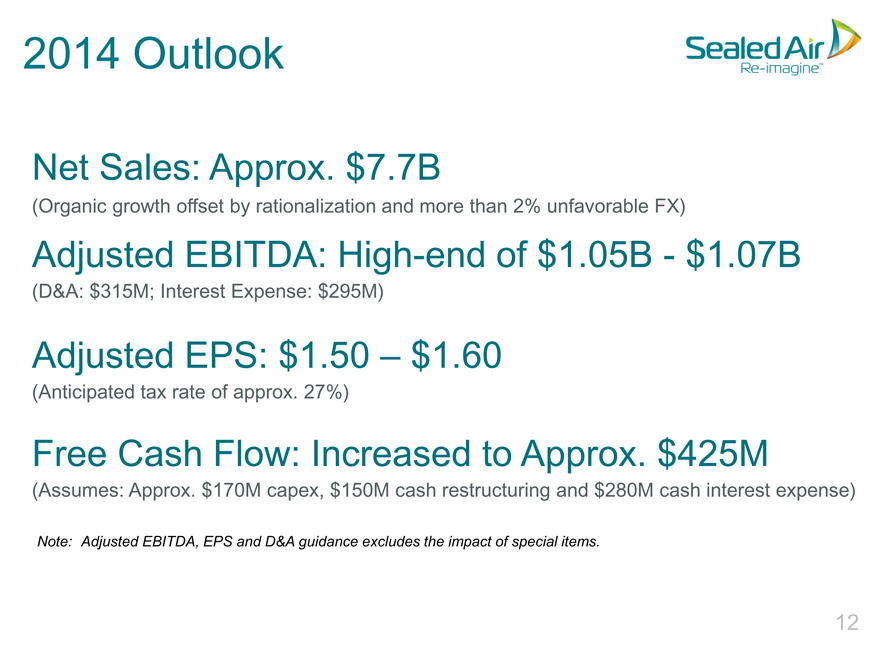

2014 Outlook

Net Sales: Approx. $7.7B

(Organic growth offset by rationalization and more than 2% unfavorable FX)

Adjusted EBITDA: High-end of $1.05B—$1.07B

(D&A: $315M; Interest Expense: $295M)

Adjusted EPS: $1.50 – $1.60

(Anticipated tax rate of approx. 27%)

Free Cash Flow: Increased to Approx. $425M

(Assumes: Approx. $170M capex, $150M cash restructuring and $280M cash interest expense)

Note: Adjusted EBITDA, EPS and D&A guidance excludes the impact of special items.

12

|

|

Q&A

Earnings Conference Call

First Quarter 2014

|

|

Appendix

|

|

Sealed Air

Re-imagine TM

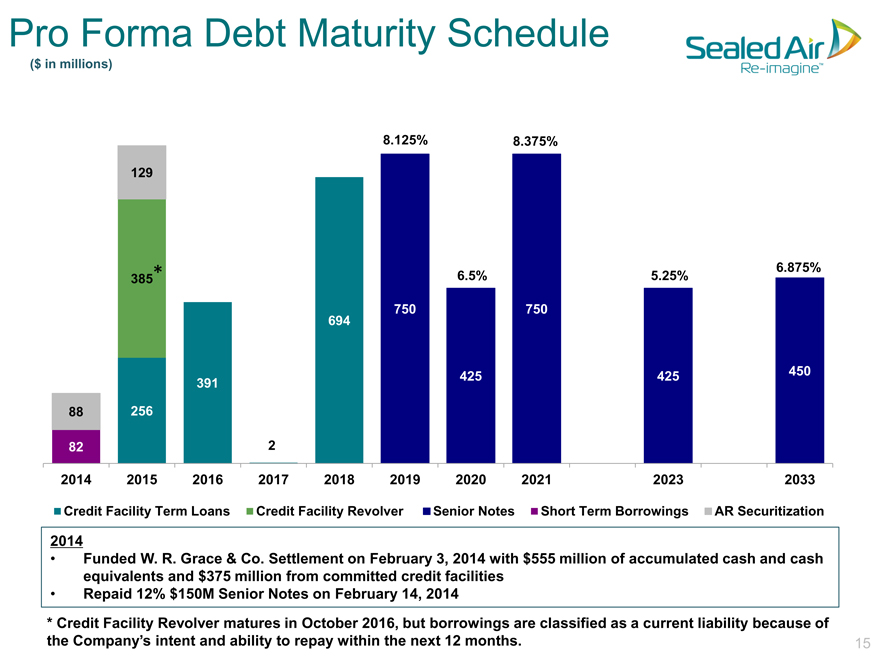

Pro Forma Debt Maturity Schedule

($ in millions)

8.125% 8.375%

129

385 * 6.5% 5.25% 6.875%

750 750

694

425 425 450

391

88 256

82 2

2014 2015 2016 2017 2018 2019 2020 2021 2023 2033

Credit Facility Term Loans Credit Facility Revolver Senior Notes Short Term Borrowings AR Securitization

2014

Funded W. R. Grace & Co. Settlement on February 3, 2014 with $555 million of accumulated cash and cash

equivalents and $375 million from committed credit facilities

Repaid 12% $150M Senior Notes on February 14, 2014

* Credit Facility Revolver matures in October 2016, but borrowings are classified as a current liability because of

the Company’s intent and ability to repay within the next 12 months. 15