Attached files

| file | filename |

|---|---|

| EX-32.1 - EX-32.1 - MTR GAMING GROUP INC | a2219944zex-32_1.htm |

| EX-32.2 - EX-32.2 - MTR GAMING GROUP INC | a2219944zex-32_2.htm |

Use these links to rapidly review the document

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D. C. 20549

Amendment No. 1

to

FORM 10-K/A

| (Mark One) | ||

ý |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the fiscal year ended December 31, 2013 |

||

or |

||

o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the transition period from to |

||

Commission File Number 000-20508

MTR GAMING GROUP, INC.

(Exact name of registrant as specified in its charter)

| DELAWARE (State of other jurisdiction of incorporation or organization) |

84-1103135 (I.R.S. Employer Identification No.) |

|

STATE ROUTE 2, SOUTH, P.O. BOX 356, CHESTER, WEST VIRGINIA 26034 (Address of principal executive offices) |

26034 (Zip Code) |

(304) 387-8000

(Issuer's telephone number, including area code)

(Former name, former address and former year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each Class: | Name of each exchange on which registered: | |

|---|---|---|

| Common Stock $.00001 par value | The NASDAQ Stock Market, LLC |

Securities registered pursuant to Section 12(g) of the Act: NONE

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 of 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by checkmark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding twelve months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer," and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer o | Accelerated filer ý | Non-accelerated filer o (Do not check if a smaller reporting company) |

Small reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in rule 12b-2 of the Exchange Act) Yes o No ý

As of June 30, 2013, the aggregate market value of our voting and non-voting common equity held by non-affiliates of the Company (based on the number of shares issued and outstanding and the NASDAQ Official Close Price on that date) was $86.8 million.

As of March 12, 2014, there were 28,144,470 outstanding shares of our Common Stock

Documents Incorporated by Reference

None

MTR Gaming Group, Inc. ("MTR," the "Company," "we," "our" or "us") is filing this Amendment No. 1 on Form 10-K/A (this "Amendment") to amend our Annual Report on Form 10-K for the year ended December 31, 2013 (the "Form 10-K"), originally filed with the Securities and Exchange Commission (the "SEC") on March 14, 2014 (the "Original Filing"), to include the information required by Items 10 through 14 of Part III of our Form 10-K. This information was previously omitted from our Form 10-K in reliance on General Instruction G(3) to Form 10-K, which permits the information in the above-referenced items to be incorporated in our Form 10-K by reference to our definitive proxy statement if such statement is filed no later than 120 days after our fiscal year end. We are filing this Amendment to include Part III information in our Form 10-K because the Company has not yet scheduled its Annual Meeting of Stockholders for 2014 and, accordingly, the Company's definitive proxy statement containing such information will not be filed on or before 120 days after our fiscal year end.

Except as described above, no other changes have been made to the Form 10-K. The Form 10-K continues to speak as of the date of the Original Filing, and the Company has not updated the disclosures contained therein to reflect any events which occurred at a date subsequent to the Original Filing other than as expressly indicated in this Amendment.

i

ITEM 10. DIRECTORS, EXECUTIVE OFFICERS, AND CORPORATE GOVERNANCE

Members of the Board of Directors and Executive Officers

Name

|

Age | Position and Office Held | |||

|---|---|---|---|---|---|

Steven M. Billick(3)(5) |

57 | Chairman of the Board | |||

Robert A. Blatt(1)(2)(6) |

73 | Vice Chairman of the Board and Assistant Secretary | |||

Richard Delatore(2)(3)(4)(6) |

74 | Director | |||

Raymond K. Lee(1)(2)(3)(5) |

57 | Director | |||

Roger P. Wagner(1)(2)(4)(5) |

66 | Director | |||

Joseph L. Billhimer, Jr. |

50 | President and Chief Operating Officer | |||

John W. Bittner, Jr. |

61 | Executive Vice President and Chief Financial Officer | |||

- (1)

- Member

of the Finance Committee

- (2)

- Member

of the Succession Committee

- (3)

- Member

of the Audit Committee

- (4)

- Member

of the Nominating and Corporate Governance Committee

- (5)

- Member

of the Compensation Committee

- (6)

- Member of the Compliance Committee

Steven M. Billick, 57, has been a director of the Company since October 2008, and was elected Chairman of the Board of Directors on March 12, 2010. Mr. Billick serves as a member of our Compensation and Audit Committees. During the period September 28, 2010 to January 10, 2011, Mr. Billick served as the Company's interim Chief Executive Officer. Mr. Billick did not serve on the Compensation Committee or the Audit Committee during the period of his service as interim Chief Executive Officer. Mr. Billick is presently a managing director with Inglewood Associates, LLC, a turnaround consulting firm, a position he has held since 2007. Since 2006, Mr. Billick has been the principal of Edgerton Associates, LLC, a management consulting firm. From 2000 to 2005, Mr. Billick was the executive vice president, chief financial officer and treasurer of Agilisys, Inc., a publicly-traded distributor of computer hardware, software and service products. Mr. Billick also worked with Deloitte & Touche in Cleveland, Ohio from 1977 to 1991. He was a partner with Deloitte & Touche from 1987 to 1991. While at Deloitte & Touche, Mr. Billick provided audit and financial consulting services to a diverse group of clients. Mr. Billick received his Bachelor of Science in Business Administration from John Carroll University in 1977.

The Board selected Mr. Billick to serve as director due to his particular knowledge and experience in a number of areas, including management, accounting, computer systems and finance. Additionally, Mr. Billick has occupied a variety of executive positions at numerous institutions, giving him extensive leadership experience. The diversity of Mr. Billick's particular qualifications and skills strengthens the Board's collective knowledge and capabilities.

Robert A. Blatt, 73, has been a director of the Company since 1995 and was a Vice President from 1999 until April 2007, when he became Vice Chairman. Mr. Blatt is Chairman of the Finance Committee and the Succession Committee and a Board representative on the Company's Compliance Committee. He is also Assistant Secretary of the Company. Since 1979, he has been chairman and chief executive officer of CRC Group, Inc., and related entities, a developer, owner, and operator of shopping centers and other commercial properties, and, from 1985 until its initial public offering in 2006, a member (seat owner) of the New York Stock Exchange, Inc. Mr. Blatt is the managing member of New England National, L.L.C., a residential real estate development firm with operations in

1

southeastern Connecticut and New Hampshire. Mr. Blatt served as a director of AFP Imaging Corp., a then-publicly traded medical and dental imaging company, from 1995 through 2009. From 1959 through 1991, Mr. Blatt also served as director, officer or principal of a number of public and private enterprises. Mr. Blatt received his Bachelor of Science in Finance from the University of Southern California in 1962 and his Juris Doctor from the University of California at Los Angeles in 1965. He is a member of the State Bar of California.

The Board selected Mr. Blatt to serve as director due to his particular knowledge and experience in a number of areas, including developing, owning and operating commercial properties, serving as a member of the New York Stock Exchange and directing companies. Mr. Blatt has served as member of, or adviser to, the boards of over 30 public and private companies. Together with this experience, Mr. Blatt's qualifications and skills strengthen the Board's collective knowledge and capabilities.

Richard Delatore, 74, has been a director of the Company since 2004. Mr. Delatore serves as a member of our Audit and Succession Committees, Chairman of our Nominating and Corporate Governance Committee and as Chairman and Board representative on the Company's Compliance Committee. Mr. Delatore has been a vice president with Schiappa & Company, which is involved in the coal mining and hauling business and located in Wintersville, Ohio, since 2002 and has been a vice president of OHI-RAIL Corporation, a short line railroad servicing the gas, oil and coal industries in southeastern Ohio, since 2005. Mr. Delatore has also been a coal and timber consultant in Steubenville, Ohio since 1970, and served as a commissioner on the Board of Commissioners in Jefferson County, Ohio from 2000 to 2004. Mr. Delatore owned, bred and raced thoroughbred horses from 1978 to 1992 and was a member of the Ohio State Racing Commission from 1995 to 1999. Mr. Delatore chaired the Medication Committee of the Ohio State Racing Commission in 1999. He was also a member of the Steubenville City School Board of Education from 1993 to 2000 and a member of the Jefferson County Joint Vocational School Board of Education from 1995 to 1998. Mr. Delatore was honored as the "Italian American of the Year" for 2006 by the Upper Ohio/ West Virginia Italian Heritage Festival. Mr. Delatore received his Bachelor of Science in Business Administration from Franciscan University of Steubenville, Ohio in 1970.

The Board selected Mr. Delatore to serve as director due to his particular knowledge and experience in a number of areas, including rail, natural resources and horse racing. Mr. Delatore also brings to the Board regulatory expertise, as well as the experience of directing educational institutions. The diversity of Mr. Delatore's qualifications and skills strengthens the Board's collective knowledge and capabilities.

Raymond K. Lee, 57, has been a director of the Company since October 2008. Mr. Lee serves as Chairman of our Audit Committee and a member of our Finance, Succession, and Compensation Committees. Since 2003, Mr. Lee has been the president and chief executive officer of Country Pure Foods, LLC (CPF), a privately-held corporation headquartered in Akron, Ohio. Prior to 2003, Mr. Lee served as chief operating officer for Roetzel and Andress, a major law firm headquartered in Akron, Ohio as well as interim chief executive officer for Khyber Technologies, a startup technology company. He also served as chief executive officer, chief financial officer and executive vice president of operations for CPF and its predecessors from 1992 to 2001, before rejoining CPF in 2003. Mr. Lee was a tax partner with Deloitte & Touche in northeast Ohio from 1988 to 1992. He served as a tax manager and senior manager with Deloitte & Touche from 1981 to 1988. While at Deloitte & Touche, Mr. Lee provided business and tax consulting services to a diverse group of clients. Since 2008, he has served on the board of directors of University Hospitals Case Medical Center in Cleveland, Ohio. From 2004 to 2010, Mr. Lee served as a director and chairman of Juice Products Association, a trade association. Mr. Lee received his CPA from the State of Ohio and his Bachelor of Science in Accounting from the University of Akron in 1979.

2

The Board selected Mr. Lee to serve as director due to his particular knowledge and experience in a number of areas, including business leadership and finance. As Chief Executive Officer of Country Pure Foods, Mr. Lee is responsible for manufacturing operations, sales, marketing, finance and human resources. Together with his financial background at Deloitte & Touche, Mr. Lee's qualifications and skills strengthen the Board's collective knowledge and capabilities.

Roger P. Wagner, 66, has been a director of the Company since May 2010. Mr. Wagner serves as Chairman of the Compensation Committee and member of the Finance, Succession and Nominating and Corporate Governance Committees. Mr. Wagner has over forty years of experience in the gaming and hotel management industry and is a former founding partner of House Advantage, LLC, a gaming consulting group that focuses on assisting gaming companies in improving market share and bottom line profits. Most recently, Mr. Wagner served as chief operating officer for Binion Enterprises from 2007 through 2010, assisting legendary Jack Binion in identifying gaming opportunities. Prior to that, Wagner served as chief operating officer of Resorts International Holdings from 2005 to 2007. Mr. Wagner served as president of Horseshoe Gaming Holding Corp. from 2001 until its sale in 2004 and as its senior vice president and chief operating officer from 1998 to 2001. Prior to joining Horseshoe, Mr. Wagner served as president of the development company for Trump Hotels & Casino Resorts from 1996 to 1998, president and chief operating officer of Trump Castle Casino Resort from 1991 to 1996 and president and chief operating officer of Claridge Casino Hotel from 1983 to 1991. Prior to his employment by Claridge Casino Hotel, he was employed in various capacities by the Edgewater Hotel Casino, Sands Hotel Casino, MGM Grand Casino—Reno, Frontier Hotel Casino and Dunes Hotel Casino. Mr. Wagner graduated from the University of Nevada Las Vegas in 1969.

The Board selected Mr. Wagner to serve as a director due to his particular knowledge and experience gained in over 40 years in the gaming and hospitality industry. Mr. Wagner has vast experience in all aspects of managing gaming and hospitality companies, including sales, marketing, development, finance and human resources. The depth of Mr. Wagner's experience as an executive of multiple gaming companies, managing multiple gaming properties and acting as a consultant to gaming companies strengthens the Board's collective knowledge and capabilities.

Joseph L. Billhimer Jr., 50, has over thirty years of experience working in the gaming industry. Mr. Billhimer joined the Company in April 2011 and has served as President and Chief Operating Officer since September 2013. Previously, Mr. Billhimer served as Acting President and Chief Operating Officer from May to September 2013, and Executive Vice President and Chief Operating Officer from November 2011 to May 2013. Mr. Billhimer also served as Senior Vice President of Operations & Development of the Company and concurrently President and General Manager of Mountaineer from April to November 2011. Mr. Billhimer was a principal of Foundation Gaming Group, an advisory and management services firm for the gaming industry, which among other engagements, managed Harlow's Casino & Resort in Greenville, Mississippi from 2009 to 2010 and marketed its sale to Churchill Downs. Prior to Foundation Gaming Group, Mr. Billhimer served as president of Trilliant Gaming Illinois, LLC, a gaming development company, from 2008 to 2009. From 2003 to 2008, he was president and chief executive officer of Premier Entertainment LLC, the developer and parent of the Hard Rock Hotel and Casino in Biloxi, Mississippi. While at Premier Entertainment, he was named Casino Journal's Executive of the Year in 2007 for his efforts in re-developing the Hard Rock Hotel and Casino after being destroyed by Hurricane Katrina and filing bankruptcy. Prior to Premier Entertainment, Mr. Billhimer spent three years as President and General Manager of Caesars Entertainment's Grand Casino Resort in Gulfport, Mississippi, and prior to that experience, eight years with Pinnacle Entertainment where he was Executive Vice President and General Manager of Casino Magic in Bay St. Louis, Mississippi.

John W. Bittner Jr., 61, was appointed as the Company's Executive Vice President and Chief Financial Officer in November 2010, after serving as interim Chief Financial Officer. Mr. Bittner previously served as Executive Vice President of Finance and Accounting, a position he held from May

3

2008 to November 2010. Mr. Bittner joined the Company as its Chief Financial Officer in January 2002 and served in that position until May 2008. Prior to joining the Company, Mr. Bittner was a partner at Ernst & Young, LLP from 1987 to 2000 and was with Ernst & Young, LLP from 1975 to 2000. While at Ernst & Young, LLP, Mr. Bittner provided accounting, auditing and business advisory services to privately- and publicly-held organizations in a variety of industries. During 2001, Mr. Bittner was an accounting and financial consultant. Mr. Bittner is a CPA licensed in Pennsylvania. Mr. Bittner received his Bachelor of Science in Accounting from Duquesne University in 1975. Mr. Bittner is a member of the American Institute of Certified Public Accountants and the Pennsylvania Institute of Certified Public Accountants.

Section 16(a) Beneficial Ownership Reporting Compliance

Under the provisions of Section 16(a) of the Exchange Act, the Company's executive officers, directors and 10% beneficial stockholders are required to file reports of their transactions in the Company's securities with the Commission. Based solely on a review of the Forms 3 and 4 and amendments thereto furnished to the Company during its most recent fiscal year and Forms 5 and amendments thereto furnished to the Company with respect to its most recent fiscal year, we believe that as of December 31, 2013, all of our executive officers, directors and greater than 10% beneficial stockholders complied with all filing requirements applicable to them during 2013.

Code of Ethics

We have adopted a code of ethics and business conduct applicable to all directors and employees, including the chief executive officer, chief financial officer and principal accounting officer. The code of ethics and business conduct is posted on our website, http://www.mtrgaming.com, under "Investor Relations—Corporate Governance" and a printed copy will be delivered on request by writing to the Corporate Secretary at MTR Gaming Group, Inc., State Route 2, South, P.O. Box 356, Chester, West Virginia 26034, Attention: Corporate Secretary. We intend to satisfy the disclosure requirement regarding certain amendments to, or waivers from, provisions of its code of ethics and business conduct by posting such information on our website.

Corporate Governance

For a director to be considered independent, the director must meet the bright-line independence standards under the listing standards of NASDAQ and the Board must affirmatively determine that the director has no material relationship with us, directly, or as a partner, stockholder or officer of an organization that has a relationship with us. The Board determines director independence based on an analysis of the independence requirements of the NASDAQ listing standards. In addition, the Board will consider all relevant facts and circumstances in making an independence determination. The Board also considers all commercial, industrial, banking, consulting, legal, accounting, charitable, familial or other business relationships any director may have with us. The Board has determined that the following four directors satisfy the independence requirements of NASDAQ: Steven M. Billick, Richard Delatore, Raymond K. Lee, and Roger P. Wagner. There are no family relationships between or among any of the executive officers or directors of the Company.

Audit Committee

The Audit Committee of the Board of Directors was established by the Board in accordance with the Securities Exchange Act of 1934, as amended, to oversee the Company's corporate accounting and financial reporting processes and audits of its financial statements. Messrs. Billick, Delatore, and Lee, all of whom are independent directors, make up the Board's Audit Committee. The Audit Committee operates under a written charter adopted by the Board of Directors, which is available on our Internet website at www.mtrgaming.com under "Investor Relations—Corporate Governance." Our website and

4

information contained on it or incorporated therein are not intended to be incorporated in this Proxy Statement or our other filings with the Securities and Exchange Commission.

The Securities and Exchange Commission adopted a rule requiring disclosure concerning the presence of at least one "audit committee financial expert" on audit committees. Our Board of Directors has determined that Mr. Lee qualifies as an "audit committee financial expert" as defined by the Securities and Exchange Commission and that Mr. Lee is independent, as independence for Audit Committee members is defined pursuant to the applicable NASDAQ listing requirements.

Shareholder Communications with Directors

Stockholders may communicate with the Board of Directors by sending written correspondence to the Chairman of the Nominating Committee at the following address: MTR Gaming Group, Inc., State Route 2, South, P.O. Box 356, Chester, West Virginia 26034, Attention: Corporate Secretary. The Chairman of the Nominating and Corporate Governance Committee and his or her duly authorized representatives shall be responsible for collecting and organizing stockholder communications. Absent a conflict of interest, the Corporate Secretary is responsible for evaluating the materiality of each stockholder communication and determining whether further distribution is appropriate, and, if so, whether to (i) the full Board, (ii) one or more Board members and/or (iii) other individuals or entities. Additional procedures to be followed by stockholders of the Company in submitting recommendations to the Nominating and Corporate Governance Committee are attached as an exhibit to the Nominating and Corporate Governance Committee's Charter.

ITEM 11. EXECUTIVE COMPENSATION

During 2013, the Compensation Committee reviewed the compensation structure for the members of our board of directors to ensure that the annual retainer stipend and committee fees represent a fair reimbursement for the level of work and responsibility assigned to different members of the board. Based on a study of the Company's peer competitor group (which is the same peer group that the Compensation Committee used with respect to the Company's named executive officers as we described under "Role of Peer Companies and Benchmarking"), the Compensation Committee established a target compensation level for its board members that are equal to the median level paid its peers in the gaming industry. In addition, the Compensation Committee compared its recommended compensation practices for its board members with a recent report published by the National Association of Corporate Directors (NACD). This study of proxy statements indicated that our compensation structure is reasonable and appropriate when compared with the median average board member compensation for the peer group. Additionally, in the Company's quest to ensure that director's interests are aligned with those of the Company's stockholders, approximately half of each director's (other than Messrs. Billick's and Blatt's) average annual compensation is now comprised of annual stock grants. Additionally, the Compensation Committee established an annual stock distribution plan for directors made pursuant to an exact formula with such grants to be distributed on a specific date in order to avoid any implication that directors might be making grants to themselves on a discretionary basis. The 2013 and prior director RSU awards vest immediately but are not redeemable until the director leaves the Company or is replaced as a result of a change of control. Effective with the January 2014 annual stock grant and pursuant to the Company's non-executive director compensation policy, all equity grants distributed to directors, who have completed a minimum of four years of service and have met the minimum stock ownership guidelines which requires the holding of Company stock with a minimum value equal to five times such director's annual base retainer fee, be made in common stock instead of RSUs. Such common stock, in accordance with such compensation policy, will be issued on the fourth Friday in January.

5

During 2013, the Company's non-employee directors received an annual stipend of $40,000 and a grant of 15,228 RSUs under the terms of the 2010 Long Term Incentive Plan, which we refer to as the 2010 Plan. The Company's chairman of the board will also receive an additional annual stipend of $65,000. Additionally, each board committee member or board representative on a corporate committee, except the committee chairman, is entitled to the following annual stipend: Audit Committee: $8,000; Compensation Committee: $4,000; Compliance Committee: $4,000; Finance Committee: $4,000; Nominating Committee: $4,000; Succession Committee: $4,000. Each board committee chairman or board representative serving as chairman of a corporate committee is entitled to the following annual stipend: Audit Committee: $16,000; Compensation Committee: $8,000; Compliance Committee: $8,000; Finance Committee: $8,000; Nominating Committee: $8,000; Succession Committee: $8,000. The Company reimburses board members for expenses incurred in attending meetings.

The Company has an agreement with Mr. Blatt that commenced in April 2009 pursuant to which, in addition to his annual director's stipend and fees for board and committee meetings and annual and special meetings of stockholders, the Company will pay Mr. Blatt $6,000 per month for his services rendered as Assistant Secretary and for office expenses. The Company will make such payments until the earlier of (i) five years or (ii) until such time that Mr. Blatt no longer serves as Secretary or Assistant Secretary. The decision to compensate and reimburse Mr. Blatt for his services was made and approved by the full board in 2009 as recognition of Mr. Blatt's continuing service and availability as Assistant Secretary. The Company's board of directors also recognized that Mr. Blatt's historical perspective and knowledge of the Company's operations would be beneficial to the Company's then newly appointed Chief Executive Officer.

The following table sets forth the compensation of the Company's non-employee directors for services rendered in 2013.

Name

|

Fees earned or paid in cash ($) |

Stock awards ($)(1) |

Option awards ($)(2) |

Non-equity incentive plan compensation ($) |

Change in pension value and nonqualified deferred compensation earnings |

All other compensation ($)(3) |

Total ($) |

|||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| (a) |

(b) |

(c) |

(d) |

(e) |

(f) |

(g) |

(h) |

|||||||||||||||

Steven M. Billick |

$ | 117,000 | $ | 59,998 | $ | 176,998 | ||||||||||||||||

Robert A. Blatt |

$ | 60,000 | $ | 59,998 | $ | 72,000 | $ | 191,998 | ||||||||||||||

Richard Delatore |

$ | 64,000 | $ | 59,998 | $ | 123,998 | ||||||||||||||||

Raymond K. Lee |

$ | 68,000 | $ | 59,998 | $ | 127,998 | ||||||||||||||||

James V. Stanton(4) |

$ | 60,000 | $ | 59,998 | $ | 119,998 | ||||||||||||||||

Roger P. Wagner |

$ | 60,000 | $ | 59,998 | $ | 119,998 | ||||||||||||||||

- (1)

- Represents

the aggregate grant date fair value computed in accordance with ASC 718—Compensation—Stock Compensation (see, for

example, Notes 2 and 12 to the Company's Consolidated Financial Statements in its Annual Report on Form 10-K for the year ended December 31, 2013). Each board member was awarded

15,228 RSUs on January 25, 2013, pursuant to the terms of the 2010 Plan. Each RSU was fully vested upon grant and represents a right to receive one share of the Company's common stock upon the

earlier to occur of (i) the person's termination of board service, and (ii) a change in control of the Company. The non-employee directors did not have any other stock awards outstanding

as of December 31, 2013, other than 10,365, 19,500 and 30,000 RSUs granted to each non-employee director during 2012, 2011, and 2010, respectively.

- (2)

- No

stock options were awarded to non-employee directors during 2013; the non-employee directors did not have any stock option awards outstanding as of

December 31, 2013.

- (3)

- Mr. Blatt

received $6,000 per month for services rendered as Assistant Secretary and for office expenses.

- (4)

- Mr. Stanton resigned from the Company's board of directors on February 28, 2014.

6

Compensation Discussion and Analysis

Introduction

The following Compensation Discussion and Analysis, or CD&A, describes the Company's 2013 executive compensation program. It summarizes our executive compensation structure and is intended to be read in conjunction with the tables beginning on page 26, which provide detailed historical compensation information for the following named executive officers, or the NEOs, during 2013:

- •

- Jeffrey J. Dahl, who served as the Company's President and Chief Executive Officer through his resignation on

May 27, 2013

- •

- Joseph L. Billhimer, Jr., who replaced Mr. Dahl and has served as the Company's current President and Chief

Operating Officer since September 8, 2013, previously serving as its Executive Vice President and Chief Operating Officer through May 27, 2013 and as its Acting President and Chief

Operating Officer from May 27, 2013 through September 8, 2013

- •

- John W. Bittner, Jr., who served as the Company's Executive Vice President and Chief Financial Officer

- •

- Narciso A. Rodriguez-Cayro, who served as the Company's Vice President—Regulatory Affairs, General Counsel and

Secretary until his resignation on January 31, 2014

- •

- Fred A. Buro, who served as the Company's Vice President and Chief Marketing Officer until his resignation on January 28, 2014

The Compensation Committee (the "Committee") has oversight responsibility for the development and administration of the Company's executive compensation policies and programs. This CD&A explains how and why the Committee arrived at specific compensation policies and decisions for the NEOs in 2013.

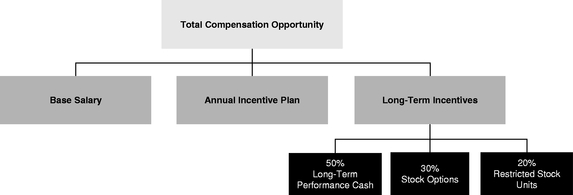

The Company's executive compensation structure consists of three primary components: base salary, annual incentives, and long-term incentives. Within the long-term incentive component, we utilize a mix of programs. Our structure is as follows:

Executive Summary

2013 Say-on-Pay Vote

At the 2013 annual stockholder meeting, the Company held a stockholder advisory vote on the compensation of the NEOs, commonly referred to as a say-on-pay vote. The Company's stockholders approved the compensation of its named executive officers, with 73.1% of stockholder votes cast in favor of our say-on-pay resolution.

7

As we evaluated our compensation practices and talent needs throughout fiscal 2013, the Committee was mindful of the support that our stockholders expressed for our philosophy of linking compensation to our operating objectives and the enhancement of stockholder value. As a result, the Committee decided to retain its general approach to executive compensation opportunity, with an enhanced emphasis on longer-term performance in our long-term performance cash unit plan (discussed later).

- •

- Leadership

structure: The Company currently separates the roles of Chairman of the Board and its principal executive officer.

- •

- Performance goal

disclosure: The Company discloses its 2013 incentive plan performance goals and achievement levels.

- •

- Incentive payment thresholds and

maximums: Both the annual bonus plan and the long-term performance cash units plan have threshold performance requirements which must be

achieved in order to receive a payment. Maximum payments are capped.

- •

- Retirement

benefits: We do not provide any pension plans or nonqualified deferred compensation arrangements for our NEOs. The NEOs are eligible to

participate in our qualified retirement plan on the same terms as other eligible employees.

- •

- Executive perquisites and other

benefits: Such benefits are limited to an automobile allowance for business use, modest company-paid medical expenses, and company-paid

life insurance premiums. We do not provide income tax gross-ups on perquisites.

- •

- Change-in-control

coverage: We believe the coverage is not excessive in that the NEOs are not provided (a) severance multiples in excess of three

times salary and target bonus, (b) single trigger cash payments, and/or (c) modified single trigger provisions. Change-in-control provisions also do not include excise tax gross-ups.

- •

- Tally

sheets: The Committee periodically reviews tally sheets in order to analyze the NEO's total compensation opportunities and potential

payments under various termination scenarios.

- •

- Anti-hedging

policy: We have a policy that prohibits all directors, executive officers, officers and employees in the Finance and Legal/Compliance

Departments and the Director of Internal Audit from engaging in hedging or monetization transactions or similar arrangements with respect to our securities.

- •

- Pledging

Policy: We have a policy that prohibits all directors, executive officers, officers and employees in the Finance and Legal/Compliance

Departments and the Director of Internal Audit from holding the Company's securities in margin accounts or pledging our securities as collateral for a loan.

- •

- Insider trading

policy: Our employees, officers and directors are prohibited from trading in the Company's securities when they are aware of material,

nonpublic information, including during regular quarterly earnings blackout periods.

- •

- Independent compensation

consultant: Aon Hewitt has been retained directly by the Committee, advises on all executive officer pay decisions, keeps the Committee

apprised of compensation best practices, and performs no other services for the Company.

- •

- Compensation risk assessment: We conduct an annual risk assessment of compensation policies and practices to ensure that its programs are not reasonably likely to have a material adverse effect on the Company.

Corporate Governance Standards

8

2013 Performance and Company Highlights

For the year ended December 31, 2013, we have experienced increasingly competitive local markets. Additionally, we changed our President, entered into a pending strategic transaction and experienced a 23% increase in the Company's stock price during the calendar year.

Mr. Dahl resigned as the Company's President and Chief Executive Officer effective May 27, 2013. At that time, Mr. Billhimer, the Company's then Executive Vice President and Chief Operating Officer, began serving as its Acting President and Chief Operating Officer, and was approved as its permanent President and Chief Operating Officer effective September 8, 2013. The Committee approved a salary adjustment in May 2013 for Mr. Billhimer to recognize his increased responsibilities as the principal executive officer of the organization, based on a review of relevant factors, including Mr. Billhimer's individual performance and contribution to the Company, and competitive compensation data for similar positions in the gaming industry. Mr. Billhimer's understanding of the Company and its operations, as well as his extensive gaming experience, facilitated a smooth transition during this period.

On September 9, 2013, the Company entered into the merger agreement pursuant to which the Company and Eldorado HoldCo LLC ("Eldorado") agreed to a strategic business combination, subject to customary regulatory and closing conditions, including the approval of the Company's stockholders. We believe that the proposed transaction will add high quality gaming assets and increased geographic diversification in attractive markets and improve the financial profile of the Company.

For the year ended December 31, 2013, the Company's total net revenues increased 2.2% to $497.8 million from $487.0 million in the prior year. Our net loss for 2013 was $9.1 million, or $0.32 per diluted share, which included $4.4 million in strategic transaction costs and approximately $3.5 million of income tax expense primarily attributable to additional valuation allowances on deferred tax assets. Results for 2013 reflect the full year of operation of our Scioto Downs gaming facility, which commenced operations in June 2012, offset in part by the decline in operating results at Mountaineer and Presque Isle Downs due to expanding Ohio competition. For the year ended 2012, we reported a net loss of $5.7 million, or $0.20 per diluted share, which included $2.7 million of project-opening costs, a loss of $0.3 million from discontinued operations and approximately $3.6 million of income tax expense primarily attributable to additional valuation allowances on deferred tax assets.

MTR's Compensation Strategy

Our executive compensation program is designed to attract, motivate and retain critical executive talent, and to motivate behaviors that drive profitable growth and the enhancement of long-term value for our stockholders. Its program includes base salary and performance-based incentives (including both cash and equity opportunities) and is designed to be flexible and to provide target total compensation opportunities at the size-adjusted 50th percentile. The Committee strives to establish and reward achievement of difficult but fair performance criteria, and enhance stock ownership at the executive level. The Committee is guided by the general principles that compensation should be designed to:

- •

- enhance stockholder value by focusing efforts on the performance metrics that drive enterprise value,

- •

- attract, motivate, and retain highly-qualified executives committed to the Company's long-term success,

- •

- assure that the Company's executives receive fair compensation opportunities relative to their peers at similar companies, and fair actual compensation relative to Company performance, and

9

- •

- align critical decision making with the Company's business strategy and goal setting.

Element

|

Primary Purpose | Key Characteristics | ||

|---|---|---|---|---|

Base Salary |

To compensate the executive fairly for the responsibility level of the position. | To compensate the executive fairly for the responsibility level of the position. | ||

|

||||

Annual Cash Bonus |

To motivate and reward organizational and individual achievement of annual strategic financial and individual objectives. | Variable compensation component. The primary performance components are:

• corporate free cash flow (FCF) goals; and

• individual performance goals. |

||

Long-Term Incentives |

To align the executive with stockholder interests, and to reinforce long-term stockholder value. |

Variable compensation component. Reviewed and granted annually. |

||

Stock Options |

To increase stockholder value. | Stock price growth above the exercise price. | ||

Restricted Stock Units (RSU) |

To increase stockholder value and promote executive retention. | Stock price growth. | ||

Long-Term Performance Cash Units |

To motivate performance achievement over a two-year period and continued retention over an additional one-year period, for a total performance period of three years. | Achievement of long-term corporate free cash flow goals. | ||

Health/Welfare Plan and Retirement Benefits |

To provide competitive benefits promoting employee health and productivity and support financial security. |

Fixed compensation component. |

||

Perquisites and Other Benefits |

To provide business-related benefits, where appropriate. |

Fixed compensation component. |

||

Change-in-Control Protection |

To bridge employment if employment is terminated following a change-in-control of the company. |

Fixed compensation component; only paid in the event the executive's employment is terminated following a change-in-control of the company. |

||

Severance Protection |

To bridge future employment if employment is terminated other than "for cause." |

Fixed compensation component; only paid in the event the executive's employment is terminated other than "for cause." |

10

2013 Executive Compensation Summary

The Committee approved the following compensation items in 2013:

Pay Component

|

Comments | |

|---|---|---|

| Base Salary | • Mr. Billhimer received an increase from $340,000 to $500,000 effective May 27, 2013 to reflect his promotion to Acting President, following Mr. Dahl's resignation. Mr. Billhimer's new salary was based on the Committee's review of relevant factors such as individual performance and competitive market data for the role. |

|

|

• None of the other NEOs received a base salary increase in 2013. |

|

Annual Cash Bonus |

• Target bonus (as a percentage of salary) did not change in 2013 for the NEOs. |

|

|

• Mr. Dahl did not receive a cash bonus with respect to 2013. |

|

|

• The Company achieved 2013 corporate free cash flow results that were 93% of budget. |

|

|

• As a result of this performance level, actual bonuses awarded to NEOs other than Mr. Dahl were 72% of their target bonus opportunity, according to the performance/payout scale approved by the Committee at the beginning of the year, incorporating both corporate and individual performance criteria, as well as the Committee's evaluation of overall company performance. |

|

Long-Term Incentives |

• Consistent with prior-year practices, the Committee approved 2013 grants based on a thorough review of competitive market data, individual and Company performance, and management's recommendations. |

|

|

• Value Mix: 50% long-term performance cash units, 30% stock options, and 20% MTR RSUs. |

|

|

• Design enhancement: To focus management on longer-term performance achievement, the 2013 grant of long-term performance cash units was subject to a two-year performance period (2013 - 2014), followed by an additional one-year vesting requirement. The Company's previous plan had a one- year performance period with a two-year additional vesting requirement. |

Compensation Decision Process

Role of the Compensation Committee

The Committee's primary role is to discharge the Board of Directors responsibilities regarding compensation policies relating to the executives of our Company and its subsidiaries. The Committee consists of independent directors and is responsible to our Board for the oversight of our executive compensation programs. Among its duties, the Committee is responsible for:

- •

- review and assessment of competitive market data from the independent compensation consultant;

- •

- review and approval of incentive goals / objectives and compensation recommendations for property general managers and

NEOs;

- •

- evaluation of the competitiveness of each executive's total compensation package;

11

- •

- approval of any changes to the total compensation package including, but not limited to, salary, annual incentives,

long-term incentive award opportunities and payouts, and retention programs; and

- •

- ensuring the Company's policies and practices relating to compensation do not encourage excessive risk-taking conduct.

Following review and discussion, the Committee submits recommendations to the Board of Directors for approval. The Committee is supported in its work by the Chief Financial Officer and staff, and an independent executive compensation consultant.

Role of the Independent Compensation Consultant

The Committee retained Aon Hewitt for independent executive compensation advisory services. Aon Hewitt reports directly to the Committee, and the Committee directly oversees the fees paid for the services provided. With the Committee's approval, Aon Hewitt may work directly with management on executive compensation matters. Aon Hewitt did not perform any other consulting services for the Company in 2013.

Specific roles of the compensation consultant include, but are not limited to, the following:

- •

- identify and advise the Committee on executive compensation trends and regulatory developments;

- •

- provide a total compensation study for executives against peer companies and recommendations for NEO pay;

- •

- provide advice to the Committee on governance best practices as well as any other areas of concern or risk;

- •

- serve as a resource to the Committee Chair for meeting agendas and supporting materials in advance of each meeting;

- •

- review, draft, and comment on proxy disclosure items, including this CD&A; and,

- •

- advise the Committee on management's pay recommendations.

The Committee has considered and assessed all relevant factors, including but not limited to those set forth in Rule 10C-1(b)(4)(i) through (vi) under the Exchange Act, that could give rise to a potential conflict of interest with respect to Aon Hewitt, on the one hand, and the Committee, the Company and its management, on the other hand. Based on this review, we are not aware of any conflict of interest that has been raised by the work performed by Aon Hewitt.

Role of Management

The Company's principal executive officer makes recommendations to the Committee concerning the compensation of the other NEOs and other senior management. In addition, our President and Chief Financial Officer are involved in setting the business goals that are used as the performance goals for the annual incentive plan and long-term performance cash units, subject to the Committee's approval. Both executives work closely with the Committee, Aon Hewitt and management to (i) ensure that the Committee is provided with the appropriate information to make its decisions, (ii) propose recommendations for the Committee's consideration and (iii) communicate those decisions to management for implementation. None of the NEOs, however, play a role in determining their own compensation and are not present at executive sessions in which their pay is discussed.

12

Role of Peer Companies and Benchmarking

The Committee commissioned Aon Hewitt to conduct an annual total compensation study for executive and key manager positions. The Committee reviews competitive market data annually to gain a comprehensive understanding of market pay practices, and combines that information with the discretion to consider experience, tenure, position, and individual contributions to assist with individual pay decisions (i.e., salary adjustments, target bonus, and long-term incentive grants).

To develop competitive market values for the NEOs, Aon Hewitt utilized both published and private compensation surveys, as well as proxy information for the following ten mid-sized gaming and casino companies:

• Affinity Gaming, LLC |

• Ameristar Casinos, Inc. |

|

• Boyd Gaming Corporation |

• Churchill Downs, Inc. |

|

• Isle of Capri Casinos, Inc. |

• Monarch Casino & Resort, Inc. |

|

• Peninsula Gaming Co, LLC |

• Penn National Gaming, Inc. |

|

• Pinnacle Entertainment, Inc. |

• Tropicana Entertainment, Inc. |

The selection criteria for the peer group included (a) companies in the Casino & Gaming GICS code, and (b) companies with annual revenues ranging from 1/3x to 3x the Company's annual revenues. Due to the relatively limited number of gaming and casino companies that meet this size criteria, the selection criteria was expanded somewhat to include other mid-sized gaming and casino companies to allow for meaningful total compensation comparisons.

To account for revenue size differences between the Company and the peer companies, size-adjusted market values were developed using a regression analysis with annual revenues as the independent variable. This statistical technique allowed the Committee to review and rely on estimated 2013 market values that were consistent with the Company's revenue relationship to peer companies.

Determination of CEO Compensation

At the Committee's annual December meeting, in executive session without management present, the Committee reviews and evaluates the compensation of the Chief Executive Officer. The Committee reviews competitive market data, and both corporate financial performance and individual performance. Pay recommendations for the CEO, including salary, incentive payments for the previous year, and equity grants for the current year, are presented to the independent members of the Board of Directors. During an executive session, the Board conducts its own review and evaluation of the CEO's performance.

Considerations for 2013 Compensation

Base Salary

Base salaries are designed to recognize the skill, competency, experience and performance an executive brings to his or her position. The Committee determines base salaries using both competitive market data from Aon Hewitt's annual study and a comprehensive assessment of relevant factors such as experience level, value to stockholders, responsibilities, future leadership potential, critical skills, individual contributions and performance, economic conditions, and the market demands for similar talent.

The NEOs did not receive a salary increase in 2013, except Mr. Billhimer to recognize his increased responsibilities as President (replacing Mr. Dahl). Mr. Billhimer's new base salary is below the size-adjusted 50th percentile market value, but is appropriate for his new role. The other NEOs are positioned at the size-adjusted 50th percentile.

13

The following table summarizes the Committee's salary decisions for 2013.

| |

Salary on 1/1/2013 |

Increase Date |

Salary on 12/31/2013 |

|||||||

|---|---|---|---|---|---|---|---|---|---|---|

J. Dahl |

$ | 630,000 | — | (1) | ||||||

J. Billhimer |

$ | 340,000 | 5/27/13 | (2) | $ | 500,000 | ||||

J. Bittner |

$ | 367,500 | — | $ | 367,500 | |||||

N. Rodriguez-Cayro |

$ | 315,000 | — | $ | 315,000 | (3) | ||||

F. Buro |

$ | 290,000 | — | $ | 290,000 | (4) | ||||

- (1)

- Mr. Dahl

resigned effective May 27, 2013.

- (2)

- Reflects

Mr. Billhimer's increased responsibilities as President, replacing Mr. Dahl in that role.

- (3)

- Mr. Rodriguez-Cayro

resigned effective January 31, 2014.

- (4)

- Mr. Buro resigned effective January 28, 2014.

Annual Incentives (Bonus Plan)

The NEOs have the opportunity to earn cash incentives annually based on the attainment of critical performance criteria. Performance targets are set annually at the start of the fiscal year. In 2013, after a thorough review of internal equity and the recommendations of Aon Hewitt, the Committee maintained individual target award opportunities for the NEOs based on a percentage of each NEO's base salary as follows:

| |

2013 Target Bonus |

|||

|---|---|---|---|---|

J. Dahl |

60 | % | ||

J. Billhimer |

50 | % | ||

J. Bittner |

40 | % | ||

N. Rodriguez-Cayro |

40 | % | ||

F. Buro |

40 | % | ||

The 2013 annual incentive plan for the NEOs was structured to measure corporate free cash flow (80% of the target award opportunity) and key individual performance objectives (20% of the target award opportunity). Free cash flow is utilized as a metric because the Committee believes that it reflects the results of operations of the Company, the positive and negative impact of capital expenditures and changes in cash flows from other activities. Individual goals were used because they are critical drivers of our financial success. The goals are customized to each NEO and provide the Committee with a mechanism to gauge individual performance achievement on metrics within each NEO's direct control.

Corporate free cash flow (80% of the target award opportunity): The corporate free cash flow target for 2013 was $90.9 million. Threshold and stretch performance goals were set at 90% and 120% of targeted free cash flow, respectively. Potential bonus payments were 50% of target bonus for achievement of threshold free cash flow and 200% of target bonus for achievement of stretch free cash flow. If threshold free cash flow was not achieved, then no bonus would be earned for this portion.

Key individual performance criteria (20% of the target award opportunity): The size of the individual performance bonus pool is dependent on the level of corporate free cash flow achievement. 50% of the individual performance pool is funded if 80% of the corporate free cash flow target is achieved. The individual performance pool is fully funded at 90% corporate free cash flow

14

performance, but may not exceed 100% funding (unlike the corporate free cash flow portion which may be funded at 200% of target if stretch performance is achieved).

The individual performance measures, approved by the Committee, typically consider and include individual measures aimed at improving and sustaining maximum profitability and operational efficiency, and responding proactively to critical industry developments. Examples of recent individual performance goals for the NEOs include EBITDA improvement, identification and evaluation of strategic alternatives, continued integration of the Scioto Downs gaming facility, improving guest service measurements, increased market development, selling off non-strategic assets, and ongoing cost containment programs. For 2013, measures were also aimed at directing and facilitating company-wide efforts to monitor and measure team member satisfaction and guest service measurements and to expand market databases of patrons.

2013 Results: The Committee evaluated actual free cash flow performance subject to certain adjustments (e.g., severance costs and strategic costs) and determined that actual free cash flow exceeded the minimum targeted goal threshold for the NEOs other than Mr. Dahl. The free cash flow attainment level, as adjusted, was $84.5 million. The Committee also determined that the NEOs, other than Mr. Dahl, accomplished their respective individual performance objectives.

| |

Corporate Free Cash Flow | Individual Performance | |

|||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

Total Incentive Earned (% of Target) |

|||||||||||||||||||||

| |

Weight | Score | Incentive Contribution |

Weight | Score | Incentive Contribution |

||||||||||||||||

J. Dahl(1) |

80 | % | — | — | 20 | % | — | — | — | |||||||||||||

J. Billhimer |

80 | % | 93 | % | 65 | % | 20 | % | 100 | % | 100 | % | 72 | % | ||||||||

J. Bittner |

80 | % | 93 | % | 65 | % | 20 | % | 100 | % | 100 | % | 72 | % | ||||||||

N. Rodriguez-Cayro(2) |

80 | % | 93 | % | 65 | % | 20 | % | 100 | % | 100 | % | 72 | % | ||||||||

F. Buro(2) |

80 | % | 93 | % | 65 | % | 20 | % | 100 | % | 100 | % | 72 | % | ||||||||

- (1)

- No

bonus award earned for 2013. Mr. Dahl resigned effective May 27, 2013.

- (2)

- Although Messrs. Rodriguez-Cayro and Buro resigned during 2014, each received bonus awards for 2013 pursuant to the terms of their respective employment agreement.

Long-Term Incentives

The Committee has worked closely with Aon Hewitt over the past three years to enhance the performance orientation of the Company's executive compensation programs. The primary objectives were to design incentive programs for the future that (a) support the Company's strategic business plan, (b) enhance the alignment of management behaviors with stockholder value, (c) address important executive retention issues, and (d) provide the compensation tools necessary for the company to attract critical talent.

- •

- Long-term performance cash units (50% weight): The

Committee believes it is critical to focus executive behavior on the performance elements that drive stockholder value. Accordingly the 2013 grants are based on the attainment of a two-year corporate

free cash flow target. Participants may earn 50% to 200% of their target opportunity based on achievement levels ranging from 90% to 120% of the free cash flow goal. No award is earned if performance

falls below the threshold. The performance period covers 2013 and 2014, with an additional one-year vesting requirement for earned amounts. Earned and vested amounts are paid in cash.

- •

- Stock options (30% weight): The Committee believes it is important to focus executive behavior on the Company's share price, in direct alignment with its stockholders' interests. With stock options, participants only recognize value to the extent the share price increases and exceeds the

15

- •

- Restricted stock units (20% weight): The Committee believes it is important to have a minimum level of retention-based awards. With RSUs, participants are focused on the enhancement of share price and the value of their grant. 2013 grants of RSUs vest on the third anniversary of the grant date and will be paid in shares of the Company's stock.

exercise price on the date of grant. 2013 grants will vest over three years in equal installments per year.

| |

January 2013 Long-Term Incentive Grants |

|||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| |

Performance Plan (Target $) |

Stock Options (#) |

Restricted Stock Units (#) |

|||||||

J. Dahl(1) |

$ | 189,000 | 54,800 | 18,300 | ||||||

J. Billhimer |

$ | 102,000 | 29,600 | 9,900 | ||||||

J. Bittner |

$ | 110,300 | 32,000 | 10,700 | ||||||

N. Rodriguez-Cayro |

$ | 94,500 | 27,400 | 9,100 | ||||||

F. Buro |

$ | 87,000 | 25,200 | 8,400 | ||||||

- (1)

- Mr. Dahl forfeited all 2013 and other unvested long-term incentive grants upon his resignation effective May 27, 2013.

CEO Compensation for 2013

Mr. Dahl served as our President and Chief Executive Officer from January 10, 2011 through his resignation effective May 27, 2013. Mr. Dahl's 2013 compensation items included a base salary rate of $630,000 annually ($322,269 for the time he served as President and Chief Executive Officer in 2013), a target bonus opportunity of 60% of base salary, and long-term incentive grants of 54,800 stock options, 18,300 RSUs, and an $189,000 performance cash unit target.

Mr. Dahl received an auto allowance of $800 per month and participated in the various Company benefit plans including health and life insurance, and retirement plans. His annual bonus and 2013 long-term incentive grants were forfeited when he resigned in May 2013.

Mr. Dahl did not receive any severance payments, vesting or other benefits in connection with his resignation other than as provided under his then existing agreements with the Company.

Retirement and Benefit Programs

The NEOs were eligible to participate in various benefit plans including, 401(k), health insurance and life insurance plans that are generally available to all employees. The 401(k) plan provides for a company match, which for 2013 was 50% of the first 4% of permitted employee contributions to the plan, subject to the nondiscrimination testing limitations. Life insurance is also provided to the NEOs at two times salary. In addition to the benefits already listed, the NEOs participate in the Executive Medical Reimbursement Plan ("EMRP"). Under the EMRP, NEOs are eligible for reimbursement of certain medical expenses which would not otherwise be reimbursed to the participant from another source. The maximum annual reimbursement amount that a participant may receive for reimbursement of eligible expenses for the participant and the participant's dependents in any year is $150,000, subject to a $1,000 aggregate deductible. Reimbursements are taxable to the NEO and the Company provides no gross-up for any reimbursements.

Perquisites/Other Benefits

It is the Company's intent to continually assess business needs and evolving market practices to ensure that perquisite offerings are competitive and in the best interest of its stockholders. In general,

16

the Company provides limited perquisites or other benefits to executives, which include an automobile allowance for business use, modest company-paid medical expenses and company-paid life insurance premiums, and reimbursement for temporary housing and relocation expenses to certain NEOs. For more information on these perquisites, see the footnotes to the Summary Compensation Table.

Severance Protection

Each NEO has an employment agreement with the Company that provides for severance payments in the event the NEO's employment is terminated under certain circumstances. See "—Potential Payments Upon Termination or Change in Control" for more information on the amounts that each NEO is entitled to in the event that his employment is terminated.

Equity Grant Practices

The Committee has adopted a policy with respect to equity awards that contains procedures to prevent stock option backdating or other improper timing issues. Under the policy, the Committee has exclusive authority to grant equity awards to the NEOs and other employees. If an employee joins the company and has been offered stock-based awards as part of their compensation, approval from the Committee will be sought at the next Committee meeting and the exercise price of any stock options will be the closing price of its common stock on NASDAQ on the date of the Committee's approval of the award, unless the Company is in a company-imposed black-out period under its insider trading policy. Under the Company's insider trading policy, NEOs, other employees with access to material non-public information about the Company and directors are always prohibited from engaging in transactions in the Company's securities when in possession of material non-public information and are otherwise restricted from engaging in transactions in the Company's securities during black-out periods. The Committee's policy with respect to equity grants is consistent with the Company's insider trading policy. We have a policy that prohibits all directors, executive officers, officers and employees in the Finance and Legal/Compliance Departments and the Director of Internal Audit from engaging in hedging or monetization transactions or similar arrangements with respect to our securities.

Compensation Risk Assessment

It is the responsibility of the Committee to ensure that the Company's policies and practices related to compensation do not encourage excessive risk-taking behavior. The Committee has worked closely with Aon Hewitt to design a performance-based compensation system that supports the Company's objective to align stockholder and management interests, supports the Company's strategic business plan, and mitigates the possibility of executives taking unnecessary or excessive risks that would adversely impact the Company. As part of this process, Aon Hewitt has reviewed our compensation programs to assess if any of its programs or policies would encourage unnecessary risks that could have a material adverse impact on the Company. Based on that independent review, we believe that our compensation programs and policies are not reasonably likely to have a material adverse effect on the Company. The following factors mitigate the risk associated with our compensation programs:

- •

- The Board of Directors approves short- and long-term performance objectives for its incentive plans, which we believe are

appropriately correlated with stockholder value and use multiple metrics to measure performance;

- •

- the Committee's discretion to amend final payouts of both short- and long-term incentive plans;

- •

- the use of company-wide performance metrics for both the short- and long-term incentive programs ensure that no single executive has complete and direct influence over outcomes, encouraging decision making that is in the best long-term interest of stockholders;

17

- •

- the use of equity and cash opportunities with vesting periods to foster retention and alignment of its executives'

interests with those of our stockholders;

- •

- capping the potential payouts under both the short- and long-term incentive plans to eliminate the potential for any

windfalls; and,

- •

- the use of competitive general and change-in-control severance programs help to ensure that executives continue to work towards the stockholders' best interests in light of potential employment uncertainty.

Tax Deductibility of Our Programs

Section 162(m) of the Internal Revenue Code generally limits the federal income tax deduction for compensation paid to NEOs in excess of $1,000,000 for a calendar year, subject to certain exceptions including relating to qualified performance-based compensation. The Committee considers the tax deductibility of compensation paid to the Company's NEOs, but also believes it is important to preserve flexibility in this regard. As discussed above, the primary objectives of our compensation program is to attract, motivate and retain critical executive talent, and to motivate behaviors that drive profitable growth and the enhancement of long-term value for our stockholder. Accordingly, the Committee recognizes that there may be instances where compensation paid by the Company may not be tax deductible.

Compensation Committee Report

The Committee has reviewed and discussed with management the Compensation Discussion and Analysis report included herein. Based on their review and discussions with management, the Committee recommended to the Company's full Board of Directors that the Compensation Discussion and Analysis be included in the Company's 2014 proxy statement and incorporated by reference in the Company's Annual Report on Form 10-K, filed on March 14, 2014.

Submitted by the Compensation Committee of the Board of Directors,

Roger

P. Wagner (Chairman)

Raymond K. Lee

Steven M. Billick

Notwithstanding anything to the contrary herein, the report of the Compensation Committee included in this proxy statement shall not be deemed incorporated by reference by any general statement incorporating by reference this proxy statement into any filing under the Securities Act of 1933, as amended, or under the Securities Exchange Act of 1934, except to the extent the Company specifically incorporates this information by reference, and shall not otherwise be deemed filed under such acts.

Compensation Committee Interlocks and Insider Participation

The current members of the Company's Compensation Committee are Messrs. Wagner, Billick and Lee, each of whom is an independent director. Mr. Billick was our interim Chief Executive Officer during the period between the resignation of our former chief executive officer on September 28, 2010 and the hiring of Jeffrey J. Dahl, as our President and Chief Executive Officer, on January 10, 2011. While he served as interim Chief Executive Officer, Mr. Billick did not serve as a member of the Compensation Committee. Other than Mr. Billick, no member of the Compensation Committee (i) was, during 2013, or had previously been an officer or employee of the Company or its subsidiaries nor (ii) had any direct or indirect material interest in a transaction of the Company or a business relationship with the Company, in each case that would require disclosure under the applicable rules of the SEC. No other interlocking relationship existed between any member of the Compensation

18

Committee or an executive officer of the Company, on the one hand, and any member of the compensation committee (or committee performing equivalent functions, or the full board of directors) or an executive officer of any other entity, on the other hand, requiring disclosure pursuant to the applicable rules of the SEC.

The Compensation Committee is authorized to review all compensation matters involving directors and executive officers and Committee approval is required for any compensation to be paid to executive officers or directors who are employees of the Company.

Tables and other narrative disclosures

Summary Compensation Table

The following table sets forth information regarding compensation for the fiscal years ended December 31, 2013, 2012, and 2011, awarded to, earned by or paid to the named executive officers.

Name and principal position |

Year | Salary | Stock Awards(7) |

Option Awards(7) |

Non-Equity Incentive Plan Compensation |

Change In Pension Value And Nonqualified Deferred Compensation Earnings |

All Other Compensation |

Total $ |

|||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| (a) |

(b) |

(c) |

(e) |

(f) |

(g) |

(h) |

(i) |

(j) |

|||||||||||||||||

Joseph L. Billhimer, Jr. |

2013 | $ | 429,231 | $ | 39,006 | $ | 78,221 | $ | 156,960 | (1) | $ | 30,014 | (2) | $ | 733,432 | ||||||||||

President and Chief |

2012 | $ | 340,000 | $ | 46,116 | $ | 90,267 | $ | 511,006 | $ | 13,171 | $ | 1,000,560 | ||||||||||||

Operating Officer(8) |

2011 | $ | 215,308 | $ | 43,680 | $ | 85,016 | $ | 246,152 | $ | 72,468 | $ | 662,624 | ||||||||||||

John W. Bittner, Jr. |

2013 |

$ |

367,500 |

$ |

42,158 |

$ |

84,563 |

$ |

128,257 |

(1) |

$ |

17,251 |

(3) |

$ |

639,729 |

||||||||||

Executive Vice |

2012 | $ | 358,077 | $ | 47,580 | $ | 92,968 | $ | 467,932 | $ | 14,278 | $ | 980,835 | ||||||||||||

President and Chief |

2011 | $ | 350,000 | $ | 51,027 | $ | 100,147 | $ | 347,727 | $ | 8,876 | $ | 857,777 | ||||||||||||

Financial Officer |

|||||||||||||||||||||||||

Narciso A. Rodriguez-Cayro |

2013 |

$ |

315,000 |

$ |

35,854 |

$ |

72,407 |

$ |

96,970 |

(1) |

$ |

81,080 |

(4) |

$ |

601,311 |

||||||||||

Vice President of |

2012 | $ | 315,000 | $ | 42,700 | $ | 83,592 | $ | 450,364 | $ | 168,428 | $ | 1,060,084 | ||||||||||||

Regulatory Affairs, |

2011 | $ | 300,000 | $ | 43,804 | $ | 85,818 | $ | 285,682 | $ | 23,022 | $ | 738,326 | ||||||||||||

General Counsel and |

|||||||||||||||||||||||||

Secretary(9) |

|||||||||||||||||||||||||

Fred A. Buro |

2013 |

$ |

278,846 |

$ |

33,096 |

$ |

66,594 |

$ |

96,020 |

(1) |

$ |

17,461 |

(5) |

$ |

492,017 |

||||||||||

Vice President and |

2012 | $ | 290,000 | $ | 39,284 | $ | 76,917 | $ | 362,048 | $ | 34,533 | $ | 802,782 | ||||||||||||

Chief Marketing |

2011 | $ | 275,577 | $ | 40,076 | $ | 78,654 | $ | 244,081 | $ | 39,546 | $ | 677,934 | ||||||||||||

Officer(10) |

|||||||||||||||||||||||||

Jeffrey J. Dahl |

2013 |

$ |

322,269 |

$ |

72,102 |

$ |

144,814 |

$ |

0 |

$ |

9,756 |

(6) |

$ |

548,941 |

|||||||||||

Former President and |

2012 | $ | 630,000 | $ | 85,644 | $ | 167,184 | $ | 1,013,205 | $ | 26,737 | $ | 1,922,770 | ||||||||||||

Chief Executive |

2011 | $ | 566,436 | $ | 87,608 | $ | 369,594 | $ | 631,042 | $ | 86,861 | $ | 1,741,541 | ||||||||||||

Officer(8) |

|||||||||||||||||||||||||

- (1)

- As to 2013, amount represents the vesting of cash-based performance awards granted in conjunction with RSUs granted in 2010, and the annual incentive compensation (bonus plan) earned but not paid in 2013. The cash-based performance awards granted in 2013 relate to the achievement of differing levels of performance (as described above) and are measured by the level of the Company's corporate free cash flow (as described above) over a two-year performance period, which is defined as calendar years 2013 and 2014. Once the performance awards are earned they will vest and become payable at the end of the vesting period, which is defined as a one-calendar year following the performance period. The 2013 cash-based awards were not earned as of December 31, 2013, and are not reported herein but will be reported as such amounts are earned. Cash awards that were granted in conjunction with the RSUs granted in 2010 were not earned as of December 31, 2010, and were not reported therein but are reported as such amounts vest. The RSUs and the cash awards granted during 2010 vest and become non-forfeitable, in equal installments, upon each of the first, second and third anniversaries of the date of grant. Refer to the Narrative Disclosure to Summary Compensation Table and Grants of Plan-Based Awards Table that follows for additional information relating to the cash awards.

19

- (2)

- As

to 2013, all other compensation for Mr. Billhimer includes $9,600 for auto allowance, $11,063 for medical reimbursement, $3,858 for

company-reimbursed healthcare contributions, $1,713 for life insurance premiums, and $3,780 for 401(k) contribution match.

- (3)

- As

to 2013, all other compensation for Mr. Bittner includes $7,200 for auto allowance, $4,709 for life insurance premiums, $300 for medical

reimbursement, $3,259 for company-reimbursed healthcare contributions, and $1,783 for 401(k) contribution match.

- (4)

- As

to 2013, all other compensation for Mr. Rodriguez-Cayro includes $9,600 for auto allowance, $54,018 for medical reimbursement, $3,858 for

company-reimbursed healthcare contributions, $12,011 for temporary housing, and $1,593 for life insurance premiums.

- (5)

- As

to 2013, all other compensation for Mr. Buro includes $7,200 for auto allowance, $3,259 for company-reimbursed healthcare contributions, $2,879

for life insurance premiums, and $4,123 for 401(k) contribution match.

- (6)

- As

to 2013, all other compensation for Mr. Dahl includes $4,000 for auto allowance, $2,366 for medical reimbursement, $1,434 for company-reimbursed

healthcare contributions and and $1,956 for life insurance premiums.

- (7)

- The

RSUs and stock option awards represent the aggregate grant date fair value computed in accordance with

ASC 718—Compensation—Stock Compensation (see, for example, Notes 2 and 12 to the Company's Consolidated Financial Statements in its Annual Report on

Form 10-K for the year ended December 31, 2013). The stock options granted in 2013 will vest ratably on the first, second and third anniversaries of the date of grant. The stock awards

granted in 2013 will vest 100% on the third anniversary of the date of grant.

- (8)

- Mr. Dahl

served as President and Chief Executive Officer through his resignation effective May 27, 2013. Mr. Billhimer replaced

Mr. Dahl and is the current President and Chief Operating Officer. Mr. Billhimer previously served as the Company's Executive Vice President and Chief Operating Officer through

May 27, 2013.

- (9)

- Mr. Rodriguez-Cayro

resigned from the Company effective January 31, 2014.

- (10)

- Mr. Buro resigned from the Company effective January 28, 2014.

20

Grants of Plan-Based Awards

The following table sets forth information regarding the grant of Plan based awards made during 2013 to the NEOs.

| |

|

|

|

|

|

|

|

All other stock awards: Number of shares of stock or units (#) |

All other option awards: Number of securities underlying options (#) |

|

|

|||||||||||||||||||||||