Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Apollo Commercial Real Estate Finance, Inc. | d715971d8k.htm |

| EX-99.1 - EX-99.1 - Apollo Commercial Real Estate Finance, Inc. | d715971dex991.htm |

April 30, 2014

Supplemental Financial Information Presentation

Q1 2014

Information is as of March 31, 2014 except as otherwise noted.

It should not be assumed that investments made in the future will

be profitable or will equal the performance of investments in this document.

Exhibit 99.2 |

1

COMMERCIAL REAL ESTATE FINANCE, INC. (“ARI”)

Legal Disclaimer

We make forward-looking statements in this presentation and other

filings we make with the SEC within the meaning of Section 27A of the Securities Act of 1933, as amended, and

Section 21E of the Securities Exchange Act of 1934, as amended, and

such statements are intended to be covered by the safe harbor provided by the same. Forward-looking

statements are subject to substantial risks and uncertainties, many of

which are difficult to predict and are generally beyond our control. These forward-looking statements include

information about possible or assumed future results of our business,

financial condition, liquidity, results of operations, plans and objectives. When we use the words “believe,”

“expect,”

“anticipate,”

“estimate,”

“plan,”

“continue,”

“intend,”

“should,”

“may”

or similar expressions, we intend to identify forward-looking

statements. Statements regarding the following subjects, among

others, may be forward-looking: our business and investment strategy; our operating results; our ability to obtain and maintain financing

arrangements;

the

return

on

equity,

the

yield

on

investments

and

risks

associated

with

investing

in

real

estate

assets,

including

changes

in

business

conditions

and

the

general

economy.

The forward-looking statements are based on our beliefs,

assumptions and expectations of our future performance, taking into account all information currently available to us.

Forward-looking statements are not predictions of future events.

These beliefs, assumptions and expectations can change as a result of many possible events or factors, not all of

which are known to us. Some of these factors are described under

“Risk Factors,”

and “Management’s Discussion and Analysis of Financial

Condition and Results of Operations” as

included

in

ARI’s

Annual

Report

on

Form

10-K

for

the

fiscal

year

ended

December

31,

2013

and

other

periodic

reports

filed

with

the

Securities

and

Exchange

Commission.

If

a

change occurs, our business, financial condition, liquidity and results

of operations may vary materially from those expressed in our forward-looking statements. Any forward-looking

statement speaks only as of the date on which it is made. New risks and

uncertainties arise over time, and it is not possible for us to predict those events or how they may affect us.

Except as required by law, we are not obligated to, and do not intend

to, update or revise any forward-looking statements, whether as a result of new information, future events or

otherwise.

This presentation may contain statistics and other data that in some

cases has been obtained from or compiled from information made available by third-party service providers.

Apollo makes no representation or warranty, expressed or implied, with

respect to the accuracy, reasonableness or completeness of such information.

Past performance is not indicative nor a guarantee of future

returns. Index performance and yield data are shown for

illustrative purposes only and have limitations when used for comparison or for other purposes due to, among other matters,

volatility,

credit

or

other

factors

(such

as

number

and

types

of

securities).

Indices

are

unmanaged,

do

not

charge

any

fees

or

expenses,

assume

reinvestment

of

income

and

do

not

employ special investment techniques such as leveraging or short

selling. No such index is indicative of the future results of

any investment by ARI. |

2

COMMERCIAL REAL ESTATE FINANCE, INC. (“ARI”)

Apollo Commercial Real Estate Finance, Inc.

2014 First Quarter Earnings Call

April 30, 2014

Stuart Rothstein

Chief Executive Officer and President

Scott Weiner

Chief Investment Officer of the Manager

Megan Gaul

Chief Financial Officer, Treasurer and Secretary

Hilary Ginsberg

Investor Relations Manager |

3

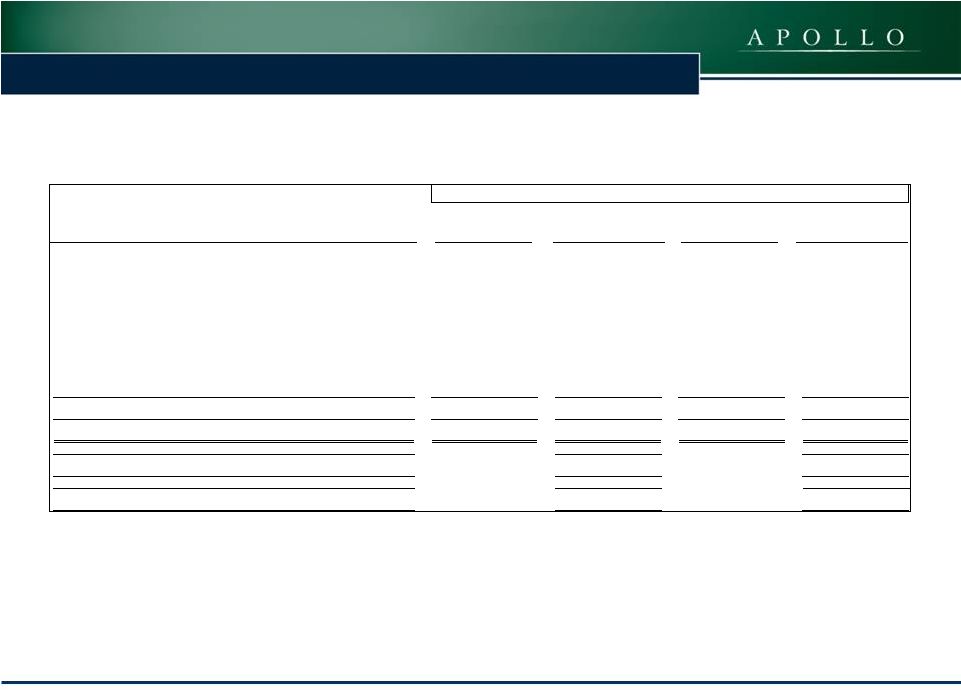

COMMERCIAL REAL ESTATE FINANCE, INC. (“ARI”)

ARI –

Financial Summary

Income Statement

March 31, 2014

March 31, 2013

% Change

21,160

$

18,135

$

16.7%

(1,757)

$

(1,068)

$

64.5%

Net interest income (in thousands)

19,403

$

17,067

$

13.7%

Operating earnings (in thousands)

13,991

$

11,963

$

17.0%

0.37

$

0.39

$

-5.1%

37,341,050

30,480,689

22.5%

Balance sheet

March 31, 2014

December 31, 2013

% Change

843,669

$

848,761

$

-0.6%

706,802

$

676,855

$

4.4%

Common stockholders equity (in thousands)

601,662

$

596,706

$

0.8%

86,250

$

86,250

$

-

166,994

$

202,033

$

-17.3%

Convertible senior notes (in thousands)

139,163

$

-

$

100.0%

0.5x

0.4x

5.1x

5.3x

Three Months Ended

Interest income (in thousands)

Interest expense (in thousands)

Operating earnings per share

(1)

Diluted weighted average shares of common

stock outstanding

Investments at amortized cost (in thousands)

Net equity in investments at cost (in thousands

Preferred stockholders equity (in thousands)

Debt to common equity

Outstanding borrowings (in thousands)

Fixed charge coverage

(2)

)

(1)

Operating Earnings is a non-GAAP financial measure that is used by

the Company to approximate cash available for distribution and is defined by the Company as net income available to common stockholders, computed in accordance with

GAAP, adjusted for (i) equity-based compensation expense (a

portion of which may become cash-based upon final vesting and settlement of awards should the holder elect net share settlement to satisfy income tax withholding) (ii) any unrealized

gains or losses or other non-cash items included in net income and

(iii) the non-cash amortization expense related to the reclassification of a portion of the senior convertible notes to stockholders’ equity in accordance with GAAP. Please see

slide 20 for a reconciliation of Operating Earnings and Operating

Earnings per Share to GAAP net income and GAAP net income per share.

(2)

Fixed charge coverage is EBITDA divided by interest expense plus the

preferred stock dividends. |

4

COMMERCIAL REAL ESTATE FINANCE, INC. (“ARI”)

ARI –

Historical Financial Overview

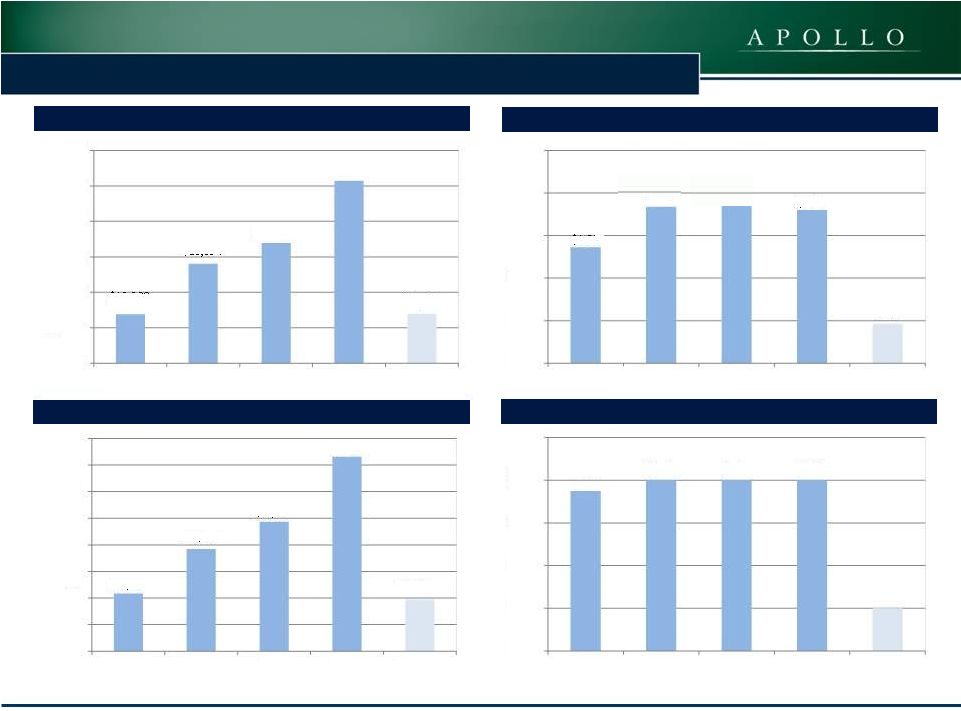

Operating Earnings ($000s)

(1)

Net Interest Income ($000s)

Dividends per Common Share

Operating Earnings per Share

(1)

(1)

Operating Earnings is a non-GAAP financial measure that is used by

the Company to approximate cash available for distribution and is defined by the Company as net income available to common stockholders, computed in accordance with GAAP, adjusted for (i) equity-based compensation

expense (a portion of which may become cash-based upon final vesting

and settlement of awards should the holder elect net share settlement to satisfy income tax withholding) (ii) any unrealized gains or losses or other non-cash items included in net income and (iii) the non-cash amortization

expense related to the reclassification of a portion of the senior

convertible notes to stockholders’ equity in accordance with GAAP. Please see slide 20 for a reconciliation of Operating Earnings and Operating Earnings per Share to GAAP net income and GAAP net income per share.

$13,830

$28,054

$33,914

$51,443

$13,991

$0

$10,000

$20,000

$30,000

$40,000

$50,000

$60,000

2010

2011

2012

2013

Q1 2014

$1.09

$1.44

$0.37

$0.00

$0.40

$0.80

$1.20

$1.60

$2.00

2010

2011

2012

2013

Q1 2014

$1.50

$1.60

$1.60

$1.60

$0.40

$0.00

$0.40

$0.80

$1.20

$1.60

$2.00

2010

2011

2012

2013

Q1 2014

$21,771

$38,464

$48,677

$73,107

$19,403

$0

$10,000

$20,000

$30,000

$40,000

$50,000

$60,000

$70,000

$80,000

2010

2011

2012

2013

Q1 2014

$1.47

$1.50 |

5

COMMERCIAL REAL ESTATE FINANCE, INC. (“ARI”)

ARI –

Q1 Highlights

Financial Results & Earnings Per Share

Operating

Earnings

for

the

quarter

ended

March

31,

2014

of

$14.0

million,

or

$0.37

per

diluted

share

of

common

stock

(1)

–

Net interest income of $19.4 million for Q1 2014

–

Total expenses of $4.0 million, comprised of management fees of $2.6

million, G&A of $1.0 million and equity-based

compensation of $0.4 million

–

GAAP

net

income

available

to

common

stockholders

for

the

quarter

ended

March

31,

2014

of

$15.7

million,

or

$0.42

per

diluted share of common stock

Dividends

Declared a dividend of $0.40 per share of common stock for the quarter

ended June 30, 2014 –

9.4% annualized dividend yield based on $17.04 closing price on April

28, 2014 Declared a dividend on the Company’s 8.625% Series

A Cumulative Redeemable Perpetual Preferred Stock of $0.5391 per

share for stockholders of record on March 31, 2014 (1) Operating Earnings is a

non-GAAP financial measure that is used by the Company to approximate cash available for distribution and is defined by the Company as net income available to common stockholders, computed

in accordance with GAAP, adjusted for (i) equity-based compensation

expense (a portion of which may become cash-based upon final vesting and settlement of awards should the holder elect net share settlement to satisfy

income tax withholding) (ii) any unrealized gains or losses or other

non-cash items included in net income and (iii) the non-cash amortization expense related to the reclassification of a portion of the senior convertible

notes to stockholders’ equity in accordance with GAAP.

Please see slide 20 for a reconciliation of Operating Earnings and Operating Earnings per Share to GAAP net income and GAAP net income per share. |

6

COMMERCIAL REAL ESTATE FINANCE, INC. (“ARI”)

ARI –

Q1 Highlights

Investment and Portfolio Activity

First

Mortgage

Loan

–

Maryland

Condominium

Development

$80 million floating rate first mortgage loan ($25 million of which was

funded at closing) for the development of a 50-unit luxury

condominium Term

–

30

months

with

a

6-month

extension

option

Underwritten

loan-to-net-sellout

(inclusive

of

cash

held

as

collateral)

–

68%

Underwritten IRR

(1)

~ 15%

Loan Repayment

Principal

repayment

from

a

$15

million

mezzanine

loan

secured

by

a

hotel

in

New

York

City

Realized IRR ~ 14%

Capital Market Activity

Amendment of Wells Facility

Extended the maturity date for one year to March 2015 and lowered the

interest rate to LIBOR+80 basis points

(1) The IRR for the investments shown in

this presentation reflect the returns underwritten by ACREFI Management, LLC, the Company’s external manager (the “Manager”), calculated on a weighted average basis assuming no dispositions, early prepayments or defaults but

assuming that extension options are exercised and that the cost of

borrowings under the master repurchase agreement with Wells Fargo Bank, N.A. (the “Wells Facility”) remains constant over the remaining terms and extension terms under this facility. With respect to

certain loans, the IRR calculation assumes certain estimates with

respect to the timing and magnitude of future fundings for the remaining commitments and associated loan repayments, and assumes no defaults. IRR is the annualized effective compounded return rate that

accounts for the time-value of money and represents the rate of

return on an investment over a holding period expressed as a percentage of the investment. It is the discount rate that makes the net present value of all cash outflows (the costs of investment) equal to the net

present value of cash inflows (returns on investment). It is derived

from the negative and positive cash flows resulting from or produced by each transaction (or for a transaction involving more than one investment, cash flows resulting from or produced by each of the

investments), whether positive, such as investment returns, or negative,

such as transaction expenses or other costs of investment, taking into account the dates on which such cash flows occurred or are expected to occur, and compounding interest accordingly. There can

be no assurance that the actual IRRs will equal the underwritten IRRs

shown above. See “Item 1A—Risk Factors—The Company may not achieve its underwritten internal rate of return on its investments which may lead to future returns that may be significantly lower than

anticipated” included in the Company’s Annual Report on Form

10-K for the year ended December 31, 2013 for a discussion of some of the factors that could adversely impact the returns received by the Company from the investments shown in the table over time.

|

7

COMMERCIAL REAL ESTATE FINANCE, INC. (“ARI”)

Capital Markets Activity (cont.)

Convertible Notes Offering

$143.75 million aggregate principal amount of 5.50% Convertible Senior

Notes due 2019 (the “Notes”) Initial conversion rate

equals 55.3649 shares of common stock per $1,000 principal amount of Notes, which is equivalent

to a conversion price of $18.06 per share of common stock,

representing a 10% conversion premium based upon the closing

price of the Company’s common stock of $16.42 per share on March 11, 2014

Portfolio Summary

Total investments with an amortized cost of $844 million at March 31,

2014 Current

weighted

average

underwritten

IRR

of

approximately

12.6%

and

levered

weighted

average

underwritten

IRR

of

approximately

14.1%

at

March

31,

2014

(1)

Book Value Per Share

GAAP book value of $16.21 per share as of March 31, 2014

Fair

value

of

$16.31

per

share

as

of

March

31,

2014

(2)

ARI –

Q1 Highlights

(1)

The underwritten IRR for the investments shown in this presentation

reflect the returns underwritten by the Manager, calculated on a weighted average basis assuming no dispositions, early prepayments or defaults but assuming that extension options

are exercised and that the cost of borrowings under the Wells Facility

remains constant over the remaining terms and extension terms under this facility. With respect to certain loans, the underwritten IRR calculation assumes certain estimates with

respect to the timing and magnitude of future fundings for the remaining

commitments and associated loan repayments, and assumes no defaults. IRR is the annualized effective compounded return rate that accounts for the time-value of money and

represents the rate of return on an investment over a holding period

expressed as a percentage of the investment. It is the discount rate that makes the net present value of all cash outflows (the costs of investment) equal to the net present value of cash

inflows (returns on investment). It is derived from the negative and

positive cash flows resulting from or produced by each transaction (or for a transaction involving more than one investment, cash flows resulting from or produced by each of the

investments), whether positive, such as investment returns, or negative,

such as transaction expenses or other costs of investment, taking into account the dates on which such cash flows occurred or are expected to occur, and compounding interest

accordingly. There can be no assurance that the actual IRRs will equal

the underwritten IRRs shown above. See “Item 1A—Risk Factors—The Company may not achieve its underwritten internal rate of return on its investments which may lead to future

returns that may be significantly lower than anticipated” included

in the Company’s Annual Report on Form 10-K for the year ended December 31, 2013 for a discussion of some of the factors that could adversely impact the returns received by the

Company from the investments shown in the table over time. In

addition, substantially all of the Company’s borrowings under the Company’s master repurchase agreement with JP Morgan Chase Bank, N.A. (the “ JPMorgan Facility”) were

repaid. The Company's ability to achieve its underwritten levered

weighted average IRR with regard to its portfolio of first mortgage loans is additionally dependent upon the Company re-borrowing approximately $88,000 under the JPMorgan Facility

or any replacement facility. Without such re-borrowing,

the levered weighted average underwritten IRRs would be the current weighted average underwritten IRR.

(2)

The Company carries loans at amortized cost and its CMBS are marked to

market. Management has estimated that the fair value of the Company’s financial assets at March 31, 2014 was approximately $3.7 million greater than the carrying value of the

Company’s investment portfolio as of the same date. This

represents a premium of $0.10 per share over the Company's GAAP book value as of March 31, 2014. |

8

COMMERCIAL REAL ESTATE FINANCE, INC. (“ARI”)

ARI –

Subsequent Events

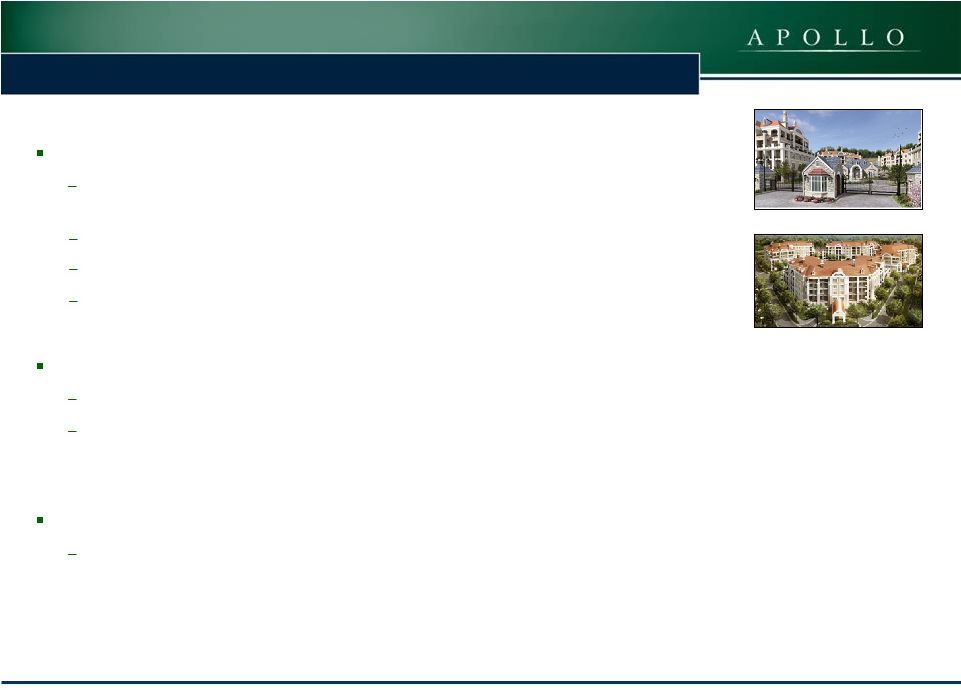

First Mortgage Loan –

Portfolio of Luxury Destination Club Residences

Mezzanine Loan –

Pre-development of London Condominium

Commercial Mortgage Backed Securities (“CMBS”)

Investment $210 million fixed rate, five-year first mortgage

loan secured by a portfolio of 229 single-family and

condominium homes located across North and Central America, the Caribbean and England;

Simultaneously with closing, ARI syndicated $104 million of the first

mortgage to other funds managed by affiliates of Apollo Global

Management, LLC and retained a $106 million participation

Underwritten

unlevered

IRR

(1)

~

8.2%;

Underwritten

levered

IRR

(1)

~

15%

$54.0 million (£32.1 million) fixed rate, nine-month mezzanine

loan in connection with the purchase of an existing commercial

building that is expected to be re-developed into a 173,000

salable square foot residential condominiums in Central London

Appraised

LTV

–

78%

Underwritten

IRR

(1)

~

12%

$24.7 million of equity deployed to acquire legacy CMBS originally

rated AAA with an aggregate purchase price of $123.4 million and

a weighted average life of 3.2 years Financed using $98.7 million

of borrowings under a new $100 million term repurchase facility

Underwritten

IRR

(1)

~

17%

(1)

The underwritten IRR for the investments shown in this presentation

reflect the returns underwritten by the Manager, calculated on a weighted average basis assuming no dispositions, early prepayments or defaults but assuming that extension options are exercised and that the cost of

borrowings under the Wells Facility remains constant over the remaining

terms and extension terms under this facility. With respect to certain loans, the underwritten IRR calculation assumes certain estimates with respect to the timing and magnitude of future fundings for the remaining

commitments and associated loan repayments, and assumes no defaults. IRR

is the annualized effective compounded return rate that accounts for the time-value of money and represents the rate of return on an investment over a holding period expressed as a percentage of the investment. It

is the discount rate that makes the net present value of all cash

outflows (the costs of investment) equal to the net present value of cash inflows (returns on investment). It is derived from the negative and positive cash flows resulting from or produced by each transaction (or for a transaction

involving more than one investment, cash flows resulting from or

produced by each of the investments), whether positive, such as investment returns, or negative, such as transaction expenses or other costs of investment, taking into account the dates on which such cash flows occurred or

are expected to occur, and compounding interest accordingly. There can

be no assurance that the actual IRRs will equal the underwritten IRRs shown above. See “Item 1A—Risk Factors—The Company may not achieve its underwritten internal rate of return on its investments which may

lead to future returns that may be significantly lower than

anticipated” included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2013 for a discussion of some of the factors that could adversely impact the returns received by the Company from the

investments shown in the table over time.

Appraised Loan-to-Value (“LTV”) – 49%

|

9

COMMERCIAL REAL ESTATE FINANCE, INC. (“ARI”)

ARI –

Portfolio Overview

Asset Type

($000s)

Amortized

Cost

Borrowings

Equity

at Cost

(1)

Remaining

Weighted

Average Life

(years )

(2)

Current

Weighted

Average

Underwritten

IRR

(3)(4)

Levered

Weighted

Average

Underwritten

IRR

(3)(5)

First Mortgage Loans

$ 185,513

1.9

11.1%

18.8%

Subordinate Loans

484,979

-

484,979

3.7

13.1%

13.1%

CMBS

173,174

166,991

36,310

3.1

13.9%

13.9%

Investments at March 31, 2014

3.2 Years

12.6%

14.1%

As of March 31, 2014.

(1)

Includes $30.1 million of restricted cash related to the UBS

Facility.

(2)

Remaining Weighted Average Life assumes all extension options are

exercised.

(3)

Borrowings under the JPMorgan Facility bear interest at LIBOR plus 250

basis points, or 2.7% at March 31, 2014. The IRR calculation further assumes the JPMorgan Facility or any replacement facility will remain available over the life of these investments.

(4)

The underwritten IRR for the investments shown in this table reflect the

returns underwritten by the Manager, calculated on a weighted average basis assuming no dispositions, early prepayments or defaults but assuming that extension options are exercised

and that the cost of borrowings under the Wells Facility remains

constant over the remaining terms and extension terms under this facility. With respect to certain loans, the underwritten IRR calculation assumes certain estimates with respect to the timing and

magnitude of future fundings for the remaining commitments and

associated loan repayments, and assumes no defaults. IRR is the annualized effective compounded return rate that accounts for the time-value of money and represents the rate of return on an

investment over a holding period expressed as a percentage of the

investment. It is the discount rate that makes the net present value of all cash outflows (the costs of investment) equal to the net present value of cash inflows (returns on investment). It is derived

from the negative and positive cash flows resulting from or produced by

each transaction (or for a transaction involving more than one investment, cash flows resulting from or produced by each of the investments), whether positive, such as investment returns,

or negative, such as transaction expenses or other costs of investment,

taking into account the dates on which such cash flows occurred or are expected to occur, and compounding interest accordingly. There can be no assurance that the actual IRRs will equal

the underwritten IRRs shown in the table. See “Item 1A—Risk

Factors—The Company may not achieve its underwritten internal rate of return on its investments which may lead to future returns that may be significantly lower than anticipated” included in the

Company’s Annual Report on Form 10-K for the year ended

December 31, 2013 for a discussion of some of the factors that could adversely impact the returns received by the Company from the investments shown in the table over time

(5)

The Company's ability to achieve its underwritten levered weighted

average IRR with regard to its portfolio of first mortgage loans is additionally dependent upon the Company re-borrowing approximately $88,000 in total under the JPMorgan Facility or any

replacement facility with similar terms. Without such

re-borrowing, the levered weighted average underwritten IRRs will be as indicated in the current weighted average underwritten IRR column above.

706,802

$

166,994

$

3

$

843,669

$

185,516

$ |

10

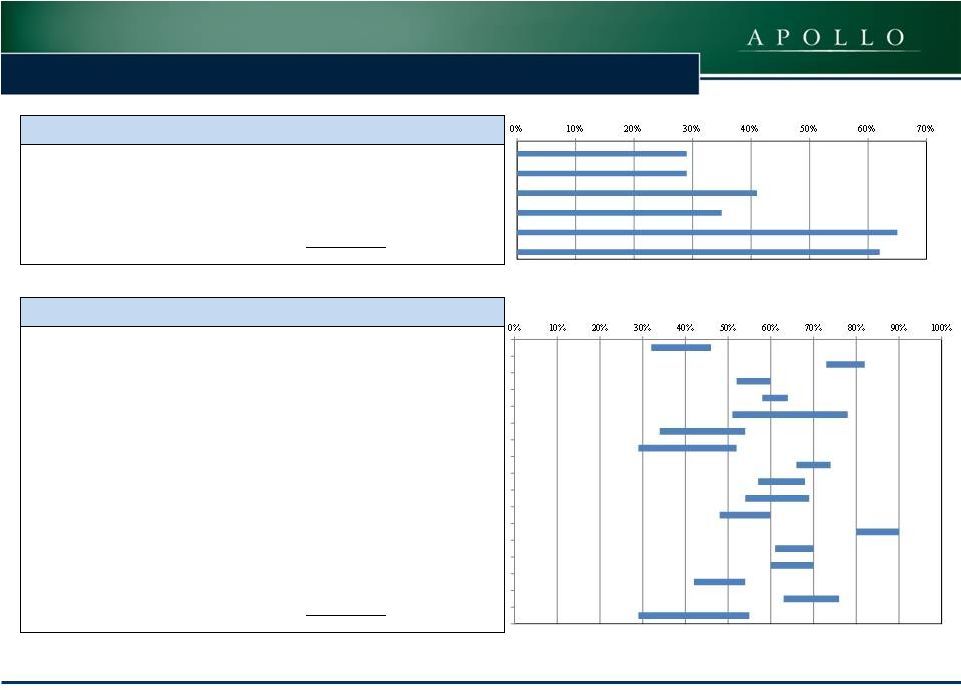

COMMERCIAL REAL ESTATE FINANCE, INC. (“ARI”)

ARI

–

Portfolio

Overview

Diversified Investment Portfolio with Amortized Cost Basis of $844

million Net Invested Equity at Amortized Cost Basis

Gross Assets at Amortized Cost Basis |

11

COMMERCIAL REAL ESTATE FINANCE, INC. (“ARI”)

ARI

–

Portfolio

Diversification

The portfolio is diversified by property type and geographic location

Geographic Diversification by Net Equity

Property Type by Net Equity

(1)

Other category includes the subordinate financing on a ski resort

|

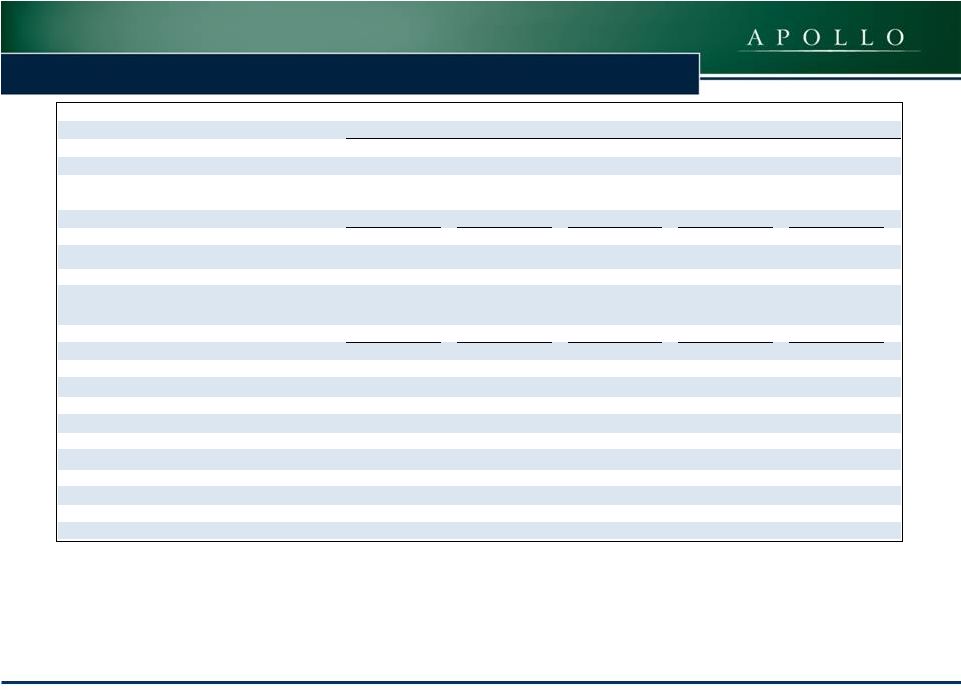

12

COMMERCIAL REAL ESTATE FINANCE, INC. (“ARI”)

ARI

–

Loan

Portfolio

-

Maturity

and

Type

Fully

Extended

Loan

Maturity

Schedule

($000s)

(1)(2)

(1)

Based upon Face Amount of Loans; Does not include CMBS.

(2)

Maturities reflect the fully funded amounts of the loans.

Loan

Position

and

Rate

Type

(1)

54% Floating Rate/46% Fixed Rate

Senior Loan Fixed

13%

Subordinate Loan

Fixed

33%

Subordinate Loan

Floating

39%

Senior Loan

Floating

15%

$91.0

$200.0

$-

$8.8

$-

$0

$40

$80

$120

$160

$200

$240

2014

2015

2016

2017

2018

2019

2020

2021

2022

2023

$32.0

$30.3

$111.0

$101.2

$185.7 |

13

COMMERCIAL REAL ESTATE FINANCE, INC. (“ARI”)

ARI

–

Loan

Portfolio

–

Loan

Level

LTV

(Through

Last

Invested

Dollar)

First Mortgage Loans

Subordinate Financings

Description ($ in thousands)

Location

Balance at

March 31, 2014

Starting

LTV

Ending

LTV

First Mortgage - Condo Conversion

(1)

New York

45,000

$

0%

29%

First Mortgage - Condo Conversion

(2)

New York

33,333

$

0%

29%

First Mortgage - Hotel

New York

31,242

$

0%

41%

First Mortgage - Office

New York

27,095

$

0%

35%

First Mortgage - Condo Development

Maryland

25,000

$

0%

65%

First Mortgage - Hotel

Maryland

24,853

$

0%

62%

Total

186,523

$

Description ($ in thousands)

Location

Balance at

March 31, 2014

Starting

LTV

Ending

LTV

Subordinate - Condo Development

New York

69,035

$

32%

46%

Subordinate - Office Portfolio

Florida

50,000

$

73%

82%

Subordinate - Hotel Portfolio

Various

48,271

$

52%

60%

Subordinate - Healthcare Portfolio

Various

47,000

$

58%

64%

Subordinate - Multifamily Conversion

New York

44,000

$

51%

78%

Subordinate - Ski Resort

California

40,000

$

34%

54%

Subordinate - Condo Conversion

(1)

New York

35,000

$

29%

52%

Subordinate - Industrial Portfolio

Various

32,000

$

66%

74%

Subordinate - Hotel Portfolio

Minnesota

24,696

$

57%

68%

Subordinate - Mixed Use

Pennsylvania

22,500

$

54%

69%

Subordinate - Multifamily Conversion

New York

18,000

$

48%

60%

Subordinate - Multifamily/Condo/Hotel

(3)

Various

17,500

$

80%

90%

Subordinate - Office

New York

14,000

$

61%

70%

Subordinate - Office

Missouri

9,814

$

60%

70%

Subordinate - Office

Michigan

8,849

$

42%

54%

Subordinate - Mixed Use

North Carolina

6,525

$

63%

76%

Subordinate - Condo Conversion

(2)

New York

297

$

29%

55%

Total

487,487

$

(1)

Both loans are for the same property.

(2)

Both loans are for the same property. The mezzanine loan ending

LTV is based upon the committed amount of $29.4 million.

(3)

Ending LTV is based upon the committed amount of $19.5 million.

|

14

COMMERCIAL REAL ESTATE FINANCE, INC. (“ARI”)

ARI

–

CMBS

Portfolio

Face

Amortized Cost

Remaining Weighted

Average Life with

Extensions (years)

Estimated

Fair Value

Debt

Net Equity

at

Cost

(1)

CMBS

–

Total

$171,778

$173,174

3.1 Years

$176,611

$166,991

$36,310

CMBS

CUSIP

Description

07388YAB8

BSCMS 07-PW16 A2

61754KAC9

MSC 07-IQ14 A2

92978YAB6

WBCMT 07-C32 A2

61751NAD4

MSC 2007-HQ11 A31

92978TAB7

WBCMT 2007-C31 A2

CMBS

CUSIP

Description

59025KAG7

MLMT 2007-C1 AM

22546BAH3

CSMC 2007-C5 AM

36159XAH3

GECMC 2007-C1 AM

46627QBC1

JMPCC 2006-CB15 AM

46631BAJ4

JPMCC 2007-LD11 AM

(1)

Includes $30.1 million of restricted cash related to the UBS

Facility. |

15

COMMERCIAL REAL ESTATE FINANCE, INC. (“ARI”)

Portfolio

Metrics

–

Quarterly

Migration

Summary

Portfolio Metrics ($ in thousands)

Q1 2014

Q4 2013

Q3 2013

Q2 2013

Q1 2013

(Investment balances represent amortized cost)

First Mortgage Loans

185,516

$

161,099

$

160,893

$

143,492

$

142,833

$

Subordinate Loans

484,979

497,484

394,554

354,865

286,569

CMBS

173,174

190,178

218,019

165,553

188,824

CMBS - Hilton

-

-

69,587

69,521

69,912

Total Investments

843,669

$

848,761

$

843,053

$

733,431

$

688,138

$

(Investment balances represent net equity, at cost)

First Mortgage Loans

185,513

$

140,716

$

160,890

$

143,489

$

142,830

$

Subordinate Loans

484,979

497,484

394,554

354,865

286,569

CMBS

36,310

(2)

38,655

(2)

36,760

(2)

21,353

24,620

CMBS - Hilton

-

-

23,049

22,412

22,175

Net Equity in Investments at Cost

706,802

$

676,855

$

615,253

$

542,119

$

476,194

$

Levered Weighted Average Underwritten IRR

(1)

14.1%

(3)

14.1%

(3)

13.9%

(3)

14.2%

(3)

14.2%

(3)

Weighted Average Duration

3.2 Years

3.3 Years

3.0 Years

3.0 Years

3.0 Years

Loan Portfolio Weighted Average Ending LTV

(4)

58.0%

58.0%

55.0%

56.0%

53.6%

Borrowings under repurchase agreements

166,994

$

202,033

$

227,167

$

191,312

$

211,944

$

Convertible senior notes

139,163

$

-

$

-

$

-

$

-

$

(1)

The underwritten IRR for the investments shown in

this presentation reflect the returns underwritten by the Manager, calculated on a weighted average basis assuming no dispositions, early prepayments or defaults but assuming that extension options are exercised and that the cost of

borrowings under the Wells Facility remains constant over the remaining

terms and extension terms under this facility. With respect to certain loans, the underwritten IRR calculation assumes certain estimates with respect to the timing and magnitude of future fundings for the remaining

commitments and associated loan repayments, and assumes no defaults. IRR

is the annualized effective compounded return rate that accounts for the time-value of money and represents the rate of return on an investment over a holding period expressed as a percentage of the investment. It is

the discount rate that makes the net present value of all cash outflows

(the costs of investment) equal to the net present value of cash inflows (returns on investment). It is derived from the negative and positive cash flows resulting from or produced by each transaction (or for a transaction

involving more than one investment, cash flows resulting from or

produced by each of the investments), whether positive, such as investment returns, or negative, such as transaction expenses or other costs of investment, taking into account the dates on which such cash flows occurred or are

expected to occur, and compounding interest accordingly. There can be no

assurance that the actual IRRs will equal the underwritten IRRs shown in the table. See “Item 1A—Risk Factors—The Company may not achieve its underwritten internal rate of return on its investments which may lead

to future returns that may be significantly lower than anticipated”

included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2013 for a discussion of some of the factors that could adversely impact the returns received by the Company from the investments shown

in the table over time

(2)

Includes $15.8 million of restricted cash related to the UBS Facility

and $16.4 million of future borrowings related to unsettled trades at September 30, 2013 and $30.1 million of restricted cash related to the UBS Facility at December 31, 2013 and March 31, 2014, respectively.

(3)

Represents an underwritten levered weighted average IRR. The

Company's ability to achieve the underwritten levered weighted average IRR additionally depends upon the Company re-borrowing approximately $88,000 under the JPMorgan Facility or any replacement facility with similar

terms with regard to its portfolio of first mortgage loans.

Without such re-borrowing, the levered weighted average underwritten IRR will be lower than the amount shown above, as indicated in the current weighted average underwritten IRR column on page 9.

(4)

Does not include CMBS. |

16

COMMERCIAL REAL ESTATE FINANCE, INC. (“ARI”)

ARI had total borrowings outstanding of $167 million at March 31,

2014: ARI’s borrowings had the following remaining

maturities at March 31, 2014:

Financing Overview

Facility ($000s)

Debt Balance

Weighted Average

Remaining

Maturity

(1)

Cost of Funds

Wells Facility

$

33,092

0.9 years

1.0%

UBS Facility

133,899

4.5 years

2.8%

JPMorgan Facility

3

0.8 years

2.7%

Total

Borrowings

at

March

31,

2014

$

166,994

3.8 years

2.4%

Facility ($000s)

Less than 1 year

1 to 3 years

3 to 5 years

Total

Wells Facility

$

33,092

$

-

$

-

$

33,092

UBS Facility

(1)

-

5,004

128,895

$

133,899

JPMorgan Facility

3

-

-

$

3

Total

Borrowings

at

March

31,

2014

$

33,095

$

5,004

$

128,895

$

166,994

(1)

Assumes extension options on the UBS Facility are exercised.

|

17

COMMERCIAL REAL ESTATE FINANCE, INC. (“ARI”)

Financials |

18

COMMERCIAL REAL ESTATE FINANCE, INC. (“ARI”)

Consolidated Balance Sheets (Unaudited)

(in thousands—except share and per share data)

March 31, 2014

December 31, 2013

Assets:

Cash

126,473

$

20,096

$

Restricted cash

30,127

30,127

Securities

available-for-sale, at estimated fair value 25,477

33,362

Securities, at

estimated fair value 151,134

158,086

Commercial mortgage loans,

held for investment 185,516

161,099

Subordinate loans, held for

investment 484,979

497,484

Interest receivable

6,220

6,022

Deferred financing costs, net

5,135

628

Other assets

550

600

Total Assets

1,015,611

$

907,504

$

Liabilities and Stockholders'

Equity Liabilities:

Borrowings under repurchase agreements

166,994

$

202,033

$

Convertible senior notes,

net 139,163

-

Accounts payable and accrued expenses

2,289

2,660

Payable to related party

2,565

2,628

Dividends payable

16,688

17,227

Total

Liabilities 327,699

224,548

Stockholders' Equity:

Preferred stock, $0.01 par value, 50,000,000 shares authorized and

3,450,000 shares issued and outstanding in 2013 and 2012

35

35

Common stock, $0.01 par value, 450,000,000 shares authorized 37,125,475

and 36,888,467 shares issued and outstanding in 2014 and 2013,

respectively 371

369

Additional paid-in-capital

701,797

697,610

Retained earnings

(accumulated deficit) (13,404)

(14,188)

Accumulated other

comprehensive loss (887)

(870)

Total Stockholders' Equity

687,912

682,956

Total Liabilities and

Stockholders' Equity 1,015,611

$

907,504

$

|

19

COMMERCIAL REAL ESTATE FINANCE, INC. (“ARI”)

Consolidated Statement of Operations (Unaudited)

March 31, 2014

March 31, 2013

Net interest income:

Interest income from securities

2,419

$

3,087

$

Interest income from commercial mortgage

loans 4,011

3,592

Interest income from subordinate

loans 14,730

11,454

Interest income from repurchase

agreements -

2

Interest expense

(1,757)

(1,068)

Net interest income

19,403

17,067

Operating expenses:

General and administrative expenses (includes $426 and $883 of

equity-based compensation in 2014 and in 2013, respectively)

(1,442)

(1,895)

Management fees to related party

(2,565)

(2,160)

Total operating expenses

(4,007)

(4,055)

Unrealized gain (loss) on securities

2,184

(1,080)

Loss on derivative instruments (includes $72

of unrealized gains in 2013)

-

-

Net income

17,580

$

11,932

$

Preferred dividends

(1,860)

(1,860)

Net income available to common

stockholders 15,720

$

10,072

$

Basic and diluted net income per share of common

stock 0.42

$

0.33

$

Basic weighted average shares of common

stock outstanding 37,122,842

30,105,939

Diluted weighted average shares of common stock outstanding

37,341,050

30,480,689

Dividend declared per share of common stock

0.40

$

0.40

$

Three months ended

|

Reconciliation of Operating Earnings to Net Income

20

COMMERCIAL REAL ESTATE FINANCE, INC. (“ARI”)

March 31, 2014

Earnings Per Share

(Diluted)

March 31, 2013

Earnings Per Share

(Diluted)

Operating Earnings:

Net income available to common stockholders

$15,720

$0.42

$10,072

$0.33

Adjustments:

Unrealized (gain)/loss on securities

(2,184)

(0.06)

1,080

0.04

Unrealized gain on derivative instruments

-

-

(72)

-

Equity-based compensation expense

426

0.01

883

0.02

Amortization of convertible notes related to equity

reclassification 29

-

-

-

Total adjustments:

(1,729)

(0.05)

1,891

0.06

Operating Earnings

13,991

$0.37

$11,963

$0.39

Basic weighted average shares of common stock outstanding

37,122,842

30,105,939

Diluted weighted average shares of common stock outstanding

37,341,050

30,480,689

Three Months Ended |

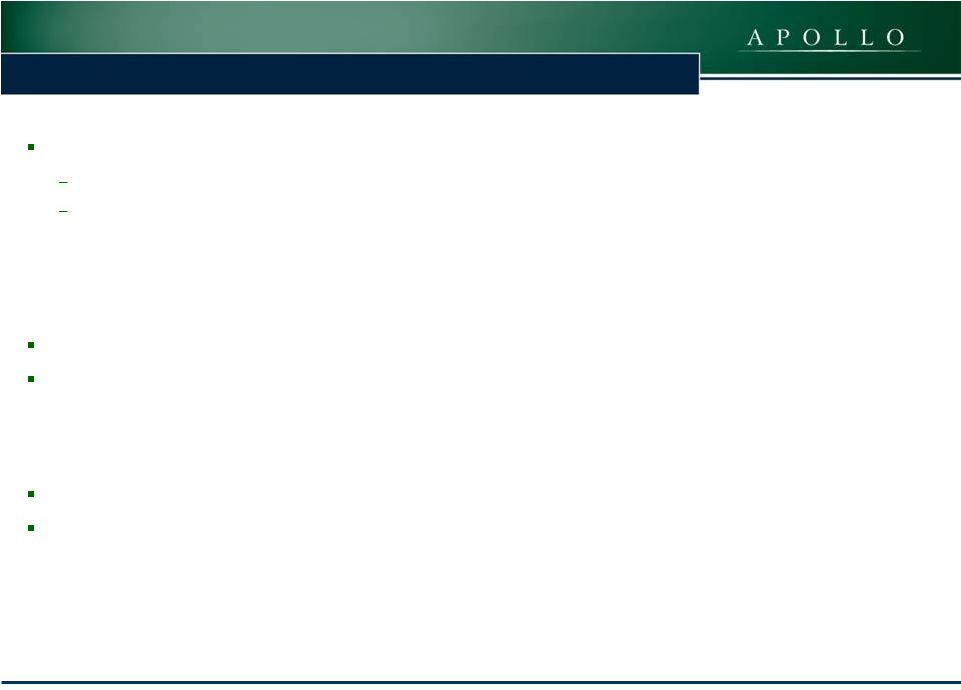

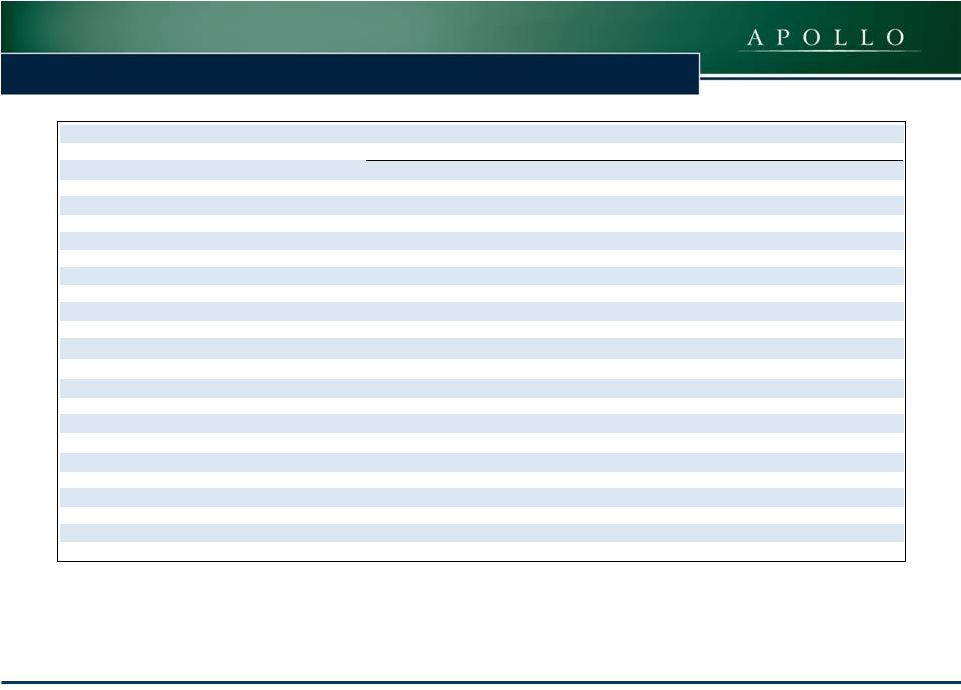

Financial Metrics –

Quarterly Migration Summary

COMMERCIAL REAL ESTATE FINANCE, INC. (“ARI”)

21

(1)

Operating Earnings is a non-GAAP financial measure that is used by

the Company to approximate cash available for distribution and is defined by the Company as net income available to common stockholders, computed in accordance with

GAAP, adjusted for (i) equity-based compensation expense (a portion

of which may become cash-based upon final vesting and settlement of awards should the holder elect net share settlement to satisfy income tax withholding) (ii) any unrealized

gains or losses or other non-cash items included in net income and

(iii) the non-cash amortization expense related to the reclassification of a portion of the senior convertible notes to stockholders’ equity in accordance with GAAP. Please see

slide 20 for a reconciliation of Operating Earnings and Operating

Earnings per Share to GAAP net income and GAAP net income per share.

(2)

The Company carries loans at amortized cost and its CMBS securities are

marked to market. Management estimates the fair value of the Company’s financial assets.

(3)

Return on common equity is calculated as annualized Operating Earnings

for the period as a percentage of average stockholders’ equity for the period.

Financial Metrics

($ in thousands, except per share data)

Q1 2014

Q4 2013

Q3 2013

Q2 2013

Q1 2013

Net Interest Income

19,403

$

20,020

$

18,786

$

17,233

$

17,067

$

Management Fee

2,565

2,627

2,625

2,600

2,160

General and Administrative Costs

1,016

1,046

1,009

1,009

1,012

Non-Cash Stock Based Compensation

426

1,392

784

428

883

Net Income Available to Common Stockholders

15,720

$

14,004

$

11,041

$

9,929

$

10,072

$

GAAP Diluted EPS

0.42

$

0.37

$

0.29

$

0.27

$

0.33

$

Operating Earnings

(1)

13,991

$

14,488

$

13,272

$

11,721

$

11,963

$

Operating EPS

(1)

0.37

$

0.39

$

0.35

$

0.31

$

0.39

$

Distributions Declared to Common Stockholders

0.40

$

0.40

$

0.40

$

0.40

$

0.40

$

GAAP Book Value per Common Share

16.21

$

16.18

$

16.18

$

16.26

$

16.41

$

Fair Value per Common Share

(2)

16.31

$

16.42

$

16.44

$

16.55

$

16.71

$

Total Stockholders' Equity

687,912

$

682,956

$

682,887

$

685,994

$

691,185

$

Diluted weighted average shares of common stock outstanding

37,341,050

37,390,369

37,379,469

37,373,885

30,105,939

9.4%

9.7%

8.9%

7.8%

9.6%

Return on Common Equity Based on Operating Earnings

(3) |