Attached files

| file | filename |

|---|---|

| EX-3.2 - EX-3.2 - K2M GROUP HOLDINGS, INC. | d640289dex32.htm |

| EX-10.16 - EX-10.16 - K2M GROUP HOLDINGS, INC. | d640289dex1016.htm |

| EX-10.15 - EX-10.15 - K2M GROUP HOLDINGS, INC. | d640289dex1015.htm |

| EX-5.1 - EX-5.1 - K2M GROUP HOLDINGS, INC. | d640289dex51.htm |

| EX-23.1 - EX-23.1 - K2M GROUP HOLDINGS, INC. | d640289dex231.htm |

| EX-10.31 - EX-10.31 - K2M GROUP HOLDINGS, INC. | d640289dex1031.htm |

| EX-10.33 - EX-10.33 - K2M GROUP HOLDINGS, INC. | d640289dex1033.htm |

| EX-10.32 - EX-10.32 - K2M GROUP HOLDINGS, INC. | d640289dex1032.htm |

| EX-3.1 - EX-3.1 - K2M GROUP HOLDINGS, INC. | d640289dex31.htm |

Table of Contents

As filed with the Securities and Exchange Commission on April 22, 2014

Registration Statement No. 333-194550

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 2

TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

K2M Group Holdings, Inc.

(Exact name of Registrant as specified in its charter)

| Delaware | 3841 | 27-2977810 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

751 Miller Drive SE

Leesburg, VA 20175

(703) 777-3155

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Luke Miller

Senior Vice President and General Counsel

751 Miller Drive SE

Leesburg, VA 20175

(703) 777-3155

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to

| Kenneth B. Wallach, Esq. Ryan Bekkerus, Esq. |

Rachel Sheridan, Esq. Jason M. Licht, Esq. Latham & Watkins LLP |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are being offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | x (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

CALCULATION OF REGISTRATION FEE

|

| ||||||||

| Title of Each Class of Securities to be Registered |

Amount to be Registered(1) |

Proposed Maximum Offering Price Per Share(2) |

Proposed Maximum Aggregate Offering Price(1)(2) |

Amount

of Registration Fee(3) | ||||

| Common stock, $0.001 par value per share |

10,148,750 | $18.00 | $182,677,500 | $23,528.86 | ||||

|

| ||||||||

|

| ||||||||

| (1) | Includes 1,323,750 common shares issuable upon exercise of the underwriters’ option to purchase additional common shares. |

| (2) | Estimated solely for the purposes of calculating the registration fee in accordance with Rule 457(a) promulgated under the Securities Act of 1933, as amended. |

| (3) | Of this amount, $12,880 was previously paid in connection with the initial filing of this Registration Statement on March 13, 2014. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this prospectus is not complete and may be changed. We may not sell these securities until the Securities and Exchange Commission declares our registration statement effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to completion, dated April 22, 2014

| 8,825,000 Shares

K2M GROUP HOLDINGS, INC.

Common Stock

$ per share |

|

| • K2M Group Holdings, Inc. is offering 8,825,000 shares. |

• This is our initial public offering and no public market currently exists for our shares. | |

| • We anticipate that the initial public offering price will be between $16.00 and $18.00 per share. |

• Proposed NASDAQ Global Select Market, or NASDAQ, trading symbol: “KTWO.” | |

After the completion of this offering, Welsh, Carson, Anderson & Stowe XI, L.P. and its affiliates will continue to own a majority of the shares eligible to vote in the election of our directors. As a result, we will be a “controlled company.” See “Management—Director Independence.”

This investment involves risks. See “Risk Factors” beginning on page 13.

We are an “emerging growth company” as defined by the Jumpstart Our Business Startups Act of 2012 and, as such, we have elected to comply with certain reduced public company reporting requirements for this prospectus and future filings.

| Per Share | Total | |||||||

| Initial public offering price |

$ | $ | ||||||

| Underwriting discounts(1) |

$ | $ | ||||||

| Proceeds, before expenses, to K2M Group Holdings, Inc. |

$ | $ | ||||||

| (1) | See “Underwriting” for additional information regarding underwriting compensation. |

The underwriters have a 30-day option to purchase up to 1,323,750 additional shares of common stock from the selling stockholders identified in this prospectus to cover over-allotments, if any. We will not receive any proceeds from the sale of shares of common stock by the selling stockholders.

Neither the Securities and Exchange Commission nor any state securities commission has approved of anyone’s investment in these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Piper Jaffray | Barclays | Wells Fargo Securities |

| William Blair |

Cowen and Company |

The date of this prospectus is , 2014.

Table of Contents

Table of Contents

| 1 | ||||

| 13 | ||||

| 57 | ||||

| 57 | ||||

| 57 | ||||

| 58 | ||||

| 59 | ||||

| 60 | ||||

| 62 | ||||

| 64 | ||||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

66 | |||

| 88 | ||||

| 117 | ||||

| 122 | ||||

| 135 | ||||

| 138 | ||||

| 142 | ||||

| 150 | ||||

| Material United States Federal Income and Estate Tax Consequences to Non-U.S. Holders |

152 | |||

| 155 | ||||

| 163 | ||||

| 163 | ||||

| 163 | ||||

| F-1 |

Unless indicated otherwise, the information included in this prospectus (1) assumes no exercise by the underwriters of the option to purchase up to an additional 1,323,750 shares of common stock from the selling stockholders, (2) assumes that the shares of common stock to be sold in this offering are sold at $17.00 per share, which is the mid-point of the price range indicated on the cover page of this prospectus, (3) reflects the automatic conversion of all of our Series A redeemable convertible preferred stock, $0.001 par value, or our Series A Preferred, and our Series B redeemable convertible preferred stock, $0.001 par value, or our Series B Preferred, into our common stock immediately prior to consummation of this offering and (4) reflects the 2.43 -for- 1.00 reverse stock split that we intend to effectuate prior to this offering.

We have not authorized anyone to provide any information or to make any representations other than those contained in this prospectus or in any free writing prospectuses we have prepared. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the shares offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus is current only as of its date.

i

Table of Contents

This summary highlights information contained elsewhere in this prospectus and does not contain all of the information you should consider before investing in shares of our common stock. You should read this entire prospectus carefully, including the sections entitled “Risk Factors,” “Selected Historical Consolidated Financial Data” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and the financial statements and the related notes included elsewhere in this prospectus, before you decide to invest in shares of our common stock.

Except where the context requires otherwise, references in this prospectus to “K2M,” “the Company,” “we,” “us” and “our” refer to K2M Group Holdings, Inc., together with its consolidated subsidiaries. Welsh, Carson, Anderson & Stowe XI, L.P. and certain of its affiliated funds, our current majority owners, are referred to herein as “WCAS” or “our Sponsor,” and WCAS, together with the other owners of K2M Group Holdings, Inc. prior to this offering, are collectively referred to as our “existing owners.”

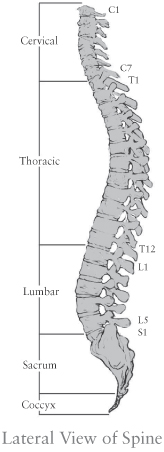

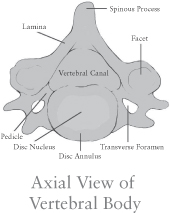

Overview

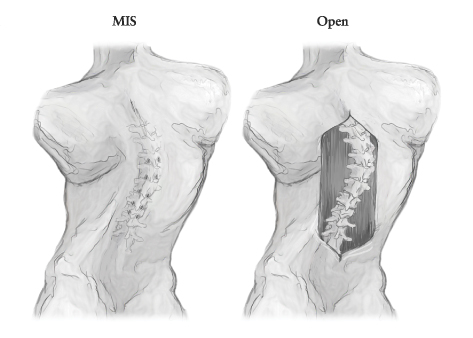

We are a global medical device company focused on designing, developing and commercializing innovative and proprietary complex spine technologies and techniques. Our complex spine products are used by spine surgeons to treat some of the most difficult and challenging spinal pathologies, such as deformity (primarily scoliosis), trauma and tumor. We believe these procedures typically receive a higher rate of positive insurance coverage and often generate more revenue per procedure as compared to traditional degenerative spine surgery procedures. We have applied our product development expertise in innovating complex spine technologies and techniques to the design, development and commercialization of an expanding number of minimally invasive surgery, or MIS, products. These proprietary MIS products are designed to allow for less invasive access to the spine and faster patient recovery times as compared to traditional open access surgical approaches. We have also leveraged these core competencies in the design, development and commercialization of an increasing number of products for patients suffering from degenerative spinal conditions.

Our products consist of implants, disposables and instruments which are marketed and sold primarily to hospitals for use by spine surgeons. During our 10 year history, we have commercialized 57 product lines that are used in complex spine surgery, MIS and degenerative procedures, enabling us to favorably compete in the $10.0 billion global spinal surgery market. Of our 57 commercialized product lines, our MESA technology or products that incorporate MESA have accounted for approximately 39%, 37% and 35% of our revenue for the years ended December 31, 2011, 2012 and 2013, respectively. While the quality, safety and efficacy of our marketed products are not yet supported by long-term clinical data, we believe many of our products provide several benefits, including:

| • | simplified surgical techniques; |

| • | less invasive access to implant sites; |

| • | enhanced capabilities to manipulate and correct the spinal column; |

| • | lower profile spinal implant technology; and |

| • | improved clinical outcomes. |

In addition to our current product portfolio, we continue to invest in the design, development and commercialization of new solutions for unmet clinical needs in the complex spine and MIS markets by leveraging our highly efficient product development process. We have introduced 34 new product lines since the beginning of 2011 demonstrating our ability to leverage this product development process to rapidly innovate new products.

1

Table of Contents

Our focus on our core competences of complex spine and MIS is highlighted by the fact that, for the years ended December 31, 2011, 2012 and 2013, 59%, 60% and 58%, respectively, of our revenue in the United States was derived from the use of our products in complex spine and MIS surgeries. We believe this represents a greater proportion of total revenue devoted to these markets as compared to our competitors. We further believe the proportion of our international revenue derived from complex spine and MIS is even higher than in the United States.

We have grown our revenue to $157.6 million in 2013 from $60.4 million in 2008, representing a five-year compound annual growth rate, or CAGR, of 21%. For the years ended December 31, 2011, 2012 and 2013, our net income (loss) was $13.3 million, $(32.7) million and $(37.9) million and our Adjusted EBITDA was $(7.4) million, $(1.8) million and $(5.3) million, respectively. For information about how we calculate Adjusted EBITDA, please see “—Summary Historical Consolidated Financial Data.” We expect to continue to incur additional losses in the near term as we invest in the global expansion of our business. As of December 31, 2013, our accumulated deficit was $70.6 million.

We currently market and sell our products in the United States and 28 other countries. For the year ended December 31, 2013, international sales represented approximately 29% of our revenue. We have made significant investments in building a hybrid sales organization consisting of direct sales employees, independent sales agencies and distributor partners. As of December 31, 2013, our U.S. sales force consisted of 114 direct sales employees and 48 independent sales agencies and our international distribution network consisted of 37 direct sales employees, five independent sales agencies and 15 independent distributorships. We expect to continue to invest in our global hybrid sales organization by increasing the number of our direct sales employees and broadening our relationships with independent sales agencies and distributor partners. We believe the continuing expansion of our global sales force will provide us with significant opportunities for future growth as we increase our penetration of existing geographic markets and enter new ones. We do not sell our products through or participate in physician owned distributorships, or PODs, and no surgeons own any shares of our common stock.

Market Opportunity

According to iData Research, Inc., or iData, the global spine surgery market was valued at approximately $10.0 billion in 2012 and is expected to grow to $14.9 billion by 2019. We believe this market will continue to grow as a result of the following growth drivers:

| • | Complex Spine: We believe the $1.2 billion global complex spine market has been underserved and underdeveloped by major spine market competitors, which generally focus on the larger degenerative spine market. As a result, we believe the complex spine patient population has and will continue to benefit from innovative technologies and techniques that simplify surgical procedures, enable MIS approaches and allow for surgical treatment earlier in the continuum of care. |

| • | MIS: We believe the overall improvement to the standard of care resulting from the introduction of new MIS products will increase demand and drive growth in the $1.4 billion MIS market. We believe the vast majority of surgeons and patients, when given the option, will utilize MIS procedures rather than traditional open procedures due to the advantages of MIS approaches, which often include less soft tissue disruption, reduced frequency of surgical morbidity, faster operating times, improved scarring-related aesthetics and, as a consequence of these advantages, shorter patient recovery times. |

| • | Degenerative Spine: We believe that several factors will continue to influence the growth in the $6.0 billion global degenerative spine market, including aging patient demographics, |

2

Table of Contents

| increased life expectancies, the desire for maintaining and/or improving lifestyles and demand from patients and surgeons for innovative technologies and techniques that enable simplified surgical procedures, faster procedure times and improved clinical outcomes. |

| • | Biomaterials: The $1.5 billion biomaterials market includes products that are used by spine surgeons during the surgical treatment of certain complex spine and degenerative pathologies to augment spinal implants and to promote fusion by accelerating, augmenting or substituting for the normal regenerative capacity of bone. Biomaterials are used in the treatment of certain complex and degenerative pathologies and, as such, we expect them to demonstrate similar growth trends. |

Our Competitive Strengths

Our executive management team is highly experienced in the spinal surgery industry. We believe this experience and the following competitive strengths have been instrumental to our success and position us well to grow our revenue and market share.

| • | Focus in Complex Spine and MIS. Our strategic focus and core competencies are the design, development and commercialization of innovative complex spine and MIS technologies and techniques supported by our strong relationships with key opinion leaders and spine societies focused on the complex spine and MIS markets. |

| • | Comprehensive Portfolio of Innovative Proprietary Technologies. We have developed a comprehensive portfolio of products that address a broad array of spinal pathologies, anatomies and surgical approaches in the complex spine and MIS markets, and this broad product portfolio provides us with an opportunity to cross-sell our product offerings in the degenerative market. We have developed and maintain an expanding intellectual property portfolio which includes 163 issued patents globally and 175 pending patent applications globally. |

| • | Highly Efficient Product Development Process. Our integrated approach to product development leverages our access to key opinion leaders, engineers, product managers and clinical and regulatory personnel to conceptualize, design and develop new products. |

| • | Broad Global Distribution Network. We have made significant investments in our global distribution network, which, as of December 31, 2013, included 151 direct sales employees and contractual relationships with 53 independent sales agencies and 15 distributor partners. We have also broadened our operational capabilities by increasing inventory levels and opened offices in strategic markets worldwide. |

| • | Demonstrated Track Record of Innovation and Execution. Our executive management team has the vision, experience and network of relationships to continue our successful growth. |

Our Strategies

Our goal is to drive sustainable growth by servicing the needs of patients, surgeons and hospitals through product innovation and differentiation in the complex spine and MIS markets and continuing to leverage these core competencies in the degenerative spinal surgery market. To achieve this goal, we intend to:

| • | Capitalize on our highly efficient product development process to innovate new technologies and techniques; |

| • | Leverage our investments in infrastructure to further penetrate the global spine market; |

| • | Expand our global distribution footprint; and |

| • | Selectively pursue opportunities to enhance our product offerings. |

3

Table of Contents

Our Products

We have developed a comprehensive portfolio of products that address a broad array of spinal pathologies, anatomies and surgical approaches in the complex spine, MIS and degenerative markets. Some of our key proprietary technologies and their associated benefits include the following:

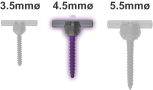

| • | MESA: a low-profile spinal screw technology, used primarily during deformity correction, featuring our proprietary locking mechanism that eliminates the need for a secondary locking feature and reduces rotational force on the spine during implantation, which has been used to treat more than 30,000 patients; |

| • | Rail 4D: an innovative “beam-like” implant, utilized with our proprietary MESA spinal screws, that aids in the restoration of spinal balance while providing enhanced rigidity and significantly greater strength as compared to existing titanium and cobalt chrome rod offerings; |

| • | Deformity Cricket: spinal correction instrumentation, utilized with our proprietary MESA spinal screws, that provides surgeons with an innovative approach to more easily capture, manipulate and align a deformed spine as compared to traditional deformity correction instrumentation such as threaded rod reducers and rod forks; |

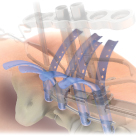

| • | SERENGETI: minimally invasive retractor systems featuring one-step placement of screws and retractors, thereby reducing the number of surgical steps, while allowing for direct visualization and improved access to the spine; |

| • | RAVINE: minimally invasive retractor systems that represent an innovative design departure from standard tubular retractors, facilitating retractor placement, positioning and fixation to the patient’s anatomy through a lateral access approach; |

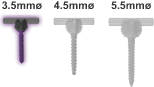

| • | EVEREST: a spinal screw technology that we believe, based on internal testing, provides for improved insertion speed, industry-leading pull-out strength and the ability to accommodate a variety of titanium and cobalt chrome rods of two different diameters; and |

| • | tifix: a locking technology integrated into a number of our interbody and plate implants providing surgeons with the flexibility to insert screws at various angles and lock them to an implant with a one-step locking mechanism that eliminates the need for a secondary locking feature. |

Risks Related to Our Business and this Offering

An investment in shares of our common stock involves substantial risks and uncertainties that may adversely affect our business, financial condition, results of operations and cash flows. Some of the more significant challenges and risks relating to an investment in our company include:

| • | We have incurred losses in the past and may not be able to achieve or sustain profitability in the future; |

| • | We must continue to successfully demonstrate to spine surgeons the merits of our technologies and techniques compared to those of our competitors; |

| • | Pricing pressure from our competitors, hospitals and changes in third-party coverage and reimbursement may impact our ability to sell our products at prices necessary to support our current business strategies; |

4

Table of Contents

| • | We operate in a highly competitive market and we must continue to develop and commercialize new products or our revenue may decline. If our competitors develop and commercialize products that are safer, more effective, less costly or otherwise more attractive than our products, our ability to generate revenue may be reduced or eliminated; |

| • | Many of our competitors have greater resources than we have; |

| • | If hospitals and other healthcare providers are unable to obtain adequate coverage and reimbursement for procedures performed using our products, it is unlikely that our products will gain widespread acceptance; |

| • | The safety and efficacy of our products are not yet supported by long-term clinical data, which could limit sales, and our products might therefore prove to be less safe and effective than initially thought; |

| • | If we are unable to maintain and expand our network of direct sales employees, independent sales agencies and international distributors, we may not be able to generate anticipated sales; |

| • | If we do not enhance our product offerings through our research and development efforts, we may be unable to effectively compete; |

| • | Our products and operations are subject to extensive governmental regulation both in the United States and abroad, and our failure to comply with applicable requirements could cause our business to suffer; |

| • | If we are unable to protect our intellectual property rights, our competitive position could be harmed or we could be required to incur significant expenses to enforce our rights; |

| • | Our international operations subject us to certain operating risks, which could adversely impact our net sales, results of operations and financial condition; |

| • | Our Sponsor, who will beneficially own approximately 62.4% of our common stock (or 59.4% if the underwriters exercise in full their option to purchase additional shares from the selling stockholders) following this offering, controls us, and its interests may conflict with ours or yours in the future; and |

| • | Upon the listing of our shares on NASDAQ, we will be a “controlled company” within the meaning of NASDAQ rules and, as a result, will qualify for, and may rely on, exemptions from certain corporate governance requirements. |

See “Risk Factors” for a discussion of these and other factors you should consider before making an investment in shares of our common stock.

Implications of Being an Emerging Growth Company

We qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. As a result, we are permitted to, and intend to, rely on exemptions from certain disclosure requirements that are applicable to other companies that are not emerging growth companies. Accordingly, we have included compensation information for only our three most highly compensated executive officers and have not included a compensation discussion and analysis of our executive compensation programs in this prospectus. In addition, for so long as we are an emerging growth company, we will not be required to:

| • | engage an independent registered public accounting firm to report on our internal controls over financial reporting pursuant to Section 404(b) of the Sarbanes-Oxley Act of 2002, or the Sarbanes-Oxley Act; |

5

Table of Contents

| • | adopt new or revised financial accounting standards applicable to public companies until such standards are also applicable to private companies; |

| • | comply with any requirement that may be adopted by the Public Company Accounting Oversight Board, or the PCAOB, regarding mandatory audit firm rotation or a supplement to the independent registered public accounting firm’s report providing additional information about the audit and the financial statements (i.e., an auditor discussion and analysis); |

| • | submit certain executive compensation matters to shareholder advisory votes, such as “say-on-pay,” “say-on-frequency” and “say-on-golden parachutes;” or |

| • | disclose certain executive compensation related items such as the correlation between executive compensation and performance and comparisons of the chief executive officer’s compensation to median employee compensation. |

We will remain an emerging growth company until the earliest to occur of:

| • | our reporting of $1.0 billion or more in annual gross revenues; |

| • | our issuance, in any three year period, of more than $1.0 billion in non-convertible debt; |

| • | the end of the fiscal year in which the market value of our common stock held by non-affiliates exceeds $700.0 million on the last business day of our second fiscal quarter; and |

| • | the end of fiscal 2019. |

Corporate History and Information

K2M Group Holdings, Inc. was incorporated in Delaware in June 2010. Our principal executive offices are located at 751 Miller Drive SE, Leesburg, Virginia 20175 and our telephone number is (703) 777-3155. Our website address is www.k2m.com. The information on, or accessible through, our website is deemed not to be incorporated in this prospectus or to be part of this prospectus.

6

Table of Contents

THE OFFERING

| Issuer |

K2M Group Holdings, Inc. |

| Common stock offered by K2M Group Holdings, Inc. |

8,825,000 shares. |

| Common stock to be outstanding immediately after this offering |

37,067,792 shares. |

| Option to purchase additional shares of common stock from the selling stockholders |

The selling stockholders have granted the underwriters a 30-day option from the date of this prospectus to purchase up to 1,323,750 additional shares of our common stock at the initial public offering price, less underwriting discounts. |

| Use of proceeds |

We estimate that our net proceeds from the sale of 8,825,000 shares of our common stock in this offering will be approximately $135.9 million assuming an initial public offering price of $17.00 per share, which is the mid-point of the price range set forth on the cover page of this prospectus, and after deducting the estimated underwriting discount and estimated offering expenses payable by us. We intend to use the net proceeds received by us from this offering (1) to retire all $39.2 million of the indebtedness outstanding under the notes held by certain of our shareholders, or the Shareholder Notes, (2) to pay all $19.1 million of accumulated and unpaid dividends on our Series A Preferred and Series B Preferred, (3) to repay all of the outstanding borrowings of $23.5 million under our existing $30.0 million asset-based revolving credit facility maturing October 2014, or our revolving credit facility, and (4) for working capital and general corporate purposes. Our use of proceeds from this offering for working capital and general corporate purposes is currently expected to include approximately $6.0 million to expand our global distribution network by hiring qualified sales employees and purchasing inventory to support their sales efforts and approximately $10.5 million in connection with our relocation to a new leased headquarters facility in 2015. See “Use of Proceeds.” |

| As a result of the payment of all indebtedness outstanding under the Shareholder Notes and the payment of all accumulated and unpaid dividends on the Series A Preferred and the Series B Preferred, approximately $56.3 million of the net proceeds from this offering will ultimately be received by affiliates of the Company, assuming the offering was completed on March 31, 2014. See “Certain Relationships and Related Party Transactions.” |

| We will not receive any proceeds from the sale of any shares of our common stock by the selling stockholders, if any, pursuant to the underwriters’ option to purchase additional shares. |

7

Table of Contents

| Directed share program |

At our request, the underwriters have reserved up to 441,250 shares of common stock, or approximately 5.0% of the shares being offered by us pursuant to this prospectus, for sale at the initial public offering price to our directors, officers and employees and certain other persons associated with us, as designated by us. The number of shares available for sale to the general public will be reduced to the extent that these individuals purchase all or a portion of the reserved shares. Any reserved shares not so purchased will be offered by the underwriters to the general public on the same basis as the other shares offered by this prospectus. For further information regarding our directed share program, please see “Underwriting.” |

| Dividend policy |

We have no current plans to pay dividends on our common stock. Any decision to declare and pay dividends in the future will be made at the sole discretion of our Board of Directors and will depend on, among other things, our results of operations, cash requirements, financial condition, contractual restrictions and other factors that our Board of Directors may deem relevant. See “Dividend Policy.” |

| Risk factors |

See “Risk Factors” for a discussion of risks you should carefully consider before deciding to invest in our common stock. |

| NASDAQ trading symbol |

“KTWO.” |

The number of shares of our common stock to be outstanding immediately after the consummation of this offering is based on 27,998,536 shares of common stock outstanding as of December 31, 2013 and does not reflect:

| • | 1,650,829 shares of common stock reserved for future issuance under our new Omnibus Incentive Plan, or the 2014 Omnibus Incentive Plan; |

| • | 411,523 shares of common stock reserved for future issuance under our new 2014 Employee Stock Purchase Program, or the ESPP; |

| • | 4,179,119 shares of common stock issuable upon exercise of outstanding options issued under our existing equity incentive plans at a weighted exercise price of $8.16 per share; or |

| • | 576,132 shares of common stock issuable upon vesting of outstanding restricted stock units. |

Unless otherwise indicated, this prospectus reflects and assumes the following:

| • | the shares of common stock to be sold in this offering are sold at $17.00 per share of common stock, which is the mid-point of the price range indicated on the cover page of this prospectus; |

| • | the automatic conversion of all of our Series A Preferred to 2,983,903 shares of our common stock upon the consummation of this offering; |

| • | the automatic conversion of all of our Series B Preferred to 2,593,123 shares of our common stock upon the consummation of this offering; |

| • | the 2.43 -for- 1.00 reverse stock split that we intend to effectuate prior to this offering; and |

| • | no exercise by the underwriters of their option to purchase additional shares from the selling stockholders. |

8

Table of Contents

SUMMARY HISTORICAL CONSOLIDATED FINANCIAL DATA

The following table sets forth our summary historical consolidated financial data for the periods indicated. We derived the summary historical consolidated financial data presented below as of December 31, 2012 and 2013, and for each of the three years in the period ended December 31, 2013, from our audited consolidated financial statements included elsewhere in this prospectus. We derived the summary historical consolidated balance sheet data presented below as of December 31, 2011 from our audited consolidated financial statements that are not included in this prospectus. Our historical results are not necessarily indicative of the results expected for any future period. The summary historical consolidated financial data reflects the 2.43 -for- 1.00 reverse stock split that we intend to effectuate prior to this offering, assuming a public offering price of $17.00 per share (the mid-point of the price range set forth on the cover page of this prospectus).

The pro forma balance sheet data as of December 31, 2013 and the pro forma basic and diluted weighted average shares and pro forma basic and diluted net loss per common share data for the year ended December 31, 2013 presented below are unaudited and give effect to the automatic conversion of all outstanding shares of our Series A Preferred to 2,983,903 shares of our common stock and the automatic conversion of all outstanding shares of our Series B Preferred to 2,593,123 shares of our common stock.

The pro forma as adjusted balance sheet data as of December 31, 2013 and the pro forma as adjusted basic and diluted weighted average shares and basic and diluted net loss per share data for the year ended December 31, 2013 are unaudited and give effect to (1) the automatic conversion of all outstanding shares of our Series A Preferred to 2,983,903 shares of our common stock and the automatic conversion of all outstanding shares of our Series B Preferred to 2,593,123 shares of our common stock, (2) the sale of 8,825,000 shares of our common stock in this offering at an initial public offering price of $17.00 per share, which is the mid-point of the price range set forth on the cover page of this prospectus, (3) the application of our net proceeds from this offering to retire all outstanding indebtedness under the Shareholder Notes, (4) the application of our net proceeds from this offering to repay all indebtedness outstanding under our revolving credit facility and (5) the application of our net proceeds from this offering to pay all accumulated dividends on our Series A Preferred and our Series B Preferred, as if each had occurred as of December 31, 2013 in the case of the pro forma as adjusted balance sheet data, and on January 1, 2013, in the case of the pro forma as adjusted basic and diluted net loss per share data. The pro forma as adjusted consolidated summary financial data is not necessarily indicative of what our financial position or results of operations would have been if this offering had been completed as of the date indicated, nor is such data necessarily indicative of our financial position or results of operations for any future date or period.

9

Table of Contents

You should read the summary historical financial data below, together with the consolidated financial statements and related notes thereto appearing elsewhere in this prospectus, as well as “Selected Historical Consolidated Financial Data,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the other financial information included elsewhere in this prospectus.

| Year Ended December 31, | ||||||||||||

| 2011 | 2012 | 2013 | ||||||||||

| (in thousands, except per share data) | ||||||||||||

| Statement of Operations Data: |

||||||||||||

| Revenue |

$ | 118,005 | $ | 135,145 | $ | 157,584 | ||||||

| Cost of revenue |

47,984 | 43,962 | 50,162 | |||||||||

|

|

|

|

|

|

|

|||||||

| Gross profit |

70,021 | 91,183 | 107,422 | |||||||||

| Operating expenses: |

||||||||||||

| Research, development and engineering |

11,930 | 9,031 | 12,402 | |||||||||

| Sales and marketing |

63,176 | 70,163 | 80,183 | |||||||||

| General and administrative |

49,431 | 57,821 | 59,758 | |||||||||

| Contingent consideration |

(50,436 | ) | (324 | ) | — | |||||||

|

|

|

|

|

|

|

|||||||

| Total operating expenses |

74,101 | 136,691 | 152,343 | |||||||||

|

|

|

|

|

|

|

|||||||

| Loss from operations |

(4,080 | ) | (45,508 | ) | (44,921 | ) | ||||||

| Other income (expense): |

||||||||||||

| Foreign currency transaction gain(loss) |

(560 | ) | 1,034 | 1,477 | ||||||||

| Interest expense |

(236 | ) | (1,222 | ) | (2,810 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Total other expense, net |

(796 | ) | (188 | ) | (1,333 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Loss before benefit from income taxes |

(4,876 | ) | (45,696 | ) | (46,254 | ) | ||||||

| Benefit from income taxes |

(18,221 | ) | (13,041 | ) | (8,341 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Net income (loss) |

13,345 | (32,655 | ) | (37,913 | ) | |||||||

| Accretion or write-up of preferred stock |

(13,773 | ) | (9,954 | ) | (19,439 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Net loss allocable to common stockholders |

$ | (428 | ) | $ | (42,609 | ) | $ | (57,352 | ) | |||

|

|

|

|

|

|

|

|||||||

| Per Share Data: |

||||||||||||

| Net loss per common share—basic and diluted |

$ | (0.02 | ) | $ | (1.94 | ) | $ | (2.58) | ||||

| Pro forma net loss per common share—basic and diluted (unaudited) |

$ | (1.37) | ||||||||||

| Pro forma as adjusted net loss per common share— basic and diluted (unaudited) |

$ | (0.97) | ||||||||||

| Weighted-average number of shares used in per share amounts: |

||||||||||||

| Basic and diluted |

21,774 | 21,921 | 22,239 | |||||||||

| Pro forma basic and diluted |

27,703 | |||||||||||

| Pro forma as adjusted basic and diluted |

36,528 | |||||||||||

10

Table of Contents

| As of December 31, | ||||||||||||||||||||

| 2011 | 2012 | 2013 | ||||||||||||||||||

| Actual | Actual | Actual | Pro Forma | Pro Forma As Adjusted |

||||||||||||||||

| (Unaudited) | ||||||||||||||||||||

| (in thousands) | ||||||||||||||||||||

| Balance Sheet Data: |

||||||||||||||||||||

| Cash and cash equivalents |

$ | 12,226 | $ | 7,011 | $ | 7,419 | $ | 7,419 | $ | 85,472 | ||||||||||

| Working capital |

44,588 | 47,369 | 32,549 | 16,849 | 134,102 | |||||||||||||||

| Total assets |

329,659 | 299,617 | 296,936 | 296,936 | 374,989 | |||||||||||||||

| Total long-term debt, net of discount |

13,000 | 26,668 | 19,650 | 19,650 | — | |||||||||||||||

| Total liabilities |

73,354 | 71,517 | 93,670 | 109,370 | 50,520 | |||||||||||||||

| Total redeemable convertible preferred stock |

65,719 | 78,068 | 109,081 | — | — | |||||||||||||||

| Total stockholders’ equity |

190,586 | 150,032 | 94,185 | 187,566 | 324,469 | |||||||||||||||

| Year Ended December 31, | ||||||||||||

| 2011 | 2012 | 2013 | ||||||||||

| (in thousands) | ||||||||||||

| Other Financial Data: |

||||||||||||

| Depreciation and amortization |

$ | 34,831 | $ | 41,824 | $ | 36,776 | ||||||

| Adjusted EBITDA(1) |

(7,353 | ) | (1,765 | ) | (5,266 | ) | ||||||

| (1) | Adjusted EBITDA represents net income (loss) plus interest expense, income tax expense (income tax benefit), depreciation and amortization, stock-based compensation expense and foreign currency transaction loss (foreign currency transaction gain), plus or minus, as applicable, adjustments related to our purchase by the Sponsor. |

| We present Adjusted EBITDA because we believe it is a useful indicator of our operating performance. Our management uses Adjusted EBITDA principally as a measure of our operating performance and believes that Adjusted EBITDA is useful to investors because it is frequently used by analysts, investors and other interested parties to evaluate companies in our industry. We also believe Adjusted EBITDA is useful to our management and investors as a measure of comparative operating performance from period to period. |

| Adjusted EBITDA is a non-GAAP financial measure and should not be considered as an alternative to net income (loss) as a measure of financial performance or cash flows from operations as a measure of liquidity, or any other performance measure derived in accordance with GAAP and it should not be construed as an inference that our future results will be unaffected by unusual or non-recurring items. In addition, Adjusted EBITDA is not intended to be a measure of free cash flow for management’s discretionary use, as it does not reflect certain cash requirements such as tax payments, debt service requirements, capital expenditures and certain other cash costs that may recur in the future. Adjusted EBITDA contains certain other limitations, including the failure to reflect our cash expenditures, cash requirements for working capital needs and cash costs to replace assets being depreciated and amortized. In evaluating Adjusted EBITDA, you should be aware that in the future we may incur expenses that are the same as or similar to some of the adjustments in this presentation. Our presentation of Adjusted EBITDA should not be construed to imply that our future results will be unaffected by any such adjustments. Management compensates for these limitations by primarily relying on our GAAP results in addition to using Adjusted EBITDA supplementally. Our definition of Adjusted EBITDA is not necessarily comparable to other similarly titled captions of other companies due to different methods of calculation. |

11

Table of Contents

| A reconciliation of net income (loss) to Adjusted EBITDA is set forth below: |

| Year Ended December 31, | ||||||||||||

| 2011 | 2012 | 2013 | ||||||||||

| (in thousands) | ||||||||||||

| Net income (loss) |

$ | 13,345 | $ | (32,655 | ) | $ | (37,913 | ) | ||||

| Interest expense |

236 | 1,222 | 2,810 | |||||||||

| Income tax benefit |

(18,221 | ) | (13,041 | ) | (8,341 | ) | ||||||

| Depreciation and amortization |

34,831 | 41,824 | 36,776 | |||||||||

| Stock-based compensation expense |

3,272 | 2,243 | 2,879 | |||||||||

| Foreign currency transaction (gain) loss |

560 | (1,034 | ) | (1,477 | ) | |||||||

| Adjustments related to our purchase by the Sponsor(a) |

(41,376 | ) | (324 | ) | — | |||||||

|

|

|

|

|

|

|

|||||||

| Adjusted EBITDA |

$ | (7,353 | ) | $ | (1,765 | ) | $ | (5,266 | ) | |||

| (a) | Adjustments related to our purchase by the Sponsor were comprised of the reversal of the contingent consideration liability of $50.4 million offset by the recognition in cost of revenue of a $9.1 million write-up of inventory to fair market value for the year ended December 31, 2011 and the reversal of the contingent consideration liability of $0.3 million for the year ended December 31, 2012. |

12

Table of Contents

Investing in our common stock involves a high degree of risk. You should consider carefully the risks and uncertainties described below and the other information contained in this prospectus, including our consolidated financial statements and the related notes, before you decide whether to purchase our common stock.

Risks Related to Our Business and Our Industry

We have incurred losses in the past and may not be able to achieve or sustain profitability in the future.

We have incurred losses in most fiscal years since inception. We incurred net losses of $32.7 million and $37.9 million in 2012 and 2013, respectively. As a result of ongoing losses, we had an accumulated deficit of $70.6 million at December 31, 2013. We expect to continue to incur significant product development, clinical and regulatory, sales and marketing and other expenses. In addition, following this offering, our general and administrative expenses will increase due to the additional costs associated with being a public company. We will need to generate significant additional revenue to achieve and maintain profitability, and even if we achieve profitability, we cannot be sure that we will remain profitable for any substantial period of time. Our failure to achieve or maintain profitability could negatively impact the value of our common stock.

We must continue to successfully demonstrate to spine surgeons the merits of our technologies and techniques compared to those of our competitors.

Spine surgeons play a significant role in determining the course of treatment and, ultimately, the type of product that will be used to treat a patient. As a result, our success depends, in large part, on effectively marketing to them. In order for us to sell our products, we must continue to successfully demonstrate to spine surgeons the merits of our technologies and techniques compared to those of our competitors for use in treating patients with spinal pathologies. Acceptance of our products depends on educating spine surgeons as to the distinctive characteristics, perceived benefits, safety, ease of use and cost-effectiveness of our products as compared to our competitors’ products, and on training spine surgeons in the proper application of our products. If we are not successful in convincing spine surgeons of the merits of our products or educating them on the use of our products, they may not use our products and we may be unable to increase our sales, sustain our growth or achieve profitability.

Furthermore, we believe many spine surgeons may be hesitant to adopt certain products unless they determine, based on experience, clinical data and published peer-reviewed journal articles, that our complex spine products, MIS technologies and techniques and degenerative products provide benefits or are an attractive alternative to existing treatments of spine disorders. Surgeons may be hesitant to change their medical treatment practices for the following reasons, among others:

| • | lack of experience with our technologies; |

| • | existing relationships with competitors and sales representatives that sell competitive products; |

| • | lack or perceived lack of evidence supporting additional patient benefits; |

| • | perceived liability risks generally associated with the use of new products and procedures; |

| • | less attractive availability of coverage and reimbursement within healthcare payment systems compared to other products and techniques; |

| • | costs associated with the purchase of new products and equipment; and |

| • | the time commitment that may be required for training. |

13

Table of Contents

In addition, we believe recommendations and support of our products by influential spine surgeons are essential for market acceptance and adoption. If we do not receive support from such surgeons or long-term data does not show the benefits of using our products, surgeons may not use our products. In such circumstances, we may not achieve expected sales or profitability.

Pricing pressure from our competitors, hospitals and changes in third-party coverage and reimbursement may impact our ability to sell our products at prices necessary to support our current business strategies.

Competition in the spinal surgery industry has increased as a result of new market entrants, new technologies and as more established companies have intensified competitive pricing pressure. As a result of these competitive forces, we believe there will be increased pricing pressure in the future. Because our products are generally purchased by hospitals that typically bill various third-party payors, changes in the purchasing behavior of such hospitals or the amount such payors are willing to reimburse our customers for procedures using our products, including as a result of healthcare reform initiatives, could create additional pricing pressure on us. In addition to these competitive forces, we continue to see pricing pressure as hospitals introduce new pricing structures into their contracts and agreements, including fixed price formulas, capitated pricing and construct pricing intended to contain healthcare costs. If we see such trends continue to drive down the prices we are able to charge for our products, our profit margins will shrink, which may adversely affect our ability to invest in and grow our business.

We operate in a highly competitive market and we must continue to develop and commercialize new products or our revenues may decline. If our competitors develop and commercialize products that are safer, more effective, less costly or otherwise more attractive than our products, our ability to generate revenue may be reduced or eliminated.

Our currently marketed products are, and any future products we develop and commercialize will be, subject to intense competition. The spinal surgery industry is intensely competitive, subject to rapid change and highly sensitive to the introduction of new products or other market activities of industry participants. Our ability to compete successfully will depend on our ability to develop products that reach the market in a timely manner, receive adequate coverage and reimbursement from third-party payors, and are safer, less invasive and more effective than competing products and treatments. Because of the size of the potential market, we anticipate that companies will dedicate significant resources to developing competing products.

We are aware of several companies that compete or are developing technologies in our current and future product areas. As a result, we expect competition to remain intense. We believe that our principal competitors include Medtronic Spine and Biologics, DePuy Synthes, Stryker, Globus Medical and NuVasive, which together represent a significant portion of the spinal surgery market. We also compete with smaller spinal surgery market participants such as Alphatec Spine, Biomet, LDR Holding Corporation, Orthofix and Zimmer, whose products generally have a smaller market share than the principal competitors listed above. At any time, these and other potential market entrants may develop new devices or treatment alternatives that may render our products obsolete or uncompetitive. In addition, they may gain a market advantage by developing and patenting competitive products or processes earlier than we can or by obtaining regulatory clearances or market registrations more rapidly than we can. Many of our current and potential competitors have substantially greater sales and financial resources than we do. In addition, these companies may have more established distribution networks, entrenched relationships with surgeons and greater experience in launching, marketing, distributing and selling products.

In addition, new market participants continue to enter the spinal surgery industry. Many of these new competitors specialize in a specific product or focus on a particular market sector, making it more difficult for us to increase our overall market position. The frequent introduction by competitors of products that are or claim to be superior to our products or that are alternatives to our existing or planned products may also create market confusion that may make it difficult to differentiate the benefits

14

Table of Contents

of our products over competing products. In addition, the entry of multiple new products and competitors may lead some of our competitors to employ pricing strategies that could adversely affect the pricing of our products and pricing in the spinal surgery market generally.

Spine surgeons often contribute to the decisions as to whether hospitals purchase our products, and we believe that many spine surgeons are highly sensitive to technological change and to the commercial reputation of spinal product companies. Accordingly, we believe that many spine surgeons actively seek new technologies and devote special attention to companies they perceive to have novel and innovative solutions to surgical challenges. As a result, we believe that we must continue to develop and commercialize innovative new products or our existing customers may decrease their purchases from us and instead purchase products from companies perceived by them to be more innovative. In order to develop innovative products, we must attract and retain talented and experienced engineers and management personnel, have productive dialogues with practicing spine surgeons and hospital purchasing administrations and have adequate capital to fund research and development efforts. If we fail to deliver innovative products to the market, our future revenue may be reduced and our stock price may decline.

In addition, we face a particular challenge overcoming the long-standing practices by some spine surgeons of using the products of our larger, more established competitors. Spine surgeons who have completed many successful, complex surgeries using the products made by these competitors may be disinclined to try new products from a source with which they are less familiar. If these spine surgeons do not try our products, then our revenue growth may slow or decline and our stock price may decline.

Our competitors may also develop and patent processes or products earlier than we can or obtain regulatory clearance, approval or CE Certificates of Conformity for competing products more rapidly than we can, which could impair our ability to develop and commercialize similar processes or products. We also compete with our competitors in establishing clinical trial sites and patient enrollment in clinical trials, as well as in acquiring technologies and technology licenses complementary to our products or advantageous to our business. In addition, we compete with our competitors to engage the services of sales agencies and independent distributors, both those presently working with us and those with whom we hope to work as we expand.

Many of our competitors have greater resources than we have.

Many of our current and potential competitors are major medical device companies that have substantially greater financial, technical and marketing resources than we do. Many of these current and potential competitors are publicly traded or are divisions of publicly-traded companies, which enjoy several competitive advantages, including:

| • | greater financial and human resources for product development, sales and marketing and patent litigation; |

| • | significantly greater name recognition; |

| • | established relationships with spine surgeons, hospitals and third-party payors; |

| • | more expansive portfolios of intellectual property rights; |

| • | broader product range and ability to cross-sell their products or offer rebates or bundle products to incentivize hospitals or surgeons to use their products; |

| • | products supported by long-term clinical data; |

| • | large and established sales and marketing and distribution networks; and |

| • | greater experience in conducting research and development, manufacturing, clinical trials, preparing regulatory submissions and obtaining regulatory clearance, approval or CE Certificates of Conformity for products and marketing approved products. |

15

Table of Contents

Aggregation of hospital purchasing from collaboration and consolidation may lead to demands for price concessions or to the exclusion of some suppliers from certain market opportunities, which could have an adverse effect on our business, results of operations or financial condition.

Because healthcare costs have risen significantly over the past decade, numerous initiatives and reforms initiated by legislators, regulators and third-party payors to curb these costs have resulted in a consolidation trend in the healthcare industry to aggregate purchasing power. As the healthcare industry consolidates, competition to provide products and services to industry participants has become more intense and may intensify. This in turn has resulted and will likely continue to result in greater pricing pressures or the exclusion of certain suppliers from certain market opportunities as group purchasing organizations, independent delivery networks and large single accounts continue to use their market power to consolidate purchasing decisions. In addition, such consolidation may lead these organizations to limit their number of suppliers. We expect that market demand, government regulation, third-party coverage and reimbursement policies and societal pressures will continue to impact the healthcare industry, resulting in further business consolidations and alliances among our customers, which may exert further downward pressure on the prices of our products and may adversely impact our business, results of operations or financial condition.

If hospitals and other healthcare providers are unable to obtain adequate coverage and reimbursement for procedures performed using our products, it is unlikely that our products will gain widespread acceptance.

Maintaining and growing sales of our products depends on the availability of adequate coverage and reimbursement from third-party payors, including government programs, such as Medicare and Medicaid, private insurance plans and managed care programs. Hospitals and other healthcare providers that purchase products, such as the ones that we manufacture, generally rely on third-party payors to pay for all or part of the costs and fees associated with the procedures performed with these products. The existence of adequate coverage and reimbursement for the procedures performed with our products by government and private insurance plans is central to the acceptance of our current and future products. We may be unable to sell our products on a profitable basis if third-party payors deny coverage or reduce their current levels of payment, or if our costs increase faster than increases in reimbursement levels. In the United States, many private payors use coverage decisions and payment amounts determined by the Centers for Medicare and Medicaid Services, or CMS, which administers the Medicare program, as guidelines in setting their coverage and reimbursement policies. Future action by CMS or other government agencies may diminish payments to physicians, outpatient centers and/or hospitals. Those private payors that do not follow the Medicare guidelines may adopt different coverage and reimbursement policies for procedures performed with our products. For some governmental programs, such as Medicaid, coverage and reimbursement differ from state to state, and some state Medicaid programs may not pay an adequate amount for the procedures performed with our products, if any payment is made at all. As the portion of the U.S. population over the age of 65 and eligible for Medicare continues to grow, we may be more vulnerable to coverage and reimbursement limitations imposed by CMS. Furthermore, the healthcare industry in the United States has experienced a trend toward cost containment as government and private insurers seek to control healthcare costs by imposing lower payment rates and negotiating reduced contract rates with service providers. Therefore, we cannot be certain that the procedures performed with our products will be reimbursed at a cost-effective level. Accordingly, even if our products and procedures using our products are currently covered and reimbursed by third-party payors, adverse changes in payors’ coverage and reimbursement policies that affect our products would harm our ability to market and sell our products and adversely impact our business, results of operations or financial condition.

Moreover, we are unable to predict what changes will be made to the reimbursement methodologies used by third-party payors. We cannot be certain that under current and future payment systems, in which healthcare providers may be reimbursed a set amount based on the type of procedure performed, such as those utilized by Medicare and in many privately managed care systems, the cost of our products will be properly reflected and incorporated into the overall cost of the procedure.

16

Table of Contents

In addition, as we continue to expand into international markets, market acceptance may depend, in part, upon the availability of coverage and reimbursement within prevailing healthcare payment systems. Reimbursement and healthcare payment systems in international markets such as in the European Economic Area, or the EEA, which is comprised of the 28 Member States of the European Union, or the EU, Iceland, Liechtenstein and Norway, vary significantly by country, and include both government-sponsored healthcare and private insurance. We may not obtain international coverage and reimbursement approvals in a timely manner, if at all. Our failure to receive such approvals, and any adverse changes in coverage and the reimbursement policies of foreign third-party payors, would negatively impact market acceptance of our products in such international markets.

The safety and efficacy of our products is not yet supported by long-term clinical data, which could limit sales, and our products might therefore prove to be less safe and effective than initially thought.

We have obtained 510(k) clearances to manufacture, market and sell the products we market in the United States, unless exempt from premarket review by the U.S. Food and Drug Administration, or the FDA, and the right to affix the CE mark to the products we market in the EEA. In the 510(k) clearance process, the FDA must determine that a proposed device is “substantially equivalent” to a legally marketed device, known as a “predicate” device, with respect to intended use, technology and safety and effectiveness, which sometimes requires the submission of clinical data. In the EEA, as a general rule, compliance with the Essential Requirements laid down in Annex I to the Council Directive 93/42/EEC of 14 June 1993 concerning medical devices, or the Medical Devices Directive, must be based on clinical data, though such clinical data can originate from the literature if equivalence to the device to which the literature relates can be demonstrated. For implantable devices and devices classified as Class III in the EEA, the provisions of Annex I to the Medical Devices Directive require manufacturers to conduct clinical investigations to generate the required clinical data, unless it is justifiable to rely on the existing clinical data related to similar devices. While clinical data generated during a clinical investigation is sometimes required to support a 510(k) clearance, CE mark or product registration in other countries, we have not yet generated our own clinical data in support of our currently marketed products. As a result, we currently lack the breadth of published long-term clinical data supporting the quality, safety and efficacy of our products that might have been generated in connection with more costly and rigorous premarket approval, or PMA, processes, and that some of our competitors who have been in business longer may have collected.

To address this issue, we are currently collecting and plan to continue collecting long-term clinical data regarding the quality, safety and effectiveness of our marketed products. For example, we are currently launching voluntary postmarket studies with respect to the degenerative disc disease market in relation to our MESA, EVEREST and RAVINE medical devices. The clinical data collected and generated as part of these studies will enable us to further strengthen our clinical evaluation concerning safety and performance of these important products. We believe that this additional data will help with the marketing of our MESA, EVEREST and RAVINE medical devices by providing our customers with additional confidence in the long-term safety and efficacy of these products. However, as we conduct clinical trials designed to generate long-term data on our products, the data we generate may not be consistent with our existing data and may demonstrate less favorable safety or efficacy. These results could reduce demand for our products and significantly reduce our ability to achieve expected revenue. We do not expect to undertake such studies for all of our products and will only do so in the future where we anticipate the benefits will outweigh the costs. In addition, in the degenerative disease market, we may determine from postmarket experience that certain patient characteristics, such as age or preexisting medical conditions, may affect fusion rates, which could lead to misleading or contradictory data on the efficacy of our degenerative disease products. For these reasons, spine surgeons may be less likely to purchase our products than competing products with longer-term clinical data. Also, we may not choose or be able to generate the comparative data that some of our competitors have or are generating and we may be subject to greater regulatory and product liability risks. Moreover, if future

17

Table of Contents

results and experience indicate that our products cause unexpected or serious complications or other unforeseen negative effects, we could be subject to mandatory product recalls or withdrawals, suspension or withdrawal of FDA or other government clearances or approvals or CE Certificates of Conformity, significant legal and regulatory liability and harm to our business reputation.

We are dependent on a limited number of third-party suppliers for most of our products and components, and the loss of any of these suppliers, or their inability to provide us with an adequate supply of quality materials, could harm our business.

We rely on third-party suppliers to supply substantially all of our products as well as the raw materials for the limited number of products we manufacture in-house. For us to be successful, our suppliers must be able to provide us with products and components in substantial quantities, in compliance with regulatory requirements, in accordance with agreed upon specifications, at acceptable costs and on a timely basis. Our anticipated growth could strain the ability of our suppliers to deliver an increasingly large supply of products, materials and components. Suppliers often experience difficulties in scaling up production, including problems with production yields and quality control and assurance, especially with biomaterials products such as allograft, which is processed human tissue. If we are unable to obtain sufficient quantities of high quality components to meet demand on a timely basis, we may not be able to produce sufficient quantities of our products to meet market demand and, as a result, could lose customers, our reputation may be harmed and our business could suffer.

Our dependence on a limited number of suppliers exposes us to risks, including limited control over pricing, availability and delivery schedules. If any one or more of our suppliers cease to provide us with sufficient quantities of manufactured products or raw materials in a timely manner or on terms acceptable to us, or cease to manufacture components of acceptable quality, we would have to seek alternative sources of supply. Because of the nature of our internal quality control requirements, regulatory requirements and the proprietary nature of the parts, we cannot quickly engage additional or replacement suppliers for many of our critical components. Failure of any of our third-party suppliers to deliver products or raw materials at the level our business requires would limit our ability to meet our sales commitments to our customers and could have a material adverse effect on our business. We may also have difficulty obtaining similar components from other suppliers that are acceptable to the FDA, the competent authorities or notified bodies of the countries of the EEA, each a Notified Body, or other foreign regulatory authorities, and the failure of our suppliers to comply with strictly enforced regulatory requirements could expose us to regulatory action including warning letters, product recalls and withdrawals, suspension or withdrawal of our regulatory clearances or CE Certificates of Conformity, termination of distribution, product seizures or civil, administrative or criminal penalties. We could incur delays while we locate and engage qualified alternative suppliers, and we may be unable to engage alternative suppliers on favorable terms or at all. Any such disruption or increased expenses could harm our business, results of operations or financial condition.

If we are unable to maintain and expand our network of direct sales employees, independent sales agencies and international distributors, we may not be able to generate anticipated sales.

In the United States we maintain a hybrid sales organization consisting of 114 direct sales employees and 48 independent agency partners. We currently generate revenue from 28 countries internationally, in addition to the United States. Our international sales organization includes 37 direct sales employees, primarily located in the United Kingdom and Germany. In addition, we directly manage five independent sales agencies across Italy and Canada. We sell to 15 distributors in certain other international markets. Our results of operations are directly dependent upon the sales and marketing efforts of not only our employees, but also our independent sales agencies and distributors. We expect our direct sales employees, independent sales agencies and distributors to develop long-lasting relationships with the surgeons and hospitals they serve. If our direct sales employees, independent sales agencies or distributors fail to adequately promote, market and sell our products, our sales could significantly decrease. During

18

Table of Contents

the year ended December 31, 2013, on a net basis, we added 55 direct sales employees and three independent sales agencies. If revenue generated by our newly hired direct sales employees and independent sales agencies fails to increase over time in line with our expectations, our business, results of operations and financial condition could be materially adversely affected.

We face significant challenges and risks in managing our geographically dispersed distribution network and retaining the individuals who make up that network. If any of our direct sales employees, independent sales agencies or distributors were to reduce their efforts to promote our products or cease to do business with us, our sales could be adversely affected. In such a situation, we may need to seek alternative direct sales employees, independent sales agencies or distributors or increase our reliance on our existing direct sales employees, which we may be unable to do in a timely and efficient manner, if at all. In addition, our competitors may require that members of our sales force cease doing business with us. We may not be able to rely on our sales force to distribute new products that we introduce that compete with products of our competitors that they also represent. If a direct sales employee, independent sales agency or distributor were to depart and be retained exclusively by one of our competitors, we may be unable to prevent them from helping competitors solicit business from our existing customers, which could further adversely affect our sales. Because of the intense competition for their services, we may be unable to recruit or retain additional qualified independent sales agencies or distributors or to hire additional direct sales employees. We also may not be able to enter into agreements with them on favorable or commercially reasonable terms, if at all. Failure to hire or retain qualified direct sales employees or independent sales agencies or distributors would adversely impact our ability to generate sales and expand our business.

As we launch new products and increase our marketing efforts with respect to existing products, we will need to expand the reach of our marketing and sales networks. Our future success will depend largely on our ability to continue to hire or contract with, train, retain and motivate skilled sales managers, direct sales employees, independent sales agencies and distributors with significant technical knowledge in various areas, such as spinal care practices, spine injuries and disease and spinal health. New hires and new independent sales agencies and distributors require training and take time to achieve full productivity. If we fail to hire quality personnel, fail to provide adequate training or experience high turnover in our sales force, the new members of our sales force may not be as productive as is necessary to maintain or increase our sales.

The proliferation of physician-owned distributorships could result in increased pricing pressure on our products or harm our ability to sell our products to physicians who own or are affiliated with those distributorships.

Physician-owned distributorships, or PODs, are product distributors that are owned, directly or indirectly, by physicians. These physicians derive a proportion of their revenue from selling or arranging for the sale of products for use in procedures they perform on their own patients at hospitals that agree to purchase from or through the POD, or that otherwise furnish ordering physicians with income that is based directly or indirectly on those orders of products.

We do not sell or distribute any of our products through PODs. The number of PODs in the spinal surgery industry may continue to grow as economic pressures increase throughout the industry, hospitals, insurers and physicians search for ways to reduce costs and, in the case of the physicians, search for ways to increase their incomes. PODs and the physicians who own, or partially own, them have significant market knowledge and access to the surgeons who use our products and the hospitals that purchase our products and thus the growth of PODs may reduce our ability to compete effectively for business from surgeons who own such distributorships.

19

Table of Contents

A large percentage of our revenue is derived from the sale of our MESA, DENALI and EVEREST spinal systems or products that incorporate these technologies, and therefore, a decline in the sales of these products could have a material impact on our business, results of operations and financial condition.