Attached files

| file | filename |

|---|---|

| EX-23.1 - EX-23.1 - HD Supply Holdings, Inc. | a2219839zex-23_1.htm |

| EX-5.1 - EX-5.1 - HD Supply Holdings, Inc. | a2219839zex-5_1.htm |

| EX-1.1 - EX-1.1 - HD Supply Holdings, Inc. | a2219839zex-1_1.htm |

Use these links to rapidly review the document

TABLE OF CONTENTS

As filed with the Securities and Exchange Commission on April 30, 2014

Registration No. 333-194887

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 1

TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

HD Supply Holdings, Inc.

(Exact Name of Registrant as Specified in its Charter)

| Delaware (State or other jurisdiction of incorporation) |

5000 (Primary Standard Industrial Classification Code Number) |

26-0486780 (I.R.S. Employer Identification No.) |

3100 Cumberland Boulevard, Suite 1480

Atlanta, Georgia 30339

(770) 852-9000

(Address, including Zip Code, and Telephone Number, including Area Code, of Registrant's Principal Executive Offices)

Ricardo J. Nunez, Esq.

Senior Vice President, General Counsel and Corporate Secretary

HD Supply Holdings, Inc.

3100 Cumberland Boulevard, Suite 1480

Atlanta, Georgia 30339

(770) 852-9000

(Name, Address, including Zip Code, and Telephone Number, including Area Code, of Agent for Service)

| With a copy to: | ||

Steven J. Slutzky, Esq. Debevoise & Plimpton LLP 919 Third Avenue New York, New York 10022 (212) 909-6000 |

Patrick O'Brien, Esq. Marko Zatylny, Esq. Ropes & Gray LLP Prudential Tower 800 Boylston Street Boston, Massachusetts 02119 (617) 951-7000 |

|

Approximate date of commencement of proposed sale of the securities to the public:

As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer o | Accelerated filer o | Non-accelerated filer ý (Do not check if a smaller reporting company) |

Smaller reporting company o |

CALCULATION OF REGISTRATION FEE

|

||||||||

| Title of Each Class of Securities to be Registered |

Amount to be Registered(1) |

Proposed Maximum Aggregate Offering Price Per Share(1)(2) |

Proposed Maximum Aggregate Offering Price(1)(2) |

Amount of Registration Fee(3) |

||||

|---|---|---|---|---|---|---|---|---|

Common stock, $0.01 par value per share |

34,500,000 | $25.305 | $873,022,500 | $112,446 | ||||

|

||||||||

- (1)

- Includes

shares/offering price of shares that may be sold upon exercise of the underwriters' option to purchase additional shares.

- (2)

- This

amount represents the proposed maximum aggregate offering price of the securities registered hereunder. These figures are estimated solely for the

purpose of calculating the amount of the registration fee pursuant to Rule 457(c) under the Securities Act of 1933, as amended. The price shown is the average of the high and low sale prices

for HD Supply Holdings, Inc.'s common stock on March 27, 2014 as reported on the NASDAQ Global Select Market.

- (3)

- Previously paid.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until this registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state or jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED APRIL 30, 2014

30,000,000 Shares

![]()

HD Supply Holdings, Inc.

Common Stock

All of the shares of common stock of HD Supply Holdings, Inc. being sold in this offering are being sold by the selling stockholders identified in this prospectus. HD Supply Holdings, Inc. will not receive any of the proceeds from the sale of the shares being sold by the selling stockholders.

The common stock of HD Supply Holdings, Inc. is listed on the NASDAQ Global Select Market under the symbol "HDS." The last reported sale price of our common stock on April 25, 2014 was $25.93 per share.

See "Risk Factors" on page 17 to read about factors you should consider before buying shares of our common stock.

|

||||||

| |

Price to Public |

Underwriting Discounts and Commissions(1) |

Proceeds to Selling Stockholders |

|||

|---|---|---|---|---|---|---|

Per Share |

$ | $ | $ | |||

Total |

$ | $ | $ | |||

|

||||||

- (1)

- See "Underwriting" for additional compensation details.

The underwriters also may purchase up to 4,500,000 additional shares from the selling stockholders at the offering price less the underwriting discounts and commissions. HD Supply Holdings, Inc. will not receive any of the proceeds from the shares of common stock sold by the selling stockholders pursuant to any exercise of the underwriters' option to purchase additional shares.

Neither the Securities and Exchange Commission ("SEC") nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares to purchasers on or about , 2014.

| BofA Merrill Lynch | Barclays | Credit Suisse | J.P. Morgan |

| Citigroup | Deutsche Bank Securities |

Goldman, Sachs & Co. |

Morgan Stanley | UBS Investment Bank |

Wells Fargo Securities |

Baird |

William Blair |

Raymond James |

BB&T Capital Markets |

SunTrust Robinson Humphrey |

|

Drexel Hamilton |

Guzman & Company |

The date of this prospectus is , 2014.

Neither we, the selling stockholders, nor the underwriters have authorized anyone to provide you with different information or to make any representations other than those contained or incorporated by reference into this prospectus or in any free writing prospectuses we have prepared. If anyone provides you with different or inconsistent information, you should not rely on it. This prospectus does not constitute an offer to sell, or a solicitation of an offer to purchase, the securities offered by this prospectus in any jurisdiction in which it is unlawful to make such offer or solicitation. You should assume that the information contained in this prospectus and the documents incorporated by reference is accurate only as of the date such information is presented.

For investors outside the United States: Neither we, the selling stockholders nor the underwriters have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. You are required to inform yourselves about and to observe any restrictions relating to this offering and the distribution of this prospectus outside of the United States.

i

SPECIAL NOTE REGARDING FORWARD LOOKING STATEMENTS AND INFORMATION

This prospectus and the information incorporated by reference into this prospectus include forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Some of the forward-looking statements can be identified by the use of forward-looking terms such as "believes," "expects," "may," "will," "should," "could," "seeks," "intends," "plans," "estimates," "anticipates" or other comparable terms. These forward-looking statements include all matters that are not historical facts. They appear in a number of places throughout this prospectus or in the documents incorporated by reference into this prospectus and include statements regarding our intentions, beliefs or current expectations concerning, among other things, our results of operations, financial condition, liquidity, prospects, growth strategies and the industries in which we operate.

Forward-looking statements are subject to known and unknown risks and uncertainties, many of which may be beyond our control. We caution you that forward looking statements are not guarantees of future performance and that our actual results of operations, financial condition and liquidity, and the development of the industries in which we operate may differ materially from those made in or suggested by the forward-looking statements contained in this prospectus and the documents incorporated by reference into this prospectus. In addition, even if our results of operations, financial condition and liquidity, and the development of the industries in which we operate are consistent with the forward-looking statements contained in this prospectus and the documents incorporated by reference into this prospectus, those results or developments may not be indicative of results or developments in subsequent periods. A number of important factors could cause actual results to differ materially from those contained in or implied by the forward-looking statements, including those reflected in forward looking statements relating to our operations and business, the risks and uncertainties discussed in "Risk Factors" in this prospectus and those described from time to time in our other filings with the SEC. Factors that could cause actual results to differ from those reflected in forward-looking statements relating to our operations and business include:

- •

- inherent risks of the maintenance, repair and operations market, infrastructure spending and the non-residential and

residential construction markets;

- •

- our ability to achieve profitability;

- •

- our ability to service our debt and to refinance all or a portion of our indebtedness;

- •

- limitations and restrictions in the agreements governing our indebtedness;

- •

- the competitive environment in which we operate and demand for our products and services in highly competitive and

fragmented industries;

- •

- the loss of any of our significant customers;

- •

- competitive pricing pressure from our customers;

- •

- our ability to identify and acquire suitable acquisition candidates on favorable terms;

- •

- cyclicality and seasonality of the maintenance, repair and operations market, infrastructure spending and the

non-residential and residential construction markets;

- •

- our ability to identify and develop relationships with a sufficient number of qualified suppliers and to maintain our

supply chains;

- •

- our ability to manage fixed costs;

- •

- the development of alternatives to distributors in the supply chain;

- •

- our ability to manage our working capital through product purchasing and customer credit policies;

ii

- •

- potential material liabilities under our self-insured programs;

- •

- our ability to attract, train and retain highly qualified associates and key personnel;

- •

- limitations on our income tax net operating loss carryforwards in the event of an ownership change;

- •

- our ability to identify and integrate new products; and

- •

- the significant influence our sponsors have over corporate decisions.

You should read this prospectus, including the uncertainties and factors discussed under "Risk Factors," and the documents incorporated by reference herein completely and with the understanding that actual future results may be materially different from expectations. All forward-looking statements made in this prospectus and the documents incorporated by reference into this prospectus are qualified by these cautionary statements. These forward looking statements are made only as of the date of this prospectus and we do not undertake any obligation, other than as may be required by law, to update or revise any forward-looking statements to reflect changes in assumptions, the occurrence of unanticipated events, changes in future operating results over time or otherwise. Comparisons of results for current and any prior periods are not intended to express any future trends or indications of future performance, unless expressed as such, and should only be viewed as historical data.

We use various trademarks, service marks and brand names, such as HD Supply, USABluebook, Creative Touch Interiors and White Cap that we deem particularly important to the advertising activities and operation of our various business units, and some of these marks are registered in the United States and, in some cases, other jurisdictions. This prospectus and the documents incorporated by reference herein also refer to the brand names, trademarks or service marks of other companies. All brand names and other trademarks or service marks cited in this prospectus and the documents incorporated by reference into this prospectus are the property of their respective holders.

This prospectus and the documents incorporated by reference herein include estimates regarding market and industry data and forecasts, which are based on publicly available information, industry publications and surveys, reports from government agencies, reports by market research firms and our own estimates based on our management's knowledge of and experience in the market sectors in which we compete. We have not independently verified market and industry data from third party sources. This information cannot always be verified with complete certainty due to the limits on the availability and reliability of raw data, the voluntary nature of the data gathering process, and other limitations and uncertainties inherent in surveys of market size.

iii

Unless the context otherwise indicates or requires, as used in this prospectus, (i) the terms "we," "our," "us," "HD Supply," and the "Company," refer to HD Supply Holdings, Inc. and its directly and indirectly owned subsidiaries as a combined entity, except where it is clear that the terms mean only HD Supply Holdings, Inc. exclusive of its subsidiaries and (ii) the term "HDS" refers to HD Supply, Inc., our primary operating company and a wholly-owned subsidiary of HD Supply Holdings, Inc.

Our fiscal year is a 52- or 53-week period ending on the Sunday nearest to January 31. Fiscal year ended February 2, 2014 ("fiscal 2013") included 52 weeks, fiscal year ended February 3, 2013 ("fiscal 2012") included 53 weeks, and fiscal year ended January 29, 2012 ("fiscal 2011") included 52 weeks.

In January 2014, we decided to dispose of our Litemor business, a specialty lighting distributor within our HD Supply Canada business. Unless otherwise indicated, the information in this prospectus excludes our Litemor results of operations. Our audited consolidated financial statements included in our Annual Report on Form 10-K for the year ended February 2, 2014, filed with the SEC on March 25, 2014, as amended by Amendment No. 1 on Form 10-K/A, filed with the SEC on March 26, 2014 and as further amended by Amendment No. 2 on Form 10-K/A, filed with the SEC on April 30, 2014 (as so amended, the "2013 Form 10-K") have been revised to present Litemor as a discontinued operation for the periods presented.

The term "GAAP" refers to accounting principles generally accepted in the United States of America.

iv

The following summary highlights information contained elsewhere in this prospectus or the documents incorporated by reference into this prospectus and does not contain all of the information that you should consider before investing in our common stock. You should read this entire prospectus and the documents incorporated by reference into this prospectus before making an investment decision.

We are one of the largest industrial distributors in North America. We believe we have leading positions in the three distinct market sectors in which we specialize: Maintenance, Repair & Operations; Infrastructure & Power; and Specialty Construction. These market sectors are large and fragmented, and we believe they present opportunities for significant growth. We aspire to be the "First Choice" of customers, associates, suppliers and the communities in which we operate. This aspiration drives our relentless focus and is reflected in the customer and market centricity, speed and precision, intense teamwork, process excellence and trusted relationships that define our culture. We believe this aspiration distinguishes us from other distributors and has created value for our shareholders, driven above market growth and delivered attractive returns on invested capital.

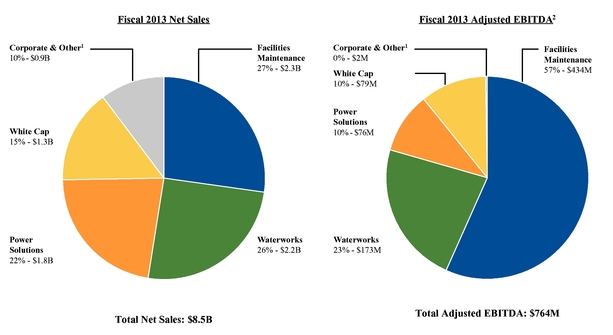

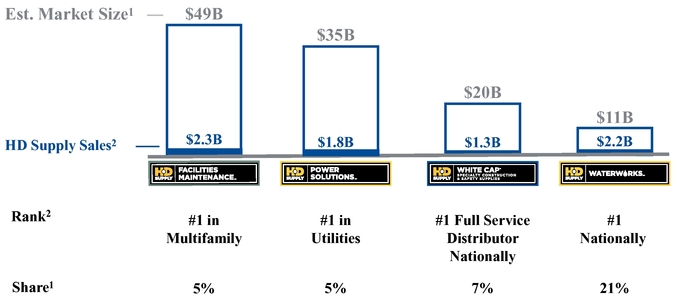

We estimate that the aggregate size of our currently addressable markets is approximately $115 billion annually. We define our currently addressable markets as the total dollars spent in markets where we currently offer products. We serve our markets with an integrated go-to-market strategy. We operate through approximately 650 locations across 47 U.S. states and seven Canadian provinces. We have more than 15,000 associates delivering localized, customer tailored products, services and expertise. We serve approximately 500,000 customers, which include contractors, maintenance professionals, home builders, industrial businesses, and government entities. Our broad range of end-to-end product lines and services include over one million stock keeping units ("SKUs") of quality, name-brand and proprietary brand products as well as value-add services supporting the entire lifecycle of a project from infrastructure and construction to maintenance, repair and operations. For fiscal 2013, we generated $8,487 million in Net sales, representing 6.8% growth over fiscal 2012, or 9.4% growth excluding the 53rd week of fiscal 2012 and the impact of the amended Crown Bolt agreement with The Home Depot, Inc. ("Home Depot"); $764 million of Adjusted EBITDA, representing 11.5% growth over fiscal 2012, or 21.3% growth excluding the 53rd week of fiscal 2012 and the impact of the amended Crown Bolt agreement with Home Depot; and incurred a Net loss of $218 million representing an improvement of 81.5% over fiscal 2012. For a reconciliation of GAAP measures to the Non-GAAP measures, including a reconciliation of Net income (loss), the most directly comparable financial measure under GAAP, to Adjusted EBITDA, see "Selected Consolidated Financial Data."

We believe our long-standing customer relationships and competitive advantage stem from our knowledgeable associates, extensive product and service offerings, national footprint, integrated best-in-class technology, broad purchasing scale and strategic supplier relationships. We believe that our comprehensive supply chain solutions improve the effectiveness and efficiency of our customers' businesses. Our value-add services include customer training, material and product fabrication, kitting, jobsite delivery, will call pick up options, as well as onsite managed inventory, online material management and emergency response capabilities. Furthermore, we believe our product application knowledge, comprehensive product assortment, and sourcing expertise allow our customers to perform reliably and provide them the tools to enhance profitability. We reach our customers through a variety of sales channels, including professional outside and inside sales forces, call centers and branch supported direct marketing programs utilizing market specific product catalogs, and business unit websites. Our distribution network allows us to provide rapid, reliable, on-time delivery and customer pickup throughout the U.S. and Canada. Additionally, we believe our highly integrated, best-in-class technology provides leading e-commerce and integrated workflow capabilities for our customers, while providing us unparalleled pricing, budgeting, reporting and analytical capabilities across our Company.

1

We believe customers view us as an integral part of the value chain due to our extensive product knowledge, expansive product availability and the ability to directly integrate with their systems and workflows.

Since 2007 we have undertaken significant operating and growth initiatives at all levels. We developed and are implementing a multi-year strategy to optimize our business mix. This strategy includes entering new markets and product lines, streamlining and upgrading our process and technology capabilities, acquiring new capabilities and selling non-core business units. At the same time, we attracted what we believe to be "best of the best" talent capitalizing on relevant experience, teamwork and change navigation. With this transformational execution behind us, we believe we are well-positioned to continue to grow in excess of the markets in which we operate.

Summary of Reportable Segments

We operate through four reportable segments: Facilities Maintenance, Waterworks, Power Solutions and White Cap. Although these reportable segments are distinct and specialized to reflect the needs of their customers, we operate our Company with an integrated go-to-market strategy.

- •

- Facilities Maintenance. Facilities Maintenance

distributes maintenance, repair and operations ("MRO") products, provides value-add services and fabricates custom products for multifamily, hospitality, healthcare and institutional facilities.

- •

- Waterworks. Waterworks distributes complete lines of water

and wastewater transmission products, serving contractors and municipalities in the water and wastewater industries for non-residential and residential uses.

- •

- Power Solutions. Power Solutions distributes electrical

transmission and distribution products, power plant MRO supplies and smart-grid products, and arranges materials management and procurement outsourcing for the power generation and distribution

industries.

- •

- White Cap. White Cap distributes specialized hardware, tools, engineered materials and safety products to non-residential and residential contractors.

2

The table below is a summary of our four reportable segments.

Overview |

Catalog-Based Distributor of MRO Products to Maintenance Professionals |

Distributor of Water, Sewer, Storm and Fire Protection Products |

Distributor of Utilities and Electrical Construction and Industrial Products |

Distributor of Specialty Construction and Safety Supplies |

|||||

Fiscal 2013 Net Sales |

$2.3 billion |

$2.2 billion |

$1.8 billion |

$1.3 billion |

|||||

Fiscal 2013 Adjusted EBITDA(1) |

$434 million |

$173 million |

$76 million |

$79 million |

|||||

Adjusted EBITDA |

18.6% |

7.8% |

4.1% |

6.1% |

|||||

Growth(3) |

13.9% |

28.1% |

8.6% |

43.6% |

|||||

Estimated Addressable |

$49 billion |

$11 billion |

$35 billion |

$20 billion |

|||||

Est. Market Share(4) |

5% |

21% |

5% |

7% |

|||||

Est. Market Position(5) |

#1 in Multifamily |

#1 Nationally |

#1 in Utilities |

#1 Full Service Distributor Nationally |

|||||

Locations |

41 Distribution Centers in U.S.; 2 in Canada |

239 Branches in 45 U.S. States |

110 Branches in 26 U.S. States; 4 in Canada |

147 Branches in 31 U.S. States |

|||||

Approx. SKUs |

185,000 |

320,000 |

205,000 |

240,000 |

|||||

Select Products |

Electrical and Lighting Items; Plumbing; HVAC Products; Appliances; Janitorial Supplies; Hardware; Kitchen and Bath Cabinets; Window Coverings; Textiles and Guest Amenities; Healthcare Maintenance; Water and Wastewater Treatment Products |

Water and Wastewater Transmission Products Including Pipe (PVC, Ductile Iron, HDPE); Fittings; Valves; Fire Protection; Metering Systems; Storm Drain; Hydrants; Fusion Machine Rental; Valve Testing and Repair |

Pole Line Hardware; Wire and Cable; Gear and Controls; Power Equipment; Fixtures and Lighting; Meters |

Concrete Accessories and Chemicals; Tools; Engineered Materials and Fasteners; Safety; Erosion and Waterproofing |

|||||

|

|

|

|

|

|||||

Value-add Services |

Next Day Delivery; Customized and Fabricated Products; Renovations and Installation Services; Technical Support; Customer Training; e-Commerce Solutions |

Proprietary PC-based Estimating Software; Job Management Reports; Electronic Billing; On-demand Customer Reports; Part Number Interchange; Material Management Online ("MMO"); Database Depot; Distributor Managed Inventory ("DMI") |

Emergency Response Solutions; Integrated Inventory and Sourcing Solutions; IT Solutions (Virtual Warehouse, EDI, Online Ordering, Custom Online Catalog); SmartGrid; Project Services (Material Take Offs and Laydown Yards); Tool Repair |

Pre-Bid Assistance; Product Submittals; Value Engineering; Change Order Support; Rentals (Tilt-Up Braces, Forming/Shoring, Equipment); Fabrication Including Detailing and Engineering; Tool Repair; Electronic Billing |

|||||

Customer Examples |

Residential Property Owners and Managers; Hotels and Lodging Facilities; Assisted Living Facilities; Institutions; Water and Wastewater Treatment Facilities |

Professional Contractors Serving Municipalities, Non-residential and Residential Construction |

Municipalities and Co-ops; Investor Owned Utilities; Non-residential, Residential and Mechanical Contractors; Industrial (Industrial Manufactures, MRO, Oil and Gas Contractors) |

Professional Contractors Serving Non-residential, Residential and Industrial Construction |

|||||

|

|||||||||

- (1)

- Adjusted EBITDA is our measure of profitability for our reportable segments as presented within our consolidated financial statements in accordance with GAAP. See Note 14 of the Notes to Consolidated Financial Statements included in the 2013 Form 10-K, incorporated by reference into this prospectus.

- (2)

- Adjusted EBITDA Margin is equal to Adjusted EBITDA divided by Net sales.

- (3)

- Growth is equal to growth in Adjusted EBITDA over fiscal 2012, excluding the 53rd week of fiscal 2012.

- (4)

- Management estimates based on market data and industry knowledge. Market share is based on our revenues relative to the estimated addressable market size.

- (5)

- Market position is based on our revenues relative to the estimated revenues of known competitors in addressable markets. Unless stated otherwise, market position refers to management's estimate of our market position in North America within the estimated addressable markets we serve.

3

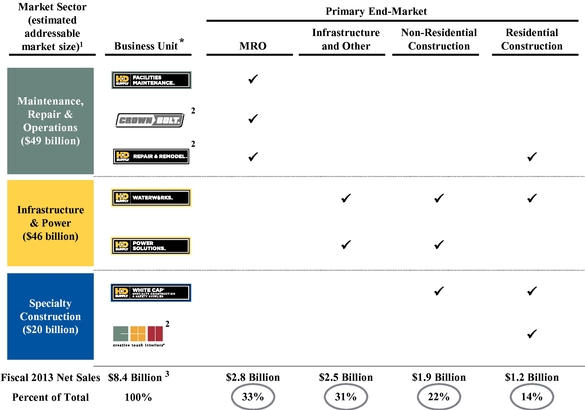

We offer a diverse range of products and services to the Maintenance, Repair & Operations, Infrastructure & Power and Specialty Construction market sectors in the U.S. and Canada. The markets in which we operate have a high degree of customer and supplier fragmentation, with customers that typically demand a high level of service and availability of a broad set of complex products from a large number of suppliers. These market dynamics make the distributor a critical element within the value chain.

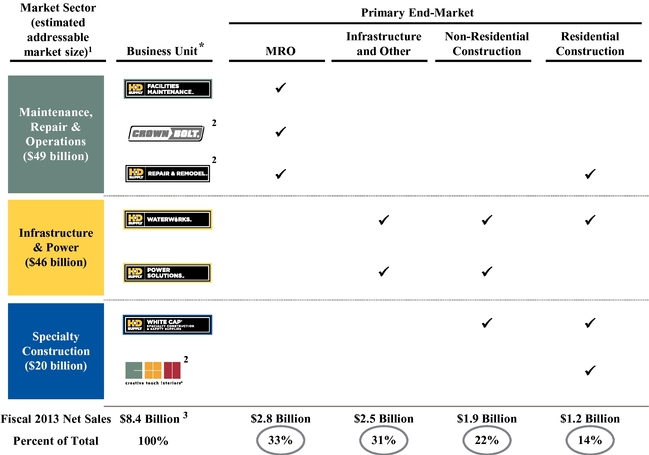

The table below summarizes our market sectors, business units and end-markets, including our Net sales by end-market.

- *

- Excludes

HD Supply Canada.

- (1)

- Management

estimates based on market data and industry knowledge.

- (2)

- Crown

Bolt, Creative Touch Interiors, Repair & Remodel and HD Supply Canada, in addition to Corporate and Eliminations, comprise "Corporate &

Other."

- (3)

- Figures do not foot due to rounding. Excludes HD Supply Canada.

Maintenance, Repair & Operations

In the Maintenance, Repair & Operations market sector, our Facilities Maintenance, Crown Bolt and Repair & Remodel business units serve customers across multiple industries by primarily delivering supplies and services needed to maintain and upgrade multifamily, hospitality, healthcare and institutional facilities. Facilities Maintenance and Crown Bolt are distribution center based models, while Repair & Remodel operates through retail outlets primarily serving cash and carry customers. We

4

estimate that this market sector currently represents an addressable market in excess of $49 billion annually with demand driven primarily by ongoing maintenance requirements of a broad range of existing structures and traditional repair and remodeling construction activity across multiple industries. We believe Facilities Maintenance customers value speed and product availability over price. In addition, we believe that our leadership position in this sector positions us to capitalize on improving business conditions across our addressable market. For example, we expect to benefit from the relative stability of demand for MRO materials during periods of lower vacancy rates within multifamily housing and higher occupancy rates within hospitality.

Infrastructure & Power

In the Infrastructure & Power market sector, Waterworks and Power Solutions support both established infrastructure and new projects by meeting demand for critical supplies and services used to build and maintain water systems and electrical power generation, transmission and distribution infrastructure. We estimate that this market sector currently represents an addressable market in excess of $46 billion annually with demand in the U.S. driven primarily by an aging and overburdened national infrastructure, general population growth trends and the need for cost-effective energy distribution. The broad geographic presence of our business units, through a regionally organized branch distribution network, reduces our exposure to economic factors in any single region. We believe we have the potential to capitalize on a substantial backlog of deferred projects that will need to be addressed in the coming years as a result of our customers delaying much needed upgrades or repairs during the recent economic downturn as well as a recovery in the non-residential and residential construction end-markets.

Specialty Construction

In the Specialty Construction market sector, White Cap and Creative Touch Interiors ("CTI") serve professional contractors and trades by meeting their distinct and customized supply needs in non-residential, residential and industrial applications. We estimate that this market sector currently represents an addressable market in excess of $20 billion annually with demand driven primarily by residential construction, non-residential construction, industrial and repair and remodeling construction spending. White Cap is our primary business unit serving this sector through the broad national presence of its regionally organized branch distribution network. CTI serves its market through a network of branches and design centers. We believe we are well-positioned to benefit from the recovery from historical lows within the non-residential and residential construction end-markets.

5

We believe that we benefit significantly from the following competitive strengths:

Collaborative results driven culture and exacting execution driving growth. Our culture of customer and market centricity, speed and precision, intense teamwork, process excellence and trusted relationships promotes continuous learning and drives our entire team to perform at the highest level. Rather than singularly investing and recognizing returns in one business unit, we leverage investments in one business unit across all of our other business units.

Leadership positions with significant scale in large, fragmented markets. Our Facilities Maintenance, Power Solutions, Waterworks and White Cap business units are leading North American industrial distributors in each of the addressable markets they serve based on sales. We believe that our size and competitive position as well as the fragmentation and competitive dynamics of the markets we serve make them opportunity-rich for profitable growth.

Specialized business model delivering a customer success based value proposition. We offer our customers a breadth of products and services tailored to their specific needs. Our local presence and intimate understanding of our customers allow us to optimize our sales coverage model. We also provide differentiated, value-add services to our customers.

We believe that the breadth of our product and service offering provides significant competitive advantages versus smaller local and regional competitors, helping us earn new business and secure repeat business.

Strategic diversity across customers, suppliers, geographic footprint, products and end-markets. We believe that by developing relationships with a diverse set of customers, we gain significant visibility into the future needs of our marketplace. Our broad base of approximately 500,000 customers has low concentration with no single customer representing more than 3% of our total sales and our top 10 customers representing only approximately 9% of our total sales during fiscal 2013. We maintain relationships with approximately 15,000 suppliers and maintain multiple suppliers for many of our products, thereby limiting the risk of product shortages. Our diverse geographic footprint of over 650 locations limits our dependence on any one region. We also believe that our diversity of end-market exposures is a key competitive strength, as our growth opportunities and ability to deploy resources are not constrained by any single end-market dynamic. We believe that we stand to benefit both from large end-markets that are characterized by stable long-term growth potential, as well as from end-markets that are exposed to cyclical dynamics.

Highly efficient and well-invested operating platform driving high returns on invested capital. Through a series of efficiency improvements and investments in the business, we believe we have transformed our business into a highly efficient platform which is well-positioned for future growth. Our operating efficiency is evidenced by the improvement in our return on invested capital, which has increased from 9% in 2009 to 32% in 2013. Return on invested capital is a non-GAAP metric. For additional detail, including a calculation of return on invested capital, see "Selected Consolidated Financial Data."

Transformational management team. HD Supply's executive management team has played a vital role in establishing our leading market share positions in each of our four main business units. Our CEO, Joseph DeAngelo, has over 30 years of global operating experience, including over 17 years in various leadership roles at General Electric Company ("GE") and Home Depot, including Chief Operating Officer. The rest of our executive management team has an average of nearly 10 years at HD Supply and its predecessors, and brings decades of experience from leading companies. Consistent themes at all levels of our management are long-tenured experience, focus on team chemistry and active presence in the field, which promote effective change.

6

Highly integrated technology infrastructure. We have an integrated IT infrastructure and a number of common technologies and centers of excellence. Our access to and ability to analyze real-time data provided by our integrated IT infrastructure allows us to take appropriate and swift action across our business units, which we believe differentiates us from our smaller competitors.

Deep and strategically aligned relationships with suppliers. We have developed extensive and long-term relationships with many of our suppliers. We believe our above market growth provides our suppliers with their own growth opportunities. This plus a history of close coordination, positions us as a preferred distributor for our key suppliers. We believe this provides access to new products, custom training on specialized products and early awareness of upcoming projects. Further, because they enable us to source both standard and difficult-to-find products in a timely manner, our strategic supplier relationships make us the distributor of choice to many of our customers.

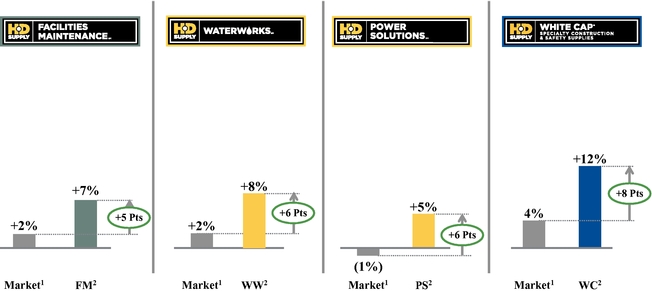

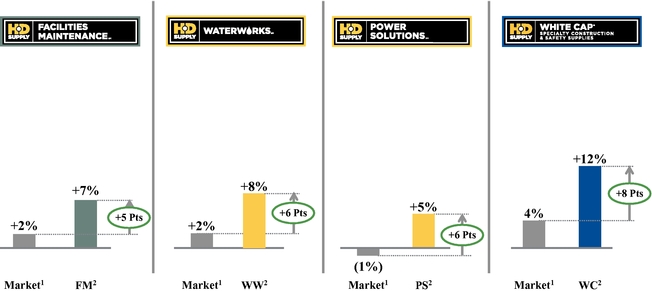

Proven results. As a result of our strengths discussed above, we have consistently achieved above market organic growth across our four reportable segments. Organic sales growth for fiscal 2013 compared to the growth in the relevant addressable market is illustrated in the chart below.

- (1)

- We

define the relevant addressable market as the estimated total dollars spent in markets where a reportable segment offers products. Market growth figures

are management estimates of changes in total spending in the relevant addressable market derived from third party data sources.

- (2)

- Segment growth based on organic sales growth (excluding acquisitions). HD Supply growth figures exclude the 53rd week of fiscal 2012.

7

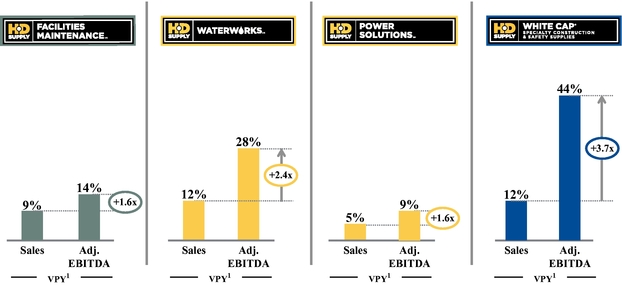

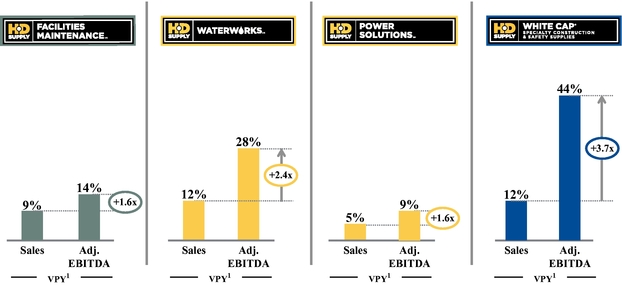

In addition, we have consistently achieved strong operating leverage driven by our transformational execution, lean and dynamic organization, and strategic growth initiatives. Operating leverage for fiscal 2013 is illustrated in the chart below.

- (1)

- Segment growth based on sales and Adjusted EBITDA growth. Both growth figures include acquisitions and exclude the 53rd week of fiscal 2012.

8

Our objective is to strengthen our competitive position, achieve above market rates of profitable growth and increase shareholder value through the following key strategies:

Be the First Choice. Our aspiration to be the "First Choice" of customers, associates, suppliers and communities drives our strategy and defines our culture. We seek to strengthen existing customer relationships and cultivate new ones through our customer centric approach and dedication to their success.

Our dedication to providing superior work environments, experiences and opportunities supports our efforts to be the "First Choice" of the most qualified and motivated associates in the industry. Similarly, we believe that we maintain excellent relationships with our suppliers and strive to be their first call when choosing a go-to-market strategy for their products. Consistent with our local presence and focus, we actively invest in the communities in which we operate, supporting organizations, programs and events that foster community development both financially and through the volunteer efforts of our associates.

Continue to invest in specific, high-return initiatives. Over the past four years, we have invested more than $1 billion into specific, targeted operating and growth initiatives driving profitability and efficient growth. We will continue to leverage these initiatives and invest in additional growth initiatives. We expect these initiatives will help us maintain above market, profitable growth rates.

Capitalize on accelerating growth across our multiple and varied end-markets. We have made significant investments and believe we can benefit from the recovery and growth in our end-markets. We have also strategically and operationally positioned ourselves to benefit from a recovery in our end-markets that are exposed to cyclical dynamics. We believe the maintenance, repair and operations market, infrastructure spending and the non-residential and residential construction markets are entering a series of inflection points which will accelerate in sequential, overlapping stages throughout the economic cycle, as they have historically. Additionally, we believe many of our customers delayed required upgrades or repairs during the recent economic downturn, and there is a substantial backlog of projects to be addressed in the coming years. We believe our ample supply capacity and significant operating leverage will result in growth across our various end-markets.

Continue to invest in attracting, retaining and developing world class talent. To be the "First Choice," we will maintain and expand our already strong talent base. We develop our employees through specialized training and learning tools. In addition, we deliver attractive opportunities to our associates while spreading knowledge and expertise across our entire organization through frequently redeploying top talent between business units. We believe these opportunities are superior to those offered by much of our competition, and help us develop, attract and retain world class talent. Furthermore, our focus and culture have led to investments in a range of broader associate benefits, such as our "Be Well" program, through which our CEO has challenged each employee to achieve a specified level of physical health (as measured by body mass index and other health targets), which we track and reward across the organization.

Continue our focus on operational excellence and speed and precision of execution. Our gross profit as a percentage of Net sales ("gross margin") has increased from 28.0% in fiscal 2009 to 29.1% in fiscal 2013 and our Selling, general and administrative expenses as a percentage of sales declined from 23.0% to 20.4% during the same time period. We emphasize sourcing, pricing discipline and working capital management across all of our business units. As a result of our discipline and ability to successfully leverage our fixed cost infrastructure, our financial performance has improved through the recent downturn. Our continued focus on operational excellence enables us to drive the speed and precision necessary to be the "First Choice."

9

Attract new customers and develop new market opportunities. We believe the comprehensive nature of our operations across a project lifecycle facilitates extensive, shared market awareness among our business leaders. We believe this widespread market insight enhances our customer relationships as it allows us to partner with customers in understanding their specific needs and providing quality products and services. We intend to capitalize on our market awareness of new projects to maximize sales across all of our business units. Our four principal business units can provide the materials and tools necessary to construct buildings and infrastructure above and below the ground, while also supplying the components needed to keep the operations well maintained. We believe this is the "HD Supply Advantage," or our differentiated ability to "supply the products and services to build your city and keep it running."

Supplement strong organic growth with "tuck-in" acquisitions in core and adjacent markets. Our organic growth is complemented by select "tuck-in" acquisitions in core and adjacent markets to supplement our product set, geographic footprint and other capabilities. Our business development team selectively pursues acquisitions that are culturally compatible and meet our growth and business model criteria. As a result of our highly efficient operations, industry leading IT systems, strategically aligned supplier relationships and broad distribution platform, there are opportunities to achieve substantial synergies in our acquisitions, and thereby reduce our effective (post-synergy) transaction multiples.

Ownership and Corporate Information

Equity Sponsor Overview

On August 30, 2007, investment funds associated with Clayton, Dubilier & Rice, Inc., The Carlyle Group and Bain Capital Partners, LLC (collectively the "Equity Sponsors") formed the HD Supply (previously named HD Supply Investment Holding, Inc.) and entered into a stock purchase agreement with Home Depot pursuant to which Home Depot agreed to sell to HD Supply, or to a wholly-owned subsidiary of HD Supply, certain intellectual property and all the outstanding common stock of HDS and the Canadian subsidiary CND Holdings, Inc. On August 30, 2007, through a series of transactions, HD Supply's direct wholly-owned subsidiary, HDS Holding Corporation, acquired direct control of HDS through the merger of its wholly-owned subsidiary, HDS Acquisition Corp., with and into HDS and CND Holdings, Inc. Through these transactions (the "2007 Transactions"), Home Depot was paid cash of $8.2 billion and 12.5% of HD Supply's then outstanding common stock.

On July 2, 2013, we completed an initial public offering ("IPO") of 61,170,212 shares of our common stock on the NASDAQ Global Select Market ("NASDAQ"). As of February 2, 2014, investment funds associated with the Bain, Carlyle and CD&R (each as defined below and, collectively our "Equity Sponsors") owned approximately 57% of our outstanding capital stock without giving effect to outstanding options.

The Equity Sponsors are in the business of making investments in companies, and may from time to time in the future acquire controlling interests in businesses that complement or directly or indirectly compete with certain portions of our business. If the Equity Sponsors pursue such acquisitions in our industry, those acquisition opportunities may not be available to us.

Bain Capital Partners, LLC. Bain Capital Partners, LLC is a global private investment firm, whose affiliates include Bain Capital Partners, LLC (along with its associated private equity investment funds, or any successor to its investment management business, "Bain"), that manages several pools of capital including private equity, venture capital, public equity, credit products and absolute return investments with over $70 billion in assets under management. Since 1984, Bain's private equity affiliates have made over 260 investments in a variety of industries around the world. Currently, Bain has a team of over 250 investment professionals supporting its private equity investments and portfolio companies.

10

Headquartered in Boston, Bain Capital, LLC has offices in New York, Palo Alto, Chicago, London, Luxembourg, Munich, Hong Kong, Shanghai, Tokyo, and Mumbai.

The Carlyle Group. The Carlyle Group (along with its associated investment funds, or any successor to its investment management business, "Carlyle") is a global alternative asset manager with $189 billion of assets under management in 118 active funds and 100 fund of fund vehicles as of December 31, 2013. Carlyle invests across four segments—Corporate Private Equity, Real Assets, Global Market Strategies and Solutions—in Africa, Asia, Australia, Europe, the Middle East, North America and South America. Carlyle employs more than 1,500 people in 34 offices across six continents. Select portfolio companies include: Nielsen, AMC, Allison Transmission, Axalta Coating Systems, and Getty Images.

Clayton, Dubilier & Rice, LLC. Clayton, Dubilier & Rice, LLC (along with its associated investment funds, or any successor to its investment management business, "CD&R") is a private equity firm composed of a combination of financial and operating executives pursuing an investment strategy predicated on building stronger, more profitable businesses. Since its founding in 1978, CD&R has managed the investment of more than $19 billion in 59 businesses with an aggregate transaction value of more than $90 billion. CD&R has a disciplined and clearly defined investment strategy with a special focus on multi-location services and distribution businesses. CD&R has a long history of investing in market leading distribution businesses, including US Foods, the second largest broadline foodservice distributor in the U.S., Rexel, the leading distributor worldwide of electrical supplies, Diversey, a leading global manufacturer and distributor of commercial cleaning, sanitation and hygiene solutions, and AssuraMed, a specialty retailer and distributor of medical supplies.

11

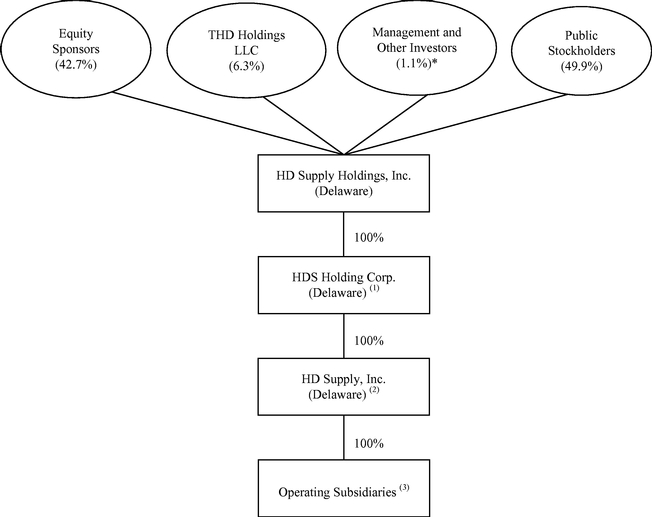

The following chart illustrates our ownership, organizational and capital structure, giving effect to this offering, assuming the underwriters do not exercise their option to purchase additional shares:

- *

- Does

not give effect to outstanding options.

- (1)

- Has

pledged all of the capital stock of HDS as security for our outstanding indebtedness.

- (2)

- Borrower

of our outstanding indebtedness. See "Description of Certain Indebtedness."

- (3)

- Domestic operating subsidiaries are guarantors of our outstanding indebtedness. See "Description of Certain Indebtedness."

* * * * *

HD Supply Holdings, Inc. is a Delaware corporation. Our principal executive offices are located at 3100 Cumberland Boulevard, Suite 1480, Atlanta, Georgia 30339, and our telephone number at that address is (770) 852-9000. Our website is www.hdsupply.com. Information on, and which can be accessed through, our website is not incorporated in this prospectus or the documents incorporated by reference into this prospectus.

12

Summary of Risk Factors

Our business is subject to a number of risks of which you should be aware and carefully consider before making an investment decision. These risks are discussed in "Risk Factors", and include but are not limited to the following:

- •

- inherent risks of the maintenance, repair and operations market, infrastructure spending and the non-residential and

residential construction markets;

- •

- decline in the new residential construction or non-residential construction markets;

- •

- residential renovation and improvement activity levels may not return to historic levels;

- •

- our ability to achieve or maintain profitability;

- •

- our ability to compete effectively;

- •

- our ability to timely and efficiently access products that meet our standards for quality;

- •

- interruptions to the proper functioning of our information technology ("IT") systems or an inability to implement our IT

initiatives;

- •

- our ability to identify new products and product lines and integrate them into our distribution network;

- •

- our substantial level of debt;

- •

- our ability to service our debt and to refinance all or a portion of our indebtedness;

- •

- securities or industry analysts may not publish research or may publish misleading or unfavorable research about our

business; and

- •

- fulfilling our obligations incident to being a public company.

13

Common stock offered by the selling stockholders |

30,000,000 shares | |

Common stock outstanding after the offering |

192,375,841 shares |

|

Option to purchase additional shares of common stock |

The underwriters have a 30-day option to purchase an additional 4,500,000 shares of common stock from the selling stockholders. |

|

Stock exchange symbol |

"HDS" |

|

Use of proceeds |

We will not receive any proceeds from the sale of our common stock by the selling stockholders. |

|

Risk factors |

See "Risk Factors" and other information included in this prospectus and the documents incorporated by reference into this prospectus for a discussion of factors you should carefully consider before deciding whether to invest in shares of our common stock. |

|

Dividend policy |

We do not expect to pay dividends on our common stock for the foreseeable future. |

As of February 2, 2014, we had outstanding 192,375,841 shares of common stock, excluding:

- •

- approximately 15 million shares of common stock issuable upon exercise of options outstanding as of

February 2, 2014 at a weighted average exercise price of $13.30 per share; and

- •

- approximately 13 million shares of common stock reserved for future issuance under our omnibus incentive plan and our employee stock purchase plan.

Unless otherwise indicated all information in this prospectus:

- •

- assumes no exercise by the underwriters of their option to purchase additional shares from the selling stockholders.

14

Summary Consolidated Financial and Operating Data

The following table presents our summary consolidated financial data, as of and for the periods indicated. The summary consolidated financial data as of February 2, 2014 and February 3, 2013 and for the fiscal years ended February 2, 2014, February 3, 2013 and January 29, 2012 have been derived from our audited consolidated financial statements included in the 2013 Form 10-K and should be read in conjunction with "Management's Discussion and Analysis of Financial Condition and Results of Operations" and the consolidated financial statements and the related notes included therein. The summary consolidated financial data as of January 29, 2012 are derived from our audited financial statements which are not included in this prospectus or the documents incorporated by reference into this prospectus. Our historical consolidated financial data may not be indicative of our future performance.

| |

Fiscal Year Ended | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| |

February 2, 2014 |

February 3, 2013 |

January 29, 2012 |

|||||||

| |

(Dollars in millions) |

|||||||||

Consolidated Statement of Operations: |

||||||||||

Net sales |

$ | 8,487 | $ | 7,943 | $ | 6,933 | ||||

Cost of sales |

6,015 | 5,644 | 4,942 | |||||||

| | | | | | | | | | | |

Gross profit |

2,472 | 2,299 | 1,991 | |||||||

Total operating expenses |

1,984 | 2,125 | 1,836 | |||||||

| | | | | | | | | | | |

Operating income |

488 | 174 | 155 | |||||||

Interest expense, net |

528 | 658 | 639 | |||||||

Loss (gain) on extinguishment and modification of debt |

87 | 709 | — | |||||||

Other (income) expense, net |

20 | — | (1 | ) | ||||||

| | | | | | | | | | | |

Income (loss) from continuing operations before provision (benefit) for income taxes and discontinued operations |

(147 | ) | (1,193 | ) | (483 | ) | ||||

Provision (benefit) for income taxes |

62 | 4 | 79 | |||||||

| | | | | | | | | | | |

Income (loss) from continuing operations |

(209 | ) | (1,197 | ) | (562 | ) | ||||

Income (loss) from discontinued operations, net of tax |

(9 | ) | 18 | 19 | ||||||

| | | | | | | | | | | |

Net income (loss) |

$ | (218 | ) | $ | (1,179 | ) | $ | (543 | ) | |

| | | | | | | | | | | |

Balance sheet data (end of period): |

||||||||||

Cash and cash equivalents(1) |

$ | 115 | $ | 141 | $ | 111 | ||||

Total assets(2) |

6,324 | 7,334 | 6,738 | |||||||

Total debt, less current maturities(3) |

5,534 | 6,430 | 5,380 | |||||||

Other financial data: |

||||||||||

Working capital(4) |

$ | 1,210 | $ | 1,120 | $ | 1,012 | ||||

Adjusted working capital(5) |

1,105 | 942 | 983 | |||||||

Adjusted EBITDA(6) |

764 | 685 | 508 | |||||||

Adjusted net income (loss)(6) |

99 | (129 | ) | (244 | ) | |||||

Capital expenditures |

131 | 115 | 115 | |||||||

Depreciation(7) |

110 | 96 | 84 | |||||||

Amortization of intangibles |

135 | 243 | 244 | |||||||

- (1)

- Cash

and cash equivalents as of February 3, 2013 excludes $936 million of cash equivalents that were restricted for the redemption of debt.

- (2)

- Includes $936 million of Cash equivalents restricted for debt redemption for the fiscal year ended February 3, 2013.

15

- (3)

- Includes

capital leases and associated discounts and premiums. Excludes $10 million, $899 million, and $82 million of Current

installments of long-term debt for fiscal years ended February 2, 2014, February 3, 2013 and January 29, 2012, respectively.

- (4)

- Working

capital represents current assets minus current liabilities.

- (5)

- Adjusted

working capital represents current assets, excluding restricted and unrestricted cash and cash equivalents, minus current liabilities, excluding

current maturities of long term debt. Adjusted working capital is not a recognized term under GAAP and does not purport to be an alternative to Working capital. For additional detail, including a

reconciliation from Working capital, the most directly comparable financial measure under GAAP, to Adjusted working capital for the periods presented, see "Selected Consolidated Financial Data."

- (6)

- Adjusted

EBITDA and Adjusted net income (loss) are not recognized terms under GAAP and do not purport to be alternatives to Net income (loss) as measures of

operating performance. For additional detail, including a reconciliation from Net income (loss), the most directly comparable financial measure under GAAP, to Adjusted EBITDA and Adjusted net income

(loss) for the periods presented, see "Selected Consolidated Financial Data."

- (7)

- Depreciation includes amounts recorded within cost of sales.

16

Investing in our common stock involves a high degree of risk. Before you make your investment decision, you should carefully consider the risks described in this prospectus and the documents incorporated by reference into this prospectus and the other information contained in this prospectus and the documents incorporated by reference into this prospectus, including our consolidated financial statements and the related notes included in the 2013 Form 10-K. If any of the following risks actually occur, our business, financial position, results of operations or cash flows could be materially adversely affected. In these circumstances, the market price of our common stock could decline, and you may lose all or part of your investment.

Risks Relating to Our Business

We are subject to inherent risks of the maintenance, repair and operations market, infrastructure spending and the non-residential and residential construction markets, including risks related to general economic conditions.

Demand for our products and services depends to a significant degree on spending in our markets. The level of activity in our markets depends on a variety of factors that we cannot control.

Historically, both new housing starts and residential remodeling have decreased in slow economic periods. In addition, residential construction activity can impact the level of non-residential construction activity. Other factors impacting the level of activity in the non-residential and residential construction markets include:

- •

- changes in interest rates;

- •

- unemployment rates;

- •

- high foreclosure rates and unsold/foreclosure inventory;

- •

- unsold new housing inventory;

- •

- availability of financing (including the impact of disruption in the mortgage markets);

- •

- adverse changes in industrial economic outlook;

- •

- a decrease in the affordability of homes;

- •

- vacancy rates;

- •

- capacity utilization;

- •

- capital spending;

- •

- commercial investment;

- •

- corporate profitability;

- •

- local, state and federal government regulation; and

- •

- shifts in populations away from the markets that we serve.

Infrastructure spending depends largely on interest rates, availability and commitment of public funds for municipal spending, capacity utilization and general economic conditions. In the maintenance, repair and operations market, the level of activity depends largely on the number of units and occupancy rates within multifamily, hospitality, healthcare and institutional facilities markets. Because all of our markets are sensitive to changes in the economy, downturns (or lack of substantial improvement) in the economy in any region in which we operate have adversely affected and could continue to adversely affect our business, financial condition and results of operations. For example, we

17

distribute many of our products to waterworks contractors in connection with non-residential building, residential and industrial construction projects. The water and wastewater transmission products industry is affected by changes in economic conditions, including national, regional and local standards in construction activity, and the amount spent by municipalities on waterworks infrastructure. While we operate in many markets in the United States and Canada, our business is particularly impacted by changes in the economies of California, Texas and Florida, which represented approximately 15%, 13% and 10%, respectively, in Net sales for fiscal 2013.

In addition, the markets in which we compete are sensitive to general business and economic conditions in the United States and worldwide, including availability of credit, interest rates, fluctuations in capital, credit and mortgage markets, and business and consumer confidence. Adverse developments in global financial markets and general business and economic conditions, including through recession, downturn or otherwise, could have a material adverse effect on our business, financial condition, results of operations and cash flows, including our ability and the ability of our customers and suppliers to access capital. There was a significant decline in economic growth, both in the United States and worldwide, that began in the second half of 2007 and continued through 2009. In addition, volatility and disruption in the capital markets during that period reached unprecedented levels, with stock markets falling dramatically and credit becoming very expensive or unavailable to many companies without regard to those companies' underlying financial strength. As a result of these developments, many lenders and institutional investors reduced, and in some cases, ceased to provide funding to borrowers. Although there have been some indications of stabilization in the general economy and certain industries and markets in which we operate, there can be no guarantee that any improvement in these areas will continue or be sustained.

We have been, and may continue to be, adversely impacted by the decline in the new residential construction market since its peak in 2005.

Most of our business units are dependent to varying degrees upon the new residential construction market. The homebuilding industry has undergone a significant decline from its peak in 2005. According to the U.S. Census Bureau, actual single family housing starts in the U.S. during 2013 increased 16% from 2012 levels, but remain 64% below their peak in 2005. The multi-year downturn in the homebuilding industry has resulted in a substantial reduction in demand for our products and services, which in turn had a significant adverse effect on our business and operating results during fiscal years 2008 to 2013, as compared to peak levels. In addition, the mortgage markets continue to experience disruption and reduced availability of mortgages for potential homebuyers due to more restrictive standards to qualify for mortgages, including with respect to new home construction loans.

We cannot predict the duration of the current housing industry market conditions, or the timing or strength of any future recovery of housing activity in our markets. We also cannot provide any assurances that the homebuilding industry will recover to historical levels, or that the operational strategies we have implemented to address the current market conditions will be successful. Continued weakness in the new residential construction market would have a significant adverse effect on our business, financial condition and operating results. In addition, because of these factors, there may be fluctuations in our operating results, and the results for any historical period may not be indicative of results for any future period.

The non-residential building construction market continues to experience a downturn which could materially and adversely affect our business, liquidity and results of operations.

Many of our business units are dependent on the non-residential building construction market and the slowdown and volatility of the United States economy in general is having an adverse effect on our business units that serve this industry. According to the U.S. Census Bureau, actual non-residential building construction put-in-place in the U.S. during 2013 was flat as compared to 2012 levels, but

18

remains 32% lower than 2008 levels. From time to time, our business units that serve the non-residential building construction market have also been adversely affected in various parts of the country by declines in non-residential building construction starts due to, among other things, changes in tax laws affecting the real estate industry, high interest rates and the level of residential construction activity. Continued uncertainty about current economic conditions will continue to pose a risk to our business units that serve the non-residential building construction market as participants in this industry may postpone spending in response to tighter credit, negative financial news and/or declines in income or asset values, which could have a continued material negative effect on the demand for our products and services.

We cannot predict the duration of the current market conditions, or the timing or strength of any future recovery of non-residential building construction activity in our markets. Continued weakness in the non-residential building construction market would have a significant adverse effect on our business, financial condition and operating results. In addition, because of these factors, there may be fluctuations in our operating results, and the results for any historical period may not be indicative of results for any future period.

Residential renovation and improvement activity levels may not return to historic levels which may negatively impact our business, liquidity and results of operations.

Certain of our business units rely on residential renovation and improvement (including repair and remodeling) activity levels. Unlike most previous cyclical declines in new home construction in which we did not experience comparable declines in our home improvement business units, the recent economic decline adversely affected our home improvement business units as well. According to Moody's Economy.com, residential improvement project spending in the United States increased 3% in 2013, but remains 10% below its peak in 2006. Continued high unemployment levels, high mortgage delinquency and foreclosure rates, limitations in the availability of mortgage and home improvement financing and significantly lower housing turnover, may continue to limit consumers' spending, particularly on discretionary items, and affect their confidence level leading to continued reduced spending on home improvement projects.

We cannot predict the timing or strength of a significant recovery in these markets. Continued depressed activity levels in consumer spending for home improvement and new home construction will continue to adversely affect our results of operations and our financial position. Furthermore, continued economic weakness may cause unanticipated shifts in consumer preferences and purchasing practices and in the business models and strategies of our customers. Such shifts may alter the nature and prices of products demanded by the end consumer and our customers and could adversely affect our operating performance.

We may be unable to achieve or maintain profitability.

We have set goals to progressively improve our profitability over time by growing our sales, increasing our gross margin and reducing our expenses as a percentage of sales. For the fiscal years 2013, 2012 and 2011 we had net losses of $218 million, $1,179 million and $543 million, respectively. There can be no assurance that we will achieve our enhanced profitability goals. Factors that could significantly adversely affect our efforts to achieve these goals include, but are not limited to, the failure to:

- •

- grow our revenue through organic growth or through acquisitions;

- •

- improve our revenue mix by investing (including through acquisitions) in businesses that provide higher margins than we have been able to generate historically;

19

- •

- achieve improvements in purchasing or to maintain or increase our rebates from vendors through our vendor consolidation

and/or low-cost country initiatives;

- •

- improve our gross margins through the utilization of improved pricing practices and technology and sourcing savings;

- •

- maintain or reduce our overhead and support expenses as we grow;

- •

- effectively evaluate future inventory reserves;

- •

- collect monies owed from customers;

- •

- maintain relationships with our significant customers; and

- •

- integrate any businesses acquired.

Any of these failures or delays may adversely affect our ability to increase our profitability.

We may be required to take impairment charges relating to our operations which could impact our future operating results.

As of February 2, 2014, goodwill represented approximately 50% of our total assets. Goodwill is not amortized and is subject to impairment testing at least annually using a fair value based approach. The identification and measurement of impairment involves the estimation of the fair value of reporting units. The estimates of fair value of reporting units are based on the best information available as of the date of the assessment and incorporate management assumptions about expected future cash flows and other valuation techniques. Future cash flows can be affected by changes in industry or market conditions among other things.

The recoverability of goodwill is evaluated at least annually and when events or changes in circumstances indicate that the fair value of a reporting unit has more likely than not declined below its carrying value. The annual impairment test resulted in no impairment of goodwill during fiscal 2013, fiscal 2012 or fiscal 2011. However, during the fourth quarter of fiscal 2012, our Crown Bolt business reached an agreement to amend and extend its strategic purchase agreement with Home Depot. While the amendment extends the agreement five years through fiscal 2019, retaining Crown Bolt as the exclusive supplier of certain products to Home Depot, it eliminates the minimum purchase requirement and adjusted future pricing. These changes resulted in a reduction of expected future cash proceeds from Home Depot. We, therefore, considered this amendment a triggering event and, as such, we performed an additional goodwill impairment analysis for Crown Bolt. As a result of the analysis, we recorded a non-cash, pre-tax goodwill impairment charge of $150 million during the fourth quarter of fiscal 2012.

We cannot accurately predict the amount and timing of any impairment of assets, and we may be required to take additional goodwill or other asset impairment charges relating to certain of our reporting units and asset groups, if weakness in the non-residential and/or residential construction markets and/or the general U.S. economy continues. Similarly, certain company transactions, such as the amendment to the Crown Bolt strategic purchase agreement with Home Depot, could result in additional goodwill impairment charges being recorded. Any such non-cash charges would have an adverse effect on our financial results.

In view of the general economic downturn in the United States, we may be required to close under-performing locations.

We may have to close under-performing branches from time to time as warranted by general economic conditions and/or weakness in the industries in which we operate. For example, during the economic downturn from 2007 through fiscal 2010, we closed branches and terminated employees as

20

part of our restructuring plans during that timeframe. Any future facility closures could have a significant adverse effect on our financial condition, operating results and cash flows.

We occupy most of our facilities under long-term non-cancelable leases. We may be unable to renew leases on favorable terms or at all. Also, if we close a facility, we remain obligated under the applicable lease.

Most of our facilities are located in leased premises. Many of our current leases are non-cancelable and typically have terms ranging from 3 to 5 years, with options to renew for specified periods of time. We believe that leases we enter into in the future will likely be long-term and non-cancelable and have similar renewal options. However, there can be no assurance that we will be able to renew our current or future leases on favorable terms or at all which could have an adverse effect on our ability to operate our business and on our results of operations. In addition, if we close or idle a facility, we generally remain committed to perform our obligations under the applicable lease, which include, among other things, payment of the base rent for the balance of the lease term. Over the course of the last three fiscal years, we closed or idled facilities for which we remain liable on the lease obligations. Our obligation to continue making rental payments in respect of leases for closed or idled facilities could have a material adverse effect on our business and results of operations.

The industries in which we operate are highly competitive and fragmented, and demand for our products and services could decrease if we are not able to compete effectively.

The markets in which we operate are fragmented and highly competitive. Our competition includes other distributors and manufacturers that sell products directly to their respective customer base and some of our customers that resell our products. To a limited extent, retailers of electrical fixtures and supplies, building materials, maintenance, repair and operations supplies and contractors' tools also compete with us. We also expect that new competitors may develop over time as internet-based enterprises become more established and reliable and refine their service capabilities. Competition varies depending on product line, customer classification and geographic area.

We compete with many local, regional and, in several markets and product categories, other national distributors. Several of our competitors in one or more of our business units have substantially greater financial and other resources than us. No assurance can be given that we will be able to respond effectively to such competitive pressures. Increased competition by existing and future competitors could result in reductions in sales, prices, volumes and gross margins that could materially adversely affect our business, financial condition and results of operations. Furthermore, our success will depend, in part, on our ability to maintain our market share and gain market share from competitors.

In addition, contracts with municipalities are often awarded and renewed through periodic competitive bidding. We may not be successful in obtaining or renewing these contracts, which could be harmful to our business and financial performance.

Our competitors continue to consolidate, which could cause markets to become more competitive and could negatively impact our business.

Our competitors in the United States and Canada are consolidating. This consolidation is being driven by customer needs and supplier capabilities, which could cause markets to become more competitive as greater economies of scale are achieved by distributors. Customers are increasingly aware of the total costs of fulfillment and of the need to have consistent sources of supply at multiple locations. We believe these customer needs could result in fewer distributors as the remaining distributors become larger and capable of being consistent sources of supply.

There can be no assurance that we will be able to take advantage effectively of this trend toward consolidation. The trend in our industry toward consolidation could make it more difficult for us to

21

maintain operating margins and could also increase competition for our potential acquisition targets and result in higher purchase price multiples. Furthermore, as our industrial and construction customers face increased foreign competition and potentially lose business to foreign competitors or shift their operations overseas in an effort to reduce expenses, we may face increased difficulty in growing and maintaining our market share and growth prospects in these markets.

The loss of any of our significant customers could adversely affect our financial condition.