Attached files

| file | filename |

|---|---|

| 8-K - 8-K - HEALTHCARE TRUST OF AMERICA, INC. | q120148k.htm |

| EX-99.1 - EXHIBIT - HEALTHCARE TRUST OF AMERICA, INC. | q12014991.htm |

99.1 SUPPLEMENTAL OPERATING AND FINANCIAL INFORMATION FIRST QUARTER 2014 HEALTHCARE TRUST OF AMERICA, INC. NYSE: HTA Healthcare Trust of America, Inc. A Leading Owner of Medical Office Buildings Exhibit 99.2

Table of Contents 2 Company Overview Company Information 3 Current Period Highlights 4 Financial Highlights 5 Company Snapshot 6 Financial Information Funds From Operations, Normalized Funds From Operations and Normalized Funds Available for Distribution 7 Market Capitalization and Debt Composition 8 Interest Expense and Covenants 9 Portfolio Information Historical Acquisition Activity and Key Market Concentration 10 Same-Property Performance and Net Operating Income 11 Portfolio Diversification by Type and Historical Campus Proximity 12 Tenant Lease Expirations and Historical Leased Rate 13 Top 15 Health System Relationships and In-House Property Management 14 Health System Relationship Highlights 15 Condensed Consolidated Balance Sheets 16 Condensed Consolidated Statements of Operations 17 Reporting Definitions 18 SUPPLEMENTAL OPERATING AND FINANCIAL INFORMATION FIRST QUARTER 2014 Forward-Looking Statements: Certain statements contained in this report constitute forward-looking statements within the meaning of the safe harbor from civil liability provided for such statements by the Private Securities Litigation Reform Act of 1995 (set forth in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act). Such statements include, in particular, statements about our plans, strategies and prospects and estimates regarding future medical office building market performance. Additionally, such statements are subject to certain risks and uncertainties, as well as known and unknown risks, which could cause actual results to differ materially and in adverse ways from those projected or anticipated. Therefore, such statements are not intended to be a guarantee of our performance in future periods. Forward-looking statements are generally identifiable by the use of such terms as “expect,” “project,” “may,” “should,” “could,” “would,” “intend,” “plan,” “anticipate,” “estimate,” “believe,” “continue,” “opinion,” “predict,” “potential,” “pro forma” or the negative of such terms and other comparable terminology. Readers are cautioned not to place undue reliance on these forward-looking statements. We cannot guarantee the accuracy of any such forward-looking statements contained in this report, and we do not intend to publicly update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise, except as required by law. Any such forward-looking statements reflect our current views about future events, are subject to unknown risks, uncertainties, and other factors, and are based on a number of assumptions involving judgments with respect to, among other things, future economic, competitive and market conditions, all of which are difficult or impossible to predict accurately. To the extent that our assumptions differ from actual results, our ability to meet such forward-looking statements, including our ability to generate positive cash flow from operations, provide dividends to stockholders, and maintain the value of our real estate properties, may be significantly hindered. Forward-looking statements express expectations of future events. All forward-looking statements are inherently uncertain as they are based on various expectations and assumptions concerning future events and they are subject to numerous known and unknown risks and uncertainties that could cause actual events or results to differ materially from those projected. Due to these inherent uncertainties, our stockholders are urged not to place undue reliance on forward- looking statements. Forward-looking statements speak only as of the date made. In addition, we undertake no obligation to update or revise forward-looking statements to reflect changed assumptions, the occurrence of unanticipated events or changes to projections over time, except as required by law. These risks and uncertainties should be considered in evaluating forward-looking statements and undue reliance should not be placed on such statements. Additional information concerning us and our business, including additional factors that could materially affect our financial results, is included herein and in our other filings with the SEC.

Senior Management Scott D. Peters Kellie S. Pruitt Mark D. Engstrom Chairman, Chief Executive Officer, Chief Financial Officer, Secretary, Executive Vice President- and President and Treasurer Acquisitions Amanda L. Houghton Robert A. Milligan Executive Vice President- Senior Vice President- Asset Management Corporate Finance Contact Information Corporate Headquarters 16435 North Scottsdale Road Suite 320 Scottsdale, AZ 85254 (480) 998-3478 Transfer Agent Financial Contact Investor Relations DST Systems, Inc. Kellie S. Pruitt Robert A. Milligan 430 West 7th Street Chief Financial Officer Senior Vice President- Corporate Finance Kansas City, MO 64105 16435 North Scottsdale Road 16435 North Scottsdale Road (888) 801-0107 Suite 320 Suite 320 Scottsdale, AZ 85254 Scottsdale, AZ 85254 (480) 258-6637 (480) 998-3478 Email: kelliepruitt@htareit.com Email: robertmilligan@htareit.com Healthcare Trust of America, Inc. (NYSE: HTA), a publicly traded real estate investment trust, is a fully-integrated, leading owner of medical office buildings. HTA is a full-service real estate company focused on acquiring, owning and operating high-quality medical office buildings that are predominantly located on, or aligned with, campuses of nationally or regionally recognized healthcare systems in the U.S. Since its formation in 2006, HTA has built a portfolio of properties that totals approximately $3.0 billion based on purchase price and is comprised of approximately 14.1 million square feet of gross leasable area (GLA) located in 27 states. HTA has developed a national property management and leasing platform which it directs through its primary regional offices located in Albany, Atlanta, Boston, Charleston, Dallas, Indianapolis, Pittsburgh and Scottsdale. At the end of the first quarter, approximately 89% of HTA’s total portfolio GLA was managed internally on this platform. 3 SUPPLEMENTAL OPERATING AND FINANCIAL INFORMATION FIRST QUARTER 2014

Current Period Highlights Operating - First Quarter • Normalized FFO: Normalized FFO increased 24.1% to $42.4 million, compared to Q1 2013. • Normalized FFO Per Share: $0.18 per diluted share, an increase of $0.02 per diluted share, or 12.5%, compared to Q1 2013. • Normalized FAD: $0.16 per diluted share, or $38.7 million, an increase of $0.02 per diluted share, or 14.3%, compared to Q1 2013. The payout ratio of Normalized FAD decreased to 88% for the first quarter. • Same-Property Cash NOI: $52.0 million, an increase of $1.5 million, or 3.0%, compared to Q1 2013. Same-property cash rental revenue increased 2.5%, compared to Q1 2013. Portfolio • In-House Property Management and Leasing Platform: Expanded HTA's in-house property management and leasing platform by 562,000 square feet of GLA during the quarter, bringing total in-house GLA to 12.6 million square feet of GLA, or 89% of the portfolio's GLA. • Leasing: During the quarter, HTA entered into new or renewal leases on approximately 300,000 square feet of GLA, or approximately 2.1% of its portfolio. Tenant retention for the quarter was approximately 75% by GLA. • Leased Rate: At the end of the quarter, the leased rate by GLA was 91.2%, an increase from 90.9% compared to Q1 2013. Balance Sheet and Liquidity • Debt Refinance: HTA amended its $300.0 million term loan to extend the initial maturity to January 2018, and to decrease the interest rate to LIBOR plus 1.2% based on our current credit rating, a decrease of 35 basis points. • Balance Sheet: At the end of the quarter, HTA had total liquidity of $602.4 million, including $575.0 million of availability on its unsecured revolving credit facility, and $27.4 million of cash and cash equivalents. The leverage ratio of total debt to total capitalization was 31.1%. 4 SUPPLEMENTAL OPERATING AND FINANCIAL INFORMATION FIRST QUARTER 2014

________________ 1. Refer to page 18 for the reporting definitions on NOI, Annualized Adjusted EBITDA, Normalized FFO and Normalized FAD. 2. Refer to page 11 for a reconciliation of GAAP Net Income to NOI. 3. Refer to page 18 for a reconciliation of GAAP Net Income to Annualized Adjusted EBITDA. 4. Refer to page 7 for a reconciliation of GAAP Net Income Attributable to Common Stockholders to Normalized FFO and FAD. 5. Calculated as EBITDA divided by interest expense (excluding change in the fair market value of derivatives) and scheduled principal payments. 6. Calculated as the common stock price on the last trading day of the period multiplied by the total diluted common shares outstanding at the end of the period plus total debt outstanding at the end of the period. Refer to Page 8 for details. Financial Highlights (unaudited and in thousands, except per share data) 5 SUPPLEMENTAL OPERATING AND FINANCIAL INFORMATION FIRST QUARTER 2014 Three Months Ended 3/31/2014 12/31/2013 9/30/2013 6/30/2013 3/31/2013 INCOME ITEMS: Revenues $ 91,304 $ 84,132 $ 82,984 $ 77,624 $ 76,861 NOl 1,2 61,715 59,521 57,147 54,995 52,892 Annualized Adjusted EBITDA 1,3 227,320 223,948 213,280 195,514 188,068 Normalized FFO 1,4 42,364 40,054 37,931 35,699 34,150 Normalized FAD 1,4 $ 38,727 $ 34,928 $ 33,777 $ 32,002 $ 31,544 Net Income Attributable to Common Stockholders per share - diluted $ 0.02 $ 0.02 $ 0.02 $ 0.06 $ 0.01 Normalized FFO per share - diluted 0.18 0.17 0.16 0.16 0.16 Normalized FAD per share - diluted $ 0.16 $ 0.15 $ 0.14 $ 0.14 $ 0.14 Same-Property Cash NOI Growth 3.0% 3.0% 3.2% 3.4% 3.4% Fixed Charge Coverage Ratio 5 3.45x 3.34x 3.19x 3.11x 3.25x As of 3/31/2014 12/31/2013 9/30/2013 6/30/2013 3/31/2013 ASSETS: Gross Real Estate Investments $ 2,976,476 $ 2,972,929 $ 2,823,337 $ 2,671,901 $ 2,667,869 Total Assets $ 2,735,246 $ 2,752,334 $ 2,681,520 $ 2,574,753 $ 2,590,204 . CAPITALIZATION: Total Debt $ 1,232,282 $ 1,214,241 $ 1,125,792 $ 1,114,204 $ 1,135,693 Total Stockholders’ Equity 1,359,204 1,387,206 1,405,806 1,330,518 1,328,853 Total Market Capitalization 6 $ 3,963,924 $ 3,570,077 $ 3,632,471 $ 3,681,556 $ 3,771,109 Total Debt/Total Market Capitalization 31.1% 34.0% 31.0% 30.3% 30.1%

Company Snapshot as of March 31, 2014 ________________ 1. Includes the impact of interest rate swaps. Gross real estate investments (billions) $3.0 Total portfolio gross leasable area (GLA) (millions) 14.1 Leased Rate 91.2% Portfolio tenant retention rate 75% Investment grade tenants (based on annualized base rent) 41% Credit rated tenants (based on annualized rent) 57% % of GLA on-campus/aligned 96% Weighted average remaining lease term for all buildings (years) 6.2 Weighted average remaining lease term for single-tenant buildings (years) 8.3 Weighted average remaining lease term for multi-tenant buildings (years) 5.1 Credit ratings Baa2(Stable)/BBB-(Stable) Cash and cash equivalents (millions) $27.4 Total debt to capitalization 31.1% Weighted average interest rate per annum on portfolio debt1 3.82% Building Type (based on GLA) Presence in 27 States (based on GLA) 6 Hospitals 5% Senior Care 4% Medical Office Buildings 91% TX 13% FL 12% AZ 10% IN 9% PA 9% Other 28% GA 5% NY 6% SC 8% SUPPLEMENTAL OPERATING AND FINANCIAL INFORMATION FIRST QUARTER 2014

Funds From Operations (FFO), Normalized Funds From Operations (Normalized FFO) and Normalized Funds Available for Distribution (Normalized FAD) (unaudited and in thousands, except per share data) Financial Information Three Months Ended March 31, 2014 2013 Net income attributable to common stockholders $ 5,292 $ 1,351 Depreciation and amortization expense 34,942 28,561 FFO $ 40,234 $ 29,912 FFO per share - basic $ 0.17 $ 0.14 FFO per share - diluted $ 0.17 $ 0.14 Acquisition-related expenses 976 1,025 Listing expenses — 4,405 Net (gain) loss on change in the fair value of derivative financial instruments 841 (1,606) Noncontrolling income from operating partnership units included in diluted shares 104 8 Other normalizing items 209 406 Normalized FFO $ 42,364 $ 34,150 Normalized FFO per share - basic $ 0.18 $ 0.16 Normalized FFO per share - diluted $ 0.18 $ 0.16 Normalized FFO $ 42,364 $ 34,150 Other (income) expense (26) (8) Non-cash compensation expense 1,388 565 Straight-line rent adjustments, net (2,100) (1,738) Amortization of acquired below and above market leases, net 668 550 Deferred revenue - tenant improvement related (133) (131) Amortization of deferred financing costs and debt discount/premium 561 814 Recurring capital expenditures, tenant improvements and leasing commissions (3,995) (2,658) Normalized FAD $ 38,727 $ 31,544 Normalized FAD per share - basic $ 0.16 $ 0.15 Normalized FAD per share - diluted $ 0.16 $ 0.14 Weighted average number of shares outstanding: Basic 237,287 217,103 Diluted 239,823 218,904 7 SUPPLEMENTAL OPERATING AND FINANCIAL INFORMATION FIRST QUARTER 2014

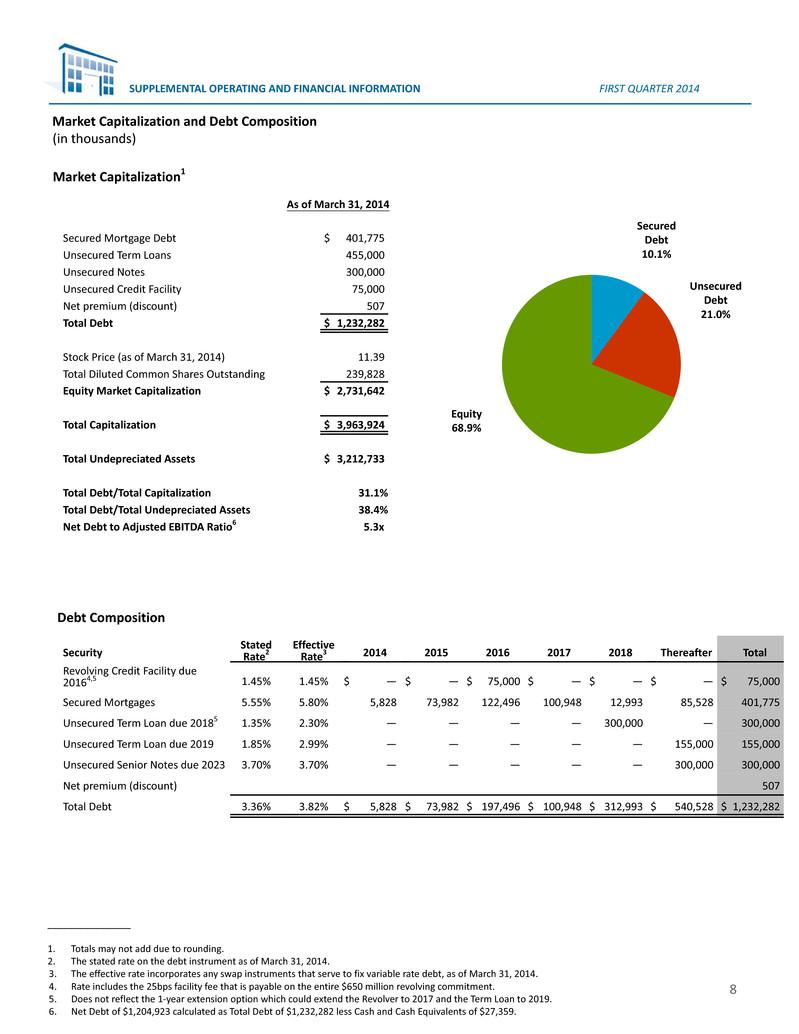

Market Capitalization and Debt Composition (in thousands) Market Capitalization1 ________________ 1. Totals may not add due to rounding. 2. The stated rate on the debt instrument as of March 31, 2014. 3. The effective rate incorporates any swap instruments that serve to fix variable rate debt, as of March 31, 2014. 4. Rate includes the 25bps facility fee that is payable on the entire $650 million revolving commitment. 5. Does not reflect the 1-year extension option which could extend the Revolver to 2017 and the Term Loan to 2019. 6. Net Debt of $1,204,923 calculated as Total Debt of $1,232,282 less Cash and Cash Equivalents of $27,359. Debt Composition As of March 31, 2014 Secured Mortgage Debt $ 401,775 Unsecured Term Loans 455,000 Unsecured Notes 300,000 Unsecured Credit Facility 75,000 Net premium (discount) 507 Total Debt $ 1,232,282 Stock Price (as of March 31, 2014) 11.39 Total Diluted Common Shares Outstanding 239,828 Equity Market Capitalization $ 2,731,642 Total Capitalization $ 3,963,924 Total Undepreciated Assets $ 3,212,733 Total Debt/Total Capitalization 31.1% Total Debt/Total Undepreciated Assets 38.4% Net Debt to Adjusted EBITDA Ratio6 5.3x Security Stated Rate2 Effective Rate3 2014 2015 2016 2017 2018 Thereafter Total Revolving Credit Facility due 20164,5 1.45% 1.45% $ — $ — $ 75,000 $ — $ — $ — $ 75,000 Secured Mortgages 5.55% 5.80% 5,828 73,982 122,496 100,948 12,993 85,528 401,775 Unsecured Term Loan due 20185 1.35% 2.30% — — — — 300,000 — 300,000 Unsecured Term Loan due 2019 1.85% 2.99% — — — — — 155,000 155,000 Unsecured Senior Notes due 2023 3.70% 3.70% — — — — — 300,000 300,000 Net premium (discount) 507 Total Debt 3.36% 3.82% $ 5,828 $ 73,982 $ 197,496 $ 100,948 $ 312,993 $ 540,528 $ 1,232,282 8 SUPPLEMENTAL OPERATING AND FINANCIAL INFORMATION FIRST QUARTER 2014 Equity 68.9% Secured Debt 10.1% Unsecured Debt 21.0%

SUPPLEMENTAL OPERATING AND FINANCIAL INFORMATION FIRST QUARTER 2014 Covenants Bank Loans Required 3/31/2014 Total Leverage 60% 39% Secured Leverage 30% 13% Tangible Net Worth 1,288 1,765 Fixed Charge Coverage 1.65x 3.45x Unencumbered Leverage 60% 36% Unencumbered Coverage 1.75x 5.60x Senior Notes Required 3/31/2014 Total Leverage 60% 39% Secured Leverage 40% 13% Unencumbered Asset Coverage 150% 283% Interest Coverage 1.50x 3.90x Three Months Ended March 31, 2014 2013 Interest related to derivative financial instruments $ 1,345 $ 1,365 Net (gain) loss on change in fair value of derivative financial instruments 841 (1,606) Total interest expense and net change in the fair value of derivative financial instruments 2,186 (241) Interest related to debt 11,904 11,318 Total Interest Expense $ 14,090 $ 11,077 Interest Expense excluding net change in the fair market value of derivatives $ 13,249 $ 12,683 Interest Expense Interest Expense and Covenants (in thousands) 9

Historical Acquisition Activity and Key Market Concentration as of March 31, 2014 ________________ 1. GLA and purchase price are in thousands. 2. Top 10 cities by GLA and other markets in which HTA is focused. 3. GLA is is based on measurements at time of acquisition. Portfolio Information Market2 GLA1 % of Portfolio Phoenix, AZ 1,152 8.2% Pittsburgh, PA 1,094 7.8% Greenville, SC 965 6.9% Albany, NY 879 6.3% Indianapolis, IN 850 6.1% Houston, TX 692 4.9% Dallas, TX 682 4.8% Atlanta, GA 597 4.2% Miami, FL 591 4.2% Boston, MA 359 2.5% Denver, CO 260 1.8% Raleigh, NC 245 1.7% Total Key Market Concentration 8,366 59.4% 10 SUPPLEMENTAL OPERATING AND FINANCIAL INFORMATION FIRST QUARTER 2014 Purchase Price1 % of Total GLA1,3 % of Total 2007 $ 413,150 13.8% 2,247 16.0% 2008 542,976 18.1% 2,919 20.7% 2009 455,950 15.2% 2,251 16.0% 2010 802,148 26.7% 3,530 25.0% 2011 68,314 2.3% 306 2.2% 2012 294,937 9.8% 1,358 9.6% 2013 397,826 13.3% 1,475 10.5% Subtotal 2,975,301 99.2% 14,086 100% Mortgage notes receivable 23,520 0.8% N/A N/A Total $ 2,998,821 100% 14,086 100% Historical Acquisition Activity Key Market Concentration

Same-Property Performance1 ________________ 1. GLA, revenues, expenses, NOI and leased square feet are in thousands. 2. The presentation for same-property rental income and expenses was adjusted to reflect consistent accounting treatment of certain lease obligations in all periods. These adjustments did not have any impact on same-property cash NOI. Same-Property Performance and Net Operating Income Three Months Ended Sequential Year - Over - Year 3/31/2014 12/31/2013 3/31/2013 Change % Change Change % Change Rental Revenue $ 60,431 $ 60,502 $ 58,948 $ (71) (0.1)% $ 1,483 2.5% Tenant Recoveries 14,704 12,585 13,972 2,119 16.8 % 732 5.2% Total Rental Income 75,135 73,087 72,920 2,048 2.8 % 2,215 3.0% Expenses 23,122 21,047 22,403 2,075 9.9 % 719 3.2% Same-Property Cash NOI2 $ 52,013 $ 52,040 $ 50,517 $ (27) (0.1)% $ 1,496 3.0% Three Months Ended 3/31/2014 12/31/2013 3/31/2013 Number of Buildings 266 266 266 GLA 12,611 12,611 12,611 Leased SF, end of period 11,456 11,505 11,424 Leased %, end of period 90.8% 91.2% 90.6% 11 SUPPLEMENTAL OPERATING AND FINANCIAL INFORMATION FIRST QUARTER 2014 Three Months Ended March 31, 2014 2013 Net income $ 5,434 $ 1,384 General and administrative expenses 6,299 6,448 Acquisition-related expenses 976 1,025 Depreciation and amortization expense 34,942 28,561 Listing expenses — 4,405 Interest expense and net change in fair value of derivative financial instruments 14,090 11,077 Other (income) expense (26) (8) NOI $ 61,715 $ 52,892 NOI percentage growth 16.7% NOI $ 61,715 $ 52,892 Straight-line rent adjustments, net (2,100) (1,738) Amortization of acquired below and above market leases, net 668 550 Lease termination fees (13) (29) Cash NOI 60,270 51,675 Notes receivable interest income (781) (546) Non Same-Property Cash NOI (7,476) (612) Same-Property Cash NOI $ 52,013 $ 50,517 Same-Property Cash NOI percentage growth 3.0% Net Operating Income

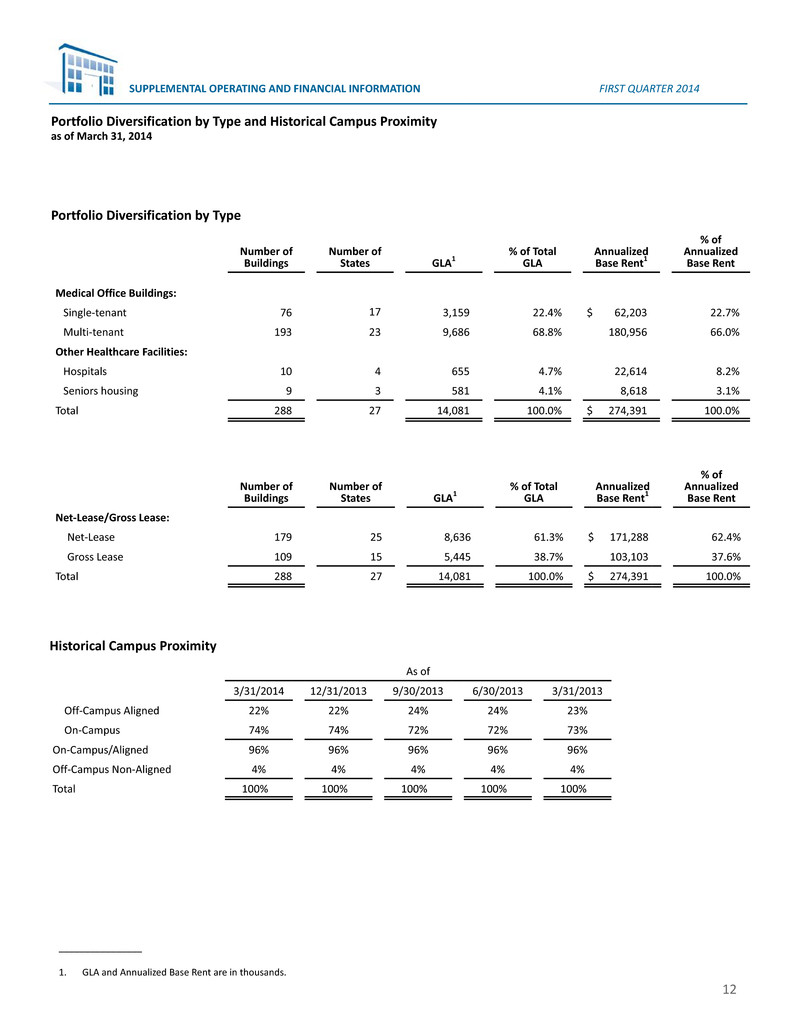

As of 3/31/2014 12/31/2013 9/30/2013 6/30/2013 3/31/2013 Off-Campus Aligned 22% 22% 24% 24% 23% On-Campus 74% 74% 72% 72% 73% On-Campus/Aligned 96% 96% 96% 96% 96% Off-Campus Non-Aligned 4% 4% 4% 4% 4% Total 100% 100% 100% 100% 100% Portfolio Diversification by Type and Historical Campus Proximity as of March 31, 2014 Historical Campus Proximity ________________ 1. GLA and Annualized Base Rent are in thousands. Number of Buildings Number of States GLA1 % of Total GLA Annualized Base Rent1 % of Annualized Base Rent Medical Office Buildings: Single-tenant 76 17 3,159 22.4% $ 62,203 22.7% Multi-tenant 193 23 9,686 68.8% 180,956 66.0% Other Healthcare Facilities: Hospitals 10 4 655 4.7% 22,614 8.2% Seniors housing 9 3 581 4.1% 8,618 3.1% Total 288 27 14,081 100.0% $ 274,391 100.0% 12 SUPPLEMENTAL OPERATING AND FINANCIAL INFORMATION FIRST QUARTER 2014 Number of Buildings Number of States GLA1 % of Total GLA Annualized Base Rent1 % of Annualized Base Rent Net-Lease/Gross Lease: Net-Lease 179 25 8,636 61.3% $ 171,288 62.4% Gross Lease 109 15 5,445 38.7% 103,103 37.6% Total 288 27 14,081 100.0% $ 274,391 100.0% Portfolio Diversification by Type

Tenant Lease Expirations and Historical Occupancy as of March 31, 2014 Historical Leased Rate (End of Period) ________________ 1. GLA and annualized base rent are in thousands. Tenant Lease Expirations As of 3/31/14 12/31/13 9/30/13 6/30/13 3/31/2013 Total Portfolio Leased Rate 91.2% 91.6% 91.4% 91.3% 90.9% On-Campus/Aligned Leased Rate 91.4% 92.0% 91.8% 91.6% 91.3% Off-Campus Leased Rate 85.2% 83.4% 82.7% 84.3% 82.2% Total Annualized % of Number of GLA of % of Base Rent of Total Leases Expiring Leased Expiring Annualized Expiration Expiring Leases1 GLA Leases1 Base Rent Month-to-month 116 240 1.9% $ 4,744 1.7% Second quarter 2014 60 164 1.3% 3,620 1.4% Third quarter 2014 65 148 1.1% 3,068 1.1% Fourth quarter 2014 92 241 1.9% 4,724 1.7% 2014 217 553 4.3% 11,412 4.2% 2015 295 891 6.9% 20,406 7.4% 2016 292 1,280 10.0% 25,997 9.5% 2017 300 1,361 10.6% 28,441 10.4% 2018 268 1,537 12.0% 31,550 11.5% 2019 156 922 7.2% 21,759 7.9% 2020 140 713 5.5% 15,201 5.6% 2021 136 1,252 9.7% 24,397 8.9% 2022 91 737 5.7% 17,679 6.4% 2023 43 627 4.9% 11,845 4.3% Thereafter 151 2,731 21.3% 60,960 22.2% Total 2,205 12,844 100.0% $ 274,391 100.0% 13 SUPPLEMENTAL OPERATING AND FINANCIAL INFORMATION FIRST QUARTER 2014

Top 15 Health System Relationships as of March 31, 2014 ________________ 1. GLA and annualized base rent are in thousands. Weighted Average % of Remaining Total % of Annualized Annualized Lease Credit Leased Leased Base Base Tenant Term Rating GLA 1 GLA Rent1 Rent Highmark 8 A- 871 6.8% $ 16,121 5.9% Greenville Hospital System 10 A1 761 5.9% 13,724 5.0% Hospital Corporation of America 4 B1 329 2.5% 7,572 2.8% Community Health Systems 4 B1 327 2.5% 7,182 2.6% Steward Health Care System 13 B3 317 2.5% 7,124 2.6% Aurora Health Care 10 A3 315 2.5% 6,684 2.4% Indiana University Health 3 Aa3 294 2.3% 4,745 1.7% Deaconess Health System 10 A+ 261 2.0% 4,011 1.5% Banner Health 1 AA+ 202 1.6% 4,716 1.7% Capital District Physicians Health Plan 2 NR 198 1.5% 3,027 1.1% Catholic Health Partners 3 A1 175 1.4% 2,790 1.0% Wellmont Health System 8 BBB+ 160 1.2% 2,697 1.0% Rush University Medical Center 6 A2 137 1.1% 4,547 1.7% Diagnostic Clinic Medical Group 16 A+ 117 0.9% 3,127 1.1% Forest Park Medical Center 7 NR 112 0.9% 3,090 1.1% Top 15 Total 4,576 35.6% $ 91,157 33.2% 14 SUPPLEMENTAL OPERATING AND FINANCIAL INFORMATION FIRST QUARTER 2014 As of March 31, 2014, 12.6 million square feet of GLA, or 89% of total portfolio GLA was managed by HTA’s national property management and leasing platform. HTA continues to roll out its national property management and leasing platform to additional markets, including approximately 562,000 square feet of GLA which transitioned to the HTA platform during the first quarter of 2014. In-House Property Management In-House SF (Single-Tenant) In-House SF (Multi-Tenant) 100.0% 90.0% 80.0% 70.0% 60.0% 50.0% 40.0% 30.0% 20.0% 10.0% 0.0% 2011 2012 2013 03/31/14

Health System Relationship Highlights Deaconess Health System (A+), based in Evansville, Indiana, is a premier provider of health care services in the Tri- State. Since its founding, Deaconess has grown into an award-winning, multi-facility health system providing compassionate, high-quality health care. The system includes six hospitals and over 20 primary care locations and several specialty facilities. Additionally, Deaconess has several ancillary facilities and partnerships with many other community health care providers. Forest Park Medical Center (NR), headquartered in Dallas, Texas, is a leading physician-owned health system focused on private-pay hospitals in key markets. With medical center locations in Dallas, Frisco, and Southlake, and plans to expand to Fort Worth, Austin, and San Antonio. Forest Park will include over 280 beds and 70 operating suites upon completion, in world-class facilities. Greenville Health System (A1), located in Greenville, South Carolina, is a nonprofit academic delivery system and is one of the largest health systems in the state of South Carolina with five medical campuses, outpatient centers, wellness centers, long-term care facilities, and research and academics – including the University of South Carolina School of Medicine-Greenville and Clemson University. The system has 1,358 beds, approximately 1,306 physicians included in medical staff, and approximately 12,000 employees. Highmark (A-), based in Pittsburgh, Pennsylvania, is among the largest health insurers in the United States and the fourth largest Blue Cross and Blue Shield-affiliated company. In 2013, Highmark and West Penn Allegheny combined to create an integrated care delivery model which they believe will preserve an important community asset that provides high-quality, efficient health care for patients. Highmark’s mission is to make high quality health care easily accessible, understandable and affordable. Hospital Corporation of America (B1), Nashville-based HCA was one of the nation’s first hospital companies. Today, they are the nation’s leading provider of healthcare services, a company comprised of locally managed facilities that includes about 165 hospitals and 115 freestanding surgery centers in 20 states and England and employing approximately 204,000 people. Approximately four to five percent of all inpatient care delivered in the country today is provided by HCA facilities. HCA is committed to the care and improvement of human life and strives to deliver high quality, cost effective healthcare in the communities they serve. Indiana University Health (Aa3), based in Indianapolis, Indiana, is Indiana’s most comprehensive healthcare system. A unique partnership with Indiana University School of Medicine, one of the nation’s leading medical schools, gives patients access to innovative treatments and therapies. IU Health is comprised of hospitals, physicians and allied services dedicated to providing preeminent care throughout Indiana and beyond. Piedmont Healthcare (Aa3), based in Atlanta, Georgia, is the Atlanta region’s premier community healthcare system. Founded in 1905, Piedmont is driven by the mission to create a system committed to compassion, advanced treatments, access to care and strong connections to make their patients, communities and region better. What started as a single hospital a century ago has grown into an integrated healthcare system with five hospitals and close to 100 physician and specialist offices across greater Atlanta and North Georgia. Steward Health Care System (B3), located in Boston, Massachusetts, is a community-based accountable care organization and community hospital network with more than 17,000 employees serving more than one million patients annually. The system includes 11 hospitals and over 2,000 beds that reach over 150 communities in the greater Boston area. Other Steward Health Care entities include Steward Medical Group, Steward Health Care network, and Steward Home Care. Tenet Healthcare System (B1), located in Dallas, Texas is a leading health care services company, through its subsidiaries operates 77 acute care hospitals, 186 outpatient centers, and Conifer Health Solutions, which provides business process solutions to more than 700 hospitals and other clients nationwide. Tenet's hospital’s and related health care facilities are committed to providing high quality care to patients in the communities they serve. 15 SUPPLEMENTAL OPERATING AND FINANCIAL INFORMATION FIRST QUARTER 2014

Condensed Consolidated Balance Sheets (unaudited and in thousands, except share data) March 31, 2014 December 31, 2013 ASSETS Real estate investments: Land $ 203,014 $ 203,001 Building and improvements 2,363,386 2,358,071 Lease intangibles 410,076 411,857 2,976,476 2,972,929 Accumulated depreciation and amortization (477,487) (445,938) Real estate investments, net 2,498,989 2,526,991 Real estate notes receivable 28,520 28,520 Cash and cash equivalents 27,359 18,081 Restricted cash and escrow deposits 18,510 18,114 Receivables and other assets, net 112,591 110,285 Other intangibles, net 49,277 50,343 Total assets $ 2,735,246 $ 2,752,334 LIABILITIES AND EQUITY Liabilities: Debt, net $ 1,232,282 $ 1,214,241 Accounts payable and accrued liabilities 78,973 82,893 Derivative financial instruments - interest rate swaps 5,025 5,053 Security deposits, prepaid rent and other liabilities 32,802 35,339 Intangible liabilities, net 11,399 11,797 Total liabilities 1,360,481 1,349,323 Commitments and contingencies Redeemable noncontrolling interest of limited partners 3,269 3,262 Equity: Preferred stock, $0.01 par value; 200,000,000 shares authorized; none issued and outstanding — — Class A common stock, $0.01 par value; 1,000,000,000 shares authorized; 237,291,746 and 236,880,614 shares issued and outstanding as of March 31, 2014 and December 31, 2013, respectively 2,373 2,369 Additional paid-in capital 2,127,709 2,126,897 Cumulative dividends in excess of earnings (770,878) (742,060) Total stockholders’ equity 1,359,204 1,387,206 Noncontrolling interest 12,292 12,543 Total equity 1,371,496 1,399,749 Total liabilities and equity $ 2,735,246 $ 2,752,334 16 SUPPLEMENTAL OPERATING AND FINANCIAL INFORMATION FIRST QUARTER 2014

Condensed Consolidated Statements of Operations (unaudited and in thousands, except per share data) Three Months Ended March 31, 2014 2013 Revenues: Rental income $ 90,452 $ 76,241 Interest income from real estate notes receivable 852 620 Total revenues 91,304 76,861 Expenses: Rental 29,589 23,969 General and administrative 6,299 6,448 Acquisition-related 976 1,025 Depreciation and amortization 34,942 28,561 Listing — 4,405 Total expenses 71,806 64,408 Income before other income (expense) 19,498 12,453 Other income (expense): Interest expense: Interest related to derivative financial instruments (1,345) (1,365) Net gain (loss) on change in the fair value of derivative financial instruments (841) 1,606 Total interest related to derivative financial instruments, including net change in the fair value of derivative financial instruments (2,186) 241 Interest related to debt (11,904) (11,318) Other income (expense) 26 8 Net income $ 5,434 $ 1,384 Net income attributable to noncontrolling interests (142) (33) Net income attributable to common stockholders $ 5,292 $ 1,351 Earnings per common share - basic: Net income attributable to common stockholders $ 0.02 $ 0.01 Earnings per common share - diluted: Net income attributable to common stockholders $ 0.02 $ 0.01 Weighted average number of common shares outstanding: Basic 237,287 217,103 Diluted 239,823 218,904 17 SUPPLEMENTAL OPERATING AND FINANCIAL INFORMATION FIRST QUARTER 2014

Reporting Definitions Adjusted Earnings Before Interest, Taxes, Depreciation and Amortization (Adjusted EBITDA): Is presented on an assumed annualized basis. HTA defines Adjusted EBITDA as net income computed in accordance with GAAP plus depreciation, amortization, interest expense and net change in the fair value of derivative financial instruments, aquisition-related expenses and non-cash compensation expense. We consider Adjusted EBITDA an important measure because it provides additional information to allow management, investors, and our current and potential creditors to evaluate and compare our core operating results and our ability to service debt. The following is a reconciliation of our net income, the most directly comparable GAAP financial measure, to Adjusted EBITDA. The Pro Forma Impact is presented to show the additional EBITDA that would have resulted if all acquisitions were completed on the first day of the quarter. Annualized Base Rent: Annualized base rent is calculated by multiplying contractual base rent for March 2014 by 12 (excluding the impact of abatements, concessions, and straight-line rent). Credit Ratings: Credit ratings of our tenants or their parent companies. Funds from Operations (FFO): HTA defines FFO, a non-GAAP measure, as net income or loss attributable to common stockholders computed in accordance with GAAP, excluding gains or losses from sales of property and impairment write downs of depreciable assets, plus depreciation and amortization, and after adjustments for unconsolidated partnerships and joint ventures. HTA presents FFO because it considers it an important supplemental measure of its operating performance and believes it is frequently used by securities analysts, investors and other interested parties in the evaluation of REITs, many which present FFO when reporting their results. FFO is intended to exclude GAAP historical cost depreciation and amortization of real estate and related assets, which assumes that the value of real estate diminishes ratably over time. Historically, however, real estate values have risen or fallen with market conditions. Because FFO excludes depreciation and amortization unique to real estate, gains and losses from property dispositions and extraordinary items, it provides a performance measure that, when compared year over year, reflects the impact to operations from trends in occupancy rates, rental rates, operating costs, development activities and interest costs, providing perspective not immediately apparent from net income or loss attributable to controlling interest. FFO should not be considered as an alternative to net income or loss attributable to common stockholders (computed in accordance with GAAP) as an indicator of our financial performance or to cash flow from operating activities (computed in accordance with GAAP) as an indicator of our liquidity, nor is it indicative of funds available to fund HTA’s cash needs, including its ability to make distributions. FFO should be reviewed in connection with other GAAP measurements. Gross Leasable Area (GLA): Gross leasable area (in square feet). Gross Real Estate Investments: Based on acquisition price and includes two portfolios of real estate notes receivable. Leased Rate: Leased rate represents the percentage of total gross leasable area that is leased, including month-to-month leases and leases that are signed but not yet commenced, as of the date reported. Three Months Ended March 31, 2014 Adjusted EBITDA Net Income $ 5,434 Add: Depreciation and amortization 34,942 Interest expense and net change in fair value of derivative financial instruments 14,090 EBITDA 54,466 Acquisition-related expenses 976 Non-cash compensation expense 1,388 Pro Forma Impact — Adjusted EBITDA 56,830 Annualized Adjusted EBITDA $ 227,320 18 SUPPLEMENTAL OPERATING AND FINANCIAL INFORMATION FIRST QUARTER 2014

Reporting Definitions (continued) Normalized Funds Available for Distribution (Normalized FAD): HTA defines Normalized FAD, a non-GAAP measure, which excludes from Normalized FFO other income, non-cash compensation expense, straight-line rent adjustments, amortization of acquired below and above market leases, deferred revenue - tenant improvement related, amortization of deferred financing costs, and debt discount/premium and recurring capital expenditures, tenant improvements and leasing commissions. HTA believes Normalized FAD provides a meaningful supplemental measure of its ability to fund its ongoing distributions. In order to understand and analyze HTA’s liquidity, Normalized FAD should be compared with cash flow (computed in accordance with GAAP). Normalized FAD should not be considered as an alternative to net income or loss attributable to common stockholders (computed in accordance with GAAP) as an indicator of HTA’s financial performance or to cash flow from operating activities (computed in accordance with GAAP) as an indicator of HTA’s liquidity. Normalized FAD should be reviewed in connection with other GAAP measurements. Normalized Funds From Operations (Normalized FFO): Changes in the accounting and reporting rules under GAAP have prompted a significant increase in the amount of non-operating items included in FFO, as defined. Therefore, HTA uses Normalized FFO, which excludes from FFO acquisition- related expenses, listing expenses, net change in fair value of derivative financial instruments, noncontrolling income from operating partnership units included in diluted shares, transitional expenses, debt extinguishment costs and other normalizing items, to further evaluate how its portfolio might perform after its acquisition stage is complete and the sustainability of its distributions in the future. However, HTA’s use of the term Normalized FFO may not be comparable to that of other real estate companies as they may have different methodologies for computing this amount. Normalized FFO should not be considered as an alternative to net income or loss attributable to common stockholders (computed in accordance with GAAP) as an indicator of HTA’s financial performance or to cash flow from operating activities (computed in accordance with GAAP) as an indicator of HTA’s liquidity, nor is it indicative of funds available to fund HTA’s cash needs, including its ability to make distributions. Normalized FFO should be reviewed in connection with other GAAP measurements. Off-Campus: A building or portfolio that is not located on or adjacent to key hospital based-campuses and is not aligned with recognized healthcare systems. On-Campus / Aligned: On-campus refers to a property that is located on or adjacent to a healthcare system. Aligned refers to a property that is not on the campus of a healthcare system, but anchored by a healthcare system. Recurring Capital Expenditures, Tenant Improvements, Leasing Commissions: Represents amounts paid for (i) recurring capital expenditures required to maintain and re-tenant our properties, (ii) second generation tenant improvements, and iii) leasing commissions paid to secure new tenants. Excludes capital expenditures and tenant improvements for recent acquisitions that were contemplated in the purchase price or closing agreements. Retention: Tenant Retention Rate is defined as the sum of the total leased GLA of tenants that renewed a lease during the period over the total GLA of leases that renewed or expired during the period. Same-Property Cash Net Operating Income: To facilitate the comparison of Cash NOI between periods, HTA calculates comparable amounts for a subset of its owned properties referred to as “same-property.” Same-property Cash NOI excludes properties which have not been owned for the entire periods reported. Same-Property Cash NOI should not be considered as an alternative to net income or loss (computed in accordance with GAAP) as an indicator of our financial performance. Same-Property Cash NOI should be reviewed in connection with other GAAP measurements. 19 SUPPLEMENTAL OPERATING AND FINANCIAL INFORMATION FIRST QUARTER 2014 Net Operating Income (NOI): NOI is a non-GAAP financial measure that is defined as net income or loss, computed in accordance with GAAP, generated from HTA’s total portfolio of properties before general and administrative expenses, acquisition-related expenses, depreciation and amortization expense, listing expenses, non-traded REIT expenses, interest expense and net change in the fair value of derivative financial instruments, and other income. HTA believes that NOI provides an accurate measure of the operating performance of its operating assets because NOI excludes certain items that are not associated with management of the properties. Additionally, HTA believes that NOI is a widely accepted measure of comparative operating performance in the real estate community. However, HTA’s use of the term NOI may not be comparable to that of other real estate companies as they may have different methodologies for computing this amount. Cash Net Operating Income (Cash NOI): Cash NOI is a non-GAAP financial measure which excludes from NOI straight-line rent adjustments, amortization of acquired below and above market leases and lease termination fees. HTA believes that Cash NOI provides an accurate measure of the operating performance of its operating assets because it excludes certain items that are not associated with management of the properties. Additionally, HTA believes that Cash NOI is a widely accepted measure of comparative operating performance in the real estate community. However, HTA’s use of the term Cash NOI may not be comparable to that of other real estate companies as such other companies may have different methodologies for computing this amount.