Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - MEDICAN ENTERPRISES, INC. | Financial_Report.xls |

| EX-10.1 - EXHIBIT 10.1 - MEDICAN ENTERPRISES, INC. | ex101.htm |

| EX-31.2 - EXHIBIT 31.2 - MEDICAN ENTERPRISES, INC. | ex312.htm |

| EX-21.1 - EXHIBIT 21.1 - MEDICAN ENTERPRISES, INC. | ex211.htm |

| EX-32 - EXHIBIT 32 - MEDICAN ENTERPRISES, INC. | ex32.htm |

| EX-3.3 - EXHIBIT 3.3 - MEDICAN ENTERPRISES, INC. | ex33.htm |

| EX-31.1 - EXHIBIT 31.1 - MEDICAN ENTERPRISES, INC. | ex311.htm |

| EX-10.2 - EXHIBIT 10.2 - MEDICAN ENTERPRISES, INC. | ex102.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

|

[X]

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended December 31, 2013

|

[ ]

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from to

MEDICAN ENTERPRISES, INC.

(Exact name of registrant as specified in charter)

Nevada

(State or other jurisdiction of incorporation)

|

000-53408

|

87-0474017

|

|

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

|

5955 Edmond Street, Suite 102

Las Vegas, NV 89118

|

||

|

(Address of Principal Executive Offices)

|

||

|

(800) 416-8802

(Registrant’s Telephone Number, Including Area Code)

|

||

Securities Registered Pursuant to Section 12(b) of the Act: None

Securities Registered Pursuant to Section 12(g) of the Act: Common Stock, par value $0.001

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [X]

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act. Yes [ ] No [X]

Indicate by check mark if the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

(1) Yes [X] No [ ] (2) Yes [X] No [ ]

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit and post such files). Yes [X] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company:

|

Large accelerated filer

|

[ ]

|

Accelerated filer

|

[ ]

|

|

Non-accelerated filer

|

[ ]

|

Smaller reporting company

|

[X]

|

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [ ] No [X]

The aggregate estimated market value was determined by multiplying the approximate number of shares of common stock held by non-affiliates by the average bid price of such stock $0.0105 on the last day of the Company’s second fiscal quarter, as quoted on the Over-the-Counter Bulletin Board (the “OTCBB”) of the Financial Industry Regulatory Authority (“FINRA”). There were 1,325,062 (pre-forward split) shares of common voting stock held by non-affiliates, valued in the aggregate at $13,913.

Outstanding Shares

As of April 8, 2014, the Registrant had 40,321,664 shares of common stock outstanding.

Documents Incorporated by Reference

See Part IV, Item 15.

TABLE OF CONTENTS

|

Page

|

|

|

CAUTIONARY STATEMENT REGARDING FORWARD LOOKING STATEMENTS

|

ii |

|

PART I

|

1 |

|

ITEM 1. BUSINESS

|

1 |

|

ITEM 1A. RISK FACTORS

|

18

|

|

ITEM 1B. UNRESOLVED STAFF COMMENTS

|

27

|

|

ITEM 2: PROPERTIES

|

27

|

|

ITEM 3: LEGAL PROCEEDINGS

|

27

|

|

ITEM 4: MINE SAFETY DISCLOSURES

|

27 |

|

PART II

|

|

|

ITEM 5: MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

|

28

|

|

ITEM 6: SELECTED FINANCIAL DATA

|

30

|

|

ITEM 7: MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

|

30

|

|

ITEM 7A: QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

|

31

|

|

ITEM 8: FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

|

32

|

|

ITEM 9A: CONTROLS AND PROCEDURES

|

45

|

|

ITEM 9B: OTHER INFORMATION

|

45

|

|

PART III

|

46 |

|

ITEM 10: DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

|

46

|

|

ITEM 11: EXECUTIVE COMPENSATION

|

49 |

|

ITEM 12: SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS

|

49 |

|

ITEM 13: CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE

|

51 |

|

ITEM 14: PRINCIPAL ACCOUNTING FEES AND SERVICES

|

52 |

|

PART IV

|

52 |

|

ITEM 15: EXHIBITS, FINANCIAL STATEMENT SCHEDULES

|

52 |

i

CAUTIONARY STATEMENT REGARDING FORWARD LOOKING STATEMENTS

This Annual Report and the documents we have filed with the United States Securities and Exchange Commission (the “SEC”) that are incorporated by reference herein contain forward-looking statements, within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, that involve significant risks and uncertainties. Any statements contained, or incorporated by reference, in this Annual Report that are not statements of historical fact may be forward-looking statements. When we use the words “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “predict,” “project,” “will” and other similar terms and phrases, including references to assumptions, we are identifying forward-looking statements. Forward-looking statements involve significant risks and uncertainties which may cause our actual results, performance or achievements to be materially different from those expressed or implied by forward-looking statements.

A variety of factors, some of which are outside our control, may cause our operating results to fluctuate significantly. They include, but are not limited to:

|

|

•

|

the new and evolving regulatory requirements in Canada regarding the production and distribution of medical marijuana;

|

|

|

•

|

our ability to secure and maintain our relationships with our key commercial partners;;

|

|

|

•

|

our expectations regarding the commercial market for our products;

|

|

|

•

|

the effect of competition; and

|

|

|

•

|

the availability of required additional financing.

|

As more fully described in this Annual Report under the heading “Risk Factors,” many important factors may affect our ability to achieve our stated objectives and to manufacture and commercialize our products, including, among other things, our ability to:

|

|

•

|

obtain substantial additional funds to commence and expand our planned operations;

|

|

|

•

|

obtain and maintain all necessary regulatory approvals and licenses and to operate our business in compliance with the same;

|

|

|

•

|

meet obligations and required milestones under agreements;

|

|

|

•

|

retain key executives, and attract, retain and motivate qualified personnel;

|

|

|

•

|

be capable of manufacturing and distributing our product in commercial quantities at reasonable costs; and

|

|

|

•

|

compete against others in a profitable manner.

|

Moreover, new risks regularly emerge and it is not possible for our management to predict all risks, nor can we assess the impact of all risks on our business or the extent to which any risk, or combination of risks, may cause actual results to differ from those contained in any forward-looking statements. All forward-looking statements included in this Annual Report are based on information available to us on the date hereof. Except to the extent required by applicable laws or rules, we undertake no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise. All subsequent written and oral forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the cautionary statements contained throughout this Annual Report and the documents we have filed with the SEC.

ii

PART I

ITEM 1. BUSINESS

Medican Enterprises, Inc. was organized under the laws of the State of Nevada on October 27, 1988, under the name “Extant Investments, Inc.”

As described below, we are a pharmaceutical company developing a business of producing and distributing medical marijuana in Canada as authorized by Health Canada. Other businesses have been operated through our company in the past. The following are the material organizational business developments related to our company since inception:

Corporate History (1990-2012)

Commencing on or about December 5, 1990, pursuant to a Registration Statement on Form S-18 filed with the SEC and Exchange Commission and a prospectus dated as of such date, our company offered and sold units consisting of common stock and warrants that was closed on January 31, 1991.

Effective May 17, 1991, we acquired all of the issued and outstanding shares of common stock of Sentinel Diagnostics, Inc., an Arizona corporation, pursuant to an Agreement and Plan of Reorganization, and changed our name to “Sentinel Scientific, Inc.” The Sentinel Diagnostics business operations were discontinued in late 1992 for lack of funding.

Effective August 10, 1993, and pursuant to a Reorganization Agreement, we acquired all of the outstanding shares of common stock of A.F.C. Entertainment, Inc., a corporation organized under The Companies Act of Barbados, and changed our name to “TC X Calibur, Inc.”

Effective December 31, 1993, we acquired all of the outstanding shares of common stock of Film Opticals Investments, Limited, a corporation organized under the laws of the Province of Ontario, Canada (“Film Opticals”).

In 1993, Film Opticals of Canada Limited, a wholly-owned subsidiary of Film Opticals (“Film Opticals of Canada”), sought court protection by filing a Notice of Intention to Make a Proposal pursuant to Subsection 50.4(1) of the Bankruptcy and Insolvency Act of Canada, because of a dispute with a creditor pursuant to a secured promissory note, and a trustee (the “Trustee”) was appointed to oversee Film Opticals of Canada’s financial management in the Ontario Justice Court, General Division, Case No. B163/94. Operation of the Film Opticals business continued pending a resolution of the dispute with this creditor.

On or about December 28, 2004, pursuant to resolutions adopted by our Board of Directors and approved by the holders of a majority our outstanding shares of common stock, we sold substantially all of our assets by the conveyance of our wholly-owned subsidiary, Film Opticals (and its subsidiary, Film Opticals of Canada), and our film library (“Film Library”), to Film Opticals of Canada 2004 Limited, a newly formed corporation organized under the Province of Ontario, Canada (“New Film Opticals”), and a wholly-owned subsidiary of Berliner Holdings, Inc. (“Berliner”). Berliner was wholly-owned by our then President, Claus Voellmecke. As consideration of the purchase and sale of these assets, Berliner agreed to cancel 500,000 shares of our common stock that it owned and agreed, together with New Film Opticals, to assume, pay and/or compromise all of our outstanding claims or liabilities related to Film Opticals and our Film Library and indemnify and hold us harmless from them. For additional information, please see our 8-K Current Report, our 8-K/A-1 Current Report and our 8-K/A-2 Current Report that have been previously filed with the Securities and Exchange Commission on or about December 8, 2004, December 9, 2004 and January 4, 2005, respectively, and which include a copy of the Definitive Proxy Statement that was mailed to our stockholders on or about December 8, 2004.

In addition to the above referenced sale of substantially all of our assets on or about December 28, 2004, pursuant to resolutions adopted by our Board of Directors and approved by the holders of a majority of our outstanding shares of common stock, we amended our Articles of Incorporation to change our capitalization to add a class of preferred stock, and gave our Board of Directors authority to effect recapitalizations and/or name changes without further stockholder approval.

1

On or about September 15, 2005, certain shares of our outstanding common stock were acquired pursuant to a private transactions which shares, when accumulated with shares of our common stock that were already owned by these persons, represented a controlling interest in us.

On November 2, 2007, we announced the execution of a Letter of Intent to acquire EV Rental, LLC, a California limited liability company. On March 3, 2008, we terminated our obligations under the Letter of Intent.

On December 28, 2007, in the OTCBB trading market on that date, we effected a forward split of our outstanding common stock on a basis of 2.3943 for one, while retaining the current par value of $0.001 per share, with all fractional shares rounded up to the nearest whole share, and with appropriate adjustments in our capital accounts. All share references and computations herein take into account this recapitalization.

On February 28, 2008, we filed Restated Articles of Incorporation with the State of Nevada, a copy of which is incorporated herein by reference. See Part IV, Item 15.

On September 11, 2008, we filed a registration statement on Form 10 of the SEC registering our common stock under Section 12(g) of the Exchange Act. This registration statement became effective on or about November 9, 2008.

There were no material business developments in 2009.

On November 29, 2010, in the OTCBB trading market on that date, we effected a reverse split of our outstanding common stock on a basis of one for four, while retaining the current par value of $0.001 per share, with all fractional shares rounded up to the nearest whole share, and with appropriate adjustments in our capital accounts. All share references and computations herein take into account this recapitalization.

There were no material business developments in 2011 or 2012.

Recent Developments

On June 25, 2013, Kenneth Williams, currently our Chief Executive Officer and a director of our company, entered into a series of Stock Purchase Agreements (the “SPAs”) with Jenson Services and several other shareholders through which Mr. Williams collectively purchased 858,946 shares of our company, representing approximately 65% of our outstanding common stock for total consideration of $96,501. At the closing of the SPAs, Mr. Williams became the holder of an aggregate of approximately 65% of our outstanding shares of common stock, and a change of control of our company occurred.

On that same date, Travis T. Jenson resigned as the Principal Executive Officer and as a director of our company and Jason Jenson resigned as the Treasurer and Secretary of the Company. Neither individual has any dispute against our company, and their resignations were a part of the transaction by which Mr. Williams acquired control of our company. At this time, we also increased the number of members of the Board of Directors from three to four, which was within the range of directors allowed by its Bylaws. Michael Thompson was appointed as a director of our company and Mr. Williams was appointed as a director and the Chief Executive Officer and Chief Financial Officer of our company. On July 19, 2013, Jason Jenson resigned as a director of our company. On July 22, 2013, Harold Jensen resigned as a director of our company. These resignations were not as a result of any dispute with our company and as also a part of the transaction by which Mr. Williams acquired control of our company.

As approved by our Board of Directors and majority shareholder on July 2, 2013, and subsequently announced to the shareholders via mailing, we filed Articles of Amendment to our Articles of Incorporation on August 6, 2013 changing our name to MEDICAN ENTERPRISES, INC. This name change became effective with FINRA, September 18, 2013, and our stock symbol was changed to “MDCN”.

2

On August 16, 2013, our board of directors approved a stock dividend, on a basis of 20:1 (the “Stock Dividend”), pursuant to which, our shareholders as at September 24, 2013 received twenty (20) shares of our common stock for each one (1) share of common stock held. The pay-out date as approved by our board of directors and FINRA was September 25, 2013.

Upon completion of the Stock Dividend, our issued and outstanding shares increased from 1,325,062 to 26,501,240 shares of common stock.

In the fourth quarter of 2013, we formed two subsidiaries in anticipation of our emerging Canadian medical marijuana business: Medican Systems, Inc., a Yukon corporation (“Medican Systems”), and Medican (Delta) Systems, Inc., a British Columbia corporation (“Medican Delta”). At that time, we were contemplating a business model based on providing information about and within the medical cannabis industry through publications and through forging strategic relationships with individuals and related businesses within the industry. We have since modified our business plan to be a holding company for a business engaged in the licensed production and distribution of medical marijuana in Canada. We formed a third subsidiary, CanaLeaf Systems, Inc., a corporation incorporated under laws of Canada under the Canada Business Corporation Act (“CanaLeaf”) on March 25, 2014. through which we will pursue our current business plan.

On November 15, 2013, Medican Delta entered into a management services agreement (the “Management Services Agreement”) with IHL Medical Marijuana Ltd., an affiliate of International Herbs Ltd. (“IHL”) and LFG Advisory Ltd. and LFG Advisory & Accounting Ltd. (LFG Advisory Ltd. and LFG Advisory & Accounting Ltd., collectively, “LFG”). Under the terms of the Management Services Agreement, IHL and LFG agree to promote and develop the business of Medican Delta and assist Medican Delta with obtaining licensed medical marijuana producer status from Health Canada, the department of the federal Canadian government which oversees public health matters. IHL is a world leader in the fresh herbs and specialty produce industry, and has assisted numerous organizations in meeting their strategic goals with the Canadian government. LFG is an independent corporate finance and accounting advisory firm, based in Vancouver, British Columbia.

On January 21, 2014, we appointed a new director, Gary Johnson.

On February 18, 2014, we appointed a new Chief Financial Officer, Wayne Hansen.

On March 13, 2014, we and our subsidiaries Medican Systems and CanaLeaf (referred to collectively herein as “Medican CanaLeaf”) entered into an Amended and Restated Management Services Agreement (the “Amended Management Services Agreement”) with International Herbs (BC) LTD., an affiliate company of IHL (“IHLBC”) and LFG. Under the terms of the Amended Management Services Agreement, we modified, clarified and restated the terms of the original Management Services Agreement entered into on November 15, 2013 among the parties to provide for updated timelines and payment schedules. According to the Amended Management Services Agreement, the parties agree to cooperate and work together to promote and develop the business of Medican CanaLeaf and to assist Medican CanaLeaf in partnering with International Herbs Medical Marijuana Ltd. (“IHMML”), also an affiliate of IHL and a company that is applying to obtain licensed producer status from Health Canada. The Amended Management Services Agreement amends the dates of the three phases of management services provided or to be provided by IHL and LFG. Phase I was deemed completed on February 24, 2014 and consisted of consulting services and the formulation of a business strategy. All fees due under Phase I have been paid in full to IHL and LFG. Phase II of the Amended Management Services Agreement is defined as the period between February 25, 2014 and March 28, 2014 (or such other date as the parties may mutually agree). During Phase II, LFG agreed to provide Medican CanaLeaf with consulting services in order to successfully acquire 50% ownership in IHMML and develop its business infrastructure. IHL agreed to cooperate with Medican CanaLeaf to design, build and develop a facility in Canada in which it will lawfully produce and from which it will lawfully distribute marijuana (which we anticipate will be our Atholville facility as described below, the “Facility”), to hire employees as deemed necessary for the operation of the Facility and all business conducted at and in relation to the Facility, to develop and implement systems and processes to optimize the production and profitability of all business conducted at and in relation to the Facility, to ensure compliance with and adherence to all applicable laws and regulations, and to prepare the Facility for a final site visit and inspection by the government and regulatory personnel. Upon completion of Phase II, Medican CanaLeaf will pay to IHL a fee of CAD$500,000 and will pay LFG a fee in the amount of CAD$100,000. The third phase of the Amended Management Services Agreement commences after the completion of Phase II and runs until a date of completion to be agreed upon by the parties (“Phase III”). During Phase III, LFG will provide Medican CanaLeaf with consulting services in relation to corporate finance work required by CanaLeaf, internal accounting services and assistance with the development of business infrastructure. IHL agrees to assist Medican CanaLeaf with the development of a strategic plan on an as-needed basis. Medican CanaLeaf agrees to pay LFG CAD$17,500 per month plus applicable taxes for the duration of Phase III. In addition to the payments mentioned above, during Phase One and Phase Two, Medican CanaLeaf agrees to pay LFG an amount equal to two percent (2%) of all money procured from investors, and the Company shall issue shares of its common stock as equity compensation to IHL and LFG or its nominees totaling 5,000,000 shares of issued and outstanding common stock of our company.

3

In early March 2014, our Board of Directors and majority stockholder approved an increase of our authorized shares of common stock from 50,000,000 to 100,000,000 shares.

On March 24, 2014, Medican Systems entered into a nonbinding Letter Agreement with IHMML that described the terms through which Medican would, subject to entering into definitive documentation and other conditions, become a 50% holder of the issued and outstanding common shares of IHMML by way of subscription for 41,600,000 common shares of IHMML (the “Investment Shares”) for an aggregate subscription price of CAD$52,000,000 (the “Investment Proceeds”). IHMML will then use the Investment Proceeds to acquire certain lands, retrofit and/or build a marijuana growing operation and attend to the growing, marketing, research and development, training, distribution and retail sale of medical marijuana in Canada as regulated by Health Canada.

On April 8, 2014 CanaLeaf entered into a Subscription Agreement with IHMML through which CanaLeaf has agreed to purchase from IMML, by way of subscription, 41,600,000 common shares of IHMML (the “Investment Shares”) for an aggregate subscription price of CAD$52,000,000 (the “Investment Proceeds”). IHMML will then use the Investment Proceeds to acquire certain lands, retrofit and/or build a marijuana growing operation Facility and attend to the growing, marketing, research and development, training, distribution and retail sale of medical marijuana in Canada as regulated by Health Canada.

Pursuant to the Subscription Agreement, we (as CanaLeaf’s parent company) shall issue 6,000,000 common share purchase warrants to IHMML’s shareholders or shareholders’ designee exercisable within two years of the date of the Subscription Agreement at an exercise price of CAD$2.86 per share.

In the Subscription Agreement, CanaLeaf subscribes for the Investment Shares at a subscription price of CAD$1.25 per share, for an aggregate subscription price equal to the Investment Proceeds. The subscription for the initial Investment Shares shall be completed on or about April 30, 2014, provided that the Investment Proceeds shall be advanced pursuant to the following investment schedule:

|

(a)

|

4,000,000 Shares will be purchased on April 30, 2014 in consideration for payment of CAD$5,000,000;

|

|

(b)

|

An additional 8,000,000 Shares will be purchased on May 31, 2014 in consideration for payment of CAD$10,000,000;

|

|

(c)

|

An additional 4,800,000 Shares will be purchased on June 30, 2014 in consideration for payment of CAD$6,000,000;

|

|

(d)

|

An additional 8,800,000 Shares will be purchased on July 31, 2014 in consideration for payment of CAD$11,000,000;

|

|

(e)

|

An additional 2,400,000 Shares will be purchased on August 31, 2014 in consideration for payment of CAD$3,000,000;

|

4

|

(f)

|

An additional 8,000,000 Shares will be purchased on September 30, 2014 in consideration for payment of CAD$10,000,000; and

|

|

(g)

|

An additional 5,600,000 Shares will be purchased on October 31, 2014 in consideration for payment of CAD$7,000,000.

|

IHMML is expected to use the Investment Proceeds to acquire certain lands, retrofit a marijuana growing operation and support the business plans of IHMML, namely, the licensed growing, marketing, research and development, training distribution and retail sale of medical marijuana in Canada as regulated by Health Canada. IHMML will enter, or will cause LandCo (as defined below) to enter, into contracts of purchase and sale for the purchase of the following buildings and adjoining lands: (a) a building in Atholville, New Brunswick with 300,000 square foot of grow space within a 393,000 square foot facility (the “Atholville Facility”); (b) a 273,000 square foot facility, in Poekmouche, New Brunswick (the “Poekmouche Facility”), and (c) a property with a 25,000 square foot facility in Delta, British Columbia (the “Delta Facility”). Subject to CanaLeaf completing its purchase of all of the Shares that it has agreed to purchase pursuant to the Subscription Agreement, IHMML agrees to use all reasonable commercial efforts to complete or cause LandCo to complete the purchase of the Atholville Facility, the Poekmouche Facility and the Delta Facility (collectively, the “Investment Property”). It is contemplated that the Investment Property will be acquired in a separate company or companies from IHMML (collectively, “LandCo”). IHMML agrees to structure the purchase of the Investment Property such that either: (a) IHMML will have a direct or indirect 100% interest in the Investment Property; or (b) the Shareholders will have a direct or indirect 100% interest in the Investment Property, in the same proportions as their Share ownership interest in IHMML, assuming the full subscription for Shares by CanaLeaf. To the extent required, the parties will enter into a shareholders’ agreement governing the terms of ownership of the shares of LandCo, the terms of which will be substantially the same as the terms of the Shareholders’ Agreement negotiated by the parties and to be signed on or before April 30, 2013. If LandCo acquires the Investment Property, then LandCo will lease such lands to IHMML at reasonable rental rate agreed between LandCo and IHMML.

In addition to the foregoing terms, the parties also agree in the Subscription Agreement to:

|

(a)

|

ensure that the IHMML’s current shareholders (who consist of Rick Brar, Monty Sikka, Mark Catroppa, Kevin Coft, Mansimrat Kaur Brar) have the ability to nominate two individuals to the board of directors of the our company (of which all nominations are subject to the approval of our shareholders);

|

|

(b)

|

ensure that the shareholders of IHMML execute consulting agreements and non-competition agreements that limit the shareholders’ involvement with any companies that compete with IHMML as long as the shareholders’ are involved with IHMML and for two years after their

involvement ceases; and

|

|

(c)

|

ensure that the Company remains compliant in its reporting obligations as a public company.

|

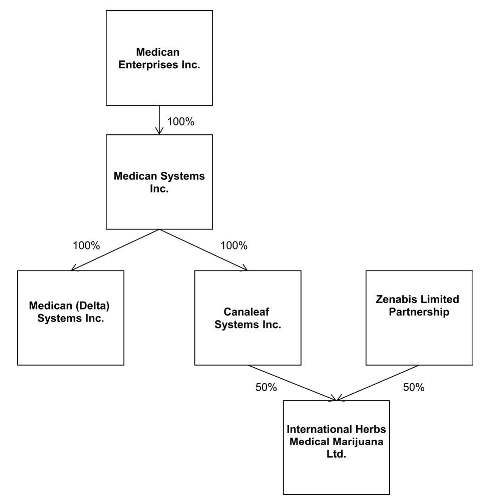

In conjunction with the Subscription Agreement, the parties have negotiated a Shareholders’ Agreement with CanaLeaf, Medican Systems., Zenabis Limited Partnership (the shareholder of 41,600,000 common shares of IHMML), and IHMML to be signed on or before April 30, 2014 upon delivery of the first $5,000,000 payment. The Shareholders’ Agreement sets forth certain material terms of the shareholders of our company following CanaLeaf’s purchase of shares in the Subscription Agreement. The Shareholders’ Agreement sets for the terms of corporate governance of IHMML, our company, and CanaLeaf, rights of the parties thereto to purchase and sell interests of IHMML, and other similar provisions standard for this type of agreement.

The Shareholders’ Agreement also sets forth what will happen if CanaLeaf fails to deliver all the funds required under the Subscription Agreement. If CanaLeaf has not on or before December 31, 2014 purchased all the Investment Shares that it has agreed to purchase pursuant to the Subscription Agreement, then the following will occur:

5

|

1.

|

if the total amount paid by CanaLeaf to IHMML for Investment Shares issued pursuant to the Subscription Agreement is CAD$10,000,000 or less, CanaLeaf will forfeit all Investment Shares purchased by and issued to CanaLeaf, all of which will be cancelled without any payment or other consideration, liability or obligation of any party hereto to CanaLeaf;

|

|

2.

|

if the total amount paid by CanaLeaf to IHMML for Shares issued pursuant to the Subscription Agreement is more than CAD$10,000,000 but not more than CAD$25,000,000, IHMML shall have the option, exercisable on notice to CanaLeaf on or before December 31, 2014, to purchase all Shares held by CanaLeaf at a price of CAD$1.00 per Share;

|

|

3.

|

if the total amount paid by CanaLeaf to IHMML for Shares issued pursuant to the Subscription Agreement is more than CAD$25,000,000, or if IHMML did not exercise its option pursuant to the Shareholders’ Agreement, CanaLeaf will be entitled to retain the Shares purchased pursuant to the Subscription Agreement, but they will not have any of the sell interests or rights defined in the Shareholders’ Agreement.

|

Overview of Current Business

We are a pharmaceutical business currently focused on developing, distributing and marketing medical marijuana in Canada. We have established joint-venture partnerships with experienced agriculture and pharmaceutical distribution companies in Canada to facilitate this business. We also are actively searching to acquire smaller operations in the medical marijuana industry in Canada with the intention of increasing their profits through economies of scale.

We currently have three subsidiaries through which we operate our business.

6

Medican Systems is a corporation incorporated under the laws of the Territory of the Yukon under incorporation number 535642 on December 30, 2013. The authorized share structure is an unlimited number of common shares without par value, with 100 common shares issued to our company, making Medican Systems our direct wholly-owned subsidiary. The primary focus of Medican Systems is to function as a holding company for Canadian based investments, joint ventures and opportunities.

Medican (Delta). is a corporation incorporated under the laws of the Province of British Columbia under incorporation number BC0989867 on December 31, 2013. The authorized share structure is an unlimited number of common shares without par value, with 100 common shares issued to Medican Systems. The primary focus of Medican Delta is to pursue opportunities in the medical marijuana industry in and around the city of Delta in British Columbia, Canada.

CanaLeaf is a corporation incorporated under laws of Canada under the Canada Business Corporation Act under incorporation number 883348-6 on March 25, 2014. The authorized share structure is an unlimited number of common shares. CanaLeaf is our principal operating subsidiary.

CanaLeaf is the entity that is a party to the Amended Management Services Agreement that creates a business partnership with IHL, LFG and our company.

IHL is Western Canada’s largest fresh herb grower and importer. Founded in 1990, IHL is the leading specialty herbal produce grower in North American, carrying products such as fresh herbs, baby vegetables, lettuces and gourmet salads. IHL and Canaleaf are members of the Canadian National Medical Marijuana Association (the “CNMMA”). The CNMMA was created to ensure all Canadian patients who benefit from medical marijuana have access to the highest quality of products and services to meet their health care needs in a well regulated environment. CanaLeaf plans to create opportunities for political lobbying and exposure through the CNMMA.

7

IHMML will be assisting with the marketing of our Company. IHMML is a full-service provider of marketing, information technology, and call center services dedicated to the pharmaceutical sector. They have 12 years of experience providing superior service and success in the pharmaceutical industry with a novel, automated prescription ordering/refill system, delivery system, and customer contact process.

CanaLeaf leverages the respective expertise of IHL and IHMML and is being led by the management team of IHL and IHMML. CanaLeaf is the consumer-facing brand name for our business, and we believe the partnership between IHL and IHMML, with our company providing the capital markets financing opportunities for the business, will allow for CanaLeaf to emerge as a leading Canadian company in medical marijuana, as we will be able to fulfill stringent requirements, understand the vision and can meet the needs of patients, can expand quickly with research and development, and horticulture advancements. With this combination of expertise and abilities, we believe CanaLeaf is poised to become an industry leader within the medical marijuana community. IHMML also owns the rights for Zenabis, another consumer facing brand that will be developed in conjunction with CanaLeaf.

Health Canada’s “Marihuana for Medical Purposes Regulations” (the “MMPR”) treats dried marijuana as much as possible like a medication by creating a licensing scheme for the commercial production and distribution of the dried marijuana for medical purposes. The introduction of the MMPR in December of 2012 allows for regulated commercial-scale production beginning in 2014. The reformed legislation now prohibits patients from growing their own medical marijuana and only licensed commercial producers will be able to control production and distribution. Health Canada has also stated that their own commercial facility will cease operations, thus opening up the market to new commercial licenses. Commercial producers licensed under the new MMPR regulations will be permitted to grow strains of their choosing based on market demand and Health Canada will allow producers to set pricing for their various strains. Portions of the MMPR were enacted in July 2013 and April 1, 2014. On March 21, 2013 a Canadian federal court judge issued an injunction that exempts currently licensed marijuana users and producers from the MMPR, until their case can be heard. This means that people with existing authorization to possess, designated-person production, or personal-use production licenses issued under the old rules are currently still be permitted to possess and/or grow medical marijuana past April 1, 2014. All new patients will be required to obtain a prescription under the new programs.

We believe that IHL is an ideal partner with the Canadian federal government on this initiative. As an agricultural grower and distributor IHL has the growing, testing and security expertise to be a licensed producer of medical marijuana and implement this program to its full extent.

The Amended Management Services Agreement with IHL and the Subscription Agreement are key steps in establishing our company as a leader in the medical marijuana industry in Canada. Currently, Health Canada has begun a major shift from designated growers to licensed commercial growers. Under the designated grower program, production was limited to two patients per grower and four patients per residential address. Under the new system, there will be no limit to the number of patients for each licensed commercial grower. To capitalize on this new development, we are working with IHL to implement our business model by becoming a licensed commercial grower and receive a commercial growing license (the “License”).

Up until April 1, 2014 in Canada, medical uses of marijuana were governed by the Marijuana Medical Access Regulations (the “MMAR”). The MMAR granted the Canadian government the sole authority to produce and sell medical marijuana to patients. As a result, only one company was contracted with the Canadian government to produce and sell to patients. The MMAR’s proposed changes will have effectively privatized the medical marijuana industry and thus, the government will no longer have contracts to grow marijuana but will open that option to free enterprise. This means that there is no subsidy for the costs of goods and therefore, growers will be allowed to set their prices. This change is unprecedented and because it is a federal initiative growers from any province or region can operate throughout Canada. This is the first development of its kind and the first time Canadian companies can produce medical marijuana. Therefore, growers that receive a License will effectively control the medical marijuana business.

8

On April 8, 2014, CanaLeaf entered into an Subscription Agreement through which CanaLeaf will became a 50% holder of the issued and outstanding common shares of IHMML by way of subscription for 41,600,000 common shares of IHMML for an aggregate subscription price of CAD$52,000,000. IHMML will use these investment proceeds to acquire certain lands, retrofit and/or build a marijuana growing operation and attend to the growing, marketing, research and development, training, distribution and retail sale of medical marijuana in Canada as regulated by Health Canada.

Specifically, with the funds delivered by CanaLeaf, IHMML will commence operations in an initial 393,000 square foot facility located in Atholville, New Brunswick. CanaLeaf has received notice from Health Notice that its application is completed and has undergone a preliminary site assessment from Health Canada. IHMML will commence retrofitting the facility with capital upgrades and will begin immediately building the growing rooms for 300,000 square feet in production area.

While we produce at Atholville, a second 273,000 square foot facility in Poekmouche, New Brunswick and a third 25,000 square foot facility in Delta, British Columbia will be retrofitted and secured for production. The Delta facility will serve as a growing distribution and R&D center for the Company in Western Canada.

Our Products and Their Markets

We are actively meeting with other companies and individuals in the medical marijuana industry to establish relationships and partnerships that we believe will benefit us going forward.

Through our CanaLeaf subsidiary, we are working with IHMMLL to obtain a License through Health Canada to become a licensed commercial grower of medical marijuana. CanaLeaf,, under Health Canada’s new regulations, intends and to begin operations in a commercial property in Atholville, New Brunswick. CanaLeaf will produce medical marijuana, conduct research and development, and coordinate its distribution efforts at the Atholville facility. We also plan to retrofit and secure a second location in Poekmouche, New Brunswick and a third facility in Delta, British Columbia.

CanaLeaf has a four-pronged approach to furthering its products offered and services provided: research and development, horticultural supremacy, distribution and market penetration, and asset security. These four principles will be the focus of our growth and potential partnerships in the future.

There are several regulatory requirements related to the entrance into the medical marijuana industry in Canada. Under the new MMPR, interested parties must apply to Health Canada to become a licensed producer. Licensed producers can be authorized to possess, sell, provide, ship, deliver, transport, destroy, and produce marijuana for medical purposes under the MMPR. CanaLeaf, through its partnerships with IHL and IHMML, has already taken steps to meet all requirements of the new MMPR, including:

|

·

|

Designating a senior person in charge, a responsible person in charge, and an alternate responsible person in charge who meet all eligibility requirements;

|

|

·

|

Completion of a site application;

|

|

·

|

Obtaining the proper personal security clearances;

|

|

·

|

Meeting the physical requirements for the cultivation and storage areas at a facility;

|

|

·

|

Submitting a completed licensed producer application.

|

9

Sales and Marketing

The sales and marketing for CanaLeaf will be led by IHMML. As a first move into the commercial production of medicinal marijuana based on MMPR regulations, the establishment of key distribution channels will be critical to CanaLeaf’s success. CanaLeaf will focus on developing two primary distribution strategies as sanctioned by MMPR regulations.

Direct Sales to Consumers via Online or Telephone Channels

|

·

|

Upon registration, consumers in Canada will be able to directly and securely purchase or re-order CanaLeaf products via the company's website which will be further enhanced through search engine optimization (“SEO”) strategies. According to the regulations of Health Canada, only patients within Canada will be able to purchase these products through these channels.

|

|

·

|

In order for customers to register with CanaLeaf and order its products they must provide the following documents:

|

|

o

|

A medical document - A medical document must be completed in full and signed by a health care practitioner.

|

|

o

|

An Authorization to Possess - This document is issued by Health Canada and can only be used until the end of its validity period, or the expiry date if no separate validity date is indicated.

|

|

o

|

A Form B "Medical Practitioner's Form" - While this form is primarily for use under the Marihuana Medical Access Regulations, if the customer’s health care practitioner has already completed it, it may be used during the transition period so long as it is within one year of the date it was signed by the health care practitioner.

|

|

·

|

CanaLeaf will ensure the highest level of security of its systems to ensure the confidentiality and security of customer and transactional information; system will be integrated with, a provider of technology solutions and support for commercial cannabis growing operations, for patient profiles, document storage and e-commerce functionalities.

|

|

·

|

CanaLeaf’s website will provide the relevant and necessary information in order to educate and advise customers to make informed purchasing decisions.

|

|

·

|

Online channels can further be expanded into mobile channels to provide greater ease of access by customers to CanaLeaf products.

|

|

·

|

Shipping will be completed by Canada Post Secured Shipping (the only approved carrier for Controlled Substances) requiring customer signature upon receipt of the product.

|

|

·

|

Per MMPR Section 5 “Packaging, Labelling and Shipping”, shipments will include the following features.

|

|

o

|

Product will only be sent to the customer’s home, shelter or his/her primary care physician.

|

|

o

|

Container for shipping will have no smell or visible indicators for the product, tamper evident and child resistant.

|

|

o

|

Shipment will contain standard information about the product and client specific label.

|

|

o

|

Maximum package size will be 30g per immediate container (150g max per shipment) measured by the percentage weight of delta-9-tetrahydrocannabinol (THC) and of cannabidiol.

|

10

|

o

|

Package will be clearly labelled “Keep Out of Reach of Children” as well as list the expiration date based on stability testing prior to shipping.

|

Sales via Intermediaries (Medical Professionals)

Critical to not only the sales of CanaLeaf medicinal marijuana products, but also the growth of the overall industry will be the ability to gain support and promotion of medicinal marijuana by health care professionals. CanaLeaf will work closely with medical professionals to provide educational and awareness training to ensure they understand the benefits of its products and incentivize professionals to recommend CanaLeaf products to patients that may benefit from its use, CanaLeaf will also verify the physician is able to practice and is not prohibited from prescribing controlled substances and/or narcotics. Further verification will be made with the physician’s office to ensure that the medical documentation and quantity is complete and correct. Medical professionals will be able to scan bar codes to place direct orders online or via the phone through a dedicated line.

Once CanaLeaf has been able to establish a stronger brand and gain recognition of its product quality, medical professionals can be strategically approached to expand this channel. However, it should be noted that intermediary channels are strongly dependent on brand and quality development and thus must be developed concurrently to optimize CanaLeaf's strategy.

Distribution Approach

Distribution strategy will be overseen by the senior management team of IHMML. Their experience has seen over $500 million in revenues and they have mastered the demanding complexity of software development in the pharmacy space. Integrating the merchant processing systems with proprietary software programs, they have fine-tuned the process that is vital in supporting fraud prevention tactics. As well, their group of over 100 trained customer support representatives with experience in the health care industry leads to thorough experience in pharmaceutical processing.

We will be negotiating with large pharmaceutical and medical sales companies within Canada to market our medical marijuana to physicians throughout Canada. Typically such firms charge 2% of all sales and that rate has been factored into our model.

11

Market

On a global scale, the environment pertaining to medical marijuana usage is rapidly changing across the globe. In the Czech Republic, the health ministry awarded its first license to import marijuana, months after the European Union member legalized marijuana for medical use. Uruguay made history by becoming the first country in the world to legalize the sale and production of cannabis. In the United States, the states of Colorado and Washington both voted to make the sale and use of marijuana legal. Eighteen other American states allow the use of medical marijuana. However, the legal environment in the United States does not currently allow for us to directly be involved in any cultivation or distribution or dispensing of medical marijuana.

Canada is also effecting major changes in the regulation of medical marijuana through the rollout of the recently-enacted MMPR. Health Canada provides two reasons for the regulatory changes: first, to address concerns about the safety of home grow-ops; and secondly, to reduce the cost of administering a program that has proven more popular than anticipated. There is a tremendous business opportunity for companies that obtain their commercial growers license as the Canadian government project revenues for the new medical marijuana industry to reach $1.3 billion by 2024.

Competition

Although Health Canada’s regulations regarding the production and distribution of medical marijuana have only changed this year, we have several competitors in this business area, and expect there to be a great deal more competition in this area as marijuana use becomes more mainstream and more Licenses are granted by Health Canada.

With the recent rollout of the new MMPR, production and sale of medical marijuana will be limited to commercial producers who are able to meet strict government and health regulations. This will effectively eliminate the 3,405 individuals licensed to grow for others and 18,063 individuals allowed to grow marijuana for personal use. As well, it will eliminate the monopoly currently enjoyed by the Saskatchewan medical marijuana producer Prairie Plant Systems. This will likely result in market consolidation with players building up scale to meet current demand. However, on March 21, 2014, a Canadian federal court judge issued an injunction that exempts currently licensed marijuana users and producers from the MMPR. Accordingly, people with existing authorization to possess, designated-person production, or personal-use production licenses issued under the old rules will still be permitted to possess and/or grow medical marijuana past April 1, 2014.

CanaLeaf has received notice from Health Canada that its application to Health Canada is complete. The market to obtain a licence from Health Canada is competitive as there were over 400 medical marijuana licence applications made over the past year, with only a few official licences granted thus far.

We believe that competition will likely result from two key sources:

|

1.

|

Incumbent producers/retailers with established customer base, market access and production facilities. These players would likely to have already established scale beyond household production however lack operational and management expertise to expand their market base. These operators will likely require substantial investments in order to upgrade its facilities to meet new regulatory requirements. Smaller incumbents would either be too small or lack the necessary expertise to compete against commercial enterprises or do not want to expose their operations due to previous legal infractions.

|

12

|

2.

|

New operators looking to leverage the opportunities provided through market liberalization will generally be enterprises possessing stronger technical and/or financial backing. These operators will likely have sound understanding of the industry and regulatory requirements, technical expertise in R&D of strains suitable and desired by the market as well as financing to establish sufficient scale to capture a substantial amount of market share from the onset. These new entrants may also purchase smaller incumbents in order to gain quicker access to key consumer markets.

|

Although competition from both sources will be likely, the second source of competition will likely pose a greater threat to the commercial viability of IMMHL. The following is an analysis of the existing competitive landscape, their key individual company characteristics and how CanaLeaf competes.

Key competitors expected in the market upon formal establishment of the MMPR regulations as of April 1, 2014 will include Canna Farms Limited, CanniMedicare Inc., Peace Naturals Projects Inc., Tweed Marijuana Inc., GreenLeaf Medicinals Ltd., In The Zone Produce Ltd., ThunderBird Biomedical Inc., and Whistler Medical Marijuana Corporation. These companies are currently registered commercial producers with Health Canada as of April 8th, 2014. CanaLeaf has identified key threats posed by these companies, their key value proposition within the market and has developed differentiating strategies against each company.

In response to these competitors, CanaLeaf has established key areas of differentiation and a strong set of value propositions which we believe we allow us to emerge as a leader within the industry. We aim to provide a pharmaceutical grade medical marijuana product at $7.50/gram, which is on par with several of the top players. CanaLeaf is an integrated distribution and growing facility. Given our plans for 600,000 square feet of production, our economies of scale will continue to make us price competitive particularly against smaller players such as Cannimed, Cannafarms, Tweed and Mettrum. In addition to CanaLeaf’s larger production capacity and advanced facilities, CanaLeaf also boasts a strong team of experienced technical experts with deep industry expertise and research and development capabilities in effectively responding to market needs.

A summary of what we believe are our key competitive advantages include:

|

|

·

|

Industry Experience: We believe CanaLeaf’s management team forms a key component of our competitive advantage. The founders of CanaLeaf currently own and operate Western Canada’s largest herb grower and importer at IHL. The management team at IHL will bring its experience and expertise into the commercial medical marijuana market.

|

|

|

·

|

Research and Development: Through our partnership with RPC Science & Engineering (“RPC”), a New Brunswick firm specializing in research and development for medical marijuana companies, and IHMML, we will be able to focus on research and development to increase production efficiencies which will allow us to further advance new medicinal marijuana strains for sale. Our partnership with RPC will also allow us to improve on our quality assurance procedures, ensuring we sell only the highest-quality medicinal marijuana to the Canadian market.

|

|

|

·

|

Government Relationships: From years of experience in agriculture, CanaLeaf’s management team has formed key relationships with officials at Health Canada that will lobby the interests of IHLMM. We believe these relationships will assist us in understanding the regulatory environment, expedite administration, as well as allow us to be privy to potential changes in regulations. We further believe these key relationships will allow us to adapt to the changing legal and market conditions.

|

|

|

·

|

Scale: As an entrant into a highly fragmented industry, it will be a critical imperative to establish operations at a scale that will capture as much market share as possible from the onset in order to establish a stronger market position going forward. CanaLeaf expects to acquire the New Brunswick property with sufficient size to be able to support growing space of 500,000 square feet with a production capacity of up to 450 kilograms per week. As per financial estimates on market potential and usage, our business plan calls for CanaLeaf to capture initially a 2% market share and continue to grow that until maximum capacity is reached, at which time additional growing space (within the financial projections) will be established to meet greater demand.

|

|

|

·

|

Quality Control: CanaLeaf will partner with RPC to conduct analytical services to ensure that Division 4 of the MMPR requirements on quality for the production and sale of dried marijuana in Canada are effectively met. RPC is licensed by Health Canada to perform analysis of cannabis for levels of cannabinol, delta-9-tetrahydrocannabinol and cannabidiol. Test methods are performed using validated, documented procedures which comply with regulatory requirements.

|

13

Intellectual Property

None.

Reports to Security Holders

We are subject to the reporting and other requirements of the Exchange Act and we intend to furnish our shareholders annual reports containing financial statements audited by our independent registered public accounting firm and to make available quarterly reports containing unaudited financial statements for each of the first three quarters of each year. We file Quarterly Reports on Form 10-Q, Annual Reports on Form 10-K and Current Reports on Form 8-K with the SEC in order to meet our timely and continuous disclosure requirements. We may also file additional documents with the SEC if they become necessary in the course of our Company’s operations.

The public may read and copy any materials that we file with the SEC at the SEC's Public Reference Room at 100 F Street, NE, Washington, D.C. 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC. The address of that site is www.sec.gov.

Effect of Existing or Probable Governmental Regulations on the Business

United States

While we intend to focus our business efforts entirely in Canada at least initially, we may, if regulatory and business conditions allow, operate in the United States. Cannabis is not legal to grow in the U.S. under U.S. federal law, although it may be imported and sold in the U.S. Importation is subject to a “zero tolerance” policy as a controlled substance under the U.S. Controlled Substances Act. In certain states, the growth and cultivation of cannabis is legal (California, Colorado, Hawaii, Kentucky, Maine, Maryland, Montano, North Dakota, Oregon, Vermont and West Virginia), although states are resistant to allow the cultivation of cannabis due to resistance from the U.S. Department of Drug Enforcement Agency (the “DEA”) and prohibitions of federal law.

Upon the production and sale of marijuana-based products to consumers, our products will be required to comply with various regulations, including approvals of the federal, state and local governments. We have no current plans to participate in any of these activities in the United States until such time as the legal environment has stabilized and there can be legal certainty surrounding any activities in the medical marijuana industry in the United States.

Canada

The legislation pertaining to medical marijuana has undergone significant recent changes in Canada. The new MMPR was announced on December 2012 as a Health Canada initiative by the Government of Canada. The purpose of this legislation was to allow for the regulation of commercial-scale production of medical marijuana. The new MMPR supersedes all other Medical Marijuana laws in Canada. In 2001 there were around 100 authorized users and this number grew to 40,000 by 2013. The rapid growth in the user base required more oversight from a health and safety standpoint as the old system was simply not economical in the long-run. This change in effect causes growers under the previous program to cease and desist on April 1, 2014. Only corporations or entities who meet the stringent requirements of the new Licensed Producer status (“LP”), under the new MMPR will be allowed to produce medical marijuana in Canada. Municipal governments across Canada, along with local and federal law enforcement are anticipating the effective closure of all current licensed growers (under the old program).

14

Health Canada’s role under the old program was to authorize and license individuals with medical support and administer production contracts. Under the new program, Health Canada will regulate the Licensed Producers, including licensing audit and inspection. Support for access to medical marijuana will be through physicians or nurse practitioners. Doctors are able to recommend medical marijuana to treat chronic diseases and conditions. Medical marijuana is used for AIDS, cancer, ADHD, multiple sclerosis, nausea resulting from chemotherapy, Crohn's disease, glaucoma, epilepsy, insomnia, migraines, arthritis and lack of appetite. Key differences between the old programs and new program are as follows:

|

Old Program

|

New Program

|

|

|

Support for Access

|

Physician

|

Physician or nurse practitioner

|

|

Authorization

|

Application to Health Canada

|

Registration with Licensed Producer

|

|

Production

|

1) Purchase from Health Canada

2) Personal use production

3) Designated-person production

|

Licensed Producer only

|

|

Distribution

|

Health Canada supply sent through secure courier; designated producer can distribute in person or by mail

|

Licensed Producer (secure direct delivery)

|

|

Health Canada Role

|

Authorize and license individuals with medical support; administer production contract

|

Regulate Licence Producers, including licensing audit and inspection

|

Commencing April 2014, under the new MMPR Program commercial growers are able to grow strains based on market demand and Health Canada will allow producers to set prices based on the different strains. CanaLeaf has unique competitive advantages that allow us to leverage the expertise of RPC Science & Engineering for the testing and establishing protocols for pharmaceutical grade medical marijuana. In addition to lowering long-term development costs, our industry partnership with RPC gives CanaLeaf credibility via an independent certification body.

It is anticipated that this major change will produce a vacuum in the supply of high grade medical marijuana. A new market is opening up and the economics are attractive: there is an existing client base, supply is currently limited (and will continue to be so), and there is significant demand for high-quality, laboratory tested and Health Canada standardized medical marijuana.

The MMPR authorizes three key activities: the possession of dried marijuana for medical purposes by individuals who have the support of an authorized health care practitioner; the production of dried marijuana by licensed producers; and the sale and distribution of dried marijuana by specific regulated parties to individuals who can possess it. Licensed producers would be subject to regulatory requirements related to security; good production practices; packaging, labeling and shipping; record keeping and reporting; and distribution. They would also be subject to Health Canada inspections.

15

Commercial producers licensed under the new MMPR regulations are permitted to grow strains of their choosing based on market demand, and Health Canada will allow producers to set pricing for their various strains.

Key Dates in the Evolution of Canadian Attitudes and Laws Regarding Marijuana

In 1999, the first two Canadian patients received federal permission to use marijuana. In 2001, the Canadian Medical Marihuana Access Regulations grant legal access to cannabis for individuals with HIV/AIDS and other illnesses. Authorized patients can grow their own pot or obtain it from authorized producers or Health Canada.

In 2013, new regulations change the Canadian Medical Marijuana Access rules, shifting to licensed commercial growers for supply of medical marijuana and away from homegrown MM. Approximately 37,800 people are authorized to possess medical marijuana under the federal program, increasing from less than 100 in 2001.

In 2014, patients and producers authorized under the previous regulations are required to destroy their medical marijuana and cannabis seeds, although a Canadian Federal Court injunction has granted a temporary injunction allowing continued use of home-grown medical marijuana until legal arguments can be heard. However, the federal government is arguing against this temporary injunction and stated its goal “to treat dried marijuana as much as possible like other narcotic drugs used for medical purposes." However, the injunction is only for existing users and will not apply for new prescriptions. According to the government, a 2010 RCMP report on medical marijuana grow operations across the country found fires up to 24 times more likely in homes with grow operations than with those without. Growing operations are being set up with hydroponic equipment and being installed without the proper permits or inspections, usually within residential areas.

New Canadian Government Steps to Help Medical Community with Medical Marijuana

On March 31, 2014, the Canadian Federal Government announced that marijuana is not an approved drug or medicine in Canada and has not gone through the rigorous scientific trials for efficacy or safety; however the courts have required reasonable access to a legal source of marijuana for medical purposes. As a result, the Government believes that this must be done in a controlled and regulated fashion to protect public health and safety. Minister Rona Ambrose, Minister of Health has directed Health Canada to work with secure commercial operators licensed to produce marijuana to enhance information sharing with regulatory oversight bodies on how doctors and nurse practitioners are authorizing the use of marijuana. The new measures, including information on dosage, educational material and increased oversight, will decrease the potential for over-prescriptions and negative health impacts. It is assumed that active engagement with the medical community is the first step towards approving the use of marijuana within Canada.

Smaller Reporting Company Status

We are subject to the reporting requirements of Section 13 of the Exchange Act, and we are subject to the disclosure requirements of Regulation S-K of the SEC, as a “smaller reporting company.” That designation will relieve us of some of the informational requirements of Regulation S-K, including comprehensive information in the Summary Compensation Tables, a reduction of information included in the Management’s Discussion and Analysis section, and decreased reporting obligations in Item 404 Transactions with Related Persons.

Sarbanes-Oxley Act

We are also subject to the Sarbanes-Oxley Act of 2002 and related rules and regulations. The Sarbanes-Oxley Act created a strong and independent accounting oversight board to oversee the conduct of auditors of public companies and strengthens auditor independence. It also requires steps to enhance the direct responsibility of senior members of management for financial reporting and for the quality of financial disclosures made by public companies; establishes clear statutory rules to limit, and to expose to public view, possible conflicts of interest affecting securities analysts; creates guidelines for audit committee members’ appointment, compensation and oversight of the work of public companies’ auditors; management assessment of our internal controls; auditor attestation to management’s conclusions about internal controls; prohibits certain insider trading during pension fund blackout periods; requires companies and auditors to evaluate internal controls and procedures; and establishes a federal crime of securities fraud, among other provisions. Compliance with the requirements of the Sarbanes-Oxley Act has the potential to substantially increase our legal and accounting costs.

16

Exchange Act Reporting Requirements

Section 14(a) of the Exchange Act requires all companies with securities registered pursuant to Section 12(g) of the Exchange Act to comply with the rules and regulations of the SEC regarding proxy solicitations, as outlined in Regulation 14A. Matters submitted to our stockholders at a special or annual meeting thereof or pursuant to a written consent will require us to provide our stockholders with the information outlined in Schedules 14A or 14C of Regulation 14; preliminary copies of this information must be submitted to the SEC at least 10 days prior to the date that definitive copies of this information are forwarded to our stockholders.

On September 11, 2008, we filed a registration statement on Form 10 of the SEC registering our $0.001 par value common stock under Section 12(g) of the Exchange Act. This registration statement became effective on or about November 9, 2008.

We are required to file Annual Reports on Form 10-K and Quarterly Reports on Form 10-Q with the SEC on a regular basis, and are required to timely disclose certain material events (e.g., changes in corporate control; acquisitions or dispositions of a significant amount of assets other than in the ordinary course of business; and bankruptcy) in a Current Report on Form 8-K. We are not considered an emerging growth company under the JOBS Act because the Company sold securities pursuant to an effective registration statement prior to December 8, 2011.

Research and Development Costs During the Last Two Fiscal Years

None; not applicable. Once we receive our commercial growers license and commence operations in our two facilities, we expect that there will be significant research and development expenses incurred related to our products and production.

Cost and Effects of Compliance with Environmental Laws

We do not believe that our current or intended business operations are subject to any material environmental laws, rules or regulations that would have an adverse material effect on our business operations or financial condition or result in a material compliance cost; however, we will become subject to all such governmental requirements to which the reorganized, merged or acquired entity is subject or may become subject.

Employees

As of March 31, 2014, we had two employees, our CEO, Ken Williams, and our CFO, Wayne Hansen.

Additional Information

You may read and copy any materials that we file with the SEC at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. You may also find all of the reports or registration statements that we have previously filed electronically with the SEC at its Internet site at www.sec.gov. Please call the SEC at 1-202-551-8090 for further information on this or other Public Reference Rooms.

17

ITEM 1A. RISK FACTORS

An investment in our common stock involves a high degree of risk. You should carefully consider the risks described below, together with all of the other information included in this Annual Report, before making an investment decision. If any of the following or similar risks actually occurs, our business, financial condition or results of operations could suffer and our business might fail. In that case, the trading price of our common stock could decline, and you may lose all or part of your investment. You should read the section entitled “Cautionary Note Regarding Forward Looking Statements” above for a discussion of what types of statements are forward-looking statements, as well as the significance of such statements in the context of this Annual Report.

Risks Related to Our Business

We have only recently commenced operations and are thus subject to the risks associated with new businesses.

We have only recently commenced our business plan of manufacturing and distributing medical marijuana in Canada. As of the date of this Annual Report, we have no cash resources, products, manufacturing facilities or sales and marketing operations. As such, we are a “start-up” company with no history of revenue-generating operations. We are, and expect for the foreseeable future to be, subject to all the risks and uncertainties, inherent in a new business. As a result, we still must establish many functions necessary to operate a business, including finalizing our managerial and administrative structure, acquiring our manufacturing facilities, continuing product development, assessing and commencing our marketing activities, implementing financial systems and controls, and recruiting personnel.

Accordingly, you should consider our prospects in light of the costs, uncertainties, delays, and difficulties frequently encountered by companies in their pre-revenue generating stages, particularly those in heavily regulated industries like the medical marijuana industry. Potential investors should carefully consider the risks and uncertainties that a company with no operating history will face. In particular, potential investors should consider that there is a significant risk that we will not be able to:

|

|

·

|

implement or execute our current business plan, or that our business plan is sound;

|

|

|

·

|

raise sufficient funds in the capital markets or otherwise to effectuate our business plan;

|

|

|

·

|

maintain and expand our management team and Board of Directors;

|

|

|

·

|

determine that the processes that we are developing are commercially viable; and/or

|

|

|

·

|

attract, enter into, or maintain contracts with, and retain customers.

|

If we cannot execute any one of the foregoing, our business may fail, in which case you would lose the entire amount of your investment in our company.

We must raise at least $52 million Canadian Dollars over the next 12 months in order to commence our business, and we will continue to need additional financing to carry out our business plan.

We need to obtain significant additional funding to successfully launch and continue our business. Such additional funds may not be readily available or may not be available on terms acceptable to us. Specifically, our Subscription Agreement entered into with IHMML on April 8, 2014 requires us to raise CAD$52,000,000 over the next 12 months, and at least CAD$5,000,000 by April 30, 2014. Any failure to acquire these funds will have adverse effects on our operations. Moreover, CanaLeaf will lose all or virtually all of its shares in IHMML under the Subscription Agreement if it does not fund IHMML certain amounts by December 31, 2014. As such, our failure to raise funding in the near future would have a significantly adverse impact on our business viability and could cause our business to fail. We do not currently have any arrangements or credit facilities in place as a source of funds, and there can be no assurance that we will be able to raise sufficient additional capital on acceptable terms, or at all.

18

If we raise additional capital by issuing equity securities, the percentage ownership of our existing stockholders may be reduced, and accordingly these stockholders may experience substantial dilution. We may also issue equity securities that provide for rights, preferences and privileges senior to those of our common stock. Given our need for cash and that equity raising is the most common type of fundraising for companies like ours, the risk of dilution is particularly significant for stockholders of our company.

Debt financing, if obtained, may involve agreements that include liens on our assets, covenants limiting or restricting our ability to take specific actions, such as incurring additional debt, could increase our expenses and require that our assets be provided as a security for such debt. Debt financing would also be required to be repaid regardless of our operating results.

If we raise additional funds through collaborations and licensing arrangements, we may be required to relinquish some rights to our technologies or candidate products, or to grant licenses on terms that are not favorable to us.

We cannot accurately predict the volume or timing of any future sales, making the timing of any revenues difficult to predict.

We may be faced with regulatory or operational challenges that could impede our ability to commence sales of our medical marijuana products. Consequently, we may incur substantial expenses and devote significant management effort and expense in launching sales efforts, which may not result in revenue generation. We must also obtain regulatory approvals to engage in our business, which is subject to risk and potential delays, and which may not actually occur. As such, we cannot accurately predict the volume or timing of any future sales of our products.

We may not be able to effectively manage our growth.