Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - SunGame Corp | Financial_Report.xls |

| EX-32.1 - EXHIBIT321 - SunGame Corp | exhibit321.htm |

| EX-31.1 - EXHIBIT311 - SunGame Corp | exhibit311.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10K

ANNUAL REPORT FOR 2013

þ Annual report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the Fiscal Year Ended: 31 December 2013

o Transition report pursuant to section 13 or 15(d) of the Securities Exchange Act of 1934

For the Transition Period from _______________ to _______________.

SUNGAME CORP.

(Exact name of registrant as specified in its charter)

|

DELAWARE

|

**-*******

|

|

State or other jurisdiction of incorporation

|

IRS Employer Identification Number

|

|

3091 West Tompkins Avenue, Las Vegas, Nevada 89103

|

|

|

Address of principal Executive offices

|

|

|

Registrants telephone number

|

(702) 789-0848

|

|

Securities Registered pursuant to §12(b) of the Act:

|

|

|

Title of Each Class

|

Name of Each Exchange on which registered

|

|

N/A

|

|

|

Securities Registered pursuant to §12(g) of the Act

|

|

|

COMMON VOTING SHARES, $0.001 PV, OTCBB

|

|

|

Title of Class

|

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act o Yes þ No

Indicate by check mark if the registrant is not required to file reports pursuant to §13 or §13(d) of the Act o Yes þ No

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. þ Yes o No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). o Yes þ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statement incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (check one):

|

Large accelerated filer o

|

Accelerated filer o

|

|

Non-accelerated filer o

|

Smaller Reporting Company þ

|

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No þ

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter.

|

As of date

|

Non-affiliate shares

|

Closing Price

|

Market Value

|

|

28 June 2013

|

9,555,734

|

$4.50

|

$43,000,803

|

Indicate the number of the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date.

|

As of Date

|

Issued and Outstanding

|

|

31 December 2013

|

177,758,067

|

|

11 April 2014

|

177,758,067

|

DOCUMENTS INCORPORATED BY REFERENCE

List hereunder the following documents if incorporated by reference and the Part of the Form 10-K (e.g., Part I, Part II, etc.) into which the document is incorporated: (1) Any annual report to security holders; (2) Any proxy or information statement; and (3) Any prospectus filed pursuant to Rule 424(b) or (c) under the Securities Act of 1933.

None

SUNGAME CORP.

A Developmental Stage Company

|

Part & Item

|

Section

|

Page

|

|

PART I

|

||

|

ITEM 1.

|

3 | |

|

ITEM 1A.

|

10 | |

|

ITEM 1B.

|

10 | |

|

ITEM 2.

|

10 | |

|

ITEM 3.

|

10 | |

|

ITEM 4.

|

10 | |

|

PART II

|

||

|

ITEM 5.

|

11 | |

|

ITEM 6.

|

14 | |

|

ITEM 7.

|

15 | |

|

ITEM 7A.

|

18 | |

|

ITEM 8.

|

19 | |

|

ITEM 9.

|

20 | |

|

ITEM 9A.

|

21 | |

|

ITEM 9B.

|

21 | |

|

PART III

|

||

|

ITEM 10.

|

22 | |

|

ITEM 11.

|

23 | |

|

ITEM 12.

|

25 | |

|

ITEM 13.

|

26 | |

|

ITEM 14.

|

26 | |

|

PART IV

|

||

|

ITEM 15.

|

27 | |

| 27 | ||

References in this Annual Report to, the terms “Company”, “Sungame Corp.”, “SGMZ”, “Sungame”, “Freevi”, “we”, “us” and “our” refer to Sungame Corp., unless otherwise stated or the context clearly indicates otherwise.

Forward Looking Statements

This report contains forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended (the “1934 Act”) and Section 27A of the Securities Act of 1933 (the “1933 Act”). Any statements contained in this report that are not statements of historical fact may be forward-looking statements. When we use the words “anticipates,” “plans,” “expects,” “believes,” “should,” “could,” “may,” “will” and similar expressions, we are identifying forward-looking statements. Further, all statements that express expectations, estimates, forecasts or projections are forward-looking statements within the meaning of the 1933 Act and 1934 Act, respectively. Forward-looking statements involve risks and uncertainties, which may cause our actual results, performance or achievements to be materially different from those expressed or implied by forward-looking statements. These factors include our limited experience with our business plan; pricing pressures on our product caused by competition; the risk that our products will not gain market acceptance; our ability to obtain additional financing; our ability to protect intellectual property; and our ability to attract and retain key employees.

Except as may be required by applicable law, we do not undertake or intend to update or revise our forward-looking statements, and we assume no obligation to update any forward-looking statements contained in this report as a result of new information or future events or developments. Thus, you should not assume that our silence over time means that actual events are bearing out as expressed or implied in such forward-looking statements. You should carefully review and consider the various disclosures we make in this report and our other reports filed with the Securities and Exchange Commission (“SEC”) that attempt to advise interested parties of the risks, uncertainties and other factors that may affect our business.

PART I

This annual report on Form 10-K contains forward-looking statements that are based on current expectations, estimates, forecasts and projections about the Company, us, our future performance, our beliefs and our Management's assumptions. In addition, other written or oral statements that constitute forward-looking statements may be made by us or on our behalf. Words such as “expects,” “anticipates,” “targets,” “goals,” “projects,” “intends,” “plans,” “believes,” “seeks,” “estimates,” or variations of such words and similar expressions are intended to identify such forward-looking statements. These statements are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict or assess. Therefore, actual outcomes and results may differ materially from what is expressed or forecast in such forward-looking statements. Except as required under the federal securities laws and the rules and regulations of the SEC, we do not have any intention or obligation to update publicly any forward-looking statements after the filing of this Form 10-K, whether as a result of new information, future events, changes in assumptions or otherwise.

History

Sungame Corporation was organized under the laws of the State of Delaware on November 14, 2006 as Sungame International, Inc. On November 17, 2006, we changed our name to Sungame Corporation. The Company merged with Freevi Corporation on April 15, 2011.

Overview

Background and History

We are an early development stage company. Prior to the merger with Freevi Corporation, Sungame was in the process of establishing 3D virtual world communities. Sungame (also known as the “Company”), trading under the symbol “SGMZ”, is the Company behind the Flightdeck.tv content management and discovery platform. Sungame also uses the brand “Freevi” from time to time as a d.b.a., as it acquired Freevi Corp. and the brand has retained its value sufficient to keep using the brand Freevi. Sungame’s mission is simple: to enrich people’s lives by becoming a leading social networking, content creation, content discovery and distribution platform. Integral to the site’s functionality is a central aggregation engine that excels at serving targeted, focused and high quality content and social media interactions based on the user’s specific interests and past usage history. Other tools available on the website are designed to simplify content creation and distribution for content producers, while providing these artists an engaged audience interested in consuming this content. Sungame is also the Company behind Vidirectory, a video based business directory that simplifies online marketing for small businesses.

Sungame builds products that support its mission by creating utility for users, developers and advertisers:

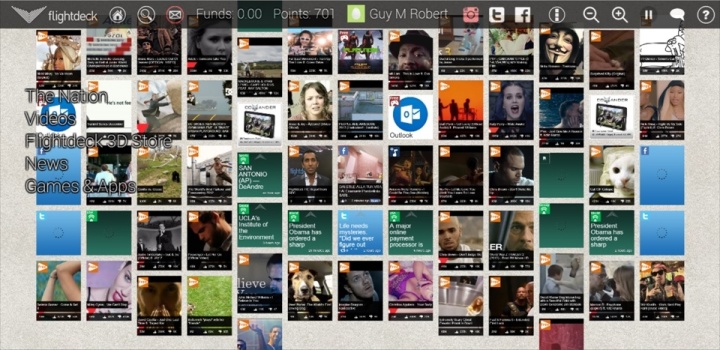

FLIGHTDECK

The Flightdeck platform is designed to be a web-based homepage that is able to pull social media, news and content feeds from all over the web into one easy to manage central location. This aggregation of feeds will allow Flightdeck members to integrate all their most important online activities into one completely customizable homepage. The platform’s chat functionality is designed to allow users to interact with their user’s Twitter and Facebook friends, as they use the platform. Flightdeck will allow users to post content and links to all their social media accounts through a central location inside the website. The platform will enhance user’s content consumption experience by layering in unique chat and sharing features, while they watch movies, listen to music or play games.

Flightdeck is designed to be the ultimate content discovery, distribution and consumption platform. The platform’s main differentiation compared to competing platforms is likely to include the platform’s multi-medium focus on audio, video, text and social content. The Flightdeck recommendation engine learns from tens of millions of small user interactions which improves the platform’s ability to serve content that is relevant to the interest and taste of the user. Flightdeck’s mission therefore is to become the user’s central online homepage that they can use to access all their social media and content needs.

Figure 1: Flightdeck landing page

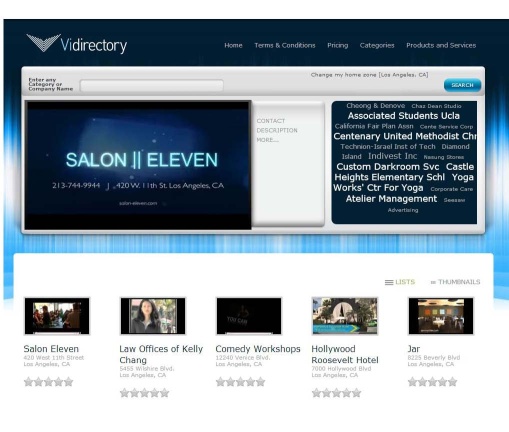

VIDIRECTORY

Sungame will also offer Vidirectory a business directory service designed to help businesses attract customers to their online and physical location by providing increased online visibility under the Company’s Vidirectory service offering, Sungame provides both free and paid products to local businesses. Vidirectory will allow businesses to create a free online business account and claim an individual page for each of their businesses locations. With their complimentary business accounts, businesses can view business trends1, message customers2, update information3 and update their product prices and inventory. Premium versions of this directory listing service allows local businesses to promote themselves as a sponsored search result on the shopping platform when users are searching for related product keywords or are visiting related business pages.

Figure 2: Vidirectory landing page

__________________

1 e.g., statistics and charts reflecting the performance of a business’s page on the platform

2 e.g., by replying to customer inquiries either publicly or privately

3 e.g., address, hours of operation

Platform Features

CENTRAL SOCIAL MEDIA HUB FUNCTIONALITY

Flightdeck’s social media aggregation bundles multiple social media accounts into one single channel for each user so everything from Instagram photos, Facebook status updates, tweets and Soundcloud tracks can be found in one easy to access place. The platform’s differentiation will lie in its unique user experience, which will allow users to chat, share and consume content at the same time.

THE FD POST

The platform allows users to simultaneously broadcast updates to multiple social media websites without ever having to leave the platform. The feature will allow users to significantly streamline their sharing, communication and networking activity across social media platforms. This will allow user and content producers to post content to their Facebook, Twitter, LinkedIn and other social media accounts with a single click of the button.

USER PROFILING AND CONTENT DISCOVERY

The Flightdeck system has been built to offer users seamless content discovery through automatic interest and past usage analysis and profiling. The Flightdeck user profiling system allows the end-user experience to transition from having to search for the content they are looking for to a more organic and natural “curated content” strategy, where the user is exposed to relevant content and social media interactions automatically.

VILLAGES

Flightdeck will feature a community discussion board or a villages feature designed to discuss, collaborate and fund creative projects together. All users are able to apply to become members of different villages or creative projects, where they can contribute by either funding or volunteering for projects. This will allow users and content producers to connect and make creative projects happen.

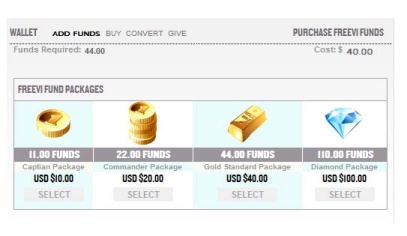

SHARED ECONOMY

The Company will actively incentivize user engagement, usage and referrals through the use of its virtual currency system. Users will be able to either redeem these points for cash, through licensed debt cards, or use it to purchase the different content as well as fund other user’s creative projects. This virtual system will also provide independent artists a way to monetize the content they produce.

Figure 4: Shared Economy Wallet

Business Model

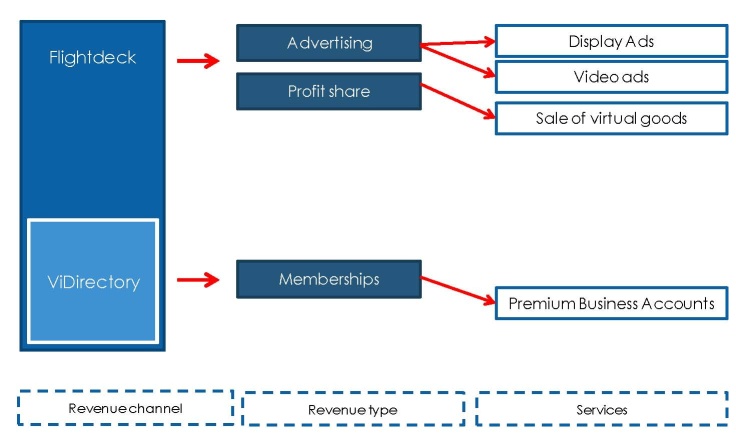

Flightdeck will generate revenue by monetizing both individual users and businesses. In regard to individuals, revenue will be generated through banner and video advertising, as well as the profit share deriving from our apps store. In regard to businesses, Sungame offers the possibility of inclusion in its database and platforms with both Free and Premium offerings.

Figure 5: Sungame’s business model

Sungame will also offer businesses several versions of a premium Vidirectory service offering complete with varying features at a variety of different price points. Fees for businesses looking to create a customized video listing for their business will be required to choose between silver, gold and platinum packages.

Figure 6: Vidirectory Business Membership Offering

Value Proposition

|

Flightdeck’s primary value proposition is its successful functional integration of video streaming, social media, shopping and apps into one easy to use platform.

Access to high quality and original content will increase the long term customer value and increase unique visits, and engagement of the platform's users. The platform’s recommendation engine is expected to significantly streamline the content discovery process and increase consumption of high quality targeted content.

The platforms will also generate significant user interest by monetizing and rewarding users based on their engagement and usage of the website. This will provide users a strong economic incentive to use the website over other competing platforms. Developed with a content creator centric approach, Flightdeck will provide content producers a revenue sharing deal that is significantly better than agreements other larger content sites offer their content creators.

Access to a large number of engaged users will allow the platform to connect these users with small businesses through its Vidirectory service. The service will allow these businesses a proven video-based online marketing strategy at an affordable price.

|

|

Future developments

Although a growing number of users is without question very relevant as a Company goal in 2014, Sungame’s team and its endless desire to grow and expand has already set up a few more objectives for the near term.

The first would be to make Sungame’s service available on mobile and tablet devices. The incredible growth in these segments of the market speaks for itself and Sungame wants to take advantage of a large potential adoption in that market.

Sungame has began selling glasses free 3D tablets on a limited scale. The Company is limiting the scale of its 3D tablet sales to make sure the manufacturing and logistics proceess is sound before committing to larger quantities, and has secured funding to place higher quantity orders through deposits from resellers and its master distributor.

|

|

Number Of Persons Employed

As of December 31, 2013, we have 5 full-time employees.

We are a smaller reporting company as defined by Rule 12b-2 of the Securities Exchange Act of 1934 and are not required to provide information under this item.

We are a smaller reporting company as defined by Rule 12b-2 of the Securities Exchange Act of 1934 and are not required to provide information under this item.

We do not own any property, real or otherwise. Our operations are principally located at 3091 West Tompkins Avenue, Las Vegas, NV 89103. We pay market price in rent.

The Company was involved in litigation in Colorado during 2012. Broadway Holdings, Inc. (Broadway) vs. Sungame Corporation. The suit was a breach of contract by Broadway Holdings, Inc. filed on or about August 2, 2011, in the District Court, Denver County, Colorado. The case was settled on December 24, 2012. All claims and counterclaims were dismissed in the confidential settlement. All Sungame shares held by the Broadway Plaintiffs shareholders amounting to 10,780 shares were cancelled in 2013.

Item 4. Mine Safety Disclosures.

Not applicable.

PART II

Our common stock is quoted on the OTC Bulletin Board (the "OTCBB:) under the symbol SGMZ.

Quotations on the OTCBB reflect inter-dealer prices, without retail mark-up, markdown or commission and may not reflect actual transactions. Our common stock will be subject to certain rules adopted by the SEC that regulate broker-dealer practices in connection with transactions in “penny stocks.” Penny stocks generally are securities with a price of less than $5.00, other than securities registered on certain national exchanges or quoted on the system, provided that the exchange or system provides current price and volume information with respect to transaction in such securities. The additional sales practice and disclosure requirements imposed upon broker-dealers are and may discourage broker-dealers from effecting transactions in our shares which could severely limit the market liquidity of the shares and impede the sale of shares in the secondary market.

The penny stock rules require broker-dealers, prior to a transaction in a penny stock not otherwise exempt from the rules, to make a special suitability determination for the purchaser to receive the purchaser's written consent to the transaction prior to sale, to deliver standardized risk disclosure documents prepared by the SEC that provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer must also provide the customer with current bid and offer quotations for the penny stock. In addition, the penny stock regulations require the broker-dealer to deliver, prior to any transaction involving a penny stock, a disclosure schedule prepared by the SEC relating to the penny stock market, unless the broker-dealer or the transaction is otherwise exempt. A broker-dealer is also required to disclose commissions payable to the broker-dealer and the registered representative and current quotations for the securities. Finally, a broker-dealer is required to send monthly statements disclosing recent price information with respect to the penny stock held in a customer's account and information with respect to the limited market in penny stocks.

|

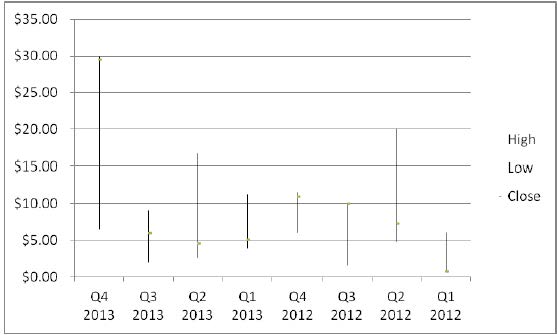

Historical Equity Sales Prices for the Prior two Fiscal Years

|

|||

|

Quarter

|

High

|

Low

|

Dividend Declared

|

|

Year ended 31 December 20134

|

|||

|

4th Quarter

|

$30.00

|

$6.50

|

None

|

|

3rd Quarter

|

$9.00

|

$2.00

|

None

|

|

2nd Quarter

|

$16.75

|

$2.60

|

None

|

|

1st Quarter

|

$11.25

|

$3.87

|

None

|

|

Year ended 31 December 20124

|

|||

|

4th Quarter

|

$11.50

|

$6.00

|

None

|

|

3rd Quarter

|

$10.00

|

$1.55

|

None

|

|

2nd Quarter

|

$20.00

|

$4.75

|

None

|

|

1st Quarter

|

$6.00

|

$3.50

|

None

|

_____________

4 As reported by OTCBB, based upon the historical High and Low as of the last trading day of the quarter, adjusted for splits.

Graphical depiction of quarterly prices.

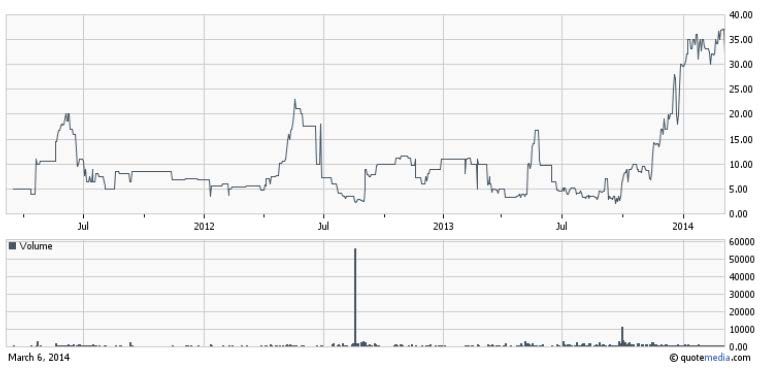

Actual price performance chart

We have not paid any dividends to shareholders. There are no restrictions which would limit our ability to pay dividends on common equity or that are likely to do so in the future. The Delaware Revised Statutes, however, do prohibit us from declaring dividends where, after giving effect to the distribution of the dividend; we would not be able to pay our debts as they become due in the usual course of business; or our total assets would be less than the sum of the total liabilities plus the amount that would be needed to satisfy the rights of shareholders who have preferential rights superior to those receiving the distribution.

As of December 31, 2013, we have 33 shareholders of record of our common stock pursuant to transfer agent records, not including various positions at the Depository Trust & Clearing Company. (“CEDE”).

No Issuer repurchases of any class were made during 2013.

|

Issuer Purchases of Equity Securities

|

||||

|

Period

|

(a)

Total number

of shares

(or units) purchased

|

(b)

Average price

paid per share

(or unit)

|

(c)

Total number of

shares (or units)

purchased as part

of publically

announced plans

or programs

|

(d)

Maximum number

(or approximate

dollar volume)

of shares

(or units) that

may yet be

purchased under

the plans or program

|

|

Quarter 1, 2013

|

-0-

|

-0-

|

-0-

|

-0-

|

|

Quarter 2, 2013

|

-0-

|

-0-

|

-0-

|

-0-

|

|

Quarter 3, 2013

|

-0-

|

-0-

|

-0-

|

-0-

|

|

Quarter 4, 2013

|

-0-

|

-0-

|

-0-

|

-0-

|

|

Totals

|

-0-

|

-0-

|

-0-

|

-0-

|

We have sold securities within the past three years without registering the securities under the Securities Act of 1933 as shown in the following table:

|

Securities sold by the Issuer within the past three years which were not registered

|

||||||||

|

Date

|

Class

|

Amount

|

Underwriter

|

Consideration5

|

Exemption

|

Conversion

|

Use of Proceeds

|

|

|

11/20/13

|

CS

|

79,333

|

None

|

$238,000

|

4 (a) (2)

|

N/A

|

OPEX & Inv.

|

|

|

9/13/13

|

CS

|

10,000

|

None

|

$30,000

|

4 (a) (2)

|

N/A

|

OPEX & Inv.

|

|

|

8/23/13

|

CS

|

18,000

|

None

|

$54,000

|

4 (a) (2)

|

N/A

|

OPEX & Inv.

|

|

|

6/13/13

|

CS

|

1,000

|

None

|

$3,000

|

4 (a) (2)

|

N/A

|

OPEX & Inv.

|

|

|

5/29/13

|

CS

|

7,500

|

None

|

$22,500

|

4 (a) (2)

|

N/A

|

OPEX & Inv.

|

|

|

5/23/13

|

CS

|

10,000

|

None

|

$30,000

|

4 (a) (2)

|

N/A

|

OPEX & Inv.

|

|

|

4/24/13

|

CS

|

68,000

|

None

|

$204,000

|

4 (a) (2)

|

N/A

|

OPEX & Inv.

|

|

|

4/15/2011

|

CS

|

300,000

|

None

|

Merger related services

|

4 (a) (2)

|

N/A

|

OPEX 6

|

|

|

4/15/2011

|

CS

|

25,000

|

None

|

Merger related services

|

4 (a) (2)

|

N/A

|

OPEX 6

|

|

Class - CS – Common Voting Shares

Exemption - 4 (a) (2) – Securities and Exchange Act of 1933, as amended, §4 (a) (2)

Use of Proceeds – INV – inventory, OPEX – Operating Expense

_____________

5 No underwriting discounts or commissions are applicable.

6 Shares were issued for services which were expensed by Sungame.

Exemptions From Registration For Unregistered Sales

All of the sales by the Company of the unregistered securities listed immediately above were made by the Company in reliance upon Section 4(2) of the Act. All of the individuals and/or entities listed above that purchased the unregistered securities were all known to the Company and its management, through pre-existing business relationships, as long standing business associates, friends, and employees. All purchasers were provided access to all material information, which they requested, and all information necessary to verify such information and were afforded access to management of the Company in connection with their purchases. All purchasers of the unregistered securities acquired such securities for investment and not with a view toward distribution, acknowledging such intent to the Company. All certificates or agreements representing such securities that were issued contained restrictive legends, prohibiting further transfer of the certificates or agreements representing such securities, without such securities either being first registered or otherwise exempt from registration in any further resale or disposition.

|

Equity Compensation Plan Information

|

|||

|

Plan Category

|

Number of

securities to be

issued upon exercise

of outstanding options,

warrants and rights

|

Weighted average

exercise price

of outstanding options,

warrants and rights

|

Number of

securities remaining

available for future

issuance under

equity compensation

plans (excluding

securities reflected

in column a))

|

|

(a)

|

(b)

|

(c)

|

|

|

Equity compensation plans approved by shareholders

|

-0-

|

-0-

|

-0-

|

|

Equity compensation plans not approved by shareholders7

|

8,334,0007

|

$0.001

|

5,334,0007

|

|

Total

|

-0-

|

-0-

|

-0-

|

We are a smaller reporting company as defined by Rule 12b-2 of the Securities Exchange Act of 1934 and Regulation S-K and are not required to provide information under this item.

______________

7 One employment agreement with Guy Robert includes an equity option, which dates to the merger of Freevi and Sungame. In the employment agreement, the options are only exercisable upon a trading volume of 500,000 average daily volume.

Statements contained in this report, which are not historical facts, may be considered forward looking information with respect to plans, projections, or future performance of the Company as defined under the Private Securities Litigation Act of 1995. These forward-looking statements are subject to risks and uncertainties, which could cause actual results to differ materially from those projected. The words “anticipate”, “believe”, “estimate”, “expect”, “objective”, and “think” or similar expressions used herein are intended to identify forward-looking statements. The forward-looking statements are based upon the Company’s current views and assumptions and involve risks and uncertainties that include, among other things, the effects of the Company’s business, actions of competitors, changes in laws and regulations, including accounting standards, employee relations, customer demand, prices of purchased material and parts, domestic economic conditions, including housing starts and changes in consumer disposable income, and foreign economic conditions, including currency rate fluctuations. Some or all of the facts are beyond the Company’s control.

The following discussion and analysis should be read in conjunction with our audited financial statements and related footnotes included elsewhere in this report, which provide additional information concerning the Company’s financial activities and condition.

COMPARATIVE ANALYSIS YEAR ENDED DECEMBER 31, 2013 AND DECEMBER 31, 2012

Critical Accounting Policies and Estimates

The discussion and analysis of our financial condition and results of operations are based upon our financial statements, which have been prepared in accordance with generally accepted accounting principles. The preparation of these financial statements requires us to make estimates and judgments that affect the reported amounts of assets, liabilities, revenue, and expenses and related disclosure of contingent assets and liabilities. On an ongoing basis, we evaluate our estimates. We based our estimates on historical experiences and on various other assumptions that we believe to be reasonable under the circumstances. These estimates and assumptions provide a basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources. Actual results may differ from these estimates under different assumptions or conditions, and these differences may be material.

Risks And Uncertainties

We operate in an emerging industry that is subject to market acceptance and technological change. Our operations are subject to significant risks and uncertainties, including financial, operational, technological and other risks associated with operating an emerging business, including the potential risk of business failure.

Revenue Recognition

We recognize revenue from tablet sales when the products are shipped since title to the products has passed when the tablets leave our shipping area. We have no advertising revenues to date but will recognize advertising revenues as advertising services are provided in the future.

Capitalized Software Costs

Capitalized software costs are capitalized when technological feasibility is proven. These costs are amortized over the estimated life of the related assets.

Long Lived Assets

“Long-lived assets” are reviewed for impairment of value whenever events or changes in circumstances indicate that the carrying value of the assets might not be recoverable or at least at the end of each reporting period. Conditions that would necessitate an impairment assessment include a significant decline in the observable market value of an asset, a significant change in the extent or manner in which an asset is used, or a significant adverse change that would indicate that the carrying value of an asset is not recoverable. For Long-lived assets to be held and used, management measures fair value based on quoted market prices or based on discounted estimates of future cash flows.

Income Taxes

We have effectively provided a full valuation allowance for the tax effects of our net operating losses during the years ended December 31, 2013 and December 31, 2012 and for the period from inception (October 21, 2010) to December 31, 2013 to offset the deferred tax asset that might otherwise have been recognized as a result of operating losses in the current period and prior periods since, because of our history of operating losses, management is unable to conclude at this time that realization of such benefit is currently more likely than not.

Recent Accounting Pronouncements

There were no recent accounting pronouncements that would have a significant effect on our future financial position, results of operations, and operating cash flows.

- 15 -

Liquidity and Capital Resources

We had $237,786 cash as of December 31, 2013 compared to $2,604 at December 31, 2012. This net increase of $235,183 consisted of cash provided by financing activities of $84,125 and cash provided by operating activities of $309,058 offset by cash used for investing activities of $158,000. Cash provided by financing activities consisted of stock sales and subscriptions totaling $343,976 and related party net payments of $289,851. Cash provided by operating activities was primarily our operating loss of $1,412,558 and an increase in prepaid expenses of $416,000 for amounts paid in advance to our tablet manufacturer for the year ended December 31, 2013, offset by deposits on future tablet sales and prepaid advertising of $1,875,253, an increase in accounts payable of $130,133, depreciation and amortization of $74,735, and compensatory stock issuance of $90,500. Cash paid for investing activities was $158,000 for capitalized software costs for the development of our tablet platform portal.

We have incurred significant losses and negative cash flows from operations since our inception in on November 14, 2006. We have an accumulated deficit of $3,121,681 and a working capital deficiency of $2,966,851 as of December 31, 2013. These conditions raise substantial doubt about our ability to continue as a going concern. We have historically financed our activities through the private placement of equity securities and through related party advances. Through December 31, 2013, we have dedicated our financial resources to the development of Flightdeck and Vidirectory and the expansion of our tablet business and general and administrative expenses as described later in the section titled Results of Operations.

Results of Operations - For the year ended December 31, 2013 compared to the year ended December 2012;

Revenues

We generated revenue of $122,399 for the year ended December, 2013, versus revenue of $22,504 for the year ended December 31, 2012. All of the revenue for the year ended December 31, 2013 is from tablet sales, $66,000 of which was to a related party, Chandran. The revenue of $22,504 for the year ended December 31, 2012 was primarily due to the product launch of ViDirectory and consulting revenue

Tablet related Revenue and Cost of Sales

Tablet related revenue and cost of sales were $122,399 and $51,135 for the years ended December 31, 2013. Of these sales, $66,000 and cost of sales of $27,616 were to a related party, Chandran. There were no tablet sales during the year ended December 31, 2012 as we did not begin selling tablets until the second quarter of 2013.

General and Administrative Expenses

General and administrative expenses were $1,404,424 and $656,520 for the years ended December 31, 2013 and 2012, respectively. This increase of $747,904 was primarily due to an increase in consulting fees of $337,889 primarily due to capital raising activities, and a stock bonus to our Chief Executive Officer of $90,500, an increase in travel and entertainment expense of $119,789 and an increase in advertising and conference and tradeshow expense of $73,607 for expected new business in the future and an increase in our legal and compliance expense of $108,992.

Interest Expense

Interest expense was $25,663 and $2,829 for the years ended December 31, 2013 and 2012, respectively. This increase of $22,834 was primarily due our borrowing $100,000 on notes payable to a lender, during the year ended December 31, 2013. These notes were paid back during the year ended December 31, 2013. There was no similar borrowing during the year ended December 31, 2012.

Net Loss

Net loss was $1,412,558 and $691,181 for the years ended December 31, 2013 and 2012, respectively. This increase in net loss of $721,377 was attributable to the changes in the revenue and expense captions as described above.

Results of Operations-For the year ended December 31, 2012 compared to the year ended December 31, 2011

Revenues

For the year ended December 31, 2012 we generated revenue of $22,504 compared to $4,569 for the year ended December 31, 2011. The increase of $17,935 is due to the product launch of Vidirectory.com.

General and Administrative Expense

General and administrative expenses for the year ended December 31, 2012 were $710,856 compared to $731,068 for the year ended December 31, 2011. This net decrease of $20,212 was the result of an increase of $39,825 in software development costs and a decrease in salaries and wages of $55,452 as we added four administrative people due to the merger and had a staff reduction during the year ended December 31, 2012.

Net Loss

The net loss for the year ended December 31, 2012 was $691,181 compared to a net loss of $727,294 for the year ended December 31, 2011. The decrease in net loss of $36,113 is directly attributable to the increase in revenue and decrease in operating expenses described above.

Off-Balance Sheet Arrangements

The Company has no Off-Balance Sheet Arrangements.

Tabular Disclosure of Contractual Obligations

Smaller Reporting Companies are not required to provide this information pursuant to Regulation S-X §229.303 (d). However, we have provided the information as a courtesy without any obligation to continue to provide the information in the future.

|

TABULAR DISCLOSURE OF OBLIGATIONS

|

|||||

|

Contractual Obligation

|

Payments due by period

|

3-5 years

|

More than 5 years

|

||

|

Total

|

Less Than one year

|

1-3 years

|

|||

|

Long Term Obligations

|

90,000

|

90,000 |

-

|

-

|

-

|

|

Capital Lease Obligations

|

-

|

-

|

-

|

-

|

-

|

|

Operating Lease Obligations

|

26,640

|

24,420

|

2,220

|

-0-

|

-0-

|

|

Purchase Obligations

|

-0-

|

-0-

|

-0-

|

-0-

|

-0-

|

|

Other Long Term

Liabilities Reflected on the

Registrants Balance Sheet

under GAAP

|

-0-

|

-0-

|

-0-

|

-0-

|

-0-

|

|

Total

|

116,640

|

114,420

|

2,220

|

-0-

|

-0-

|

Going Concern

The accompanying consolidated financial statements have been prepared assuming that the Company will continue as a going concern which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business. The Company has incurred net losses of $1,412,558 and $691.181 for the years ended December 31, 2013 and 2012, respectively. The Company has a working capital deficiency of $2,966,851 and $1,935,503 as of December 31, 2013 and 2012, respectively and a stockholders’ deficiency of $2,761,930 and $1,813,848 at December 31, 2013 and 2012, respectively. The Company continues to incur recurring losses from operations and has an accumulated deficit since inception of $3,121,686.

The Company’s plan of operations, even if successful, may not result in cash flow sufficient to finance and expand its business. Realization of assets is dependent upon continued operations of the Company, which in turn is dependent upon management’s plans to meet its financing requirements and the success of its future operations. The ability of the Company to continue as a going concern is dependent on the Company’s profitability, cash flows and securing additional financing.

While the Company believes in the viability of its strategy to generate revenues and profitability and in its ability to raise additional funds, and believes that the actions presently being taken by the Company provide the opportunity for it to continue as a going concern. However the Company provides no assurance that such financing will be available on terms advantageous to the Company, or at all and should the Company not be successful in obtaining the necessary financing to fund its operations, the Company would need to curtail certain or all of its operational activities detailed above.

Outlook

The United States has been experiencing a widespread and severe economic recession that, among other things, has reduced availability of credit and capital financing and heightened economic risks. We have been grossly undercapitalized in 2013 but were able to raise $343,976 of capital through sales of our common stock and continued to receive advances from our majority shareholder. The Company has received advanced deposits for tablet sales and prepaid advertising of $1,875,253.

The continuing effects and duration of these developments and related uncertainties on the Company’s future operations and cash flows cannot be estimated at this time but likely will be significant, and in its audit report on our consolidated financial statements, our independent registered accounting firm has expressed substantial doubt as to our ability to continue as a going concern (see Note 3 to our consolidated financial statements).

We presently are unable to satisfy our obligations as they come due and do not have enough cash to sustain our anticipated working capital requirements and our business expansion plans for the remainder of 2014. Subject to unforeseen effects of the economic risks and uncertainties discussed in the foregoing paragraph and to our ability to raise working capital, we expect to continue for the remainder of the calendar year 2014 to incur expenses related to software development. The further delay of the rollout of our virtual world products, will have material adverse effects on our cash flow, results of operations and financial condition including significant uncertainty as to our ability to continue as a going concern. No assurance can be given that we will be able to secure any third party financing or that such financing will be available to us on acceptable terms.

Given the current financial market disruptions, credit crisis and economic recession, it is difficult at this time to obtain any third-party financing on acceptable terms, whether public or private equity or debt, strategic relationships, capital leases or other arrangements. Furthermore, any additional equity financing may be dilutive to stockholders, and debt financing, if available, may involve restricting covenants. Strategic arrangements, if necessary to raise additional funds, may require that we relinquish rights to certain of our technologies or products or agree to other material obligations and covenants.

So far though, we cannot provide assurance that the market will ever accept our products. Any failure by us to sell our products within our expected schedule or on terms acceptable to us will likely have a material adverse impact on our cash flow, results of operations and financial condition. In addition, we expect to face competition from larger, more formidable competitors. A lack of market acceptance of our products, failure to obtain additional financing, or unforeseen adverse competitive, economic, or other factors may adversely impact our cash position, and thereby materially adversely affect our financial condition and business operations.

The Company is a “smaller reporting company” as defined by Regulation S-K and as such, are not required to provide the information contained in this item pursuant to Regulation S-K. The Financial Statements begin on page 19.

SUNGAME CORPORATION

(A DEVELOPMENT STAGE CORPORATION)

Financial Statements

TABLE OF CONTENTS

|

Page

|

|

|

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

|

F-1

|

|

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

|

F-2

|

|

FINANCIAL STATEMENTS

|

|

|

Balance Sheets

|

F-3

|

|

Statements of Operations

|

F-4

|

|

Statements of Changes in Stockholders' Deficiency

|

F-5

|

|

Statements of Cash Flows

|

F-6

|

|

Notes to Financial Statements

|

F-7 - F-12

|

- 19 -

Cutler & CO., LLC.

Certified Public Accountants

12191 West 64th Avenue, Suite 205B

Arvada, Colorado 80004

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Board of Directors

Sungame Corporation

Las Vegas, Nevada

We have audited the accompanying balance sheet of Sungame Corporation (a development stage company) as of December 31, 2013, and the related statements of operations, changes in stockholders' deficiency and cash flows for the year then ended. These financial statements are the responsibility of the Company's management. Our responsibility is to express an opinion on these financial statements based on our audit. The financial statements as of December 31, 2012, for the year then ended and for the period from October 21, 2010 (inception) through December 31, 2012 were audited by another auditor who expressed an unqualified opinion on March 8, 2013. Our opinion, in so far as it relates to the period from October 21, 2010 (inception) through December 31, 2012, is based solely on the report of the other auditor.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audit provides a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of Sungame Corporation as of December 31, 2013, and the results of its operations and its cash flows for the year then ended in conformity with accounting principles generally accepted in the United States of America.

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 3 to the financial statements the Company has suffered a loss from operations and has negative working capital and a stockholders’ deficit that raise substantial doubt about its ability to continue as a going concern. Management's plans in regard to these matters are also described in Note 3. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

/s/ CUTLER & CO., LLC

CUTLER & CO., LLC

Arvada, Colorado

April 15, 2014

F - 1

RONALD R. CHADWICK, P.C.

Certified Public Accountant

2851 South Parker Road, Suite 720

Aurora, Colorado 80014

Telephone (303)306-1967

Fax (303)306-1944

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Board of Directors

Sungame Corporation

Las Vegas, Nevada

I have audited the accompanying balance sheet of Sungame Corporation (a development stage company) as of December 31, 2012, and the related statements of operations, stockholders' equity and cash flows for the year then ended and for the period from October 21, 2010 (inception of the development stage) through December 31, 2012. These financial statements are the responsibility of the Company's management. My responsibility is to express an opinion on these financial statements based on my audit.

I conducted my audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that I plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. I believe that my audit provides a reasonable basis for my opinion.

In my opinion, the financial statements referred to above present fairly, in all material respects, the financial position of Sungame Corporation as of December 31, 2012 and the results of its operations and its cash flows for the year then ended and for the period from October 21, 2010 (inception of the development stage) through December 31, 2012 in conformity with accounting principles generally accepted in the United States of America.

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 3 to the financial statements, the Company has suffered recurring losses from operations and has a working capital deficit and stockholders' deficit. These conditions raise substantial doubt about its ability to continue as a going concern. Management's plans in regard to these matters are also described in Note 3. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

Aurora, Colorado /s/ Ronald R. Chadwick, P.C.

March 8, 2013 RONALD R. CHADWICK, P.C.

F - 2

SUNGAME CORPORATION

(A DEVELOPMENT STAGE COMPANY)

Balance Sheet

|

December 31,

|

December 31,

|

|||||||

|

2013

|

2012

|

|||||||

|

ASSETS:

|

||||||||

|

Current Assets:

|

||||||||

|

Cash

|

$ | 237,786 | $ | 2,604 | ||||

|

Inventory

|

27,795 | |||||||

|

Prepaid Expenses

|

416,000 | - | ||||||

|

Total Current Assets

|

681,581 | 2,604 | ||||||

|

Equipment

|

||||||||

|

Office Equipment

|

2,140 | 2,140 | ||||||

|

Accumulated Depreciation

|

(1,955 | ) | (1,528 | ) | ||||

|

Total Equipment

|

185 | 612 | ||||||

|

Capitalized Software

|

||||||||

|

Capitalized Software

|

341,419 | 183,419 | ||||||

|

Accumulated Depreciation

|

(136,683 | ) | (62,376 | ) | ||||

|

Total Capitalized Software

|

204,736 | 121,043 | ||||||

|

TOTAL ASSETS

|

$ | 886,502 | $ | 124,259 | ||||

|

LIABILITIES AND STOCKHOLDERS' DEFICIENCY:

|

||||||||

|

Current Liabilities:

|

||||||||

|

Accounts Payable

|

$ | 397,212 | $ | 267,079 | ||||

|

Related party advances

|

1,375,967 | 1,665,819 | ||||||

|

Unearned revenue

|

1,875,253 | |||||||

|

Other liabilities

|

- | 5,209 | ||||||

|

Total Current Liabilities

|

3,648,432 | 1,938,107 | ||||||

| Total Liabilities | 3,648,432 | 1,938,107 | ||||||

|

Stockholders' Deficiency:

|

||||||||

|

Preferred stock, $.001 par value;

|

||||||||

|

5,000,000 shares authorized with none outstanding

|

||||||||

|

Common stock subscriptions

|

30,000 | |||||||

|

Common stock, $.001 par value;

|

||||||||

|

300,000,000 authorized with:

|

||||||||

|

177,758,067 and 177,575,014 shares issued and outstanding

|

177,758 | 177,575 | ||||||

|

Additional paid in capital

|

151,998 | (282,295 | ) | |||||

|

Accumulated deficit

|

(3,121,686 | ) | (1,709,128 | ) | ||||

|

Total Stockholders' Deficiency

|

(2,761,930 | ) | (1,813,848 | ) | ||||

|

TOTAL LIABILITIES AND STOCKHOLDERS' DEFICIENCY

|

$ | 886,502 | $ | 124,259 | ||||

The accompanying notes are an integral part of these financial statements

SUNGAME CORPORATION

(A DEVELOPMENT STAGE COMPANY)

Statement of Operations

|

October 21, 2010

|

||||||||||||

|

(Inception of

|

||||||||||||

|

Dev. Stage)

|

||||||||||||

|

Year ended

|

Through

|

|||||||||||

|

December 31,

|

December 31 2013

|

|||||||||||

|

2013

|

2012

|

2013

|

||||||||||

|

Revenues

|

$

|

56,399

|

$

|

22,504

|

$

|

83,472

|

||||||

|

Revenues – related party

|

66,000

|

-

|

66,000

|

|||||||||

|

Total revenue

|

122,399

|

22,504

|

149,472

|

|||||||||

|

Cost of goods sold

|

51,135

|

-

|

51,135

|

|||||||||

|

Gross profit

|

71,264

|

22,504

|

98,337

|

|||||||||

|

Costs and Expenses:

|

||||||||||||

|

Depreciation & amortization

|

74,735

|

54,336

|

137,860

|

|||||||||

|

General & administrative

|

1,404,424

|

656,520

|

3,073,876

|

|||||||||

|

Total Expenses

|

1,479,159

|

710,856

|

3,211,737

|

|||||||||

|

Loss From Operations

|

(1,407,895

|

)

|

(688,352

|

)

|

(3,113,399

|

)

|

||||||

|

Other Income and (Expenses)

|

||||||||||||

|

Interest income

|

-

|

-

|

10

|

|||||||||

|

Interest expense

|

(25,663

|

)

|

(2,829

|

)

|

(29,297

|

)

|

||||||

|

Other income

|

21,000

|

- |

|

21,000

|

||||||||

|

Total Other Income and (Expense)

|

(4,663

|

)

|

(2,829

|

)

|

(8,287

|

)

|

||||||

|

Net Loss

|

$

|

(1,412,558

|

)

|

$

|

(691,181

|

)

|

$

|

(3,121,686

|

)

|

|||

|

Per Share Information

|

||||||||||||

|

Loss per common share: Basic and Diluted

|

$

|

(0.00

|

)*

|

$

|

(0.00

|

)*

|

||||||

|

Weighted average number

|

||||||||||||

|

of shares outstanding: Basic and Diluted

|

177,645,230

|

177,575,014

|

||||||||||

* denotes a loss of less than $(0.01) per share.

The accompanying notes are an integral part of these financial statements

F - 4

SUNGAME CORPORATION

(A DEVELOPMENT STAGE COMPANY)

Statement of Changes in Stockholders’ Deficiency

|

Common

|

Deficit

|

||||||||||||||||||

|

Stock

|

Accumulated

|

||||||||||||||||||

|

Common

|

Amount

|

During The

|

Stockholders

|

||||||||||||||||

|

Stock

|

$ (0.001 |

Paid in

|

Development

|

Equity

|

|||||||||||||||

|

Shares

|

Par)

|

Capital

|

Stage

|

(Deficit)

|

|||||||||||||||

| Balances at December 31, 2009 | - | $ | - | $ | - | $ | - | $ | - | ||||||||||

|

Issuance of founders’ stock for services

|

12,000,000 | 12,000 | - | - | 12,000 | ||||||||||||||

|

Shares issued for licensing agreement

|

165,000,000 | 165,000 | - | - | 165,000 | ||||||||||||||

| Net loss for year | - | - | - | (290,653 | ) | (290,653 | ) | ||||||||||||

|

Balances at December 31, 2010

|

177,000,000 | $ | 177,000 | - | $ | (290,653 | ) | $ | (113,653 | ) | |||||||||

|

Shares issued for reverse merger

|

250,000 | 250 | (282,295 | ) | - | (282,295 | ) | ||||||||||||

|

Shares issued for services

|

325,014 | 325 | - | - | 325 | ||||||||||||||

| Net loss for year | - | - | - | (727,294 | ) | (727,294 | ) | ||||||||||||

|

Balances at December 31, 2011

|

177,575,014

|

$

|

177,575

|

$

|

(282,295

|

) |

$

|

(1,017,947

|

) |

$

|

(1,122,667

|

) | |||||||

|

Net loss for year

|

- | - | - |

(691,181

|

) |

(691,181

|

) | ||||||||||||

|

Balances at December 31, 2012

|

177,575,014

|

$ |

177,575

|

$ |

(282,295

|

) | $ |

(1,709,128

|

) | $ |

(1,813,848

|

) | |||||||

|

Common stock issued for cash

|

118,333

|

118

|

343,869

|

- |

343,987

|

||||||||||||||

|

Compensatory stock issuance

|

75,500

|

76

|

90,424

|

- |

90,500

|

||||||||||||||

|

Common stock subscriptions

|

- | - | - | - |

30,000

|

||||||||||||||

|

Common stock cancelled

|

(10,780

|

) |

(11

|

) | - | - |

(11

|

) | |||||||||||

|

Net loss for the year

|

- | - | - |

(1,412,558

|

) |

(1,412,558

|

) | ||||||||||||

|

Balances at December 31, 2013

|

177,758,067

|

$

|

177,758

|

$

|

151,998

|

$

|

(3,121,686

|

) |

$

|

(2,761,930

|

) | ||||||||

The accompanying notes are an integral part of these financial statements

SUNGAME CORPORATION

(A DEVELOPMENT STAGE COMPANY)

Statement of Cash Flows

|

October 21, 2010

|

||||||||||||

|

(Inception of

|

||||||||||||

|

Dev. Stage)

|

||||||||||||

|

Year ended

|

Through

|

|||||||||||

|

December 31,

|

Dec 31, 2013

|

|||||||||||

|

2013

|

2012

|

2013

|

||||||||||

|

Cash Flows from Operating Activities

|

|

|

|

|

|

|

|

|

|

|||

|

Net Loss

|

$ | (1,412,558 | ) | $ | (691,181 | ) | $ | (3,121,686 | ) | |||

|

Adjustments to reconcile net loss to

|

||||||||||||

|

net cash provided by (used for)

|

||||||||||||

|

operating activities:

|

||||||||||||

|

Depreciation and amortization

|

74,735

|

54,336

|

137,860

|

|||||||||

|

Stock issued for licensing agreement

|

-

|

-

|

165,000

|

|||||||||

|

Compensatory stock issuances

|

90,500

|

-

|

102,825

|

|||||||||

|

Changes in operating assets and liabilities

|

||||||||||||

|

Inventory

|

(27,796

|

)

|

-

|

(27,796

|

)

|

|||||||

|

Unearned revenue

|

1,875,253

|

-

|

1,875,253

|

|||||||||

|

Prepaid expenses

|

(416,000

|

)

|

1,250

|

(416,000

|

)

|

|||||||

|

Accounts payable

|

130,133

|

30,353

|

276,494

|

|||||||||

|

Accrued liabilities

|

(5,209

|

)

|

890

|

(316

|

)

|

|||||||

|

Net cash provided by (used for)

|

||||||||||||

|

operating activities

|

309,058

|

(604,352

|

)

|

(1,008,366

|

)

|

|||||||

|

Cash Flows from Investing Activities

|

||||||||||||

|

Investment in capitalized

|

||||||||||||

|

software

|

(158,000

|

)

|

(59,975

|

)

|

(341,419

|

)

|

||||||

|

Net cash used for

|

||||||||||||

|

investing activities

|

(158,000

|

)

|

(59,975

|

)

|

(341,419

|

)

|

||||||

|

Cash Flows from Financing Activities

|

||||||||||||

|

Common stock issued

|

343,976

|

-

|

343,976

|

|||||||||

|

Common stock subscriptions

|

30,000

|

-

|

30,000

|

|||||||||

|

Related party advances

|

2,868,597

|

653,593

|

1,213,595

|

|||||||||

|

Related party payments

|

(3,158,449

|

)

|

-

|

-

|

||||||||

|

Borrowings on notes payable

|

100,000

|

|||||||||||

|

Payments on notes payable

|

(100,000

|

)

|

-

|

-

|

||||||||

|

Net cash provided by

|

||||||||||||

|

financing activities

|

84,124

|

653,593

|

1,587,571

|

|||||||||

|

Net Increase (Decrease) In Cash

|

235,182

|

(10,734

|

)

|

237,786

|

||||||||

|

Cash At The Beginning Of The Period

|

2,604

|

13,338

|

-

|

|||||||||

|

Cash At The End Of The Period

|

$

|

237,786

|

$

|

2,604

|

$

|

237,786

|

||||||

|

SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION

|

||||||||||||

|

Cash paid for interest expense

|

$

|

25,663

|

$

|

2,829

|

$

|

29,297

|

||||||

|

Cash paid for income taxes

|

$

|

-

|

$

|

-

|

$

|

-

|

||||||

|

NON-CASH TRANSACTIONS

|

||||||||||||

|

Stock issued for merger and consulting services

|

$

|

-

|

$

|

-

|

$

|

177,325

|

||||||

|

Net liabilities assumed in the merger

|

$

|

-

|

$

|

-

|

$

|

282,045

|

||||||

The accompanying notes are an integral part of these financial statements

SUNGAME CORPORATION

(A DEVELOPMENT STAGE COMPANY)

NOTES TO FINANCIAL STATEMENTS

FOR THE YEARS ENDED DECEMBER 31, 2013 AND 2012

1. Business and Summary of Significant Accounting Policies

Business

The accompanying financial statements include the accounts of Sungame Corporation (“the Company”), a Delaware corporation. The Company is an early development stage company.

The Company, trading under the symbol “SGMZ”, is the Company behind the Flighteck.tv content management and discovery platform. Sungame also uses the brand “Freevi” as a d.b.a., as it acquired Freevi Corp. and the brand has retained its value sufficient to keep using the brand Freevi. Sungame’s mission is simple: to enrich people’s lives by becoming a leading social networking, content creation, content discovery and distribution platform. Integral to the site’s functionality is a central aggregation engine that excels at servicing targeted, focused and high quality content and social media interactions based on the user’s specific interests and past usage history. Other tools available on the website are designed to simplify content creation and distribution for content producers, while providing these artists an engaged audience interested in consuming this content. Sungame is also the Company behind Vidirectory, a video based business directory that simplifies online marketing for small businesses. The Company is making efforts to offer an innovative 3D line of tablets. This new tablet line, due to the proprietary and patented glass viewing screen assembly, has the ability to display HD quality glasses-free 3D pictures and videos, as well as maintaining the ability to act as standard 2D tablets to take full advantage of the existing content currently available.

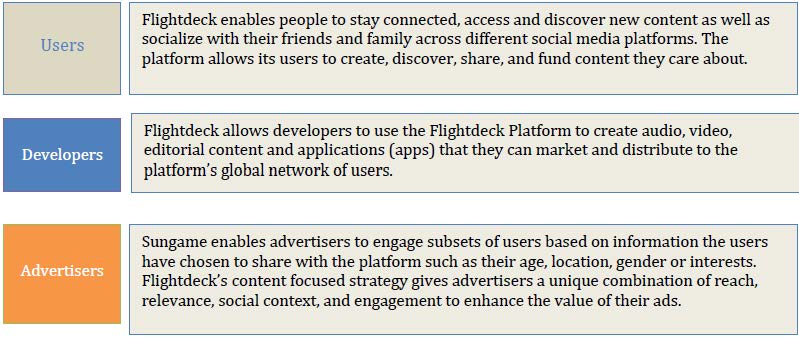

Sungame shapes products that support its mission by creating utility for users, developers and advertisers as follows:

1. Flightdeck enables people to stay connected, access and discover new content as well as socialize with their friends and family across different social medial platforms. The platform allows its users to create, discover, share, and fund content they care about.

2. Flightdeck allows developers to use the Flightdeck Platform to create audio, video, editorial content and applications (apps) that they can market and distribute to the platform’s global network of users.

3. Sungame enables advertisers to engage subsets of users based on information the users have chosen to share with the platform such as their age, location, gender or interests. Flightdeck’s content focused strategy gives advertisers a unique combination of reach, relevance, social context, and engagement to enhance the value of their ads.

The Company merged with Freevi Corporation on April 15, 2011. Freevi brings a rich media platform to the Company revolving around its core product the “Freevi Flightdeck” ™, a graphical user interface that allows users to consume video and audio content, network with other Freevi users, engage in e-commerce transactions, and access games and other applications. Freevi’s proprietary technologies were licensed from Chandran Holding Media, Inc., its majority shareholder at the time of its acquisition by the Company.

The Company was incorporated in Delaware on November 14, 2006. The Company’s fiscal year end is December 31st.

SUNGAME CORPORATION

(A DEVELOPMENT STAGE COMPANY)

NOTES TO FINANCIAL STATEMENTS

FOR THE YEARS ENDED DECEMBER 31, 2013 AND 2012

(continued)

Summary of Significant Accounting Policies

Development Stage Company

The Company is a development stage company as defined by Accounting Standards Codified No. 915. The Company is devoting substantially all of its present efforts to establish a new business. All losses accumulated since inception, have been considered as part of the Company’s development stage activities.

Risks and Uncertainties

Our business is rapidly evolving and intensely competitive, and is subject to changing technology, shifting user needs and frequent introductions of new products and services. We have many competitors in different industries, including traditional search engines, vertical search engines, e-commerce sites, social networking sites, traditional media companies, and providers of online products and services. Our current and potential competitors range from large and established companies to emerging startups. Established companies have longer operating histories and more established relationships with customers and end users, and they can use their experience and resources against us in a variety of competitive ways, including by making acquisitions, investing aggressively in research and development, and competing aggressively for advertisers and websites. Emerging startups may be able to innovate and provide products and services faster than we can. If our competitors are more successful than we are in developing competing products or in attracting and retaining users, advertisers, and content providers, our revenues and growth rates could decline.

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make certain estimates and assumptions that affect the reported amounts and timing of revenue and expenses, the reported amounts and classification of assets and liabilities, and disclosure of contingent assets and liabilities. These estimates and assumptions are based on management’s future expectations for the Company’s operations. The Company’s actual results could vary materially from management’s estimates and assumptions.

Revenue Recognition

We recognize revenue from tablet sales when the products are shipped since title to the products has passed when the tablets leave our shipping area. We have no advertising revenues to date but will recognize advertising revenues as advertising services are provided in the future.

Cash and Cash Equivalents

The Company considers all highly liquid investments with an original maturity of three months or less as cash equivalents. Included in cash of $2,064 at December 31, 2012 is $1,986 held in reserve by the Company’s sales processing agency.

Equipment

Equipment, when acquired, is stated at cost. Depreciation will be computed using the straight-line method to allocate the cost of depreciable assets over the estimated useful lives of the assets.

SUNGAME CORPORATION

(A DEVELOPMENT STAGE COMPANY)

NOTES TO FINANCIAL STATEMENTS

FOR THE YEARS ENDED DECEMBER 31, 2013 AND 2012

(continued)

Capitalized Software Costs

Capitalized software costs are capitalized when technological feasibility is proven. These costs are amortized over the estimated life of the related assets. Capitalized software costs were $183,419 in prior years for two products that have proven technological feasibility. There were $158,000 of capitalized software costs for the development of the tablet platform portal during the year ended December 31, 2013.

Long Lived Assets

“Long-lived assets” are reviewed for impairment of value whenever events or changes in circumstances indicate that the carrying value of the assets might not be recoverable or at least at the end of each reporting period. Conditions that would necessitate an impairment assessment include a significant decline in the observable market value of an asset, a significant change in the extent or manner in which an asset is used, or a significant adverse change that would indicate that the carrying value of an asset is not recoverable. For long-lived assets to be held and used, management measures fair value based on quoted market prices or based on discounted estimates of future cash flows.

Concentration of Credit Risk

The Company’s financial instruments that are exposed to concentrations and credit risk primarily consist of amounts due to related parties. (see Note 4).

Income Taxes

Income taxes are accounted for using the asset and liability method. Deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases and operating loss and tax credit carry-forwards. Deferred tax assets and liabilities are measured using enacted tax rates expected to be applied to taxable income in the years in which those temporary differences are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in income in the period that includes the enactment date. A valuation allowance is provided for significant deferred tax assets when it is more likely than not, that such asset will not be recovered.

At December 31, 2013 and 2012, the Company had net operating loss carry-forwards of approximately $3,122,000 and $1,709,000, which begin to expire in 2026. At December 31, 2013 and 2012 the Company had deferred tax assets of approximately $1,093,000 and $598,000 in 2013 and 2012 created by the net operating losses, which have been offset by a 100% valuation allowance.

Net Loss Per Share

Basic net loss per share is computed by dividing net loss by the weighted average number of common shares outstanding during the year. Potentially dilutive securities are stock options for 8,334,000 shares (see Note 10) which were not considered outstanding shares because the effect would have been anti-dilutive.

2. REVERSE MERGER

Effective April 15, 2011 Sungame Corporation entered into a merger agreement (the "Agreement") with Freevi Corporation, acquiring 100% of the outstanding common stock of Freevi Corporation through the issuance of 177,000,000 shares of its common stock with no readily available market price. Freevi Corporation was incorporated in Nevada on October 21, 2010. The transaction was accounted for as a reverse merger as the shareholders of Freevi Corporation retained the majority of the outstanding common stock of Sungame Corporation

SUNGAME CORPORATION

(A DEVELOPMENT STAGE COMPANY)

NOTES TO FINANCIAL STATEMENTS

FOR THE YEARS ENDED DECEMBER 31, 2013 AND 2012

(continued)