As filed with the Securities and Exchange Commission on April 29, 2014

Registration No. 333-194591

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

AMENDMENT NO. 1

TO

FORM S-1

FOR REGISTRATION

UNDER

THE SECURITIES ACT OF 1933

TIAA REAL ESTATE ACCOUNT

(Exact name of registrant as specified in its charter)

New York

(State or other jurisdiction of incorporation or organization)

(Not applicable)

(Primary Standard Industrial Classification Code Number)

(Not applicable)

(I.R.S. Employer Identification No.)

c/o Teachers Insurance and Annuity Association of America

730 Third Avenue

New York, New York 10017-3206

(212) 490-9000

(Address including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Keith F. Atkinson, Esquire

Teachers Insurance and Annuity Association of America

8500 Andrew Carnegie Blvd.

Charlotte, North Carolina 28262

(704) 988-1000

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copy to:

Jeffrey S. Puretz, Esquire

Dechert LLP

1775 I Street, N.W.

Washington, D.C. 20006

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of the registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box: S

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: £

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: £

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: £

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act.

Large accelerated filer £ Accelerated filer £ Non-accelerated filer

S Smaller Reporting Company £

Pursuant to Rule 429 under the Securities Act, the prospectus contained herein also relates to and constitutes a post-effective amendment to Securities Act registration statements 33-92990, 333-13477, 333-22809, 333-59778, 333-83964, 333-113602, 333-121493, 333-132580, 333-141513, 333-149862, 333-158136, 333-165286, 333-172900, 333-180173 and 333-187309 (collectively, the

“Prior Registration Statements”).

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

|

|

|

|

Title of Each Class of

Securities to be Registered |

|

Amount to be

Registered |

|

Proposed

Maximum Offering

Price Per Unit |

|

Proposed

Maximum Aggregate

Offering Price |

|

Amount of

Registration

Fee(1)(2)

|

|

|

Accumulation units in TIAA Real Estate Account |

|

* |

|

* |

|

$1,000,000,000** |

|

$128,800** |

|

|

* |

|

|

|

The securities are not issued in predetermined amounts or units, and the maximum aggregate offering price is estimated solely for purposes of determining the registration fee pursuant to Rule 457(o) under the Securities Act. |

|

|

** |

|

|

|

In addition to the $1,000,000,000 of accumulation units registered hereunder, the registrant is carrying forward securities which remain unsold but which were previously registered under the Prior Registration Statements for which filing fees were previously paid. |

|

|

(1) |

|

|

|

The Registrant paid filing fees in the amount of $136,400 in connection with the registration of accumulation units on its Registration Statement on Form S-1 (File No. 333-187309), which was initially filed with the Commission on March 15, 2013 and declared effective on May 1, 2013. The Registrant is not offsetting any filing fees previously paid in connection with any prior

Registration Statement. |

|

|

|

(2) |

|

|

|

Previously paid.

|

|

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become

effective on such date as the Securities and Exchange Commission, acting pursuant to Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and we are not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED APRIL 29, 2014

PROSPECTUS

__________, 2014

TIAA Real Estate Account

A tax-deferred variable annuity option offered by Teachers Insurance and Annuity Association of America (“TIAA”)

This prospectus tells you about the TIAA Real Estate Account, an investment option offered through individual and group variable annuity contracts issued by TIAA. Please read it carefully before investing and keep it for future reference. The Real Estate Account, which we refer to sometimes as “the Account” in this prospectus, invests primarily in real estate and real estate-related investments. TIAA, one of the largest and most experienced mortgage and real estate investors in the nation,

manages the Account’s assets.

The value of your investment in the Real Estate Account will go up or down depending on how the Account performs and you could lose money. The Account’s performance depends mainly on the value of the Account’s real estate and other real estate-related investments, the income generated by those investments and the Account’s expenses. The Account’s returns could go down if, for example, real estate values or rental and occupancy rates, or the value of real estate-related securities,

decrease due to general economic conditions and/or a weak market for real estate generally. Property operating costs, costs associated with leverage on the Account’s properties, and government regulations, such as zoning or environmental laws, could also affect a property’s profitability. TIAA does not guarantee the investment performance of the Account, and you will bear the entire investment risk. For a detailed discussion of the specific risks of investing in the Account, see “Risk factors” on

page 14.

We take deductions daily from the Account’s net assets for the Account’s operating and investment management expenses. The Account also pays TIAA for bearing mortality and expense risks and for providing a liquidity guarantee. The current estimated annual expense deductions from the Account’s net assets over the next 12 months total 0.870%.

The Real Estate Account is designed as an option for retirement and tax-deferred savings plans for employees of nonprofit and governmental institutions. TIAA currently offers the Real Estate Account under the following annuity contracts:

|

< |

|

|

|

RAs and GRAs (Retirement Annuities and Group Retirement Annuities) |

|

|

< |

|

|

|

SRAs (Supplemental Retirement Annuities) |

|

|

< |

|

|

|

GSRAs (Group Supplemental Retirement Annuities) |

|

|

< |

|

|

|

Retirement Choice and Retirement Choice Plus Annuity |

|

|

< |

|

|

|

GAs (Group Annuities) and Institutionally-Owned GSRAs |

|

|

< |

|

|

|

Classic and Roth IRAs (Individual Retirement Annuities) including SEP IRAs (Simplified Employee Pension Plans) |

|

|

< |

|

|

|

Keoghs |

|

|

< |

|

|

|

ATRAs (After-Tax Retirement Annuities) |

|

|

< |

|

|

|

Real Estate Account Accumulation Contract

|

Note that state regulatory approval may be pending for certain of these contracts and these contracts may not currently be available in your state. TIAA may also offer the Real Estate Account as an investment option under additional contracts, both at the individual and plan sponsor level, in the future.

Neither the Securities and Exchange Commission (“SEC”) nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy of the information in this prospectus. Any representation to the contrary is a criminal offense.

An investment in the Real Estate Account is not a bank deposit and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

Table of contents

Please see Appendix C for definitions of certain special terms used in this prospectus.

The Real Estate Account securities offered by this prospectus are only being offered in those jurisdictions where it is legal to do so. No person may make any representation to you or give you any information about the offering that is not in the prospectus. If anyone provides you with information about the offering that is not in the prospectus, you shouldn’t rely on it.

Prospectus summary

TIAA Real Estate Account

You should read this summary together with the more detailed information regarding the Account, including the Account’s financial statements and related notes, appearing elsewhere in this prospectus. More information about the Account may be obtained by writing us at 730 Third Avenue, New York, NY 10017-3206, calling us at 877

518-9161 or visiting our website at www.tiaa-cref.org.

About the TIAA Real Estate Account

The TIAA Real Estate Account was established in February 1995 as a separate account of Teachers Insurance and Annuity Association of America (“TIAA”) and interests in the Account were first offered to eligible participants on October 2, 1995. The Account offers individual and group accumulating annuity contracts (with

contributions made on a pre-tax or after-tax basis), as well as individual lifetime and term-certain variable payout annuity contracts (including the payment of death benefits to beneficiaries). Investors are entitled to transfer funds to or from the Account under certain circumstances. Funds invested in the Account for each category of

contract are expressed in terms of units, and unit values will fluctuate depending on the Account’s performance.

Investment objective

The Account seeks favorable long-term returns primarily through rental income and appreciation of real estate and real estate-related investments owned by the Account. The Account will also invest in non-real estate-related publicly traded securities and short-term higher quality liquid investments that are easily converted to cash to

enable the Account to meet participant redemption requests, purchase or improve properties or cover other expense needs.

Investment strategy

Real Estate-Related Investments. The Account intends to have between 75% and 85% of its net assets invested directly in real estate or real estate-related investments with the goal of producing favorable long-term returns primarily through rental income and appreciation. These investments may consist of:

|

• |

|

|

|

Direct ownership interests in real estate, |

|

|

• |

|

|

|

Direct ownership of real estate through interests in joint ventures, |

|

|

• |

|

|

|

Indirect interests in real estate through real estate-related securities, such as:

|

|

• |

|

|

|

equity investments in real estate investment trusts (“REITs”), which investments may consist of common or preferred stock interests,

|

TIAA Real Estate Account ¡ Prospectus3

|

|

• |

|

|

|

real estate limited partnerships, |

|

|

• |

|

|

|

investments in equity or debt securities of companies whose operations involve real estate (i.e., that primarily own or manage real estate) which may not be REITs, and |

|

|

• |

|

|

|

conventional commercial mortgage loans, participating mortgage loans, secured mezzanine loans and collateralized mortgage obligations, including commercial mortgage-backed securities (“CMBS”) and other similar investments.

|

The Account’s principal strategy is to purchase direct ownership interests in income-producing real estate, primarily office, industrial, retail and multi-family residential properties. The Account is targeted to hold between 65% and 80% of the Account’s net assets in such direct ownership interests at any time. Historically,

approximately 70% of the Account’s net assets have been comprised of such direct ownership interests in real estate.

In addition, while the Account is authorized to hold up to 25% of its net assets in liquid real estate-related securities, such as REITs and CMBS, management intends that the Account will not hold more than 10% of its net assets in such securities on a long-term basis. Traditionally, less than 10% of the Account’s net assets have

been comprised of interests in these securities, although the Account has recently held approximately 10% of its net assets in equity REIT securities. In addition, under the Account’s current investment guidelines, the Account is authorized to hold up to 10% of its net assets in CMBS. As of December 31, 2013, REIT securities

comprised approximately 8.9% of the Account’s net assets, and the Account held no CMBS as of such date.

Non-Real Estate-Related Investments. The Account will invest the remaining portion of its assets (targeted to be between 15% and 25% of its net assets) in publicly traded, liquid investments; namely:

|

|

• |

|

|

|

Short-term government related instruments, including U.S. Treasury bills, |

|

|

• |

|

|

|

Long-term government related instruments, such as securities issued by U.S. government agencies or U.S. government sponsored entities, |

|

|

• |

|

|

|

Short-term non-government related instruments, such as money market instruments and commercial paper, |

|

|

• |

|

|

|

Long-term non-government related instruments, such as corporate debt securities, and |

|

|

• |

|

|

|

stock of companies that do not primarily own or manage real estate.

|

However, from time to time (most recently between late 2008 and mid-2010), the Account’s non-real estate-related liquid investments may comprise less than 15% (and possibly less than 10%) of its assets (on a net basis and/or a gross basis), especially during and immediately following periods of significant net participant

outflows, in particular due to significant participant transfer activity. In addition, the Account, from time to time and on a temporary basis, may hold in excess of 25% of its net assets in non-real estate-related liquid investments, particularly during times of significant inflows into the Account and/or a lack of attractive real estate-related

investments available in the market.

4Prospectus ¡ TIAA Real Estate Account

Liquid Securities Generally. Primarily due to management’s need to manage fluctuations in cash flows, in particular during and immediately following periods of significant participant net transfer activity into or out of the Account, the Account may, on a temporary basis (i) exceed the upper end of its targeted holdings (currently 35% of

the Account’s net assets) in liquid securities of all types, including both publicly traded non-real estate-related liquid investments and liquid real estate-related securities, such as REITs and CMBS, or (ii) be below the low end of its targeted holdings in such liquid securities (currently 15% of the Account’s net assets).

The portion of the Account’s net assets invested in liquid investments of all types may exceed the upper end of its target, for example, if (i) the Account receives a large inflow of money in a short period of time, in particular due to significant participant transfer activity into the Account, (ii) the Account receives significant proceeds

from sales or financings of direct real estate assets, (iii) there is a lack of attractive direct real estate investments available on the market, and/or (iv) the Account anticipates more near-term cash needs, including to apply to acquire direct real estate investments, pay expenses or repay indebtedness.

Foreign Investments. The Account from time to time will also make foreign real estate investments. Under the Account’s investment guidelines, investments in direct foreign real estate, together with foreign real estate-related securities and foreign non-real estate-related liquid investments, may not comprise more than 25% of the

Account’s net assets. However, through the date of this prospectus, such foreign real estate-related investments have never represented more than 7.5% of the Account’s net assets and management does not intend such foreign investments to exceed 10% of the Account’s net assets. As of December 31, 2013, the Account’s foreign

assets represented approximately 1.3% of the Account’s net assets (after netting out the fair value of debt on our foreign properties).

Investments Summary. At December 31, 2013, the Account’s net assets totaled $16.9 billion. As of that date, the Account’s investments in real estate properties, real estate joint ventures, limited partnerships and real estate-related marketable securities, net of the fair value of mortgage loans payable on real estate, represented

81.1% of the Account’s net assets.

At December 31, 2013, the Account held a total of 102 real estate property investments (including its interests in 13 real estate-related joint ventures), representing 73.9% of the Account’s total investments, measured on a gross asset value basis (“Total Investments”). As of that date, the Account also held investments in REIT

equity securities (representing 7.9% of Total Investments), real estate limited partnerships (representing 1.9% of Total Investments), government agency notes (representing 10.4% of Total Investments) and U.S. Treasury Securities (representing 5.9% of Total Investments). See the Account’s audited financial statements for more

information as to the Account’s investments as of December 31, 2013.

TIAA Real Estate Account ¡ Prospectus5

Borrowing. The Account is authorized to borrow money in accordance with its investment guidelines. Under the Account’s current investment guidelines, management intends to maintain the Account’s loan to value ratio at or below 30%. The Account’s “loan to value ratio” at any time is based on the outstanding principal amount of

the Account’s debt to the Account’s total gross asset value. This ratio will be measured at the time of any debt incurrence and will be assessed after giving effect thereto.

As of December 31, 2013, the Account’s loan to value ratio was approximately 18.4%.

In addition, the Account may borrow up to 70% of the then-current value of a particular property. Non-construction mortgage loans on a property will be non-recourse to the Account. See “General investment and operating policies — Other real estate-related policies — Borrowing” on page 42.

Summary of expense deductions

Expense deductions are made each valuation day from the net assets of the Account for various services to manage the Account’s investments, administer the Account and the contracts, and distribute the contracts and to cover certain risks borne by TIAA. Investment management, administration and distribution services are

provided “at cost” by TIAA and TIAA-CREF Individual & Institutional Services, LLC (“Services”), a registered broker-dealer and wholly owned subsidiary of TIAA. Currently, TIAA provides investment management services and administration services for the Account, and Services provides distribution services for the Account. In addition,

TIAA charges the Account a fee to bear certain mortality and expense risks, and risks associated with providing the liquidity guarantee. TIAA guarantees that in the aggregate, the expense charges will never be more than 2.50% of average net assets per year.

The estimated annual expense deduction rate that appears in the expense table below reflects an estimate of the amount we currently expect to deduct to approximate the costs that the Account will incur from May 1, 2014 through April 30, 2015. Actual expenses may be higher or lower. The expenses identified in the table below do

not include any fees which may be imposed by your employer under a plan maintained by your employer.

|

|

|

|

|

Type of Expense Deduction |

|

Estimated

Percent of Net

Assets Annually |

|

Services Performed |

|

Investment Management |

|

0.380%

|

|

For investment advisory, investment management, portfolio accounting, custodial and similar services, including independent fiduciary and appraisal fees |

Administration |

|

0.240%

|

|

For administration and operations of the Account and the contracts, including administrative services such as receiving and allocating premiums and calculating and making annuity payments |

Distribution |

|

0.095%

|

|

For services and expenses associated with distributing the annuity contracts |

Mortality and Expense Risk |

|

0.005%

|

|

For TIAA’s bearing certain mortality and expense risks |

Liquidity Guarantee |

|

0.150%

|

|

For TIAA’s liquidity guarantee |

Total Annual Expense Deduction1,2 |

|

0.870%

|

|

Total |

|

6Prospectus ¡ TIAA Real Estate Account

|

1 |

|

|

|

TIAA guarantees that the total annual expense deduction will not exceed an annual rate of 2.50% of average net assets. |

|

|

2 |

|

|

|

Property-level expenses, including property management fees and transfer taxes, are not reflected in the table above; instead these expenses are charged directly to the Account’s properties.

|

Please see “Expense deductions” on page 69 and “Selected financial data” on page 73 for additional information.

TIAA currently does not impose a fee on transfers from the Account, but reserves the right to impose a fee on transfers from the Account in the future.

Example. The following table shows you an example of the expenses you would incur on a hypothetical investment of $10,000 in the TIAA Real Estate Account over several periods. The table assumes a 5% annual return on assets and an annual expense deduction equal to 0.870%. These figures do not represent actual expenses or

investment performance, which may differ.

|

|

|

|

|

|

|

|

1 Year |

|

3 Year |

|

5 Year |

|

10 Year |

|

|

$89

|

|

$278 |

|

$483 |

|

$1,077 |

|

|

Summary risk factors

The value of your investment in the Account will fluctuate based on the value of the Account’s assets and the income the assets generate. You may lose money by investing in this Account. The Account’s assets and income can be affected by many factors, and you should consider the specific risks presented in this prospectus

before investing in the Account. The principal risks include the following:

|

• |

|

|

|

Acquiring and Owning Real Estate: The risks associated with acquiring and owning real property, including general economic and real estate market conditions, the availability of, and economic cost associated with, financing the Account’s properties, the risk that the Account’s properties become too concentrated (whether by

geography, sector or tenant mix), competition for acquiring real estate properties, leasing risk (including tenant defaults) and the risk of uninsured losses at properties (including due to terrorism, natural disasters or acts of violence); |

|

|

• |

|

|

|

Selling Real Estate: The risk that the sales price of a property might differ, perhaps significantly, from its estimated or appraised value, leading to losses or reduced profits to the Account, the risk that the Account might not be able to sell a property at a particular time for a price which management believes represents its fair or

full value, the risk of a lack of availability of financing (for potential purchasers of the Account’s properties), risks associated with disruptions in the credit and capital markets, and the risk that the Account may be required to make significant expenditures before the Account is able to market and/or sell a property; |

|

|

• |

|

|

|

Valuation: The risks associated with property valuations, including the fact that appraisals can be subjective in a number of respects and the fact that the Account’s appraisals are generally obtained on a quarterly basis and there may be periods in between appraisals of a property during which the value attributed to the property

for purposes of the Account’s daily |

TIAA Real Estate Account ¡ Prospectus7

|

|

|

|

accumulation unit value may be more or less than the actual realizable value of the property; |

|

|

• |

|

|

|

Borrowing: Risks associated with financing the Account’s properties, including the risk of default on loans secured by the Account’s properties (which could lead to foreclosure), the risk associated with high loan to value ratios on the Account’s properties (including the fact that the Account may have limited, or no net value in

such a property), the risk that significant sums of cash could be required to make principal and interest payments on the loans and the risk that the Account may not have the ability to obtain financing or refinancing on favorable terms (or at all), which may be aggravated by general disruptions in credit and capital markets; |

|

|

• |

|

|

|

Participant Transactions and Cash Management: Investment risk associated with participant transactions, in particular that (i) significant net participant transfers out of the Account may impair our ability to pursue or consummate new investment opportunities that are otherwise attractive to the Account and/or may result in sales

of real estate-related assets to generate liquidity, (ii) significant net participant transfers into the Account may result, on a temporary basis, in our cash holdings and/or holdings in liquid real estate-related investments exceeding our long-term targeted holding levels and (iii) high levels of cash in the Account during times of

appreciating real estate values can impair the Account’s overall return; |

|

|

• |

|

|

|

Joint Venture Investments: The risks associated with joint venture partnerships, including the risk that a co-venturer may have interests or goals inconsistent with that of the Account, that a co-venturer may have financial difficulties, and the risk that the Account may have limited rights with respect to operation of the property and

transfer of the Account’s interest; |

|

|

• |

|

|

|

Regulatory Matters: Uncertainties associated with environmental liability and regulations and other governmental regulatory matters such as zoning laws, rent control laws, and property taxes; |

|

|

• |

|

|

|

Foreign Investments: The risks associated with purchasing, owning and disposing of foreign investments (primarily real estate properties), including political risk, the risk associated with currency fluctuations (whether hedged or not), regulatory and taxation risks and risks associated with enforcing judgments; |

|

|

• |

|

|

|

Conflicts of Interest: Conflicts of interest associated with TIAA serving as investment manager of the Account and provider of the liquidity guarantee at the same time as TIAA and its affiliates are serving as an investment manager to other real estate accounts or funds, including conflicts associated with satisfying its fiduciary

duties to all such accounts and funds associated with the purchasing, selling and leasing of properties; |

|

|

• |

|

|

|

Required Property Sales: The risk that, if TIAA were to own too large a percentage of the Account’s accumulation units through funding the liquidity guarantee (as determined by the independent fiduciary), the independent |

8Prospectus ¡ TIAA Real Estate Account

|

|

|

|

fiduciary could require the sales of properties to reduce TIAA’s ownership interest, which sales could occur at times and at prices that depress the sale proceeds to the Account; |

|

|

• |

|

|

|

Government and Government Agency Securities: Risks associated with investment securities issued by U.S. government agencies and U.S. government-sponsored entities, including the risk that the issuer may not have their securities backed by the full faith and credit of the U.S. government, and that transaction activity may

fluctuate significantly from time to time, which could negatively impact the value of the securities and the Account’s ability to dispose of a security at a favorable time; and |

|

|

• |

|

|

|

Liquid Assets and Securities: Risks associated with investments in real estate-related liquid assets (which could include, from time to time, REIT securities and CMBS), and non-real estate-related liquid assets, including:

|

|

• |

|

|

|

Financial/credit risk — Risks that the issuer will not be able to pay principal and interest when due or that the issuer’s earnings will fall; |

|

|

• |

|

|

|

Market volatility risk — Risk that the changing conditions in financial markets may cause the Account’s investments to experience price volatility; |

|

|

• |

|

|

|

Interest rate volatility risk — Risk that interest rate volatility may affect the Account’s current income from an investment or the pricing of that investment. As of the date of this prospectus, interest rates in the United States are at or near historic lows, which may increase the Fund’s exposure to risk associated with rising interest

rates; and |

|

|

• |

|

|

|

Deposit/money market risk — Risk that the Account could experience losses if banks fail.

|

More detailed discussions of these risks and other risk factors associated with an investment in the Account are contained starting on page 14 of this prospectus in the section entitled “Risk factors.”

Valuing the Account’s assets

The assets of the Account are valued at the close of each valuation day and the Account calculates and publishes a unit value, which is available on TIAA-CREF’s website (www.tiaa-cref.org), for each valuation day. The values of the Account’s properties are adjusted daily to account for capital expenditures and appraisals as they

occur.

With respect to the Account’s real property investments, following the initial purchase of a property or the making of a mortgage loan on a property by the Account (at which time the Account normally receives an independent appraisal on such property), each of the Account’s real properties are appraised, and mortgage loans are

valued, at least once every calendar quarter. Each of the Account’s real estate properties is appraised each quarter by an independent external state-certified (or its foreign equivalent) appraiser (which we refer to in this prospectus as an “independent appraiser”) who is a member of a professional appraisal organization. In addition,

TIAA’s internal appraisal staff

TIAA Real Estate Account ¡ Prospectus9

performs a review of each of these quarterly appraisals, in conjunction with the Account’s independent fiduciary, and TIAA’s internal appraisal staff or the independent fiduciary may request an additional appraisal or valuation outside of this quarterly cycle. Any differences in the conclusions of TIAA’s internal appraisal staff and the

independent appraiser will be reviewed by the independent fiduciary, which will make a final determination on the matter (which may include ordering a subsequent independent appraisal).

In general, the Account obtains appraisals of its real estate properties spread out throughout the quarter, which is intended to result in appraisal adjustments and thus adjustments to the valuations of its holdings (to the extent adjustments are made) that happen regularly throughout each quarter and not on one specific day in each

period. In addition, an estimated daily equivalent of net operating income is taken into consideration and is adjusted for actual transactional activity. The remaining assets in the Account are primarily marketable securities that are priced on a daily basis and are included in the Account’s daily unit value.

As of December 31, 2013, the Account’s net assets totaled approximately $16.9 billion. See “Valuing the Account’s assets” on page 63 for more information on how each class of the Account’s investments are valued.

Past performance

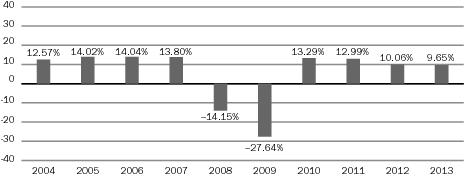

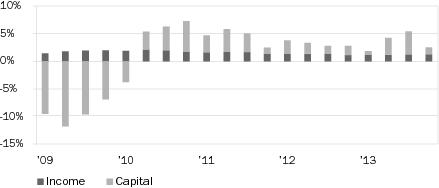

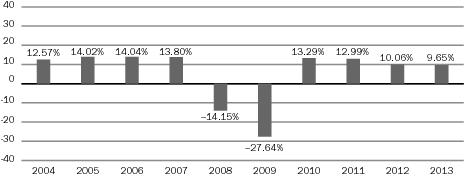

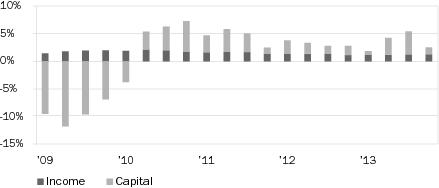

The bar chart and performance table below illustrate how investment performance during the accumulation period has varied. The chart shows the Account’s total return (which includes all expenses) during the accumulation period over each of the last ten calendar years. It also shows the Account’s returns during the accumulation

period for the one-, three-, five- and ten-year periods through December 31, 2013. These returns represent the total return during each such year and reflect both the Account’s investment income and capital appreciation from the Account’s total investments during each such year. How the Account has performed in the past is not

necessarily an indication of how it will perform in the future. Please see “Risk factors” beginning on page 14.

Best quarter: 5.68%, for the quarter ended December 31, 2010.

Worst quarter: –13.18%, for the quarter ended December 31, 2008.

10Prospectus ¡ TIAA Real Estate Account

AVERAGE ANNUAL TOTAL RETURNS (AS OF DECEMBER 31, 2013)

|

|

|

|

|

|

|

|

|

|

|

|

1 Year |

|

3 Year |

|

5 Year |

|

10 Year |

|

|

TIAA Real Estate Account |

|

9.65% |

|

10.89% |

|

2.25% |

|

4.80% |

|

About TIAA and TIAA’s role with the Account

TIAA is the companion organization of the College Retirement Equities Fund (“CREF”), the first company in the United States to issue a variable annuity. CREF is a nonprofit membership corporation established in New York State in 1952. Together, TIAA and CREF, serving approximately 4.0 million people and approximately 15,000

institutions as of December 31, 2013, form the principal retirement system for the nation’s education and research communities and form one of the largest pension systems in the U.S., based on assets under management. As of December 31, 2013, TIAA’s total statutory admitted assets were approximately $250 billion and the

combined assets under management for TIAA, CREF and other entities within the TIAA-CREF organization (including TIAA-sponsored mutual funds) totaled approximately $564 billion. CREF does not stand behind TIAA’s guarantees and TIAA does not guarantee CREF products.

The Account does not have officers, directors or employees. TIAA employees, under the direction and control of TIAA’s Board of Trustees (the “Board”) and its Investment Committee, manage the investment of the Account’s assets, following investment management procedures TIAA has adopted for the Account. In addition, TIAA

performs administration functions for the Account (which include receiving and allocating premiums, calculating and making annuity payments and providing recordkeeping and other services). Distribution services for the Account (which include, without limitation, distribution of the annuity contracts, advising existing annuity contract

owners in connection with their accumulations and helping employers implement and manage retirement plans) are performed by Services. TIAA and Services provide investment management, administration and distribution services, as applicable, on an “at-cost” basis.

With over 65 years in the real estate business and interests in properties located across the U.S. and internationally, TIAA is one of the nation’s largest and most experienced investors in mortgages and real estate equity interests. As of December 31, 2013, the TIAA General Account had a mortgage and real property portfolio

(including interests in TIAA subsidiaries that hold real estate, real estate funds and joint ventures but excluding mortgage-backed securities and REIT securities) valued at approximately $22.4 billion.

Liquidity Guarantee. In the event that the Account’s level of liquidity is not sufficient to guarantee that Account participants may redeem their accumulation units (at their accumulation unit value as of the date of such redemption request received in good order), the TIAA General Account will purchase accumulation units issued by the

Account (sometimes called “liquidity units”) in accordance with its liquidity guarantee. The cost of this guarantee is embedded in the overall expense charge of the Account. This liquidity guarantee is not a guarantee of either investment performance or the value of units in the Account.

TIAA Real Estate Account ¡ Prospectus11

This liquidity guarantee was first exercised in December 2008 and between December 2008 and June 2009, approximately $1.2 billion in liquidity units in the aggregate were purchased. The liquidity guarantee has not been exercised since June 2009. The independent fiduciary has since completed the systematic redemption of all

of the liquidity units held by the TIAA General Account. Approximately one-quarter of such units were redeemed evenly over the business days in each of June, September and December 2012, and March 2013, representing a total of $1.3 billion redeemed during this period. See “Establishing and managing the Account — The role of

TIAA — Liquidity guarantee” on page 45 and “—Role of the independent fiduciary” on page 47.

The contracts

TIAA offers the Account as a variable option for the annuity contracts listed on the cover page of this prospectus, although some employer plans may not offer the Account as an option for certain contracts. Each payment to the Account buys a number of accumulation units. Similarly, any transfer or withdrawal from the Account

results in the redemption of a number of accumulation units. The price you pay for an accumulation unit, and the price you receive for an accumulation unit when you redeem accumulation units, is the accumulation unit value (“AUV”) calculated for the business day on which we receive your purchase, redemption or transfer request in

good order (unless you ask for a later date for a redemption or transfer).

The Right to Cancel Your Contract. Generally, you may cancel any RA, SRA, GSRA, Classic IRA, Roth IRA, ATRA or Keogh contract in accordance with the contract’s Right to Examine provision (unless we have begun making annuity payments from it) and subject to the time period regulated by the state in which the contract is issued.

Although the contract terms and state law provisions differ, you will generally have between 10 and 60 days to exercise this cancellation right.

Transfers and Withdrawals. Subject to the terms of the contracts and your employer’s plan, you can move your money to and from the Account in the following ways:

|

• |

|

|

|

from the Account to a CREF investment account, a TIAA Access variable account (if available), TIAA’s Traditional Annuity or a fund (including TIAA-CREF affiliated funds) or other option available under your plan; |

|

|

• |

|

|

|

to the Account from a CREF investment account, a TIAA Access variable account (if available), TIAA’s Traditional Annuity (transfers from TIAA’s Traditional Annuity under RA, GRA or Retirement Choice contracts are subject to restrictions), a TIAA-CREF affiliated fund or other options available under your plan or from other

companies/plans; |

|

|

• |

|

|

|

by withdrawing cash; and/or |

|

|

• |

|

|

|

by setting up a program of automatic withdrawals or transfers.

|

Importantly, transfers out of the Account to a TIAA or CREF account or into another investment option can be executed on any business day but are limited

12Prospectus ¡ TIAA Real Estate Account

to once per calendar quarter, although some plans may allow systematic transfers that result in more than one transfer per calendar quarter. Other limited exceptions may apply. Also, transfers to CREF accounts or to certain other options may be restricted by your employer’s plan, current tax law or by the terms of your contract.

In addition, individual participants are limited from making internal funding vehicle transfers into their Account accumulation if, after giving effect to such transfer, the total value of such participant’s Account accumulation (under all contracts issued to such participant) would exceed $150,000. Categories of transactions that TIAA

deems “internal funding vehicle transfers” for purposes of this limitation are described in detail on pages 126–127. As of the date of this prospectus, all jurisdictions in which the Account is offered have approved this limitation, but the effective date of the limitation as applies to an individual participant will be reflected on his or her

applicable contract or endorsement form. Please see “How to transfer and withdraw your money” beginning on page 122.

By limiting these transfers to the Real Estate Account, as anticipated, the amount of funds going into and out of the Account has become more predictable, which we believe will continue to enhance our ability to invest and manage the Real Estate Account’s portfolio with a long-term perspective. See “Management’s discussion and

analysis of the Account’s financial condition and results of operations — Liquidity and capital resources” on page 99 for a discussion of participant flow activity.

The Annuity Period. Your income payments may be paid out of the Account through a variety of income options. Ordinarily, your annuity payments begin on the date you designate as your annuity starting date, subject to the terms of your employer’s plan. Your initial income payments are based on the value of your accumulation on

the last valuation day before the annuity starting date and annuity payments can change after the initial payment based on the Account’s investment experience, the income option you choose and the income change method you choose. Important tax considerations may also apply. See “Receiving annuity income” beginning on page 129.

Death Benefits. Subject to the terms of your employer’s plan, TIAA may pay death benefits if you or your annuity partner dies. When you purchase your annuity contract, you name one or more beneficiaries to receive the death benefit if you die. You can change your beneficiaries anytime before you die, and, unless you instruct

otherwise, your annuity partner can do the same after your death. Your choice of beneficiary for death benefits may, in some cases, be subject to the consent of your spouse and federal and state law may impose additional restrictions. If you die during the accumulation period, the death benefit is the amount of your accumulation. If

you and your annuity partner die during the annuity period while payments are still due under a fixed-period annuity or for the remainder of a guaranteed period, the death benefit is the present value, based on interest at the effective annual rate of 4%, of the unit annuity payments due for the remainder of the period. Death benefits may

be paid out during the accumulation period (currently under one of five available methods) or during the

TIAA Real Estate Account ¡ Prospectus13

annuity period. Ordinarily, death benefits are subject to federal estate tax. Generally, if taken as a lump sum, death benefits would be taxed like complete withdrawals. If taken as annuity benefits, death benefits would be taxed like annuity payments. See “Death benefits” on page 134.

Risk factors

The value of your investment in the Account will fluctuate based on the value of the Account’s assets, the income the assets generate and the Account’s expenses. Participants can lose money by investing in the Account. There is risk associated with an investor attempting to “time” an investment in the Account’s units, or effecting a

redemption of an investor’s units. The Account’s assets and income can be affected by many factors, and you should consider the specific risks presented below before investing in the Account. In particular, for a discussion of how forward-looking statements contained in this prospectus are subject to uncertainties that are difficult to

predict, which may be beyond management’s control and which could cause actual results to differ materially from historical experience or management’s present expectations, please refer to the subsection entitled “Forward-looking statements,” which is contained in the section entitled “Management’s discussion and analysis of the

Account’s financial condition and results of operations” on page 75.

Risks associated with real estate investing

General Risks of Acquiring and Owning Real Property: As referenced elsewhere in this prospectus, the substantial majority of the Account’s net assets are comprised of direct ownership interests in real estate. As such, the Account is particularly subject to the risks inherent in acquiring and owning real property, including in particular

the following:

|

• |

|

|

|

Adverse Global and Domestic Economic Conditions. The economic conditions in the markets where the Account’s properties are located may be adversely impacted by factors which include:

|

|

|

• |

|

|

|

adverse domestic or global economic conditions, particularly in the event of a deep recession which results in significant employment losses across many sectors of the economy and reduced levels of consumer spending; |

|

|

• |

|

|

|

a weak market for real estate generally and/or in specific locations where the Account may own property; |

|

|

• |

|

|

|

business closings, industry or sector slowdowns, employment losses and related factors; |

|

|

• |

|

|

|

the availability of financing (both for the Account and potential purchasers of the Account’s properties); |

|

|

• |

|

|

|

an oversupply of, or a reduced demand for, certain types of real estate properties;

|

14Prospectus ¡ TIAA Real Estate Account

|

|

• |

|

|

|

natural disasters, flooding and other significant and severe weather-related events, including those caused by global climate change; |

|

|

• |

|

|

|

terrorist attacks and/or other man-made events; and |

|

|

• |

|

|

|

decline in population or shifting demographics.

|

The incidence of some or all of these factors could reduce occupancy, rental rates and the fair value of the Account’s real properties or interests in investment vehicles (such as limited partnerships) which directly hold real properties.

|

• |

|

|

|

Concentration Risk. The Account may experience periods in which its investments are geographically concentrated, either regionally or in certain markets with similar demographics. Further, while the Account seeks diversification across its four primary property types: office, industrial, retail and multifamily residential properties,

the Account may experience periods where it has concentration in one property type, increasing the potential exposure if there were to be an oversupply of, or a reduced demand for, certain types of real estate properties in the markets in which the Account operates. |

|

|

|

|

|

|

Also, the Account may experience periods in which its tenant base is concentrated within a particular industry sector. For example, the Account owns and operates a number of industrial properties, which typically feature larger tenant concentration. The insolvency and/or closing of a single tenant in one of our industrial

properties may significantly impair the income generated by an industrial property, and may also depress the value of such property.

|

In addition, the Account owns and operates a number of properties in the Washington, DC metropolitan area and a prolonged period of significantly diminished federal expenditures could have an adverse impact on demand for office space by the U.S. government and the sectors and industries dependent upon the U.S. government

in such region or other regions where the government or such related businesses are large lessees.

If any or all of these events occur, the Account’s income and performance may be adversely impacted disproportionately by deteriorating economic conditions in those areas or industry sectors in which the Account’s investments are concentrated. Also, the Account could experience a more rapid negative change in the value of its

real estate investments than would be the case if its real estate investments were more diversified.

|

• |

|

|

|

Leasing Risk. A number of factors could cause the Account’s rental income, a key source of the Account’s revenue and investment return, to decline, which would adversely impact the Account’s results and investment returns. These factors include the following:

|

|

|

• |

|

|

|

A property may be unable to attract new tenants or retain existing tenants. This situation could be exacerbated if a concentration of lease expirations occurred during any one time period or multiple tenants exercise early termination at the same time.

|

TIAA Real Estate Account ¡ Prospectus15

|

|

• |

|

|

|

The financial condition of our tenants may be adversely impacted, particularly in a prolonged economic downturn. The Account could lose revenue if tenants do not pay rent when contractually obligated, request some form of rent relief and/or default under a lease at one of the Account’s properties. Such a default could occur if

a tenant declared bankruptcy, suffered from a lack of liquidity, failed to continue to operate its business or for other reasons. In the event of any such default, we may experience a delay in, or an inability to effect, the enforcement of our rights against that tenant, particularly if that tenant filed for bankruptcy protection. Further,

any disputes with tenants could involve costly and time consuming litigation. |

|

|

• |

|

|

|

In the event a tenant vacates its space at one of the Account’s properties, whether as a result of a default, the expiration of the lease term, rejection of the lease in bankruptcy or otherwise, given current market conditions, we may not be able to re-lease the vacant space either (i) for as much as the rent payable under the

previous lease or (ii) at all. Also, we may not be able to re-lease such space without incurring substantial expenditures for tenant improvements and other lease-up related costs, while still being obligated for any mortgage payments, real estate taxes and other expenditures related to the property.

|

|

|

• |

|

|

|

In some instances, our properties may be specifically suited to and/or outfitted for the particular needs of a certain tenant based on the type of business the tenant operates. For example, many companies desire space with an open floor plan. We may have difficulty obtaining a new tenant for any vacant space in our properties,

particularly if the floor plan limits the types of businesses that can use the space without major renovation, which may require us to incur substantial expense in re-planning the space. Also, upon expiration of a lease, the space preferences of our major tenants may no longer align with the space they previously rented, which

could cause those tenants to not renew their lease, or may require us to expend significant sums to reconfigure the space to their needs. |

|

|

• |

|

|

|

The Account owns and operates retail properties, which, in addition to the risks listed above, are subject to specific risks, including the insolvency and/or closing of an anchor tenant. Many times, anchor tenants will be “big box” stores and other large retailers that can be particularly adversely impacted by a global recession and

reduced consumer spending generally. Factors that can impact the level of consumer spending include increases in fuel and energy costs, residential and commercial real estate and mortgage conditions, labor and healthcare costs, access to credit, consumer confidence and other macroeconomic factors. Under certain

circumstances, co-tenancy clauses in tenants’ leases may allow certain tenants in a retail property to terminate their leases or reduce or withhold rental payments when overall occupancy at the property falls below certain minimum levels. The insolvency and/or closing of an anchor tenant may also cause such |

16Prospectus ¡ TIAA Real Estate Account

|

|

|

|

tenants to terminate their leases, or to fail to renew their leases at expiration. |

|

|

• |

|

|

|

Competition. The Account may face competition for real estate investments from multiple sources, including individuals, corporations, insurance companies or other insurance company separate accounts, as well as real estate limited partnerships, real estate investment funds, commercial developers, pension plans, other

institutional and foreign investors and other entities engaged in real estate investment activities. Some of these competitors may have similar financial and other resources as the Account, and/or they may have investment strategies and policies (including the ability to incur significantly more leverage than the Account) that

allow them to compete more aggressively for real estate investment opportunities, which could result in the Account paying higher prices for investments, experiencing delays in acquiring investments or failing to consummate such purchases. Any resulting delays in the acquisition of investments, or the failure to consummate

acquisitions the Account deems desirable, may increase the Account’s costs or otherwise adversely affect the Account’s investment results. |

|

|

|

|

|

|

|

In addition, the Account’s properties may be located close to properties that are owned by other real estate investors and that compete with the Account for tenants. These competing properties may be better located or more suitable for tenants than our properties, or have owners who may compete more aggressively for

tenants, resulting in a competitive advantage for these other properties. We may also face similar competition from other properties that may be developed in the future. This competition may limit the Account’s ability to lease space, increase its costs of securing tenants, and limit our ability to maximize our rents and/or require

the Account to make capital improvements it otherwise would not, in order to make its properties more attractive to prospective tenants.

|

|

|

|

• |

|

|

|

Operating Costs. A property’s cash flow could decrease if operating costs, such as property taxes, utilities, litigation expenses associated with a property, maintenance and insurance costs that are not reimbursed by tenants, increase in relation to gross rental income, or if the property needs unanticipated repairs and

renovations. In addition, the Account’s expenses of owning and operating a property are not necessarily reduced when the Account’s income from a property is reduced. |

|

|

• |

|

|

|

Condemnation. A governmental agency may condemn and convert for a public use (i.e., through eminent domain) all or a portion of a property owned by the Account. While the Account would receive compensation in connection with any such condemnation, such compensation may not be in an amount the Account believes

represents equivalent value for the condemned property. Further, a partial condemnation could impair the ability of the Account to maximize the value of the property during its operation, including making it more difficult to find new tenants or retain existing tenants. Finally, |

TIAA Real Estate Account ¡ Prospectus17

|

|

|

|

a property which has been subject to a partial condemnation may be more difficult to sell at a price the Account believes is appropriate. |

|

|

• |

|

|

|

Terrorism and Acts of War and Violence. Terrorist attacks may harm our property investments. The Account cannot assure you that there will not be further terrorist attacks against the United States or U.S. businesses or elsewhere in the world. These attacks or armed conflicts may directly or indirectly impact the value of the

property we own or that secure our loans. Losses resulting from these types of events may be uninsurable or not insurable to the full extent of the loss suffered. Moreover, any of these events could cause consumer confidence and spending to decrease or result in increased volatility in the United States, worldwide financial

markets, and the global economy. Such events could also result in economic uncertainty in the United States or abroad. Adverse economic conditions resulting from terrorist activities could reduce demand for space in the Account’s properties and thereby reduce the value of the Account’s properties and therefore your

investment return.

|

General Risks of Selling Real Estate Investments: Among the risks of selling real estate investments are:

|

• |

|

|

|

The sale price of an Account property might differ, perhaps significantly, from its estimated or appraised value, leading to losses or reduced profits to the Account. |

|

|

• |

|

|

|

The Account might not be able to sell a property at a particular time for a price which management believes represents its fair or full value. This illiquidity may result from the cyclical nature of real estate, general economic conditions impacting the location of the property, disruption in the credit markets or the availability of

financing on favorable terms or at all, and the supply of and demand for available tenant space, among other reasons. This might make it difficult to raise cash quickly which could impair the Account’s liquidity position (particularly during any period of sustained significant net participant outflows) and also could lead to Account

losses. Further, the liquidity guarantee does not serve as a working capital facility or credit line to enhance the Account’s liquidity levels generally, as its purpose is tied to participants having the ability to redeem their accumulation units upon demand (thus, alleviating the Account’s need to dispose of properties solely to

increase liquidity levels in what management deems a suboptimal sales environment). |

|

|

• |

|

|

|

The Account may need to provide financing to a purchaser if no cash buyers are available, or if buyers are unable to receive financing on terms enabling them to consummate the purchase. Such seller financing introduces a risk that the counterparty may not perform its obligations to repay the amounts borrowed from the Account

to complete the purchase. |

|

|

• |

|

|

|

For any particular property, the Account may be required to make expenditures for improvements to, or to correct defects in, the property before the Account is able to market and/or sell the property.

|

18Prospectus ¡ TIAA Real Estate Account

|

|

• |

|

|

|

Interests in real estate limited partnerships tend to be in particular illiquid, and the Account may be unable to dispose of such investments at opportune times.

|

Valuation and Appraisal Risks: Investments in the Account’s assets are stated at fair value, which is defined as the price that would be received to sell the asset in an orderly transaction between market participants at the measurement date. Determination of fair value, particularly for real estate assets, involves significant

judgment. Valuation of the Account’s real estate properties (which comprise a substantial majority of the Account’s net assets) are based on real estate appraisals, which are estimates of property values based on a professional’s opinion and may not be accurate predictors of the amount the Account would actually receive if it sold a

property. Appraisals can be subjective in certain respects and rely on a variety of assumptions and conditions at that property or in the market in which the property is located, which may change materially after the appraisal is conducted. Among other things, market prices for comparable real estate may be volatile, in particular if there

has been a lack of recent transaction activity in such market. Recent disruptions in the macroeconomy, real estate markets and the credit markets have led to a significant decline in transaction activity in most markets and sectors and the lack of observable transaction data may have made it more difficult for an appraisal to

determine the fair value of the Account’s real estate. In addition, a portion of the data used by appraisers is based on historical information at the time the appraisal is conducted, and subsequent changes to such data, after an appraiser has used such data in connection with the appraisal, may not be adequately captured in the

appraised value. Also, to the extent that the Account uses a relatively small number of independent appraisers to value a significant portion of its properties, valuations may be subject to any institutional biases of such appraisers and their valuation procedures.

Further, as the Account generally obtains appraisals on a quarterly basis, there may be circumstances in the period between appraisals or interim valuation adjustments in which the true realizable value of a property is not reflected in the Account’s daily net asset value calculation or in the Account’s periodic consolidated financial

statements. This disparity may be more apparent when the commercial and/or residential real estate markets experience an overall and possibly dramatic decline (or increase) in property values in a relatively short period of time between appraisals.

If the appraised values of the Account’s properties as a whole are too high, those participants who purchased accumulation units prior to (i) a downward valuation adjustment of a property or multiple properties or (ii) a property or properties being sold for a lower price than the appraised value will be credited with less of an interest

than if the value had previously been adjusted downward. Also, those participants who redeem during any such period will have received more than their pro rata share of the value of the Account’s assets, to the detriment of other non-redeeming participants. In particular, appraised property values may prove to be too high (as a whole)

in a rapidly declining commercial

TIAA Real Estate Account ¡ Prospectus19

real estate market. Further, implicit in the Account’s definition of fair value is a principal assumption that there will be a reasonable time to market a given property and that the property will be exchanged between a willing buyer and willing seller in a nondistressed scenario. However, an appraised value may not reflect the actual

realizable value that would be obtained in a rush sale where time was of the essence. Also, appraised values may lag actual realizable values to the extent there is significant and rapid economic deterioration in a particular geographic market or a particular sector within a geographic market.

If the appraised values of the Account’s properties as a whole are too low, those participants who redeem prior to (i) an upward valuation adjustment of a property or multiple properties or (ii) a property or properties being sold for a higher price than the appraised value will have received less than their pro rata share of the value of

the Account’s assets, and those participants who purchase units during any such period will be credited with more than their pro rata share of the value of the Account’s assets.

Finally, the Account recognizes items of income (such as net operating income from real estate investments, distributions from real estate limited partnerships or joint ventures, or dividends from REIT stocks) and expense in many cases on an intermittent basis, where the Account cannot predict with certainty the magnitude or the

timing of such item. As such, even as the Account estimates items of net operating income on a daily basis, the AUV for the Account may fluctuate, perhaps significantly, from day to day, as a result of adjusting these estimates for the actual recognized item of income or expense.

Investment Risk Associated with Participant Transactions: The amount we have available to invest in new properties and other real estate-related assets will depend, in large part, on the level of net participant transfers into or out of the Account as well as participant premiums into the Account. As noted elsewhere in this prospectus,

the Account intends to hold between 15% and 25% of its net assets in publicly traded, liquid investments (other than real estate and real estate-related investments), comprised of publicly traded, liquid investments. These liquid assets are intended to be available to purchase real estate-related investments in accordance with the

Account’s investment objective and strategy and are also available to meet participant redemption requests and the Account’s expense needs (including, from time to time, obligations on debt). Significant participant transaction activity into or out of the Account’s units is generally not predictable, and wide fluctuations can occur as a

result of macroeconomic or geopolitical conditions, the performance of equities or fixed income securities or general investor sentiment, regardless of the historical performance of the Account or of the performance of the real estate asset class generally.

In the second half of 2008 and in 2009, the Account experienced significant net participant transfers out of the Account, eventually causing the Account’s liquid assets to comprise less than 10% of the Account’s assets (on a net and total basis) throughout all of 2009 and into early 2010. Due in large part to this activity, the TIAA

liquidity guarantee was initially executed in December 2008. See “Establishing and managing the Account — The role of TIAA — Liquidity

20Prospectus ¡ TIAA Real Estate Account

guarantee” on page 45. Among other things, this continued shortfall in the amount of liquid assets impaired management’s ability to consummate new transactions. If a significant amount of net participant transfers out of the Account were to recur, particularly in high volumes similar to those experienced in late 2008 and 2009, we

may not have enough available liquid assets to pursue, or consummate, new investment opportunities presented to us that are otherwise attractive to the Account. This, in turn, could harm the Account’s returns. Even though net transfers out of the Account ceased in early 2010 and, as of the date of this prospectus, the Account has

been in a net inflow position since such time, there is no guarantee that redemption activity will not increase again, perhaps in a significant and rapid manner.

Alternatively, periods of significant net transfer activity into the Account can result in the Account holding a higher percentage of its net assets in publicly traded liquid non-real estate-related investments than the Account’s managers would target to hold under the Account’s long-term strategy. As of December 31, 2013, the

Account’s non-real estate-related liquid assets comprised 18.5% of its net assets. At times, the portion of the Account’s net assets invested in these types of liquid instruments may exceed 25%, particularly if the Account receives a large inflow of money in a short period of time, coupled with a lack of attractive real estate-related

investments on the market. Also, large inflows from participant transactions often occur in times of appreciating real estate values and pricing, which can render it challenging to execute on some transactions at ideal prices.

In an appreciating real estate market generally, this large percentage of assets held in liquid investments and not in real estate and real estate-related investments may impair the Account’s overall returns. This scenario may be exacerbated in a low interest rate environment for U.S. Treasury securities and related highly liquid

securities, such as has existed since 2009 and which may persist in the future. In addition, to manage cash flow, the Account may temporarily hold a higher percentage of its net assets in liquid real estate-related securities, such as REIT and CMBS securities, than its long-term targeted holdings in such securities, particularly during

and immediately following times of significant net transfer activity into the Account. Such holdings could increase the volatility of the Account’s returns.

Risks of Borrowing: The Account acquires some of its properties subject to existing financing and from time to time borrows new funds at the time of purchase. Also, the Account may from time to time place new leverage on, increase the leverage already placed on, or refinance maturing debt on, existing properties the Account owns.

Under the Account’s current investment guidelines, the Account intends to maintain its loan to value ratio at or below 30% (measured at the time of incurrence and after giving effect thereto). As of December 31, 2013, the Account’s loan to value ratio was approximately 18.4%. Also, the Account may borrow up to 70% of the then-

current value of a particular property. Non-construction mortgage loans on a property will be non-recourse to the Account.

TIAA Real Estate Account ¡ Prospectus21

Among the risks of borrowing money or otherwise investing in a property subject to a mortgage are:

|

• |

|

|

|

General Economic Conditions. General economic conditions, dislocations in the capital or credit markets generally or the market conditions then in effect in the real estate finance industry, may hinder the Account’s ability to obtain financing or refinancing for its property investments on favorable terms or at all, regardless of the

quality of the Account’s property for which financing or refinancing is sought. Such unfavorable terms might include high interest rates, increased fees and costs and restrictive covenants applicable to the Account’s operation of the property. Longer term disruptions in the capital and credit markets as a result of uncertainty,

changing or increased regulation, reduced alternatives, rising interest rates or failures of significant financial institutions could adversely affect our access to financing necessary to make profitable real estate investments. Our failure to obtain financing or refinancing on favorable terms due to the current state of the credit

markets or otherwise could have an adverse impact on the returns of the Account. Also, the Account’s ability to secure financing may be impaired if negative marketplace effects such as those which followed from the worldwide economic slowdown following the banking crisis of 2008 and the subsequent sovereign debt and

banking difficulties recently experienced in parts of the Eurozone were to persist. These difficulties could include tighter lending standards instituted by banks and financial institutions, the reduced availability of credit facilities and project finance facilities from banks and the fall of consumer and/or business confidence. |

|

|

• |

|

|

|

Default Risk. The property or group of encumbered properties may not generate sufficient cash flow to support the debt service on the loan, the property may fail to meet certain financial or operating covenants contained in the loan documents and/or the property may have negative equity (i.e., the loan balance exceeds the value

of the property) or inadequate equity. In any of these circumstances, we (or a joint venture in which we invest) may default on the loan, including due to the failure to make required debt service payments when due. If a loan is in default, the Account or the venture may determine that it is not economically desirable and/or in the

best interests of the Account to continue to make payments on the loan (including accessing other sources of funds to support debt service on the loan), and/or the Account or venture may not be able to otherwise remedy such default on commercially reasonable terms or at all. In either case, the lender then could accelerate

the outstanding amount due on the loan and/or foreclose on the underlying property, in which case the Account could lose the value of its investment in the foreclosed property. Further, any such default or acceleration could trigger a default under loan agreements in respect of other Account properties pledged as security for the

defaulted loan or other loans. Finally, any such default could increase the Account’s borrowing costs, or result in less favorable terms, with respect to financing future properties.

|

22Prospectus ¡ TIAA Real Estate Account

|

|

• |

|

|

|

Balloon Maturities. If the Account obtains a mortgage loan that involves a balloon payment, there is a risk that the Account may not be able to make the lump sum principal payment due under the loan at the end of the loan term, or otherwise obtain adequate refinancing on terms commercially acceptable to the Account or at all.

The Account then may be forced to sell the property or other properties under unfavorable market conditions, restructure the loan on terms not advantageous to the Account, or default on its mortgage, resulting in the lender exercising its remedies, which may include repossession of the property, and the Account could lose the

value of its investment in that property. |

|

|

• |

|

|

|

Variable Interest Rate Risk. If the Account obtains variable-rate loans, the Account’s returns may be volatile when interest rates are volatile. Further, to the extent that the Account takes out fixed-rate loans and interest rates subsequently decline, this may cause the Account to pay interest at above-market rates for a significant

period of time. Any interest rate hedging activities the Account engages in to mitigate this risk may not fully protect the Account from the impact of interest rate volatility. |

|

|

|

• |

|

|

|

Variable Rate Demand Obligation (VRDO) Risk. To the extent the Account obtains financing pursuant to a variable rate demand obligation subject to periodic remarketing or similar mechanisms, the Account or the joint ventures in which it invests could face higher borrowing costs if the remarketing results in a higher prevailing

interest rate. In addition, the terms of such variable rate obligations may allow the remarketing agent to cause the Account or venture to repay the loan on demand in the event insufficient market demand for such loans is present. In particular, RGM 42, LLC, a joint venture in which the Account holds a 70% interest, is the