Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CNL Growth Properties, Inc. | d714835d8k.htm |

| EX-10.2 - PROMISSORY NOTE - CNL Growth Properties, Inc. | d714835dex102.htm |

Exhibit 10.1

LOAN AGREEMENT

executed by and between

GGT TRG RIM TX, LLC,

a Delaware limited liability company

and

REGIONS BANK,

an Alabama state banking corporation

TABLE OF CONTENTS

| Page | ||||||||||

| ARTICLE I. DEFINITIONS |

1 | |||||||||

| 1.1. |

Defined Terms |

1 | ||||||||

| ARTICLE II. THE LOAN 12 |

||||||||||

| 2.1. |

The Loan |

12 | ||||||||

| 2.2. |

Security for the Loan |

13 | ||||||||

| 2.3. |

Loan Origination Fee; Travel and Underwriting Fee |

13 | ||||||||

| 2.4. |

Schedule of Disbursements |

13 | ||||||||

| ARTICLE III. REPRESENTATIONS AND WARRANTIES OF BORROWER |

13 | |||||||||

| 3.1. |

Representations and Warranties |

13 | ||||||||

| (a) |

Financial Matters |

13 | ||||||||

| (b) |

No Default or Violation |

13 | ||||||||

| (c) |

No Suits |

14 | ||||||||

| (d) |

Organization |

14 | ||||||||

| (e) |

Enforceability |

14 | ||||||||

| (f) |

Not a Foreign Person |

14 | ||||||||

| (g) |

ERISA |

14 | ||||||||

| (h) |

Executive Order 13224 |

15 | ||||||||

| (i) |

Title and Authority |

15 | ||||||||

| (j) |

Permitted Encumbrances |

15 | ||||||||

| (k) |

No Financing Statement |

15 | ||||||||

| (l) |

Location of Collateral |

15 | ||||||||

| (m) |

No Homestead |

15 | ||||||||

| (n) |

Compliance with Legal Requirements |

15 | ||||||||

| (o) |

Brokerage Commissions |

16 | ||||||||

| (p) |

Leases |

16 | ||||||||

| (q) |

Wage Claims |

16 | ||||||||

| (r) |

Nature of Loan |

16 | ||||||||

| 3.2. |

Special Construction Loan Representations and Warranties |

16 | ||||||||

| (a) |

Availability of Utilities |

16 | ||||||||

| (b) |

Roads |

17 | ||||||||

| (c) |

Condition of Property |

17 | ||||||||

| (d) |

Building Permits |

17 | ||||||||

| (e) |

No Prior Work |

17 | ||||||||

| (f) |

Sufficiency of Funds |

17 | ||||||||

| ARTICLE IV. COVENANTS AND AGREEMENTS OF BORROWER |

18 | |||||||||

| 4.1. |

Covenants and Agreements |

18 | ||||||||

| (a) |

Payment |

18 | ||||||||

i

| (b) |

Taxes on Note and Other Taxes |

18 | ||||||||

| (c) |

Ad Valorem Taxes; No Other Liens |

18 | ||||||||

| (d) |

Insurance Requirements |

19 | ||||||||

| (e) |

Tax and Insurance Escrow Account |

19 | ||||||||

| (f) |

Fees and Expenses |

20 | ||||||||

| (g) |

Tax on Lien |

21 | ||||||||

| (h) |

Existence |

21 | ||||||||

| (i) |

Change of Name, Identity or Structure |

21 | ||||||||

| (j) |

Single Asset Entity; Operation of Borrower |

22 | ||||||||

| (k) |

Executive Order 13224 |

24 | ||||||||

| (l) |

Books and Records |

24 | ||||||||

| (m) |

Financial Statements and Reports; Rent Roll |

24 | ||||||||

| (n) |

Indemnification |

26 | ||||||||

| (o) |

Reserved |

26 | ||||||||

| (p) |

Leases |

26 | ||||||||

| (q) |

Operation of Property |

28 | ||||||||

| (r) |

Inspection by Lender |

28 | ||||||||

| (s) |

Repair and Maintenance |

29 | ||||||||

| (t) |

Casualty |

29 | ||||||||

| (u) |

Condemnation |

32 | ||||||||

| (v) |

Further Assurances |

34 | ||||||||

| (w) |

Location and Use of Collateral |

34 | ||||||||

| (x) |

Estoppel Certificate |

34 | ||||||||

| (y) |

Proceeds of Collateral |

34 | ||||||||

| (z) |

Permitted Encumbrances |

34 | ||||||||

| (aa) |

Title Insurance |

35 | ||||||||

| (bb) |

Management of the Property |

35 | ||||||||

| (cc) |

Appraisal |

35 | ||||||||

| (dd) |

Operating, Deposit and Reserve Accounts |

36 | ||||||||

| (ee) |

Hedge Agreement |

36 | ||||||||

| (ff) |

Maintenance of Pledged Liquidity Account |

36 | ||||||||

| (gg) |

ERISA |

36 | ||||||||

| (hh) |

Prohibited Distributions |

37 | ||||||||

| (ii) |

Interest Rate Risk Management |

37 | ||||||||

| 4.2. |

Failure to Perform |

38 | ||||||||

| 4.3. |

Special Construction Loan Covenants |

38 | ||||||||

| (a) |

Project Budget and Application of Loan Proceeds |

38 | ||||||||

| (b) |

Construction Schedule |

39 | ||||||||

| (c) |

Commencement and Completion of Construction |

39 | ||||||||

| (d) |

Evidence Regarding Commencement of Construction |

39 | ||||||||

| (e) |

Right of Lender and Construction Consultant to Inspect Property |

40 | ||||||||

| (f) |

Correction of Defects |

40 | ||||||||

| (g) |

Off Site Work |

40 | ||||||||

| (h) |

Storage of Materials |

40 | ||||||||

ii

| (i) |

Vouchers |

41 | ||||||||

| (j) |

Encroachments |

41 | ||||||||

| (k) |

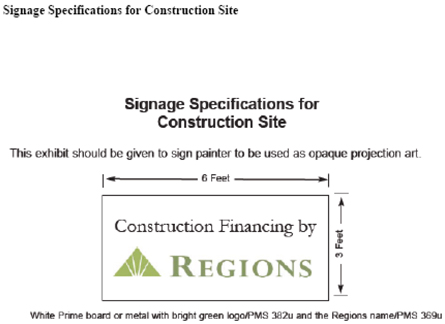

Construction/Financing Sign |

41 | ||||||||

| (l) |

Additional Expenditures by Lender |

41 | ||||||||

| (m) |

Plans and Specifications |

42 | ||||||||

| (n) |

Supplemental Data |

42 | ||||||||

| (o) |

Changes in Plans |

42 | ||||||||

| (p) |

Review of Plans and Specifications; Construction Consultant |

42 | ||||||||

| ARTICLE V. ADDITIONAL COLLATERAL |

43 | |||||||||

| 5.1. |

Additional Collateral |

43 | ||||||||

| (a) |

Licenses |

43 | ||||||||

| (b) |

Project Contracts |

43 | ||||||||

| (c) |

Plans and Specifications |

44 | ||||||||

| 5.2. |

Representations |

44 | ||||||||

| 5.3. |

Covenants, Agreements and Warranties |

44 | ||||||||

| 5.4. |

Rights of Borrower; Termination of License |

45 | ||||||||

| 5.5. |

Limitation of Lender’s Obligations |

45 | ||||||||

| 5.6. |

Reassignment |

46 | ||||||||

| 5.7. |

Additional Instruments |

46 | ||||||||

| ARTICLE VI. LOAN FUNDING; COMMITMENT |

46 | |||||||||

| 6.1. |

Rights to Advances; Generally |

46 | ||||||||

| 6.2. |

Conditions to Closing and Initial Advance |

46 | ||||||||

| (a) |

Loan Documents and Certain Third Party Documents |

46 | ||||||||

| (b) |

Additional Closing Deliveries |

47 | ||||||||

| (c) |

Construction Documents |

49 | ||||||||

| (d) |

Borrower’s Initial Equity Investment |

50 | ||||||||

| (e) |

Fees and Expenses |

50 | ||||||||

| 6.3. |

Conditions to All Advances |

50 | ||||||||

| (a) |

Draw Package |

50 | ||||||||

| (b) |

Construction Consultant |

51 | ||||||||

| (c) |

Title Endorsements |

51 | ||||||||

| (d) |

Loans In Balance |

51 | ||||||||

| (e) |

No Event of Default or Unmatured Default |

51 | ||||||||

| (f) |

Representations and Warranties |

51 | ||||||||

| (g) |

Foundation Survey |

52 | ||||||||

| (h) |

Casualty and Insurance Proceeds |

52 | ||||||||

| (i) |

Monthly Draws |

52 | ||||||||

| 6.4. |

Loan Disbursements |

52 | ||||||||

| 6.5. |

Advances to Pay Interest; Interest Reserve Amount |

53 | ||||||||

| 6.6. |

Balancing of Loan and Borrower’s Deposit |

53 | ||||||||

| 6.7. |

Contractor’s Fee |

54 | ||||||||

| 6.8. |

Hard Costs |

54 | ||||||||

iii

| 6.9. |

Soft Costs; Developer Fee |

54 | ||||||||

| 6.10. |

Stored Materials Not Yet Incorporated |

54 | ||||||||

| 6.11. |

Retainage and Final Disbursement |

55 | ||||||||

| 6.12. |

Deposit of Funds Advanced |

57 | ||||||||

| 6.13. |

Advances Do Not Constitute a Waiver |

57 | ||||||||

| 6.14. |

Reductions of Commitment |

57 | ||||||||

| ARTICLE VII. DEFAULTS |

57 | |||||||||

| 7.1. |

Event of Default |

57 | ||||||||

| (a) |

Monetary Obligations |

57 | ||||||||

| (b) |

Involuntary Proceeding |

58 | ||||||||

| (c) |

Voluntary Proceedings |

58 | ||||||||

| (d) |

Assignment for Benefit of Creditors |

58 | ||||||||

| (e) |

Unable to Pay Debts |

58 | ||||||||

| (f) |

Liquidation of Borrower or Guarantor |

58 | ||||||||

| (g) |

Transfer or Encumbrance of Interest in Property |

58 | ||||||||

| (h) |

Transfer or Encumbrance of Interest in Borrower |

58 | ||||||||

| (i) |

Levy; Attachment; Seizure |

59 | ||||||||

| (j) |

Failure of Representations |

59 | ||||||||

| (k) |

Claims; Liens; Encumbrances; Stop Notices |

59 | ||||||||

| (l) |

Cessation of Construction |

59 | ||||||||

| (m) |

Permits; Utilities; Insurance |

59 | ||||||||

| (n) |

Change in Contractor |

60 | ||||||||

| (o) |

Cessation of Loan Documents to be Effective |

60 | ||||||||

| (p) |

ERISA |

60 | ||||||||

| (q) |

Prohibited Distributions |

60 | ||||||||

| (r) |

Operations of Borrower |

60 | ||||||||

| (s) |

Failure to Satisfy Construction Obligations |

60 | ||||||||

| (t) |

Judgments |

60 | ||||||||

| (u) |

Borrower Cross-Default |

60 | ||||||||

| (v) |

Guarantor Cross-Default |

61 | ||||||||

| (w) |

Failure to Perform Covenants |

61 | ||||||||

| (x) |

Hedge Agreement |

61 | ||||||||

| ARTICLE VIII. REMEDIES |

62 | |||||||||

| 8.1. |

Remedies |

62 | ||||||||

| ARTICLE IX. GENERAL CONDITIONS |

63 | |||||||||

| 9.1. |

Waiver by Lender |

63 | ||||||||

| 9.2. |

Actions by Lender |

64 | ||||||||

| 9.3. |

Rights of Lender |

64 | ||||||||

| 9.4. |

Rights of Third Parties |

64 | ||||||||

| 9.5. |

Evidence of Satisfaction of Conditions |

65 | ||||||||

| 9.6. |

Assignment by Borrower |

65 | ||||||||

iv

| 9.7. |

Heirs, Successors and Assigns |

65 | ||||||||

| 9.8. |

Exercise of Rights and Remedies |

65 | ||||||||

| 9.9. |

Headings |

65 | ||||||||

| 9.10. |

Applicable Law |

65 | ||||||||

| 9.11. |

Consent to Forum |

65 | ||||||||

| 9.12. |

Usury |

66 | ||||||||

| 9.13. |

Severability |

67 | ||||||||

| 9.14. |

Counterparts |

67 | ||||||||

| 9.15. |

Joint and Several |

67 | ||||||||

| 9.16. |

Reporting Requirements |

67 | ||||||||

| 9.17. |

Modification or Termination |

67 | ||||||||

| 9.18. |

Notice |

67 | ||||||||

| 9.19. |

Effectiveness of Facsimile Documents and Signatures |

68 | ||||||||

| 9.20. |

Limited Use of Electronic Mail |

69 | ||||||||

| 9.21. |

Legal Proceedings |

69 | ||||||||

| 9.22. |

Assignment by Lender |

69 | ||||||||

| 9.23. |

Loan Participation |

69 | ||||||||

| 9.24. |

Negation of Partnership |

70 | ||||||||

| 9.25. |

Time Is of the Essence |

70 | ||||||||

| 9.26. |

Waiver of Judicial Procedural Matters |

70 | ||||||||

| 9.27. |

USA Patriot Act |

70 | ||||||||

| 9.28. |

Consent of Lender; Approvals |

70 | ||||||||

| 9.29. |

Confidentiality |

71 | ||||||||

| 9.30. |

Entire Agreement |

71 | ||||||||

v

LOAN AGREEMENT

THIS LOAN AGREEMENT (this “Agreement”), is dated effective as of April 17, 2014 (the “Effective Date”), by and between GGT TRG RIM TX, LLC, a Delaware limited liability company (“Borrower”), and REGIONS BANK, an Alabama state banking corporation (“Lender”).

R E C I T A L S

A. Lender has agreed to make the Loan to Borrower and Borrower and Lender wish to enter into this Agreement in order to set forth the terms and conditions of the disbursement of the Loan;

B. In consideration of the mutual promises hereinafter contained and of other valuable consideration, the receipt and sufficiency of which are hereby acknowledged, Borrower and Lender agree as follows:

ARTICLE I.

DEFINITIONS

1.1. Defined Terms. As used in this Agreement, the following terms shall have the meanings shown:

“Additional Collateral” shall have the meaning ascribed to such term in Section 5.1.

“Additional Costs” shall have the meaning ascribed to such term in the Note.

“Additional Funds” shall have the meaning ascribed to such term in Section 4.3(b).

“Advance” means an advance of a portion of the proceeds of the Loan made by Lender on a Funding Date.

“Advance Request” means a request for an Advance executed by Borrower in a form acceptable to Lender.

“Affiliate” means, with respect to a specified Person, another Person that directly, or indirectly through one or more intermediaries, Controls or is Controlled by or is under common Control with the Person specified.

“Akard Street Member” means Akard Street The Rim, LLC, a Delaware limited liability company

“Annualized Debt Service” means the product of (a) the constant monthly payment amount (i.e., payment including both principal and interest) sufficient to fully amortize (using

1

mortgage amortization) the outstanding principal balance of the Loan, plus any amounts remaining available to be funded under the Loan (if any) at the time of determination, in equal installments over a thirty (30) year period using an annual interest rate equal to the greater of (i) the highest interest rate which then applies to any outstanding principal of the Note, (ii) the Treasury Note Rate plus two and one-quarter percent (2.25%), and (iii) six and one-quarter percent (6.25%), multiplied by (b) twelve (12).

“Appraisal” means a written statement setting forth an opinion of the market value of the Property that (a) has been independently and impartially prepared by a qualified appraiser directly engaged by Lender, (b) complies with all applicable federal and state laws and regulations dealing with appraisals or valuations of real property, and (c) has been reviewed as to form and content and approved by Lender, in its reasonable discretion.

“Architect” means Architecture Demarest, L.P., a Texas limited partnership.

“Architect’s Certificate” means a certificate of Architect in form and substance acceptable to Lender.

“Architect’s Contract” means the agreement to be executed by and between Borrower and Architect relating to the design of the Improvements, subject to review and acceptance by Lender, and any and all extensions, renewals, modifications, amendments, supplements and replacements thereto or therefor.

“Architect Consent and Agreement” means the Architect/Lender Agreement to be executed by Architect in favor of Lender, in form and substance acceptable to Lender, as amended from time to time.

“Award” shall have the meaning ascribed to such term in Section 4.3(b).

“Borrower’s Deposit” shall have the meaning ascribed to such term in Section 6.6(b).

“Borrower’s Initial Equity” means cash funds in the amount of $11,858,700 obtained by Borrower from equity contributions and which are to be applied to the payment of Project Costs.

“Borrower’s Knowledge” means the actual knowledge of the Borrower Knowledgeable Parties solely on the basis of the facts known on the date that such representation was made (provided that in no event shall any such person have any personal liability arising under or in connection with this Agreement or the other Loan Documents).

“Borrower’s LLC Agreement” means that certain Limited Liability Company Agreement dated February 18, 2014, by and among Akard Street Member, TRG and CNL, and any and all extensions, renewals, modifications, amendments, supplements and replacements thereto and therefor.

2

“Borrower Knowledgeable Parties” means Greg Jones and Brian Tusa.

“Business Day” shall have the meaning ascribed to such term in the Note.

“CNL” means GGT Rim TX Holdings, LLC, a Delaware limited liability company.

“Code” means the Internal Revenue Code of 1986, as amended.

“Collateral” shall have the meaning ascribed to such term in the Security Instrument.

“Commitment” means the commitment of Lender to make advances of proceeds of the Loan hereunder in an amount not exceeding TWENTY-SEVEN MILLION SIX HUNDRED SEVENTY THOUSAND THREE HUNDRED AND NO/100 DOLLARS ($27,670,300.00), as such amount may be reduced or otherwise modified from time to time pursuant to the terms hereof.

“Completion Date” means the date which is twenty-four (24) months after the Effective Date, being the outside date by which the Completion Event must be achieved.

“Completion Event” means the date on which all of the following events have occurred: (a) the Improvements have been Substantially Completed; (b) receipt by Lender of a certificate of completion covering the Improvements executed by Contractor and Architect, if required by Lender; (c) final certificates of occupancy for all of the Improvements have been issued by the appropriate Governmental Authority; (d) receipt by Lender of evidence satisfactory to Lender that all invoices for labor and/or material provided in connection with the construction of the Improvements have been paid in full together with full and final unconditional lien waivers and releases by Contractor and all first tier subcontractors and suppliers; and (e) the Title Company has issued a down date or other similar endorsement to the Title Policy confirming that there are no mechanic’s or materialman’s liens outstanding against the Property and an endorsement deleting the general exception for mechanics’ liens, if any, and, if no further disbursements of the Loan will be made after such time, deleting the exception for pending disbursements.

“Construction Consultant” means the architectural or engineering firm or other Person (and if there is more than one, all such firms and other Persons) including, but not limited to C.D. Construction Consulting, who or which shall be retained by Lender at Borrower’s expense for the purposes of approving the Plans and Specifications and the Construction Contract; verifying the Project Budget; performing inspections as construction progresses to verify that the Improvements are constructed to completion in accordance with the approved Plans and Specifications; certifying that the amount of each advance included in an Advance Request does not exceed the value of the work completed less prior advances and then required retainage; certifying that the undisbursed Loan proceeds are sufficient to complete all of the Improvements; and performing such other consulting tasks as Lender shall direct from time to time.

“Construction Contract” means that certain contract to be executed by and between Borrower and Contractor for construction of the Improvements, subject to review and acceptance

3

by Lender, and any and all extensions, renewals, modifications, amendments, supplements and replacements thereto and therefor.

“Construction Schedule” shall have the meaning ascribed to such term in Section 4.3(b).

“Contractor” means Trinsic Residential Builders, LLC, a Delaware limited liability company.

“Contractor Consent and Agreement” means the Contractor/Lender Agreement to be executed by Contractor in favor of Lender, in form and substance acceptable to Lender, as amended from time to time.

“Control” or “controls” means with respect to any Person, the possession, directly or indirectly, of the power to direct or cause the direction of the management and policies of such Person, directly or indirectly, whether through the ownership of voting securities or other beneficial interests, by contract or otherwise; and the terms “Controlling” and “Controlled” have the meanings correlative to the foregoing.

“Damage” shall have the meaning ascribed to such term in Section 4.3(b).

“Debt Service Coverage Ratio” means, as of any Determination Date, the ratio of (i) Net Operating Income as of such Determination Date, to (ii) Annualized Debt Service as of such Determination Date.

“Debt Yield” means, as of any Determination Date, the ratio of (i) Net Operating Income as of such Determination Date, to (ii) the outstanding principal balance of the Loan, plus any amounts remaining to be funded under the Loan (if any), as of such Determination Date.

“Debtor Relief Laws” means any applicable liquidation, conservatorship, bankruptcy, moratorium, rearrangement, insolvency, fraudulent conveyance, reorganization, or similar laws affecting the rights, remedies or recourse of creditors generally, including without limitation, the United States Bankruptcy Code and all amendments thereto, as are in effect from time to time during the term of the Loan.

“Default Rate” shall have the meaning ascribed to such term in the Note.

“Determination Date” means any date the Debt Service Coverage Ratio and/or Debt Yield is calculated for purposes of this Agreement and/or any of the other Loan Documents.

“Developer” means Trinsic Residential Group LP, a Delaware limited partnership.

“Development Agreement” means that certain Development Agreement dated February 18, 2014, by and between Borrower and Developer, and any and all extensions, renewals, modifications, amendments, supplements and replacements thereto and therefor.

4

“Developer Fee” means the fee payable to Developer under the Development Agreement, subject to Section 6.8.

“Developer Subordination Agreement” means the Developer/Lender Agreement to be executed by Developer in favor of Lender, in form and substance acceptable to Lender, as amended from time to time.

“Engineer” means Pape-Dawson Engineers, Inc.

“Engineer’s Contract” means that certain agreement to be executed by and between Borrower and Engineer, subject to review and acceptance by Lender, and any and all extensions, renewals, modifications, amendments, supplements and replacements thereto or therefor.

“Engineer Consent and Agreement” means the Design Professional/Lender Agreement to be executed by Engineer in favor of Lender, in form and substance acceptable to Lender, as amended from time to time.

“Environmental Indemnity Agreement” means (a) at all times until the occurrence of the Guaranty/Pledged Liquidity Account Release Event, that certain Environmental Indemnity Agreement of even date herewith executed by Borrower and Original Guarantor in favor of Lender relating to the Loan; and (b) at all times after the occurrence of the Guaranty/Pledged Liquidity Account Release Event, the replacement environmental indemnity agreement executed by Borrower and Replacement Guarantor in favor of Lender and relating to the Loan in accordance with the requirements of the Guaranty/Pledged Liquidity Account Release Event.

“ERISA” means the Employee Retirement Income Security Act of 1974, as amended from time to time, and any successor statute.

“Event of Default” shall have the meaning ascribed to such term in Section 7.1.

“Extension Period” shall have the meaning ascribed to such term in the Note.

“Financing Statement” means a UCC-Financing Statement naming Borrower, as debtor, and Lender, as secured party, perfecting the security interest in the Collateral.

“Force Majeure” means delays caused by fire, earthquake, unusual weather conditions or other acts of God, acts of public enemies, riot, insurrection, governmental regulation of the sale of materials and supplies or the transportation thereof, strikes, shortages of material or labor resulting directly from general market shortages, governmental control or diversion and other causes not within Borrower’s control which cause a delay in Borrower’s performance of an obligation related to the work of construction; provided, however, that (a) Borrower must give notice to Lender within ten (10) days after the occurrence of an event which it believes to constitute Force Majeure, (b) in no event shall Force Majeure extend the time for the performance of an obligation by more than ninety (90) days, and (c) circumstances that can be remedied or mitigated through the payment of money shall not constitute Force Majeure

5

hereunder to the extent such remedy or mitigation is deemed reasonable by Lender in its sole discretion.

“Funding Date” means a date on which an Advance is made hereunder.

“Governmental Authority” means the United States, the State, the county, and the city, or any other political subdivision in which the Land is located, and any other political subdivision, agency or instrumentality exercising jurisdiction over Borrower, Guarantor or the Property.

“Guarantor” means (a) at all times until the occurrence of the Guaranty/Pledged Liquidity Account Release Event, the Original Guarantor; and (b) at all times after the occurrence of the Guaranty/Pledged Liquidity Account Release Event, the Replacement Guarantor.

“Guaranty” means (a) at all times until the occurrence of the Guaranty/Pledged Liquidity Account Release Event, that certain Guaranty of even date herewith executed by the Original Guarantor in favor of Lender relating to the Loan; and (b) at all times after the occurrence of the Guaranty/Pledged Liquidity Account Release Event, that certain replacement guaranty executed by the Replacement Guarantor in favor of Lender relating to the Loan in accordance with the requirements of the Guaranty/Pledged Liquidity Account Release Event.

“Guaranty/Pledged Liquidity Account Reduction Event” means the date on which all of the following events have occurred: (i) the Completion Event has occurred; and (ii) no Event of Default or Unmatured Default shall exist.

“Guaranty/Pledged Liquidity Account Release Event” means the date on which all of the following events have occurred: (i) the Guaranty/Pledged Liquidity Account Reduction Event has occurred; (ii) Lender has received and approved evidence reasonably satisfactory to Lender that the Property has achieved (A) a Debt Service Coverage Ratio equal to or greater than 1.30:1.00 and (B) a Debt Yield equal to or greater than ten percent (10%); (iii) the Replacement Guarantor has executed and unconditionally delivered to Lender (A) a replacement “carve-out” and “springing liability” guaranty in a form substantially similar to the Guaranty originally executed and delivered by Original Guarantor to Lender, so as to cause Replacement Guarantor to be liable to Lender for the obligations described in Sections 1(c) and 1(d) , but not for any obligations described in Sections 1(a), 1(b) and 1(e), of such original Guaranty, and (B) together with Borrower, a replacement environmental indemnity agreement in a form substantially similar to the Environmental Indemnity Agreement originally executed and delivered by Borrower and Original Guarantor to Lender; and (iv) no Event of Default or Unmatured Default shall exist.

“Hedge Agreement” means any existing or future “SWAP agreement” (as defined in 11 U.S.C § 101, as in effect from time to time) executed by the Borrower with Lender or any of Lender’s affiliates.

6

“Hard Costs” means costs for work, labor and materials required to demolish pre-existing structures on the Land (if any) and construct and complete the Improvements, including, without limitation, those items identified as “Hard Costs” on the Project Budget.

“Improvements” means the multifamily project improvements containing approximately 308 units to be constructed on the Land in accordance with the Plans and Specifications, as provided herein and contemplated hereby.

“Indebtedness” means all outstanding obligations, liabilities and indebtedness of Borrower under the Loan Documents and any Hedge Agreement, in each case howsoever created, arising or evidenced, whether direct or indirect, absolute or contingent, now or hereafter existing, or due or to become due.

“Initial Advance” means the first amount of the Loan funded by the Lender to the Borrower.

“Interest Reserve Amount” means the portion of the Loan which is allocated in the Project Budget for monthly payments of accrued interest on the principal of the Note.

“Land” means the land described in Exhibit A attached hereto and made a part hereof.

“Leases” shall have the meaning ascribed to such term in the Security Instrument.

“Legal Requirements” shall have the meaning ascribed to such term in Section 3.1(n).

“Licenses” shall have the meaning ascribed to such term in Section 5.1(a).

“Lien” means, with respect to any asset, (a) any mortgage, deed of trust, lien, pledge, hypothecation, encumbrance, charge or security interest in, on or of such asset, (b) the interest of a vendor or a lessor under any conditional sale agreement, capital lease or title retention agreement (or any financing lease having substantially the same economic effect as any of the foregoing) relating to such asset and (c) in the case of securities, any purchase option, call or similar right of a third party with respect to such securities.

“Loan” means the aggregate principal sum equal to the amount of the Commitment that Lender agrees to lend and Borrower agrees to borrow pursuant to the terms and conditions of this Agreement.

“Loan Documents” means this Agreement, the Note, the Security Instrument, the Guaranty, the Environmental Indemnity Agreement, the Pledged Liquidity Account Security Agreement, the Developer Subordination Agreement, the Property Manager Subordination Agreement (upon execution) and all other instruments evidencing, securing or relating to the Loan; provided, however, that Hedge Agreements between Borrower and Lender or any Affiliate of Lender shall not constitute Loan Documents.

7

“Loan Origination Fee” means the amount of $138,351.50, which fee is the consideration for Lender’s agreement to make the Loan to Borrower.

“Loan-to-Cost Ratio” means the ratio, expressed as a percentage, of (a) the Commitment to (b) the total amount of Project Costs.

“Loan-to-Value Ratio” means the ratio, expressed as a percentage, of (a) the Commitment to (b) the “stabilized value” value of the Property (assuming completion of the Improvements) shown in the initial Appraisal of the Property obtained by and approved by Lender in connection with the closing of the Loan.

“Maturity Date” shall have the meaning ascribed to such term in the Note.

“Net Operating Income” means, as of any Determination Date, for the applicable period, (a) Operating Revenues for such period, less (b) the greater of (i) Operating Expenses for such period, or (b) the annual operating expenses amount for the Property as shown and set forth in the most recent “stabilized value” Appraisal of the Property approved by Lender.

“Net Proceeds” shall have the meaning ascribed to such term in Section 4.3(b).

“Note” means that certain Promissory Note of even date herewith payable to the order of Lender and in the principal amount of the Loan, as the same may hereafter be renewed, extended, amended, modified and/or restated from time to time.

“Operating Expenses” means, as of any Determination Date, all actual operating expenses of the Property for the three (3) calendar months ending immediately prior to such Determination Date, which sum shall then be annualized and which shall in any event include (a) annualized ad valorem real estate taxes and assessments (on an accrual basis, whether or not paid, based on the best information then available and approved by Lender); (b) annualized insurance premiums (on an accrual basis, whether or not paid, based on the best information then available and approved by Lender); (c) management fees equal to the greater of (i) the annualized management fees actually incurred or (ii) an assumed annualized management fee based upon 3% of Operating Revenues; and (d) a replacement reserve equal to the greater of (i) the annualized actual replacement reserves, or (ii) $250.00 per unit. Operating Expenses for this purpose shall exclude (1) any interest or principal payments on the Loan, (2) any capital expenditures, and (3) any payment or expense to which the Borrower was or is to be reimbursed for costs from proceeds of the Loan, insurance, eminent domain, or any source other than Operating Revenues. Operating Expenses shall not include any non-cash expense item such as depreciation or amortization, as such terms are used for accounting or federal income tax purposes.

“Operating Revenues” means, as of any Determination Date, the recurring gross rental payments and other normal income actually received by Borrower from the operation of the Property for the three (3) calendar months ending immediately prior to such Determination Date (net of any concessions and/or abatements), which sum shall then be annualized and which shall

8

in any event exclude (1) security deposits until and unless forfeited by the depositor; (2) lump sum payments to Borrower for capital items, such as laundry room and other equipment, and telephone, cable and security installation and equipment; (3) any payment to Borrower from the proceeds of the Loan, insurance or any other non-recurring source for reimbursement of costs; (4) advances or loans to Borrower from any partners of Borrower; and (5) other non-recurring income.

“Original Guarantor” means TRG Regions Rim Guaranty Company, LLC, a Delaware limited liability company.

“Permitted Encumbrances” means (i) the exceptions and encumbrances set forth in Schedule B of the Title Policy (ii) customary easements entered into by Borrower in connection with the development and operation of the Property; (iii) documents required to be recorded by applicable law; and (iv) apartment leases executed in accordance with the terms of this Agreement.

“Permitted Indebtedness” means (a) the Indebtedness, (b) unsecured letters of credit or guarantees required by Governmental Authorities in connection with the construction of the Improvements, (c) trade debt incurred in the ordinary course of operation of the Property in such amounts as are normal and reasonable under the circumstances, provided that such debt is not evidenced by a note and is paid when due (unless such trade debt is being contested in good faith by Borrower) and provided in any event that the outstanding principal balance of such debt shall not exceed at any one time one percent (1.0%) of the outstanding Indebtedness, (d) equipment leases entered into in the ordinary course of the operation of the Property and (e) apartment Leases executed in accordance with the terms of this Agreement.

“Permitted Transfers” means any and all of the following: (a) any sale, transfer, assignment, conveyance, pledge or disposition of any ownership interests (i) in Borrower owned by TRG or (ii) in any direct or indirect owner of TRG, as long as following such sale, transfer, assignment, conveyance, pledge or disposition, Developer and/or any Affiliates of Developer Control(s) not less than ten percent (10%) of the issued and outstanding equity membership interests in Borrower; provided however, any such “Permitted Transfer” to such an Affiliate will require Lender’s prior written approval; (b) any sale, transfer, assignment, conveyance, pledge or disposition of any ownership interests (i) in Borrower owned by CNL or Akard Street Member or (ii) in any direct or indirect owner of CNL or Akard Street Member, as long as following such sale, transfer, assignment, conveyance, pledge or disposition, Hunt Realty Investments, Inc., The Teacher Retirement System of Texas, CNL Lifestyle Properties, Inc., CNL Growth Properties, Inc., Global Income Trust, Inc. and/or Affiliates of any of them Control(s) the “Managing Member” of Borrower; provided however, any such “Permitted Transfer” to such an Affiliate will require Lender’s prior written approval; and (c) the exercise by CNL of its right, (i) pursuant to the terms of Section 6.7(b) of the Borrower’s LLC Agreement, to remove TRG as “Operating Member” of Borrower for Cause (as defined in the Borrower’s LLC Agreement) or (ii) pursuant to the terms of Section 6.1 of the Development Agreement to terminate Developer as the developer of the Property as a result of an Event of Default (as defined in the Development Agreement); provided, however, that any such removal or termination event occurring prior to

9

the occurrence of the Completion Event shall require Lender’s prior written approval, to be given or withheld at the sole discretion of Lender, in order to constitute a “Permitted Transfer.”

“Person” means any individual, corporation, partnership, limited liability company, joint venture, estate, trust, unincorporated association, any other person or entity, and any federal, state, county or municipal government or any bureau, department or agency thereof and any fiduciary acting in such capacity on behalf of any of the foregoing.

“Plans and Specifications” shall have the meaning ascribed to such term in Section 5.1(c).

“Pledged Liquidity Account” means account number 0128183762 established and maintained with Lender in the name of Original Guarantor at all times until the occurrence of the Guaranty/Pledged Liquidity Account Release Event (a) in an amount of (i) not less than $1,383,515.00 at all times until the occurrence of the Guaranty/Pledged Liquidity Account Reduction Event, and (ii) not less than $691,757.50 at all times until the occurrence of the Guaranty/Pledged Liquidity Account Release Event, and (b) pledged by Original Guarantor to Lender as additional collateral for the Indebtedness pursuant to the terms of the Pledged Liquidity Account Security Agreement.

“Pledged Liquidity Account Security Agreement” means the Pledge and Security Agreement of even date herewith, executed by Original Guarantor in favor of Lender, evidencing a first-priority security interest in and to the Pledged Liquidity Account as additional collateral for the Indebtedness at all times until the occurrence of the Guaranty/Pledged Liquidity Account Release Event, as the same may hereafter be renewed, extended, amended, modified and/or restated from time to time.

“Project Budget” shall have the meaning ascribed to such term in Section 4.3(a) and as attached hereto as Exhibit B.

“Project Contracts” shall have the meaning ascribed to such term in Section 5.1(b).

“Project Costs” shall have the meaning ascribed to such term in Section 4.3(a).

“Project Revenues” shall have the meaning ascribed to such term in Section 4.3(a).

“Property” means the Land, the Improvements and the Collateral.

“Property Management Agreement” means any property management agreement at any time entered into by and between Borrower and a Property Manager for the management and/or leasing of the Property, subject to review and acceptance by Lender, and any and all extensions, renewals, modifications, amendments, supplements and replacements thereto and therefor.

“Property Manager” shall have the meaning ascribed to such term in Section 4.3(a).

10

“Property Manager Consent and Agreement” means a Manager/Lender Agreement to be executed by Property Manager in favor of Lender, in form and substance acceptable to Lender, as amended from time to time.

“Rental” shall have the meaning ascribed to such term in the Security Instrument.

“Rental Loss Proceeds” shall have the meaning ascribed to such term in Section 4.3(a).

“Replacement Guarantor” means TRINSIC RESIDENTIAL GROUP LP, a Delaware limited partnership.

“Restoration” shall have the meaning ascribed to such term in Section 4.3(a).

“Security Instrument” means that certain Construction Deed of Trust, Security Agreement, Assignment of Leases and Rents and Fixture Filing of even date herewith, in favor of the Trustee for the benefit of Lender, covering the Property, as the same may hereafter be renewed, extended, amended, modified and/or restated from time to time.

“State” means the state where the Land is located.

“Soft Costs” means those costs associated with the development, construction, marketing, leasing, operation and maintenance of the Improvements which are not Hard Costs, including, without limitation, the Developer Fee, leasing commissions, architectural and engineering fees, consultant fees, professional fees, marketing fees and expenses, real estate taxes, insurance costs, interest and financing fees and any other items identified as “Soft Costs” on the Budget.

“Substantially Complete,” “Substantially Completed” or “Substantial Completion” means, with respect to the Improvements, that the Improvements (including all apartments and other interior space) and all related site improvements have been substantially completed (subject to customary punch-list items) in accordance with the Plans and Specifications (except for landscaping not completed due to seasonal conditions) and all applicable Legal Requirements in all material respects.

“Taking” – shall have the meaning ascribed to such term in Section 4.3(a).

“Tax and Insurance Escrow Account” shall have the meaning ascribed to such term in Section 4.1(e).

“Taxpayer Identification Number” means the federal tax identification number of Borrower, which is 46-4800409.

“Title Company” means Bridge Title Company, as agent for Old Republic National Title Insurance Company.

11

“Title Policy” means an ALTA standard Loan Policy of Title Insurance in form and substance satisfactory to Lender issued by the Title Company in the amount of the Commitment, insuring the Deed of Trust as a first priority lien on the Property, containing such endorsements and with such re-insurance as Lender may request, excepting only such items as shall be acceptable to Lender.

“Treasury Note Rate” – The latest Treasury Constant Maturity Series yields reported, for the latest day for which such yields shall have been so reported as of the applicable LIBOR Business Day (as defined in the Note), in Federal Reserve Statistical Release H.15 (519) (or any comparable successor publication) for actively traded U.S. Treasury securities having a constant maturity equal to ten (10) years. Such implied yield shall be determined, if necessary, by (i) converting U.S. Treasury bill quotations to bond-equivalent yields in accordance with accepted financial practice, and (ii) interpolating linearly between reported yields.

“TRG” means TRG Rim, L.P., a Delaware limited partnership.

“Trustee” – As defined in the Security Instrument.

“Unmatured Default” means the occurrence of an event which with notice or lapse of time or both would constitute an Event of Default.

References in this Agreement to “Articles”, “Sections”, “Exhibits” or “Schedules” shall be to Articles, Sections, Exhibits or Schedules of or to this Agreement unless otherwise specifically provided. Any term defined herein may be used in the singular or plural. Words of any gender shall be held and construed to include any other gender. “Include”, “includes” and “including” shall be deemed to be followed by “without limitation”. Except as otherwise specified or limited herein, references to any Person includes successors and assigns of such Person. References “from” or “through” any date mean, unless otherwise specified, “from and including” or “through and including”, respectively. References to any statute or act shall include all related current regulations and all amendments and any successor statutes, acts and regulations. References to any statute or act, without additional reference, shall be deemed to refer to federal statutes and acts of the United States. References to any agreement, instrument or document shall include all schedules, exhibits, annexes and other attachments thereto.

ARTICLE II.

THE LOAN

2.1. The Loan. Subject to and upon the terms contained in this Agreement and, Section 11(d) of the Note, and relying on the representations and warranties contained in the Loan Documents, Lender agrees to lend, and Borrower agrees to borrow, the Loan to be evidenced by the Note. Amounts repaid under the Loan may not be reborrowed.

12

2.2. Security for the Loan. The Loan, as evidenced by the Note, is secured by the Security Instrument and shall be guaranteed by the Guaranty.

2.3. Loan Origination Fee; Travel and Underwriting Fee; and Tax Tracking Fee. The Loan Origination Fee, together with a travel and underwriting fee in the amount of $2,500.00, shall be due and payable in immediately available funds at the closing of the Loan. Additionally, Borrower agrees to pay Lender a tax tracking fee in the amount required by Lender to be paid to Lender by Borrower at the closing of the Loan. Said tax tracking fee shall be in the amount required to reimburse Lender for its cost of verifying that property taxes due on the Property are paid during the term of the Loan.

2.4. Schedule of Disbursements. Disbursement of the proceeds of the Loan is to be made by Lender to Borrower in accordance with the Project Budget. All proceeds of the Loan shall be advanced against the Note as provided herein and shall be used by Borrower to pay for Project Costs as contained in the Project Budget.

ARTICLE III.

REPRESENTATIONS AND WARRANTIES OF BORROWER

3.1. Representations and Warranties. Borrower hereby represents and warrants to Lender that the following representations and warranties made hereunder shall be true and correct, in all material respects, as of the date hereof and any other applicable date during the term of the Loan, except to the extent any such representation or warranty is made as of a specific date, in which case such representation or warranty shall have been true and correct on and as of such specified date:

(a) Financial Matters. Borrower is solvent, is not bankrupt and has no outstanding Liens, suits, garnishments, bankruptcies or court actions which could render Borrower insolvent or bankrupt. There has not been filed by or against Borrower a petition in bankruptcy or a petition or answer seeking an assignment for the benefit of creditors, the appointment of a receiver, trustee, custodian or liquidator with respect to Borrower or any substantial portion of Borrower’s property, reorganization, arrangement, rearrangement, composition, extension, liquidation or dissolution or similar relief under the Federal Bankruptcy Code or any state law. To Borrower’s knowledge, all reports, statements and other data furnished by Borrower to Lender in connection with the Loan are true and correct in all material respects and do not omit to state any fact or circumstance necessary to make the statements contained therein not misleading. To Borrower’s knowledge, no material adverse change has occurred since the dates of such reports, statements and other data in the financial condition of Borrower or of any tenant under leases described in such reports, statements and other data. .

(b) No Default or Violation. The execution, delivery and performance of the Loan Documents do not contravene, result in a breach of or constitute a default under any mortgage, deed of trust, lease, promissory note, loan agreement or other contract or agreement to which

13

Borrower is a party or by which Borrower or any of its properties may be bound or affected and, to Borrower’s Knowledge, do not violate or contravene any law, order, decree, rule or regulation to which Borrower is subject. No consent of any other party, and no consent, license, approval or authorization of, or registration or declaration with, any Governmental Authority is required in connection with the execution, delivery, performance, validity or enforceability of the transactions contemplated by the Loan Documents.

(c) No Suits. There are no judicial or administrative actions, suits or proceedings pending or, to Borrower’s knowledge, threatened against or directly affecting Borrower, any other person liable, directly or indirectly, for the Indebtedness, or the Property or involving the validity, enforceability or priority of any of the Loan Documents.

(d) Organization. Borrower is duly formed and legally existing under the laws of the state of its formation and is qualified to do business in the State. Borrower has all requisite power and all governmental certificates of authority, licenses, permits, qualifications and other documentation to own, lease and operate its properties and to carry on its business as now conducted and as contemplated to be conducted. The foregoing representations in this Section shall also apply to any corporation, limited liability company, partnership, joint venture or limited partnership which is a general partner, managing member or joint venturer of Borrower.

(e) Enforceability. The Loan Documents constitute the legal, valid and binding obligations of Borrower enforceable in accordance with their terms, subject to bankruptcy, insolvency, reorganization, fraudulent conveyance, moratorium and other laws applicable to creditors’ rights or the collection of debtors’ obligations generally. The execution and delivery of, and performance under, the Loan Documents are within Borrower’s powers and have been duly authorized by all requisite action and are not in contravention of the powers of Borrower’s organizational documents.

(f) Not a Foreign Person. Borrower is not a “foreign person” within the meaning of the Internal Revenue Code of 1986, as amended, Sections 1445 and 7701 (i.e. Borrower is not a non-resident alien, foreign corporation, foreign partnership, foreign trust or foreign estate as those terms are defined therein and regulations promulgated thereunder). Borrower’s Taxpayer Identification Number is as set forth in Section 1.1 above.

(g) ERISA. Borrower is not an “employee benefit plan” as defined in Section 3(3) of ERISA or a “plan” as defined in Section 4975(e)(1) of the Code. Each Employee Benefit Plan is in material compliance with all applicable requirements under ERISA and the Code, and, to the extent that such Employee Benefit Plan is also intended to be “qualified” within the meaning of Section 401(a) of the Code, it is in material compliance with the applicable requirements under the Code, except to the extent that any defects can be remedied without material liability to Borrower under Revenue Procedure 2008-50 or any similar procedure. None of the Employee Benefit Plans is subject to the requirements of Section 412 of the Code, Part 3 of Title I of ERISA or Title IV of ERISA or is a “multiemployer plan” as defined in Section 3(37) of ERISA. Borrower has no material liability under Title IV of ERISA or Section 412 of the Code with respect to any Employee Benefit Plan.

14

(h) Executive Order 13224. Borrower and, to Borrower’s Knowledge, all Persons holding any legal or beneficial interest whatsoever in Borrower are not included in, owned by, controlled by, acting for or on behalf of, providing assistance, support, sponsorship, or services of any kind to or otherwise associated with, any of the Persons referred to or described in Executive Order 13224 (Blocking Property and Prohibiting Transactions with Persons Who Commit, Threaten to Commit or Support Terrorism, as amended).

(i) Title and Authority. Borrower is the lawful owner of good and marketable title to the Property subject to the Permitted Encumbrances, and has good right and authority to grant, bargain, sell, convey, transfer, assign and mortgage the Property and to grant a security interest in the Collateral. The foregoing statement, however, is based solely on the owner’s title policy and the fact that Borrower has not transferred title to the Property.

(j) Permitted Encumbrances. The Property is free and clear from all Liens and other encumbrances except for (i) the Lien evidenced by the Security Instrument and (ii) the Permitted Encumbrances. There are no mechanic’s or materialmen’s liens, lienable bills or other claims constituting or that may constitute a Lien on the Property, or any part thereof other than claims for ad valorem taxes which are not yet due or payable.

(k) No Financing Statement. To Borrower’s Knowledge there is no financing statement covering all or any part of the Property or its proceeds on file in any public office, except with respect to the Loan.

(l) Location of Collateral. All tangible Collateral is located on the Land or at Borrower’s principal office.

(m) No Homestead. No portion of the Property is being used as Borrower’s business or residential homestead.

(n) Compliance with Legal Requirements. To Borrower’s knowledge, the Property and the intended use thereof by Borrower comply in all material respects with (and no notices of violation have been received in connection with) all applicable laws, ordinances, orders, determinations and court decisions, covenants, conditions and restrictions (including private restrictive covenants) and other requirements relating to land and building design and construction, use and maintenance, that may now or hereafter pertain to or affect the Property or any part thereof or the use of the Property, including, without limitation, planning, zoning, subdivision, environmental, air quality, flood hazard, fire safety, laws relating to the disabled, building, health, fire, traffic, safety, wetlands, coastal and other governmental or regulatory rules, laws, ordinances, statutes, codes and requirements applicable to the Property, without reliance upon grandfather provisions or adjacent or other properties (collectively the “Legal Requirements”). Borrower shall at all times comply in all material respects with all present or future Legal Requirements affecting or relating to the Property and/or the use thereof by Borrower. Upon request, Borrower shall furnish to Lender proof of compliance with the Legal Requirements if Lender reasonably believes that the Property is not in compliance in any material respect with the Legal Requirements. Borrower shall not use or permit the use of the

15

Property, or any part thereof, for any illegal purpose. Borrower has obtained or will prior to commencement of construction obtain, all requisite zoning, utility, building, health and operating permits from all applicable Governmental Authorities having jurisdiction over the Property to comply with the Legal Requirements.

(o) Brokerage Commissions. To Borrower’s Knowledge any brokerage commissions due in connection with the transaction contemplated hereby have been paid in full and any such commissions coming due in the future will be promptly paid by Borrower. Borrower agrees to and shall indemnify Lender from any liability, claims or losses arising by reason of any brokerage commissions (except any mortgage brokerage commission incurred by Lender). This provision shall survive the repayment of the Loan and shall continue in full force and effect so long as the possibility of such liability, claims or losses exists.

(p) Leases. Borrower is the sole owner of the entire lessor’s interest in the Leases and has good title and good right to assign and grant a security interest in the Leases and Rental assigned pursuant to the Security Instrument and no other person or entity has any right, title or interest therein. Borrower has not at any time prior to the date hereof exercised any right to subordinate any Lease to any deed of trust, security deed or mortgage or any other encumbrance of any kind. Borrower has not executed any prior assignments of or granted any prior security interests in the Leases or the Rental thereunder and no Rental reserved in any Lease has been anticipated and no Rental for any period subsequent to the date hereof has been collected more than two (2) months in advance of the time when the same became due under the terms of the applicable Lease. Borrower has not performed any act or executed any other instrument which might prevent Lender from enjoying and exercising any of its rights and privileges evidenced by the Loan Documents. To Borrower’s Knowledge each of the Leases is valid and subsisting and in full force and effect and unmodified; there exists no defense, counterclaim or set-off to the payment of the Rental under the Leases; there are no defaults now existing under the Leases and no event has occurred which with the passage of time or the giving of notice, or both, would constitute such a default.

(q) Wage Claims. To Borrower’s Knowledge, no wage claim is currently pending with the Texas Workforce Commission (the “Commission”) against Borrower pursuant to Section 61 of the Texas Labor Code and no Lien exists against the Property pursuant to Section 61 of the Texas Labor Code.

(r) Nature of Loan. Borrower represents and warrants that (i) it is a business or commercial organization operating for the purpose of holding, developing and managing real estate for profit and/or (ii) that the secured indebtedness was made and transacted solely for the purpose of carrying on or acquiring a business or investment or commercial enterprise.

3.2. Special Construction Loan Representations and Warranties. Borrower hereby represents and warrants to Lender that:

(a) Availability of Utilities. All utility and municipal services necessary for the proper operation of the Improvements for their intended purpose are available at the

16

Property, including water supply, storm and sanitary sewer facilities, gas or electricity and telephone facilities, or will be available at the Property when constructed or installed as part of the Improvements, and written permission has been or will be obtained from the applicable utility companies or municipalities to connect the Improvements into each of said services, and Borrower will supply evidence thereof satisfactory to Lender. All of such utility and municipal services will, to Borrower’s knowledge, comply with all applicable Legal Requirements.

(b) Roads. All roads necessary for the full utilization of the Improvements for their intended purposes have been or will be completed in connection with the completion of the Improvements and, except for any private roads located entirely on the Land, the necessary rights of way therefor have either been acquired by the appropriate Governmental Authority or have been dedicated to the public use and accepted by such Governmental Authority and all necessary steps have been taken by Borrower and any such Governmental Authority to assure the complete construction and installation thereof.

(c) Condition of Property. The Property is not now damaged or injured as a result of any fire, explosion, accident, flood or other casualty. To Borrower’s Knowledge, design conditions of the Property are such that no drainage or surface or other water will drain across or rest upon either the Property or land of others except as disclosed in the Plans and Specifications and in accordance with applicable Legal Requirements. To Borrower’s Knowledge, none of the Property is within a flood plain except as indicated on a survey of the Property delivered to Lender. Except as may be disclosed in the Plans and Specifications, none of the Improvements to be constructed on the Land are designed to protrude over, across or upon any of the boundary lines of the Land, rights of way or easements, and no buildings or other improvements on adjoining land create an encroachment on the Land.

(d) Building Permits. All zoning, utility, building, health and operating permits (if any) required for the construction of the Improvements either have been obtained or will be obtained prior to commencement of construction of the Improvements and copies of all of same will be delivered to Lender not later than 30 days after the Effective Date.

(e) No Prior Work. No work or construction has been commenced on the Land and no materials have been delivered to the Land which could, in either case, result in the imposition of a mechanic’s or materialmen’s lien on the Property prior to or on parity with the Lien created by the Security Instrument.

(f) Sufficiency of Funds. Sufficient funds are available to Borrower in addition to proceeds of the Note and Borrower’s Initial Equity to pay all Project Costs. Upon request of Lender, Borrower will demonstrate to Lender that such funds are available.

17

ARTICLE IV.

COVENANTS AND AGREEMENTS OF BORROWER

4.1. Covenants and Agreements. Borrower hereby covenants and agrees with Lender as follows:

(a) Payment. Borrower will make prompt payment of the Indebtedness, as the same becomes due.

(b) Taxes on Note and Other Taxes. Borrower will promptly pay all income, franchise, margin and other taxes owing by Borrower (unless payment is protested in accordance with Section 4.1(c) of this Agreement) and any stamp taxes which may be required to be paid with respect to the Loan Documents.

(c) Ad Valorem Taxes; No Other Liens.

(i) Liens. Borrower shall pay, satisfy and obtain the release of all other claims and Liens affecting or purporting to affect the title to, or which may be or appear to be Liens on, any of the Property or any part thereof (other than the Permitted Encumbrances), and all costs, charges, interest and penalties on account thereof, including without limitation the claims of all Persons supplying labor or materials to the Property, and to give Lender, upon demand, evidence satisfactory to Lender of the payment, satisfaction or release thereof. Notwithstanding the foregoing, nothing herein contained shall require Borrower to pay any claims or Liens which Borrower in good faith disputes and which Borrower, at its own expense, is currently and diligently contesting, provided that Borrower complies with the provisions of Section 4.1(c)(iii) hereof.

(ii) Taxes. Borrower agrees to pay or cause to be paid, prior to the date they would become delinquent if not paid, any and all taxes, assessments and governmental charges whatsoever levied upon or assessed or charged against any of the Property, including all water and sewer taxes, assessments and other charges, fines, impositions and rents, if any. If requested by Lender, Borrower shall give to Lender a receipt or receipts, or certified copies thereof, evidencing every such payment by Borrower, not later than forty-five (45) days after such payment is made. Notwithstanding the foregoing, nothing herein contained shall require Borrower to pay any taxes, assessments or governmental charges which Borrower in good faith disputes and which Borrower, at its own expense, is currently and diligently contesting, provided that applicable law allows non-payment thereof during the pendency of such contest, and provided further that Borrower complies with the provisions of Section 4.1(c)(iii) hereof.

(iii) Contest. Borrower shall not be required to pay any taxes, claims or governmental charges, or claims, or Liens being contested in accordance with the

18

provisions of Section 4.1(c)(i) or (c)(ii) hereof, as the case may be, so long as (i) Borrower diligently prosecutes such dispute or contest to a prompt determination in a manner not prejudicial to Lender and promptly pays all amounts ultimately determined to be owing, and (ii) Borrower provides security for the payment of such tax, assessment or governmental charge, or claim, or Lien (together with interest and penalties relating thereto) in an amount and in form and substance satisfactory to Lender. If Borrower shall fail to pay any such amounts ultimately determined to be owing or to proceed diligently to prosecute such dispute or contest as provided herein, then, upon the expiration of ten (10) days after written notice to Borrower by Lender of Lender’s determination thereof, in addition to any other right or remedy of Lender, Lender may, but shall not be obligated to, discharge the same, and the cost thereof shall be reimbursed by Borrower to Lender. The payment by Lender of any delinquent tax, assessment or governmental charge, or any claim, or Lien which Lender in good faith believes might be prior hereto, shall be conclusive between the parties as to the legality and amount so paid, and Lender shall be subrogated to all rights, equities and liens discharged by any such expenditure to the fullest extent permitted by law.

(d) Insurance Requirements. Borrower shall obtain and maintain, or cause to be obtained and maintained, insurance and evidence of insurance in accordance with Lender’s requirements set forth on Exhibit C attached hereto and made a part hereof for all purposes. TEXAS FINANCE CODE SECTION 307.052 COLLATERAL PROTECTION INSURANCE NOTICE: (A) BORROWER IS REQUIRED TO: (I) KEEP THE PROPERTY INSURED AGAINST DAMAGE IN THE AMOUNT LENDER SPECIFIES; (II) PURCHASE THE INSURANCE FROM AN INSURER THAT IS AUTHORIZED TO DO BUSINESS IN THE STATE OF TEXAS OR AN ELIGIBLE SURPLUS LINES INSURER; AND (III) NAME LENDER AS THE PERSON TO BE PAID UNDER THE POLICY IN THE EVENT OF A LOSS; (B) BORROWER MUST, IF REQUIRED BY LENDER, DELIVER TO LENDER A COPY OF THE POLICY AND PROOF OF THE PAYMENT OF PREMIUMS; AND (C) IF BORROWER FAILS TO MEET ANY REQUIREMENT LISTED IN PARAGRAPH (A) OR (B), LENDER MAY OBTAIN COLLATERAL PROTECTION INSURANCE ON BEHALF OF BORROWER AT THE BORROWER’S EXPENSE.

(e) Tax and Insurance Escrow Account. As additional security for the Loan and in order to secure the performance and discharge of Borrower’s obligations under Section 4.1(c) and Section 4.1(d) above, but not in lieu of such obligations, upon the occurrence of an Event of Default and continuing thereafter as long an Event of Default remains uncured, upon Lender’s written request, Borrower shall establish and maintain at all times during the term of the Loan an impound account (the “Tax and Insurance Escrow Account”) with Lender for payment of real estate taxes and assessments and insurance on the Property. Upon such request after the occurrence of an Event of Default, Borrower will deposit with Lender a sum equal to ad valorem taxes, assessments

19

and charges (which charges for the purpose of this Section shall include without limitation ground rents and water and sewer rents and any other recurring charge which could create or result in a lien against the Property) against the Property for the then current year and the premiums for policies of insurance covering the period for the then current year, all as estimated by Lender. Thereafter, commencing with the payment of the next monthly installment under the Note and continuing thereafter on each and every monthly payment date under the Note as long an Event of Default remains uncured, until the Indebtedness is fully paid and performed, Borrower will deposit with Lender sufficient funds (as estimated from time to time by Lender) to permit Lender to pay, at least thirty (30) days prior to the due date thereof, the next maturing ad valorem taxes, assessments and charges and premiums for such policies of insurance. Borrower shall be responsible for ensuring the receipt by Lender, at least thirty (30) days prior to the respective due date for payment thereof, of all bills, invoices and statements for all taxes, assessments and insurance premiums to be paid from the Tax and Insurance Escrow Account, and Lender shall pay (or shall permit Borrower to make withdrawals from the Tax and Insurance Escrow Account to pay) the Governmental Authority or other party entitled thereto directly to the extent funds are available for such purpose in the Tax and Insurance Escrow Account. Lender shall have the right to rely upon tax information furnished by applicable taxing authorities in the payment of such taxes or assessments and shall have no obligation to make any protest of any such taxes or assessments. Any excess over the amounts required for such purposes shall be applied to any Indebtedness or refunded to Borrower, at Lender’s option, and any deficiency in such funds so deposited shall be made up by Borrower upon demand of Lender. The Tax and Insurance Escrow Account shall not, unless otherwise explicitly required by applicable law, be or be deemed to be escrow or trust funds. All such funds so deposited shall bear no interest whatsoever, may be mingled with the general funds of Lender and shall be applied by Lender toward the payment of such taxes, assessments, charges and premiums when statements therefor are presented to Lender by Borrower; provided, however, that following an Event of Default which remains uncured, such funds may at Lender’s option be applied to the payment of the Indebtedness then due in the order determined by Lender in its sole discretion (such application to be deemed a voluntary prepayment and subject to the Additional Costs), and that Lender may at any time, in its discretion, apply all or any part of such funds toward the payment of any such taxes, assessments, charges or premiums which are past due, together with any penalties or late charges with respect thereto. The conveyance or transfer of Borrower’s interest in the Property for any reason (including without limitation the foreclosure of a subordinate lien or security interest or a transfer by operation of law) shall constitute an assignment or transfer of Borrower’s interest in and rights to such funds held by Lender under this Section but subject to the rights of Lender hereunder.

(f) Fees and Expenses. Borrower will pay all appraisal fees, filing and recording fees, reasonable inspection fees, survey fees, taxes, brokerage fees and commissions (except as provided in this Agreement), abstract fees, title policy fees, uniform commercial code search fees, escrow fees, reasonable attorneys’ fees and legal

20

expenses and all other costs and expenses of every character incurred by Borrower or Lender in connection with the Loan, either at the closing thereof or at any time during the term thereof, or otherwise attributable or chargeable to Borrower as owner of the Property, and will reimburse Lender for all such costs and expenses incurred by it. Borrower shall pay all expenses and reimburse Lender for any reasonable expenditures, including reasonable attorneys’ fees and legal expenses, incurred or expended in connection with (i) the breach by Borrower of any covenant herein or in any other Loan Document, (ii) Lender’s exercise of any of its rights and remedies hereunder or under the Note or any other Loan Document or Lender’s protection of the Property and its lien and security interest therein, or (iii) any amendments to the Loan Document or any matter requested by Borrower or any approval required hereunder.

(g) Tax on Lien. In the event of the enactment after this date of any law of the State or of any other governmental entity deducting from the value of property for the purpose of taxation any lien or security interest thereon, or imposing upon Lender the payment of the whole or any part of the taxes or assessments or charges or liens herein required to be paid by Borrower, or changing in any way the laws relating to the taxation of deeds of trust, security deeds, mortgages or security agreements or debts secured by deeds of trust, secured deeds, mortgages or security agreements or the interest of the mortgagee or secured party in the property covered thereby, or the manner of collection of such taxes, so as to affect the Security Instrument or the Indebtedness or Lender, then, and in any such event, Borrower, upon demand by Lender, shall pay such taxes, assessments, charges or liens, or reimburse Lender therefor; provided, however, that if in the opinion of counsel for Lender (i) it might be unlawful to require Borrower to make such payment or (ii) the making of such payment might result in the imposition of interest beyond the maximum amount permitted by law, then and in such event, Lender may elect, by notice in writing given to Borrower, to declare all of the Indebtedness to be and become due and payable one hundred eighty (180) days from the giving of such notice.

(h) Existence. Borrower will continuously maintain its existence, good standing and authority to transact business in the State together with its franchises and trade names.

(i) Change of Name, Identity or Structure. Borrower will not change Borrower’s name, identity (including its trade name or names) or, if not an individual, Borrower’s corporate, partnership or other structure without notifying Lender of such change in writing at least thirty (30) days prior to the effective date of such change. At the request of Lender, Borrower shall execute a certificate in form reasonably satisfactory to Lender listing the trade names under which Borrower intends to operate the Property, and representing and warranting that Borrower does business under no other trade name with respect to the Property.

21

(j) Single Asset Entity; Operation of Borrower. During the term of the Loan, Borrower shall not:

(i) engage in any business or activity other than the acquisition, development, construction, ownership, leasing, operation and maintenance of the Property, and activities incidental thereto;

(ii) acquire or own any material asset other than the Property and such incidental personal property as may be necessary for the construction and operation of the Improvements;

(iii) merge into or consolidate with any Person or dissolve, terminate or liquidate in whole or in part, transfer or otherwise dispose of all or substantially all of its assets or change its legal structure, without in each case the prior written consent of Lender;

(iv) fail to preserve its existence as an entity duly organized, validly existing and in good standing (if applicable) under the laws of the jurisdiction of its organization or formation, or without the prior written consent of Lender, materially amend, modify, terminate or fail to comply with the provisions of Borrower’s organizational documents;

(v) own any subsidiary or make any investment in or acquire the obligations or securities of any other Person without the prior written consent of Lender;

(vi) commingle its assets with the assets of any of its partner(s), members, shareholders, Affiliates, or of any other Person or transfer any assets to any such Person other than distributions on account of equity interests in Borrower permitted hereunder and properly accounted for;

(vii) incur any Indebtedness other than Permitted Indebtedness;

(viii) allow any Person to pay its debts and liabilities or fail to pay its debts and liabilities solely from its own assets;

(ix) fail to maintain its records, books of account and bank accounts separate and apart from those of the shareholders, partners, members, principals and Affiliates of Borrower, the affiliates of a shareholder, partner or member of Borrower, and any other Person or fail to prepare and maintain its own financial statements in accordance with federal income tax basis of accounting procedures consistently applied and susceptible to audit, or if such financial statements are consolidated, fail to cause such financial statements to contain footnotes disclosing that the Property is actually owned by Borrower;

22

(x) enter into any contract or agreement with any shareholder, partner, member, principal or Affiliate of Borrower, Guarantor or any shareholder, partner, member, principal or Affiliate thereof, except upon terms and conditions that are intrinsically fair and substantially similar to those that would be available on an arms-length basis with third parties other than any shareholder, partner, member, principal or Affiliate of Borrower or Guarantor, or any shareholder, partner, member, principal or Affiliate thereof;

(xi) seek dissolution or winding up, in whole or in part;

(xii) fail to correct any known misunderstandings regarding the separate identity of Borrower;

(xiii) hold itself out to be responsible or pledge its assets or credit worthiness for the Indebtedness of another Person or allow any Person to hold itself out to be responsible or pledge its assets or credit worthiness for the Indebtedness of Borrower (except pursuant to the Loan Documents);

(xiv) make any loans or advances to any third party, including any shareholder, partner, member, principal or Affiliate of Borrower, or any shareholder, partner, member, principal or Affiliate thereof;

(xv) fail to file its own tax returns;

(xvi) fail either to hold itself out to the public as a legal entity separate and distinct from any Person or to conduct its business solely in its own name in order not (i) to mislead others as to the entity with which such other party is transacting business, or (ii) to suggest that Borrower is responsible for the Indebtedness of any third party (including any shareholder, partner, member, principal or affiliate of Borrower, or any shareholder, partner, member, principal or Affiliate thereof);