Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - EXELON CORP | d720511d8k.htm |

| EX-99.1 - PRESS RELEASE - EXELON CORP | d720511dex991.htm |

Exelon Announces Acquisition of

Pepco Holdings, Inc.

April 30, 2014

Exhibit 99.2 |

1

Cautionary Statements Regarding Forward-Looking

Information

Except for the historical information contained herein, certain of the matters

discussed in this communication constitute “forward- looking

statements” within the meaning of the Securities Act of 1933 and the Securities Exchange Act of 1934, both as amended by

the Private Securities Litigation Reform Act of 1995. Words such as

“may,” “might,” “will,” “should,” “could,” “anticipate,” “estimate,”

“expect,” “predict,” “project,”

“future”, “potential,” “intend,” “seek to,” “plan,” “assume,” “believe,” “target,” “forecast,” “goal,”

“objective,” “continue” or the negative of such terms or

other variations thereof and words and terms of similar substance used in

connection with any discussion of future plans, actions, or events identify

forward-looking statements. These forward-looking statements

include, but are not limited to, statements regarding benefits of the proposed merger, integration plans and expected

synergies, the expected timing of completion of the transaction, anticipated

future financial and operating performance and results, including

estimates for growth. These statements are based on the current expectations of management of Exelon Corporation

(Exelon) and Pepco Holdings, Inc. (PHI), as applicable. There are a number of

risks and uncertainties that could cause actual results to differ

materially from the forward-looking statements included in this communication. For example, (1) PHI may be unable to obtain

shareholder approval required for the merger; (2) the companies may be unable

to obtain regulatory approvals required for the merger, or required

regulatory approvals may delay the merger or cause the companies to abandon the merger; (3) conditions to the

closing of the merger may not be satisfied; (4) an unsolicited offer of another

company to acquire assets or capital stock of Exelon or PHI could

interfere with the merger; (5) problems may arise in successfully integrating the businesses of the companies, which may

result in the combined company not operating as effectively and efficiently as

expected; (6) the combined company may be unable to achieve

cost-cutting synergies or it may take longer than expected to achieve those synergies; (7) the merger may involve unexpected

costs, unexpected liabilities or unexpected delays, or the effects of purchase

accounting may be different from the companies’ expectations; (8)

the credit ratings of the combined company or its subsidiaries may be different from what the companies expect;

(9) the businesses of the companies may suffer as a result of uncertainty

surrounding the merger; |

2

Cautionary Statements Regarding Forward-Looking

Information (Continued)

(10)

the

companies

may

not

realize

the

values

expected

to

be

obtained

for

properties

expected

or

required

to

be

sold;

(11)

the industry may be subject to future regulatory or legislative actions that

could adversely affect the companies; and (12)

the companies may be adversely affected by other economic, business, and/or

competitive factors. Other unknown or unpredictable factors could also

have material adverse effects on future results, performance or achievements of the

combined company. Therefore, forward-looking statements are not guarantees

or assurances of future performance, and actual results could differ

materially from those indicated by the forward-looking statements. Discussions of some of these

other important factors and assumptions are contained in Exelon’s and

PHI’s respective filings with the Securities and Exchange

Commission

(SEC),

and

available

at

the

SEC’s

website

at

www.sec.gov,

including:

(1)

Exelon’s

2013

Annual

Report on Form 10-K in (a)

ITEM

1A. Risk Factors, (b)

ITEM

7. Management’s Discussion and Analysis of Financial Condition

and

Results

of

Operations

and

(c)

ITEM

8.

Financial

Statements

and

Supplementary

Data:

Note

22;

and

(2)

PHI’s

2013

Annual Report on Form 10-K in (a) ITEM 1A. Risk Factors, (b) ITEM 7.

Management’s Discussion and Analysis of Financial Condition and

Results of Operations and (c) ITEM 8. Financial Statements and Supplementary Data: Note 15. In light of

these risks, uncertainties, assumptions and factors, the forward-looking

events discussed in this communication may not occur. Readers are

cautioned not to place undue reliance on these forward-looking statements, which speak only as of the

date of this communication. Neither Exelon nor PHI undertakes any obligation to

publicly release any revision to its forward- looking statements to

reflect events or circumstances after the date of this communication. New factors emerge from time

to

time,

and

it

is

not

possible

for

Exelon

or

PHI

to

predict

all

such

factors.

Furthermore,

it

may

not

be

possible

to

assess

the

impact of any such factor on Exelon’s or PHI’s respective businesses

or the extent to which any factor, or combination of factors, may cause

results to differ materially from those contained in any forward-looking statement. Any specific factors

that may be provided should not be construed as exhaustive.

|

3

Agenda

Transaction Overview and Exelon

Strategic Rationale

Chris Crane

President and CEO, Exelon

Benefits to PHI Shareholders and

Customers

Joe Rigby

Chairman, President and CEO,

Pepco Holdings

Combined Company Profile

and Financial Summary

Jack Thayer

Executive Vice President and

CFO, Exelon

Closing Comments

Chris Crane

President and CEO, Exelon

Q&A Session |

4

Executive Summary

•

A

strategic

acquisition

that

creates

the

leading

Mid-Atlantic

electric

and

gas

utility. The combined utility businesses will serve nearly 10 million customers,

with a rate base of ~$26 billion.

•

Purchase price of

$27.25 per share.

•

Earnings composition supports incremental leverage and is expected to be highly

accretive

to

operating

earnings

starting

in

the

first

full

year

post-close

with

steady-

state accretion of $0.15-$0.20 per share starting in 2017

•

Increases Exelon’s

utility derived earnings and cash flows, providing a solid base

for the dividend and

maintaining the upside from a recovery in power markets.

•

Balanced financing mix allows Exelon to maintain balance sheet strength

and

provides flexibility to continue to invest in opportunities aligned with our growth

strategy.

•

The combination of Exelon and Pepco Holdings (PHI) will offer significant benefits

to customers. |

5

Strategic Rationale

Growing regulated

cash flow and

earnings while

maintaining

upside from power

price recovery

Strong financial fit

Strong

geographic fit and

operations mix |

6

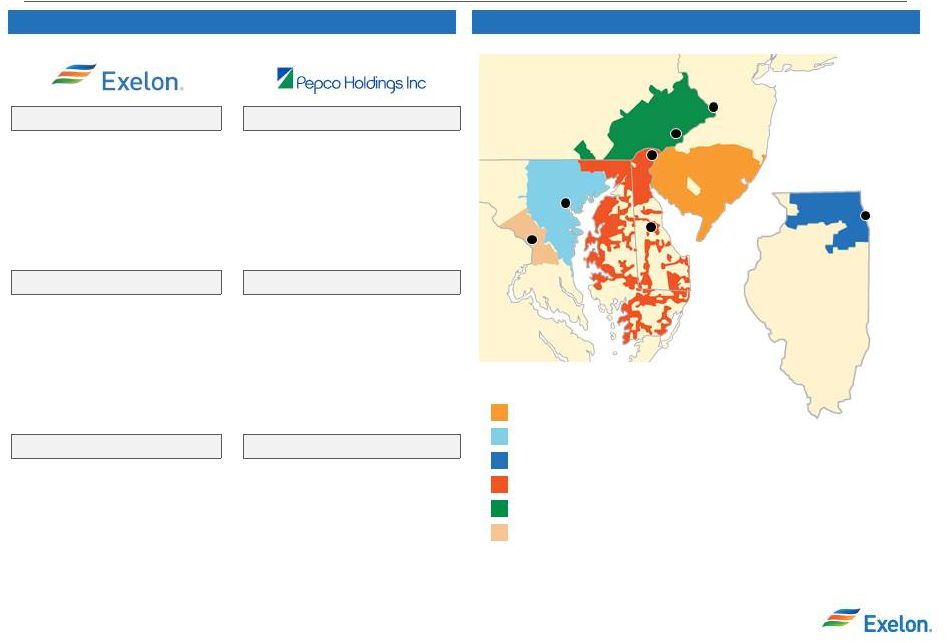

Expertise in Operating Regulated Utilities in Large

Metropolitan Areas

Commonwealth Edison

Potomac Electric Power

Customers:

Service Territory:

Peak Load:

2013 Rate Base:

3,800,000

11,400 sq.

miles

23,753 MW

$8.7 bn

Customers:

Service Territory:

Peak Load:

2013 Rate Base:

801,000

640 sq. miles

6,674 MW

$3.4 bn

PECO Energy

Atlantic City Electric Co.

Customers:

Service Territory:

Peak Load:

2013 Rate Base:

2,100,000

2,100 sq. miles

8,983 MW

$5.4 bn

Customers:

Service Territory:

Peak Load:

2013 Rate Base:

545,000

2,700 sq. miles

2,797

MW

$1.6 bn

Baltimore Gas & Electric

Delmarva Power & Light

Customers:

Service Territory:

Peak Load:

2013 Rate Base:

1,900,000

2,300 sq. miles

7,236 MW

$4.6 bn

Customers:

Service Territory:

Peak Load:

2013 Rate Base:

632,000

5,000 sq. miles

4,121 MW

$2.0 bn

___________________________

Source: Company filings.

Note: Operational statistics as of 12/31/2013

DE

MD

PA

NJ

VA

Philadelphia

Baltimore

Dover

Wilmington

Trenton

Washington, DC

IL

Chicago

Potomac Electric Power Service Territory

Atlantic City Electric Co. Service Territory

Delmarva Power & Light Service Territory

Baltimore Gas and Electric Co. Service Territory

PECO Energy Service Territory

ComEd Service Territory

Operating Statistics

Combined Service Territory |

7

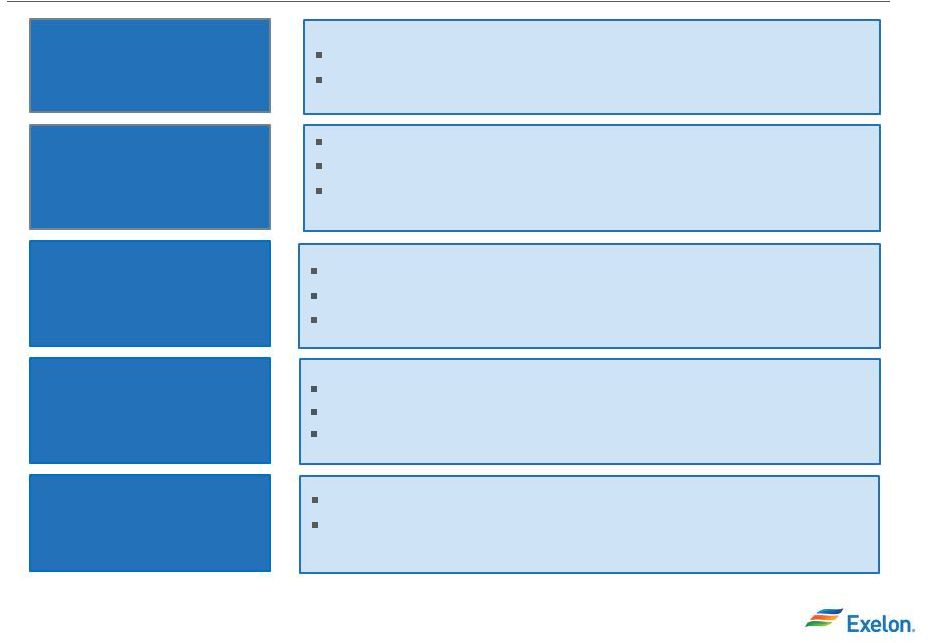

Transaction Overview

Consideration

Headquarters

Governance

All-cash transaction

Upfront

transaction

premium

of

24.7%

(1)

Corporate headquarters: Chicago

No change to utilities’

headquarters

Significant employee presence maintained in IL, PA, MD, DC,

DE and NJ

President and CEO: Chris Crane

No change to Exelon senior management team

No change to Exelon Board of Directors

Expect

to

close

2

nd

or

3

rd

quarter

2015

PHI shareholder approval later in 2014

Regulatory approvals including FERC, DOJ, DC, DE, MD, NJ and VA

(1)

Based on PHI closing stock price as of April 25, 2014.

(2)

Subject to market conditions

~50% debt

Remainder

via

issuance

of

equity

(including

mandatory

convertibles)

and

up

to

$1B

of

cash

from

non-core

asset

sales

(2)

Approvals and Timing

Financing |

8

Regulatory Approval Timeline

•

Applications for approval will be filed as promptly as possible and no later

than 60 days from the time of the announcement.

•

FERC has 180 days to review the transaction and issue an order. We

would expect approvals by FERC, Virginia and DOJ within 180 days.

•

Expect Maryland PSC to issue a merger order within 225 days of the

application as required by law.

•

Anticipate other state commissions may take as long as Maryland or

slightly longer to review merger applications.

•

Targeting

a

2

or

3

quarter

2015

closing.

rd

nd |

9

•

Attractive 24.7% premium

(1)

for PHI shares

•

Commitment to build upon significant improvements in system reliability,

customer service and outage restoration

•

Direct benefits for Atlantic City Electric, Delmarva Power and Pepco’s

customers $100 million Customer Investment Fund for rate credits, low

income assistance, energy efficiency programs

Commitment to further improve system reliability

Enhanced storm restoration capabilities

•

Shared culture of continuous improvement, accountability, safety, and

community support

Leverage operational and customer service best practices

Commitment to highest ever levels of charitable giving for 10 years

Delivering Value to PHI’s Shareholders, Employees, Customers

and Local Communities

(1) Based on PHI closing stock price as of April 25, 2014. •

Immediately takes PHI to the “next level”

as part of larger, well capitalized

company |

Financial Overview |

11

Transaction Economics Are Attractive

(1)

(3)

(1)

Reflects 2015 YE rate base

•

Significantly earnings accretive starting in first full year after closing.

Anticipate run-rate accretion of $0.15-$0.20 per share starting

in 2017.

•

Supports incremental leverage at Exelon and maintains investment grade ratings

at Exelon and PHI entities. •

An incremental ~$8.3 billion

(1)

in regulated rate base adds meaningful size to Exelon’s

regulated business -- bolstering regulated earnings, stable cash flows

and financial strength. •

~$3.1 billion of regulated CapEx during 2015-2017 adds attractive rate base

growth opportunities to supplement Exelon’s current investment

program.

•

Utility earnings can fully support Exelon dividend of $1.24 per share by 2015.

•

Net synergies of more than $250 million over the first five years, of which

one-third is retained. •

Preserves power market recovery upside.

•

Committed financing in place with balanced permanent financing mix. |

12

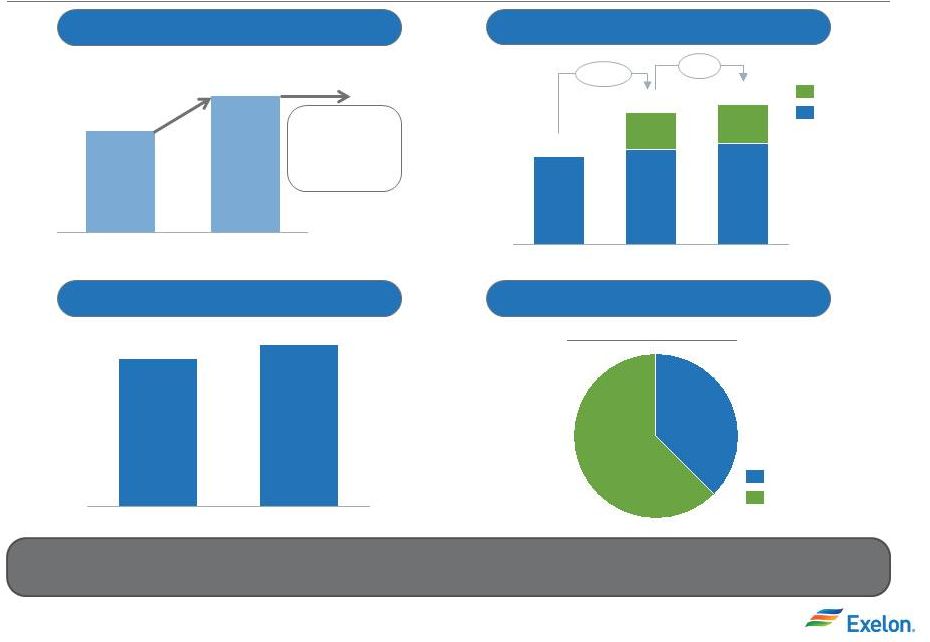

Earnings Accretive First Full Year

(1)

Transaction Economics

Exelon Consolidated S&P FFO/Debt

2016

2015

(1) Assumes funding mix of assumed debt, new debt, asset sales and equity

issuance with appropriate discount to market price (2) Reflects YE rate

base The transaction is significantly EPS accretive, adds to rate base

growth and further strengthens our financials

2015-2016 Operating Earnings

60%-65%

35%-40%

Pro

Forma

Business

Mix

Regulated

Unregulated

Rate Base Growth ($B)

(2)

2016

$31.8

$23.0

$8.8

2015

$30.0

$21.7

$8.3

2014

Exelon

PHI

2017

2016

$0.10 -

$0.15

$0.15 -

$0.20

$20.0

24%

22%

Achieve run-rate

accretion of

$0.15-$0.20

starting in 2017

+6%

+50% |

13

Financing Overview

Committed $7.2 billion bridge facility signed and in place to support the

contemplated transaction and provide flexibility for timing of

permanent financing.

Interim

Financing

Permanent

Financing

Exelon will use a balanced mix of debt, equity and cash to finance the

acquisition in order to maintain current investment grade ratings at all

registrants Strong liquidity profile for combined company, supported by

revolving credit facilities totaling $9.5 billion.

Adequate liquidity will be maintained to support all utility operations.

Opportunities to right size liquidity facilities will be explored.

Liquidity

No change of control provisions in public debt of PHI or subsidiaries.

Future PHI maturities expected to be refinanced at Exelon Corp as needed

–

no further debt issuance at PHI expected post-closing.

Exelon

Corporation

debt

will

be

used

for

regulated

investment

in

utilities;

Exelon

Generation

debt

will

be

used

to

fund

competitive

growth.

Go Forward

Financing Plan

(1)

Subject to market conditions

Financing structure fully expected to maintain investment grade ratings at

all Exelon and PHI registrants.

Permanent financing will include Exelon Corp debt, equity (including

mandatory

convertibles)

and

cash

proceeds

from

asset

sales

(1)

. |

14

Closing Comments

•

Transaction is another example of our actions to grow our company, our

earnings and our returns to our shareholders.

•

Opportunity to create significant customer savings and build upon existing

reliability enhancements.

•

Tremendous value unlocked through the addition of incremental regulated

operating earnings and cash flows.

•

Accelerates

our

ability

to

fully

fund

the

external

dividend

from

our

regulated

operations.

•

Balance sheet remains strong after this transaction and allows us flexibility

to pursue additional regulated and merchant investments.

|

Appendix |

16

Standalone

Pro Forma

Exelon

PHI

Regulated Jurisdictions

IL, MD, PA

DC, DE, MD, NJ

DC, DE, IL, MD, NJ,

PA

Electric Customers (in M)

6.65

1.85

8.50

Gas Customers (in M)

1.15

0.13

1.28

Total Customers (in M)

7.80

1.98

9.78

Utility Service Area (Square Miles)

15,800

8,340

24,140

Electric Transmission (Miles)

7,404

4,600

12,004

Electric Distribution (Miles)

113,345

34,100

147,445

Gas Transmission (Miles)

194

105

299

Gas Distribution (Miles)

13,818

3,157

16,975

A Compelling Combination –

Creates The Premier

Mid-Atlantic Utility Franchise

___________________________

Source: Company filings.

Note: Operational statistics as of 12/31/2013

Combined Statistics |

17

$700

$600

$550

$350

$300

$325

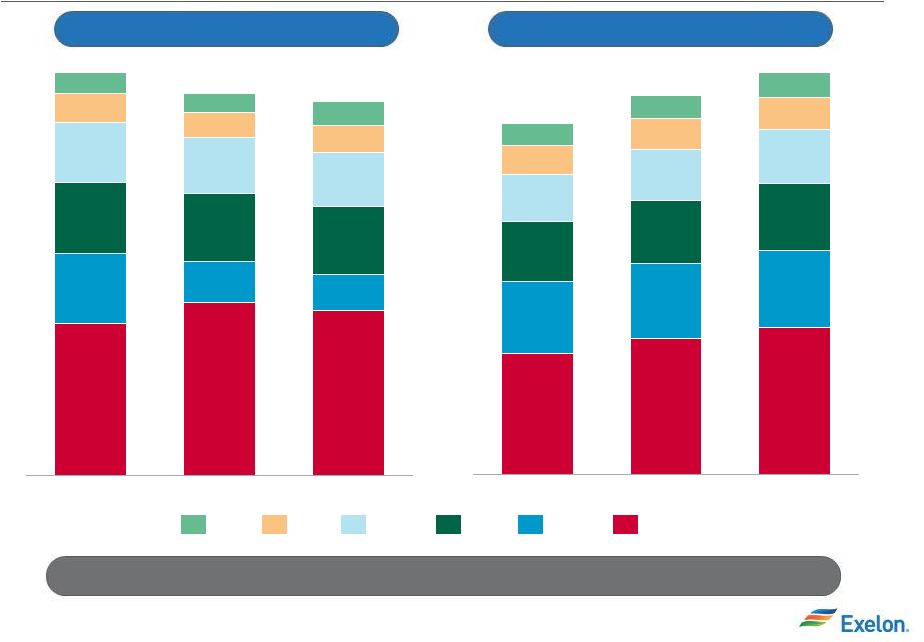

Exelon Utilities: Capital Expenditures and Rate Base

(1)

2016E

$4,300

$1,925

$425

$800

$275

2015E

$4,425

$2,025

$475

$800

$225

2014E

$4,725

$1,775

$825

$825

$250

ComEd

PECO

BGE

Pepco

DPL

ACE

Strong rate base growth will provide stable utility earnings growth

Rate Base ($B)

Capital Expenditures ($M)

(2)

$4.0

$4.3

$2.4

$2.5

$3.8

$2.3

2016E

$6.1

$5.3

$11.6

$2.0

$30.0

$10.7

$5.9

$5.1

$1.8

2014E

$27.7

$9.5

$5.7

$4.8

$1.7

2015E

$31.8

(1) Illustrative view of combined company

(2) Numbers rounded to nearest $25 million |

18

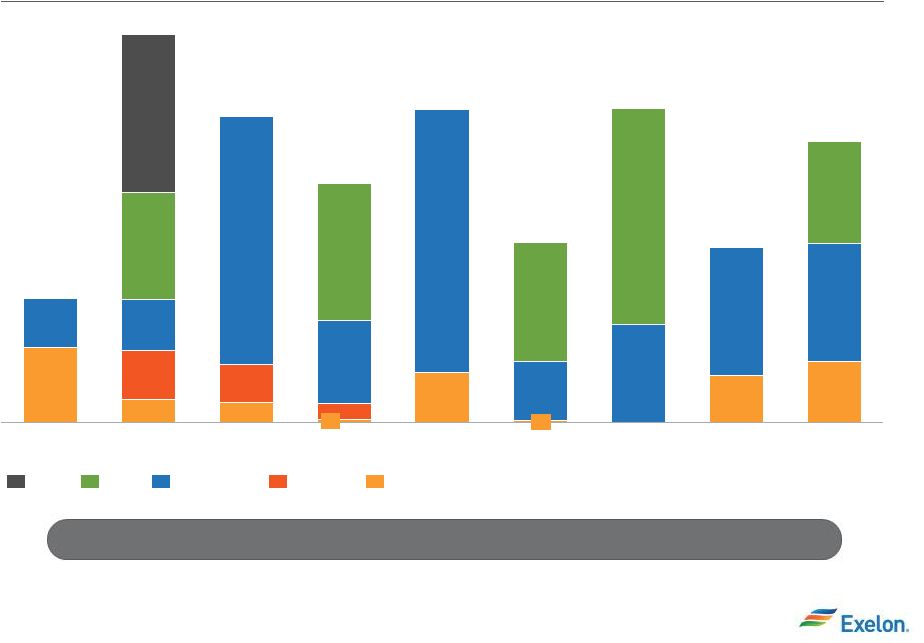

Pro Forma Debt Maturity Profile

(1)

310

2022

1,433

700

2016

1,557

102

190

1,265

2015

1,975

115

250

260

800

2014

632

382

250

550

600

523

2021

889

239

650

2020

1,600

500

1,100

2019

912

12

300

600

2018

1,594

254

1,340

2017

1,220

14

81

425

ExCorp

PHI Holdco

PHI Regulated

EXC Regulated

ExGen

Ample liquidity and manageable debt maturities

(1) PHI

Regulated

debt

includes

$100

mm

term

loan

which

matures

in

2014;

ExGen

debt

includes

former

CEG

debt

assumed

by

ExGen;

Excludes

PHI

unregulated

debt

which

totals

$25

mm;

Includes

Exelon’s

regulated

capital

trust

securities;

Excludes

tax-exempt,

preferred

and

non-recourse

debt;

Acquisition

debt

will

be

held

at

corporate

but

is

not

included.

Source

Bloomberg,

Company

Filings. |

19

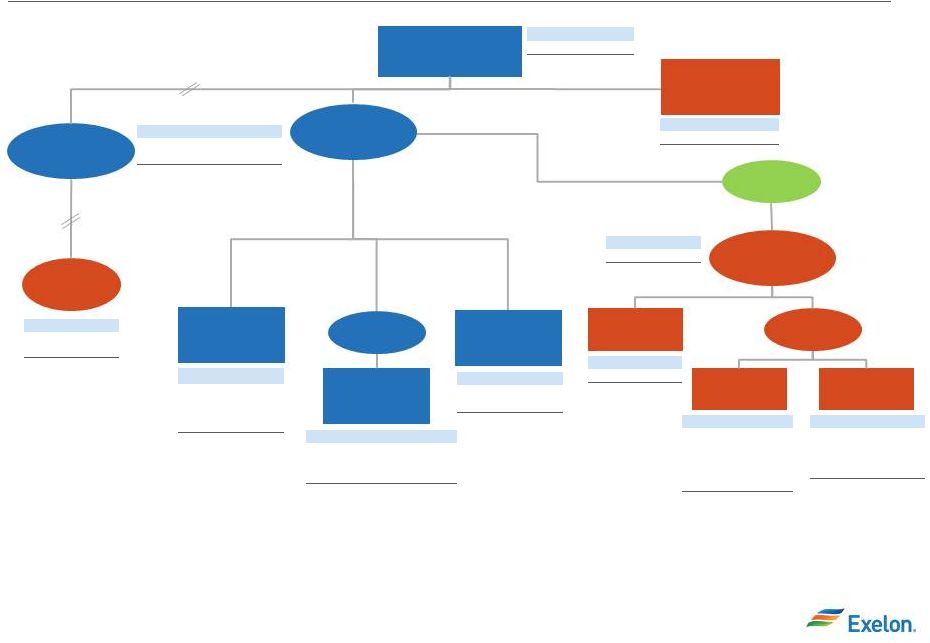

Corporate Structure

Exelon Corporation

Commonwealth Edison

Baltimore Gas &

Electric

Potomac Electric

Power Company

Delmarva Power &

Light

Atlantic City Electric

Company

Exelon Energy

Delivery Company

Conectiv

Pepco Holdings

SPE

RF Holdco

Exelon Generation

Pepco Energy

Services

Type

Amt ($mm)

FMB

$650

Notes

$200

Tax Exempt

$78

Medium

Term Notes

$40

Total

$968

Type

Amt ($mm)

FMB

$761

Transition

Bonds

(2)

$246

Term Loan

$100

Total

$1,107

Type

Amt ($mm)

Recourse

(2)

$11

Total

$11

Type

Amt ($mm)

FMB

(2)

$2,310

Total

$2,310

Type

Amt ($mm)

Secured

Notes

$14

Total

$14

Type

Amt ($mm)

Notes

$706

Total

$706

Type

Amt ($mm)

Notes

$1,750

Rate Stabilization

(2)

$265

Trusts

$258

Total

$2,273

Type

Amt ($mm)

FMB

$5,579

Trusts

$206

Other

$140

Total

$5,924

Type

Amt ($mm)

FMB

$2,200

Trusts

$184

Total

$2,384

Type

Amt ($mm)

Notes

(1)

$5,771

Non-Recourse

(2)

$1,516

Total

$7,287

Type

Amt ($mm)

Notes

$1,300

Total

$1,300

PECO Energy

Potomac

Capital

Investment Corporation

Note: Simplified organizational chart; additional subsidiaries are not shown.

Former direct and indirect subsidiaries of PHI are in red; newly created ring fencing entity is in green

Note: Debt outstanding is as of 3/31/14; does not include any projected

acquisition financing (1)

Includes intercompany loan agreements between Exelon and Generation that mirror

the terms and amounts of the third-party obligations of Exelon

(2)

The following retirements occurred in April 2014 and are not reflected on the

chart above: PCI Recourse Debt - $11M, PEPCO FMB $175M, ACE Transition Bonds - $10M, BGE

Rate Stabilization Bonds - $35M, various ExGen Project Finance Debt -

$3M |