Attached files

| file | filename |

|---|---|

| 8-K - 8-K - HEALTHPEAK PROPERTIES, INC. | a14-11004_18k.htm |

| EX-99.1 - EX-99.1 - HEALTHPEAK PROPERTIES, INC. | a14-11004_1ex99d1.htm |

Exhibit 99.2

|

|

2014 New $1.2 Billion CCRC JV with Brookdale and Amendment of Emeritus Leases Cypress Village – Jacksonville, FL Freedom Pointe at The Villages – The Villages, FL Robin Run – Indianapolis, IN |

|

|

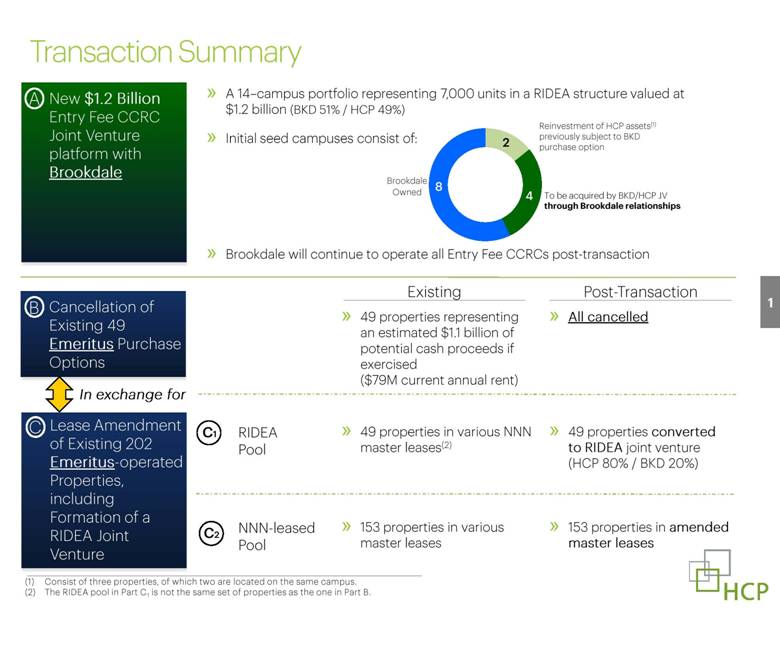

Transaction Summary B Cancellation of Existing 49 Emeritus Purchase Options Existing Post-Transaction 49 properties representing an estimated $1.1 billion of potential cash proceeds if exercised ($79M current annual rent) All cancelled RIDEA Pool 49 properties in various NNN master leases(2) 49 properties converted to RIDEA joint venture (HCP 80% / BKD 20%) NNN-leased Pool 153 properties in various master leases 153 properties in amended master leases C2 C1 In exchange for New $1.2 Billion Entry Fee CCRC Joint Venture platform with 8 2 4 Brookdale A 14–campus portfolio representing 7,000 units in a RIDEA structure valued at $1.2 billion (BKD 51% / HCP 49%) Initial seed campuses consist of: Brookdale will continue to operate all Entry Fee CCRCs post-transaction Reinvestment of HCP assets(1) previously subject to BKD purchase option To be acquired by BKD/HCP JV through Brookdale relationships Lease Amendment of Existing 202 Emeritus-operated Properties, including Formation of a RIDEA Joint Venture C A (1) Consist of three properties, of which two are located on the same campus. (2) The RIDEA pool in Part C1 is not the same set of properties as the one in Part B. |

|

|

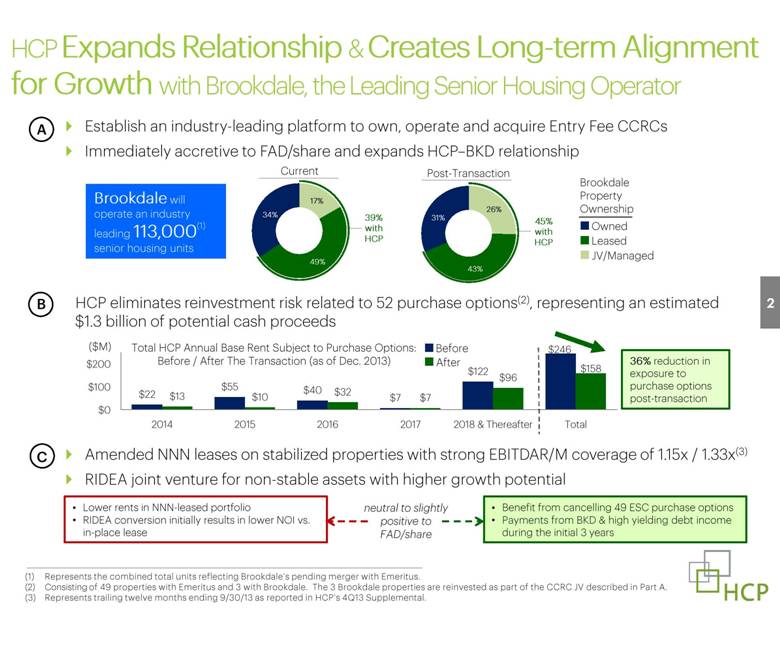

Establish an industry-leading platform to own, operate and acquire Entry Fee CCRCs Immediately accretive to FAD/share and expands HCP–BKD relationship HCP eliminates reinvestment risk related to 52 purchase options(2), representing an estimated $1.3 billion of potential cash proceeds Amended NNN leases on stabilized properties with strong EBITDAR/M coverage of 1.15x / 1.33x(3) RIDEA joint venture for non-stable assets with higher growth potential (1) Represents the combined total units reflecting Brookdale’s pending merger with Emeritus. (2) Consisting of 49 properties with Emeritus and 3 with Brookdale. The 3 Brookdale properties are reinvested as part of the CCRC JV described in Part A. (3) Represents trailing twelve months ending 9/30/13 as reported in HCP’s 4Q13 Supplemental. HCP Expands Relationship & Creates Long-term Alignment for Growth with Brookdale, the Leading Senior Housing Operator A B C Lower rents in NNN-leased portfolio RIDEA conversion initially results in lower NOI vs. in-place lease Benefit from cancelling 49 ESC purchase options Payments from BKD & high yielding debt income during the initial 3 years neutral to slightly positive to FAD/share 36% reduction in exposure to purchase options post-transaction Total HCP Annual Base Rent Subject to Purchase Options: Before / After The Transaction (as of Dec. 2013) Before After ($M) Current Post-Transaction Owned JV/Managed Leased Brookdale will operate an industry leading 113,000(1) senior housing units 39% with HCP 45% with HCP Brookdale Property Ownership |

|

|

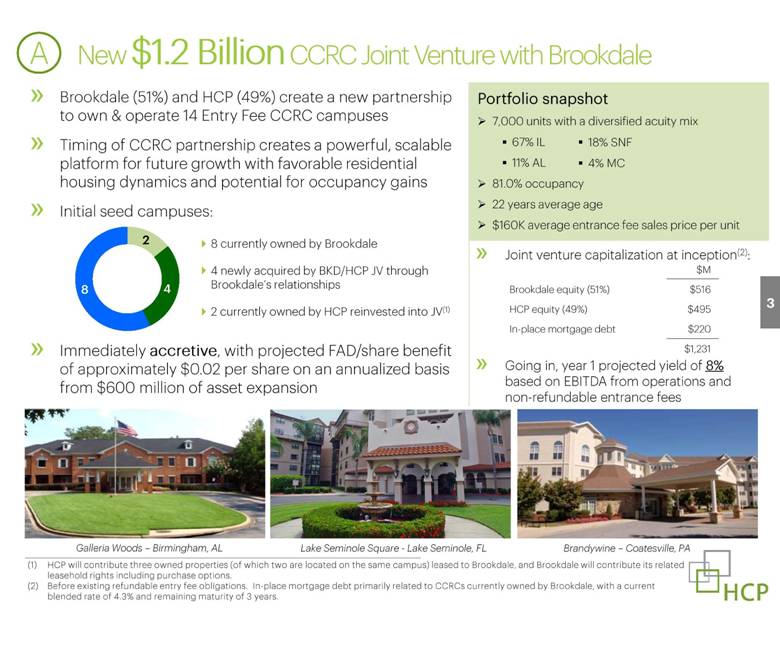

A New $1.2 Billion CCRC Joint Venture with Brookdale Brookdale (51%) and HCP (49%) create a new partnership to own & operate 14 Entry Fee CCRC campuses Timing of CCRC partnership creates a powerful, scalable platform for future growth with favorable residential housing dynamics and potential for occupancy gains Initial seed campuses: Immediately accretive, with projected FAD/share benefit of approximately $0.02 per share on an annualized basis from $600 million of asset expansion (1) HCP will contribute three owned properties (of which two are located on the same campus) leased to Brookdale, and Brookdale will contribute its related leasehold rights including purchase options. (2) Before existing refundable entry fee obligations. In-place mortgage debt primarily related to CCRCs currently owned by (1) Brookdale, with a current blended rate of 4.3% and remaining maturity of 3 years. Portfolio snapshot 7,000 units with a diversified acuity mix 67% IL 11% AL 81.0% occupancy 22 years average age $160K average entrance fee sales price per unit 8 2 4 8 currently owned by Brookdale 4 newly acquired by BKD/HCP JV through Brookdale’s relationships 2 currently owned by HCP reinvested into JV(1) 18% SNF 4% MC Joint venture capitalization at inception(2): Going in, year 1 projected yield of 8% based on EBITDA from operations and non-refundable entrance fees $M Brookdale equity (51%) $516 HCP equity (49%) $495 In-place mortgage debt $220 $1,231 Galleria Woods – Birmingham, AL Lake Seminole Square - Lake Seminole, FL Brandywine – Coatesville, PA |

|

|

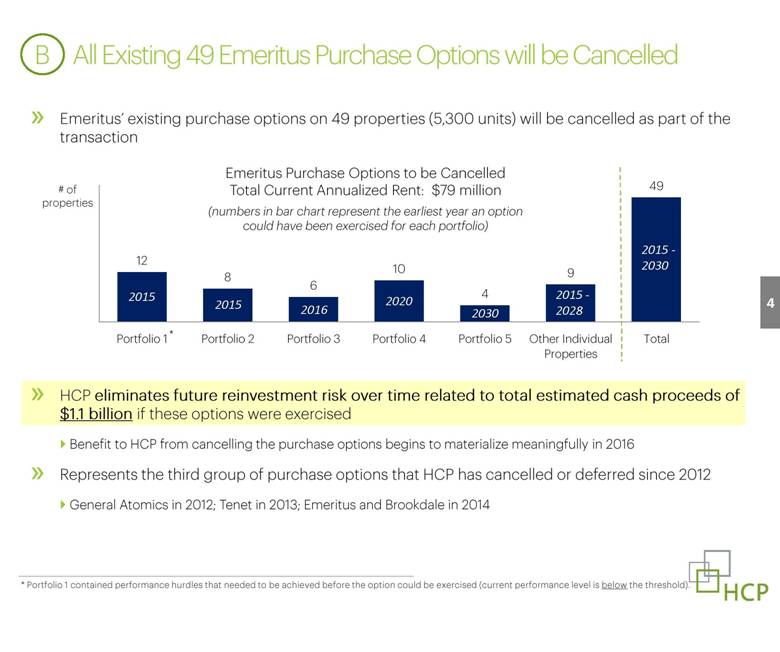

Emeritus’ existing purchase options on 49 properties (5,300 units) will be cancelled as part of the transaction HCP eliminates future reinvestment risk over time related to total estimated cash proceeds of $1.1 billion if these options were exercised Benefit to HCP from cancelling the purchase options begins to materialize meaningfully in 2016 Represents the third group of purchase options that HCP has cancelled or deferred since 2012 General Atomics in 2012; Tenet in 2013; Emeritus and Brookdale in 2014 B All Existing 49 Emeritus Purchase Options will be Cancelled * Portfolio 1 contained performance hurdles that needed to be achieved before the option could be exercised (current performance level is below the threshold). 2015 2015 2016 2020 2030 2015 - 2028 2015 - 2030 # of properties Emeritus Purchase Options to be Cancelled Total Current Annualized Rent: $79 million (numbers in bar chart represent the earliest year an option could have been exercised for each portfolio) * |

|

|

C1 New RIDEA Partnership: 49 Properties with Higher Growth Potential HCP (80%) and BKD (20%) form a RIDEA joint venture to own and operate 49 senior housing properties formerly NNN-leased to Emeritus Represents HCP’s second senior housing RIDEA portfolio, both in partnerships with Brookdale Non-stabilized communities with high growth potential Opportunity to increase rate, occupancy and margins through incremental CapEx investments Optimal flexibility to individually select properties with attractive growth profile, as our ESC-operated portfolio was substantially unencumbered Note: assumes the lease restructure transaction occurred on January 1, 2014 on a pro forma basis. Brookdale’s purchase of its 20% equity ownership values the portfolio at a 6.7% cap rate. HCP expects to finance Brookdale’s equity contribution via a debt investment yielding 7% annually, prepayable by Brookdale at anytime. Portfolio snapshot 5,400 units 79.7% occupancy 17 years average age Consideration for cancelling Emeritus purchase options: In favor of HCP: HCP to receive $34M in payments from Brookdale during the initial two years High yielding debt income benefit from favorable financing provided to the JV for the first 3 years In favor of BKD: Conversion to RIDEA allows Brookdale to immediately phase out of above-market rent obligations 2014 rent of $76M; EBITDAR coverage of 0.84x (trailing 12 months at 9/30/13) HCP to fund pro rata share of CapEx in RIDEA structure Summary Joint Venture Capitalization at Inception Gross Asset Value $970M Debt provided by HCP 20% effect from BKD ownership (i.e., net of 80% HCP ownership) $630M $126M Equity Interest: 80% HCP 20% BKD $272M $68M(1) Yrs 1-3: 11.4% annually on average Yrs 4-5: 5.5% annually Interest rate during first 5 years: |

|

|

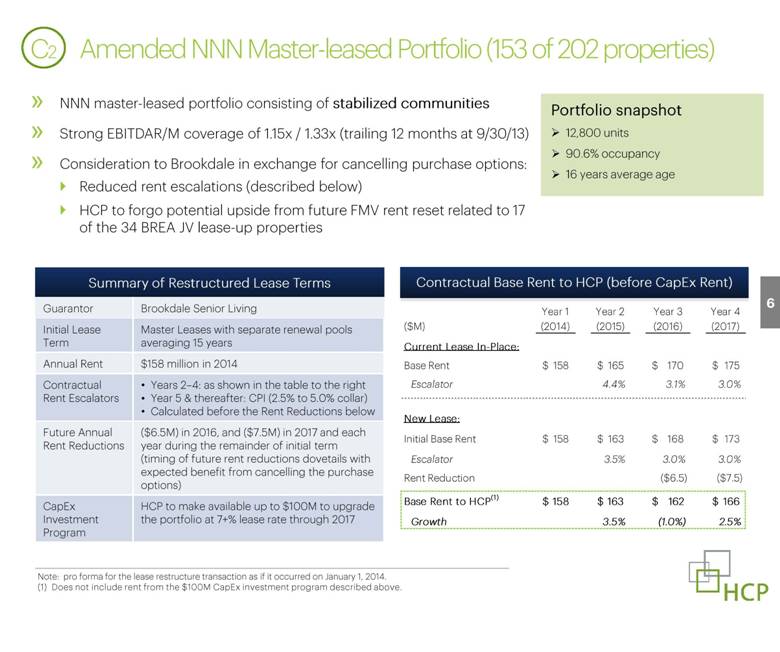

C2 Amended NNN Master-leased Portfolio (153 of 202 properties) NNN master-leased portfolio consisting of stabilized communities Strong EBITDAR/M coverage of 1.15x / 1.33x (trailing 12 months at 9/30/13) Consideration to Brookdale in exchange for cancelling purchase options: Reduced rent escalations (described below) HCP to forgo potential upside from future FMV rent reset related to 17 of the 34 BREA JV lease-up properties Note: pro forma for the lease restructure transaction as if it occurred on January 1, 2014. (1) Does not include rent from the $100M CapEx investment program described above. Portfolio snapshot 12,800 units 90.6% occupancy 16 years average age Summary of Restructured Lease Terms Contractual Base Rent to HCP (before CapEx Rent) Guarantor Brookdale Senior Living Initial Lease Term Master Leases with separate renewal pools averaging 15 years Annual Rent $158 million in 2014 Contractual Rent Escalators Years 2–4: as shown in the table to the right Year 5 & thereafter: CPI (2.5% to 5.0% collar) Calculated before the Rent Reductions below Future Annual Rent Reductions ($6.5M) in 2016, and ($7.5M) in 2017 and each year during the remainder of initial term (timing of future rent reductions dovetails with expected benefit from cancelling the purchase options) CapEx Investment Program HCP to make available up to $100M to upgrade the portfolio at 7+% lease rate through 2017 ($M) Year 1 (2014) Year 2 (2015) Year 3 (2016) Year 4 (2017) Current Lease In-Place: Base Rent 158 $ 165 $ 170 $ 175 $ Escalator 4.4% 3.1% 3.0% New Lease: Initial Base Rent 158 $ 163 $ 168 $ 173 $ Escalator 3.5% 3.0% 3.0% Rent Reduction ($6.5) ($7.5) Base Rent to HCP (1) 158 $ 163 $ 162 $ 166 $ Growth 3.5% (1.0%) 2.5% |

|

|

HCP principally evaluated the merits of the entire transaction based on cash economics and FAD impact Numerous accounting considerations and related treatment for EPS and FFO are underway, depending in part on the outcome of independent 3rd party valuations: Consideration for cancelling existing Emeritus purchase options (Part B) Amendment of existing Emeritus leases – reduction in rental income related to the RIDEA conversion (Part C1) and reconstituted NNN leases (Part C2) – and corresponding impact to straight-line rent, intangible assets, etc. Benefit from Brookdale cash payments & favorable debt income as part of the lease restructure and conversion to RIDEA (Part C1) Entire transaction contingent upon the closing of Brookdale’s pending merger with Emeritus Additional updates to be discussed on our next earnings call, including 2014 guidance and anticipated timing of close Additional Information |

|

|

Disclaimer The statements in this presentation, as well as statements made by management, which are not historical facts, are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and HCP intends such “forward-looking statements” to be covered by the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These statements include, among other things, statements regarding projected outcomes relating to the proposed Brookdale and Emeritus merger transaction, including FAD, EBITDAR/M, rent and other financial and growth projections, and the potential benefits of an expanded relationship and joint venture between HCP and Brookdale. These statements are made as of the date hereof, are not guarantees of future performance and are subject to known and unknown risks, uncertainties, assumptions and other factors — many of which are out of HCP’s control and difficult to forecast — that could cause actual results to differ materially from those set forth in or implied by such forward-looking statements. These risks and uncertainties include but are not limited to: risks relating to the merger of Brookdale and Emeritus, including in respect of the satisfaction of closing conditions to the merger, unanticipated difficulties relating to the merger, the risk that regulatory approvals required for the merger are not obtained or are obtained subject to unanticipated conditions, uncertainties as to the timing of the merger, litigation relating to the merger, the impact of the transaction on each party’s relationships with its residents, employees and third parties, and the parties’ inability to obtain, or delays in obtaining, cost savings and synergies from the merger; changes in global, national and local economic conditions, including a prolonged period of weak economic growth; volatility or uncertainty in the capital markets, including changes in the availability and cost of capital (impacted by changes in interest rates and the value of HCP’s common stock), which may adversely impact HCP’s ability to consummate transactions or reduce the earnings from potential transactions; HCP’s ability to manage its indebtedness level and changes in the terms of such indebtedness; the effect on healthcare providers of the recently enacted and pending Congressional legislation addressing entitlement programs and related services, including Medicare and Medicaid, which may result in future reductions in reimbursements; the ability of operators, tenants and borrowers to conduct their respective businesses in a manner sufficient to maintain or increase their revenues and to generate sufficient income to make rent and loan payments to HCP and HCP’s ability to recover investments made, if applicable, in their operations; the financial weakness of some operators and tenants, including potential bankruptcies and downturns in their businesses, which results in uncertainties regarding HCP’s ability to continue to realize the full benefit of such operators’ and/or tenants’ leases; changes in federal, state or local laws and regulations, including those affecting the healthcare industry that affect HCP’s costs of compliance or increase the costs, or otherwise affect the operations of operators, tenants and borrowers; the potential impact of future litigation matters, including the possibility of larger than expected litigation costs, adverse results and related developments; competition for tenants and borrowers, including with respect to new leases and mortgages and the renewal or rollover of existing leases; HCP’s ability to negotiate the same or better terms with new tenants or operators if existing leases are not renewed or HCP exercises its right to replace an existing operator or tenant upon default; availability of suitable properties to acquire at favorable prices and the competition for the acquisition and financing of those properties; the financial, legal, regulatory and reputational difficulties of significant operators of HCP’s properties; the risk that HCP may not be able to achieve the benefits of investments within expected time-frames or at all, or within expected cost projections; the ability to obtain financing necessary to consummate acquisitions on favorable terms; risks associated with HCP’s investments in joint ventures and unconsolidated entities, including its lack of sole decision-making authority and its reliance on its joint venture partners’ financial condition and continued cooperation; changes in the credit ratings on U.S. government debt securities or default or delay in payment by the United States of its obligations; and other risks described from time to time in HCP’s Securities and Exchange Commission filings, including our 2013 Annual Report on Form 10-K. HCP assumes no, and hereby disclaims any, obligation to update any of the foregoing or any other forward-looking statements as a result of new information or new or future developments, except as otherwise required by law. This presentation contains certain supplemental non-GAAP financial measures. While HCP believes that non-GAAP financial measures are helpful in evaluating its operating performance, the use of non-GAAP financial measures in this presentation should not be considered in isolation from, or as an alternative for, a measure of financial or operating performance as defined by GAAP. You are cautioned that there are inherent limitations associated with the use of each of these supplemental non-GAAP financial measures as an analytical tool. Additionally, HCP’s computation of non-GAAP financial measures may not be comparable to those reported by other REITs. Reconciliations of the non-GAAP financial measures to the most directly comparable GAAP financial measures can be found in the Company’s supplemental information packages and earnings releases, which are available on the Company’s website at www.hcpi.com in the “Presentations” section of the “Investor Relations” tab. |