Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ALLIANCE DATA SYSTEMS CORP | form_8k.htm |

©2014 ADS Alliance Data Systems, Inc. Confidential and Proprietary Earnings Release | April 17, 2014 * Alliance Data NYSE: ADS First Quarter Results April 17, 2014 Exhibit 99.1

©2014 ADS Alliance Data Systems, Inc. Confidential and Proprietary Earnings Release | April 17, 2014 * Agenda Speakers: Ed Heffernan President and CEO Charles Horn EVP and CFO Bryan Pearson EVP and President - LoyaltyOne First Quarter 2014 Consolidated Results Segment Results Liquidity 2014 Outlook Raising 2014 Guidance

©2014 ADS Alliance Data Systems, Inc. Confidential and Proprietary Earnings Release | April 17, 2014 * First Quarter 2014 Consolidated Results (MM, except per share) Note: EPS is ‘net income attributable to ADS stockholders per diluted share’. Core EPS is ‘core earnings attributable to ADS stockholders per diluted share’. Adjusted EBITDA, net is ‘adjusted EBITDA net of funding costs and non-controlling interest’. Quarter Ended March 31, Quarter Ended March 31, 2014 2013 % Change Revenue $ 1,233 $ 1,053 +17% EPS $ 2.08 $ 1.92 +8% Core EPS $ 2.79 $ 2.55 +9% Adjusted EBITDA, net $ 335 $ 326 +3% Diluted shares outstanding 66.1 67.3 -2% Phantom shares 5.7 10.1 Organic revenue increased a robust 8 percent compared to the first quarter of 2013. Acquisition costs related to BrandLoyalty reduced core EPS by $0.04.

©2014 ADS Alliance Data Systems, Inc. Confidential and Proprietary Earnings Release | April 17, 2014 * LoyaltyOne (MM) BrandLoyalty contributed $112 million in revenue and $14 million ($9 million, net) in adjusted EBITDA. Unfavorable FX rates reduced revenue and adjusted EBITDA, net by $19 million and $5 million, respectively. AIR MILES reward miles issued decreased 4 percent due to weak consumer spend. Quarter Ended March 31, Quarter Ended March 31, 2014 2013 % Change Revenue $ 329 $ 241 +37% Adjusted EBITDA $ 71 $ 63 +13% Non-controlling interest -6 0 Adjusted EBITDA, net $ 65 $ 63 +4% Adjusted EBITDA % 22% 26% -4% Key Metrics: AIR MILES® reward miles issued 1,147 1,192 -4% AIR MILES reward miles redeemed 1,056 1,104 -4% Average FX rate 0.91 0.99 -0.8%

©2014 ADS Alliance Data Systems, Inc. Confidential and Proprietary Earnings Release | April 17, 2014 * LoyaltyOne BrandLoyalty A leader in transactional and emotional loyalty creating change in consumer behavior through promotional campaign-driven loyalty programs Primarily offered through grocers Combination of Data Loyal ROI, consistent with the Alliance Data model Program generally runs for 12 – 20 weeks Consumer points can be collected in paper form or digitally Currently operates in Europe, Asia and Latin America Opportunity to further expand in these countries as well as expand into new markets Consistent history of driving high-single-digit organic revenue growth Acquisition structure and accounting: Alliance Data acquired 60 percent of BrandLoyalty, with options to acquire the remaining 40 percent ownership stake over a four-year period There is an earn-out arrangement for 2014 related to the original 60 percent purchase, which, if met, could result in a one-time P&L charge under purchase accounting Revenue is recorded gross, while EPS, core EPS and adjusted EBITDA are recorded net of the 40 percent non-controlling interest

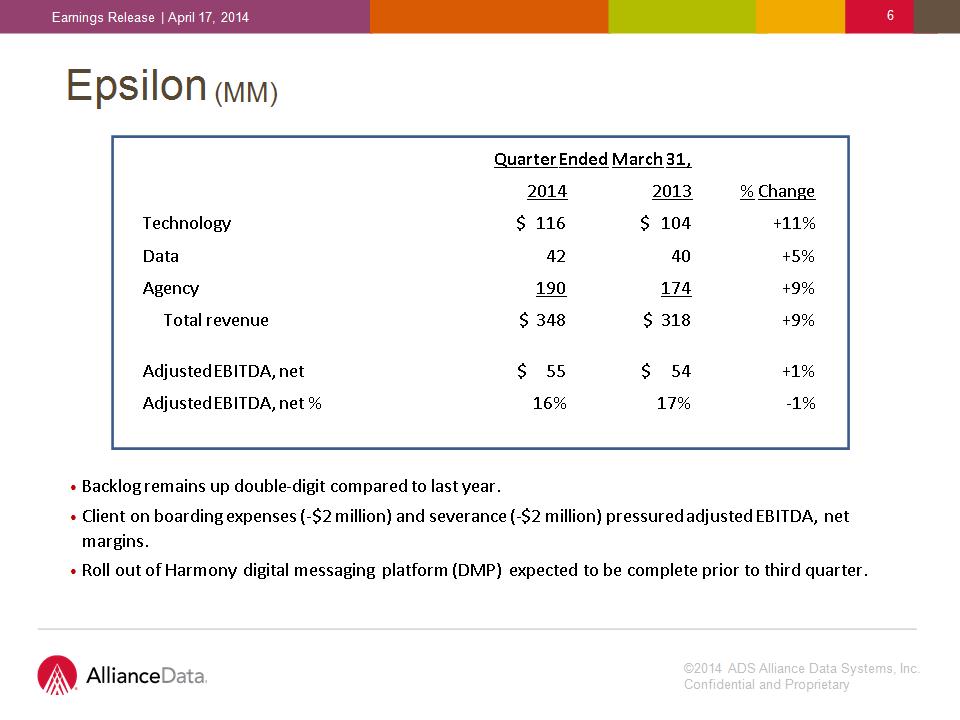

©2014 ADS Alliance Data Systems, Inc. Confidential and Proprietary Earnings Release | April 17, 2014 * Epsilon (MM) Backlog remains up double-digit compared to last year. Client on boarding expenses (-$2 million) and severance (-$2 million) pressured adjusted EBITDA, net margins. Roll out of Harmony digital messaging platform (DMP) expected to be complete prior to third quarter. Quarter Ended March 31, Quarter Ended March 31, 2014 2013 % Change Technology $ 116 $ 104 +11% Data 42 40 +5% Agency 190 174 +9% Total revenue $ 348 $ 318 +9% Adjusted EBITDA, net $ 55 $ 54 +1% Adjusted EBITDA, net % 16% 17% -1%

©2014 ADS Alliance Data Systems, Inc. Confidential and Proprietary Earnings Release | April 17, 2014 * Private Label Services and Credit (MM) Revenue increased 13 percent on a 15 percent increase in average credit card receivables. Operating expenses (primarily payroll) increased 26 percent for the first quarter, as approximately 1,000 employees were added to support expected growth. Funding costs decreased 30 basis points as a percentage of average credit card receivables. Quarter Ended March 31, Quarter Ended March 31, 2014 2013 % Change Finance charges, net $ 536 $ 477 +12% Other revenue 26 20 +28% Total revenue $ 562 $ 497 +13% Operating expenses 216 172 +26% Provision for loan losses 71 67 +6% Funding costs 31 31 0% Adjusted EBITDA, net $ 244 $ 227 +7% Adjusted EBITDA, net % 43% 46% -3%

©2014 ADS Alliance Data Systems, Inc. Confidential and Proprietary Earnings Release | April 17, 2014 * Private Label Services and Credit (MM) The decrease in gross yield is due to the influence of new programs. The yield for core programs was essentially flat compared to the first quarter of 2013. Normalized principal loss rates (adjusted for fair value accounting treatment of acquired portfolios) were up slightly in the first quarter, but are expected to be flat for 2014. Quarter Ended March 31, Quarter Ended March 31, 2014 2013 Change Key metrics: Total gross yield* 28.0% 28.6% -0.6% Credit sales $ 3,614 $ 3,096 +17% Average credit card receivables $ 8,023 $ 6,964 +15% Ending credit card receivables $ 8,089 $ 7,027 +15% Principal loss rates 4.8% 4.5% +0.3% Normalized principal loss rates 4.9% 4.7% +0.2% Delinquency rate 3.9% 3.8% +0.1% Return on average assets 6.4% 6.5% -0.1% * Annualized total revenue divided by average credit card receivables.

©2014 ADS Alliance Data Systems, Inc. Confidential and Proprietary Earnings Release | April 17, 2014 * Liquidity Liquidity Corporate: $1.1 billion in usable liquidity at March 31, 2014 $345 million convertible notes mature May 15, 2014 (~$1.9 billion* current fair value) Convertible noteholders will receive 100 percent cash ($345 million from Alliance Data; $1.55 billion from counterparties under hedge agreement) Alliance Data would issue 5.1 million shares to counterparties at a later date (warrants already included in diluted share count) Debt levels remain moderate; leverage ratio of 2.3x at March 31, 2014 Banks: $3.4 billion of available liquidity at March 31, 2014 $75 million in dividends to parent during quarter Comenity Bank regulatory ratios at March 31, 2014 were Tier 1: 16 percent; Leverage: 15 percent; Total Risk-based: 17 percent Repurchase Program $115 million of $400 million board authorization spent year-to-date; 453 thousand shares acquired * Not the final valuation, thus amounts are subject to change.

©2014 ADS Alliance Data Systems, Inc. Confidential and Proprietary Earnings Release | April 17, 2014 * 2013 2014 14/13 Actual New Guidance Increase Average ADS share price $192 $270* +$78 Revenue $4,319 $5,250 +22% Core Earnings $669 $766 +14% Diluted shares outstanding 66.9 62.5 -7% Core EPS $10.01 $12.25 +22% 2014 Updated Guidance ($MM, except per share) * 1st quarter average +9% organic Weak Canadian dollar is a headwind – expected FX rates of $0.91 vs. $0.97 last year drag of $55 million to revenue and 17 cents to core EPS Revenue guidance increased $110 million due to stronger expected performances at BrandLoyalty, Epsilon and Private Label. Core EPS guidance increased by $0.05.

©2014 ADS Alliance Data Systems, Inc. Confidential and Proprietary Earnings Release | April 17, 2014 * 2014 Outlook LoyaltyOne: AIR MILES: revenue up low single-digits, adjusted EBITDA, net up mid single-digits (constant currency) Revenue dampened by lower redemption rate AIR MILES issuance goal of +4 percent, same as 2013 actuals; some risk (~1 percent) due to pharmacy legislation BrandLoyalty: trending stronger Revenue of $550 million versus $500 million initial guidance Organic revenue growth over 20 percent Brazil: scale, scale, scale – grow members 2011: 1.6 million 2012: 6.0 million 2013: 10.8 million Q1, 2014: 12 million Rule of thumb: ~2.5 Dotz equivalent to 1 AIR MILES collector due to different spend profile Epsilon: High single-digit organic revenue growth Heavy spend to ramp up record loyalty/marketing platform builds 23+ builds in 2014, compared to historical levels of about 15 2014 wins tracking to record 2013 levels New digital messaging platform (Harmony) roll-out…. so far, so good. Second quarter is key.

©2014 ADS Alliance Data Systems, Inc. Confidential and Proprietary Earnings Release | April 17, 2014 * Private Label: New client growth Historically, 5 new clients per year (~$375 million A/R vintage) 2012: we signed our first $1 billion A/R vintage 2013: we signed our first $2 billion A/R vintage 2014: tracking to another $2 billion A/R vintage - Virgin America (airline), Venus (online fashion), DSW (footwear), IDD (diamond jewelry) Tender share growth: For our core retail clients (pre-2012), we continue to drive card sales growth more than double that of our clients’ total sales growth (Q1: 7 percent ADS vs. flat client total ) Results: Credit card portfolio growth of about 20 percent Principal loss rates stable and funding rates down Personnel increase (+1,000 people) dampened revenue flow through to earnings during the first quarter; expect leveraging in back half of 2014 Outlook: mid/high teens growth in revenue; double-digit growth in adjusted EBITDA, net for 2014 2014 Outlook (cont.)

©2014 ADS Alliance Data Systems, Inc. Confidential and Proprietary Earnings Release | April 17, 2014 * No let up in shift of marketing dollars into data-driven marketing and loyalty programs. For Alliance Data, we have four objectives – 1. Organic revenue of approximately 9 percent or 3x GDP 2. Overall revenue growth of 22 percent BrandLoyalty, Epsilon and Private Label are all running strong, with some dampening from weak Canadian dollar at LoyaltyOne 3. Core EPS growth of 22 percent Includes significant front-loading of expenses (headcount) at Private Label and Epsilon to handle record growth expectations 4. Building the foundation for the future Deliver strong performance, while on boarding record new business (and related expenses), which does not help 2014, but benefits 2015, 2016 and 2017 2014 Outlook (cont.)

©2014 ADS Alliance Data Systems, Inc. Confidential and Proprietary Earnings Release | April 17, 2014 * Q & A

©2014 ADS Alliance Data Systems, Inc. Confidential and Proprietary Earnings Release | April 17, 2014 * Safe Harbor Statement and Forward-Looking Statements This presentation may contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Such statements may use words such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “predict,” “project,” “would” and similar expressions as they relate to us or our management. When we make forward-looking statements, we are basing them on our management’s beliefs and assumptions, using information currently available to us. Although we believe that the expectations reflected in the forward-looking statements are reasonable, these forward-looking statements are subject to risks, uncertainties and assumptions, including those discussed in our filings with the Securities and Exchange Commission. If one or more of these or other risks or uncertainties materialize, or if our underlying assumptions prove to be incorrect, actual results may vary materially from what we projected. Any forward-looking statements contained in this presentation reflect our current views with respect to future events and are subject to these and other risks, uncertainties and assumptions relating to our operations, results of operations, growth strategy and liquidity. We have no intention, and disclaim any obligation, to update or revise any forward-looking statements, whether as a result of new information, future results or otherwise, except as required by law. “Safe Harbor” Statement under the Private Securities Litigation Reform Act of 1995: Statements in this presentation regarding Alliance Data Systems Corporation’s business which are not historical facts are “forward-looking statements” that involve risks and uncertainties. For a discussion of such risks and uncertainties, which could cause actual results to differ from those contained in the forward-looking statements, see “Risk Factors” in the Company’s Annual Report on Form 10-K for the most recently ended fiscal year. Risk factors may be updated in Item 1A in each of the Company’s Quarterly Reports on Form 10-Q for each quarterly period subsequent to the Company’s most recent Form 10-K.

©2014 ADS Alliance Data Systems, Inc. Confidential and Proprietary Earnings Release | April 17, 2014 * Financial Measures In addition to the results presented in accordance with generally accepted accounting principles, or GAAP, the Company may present financial measures that are non-GAAP measures, such as constant currency financial measures, adjusted EBITDA, adjusted EBITDA margin, adjusted EBITDA net of funding costs and non-controlling interest, core earnings and core earnings per diluted share (core EPS). The Company believes that these non-GAAP financial measures, viewed in addition to and not in lieu of the Company’s reported GAAP results, provide useful information to investors regarding the Company’s performance and overall results of operations. These metrics are an integral part of the Company’s internal reporting to measure the performance of reportable segments and the overall effectiveness of senior management. Reconciliations to comparable GAAP financial measures are available on the Company’s website. The financial measures presented are consistent with the Company’s historical financial reporting practices. Core earnings and core earnings per diluted share represent performance measures and are not intended to represent liquidity measures. The non-GAAP financial measures presented herein may not be comparable to similarly titled measures presented by other companies, and are not identical to corresponding measures used in other various agreements or public filings.