Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ASSOCIATED BANC-CORP | d712732d8k.htm |

| EX-99.1 - EX-99.1 - ASSOCIATED BANC-CORP | d712732dex991.htm |

ASSOCIATED

BANC-CORP

1Q 2014 EARNINGS PRESENTATION

APRIL 17, 2014

Exhibit 99.2

*

*

*

* |

FORWARD-LOOKING

STATEMENTS

Important

note

regarding

forward-looking

statements:

Statements

made

in

this

presentation

which

are

not

purely

historical

are

forward-looking

statements,

as

defined

in

the

Private

Securities

Litigation

Reform

Act

of

1995.

This

includes

any

statements

regarding

management’s

plans,

objectives,

or

goals

for

future

operations,

products

or

services,

and

forecasts

of

its

revenues,

earnings,

or

other

measures

of

performance.

Such

forward-looking

statements

may

be

identified

by

the

use

of

words

such

as

“believe”,

“expect”,

“anticipate”,

“plan”,

“estimate”,

“should”,

“will”,

“intend”,

“outlook”,

or

similar

expressions.

Forward-

looking

statements

are

based

on

current

management

expectations

and,

by

their

nature,

are

subject

to

risks

and

uncertainties.

Actual

results

may

differ

materially

from

those

contained

in

the

forward-looking

statements.

Factors

which

may

cause

actual

results

to

differ

materially

from

those

contained

in

such

forward-looking

statements

include

those

identified

in

the

Company’s

most

recent

Form

10-K

and

subsequent

SEC

filings.

Such

factors

are

incorporated

herein

by

reference.

1 |

2014

FIRST QUARTER HIGHLIGHTS 2

Balance Sheet Growth drives Solid Earnings

•

Average loans of $16.2 billion were up $416 million, or 3% from the fourth

quarter •

Net interest income net of interest recoveries of $164 million was up $1 million

from the fourth quarter

–

Net interest margin of 3.12% compared to 3.17% in the first quarter 2013

•

Quarterly dividend of $0.09 / common share

•

Repurchased 2.3 million shares of common stock during the first quarter

•

Capital

ratios

remain

very

strong

with

a

Tier

1

common

equity

ratio

of

11.20%

•

Noninterest income of $74 million was down $2 million compared to the fourth

quarter •

Noninterest expense of $168 million was down $12 million from the fourth

quarter •

Net income available to common shareholders of $44 million or $0.27 per share

•

Pretax income of $66 million was up $4 million, or 7% from the fourth

quarter •

Return on Tier 1 Common Equity of 9.4%

Net Interest Income

&

Net Interest Margin

Noninterest Income

&

Expenses

Capital

Balance Sheet

Net Income

&

ROT1CE

–

Total average commercial loans grew a record $420 million from the fourth

quarter –

Average mortgage loans grew 2% from the fourth quarter

–

Efficiency ratio improved from the fourth quarter to 69%

|

LOAN

PORTFOLIO COMPOSITION 3

Average Loans of $16.2 billion for First Quarter of 2014

1Q 2014 Average Net Loan Change (+$416 mln)

Loan Mix –

1Q 2014 (Average)

($ in millions)

Home Equity & Installment

Commercial Real Estate

Residential Mortgage

Power & Utilities

Oil & Gas

Mortgage Warehouse

General Commercial Loans

Average Quarterly Loans ($ in billions)

+5%

% Chg

+3%

+21%

+2%

(21%)

(3%)

+7%

Total

Commercial &

Business

Lending

+4% |

COMMERCIAL LINE UTILIZATION TRENDS

4

Line utilization increased in all Commercial lines of business

Increase from 4Q 13

CRE + 110 bps

Specialized + 170 bps

Commercial + 200 bps |

GROWING

NET INTEREST INCOME WHILE MARGIN COMPRESSES

5

Yield on Interest-earning Assets

Cost of Interest-bearing Liabilities

Net Interest Income & Net Interest Margin

($ in millions)

Net Interest Margin |

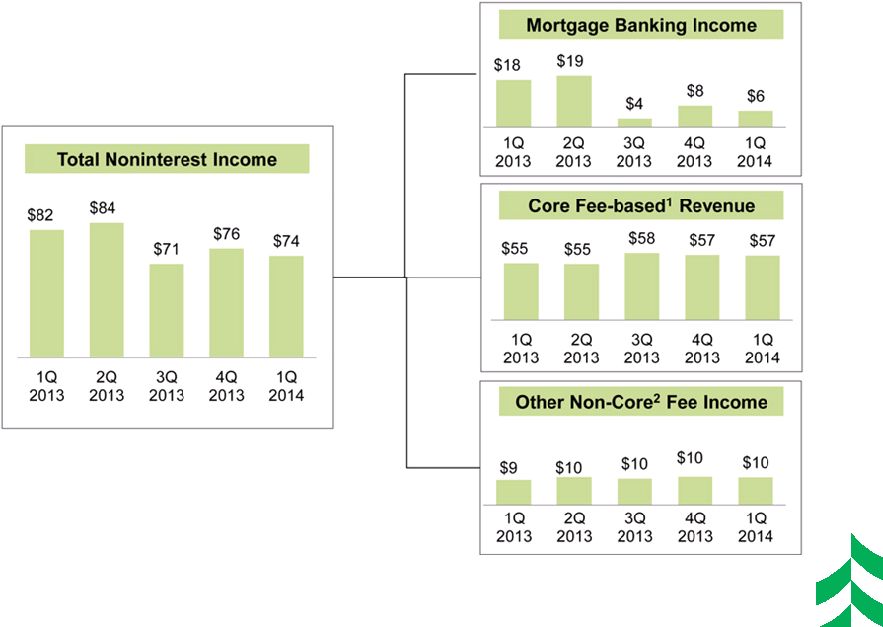

NONINTEREST INCOME TRENDS

($ IN MILLIONS)

6

1

–

Core

Fee-based

Revenue

=

Trust

service

fees

plus

Service

charges

on

deposit

accounts

plus

Card-based

and

other

non

deposit

fees

plus

Insurance

commissions

plus

Brokerage

and

annuity

commissions.

This

is

a

non-GAAP

measure.

Please

refer

to

press

release

tables

for

more

information.

2

–

Other

Non-core

Fee

Income

=

Total

Noninterest

Income

minus

Core

Fee-based

Revenue

minus

Mortgage

Banking

Income. |

NONINTEREST EXPENSE TRENDS

($ IN MILLIONS)

7

1

–

Efficiency

ratio

=

Noninterest

expense,

excluding

amortization

of

intangibles,

divided

by

sum

of

taxable

equivalent

net

interest

income

plus

noninterest

income,

excluding

investment

securities

gains,

net,

and

asset

gains,

net.

This

is

a

non-GAAP

financial

measure.

Please

refer

to

the

appendix

for

a

reconciliation

of

this.

2

–

FTE

=

Average

Full

Time

Equivalent

Employees

3

–

Technology

Spend

=

Data

Processing

and

Equipment

expenses

4

–

Other

Non-Personnel

Spend

=

Total

Noninterest

Expense

less

Personnel

and

Technology

spend |

IMPROVEMENT IN CREDIT QUALITY INDICATORS

($ IN MILLIONS)

8 |

STRONG

CAPITAL PROFILE & SUSTAINED EARNINGS

•

Current capital levels are well in excess

of “well-capitalized”

regulatory

benchmarks

–

Existing capital levels are already

above Basel III capital levels

9

Tier 1 Common Equity Ratio

Net Income Available to Common & ROT1CE

Net Income Available

to Common

($ in millions)

Return on Tier 1

Common Equity

Definition of Tier 1 Common Equity:

Tier

1

Common

Equity

(T1CE),

a

non-GAAP

financial

measure,

is

used

by

banking

regulators,

investors

and

analysts

to

assess

and

compare

the

quality

and

composition of our capital with the capital of other financial services companies.

Management uses Tier 1 common equity, along with other capital measures, to assess

and

monitor

our

capital

position.

Tier

1

Common

Equity

is

Tier

1

capital

excluding

qualifying

perpetual

preferred

stock

and

qualifying

trust

preferred

securities. |

2014

OUTLOOK 10

Asset Growth

Deposits / Funding

Mix

Margin

Noninterest

Income

Noninterest

Expense

Capital

Provision

•

Annual

average loan growth of 6-8%

•

High single digit average deposits and other funding growth

•

Continued modest NIM compression

•

NII down slightly. Mortgage banking income decline offset by

other fee categories growth

•

Flat compared to 2013 with continued focus on efficiency

initiatives

•

Continue to follow stated corporate priorities for capital

deployment

•

Provision will grow based on expected loan growth |

APPENDIX

11

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

* |

RECONCILIATION AND DEFINITIONS OF

NON-GAAP ITEMS

12

1Q 2013

2Q 2013

3Q 2013

4Q 2013

1Q 2014

Efficiency Ratio Reconciliation:

Efficiency ratio (1)

70.03%

69.01%

71.45%

73.70%

70.41%

Taxable equivalent adjustment

(1.46)

(1.38)

(1.50)

(1.49)

(1.35)

Asset gains (losses), net

0.24

(0.01)

0.59

0.80

0.22

Other intangible amortization

(0.42)

(0.41)

(0.44)

(0.42)

(0.42)

Efficiency ratio, fully taxable equivalent (1)

68.39%

67.21%

70.10%

72.59%

68.86%

(1)

Efficiency

ratio

is

defined

by

the

Federal

Reserve

guidance

as

noninterest

expense

divided

by

the

sum

of

net

interest

income

plus

noninterest

income, excluding investment securities gains / losses, net. Efficiency

ratio, fully taxable equivalent, is noninterest expense, excluding other

intangible amortization, divided by the sum of taxable equivalent net interest

income plus noninterest income, excluding investment securities gains /

losses, net and asset gains / losses, net. This efficiency ratio is presented on a taxable equivalent basis, which adjusts net interest

income for the tax-favored status of certain loans and investment

securities. Management believes this measure to be the preferred industry

measurement of net interest income as it enhances the comparability of net interest

income arising from taxable and tax-exempt sources and it excludes

certain specific revenue items (such as investment securities gains / losses, net and asset gains / losses, net). |