Attached files

| file | filename |

|---|---|

| EX-3.3 - EX-3.3 - Radius Health, Inc. | a2219551zex-3_3.htm |

| EX-3.4 - EX-3.4 - Radius Health, Inc. | a2219551zex-3_4.htm |

| EX-23.1 - EX-23.1 - Radius Health, Inc. | a2219551zex-23_1.htm |

| EX-10.84 - EX-10.84 - Radius Health, Inc. | a2219551zex-10_84.htm |

| EX-10.150 - EX-10.150 - Radius Health, Inc. | a2219551zex-10_150.htm |

Use these links to rapidly review the document

TABLE OF CONTENTS

TABLE OF CONTENTS 2

As filed with the Securities and Exchange Commission on April 21, 2014

Registration No. 333-194150

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

AMENDMENT NO. 2

TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Radius Health, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 2834 | 80-0145732 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

201 Broadway, 6th Floor

Cambridge, Massachusetts 02139

(617) 551-4700

(Address, including zip code, and telephone number, including area code, of registrant's principal executive offices)

Robert E. Ward

Chief Executive Officer

Radius Health, Inc.

201 Broadway, 6th Floor

Cambridge, Massachusetts 02139

(617) 551-4700

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies To:

| Peter N. Handrinos B. Shayne Kennedy Latham & Watkins LLP John Hancock Tower, 20th Floor 200 Clarendon Street Boston, Massachusetts 02116 (617) 948-6000 |

Julio E. Vega William S. Perkins Bingham McCutchen LLP One Federal Street Boston, Massachusetts 02110 (617) 951-8000 |

Approximate date of commencement of proposed sale to the public:

As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of "large accelerated filer," "accelerated filer," and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer o | Accelerated filer o | Non-accelerated filer o (Do not check if a smaller reporting company) |

Smaller reporting company ý |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED, APRIL 21, 2014

PRELIMINARY PROSPECTUS

Prospectus

Shares

Radius Health, Inc.

Common Stock

We are offering shares of our common stock. This is our initial public offering and no public market currently exists for our common stock. We expect the initial public offering price to be between $ and $ per share. We have applied to list our common stock on the NASDAQ Global Market under the symbol "RDUS."

Investing in our common stock involves a high degree of risk. Please read "Risk factors" beginning on page 12 of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission nor any other regulatory body has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| |

PER SHARE | TOTAL | |||||

|---|---|---|---|---|---|---|---|

Public Offering Price |

$ | $ | |||||

Underwriting Discounts and Commissions(1) |

$ | $ | |||||

Proceeds to Radius Health, Inc. (Before Expenses) |

$ | $ | |||||

- (1)

- The underwriters will also be reimbursed for certain expenses incurred in this offering. See "Underwriting" for details.

Delivery of the shares of common stock is expected to be made on or about , 2014. We have granted the underwriters an option for a period of 30 days to purchase an additional shares of our common stock. If the underwriters exercise the option in full, the total underwriting discounts and commissions payable by us will be $ , and the total proceeds to us, before expenses, will be $ .

| Joint Book-Running Managers | ||

Jefferies |

Cowen and Company |

|

Co-Lead Manager |

Co-Manager |

|

Canaccord Genuity |

Cantor Fitzgerald & Co. |

|

Prospectus dated , 2014

Neither we nor the underwriters have authorized anyone to provide any information or to make any representations other than those contained in this prospectus or in any free writing prospectuses we have prepared. We do not, and the underwriters do not, take responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the shares offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus is current only as of its date.

For investors outside the United States: Neither we nor the underwriters have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than the United States. You are required to inform yourselves about, and to observe any restrictions relating to, this offering and the distribution of this prospectus outside of the United States.

In this prospectus, references to "dollar" or "$" are to the legal currency of the United States, and references to "euro" or "€" are to the single currency introduced on January 1, 1999 at the start of the third stage of European Economic and Monetary Union, pursuant to the Treaty establishing the European Communities, as amended by the Treaty on European Union and the Treaty of Amsterdam. Unless otherwise indicated, the financial information in this prospectus has been expressed in U.S. dollars. Unless otherwise stated, the U.S. dollar equivalent information translating euros into U.S. dollars has been made, for convenience purposes, on the basis of the noon buying rate published by the Board of Governors of the Federal Reserve as of December 31, 2013, which was €1.00 = $1.3779. Such translations should not be construed as a representation that the euro has been, could have been or could be converted into U.S. dollars at the rate indicated, any particular rate or at all.

This summary highlights information contained elsewhere in this prospectus and does not contain all of the information you should consider before investing in our common stock. Investing in our common stock involves a high degree of risk. You should carefully read this entire prospectus, including our financial statements and the related notes included in this prospectus and the information set forth under the headings "Risk factors" and "Management's discussion and analysis of financial condition and results of operations."

Unless the context requires otherwise, the terms "Radius," "Company," "we," "us" and "our" refer to Radius Health, Inc.

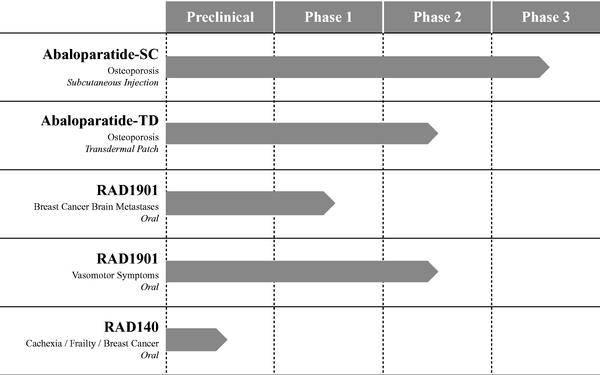

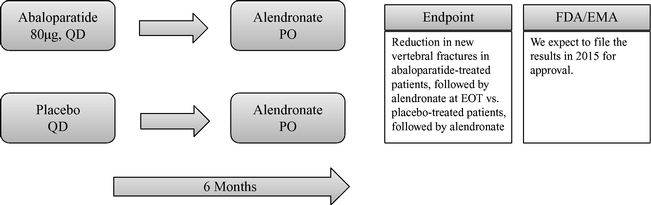

We are a science-driven biopharmaceutical company focused on developing novel differentiated therapeutics for patients with osteoporosis as well as other serious endocrine-mediated diseases. Our lead product candidate is abaloparatide (BA058), a bone anabolic for the treatment of osteoporosis delivered via subcutaneous injection, which we refer to as Abaloparatide-SC. We are currently in Phase 3 development of Abaloparatide-SC and expect to announce top-line data from this study in late 2014. If the results are positive, we plan to submit a new drug application, or NDA, in the United States, and a marketing authorization application, or MAA, in Europe, in mid-2015. We hold worldwide commercialization rights to Abaloparatide-SC, other than in Japan, and with a favorable regulatory outcome, we anticipate our first commercial sales of Abaloparatide-SC will take place in 2016. We are leveraging our investment in Abaloparatide-SC to develop Abaloparatide-TD. We expect this line extension will provide improved patient convenience by enabling administration of abaloparatide through a short-wear-time transdermal patch. We have recently completed a successful Phase 2 proof of concept study.

Our current clinical product portfolio also includes a novel oral agent, RAD1901, a selective estrogen receptor down-regulator/degrader, or SERD. We are developing RAD1901 at higher doses, for the treatment of breast cancer brain metastases, or BCBM, and at lower doses as a selective estrogen-receptor modulator, or SERM, for the treatment of vasomotor symptoms such as hot flashes. In 2014, we expect to commence a Phase 1 clinical trial to evaluate RAD1901 for the treatment of BCBM, and we previously completed a successful Phase 2 clinical trial of RAD1901 for the treatment of vasomotor symptoms.

1

OUR PRODUCT CANDIDATES

The following table identifies the product candidates in our current product portfolio, their proposed indication and stage of development:

Abaloparatide

Abaloparatide is a novel synthetic peptide analog of parathyroid hormone-related protein, or PTHrP, that we are developing as a bone anabolic treatment for osteoporosis. Osteoporosis is a disease that affects nearly 10 million people in the United States, with an additional approximately 43 million people at increased risk for the disease. It is characterized by low bone mass and structural deterioration of bone tissue, which leads to greater fragility and an increase in fracture risk. Anabolic agents, like Forteo (teriparatide), are used to increase bone mineral density, or BMD, and to reduce the risk of fracture. We believe abaloparatide has the potential to increase BMD and bone quality to a greater degree and at a faster rate than other approved drugs for the treatment of osteoporosis. We are developing two formulations of abaloparatide:

- •

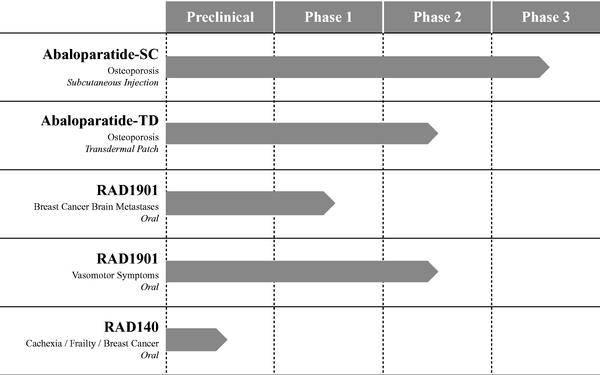

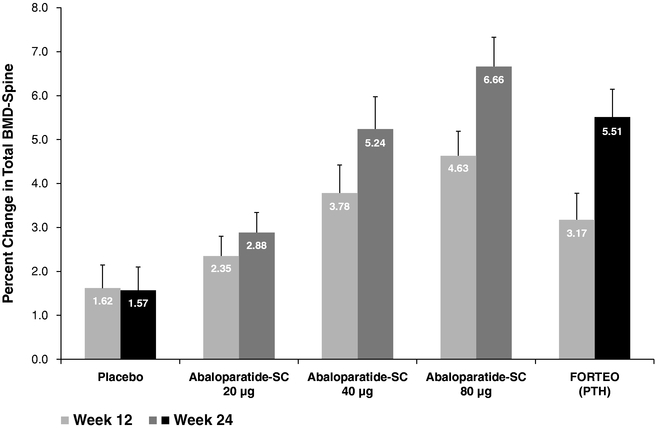

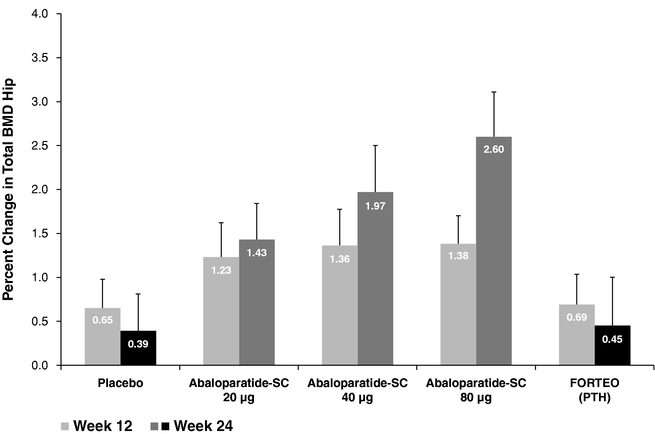

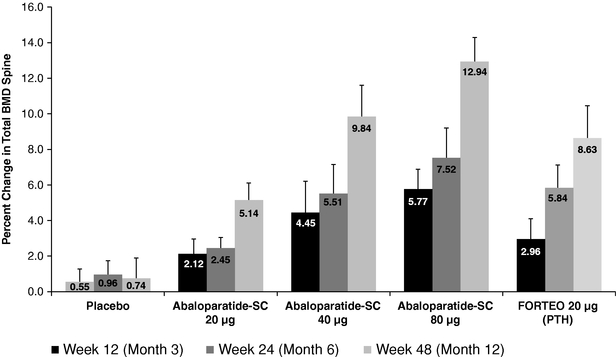

- Abaloparatide-SC is an injectable subcutaneous formulation of abaloparatide. In August 2009, we announced positive Phase 2 data that showed Abaloparatide-SC produced faster and greater BMD increases at the spine and the hip with substantially less hypercalcemia than Forteo (teriparatide), which is the only approved subcutaneous injectable anabolic agent for the treatment of osteoporosis in the United States. A subsequent Phase 2 clinical trial announced in January 2014 also confirmed the results of our first clinical trial by demonstrating that Abaloparatide-SC produces BMD increases from baseline in the spine and hip that are comparable to our earlier Phase 2 clinical trial. In April 2011, we commenced a Phase 3 clinical trial of Abaloparatide-SC. Enrollment was completed in March 2013, and we expect to announce top-line data at the end of the fourth quarter of 2014. Assuming a favorable outcome, we plan to use the results from this Phase 3 clinical trial to support a new drug application, or NDA, with the U.S. Food and Drug Administration, or FDA, and believe we could obtain approval of the NDA in 2016.

2

- •

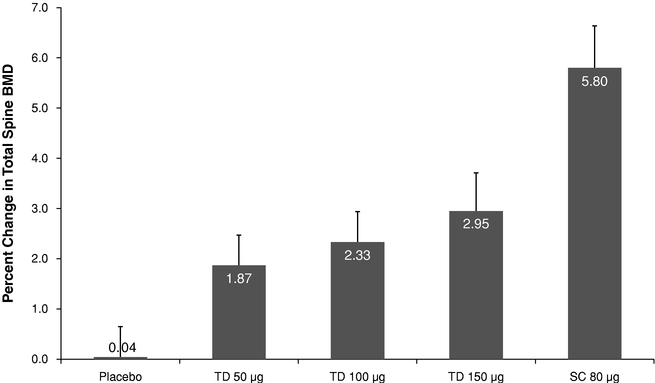

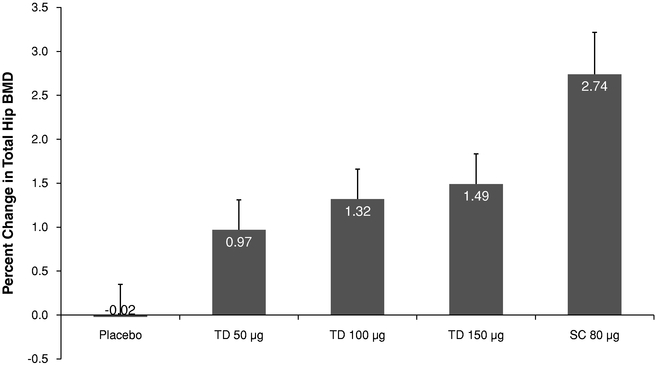

- Abaloparatide-TD is a line extension of Abaloparatide SC in the form of a convenient, short-wear-time (approximately five minutes) transdermal patch. In a recent Phase 2 clinical trial, Abaloparatide-TD demonstrated a statistically significant mean percent increase from baseline in BMD as compared to placebo at the lumbar spine and at the hip. These results demonstrated a clear proof of concept by achieving a dose dependent increase in BMD. Following additional formulation development work, we intend to advance an optimized Abaloparatide-TD product in additional clinical studies and to a Phase 3 bridging study and to subsequently submit for approval. We hold worldwide commercialization rights to Abaloparatide-TD technology.

RAD1901

RAD1901 is a SERD that we believe crosses the blood-brain barrier and that we are evaluating for the treatment of BCBM. RAD1901 has been shown to bind with good selectivity to the estrogen receptor and to have both estrogen-like and estrogen-antagonistic effects in different tissues. In many cancers, hormones, like estrogen, stimulate tumor growth and a desired therapeutic goal is to block this estrogen-dependent growth while inducing apoptosis of the cancer cells. SERDs are an emerging class of endocrine therapies that directly induce estrogen receptor, or ER, degradation, enabling them to remove the estrogen growth signal in ER-dependent tumors without allowing ligand-independent resistance to develop. There is currently only one SERD, Faslodex (fulvestrant), approved for the treatment of hormone-receptor positive metastatic breast cancer; however, for patients with brain metastases (BCBM), there are no approved targeted therapies that cross the blood-brain barrier. We believe there is a significant opportunity for RAD1901 to be the first ER-targeted therapy that crosses the blood-brain barrier to more effectively treat ER-positive BCBM and potentially reduce both intracranial and extracranial BCBM tumors. We intend to commence a Phase 1 clinical trial in 2014 to evaluate high-dose RAD1901 for the treatment of BCBM. In March 2014, we submitted to the FDA an application for orphan-medicinal product designation of RAD1901 for the treatment of BCBM.

We are also developing RAD1901 at lower doses as a selective estrogen receptor modulator, or SERM, for the treatment of vasomotor symptoms. Historically, hormone replacement therapy, or HRT, with estrogen or progesterone was considered the most efficacious approach to relieving menopausal symptoms such as hot flashes. However, because of the concerns about the potential long-term risks and contraindications associated with HRT, we believe a significant need exists for new therapeutic treatment options to treat vasomotor symptoms. In a Phase 2 proof of concept study, RAD1901 at lower doses demonstrated a reduction in the frequency and severity of moderate and severe hot flashes. We believe RAD1901 is an attractive candidate for advancement into Phase 2b development as a treatment for vasomotor symptoms.

Osteoporosis

Osteoporosis is a disease characterized by low bone mass and structural deterioration of bone tissue, which leads to greater fragility and an increase in fracture risk. All bones become more fragile and susceptible to fracture as the disease progresses. People tend to be unaware that their bones are getting weaker, and a person with osteoporosis can fracture a bone from even a minor fall. The debilitating effects of osteoporosis have substantial costs. Loss of mobility, admission to nursing homes and dependence on caregivers are all common consequences of osteoporosis. The prevalence of osteoporosis is growing and, according to the National Osteoporosis Foundation, or the NOF, is significantly under-recognized and under-treated in the population. While the aging of the population is a primary driver of an increase in cases, osteoporosis is also increasing from the use of drugs that induce bone loss, such as chronic use of glucocorticoids and aromatase inhibitors that are increasingly used for breast cancer and the hormone therapies used for prostate cancer.

The NOF has estimated that 10 million people in the United States, composed of eight million women and two million men, already have osteoporosis, and another approximately 43 million have low bone mass placing them at increased risk for osteoporosis. In addition, the NOF has estimated that osteoporosis is

3

responsible for more than two million fractures in the United States each year resulting in an estimated $19 billion in costs annually. The NOF expects that the number of fractures in the United States due to osteoporosis will rise to three million by 2025, resulting in an estimated $25.3 billion in costs each year. Worldwide, osteoporosis affects an estimated 200 million women according to the International Osteoporosis Foundation, or IOF, and causes more than 8.9 million fractures annually, which is equivalent to an osteoporotic fracture occurring approximately every three seconds. The IOF has estimated that 1.6 million hip fractures occur worldwide each year, and by 2050 this number could reach between 4.5 million and 6.3 million. The IOF estimates that in Europe alone, the annual cost of osteoporotic fractures could surpass €76 billion by 2050.

There are two main types of osteoporosis drugs currently available in the United States, anti-resorptive agents and anabolic agents. Anti-resorptive agents act to prevent further bone loss by inhibiting the breakdown of bone, whereas anabolic agents stimulate bone formation to build new, high-quality bone. According to industry sources, sales of these drugs in the United States, Japan and the five major markets in Europe exceeded $6 billion in 2011. We believe there is a large unmet need in the market for osteoporosis treatment because existing therapies have shortcomings in efficacy, tolerability and convenience. For example, one current standard of care, bisphosphonates, an anti-resorptive agent, has been associated with infrequent but serious adverse events, such as osteonecrosis of the jaw and atypical fractures, especially of long bones. These side effects, although uncommon, have created increasing concern with physicians and patients. Many physicians are seeking alternatives to bisphosphonates. The two primary alternatives to bisphosphonates that are approved for the treatment of osteoporosis, Lilly's Forteo and Amgen's Prolia, had reported sales of approximately $1.2 billion and $700 million, respectively, in 2013. Forteo, a 34 amino acid recombinant peptide of human parathyroid hormone, is the only anabolic drug approved in the United States for the treatment of osteoporosis. We believe there is a significant opportunity for an anabolic agent that is able to increase BMD to a greater degree and at a faster rate than other approved drugs for the treatment of osteoporosis with added advantages in convenience and safety.

Our Solution — Abaloparatide

We believe that abaloparatide is the most advanced PTHrP analog in clinical development for the treatment of osteoporosis and that it can provide the following advantages over other current standard of care treatments for osteoporosis:

- •

- improved efficacy — greater bone build at hip and spine;

- •

- faster benefit for building bone;

- •

- shorter treatment duration;

- •

- less hypercalcemia;

- •

- no additional safety risks; and

- •

- no refrigeration required in use.

Abaloparatide-SC. Abaloparatide-SC is an injectable, subcutaneous formulation of abaloparatide. In April 2011, we began dosing patients in a pivotal, multinational Phase 3 clinical trial designed to show that Abaloparatide-SC prevents new vertebral fracture compared to placebo. We completed enrollment in this Phase 3 clinical study in March 2013 and expect to report top-line, 18-month fracture data at the end of the fourth quarter of 2014. If the data from this Phase 3 clinical trial are positive, we plan to submit the NDA and the MAA for Abaloparatide-SC in mid-2015. We expect commercial launch to follow in 2016 in the United States, if and when the FDA approves the NDA for Abaloparatide-SC, and in the EU if and when an MAA for Abaloparatide-SC is approved.

Abaloparatide-TD. Abaloparatide-TD is a convenient, short-wear-time transdermal patch formulation of abaloparatide with Phase 2 clinical results suggesting efficacy, safety and tolerability in the treatment of osteoporosis. We currently plan to optimize Abaloparatide-TD to achieve efficacy comparable to that of Abaloparatide-SC. If Abaloparatide-SC is approved by the FDA, we believe that we will only need to conduct a single non-inferiority Phase 3 clinical trial comparing the change in lumbar spine BMD at 12 months for

4

patients dosed with Abaloparatide-TD to patients dosed with Abaloparatide-SC to show that the effect of Abaloparatide-TD treatment is comparable to that of Abaloparatide-SC. If our clinical trials of Abaloparatide-SC and Abaloparatide-TD are successful, we expect to seek marketing approval of Abaloparatide-TD as a line extension of Abaloparatide-SC. The FDA approval of Abaloparatide-TD, and the timing of any such approval, is dependent upon the approval of Abaloparatide-SC.

Metastatic Breast Cancer

According to the World Health Organization, breast cancer is the second most common cancer in the world and the most prevalent cancer in women, accounting for 16% of all female cancers. The major cause of death from breast cancer is metastases, most commonly to the bone, liver, lung and brain. About 5% of patients have distant metastases at the time of diagnoses, and these patients have a 5-year survival rate of only 24%, compared with a greater than 98% survival rate for patients with only local disease. Importantly, even patients without metastases at diagnosis are at risk for developing metastases over time.

Approximately, 70% of breast cancers express the estrogen receptor, or ER, and depend on estrogen signaling for growth and survival. There are three main classes of therapies for ER-positive tumors available: aromatase inhibitors, or AIs; SERMs; and SERDs. AIs, which block the generation of estrogen, and SERMs, which selectively inhibit an ER's ability to bind estrogen, both block ER-dependent signaling but leave functional ERs present on breast cancer cells. For this reason, although these classes of drugs are effective as adjuvants for breast cancer, patients' tumors often acquire resistance to them by developing the ability to signal through the ER in a ligand-independent manner. SERDs, in contrast, are an emerging class of endocrine therapies that directly induce ER degradation. Therefore, these agents should be able to treat ER-dependent tumors without allowing ligand-independent resistance to develop, and they should also be able to act on AI- and SERM-resistant ER-positive tumors. Symptomatic BCBM occur in 10% to 16% of patients with metastatic breast cancer and are associated with particularly high morbidity and mortality. Current standard of care involves a combination of whole-brain radiotherapy, surgery or stereotactic radiosurgery, depending on the clinical context. These treatments are often only marginally effective, and are themselves associated with significant morbidity and mortality.

There is currently only one SERD approved for the treatment of ER-positive metastatic breast cancer, but there are no approved targeted therapies that cross the blood-brain barrier and can treat patients with ER-positive BCBM. We believe a significant opportunity exists for a SERD that can cross the blood-brain barrier to more effectively treat ER-positive BCBM and potentially delay or eliminate the need for radiation or surgery.

Our Solution — RAD1901

We are developing RAD1901 as a high-dose SERD in an oral formulation in Phase 1 clinical development for the treatment of BCBM. RAD1901 has been shown to bind with good selectivity to the estrogen hormone receptor and to have both estrogen-like and estrogen-antagonist effects in different tissues. In cell culture, RAD1901 does not stimulate replication of breast cancer cells, and antagonizes the stimulating effects of estrogen on cell proliferation. Furthermore, in breast cancer cell lines a dose dependent down regulation of ER, has been observed, a process we have shown to involve proteosomal mediated degradation pathway. In a model of breast cancer in which human breast cancer cells are implanted in mice and allowed to establish tumors in response to estrogen treatment, we have shown that treatment with RAD1901 results in decreased tumor growth. Studies with RAD1901 have established the pharmacokinetic profile, including demonstration of good oral bioavailability and the ability of RAD1901 to cross the blood-brain barrier, with therapeutic levels detectable in the brain. We believe that RAD1901 could offer the following advantages over other current standard of care treatments for BCBM:

- •

- ability to penetrate the blood-brain barrier;

- •

- oral administration; and

- •

- treatment of hormone-resistant breast cancers.

5

In late 2014, we intend to advance the development of high-dose RAD1901 for the treatment of ER-positive BCBM with the initiation of a Phase 1b clinical trial.

Vasomotor symptoms

Vasomotor symptoms, such as hot flashes and night sweats, are common during menopause, with up to 85% of women experiencing them during the menopause transition, for a median duration of four years. In 2010, approximately 11.5 million women in the United States were in the 45 to 49 year age range upon entering menopause. In addition, most women receiving systemic therapy for breast cancer suffer hot flashes, often with more severe or prolonged symptoms than women experiencing menopause. These symptoms can disrupt sleep and interfere with quality of life. An estimated two million women go through menopause every year in the United States, with a total population of 50 million postmenopausal women.

Historically, hormone replacement therapy, or HRT, with estrogen and/or progesterone was considered the most efficacious approach to relieving menopausal symptoms such as hot flashes. However, data from the Women's Health Initiative, or WHI, identified increased risks for malignancy and cardiovascular disease associated with estrogen therapy. Sales of HRT declined substantially after the release of the initial WHI data, but HRT remains the current standard of care for many women suffering from hot flashes. However, due to concerns about the potential long-term risks and contraindications associated with HRT, we believe that there is a significant need for new therapeutic options to treat vasomotor symptoms.

Our Solution — RAD1901

We are developing RAD1901 as a low dose SERM in an oral formulation for the treatment of vasomotor symptoms. We conducted a Phase 2 proof of concept study in 100 healthy perimenopausal women using four doses of RAD1901 — 10 mg, 25 mg, 50 mg and 100 mg — and placebo. While a classic dose-response effect was not demonstrated, at the 10 mg dose level RAD1901 achieved a statistically significant reduction in the frequency of moderate and severe hot flashes both by linear trend test and by comparison to placebo and in overall hot flashes at either the two-, three- or four-week time-points. A similar reduction in composite score — frequency × severity of hot flashes — was identified at all time-points, with a statistically significant difference from placebo achieved at the two-, three- or four-week time-points.

We anticipate our next clinical study will be a Phase 2b study conducted in approximately 200 perimenopausal women experiencing a high frequency of hot flashes at baseline. The main study endpoints would be an assessment of the change in the frequency and severity of moderate and severe hot flashes.

Our goal is to become a leading provider of therapeutics for osteoporosis and other serious endocrine-mediated diseases. To achieve this goal we plan to:

- •

- advance the development and obtain regulatory approval of Abaloparatide-SC;

- •

- extend the lifecycle of abaloparatide through the continued development of

Abaloparatide-TD;

- •

- establish internal sales and marketing capabilities to commercialize our

product candidates in the United States;

- •

- selectively pursue collaborations to commercialize our product candidates

outside the United States; and

- •

- continue to expand our product portfolio through drug discovery, in-licensing, acquisitions or partnerships.

6

Investing in our common stock involves a high degree of risk. These risks are discussed more fully in the "Risk factors" section of this prospectus. In particular, these risks include:

- •

- We have a short operating history. We currently have no commercial products,

and we have not received regulatory approval for, nor have we generated commercial revenue from, any of our product candidates. If we do not obtain the necessary United States or worldwide regulatory

approvals to commercialize any product candidate, we will not be able to sell our product candidates.

- •

- Most of our product candidates are in early stages of clinical trials. We

cannot predict with any certainty if or when we might submit a New Drug Application, or NDA, for regulatory approval for any of our product candidates or whether any such NDA will be accepted.

- •

- We have a history of net losses and expect to incur substantial losses and

negative operating cash flow for the foreseeable future, and may never achieve or maintain profitability.

- •

- We are heavily dependent on the success of Abaloparatide-SC, which is under

clinical development. We cannot be certain that Abaloparatide-SC will receive regulatory approval or be successfully commercialized even if we receive regulatory approval.

- •

- Clinical trials of our product candidates may not be successful. If we are

unable to obtain required marketing approvals for, commercialize, obtain and maintain patent protection for or gain sufficient market acceptance by physicians, patients and healthcare payers of our

product candidates, or experience significant delays in doing so, our business will be materially harmed and our ability to generate revenue will be materially impaired.

- •

- We rely exclusively on third parties to formulate and manufacture our

product candidates.

- •

- We have no experience selling, marketing or distributing products and currently do not have the internal capacity to do so.

We were incorporated in Delaware on February 4, 2008 under the name MPM Acquisition Corp. In May 2011, we entered into a reverse merger transaction, or the Merger, with our predecessor, Radius Health, Inc., a Delaware corporation formed on October 3, 2003, or the Former Operating Company. Pursuant to the Merger, the Former Operating Company became a wholly-owned subsidiary of ours. Immediately following the Merger, we merged the Former Operating Company with and into us, and we assumed the business of the Former Operating Company and changed our name to "Radius Health, Inc."

Our executive offices are located at 201 Broadway, 6th Floor, Cambridge, MA 02139. Our telephone number is (617) 551-4700. Our website address is www.radiuspharm.com. The information contained in, or that can be accessed through our website is not part of, and is not incorporated into, this prospectus and should not be considered part of this prospectus.

All trademarks appearing in this prospectus are the property of their respective holders.

7

Common stock offered by us |

shares | |

Common stock to be outstanding after the offering |

shares |

|

Option to purchase additional shares of common stock |

We have granted the underwriters a 30-day option to purchase up to an additional shares of our common stock. |

|

Use of proceeds |

We estimate that our net proceeds from this offering will be approximately $ million at an assumed initial public offering price of $ per share, which is the midpoint of the price range set forth on the cover page of this prospectus, after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. We expect to use the net proceeds of this offering to fund the clinical development of our most advanced product candidates and for other general corporate purposes. |

|

Risk factors |

See "Risk factors" beginning on page 12 of this prospectus for a discussion of factors you should carefully consider before you decide to invest in our common stock. |

|

Proposed NASDAQ Global Market symbol |

RDUS |

|

Directed share program |

At our request, the underwriters have reserved up to shares of our common stock offered by this prospectus for sale, at the initial public offering price, to our directors and officers and certain employees and other parties related to us. Shares purchased by our directors and officers will be subject to the 180-day lock-up restriction described in the "Underwriting" section of this prospectus. The number of shares of common stock available for sale to the general public will be reduced to the extent these individuals purchase such reserved shares. Any reserved shares that are not so purchased will be offered by the underwriters to the general public on the same basis as the other shares offered by this prospectus. |

The number of shares of our common stock outstanding after this offering is based on the 47,766,141 shares of our common stock outstanding as of March 31, 2014 and excludes the following potentially dilutive shares of common stock outstanding at March 31, 2014:

- •

- 6,143,839 shares of our common stock issuable upon the exercise of

outstanding stock options at a weighted average exercise price of $3.19 per share;

- •

- 3,547,280 shares of our common stock reserved for future issuance

under our 2011 equity incentive plan; and

- •

- 3,034,683 shares of our common stock issuable upon the exercise of outstanding warrants at a weighted average exercise price of $6.21 per share.

8

Except as otherwise indicated, all information in this prospectus reflects or assumes the following:

- •

- the automatic conversion of all outstanding shares of our convertible

preferred stock at March 31, 2014 into 41,016,469 shares of our common stock in connection with this offering;

- •

- the series B-2 convertible preferred stock will convert into shares

of common stock on a ten-for-one basis, which is dependent upon the initial public offering price in this offering being equal to or greater than $6.142 per share. If the initial public offering price

per share in this offering is less then $6.142, then the number of shares issuable upon conversion of the series B-2 convertible preferred stock will increase. See "Capitalization —

Series B-2 Convertible Preferred Stock";

- •

- the issuance of 5,870,302 shares of our common stock to the holders

of our series B, B-2, A-1, A-2 and A-3 convertible preferred stock in connection with this offering in satisfaction of accumulated dividends as of March 31, 2014, all of which is

described in more detail in the section of this prospectus entitled "Capitalization — Preferred Stock Dividends";

- •

- the effectiveness of our restated certificate of incorporation and amended

and restated bylaws, which will occur concurrently with the closing of this offering;

- •

- no exercise of the outstanding options or warrants described above; and

- •

- no exercise of the underwriters' option to purchase an additional shares of our common stock.

9

You should read the following summary financial data in conjunction with "Selected financial data," "Management's discussion and analysis of financial condition and results of operations" and our financial statements and related notes, all included elsewhere in this prospectus.

We derived the statements of operations data for the years ended December 31, 2013, 2012 and 2011 and the balance sheet data as of December 31, 2013 from our audited financial statements included elsewhere in this prospectus. Our historical results are not necessarily indicative of the results to be expected in the future.

| |

YEARS ENDED DECEMBER 31, | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS DATA:

|

2013 | 2012 | 2011 | |||||||

| |

(in thousands, except share and per share amounts) |

|||||||||

Operating expenses: |

||||||||||

Research and development |

$ | 60,536 | $ | 54,961 | $ | 36,179 | ||||

General and administrative |

6,829 | 9,469 | 5,330 | |||||||

Loss from operations |

(67,365 | ) | (64,430 | ) | (41,509 | ) | ||||

Other income (expense), net |

9,085 | (2,095 | ) | (236 | ) | |||||

Interest (expense) income, net |

(2,410 | ) | (2,603 | ) | (731 | ) | ||||

Net loss |

$ | (60,690 | ) | $ | (69,128 | ) | $ | (42,476 | ) | |

Other comprehensive loss, net of tax: |

||||||||||

Unrealized (loss) gain from available-for-sale securities |

— | (5 | ) | 8 | ||||||

Comprehensive loss |

$ | (60,690 | ) | $ | (69,133 | ) | $ | (42,468 | ) | |

(Loss) earnings attributable to common stockholders — basic and diluted |

$ | (78,161 | ) | $ | (83,120 | ) | $ | 253 | ||

(Loss) earnings per share — basic |

$ | (89.43 | ) | $ | (98.99 | ) | $ | 0.51 | ||

(Loss) earnings per share — diluted |

$ | (89.43 | ) | $ | (98.99 | ) | $ | 0.07 | ||

Weighted average shares — basic |

874,004 | 839,698 | 499,944 | |||||||

Weighted average shares — diluted |

874,004 | 839,698 | 3,454,276 | |||||||

Pro forma loss attributable to common stockholders — basic and diluted(1) (unaudited) |

$ |

(60,690 |

) |

|||||||

Pro forma loss per share — basic(1) (unaudited) |

$ | (1.75 | ) | |||||||

Pro forma loss per share — diluted(1) (unaudited) |

$ | (1.75 | ) | |||||||

Weighted-average common shares used in computing pro forma earnings per share — basic(1) (unaudited) |

34,765,779 | |||||||||

Weighted-average common shares used in computing pro forma earnings per share — diluted(1) (unaudited) |

34,765,779 | |||||||||

- (1)

- For a description of the calculation of basic and diluted pro forma loss attributable to common stockholders and basic and diluted pro forma loss per share, see note 2 to our financial statements included elsewhere in this prospectus.

10

| |

AS OF DECEMBER 31, 2013 | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

BALANCE SHEET DATA:

|

ACTUAL | PRO FORMA(1) | PRO FORMA AS ADJUSTED(1)(2) |

|||||||

| |

(unaudited, in thousands) |

|||||||||

Cash, cash equivalents and marketable securities |

$ | 12,303 | $ | 39,671 | $ | |||||

Working capital |

(22,675 | ) | 13,419 | |||||||

Total assets |

12,758 | 43,524 | ||||||||

Convertible preferred stock(3) |

252,802 | — | ||||||||

Total stockholders' (deficit) equity |

(277,301 | ) | 10,379 | |||||||

- (1)

- Gives

effect to:

- •

- the issuance and sale of 448,060

shares of our series B-2 convertible preferred stock for net proceeds of $27.4 million, which occurred during the first quarter of 2014;

- •

- the declaration of a stock dividend of

29 shares of series A-6 convertible preferred stock, for each outstanding share of series A-5 convertible preferred stock, for a total of 186,847 shares of series A-6

convertible preferred stock. See "Management's Discussion and Analysis of Financial Condition and Results of Operations — Research and Development Agreements" for additional

information;

- •

- the automatic conversion of all

outstanding shares of our convertible preferred stock as of December 31, 2013, giving effect to the shares of series B-2 and A-6 convertible preferred stock described in the previous bullets,

into 41,016,469 shares of our common stock in connection with this offering; and

- •

- the issuance of 5,171,472 shares of

our common stock to the holders of our series B, B-2, A-1, A-2 and A-3 convertible preferred stock in connection with this offering in satisfaction of accumulated dividends as of

December 31, 2013, all of which is described in more detail in the section of this prospectus entitled "Capitalization — Preferred Stock

Dividends."

The third bullet above assumes that the series B-2 convertible preferred stock will convert into shares of common stock on a ten-for-one basis, which is dependent upon the the initial public offering price in this offering being equal to or exceeding $6.142 per share. If the initial public offering price per share in this offering is less than $6.142, then the number of shares issuable upon conversion will increase. See "Capitalization — Series B-2 Convertible Preferred Stock."

- (2)

- Gives further effect to: the issuance and sale of shares of our common stock in this offering at an assumed public offering price of $ per share, which is the midpoint of the price range set forth on the cover page of this prospectus, after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. Each $1.00 increase or decrease in the assumed public offering price of $ per share, which is the midpoint of the price range set forth on the cover page of this prospectus, would increase or decrease each of the pro forma as adjusted cash, cash equivalents and marketable securities, working capital, total assets and total stockholders' equity by approximately $ million, assuming that the number of shares offered by us, as set forth on the cover page of this prospectus, remains the same and after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us. Each increase or decrease of one million shares in the number of shares to be offered by us would increase or decrease each of the pro forma as adjusted cash, cash equivalents and marketable securities, working capital, total assets and total stockholders' equity by approximately $ million, assuming that the public offering price is $ per share, the midpoint of the price range set forth on the cover page of this prospectus, and after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us. The pro forma as adjusted information discussed above is illustrative only and will adjust based on the actual public offering price and other terms of this offering.

11

Investing in our common stock involves a high degree of risk. Before you decide to invest in our common stock, you should carefully consider the following risk factors, together with the other information contained in this prospectus, including our financial statements and the related notes and the information set forth under the heading "Management's discussion and analysis of financial condition and results of operations." Our business results are subject to the following risks, and if any of them occur, our business, financial condition and results of operations could be materially and adversely affected. In this case, the price of our common stock could decline and you could lose all or a part of your investment.

RISKS RELATED TO OUR BUSINESS

Risks related to our financial position and need for capital

We currently have no product revenues and the report of our independent auditors expresses doubt about our ability to continue as a going concern. We will need to raise additional capital, which may not be available on favorable terms, if at all, in order to continue operating our business.

To date, we have generated no product revenues. Until, and unless, we receive approval from the U.S. Food and Drug Administration, or the FDA, and other regulatory authorities for our product candidates, we will not be permitted to sell our drugs and will not have product revenues. Currently, our only product candidates are Abaloparatide-SC, Abaloparatide-TD, RAD1901 and RAD140, and none of these product candidates is approved by the FDA for sale. Therefore, for the foreseeable future, we will have to fund our operations and capital expenditures from cash on hand, borrowings, licensing fees and grants and, potentially, future offerings of our securities. We believe that our existing resources will be sufficient to fund our planned operations into the third quarter of 2014. However, our recurring losses from operations and net capital deficiency raise substantial doubt about our ability to continue as a going concern, which is expressed in the report of our independent auditors. Our financial statements do not include any adjustments that might result from the outcome of this uncertainty. If we fail to obtain additional capital, we may be unable to complete our planned preclinical and clinical trials and obtain approval of any product candidates from the FDA and other regulatory authorities. In addition, we could be forced to discontinue product development, reduce or forego sales and marketing efforts, forego attractive business opportunities or discontinue our operations entirely, in which case you would lose your investment.

We believe that the proceeds from this offering, together with our existing resources, will be sufficient to fund our planned operations into the quarter of . We have based this estimate on assumptions that may prove to be wrong, and we could use up our available capital resources sooner than we currently expect. Our future capital requirements will depend on many factors, including the scope and progress made in our research and development activities and our clinical studies.

We are not currently profitable and may never become profitable.

We have a history of net losses and expect to incur substantial losses and have negative operating cash flow for the foreseeable future, and may never achieve or maintain profitability. We had net losses of $60.7 million, $69.1 million and $42.5 million during the years ended December 31, 2013, 2012 and 2011, respectively. As of December 31, 2013, we had an accumulated deficit of $277.3 million. Even if we succeed in developing and commercializing one or more of our product candidates, we expect to incur substantial losses for the foreseeable future and may never become profitable. We also expect to continue to incur significant operating and capital expenditures and anticipate that our expenses will increase substantially in the foreseeable future as we:

- •

- continue to undertake preclinical development and clinical trials for

product candidates;

- •

- seek regulatory approvals for product candidates;

- •

- implement additional internal systems and infrastructure; and

- •

- hire additional personnel.

12

We also expect to experience negative cash flow for the foreseeable future as we fund our operating losses and capital expenditures. As a result, we will need to generate significant revenues in order to achieve and maintain profitability. Accordingly, unless and until we generate revenues and become profitable, we will need to raise additional capital to continue to operate our business, including after the consummation of this offering. Our failure to achieve or maintain profitability or to raise additional capital could negatively impact the value of our securities.

Our credit facility imposes significant restrictions on our business, and if we default on our obligations, the lenders would have a right to foreclose on substantially all our assets.

In May 2011, we entered into our $25.0 million credit facility with General Electric Capital Corporation, or GECC, as agent and lender, and Oxford Finance LLC, as lender. We drew $12.5 million under our credit facility during 2011 and we drew the remaining $12.5 million on May 29, 2012. Our credit facility contains a number of covenants that impose significant operating and financial restrictions on us. These covenants limit our ability to:

- •

- dispose of our business or certain assets;

- •

- change our business, management, ownership or business locations;

- •

- incur additional debt or liens;

- •

- make certain investments or declare dividends;

- •

- acquire or merge with another entity for consideration in excess of an

allowable amount;

- •

- engage in transactions with affiliates; or

- •

- encumber our intellectual property.

Our credit facility may limit our ability to finance future operations or capital needs or to engage in, expand or pursue our business activities. It may also prevent us from engaging in activities that could be beneficial to our business and our stockholders unless we repay the outstanding debt, which may not be desirable or possible.

We have pledged substantially all of our assets other than our intellectual property to secure our obligations under our credit facility. If we default on our obligations and are unable to obtain a waiver for such a default, the lenders would have a right to accelerate the debt and terminate all commitments under our credit facility. They would also have the right to foreclose on the pledged assets, including our cash and cash equivalents and the proceeds from this offering. Any such action on the part of lenders against us would significantly harm our business and our ability to operate.

Raising additional capital may cause dilution to our existing stockholders, restrict our operations or require us to relinquish rights to our technologies or product candidates.

Until such time, if ever, as we can generate substantial product revenues, we expect to finance our cash needs through a combination of equity offerings, debt financings, collaborations, strategic alliances, licensing arrangements and other marketing and distribution arrangements. We do not have any committed external source of funds. To the extent that we raise additional capital through the sale of equity or convertible debt securities, your ownership interest will be diluted, and the terms of these securities may include liquidation or other preferences that adversely affect your rights as a stockholder. Debt financing, if available, may involve agreements that include covenants limiting or restricting our ability to take specific actions, such as incurring additional debt, making capital expenditures or declaring dividends. If we raise additional funds through marketing and distribution arrangements or other collaborations, strategic alliances or licensing arrangements with third parties, we may have to relinquish valuable rights to our technologies, future revenue streams, research programs or product candidates, or we may need to grant licenses on terms that may not be favorable to us. If we are unable to raise additional funds through equity or debt financings when needed, we may be required to delay, limit, reduce or terminate our product development or commercialization efforts or grant rights to develop and market product candidates that we would otherwise prefer to develop and market ourselves.

13

We are a company with a limited operating history upon which to base an investment decision.

We are a company with a limited operating history and have not demonstrated an ability to perform the functions necessary for the successful commercialization of any product candidates. The successful commercialization of any product candidates will require us to perform a variety of functions, including:

- •

- continuing to undertake preclinical development and clinical trials;

- •

- participating in regulatory approval processes;

- •

- formulating and manufacturing products; and

- •

- conducting sales and marketing activities.

Our operations have been limited to organizing and staffing our company, acquiring, developing and securing our proprietary technology and undertaking preclinical and clinical trials of our product candidates. These operations provide a limited basis for you to assess our ability to commercialize our product candidates and the advisability of investing further in our securities.

Our financial results may fluctuate from quarter to quarter, which makes our results difficult to predict and could cause our results to fall short of expectations.

Our financial results may fluctuate as a result of a number of factors, many of which are outside of our control. For these reasons, comparing our financial results on a period-to-period basis may not be meaningful, and you should not rely on our past results as an indication of our future performance. Our revenues, if any, may fluctuate from quarter to quarter and our future quarterly and annual expenses as a percentage of our revenues may be significantly different from those we have recorded in the past or which we expect for the future. Our financial results in some quarters may fall below expectations. Any of these events as well as the various risk factors listed in this "Risk Factors" section could adversely affect our financial results and cause our stock price to fall.

Risks related to the discovery, development and commercialization of our product candidates

We are heavily dependent on the success of Abaloparatide-SC, which is under clinical development. We cannot be certain that Abaloparatide-SC will receive regulatory approval or be successfully commercialized even if we receive regulatory approval.

Abaloparatide-SC is our only product candidate in late stage clinical development, and our business currently depends heavily on its successful development, regulatory approval and commercialization. We have no drug products for sale currently and may never be able to develop marketable drug products. The research, testing, manufacturing, labeling, approval, sale, marketing and distribution of drug products are subject to extensive regulation by the FDA and other regulatory authorities in the United States and other countries, which regulations differ from country to country. We are not permitted to market Abaloparatide-SC in the United States unless and until we receive approval of a New Drug Application, or NDA, from the FDA, or in any foreign countries unless and until we receive the requisite approval from regulatory authorities in foreign countries. In addition, the approval of Abaloparatide-TD as a line extension to Abaloparatide-SC is dependent on the earlier approval of Abaloparatide-SC. We have not submitted an NDA to the FDA or comparable applications to regulatory authorities in other countries. Obtaining approval of an NDA is an extensive, lengthy, expensive and uncertain process, and any approval of Abaloparatide-SC may be delayed, limited or denied for many reasons, including:

- •

- we may not be able to demonstrate that abaloparatide is safe and effective

as a treatment for osteoporosis to the satisfaction of the FDA;

- •

- the results of our clinical studies may not meet the level of statistical or

clinical significance required by the FDA for marketing approval;

- •

- the FDA may disagree with the number, design, size, conduct or implementation of our clinical studies;

14

- •

- any clinical research organizations, or CROs, that we have retained or may

in the future retain, to conduct clinical studies may take actions outside of our control that materially adversely impact our clinical studies;

- •

- the FDA may not find the data from preclinical studies and clinical studies

sufficient to demonstrate that abaloparatide's clinical and other benefits outweigh its safety risks;

- •

- the FDA may disagree with our interpretation of data from our preclinical

studies and clinical studies or may require that we conduct additional studies;

- •

- the FDA may not accept data generated at our clinical study sites;

- •

- the FDA may require development of a Risk Evaluation and Mitigation

Strategy, or REMS, as a condition of approval;

- •

- if our NDA is reviewed by an advisory committee, the FDA may have

difficulties scheduling an advisory committee meeting in a timely manner or the advisory committee may recommend against approval of our application or may recommend that the FDA require, as a

condition of approval, additional preclinical studies or clinical studies, limitations on approved labeling or distribution and use restrictions; or

- •

- the FDA may identify deficiencies in the manufacturing processes or facilities of our third-party manufacturers.

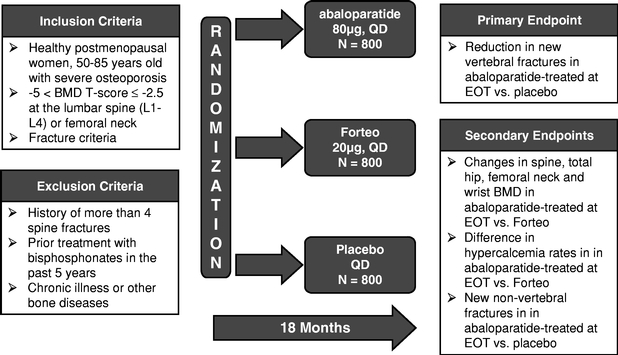

In addition, the FDA may change its approval policies or adopt new regulations. For example, on February 15, 2012, we received a letter from the FDA stating that, after internal consideration, the agency believes that a minimum of 24-month fracture data are necessary for approval of new products for the treatment of postmenopausal osteoporosis. Our ongoing Abaloparatide-SC pivotal Phase 3 clinical study is designed to produce fracture data based on an 18-month primary endpoint. Based on our discussions with the FDA, we believe that continued use of the 18-month primary endpoint will be acceptable, provided that our NDA includes the 24-month fracture data derived from a 6-month extension of the abaloparatide 80 µg and placebo groups in our Phase 3 study, which groups will receive an approved alendronate (generic Fosamax) therapy for osteoperosis management. We plan to submit our NDA with the 24-month fracture data. We cannot be certain that the FDA will be supportive of this plan, will not change this approval policy again or will not adopt other approval policies or regulations that adversely affect any NDA that we may submit, the occurrence of any of which may further delay FDA approval.

Before we submit an NDA to the FDA for Abaloparatide-SC as a treatment for osteoporosis, we must complete our pivotal Phase 3 study based upon 18-month fracture data, a carcinogenicity study in rats, and bone quality studies in rats and monkeys. We also may need to complete several additional studies, including, but not limited to, a thorough QT Phase 1 study, a Phase 1 pharmacokinetic, or PK, study in renal patients, a Phase 1 absolute bioavailability PK study and several drug interaction studies. Not all of these studies have commenced and the results of these studies will have an important bearing on the approval of abaloparatide. In addition to fracture and bone mineral density, or BMD, our pivotal Phase 3 study will measure a number of other potential safety indicators, including blood calcium levels, orthostatic hypotension, nausea, dizziness and anti-abaloparatide antibodies, which may have an important bearing on the approval of abaloparatide.

We cannot assure you that we will receive the approvals necessary to commercialize any of our product candidates, including Abaloparatide-SC, Abaloparatide-TD, RAD1901 and RAD140, or any product candidate we may acquire or develop in the future. We will need FDA approval to commercialize our product candidates in the United States and approvals from regulatory authorities in foreign jurisdictions to commercialize our product candidates in those jurisdictions. In order to obtain FDA approval of any product candidate, we must submit to the FDA an NDA demonstrating that the product candidate is safe for humans and effective for its indicated use. This demonstration requires significant research and animal tests, which are referred to as preclinical studies, as well as human tests, which are referred to as clinical trials. Satisfaction of the FDA's regulatory requirements typically takes many years, depends upon the type, complexity and novelty of the product candidate and requires substantial resources for research, development and testing. We cannot predict whether our research and clinical approaches will result in

15

drugs that the FDA considers safe for humans and effective for indicated uses. The FDA has substantial discretion in the drug approval process and may require us to conduct additional preclinical and clinical testing or to perform post-marketing studies. The approval process may also be delayed by changes in government regulation, future legislation or administrative action or changes in FDA policy that occur prior to or during its regulatory review, such as the request we received from the FDA with respect to providing a minimum of 24-month fracture data for approval of abaloparatide. Delays in obtaining regulatory approvals may:

- •

- delay commercialization of, and our ability to derive product revenues from,

our product candidates;

- •

- impose costly procedures on us; and

- •

- diminish any competitive advantages that we may otherwise enjoy.

Even if we comply with all FDA requests, the FDA may ultimately reject one or more of our NDAs. We may never obtain regulatory clearance for any of our product candidates. Failure to obtain FDA approval of any of our product candidates will severely undermine our business by leaving us without a saleable product, and therefore without any source of revenues, until another product candidate can be developed. There is no guarantee that we will ever be able to develop or acquire any product candidate.

In foreign jurisdictions, we must receive approval from the appropriate regulatory authorities before we can commercialize any drugs. Foreign regulatory approval processes generally include all of the risks associated with the FDA approval procedures described above. We cannot assure you that we will receive the approvals necessary to commercialize any of our product candidates for sale outside the United States.

Clinical trials are very expensive, time-consuming and difficult to design and implement.

Human clinical trials are very expensive and difficult to design and implement, in part because they are subject to rigorous regulatory requirements. A substantial portion of our abaloparatide development costs are denominated in euros and any adverse movement in the dollar/euro exchange rate will result in increased costs and require us to raise additional capital to complete the development of our products. The clinical trial process is also time consuming. Furthermore, failure can occur at any stage of the trials, and we could encounter problems that cause us to abandon or repeat clinical trials. The commencement and completion of clinical trials may be delayed by several factors, including:

- •

- changes in government regulation, administrative action or changes in FDA

policy with respect to clinical trials that change the requirements for approval;

- •

- unforeseen safety issues;

- •

- determination of dosing issues;

- •

- lack of effectiveness during clinical trials;

- •

- slower than expected rates of patient recruitment and enrollment;

- •

- inability to monitor patients adequately during or after treatment; and

- •

- inability or unwillingness of medical investigators to follow our clinical protocols.

In addition, we, the FDA, or other regulatory authorities and ethics committees with jurisdiction over our studies may suspend our clinical trials at any time if it appears that we are exposing participants to unacceptable health risks or if the FDA or other authorities find deficiencies in our regulatory submissions or the conduct of these trials. Therefore, we cannot predict with any certainty the schedule for existing or future clinical trials. Any such unexpected expenses or delays in our clinical trials could increase our need for additional capital, which may not be available on favorable terms or at all.

Most of our product candidates are in early stages of clinical trials.

Except for Abaloparatide-SC and Abaloparatide-TD, each of our other product candidates (i.e., RAD1901 and RAD140) is in early stages of development and requires extensive preclinical and clinical testing. We cannot predict with any certainty if or when we might submit an NDA for regulatory approval for any of our product candidates or whether any such NDA will be accepted.

16

The results of our clinical trials may not support our product candidate claims.

Even if our clinical trials are completed as planned, we cannot be certain that the results will support our product candidate claims. Success in preclinical testing and early clinical trials does not ensure that later clinical trials will be successful, and we cannot be sure that the results of later clinical trials will replicate the results of prior clinical trials and preclinical testing. For example, our Phase 3 trial of Abaloparatide-SC for fracture prevention may not replicate the positive efficacy results for BMD from our two Phase 2 trials. The clinical trial process may fail to demonstrate that our product candidates are safe for humans and effective for indicated uses. This failure would cause us to abandon a product candidate and may delay development of other product candidates. Any delay in, or termination of, our clinical trials will delay the filing of our NDAs with the FDA and, ultimately, our ability to commercialize our product candidates and generate product revenues. In addition, our clinical trials to date have involved small patient populations. Because of the small sample sizes, the results of these clinical trials may not be indicative of future results.

If serious adverse or undesirable side effects are identified during the development of our product candidates, we may need to abandon our development of some of our product candidates.

All of our product candidates are still in preclinical or clinical development. It is impossible to predict when or if any of our product candidates will prove effective or safe in humans or will receive regulatory approval, if ever. If our product candidates result in undesirable side effects or have characteristics that are unexpected, we may need to abandon their development.

Any product candidate for which we obtain marketing approval could be subject to restrictions or withdrawal from the market and we may be subject to penalties if we fail to comply with regulatory requirements or if we experience unanticipated problems with our products, when and if any of them are approved.

Any product candidate for which we obtain marketing approval, along with the manufacturing processes, post-approval clinical data, labeling, advertising and promotional activities for such product, will be subject to continual requirements of and review by the FDA and other regulatory authorities. These requirements include submissions of safety and other post-marketing information and reports, registration and listing requirements, current good manufacturing practices, or cGMP, requirements relating to quality control, quality assurance and corresponding maintenance of records and documents, requirements regarding the distribution of samples to physicians and recordkeeping. Even if we obtain marketing approval of a product candidate, the approval may be subject to limitations on the indicated uses for which the product may be marketed or to the conditions of approval, or contain requirements for costly post-marketing testing and surveillance to monitor the safety or efficacy of the product. The FDA closely regulates the post-approval marketing and promotion of drugs to ensure drugs are marketed only for the approved indications and in accordance with the provisions of the approved labeling. The FDA imposes stringent restrictions on manufacturers' communications regarding off-label use and, if we do not market our products for their approved indications, we may be subject to enforcement action for off-label marketing.

In addition, later discovery of previously unknown problems with our products, manufacturers or manufacturing processes, or failure to comply with regulatory requirements, may yield various results, including:

- •

- restrictions on such products, manufacturers or manufacturing processes;

- •

- restrictions on the labeling or marketing of a product;

- •

- restrictions on product distribution or use;

- •

- requirements to conduct post-marketing clinical trials;

- •

- warning or untitled letters;

- •

- withdrawal of the products from the market;

- •

- refusal to approve pending applications or supplements to approved

applications that we submit;

- •

- voluntary or mandatory recall of products and related publicity

requirements;

- •

- fines, restitution or disgorgement of profits or revenue;

- •

- suspension or withdrawal of marketing approvals;

- •

- refusal to permit the import or export of our products;

- •

- product seizure; or

- •

- injunctions or the imposition of civil or criminal penalties.

17

The commercial success of any product candidates that we may develop will depend upon the degree of market acceptance by physicians, patients, healthcare payers and others in the medical community.

Even if the FDA approves one or more of our product candidates, physicians and patients may not accept and use them. Acceptance and use of any of our products will depend upon a number of factors including:

- •

- perceptions by members of the healthcare community, including physicians,

about the safety and effectiveness of our drug;

- •

- cost-effectiveness of our product relative to competing products;

- •

- availability of coverage and reimbursement for our product from government

or other healthcare payers; and

- •

- effectiveness of marketing and distribution efforts by us and our licensees and distributors, if any.

Because we expect sales of our current product candidates, if approved, to generate substantially all of our product revenues for the foreseeable future, the failure of these drugs to gain market acceptance would harm our business and would require us to seek additional financing.

We may expend our limited resources to pursue a particular product candidate or indication and fail to capitalize on product candidates or indications that may be more profitable or for which there is a greater likelihood of success.

Because we have limited financial and managerial resources, we narrowly focus on research programs and product candidates that we identify for specific indications. As a result, we may forego or delay pursuit of opportunities with other product candidates or for other indications that later prove to have greater commercial potential. Our resource allocation decisions may cause us to fail to capitalize on viable commercial products or profitable market opportunities. Our spending on current and future research and development programs and product candidates for specific indications may not yield any commercially viable products. If we do not accurately evaluate the commercial potential or target market for a particular product candidate, we may relinquish valuable rights to that product candidate through collaboration, licensing or other royalty arrangements in cases in which it would have been more advantageous for us to retain sole development and commercialization rights to such product candidate.

If we experience delays in the enrollment of patients in our clinical trials, our receipt of necessary regulatory approvals could be delayed or prevented.

We may not be able to initiate or continue clinical trials for some of our product candidates if we are unable to locate and enroll a sufficient number of eligible patients to participate in these trials as required by the FDA or other regulatory authorities. In addition, many of our competitors have ongoing clinical trials for product candidates that could be competitive with our product candidates, and patients who would otherwise be eligible for our clinical trials may instead enroll in clinical trials of our competitors' product candidates.

Enrollment delays in our clinical trials may result in increased development costs for our product candidates, which would cause the value of the company to decline and limit our ability to obtain additional financing. Our inability to enroll a sufficient number of patients for any of our current or future clinical trials would result in significant delays or may require us to abandon one or more clinical trials altogether.

Risks related to our dependence on third parties

Our drug development program depends upon third-party researchers, investigators and collaborators who are outside our control.

We depend upon independent researchers, investigators and collaborators, such as Nordic, to conduct our preclinical and clinical trials under agreements with us. These third parties are not our employees and we cannot control the amount or timing of resources that they devote to our programs. These third parties may not assign as great a priority to our programs or pursue them as diligently as we would if we were undertaking such programs ourselves. If outside collaborators fail to devote sufficient time and resources to our drug-development programs, or if their performance is substandard, the approval of our FDA

18

applications, if any, and our introduction of new drugs, if any, will be delayed. These collaborators may also have relationships with other commercial entities, some of whom may compete with us. If our collaborators assist competitors at our expense, our competitive position would be harmed.

If a regulatory or governmental authority determines that a financial interest in the outcome of the Phase 3 study of Abaloparatide-SC by any of the entities managing our Phase 3 clinical trial affected the reliability of the data from the Phase 3 clinical trial, our ability to use the data for our planned regulatory submissions could be compromised, which could harm our business and the value of our common stock.

The Phase 3 clinical trial and subsequent extension studies of Abaloparatide-SC are being managed by Nordic at certain clinical sites operated by the Center for Clinical and Basic Research, or CCBR, a leading global CRO with extensive experience in global osteoporosis registration studies. Nordic controls, and holds an ownership interest in, the local CCBR clinical sites. The clinical trial investigators are employees of CCBR and may also hold an equity interest in the local CCBR clinical trials.

In consideration of Nordic's management of our Phase 3 clinical trial and subsequent extension studies, we have agreed to make various cash payments to Nordic denominated in both euros and U.S. dollars over the course of the Phase 3 study equal to a total of up to approximately €48.6 million ($67.0 million) and a total of up to approximately $4.4 million plus up to an additional $5.0 million in aggregate performance incentive payments, payable in cash or stock depending on the timing of the closing of this offering. We also agreed to sell shares of capital stock to Nordic that were exchanged in the Merger for 6,443 shares of our series A-5 convertible preferred stock for proceeds of approximately $0.5 million. These shares of our series A-5 convertible preferred stock will automatically convert into 64,430 shares of our common stock upon the listing of our common stock on the NASDAQ Global Market. Pursuant to the terms of our agreements with Nordic, we will also issue to Nordic shares of stock with an aggregate value of up to approximately €44.3 million ($61.0 million) and $0.8 million in consideration of Nordic's management of the Phase 3 clinical trial. These shares of stock accrue or have accrued at a quarterly rate based on the progress of the Phase 3 clinical trial at a price per share equal to $8.142. On each of December 31, 2013 and March 31, 2014, our board of directors declared a stock dividend to pay all shares of stock that had accrued as of such dates and that are anticipated to accrue through December 31, 2014, representing an aggregate of 682,958 shares of our series A-6 convertible preferred stock that will automatically convert into 6,829,580 shares of our common stock in connection with this offering. Following the consummation of this offering, all compensation remaining payable to Nordic in consideration of their management of our Phase 3 clinical trial will be paid in cash.

The fair market value of our common stock may be subject to wide fluctuations in response to various factors, many of which are beyond our control, including any negative outcome of the Phase 3 clinical trial. Accordingly, the shares of stock that have issued to Nordic in consideration of Nordic's management of the Phase 3 clinical trial may be less than the full value originally anticipated under our agreements with Nordic, assuming Nordic did not expect the fair market value of our stock to fluctuate widely over the term of such agreements. As a result, the total consideration that Nordic will receive in cash and stock may be viewed by Nordic to be below the market price paid by other companies for comparable clinical trial services.