Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Energy Transfer, LP | d716604d8k.htm |

| EX-99.1 - EX-99.1 - Energy Transfer, LP | d716604dex991.htm |

| Exhibit 99.2

|

ENERGY TRANSFER PARTNERS

INVESTOR CONFERENCE CALL

Acquisition of Susser Holdings Corporation

Monday, April 28th, 2014

|

|

LEGAL DISCLAIMER

IMPORTANT ADDITIONAL INFORMATION WILL BE FILED WITH THE SEC

In connection with the proposed business combination transaction between Energy Transfer Partners, L.P. (“ETP”) and Susser Holdings Corp. (“Susser”). ETP plans to file with the U.S.

Securities and Exchange Commission (the “SEC”) a registration statement on Form S-4 that will contain a proxy statement/prospectus to be mailed to the Susser shareholders in connection with the proposed transaction. THE REGISTRATION STATEMENT AND THE PROXY STATEMENT/PROSPECTUS WILL CONTAIN IMPORTANT INFORMATION ABOUT ETP, SUSSER, THE PROPOSED TRANSACTION AND RELATED MATTERS. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT AND THE PROXY/PROSPECTUS CAREFULLY WHEN THEY BECOME AVAILABLE. Investors and security holders will be able to obtain free copies of the registration statement and the proxy statement/prospectus and other documents filed with the SEC by ETP and Susser through the web site maintained by the SEC at www.sec.gov. In addition, investors and security holders will be able to obtain free copies of the registration statement and the proxy statement/prospectus by phone, e-mail or written request by contacting the investor relations department of ETP or Susser at the following:

Energy Transfer Partners, L.P. Susser Holdings Corp. 3738 Oak Lawn Ave. 4525 Ayers Street Dallas, TX 75219 Corpus Christi, TX 78415 Attention: Investor Relations Attention: Investor Relations Phone: (214) 981-0795 Phone: (361) 693-3743 E-mail: InvestorRelations@energytransfer.com E-mail: msullivan@susser.com

PARTICIPANTS IN THE SOLICITATION

ETP and Susser, and their respective directors and executive officers, may be deemed to be participants in the solicitation of proxies in respect of the proposed transactions contemplated by the merger agreement. Information regarding directors and executive officers of ETP’s general partner is contained in ETP’s Form 10-K for the year ended December

31, 2013, which has been filed with the SEC. Information regarding Susser’s directors and executive officers is contained in Susser’s definitive proxy statement dated April 14, 2014, which is filed with the SEC. A more complete description will be available in the registration statement and the proxy statement/prospectus.

SAFE HARBOR FOR FORWARD-LOOKING STATEMENTS

Statements in this document regarding the proposed transaction between ETP and Susser, the expected timetable for completing the proposed transaction, future financial and operating results, benefits and synergies of the proposed transaction, future opportunities for the combined company, and any other statements about ETP, Energy Transfer Equity,

L.P. (“ETE”), Susser Petroleum Partners LP (“SUSP”), or Susser managements’ future expectations, beliefs, goals, plans or prospects constitute forward looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Any statements that are not statements of historical fact (including statements containing the words “believes,” “plans,”

“anticipates,” “expects,” estimates and similar expressions) should also be considered to be forward looking statements. There are a number of important factors that could cause actual results or events to differ materially from those indicated by such forward looking statements, including: the ability to consummate the proposed transaction; the ability to obtain the requisite regulatory approvals, Susser shareholder approval and the satisfaction of other conditions to consummation of the transaction; the ability of ETP to successfully integrate Susser’s operations and employees; the ability to realize anticipated synergies and cost savings; the potential impact of announcement of the transaction or consummation of the transaction on relationships, including with employees, suppliers, customers and competitors; the ability to achieve revenue growth; national, international, regional and local economic, competitive and regulatory conditions and developments; technological developments; capital and credit markets conditions; inflation rates; interest rates; the political and economic stability of oil producing nations; energy markets, including changes in the price of certain commodities; weather conditions; environmental conditions; business and regulatory or legal decisions; the pace of deregulation of retail natural gas and electricity and certain agricultural products; the timing and success of business development efforts; terrorism; and the other factors described in the Annual Reports on Form 10-K for the year ended December 31, 2013 filed with the SEC by ETP, ETE, SUSP and Susser. ETP, ETE, and Susser disclaim any intention or obligation to update any forward looking statements as a result of developments occurring after the date of this document.

| 2 |

|

|

|

INTRODUCTIONS

Speakers:

Martin Salinas

Chief Financial Officer, ETP

Jamie Welch

Group Chief Financial Officer & Head of Corp. Development, ETE

Bob Owens

President & Chief Executive Officer, Sunoco

Participants:

Kelcy Warren

Chief Executive Officer & Chairman, ETP

Sam L. Susser

Chairman & Chief Executive Officer, SUSS/SUSP

| 3 |

|

|

|

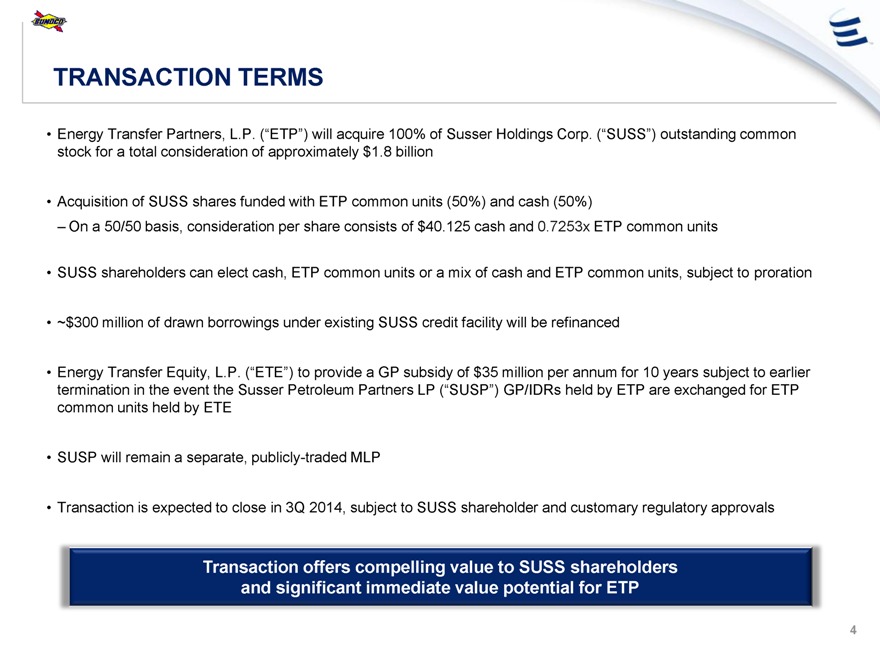

TRANSACTION TERMS

Energy Transfer Partners, L.P. (“ETP”) will acquire 100% of Susser Holdings Corp. (“SUSS”) outstanding common stock for a total consideration of approximately $1.8 billion

Acquisition of SUSS shares funded with ETP common units (50%) and cash (50%)

– On a 50/50 basis, consideration per share consists of $40.125 cash and 0.7253x ETP common units

SUSS shareholders can elect cash, ETP common units or a mix of cash and ETP common units, subject to proration

~$300 million of drawn borrowings under existing SUSS credit facility will be refinanced

Energy Transfer Equity, L.P. (“ETE”) to provide a GP subsidy of $35 million per annum for 10 years subject to earlier termination in the event the Susser Petroleum Partners LP (“SUSP”) GP/IDRs held by ETP are exchanged for ETP common units held by ETE

SUSP will remain a separate, publicly-traded MLP

Transaction is expected to close in 3Q 2014, subject to SUSS shareholder and customary regulatory approvals

Transaction offers compelling value to SUSS shareholders and significant immediate value potential for ETP

4

|

|

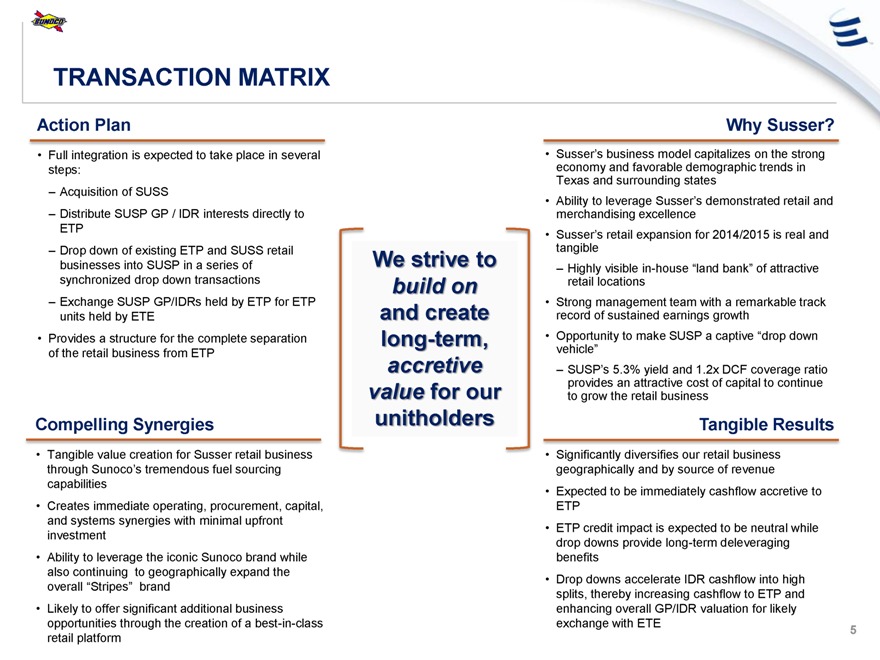

TRANSACTION MATRIX

Action Plan

Full integration is expected to take place in several steps:

– Acquisition of SUSS

– Distribute SUSP GP / IDR interests directly to ETP

– Drop down of existing ETP and SUSS retail businesses into SUSP in a series of synchronized drop down transactions

– Exchange SUSP GP/IDRs held by ETP for ETP units held by ETE

Provides a structure for the complete separation of the retail business from ETP

Compelling Synergies

Tangible value creation for Susser retail business through Sunoco’s tremendous fuel sourcing capabilities

Creates immediate operating, procurement, capital, and systems synergies with minimal upfront investment

Ability to leverage the iconic Sunoco brand while also continuing to geographically expand the overall “Stripes” brand

Likely to offer significant additional business opportunities through the creation of a best-in-class retail platform

We strie to build on and create long term, accretive value for our unitholders

Why Susser?

Susser’s business model capitalizes on the strong economy and favorable demographic trends in Texas and surrounding states

Ability to leverage Susser’s demonstrated retail and merchandising excellence

Susser’s retail expansion for 2014/2015 is real and tangible

– Highly visible in-house “land bank” of attractive retail locations

Strong management team with a remarkable track record of sustained earnings growth

Opportunity to make SUSP a captive “drop down vehicle”

– SUSP’s 5.3% yield and 1.2x DCF coverage ratio provides an attractive cost of capital to continue to grow the retail business

Tangible Results

Significantly diversifies our retail business geographically and by source of revenue

Expected to be immediately cashflow accretive to ETP

ETP credit impact is expected to be neutral while drop downs provide long-term deleveraging benefits

Drop downs accelerate IDR cashflow into high splits, thereby increasing cashflow to ETP and enhancing overall GP/IDR valuation for likely exchange with ETE

| 5 |

|

|

|

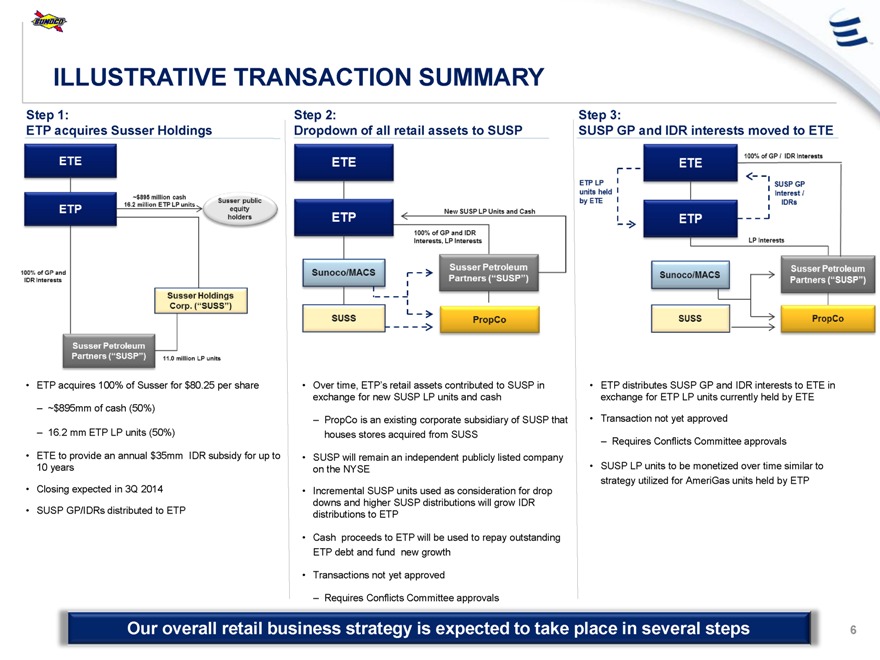

ILLUSTRATIVE TRANSACTION SUMMARY

Step 1:

ETE

ETP

100% of GP and IDR Interests

~$895 million cash 16.2 million ETP LP units

Susser Holdings Corp. (“suss”)

Susser Petroleum Partners (“SUSP”)

11.0 million LP units

ETE

ETP

Sunoco/MACS

SUSS

New SUSP LP Units and Cash

100% of GP and IDR Interests, LP Interests

Susser Petoleum Partners (“SUSP”)

PropCo.

ETP LP units held by ETE

ETE

ETP

Sunoco/MACS

SUSS

100% of GP / IDR Interests

SUSP GP Interests / IDRs

LP Interests

Susser Petroleum Partners (“SUSP”)

PropCo

ETP acquires Susser Holdings

ETP acquires 100% of Susser for $80.25 per share

– ~$895mm of cash (50%)

– 16.2 mm ETP LP units (50%)

ETE to provide an annual $35mm IDR subsidy for up to 10 years

Closing expected in 3Q 2014

SUSP GP/IDRs distributed to ETP

Step 2:

Dropdown of all retail assets to SUSP

Over time, ETP’s retail assets contributed to SUSP in exchange for new SUSP LP units and cash

– PropCo is an existing corporate subsidiary of SUSP that houses stores acquired from SUSS

SUSP will remain an independent publicly listed company on the NYSE

Incremental SUSP units used as consideration for drop downs and higher SUSP distributions will grow IDR distributions to ETP

Cash proceeds to ETP will be used to repay outstanding ETP debt and fund new growth

Transactions not yet approved

– Requires Conflicts Committee approvals

Step 3:

SUSP GP and IDR interests moved to ETE

ETP distributes SUSP GP and IDR interests to ETE in exchange for ETP LP units currently held by ETE

Transaction not yet approved

– Requires Conflicts Committee approvals

SUSP LP units to be monetized over time similar to strategy utilized for AmeriGas units held by ETP

Our overall retail business strategy is expected to take place in several steps 6

|

|

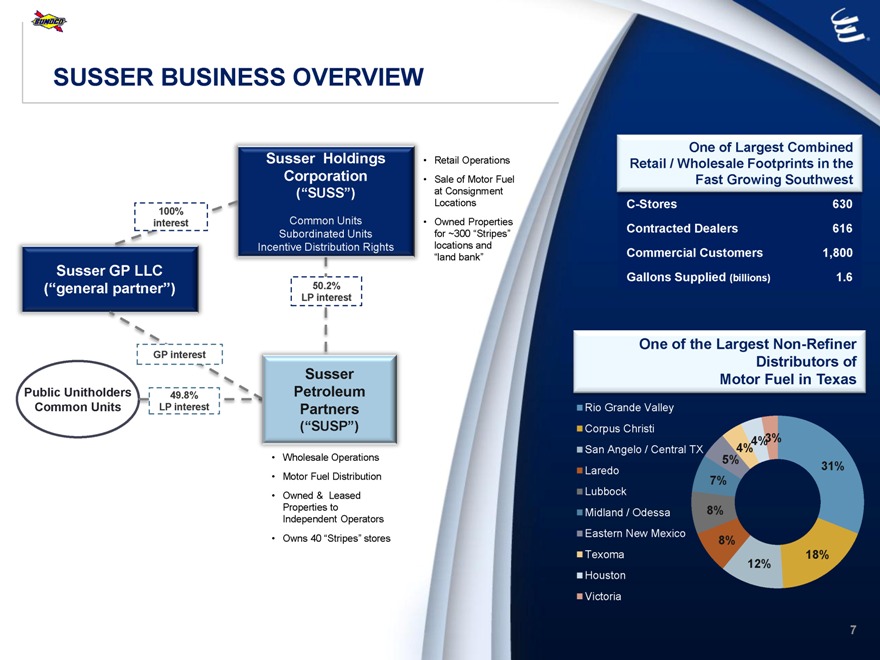

SUSSER BUSINESS OVERVIEW

Susser Holdings

• Retail Operations

Corporation

• Sale of Motor Fuel (“SUSS”) at Consignment 100% Locations interest Common Units

• Owned Properties

Subordinated Units for ~300 “Stripes” Incentive Distribution Rights locations and

“land bank”

Susser GP LLC

(“general partner”) 50.2%

LP interest

GP interest

Susser

Public Unith olders Petroleum

Common Un its Partners

49.8%

LP interest

(“SUSP”)

Wholesale Operations

Motor Fuel Distribution

Owned & Leased Properties to Independent Operators

Owns 40 “Stripes” stores

One of Largest Combined Retail / Wholesale Footprints in the Fast Growing Southwest

C-Stores 630 Contracted Dealers 616 Commercial Customers 1,800 Gallons Supplied (billions) 1.6

One of the Largest Non-Refiner Distributors of Motor Fuel in Texas

Rio Grande Valley Corpus Christi

4% 3%

San Angelo / Central TX 4%

5%

Laredo 31%

7%

Lubbock

Midland / Odessa 8% Eastern New Mexico

8%

Texoma 18% 12%

Houston Victoria

7

|

|

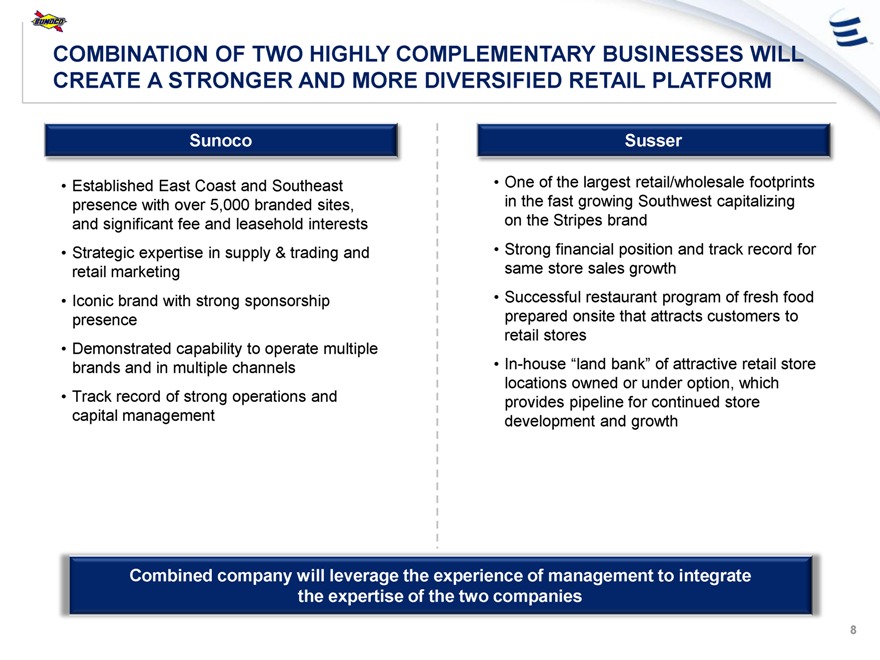

COMBINATION OF TWO HIGHLY COMPLEMENTARY BUSINESSES WILL

CREATE A STRONGER AND MORE DIVERSIFIED RETAIL PLATFORM

Sunoco

Established East Coast and Southeast presence with over 5,000 branded sites, and significant fee and leasehold interests

Strategic expertise in supply & trading and retail marketing

Iconic brand with strong sponsorship presence

Demonstrated capability to operate multiple brands and in multiple channels

Track record of strong operations and capital management

Susser

One of the largest retail/wholesale footprints in the fast growing Southwest capitalizing on the Stripes brand

Strong financial position and track record for same store sales growth

Successful restaurant program of fresh food prepared onsite that attracts customers to retail stores

In-house “land bank” of attractive retail store locations owned or under option, which provides pipeline for continued store development and growth

Combined company will leverage the experience of management to integrate the expertise of the two companies

8

|

|

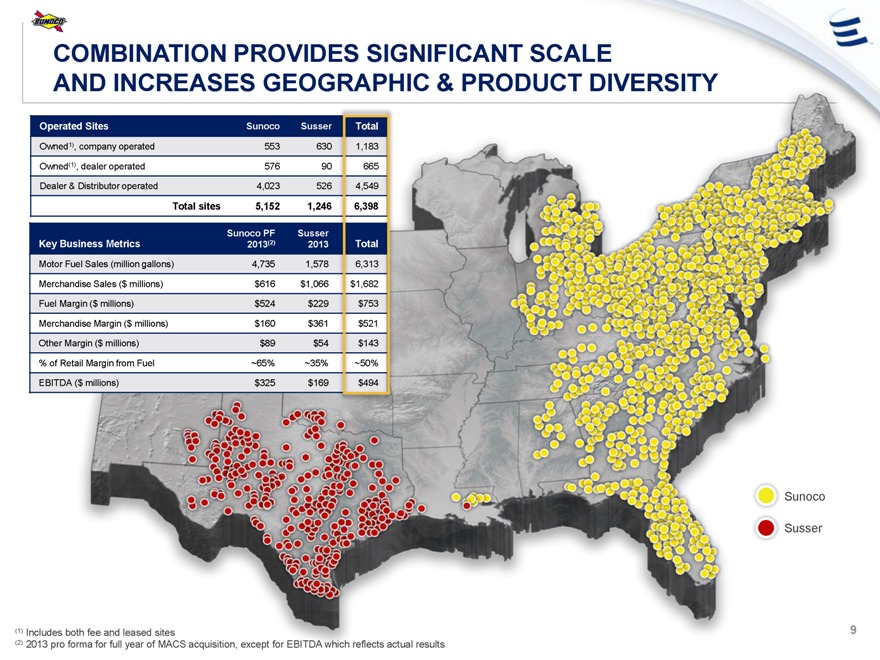

COMBINATION PROVIDES SIGNIFICANT SCALE

AND INCREASES GEOGRAPHIC & PRODUCT DIVERSITY

Operated Sites Sunoco Susser

Owned1), company operated 553 630 Owned(1), dealer operated 576 90 Dealer & Distributor operated 4,023 526

Total sites 5,152 1,246

1,183 665 4,549 6,398

Sunoco PF Susser

Key Business Metrics 2013(2) 2013

4,735 $616 $524 $160 $89 ~65% $325

1,578 $1,066 $229 $361 $54 ~35% $169

6,313 $1,682 $753 $521 $143 ~50% $494

Motor Fuel Sales (million gallons) Merchandise Sales ($ millions) Fuel Margin ($ millions) Merchandise Margin ($ millions)

Other Margin ($ millions)

% of Retail Margin from Fuel

EBITDA ($ millions)

Sunoco

Susser

Includes both fee and leased sites

2013 pro forma for full year of MACS acquisition, except for EBITDA which reflects actual results

|

|

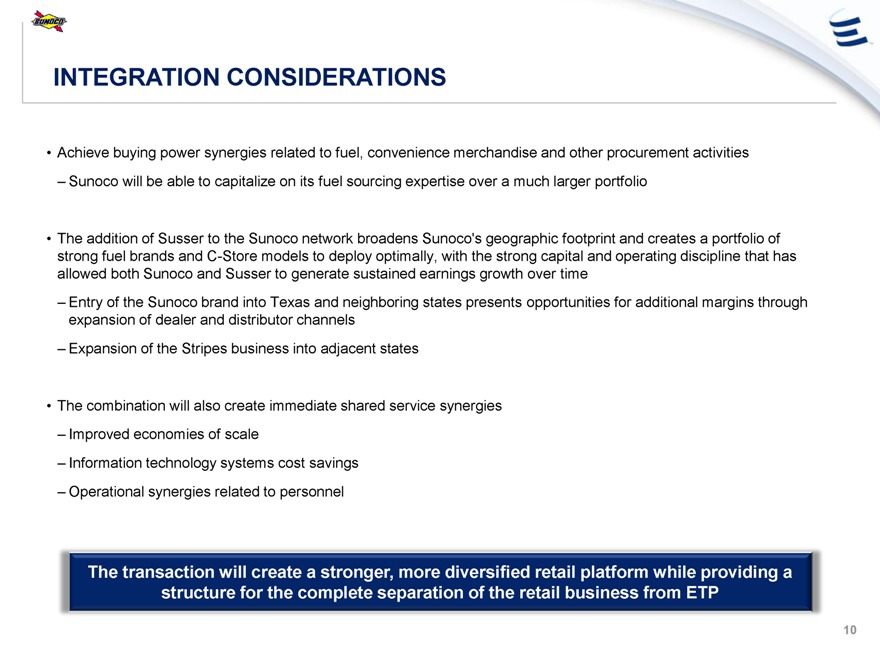

INTEGRATION CONSIDERATIONS

Achieve buying power synergies related to fuel, convenience merchandise and other procurement activities

– Sunoco will be able to capitalize on its fuel sourcing expertise over a much larger portfolio

The addition of Susser to the Sunoco network broadens Sunoco’s geographic footprint and creates a portfolio of strong fuel brands and C-Store models to deploy optimally, with the strong capital and operating discipline that has allowed both Sunoco and Susser to generate sustained earnings growth over time

– Entry of the Sunoco brand into Texas and neighboring states presents opportunities for additional margins through expansion of dealer and distributor channels

– Expansion of the Stripes business into adjacent states

The combination will also create immediate shared service synergies

– Improved economies of scale

– Information technology systems cost savings

– Operational synergies related to personnel

The transaction will create a stronger, more diversified retail platform while providing a structure for the complete separation of the retail business from ETP

10

|

|

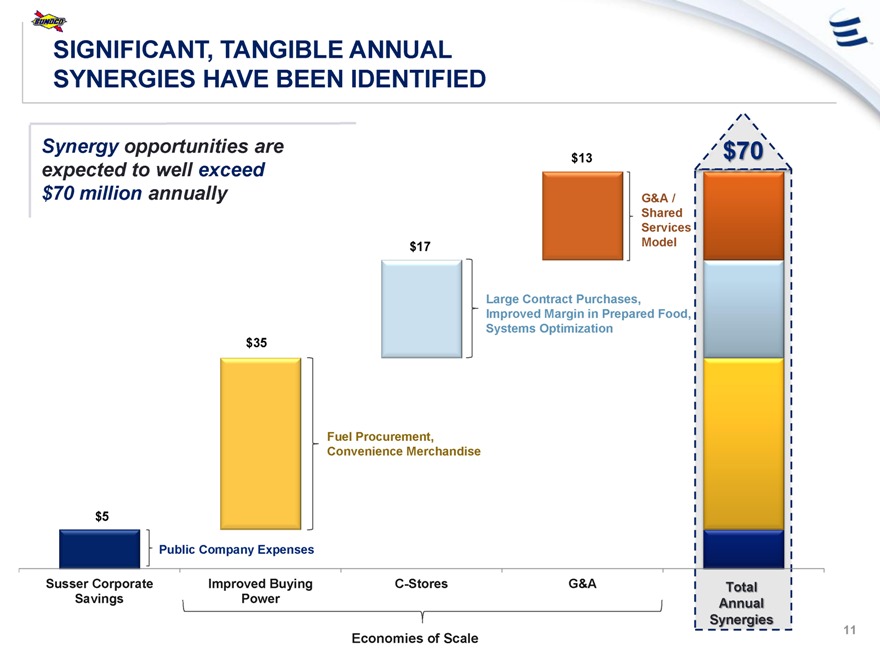

SIGNIFICANT, TANGIBLE ANNUAL SYNERGIES HAVE BEEN IDENTIFIED

Synergy opportunities are expected to well exceed $70 million annually

$5

Susser Corporate Savings

$35

Public Company Expenses

Improved Buying Power

Fuel Procurement,

Convenience Merchandise

$17

Large Contract Purchases,

Improved Margin in Prepared Food, Systems Optimization

$13

G&A / Shared Services Model

$70

Total Annual

Synergies 11

C-Stores G&A

Economies of Scale

|

|

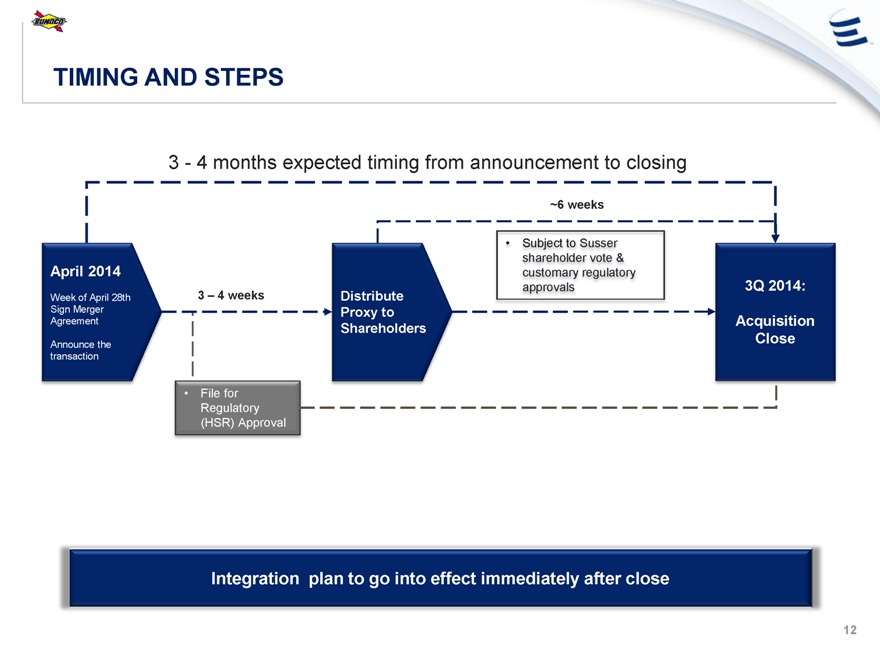

TIMING AND STEPS

3—4 months expected timing from announcement to closing

~6 weeks

April 2014

Week of April 28th Sign Merger Agreement

Announce the transaction

3 – 4 weeks

File for

Regulatory

(HSR) Approval

Distribute Proxy to Shareholders

Subject to Susser shareholder vote & customary regulatory approvals

3Q 2014:

Acquisition Close

Integration plan to go into effect immediately after close

12

|

|

CONCLUSION

“Smart” transaction for ETP

– Anticipated drop downs of the existing Sunoco and Susser retail businesses into SUSP provide a clear path for ETP to segregate the retail business into a dedicated vehicle with its own independent access to capital to support its growth strategy

– Expected drop downs would generate significant cash proceeds to ETP over the next several years, further strengthening ETP credit metrics

– An exchange of SUSP GP/IDRs held by ETP for ETP common units held by ETE, combined with the eventual monetization of SUSP units would allow ETP to fully exit the retail business in a highly accretive manner

Compelling retail combination

– The high growth markets in Texas & neighboring states are highly complementary to Sunoco’s established East Coast and Southeast presence

– Significant commercial/operational synergies created by combining retail operations

– A powerful platform for future growth while creating a more diversified cashflow profile

Transaction is accretive to DCF per unit for ETP and expected to be credit neutral

– Level of cashflow accretion is expected to increase as the overall action plan is executed

– Cash proceeds from subsequent drop downs allows for de-leveraging and capital for new growth

The transaction will create a stronger, more diversified retail platform while providing a structure for the complete separation of the retail business from ETP 13

|

|

Q&A