Attached files

| file | filename |

|---|---|

| EX-31.2 - CERTIFICATION - Native American Energy Group, Inc. | nagp_ex312.htm |

| EX-32.1 - CERTIFICATION - Native American Energy Group, Inc. | nagp_ex321.htm |

| EX-31.1 - CERTIFICATION - Native American Energy Group, Inc. | nagp_ex311.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

FORM 10-K/A

(Amendment No. 1)

x ANNUAL REPORT UNDER SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended: December 31, 2012

¨ TRANSITION REPORT UNDER SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission file number: 000-54088

NATIVE AMERICAN ENERGY GROUP, INC.

(Exact Name of Registrant as specified in its charter)

|

Delaware

|

65-0777304

|

|

|

(State of Incorporation)

|

(IRS Employer ID No.)

|

61-43 186th Street Suite 507

Fresh Meadows, NY 11365

(Address of principal executive offices)

(718) 408-2323

(Registrant’s telephone number, including area code)

Securities registered under Section 12(b) of the Exchange Act: None

Securities registered under Section 12(g) of the Exchange Act: Common Stock, $0.001 par value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (section 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definition of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer

|

¨

|

Non-accelerated filer

|

¨

|

|

|

Accelerated filer

|

¨

|

Smaller reporting company

|

x

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of registrant’s voting and non-voting common equity held by non-affiliates (as defined by Rule 12b-2 of the Exchange Act) computed by reference to the average bid and asked price of such common equity on June 30, 2012 is $10,189,314. As of May 20, 2013, the issuer has one class of common equity, and the number of shares outstanding of such common equity was 40,522,018.

EXPLANATORY NOTE

Native American Energy Group, Inc. (the “Company,” “we,” “us” or “our”) is filing this Amendment No. 1 on Form 10-K/A (this “Amendment No. 1”) to amend its Annual Report on Form 10-K for the fiscal year ended December 31, 2012, filed with the Securities and Exchange Commission (the “SEC”) on May 20, 2013.

This Amendment No. 1 on Form 10K/A amends and restates our Annual Report on Form 10-K for the fiscal year ended December 31, 2012 (the “Original 10-K”) filed with the Securities and Exchange Commission (the ”SEC”) on May 20, 2013 in response to a comment issued by the SEC and to clarify certain prior disclosures. This 10-K/A contains changes to Part IV—Item 15 (Exhibits, F-3, F-4 and F-8.) Please note that there were no changes to the Consolidated Financial Statements other than marking pages F-3, F-4 and F-8 as “Unaudited” to clarify that the financial statements for the cumulative period have not been audited.

Except for the changes stated above, no other changes have been made to the Company Annual Report on Form 10-K for the fiscal year ending December 31, 2012.

In accordance with Sections 302 and 906 of the Sarbanes-Oxley Act of 2002, currently dated certifications of our principal executive officer and our principal financial officer are attached to this Form 10-K/A as Exhibits 31.1, 31.2 and 32.1.

Except for the foregoing amended information, we have not updated the disclosures contained in the Form 10-K/A to reflect events that have occurred subsequent to the filing date of the Original 10-K. Accordingly, this Form 10-K/A should be read in conjunction with the Original 10-K and our subsequent filings with the SEC.

INFORMATION REGARDING FORWARD-LOOKING STATEMENTS

Written forward–looking statements may appear in documents filed with the Securities and Exchange Commission (“SEC”), including this Annual Report on Form 10-K, documents incorporated by reference, reports to shareholders and other communications.

Forward–looking statements appear in a number of places in this quarterly report and include but are not limited to management’s comments regarding business strategy, workover activities at our oil and gas properties, meeting our capital raising targets and following any use of proceeds plans, our ability to and methods by which we may raise additional capital, production and future operating results.

In this quarterly report, the use of words such as “anticipate,” “continue,” “estimate,” “expect,” “likely,” “may,” “project,” “should,” “believe” and similar expressions are intended to identify uncertainties. While we believe that the expectations reflected in those forward–looking statements are reasonable, we cannot assure you that these expectations will prove to be correct. Our actual results could differ materially from those anticipated in these forward–looking statements. The differences between actual results and those predicted by the forward-looking statements could be material. Forward-looking statements are based upon our expectations relating to, among other things:

|

●

|

oil and natural gas prices and demand;

|

|

●

|

our future financial position, including cash flow, debt levels and anticipated liquidity;

|

|

●

|

the timing, effects and success of our acquisitions, dispositions and workover activities;

|

|

●

|

uncertainties in the estimation of proved reserves and in the projection of future rates of production;

|

|

●

|

timing, amount, and marketability of production;

|

|

●

|

our ability to find, acquire, market, develop and produce new properties;

|

|

●

|

effectiveness of management strategies and decisions;

|

|

●

|

the strength and financial resources of our competitors;

|

|

●

|

climatic conditions;

|

|

●

|

the receipt of governmental permits and other approvals relating to our operations;

|

|

●

|

unanticipated recovery or production problems; and

|

|

●

|

uncontrollable flows of oil, gas, or well fluids.

|

Many of these factors are beyond our ability to control or predict. These factors do not represent a complete list of the factors that may affect us. We do not undertake to update our forward–looking statements.

2

TABLE OF CONTENTS

|

PAGE

|

|||||

|

PART I

|

|||||

|

Item 1.

|

Business.

|

4 | |||

|

Item 1A.

|

Risk Factors.

|

10 | |||

|

Item 1B.

|

Unresolved Staff Comments.

|

10 | |||

|

Item 2.

|

Properties.

|

10 | |||

|

Item 3.

|

Legal Proceedings.

|

12 | |||

|

Item 4.

|

Mine Safety Disclosures.

|

12 | |||

|

PART II

|

|||||

|

Item 5.

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

|

13 | |||

|

Item 6.

|

Selected Financial Data.

|

14 | |||

|

Item 7.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations.

|

14 | |||

|

Item 7A.

|

Quantitative and Qualitative Disclosures about Market Risk.

|

20 | |||

|

Item 8.

|

Financial Statements and Supplementary Data.

|

20 | |||

|

Item 9.

|

Changes In and Disagreements with Accountants on Accounting and Financial Disclosure.

|

21 | |||

|

Item 9A.

|

Controls and Procedures.

|

21 | |||

|

Item 9B.

|

Other Information.

|

21 | |||

|

PART III

|

|||||

|

Item 10.

|

Directors, Executive Officers and Corporate Governance.

|

22 | |||

|

Item 11.

|

Executive Compensation.

|

24 | |||

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters.

|

26 | |||

|

Item 13.

|

Certain Relationships and Related Transactions and Director Independence.

|

27 | |||

|

Item 14.

|

Principal Accountant Fees and Services.

|

28 | |||

|

PART IV

|

|||||

|

Item 15.

|

Exhibits, Financial Statement Schedules.

|

28 | |||

|

SIGNATURES

|

30 | ||||

3

PART I

Item 1. Business.

Business Development

Native American Energy Group, Inc. (“we,” “us,” “our”) was incorporated in the State of Nevada on January 18, 2005 under the name Halstead Energy Corporation (“Halstead”). On January 25, 2005, our name was changed to Native American Energy Group, Inc.

In October 2009, we completed a reverse merger transaction with Flight Management International, Inc. (“Flight Management”), a Delaware corporation. Simultaneous with the consummation of the merger, Flight Management changed its name to Native American Energy Group, Inc.

As of the date of this filing, our common stock is quoted on the Over-the-Counter Quotation Bureau (“OTCQB”) market under the symbol “NAGP.” Our wholly owned subsidiaries, NAEG Alaska Corporation (“NAEG Alaska”), a Delaware corporation incorporated in 2005 that was formerly known as Fowler Oil & Gas Corporation, and NAEG CBM Operations LLC (“NAEG Operations”), an Alaskan limited liability company formed in August 2006 that was formerly known as Fowler Oil & Gas Alaska, LLC, are our operating entities in Alaska. In November 2011, we reinstated NAEG Economic Development Corporation (“NEDC”), a not-for-profit company established for the purpose of supporting worthy causes and local programs, which in turn promote Native American economic self-sufficiency.

Operations

We are a development-stage energy resource development and management company, which is defined by the Financial Accounting Standards Board (FASB) as an entity that has not commenced planned principal operations and has no significant revenue. In August 2011, we commenced a pilot five well-workover program on four oil and gas lease holdings in the Williston Basin in Montana. During the months of August 2011 through December 2011, we completed the first phase of enhanced oil recovery (“EOR”) operations on four of our five wells. As a result of the initial EOR operations during the 3rd and 4th quarters of 2011, we collected and sold approximately 919 barrels of oil, in aggregate, from two wells during the 4th quarter ending December 31, 2011. Subsequently, we collected and sold approximately 314 barrels of oil, in aggregate during 2012. During the summer of 2013, subject to adequate financing, we intend to complete Phase 2 of the 5-Well Program and commence full-scale oil production shortly thereafter.

Currently, we have four principal projects:

|

·

|

development of oil and gas interests in the Williston Basin in Montana (5-Well Program)

|

|

·

|

development of coal-bed methane natural gas (“CBM”) in the Cook Inlet Basin in Alaska; and

|

|

·

|

development of oil & gas properties on Native and non-Native American lands in Oklahoma using newer drilling and Enhanced Oil Recovery (EOR) technologies; and

|

|

·

|

the implementation of vertical axis wind turbine power generation technology for the production of clean, cost-efficient green energy on all U.S. Native American Indian reservations.

|

We have been in the process of developing several energy projects for the past eight years. This has included the acquisition of oil properties in Montana, natural gas properties in Alaska and identifying both oil & gas properties in Oklahoma. Our management believes, however, that properties in these three states have potential based on the limited EOR operations that have been conducted there and that there are opportunities to acquire properties that formerly produced oil and gas that can be re-developed for commercial profitable operation using newer production techniques. We are also pursing oil properties in on both Native and non-Native American lands in Oklahoma whereby we can implement similar enhanced oil recovery techniques as we applied on the 5-Well EOR pilot program in Montana in addition to other technologies.

4

We have limited financial resources available, which has had an adverse impact on our activities and operations. Additional funding would allow the development of future wells, and pay for expenditures for exploration and development, general administrative costs, and possible entrance into strategic arrangements with a third parties. We plan to raise capital through the sale of equity or convertible debt securities and through loans from our stockholders and third parties. There can be no assurance that additional funds will be available to us on favorable terms, or at all. If adequate funds are not available, we may be required to curtail our operations significantly or obtain funds through entering into arrangements with collaborative partners or others that may require us to relinquish rights to certain of our assets that we would not otherwise relinquish.

Relations with Native American Tribes

We have dedicated a substantial portion of our business plan to the conscientious development and responsible management of our relationships with Native American tribes, which own vast reserves of a wide assortment of minerals, including oil, gas, coal and other valuable minerals. Much of this potential energy has gone undeveloped for a variety of reasons, including a lack of communication and distrust of potential development partners as well as tribal reasons to maintain lands in an undeveloped state.

Our management has committed the past decade to familiarizing themselves with the various Native American tribes, cultures, organizational structures, protocols and customs and believes that attractive arms-length mineral development arrangements can be reached with a large number of Native American tribes once a level of mutual trust and understanding is reached.

On August 15, 2005, we received the approval of our Nationwide Oil and Gas Bond from the Bureau of Indian Affairs at the United States Department of Interior in Washington D.C, which authorizes us to enter into or otherwise acquire an interest in oil and gas mining leases and oil and gas prospecting permits of various dates and periods of duration covering all lands or interests in lands held by the United States in trust for individual Native Americans or Native American tribes or bands also known as Federal Indian Reservations.

According to the Bureau of Indian Affairs at the United States Department of Interior, approximately 56.2 million acres are held in trust by the United States for various Indian tribes and individuals. There are approximately 326 Indian land areas in the U.S. administered as federal Indian reservations (i.e., reservations, pueblos, rancherias, missions, villages, communities, etc.).

In April 2007, we created a proprietary initiative called the Tribal Empowerment Program (the “Program”) whereby we promote tribal self-sufficiency by helping Native Americans to develop their own mineral resources and to use the revenue from such sources to implement renewable energy systems on their tribal lands. The Program has gained attention from tribes throughout the country and continues to win support from Native American activists, tribal leaders, U.S. politicians, spiritual leaders and business and energy professionals. In addition, in November 2011, we reinstated NAEG Economic Development Corporation (NEDC) for the purpose of supporting worthy causes and local programs, which in turn promote Native American economic self-sufficiency.

Williston Basin Operations, Montana

Since January 2005, we have been active in evaluating and acquiring oil and gas leases both on and around the Fort Peck Indian Reservation in the Williston Basin in Northeast Montana. We are currently focused on completing Phase 2 of our 5-Well Enhanced Oil Recovery Pilot Program on four oil and gas leases containing an aggregate of five wells on and around the Fort Peck Indian Reservation in the Williston Basin in Montana. The leases include historically producing oil and gas wells that were shut-in by previous oil and gas companies due to depressurization, paraffin, production falling below commercial levels at that time, termination of previous oil and gas leases by the tribal governments due to improper development and various economic reasons, and most commonly, declining oil prices. Phase 1 was completed in early 2012.

5

Our base of operations in the Williston Basin is located in the city of Wolf Point on the Fort Peck Indian Reservation. We have an equipment yard and maintenance facility with a workshop and three vehicle bays which is situated on approximately five acres. We own our own workover and well-servicing rig, which is used to re-work, service and drill shallow wells. Our standby field team includes fabricators, welders, machinists, heavy equipment operators, derrickmen, floor hands, roughnecks and rig operators, all of whom are independent contractors. The terms of the oil and gas leases typically range from three to five years and are automatically extended as long as any oil or gas is being sold off the lease or there is an agreement or understanding with the landowner to extend the lease due to permitting issues, or delayed development or production.

Due to stronger market prices for crude oil as compared to natural gas, our current focus has been on four oil and gas leases, containing an aggregate of five wells, on and around the Fort Peck Indian Reservation in the Williston Basin in Montana. In August 2011, we began the initial phase of work-overs and EOR operations on five wells in Montana which is hereinafter referred to collectively as the “Five-Well Program.” See Item 2—Properties.

In our Five-Well Program, we leveraged advanced technology to enhance oil recovery on our leases. This technology, known as Single Entry Multi-Lateral Jetting System, or SEMJet®, has demonstrated its ability to enhance and exploit reservoirs and increase recovery of up to 50% more oil in place reserves from mature properties. Moreover, the SEMJet System gives us the ability to:

|

·

|

inspect the condition of production tubing with in-situ inspection, log the cement bond and correlate the casing collars using its built-in logging system;

|

|

·

|

create horizontal channels off any new or old wellbores that have 4.5” casing or greater, whether the wells are vertical, deviated or horizontal in design;

|

|

·

|

enter mono-bore completions and jet lateral channels at a true 90º in casing as small as 3.5” using a secondary, unique coiled tubing system;

|

|

·

|

unlock and stimulate trapped oil reserves beyond any near wellbore damage by displacing acid, specialty fluids or microbial products into the laterals;

|

|

·

|

penetrate the reservoir and open up larger producing channels without using conventional perforating guns, which can damage the formation and are hazardous; and

|

|

·

|

create a low pressure, high velocity circulating environment within the wellbore to ensure cuttings removal, geological samples and efficient well cleaning;

|

6

Jetting Down-Hole Schematic – Diagram Provided by SEMJET®

In September 2006, we consummated an Oil Sale and Purchase Agreement with Shell Trading U.S. Company (Shell), which provides for Shell to purchase all crude oil produced from our leases; and subjects us to no delivery commitments. Since 2006, we have sold oil from these five wells while performing minimal workover operations with our own workover service rig, surfactant treatments and flow testing. As a result of the initial EOR operations during the 3rd and 4th quarters of 2011, we collected and sold approximately 919 barrels of oil, cumulatively, from two wells during the 4th quarter ending December 31, 2011 and 175 barrels in the 1st quarter of 2012. During the summer of 2013, subject to adequate financing, we intend to complete Phase 2 of the 5-Well Program and commence full-scale oil production shortly thereafter.

7

The price of oil is a function of oil’s supply and demand, among other factors. Throughout 2008 and 2009, oil prices swung materially as demand contracted in light of the global recession.

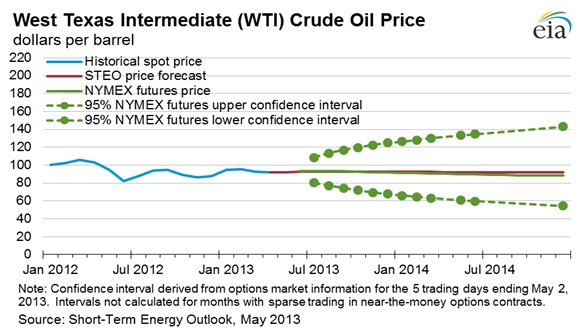

According to the U.S. Energy Information Administration’s (“EIA”) Short-Term Energy Outlook, (the “Report”) dated May 7, 2013, the EIA projects that the West Texas Intermediate (“WTI”) spot prices are expected to average about $93 per barrel in 2013, which is $1.00 higher than the average WTI price of crude oil during 2012. The report can be accessed at the following link: http://www.eia.gov/forecasts/steo/pdf/steo_full.pdf

Cook Inlet Operations, Alaska

We explore areas where there are known coal resources because such areas have an increased likelihood of containing Coal Bed Methane (“CBM”). The Matanuska-Susitna (“Mat-Su”) Valley in Alaska is known for its significant coal reserves, which are larger than those in the prolific Powder River Basin of the United States. While the Mat-Su Borough Assembly has adopted some of the strictest regulations for coal bed methane drilling in the United States, our environmentally conscious approach to coal bed methane development led to approval of a Mat-Su Borough drilling permit in October 2, 2007 (“Permit”) and is the first and only CBM drilling permit issued by the Mat-Su Borough Planning Commission (“Mat-Su Borough”).

The issuance of the Mat-Su drilling permit was followed by the economic downturn and further decline in commodity prices in 2008 which changed the economics and fundability of the project. The permit expired on October 1, 2012. Today, we remain the only applicant that has ever received a CBM drilling permit in the Mat-Su Valley due to the Mat-Su Borough Assembly having adopted some of the strictest regulations for coal bed methane drilling in the United States. In addition, we have been approached by other local government agencies in the Mat-Su Valley that are pro-development of CBM and have the authority to issue drilling permits individually using the same permitting guidelines.

Natural gas production is in high demand by purchasers in the Mat-Su Valley such as the local gas and electric utilities including the Conoco Phillips LNG plant (“Conoco”) as they export liquefied natural gas to Japan directly from Alaska. Since 2008 and until recently, we have continued to maintain communication with the various prospective purchasers in the Cook Inlet area such as Conoco, Chugach Electric Association Inc. and the Matanuska Electric Association (“MEA”). In addition, MEA is working to build a 180 megawatt natural gas power generation plant as part of its mission of bringing reliable, affordable power to the residents of the Cook Inlet. Construction is proposed to begin 2013 and they expect to be ready for testing by October 2014. MEA expects to begin generating power by January 1, 2015.

8

As per our discussions with local officials, city governments, landowners, gas purchasers and the various permitting agencies in the region, we are confident that once adequate financing is identified, lease acquisitions and re-permitting can be achieved in an expeditious manner due to our relationships in the region as well as the growing demand and the dwindling supply of natural gas in the region.

According to the U.S. Energy Information Administration’s (“EIA”) Short-Term Energy Outlook, (the “Report”) dated May 7, 2013, EIA’s average 2013 Henry Hub natural gas spot price forecast is $3.80 per million British thermal units (MMBtu), an increase of $1.05 per MMBtu from the 2012 average spot price of $2.75. EIA expects that Henry Hub spot prices will average $4.00 per MMBtu in 2014. The report can be accessed at the following link: http://www.eia.gov/forecasts/steo/pdf/steo_full.pdf

Wind Energy Division – Overview

In February 2007, we entered into an exclusive technology and distribution rights agreement (the “Original Windaus Agreement”) for proprietary vertical axis wind turbines created by Windaus Energy, Inc. of Brantford, Ontario (“Windaus”). In March, 2010, we executed an amendment to the Original Windaus Agreement (the “Amendment” and, together with the Original Windaus Agreement, the “Windaus Agreement”), whereby we acquired exclusive manufacturing, marketing, sales, sublicensing and distribution rights to bring Windaus’ proprietary, highly advanced Vertical Axis Wind Turbine Energy Systems (the “Wind Turbine”) to the entire U.S. market, including all Native American Indian lands and reservations with boundaries established by treaty, statute, and/or executive or court order, and that are recognized by the U.S. Federal Government as territory in which U.S. federally recognized tribes American Indian tribes have jurisdiction (includes, without limitation, Rancherias, Pueblos, Indian Colonies, Alaska Native Villages and lands owned by Alaska Native Corporations.

Due to our current focus on the five well enhanced oil recovery program in Montana and other oil & gas development initiatives, in April 2012, we negotiated with Windaus to further amend the license agreement to reduce the licensed territory and relinquish NAGP’s manufacturing rights. On April 25, 2012, we amended the Windaus Agreement to reduce the licensed territory by approximately 95%, leaving NAGP only with distribution rights for all Indian Lands as specified in Exhibit A of the Technology License & Distribution Agreement which were filed as Exhibit 10.3 to Amendment No. 1 to our Form 10 Registration Statement filed November 16, 2010, all of which are incorporated herein by reference.

9

Contingent on funding, capital availability, certain strategic partnerships, we intend to engage in two segments of wind power generation:

|

1.

|

Wind Community Development: small to large-scale wind farms jointly owned by Native American Indian communities, small town local communities, farm owners and us. We plan to connect to the general utility electric grid to produce clean, environmentally sound wind power for use by the electric power industry.

|

|

2.

|

Single Unit Distribution: wind turbine systems to produce electrical power, both on and off the grid, for use by individual homeowners, small businesses, commercial industry, institutions, utility companies, schools, government buildings, apartment complexes, industrial sites, communication towers and military facilities.

|

Item 1A. Risk Factors.

We are a smaller reporting company as defined by Rule 12b-2 of the Exchange Act and are not required to provide the information under this item.

Item 1B. Unresolved Staff Comments.

We are a smaller reporting company as defined by Rule 12b-2 of the Securities Exchange Act of 1934 and are not required to provide the information under this item.

Item 2. Properties.

Oil & Gas Properties, Wells, Operations and Acreage

Our properties consist primarily of interests in properties on which oil and gas wells are located, both non-producing and in progress, as well as undeveloped properties. Such property interests are often subject to landowner royalties, overriding royalties and other oil and gas leasehold interests and are listed below.

Five-Well Pilot Program

Below are background information and a field update on each well in the Five-Well Pilot Program. These five wells were specifically chosen due to the following important characteristics present in all wells: Permeability, Porosity and Pressure. Our management’s strategy regarding the Five-Well Program was to complete the initial workover (casing scraping, tubing testing), surfactant treatment and lateral jetting EOR process for the five wells as quickly as possible and complete the final phase of workovers necessary to bring the wells online and into production once we are adequately capitalized to do so. Due to our limited resources, our management completed as much of the plan as possible and intends to complete the Five-Well Program in its entirety by the end of the 3rd quarter of 2013 providing that we are able to raise sufficient funds in a private placement offering.

10

Cox 7-1 Well - located on 80 acres (SW NW of Sec.11-31N-44E) in Roosevelt County, Montana

Historically producing sweet crude from the shallow Mississippian Charles Formation, Cox 7-1 was first drilled in 1981 by Century Oil & Gas Corporation and completed at 35 barrels of oil per day, but was later shut-in primarily due to a build-up of naturally occurring paraffin which clogged perforations in the original well bore as well as a tubing anchor that was not able to be released or retrieved over the years by other operators. In addition, the well was only operating approximately 50% of the time mainly due to past operator’s inability to effectively correct mechanical problems with surface equipment. We began the workover and EOR process on this well in August 2011. During the well operations to retrieve the tubing anchor, it was discovered that, in fact, it was a packer instead of an anchor. We were successful in retrieving the packer and then proceeded with the EOR plan for the well. We completed the workover and EOR process in mid-September with satisfactory results. We installed updated surface equipment and in-ground flow lines. We plan to re-enter the well during the fall of 2013 and recomplete it by implementing a casing patch operation to bring the well online for production.

Sandvick 1-11 Well - located on 320 acres (SW NW of Sec.11-31N-44E) in Valley County, Montana

The well was originally drilled in 1983 by Clayton W. Williams, Jr. and was completed at 99 barrels of oil per day; however the average historical production of the well through the 1980s and 1990s declined to approximately 20 barrels per day, due largely to mud blockages down hole. During the initial phase of the workover, we succeeded in overcoming mud filtration issues which hindered past production. After jetting the laterals in the Ratcliffe formation, approximately 60 barrels of oil almost immediately flowed back into the pits on location, which indicated that we definitely stimulated the section of rock from which oil or gas is expected to be produced in commercial quantities (the “pay zone”). Swab testing showed a 30% oil cut (difference between oil and water) from total fluids. The well was brought online for testing in November at which time it exhibited strong oil production – during the initial 18 hours the well was online, it produced approximately 80 barrels of oil. However, a packer installed to close off a casing leak from a water zone above the oil zone lost integrity and allowed water to migrate into the wellbore which overpowered the pay zone. Consequently, we plan to re-enter the well during the fall of 2013 and recomplete the well by applying a cement squeeze into the casing to close off the water zone and then bring the well online for production.

Wright 5-35 Well - located on 160 acres (SW NW of Sec.35-24N-46E) in McCone County, Montana

This well was first drilled in 1960 by State Oil and Cities Service Oil Company. Original completion of the well resulted in 36 barrels of oil per day, a production level which persisted for most of its productive life through 1985 when it was shut down for two years. The well was brought back into production in 1987 and continued to produce oil until 1995 when it was again shut down. At that point in time, oil production had declined to approximately six barrels of oil per day due to a build-up of paraffin that plugged off perforations in the well bore. Following our acquisition of the lease in 2006, we serviced the well and applied a paraffin surfactant to clean the perforations, casing and tubing. Over the two-day testing period, the well produced over 400 barrels of 36 Degree API Gravity Oil. In November 2011, we completed the initial workover and EOR process of the Wright 5-35 well. Further, field crews successfully upgraded the electrical systems which power the surface equipment, replaced the pad under the pumpjack and winterized the well site. The production on the Wright 5-35 prior to originally being shut-in during 1995 was 9 barrels of oil per day. Well testing during the completion stage exhibited an oil cut ranging from 25% to 50%. On December 10, 2011, the well was brought online into minimal production and underwent adjustments to surface equipment to stabilize the well. During the following 2 weeks after being brought online, the well was generating approximately 24 barrels of 36 degree API Gravity Oil per day until it was shut-in during the last week of December 2011 pending purchase of additional equipment needed to effectively operate the well. Based on the well test which included swab testing, we estimate that daily oil production will approximate 60 barrels per day once we begin steady production from this well.

11

Beery 2-24 & 22-24 - located on 320 acres (N/2 of Sec.24-23N-49E) in McCone County, Montana

Both Beery 2-24 and Beery 22-24 are situated on NAGP’s 320 acre lease in north McCone County, and located in an oil and gas field originally discovered by Shell Oil in the early 1950s. Beery 22-24 was first drilled and completed in 1953 and is the only original well drilled by Shell that remains in the field today. This well was the second largest producer in the East Richey Field, producing 2300 barrels of oil per day (“BOPD”) during its active production life. Beery 2-24 was originally drilled and completed by Dick Shackelford and Edward Beery in 1980 and initially produced 24 BOPD. The Beery property produced approximately 350,000 barrels of the 2 million barrels of cumulative oil produced in the entire field.

In January 2012, we completed the lateral jetting operations of the Beery 2-24. We also purchased and installed four oil storage tanks at the tank battery location onsite providing 1600 barrels of total oil capacity. Since the jetting of the laterals combined with a proprietary chemical blend, the down-hole pressures have increased significantly and the well has naturally flowed in excess of 5 barrels of oil and a significant amount of gas every morning when the well was being bled off for daily operations. The swab tests indicate a consistent 50% oil cut from total fluids. We plan to mobilize the work-over rig to this site during the summer of 2013 and complete the workover process which includes installation of a specialized down-hole pump specifically designed for this well, replacing the current pumpjack with a larger pumpjack that will allow us to get a longer stroke when the well is in production and install electric equipment needed to operate the well which includes a 50 Horsepower motor. We plan to re-enter the well during the early summer of 2013 and recomplete it by implementing a casing patch operation and bring the well online for production. Based on the well tests from the EOR process, we are estimating the daily production from this well to be at least 100 barrels per day.

Beery 22-24 – Rework Plan

The Beery 22-24 is the fifth and final well in NAEG's five well Rework Program. Shell completed this well at 2600 barrels of oil per day in 1950's and it was one of the largest producers in the area. In 1986, the operator at the time installed a 385' liner at the bottom of the well in order to shut off water from one of three zones open. (B2, C2 and Mission Canyon) Until recently, this well would not have many options to improve oil production but with perforating technology achieving penetration distances of three feet or better and with the success of surfactants, we feel that after what was learned from the Beery 2-24 EOR program, this well has very similar potential as we are exploiting the same geological formations and pay-zones. Our plans include, perforating more holes in the B2 zone but more importantly, perforate the same part of the C2 zone that was completed in the Beery 2-24. The perforating will be followed up with a two hundred barrel surfactant and acid treatment. Ball sealers will be used to make sure all of the perforations are open. Based on the geology, production history of the well and our experience with the same formations in the Beery 2-24 which is in the same field, we are estimating the daily production from the Beery 22-24 well to be at 70 barrels per day. Subject to adequate financing, we plan to commence the workover and EOR operations on the Beery 22-24 well during the summer of 2013 after completion of the Beery 2-24 well.

Facilities

Corporate Office - We maintain our current principal office at 61-43 186th Street Fresh Meadows NY 11365.

Montana Maintenance Facility – We maintain an equipment yard and maintenance facility on the Fort Peck Indian Reservation in Montana. It is located on 5 acres and includes a tool workshop and three vehicle bays. It is located on Highway 2 in Wolf Point, Montana. There is no physical address for this location.

Item 3. Legal Proceedings.

The information required by Item 3 is included in “Notes to the Consolidated Financial Statements—Note 15 – Commitments and Obligation—Litigation.”

Item 4. Mine Safety Disclosures.

Not applicable.

12

PART II

Item 5. Market for Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

Market Information.

While there is no established public trading market for our common stock, our common stock is quoted on the OTCQB market under the symbol NAGP. The following table sets forth the high and low bid prices for our common stock reported by the OTC marketplace for the periods indicated below. These quotations reflect inter-dealer prices, without retail mark-up, mark-down or commission and may not necessarily represent actual transactions.

|

Price Range Per Share

|

||||||||

|

High ($)

|

Low ($)

|

|||||||

|

Year Ending December 31, 2012

|

||||||||

|

First Quarter

|

1.01

|

0.14

|

||||||

|

Second Quarter

|

0.64

|

0.10

|

||||||

|

Third Quarter

|

6.00

|

0.15

|

||||||

|

Fourth Quarter

|

0.23

|

0.05

|

||||||

|

Year Ending December 31, 2011

|

||||||||

|

First Quarter

|

0.64

|

0.13

|

||||||

|

Second Quarter

|

0.90

|

0.25

|

||||||

|

Third Quarter

|

0.83

|

0.15

|

||||||

|

Fourth Quarter

|

1.02

|

0.08

|

||||||

On March 13, 2008, the Depository Trust & Clearing Corporation (“DTC”) had originally suspended trade and settlement services (known as a “Global Lock” or “Chill”) for our Company’s security along with 25 other companies, resulting in our common stock not being ineligible for delivery, transfer or withdrawal through the DTC system and not being electronically tradable. On June 21, 2012, after a four year appeal, the Depository Trust Company (DTC) restored full electronic clearance and settlement services for the Company’s “NAGP” security. A notice of reinstatement was filed as Exhibit 99.1 to an 8-K filed on June 25, 2012.

Holders

As of May 20, 2013, we had 756 registered shareholders of common stock.

Dividends

We have not paid any cash dividends to date and do not anticipate or contemplate paying any dividends in the foreseeable future. It is the present intention of our management to utilize all available funds for the growth of our business.

Equity Compensation Plan Information

|

Plan category

|

Number of securities

to be issued upon

exercise of

outstanding options,

warrants and rights

|

Weighted-average

exercise price of

outstanding options,

warrants and rights

|

Number of securities

remaining available

for future

issuance under equity

compensation plans

|

|||||||||

|

Equity compensation plans approved by security holders

|

10,000,000

|

$ |

0.92

|

20,000,000

|

(1)

|

|||||||

|

Equity compensation plans not approved by security holders

|

-0-

|

-0-

|

-0-

|

|||||||||

13

Our 2011 Equity Incentive Plan (the “2011 Equity Incentive Plan”) was adopted by our Board of Directors effective June 6, 2011, and has been approved by the written consent of holders of shares of our common stock and Series A Preferred Stock.

Recent Sales of Unregistered Securities

In the fiscal year ended December 31, 2012, we made the following shares of unregistered securities, some of which have previously been disclosed on our Current Reports on Form 8-K and our Quarterly Reports on Form 10-Q:

|

·

|

During the three months ended March 31, 2012, we issued and sold to four investors an aggregate of 592,000 shares of our common stock at a per share purchase price of $.25 for proceeds of $148,000.

|

|

·

|

During the three months ended June 30, 2012, we issued and sold to 13 investors an aggregate of 675,800 shares of our common stock at a per share purchase price of $0.25 for proceeds of $168,950.

|

|

·

|

During the three months ended September 30, 2012, we issued and sold to 15 investors an aggregate of 551,200 shares of our common stock at a per share purchase price of $0.25 for proceeds of $137,800.

|

|

·

|

During the three months ended December 31, 2012, we issued and sold to 2 investors an aggregate of 850,000 shares of our common stock at a per share purchase price of $0.10 for proceeds of $85,000.

|

Item 6. Selected Financial Data.

We are a smaller reporting company as defined by Rule 12b-2 of the Securities Exchange Act of 1934 and are not required to provide the information under this item.

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

The following information should be read in conjunction with the consolidated financial statements and notes thereto appearing elsewhere in this Annual Report on Form 10-K.

Overview

Native American Energy Group, Inc. is a development-stage energy resource development and management company, with four principal projects:

|

·

|

development of oil and gas interests in the Williston Basin in Montana (5-Well EOR Program);

|

|

·

|

development of coal-bed methane natural gas (“CBM”) in the Cook Inlet Basin in Alaska;

|

|

·

|

development of oil & gas properties on Native and non-Native American lands in Oklahoma using newer drilling and Enhanced Oil Recovery (EOR) technologies; and

|

|

·

|

implementation of vertical axis wind turbine power generation technology for the production of clean, cost-efficient green energy on all U.S. Native American Indian reservations.

|

Since inception (2005), we have primarily been involved in the acquisition and management of Native American land and fee land acreage in Montana and Alaska and the exploration for, and development of, oil and natural gas properties which management believes have potential for improved production rates and resulting income by application of both conventional and non-conventional improvement and enhancement techniques, including horizontal drilling.

Our consolidated financial statements include the accounts, including our wholly owned subsidiaries, NAEG Alaska and NAEG Operations. All significant intercompany balances and transactions have been eliminated in consolidation.

14

To implement our current business plan, significant additional financing will be required and we will need to be successful in its efforts to identify, acquire and develop oil and gas reserves that are economically recoverable.

We are in the development stage as defined by Accounting Standards Codification subtopic 915-10 Development Stage Entities (“ASC 915-10”) with its efforts principally devoted to developing oil and gas reserves. To date, we have not generated sales revenues; have incurred expenses and sustained losses. Consequently, its operations are subject to all the risks inherent in the establishment of a new business enterprise. For the period from inception through December 31, 2012, the Company has accumulated losses of $31,331,949.

Critical Accounting Policies

Our discussion and analysis of our financial condition and results of operations are based upon our financial statements, which have been prepared in accordance with accounting principles generally accepted in the United States of America. The preparation of these financial statements requires us to make estimates and judgments that affect the reported amounts of assets, liabilities, revenues and expenses. In consultation with our Board of Directors, we have identified several accounting principles that we believe are key to the understanding of our financial statements. These important accounting policies require management’s most difficult, subjective judgments.

Property and Equipment

Property and equipment is recorded at cost. Depreciation of assets is provided by use of a straight line method over the estimated useful lives of the related assets. Expenditures for replacements, renewals, and betterments are capitalized. Maintenance and repairs are charged to operations as incurred.

Undeveloped Oil and Gas Properties

Acquisition, exploration, and development of oil and gas activities are capitalized when costs are recoverable and directly result in an identifiable future benefit, following the full cost method of accounting. Improvements that increase capacity or extend the useful lives of assets are capitalized. Maintenance and turnaround costs are expensed as incurred.

Undeveloped oil and gas properties are assessed, at minimum annually or as economic events dictate, for potential impairment. Impairment is assessed by comparing the estimated net undiscounted future cash flows to the carrying value of the asset. If required, the impairment recorded is the amount by which the carrying value of the asset exceeds its fair value.

Capitalized costs are depleted and depreciated on the unit-of-production method based on the estimated gross proved reserves once determined by the independent petroleum engineers. Depletion and depreciation is calculated using the capitalized costs, including estimated asset retirement costs, plus the estimated future costs to be incurred in developing proved reserves, net of estimated salvage value.

Costs of acquiring and evaluating unproved properties and major development projects are excluded from the depletion and depreciation calculation if and until it is determined whether or not proved reserves can be assigned to such properties. Costs of unproved properties and major development projects are transferred to depletable costs based on the percentage of reserves assigned to each project over the expected total reserves when the project was initiated. These costs are assessed periodically to ascertain whether impairment has occurred.

Depletion and Amortization of Oil and Gas Properties

We follow the full cost method of accounting for oil and gas properties. Accordingly, all costs associated with acquisition, exploration and development of properties within a relatively large geopolitical cost center are capitalized when incurred and are amortized as mineral reserves in the cost center are produced, subject to a limitation that the capitalized costs not exceed the value of those reserves. All costs incurred in oil and gas producing activities are regarded as integral to the acquisition, discovery, and development of whatever reserves ultimately result from the efforts as a whole, and are thus associated with our reserves. We capitalize internal costs directly identified with performing or managing acquisition, exploration, and development activities. Unevaluated costs are excluded from the full cost pool and are periodically evaluated for impairment rather than amortized. Upon evaluation, costs associated with productive properties are transferred to the full cost pool and amortized. Gains or losses on the sale of oil and natural gas properties are generally included in the full cost pool unless the entire pool is sold.

15

Capitalized costs and estimated future development costs are amortized on a unit-of-production method based on proved reserves associated with the applicable cost center. We have assessed for impairment for oil and natural gas properties for the full cost pool quarterly using a ceiling test to determine if impairment is necessary. Specifically, the net unamortized costs for each full cost pool, less related deferred income taxes, should not exceed the following: (a) the present value, discounted at 10%, of future net cash flows from estimated production of proved oil and gas reserves, plus (b) all costs being excluded from the amortization base, plus (c) the lower of cost or estimated fair value of unproved properties included in the amortization base, less (d) the income tax effects related to differences between the book and tax basis of the properties involved. The present value of future net revenues should be based on current prices, with consideration of price changes only to the extent provided by contractual arrangements, as of the latest balance sheet presented. The full cost ceiling test must take into account the prices of qualifying cash flow hedges in calculating the current price of the quantities of the future production of oil and gas reserves covered by the hedges as of the balance sheet date. In addition, the use of the hedge-adjusted price should be consistently applied in all reporting periods and the effects of using cash flow hedges in calculating the ceiling test, the portion of future oil and gas production being hedged, and the dollar amount that would have been charged to income had the effects of the cash flow hedges not been considered in calculating the ceiling limitation should be disclosed. Any excess is charged to expense during the period that the excess occurs. We did not have any hedging activities during the year ended December 31, 2012 and 2011. Application of the ceiling test is required for quarterly reporting purposes, and any write-downs cannot be reinstated even if the cost ceiling subsequently increases by year-end. Sales of proved and unproved properties are accounted for as adjustments of capitalized costs with no gain or loss recognized, unless such adjustments would significantly alter the relationship between capitalized costs and proved reserves of oil and gas, in which case the gain or loss is recognized in income.

Abandonment of properties is accounted for as adjustments of capitalized costs with no loss recognized.

During the years ended December 31, 2012 and 2011, our management performed an evaluation of its unproved properties for purposes of determining the implied fair value of the assets at the end of each respective year. The test indicated that the recorded remaining book value of its unproved properties exceeded its fair value for the years ended December 31, 2012 and 2011. As a result, upon completion of the assessment, management recorded a non-cash impairment charge of $-0-, net of tax, during the year ended December 31, 2012 and $690,552, net of tax, or $0.02 per share during the year ended December 31, 2011 to reduce the carrying value of the unproved properties to $-0-. Considerable management judgment is necessary to estimate the fair value. Accordingly, actual results could vary significantly from management’s estimates.

Revenue Recognition

Revenues from the sale of petroleum and natural gas are recorded when title passes from us to our petroleum or natural gas purchaser and collectability is reasonably assured. During the years ended December 31, 2012 and 2011, we received proceeds from the sale of oil from two wells on our sites in the amount of $41,831 and $111,606 respectively.

Income Taxes

We have adopted Accounting Standards Codification subtopic 740-10, Income Taxes (“ASC 740-10”) which requires the recognition of deferred tax liabilities and assets for the expected future tax consequences of events that have been included in the financial statement or tax returns. Under this method, deferred tax liabilities and assets are determined based on the difference between financial statements and tax basis of assets and liabilities using enacted tax rates in effect for the year in which the differences are expected to reverse. Temporary differences between taxable income reported for financial reporting purposes and income tax purposes are insignificant

16

Derivative Instruments and Fair Value of Financial Instruments

We have evaluated the application of Accounting Standards Codification 815-40, Derivatives and Hedging, Contracts in Entity’s Own Equity (“ASC 815-40”) to certain convertible debentures that contain exercise price adjustment features known as reset provisions, issued warrants with anti-dilutive provisions and an obligation it issue common shares under anti-dilutive provision in a settlement agreement . Based on the guidance in ASC 815-40, we have concluded these instruments and obligations are required to be accounted for as derivatives effective upon issuance.

We have recorded the fair value of the reset provisions of the convertible debentures and classified as derivative liabilities in our balance sheet at fair value with changes in the value of these derivatives reflected in the consolidated statements of operations as gain or loss on derivative liabilities. These derivative instruments are not designated as hedging instruments under ASC 815-10.

Net Loss per Share

We follow Accounting Standards Codification subtopic 260-10, Earnings Per Share (“ASC 260-10”), which specifies the computation, presentation and disclosure requirements of earnings per share information. Basic earnings per share have been calculated based upon the weighted average number of common shares outstanding. Our common stock equivalents, represented by convertible preferred stock and warrants, were not considered as including such would be anti-dilutive.

Results of Operations for the Twelve Months Ended December 31, 2012 and 2011

Revenues

During the years ended December 31, 2012 and 2011, we received proceeds from the sale of oil for test purposes from two wells on our sites in the amount of $26,702 and $111,606 respectively.

Operating Expenses

Selling, General and Administrative

Selling, general and administrative expenses decreased from $5,293,927 for the twelve months ended December 31, 2011 to $1,758,749 for the twelve months ended December 31, 2012. The decrease of $3,535,178 or 67% is primarily attributable to a decrease in equity based compensation to consultants and service providers of $2,751,192 along with a reduction in operations expenses due to funding constraints.

Impairment of undeveloped properties

Impairment of undeveloped properties in the current fiscal year decreased from $690,552 for the twelve months ended December 31, 2011 to $-0- for the twelve months ended December 31, 2012. This decrease of $690,552 is attributed to an reduced investments in our undeveloped properties.

Litigation Settlement

During the year ended December 31, 2012, we concluded litigation as described in our accompanying financial statements. As such, we incurred a $1,757,182 charge in the year ended December 31, 2012 comprised of additional shares of our common stock and an obligation to issue warrants based on certain conditions occurring. During the year ended December 31, 2011, we incurred costs of $247,438.

Depreciation and Amortization

In the twelve months ended December 31, 2012, depreciation and amortization decreased by $5,839 from $159,594 for the twelve months ended December 31, 2011 to $153,755 for the twelve months ended December 31, 2012. The decrease is attributable aging of our field equipment purchased in prior years.

17

Total Operating Expenses

Total operating expenses decreased to $3,669,686 for the year ended December 31, 2012 from $6,391,511 for the year ended December 31, 2011. The decrease of $2,721,825 is primarily attributable to a decrease in equity based compensation issued to consultants and services providers net with the settlement of litigation as described above.

Loss on change in fair value of derivative liabilities

During the year ended December 31, 2012, we issued convertible debentures with certain conversion features and entered into a settlement agreement requiring us to issue warrants and common stock with anti-dilution provisions, which we identified as embedded derivatives. All require us to fair value the derivatives each reporting period and mark to market as a non-cash adjustment to our current period operations. This resulted in a net loss of $149,965 for the year ended December 31, 2012, $-0- for the same period, last year.

Gain on settlement of debt

During the year ended December 31, 2012, we amended our previously acquired and expensed licensing agreement, reducing our remaining debt obligation from $469,500 to $69,500 realizing a gain from debt cancelation. In addition, we settled accounts payable, debt and related accrued interest by issuance of our common stock realizing a gain of $253,220. During the year ended December 31, 2011, we received notification of the cancellation of two vehicle notes from the financing company totaling $21,606; due to the cancellation of certain oil & gas leases, we were notified that certain lease payments totaling $25,698 were no longer payable; and a lender and a former consultant forgave a loan payable and an account payable, respectively, in the amount of $10,197 and $4,500. Accordingly, we recognized $62,002 included as gain on settlement of debt on the statement of operations.

Loss on Debt Modification

On October 26, 2012, we entered into a settlement agreement with our bridge note holders and High Capital Funding LLC, holder of $723,000 in matured notes payable. In connection with a forbearance on the security held, we agreed to issue common stock and warrants in conjunction with the settlement. In addition, we agreed to assume the legal costs incurred by the note holders. As such, we recorded the fair valve of the issued common, warrants and debt assumption as loss on debt modification of $426,980 for the year ended December 31, 2012.

Interest Expenses, net

Interest expense, net for the twelve months ended December 31, 2012 decreased by $38,218 to $511,943 from $69,374 for the twelve months ended December 31, 2011. The decrease in interest expense was due to issuing common shares in connection with our bridge financing charged to period interest in 2011.

Net (Loss)

Net loss for the twelve months ended December 31, 2012 decreased to $4,072,286 from a net loss of $6,767,737 for the twelve months ended December 31, 2011. The decrease of $2,695,451 is primarily attributable to the following factors: (i) a decrease in field operations expenses in our Montana field site and the Five-Well Program; (2) an decrease in equity based compensation to consultants and service providers; (iii) a decrease in the amount of impairment of undeveloped properties for the twelve months ended December 31, 2012 as compared to the twelve months ended December 31, 2011; (iv) gain on settlement of debt in 2012 of $653,220 and compared with $62,002 in 2011; (v) net with a loss on debt modification of $426,980 in 2012 as compared to nil in 2011 and a loss on change in fair value of derivatives of $149,965.

Liquidity, Capital Resources and Going Concern

We generated minimum revenues in the year ended December 31, 2012. We have continued to incur expenses and have limited sources of liquidity. Our limited financial resources have had an adverse impact on our liquidity, activities and operations. These limitations have also adversely affected our ability to obtain certain projects and pursue additional business ventures. We may have to borrow money from stockholders or issue debt or equity securities in order to find expenditures for exploitation and development and general administration or enter into a strategic arrangement with a third party. There can be no assurance that additional funds will be available to us on favorable terms or at all.

18

Our liquidity needs consist of our working capital requirements, indebtedness payments and property development expenditure funding. Historically, we have financed our operations through the sale of equity and debt, as well as borrowings from various credit sources, and we have adjusted our operations and development to our level of capitalization. On a going-forward basis, we anticipate that we may need approximately $250,000 to $350,000 annually to maintain our corporate existence and pay the expenses and costs that we likely will incur to ensure that we can remain a corporate enterprise with all of our attendant responsibilities, filings, and associated documentation.

As of December 31, 2012 we had a working capital deficit of $4,523,197. For the twelve months ended December 31, 2012, we generated a net cash flow deficit from operating activities of $529,723, consisting primarily of year to date loss of $4,072,286. Non cash adjustments included $153,755 in depreciation and amortization charges, $448,500 for equity based compensation, $27,901 amortization of debt discount, $426,980 loss on debt modification, $1,757,182 for fair value of common stock and warrants issued in litigation settlement, $87,514 non-cash interest paid, $149,965 for loss on change in fair value of derivative liabilities, $162,500 in fair value of vesting options and $185,306 for the fair value of warrants issued in connection with debt net with $663,220 gain on settlement of debt Additionally, we had a net decrease in assets of $64,455 and a net increase in current liabilities of $741,725. A net cash flow deficit from investing activities for the twelve months ended December 31, 2012 was nil. Cash provided by financing activities for the twelve months ended December 31, 2012 totaled $516,945, consisting of proceeds from the sale of our common stock and proceeds from loans and notes payable, net with repayments on loans and notes payable.

We expect that exploitation of potential revenue sources will be financed primarily through the private placement of securities, including issuance of notes payable and other debt or a combination thereof, depending upon the transaction size, market conditions and other factors.

While we have raised capital to meet our working capital and financing needs in the past, additional financing is required within the next three months in order to meet our current and projected cash flow deficits from operations and development. Our registered independent certified public accountants have stated in their report dated May 20, 2013, that we have incurred operating losses in the last year, and that we are dependent upon management’s ability to develop profitable operations and raise additional capital. These factors, among others, may raise substantial doubt about our ability to continue as a going concern.

We also are unable to determine whether we will generate sufficient cash flow from our future oil and gas operations to fund our future operations. Although we would expect cash flow from future operations to rise as our as we are able to improve our operations, post funding, and the number of projects we successfully develop grows, we will continue to focus, in the near term, on raising additional capital, probably through the private placement of equity securities, to assure we have the necessary liquidity for 2013.

We need to raise capital to fund the development of future wells. To the extent that additional capital is raised through the sale of equity or equity-related securities, the issuance of such securities would result in dilution of the existing stockholders’ shares. There can be no assurance that additional funding will be available on favorable terms, if at all. If adequate funds are not available within the next 12 months, we may be required to curtail our operations significantly or to obtain funds through entering into arrangements with collaborative partners or others that may require us to relinquish rights to certain of our assets that we would not otherwise relinquish.

Our long term viability depends on our ability to obtain adequate sources of debt or equity funding to meet current commitments and fund the continuation of our business operations, and our ability to ultimately achieve adequate profitability and cash flows from operations to sustain our operations.

Impact of Default

As we disclosed in our financial statements, our notes, loan payables and operating lease obligations are currently in default.

19

Notes and loans payable are being resolved through debt-to-equity conversion agreements. We plan to resolve our operating lease obligations by the future commencement of production, or by additional equity financing or debt financing.

Default on lease obligations could result in the impairment of our ability to conduct executive functions, which would be the case if we lost the New York executive office space. The loss any of our oil and gas leases will likely result in the curtailment of potential oil and gas production revenues to us. There are no other known alternative sources of funding to pay off or replace these obligations.

Going Concern

Our financial statements have been presented on the basis that we continue as a going concern, which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business. As shown in the accompanying financial statements, we incurred a net operating loss in the years ended December 31, 2012, 2011, 2010, 2009 and 2008, and have minimum revenues at this time. These factors create an uncertainty about our ability to continue as a going concern. We are currently trying to raise capital through a private offering of our stock. Our ability to continue as a going concern is dependent on the success of this plan. The financial statements do not include any adjustments that might be necessary if we are unable to continue as a going concern.

Material Commitments

Among other debts, as of December 31, 2012, we owed:

|

·

|

Bridge Notes Payable of an aggregate of $750,000, that are secured by a first lien on certain oil and gas leases and related equipment and are already past due and are currently accruing interest at the rate of 12.00% per year as of November 1, 2012, increasing to 18% by May 1, 2014. On October 26, 2012, we entered into a settlement agreement and in connection with a forbearance not to exercise their security rights, we agreed to term modifications, issued warrants and common stock with anti-dilutive provisions and settled on payment terms based on future well production

|

|

·

|

Loans payable of an aggregate of $593,000, under the Loan Terms Agreement that are secured by a second lien on certain oil and gas leases and related equipment, bear interest at the rate of 6.25% per year and were due on February 29, 2012; these loans were part of the October 26, 2012 settlement.

|

|

·

|

SLA Notes payable of $130,000, under the Third Secured Loan Agreement that are secured by (i) a second lien pari pasu with the secured loans under the Loan Term Agreement and (ii) bear interest at the rate of 12% per year until February 29, 2012, at the rate of 15% per year until April 30, 2012, and at the rate of 18% per year after April 30, 2012, and that are due the earlier of (i) April 30, 2012; and (ii) the final closing of any equity and/or debt financing totaling at least $3,000,000 which occurs after December 31, 2011. These loans were part of the October 26, 2012 settlement

|

Off-Balance Sheet Arrangements

We do not have any off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, or result in changes in financial condition, revenues or expenses, results or operations, liquidity, capital expenditures or capital resources that is material to investors.

Item 7A. Quantitative and Qualitative Disclosures about Market Risk.

We are a smaller reporting company as defined by Rule 12b-2 of the Securities Exchange Act of 1934 and are not required to provide the information under this item.

Item 8. Financial Statements and Supplementary Data.

Our financial statements, together with the report of our independent registered public accounting firm, are contained in pages F-1 through F-30 which appear at the end of this Annual Report.

20

Item 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure.

None.

Item 9A. Controls and Procedures.

Evaluation of Disclosure Controls and Procedures

Our management is responsible for establishing and maintaining disclosure controls and procedures that are designed to ensure that material information required to be disclosed in our periodic reports filed under the Securities Exchange Act of 1934, as amended (the “1934 Act”), is recorded, processed, summarized, and reported within the time periods specified in the SEC’s rules and forms and to ensure that such information is accumulated and communicated to our management to allow timely decisions regarding required disclosure. We carried out an evaluation, under the supervision and with the participation of our management, including the principal executive officer and the principal financial officer, of the effectiveness of the design and operation of our disclosure controls and procedures as of December 31, 2012. Based on this evaluation, and because of our limited resources and limited number of employees, management concluded that our disclosure controls and procedures were ineffective as of December 31, 2012.

Management’s Report on Internal Control over Financial Reporting

Our management is also responsible for establishing and maintaining adequate internal control over financial reporting. Our internal control over financial reporting is designed to provide reasonable assurances regarding the reliability of financial reporting and the preparation of our financial statements in accordance with U.S. generally accepted accounting principles.

Our Chief Executive Officer and Chief Financial Officer conducted an evaluation of the effectiveness of our internal control over financial reporting as of December 31, 2012 based on the framework in Internal Control—Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission ("COSO"). Based on our evaluation and the material weaknesses described below, our management concluded that we did not maintain effective internal control over financial reporting as of December 31, 2012 based on the COSO framework criteria. Management has identified control deficiencies regarding the lack of segregation of duties and the need for a stronger internal control environment. These control deficiencies could result in a misstatement of account balances that would result in a reasonable possibility that a material misstatement to our consolidated financial statements may not be prevented or detected on a timely basis, and thus are a material weakness. Our management believes that these material weaknesses are due to the small size of our accounting staff due to financial restrictions. As we grow and obtain financing, we expect to increase our number of employees, which will enable us to implement adequate segregation of duties within the internal control framework.

This annual report does not include an attestation report of our registered public accounting firm regarding internal control over financial reporting. Management’s report was not subject to attestation by our registered public accounting firm pursuant to rules of the Securities and Exchange Commission that permit us to provide only management’s report in this Annual Report on Form 10-K.

Changes in Internal Control over Financial Reporting

There has been no change in our internal control over financial reporting, as defined in Rules 13a-15(f) and 15d-15(f) of the Exchange Act, during the fourth fiscal quarter of December 31, 2012 that has materially affected, or is reasonably likely to materially affect, our internal control over financial reporting.

Item 9B. Other Information.

None.

21

PART III

Item 10. Directors, Executive Offices and Corporate Governance.

Directors and Executive Officers

The following table and text sets forth the names and ages of all our directors and executive officers and our key management personnel as of December 31, 2012. All of our directors serve until the next annual meeting of stockholders and until their successors are elected and qualified, or until their earlier death, retirement, resignation or removal. Executive officers serve at the discretion of the Board of Directors, and are elected or appointed to serve until the next Board of Directors meeting following the annual meeting of stockholders. Also provided is a brief description of the business experience of each director and executive officer and the key management personnel during the past five years and an indication of directorships held by each director in other companies subject to the reporting requirements under the Federal securities laws.

|

Name

|

Age

|

Position

|

||

|

Joseph G. D’Arrigo

|

51

|

President, Chief Executive Officer and Chairman

|

||

|

Raj S. Nanvaan

|

35

|

Chief Financial Officer, Chief Operations Officer, Vice President, Treasurer and Director

|

||

|

Richard Ross

|

61

|

Corporate Secretary, Chief Communications Officer and Director

|

||

|

Doyle A. Johnson

|

58

|

Chief Geologist & Petroleum Engineer

|

||

|

Linda C. Chontos

|

58

|

Administrative Operations Officer

|

Following is a brief summary of the background and experience of each director and executive officer of our Company:

Joseph G. D’Arrigo. Mr. D’Arrigo has served as our President, Chief Executive Officer and Chairman since our formation in January 2005. Since our inception, he has been responsible for guiding us through all aspects of our early stage development, including capital formation, project assessments, lease acquisitions, and tribal employment policy. In addition to his services as our officer and director, Mr. D’Arrigo has served as President, Chief Executive Officer and sole director of our subsidiary, NAEG Alaska Corporation (formerly Fowler Oil and Gas Corporation) since May 2009. Concurrently, he has served as President and director of Founders since our formation in April 2005. In November 2011, he was appointed as President and director of NEDC.

Raj S. Nanvaan. Mr. Nanvaan has served as our Chief Financial Officer, Vice President, Treasurer, and director since our formation in January 2005. He resigned from his position as our Corporate Secretary in July 2009 and was appointed Chief Operating Officer on that date. Concurrent with his services as our officer and director, Mr. Nanvaan has served as Secretary, Treasurer and director of Founders since our formation in April 2005. He resigned as Secretary of Founders in September 2010. In November 2011, he was appointed as Vice President, Treasurer and director of NEDC.