Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CHARTER COMMUNICATIONS, INC. /MO/ | chtr425148k.htm |

| EX-99.1 - EXHIBIT 99.1 - CHARTER COMMUNICATIONS, INC. /MO/ | chtr425148kexhibit991.htm |

| EX-2.1 - EXHIBIT 2.1 - CHARTER COMMUNICATIONS, INC. /MO/ | chtr425148kexhibit21.htm |

| EX-99.3 - EXHIBIT 99.3 - CHARTER COMMUNICATIONS, INC. /MO/ | chtr425148kexhibit993.htm |

Charter and Comcast Agree to Transactions That Will Benefit Shareholders, Industry and Consumers April 28, 2014 Filed by Charter Communications Inc. Pursuant to Rule 425 under the Securities Act of 1933 and deemed filed pursuant to Rule 14a-12 under the Securities Exchange Act of 1934 Subject Company: Charter Communications Inc. Commission File No. 001-33664 Exhibit 99.2

2 Important Information for Investors and Shareholders This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. In connection with the proposed transaction between Comcast Corporation (“Comcast”) and Charter Communications, Inc. (“Charter”), Charter will file with the Securities and Exchange Commission (“SEC”) a registration statement on Form S-4 that will include a proxy statement of Charter that also constitutes a prospectus of Charter, and a definitive proxy statement/prospectus will be mailed to shareholders of Charter. INVESTORS AND SECURITY HOLDERS OF COMCAST AND CHARTER ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS AND OTHER DOCUMENTS THAT WILL BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Investors and security holders will be able to obtain free copies of the registration statement and the proxy statement/prospectus (when available) and other documents filed with the SEC by Comcast or Charter through the website maintained by the SEC at http://www.sec.gov. Copies of the documents filed with the SEC by Comcast are available free of charge on Comcast’s website at http://cmcsa.com or by contacting Comcast’s Investor Relations Department at 866-281-2100. Copies of the documents filed with the SEC by Charter will be available free of charge on Charter’s website at charter.com, in the “Investor and News Center” near the bottom of the page, or by contacting Charter’s Investor Relations Department at (203) 905-7955. In addition, in connection with the proposed transaction between Comcast and Time Warner Cable Inc. (“Time Warner Cable”), on March 20, 2014, Comcast filed with the SEC a registration statement on Form S-4 containing a preliminary joint proxy statement of Comcast and Time Warner Cable that also constitutes a preliminary prospectus of Comcast. The registration statement has not yet become effective. After the registration statement is declared effective by the SEC, a definitive joint proxy statement/prospectus will be mailed to shareholders of Comcast and Time Warner Cable. INVESTORS AND SECURITY HOLDERS OF COMCAST AND TIME WARNER CABLE ARE URGED TO READ THE JOINT PROXY STATEMENT/PROSPECTUS AND OTHER DOCUMENTS FILED OR THAT WILL BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION. Investors and security holders may obtain free copies of the registration statement and the joint proxy statement/prospectus and other documents filed with the SEC by Comcast or Time Warner Cable through the website maintained by the SEC at http://www.sec.gov. Copies of the documents filed with the SEC by Comcast are available free of charge on Comcast’s website at http://cmcsa.com or by contacting Comcast’s Investor Relations Department at 866-281-2100. Copies of the documents filed with the SEC by Time Warner Cable will be available free of charge on Time Warner Cable’s website at http://ir.timewarnercable.com or by contacting Time Warner Cable’s Investor Relations Department at 877-446- 3689. Shareholders of Comcast and Time Warner Cable are not being asked to vote on the proposed transaction between Comcast and Charter, and the proposed transaction between Comcast and Time Warner Cable is not contingent upon the proposed transaction between Comcast and Charter. Comcast, Time Warner Cable, Charter and their respective directors and certain of their respective executive officers may be considered participants in the solicitation of proxies in connection with the proposed transaction between Comcast and Time Warner Cable, and Comcast, Charter and their respective directors and certain of their respective executive officers may be considered participants in the solicitation of proxies in connection with the proposed transaction between Comcast and Charter. Information about the directors and executive officers of Time Warner Cable is set forth in its Annual Report on Form 10-K for the year ended December 31, 2013, which was filed with the SEC on February 18, 2014, and its preliminary proxy statement for its 2014 annual meeting of stockholders, which was filed with the SEC on April 8, 2014. Information about the directors and executive officers of Comcast is set forth in its Annual Report on Form 10-K for the year ended December 31, 2013, which was filed with the SEC on February 12, 2014, and its proxy statement for its 2014 annual meeting of stockholders, which was filed with the SEC on April 11, 2014. Information about the directors and executive officers of Charter is set forth in its Annual Report on Form 10-K for the year ended December 31, 2013, which was filed with the SEC on February 21, 2014, and its proxy statement for its 2014 annual meeting of stockholders, which was filed with the SEC on March 27, 2014. These documents can be obtained free of charge from the sources indicated above. Additional information regarding the participants in the proxy solicitations and a description of their direct and indirect interests, by security holdings or otherwise, are contained in the preliminary joint proxy statement/prospectus of Comcast and Time Warner Cable filed with the SEC and will be contained in the definitive joint proxy statement/prospectus of Comcast and Time Warner Cable and other relevant materials to be filed with the SEC when they become available, and will also be contained in the preliminary proxy statement/prospectus of Charter when it becomes available.

3 Cautionary Statement Regarding Forward-Looking Statements Certain statements in this communication regarding the proposed acquisition of Time Warner Cable by Comcast and the proposed transaction between Comcast and Charter, including any statements regarding the expected timetable for completing the transactions, benefits and synergies of the transactions, future opportunities for the respective companies and products, and any other statements regarding Comcast’s, Time Warner Cable’s and Charter’s future expectations, beliefs, plans, objectives, financial conditions, assumptions or future events or performance that are not historical facts are “forward-looking” statements made within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements are often, but not always, made through the use of words or phrases such as “may”, “believe,” “anticipate,” “could”, “should,” “intend,” “plan,” “will,” “expect(s),” “estimate(s),” “project(s),” “forecast(s)”, “positioned,” “strategy,” “outlook” and similar expressions. All such forward-looking statements involve estimates and assumptions that are subject to risks, uncertainties and other factors that could cause actual results to differ materially from the results expressed in the statements. Among the key factors that could cause actual results to differ materially from those projected in the forward-looking statements are the following: the timing to consummate the proposed transactions; the risk that a condition to closing either of the proposed transactions may not be satisfied; the risk that a regulatory approval that may be required for either of the proposed transactions is not obtained or is obtained subject to conditions that are not anticipated; the parties’ ability to achieve the synergies and value creation con templated by the proposed transactions; the parties’ ability to promptly, efficiently and effectively integrate acquired operations into their own operations; and the diversion of management time on transaction-related issues. Additional information concerning these and other factors can be found in Comcast’s, Time Warner Cable’s and Charter’s respective filings with the SEC, including Comcast’s, Time Warner Cable’s and Charter’s most recent Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. Comcast, Time Warner Cable and Charter assume no obligation to update any forward-looking statements. Readers are cautioned not to place undue reliance on these forward- looking statements that speak only as of the date hereof.

Brian L. Roberts Chairman and CEO, Comcast Corporation

5 Transaction Overview Mutually beneficial and tax-efficient agreement Value enhancing for Comcast shareholders Comcast’s divesting 3.9 million customers facilitates regulatory approval process for Time Warner Cable merger Three part transaction: Asset Sale: Charter acquires systems serving ~1.4 million former TWC customers for an estimated $7.3 billion in cash Asset Transfer: Charter and Comcast transfer assets in a tax-efficient exchange involving ~1.6 million former TWC customers and ~1.6 million Charter customers Asset Spin-off: Comcast will spin-off a new entity (“SpinCo”) composed of cable systems serving ~2.5 million Comcast customers to its shareholders, with Charter acquiring ~33% of the equity of SpinCo in exchange for 13% of the equity of a new holding company of Charter Improves rationalization of each company’s footprint, enhancing operating efficiencies and technology deployments

6 Overview and Summary Charter and Comcast, with Time Warner Cable’s (TWC) consent, have entered into an agreement for a series of transactions following the close of Comcast’s proposed merger with TWC 1) See notes on page 13 2) Ownership percentage to be greatest percentage that results in Comcast stockholders as of immediately prior to the TWC merger holding at least 50.75% of SpinCo immediately after Charter acquisition of SpinCo equity Asset Purchase: • Charter acquires systems from Comcast, representing approximately 1.4 million former TWC video customers for an estimated $7.3 billion(1) in cash SpinCo All value transfers to be valued at 7.125x 2014 EBITDA(1) 1.4 Million Video Customer Asset Purchase 1.6 Million Video Customer Transfer 2.5 Million Video Customer Spin-Off to Shareholders (~67%) ~33%(2) Stake Purchase 1 2 3 3 1 Asset Transfer: • Charter and Comcast transfer assets in a tax-efficient exchange involving approximately 1.6 million former TWC video customers and approximately 1.6 million Charter video customers Spin-Off and Stake Purchase: • Comcast will spin-off a new entity (“SpinCo”) composed of cable systems serving approx. 2.5 million Comcast video customers to its shareholders • Charter will acquire approx. 33%(2) of SpinCo equity by issuing an estimated $2.1 billion(1) of equity of a new holding company of Charter to SpinCo shareholders 2 3

Thomas M. Rutledge President and CEO, Charter Communications

8 Announced Transactions Drive Value for Charter Creates Strong #2 Cable Player – Charter • Charter will own systems with an estimated 5.7 million video customers(1) • Through its services agreement with SpinCo, Charter will manage an additional estimated 2.5 million SpinCo video customers(1) • As a result of the transactions Charter will own 5.7 million video customers and manage systems comprising 8.2 million video customers(1), providing scale and operating efficiencies for both companies • For Charter shareholders, we believe the transactions will be accretive relative to Charter’s stand-alone plan pp Creates New Publicly Traded MSO That Will Leverage Charter’s Strategy and Services SpinCo to benefit from its services agreement with Charter, providing synergies to SpinCo that it would not have on a standalone basis Charter’s proven operating model intended to drive long-term growth and value at SpinCo Charter executives to serve on SpinCo Board of Directors, with Tom Rutledge as chairman 1) Charter customer count on its reporting methodology, net additions and SpinCo on respective TWC and Comcast reporting methodology, where there may be small definitional differences. Totals may not recalculate due to rounding.

9 Benefits of Transactions for Charter 1) See notes on page 13 • Ownership in SpinCo expected to deliver attractive returns for Charter shareholders • Scale will drive benefits for both Charter and SpinCo • Charter representation on SpinCo Board • Service fee to Charter of 4.25% of SpinCo revenue, plus cost reimbursement ~33% Ownership in SpinCo Drives Operational and Financial Benefits • Enterprise Value/2014E EBITDA = 7.125x(1) • Ability to drive operating synergies and enhance growth profile • System synergies driven by more logical geographic operations, partly offset by programming cost increases coming off of Comcast/TWC programming agreements Fair Valuation and Growth Potential • Pro forma leverage of ~5x for Charter, preserves levered equity profile • Existing tax assets (NOL & outsized basis) remain intact at Charter and their present value is enhanced with accelerated use of tax loss carryforwards via asset purchase Levered Equity Returns • Nearly doubles the number of video customers owned or managed by Charter to over 8 million • Significantly improved operating footprint provides better marketing and service capabilities • Charter and SpinCo will be the leading cable operators in 10 states • Attractive competitive dynamics Enhances Scale and Footprint

10 Pro Forma Charter and SpinCo: Scale and Footprint Acquired Systems SpinCo Charter Less Divested Systems Note: Larger Circles Representing Major Markets Video Customers (in Millions)(1) Current Charter 4.4 + Acquired Systems ~1.4 = Pro Forma Charter ~5.7 SpinCo ~2.5 Charter Owned or Managed ~8.2 Charter will • Acquire systems in Ohio, Kentucky, Wisconsin, Indiana and Alabama DMAs • Divest systems in California, New England, Tennessee, Georgia, North Carolina, Texas, Oregon, Washington and Virginia DMAs SpinCo to own systems that are adjacent and/or contiguous to Charter systems in • Michigan, Minnesota, Indiana, Alabama, Eastern Tennessee, Kentucky and Wisconsin DMAs 1) Charter customer count on its reporting methodology, net additions and SpinCo on respective TWC and Comcast reporting methodology, where there may be small definitional differences. Totals may not recalculate due to rounding.

Christopher L. Winfrey Executive Vice President and CFO, Charter Communications

12 Transactions Summary for Charter • In addition to ~1.6 million asset transfer in a tax-efficient exchange, transaction values will all be determined at closing, based on carve-out financials for asset transfer systems, purchased systems and SpinCo • The calculations below are based on preliminary estimates, with all systems valued at 7.125x 2014 carve-out EBITDA as defined in the agreement • Charter will merge into a newly formed subsidiary of CCH I (“New Charter”); shares of Charter become shares of New Charter Systems Acquisition • Charter will issue debt to acquire systems serving approximately 1.4 million of the prior TWC video customers • Based on estimated 2014 EBITDA (pro-rated as a proxy for the acquired systems), this transaction is estimated to be valued at $7.3 billion(1) • Charter expects to have leverage of ~5x EBITDA at close and to naturally delever back to its target leverage range of 4.0-4.5x EBITDA • Comcast and Charter have also agreed that Comcast will receive the value of the tax benefits Charter realizes from a step-up in basis of the acquired assets, at the earlier of time of realization and 8 years Spin-Off and Stake Aquisition • SpinCo will raise new debt of ~5x EBITDA prior to its spin off • Based on the estimated 2014 carve-out EBITDA of SpinCo, SpinCo would have an estimated enterprise value of $14.3 billion and an estimated equity value of $5.8 billion (assuming leverage of ~5x)(1) • New Charter will issue equity to SpinCo shareholders to acquire its ~33% stake in SpinCo(2), Comcast will have no ownership of SpinCo • SpinCo shareholders would receive shares representing an approximate 13% ownership stake in New Charter(1) • SpinCo will employ an executive team and have a Board of Directors of 9 members, 3 of whom will be Charter executives • SpinCo operations to benefit from Charter Board participation and services agreement 1) See notes on page 13 2) Ownership percentage to be greatest percentage that results in Comcast stockholders as of immediately prior to the TWC merger holding at least 50.75% of SpinCo immediately after Charter acquisition of SpinCo equity

13 Illustrative Transaction Details for Charter Acquisition Transaction Est. Net 2014 Carve-out EBITDA Acquired $1.0B Transaction Valuation Multiple 7.125x = Estimated Purchase Price $7.3B SpinCo Transaction Estimated 2014 SpinCo Carve-out EBITDA $2.0B Transaction Valuation Multiple 7.125x = Estimated SpinCo Enterprise Value $14.3B SpinCo Leverage ~5x Debt to be Raised at SpinCo $8.5B Implied SpinCo Equity Value $5.8B Stake Purchased by Charter ~33% = Est. Charter Equity to SpinCo Shareholders $2.1B Pro Forma Charter Ownership Current Charter Shareholders ~87% SpinCo Shareholders ~13% Pro Forma Charter Debt (excl. SpinCo) Projected Charter Debt at Close 12/31/2014 $14.1B + New Debt and Fees for Acquisition of Systems $7.7B = Pro Forma Charter Debt at Close $21.8B Estimated PF Leverage at Close ~5x Notes: • EBITDA defined as all revenue less direct costs and fully allocated indirect costs of the respective systems, including corporate overhead, as defined in agreement • The shares issued to SpinCo shareholders will be based on the VWAP of Charter shares for 60 calendar days ending on the last trading day prior to closing. 12% ownership on a fully diluted basis (based on 4/25/2014 share price). • $7.3 billion acquisition purchase price estimate based on 7.125x estimated 2014 carve-out EBITDA, less $22 million of other expense allocation. Estimated carve-out EBITDA based on fully allocated EBITDA/video customer derived from Comcast S-4 filing dated 3/20/14. • $2.1 billion Charter equity issuance estimate based on 7.125x estimated 2014 carve-out EBITDA, less $22 million of Comcast corporate allocation, less ~5x leverage based on estimated 2014 pro forma EBITDA, multiplied by ~33% stake purchased. Estimated carve-out EBITDA based on EBITDA/video customer derived from Comcast S-4 filing dated 3/20/14, less non-allocable corporate overhead. Est. pro forma EBITDA based on est. carve-out EBITDA less Charter service fee and any other customary pro forma adjustments. • All numbers and calculation shown are based on preliminary estimates pending preparation of financial statements. • Charter customer count on its reporting methodology, net additions and SpinCo on respective TWC and Comcast reporting methodology, where there may be small definitional differences. Totals may not recalculate due to rounding.

Michael J. Angelakis Vice Chairman and CFO, Comcast Corporation

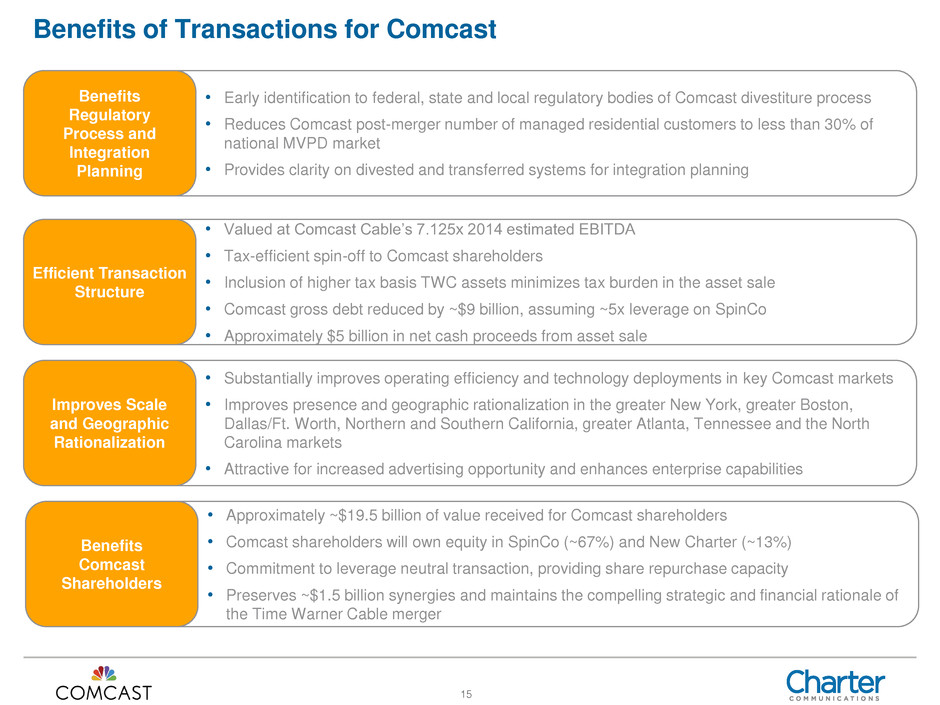

15 Benefits of Transactions for Comcast • Valued at Comcast Cable’s 7.125x 2014 estimated EBITDA • Tax-efficient spin-off to Comcast shareholders • Inclusion of higher tax basis TWC assets minimizes tax burden in the asset sale • Comcast gross debt reduced by ~$9 billion, assuming ~5x leverage on SpinCo • Approximately $5 billion in net cash proceeds from asset sale Efficient Transaction Structure • Substantially improves operating efficiency and technology deployments in key Comcast markets • Improves presence and geographic rationalization in the greater New York, greater Boston, Dallas/Ft. Worth, Northern and Southern California, greater Atlanta, Tennessee and the North Carolina markets • Attractive for increased advertising opportunity and enhances enterprise capabilities Improves Scale and Geographic Rationalization • Approximately ~$19.5 billion of value received for Comcast shareholders • Comcast shareholders will own equity in SpinCo (~67%) and New Charter (~13%) • Commitment to leverage neutral transaction, providing share repurchase capacity • Preserves ~$1.5 billion synergies and maintains the compelling strategic and financial rationale of the Time Warner Cable merger Benefits Comcast Shareholders • Early identification to federal, state and local regulatory bodies of Comcast divestiture process • Reduces Comcast post-merger number of managed residential customers to less than 30% of national MVPD market • Provides clarity on divested and transferred systems for integration planning Benefits Regulatory Process and Integration Planning

16 Pro Forma Estimated Comcast Est. Initial Value to Comcast Shareholders ($ in Billions) SpinCo Equity $3.5 Charter Equity + $2.0 Total SpinCo and Charter Equity $5.5 Reduction in Comcast Debt +$9.0 Net Cash Proceeds +$5.0 Est. Initial Value to Comcast Shareholders $19.5 Illustrative Pro Forma Comcast EBITDA ($ in Billions) Comcast consensus 2014E EBITDA $22.9 TWC consensus 2014E EBITDA + $8.4 Combined 2014E EBITDA $31.3 Net EBITDA reduction ($3.0) Pro Forma 2014E Comcast Consensus EBITDA $28.3 Highlights • Less than 30 million managed residential customers • Increased presence in key strategic markets • Improved business opportunity to serve regional and enterprise businesses • Significant opportunities for operating efficiencies and revenue growth • Additional buyback capacity through cash proceeds from sale proceeds and debt reduction • Preserves balance sheet strength and will remain leverage neutral • Pro forma leverage at 12/31/2014 remains at 2.2x Commitment to Continue to Build Shareholder Value

17 Regulatory Implications We believe this agreement facilitates the regulatory review by bringing certainty to our divestitures early in the process pp Regulatory filings • We will continue to pursue the pending applications and filings for the Comcast-TWC deal • These transactions will require their own HSR filings • We will file new public interest statements and applications at the FCC for these transactions • We will also file new LFA and state PUC applications in multiple jurisdictions We will aim to make all additional filings in approximately 30 days We will request review of all transactions on an integrated basis and we are hopeful that review will be completed by the end of the year

Q&A