Attached files

| file | filename |

|---|---|

| EX-31.2 - CERTIFICATION - Rafina Innovations Inc. | ex312.htm |

| EX-31.1 - CERTIFICATION - Rafina Innovations Inc. | ex311.htm |

| EX-32.1 - CERTIFICATION - Rafina Innovations Inc. | ex321.htm |

| EXCEL - IDEA: XBRL DOCUMENT - Rafina Innovations Inc. | Financial_Report.xls |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.20549

Form 10-K

|

(Mark One)

|

|

|

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

For the fiscal year ended December 31, 2013

|

|

|

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

For the transition period from __________ to __________

|

|

|

000-53089

|

|

|

Commission File Number

|

|

|

HCi VioCare

|

|

|

(Exact name of registrant as specified in its charter)

|

|

|

Nevada

|

30-0428006

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

|

Centrum Offices, 38 Queen Street, Glasgow, U.K.

|

G1 3DX

|

|

(Address of principal executive offices)

|

(Zip Code)

|

|

(0808) 178 4373

|

|

|

(Registrant’s telephone number, including area code)

|

|

|

Securities registered pursuant to Section 12(b) of the Exchange Act:

|

|

|

Title of each class

|

Name of each exchange on which registered

|

|

n/a

|

n/a

|

|

Securities registered pursuant to Section 12(g) of the Exchange Act:

|

|

Common Stock

|

|

Title of class

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

|

Yes

|

[ ]

|

No

|

[X]

|

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act.

|

Yes

|

[ ]

|

No

|

[X]

|

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

|

Yes

|

[X]

|

No

|

[ ]

|

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

|

Yes

|

[X]

|

No

|

[ ]

|

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

|

Yes

|

[ ]

|

No

|

[X]

|

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

[ ]

|

Accelerated filer

|

[ ]

|

|

Non-accelerated filer

|

[ ]

|

Smaller reporting company

|

[X]

|

|

(Do not check if a smaller reporting company)

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

|

Yes

|

[ ]

|

No

|

[X]

|

|

The aggregate market value of voting and non-voting common stock held by non-affiliates of the registrant as at June 30, 2013(the last business day of the registrant’s most recently completed second quarter),was approximately $110,000 based on the $0.20 per share which was the last selling price of the Company’s common stock, assuming solely for the purpose of this calculation that all directors, officers and greater than 10% stockholders of the registrant are affiliates. The determination of affiliate status for this purpose is not necessarily conclusive for any other purpose.

|

APPLICABLE ONLY TO REGISTRANTS INVOLVED IN BANKRUPTCY

PROCEEDINGS DURING THE PAST 5 YEARS:

Indicate by check mark whether the issuer has filed all documents and reports required to be filed by Section 12, 13, or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

|

Yes

|

[ ]

|

No

|

[ ]

|

APPLICABLE ONLY TO CORPORATE REGISTRANTS

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date.

|

5,003,650 shares of common stock issued and outstanding as of March 24, 2014

|

DOCUMENTS INCORPORATED BY REFERENCE

List hereunder the following documents if incorporated by reference and the Part of the Form 10-K (e.g. Part I, Part II, etc.) into which the document is incorporated: (1) Any annual report to security holders; (2) Any proxy or information statement; and (3) Any prospectus filed pursuant to Rule 424(b) or (c) of the Securities Act of 1933. The listed documents should be clearly described for identification purposes.

|

None

|

|

Page

|

||

|

PART I

|

||

|

Business

|

2 | |

|

Risk Factors

|

19 | |

|

Unresolved Staff Comments

|

29 | |

|

Properties

|

29 | |

|

Legal Proceedings

|

29 | |

|

Mine Safety Disclosures

|

29 | |

|

PART II

|

||

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

31 | |

|

Selected Financial Data

|

32 | |

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

33 | |

|

Quantitative and Qualitative Disclosures About Market Risk

|

34 | |

|

Financial Statements and Supplementary Data

|

34 | |

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

|

35 | |

|

Controls and Procedures

|

35 | |

|

Other Information

|

36 | |

|

PART III

|

||

|

Directors, Executive Officers and Corporate Governance

|

37 | |

|

Executive Compensation

|

39 | |

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

41 | |

|

Certain Relationships and Related Transactions, and Director Independence

|

42 | |

|

Principal Accounting Fees and Services

|

43 | |

|

PART IV

|

||

|

Exhibits, Financial Statement Schedules

|

44 | |

| 45 |

Forward Looking Statements

This Annual Report on Form 10-K (“Annual Report”) contains forward-looking statements. These statements relate to future events or our future financial performance. A number of important factors could cause our actual results to differ materially from those expressed in any forward-looking statements made by us in this Form 10-K. In some cases, you can identify forward-looking statements by terminology such as "may," "should," "expects," "plans," "anticipates," "believes," "estimates," "predicts," "potential," or "continue" or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks in the section entitled "Risk Factors" and the risks set out below, any of which may cause our or our industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.

Our business is subject to a number of risks of which you should be aware before making an investment decision. These risks are discussed more fully in the "Risk factors" section of this annual report. These risks include, by way of example and not in limitation:

|

·

|

we have a limited operating history, and have never generated any revenue, and we currently have no commercial products;

|

|

·

|

we currently have one technology which requires further development to commercialize its applications. Our ability to generate product revenues, which may not occur for several years, if ever, will depend on the successful development and commercialization of our SocketFit technology;

|

|

·

|

our current and any future collaborations with third parties for the development and commercialization of our current product or any newly acquired products or businesses may not be successful;

|

|

·

|

we intend to acquire and operate clinics related to our business, however, there can be no assurance that we will successful in doing so or if that if we do acquire such clinics that they will be profitable;

|

|

·

|

risks related to the failure to successfully manage or achieve growth of our business if we are successful in development of our technology or the acquisition of clinics; and

|

|

·

|

other risks and uncertainties related to our business strategy.

|

This list is not an exhaustive list of the factors that may affect any of our forward-looking statements. These and other factors should be considered carefully and readers should not place undue reliance on our forward-looking statements.

Forward looking statements are made based on management’s beliefs, estimates and opinions on the date the statements are made and we undertake no obligation to update forward-looking statements if these beliefs, estimates and opinions or other circumstances should change. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

The safe harbors of forward-looking statements provided by Section 21E of the Exchange Act are unavailable to issuers of penny stock. As we issued securities at a price below $5.00 per share, our shares are considered penny stock and such safe harbors set forth under the Private Securities Litigation Reform Act of 1995 are unavailable to us.

Our financial statements are stated in United States dollars and are prepared in accordance with United States generally accepted accounting principles.

In this annual report, unless otherwise specified, all dollar amounts are expressed in United States dollars and all references to "common stock" refer to the common shares in our capital stock.

As used in this Annual Report, the terms "we," "us," "Company," "our" and "VioCare" mean HCi VioCare, unless otherwise indicated.

Background

The address of our principal executive office is Centrum Office, 38 Queen Street, Glasgow, UK G1 3DX. Our telephone number is (0808) 178 4373. The Company’s web-site is currently under development and in beta testing.

Our common stock is quoted on the Over the Counter Bulletin Board (“OTCBB”) and the OTC Markets Inc. owned and operated Inter-dealer Quotation System (“OTCQB”) under the symbol "VICA".

We were incorporated in the State of Nevada on March 26, 2007 as a company intending to sell medical devices in the northern regions of China. Our intent was to seek strategic relationships with medical device manufacturers both in China and North America with the aim to be their sales and distribution agent in northern China. We also intended to assist Chinese medical device manufacturers on the development of the North American market. The Company did not find suitable relationships with which to progress its business until it undertook a change in management in September 2013. With the change in management, the Company determined that it would initially concentrate on the development and marketing of medical devices in Europe, more particularly initially in Scotland, where management had identified several opportunities for entry into the markets for prosthetics and orthotics. We are currently engaged in healthcare innovation in the fields of prosthetics and orthotics (P&O), and we intend to be engaged in the operation of P&O total rehabilitation clinics. We have two recently incorporated wholly-owned Scottish subsidiaries: HCi VioCare Technologies Limited and HCi VioCare Clinics UK Limited, which were incorporated on January 15, 2014.

On December 27, 2013, pursuant to approval of the board of directors and the majority stock holder on November 28, 2013 and November 29, 2013 respectively, the Company filed a Certificate of Amendment to the Articles of Incorporation of the Company for the purpose of clearly providing the directors of the Company with the authority to issue both common and preferred stock without approval by the stockholders and to grant the authority of the directors of the Company to issue such shares of common and/or preferred stock in one or more series, with such voting power, designation, preferences and rights or qualifications, limitations or restriction as they may determine by resolution of the Board of Directors.

On January 13, 2014, the Company filed a Certificate of Designation with the Secretary of State of the State of Nevada. The Certificate of Designation sets forth the rights, preferences and privileges of a class of the Company’s preferred stock. Such class shall be designated as the “Series A Preferred Stock” and the number of shares constituting such series shall be 5,000,000 shares. The holders of Series A Preferred Stock will be entitled to a preference over all of the shares of the Company’s common stock. The holders of common stock and the holders of Series A preferred stock vote together as a single class with the holders of the Series A preferred stock having 50 votes per share of Series A preferred stock and the holders of common stock having 1 vote per share of common stock. Holders of Series A Preferred Stock are entitled to notice of any stockholders’ meeting. No shares of Series A preferred stock have been issued as of the filing date of this report.

On February 12, 2014, we acquired the intellectual property rights over what we believe to be an innovative medical technology which we refer to as the ‘SocketFit’ technology.

On March 21, 2014, the Company’s name changed from China Northern Medical Device, Inc. to HCi VioCare in regard to actions taken on November 28, 2013, when the Board of Directors of the Company (the “Board”) approved, and recommended to the Majority Stockholder that they approve the Name Change. On November 29, 2013, the Majority Stockholder approved the Name Change by written consent in lieu of a meeting, in accordance with Nevada law. On February 21, 2014, the Company submitted the Name Change to FINRA for their review and approval. On February 26, 2014, the Company received notification from FINRA that on March 20, 2014, FINRA would announce the Name Change on the FINRA 03/20/2014 Daily List and that the Name Change would take effect at the open of business on March 21, 2014. At that time the Company’s new symbol became VICA. The Company filed an amendment to our Articles of Incorporation with the Secretary of State of Nevada changing our name to HCi VioCare to be effective on March 21, 2014.

Other than as set out herein, we have not been involved in any bankruptcy, receivership or similar proceedings, nor have we been a party to any material reclassification, merger, consolidation or purchase or sale of a significant amount of assets not in the ordinary course of our business.

Our Current Business – Research and Development and Marketing of devices for healthcare innovation and operation of Prosthetics and Orthotics clinics

We are a development stage company, and are primarily engaged in the research and development and marketing of innovative medical technologies, and intend to be engaged in the operation of prosthetics and orthotics (“P&O”) and diabetic foot total rehabilitation clinics.

On the 15th of January, 2014, we formed our wholly-owned subsidiary, HCi VioCare Technologies Limited (“VioCare Technologies”), a corporation incorporated pursuant to the laws of Scotland, under registration number SC467480. VioCare Technologies intends to research, develop and commercialize state of the art, new, innovative medical devices, methods and products in the fields of prosthetics, orthotics, rehabilitation, bioengineering, mobility, diabetes, diabetic foot, tissue mechanics, ultrasonics, medical signal processing and analysis, medical technology, orthopedics and robotic surgery. VioCare Technologies also plans to expand its research and development reach, to create a stable pipeline of new products and upgrades in the fields of prosthetics, orthotics, and diabetes. VioCare Technologies is intended to be staffed by a world class scientific team, and its current research and development (“R&D”) takes place in Scotland, UK. Dr. Christos Kapatos, the developer of our recently acquired SocketFit technology detailed below will head the R&D and expects to work with a Scientific Advisory Board which we are currently forming in order to ensure that we have the best possible advice and guidance on our developing technologies.

On the 12th of February, 2014 we acquired intellectual property rights ("IPR”) over an innovative medical technology entitled ‘SocketFit’, as well as over any additional technologies under development or that may be developed in the future. SocketFit is a system that will help overcome technical and resource hurdles endemic to the prosthetic sector. The system has been designed with the aim of offering optimally fitted prosthetic sockets that will reduce the number of prostheses made for, resulting in a reduced number of visits by the patient to the prosthetic, and also assisting in the rehabilitation of amputees. VioCare Technologies intends to fund any further development on the aforementioned innovative technology, as well as to complete the development of five additional technologies in P&O and wearable devices which it is currently in negotiation to acquire from Dr. Kapatos. More specifically, it intends to launch three products which it hopes to acquire from Dr. Kapatos during the 2nd and 3d quarter of the year 2014 (Light-IS, W-Mode, and H-Cast). These products require less research and development to get to market. Remaining products that it hopes to acquire it will launch in 2015 and 2016 (SocketFit, A-Cone, D-Ring). As at the date of this filing, the only technology which has been acquired by VioCare Technologies is SocketFit which will take a minimum of two years to get to market from the commencement of the research and development of the product.

SocketFit:

Details of the Project

The number of amputees world-wide is estimated to be 20 million, and for most amputees finding a well-fitted prosthesis is far from easy. Traditional methods of design, manufacture and fitting of a prosthetic socket are typically carried out by “artisan” techniques but unfortunately often result in ill-fitting devices that make wearing a prosthesis almost intolerable for a large number of amputees.

A prosthetic socket is a custom-made “cone” that connects the rest of the prosthesis (foot, shank and knee) to an amputee’s residual limb. Sockets generally need to be replaced once or twice a year. While many significant technological advances have been made with the design and manufacture of prosthetic components, such as electronic knee assemblies and feet, socket design has not kept up. Over the past 20 years a great deal of research has been undertaken to automate the process of socket design and manufacturing, but it has met with limited success. Most sockets continue to be created with hand-sculpted plaster moulds made by the Prosthetist or a technician hours or days after examining the amputee. The result is that, typically, one in four sockets are discarded because of their poor fit.

Many prosthetists, (if not all), are frustrated by the lack of an objective method that would ensure an optimum fit of the socket. This ‘need’ for assistance instigated the advent of industrial sector technologies to be taken up in the field, even though these systems, in reality, lack the necessary ‘ingredient’ to allow the optimum socket to be produced. They merely attempt to replicate current practices in a digital manner (CAD-CAM systems), without taking into account the biomechanical or anatomical characteristics of the residual limb.

The key element of the project is work done by Dr. Christos Kapatos to improve the nature of the data used in socket modeling software. Finite element analysis has been used widely in a variety of applications, including prosthetics. But its prosthetics applications have suffered from the fact that only external boundary data and limited information on the nature of the internal tissue was provided. The results were not promising. By including far more data on the nature of the internal anatomy as well as, for the first time ever (to our knowledge) data on the bio-mechanical properties of the tissue to the FEA, a system can be created that enables Prosthetists to build a socket that evenly distributes weight, provides enhanced comfort, and raises the bar across the industry on socket creation.

SocketFit is a digital system for assessing an amputee’s residual limb and for the production of truly functional and comfortable prosthetic sockets. It takes account of the external and internal geometry of the amputee’s stump, the biomechanical properties of the each individual soft tissue layer i.e. skin, fat, muscle and bone, and the boundary and loading conditions of a complete prosthesis to generate a virtual 3D model of the residual limb. It is then possible to produce an accurate, functional and comfortable prosthetic socket.

Socket Fit Background IPR

Existing techniques of socket production can neither provide information relating to the internal geometry of the residual limb nor offer information on the biomechanical properties of living tissue. The introduction of a system that is capable of providing the Prosthetist with on-line information concerning a detailed mapping of the residual limb and the pressure distribution at the stump/socket interface, as well as the maximum stresses in the tissue, is an innovation in this field and offers the following key advantages over existing techniques:

|

·

|

Provides optimally fitted prosthesis.

|

|

·

|

Provides the Prosthetist with on-line information concerning the detailed mapping of the residual limb (external and internal geometry and structure).

|

|

·

|

Real diagnosis of residual limb problems.

|

|

·

|

Accelerates the rehabilitation of the patient.

|

|

·

|

Improves the quality of prosthetic socket design.

|

|

·

|

Reduces costs by reducing the number of visits to the Prosthetist by the patient.

|

|

·

|

Reduces costs by reducing materials and time wastage due to poor fitted prostheses.

|

|

·

|

Improves the physical and mental well-being of the patients and therefore increase the usage of their prosthesis as they will be more satisfied and feel more comfortable wearing them.

|

|

·

|

The system requires minimum training and familiarisation by the Prosthetists.

|

|

·

|

Compact, mobile, and cost-effective.

|

Dr Christos Kapatos has carried out extensive research in designing a new system to aid the creation of sockets for prosthetic limbs. This research differed from other research as it aimed to acquire and utilise not only the external shape of a residual limb but also:

|

·

|

The internal anatomy of the limb.

|

|

·

|

Bio-mechanical properties of each individual tissue layer of the residual limb.

|

|

·

|

Known boundary conditions (i.e. socket template information and the effects of internal and external forces on the residual limb).

|

By minimising the time and cost of socket production and by reducing the number of faulty sockets (it has been reported that a quarter of all prostheses are currently rejected due to poor fit), there will be a reduction in costs incurred by health services and insurance companies worldwide as well as great benefits to the amputee.

Socket-Fit consists out of three modules:

|

1.

|

The Ring - a device to scan the residual limb and export data.

|

|

2.

|

Data Tools – software to analyse and collate the data into intelligible information.

|

|

3.

|

Socket Modelling – FEA simulation procedures that combine scanned information with known boundary conditions to create a model of a socket for the specific amputee.

|

The system consists of a “ring” attached on a vertical axis, capable of moving vertically along this axis as well as spinning, with the use of a stepper motor and a liner stepper slider. The “ring” is equipped with ultrasound transducers and load transducers as well as with rotary position sensors. An ultrasound transducer and a load transducer are placed on top of each other at the tip of a protruding (spring-supported) arm at the internal side of the ring. A rotary position sensor is also attached on the base of the arm. Two such arms are present on the device.

The external geometry of the medium under examination, is acquired by the position data from the stepper instruments and the use of the rotary position sensors; as the ring moves vertically, spinning at the same time, the spring-supported arms comes in contact with the entire residual limb, mapping every detail and transmitting it to a PC.

The internal geometry is acquired with the use of the on-board ultrasound transducers. Information on the mechanical properties of the tissues are also been captured.

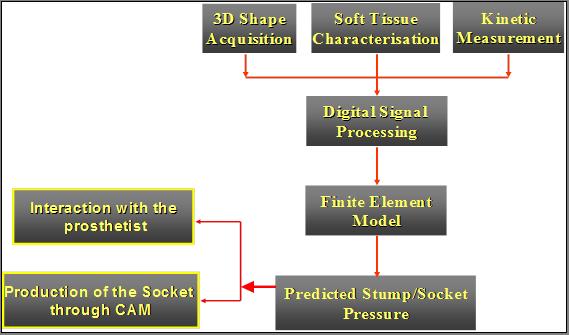

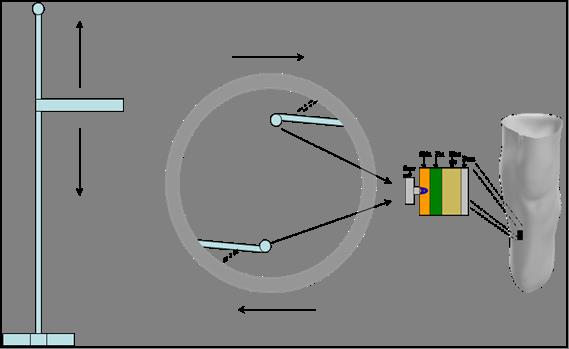

All the data are telemeter to the control box for onward transmission to the PC. Software generates a 3D image of the stump’s external and internal geometry. FEA and optimisation software generate the optimum design for the socket in order to obtain the best pressure distribution, and therefore the most comfortable prosthesis for the amputee. (Figures 1 and 2).

Figure 1, Basic elements of the SocketFit System.

Figure 2, Schematic diagram of the system.

The software

Automation software that controls the hardware, and collects and pre-processes the data.

The automation software calibrates all the sensors and initialises them, controls the motion of both the stepper motor and the slider and acquires the scanning data. These are then saved in a series of ASCI format files and are passed to the appropriate analysis software.

The 1D ultrasonic data are processed by dedicated signal analysis software, which by incorporating a number of advanced analysis methods, such as de-convolution, spectral analysis and speckle registration, produces 2D images/maps of the medium under investigation. It also calculates the displacement caused to the different tissue layers inside the medium by the load applied by the contact “arms”.

The displacement data supplied by the ultrasonic analysis software, together with the pressure data collected by the pressure sensor, are fed in custom made bio-mechanical properties calculation software. The data, in the form of stress vs. strain are processed and the bio-mechanical properties of the tissue layers in the medium under examination calculated.

The final step of the analysis is the Finite Elements Analysis software, or FEA.

A 3D geometry is generated by the 2D images supplied by the ultrasonic analysis software and the appropriate bio-mechanical properties are input into the FE model. The FEA software then generates the shape a prosthetic socket that applies even pressure at the entire surface of the specific medium, residual limb, apart of course from specific points that cannot take any pressure.

The final data from the FEA analysis will be transferred, by means of email or uploaded on data cloud to a 3D carver or a 3D printer where the prosthetic socket, or in the case of a carver the negative mould, will be created. The amputee will then wear the prosthesis and continue with his/her way of living.

1. Control and Acquisition Software

The vertical and rotational movement of the Ring is controlled by the control software. Based upon thorough testing of the device the optimum resolution for rotational movement was calculated to be 1 degree and for vertical movement 1 mm.

The software then acquires and saves the scanning data for later use in the Ultrasonic Analysis and Bio-mechanical Properties Software. Data is saved in a series of ASCI format files and then passed to the appropriate analysis software. Stored data includes:

|

·

|

pressure data

|

|

·

|

displacement data

|

|

·

|

positional data

|

|

·

|

coordinates data

|

|

·

|

ultrasound data

|

2. Ultrasonic Analysis Software

The Ultrasonic Analysis Software is a set of signal and image processing algorithms that have been combined to analyse and process the scanned data.

The algorithms were initially developed and used very successfully in the seismic exploration industry. The algorithms are been adapted and optimised to work with Ultrasound for the first time.

The 1D ultrasonic data derived from the scan is processed by dedicated signal analysis software, which by incorporating a number of advanced analysis methods, such as de-convolution, spectral analysis and speckle registration, produces 2D images/maps of the medium under investigation.

Additionally it also calculates the displacement caused to the different tissue layers inside the medium by the load applied by the contact “arms”.

2D Images will only include the following anatomical information:

|

·

|

Bones (including exact positional information)

|

|

·

|

Fat (note we are only interested in the fat surrounding the muscle and not any fat in between muscles in the centre of the leg)

|

|

·

|

Other Materials (all other materials will be grouped together as one, i.e. different muscle groups, etc.)

|

The displacement data supplied by the ultrasonic analysis software, together with the pressure data collected by the pressure sensor, are fed to a custom-made bio-mechanical properties calculation software.

3. Volume Rendering

This module will take each of the 2D slices and generate a 3D representation of the limb. This representation will be fed into the Socket Modeling module.

There is still some debate around the best tools to use for this module. Options include:

|

·

|

developing a bespoke application

|

|

·

|

use an existing application

|

|

·

|

use existing facilities within FEA

|

4. Bio-Mechanical Tools

The Bio-Mechanical Tools are a set of algorithms that use Bio-Mechanical data derived from the scans to generate stress-strain curves for the tissue within the limb.

This software can predict the stress distribution at any point inside the residual limb, by just knowing the surface pressure applied. The calculated stress, together with the known strain that is calculated by the ultrasonic analysis software from tissue displacement data, produce actual stress vs. strain curves which characterise the tissue layers derived from.

This information will also be fed into the Socket Modelling module.

Socket Modelling

The final step of the analysis is the Finite Elements Analysis software, or FEA. The FEA module incorporates all the information output from the Data Tools (external and internal geometry and bio-mechanical properties) against known Boundary Information to create a model of a customised “uniform pressure” socket for the amputee.

Boundary Information will include:

|

1.

|

Standard Socket Information – template sockets exist which are modified to suit individuals.

|

|

2.

|

Information regarding the impact of external and internal forces (e.g. weight of the amputee).

|

The FEA software then generates the shape a prosthetic socket that applies even pressure at the entire surface of the specific medium, residual limb, apart of course from specific points that cannot take any pressure.

The final data from the FEA analysis will be transferred, by means of email, CDs or any other media, to a 3D carver or a 3D printer where the prosthetic socket, or in the case of a carver the negative mould, will be created. The amputee will then wear the prosthesis and continue with his/her way of living.

Current Status of SocketFit

We have just acquired the rights to the Background IPR and are putting together our development plans for ongoing research and development which we hope will result in a marketable product. We plan to finalize research and development and to launch the product within two years of commencement of the research and development.

Clinics:

On January 15, 2014,we formed our other wholly-owned Scottish subsidiary, HCi VioCare Clinics UK Limited with registration number SC467486 (“VioCare Clinics”), with the intent to create the first state-of-the-art chain of Prosthetic and Orthotic (P&O) and diabetic foot clinics with global reach, while capitalizing on the aforementioned internally developed technologies. VioCare Clinics will establish and/or acquire movement rehabilitation clinics, limb fitting centers and diabetic foot centers, in the UK, Europe and the Middle East, initially. These centers will offer standardized and specialized rehabilitation and consultation services for the physically impaired, as well as for their families, friends, their workplaces and companies that employ or work with them. Some of the sections that will be covered by the centers are:

|

·

|

Prosthetic rehabilitation;

|

|

·

|

Orthotic rehabilitation;

|

|

·

|

Diabetic foot;

|

|

·

|

Foot congenital disorder and musculoskeletal defects;

|

|

·

|

Movement assisting devices;

|

|

·

|

Gait analysis;

|

|

·

|

Pediatric movement analysis and consultation;

|

|

·

|

Living and working spaces design and consultation for people with disabilities;

|

|

·

|

Walking training and body strengthening following amputation, stroke or accident;

|

|

·

|

«Phantomlimb» syndrome consultation;

|

|

·

|

Workshops and educational and training programs; and

|

|

·

|

Expert opinion mediation with insurance companies and organizations.

|

The primary customers will be the physically impaired:

|

·

|

Amputees;

|

|

·

|

People with spasticity;

|

|

·

|

People with walking difficulties;

|

|

·

|

People with genetic abnormalities;

|

|

·

|

People with deformities;

|

|

·

|

People with musculoskeletal pain;

|

|

·

|

People with diabetes;

|

|

·

|

People with flat foot problems or just pain caused by long working hours or hard labor; and

|

|

·

|

Companies or organizations that employ or work with people with disabilities.

|

However the market is not limited to these people; our customers will be families with children with disabilities and businesses that employ disabled persons.

VioCare Clinics will operate under British standards, and will be certified by the International Society of Prosthetics and Orthotics. We have commenced negotiations to acquire our initial clinic in Scotland and hope to have the acquisition completed before the end of our second report quarter, June 30, 2014.

Market and Industry

It is estimated that the global health market is growing by 6-8% per annum, which suggests it will double in the next 10 years. The global Orthopedic Prosthetics market seems to be following the same pattern, as it is growing rapidly, and is projected to exceed US$ 4.5 billion by 2017, according to the 2011 Global Data’s report “Orthotics and Prosthetics - Global Pipeline Analysis, Competitive Landscape and Market Forecasts to 2017”.

Demand for orthopedic prosthetics products is driven by a multitude of factors, including:

|

·

|

growing elderly population in the West: The percentage of people aged 65 and older will increase at a rate three times that of younger generations. Subsequently, the frequency of vascular diseases and diabetes – diseases that often lead to amputation – will increase considerably;

|

|

·

|

causes of amputation: the most common causes of amputation are prosperity diseases related to diseases, such as diabetes and vascular diseases. Accidents account for only 26% of all amputations in developed countries. Indicatively, it is estimated that the number of people with diabetes worldwide (382 million as of November 2013) is expected to reach 592 million by 2035. As a result of the general increase in diabetes and vascular diseases, the number of amputations in the western world is also likely to continue to increase;

|

|

·

|

rising incidence of degenerative joint diseases, such as osteoporosis and arthritis, and increasing numbers of sports injuries;

|

|

·

|

social demands: the growing desire of more and more disabled individuals – especially young people – to become independent, lead active lifestyles, and go about their daily routines without outside help;

|

|

·

|

renewal: the lifetime of traditional prosthetic devices used by previous generations is three to five years. Also prosthetic sockets require replacement after three to six months;

|

|

·

|

market niche: reorganization of healthcare services has led to increased pressure to lower costs within the health sector, which in turn increases the demand for the efficiency of the solutions chosen; and

|

|

·

|

the growing demand for orthopedic prosthetics products is also driving the development of innovative medical devices forward. Advancements in biological science and stem cells technology, as well as rapid technological advances in medical science and development of durable and improved materials and implants have led to large number of people requiring physical rehabilitation, thus contributing to the market’s growth.

|

Overall, the market is set to grow significantly as the incidence of amputation increases. The number of amputees living on developing countries is estimated by the World Health Organization to have reached 300 million with up to 95% lacking access to prosthetic devices, thereby creating an increasing consumer base in need for affordable and reliable orthopedic prosthetics products and services that will improve the amputees’ long-term health and well-being.

Current solutions are inadequate, however, as state-of-the-art solutions from the US and Europe are cost-prohibitive, while low-cost devices run the risk of poor quality and/or unreliable performance. Especially in low-income areas and in developing countries, where the P&O industry is highly fragmented and poorly organized, with significant disparities in terms of clinical infrastructure, provision of medical rehabilitation and assistive devices, demographics (such as gender and/or socioeconomic inequalities), and funding.

Competition

The global Orthopedic Prosthetics industry is highly competitive. The major companies in the sector with whom we compete, through our subsidiary VioCare Clinics, are: Otto Bock with a market share of circa 20%, Ossur with a turnover of around $74 million, USMC who is mostly active in the USA, Blatchford that dominates the domestic market in the UK, and Hanger. The ten largest firms in the field have a combined market share of approximately 40%, and the remaining 60% is divided amongst over 90 smaller companies. In addition, we compete, through our second subsidiary VioCare Technologies, with companies such as General Electric, Siemens, and Google.

Although we are a development stage company with limited operating history, it is intended that our scientific team will lead the technological diversification of the clinics, thereby setting our Company apart from the competition. We will capitalize on our Scientific Board’s vast network of connections to attract customers from neighboring nations and will seek cooperation with global Medical Tourism operators. Moreover, our internally developed technologies are innovative and address very important problems. SocketFit, for example, we believe is unlike any known product currently being sold in the prosthetics sector, and, as such, it does not currently have any direct competitors. Although its target market is niche, given its innovative character and provided that it addresses a significant issue in the sector, it could potentially achieve high penetration levels.

Furthermore, we hope to compete successfully in the prosthetics orthotics industry also by keeping our costs low, relying on the strength of our management’s contacts, and using our size and experience to our advantage by adapting quickly to changing market conditions or responding swiftly to potential opportunities.

Research and Development

As at December 31, 2013, the date of this Annual Report, we had expended a total of $2,739 on research and development.

Intellectual Property

We have acquired exclusive ownership of the innovative medical device ‘SocketFit’. Dr. Kapatos in conjunction with another development Company had prior filed a patent application which has been abandoned. Significant development of the technology has been undertaken since the filing of the abandoned patent and, after corresponding with our patent agents, it was deemed in the best interests of the Company not to revive the old patent, but to apply for new – multiple patents on the technology, and use the old patent as background technology, as new innovations have sprang out of the initial patent and additional fields of application have been identified.

Government Regulations

SocketFit

Our initial market for our products is intended to be the EU, particularly Scotland and Greece. However, we may also market our products in the USA once we have established our European market.

EU Directives

We will be required to comply with the EU Directives regarding medical devices, which apply to all EU member states, including Greece and the UK. The basic relevant EU Directive which applies to our case is Directive 93/42/EEC (as amended by 2007/47/EC) regulating medical devices, as well as Directive 98/68/EEC that requires the manufacturers to place CE marking on their products to demonstrate compliance with the above regulations.

Overview of Directive 93/42/EEC concerning medical devices

|

·

|

Definition and scope of medical devices

|

According to Article 1, par. 2(a), ‘medical device’ means any instrument, apparatus, appliance, material or other article, whether used alone or in combination, together with any accessories, including software intended by the manufacturer to be used specifically for diagnosis or therapeutic purposes or both and necessary for its proper application which:

(a) intended by the manufacturer to be used for human beings for the purpose of:

(i) diagnosis, prevention, monitoring, treatment or alleviation of disease,

(ii) diagnosis, monitoring, treatment, alleviation, or compensation for an injury or handicap,

(iii) investigation, replacement or modification of the anatomy or of a physiological process,

(iv) control of conception; and

(b) which does not achieve its principal intended action in or on the human body by pharmacological, immunological or metabolic means, but which may be assisted in its function by such means.

Having considered the nature of the imaging system and the intended uses, it is our view that the SocketFit system does falls under the above Directive, since, as previously described, the device is intended at least to investigate the anatomy of the amputee’s residual limb and probably to monitor the amputation. The Directive includes in the definition of “medical device” products which are intended for the purpose of investigation of the anatomy (Article 1, par. 2(a) third indent) as well as those for the purpose of diagnosis or monitoring an injury or handicap (article 2(a) second indent). Therefore even very simple claims relating to presenting an image of the anatomy in a clinical context would in our view result in its being classified as a device.

|

·

|

Classification

|

The Directive also lays down rules in Annex IX for the classification of devices based essentially on the potential risks involved, with class III devices having the highest potential risk and class I device the lowest.

Although the SocketFit technology contacts the patient, the imager does not itself enter the stump and is only used once the stump surface has healed. It can therefore be considered to be surgically non invasive and in contact with intact skin only. As it functions by delivering energy in the form of ultrasound to the patient, the imager would be considered as an active device.

Rules 9-12 apply to active devices, however rules 9 and 11 can be eliminated as the system is not therapeutic and does not administer or remove medicines or other substances to or from the patient.

Rule 10 applies to active devices for diagnosis including diagnostic ultrasound. Although the title of the rule is active devices for diagnosis, it should be noted that it also covers devices which are intended for monitoring and it includes all MRI equipment. It can therefore be argued that this rule would apply to the system even if very basic claims are made. As it is not intended to image radiopharmaceuticals, monitor vital signs, or emit ionizing radiation, the system would be a class IIa device under rule 10.

In the event that Rule 10 is considered not to apply, then rule 12 “All other active devices” would apply which would result in the system being a class I device. In this case it is important to consider whether the system has a measuring function and here three criteria are applied:

|

-

|

Is the device intended to measure quantitatively an anatomic parameter?

|

|

-

|

Is it displayed in legal units or compared to at least one point of reference in legal units?

|

|

-

|

Is accuracy implied by implicit or explicit claims with a significant adverse effect in the patient’s health and safety if not achieved?

|

The first parameter would certainly apply regardless of the claims. In the event that the system is intended to be used to compare images over time in order to assess changes in the stump anatomy or/and that it is used to optimise socket geometry then the second and third parameters would also apply and the device would be considered to have a measuring function.

In our view, based on the information provided so far, it is most likely that the system will be a class IIa. If it is considered a class I device it is likely that it will be deemed to have a measuring function. These differences in classification are important as they will affect the conformity assessment routes which can be applied under the directive and the actions which must be taken in order to place the CE mark on the product, pursuant to the aforementioned EU Directive 98/68/EEC.

|

·

|

Conformity Assessment Route

|

The conformity assessment process: In general terms, a manufacturer wishing to place their products on the market under this Directive must:

|

-

|

assign his devices to one of the relevant risk categories defined in the Directive;

|

|

-

|

ensure that the device meets the ‘essential requirements’ specified in Annex I of the Directive;

|

|

-

|

follow the appropriate conformity assessment procedure; and

|

|

-

|

if appropriate (depending on the risk category of the device), ensure that an independent certification body (called a ‘notified body’) is involved in the conformity assessment procedure.

|

Manufacturers are free to apply to any notified body in the EU designated to carry out the desired conformity assessment procedure, regardless of which Member State that notified body is designated in.

As indicated previously, there are three possible classifications: Class IIa, Class I and class I with a measuring function (class Im) which are considered here in turn:

|

i)

|

Class I: This is the simplest scenario as it does not require certification from a Notified Body. In order to place the CE mark on the system, we would simply follow the conformity assessment route in Annex VII of the Directive which is commonly known as self-certification. This involves:

|

|

-

|

Preparation of a technical file on the system (this should include all information required to demonstrate conformity with the essential requirements in Annex I of the Directive);

|

|

-

|

Preparation and implementation of procedure for reviewing experience once on the market, including complaints and positive feedback (known as Post market Surveillance) and for applying any corrective actions;

|

|

-

|

Preparation and implementation of procedure for notifying the relevant competent authorities of any reportable incidents or near incident;

|

|

-

|

Signing a declaration of conformity that the products meet the provisions of the directive which apply to them; and

|

|

-

|

Registering the device under article 14 of the Directive with the relevant competent authority. As we are located in the UK, this would be the Medicines and Healthcare Regulatory Authority, MHRA.

|

Although no Notified Body input is required in this case, it is important to note that the MHRA operates active surveillance of class I devices and may well request the technical file. There is no requirement to have a certified quality system, however we would recommend that ISO 13485 is applied and indeed some customers may require this.

|

ii)

|

Class I Measuring function: In this case Annex VII also applies as above but in addition the procedure in annex IV, V or VI must be applied for those aspects relating to the measuring function. This means that a Notified Body certification is required. Annex VI is arguably the simplest of the annexes as the Notified Body certification is focused on final inspection and testing, however this will depend on the nature of the manufacturing processes and the type of testing which can be conducted routinely. Annex V covers the whole of manufacture and would be the simplest route for a company who already has a quality system such as ISO 13485 in place. Annex IV requires the Notified Body to test every product or to sample batches of every product before they are placed on the market. This is generally not recommended due to cost and inconvenience, unless it is planned only to manufacture small numbers of product infrequently.

|

|

iii)

|

Class IIa: The choices are the same as for a class I measuring device i.e. Annex VII plus either Annex Iv, V or VI. However the Notified Body surveillance concerns the whole of the device not just the measuring function. There is an additional choice – Annex II in which the quality system and Notified Body assessment has to cover both manufacture and design. However, this is not recommended as it involves additional unnecessary work in this case.

|

Once the necessary steps have been successfully completed, the CE marking must be affixed to the medical device. The CE marking has to be placed visibly and legibly on the product or, if not possible due to the nature of the product, be affixed to the packaging and the accompanying document. The CE marking shall consist of the initials 'CE' taking the following form:

The various components of the CE marking must have the same vertical dimension and may not be smaller than 5 mm. If the CE marking is reduced or enlarged, the proportions given in the graduated drawing above must be respected.

When the product is subject to other Directives covering other aspects and which also provide for the ‘CE’ marking, the accompanying documents must indicate that the product also conforms to those other Directives.

If a Notified Body has been involved in the conformity assessment procedure, its identification number must also be displayed.

Scottish Regulations

The following UK regulation implements the above EU medical devices Directives and amendments to date, and are enforced by the MHRA (The UK Medicines and Healthcare Products Regulatory Authority):

|

·

|

Statutory Instruments 2002 No. 618 (Consolidated legislation) that regulate, among others, general medical devices in part II, thus implementing Directive 93/42/EEC (as amended by the Medical Devices Regulations 2008 No. 2936 which transpose Directive 2007/47/EC into UK law).

|

Pursuant to Regulation 44, a manufacturer with a registered place of business in the UK, who places a relevant device on the market (remember that for these purposes, market means the EU market), or who makes available a device for performance evaluation under his own name must register with the MHRA. In addition, a person with a registered places of business in the UK who (a) places a relevant device on the UK market, or (b) who makes a device available for performance evaluation, on behalf of a manufacturer who does not have a registered place of business in the Community or in a state which is party to an Association Agreement, must register with the MHRA. The process is set out on their website.

Greek Regulations

|

1.

|

Presidential Decree ΔΥ8δ/οικ.130648/2009 for the harmonization of Greek law with the Directive 93/42/EEC on medical devices in conjunction with Circular 62701/27-11-2003 of the National Medicines Agency:

|

|

·

|

According to Article 1 par. 9 and Article 2 par. 2, “the relevant regulatory authority is the National Medicines Agency” that takes all necessary measure for the marketing and/or use of the relevant product, and ensures the product’s security and quality compliance;

|

|

·

|

Article 14 states that manufacturers of and/or anyone who markets medical devices in the Greek territory, must be registered with the National Medicines Agency. The registration process is detailed on the website of the National Medicines Agency but essentially requires the same actions as laid down in the description of the EU Directive 93/42 above.

|

|

2.

|

Presidential Decree ΔΥ8δ/Γ.Π.οικ.1348/2004 on the principles and guidelines of good distribution practice of medical devices, compliance with which is ensured by the National Medicines Agency. These principles are defined in Clause 3, some of which are the following:

|

|

-

|

special transportation. storage, preservation, and handling conditions, for public health protection reasons, according to international and European quality standards;

|

|

-

|

the staff responsible for implementing the principles in question must be trained according to its duties;

|

|

-

|

detailed record keeping of all purchase and/or sale of products; and

|

|

-

|

appropriate facilities and equipment so that proper product storage and distribution is ensured.

|

USA Regulations

Essentially, medical devices are subject to the general controls of the Federal Food Drug & Cosmetic (FD&C) Act which are contained in the final procedural regulations in Title 21 Code of Federal Regulations Part 800-1200 (21 CFR Parts 800 - 1299). These controls are the baseline requirements that apply to all medical devices necessary for marketing, proper labeling and monitoring its performance once the device is on the market.

The Company will be required to determine how FDA may classify our device - which one of the three classes the device may fall into. Unless exempt, FDA will classify our device. Classification identifies the level of regulatory control that is necessary to assure the safety and effectiveness of a medical device. Most importantly, the classification of the device will identify, unless exempt, the marketing process (either premarket notification [510(k)] or premarket approval (PMA)) the manufacturer must complete in order to obtain FDA clearance/approval for marketing.

The Company will need to review the development of data and/or information necessary to submit a marketing application, and to obtain FDA clearance to market. For some [510(k)] submissions and most PMA applications, clinical performance data is required to obtain clearance to market. In these cases, conduct of the trial must be done in accord with FDA's Investigational Device Exemption (IDE) regulation, in addition to marketing clearance.

We do not believe that we will be required to submit for a PMA but believe that SocketFit will comply by the submission of a 510(k) to the FDA.

Each person who wants to market in the U.S., a Class I, II, and III device intended for human use, for which a Premarket Approval (PMA) is not required, must submit a 510(k)to FDA unless the device is exempt from 510(k) requirements of the Federal Food, Drug, and Cosmetic Act (the Act) and does not exceed the limitations of exemptions in .9 of the device classification regulation chapters (e.g., 21 CFR 862.9, 21 CFR 864.9). Before marketing a device, each submitter must receive an order, in the form of a letter, from FDA which finds the device to be substantially equivalent (SE) and states that the device can be marketed in the U.S. This order "clears" the device for commercial distribution.

A 510(k) is a premarket submission made to FDA to demonstrate that the device to be marketed is at least as safe and effective, that is, substantially equivalent, to a legally marketed device (21 CFR 807.92(a)(3)) that is not subject to PMA. Submitters must compare their device to one or more similar legally marketed devices and make and support their substantial equivalency claims. A legally marketed device, as described in 21 CFR 807.92(a)(3), is a device that was legally marketed prior to May 28, 1976 (pre-amendments device), for which a PMA is not required, or a device which has been reclassified from Class III to Class II or I, or a device which has been found SE through the 510(k) process. The legally marketed device(s) to which equivalence is drawn is commonly known as the "predicate." Although devices recently cleared under 510(k) are often selected as the predicate to which equivalence is claimed, any legally marketed device may be used as a predicate. Legally marketed also means that the predicate cannot be one that is in violation of the Act.

Until the submitter receives an order declaring a device SE, the submitter may not proceed to market the device. Once the device is determined to be SE, it can then be marketed in the U.S. The SE determination is usually made within 90 days and is made based on the information submitted by the submitter.

Please note that FDA does not perform 510(k) pre-clearance facility inspections. The submitter may market the device immediately after 510(k) clearance is granted. The manufacturer should be prepared for an FDA quality system (21 CFR 820) inspection at any time after 510(k) clearance.

What is Substantial Equivalence

A 510(k) requires demonstration of substantial equivalence to another legally U.S. marketed device. Substantial equivalence means that the new device is at least as safe and effective as the predicate.

A device is substantially equivalent if, in comparison to a predicate it:

|

·

|

has the same intended use as the predicate; and

|

|

·

|

has the same technological characteristics as the predicate;

|

|

|

or

|

|

·

|

has the same intended use as the predicate; and

|

|

·

|

has different technological characteristics and the information submitted to FDA;

|

|

-

|

does not raise new questions of safety and effectiveness; and

|

|

-

|

demonstrates that the device is at least as safe and effective as the legally marketed device.

|

A claim of substantial equivalence does not mean the new and predicate devices must be identical. Substantial equivalence is established with respect to intended use, design, energy used or delivered, materials, chemical composition, manufacturing process, performance, safety, effectiveness, labeling, biocompatibility, standards, and other characteristics, as applicable.

A device may not be marketed in the U.S. until the submitter receives a letter declaring the device substantially equivalent. If FDA determines that a device is not substantially equivalent, the applicant may:

|

-

|

resubmit another 510(k) with new data,

|

|

-

|

request a Class I or II designation through the de novo process,

|

|

-

|

file a reclassification petition, or

|

|

-

|

submit a premarket approval application (PMA).

|

Who is Required to Submit a 510(k)

The Act and the 510(k) regulation (21 CFR 807) do not specify who must apply for a 510(k). Instead, they specify which actions, such as introducing a device to the U.S. market, require a 510(k) submission.

The following four categories of parties must submit a 510(k) to the FDA:

|

1.

|

Domestic manufacturers introducing a device to the U.S. market;

|

|

|

Finished device manufacturers must submit a 510(k) if they manufacture a device according to their own specifications and market it in the U.S. Accessories to finished devices that are sold to the end user are also considered finished devices. However, manufacturers of device components are not required to submit a 510(k) unless such components are promoted for sale to an end user as replacement parts. Contract manufacturers, those firms that manufacture devices under contract according to someone else’s specifications, are not required to submit a 510(k).

|

|

2.

|

Specification developers introducing a device to the U.S. market;

|

|

|

A specification developer develops the specifications for a finished device, but has the device manufactured under contract by another firm or entity. The specification developer submits the 510(k), not the contract manufacturer.

|

|

3.

|

Re-packers or re-labelers who make labeling changes or whose operations significantly affect the device.

|

|

|

Re-packagers or re-labelers may be required to submit a 510(k) if they significantly change the labeling or otherwise affect any condition of the device. Significant labeling changes may include modification of manuals, such as adding a new intended use, deleting or adding warnings, contraindications, etc. Operations, such as sterilization, could alter the condition of the device. However, most re-packagers or re-labelers are not required to submit a 510(k).

|

|

4.

|

Foreign manufacturers/exporters or U.S. representatives of foreign manufacturers/exporters introducing a device to the U.S. market.

|

Please note that all manufacturers (including specification developers) of Class II and III devices and select Class I devices are required to follow design controls (21 CFR 820.30) during the development of their device. The holder of a 510(k) must have design control documentation available for FDA review during a site inspection. In addition, any changes to the device specifications or manufacturing processes must be made in accordance with the Quality System regulation (21 CFR 820) and may be subject to a new 510(k).

When a 510(k) is Required

A 510(k) is required when:

|

1.

|

Introducing a device into commercial distribution (marketing) for the first time. After May 28, 1976 (effective date of the Medical Device Amendments to the Act), anyone who wants to sell a device in the U.S. is required to make a 510(k) submission at least 90 days prior to offering the device for sale, even though it may have been under development or clinical investigation before that date. If your device was not marketed by your firm before May 28, 1976, a 510(k) is required.

|

|

2.

|

You propose a different intended use for a device which you already have in commercial distribution. The 510(k) regulation (21 CFR 807) specifically requires a 510(k) submission for a major change or modification in intended use. Intended use is indicated by claims made for a device in labeling or advertising. Most, if not all changes in intended use will require a 510(k). Please note that prescription use to over the counter use is a major change in intended use and requires the submission of a new 510(k).

|

There is a change or modification of a legally marketed device and that change could significantly affect its safety or effectiveness. The burden is on the 510(k) holder to decide whether or not a modification could significantly affect safety or effectiveness of the device. Any modifications must be made in accordance with the Quality System regulation, 21 CFR 820, and recorded in the device master record and change control records. It is recommended that the justification for submitting or not submitting a new 510(k) be recorded in the change control records.

A new 510(k) submission is required for changes or modifications to an existing device, where the modifications could significantly affect the safety or effectiveness of the device or the device is to be marketed for a new or different indication for use.

Other Requirements Besides Marketing Clearance

Premarket Requirements: Labeling, Registration, Listing

Before marketing clearance is obtained the manufacturer must assure that the device is properly labeled in accordance with FDA's labeling regulations. Once clearance for marketing is obtained, the manufacturer must register their establishment and list the type of device they plan to market with the FDA. All registration and listing information (Annual, Initial or Updates) are to be submitted electronically unless FDA grants you a waiver.

Post-market Requirements: Quality System, Medical Device Reporting

Once on the market, there are post-market surveillance controls with which a manufacturer must comply. These requirements include the Quality Systems (QS) (also known as Good Manufacturing Practices, GMPs) and Medical Device Reporting (MDR) regulations. The QS regulation is a quality assurance requirement that covers the design, packaging, labeling and manufacturing of a medical device. The MDR regulation is an adverse event reporting program.

Regulations for P&O Clinics

The operation of our clinics will be subject to, and must comply with, the respective country’s government regulations. Given our planned acquisition or establishment of clinics in Scotland, UK and Athens, Greece, we are currently most interested in the respective applicable regulations. As we determine to establish clinics in other jurisdictions we will be required to understand and be compliant with the laws in those respective jurisdictions in which we intend to operate.

Scotland

|

1.

|

The Health and Social Work Professions Order 2001, made under section 60 of the Health Act 1999, established the UK Health & Care Professions Council (HCPC) that regulates, among others, prosthetists/orthotists in the UK:

|

|

·

|

according to the interpretation set out in Schedule 3, “relevant professions means arts therapists; chiropodists; clinical scientists; dietitians; medical laboratory technicians; occupational therapists; orthoptists; paramedics; physiotherapists; prosthetists and orthotists; radiographers; and speech and language therapists”;

|

|

·

|

according to article 3, par. 1, the Council is responsible for setting out “the standards of education, training, conduct and performance for members of the relevant professions and to ensure the maintenance of those standards”;

|

|

·

|

according to article 5, “the Council shall establish and maintain a register of members of the relevant professions”;

|

|

·

|

the HCPC sets out for all registrants standards of conduct, performance and ethics, and standards for CPD, as well as standards of proficiency for prosthetists/orthotists specifically.

|

|

2.

|

The Health and Care Professions Council (Constitution) Order 2009 which sets out the composition of the Council (as amended by the Health and Care Professions Council (Constitution) Order 2014);

|

|

3.

|

The Regulation of Care (Scotland) Act of 2001 established the Scottish Commission for the Regulation of Care (‘the Care Commission’), and set out the care services that it will regulate, i.e. all adult, child and independent healthcare services in Scotland, one of which independent healthcare services is ‘independent clinics’. As of April 1st 2011, the work of the Care Commission passed to a new body, the Care Inspectorate. Regulation of independent healthcare, including regulation of independent clinics, has passed to Healthcare Improvement Scotland. Healthcare Improvement Scotland is currently responsible for regulating independent hospitals, voluntary hospices, and private psychiatric hospitals. Regulation of independent clinics, independent medical agencies and independent ambulance services has not yet commenced. The Scottish Government consulted on the future arrangements for regulation of independent healthcare services, including the definition and scope of the services that should be regulated last year and are currently considering the way forward.

|

Greece:

We will be governed in Greece by Law 2072/1992 on Regulations for the profession of the technical specialist of prosthetic and orthotic products and other rehabilitation products, and other provisions. More specifically the law states that companies that operate laboratories of prosthetic, orthotic and other rehabilitation products can be formed by any person or legal entity, provided that they have as their chief technical officer an individual licensed as a technical specialist of prosthetic and orthotic products and other rehabilitation products. There is also a clause in the laws of Greece that refer to the necessary mechanical equipment, the specifications of the laboratory space, the required technical staff, and the committee in charge for granting the relevant permit, all of which are determined by a decision of the Minister of Health. In a review of the laws and conversations with the Ministry of Health directly this clause has not yet been enacted and there is no supporting documentation in regard to the requirements. We will be required to monitor the laws closely to ensure that if and when further regulations are enacted we are compliant.

We will be required to obtain those licenses, permits or other authorizations currently required to launch our products and operate our P&O clinics conduct exploration and other programs. It is possible that the costs and delays associated with such compliance could become so prohibitive that we may decide to not proceed with our business plans.

Employees

The Company does not have any direct employees, We presently have a consulting agreement with our Chief Executive Officer, Sotirios Leontaritis which was entered into on January 15, 2014, whereby Mr. Leontaritis shall provide services to the Company as the Company’s President and Chief Executive Officer in regards to the Company’s management and operations for the period from January 1, 2014 to December 31, 2017. Under the terms of the agreement, the Company agreed to pay to Mr. Leontaritis US$60,000 per annum payable in monthly payments of US$5,000 a month for the term of the contract. Further, under the terms of the contract, Mr. Leontaritis will receive cash compensation of US$5,000 and a stock award of 1,000,000 shares of common stock of the Company in consideration of his services as an officer and director for the period from September 10, 2013 to December 31, 2013. On January 22, 2014, the Company issued the 1,000,000 shares to Mr. Leontaritis pursuant to the agreement.

On December 1, 2013, we entered into a verbal compensation agreement with our current Chief Financial Officer, Grigorios Tsourtos whereby Mr. Tsourtos will receive €1,000 per month for his services as Chief Financial Officer. Mr. Tsourtos will be paid as a consultant and will not have an employment agreement with the Company.

We presently do not have pension, health, annuity, insurance, stock options, profit sharing or similar benefit plans; however, we may adopt such plans in the future.

Available Information

Our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and all amendments to those reports that we file with the Securities and Exchange Commission, or SEC, are available at the SEC's public reference room at 100 F Street, N.E., Washington, D.C. 20549. The public may obtain information on the operation of the public reference room by calling the SEC at 1-800-SEC-0330. The SEC also maintains a website at www.sec.gov that contains reports, proxy and information statements and other information regarding reporting companies.

An investment in our securities should be considered highly speculative due to various factors, including the nature of our business and the present stage of our development. An investment in our securities should only be undertaken by persons who have sufficient financial resources to afford the total loss of their investment. In addition to the usual risks associated with investment in a business, the following is a general description of significant risk factors which should be considered. You should carefully consider the following material risk factors and all other information contained in this Annual Report before deciding to invest in our common stock. If any of the following risks occur, our business, financial condition and results of operations could be materially and adversely affected. Additional risks and uncertainties we do not presently know or that we currently deem immaterial may also impair our business, financial condition or operating results.

Risks Associated with our Business

Implications of being an emerging growth company

As a company with less than $1 billion in revenue during our last fiscal year, we qualify as an "emerging growth company" as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act, and we may remain an emerging growth company until December 31, 2018, subject to satisfaction of certain conditions. For so long as we remain an emerging growth company, we are permitted and intend to rely on exemptions from certain disclosure and other requirements that are applicable to other public companies that are not emerging growth companies. In particular, in this annual report, we have provided only two years of audited financial statements and have not included all of the executive compensation related information that would be required if we were not an emerging growth company. Accordingly, the information contained herein may be different than the information you receive from other public companies in which you hold stock.