Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Capella Healthcare, Inc. | d713650d8k.htm |

Lender

Presentation April 2014

Exhibit 99.1 |

Disclaimer

2

Forward-Looking Statement

Certain statements made in this presentation, as well as information included in oral

statements or other written statements made, or to be made, by our management, contain,

or will contain, disclosures that are “forward-looking statements” within the meaning of the safe harbor provisions of the Private

Securities Litigation Reform Act of 1995. Forward-looking statements include all

statements that do not relate solely to historical or current facts and can be

identified by the use of words such as “may,” “will,” “expect,” “believe,” “intend,” “plan,” “estimate,” “project,” “continue,” “should” and other

comparable terms. These forward-looking statements are based on the current plans

and expectations of our management and are subject to a number of risks and

uncertainties, which could significantly affect our current plans and expectations and future financial condition and results and there can be no

assurance that the plan or expectation will be achieved or accomplished. Except as required by

law, we undertake no obligation to publicly update or revise any forward-looking

statements, whether as a result of new information, future events or otherwise. Investors are cautioned against relying on such

forward-looking statements when evaluating the information contained in this presentation

or included in oral statements or other written statements. Presentation of Non-GAAP Information

The presentation also contains certain financial measures. The SEC has issued rules to

regulate the use in filings with the SEC of “non-GAAP financial

measures,” such as EBITDA and adjusted EBITDA, that are derived on the basis of

methodologies other than in accordance with accounting principles generally accepted in

the United States, or GAAP. Our management relies on EBITDA and adjusted EBITDA as the primary measures to review and assess

the operating performance of our facilities and their management teams. We believe it is

useful to investors to provide disclosures of our operating results on the same basis as

that used by management. Management and investors also review EBITDA and adjusted EBITDA to evaluate our overall performance

and to compare our current operating results with corresponding periods and with other

companies in the health care industry. EBITDA and adjusted EBITDA should not be

considered in isolation or as a substitute for GAAP financial measures. Because EBITDA and adjusted EBITDA are not measurements

determined in accordance with GAAP and are thus susceptible to varying calculations, they may

not be comparable as presented to other similarly titled measures of other companies.

|

Presenters

3

Michael Wiechart

President & Chief Executive Officer

James Brett

Bank of America Merrill Lynch

Denise Wilder Warren

EVP and Chief Financial Officer |

4

Executive Summary |

($ in

millions) As of

Pro Forma

1Q14

Adj.

1Q14

Leverage

Cash and Cash Equivalents

$11.4

$4.6

$16.0

New Revolver

-

-

-

Muskogee, M6 and Athena Leases

53.4

(39.9)

13.5

Muskogee Promissory Note

3.4

(3.4)

-

New First Lien Term Loan

-

425.0

425.0

Total First Lien Debt

$56.8

$438.5

4.75x

New Second Lien Term Loan

-

160.0

160.0

Total Senior Secured Debt

$56.8

$598.5

6.48x

9.250% Senior Notes

500.0

(500.0)

-

Total Debt

$556.8

$598.5

6.48x

Total Net Debt

$545.4

$582.5

6.30x

Financial Statistics as of 3/31/14:

LTM Adjusted EBITDA

$92.4

$92.4

Executive Summary

Transaction Overview

5

Capella Healthcare, Inc. (“Capella”) is pursuing a transaction to purchase

the MCH Capital Lease, payoff the MCH Promissory Note and refinance the existing

Senior Notes due 2017 The transaction will provide Capella with an overall

maturity extension, prepayable debt and substantial interest savings

The contemplated transaction consists of a $100 million ABL Revolver, a $425 million

First Lien Term Loan, and a $160 million Second Lien Term Loan

Note: All 1Q14 results are unaudited.

(1) Assumes the call price of 104.625% of par on 7/1/14.

($ in millions)

Sources

Amount

%

New Term Loan B

$425.0

73%

New Second Lien Term Loan

160.0

27%

Total Sources

$585.0

100%

Uses

Amount

%

Refinance Existing Senior Notes

$500.0

85%

Muskogee Lease Buyout

39.9

7%

Muskogee Promissory Note Pay Off

3.4

1%

Estimated Call Premium

(1)

23.1

4%

Estimated Fees, Expenses and OID

14.0

2%

Cash To Balance Sheet

4.6

1%

Total Uses

$585.0

100% |

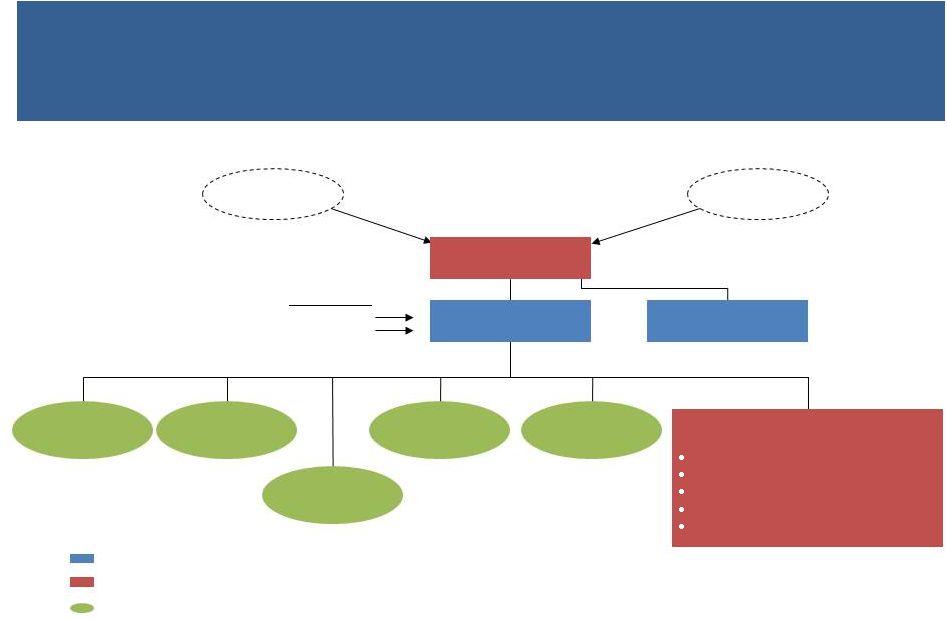

New

Financing $100 mm ABL RC

$425 mm First Lien TL

$160 mm Second Lien TL

(100%)

Common

Stock

–

729.5M

shares

(85.0%)

(90.3%)

Capital

Medical

Center (WA)*

5 wholly-owned domestic subsidiaries:

St. Mary’s Regional Medical Center (AR)

Mineral Area Regional Medical Center (MO)

EASTAR Health System (OK)

Southwestern Medical Center (OK)

Willamette Valley Medical Center (OR)

Auriga Insurance Group

= Borrower: pledge of all owned stock, intercompany notes and other assets (including

mortgages) = Guarantor: pledge of all owned stock, intercompany notes and other

assets (including mortgages) = Non-Guarantor Joint Venture: pledge of all

stock, GP and LP interests held by Capella and pledge of all secured

intercompany notes owing to Capella

(100%)

Capella Healthcare Inc.

(DE)

Common

Stock

–

128.7M

shares

(15.0%)

(100%)

Executive Summary

Legal Structure

6

River Park

Hospital (TN)*

(93.5%)

GTCR

Capella

Management

Capella Holdings, Inc.

(DE)

(58.0%)

Cannon

County (TN)*

National Park

Medical Center

(AR)*

Highlands Medical

Center (TN)*

(81.2%)

(95.3%)

* St. Thomas owns a 6.49% stake in Highlands Medical Center,

River Park Hospital, and Cannon County. The remainder of minority interest is physician-owned.

|

Executive

Summary Key Investment Highlights

7

Diversified Portfolio

of Well Positioned

Assets

Capitalize on

Identified and

Actionable Growth

Strategies

Geographically

Positioned to

Capitalize on Network

/ Affiliation

Opportunities

Meaningful Upside

from Healthcare

Reform

Significant Resources

Dedicated to Patient

Care Excellence

Consistent Operating

Performance

Strong Credit and

Liquidity Profile |

8

Capella Overview |

Company

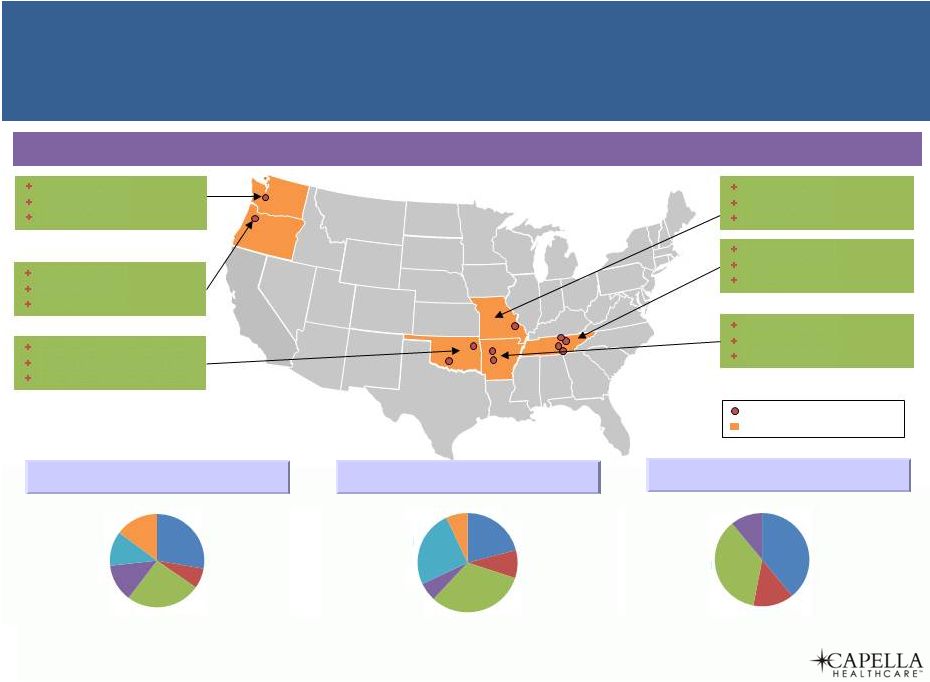

Overview Unique & Diversified Portfolio of Assets in Strong Geographic

Markets 9

Well Capitalized Portfolio | Limited CapEx Needs | Future CapEx for

Revenue-Generating, Targeted Growth Initiatives Arkansas

2 hospitals

336 beds

Washington

1 hospital

110 beds

Oklahoma

2

hospitals

(4

hospital

campuses)

519 beds

Missouri

1 hospital

135 beds

Tennessee

4 hospitals

316 beds

Oregon

1 hospital

88 beds

States with Capella Presence

Capella Facilities

Source: Company website, Public Filings.

2013 Payor Mix by Net Revenue

(ex. Bad Debt)

Beds by Geography

2013 Net Revenue by Geography

12%

38%

14%

36%

Medicare

Medicaid

Managed

Care &

Other

Self Pay

22%

9%

35%

6%

21%

7%

AR

MO

OK

OR

TN

WA

AR

MO

OK

OR

TN

WA

28%

6%

26%

13%

12%

15% |

Company

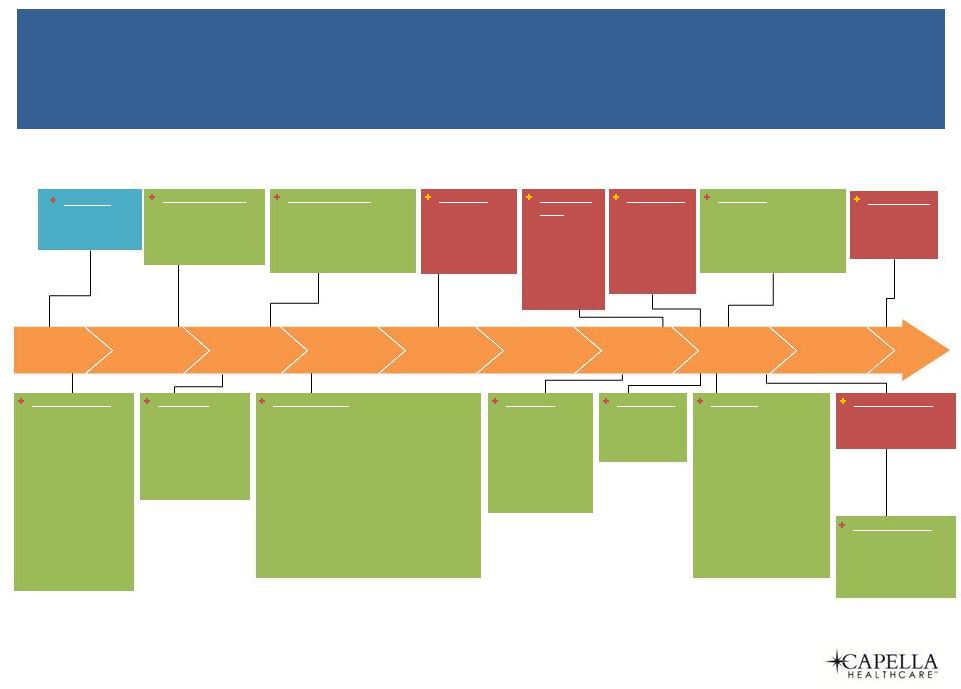

Overview Strategic Timeline of Events: Building & Shaping an Attractive

Portfolio 10

December 2006:

Acquired Middle

Tenn. Surgical Care

(River Park Hospital

(TN))

November

2005:

Acquired Facilities

(GTCR Investment:

$70mm)

April

2007:

Leased Muskogee

Regional Medical

Center (EASTAR

Health System,

OK) (GTCR

Investment:

$36mm )

July

2009:

Divested

Woodland

Medical Center

(AL)

February

2008:

Acquired

Facilities

from

Community Health Systems (CYH) (GTCR

Investment: $102mm)

December

2011:

Divested

Parkway

Medical

Center (AL)

July

2011:

Partnered with

Cannon County

Hospitals

November 2007:

Acquired Providence MRI

Associates and

Providence Radiological

Services (EASTAR Health

System (OK))

March

2012:

Divested

Hartselle

Medical

Center (AL)

July

2012:

Acquired

Muskogee Community

Hospital through long-

term lease to expand

presence in

Northeastern OK

March

2012:

Acquired

Muskogee RT

Associates

(OK)

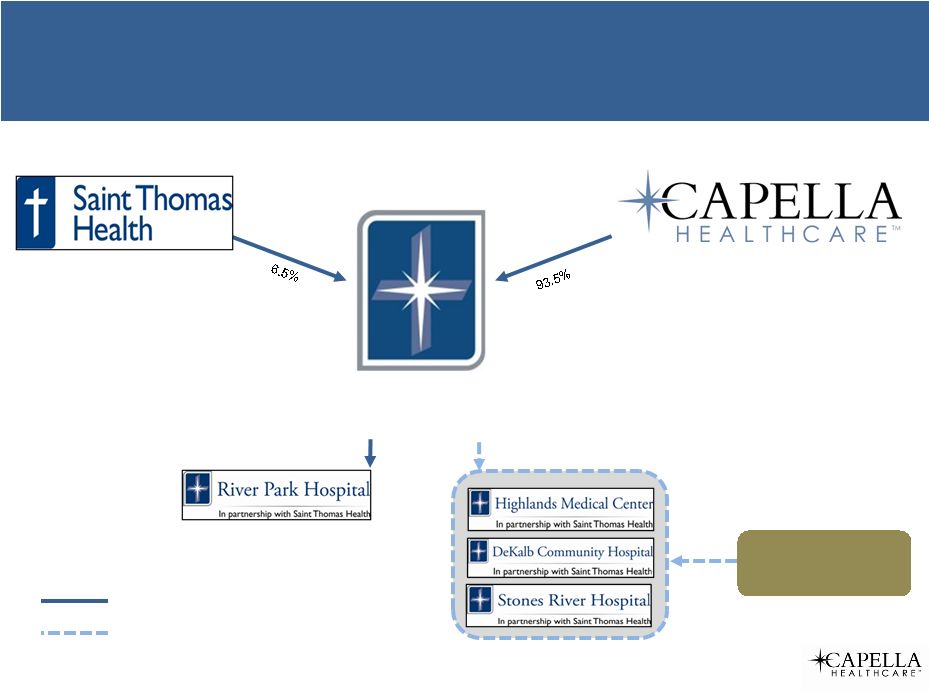

May

2012:

Partnered

with Saint Thomas

Health (Ascension)

resulting in joint

ownership and

operation of the

Company’s four Middle

TN hospitals including

River Park Hospital,

Highlands Medical

Center, DeKalb

Community Hospital,

and Stones River

Hospital

December

2012:

Divested

Jacksonville

Medical Center

(AL)

December 2012:

Acquired Southwest

Imaging Center

(OK) and

Raindancer (DIC)

(OK)

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

March 2014:

Divested

Grandview

Medical

Center (TN)

May 2005:

GTCR Initial

Commitment:

$200mm

•

Southwestern

Medical Center

(OK)

•

Grandview

Medical Center

(TN)

•

River Park

Hospital (TN)

•

Capital Medical

Center (WA)

from HCA

•

National Park Medical Center (AR)

•

St. Mary's Regional Medical Center (AR)

•

Mineral

Area

Regional

Medical

Center

(MO)

•

White County Community Hospital (TN)

(Highlands Medical Center)

•

Willamette Valley Medical Center (OR)

•

Hartselle Medical Center (AL)

•

Jacksonville Medical Center (AL)

•

Parkway Medical Center (AL)

•

Woodland Medical Center (AL)

•

DeKalb

Community

Hospital (TN)

•

Stones River

Hospital (TN) |

11

Source: Company website.

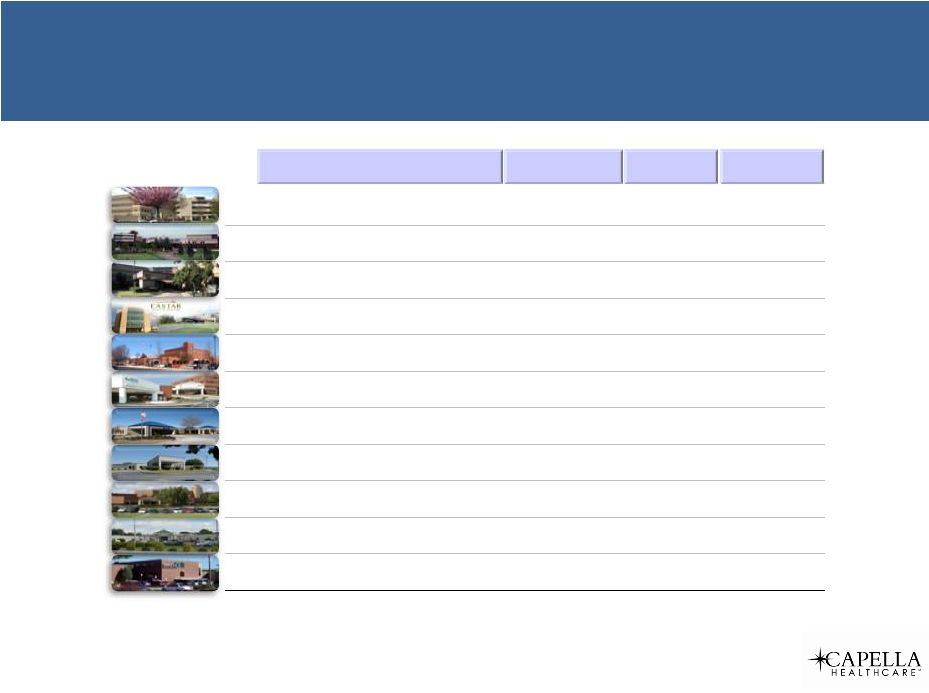

Company Overview

Consolidated Facilities Summary

Name

City

State

# of Beds

Capital Medical Center

Olympia

WA

110

Willamette Valley Medical Center

McMinnville

OR

88

Southwestern Medical Center

Lawton

OK

199

EASTAR Health System

Muskogee

OK

320

St. Mary’s Regional Medical Center

Russellville

AR

170

National Park Medical Center

Hot Springs

AR

166

Highlands Medical Center

Sparta

TN

60

Stones River Hospital

Woodbury

TN

60

River Park Hospital

McMinnville

TN

125

DeKalb Community Hospital

Smithville

TN

71

Mineral Area Regional Medical Center

Farmington

MO

135

Total

1,504 |

12

Source: Company website.

Michael Wiechart

President,

Chief Executive Officer

26+ years

Tom Anderson

Vice Chair

39+ years

Quality

Development

Operations

Finance

Administrative

Open

EVP, Chief Medical Officer

Andy Slusser

EVP, Acquisitions & Development

32+ years

Michael Wiechart

President & Chief Executive

Officer

26+ years

Denise Warren

EVP, Chief Financial Officer

29+ years

Neil Kunkel

EVP, Chief Legal &

Administrative Officer

21+ years

Average 30

Years of

Experience

Company Overview

Proven & Experienced Leadership Team

Dan Slipkovich

Executive Chair

33+ years |

Hospital

Management

Teams

Local

Physician

Leadership

Groups

13

Patient Care

Excellence

Begins in our

Communities

Boards of

Trustees &

Community

Leaders

Participation

in our

National

Leadership

Meetings

National

Physician

Leadership

Group / Physician

Advisory

Group

“O”

Leadership

Council

Company Overview

Foundation of Patient Care Excellence |

Company

Overview Physician Engagement

14

5 Whole Hospital

1 ASC

5 Whole Hospital

1 ASC

Physician JVs

Physician JVs

More than

800 with active

admitting privileges

More than

800 with active

admitting privileges

Affiliate

Affiliate

Physician

Leadership

Physician

Leadership

CMO

NPLG

CMO

NPLG

LPLG

PAG

LPLG

PAG

National Park

Medical Center

166

4.7%

May 2006

(Hot Springs, AR)

Capital Medical

Center

110

9.8%

June 2007

(Olympia, WA)

Highlands Medical

Center

60

12.3%

August 2009

(Sparta, TN)

DeKalb Community

Hospital

71

35.5%

July 2011

(Smithville, TN)

Stones River

Hospital

60

35.5%

July 2011

(Woodbury, TN)

Hospital

(City, State)

Beds

%JV

Year of JV |

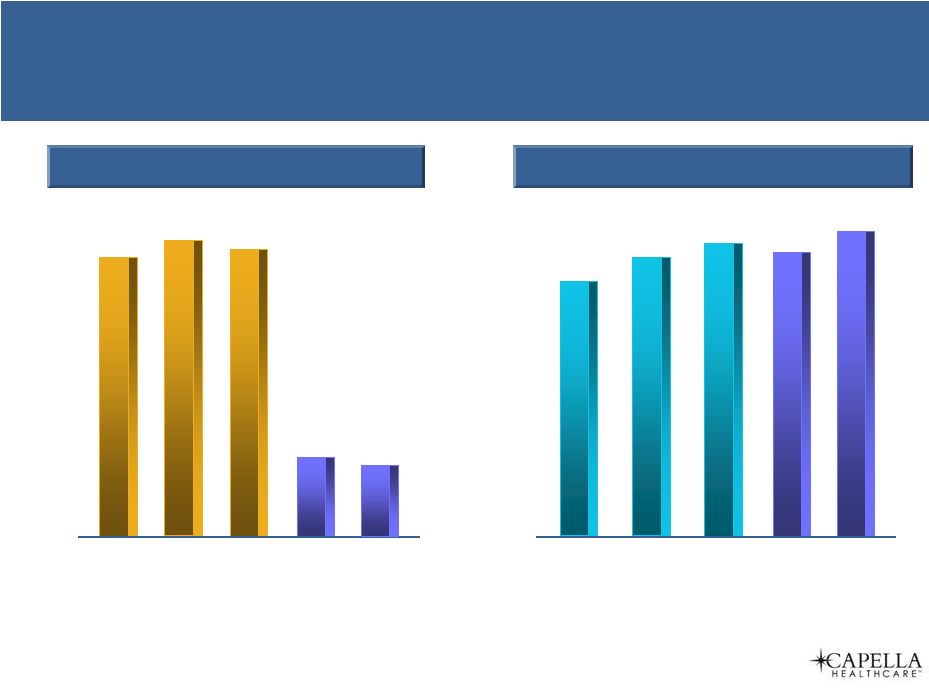

15

Company Overview

Physician Engagement

Employed Physicians

Recruitment

Mix

2009

2010

2011

2012

2013

120

133

143

132

145

2009

2010

2011

2012

2013

14

Target

62

51

31

37

41

40

PC,

36%

Spclsts,

64% |

16

Portfolio Overview |

17

Capital Medical

Center |

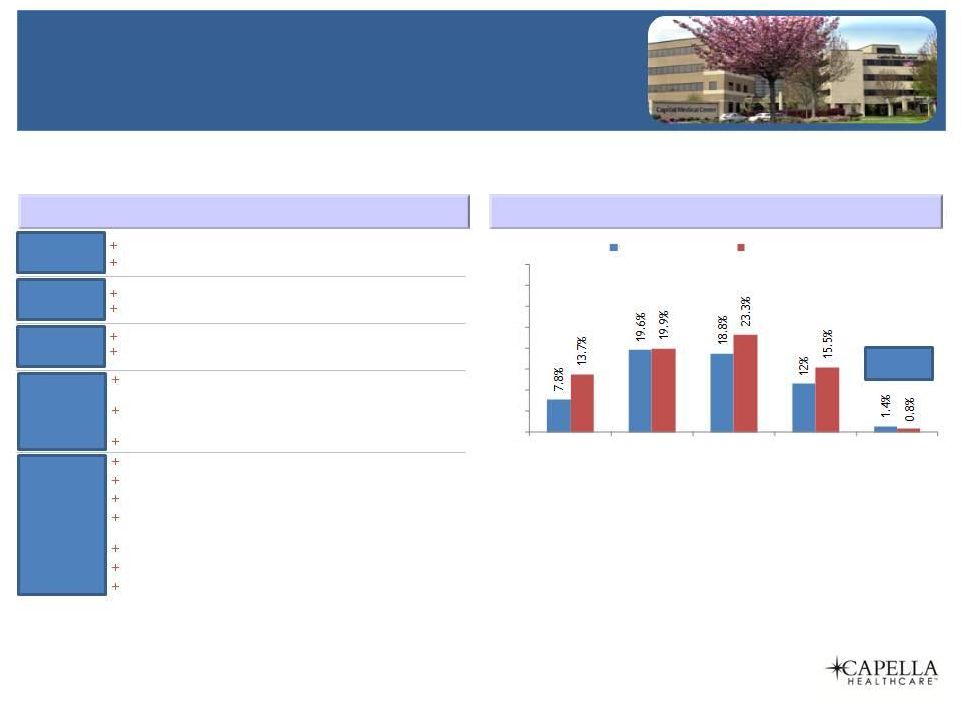

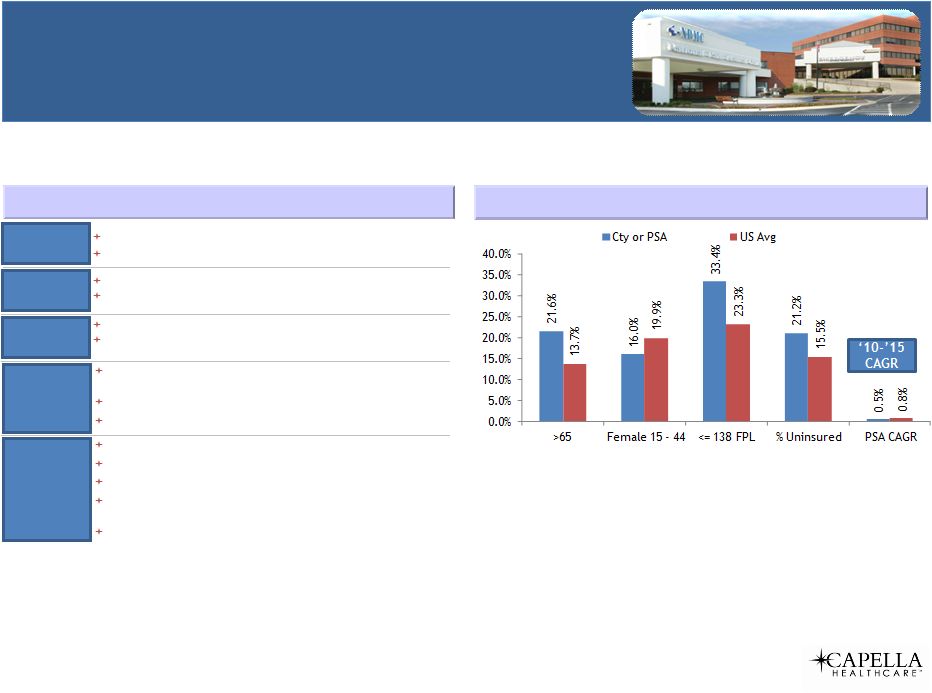

Capital

Medical Center Olympia, WA

18

Market -

Key Demographics (2010)

(1)

Acquired in December of 2005

JV Hospital with physician ownership at 9.75%

History & Overview

Key Awards

&

Accreditations

Location

Size

History

110 bed hospital

70 active physicians

Located approximately 65 miles south of Seattle

Closest competitor, Providence St. Peter Hospital is ~7 miles away

Blue

Distinction

“Total

Value

Designation”

for

knee/hip

and

spine

surgery

#1 in WA for Medical Excellence for Orthopedic Care, Major

Neurosurgery

Top 10% in WA for General Surgery

‘10-’15

CAGR

(1) US Census.

Positioning

Overall #2 player behind local NFP

Strong state-wide reputation for quality

Strength in advanced surgical services

Newer service offerings of expanded Diagnostic Imaging Center,

wound care/hyperbarics, cardiac cath lab

Highly supportive and engaged medical staff

Tertiary partner linkage with University of Washington

Cap-X focus: (ICU, OR, nurse call system)

0.0%

5.0%

10.0%

15.0%

20.0%

25.0%

30.0%

35.0%

40.0%

>65

Female

15

-

44

-

<= 138 FPL

% Uninsured

PSA CAGR

Cty or PSA

US Avg |

19

Willamette Valley

Medical Center |

Willamette Valley Medical Center

McMinnville, OR

20

Acquired in February 2008

Major renovations in 2007 ($35mm-$40mm)

Key Awards

&

Accreditations

Location

Size

History

88 bed hospital

99 active physicians

~34 miles from Portland

Closest competitor, Providence Newberg is ~15 miles away

Certification and Gold Seal of Approval by The Joint Commission

for knee and hip replacement

5-Star rated by HealthGrades

Market

-

Key

Demographics

(2010)

(1)

History & Overview

(1) US Census.

Positioning

Geographically isolated; strong community support

Strength in all key services; cohesive physician base with strong

reputation for quality

Very attractive, well capitalized facility

$35mm-$40mm renovation in late 2007/2008

Manage additional 7,000 commercial lives under the Willamette

Valley Health Solution ACO (separate from YCCO)

Manage additional 3,300 lives under Medicaid through regional

YCCO initiative

One of Nation’s 100 “strongest hospitals” (iVantage Health) |

21

Southwestern

Medical Center |

Southwestern Medical Center

Lawton, OK

22

Key Awards

&

Accreditations

Location

Size

History

Acquired in December 2005

2 campuses

199 total beds

85 active physicians

Located approximately 75 miles SW of Oklahoma City

Closest competitor, Comanche County Memorial Hospital is

~3 miles away

Becker’s Hospital Review’s Top 100 “Greatest Places to Work in

HC”

First Hospital in OK to receive TJC Stroke Certification

Only Sleep Services program in South West OK to be AASM

accredited

Market

-

Key

Demographics

(2010)

(1)

History & Overview

(1) US Census.

Positioning

# 2 player behind local NFP

Well positioned in targeted service lines that align with

demographics

Behavioral Health, Obstetrics and Neuro-surgery

Significantly expanded outpatient presence with recent in-market

acquisitions of ASC and two diagnostic imaging centers

Building new ASC; will convert to HOPD

-10.0%

-5.0%

5.0%

10.0%

15.0%

20.0%

25.0%

30.0%

35.0%

40.0%

>65

Female 15 -

44

<= 138 FPL

% Uninsured

PSA CAGR

Cty or PSA

US Avg

0.0%

‘10-’15

CAGR |

23

EASTAR

Health System |

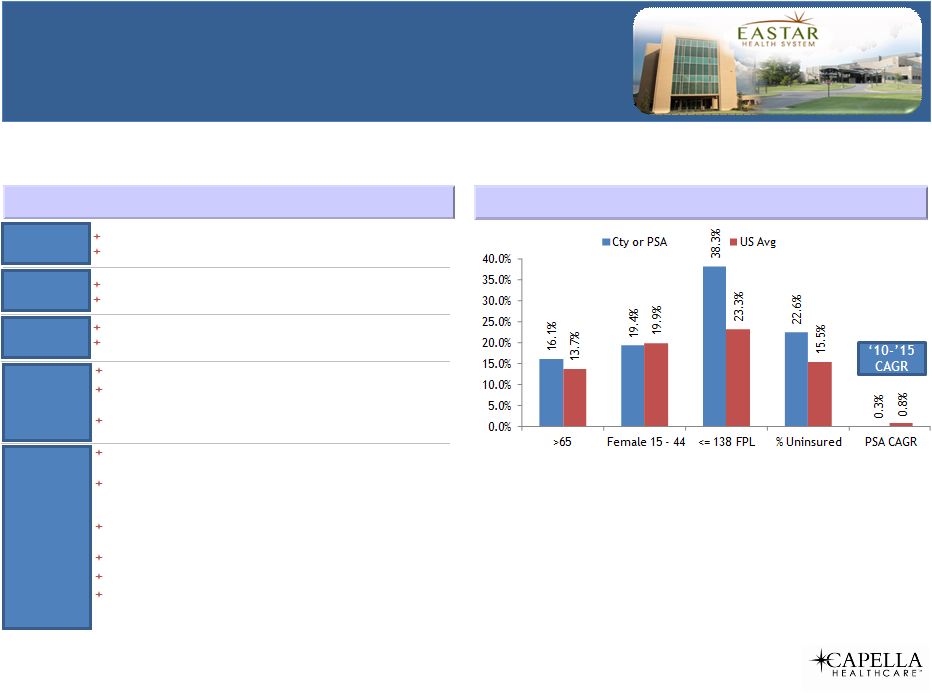

EASTAR

Health System Muskogee, OK

24

Key Awards

&

Accreditations

Location

Size

History

320

bed

hospital;

located

on

two

campuses

~3

miles

apart

98

active

physicians

Located

approximately

50

miles

from

Tulsa

Strongest

competitor,

Tahlequah,

is

~29

miles

away

Full

3-year

accreditation

from

Commission

on

Cancer

HealthStream

“Excellence

Through

Insight”

award

–

most

improved

physician

satisfaction

Part

of

OSU’s

Community

Hospital

Rotation

for

high

quality

student

training

Muskogee

Regional

acquired

in

2007

via

long

term

lease

MCH

acquired

in

2012;

merged

with

MRMC

to

become

EASTAR

Market -

Key Demographics (2010)

(1)

History & Overview

(1) US Census.

Positioning

Clear

#

1

market

player;

sole

community

provider

in

PSA

with

deep

penetration

into

SSA

Market

leader

in

cancer

care

with

April

2012

acquisition

of

competing

Artesian

Cancer

Center

as

well

as

Novalis

Tx

Radiation

Oncology

platform

and

CT

simulator

East

Campus

Focus:

women’s

health,

elective

surgery,

Dx

Imaging,

wound

care

&

sleep

center

Re-launch

of

bariatric

services

from

East

Campus

Expand

neonatology

services

to

support

28+

week

babies

Renovate

former

women’s

unit

and

consolidate

ICU

services;

add

step

down

unit

in

former

ICU

space

to

support

resource

management

initiatives |

25

St. Mary's Regional

Medical Center |

St.

Mary's Regional Medical Center Russellville, AR

26

Acquired

in

2008

Key Awards

&

Accreditations

Location

Size

History

170

beds

53

active

physicians;

40

physicians

in

affiliated

Millard

Henry

Clinic

Located

approximately

70

miles

NW

of

Little

Rock

Strongest

competitor,

Conway

Regional,

is

~47

miles

away

Leapfrog

“A”

safety

Rating

#1

in

AR,

Top

100

for

Women’s

Health

HealthStream

“Excellence

Through

Insight”

award

–physician

satisfaction

Market -

Key Demographics (2010)

(1)

History & Overview

(1) US Census.

Positioning

Clear

#1

player

in

the

market;

only

full-service

facility

within

35

miles

Affiliated

Millard

Henry

Clinic

is

a

large,

multi-specialty

group

poised

to

expand

in

new

adjacent

MOB

High

quality,

regional

women’s

health

provider

Recent

expansion

in

cardiology

(2nd

cath

lab);

cancer

care

(new

IMRT)

and

growing

adult

psych

services |

27

National Park

Medical Center |

National

Park Medical Center Hot Springs, AR

28

Key Awards

&

Accreditations

Location

Size

History

Built

a

new

main

facility

in

1985

Joint

venture

with

physicians;

4.7%

physician

ownership

166

beds

127

active

physicians

Located

approximately

50

miles

SW

of

Little

Rock

Closest

competitor,

Mercy

Hospital

Hot

Springs,

is

~5

miles

away

HealthStream

“Excellence

Through

Insight”

award,

most

improved

OP

satisfaction

2011

AR

Medicaid

Inpatient

Quality

Incentive

3

time

winner

of

STAR

Award

for

best

overall

performance

Market -

Key Demographics (2010)

(1)

History & Overview

(1) US Census.

Positioning

#

2

player

behind

Mercy

Hospital

Hot

Springs

Physician

JV

(4.7%)

Adjacent

land

purchase

to

expand

facility

footprint

Recent

inclusion

in

large

Employer

Health

Coalition,

which

expands

access

to

commercial

lives

Exceptional

employee,

physician

and

patient

satisfaction

results |

29

Tennessee Facilities |

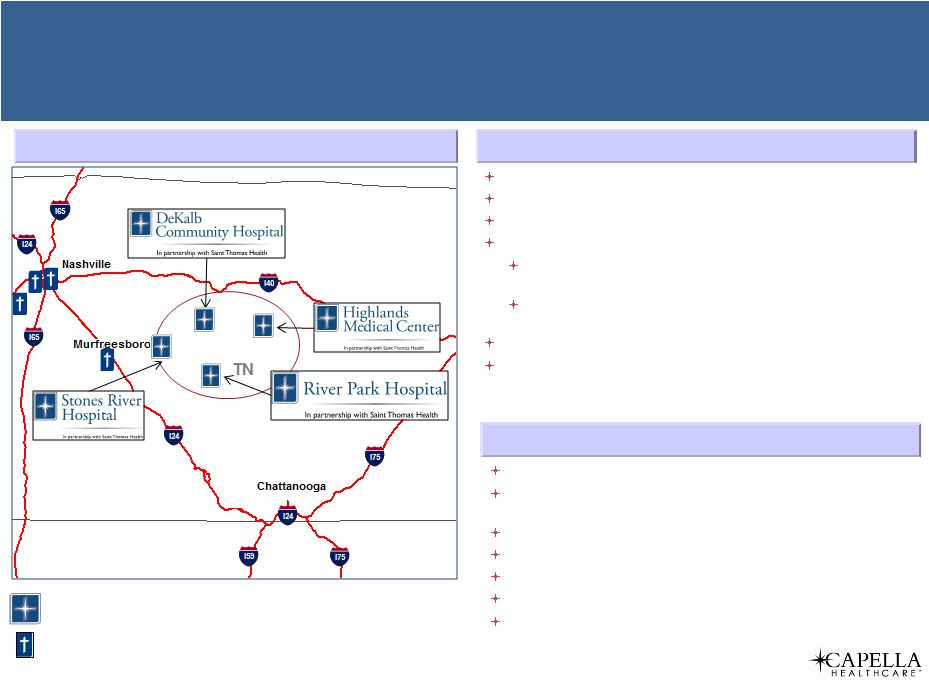

Geographic Location

Tennessee Facilities

Ascension-Capella Joint Venture

30

Timeline-Milestones

Ascension-Capella JV Facilities

Ascension Facilities

December

2005:

Acquired

River

Park

Hospital

March

2008:

Acquired

Highlands

Medical

Center

Aug

2009:

Initial

JV

with

Highlands

Physicians

(88%/12%)

July

2011:

Acquired

Cannon

County

LLC

via

contribution

agreements

Highlands

Physician

Investors

“re-up”

via

contribution

of

ownership

interests

to

form

UCHI

Jan

2012:

UCHI

secondary

offering

adds

8

physicians

May

2012:

Ascension

–

Capella

JV;

including

River

Park

Hospital

Key Provisions

Capella

Managing

Member

Saint

Thomas

–

contributed

brand,

in-market

ancillaries,

physician

staffing,

service

development

60

county

exclusive

development

Physician

5-year

non-competes

Ethical

&

Religious

Directives

compliant;

charity

policy

Capella

Hospitals

Tier

1

Mission

Point

ACO

members

Reciprocal

Change

in

Control

rights |

Ascension-Capella Joint Venture

31

Saint

Thomas-

Capella

LLC

UCHI LLC

(Physicians)

~23.3%

~76.7%

100%

STHe-Capella

Partnership

Capella-UCHI

Partnership |

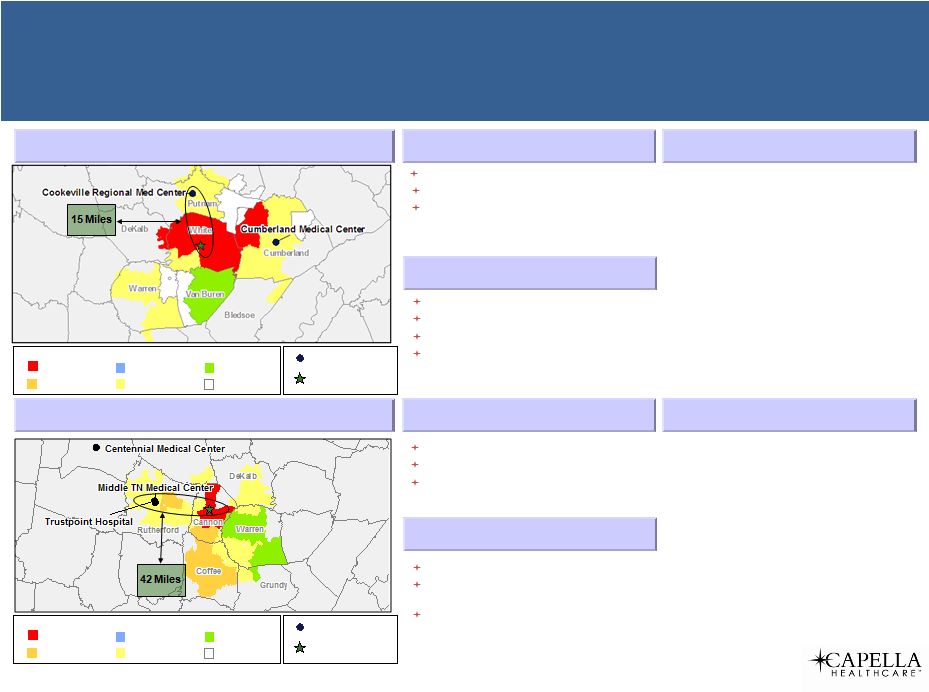

Highlands Medical Center (Sparta, Tennessee)

32

Demographics

2011A Adj. Admits

Over 500

76 to 150

351 to 500

25 to 75

151 to 350

Below 25

Competition

Capella Facility

Overview

Population 2010:

25,841

Pop. Growth '10-'15:

5.3%

Median Income 2010:

$35,345

Positioning

Established primary care base

Strong Geropsych program

Competing for SSA market share

Opportunity to acquire in-market ancillary

services

Stones River Hospital (Woodbury, Tennessee)

Demographics

2011A Adj. Admits

Over 500

76 to 150

351 to 500

25 to 75

151 to 350

Below 25

Competition

Capella Facility

Overview

Population 2010:

2,680

Pop. Growth '10-'15:

1.3%

Median Income 2010:

$55,144

Positioning

Sole community provider

Good working relationship with other UCHI

hospitals

Growing Geropsych program

60 beds

Highlands JV Ownership: 81.23%

Chief Quality Officer selected as presenter

for CRIMSON Clinical Advantage educational

program

60 beds

Stones River JV Ownership: 58.01%

Joint Commission’s “Gold Seal of Approval”

Tennessee Facilities |

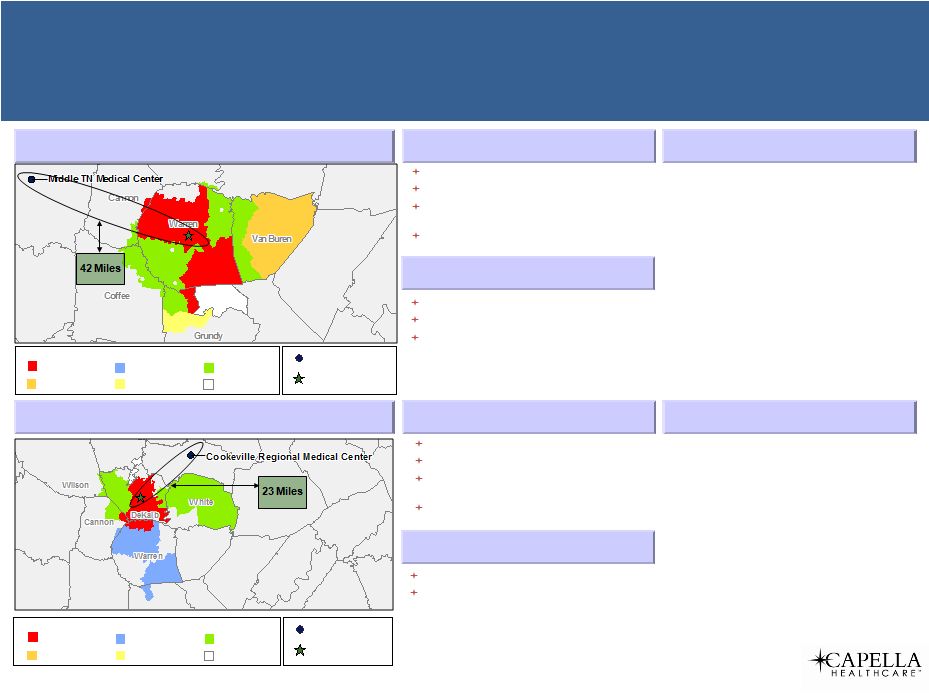

River

Park Hospital (McMinnville, Tennessee) 33

Demographics

125 beds

River Park JV Ownership: 93.51%

Chest Pain Center accredited Emergency

Department

“Stroke Ready”

affiliation, part of Saint

Thomas Stroke Network

2011A Adj. Admits

Over 500

76 to 150

351 to 500

25 to 75

151 to 350

Below 25

Competition

Capella Facility

Overview

Population 2010:

36,473

Pop. Growth '10-'15:

1.7%

Median Income 2010:

$37,620

Positioning

Attractive physical plant

Strong ED volumes

24/7 general surgery coverage

DeKalb Community Hospital (Smithville, Tennessee)

Demographics

2011A Adj. Admits

Over 500

76 to 150

351 to 500

25 to 75

151 to 350

Below 25

Competition

Capella Facility

Overview

Population 2010:

4,530

Pop. Growth '10-'15:

(0.5%)

Median Income 2010:

$59,455

Positioning

Sole community provider

Good working relationship with other UCHI

hospitals

71 beds

DeKalb JV Ownership: 58.01%

“Stroke Ready”

affiliation, part of Saint

Thomas Stroke Network

“Most Improved”

ED Patient Satisfaction

(HealthStream)

Tennessee Facilities |

34

Mineral Area Regional

Medical Center |

35

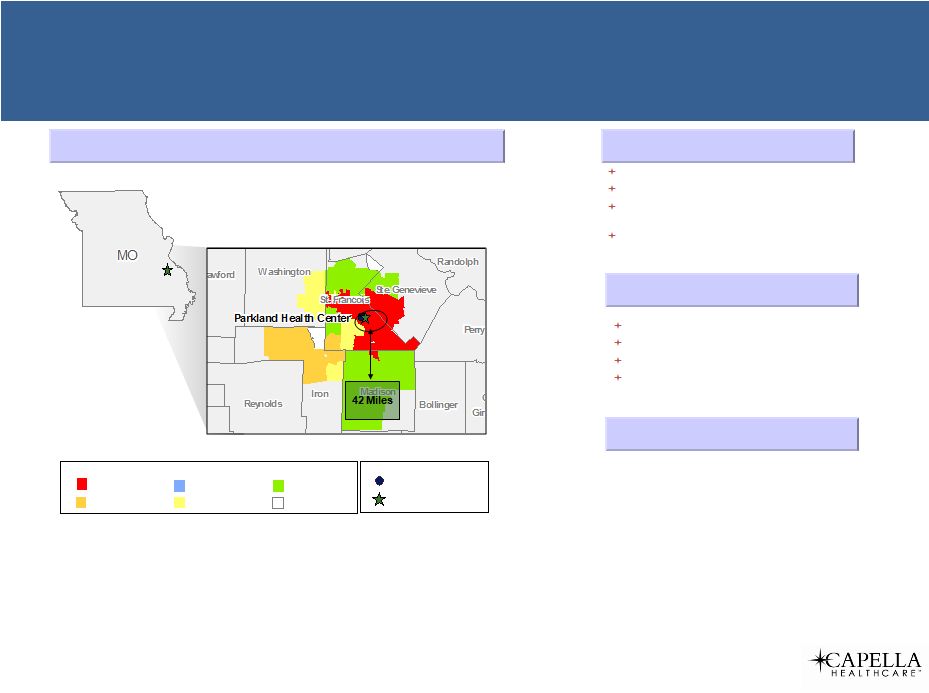

Demographics

Overview

Population 2010:

65,359

Pop. Growth '10-'15:

5.0%

Median Income 2010:

$38,589

Positioning

Strong local management team

Psych unit is a market differentiator

Potential for a tertiary partnership

Potential to sell MOBs

Primary Service Area

Mineral Area Regional Medical Center

Farmington, MO

135 beds

Leapfrog “A”

Safety Rating, 1 of 16 in MO

HealthStream “Excellence Through Insight”

award

First hospital in MO to add Airstrip

OB technology

2011A Adj. Admits

Over 500

76 to 150

351 to 500

25 to 75

151 to 350

Below 25

Competition

Capella Facility |

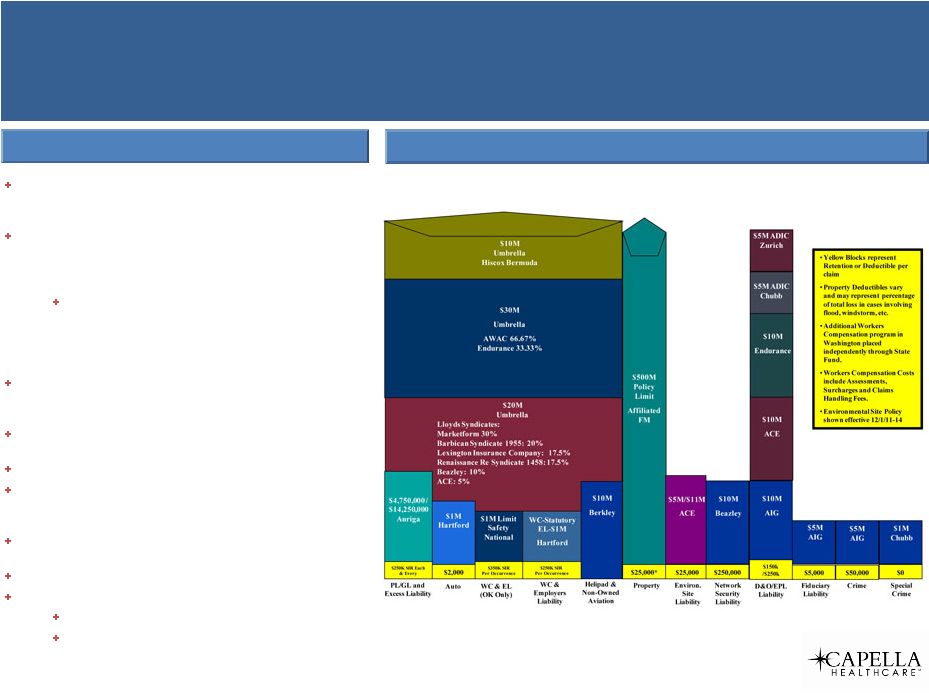

Auriga

Insurance Group 36

Formed in March 2009 to write medical malpractice

and general liability insurance for Capella hospitals,

employed physicians, physician extenders and nurses

Under terms of coverage, Capella pays the first

$250,000 of each and every claim, Auriga then steps in

and pays the next $4,750,000 per claim up to an

aggregate of $14,250,000

Auriga buys its first level of re-insurance

($20mm) from the Lloyds of London Syndicate;

its second level of re-insurance ($30mm) from

the Bermuda market; and its third level

($10mm) also from the Bermuda market

Domiciled in Grand Cayman, where the majority of

healthcare captives and domiciled, and managed by

AON Insurance Managers -

Cayman

Scribner

Hall

provided

tax

opinion

–

953d

election

take

(US taxpayer)

Honigman Miller selected as captive Counsel

Ernst

&

Young

selected

as

original

auditors

-

change

made to PKF Cayman for 2013 audit due to fee and

simplicity

AON alternative risk provides actuarial reports twice a

year

Vanguard Funds manage investment portfolio

Employee medical stop loss added in late 2009

No lazers

Policy provides unlimited coverage in excess of

a $350,000 deductible

Capella Program Snapshot 2014

Auriga Insurance Group |

37

Financial Overview |

2013

Financial & Operational Highlights 38

Terminated APA for Mercy Hospital Hot Springs

Purchased

land

for

expansion

of

National

Park

–

Plan

B

Implementation

Strategic portfolio management:

Exited Alabama market at end of 12/31/12

Signed

LOI

for

one

facility

–

Grandview

transaction

closed

February

28,

2014

Met Meaningful Use Requirements for Stage 1 –

Progressing to Stage 2

Completed EASTAR East Campus Women’s Facility & Ambulatory Project

Healthcare Reform –

Prepared facilities for enrollment and negotiated new

Exchange Contracts for each facility

Implemented physician training for Two Midnight Rule (on-going process)

Implemented training for ICD-10 (on-going process)

Began construction of new ASC on Southwestern Medical Center campus

Helped organize and lead Coordinated Care Organization in Oregon

|

2013

Financial Highlights Excludes SHOPP and MRF items

39

Adj Net Revenue growth of $22.2m or 3.2% excluding one-time charge for change

in estimate related to the allowance for doubtful accounts

Growth in orthopedic and cardiac services lines

Adj EBITDA decline from $96.8m to $95.0m or -1.9%

Ramp-up EASTAR East Campus; Two Midnight Rule (-$1.2m); Sequestration

(-$4.6m); SSI% updates (-$1.4m); one time training costs for Meditech 6.0

installations (-$1.7m)

Uncompensated care challenges -

growth in self pay revenues as well as in high

deductible and co-pay plans; from 21.8% to 23.3% of Adj NR or up $21.0m

Consolidated admissions decline of 3.7%, adjusted admissions -1.7%

Strongest volume indicators in peer class

Surgical Volumes best in peer class

IP Surgeries down 2.4%; OP Surgeries up 3.6%

ER visits down 0.6% or -1,268; ER self-pay visits up 3.6% or 1,589

|

Q1 2014

Preliminary Financial and Operational Highlights All Numbers Compared to Q1

2013 40

Net Revenue growth of $2.1 million

Adj. EBITDA contraction of $2.5m

Sequestration (-$1.5m); 2 Midnight Rule (-$1.0)

Admissions decline of 672 or 6.1%

One-day stay decline of 372 or 16.4%

Observation visits up 409 or 11.9%

Adj. Admissions decline of 3.8%

ER visits were down 4.6% …

82% of the decline was in self-pay

Grand opening of the Millard-Henry Clinic new MOB at St. Mary’s Regional

Medical Center

Completed final plans for the OB renovation at Capital Medical Center

Completed corporate re-organization that resulted in leadership changes,

reporting line changes and a reduction in the corporate staff of

approximately

10%

Note: All 1Q14 results are unaudited. |

Company

Overview Statistical Highlights

41

1Q13

1Q14

Variance

Admissions

11,001

10,329

(672)

-6.1%

Adjusted Admissions

22,677

21,810

(868)

-3.8%

ER Visits

55,938

53,340

(2,598)

-4.6%

SP ER Visits

11,171

9,035

(2,136)

-19.1%

IP –

Surgeries

2,413

2,199

(214)

-8.9%

OP -

Surgeries

5,632

5,303

(329)

-5.8%

Observations

3,433

3,842

409

11.9%

One-Day Stays

2,271

1,899

372

16.4%

NR / AA

$7,959

$8,368

$409

5.1%

Note: All 1Q14 results are unaudited. |

Company

Overview 2 Midnight Rule

42

4Q12

4Q13

Variance

Observations

3,471

3,864

393

11.3%

One-Day Stays

2,164

1,706

-458

-21.2%

FY 2012

FY 2013

Variance

Observations

14,061

14,339

278

2.0%

One-Day Stays

8,275

7,367

-908

-11.0%

1Q13

1Q14

Variance

Observations

3,433

3,842

409

11.9%

One-Day Stays

2,271

1,899

372

16.4%

Estimate quarterly EBITDA impact to be -$1.0 million

Note: All 1Q14 results are unaudited. |

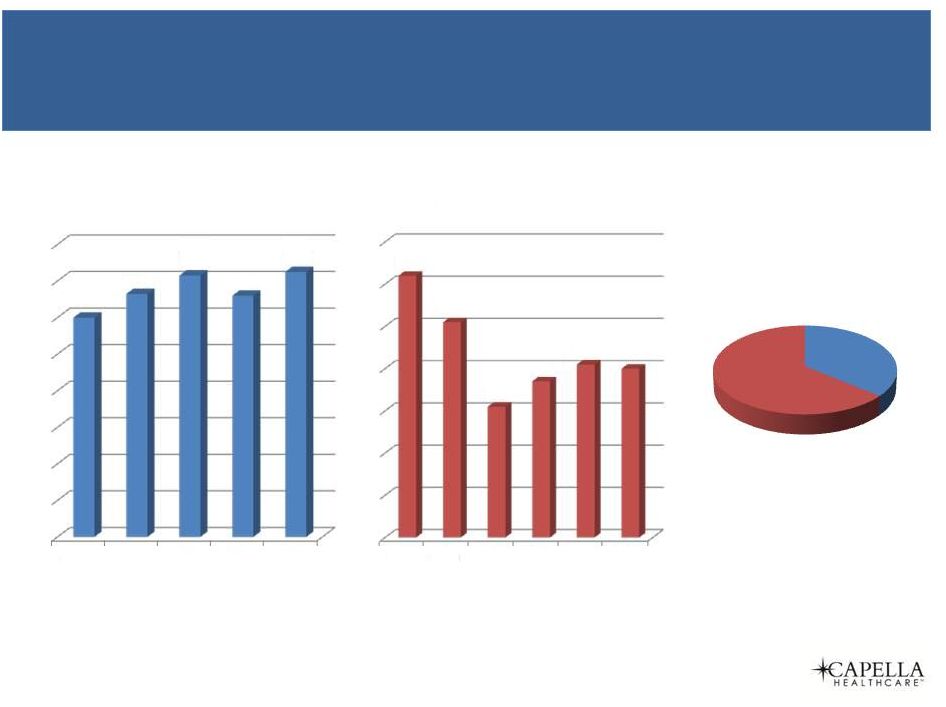

Adjusted EBITDA

* Excluding Out of Period SHOPP+Rural Floor Net Rev = $13.4m

(EBITDA $8.3m)

** Excluding one-time change in estimate for the allowance for

doubtful accounts.

43

Adj EBITDA: EBITDA plus transaction costs + stock comp + restructuring

costs + one-time change in estimate

2010

2011

2012

$625

$651

$705

*

2013

$727**

15.0%

14.6%

13.8%

Adjusted EBITDA Margin

13.1%

12.6%

$94

$97*

$95

2010

2011

2012

2013

$95

LTM 1Q14

$92

LTM 1Q14

$729**

Note: All 1Q14 results are unaudited.

Adjusted Net Revenue

Financial Performance

($ in millions) |

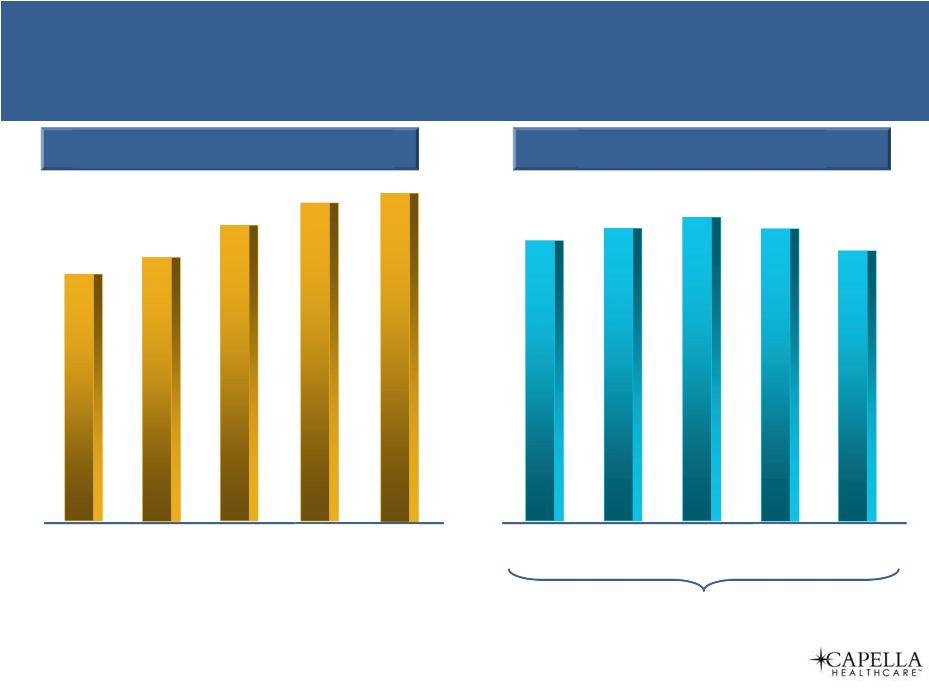

Adjusted Admissions

44

Revenue Per Adjusted Admission

2011

2012

90,037

91,770

2013

90,207

$7,234

2011

2012

2013

$7,827

$8,007

1Q13

1Q13

$7,959

1Q14

$8,368

22,677

1Q14

21,810

Operating Metrics

Note: All 1Q14 results are unaudited. |

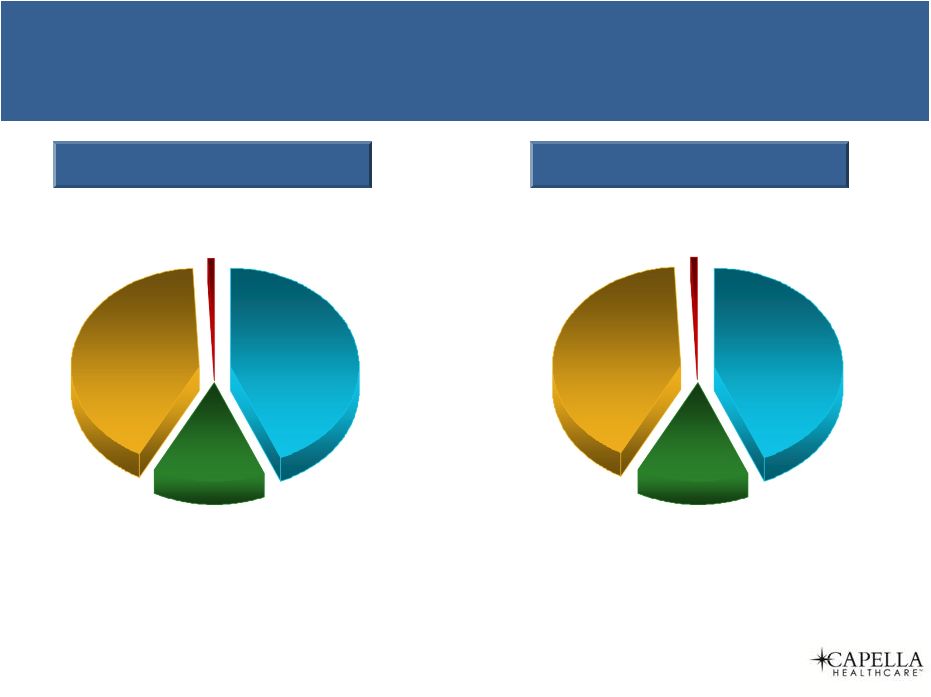

Diversified Net Revenue Payor Mix

Medicare

and

Managed

Medicare

Managed

Care/Other

Self Pay

Medicaid and

Managed Medicaid

43.6%

17.2%

1.7%

37.5%

2012 Payor Mix

Medicare

and

Managed

Medicare

Managed

Care/Other

Self Pay

Medicaid and

Managed Medicaid

43.2%

16.5%

1.3%

38.9%

2013 Payor Mix

45 |

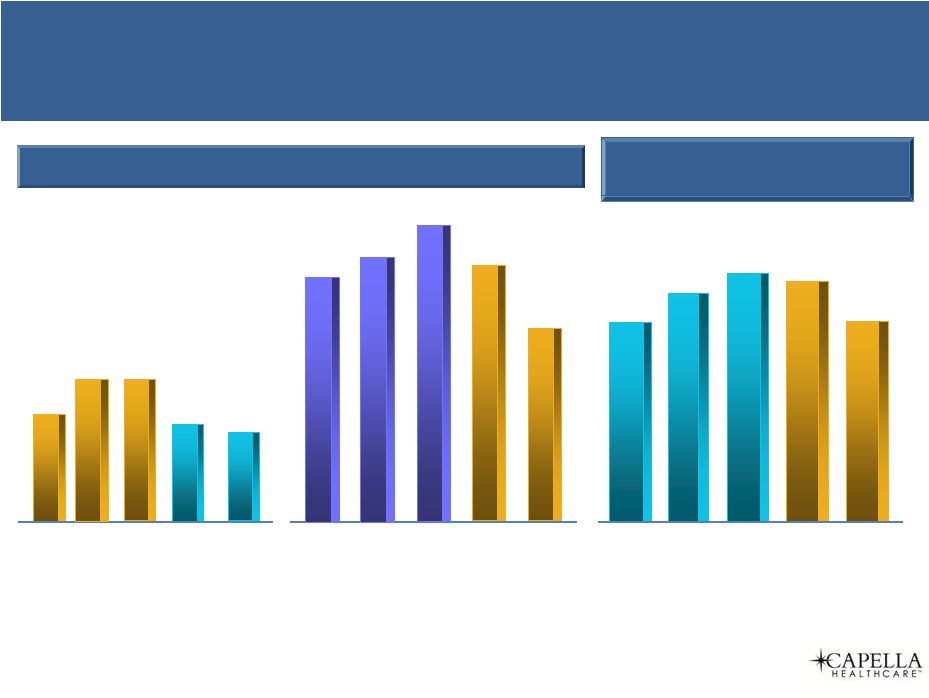

Uncompensated Care

Self-Pay Stats as % of Total

5.6%

6.0%

6.0%

2011

2012

2013

Uncompensated Care

Measures

20.3%

23.3%

21.8%

2011

2012

2013

2011

2012

2013

19.4%

20.3%

21.2%

Admissions

ER Visits

46

5.2%

1Q13

4.5%

1Q14

1Q13

20.0%

1Q14

16.9%

22.0%

1Q13

20.1%

1Q14

Note: All 1Q14 results are unaudited. |

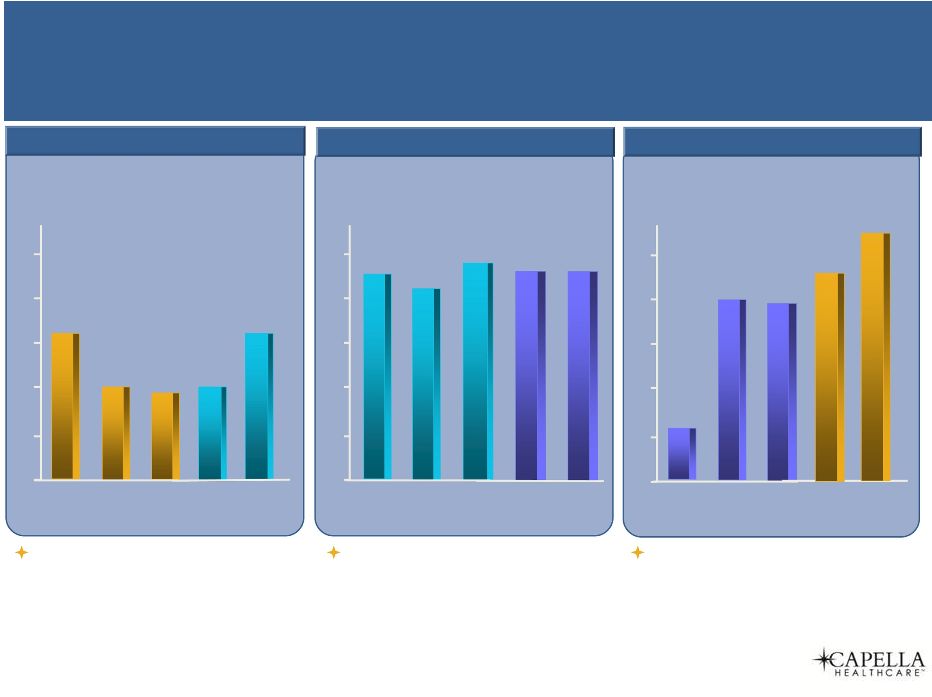

Some shift from employment

models to managed services

combined with increases in

contract labor and benefits

2011

2012

2013

46.8%

48.2%

47.3%

Salaries and Benefits Expense

50%

49%

48%

47%

46%

45%

Supplies expense increase

consistent with increases in

orthopedic & cardiac

procedures

16.9%

16.6%

16.3%

Supplies Expense

17%

16%

15%

14%

13%

12%

2011

2012

2013

Shift from SWB to Pro Fees

and Contract Services; Hi-

Tech income recorded as

contra expense

23.8%

21.1%

24.3%

Other Operating Expenses

25%

24%

23%

22%

21%

20%

2011

2012

2013

47

1Q13

1Q14

47.0%

48.1%

16.7%

1Q13

1Q14

16.6%

24.7%

1Q13

25.5%

1Q14

Expense Metrics

(% of Adjusted Net Revenue)

Note: All 1Q14 results are unaudited.

* 2012 excludes Out of Period SHOPP & Rural Floor

|

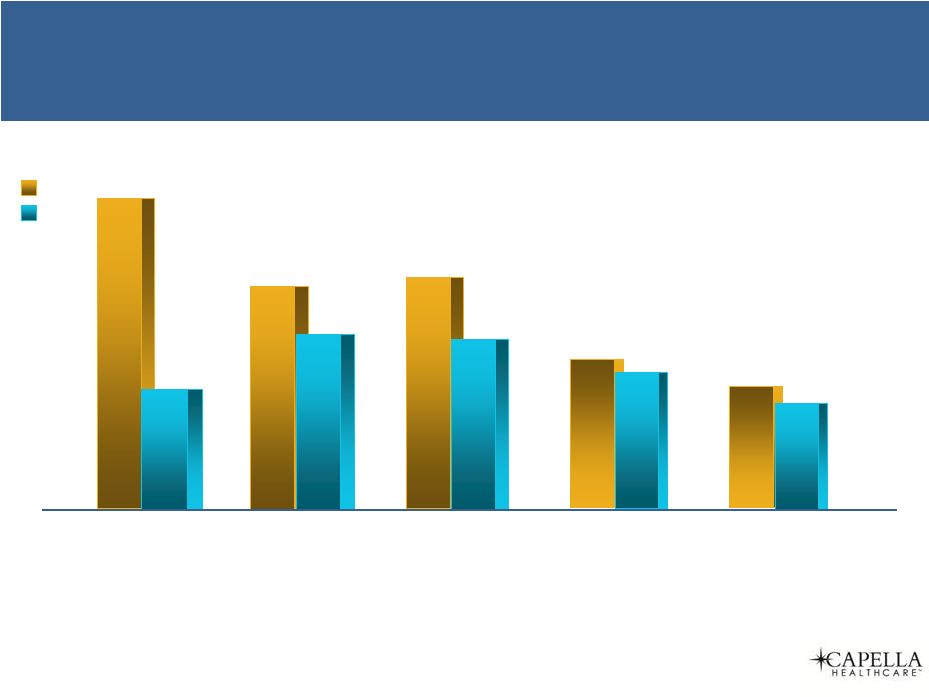

CFFO

CapX

Operating Cash Flow & Capital Expenditures

2010

2011

$62.7

(1)

$26.1

$34.2

$43.0

2012

$33.8

$44.0

$28.4

$30.8

2013

First 9 Months

($ in millions)

2012: $13.6m out of period cash

from prior period SHOPP and

Medicare Rural Floor settlement

48

$24.0

$26.3

LTM 1Q14

Note: All 1Q14 results are unaudited.

(1) Increase due to timing of indenture payment. |

49

1Q14 Early ACA Data

49

Preliminary Results –

Data Remains Limited

Note: All 1Q14 results are unaudited.

Self-pay gross revenue down 5%

Medicaid expansion states make up 105% of the decline

ER Visits down 4.6% …

self pay ER visits down 19.1% accounting for 82.2% of the

Uncompensated care down 10%

70.5% of the decline from expansion states

Uninsured discounts down 13%

92.1% of the decline from expansion states

Bad Debts Expense down 1.9%; but expansion states up slightly

decline |

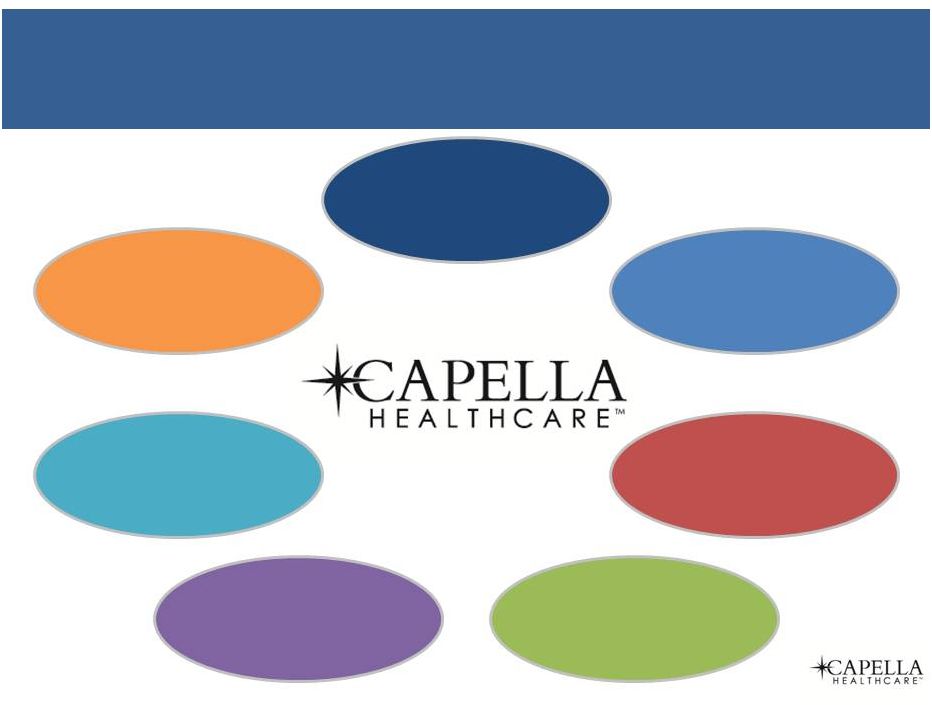

Key

Investment Highlights 50

Diversified Portfolio

of Well Positioned

Assets

Capitalize on

Identified and

Actionable Growth

Strategies

Geographically

Positioned to

Capitalize on Network

/ Affiliation

Opportunities

Meaningful Upside

from Healthcare

Reform

Significant Resources

Dedicated to Patient

Care Excellence

Consistent Operating

Performance

Strong Credit and

Liquidity Profile |