Attached files

| file | filename |

|---|---|

| EX-31.1 - EXHIBIT - QUESTCOR PHARMACEUTICALS INC | questcorexhibit3112013amen.htm |

| EX-31.2 - EXHIBIT - QUESTCOR PHARMACEUTICALS INC | questcorexhibit3122013amen.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________________________________________

Form 10-K/A

Amendment No. 1 to Form 10-K

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Fiscal Year ended December 31, 2013

Or

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number 001-14758

_________________________________________________________

Questcor Pharmaceuticals, Inc.

(Exact name of registrant as specified in its charter)

California | 33-0476164 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

1300 North Kellogg Drive, Suite D Anaheim, California | 92807 | |

(Address of principal executive offices) | (Zip Code) | |

Registrant’s telephone number, including area code:

(714) 786-4200

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class | Name of Each Exchange on Which Registered | |

Common Stock, no par value | Nasdaq Stock Market, LLC (Nasdaq Global Select Market) | |

Securities registered pursuant to Section 12(g) of the Act:

None

(Title of class)

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No o

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes o No x

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). x Yes o No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

x Large accelerated filer | o Accelerated filer | o Non-accelerated filer | o Smaller reporting company | |||

(Do not check if a smaller reporting company) | ||||||

Indicate by check mark whether the Registrant is a shell company (as defined by Rule 12b-2 of the Act). Yes o No x

The aggregate market value of the voting and non-voting Common Stock held by non-affiliates of the Registrant was approximately $1,756,532,593 as of June 30, 2013.

As of January 31, 2014 the Registrant had 60,583,618 shares of Common Stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

TABLE OF CONTENTS

EXPLANATORY NOTE

Page | ||

PART III | ||

Item 10. | ||

Item 11. | ||

Item 12. | ||

Item 13. | ||

Item 14. | ||

PART IV | ||

Item 15. | ||

EXPLANATORY NOTE

References in this Amendment No. 1 (this “Amendment”) to “Questcor,” “Questcor Pharmaceuticals,” “Company,” “we,” “us” and “our” refer to Questcor Pharmaceuticals, Inc. and its consolidated subsidiaries, unless the context requires otherwise.

As previously announced, on April 5, 2014, Questcor, Mallinckrodt plc (“Mallinckrodt”) and Quincy Merger Sub, a wholly owned subsidiary of Mallinckrodt (“Merger Sub”) entered into an Agreement and Plan of Merger (the “Merger Agreement”), pursuant to which, subject to the terms and conditions set forth in the Merger Agreement, Merger Sub will be merged with and into the Company, with the Company continuing as the surviving corporation (the “Merger”). The Merger Agreement provides that, upon completion of the Merger, each share of Company common stock, no par value, issued and outstanding immediately prior to the Merger (other than dissenting shares, shares of restricted Company common stock granted to individuals other than non-employee directors, and Company common stock owned by the Company, Mallinckrodt, Merger Sub or any of their respective subsidiaries) will be converted into the right to receive a combination of (1) $30.00 per share of Company common stock in cash, without interest, plus (2) 0.897 validly issued, fully paid and nonassessable shares of Mallinckrodt ordinary shares. Completion of the Merger is subject to, among other conditions, approval of the Company’s shareholders of the adoption and approval of the Merger Agreement, such approval to be obtained at a special meeting of the Company’s shareholders.

This Amendment amends our Annual Report on Form 10-K for the fiscal year ended December 31, 2013 (the “Original Form 10-K”), which was originally filed with the Securities and Exchange Commission (the “SEC”) on February 26, 2014. We are filing this Amendment solely to include the information required by Items 10, 11, 12, 13 and 14 of Part III of Form 10-K, which, pursuant to General Instruction G to Form 10-K, incorporated by reference certain information from the definitive proxy statement that we anticipated would be filed with the SEC within 120 days after December 31, 2013. In light of the special meeting, we will not file a definitive proxy statement containing the previously omitted information with the SEC within such timeframe and, accordingly, Part III of the Original Form 10-K is hereby amended. Except as expressly noted, this Amendment does not reflect events occurring after the filing of our Original Form 10-K or modify or update in any way any of the disclosures contained in our Original Form 10-K. Accordingly, this Amendment should be read in conjunction with our Original Form 10-K and other SEC filings.

Item 10. Directors, Executive Officers and Corporate Governance

The individuals discussed below all currently serve as directors of Questcor. Our Board of Directors, with input from its Nominating and Corporate Governance Committee, from time to time reviews the composition of our Board of Directors and whether any changes to its composition, including through the addition of a new director or directors, are necessary or appropriate. Among other factors, our Board of Directors considers balancing continuity on the Board with the benefit of proposing changes to the Board, including by adding new directors. Our Board of Directors also seeks to have directors with diverse professional experiences in an effort to ensure that multiple points of view are available to our Board of Directors during its deliberations. For information regarding the factors that are considered in evaluating director nominees, please see the Nominating and Corporate Governance Committee section below.

The names of the members of the Board of Directors and certain information about them are set forth below:

Name | Age | Principal Occupation |

Don M. Bailey | 68 | President and Chief Executive Officer, Questcor; Director |

Neal C. Bradsher | 48 | President, Broadwood Capital, Inc.; Director |

Stephen C. Farrell | 49 | Chief Executive Officer, Convey Health Solutions, Inc.; Director |

G. Kelly Martin | 55 | Director |

Angus C. Russell | 58 | Director |

Louis Silverman | 55 | Chairman and Chief Executive Officer, Advanced ICU Care, Inc.; Director |

Virgil D. Thompson | 74 | Chief Executive Officer, Spinnaker Biosciences, Inc.; Director |

Scott M. Whitcup, M.D. | 54 | Executive VP & Chief Scientific Officer, Allergan, Inc.; Director |

Don M. Bailey, 68, President and CEO, joined our Board in May 2006. Mr. Bailey was appointed our interim President in May 2007. Mr. Bailey was appointed President and Chief Executive Officer in November 2007. Mr. Bailey is currently a member of the Board of Directors of STAAR Surgical Company. STAAR Surgical Company is a leader in the development, manufacture, and marketing of minimally invasive ophthalmic products employing proprietary technologies. Mr. Bailey was the Chairman of the Board of Comarco, Inc. from 1998 until 2007 and served as Comarco’s Chief Executive Officer from 1991 to 2000. Mr. Bailey was Chairman of the Board of STAAR from April 2005 until January 2014. Mr. Bailey holds a B.S. degree in mechanical engineering from the Drexel Institute of Technology, an M.S. degree in operations research from the University of Southern California, and an M.B.A. from Pepperdine University.

We believe that Mr. Bailey's qualifications to serve on our Board of Directors include his serving as our interim President since May 2007, and as our President and Chief Executive Officer since November 2007, as well as his over 13 years of experience as a chief executive officer of various corporations, and his over 20 years of experience as a director of various public companies. During Mr. Bailey's tenure as our President and Chief Executive Officer, we have served dramatically increasing numbers of patients suffering from difficult-to-treat diseases, including babies suffering from infantile spasms as well as adult populations suffering from other difficult-to-treat diseases. Under Mr. Bailey's leadership, we have generated strong shareholder returns, with our stock price appreciating by approximately 1,297% from March 1, 2009 to April 4, 2014, the trading day immediately preceding the day we entered into an Agreement and Plan of Merger with Mallinckrodt plc. We also have returned $483.3 million to our shareholders via share buybacks and dividends during this same period.

Neal C. Bradsher, CFA, joined our Board of Directors in March 2004. Since 2002, Mr. Bradsher has been the founder and President of Broadwood Capital, Inc., a New York-based private investment firm that is a shareholder of Questcor. Mr. Bradsher currently is a director of BioTime, Inc., whose board of directors he joined in July 2009. BioTime is a biotechnology company focused on regenerative medicine, an emerging field of therapeutic product development based on technologies developed in stem cell research. Mr. Bradsher holds a B.A. degree in economics from Yale College and is a Chartered Financial Analyst.

We believe that Mr. Bradsher's qualifications to serve on our Board of Directors include his extensive record as a successful investor in public companies, including companies in the healthcare industry, his record as a shareholder activist, his experience in implementing corporate governance initiatives that have led to increases in shareholder value, and his extensive financial analyst background. A partnership managed by Mr. Bradsher provided a portion of the financing that enabled us to purchase H.P. Acthar Gel® (repository corticotropin injection), or Acthar in 2001, upgrade the manufacturing process for Acthar, and make other investments that enabled us to maintain an adequate supply of Acthar. Because of his involvement in that financing, Mr. Bradsher brings a historical perspective to our Board of Directors regarding the unique nature of the product and its importance to patients.

Stephen C. Farrell, joined our Board of Directors in November 2007. Since February 2011, Mr. Farrell has served as Chief Executive Officer of Convey Health Solutions, Inc., a healthcare business process outsourcing company. Mr. Farrell previously served as President of PolyMedica Corporation until PolyMedica was acquired by Medco Health Solutions. During his eight year tenure at PolyMedica, Mr. Farrell served in various positions, including President, Chief Operating Officer, Chief Financial Officer, Chief Compliance Officer, and Treasurer. Mr. Farrell was also Executive Vice President and Chief Financial Officer of Stream Global Services, Inc., a business process outsourcing company with 17,000 employees worldwide. Earlier in his career, Mr. Farrell served as Senior Manager at PricewaterhouseCoopers LLP. Mr. Farrell is currently on the board of directors of BioTime, Inc., a biotechnology company focused on regenerative medicine, an emerging field of therapeutic product development based on technologies developed in stem cell research, which he joined in March 2013. Mr. Farrell holds an A.B. from Harvard University and an M.B.A. from the University of Virginia. Mr. Farrell was also a certified public accountant from 1998 through 2012.

We believe that Mr. Farrell's qualifications to serve on our Board of Directors include his significant accounting, auditing and financial reporting experience, which allows him to serve as an audit committee financial expert and as Chairman of our Audit Committee, his substantial experience as a healthcare executive, and his experience as a senior executive of a public healthcare company during a period of significant growth.

G. Kelly Martin joined our Board of Directors in November 2013. From 2003 to December 2013, Mr. Martin served as the Chief Executive Officer of Elan Corporation plc, a specialty pharmaceutical company headquartered in Dublin, Ireland, and served as a member of its Board of Directors. In December 2013, Perrigo Company plc acquired Elan. From 1981 to 2002, Mr. Martin held various positions with Merrill Lynch & Co.

We believe that Mr. Martin's qualifications to serve on our Board of Directors include his over ten years of experience as a Chief Executive Officer of an international publicly traded specialty biopharmaceutical company and specifically his substantial experience in leading strategic initiatives that transformed Elan and generated significant gains for Elan shareholders.

Angus C. Russell joined our Board of Directors in June 2013. From June 2008 to April 2013, Mr. Russell served as the Chief Executive Officer of Shire plc and served as a member of the Board of Directors and Chairman of the Leadership Team. He served as the Chief Financial Officer of Shire from 1999 to 2008 and also served as its Principal Accounting Officer and Executive Vice President of Global Finance. Shire plc is a publicly listed company on the London Stock Exchange and NASDAQ. Prior to joining Shire, Mr. Russell served at ICI, Zeneca and AstraZeneca for 19 years, most recently as Vice President of Corporate Finance at AstraZeneca plc. In that role, he was responsible for financial input into merger and acquisition activities, management of tax, legal and finance structure, investor relations, and the management of various financial risks. Mr. Russell also held a number of positions within Zeneca Group plc from 1993 to 1999, including Group Treasurer. He is a charted accountant, having qualified with Coopers & Lybrand (now PriceWaterhouseCoopers LLP). Mr. Russell also serves as the Chairman of the Board of Directors of Revance Therapeutics, Inc. (Nasdaq: RVNC).

We believe that Mr. Russell's qualifications to serve on our Board of Directors include his numerous years of experience as a Chief Executive Officer of an international publicly traded specialty biopharmaceutical company and his substantial experience as an officer and director in the specialty pharmaceutical industry. During his tenure at Shire, Mr. Russell spearheaded and achieved numerous strategic initiatives and helped to transform the company into the global industry leader that it is today.

Louis Silverman joined our Board of Directors in November 2009. Since February 2014, Mr. Silverman has served as the Chairman and Chief Executive Officer of Advanced ICU Care, Inc., a technology enabled health care services company. From July 2012 to February 2014, Mr. Silverman has served as an advisor to a variety of healthcare companies and investors. Mr. Silverman served as Chief Executive Officer of Marina Medical Billing Service, a medical coding and billing company, from August 2009 through the successful sale of the company in June 2012. From August 2008 until August 2009, Mr. Silverman served as Chief Executive Officer of LifeComm, a wireless health services initiative founded by Qualcomm Incorporated. From August 2000 until August 2008, Mr. Silverman served as President and Chief Executive Officer of Quality Systems, Inc., a publicly traded, healthcare information technology company. From May 2005 until June 2008, Mr. Silverman also served as a director of Quality Systems. During his tenure as President, Quality Systems grew from $30 million in revenue to $250 million, and the market capitalization of Quality Systems increased from $42 million to $1.2 billion. Among a host of awards, Forbes magazine recognized Quality Systems as one of its 200 Best Small Companies during each of his eight years with that company. Prior to joining Quality Systems, Mr. Silverman served as the Chief Operating Officer of CorVel Corporation, a worker's compensation managed care services company. CorVel Corporation was named to the Forbes' 200 Best Small Companies list during each year of Mr. Silverman's seven year tenure with that company. Mr. Silverman currently serves as Chairman of the Board of Comarco, Inc. Mr. Silverman earned a B.A. from Amherst College and an M.B.A. from Harvard Business School.

We believe that Mr. Silverman's qualifications to serve on our Board of Directors include his over eight years of experience as a President and Chief Executive Officer of a public healthcare information technology company during a period of significant growth and his substantial experience as an officer and director in the healthcare industry.

Virgil D. Thompson joined our Board of Directors in January 1996. Since July 2009, Mr. Thompson has served as Chief Executive Officer and director of Spinnaker Biosciences, Inc., a private ophthalmic drug delivery company. Mr. Thompson served as the President, Chief Executive Officer and as a director of Angstrom Pharmaceuticals, Inc. from November 2002 until July 2007. From September 2000 until August 2002, Mr. Thompson was President, Chief Executive Officer and a director of Chimeric Therapies, Inc. From May 1999 until September 2000, Mr. Thompson was President, Chief Operating Officer and a member of the board of directors of Bio-Technology General Corporation, a pharmaceutical company (now Savient Pharmaceuticals, Inc.). Mr. Thompson is also the Chairman of the board of directors of Aradigm Corporation. Mr. Thompson holds a B.S. degree in pharmacy from the University of Kansas and a J.D. degree from The George Washington University Law School.

We believe that Mr. Thompson's qualifications to serve on our Board of Directors include his over 40 years of significant senior management and financial oversight experience in the pharmaceutical and biopharmaceutical industries. He provides our Board of Directors with invaluable insight into the functioning of pharmaceutical companies, and his involvement on various committees of the boards of directors of other pharmaceutical companies allows him to bring meaningful perspective to the committees on which he serves.

Scott M. Whitcup, M.D., joined our Board of Directors in February 2012. Dr. Whitcup is the Executive Vice President, R&D and Chief Scientific Officer at Allergan. Previously, Dr. Whitcup was Senior Vice President and Head of the Ophthalmology Therapeutic Area at Allergan. Dr. Whitcup is on the faculty at the Jules Stein Eye Institute/David Geffen School of Medicine at UCLA and also serves as a Director on the board of directors of Semnur Pharmaceuticals, Inc. and as a member of the Biology Chair's Council at the California Institute of Technology, or Caltech. Dr. Whitcup graduated from Cornell University Medical College and completed residency training both in internal medicine at UCLA Medical Center and in ophthalmology at the Massachusetts Eye and Ear Infirmary-Harvard Medical School. Dr. Whitcup then received fellowship training in uveitis and ocular immunology at the National Eye Institute at the National Institutes of Health. Prior to coming to Allergan, Dr. Whitcup was Clinical Director of the National Eye Institute, and also served as head of the Clinical Branch and Director of the uveitis and ocular immunology fellowship program. Dr. Whitcup also served as Chair of the NIH Medical Executive Committee and on the board of directors of Avanir Pharmaceuticals, Inc. Dr. Whitcup currently directs Allergan's discovery efforts and the worldwide clinical development programs that include ophthalmology, neurosciences, dermatology, plastic surgery, and urology. Dr. Whitcup's laboratory work has focused on inflammatory disease and the role of cell adhesion molecules in the pathogenesis of autoimmune disease. Dr. Whitcup is an author on over 150 scientific articles, book chapters, and a textbook on ocular inflammatory disease. Dr. Whitcup has been the recipient of numerous awards including the Cogan Award from the Association for Research in Vision and Ophthalmology (ARVO).

We believe that Dr. Whitcup's qualifications to serve on our Board of Directors include his extensive experience as a director and executive officer in pharmaceutical and healthcare companies. Dr. Whitcup also provides a unique perspective to our Board of Directors because of his extensive experience and skills related to the scientific and medical field, including his significant involvement in drug discovery efforts.

Other Executive Officers

Stephen L. Cartt, 51, Chief Operating Officer, joined us in March 2005. On February 15, 2012, our Board appointed Mr. Cartt, our current Executive Vice President and Chief Business Officer, as our Chief Operating Officer. Mr. Cartt was a private consultant from August 2002 until March 2005. From March 2000 through August 2002, Mr. Cartt was the Senior Director of Strategic Marketing for Elan Pharmaceuticals. Prior to that, Mr. Cartt held a variety of R&D and Commercial positions at ALZA Corporation during the period July 1985 to March 2000. Mr. Cartt holds a B.S. degree from the University of California at Davis in biochemistry, and an M.B.A. from Santa Clara University.

David J. Medeiros, 62, Executive Vice President and Chief Technical Officer, joined us in June 2003 as Vice President, Manufacturing. On February 15, 2012, our Board appointed Mr. Medeiros, our Senior Vice President, Pharmaceutical Operations, to the position of Executive Vice President and Chief Technical Officer. Prior to joining us, Mr. Medeiros served as Senior Director, Manufacturing at Titan Pharmaceuticals, Inc. from November 2000 to June 2003. Mr. Medeiros holds a B.S. degree in chemical engineering from San Jose State University, a Master’s degree in chemical engineering from University of California, Berkeley and an M.B.A. from the University of California at Berkeley.

Michael H. Mulroy, 49 Executive Vice President, Strategic Affairs and General Counsel and Corporate Secretary, joined us in January 2011 as Senior Vice President, Chief Financial Officer, General Counsel and Corporate Secretary. Mr. Mulroy was appointed to his current position on February 10, 2014, to spend increased time on our previously announced initiative to

investigate and evaluate potential strategic transactions to enhance shareholder value. Mr. Mulroy is a member of the Board of Directors of Comarco, Inc., a developer and designer of innovative technologies and intellectual property used in power adapters. From 2003 to 2011, Mr. Mulroy was employed by the law firm of Stradling Yocca Carlson & Rauth, where he served as a partner from 2004, and represented Questcor and other publicly-traded companies. From 1997 to 2003, Mr. Mulroy was an investment banker at Merrill Lynch and Citigroup. Mr. Mulroy earned his J.D. degree from the University of California, Los Angeles and his B.A. (Economics) from the University of Chicago.

David Young, Ph.D., 61, Chief Scientific Officer, joined our Board of Directors in September 2006. Dr. Young was appointed Chief Scientific Officer in October 2009. Prior to joining Questcor as an executive officer, Dr. Young was a member of our Board of Directors from September 2006 until his commencement of employment with us. Dr. Young was President of AGI Therapeutics, Inc. from 2006 to 2009. Previously, Dr. Young was the Executive Vice President of the Strategic Drug Development Division of ICON plc, an international contract research organization, from 2003 to 2006, and founder and CEO of GloboMax LLC, a contract drug development firm purchased by ICON plc in 2003, from 1997 to 2003. Prior to forming GloboMax, Dr. Young was an Associate Professor at the School of Pharmacy, University of Maryland where he held a number of roles including Director of the Pharmacokinetics and Biopharmaceutics Lab and Managing Director of the University of Maryland-VA Clinical Research Unit. Dr. Young holds a B.S. degree in physiology from the University of California, Berkeley, an M.S. degree in medical physics from the University of Wisconsin-Madison, a Pharm.D. from the University of Southern California and a Ph.D. in pharmaceutical sciences from the University of Southern California.

Rajesh Asarpota, 47, Senior Vice President, Chief Financial Officer, joined us in February 2014. Prior to joining Questcor, from May 2004 to February 2014, Mr. Asarpota held various financial leadership roles with Life Technologies Corporation. Most recently, Mr. Asarpota was Vice President, Finance at Life Technologies, where he was responsible for providing financial leadership on the company’s growth strategy, manufacturing operations, corporate and business unit forecasting and analysis, and mergers and acquisitions. From July 1992 to April 2004, Mr. Asarpota held various financial positions with the General Electric Corporation. Mr. Asarpota holds a M.B.A. from Marquette University and a Bachelor of Commerce from the University of Bombay.

Family Relationships

There are no family relationships between any of our directors or executive officers.

Board Leadership Structure

Our Board of Directors has, as with prior years, chosen to separate the positions of principal executive officer and Chairman of our Board of Directors. Our Board of Directors believes that it is in the best interests of our shareholders to separate the two positions because combining both positions in the same individual may concentrate too much power in the hands of a single executive. Having an independent Chairman of our Board of Directors may help facilitate communications and relations between our Board of Directors and our officers.

Board of Directors and Committee Meetings

The Board of Directors held twelve meetings during the year ended December 31, 2013. The Board of Directors has an Audit Committee, which held five meetings during the year ended December 31, 2013, a Nominating and Corporate Governance Committee, which held six meetings during the year ended December 31, 2013, a Compliance Committee, which held eleven meetings during the year ended December 31, 2013, a Compensation Committee, which held twelve meetings during the year ended December 31, 2013, a Science Committee, which was formed in December 2013 and held one meeting during the year ended December 31, 2013, and a Strategic Advisory Committee, which was formed in December 2013 and did not hold a meeting during the year ended December 31, 2013. Each of the directors attended at least 75% of the aggregate number of meetings of both our Board of Directors and the committees on which he served, held during the period for which he was a director or committee member, respectively.

We have not adopted a formal policy on members of our Board of Directors attendance at our annual meetings of shareholders, although all members of our Board of Directors are encouraged to attend. All of the then-members of our Board of Directors attended our 2013 annual meeting of shareholders.

The Audit Committee, Nominating and Corporate Governance Committee, Compensation Committee, Compliance Committee, Science Committee, and Strategic Advisory Committee operate under written charters adopted by our Board of Directors. Current copies of all of our committees' charters are available on our website at www.questcor.com.

Committees of our Board of Directors

Audit Committee

We have a separately designated standing Audit Committee of our Board of Directors established in accordance with the requirements of Section 3(a)(58)(A) of the Exchange Act. The Audit Committee is responsible for overseeing our financial controls, including the selection of our independent registered public accounting firm, the scope of the audit procedures, the nature of the services to be performed by and the fees to be paid to our independent registered public accounting firm, and any changes to our accounting standards. The Audit Committee is currently composed of three non-employee directors: Mr. Farrell, who serves as Chairman, Mr. Russell and Mr. Thompson.

After reviewing the qualifications of all current Audit Committee members and any relationship they may have that might affect their independence from us or our management, our Board of Directors has determined that (i) all current Audit Committee members are “independent” as that concept is defined under Section 10A of the Exchange Act, (ii) all current Audit Committee members are “independent” as that concept is defined under the NASDAQ listing rules, (iii) all current Audit Committee members have the ability to read and understand financial statements, and (iv) Mr. Farrell and Mr. Russell qualify as an “audit committee financial expert.” The determination set forth in (iv) of the foregoing sentence is based on a qualitative assessment of Mr. Farrell's and Mr. Russell's level of knowledge and experience based on a number of factors, including their formal education and experience.

The Board of Directors will continue to assess the qualifications of the members of its Audit Committee in light of our financial complexity, position and requirements in order to serve the best interests of us and our shareholders.

Nominating and Corporate Governance Committee

We have a separately designated standing Nominating and Corporate Governance Committee of our Board of Directors. The Nominating and Corporate Governance Committee is responsible for (i) the identification of qualified candidates to become members of our Board of Directors; (ii) the selection of candidates for recommendation to our Board of Directors as nominees for election as directors at the next annual meeting of shareholders; (iii) the selection of candidates for recommendation to our Board of Directors to fill any vacancies on our Board of Directors; (iv) the selection of a candidate for recommendation to our Board of Directors as the chairperson of our Board of Directors; (v) making recommendations to our Board of Directors regarding the staffing of committees of our Board of Directors and the chairpersons of such committees; and (vi) analyzing and making recommendations to our Board of Directors regarding corporate governance matters applicable to us. The Nominating and Corporate Governance Committee is composed of two non-employee directors: Mr. Bradsher, who serves as Chairman and Mr. Silverman. Each member of the Nominating and Corporate Governance Committee is “independent” as that concept is defined under the NASDAQ listing rules.

The Nominating and Corporate Governance Committee identifies director nominees through a combination of referrals, including from shareholders, existing members of our Board of Directors and management, and direct solicitations, where warranted. The Nominating and Corporate Governance Committee is empowered to engage organizations or companies that may help the Nominating and Corporate Governance Committee identify prospective outside director candidates. Once a candidate has been identified, the Nominating and Corporate Governance Committee reviews the individual's experience and background, and may discuss the proposed nominee with the source of the recommendation. The Nominating and Corporate Governance Committee ensures that the proposed nominee is interviewed by its committee members before making a final determination whether to recommend the individual as a nominee to the entire Board of Directors either for appointment to our Board of Directors or to stand for election by the shareholders to our Board of Directors.

The Nominating and Corporate Governance Committee will consider candidates for directors proposed by shareholders. Procedures relating to the submission of candidates to be voted upon at the Annual Meeting are set forth in our Amended and Restated Bylaws, which provide that nominations must be received not less than sixty (60) nor more than ninety (90) calendar days prior to the anniversary date of the date on which we first mailed our proxy materials for our immediately preceding annual meeting of shareholders, subject to limited exceptions. The notice of the nomination must set forth (i) the shareholder's intent to nominate one or more persons for election as a director of Questcor, the name of each such nominee proposed by the shareholder giving the notice, and the reason for making such nomination at the Annual Meeting; (ii) the name and address of the shareholder proposing such nomination and the beneficial owner, if any, on whose behalf the nomination is proposed; (iii) the class and number of our shares of capital stock that are owned beneficially and of record by the shareholder proposing such nomination and by the beneficial owner, if any, on whose behalf the nomination is proposed; (iv) whether and the extent to which any hedging or other transaction or series of transactions has been entered into by or on behalf of, or any other agreement, arrangement or understanding (including any short position or any borrowing or lending of shares of stock) has been made, the effect or intent of which is to mitigate the loss to or manage risk of stock price changes for, or to increase the voting power of, such shareholder or beneficial owner with respect to any share of our stock (which information shall be supplemented by such shareholder and beneficial owner, if any, not later than ten calendar days after the record date for the

meeting to disclose such ownership as of the record date); (v) any material interest of such shareholder proposing such nomination and the beneficial owner, if any, on whose behalf the proposal is made; (vi) a description of all arrangements or understandings between or among any of (A) the shareholder giving the notice, (B) each nominee, and (C) any other person or persons (naming such person or persons) pursuant to which the nomination or nominations are to be made by the shareholder giving the notice; (vii) such other information regarding each nominee proposed by the shareholder giving the notice as would be required to be included in a proxy statement filed in accordance with the proxy rules of the SEC had the nominee been nominated, or intended to be nominated, by our Board of Directors; and (viii) the signed consent of each nominee proposed by the shareholder giving the notice to serve as a director of Questcor if so elected.

Among the factors that the Nominating and Corporate Governance Committee considers when evaluating proposed nominees include (i) their understanding of, and commitment to, the interests of shareholders; (ii) their independence; (iii) their experience and involvement in the successful creation of shareholder value; (iv) their demonstrated commitment to good corporate citizenship, compliance with applicable laws and regulations, and efforts related to the advancement of patient care; (v) their experience in the biopharmaceutical and broader healthcare industry; and (vi) their knowledge of and experience in business matters, accounting, finance, capital markets and mergers and acquisitions. There are no stated minimum criteria for director nominees, and the Nominating and Corporate Governance Committee may consider other factors including the appropriate size of our Board of Directors and the overall mix of professional experience of the members of our Board of Directors. The Nominating and Corporate Governance Committee may request references and additional information from the candidate prior to reaching a conclusion on the appropriateness of making a recommendation regarding any prospective candidate. The Nominating and Corporate Governance Committee welcomes unsolicited recommendations, but is under no obligation to formally respond to such recommendations.

The Nominating and Corporate Governance Committee believes that differences in background, professional experiences, education, skills and viewpoints enhance our Board of Directors' performance. Thus, the Nominating and Corporate Governance Committee considers such diversity in selecting, evaluating and recommending proposed nominees. However, neither the Nominating and Corporate Governance Committee nor our Board of Directors has implemented a formal policy with respect to the consideration of diversity for the composition of our Board of Directors.

Compensation Committee

We have a separately designated standing Compensation Committee of our Board of Directors. The Compensation Committee is responsible for (i) recommending the type and level of compensation for our officers; (ii) managing our equity incentive plans; (iii) approving grants under our equity incentive plans to our non-executive officers and employees; and (iv) reviewing the Compensation Discussion and Analysis as required by SEC rules, and recommending to our Board of Directors whether the Compensation Discussion and Analysis should be included in our annual proxy statement or other applicable filings. The Compensation Committee is currently composed of three non-employee directors: Mr. Silverman, who serves as Chairman of the committee, Mr. Farrell, and Mr. Thompson. Each member of the Compensation Committee is “independent” as that concept is defined under the NASDAQ listing rules.

Compliance Committee

We have a separately designated Compliance Committee of our Board of Directors. The purpose of the Compliance Committee is to assist the Board with its oversight of significant healthcare related compliance and regulatory issues. The Compliance Committee is responsible for (i) reviewing and overseeing our compliance program; (ii) reviewing the status of our compliance with relevant laws, regulations, and internal procedures, U.S. pharmaceutical product promotional rules and regulations, product manufacturing quality control, clinical studies quality control, and required reporting to the Food and Drug Administration; and (iii) reviewing and evaluating internal reports and external data to assess whether there are opportunities for improvement regarding our regulatory and/or compliance practices. The Compliance Committee is currently composed of four non-employee directors: Dr. Whitcup, who serves as Chairman, Mr. Russell, Mr. Thompson and Mr. Silverman.

Science Committee

We have a separately designated Science Committee of our Board of Directors, which was formed on December 10, 2013. In light of the significant ongoing expansion of our research and development efforts, in terms of the number of clinical trials across multiple different diseases and disorders and with respect to Acthar and Synacthen® (tetracosactide), or Synacthen, development efforts generally, the Board appointed the Science Committee to support management's endeavors in this important area for us. The Science Committee is currently composed of two non-employee directors: Dr. Whitcup, who serves as Chairman and Mr. Thompson.

Strategic Advisory Committee

We have a separately designated Strategic Advisory Committee of our Board of Directors, which was formed on December 10, 2013. The purpose of the Strategic Advisory Committee is to provide advice and counsel to the management team and to assist the Board in its ongoing evaluation of various factors that may be contributing to what the Board believes has been a persistent and significant discount in our valuation relative to its peer companies. The Strategic Advisory Committee is responsible for supporting management's and the Board's investigation and evaluation of potential strategies to utilize the future potential cash flow to continue to generate long-term growth and value for all of our constituencies including shareholders, patients and the healthcare community. The Strategic Advisory Committee is currently composed of two non-employee directors and one employee director: Mr. Martin, who serves as Chairman, Mr. Russell and Mr. Bailey.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires our directors and executive officers, and persons who own more than ten percent of a registered class of our equity securities, to file with the SEC initial reports of ownership and reports of changes in ownership of our common stock and other equity securities. Officers, directors and greater than 10% shareholders are required by SEC regulation to furnish us with copies of all Section 16(a) forms they file. To our knowledge and based solely on a review of the copies of such reports furnished to us and written representations that no other reports were required, during the year ended December 31, 2013, all Section 16(a) filing requirements applicable to our officers, directors and greater than 10% beneficial owners were complied with.

CODE OF BUSINESS CONDUCT AND ETHICS

We have established a Code of Conduct to help our officers, directors and employees comply with the law and maintain the highest standards of ethical conduct. The Code of Conduct contains general guidelines for conducting our business, and is intended to qualify as a “code of ethics” within the meaning of Section 406 of the Sarbanes-Oxley Act of 2002 and the rules promulgated thereunder. All of our officers, directors and employees must carry out their duties in accordance with the policies set forth in the Code of Conduct and with applicable laws and regulations. A copy of the Code of Conduct can be accessed on the Internet via our website at www.questcor.com. We intend to post any amendments to, and waivers from, the Code of Conduct to our website at www.questcor.com within five days following the date of such amendment or waiver.

Item 11. Executive Compensation

COMPENSATION DISCUSSION AND ANALYSIS

Introduction

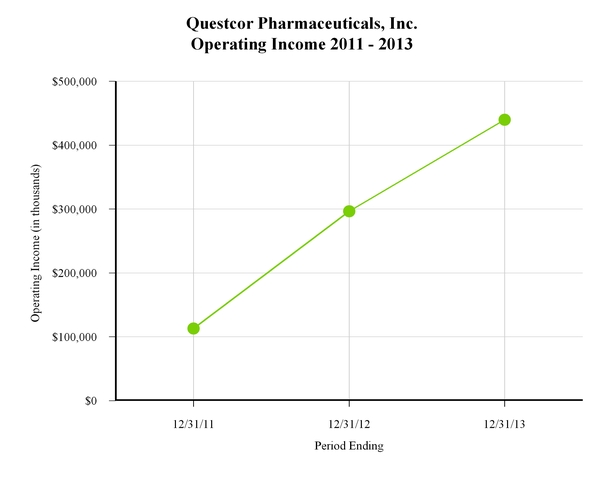

For the year ended December 31, 2013, we generated strong financial results, with net sales, operating income and earnings per share at levels higher than in 2012.

During 2013, we continued to strengthen our company and achieved numerous milestones during the year, including the following:

• | Approximately 7,400 patients with serious diseases were treated with Acthar prescribed by approximately 3,000 physicians. |

• | We acquired BioVectra, providing us with third party manufacturing capabilities and enabling us to further secure the manufacturing process trade secrets surrounding Acthar. |

• | We acquired the rights to develop Synacthen and Synacthen Depot® in the U.S. Subject to certain closing conditions, we also acquired rights to Synacthen and Synacthen Depot in certain countries outside the U.S. |

• | We completed hiring and training our Rheumatology Sales Force and began the process of educating rheumatologists about the several FDA-approved rheumatology indications on the Acthar label. We also initiated a pilot commercialization effort in pulmonology. |

• | We initiated company-sponsored, multi-center clinical trials in Amyotrophic Lateral Sclerosis (ALS) and Acute Respiratory Distress Syndrome (ARDS). We also provided financial grants to an increased number of investigator-initiated studies, some of which have resulted in important publications in peer-reviewed journals. We also began preclinical work on Synacthen, our first non Acthar U.S. pipeline program. |

• | The Board of Directors of Questcor formed two new committees. The Science Committee is charged with providing advice and counsel on all of the Company’s scientific and R&D efforts. The Strategic Advisory |

Committee was formed to help management’s investigation and evaluation of strategic alternatives, including business development opportunities, partnering, in-licensing, acquisitions, mergers, other strategic transactions and financial transactions.

• | We continued to expand our investment in research and development. We spent approximately 74% more in this area than we spent in 2012, and over 463% more than we spent in 2008. As part of this program, we have initiated two multi-center clinical trials, continued enrollment in a third, and initiated discussions with the FDA for a fourth trial. We have approximately 70 studies or trials currently underway related to Acthar. |

• | In 2013, we returned $101.2 million to our shareholders via share buybacks and dividends. |

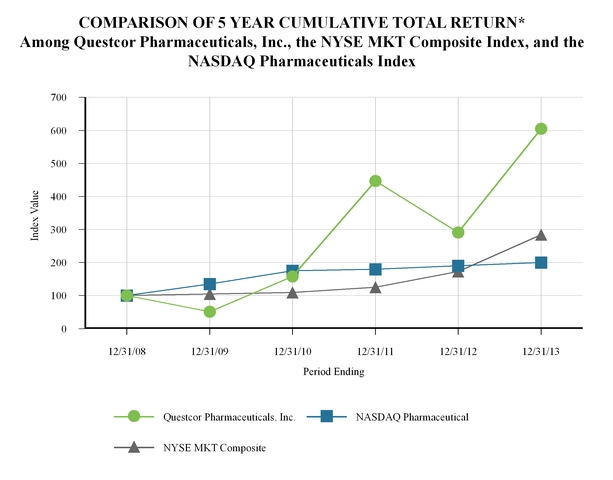

We generated strong financial results in 2013. This continued strong financial performance allowed us to continue and expand our patient focus and investments in Questcor which we believe will generate sustainable value over the long-term for our shareholders, employees, patients and all of the communities that we serve. As shown below, shareholder value has increased by 43% on an annualized basis over the last five years for a total return during that period of approximately 600%:

* $100 invested on 12/31/08 in stock or index, including reinvestment of dividends. Fiscal year ending December 31.

2013 Results of our Shareholder Vote on Executive Compensation

At our annual meeting of shareholders held in May 2013, more than 90% of the votes cast on the say-on-pay proposal were voted in favor of the proposal. The Compensation Committee believes this affirms our shareholders' support of our approach to executive compensation, which we believe has contributed greatly to our operating performance. The Compensation Committee continues to monitor and consider the results of such votes in its analysis of our executive compensation programs. Additionally, our general approach with respect to executive compensation for 2013 was substantially similar to the approach taken for 2012.

Philosophy and Overview of Compensation

Our compensation philosophy is designed to focus and incentivize management to pursue responsible, ethical, financial and operational performance which we believe will have a significant likelihood to increase shareholder value. Our

compensation programs for our employees are designed to integrate compliance and corporate citizenship objectives with the financial interests of our shareholders. Further, we seek to balance long-term and near-term objectives. Our compensation programs are additionally intended to incorporate recruitment and retention goals and relevant industry compensation levels.

On an ongoing basis, our Board of Directors reviews and considers the competitive landscape for talent within the biopharmaceutical and healthcare industries and assesses our specific senior management skills and needs and reviews our compensation programs in the context of our market environment and goals for company success and increasing shareholder value.

The compensation package for most of our full-time employees includes a number of standard components including base salary, bonus pay and equity incentive compensation. We examine these components separately and in combination in addressing the objectives set forth above:

• | Base Salary: Base salary is initially determined at the time an employee is hired by us and is evaluated and potentially adjusted annually based on a review of our performance and the performance of the employee during the prior year as well as the importance of the employee's skill set, their expected future contributions, and their ability to advance within Questcor. We seek to set executive base salary to be consistent with the depth of the experience, potential contribution and past and current performance of each individual executive compared to a wide range of comparably paid executives with comparable responsibilities and each executive officer's potential future contribution to Questcor. |

• | Bonus Pay: All of our employees are potentially eligible to earn cash bonuses based on performance. Our Acthar representatives and their managers are eligible to earn cash bonuses based on the level of prescriptions written for on-label indications in their territories. The bonuses for members of our medical affairs and compliance teams were not tied solely to financial performance measures, but, rather, were based on a management by objectives (MBO) program which included factors for performance against individual, department and company objectives. All other employees of Questcor Pharmaceuticals, Inc. were eligible to receive cash bonuses based on our achieved operating income. For these employees, which include our executive officers, the Board of Directors may adjust the bonus pool calculation to account for unusual items and reserves the right to make further discretionary adjustments before awarding bonuses from this pool based upon achievement of and compliance with certain corporate goals and objectives. For our executive officers, we compare the target bonus levels to the same benchmark data used for base salaries and, if applicable, bonus amounts in excess of a certain level of an individual's target bonus amounts are paid in the form of restricted stock. |

• | Annual Cash Compensation - Base Salary plus Bonus Pay: The sum of base salary and the cash component of any bonus pay is total cash compensation. We seek to establish total cash compensation targets for our executive officers such that the total cash compensation awarded to an executive at target, combined with any stock bonus payments, is consistent with the quality and depth of the past and current performance and the potential future contribution and experience of each individual executive compared to a wide range of peer executives at comparable companies. Cash compensation earned at levels above target is based upon outstanding and above-target performance. |

• | Equity Incentive Compensation: Equity incentive compensation consists of (i) long-term incentive awards, such as stock option grants or restricted stock awards, which are discretionary, and (ii) bonus amounts paid in the form of restricted stock. Equity incentive compensation is provided to further align individual, company, and shareholder interests. Individual long-term incentive awards are based on the quality and depth of the past and current performance and the potential future contribution and experience of each individual executive compared to a wide-range of peer executive officers at comparable companies. Compensation expense, as well as the impact of equity incentive awards on total diluted shares outstanding, is additionally taken into account when determining equity-based grants. Equity awards, whether in the form of options or restricted stock, may be subject to time-based or performance-based vesting. We award equity in the form of time-based stock options, performance-based stock options, and restricted stock to align the priorities of the executive to the priorities established by our Board of Directors. |

Finally, we compute the total compensation expense for each employee and consider its appropriateness in meeting the objectives set out above.

We also recognize that the competitive landscape within the biopharmaceutical and healthcare industries, and our position within that landscape, is constantly evolving. We continue to monitor our compensation philosophy, objectives, and outcomes with the goal of best positioning us to continue to achieve our main objective of increasing shareholder value.

Compensation and Risk Management

Our Compensation Committee and Board of Directors evaluates, on an on-going basis, our compensation practices, including for executive officers, and seeks to avoid creating improper incentives that are reasonably likely to have a material adverse affect on the Company. The Compensation Committee and Board of Directors believe that risk is appropriately managed through a combination of operational controls, discretion in awarding compensation and our compensation program's balance between long and short-term performance incentives.

Process for Determining Executive Officer Compensation at Questcor

The Compensation Committee makes recommendations to our Board of Directors relating to compensation for our executive officers. In formulating recommendations made to our Board of Directors, the Compensation Committee reviews a variety of sources.

Chief Executive Officer Input

Our Chief Executive Officer aids our Compensation Committee by providing annual performance summaries and compensation recommendations regarding our executive officers, other than him. The performance of our Chief Executive Officer is reviewed annually by our Compensation Committee and our Board of Directors.

Market Surveys

The Compensation Committee's independent executive compensation consultant consulted compensation survey data to assist in determining market pay practices for our executive officers.

Independent Executive Compensation Consultant

As done for 2012, for 2013 the Compensation Committee commissioned Radford as an independent executive compensation consultant to assist our Compensation Committee in defining an updated industry peer group for our company as well as compiling and analyzing relevant company, industry and peer group data to inform our executive compensation plans, targets and practices. Radford does not provide any other services to us and interfaces with our management only on matters for which the Compensation Committee is responsible. The Compensation Committee has assessed the independence of Radford in accordance with SEC rules and concluded that no conflict of interest exists that would prevent Radford from serving as an independent compensation consultant to the Compensation Committee. The Compensation Committee periodically sought input from Radford on a range of external market factors, including evolving compensation trends, appropriate peer companies and the aforementioned market survey data. Radford also provided general observations on our compensation programs, but it did not specifically determine the amount or form of compensation for our named executive officers.

Peer Group

In setting compensation for 2013, the Compensation Committee and our Board of Directors also reviewed the compensation practices of a group of 16 specialty pharmaceutical companies. In selecting the peer group for evaluating 2013 compensation, the Compensation Committee generally selected biopharmaceutical companies with revenues between $150 million and $900 million, and market capitalizations between approximately $900 million and $5.9 billion. The peer group companies examined by the Committee for setting 2013 compensation were as follows:

Acorda Therapeutics, Inc. | Medivation |

Alkermes, Inc. | Myriad Genetics, Inc. |

Auxilium Pharmaceuticals, Inc. | Onyx Pharmaceuticals, Inc. |

Biomarin Pharmaceutical Inc. | Salix Pharmaceuticals, Ltd. |

Cubist Pharmaceuticals, Inc. | Seattle Genetics |

Incyte | The Medicines Company |

Jazz Pharmaceuticals, Inc. | United Therapeutics Corporation |

Medicis Pharmaceutical Corporation | ViroPharma Incorporated |

Compensation Committee

The Compensation Committee and our management use the survey data, the compensation consultant's report, and its review of the peer group to assist in the analysis of market pay practices relevant to our executive officers. The survey data, the

compensation consultant's report, and the peer group company data are complementary to one another. The Compensation Committee reviewed the survey data, the compensation consultant's report, and the peer group data to compare our compensation levels to market compensation levels, taking into consideration company performance, size, and industry sector, as well as the individual executive officer's level of skill and responsibility.

The Compensation Committee uses the data contained in surveys, the compensation consultant's report, and peer group data as reference points for Compensation Committee decisions and recommendations, but without any formulaic benchmarking. These factors, together with risk management, recruitment and retention considerations, shareholder value considerations, and appropriately blending near and longer term incentive considerations provide the strategic foundation for our plans and policies. In 2013, we utilized a bonus policy driven by 2013 operating income to incentivize management to consider both near- and long-term investment and operational performance in their decision-making processes regarding strategic priorities and allocation of resources.

Total Compensation

The compensation package provided for each executive officer is comprised of four elements, which are described in more detail below:

• | base salary; |

• | annual performance-based cash bonus awards; |

• | long-term stock-based incentive awards; and |

• | employee benefits. |

Base Salary

Executive officer base salaries are initially set at the time of hire. Base salaries are reviewed annually and adjusted as appropriate in light of the individual executive officer's responsibilities, level of performance and in comparison to how the executive officer's salary compares with the salaries of our other executive officers. We also review comparable company salary data and believe that the base salaries we provide to our executive officers are reasonable relative to the base salaries offered by similarly situated companies, including peer companies. Base salaries impact target bonus amounts which are set as a percentage of base salary, though actual bonus awards are subject to multiple factors.

Annual Performance-Based Cash Bonus Awards

It is the Compensation Committee's objective to have a substantial portion of each executive officer's compensation contingent upon our performance as well as upon his or her own level of performance and contribution to our performance against our quantitative and qualitative corporate objectives. Employees, other than Acthar representatives, their managers and members of medical affairs and compliance teams, are eligible to receive bonus compensation upon our achievement of certain levels of operating income. As in previous years, our incentive programs are designed to align pay with performance.

Our executive officers participate in our company-wide annual bonus pool. The size of the bonus pool is based on the level of “achieved operating income” which is driven by our income from operations, or operating income, under Generally Accepted Accounting Principles, which we refer to as GAAP, but subject to possible adjustments, including for items that the Compensation Committee determines to be extraordinary in nature. For 2013, the bonus pool was determined based on the following formula, which was determined at the beginning of 2013:

• | if achieved operating income was less than $360 million, the bonus pool was equal to zero; |

• | if achieved operating income was at least $360 million, but less than $447.7 million (which reflected an increase of 51% from 2012 levels), the bonus pool was equal to 5.8141% of the portion of achieved operating income that exceeds $360 million; and |

• | if achieved operating income was $447.7 million (which reflected an increase of 51% from 2012 levels) or more, the bonus pool was equal to an additional 6.696% of achieved operating income in excess of $447.7 million. |

The formula described above was intended to provide bonus levels approximately equal to target bonus amounts if the achieved operating income equaled approximately $447.7 million (which reflected an increase of 51% from 2012 levels).

In determining its recommendation with respect to an executive officer's performance compensation, the Compensation Committee first considers the size and potential allocation of the objectively determined company-wide annual bonus pool and then evaluates each executive officer's individual performance using a variety of subjective factors. Our Chief Executive Officer presents his recommendations to the Compensation Committee, which may incorporate the input into its recommendations for individual executive officer performance compensation. The Compensation Committee reviews all recommendations, applies its judgment, and may make adjustments to the recommendations of the Chief Executive Officer.

The Board of Directors reviews the Compensation Committee's recommendations, considers further adjustments, and ultimately is responsible for approving final award amounts. Throughout this process, the Chief Executive Officer, the Compensation Committee and our Board of Directors also consider other factors relating to our performance during the year and each executive officer's contribution to that performance.

In February 2014, the Compensation Committee and Board of Directors reviewed the Chief Executive Officer's recommendations and subsequently determined each executive officer's performance compensation for 2013. Among our performance-related factors that impacted the deliberations of the Chief Executive Officer, the Compensation Committee and our Board of Directors were the following:

• | We had strong financial results in 2013, with net sales, operating income and earnings per share increasing by 57%, 48% and 52%, respectively, from 2012 levels. |

• | We continued to expand our investment in research and development. We spent approximately 74% more in this area than we spent in 2012, and over 463% more than we spent in 2008. As part of this program, we have initiated two multi-center clinical trials, continued enrollment in a third, and initiated discussions with the FDA for a fourth trial. |

• | We acquired BioVectra, providing us with third party manufacturing capabilities and enabling us to further secure the manufacturing process trade secrets surrounding Acthar. |

• | We acquired the rights to develop Synacthen and Synacthen Depot in the U.S. Subject to certain closing conditions, we also acquired rights to Synacthen® and Synacthen Depot® in certain countries outside the U.S. |

• | We completed the hiring and training of our Rheumatology Sales Force and began the process of educating rheumatologists about the several FDA-approved rheumatology indications on the Acthar label. We also initiated a pilot commercialization effort in pulmonology. |

• | We initiated company-sponsored, multi-center clinical trials in Amyotrophic Lateral Sclerosis (ALS) and Acute Respiratory Distress Syndrome (ARDS). We also provided financial grants to an increased number of investigator-initiated studies, some of which have resulted in important publications in peer-reviewed journals. We also began preclinical work on Synacthen, our first non Acthar U.S. pipeline program. |

• | In 2013, we returned $101.2 million to our shareholders via share buybacks and dividends. |

As a result, the Compensation Committee and Board of Directors carefully reviewed our strong performance during 2013 and elected to award bonuses as determined by the formula described above and set forth in the 2013 bonus policy.

Target incentive amounts are developed for each executive officer and are set as a percent of the executive officer's base salary. The percentage is correlated to the importance and difficulty of that executive officer's role in our achieving operating income, and is part of the analysis to determine that executive officer's share of our company-wide annual bonus pool.

Generally, to qualify for an award payment, the employee must be employed continuously and in good standing through the date on which the award is paid. For executives, incentive awards approved by our Board of Directors will be paid only after the Audit Committee determines that the results for the year are finalized.

The degree to which an executive officer has performed as well as consideration of extraordinary achievements will guide, but not dictate, the Chief Executive Officer's recommendation to the Compensation Committee, the Compensation Committee's recommendation to our Board of Directors and our Board of Directors' decision. The Compensation Committee and our Board of Directors may elect to waive any conditions, accept, reject, increase, reduce or delay the Chief Executive Officer's recommendation at its sole discretion. Furthermore, the Compensation Committee has the power to recommend and our Board of Directors has the ability to approve bonuses substantially in excess of or substantially less than the previously established target bonuses.

The award determination of our Board of Directors, if any, is final.

Our 2013 achieved operating income of $462.6 million was driven by our GAAP operating income of $439.8 million, which amount was higher than our budgeted operating income for 2013 and 48% higher than our achieved operating income for 2012. As a result of our 2013 achieved operating income exceeding $447.7 million, our executive officers received bonuses of approximately 1.19 times their target bonus amounts as determined at the beginning of 2013.

For 2013, our Board of Directors, based on the recommendation of the Compensation Committee, determined the bonus amounts awarded to our named executive officers (other than Mr. Bailey) as follows, as compared to their 2013 incentive bonus target, expressed as a percentage of the executive officers' 2013 base salary. As explained above, in each case, the actual 2013 bonus awarded was higher than an amount solely based upon the 2013 bonus target.

Name | Title | 2013 Bonus Target | 2013 Cash Incentive Compensation | |||

Stephen L. Cartt | Chief Operating Officer | 70 | % | $ | 368,813 | |

David J. Medeiros | Executive Vice President and Chief Technical Officer | 55 | % | $ | 306,828 | |

Michael H. Mulroy | Executive Vice President, Strategic Affairs and General Counsel | 55 | % | $ | 307,555 | |

David Young, Pharm.D., Ph.D. | Chief Scientific Officer | 60 | % | $ | 371,913 | |

The awarding of the executive officers' bonus awards were contingent on the satisfactory completion of the audit of our financial statements for the year ended December 31, 2013 by our independent registered public accounting firm. While the bonus awards were paid in February 2014, the cash bonus awards were expensed in 2013 as they related to 2013 performance.

Long-Term Stock Based Incentive Awards

We believe that long-term stock based compensation helps drive our long-term performance by aligning the interests of our executive officers with those of our shareholders. Long-term incentive compensation also facilitates retention of executive officers and other employees through long-term vesting and wealth accumulation. Our long-term incentive compensation program is broad-based, with all of our full-time employees as of December 31, 2013 participating in the program.

We generally use stock options or restricted stock grants for long-term incentive compensation. We believe equity compensation aligns the interests of executive officers with the interests of shareholders as the value of these awards increases if and as the stock price increases. Stock options are granted with exercise prices equal to the fair market value of our common stock and we do not re-price stock options.

The Compensation Committee and our Board of Directors also take into account the price of our stock and the overall value of the grant when approving awards. We also consider the accounting impact of granting equity compensation, including the requirement to expense grant date fair value of options and restricted stock grants under ASC Topic 718.

Each year, the Compensation Committee and our Board of Directors consider guidelines relating to the maximum number of stock options and restricted shares available for granting to all employees during that year. This amount, which is not binding on the Compensation Committee or our Board of Directors, varies from year to year, based on specific hiring and retention needs as well as competitive factors, but is generally equal to approximately 2-3% of our outstanding shares. Most of our grants vest over a four year period from the date of grant and unvested options are returned to the available pool of options if an employee leaves Questcor. We have used a majority of our free cash flow to repurchase a significant number of shares of our common stock since 2008, which has decreased the total number of shares outstanding during this period. The Compensation Committee considers the impact of these repurchases, which it believes benefits all of our shareholders, on the total number of shares outstanding when reviewing the number of equity grants awarded to employees.

In February 2013, at a regularly scheduled meeting, our Board of Directors approved restricted stock awards to each of the executive officers under the 2006 Equity Incentive Award Plan. A portion of the restricted stock awards granted were subject to time-based vesting and the remainder was subject to performance-based vesting. The performance-based restricted stock awards vest based on the level of achieved operating income during 2013.

The grants to our named executive officers are reflected in the compensation tables summarized below. The table below does not include Mr. Bailey, whose compensation is discussed under “CEO Compensation” below.

Named Executive Officer | Restricted Stock Awards | ||

Stephen L. Cartt | 62,000 | (1) | |

David J. Medeiros | 36,500 | (2) | |

Michael H. Mulroy | 46,500 | (3) | |

David Young | 50,000 | (4) | |

1. | 31,000 shares of Mr. Cartt's grant consist of time-based vesting and 31,000 shares of Mr. Cartt's grant vest based on the level achievement of certain performance goals and targets. |

2. | 18,250 shares of Mr. Medeiros' grant consist of time-based vesting and 18,250 shares of Mr. Medeiros' grant vest based on the level achievement of certain performance goals and targets. |

3. | 28,250 shares of Mr. Mulroy's grant consist of time-based vesting and 18,250 shares of Mr. Mulroy's grant based on the level the achievement of certain performance goals and targets. |

4. | 25,000 shares of Dr. Young's grant consist of time-based vesting and 25,000 shares of Dr. Young's grant vest based on the level achievement of certain performance goals and targets. |

Recoupment Policy

In April 2010, we adopted a Bonus Compensation Recoupment Policy. The Bonus Compensation Recoupment Policy includes standards for seeking the return (claw-back) from our Chief Executive Officer and Chief Financial Officer of all or a portion of bonus compensation, whether in the form of cash or equity, upon the occurrence of certain events. We adopted our Bonus Compensation Recoupment Policy prior to the enactment of federal legislation mandating the SEC to implement regulations requiring publicly-traded companies to have claw-back policies. We anticipate that we will revise our Bonus Compensation Recoupment Policy at such time as the SEC completes its rulemaking process with respect to such policies, but we may revisit our policy in advance of SEC rulemaking.

Employee Benefits

In order to attract and retain employees, we provide our executive officers and other employees the following benefits:

Medical Insurance. We provide to each executive officer, the executive officer's spouse and children such health, dental and vision insurance coverage as we may from time to time make available to our other executive officers of the same level of employment. We pay 100% of the employee premium and 90% of the dependent premium for this insurance for all of our employees. We pay 100% of the dependent premiums for this insurance for our executive and non-executive officers. In addition, for all executive and non-executive officers, we provide a benefit that offers reimbursement for many out-of-pocket medical expenses including, for example, deductibles and prescription co-pays.

Life and Disability Insurance. We provide all of our employees, including our executive officers, with disability and life insurance. Employees at the director level and above, including our executive officers, receive a disability and life insurance benefit equal to two times base salary, up to $600,000.

Defined Contribution Plan. We offer a Section 401(k) Savings/Retirement Plan, which we refer to as the 401(k) Plan, a tax-qualified retirement plan, to our eligible employees, including our executive officers. The 401(k) Plan permits eligible employees to defer up to 60% of their annual eligible compensation, subject to certain limitations imposed by the Internal Revenue Code of 1986, as amended, which we refer to as the Code. The employees' elective deferrals are immediately vested and non-forfeitable in the 401(k) Plan. The plan allows for us to make matching contributions, which are equal to 100% of the first 3% of the employee contribution.

Stock Purchase Plan. Our Amended and Restated 2003 Employee Stock Purchase Plan, which qualifies under Section 423 of the Internal Revenue Code, permits participants voluntarily to invest a portion of their own funds in our stock on a discounted basis. During 2013, participants in our Amended and Restated 2003 Employee Stock Purchase Plan could purchase shares at a price equal to 85% of the stock price on the applicable three month purchase date. To pay for the shares, each participant may authorize periodic payroll deductions between 1% and 15% of his or her base cash compensation, subject to certain limitations imposed by the Code, including a limitation of no more than $25,000 purchased through this plan per calendar year. Our Amended and Restated 2003 Employee Stock Purchase Plan is available to all of our employees, including our executive officers.

Chief Executive Officer Compensation

In February 2013, at a regularly scheduled meeting, our Board of Directors reviewed the Compensation Committee's recommendations for Mr. Bailey's compensation. The Compensation Committee based its recommendation on Mr. Bailey's performance, as well as on a review of our peer group data and other available compensation survey data. Based on this recommendation, the Board of Directors set Mr. Bailey's base salary for 2013 at $832,000, and set Mr. Bailey's 2013 bonus target at 100% of his annual base salary, which was part of the analysis used by the Compensation Committee and our Board of Directors to determine his share of our company-wide annual bonus pool.

At the same meeting, our Board of Directors approved two restricted stock award grants to Mr. Bailey under the 2006 Equity Incentive Award Plan. Mr. Bailey was granted 85,250 shares of restricted stock which vest annually in four equal installments and 85,250 shares of restricted stock which vest based on the achievement of certain performance criteria.

The 85,250 shares of restricted stock subject to performance-based vesting included a one-time performance achievement and vest according to the degree at which the performance milestone is achieved. At December 31, 2013, we determined achievement of the milestone was reasonably probable and estimable at a level equal to one-third the value and, therefore, recorded an appropriate amount of stock-based compensation expense associated with such grants.

Mr. Bailey and Questcor entered into an employment agreement on June 2, 2008. The terms of that employment agreement provide Mr. Bailey with certain severance and change-of-control provisions should we terminate Mr. Bailey's employment without cause or Mr. Bailey terminates his employment for good reason. Also under the terms of that agreement, Mr. Bailey would receive additional severance compensation and have the vesting of his stock options and restricted stock awards fully accelerated if his employment is terminated without cause or by Mr. Bailey for good reason in connection with a change in control of Questcor. Certain provisions of Mr. Bailey's agreement were amended in December 2008 to ensure that the terms of the agreement are compliant with Section 409A of the Code.

In providing the employment agreement to Mr. Bailey, we intended that he not be subject to a tax penalty as a result of the vesting of his stock options or restricted stock being accelerated, or his receipt of severance compensation, if his employment terminates in connection with a change of control in which our shareholders receive a significant benefit. Accordingly, in the event of certain transactions providing a required return to our shareholders, our employment agreement entered into with Mr. Bailey in 2008 provides for tax protection in the form of a potential gross-up payment to reimburse Mr. Bailey for certain excise taxes imposed under Section 4999 of the Code as well as additional taxes resulting from such reimbursement. If the total of all payments to which Mr. Bailey is entitled in connection with the change of control is less than 125% of the safe harbor under the applicable IRS regulations, as more fully described below in the section entitled, “Sections 280G and 4999,” then our shareholders are deemed to have not received enough of a benefit in the transaction and, as such, Mr. Bailey is not entitled to a gross-up payment and the amounts payable to him are reduced to the amount of the safe harbor.