Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT DATED 4-24-14 - Tianci International, Inc. | g7380.htm |

Exhibit 10.1

PURCHASE AND SALE AGREEMENT

BETWEEN:

LORNEX FINANCIAL LTD.

AND

FREEDOM PETROLEUM INC.

DATED AS OF THE 28TH APRIL 2014

THIS AGREEMENT is dated effective 28TH APRIL 2014

BETWEEN:

Lornex Financial Ltd., a company incorporated pursuant to the laws of Nevis.

(“Lornex”)

AND:

Freedom Petroleum Inc., a company incorporated pursuant to the laws of Nevada, U.S.A.

(“Freedom”)

Lornex and Freedom are hereinafter referred to collectively as the “Parties”, and each, individually, as a “Party”.

WHEREAS:

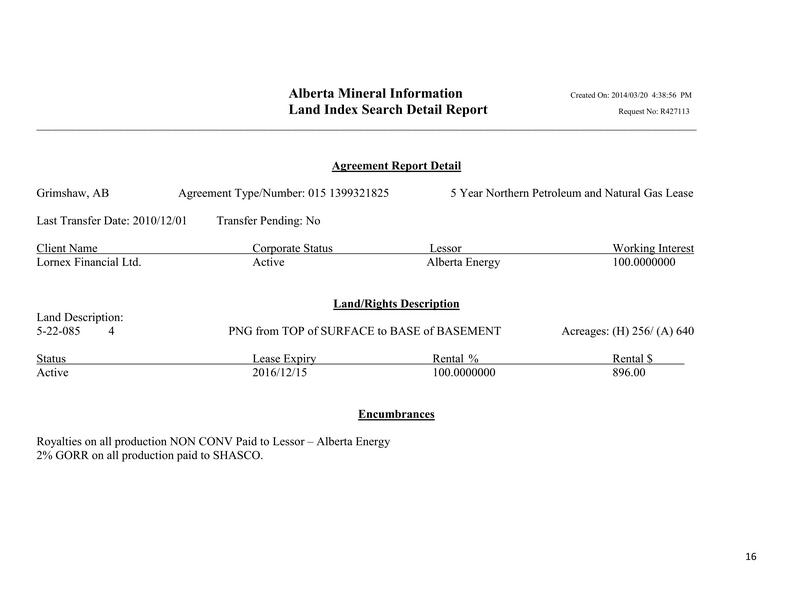

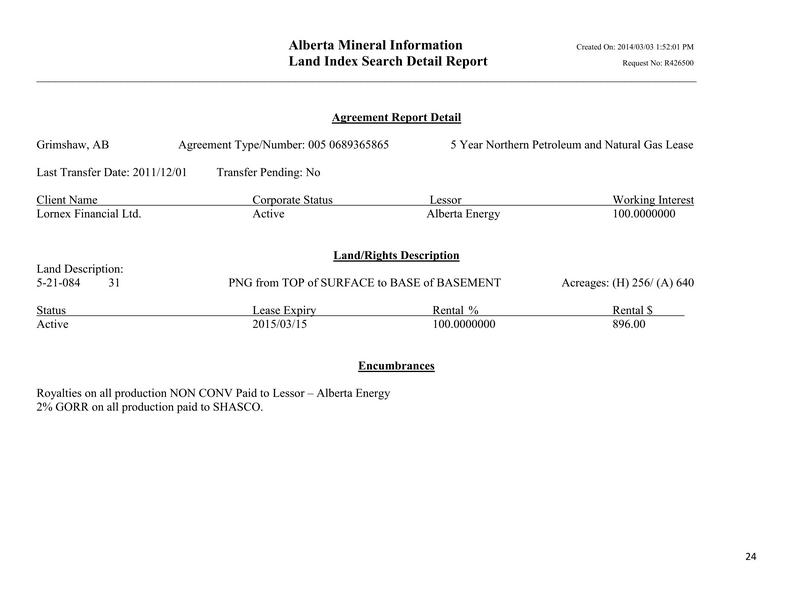

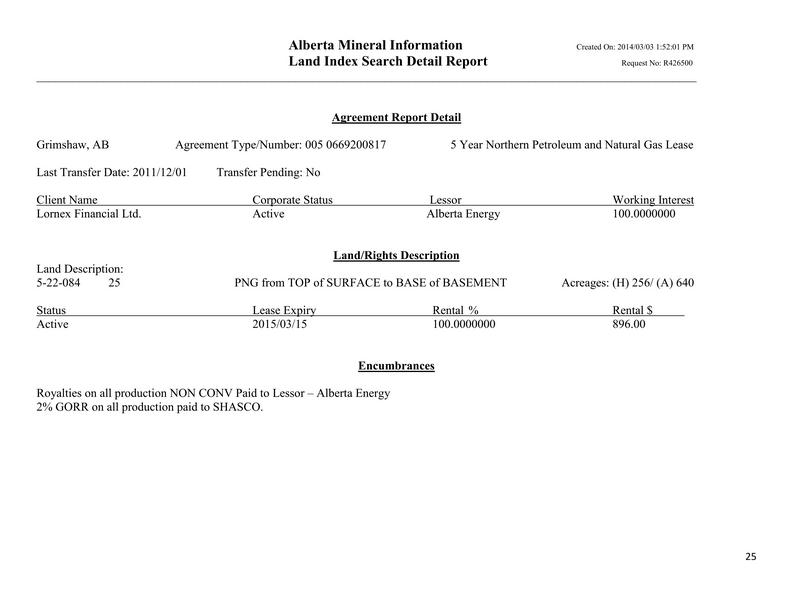

(A) Lornex is the owner of a one hundred percent (100%) undivided working interest and can deliver 90% Net Revenue Interest (NRI) in certain oil and gas interests (Crown Land) and properties arising from the oil and gas leases (the “Leases”) set out in Exhibit “A” attached hereto, which together comprise a parcel of 11,680 acres in Grimshaw area of Northern Alberta, Canada (the “Property”);

(B) Each Lease encompasses and represents Lornex’s right, title and interest in the portion of the Property subject to the Lease;

(C) The Parties have agreed that this Agreement will set out the general terms and conditions of a transaction (the “Transaction”) whereby Lornex would grant 100% right to purchase all of the right, title and interest of Lornex as described herein in 11,680 acres in the oil and gas leases listed on Exhibit “A”; and,

(D) The Parties have agreed that this Agreement shall supersede all previous agreements and understandings related to the Transaction with the terms, conditions and covenants set out herein.

NOW THEREFORE, in consideration of the mutual promises covenants contained herein, the parties hereby agree as follows:

1

PART 1

INTERPRETATIONS

Definitions

1.1 In this Agreement:

(a) “AFE” means authorization for expenditure for any drilling, rework or development activity in respect of a pre-existing Well or a new Well;

(b) “Affiliate” means any Person that controls, is controlled by, or is under common control with, a Party. For the purposes of the preceding sentence only, “control” means the right to the exercise, directly or indirectly, of more than fifty percent (50%) of the voting rights attributable to the controlled Person;

(c) “Agreement” means this Agreement for Purchase and Sale and all of the Exhibits attached hereto, as the same may be amended from time to time in accordance with the terms hereof;

(d) “AMI” means Area of Mutual Interest wherein the Parties shall have exclusive right to operate to the mutual benefit each party during the term of the Agreement.

(e) “Applicable Law” means in relation to any person, transaction or event, all laws, statutes, regulations, directives and decisions of any governmental body having jurisdiction over such person, transaction or event;

(f) “Business Day” means any day that is not a Saturday, Sunday or statutory holiday in Nevada, USA;

(g) “Development” means any development activity related to the exploitation of Petroleum Substances on the Property, from a Well, or pursuant to a Lease, including but not limited to drilling, exploration, rework or development of a Well;

(h) “Effective Date” means the date of execution of this Agreement and shall in no event be later than 28TH APRIL 2014;

(i) “Encumbrances” has the meaning ascribed thereto in §2.1;

(j) “Exchange” means the TSX Venture Exchange or other recognizable exchange in North America;

(k) “Governmental Authority” means any Canadian or United States federal, provincial, territorial, state, regional, municipal or local government or authority, quasi-governments’ authority, fiscal or judicial body, government or self-regulatory organization, commission, board, tribunal, organization, or any regulatory, administrative or other agency, or any political or other subdivision, department, or branch of any of the foregoing;

2

(l) “Leases” has the meaning ascribed thereto in Recital (A) hereof;

(m) “Net Profits Interest” means the gross revenues realized from the sale of Petroleum Substances less all royalties owed in respect of the Property or government royalties on attributable gross revenues, less any and all applicable pipeline transportation costs, and all direct field operating costs excluding the general and administrative costs attributable to the Parties;

(n) “New Well” means a Well drilled upon the Property after the Effective Date;

(o) “Operator” means the Person responsible for supervising or managing all work performed with respect to a development on the Property, including but not limited to any activity related to drilling, exploration or development of a Well;

(p) “Person” means an individual, corporation, trust, partnership, limited liability company, contractual mining company, joint venture, unincorporated organization, firm, estate, Governmental Authority or any agency or political subdivision thereof, or other entity;

(q) “Petroleum Substances” means petroleum, natural gas and every other mineral or substance or, any of them, in which an interest in or the right to explore for is granted or acquired under the Leases;

(r) “Pre-Existing Well” means a Well existing on the Property as of the date of this Agreement;

(s) “Press release” has the meaning ascribed thereto in §6.3 hereof;

(t) “Property” has the meaning ascribed thereto in Recital A hereof;

(u) “Regulations” means all statutes, laws, rules, orders and regulations in effect from time to time and made by governments or governmental boards or agencies having jurisdiction over the Property, and over the operations to be conducted thereon;

(v) “Third Party” means a person, partnership, joint venture, corporation or other form of enterprise that is not a Party to this Agreement or an Affiliate of any such entity, and does not include a Governmental Authority;

(w) “Transaction” means the transaction to be carried out by the Parties in accordance with the terms of this Agreement and each other agreement, document or instrument executed in connection herewith, whereby Lornex will grant 100% legal title in consideration of the terms, conditions, representations and warranties, and mutual covenants contained herein;

(x) “Transfer” means to transfer, sell, convey, assign, mortgage, pledge, create a security interest in or grant an option in respect of a right to purchase or in any other manner transfer, alienate or dispose of or otherwise dispose of;

3

(y) “Well” means a Pre-existing Well and a New Well on the Property;

(z) “Wholly Owned Affiliate” means an Affiliate of a Party that is wholly-owned by such Party or such Party’s parent company or companies;

Interpretation

1.2 For the purposes of this Agreement, except as otherwise expressly provided herein:

(a) The words “herein”, “hereof”, and “hereunder” and other words of similar import refer to this Agreement as a whole and not to any particular Part, clause, subclause or other subdivision or Exhibit;

(b) A reference to a Part means a Part of this Agreement and the symbol § followed by a number or some combination of numbers and letters refers to the section, paragraph or subparagraph of this Agreement so designated;

(c) The headings are for convenience only, do not form a part of this Agreement and are not intended to interpret, define or limit the scope, extent or intent of this Agreement or any of its provisions;

(d) The word “including”, when following a general statement, term or matter, is not to be construed as limiting such general statement, term or matter to the specific items or matters set forth or to similar items or matters (whether or not qualified by non-limiting language such as “without limitation” or “but not limited to” or words of similar import) but rather as permitting the general statement or term to refer to all other items or matters that could reasonably fall within its possible scope;

(e) Where the phrase “to the knowledge of” or phrases of similar import are used in respect of the parties, it will be a requirement that the party in respect of who the phrase is used will have made such due inquiries as is reasonably necessary to enable such party to make the statement or disclosure;

(f) A reference to currency means currency of the United States of America; and

(g) Words importing the masculine gender include the feminine or neuter, words in the singular include the plural, words importing a corporate entity include individuals, and vice versa.

Exhibits

1.3 The following Exhibits are attached hereto and made part of this Agreement:

(a) Exhibit “A” – Property and Land Map;

(b) Exhibit “B” – Encumbrances on the Property.

4

PART 2

TITLE, ENCUMBRANCES AND REPRESENTATIONS AND WARRANTIES

Title and Encumbrances

2.1 Freedom will not earn any better interest in the Property than Lornex has at the date hereof, and, except as may be provided herein, will acquire any interest earned by it hereunder subject to the royalties and encumbrances specifically listed in Exhibit “B” (the “Encumbrances”).

2.2 Lornex represents to Freedom that:

(a) Except for the Encumbrances and this Agreement, Lornex has not granted any interest (or the right to earn any interest) in the Property whereby a Third Party may acquire any portion of Lornex’s interest right in the Property, a Well, or in the Petroleum Substances produced there from or attributable thereto and that, except for the Encumbrances, no encumbrances, royalties or other burdens affecting the Property have been created by, through or under Lornex, or of which Lornex has knowledge;

(b) Lornex is not aware of any act or omission whereby it is or would be in default under (i) the terms of any agreement under which Lornex has earned, or has the right to earn, any interest in the Leases, the Property or a Well, or (ii) any applicable laws or regulations of adverse effect and is not aware of any fact or circumstance giving rise to such default; and

(c) Lornex, on or before the Effective Date, has not received or otherwise become aware of, any notice of default of adverse effect for or in respect of the Property or the Leases that has not been remedied or that has not been addressed specifically herein.

Reimbursement of Payments on Property

2.3 From the Effective Date, Freedom shall make on behalf of the Parties all payments, including but not limited to all payments of security, penalty or compensatory royalty, required to maintain in good standing such portion of the Property or any Well subject to the payments.

Mutual Representations

2.4 Each Party represents and warrants to the other Party that:

(a) It is a legal entity duly incorporated and validly existing under the laws of its jurisdiction of organization and has power to carry on its business and to own its property and assets;

(b) It is not insolvent under the laws of the place of its establishment or incorporation and is able to pay its debts as they fall due;

5

(c) It has all requisite power and authority required to enter into this Agreement and each other document or instrument delivered in connection herewith and has all requisite power and authority to perform fully each and every one of its obligations hereunder;

(d) It has taken all internal actions necessary to authorize it to enter into this Agreement and its representative whose signature is affixed hereto is fully authorized to sign this Agreement and to bind such Party thereby;

(e) Neither the entering into this Agreement nor the performance of the obligations hereunder will conflict with, or result in a breach of, or constitute a default under, any provision of its constituent documents, articles or by-laws, or any law, regulation, rule, authorization or approval of any governmental authority, or of any contract or agreement, to which it is a party or is subject; and

(f) This Agreement and each other agreement, document or instrument delivered in connection herewith, when executed and delivered, will constitute, valid and legally binding obligations of each Party, enforceable in accordance with their respective terms.

PART 3

FUNDING OF OBLIGATIONS AND ACQUISITION OF THE PROPERTY

Purchase Price

3.1 On and from the Effective Date, Lornex, subject to the terms hereof, hereby agrees to execute the Acquisition Agreement and to sell to Freedom and, on the Closing Date, to cause Lornex to transfer to Freedom, a 100% undivided right, title and interest (100% Working Interest) in and to the Property, and to the best of its knowledge, free from all liens, mortgages, charges, pledges, encumbrances, claims, liabilities, adverse interests or other burdens, with the exception of landowner’s royalty to Lornex who will deliver an 90% net revenue interest in the Leases to Freedom.

Freedom agrees to purchase the Property and pay the consideration hereinafter specified.

3.2 Freedom will pay Lornex the sum of FOUR HUNDRED THOUSAND DOLLARS (US $400,000) as follows:

(a) SEVENTY FIVE THOUSAND DOLLARS (US $75,000) in cash within Fifteen (15) business days of Lornex’s compliance with the conditions precedent set forth in Section 5.3;

(b) SEVENTY FIVE THOUSAND DOLLARS (US $75,000) in cash within Forty Five (45) days of Lornex’s compliance with the conditions precedent set forth in Section 5.3;

6

(c) SEVENTY FIVE THOUSAND DOLLARS (US $75,000) in cash within One Hundred and Twenty (120) days of Lornex’s compliance with the conditions precedent set forth in Section 5.3;

(d) SEVENTY FIVE THOUSAND DOLLARS (US $75,000) in cash within One Hundred and Eighty (180) days of Lornex’s compliance with the conditions precedent set forth in Section 5.3.

(e) FIFTY THOUSANDS DOLLARS (US $50,000) in cash within Two Hundred and Forty (240) days of Lornex’s compliance with the conditions precedent set forth in Section 5.3; and

(f) FIFTY THOUSANDS DOLLARS (US $50,000) in cash within Three Hundred (300) days of Lornex’s compliance with the conditions precedent set forth in Section 5.3;

(g) Provided, however, that for all payments due from Freedom to Lornex, as set forth in Section 3.2(a) through (f), Freedom shall be permitted a five (5) business day grace period in which to cure any default and that if payment is made within such grace period, such payment shall be considered timely under this Agreement.

3.3 All payments made shall be subject to the terms of paragraph 3.2 herein and shall be deemed non-refundable as liquidated damages and not as a penalty until the Total Purchase Price is paid by Freedom within the time frames set forth above. Freedom may pay the Total Purchase Price earlier than required without penalty, and upon payment of the Total Purchase Price, Closing shall occur within thirty (30) days. Freedom shall make all payments by wire transfer to Lornex using the following wiring instruction:

[Lornex bank wiring instructions provided]

3.4 Lornex will pay all rentals due on any of the Leases before closing of the Agreement, however, Freedom shall reimburse Lornex for delay rentals it paid subsequent to executing said Agreement.

3.5 At closing, which shall be no later than Three Hundred (300) days of executing the Agreement, after Freedom makes the payments as set out in §3.2(a) to §3.2(a) above, Lornex shall immediately transfer the Property, without warranty of title, to Freedom and execute and deliver, or cause to be executed and delivered, all documents, agreements and instruments as required to obtain a Transfer in registerable form. Lornex shall prepare and record all such documents necessary to transfer title and assign royalties.

7

Title to the Leases may be conveyed to Freedom using standard assignment forms for such type of assignments and, to the best of Lornex’s knowledge, shall be free and clear of all liens, mortgages, encumbrances or other adverse claims. Prior to Closing, Freedom shall review the assignments on the Leases as to form and review title to the Leases to its satisfaction. Freedom will forward the assignments for approval and recordation in the appropriate county, and BLM offices. After recording or governmental approval, as applicable, Freedom will forward to Lornex a copy of the recorded instrument and/or a copy of the approved governmental assignment form.

3.6 In the event that Freedom desires to surrender in whole or part any of the Leases by non-payment of delay rentals, Freedom agrees to give Lornex written notice of at least 60 days prior to the surrender date. Lornex shall then have fifteen (15) days from receipt of such notice, to deliver its written election to Freedom as to whether Lornex desires to receive a reassignment of such portion of said Lease(s) to be surrendered. In the event that Lornex does not agree to the surrender, Freedom shall assign all interest conveyed pursuant to this agreement on the Lease(s) to Lornex absolutely free and clear of any liens, overriding royalty or other encumbrances of any kind whatsoever other than those in existence at the time of this agreement or placed thereon under the terms of this agreement.

3.7 Lornex shall hold the interests Transferred to Freedom pursuant to §3.1 in trust for Freedom, together with all benefits and advantages there under and any and all obligations pursuant thereto from the Effective Date and until such time as the Transfer is either completed or terminated in accordance with the terms of this Agreement.

3.8 Lornex shall execute in favour of Freedom, a declaration of trust agreement, or such other documents as may be reasonably required, to give effect to the intent of §3.7, all in forms acceptable to Freedom.

3.9 If any term or condition of a Transfer of an interest in the Property conflicts with any term or condition of a subject Lease or this Agreement, the terms or conditions of the subject Lease and this Agreement will prevail and the Transfer will be deemed to be amended accordingly.

Encumbrance Responsibility

3.10 If the interest of either Party in the Property is now or hereafter becomes encumbered (other than pursuant to the Encumbrances), the Parties covenant and agree that such encumbrance will at all times during the term of this Agreement remain the sole responsibility of the Party who creates such encumbrance or whose interest is now encumbered and in no event will such encumbrance be considered to be borne jointly by the Parties.

8

PART 4

OPERATIONS

Disclosure of Property Data

4.1 Lornex shall provide Freedom with all technical data and information reports in the possession of Lornex relating to the Property, or relating to any Development activities proposed in respect of any Lease, and Lornex shall provide Freedom full access to all Property, data and accounting records relating to the Property.

4.2 Each Party shall immediately inform the other Party of any Development, whether proposed or ongoing, occurring on or in relation to the Property upon learning about the Development up until Closing of the Agreement. During this period, each Party shall immediately provide the other Party with all material information related to every stage of a Development not in the other Party’s possession, including but not limited to detailed descriptions of all Development activities, progress reports, information reports, all technical data and accounting records related to the Development. For greater certainty, each Party shall be obligated to immediately disclose to the other Party all material information related to a Well drilled, or proposed to be drilled, on or in relation to the Property.

PART 5

ASSIGNMENT

Transfers to Related Entities

5.1 Each Party (each a “Transferring Party”) may Transfer all or part of its rights under this Agreement, or all or part of its interests in the Property acquired hereunder or otherwise, to a Wholly Owned Affiliate or Related Body Corporate without the consent of the other Party provided that the transferee covenants to be bound by this Agreement to the extent of the relevant interest transferred, and notwithstanding such Transfer, the Transferring Party will remain liable for all its obligation and liabilities hereunder prior to the date of the Transfer.

Transfers to Third Parties

5.2 Each Party may Transfer all or part of its rights under this Agreement, or all or part of its interests in the Property acquired hereunder or otherwise, to a Third Party as follows:

(a) Freedom may Transfer all or part of its rights under this Agreement, or all or part of its interests in the Property acquired hereunder, to a Third Party;

9

(b) Lornex may Transfer all or part of its rights under this Agreement, or all or part of its interests in the Property, to a Third Party, including but not limited to its right to collect the payments set out in §3.2(a) to §3.2(f); and,

(c) If a Transfer to a Third Party is effected in conformity with the preceding provisions of this 5.2, the Transferring Party will only be released from all obligations and liabilities assigned to and assumed by the Third Party under this Agreement to the extent of the right or interest transferred when the Third Party has covenanted to be bound by the terms of this Agreement.

CONDITIONS PRECEDENT

5.3 The terms and conditions of this Agreement and the obligations of the Parties hereunder, are subject to receipt by Lornex and Freedom of all required corporate and regulatory approvals necessary to effect the Transaction and Lornex providing financial information with regard to the Property, Leases and related operations to Freedom sufficient for Freedom, in its sole judgment, to comply with its obligations under the Securities Exchange Act of 1934, as amended.

PART 6

MISCELLANEOUS PROVISIONS

Force Majeure

6.1 In this §6.1, the term “event of force majeure” means any event the occurrence or subsistence of which prevents a party from performing any obligation described in this Agreement and which is not reasonably within the control of such Party, and includes, without limitation, an act of God, a governmental directive or restriction, a labour dispute, and an act of war or other unlawful act against public order or authority. Any Party which is at any time prevented by an event of force majeure from conducting any operation or activity, or from performing any obligation hereunder will promptly so notify the other Party, providing reasonable particulars of the event of force majeure and the operation, activity or obligation the conduct or performance of which is prevented thereby, and will take all such steps as may be reasonable in the circumstances to remedy such event of force majeure; provided, however, that no party will be required by the provisions hereof to settle any strike, lockout or other labour dispute on terms which it would not otherwise so settle. If either Party is at any time prevented by an event of force majeure from performing any obligation hereunder (other than an obligation to pay money), such obligation will, to the extent that its performance is prevented by such event of force majeure, be suspended for so long as the event of force majeure continues to prevent such performance, and the non-performance of such obligation to such extent during such period of suspension will not constitute a breach of default hereunder.

10

Confidentiality

6.2 The Parties will keep confidential from Third Parties all information obtained in the course of or as a result of any operations conducted pursuant to this Agreement or supplied by one Party to the other hereunder, except information which the Parties have expressly agreed to release or are required to disclose by applicable law or regulation. Each Party will take measures in connection with operations and internal security as will be advisable in the circumstances to maintain such confidentiality.

6.3 Each Party may issue a press release or, in the case of Freedom, a Current Report on Form 8-K, relating to this Agreement and any operation subject to this Agreement at any time and without the prior approval of the other Party if the press release is drafted and issued in accordance with all applicable laws, Regulations, regulatory authorities and stock exchanges having jurisdiction over the press release, the Parties, the Property, the Transaction and this Agreement. Notwithstanding each Party’s right to issue a press release or Current Report at its sole discretion, each Party shall use its best efforts to consult with the other Party regarding the content of a press release or Current Report prior to issuing it if the issuing Party has reason to believe that the press release could affect the other Party in a material way. For the purposes of this §6.3, “press release”, will include any release of information or dissemination to the public by the media including, without limitation, the press, internet, radio or television media or any one or more of them.

Notice

6.4 Any notice, consent, waiver, direction or other communication required or permitted to be given under this Agreement by a party will be in writing and will be delivered by hand to the party to which the notice is to be given at the following address or sent by facsimile to the following numbers or to such other address or facsimile number as will be specified by a party by like notice. Any notice, consent, waiver, direction or other communication aforesaid will, if delivered, be deemed to have been given and received on the date on which it was delivered to the address provided herein (if a Business Day or, if not, then the next succeeding Business Day) and if sent by facsimile be deemed to have been given and received at the time of receipt (if a Business Day or, if not, then the next succeeding Business Day) unless actually received after 4:00 p.m. (Vancouver time) at the point of delivery in which case it will be deemed to have been given and received on the next Business Day.

The address for sending notice to each Party will be as follows:

(a)

To: Lornex Financial Ltd.

Henville Building

Charlestown, Nevis

Attention: Cliff Wilkins

11

To: Freedom Petroleum.

Office 15, Suite 1400

650 Poydras St

The Poydras Center

New Orleans, Louisiana - 70130

Attention: Anton Lin

Any Party may at any time and from time to time notify the other parties in writing of a change of address and the new address to which notice will be given to it thereafter until further change.

Supersedes Prior Agreements

6.5 All the agreements, arrangements and understandings between the Parties hereto which are the subject matter of this Agreement are embodied in this Agreement and this document will supersede all prior agreements, arrangements and understandings and any modification or amendment hereof will not be valid or binding on the Parties unless made in writing and duly signed by or on behalf of that Party.

Laws and Regulations

6.6 This Agreement and the respective rights and obligations of the Parties created by it, will be subject to all applicable Regulations, and in the event that any of the provisions contained in this Agreement or the operations contemplated under it are found to be inconsistent with or contrary to any such Regulation, the Regulations will be deemed to control and this Agreement will be regarded as modified accordingly and as so modified will continue in full force and effect.

6.7 This Agreement will be interpreted and construed in accordance with the laws of the state of New York and the federal laws of the United States as applicable therein. The Parties agree to submit to the jurisdiction in any actions related to this Agreement.

Further Assurances

6.8 Each of the Parties will from time to time and at all times do such further acts and execute and deliver all such further deeds and documents as will be reasonably required in order to fully perform and carry out the terms of this Agreement.

Enurement

6.9 Subject to the terms of this Agreement, this Agreement will be binding upon and enure to the benefit of the parties and their respective successors and permitted assigns.

Time

6.10 Time will be of the essence in this Agreement.

12

Entire Agreement

6.11 This Agreement constitutes the entire agreement between the parties with respect to the subject matter hereof and supersedes and replaces all previous understandings and agreements, whether written or oral, between the parties with respect to the subject matter hereof.

No Partnership

6.12 This Agreement will not be construed for any purpose to give rise to a partnership, association or any other relationship in which the Parties hereto may be liable for the acts or omissions of the other Party hereto nor to constitute a Party, the agent or legal representative of the other Party and each Party will be individually and severely responsible only for its obligations as set out in this Agreement.

Waiver

6.13 No waiver by either Party of any default by the other Party in the performance of this Agreement will operate or be construed as a waiver of any future default or defaults by that Party whether of a like or of a different character.

Costs

6.14 Each Party will be solely responsible for all costs, expenses and fees of any nature, including but not limited to legal fees, payable by such Party in connection with the preparation and negotiation of this Agreement.

Counterpart Execution

6.15 This Agreement may be executed in separate counterparts and all of the executed counterparts (including facsimile copies thereof) will together constitute one instrument and have the same force and effect as if all executed counterparts were of the same instrument.

[REMAINDER OF PAGE INTENTIONALLY LEFT BLANK]

13

IN WITNESS WHEREOF, the Parties have caused their duly authorized representatives to execute these presents on the day and year above first written.

28TH APRIL 2014

LORNEX FINANCIAL LTD.

Per: /s/ Cliff Wilkins

Cliff Wilkins, President

FREEDOM PETROLEUM INC.

Per: /s/ Anton Lin

Anton Lin, CEO

14

EXHIBIT “A”

PROPERTY AND LAND MAP

This is Exhibit “A” to the Agreement for Purchase and Sale dated 28TH APRIL 2014 between Lornex and Freedom. (the “Agreement”).