Attached files

| file | filename |

|---|---|

| EX-32.2 - CERTIFICATION - Gamzio Mobile, Inc. | ex322.htm |

| EX-31.1 - CERTIFICATION - Gamzio Mobile, Inc. | ex311.htm |

| EX-31.2 - CERTIFICATION - Gamzio Mobile, Inc. | ex312.htm |

| EX-32.1 - CERTIFICATION - Gamzio Mobile, Inc. | ex321.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

S ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2013

OR

£ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _______ to ________

Commission File Number 000-53502

|

GAMZIO MOBILE INC.

|

| (Name of registrant as specified in its charter) |

|

Nevada

|

68-0676667

|

|

|

(State or Other Jurisdiction of Incorporation or Organization)

|

(I.R.S. Employer Identification Number)

|

|

|

|

|

|

123 West NYE Ln., Ste. 129, Carson City NV

|

89706

|

|

|

(Address of Principal Executive Offices)

|

(Zip Code)

|

|

|

(415) 839-1055

|

| (Registrant’s telephone number) |

Securities registered pursuant to Section 12(b) of the Act:

|

None

|

None

|

|

|

(Title of each class)

|

(Name of each exchange on which registered)

|

Securities registered pursuant to Section 12(g) of the Act:

| Common Stock, $0.001 par value |

| (Title of class) |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

|

YES [ ]

|

NO x

|

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

|

YES [ ]

|

NO x

|

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

|

YES x

|

NO [ ]

|

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

|

YES

|

NO [ x]

|

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer, or a small reporting company. See definition of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Accelerated ofiler [ ]

|

|

|

Non-accelerated ofiler (do not check if smaller reporting company) [ ]

|

Smaller reporting company x

|

The aggregate market value of voting and non-voting common stock held by non-affiliates of the registrant was approximately $256,282 (based on 25,628,220 shares held by non-affiliates and closing market price of $0.01 per share as of June 30, 2013 (the last business day of the registrant’s most recently completed second quarter)), assuming solely for the purpose of this calculation that all directors, officers and greater than 10% stockholders of the registrant are affiliates. The determination of affiliate status for this purpose is not necessarily conclusive for any other purpose.

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

|

YES [ ]

|

NO x

|

As of April 14, 2014, there were outstanding 55,658,220 shares of registrant’s common stock, par value $0.001 per share.

Documents Incorporated By Reference: None

2

TABLE OF CONTENTS

|

|

Page

|

||

|

BUSINESS

|

4

|

||

|

RISK FACTORS

|

19

|

||

|

UNRESOLVED STAFF COMMENTS

|

19

|

||

|

PROPERTIES

|

29

|

||

|

LEGAL PROCEEDINGS

|

29

|

||

|

RESERVED

|

29

|

||

| ITEM 5 | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES | ||

|

SELECTED FINANCIAL DATA

|

30

|

||

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

|

30

|

||

|

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

|

34

|

||

|

FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

|

34

|

||

|

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE

|

35

|

||

|

CONTROLS AND PROCEDURES

|

35

|

||

|

OTHER INFORMATION

|

36

|

||

|

DIRECTORS, EXECUTIVE OFFICERS, AND CORPORATE GOVERNANCE

|

36

|

||

|

EXECUTIVE COMPENSATION

|

38

|

||

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS

|

40

|

||

|

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE

|

41

|

||

|

PRINCIPAL ACCOUNTING FEES AND SERVICES

|

42

|

||

|

EXHIBITS, FINANCIAL STATEMENT SCHEDULES

|

42

|

||

|

43

|

|||

|

34

|

|||

| 42 | |||

3

PART I

Some discussions in this Annual Report on Form 10-K contain forward-looking statements that have been made pursuant to the provisions of the Private Securities Litigation Reform Act of 1995. These statements involve risks and uncertainties and relate to future events or future financial performance. A number of important factors could cause our actual results to differ materially from those expressed in any forward-looking statements made by us in this Form 10-K. Forward-looking statements are often identified by words such as “believe,” “expect,” “estimate,” “anticipate,” “intend,” “project,” “plans,” “seek” and similar expressions or words which, by their nature, refer to future events. In some cases, you can also identify forward-looking statements by terminology such as “may,” “will,” “should,” “plans,” “predicts,” “potential” or “continue” or the negative of these terms or other comparable terminology.

These forward-looking statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks in the section entitled “Risk Factors” below that may cause our or our industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. In addition, you are directed to factors discussed in the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” section as well as those discussed elsewhere in this Form 10-K.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity or achievements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results. However, readers should carefully review the risk factors set forth in other reports or documents the Company files from time to time with the Securities and Exchange Commission (the “SEC”), particularly the Company’s Quarterly Reports on Form 10-Q and any Current Reports on Form 8-K. All written and oral forward-looking statements made subsequent to the date of this report and attributable to us or persons acting on our behalf are expressly qualified in their entirety by this section.

Unless otherwise indicated, references to “we,” “our,” “us,” “Gamzio,” “GAMZ,” the “Company” or the “Registrant” refer to Gamzio Mobile, Inc., a Nevada corporation, and its wholly owned subsidiary, Gamzio, Inc., a Nevada corporation.

4

ITEM 1— BUSINESS

History

We were incorporated under the laws of the State of Nevada on January 18, 2007, under the name “Sona Resources, Inc.”, with authorized capital stock of 250,000,000 shares at $0.001 par value. We were originally organized for the purpose of acquiring and developing mineral properties.

On June 6, 2011, we entered into the Exchange Agreement to acquire Marine Drive Technologies Inc., a corporation organized under the laws of Canada (“MDT”), a developer of scalable m-Commerce applications and services, and on July 6, 2011, we changed our name to “Marine Drive Mobile Corp.” On August 26, 2011, we entered into a Membership Interests Purchase Agreement for the acquisition of the outstanding membership interests of I Like A Deal, LLC (“ILAD”), a developer of group buying web based software (the “ILAD Transaction”). On September 12, 2011 we closed the Exchange Agreement with MDT and on October 3, 2011 we closed the Membership Interests Purchase Agreement with ILAD.

On September 11, 2013, we effected a one-for-one hundred reverse stock split of all of our issued and outstanding shares of common stock.

On October 23, 2013, we entered into and consummated a voluntary share exchange transaction with Gamzio, Inc., a Nevada corporation and the sole stockholder of Gamzio, Inc. (the “Selling Stockholder”), pursuant to a Share Exchange Agreement by and among us, Gamzio, Inc. and the Selling Stockholder (the “Exchange Agreement”).

In accordance with the terms of the Exchange Agreement, we issued 30,000,000 shares of our common stock, par value $0.001 to the Selling Stockholder in exchange for 100% of the issued and outstanding capital stock of Gamzio, Inc. (the “Exchange Transaction”). As a result of the Exchange Transaction, the Selling Stockholder acquired 54% of our issued and outstanding shares of common stock, Gamzio, Inc. became our wholly-owned subsidiary, and we acquired the business and operations of Gamzio.

On November 15, 2013, we changed our name from "Marine Drive Mobile Corp." to "Gamzio Mobile, Inc.” On February 4, 2014, we changed our fiscal year to begin on January 1 and end on December 31.

Overview

We operate in two distinct business segments: (1) social casino gaming, and (2) customer loyalty technology.

Social Casino Gaming

Our strategy is to innovate Social Casino Games. Our mission is to create high quality social casino games with the intent to provide widespread appeal for consumers worldwide. We believe that our games are designed to provide unique social gaming experiences for players and drive optimized earnings for shareholders.

We market and distribute our flagship social casino game Slots-O-Luck Adventure HD for iPhone and iPad through Apple’s App Store. We advertise on high volume acquisition channels including Facebook in order to grow our user-base. In the future, we plan to distribute our games on other high volume distribution channels.

5

Customer Loyalty Technology

We provide mobile rewards programs, digital coupons, promotions, and deal management solutions (DMS). We enable our clients to manage sales through real-time transactions, end-user data, enhanced brand marketing strategies, and customer loyalty-reward programs. Our loyalty engine works across all communication platforms and displays – mobile, tablet, & PC – putting real-time deals in the hands of today’s consumer.

Our goal is to provide businesses with a marketing platform that builds incremental business with their existing clients and introduces new customers to their products and services. We do this by providing merchants convenient access to our m-Commerce applications and services.

SOCIAL CASINO GAMING

Gamzio recently “soft” launched its first Social Casino Game title, Slots-O-Luck Adventure HD for iPad and iPhone in the Apple iTunes Store. Gamzio spent approximately over $197,000 in 2012 and over $127,000 in 2013 to develop and optimize the game. At present the company’s management has spent minimal money on advertising and marketing Slots-O-Luck Adventure, choosing instead to optimize the game revenue.

Objectives

Gamzio’s current focus is to grow market share, including the following key objectives:

|

·

|

Procure necessary funding for further advertising and marketing;

|

|

·

|

Acquire customers based on CPI (Cost Per Install) advertising campaigns;

|

|

·

|

Execute the CPI advertising plan to acquire an initial 100,000 users for Slots-O-Luck Adventure HD;

|

|

·

|

Expand to new markets internationally for real money gaming; and

|

|

·

|

Expand to new platforms to capture more market share.

|

Description of Products/Services

Gamzio creates innovative social games and applications (“apps”) for mobile devices. With distribution channels, key strategic partnerships, and a proprietary sharing system to increase game virality, Gamzio hopes to acquire players (customers) and convert those players into revenues greater than the cost of acquiring them. With its in-house data tracking systems, Gamzio is able to optimize player experience, monetization, and virality of its games and apps.

Gamzio’s newest title Slots-O-Luck Adventure was recently released for iPad and iPhone on the Apple App Store. Slots-O-Luck is a social slots game where players can play Las Vegas style slot machines for virtual currency.

Future Products and Services

Real Money Wagering

Gamzio is currently using its experience and talent to position itself in future markets such as real money wagering and will continue to develop enhancements, as well as create new services to keep expanding its position. In the future, Gamzio plans on partnering with a real money gaming licensor.

Gamzio creates and builds the front end of its games. If we successfully partner with a real money gaming licensor, such licensor’s servers would handle the back-end processing. Users would see the front end, such as the Slots-O-Luck Adventure slot machine and bet real money while playing the slot machine. The game would then turn this information over to a licensor, which then calculates the result. If the player wins, the licensor credits the account. If he loses, the licensor deducts money from the account. The licensor handles the payment processing on its own.

The licensor’s platform would be universal. Any Gamzio game can be plugged into its applications programming interface and be converted into a real-money gambling game.

The partnership with such a licensor would be a part of a campaign to break down barriers between real-money online gambling and social-mobile games.

6

Blackjack Tournament Game

Gamzio is also in the process of developing a Blackjack tournament game under the Slots-O-Luck name. We believe that this title will add users and revenue to the current portfolio, and can be cross-promoted to the current user base, reducing the cost of player acquisition.

In addition, Gamzio is currently in preliminary planning to add an Android version of Slots-O-Luck Adventure to the marketplace. Development is estimated to take 5 weeks. We believe this will allow Gamzio to capture more market share in the Mobile Social Casino Game industry.

7

Competition

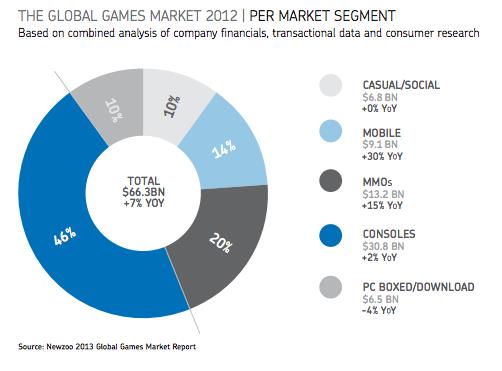

The total social games industry was estimated at $3.65 billion and the online gambling industry was measured at $30.3 billion in 2010. Both social games and online gaming are healthy markets, and together they have the potential to accelerate each other’s growth: Online gambling monetizes very well on a per-player basis, and social games have a huge reach.

Together, the top five Facebook casino games – Texas HoldEm Poke (developed by Zynga), Slotomania (Playtika), DoubleDown Casino (Double Down Interactive), Bingo Blitz (Buffalo Studios) and Best Casino (diwip) – attract 49,800,000 monthly active users and 11,240,000 daily active users.

The following highlights our direct and indirect competitors:

Slotomania - Social Slot machine game acquired by Caesars Entertainment for $81 million. Dec 2012 estimated Rev: $10.72 million. Slotomania serves more than 150 markets in North America and 100 markets in Europe, Asia and South America and has amassed 35 million registered users;

Double Down Casino - a social casino game offered on Facebook and mobile devices. Monthly active users (MAU) is approximately 4.68 million players. Recently acquired by International Gaming Technologies for $500 million. Dec 2012 estimated Rev: $11.85 million;

Jackpot Party Casino - a social casino game offered on Facebook and mobile devices. Monthly active users (MAU) is approximately 1.69 million players. Dec 2012 estimated Rev: $3.29 million;

Further differentiating itself from the competition, Gamzio has enlisted the talents of high-level designers from the land-based slot machine industry to consult on gameplay. Slot machines have been historically used offline. The ability to draw from the knowledge of people who have experience in the offline industry is invaluable.

Order Fulfillment

Gamzio holds no inventory and has programmed the completion of fulfillment requirements via digital in app purchases of virtual casino currency. Management has determined that when necessary, state of the art software and appropriate hardware will be implemented to assist in gaining maximum product sales productivity. Gamzio utilizes accounting procedures offline and online to monitor daily, weekly, monthly, quarterly and annual results of all aspects of its operations.

8

Advertising

Using realtime bidding (RTB) advertising platforms like AppFlood, Flurry, and Facebook; Gamzio can closely monitor acquisition costs, and divert ad-spend to the platforms providing downloads from players with the highest revenue per user.

With newly installed predictive analytics tracking, Gamzio can estimate the lifetime value (LTV) of a user within days as opposed to months as was the case previously. In doing so, Gamzio is able to pinpoint the most profitable acquisition channels and scale up ad-spend.

Social Gaming Market

9

A social network game is a type of online game that is played through social networks, and typically features multiplayer and asynchronous gameplay mechanics. Social network games are most often implemented as games played on internet browsers but can also be implemented on other platforms such as mobile devices. Our focus initially is on mobile devices.

They are amongst the most popular games played in the world, with several products with hundreds of millions of players. FrontierVille, CityVille, Gardens of Time and The Sims Social are more recent examples of very popular social network games.

Social Gaming refers to the virality of playing socially integrated games of chance or skill for money by using a remote device such as a tablet computer, smartphone or a mobile phone with a wireless internet connection.

According to a Juniper Research report released in September 2010, the total sum wagered on mobile casino games is expected to surpass $48 billion US dollars by 2015.

The report bases this prediction on:

(1) the high growth rates of mobile casinos, lotteries and sports betting providers in major emerging markets and China;

(2) liberalization of mobile gambling legislation in Europe;

(3) United States repealing the Unlawful Internet Gambling Enforcement Act of 2006, permitting people in the US to legally gamble online again.

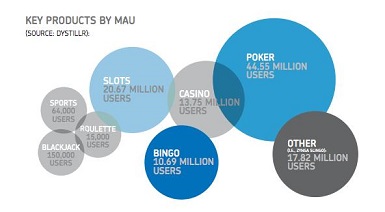

Gamzio strives to target the digital media segment of the market that is in the ideal position to need its service, afford its service, and be in a position to act on purchasing premium content immediately. The primary demographic for social slots games like Slots-O-Luck Adventure is females age 45-65. As of January, 2013, the Social Casino Gaming segment shows an addressable market of 20.67 million users for the slots segment.

Gamzio and its marketing team evaluates the market primarily from the standpoint of what the needs are of the individual consumer. We believe that players are rapidly moving from traditional console-based games that can cost $50 or more upfront, to all the free game content available for download on their mobile devices. Gamzio is hoping to capitalize on this ideal timing by continuously creating high-quality content offered for free, with proven monetization strategies, and recurring revenue models in place to maximize player values.

By utilizing Gamzio’s proprietary technology, players are able to experience a distinctive social casino gaming experience. With Gamzio’s integration of social networks, we can identify trends of players that have the ability to link with and share game experiences with friends, family and other game enthusiasts. With this unique integration, player acquisition cost is greatly reduced, which has the potential to result in increased revenues for the company.

10

Social Casino Industry

According to a Juniper Research report1 released in September 2010 the total sum wagered on mobile casino games is expected to surpass $48 billion US dollars by 2015, and could exceed $100 billion by 2017. The report bases this prediction on (1) the high growth rates of mobile casinos, lotteries and sports betting providers in major emerging markets and China; (2) liberalization of mobile gambling legislation in Europe; and (3) repeal of the Unlawful Internet Gambling Enforcement Act of 2006, permitting people in the US to gamble legally online again.

However, the ’Social Casino Gaming’ market for the mobile gaming industry is fragmented and offers few well-known name brand competitors. Together, the top five Facebook casino games – Texas HoldEm Poke (developed by Zynga), Slotomania (Playtika), DoubleDown Casino (Double Down Interactive), Bingo Blitz (Buffalo Studios) and Best Casino (diwip) – attract 49,800,000 monthly active users and 11,240,000 daily active users.

Gamzio’s apps fall under 2 models - Premium and Freemium. Slots-O-Luck Adventures HD is a Freemium app.

|

●

|

Premium apps generate revenue upfront with users paying a fee between $0.99 and $2.99 to initially download the app. Revenues for Premium title revenues are supplemented with in-app purchases ranging from $0.99 to $99.99.

|

|

●

|

Freemium apps, which is the model for Gamzio’s title - Slots-of-Luck Adventure - are high-quality free apps for the user to download and play. Freemium apps work on an in-game virtual currency monetization system. Users can unlock enhanced items and features within the app using the game’s virtual currency to enhance their experience with the games. This virtual in-app currency can be earned though playing the base version of the game, or purchased with real money via in-app purchases ranging from $.99 to $199.99. Freemium title revenues are also supplemented with ads shown in-game which users can opt to remove for a fee.

|

11

Lifetime customer value of social casino games has been shown to be $1-$3 per player. For Real-Money games, player value can equal up to $1,800 (Source: Betable.com). Player acquisition costs are significantly lower than lifetime player values. Gamzio expects player acquisition costs to be approximately $1.00 to $2.50 per player.

By using analytics to analyze all aspects of player activity, player data, and virtual currency performance, Gamzio has the ability to create more efficient advertising campaigns with industry related advertisers, with the ultimate goal of maximizing revenues and decreasing player acquisition costs. Gamzio has also developed a proprietary system within its games, to reward users for sharing Gamzio’s apps and games with friends. Traditional “passive” methods of in-game sharing techniques have shown to be only mildly effective. However Gamzio’s “active” incentivized in-game sharing system helps promote sharing of the games with other potential users. We believe this not only reduces the cost of user acquisition, but could potentially increase revenues for the company.

Market Segmentation

We believe the industry presents an ever increasing market, a healthy bottom line, and excellent opportunities for growth. According to Morgan Stanley, in an optimistic scenario the social casino industry is on target to reach $7 billion by 2015. Born from the depths of SmartPhones and Facebook, the Social Gaming industry has experienced extremely fast growth in the five years prior to 2013, with IBISWorld estimating revenue to rise at an annualized rate of 304.2% to $2.8 billion. Industry operators have benefited from a customer base which possesses the ability to play and interact with their products, right in the palm of their hand. Social Gaming companies have also taken advantage of the increasingly connected population, with the number of mobile internet connections growing 57.6% in the five years prior to 2012. Industry revenue is expected to grow to $2.8 billion this year [in 2013]. In the five years prior to 2013, IBISWorld estimates that the number of industry firms will increase at an average of 175.3% annually to 632. However, the industry has already started to experience consolidation.

Digital Media - According to a new research report from Gartner, consumers are on track to spend a record $2.1 trillion on digital information and entertainment products this year. That figure is expected to hit $2.8 trillion by 2015. $1.2 trillion (62%) is spent on subscription-based communication services such as mobile, voice, and data services, broadband packages, video services, online gaming, and cable TV subscriptions. $600 billion, 28% of the total $2.1 trillion, is spent on devices themselves, and 10% is spent on content such as computer software, video on-demand, and pay-per-view services. Of the $2 trillion consumers spent globally on digital information and entertainment products and services, the largest spending segment was for communications subscription-based access and usage services. The $1.2 trillion included mobile and wired voice services; mobile data services, such as SMS/TXT and broadband; fixed broadband services; video services, such as subscriptions to pay TV; and the overall online gaming market.

12

The second-largest spending segment (28%) was for devices. The $600 billion is made up of consumer electronic devices, such as mobile/handheld devices, PCs and related devices, and stationary entertainment equipment. The smallest spending segment (10%) was for content and software for a total of $200 billion. Video content that has been purchased/rented/streamed/downloaded, as well as premium channel/pay per view (PPV)/video on demand (VOD), and that portion of pay TV subscriptions allocated to licensing fees made up half of this segment, while the other half was for PC and gaming software, digital music and books, and overall purchases from mobile apps stores.

Online Advertising Market - U.S. online advertising spending is expected to grow 23.3% to $39.5 billion this year, pushing it ahead of total advertising spending in print newspapers and magazines, according to an eMarketer report. Meanwhile, print advertising spending is expected to fall to $33.8 billion in 2012 from $36 billion last year, the market research company said. The 2012 estimates come after a robust year for United States advertising in 2011. eMarketer said online ad spending grew 23% to $32.03 billion last year while total ad spending rose 3.4% to $158.9 billion. Overall, total media ad spending in the United States is expected to grow an estimated 6.7% to $169.48 billion.

The primary driver of the change in projected spending is greater ad spending on Facebook, by far the biggest player in the space. eMarketer predicts ad spending on the world’s top social network will reach $2.19 billion in the U.S. this year and just over $4 billion worldwide; both more than double last year’s figure. United States advertisers are expected to spend $12.33 billion on online display ads this year, a gain of nearly 25% from a year earlier. These projected gains in display ad spending are narrowing the traditional gap between these types of ads and those placed next to Internet search results. Spending on search ads will reach $14.38 billion this year, up 20% from a year ago. In 2015, there will be over 285 million U.S. Internet users and over 2.6 billion global Internet users. The amount of time Internet users spend online per week has also increased. U.S. Internet users spent 15.3 hours a week online last year.

Mobile Advertising Market – According to eMarketer, the U.S. mobile ad market is expected to generate $2.61 billion. eMarketer predicts that spend in mobile search will double in 2012, with $1.28 billion spent in the medium compared to $652.5 million in 2011. Higher-value display and rich-media ads will see less investment, which could either be a sign that mobile is still working to earn its stripes as a credible medium with big brands, or a tacit belief that these formats simply are not working as effectively as search at the moment. Display will be worth $861.7 million, a rise of 93.5% on 2011; video will be worth $151.5 million, a very respectable rise of 122%.

Market Overview for Ad Audience Mobile and Online:

|

United States

|

Worldwide

|

|

In 2015 - over 285 million Internet users

In 2015 - over 335 million PCs in use

Over 80% of office workers use PCs

Over 95% of households will have PCs

There will be over 340 million cell phones in use

There will be 195 million wireless Internet users

|

In 2015 - over 2.6 billion Internet users

In 2015 - over 1.9 billion PCs in use

Over 65% of office workers use PCs

Over 50% of households will have PCs

There will be over 5 billion cell phones in use

There will be 2 billion wireless Internet users

|

Distribution

Gamzio believes that the best places to promote its services are through online exposure such as the Apple iTunes Store, and high-volume distribution networks. Creative campaigns will be developed to engage prospective clients through CPI, banner advertising, Pre-Roll ads, Mobile Install Ads with Facebook, as well as strategic partnerships with download networks offering a near unlimited amount of players for acquisition. Gamzio is excited about its position in relationship to its competition. Management has discovered innovative and creative ways of acquiring components that may translate into maximization of userbase monetization.

The need for a low-based cost that transcends to a lower net cost prior to sale and therefore transcends into a greater profit is what keeps Gamzio on the cutting edge and potentially allows it to compete with its peers on a favorable basis.

Marketing Strategy

Sales, Marketing and Distribution

We market, sell and distribute our games primarily through direct-to-consumer digital storefronts, such as Apple’s App Store. In the future we may also sell and distribute on Facebook, Mac App Store, Google Chrome, the Google Play Store, Amazon’s Appstore, Microsoft’s Xbox Live Marketplace and the Samsung App Store.

13

We also intend to work with third parties, including Facebook, to recruit new players. As part of our efforts to successfully market our games on the direct-to-consumer digital storefronts, we intend to educate the storefront owners about our games. We believe that the featuring or prominent placement of our games facilitates organic user discovery and has the potential to result in our games achieving a greater degree of commercial success.

Pricing Strategy

Gamzio has, after careful consideration, decided to align its game pricing at a freemium model (free to download with in app purchases) level in comparison to some of its competitors. This fits in perfectly with where we see ourself positioned in the total marketplace and from communication with our customer base, as far as getting appropriate value and still maintaining sufficient motivation for high volume. Gamzio looks to create a universal, cross-platform social casino gaming environment for players worldwide. We anticipate that players will also share Gamzio games with their contacts, propagating more viral sales.

Promotion Strategy

The management of Gamzio believes strongly in press releases to promote the value of its services. This will always be a focus of its promotion efforts. However, though this is a crucial part, this is only one part of its promotion strategy. The Company will be promoting what it does through paid downloads (CPIs), partnerships, online activity, email, word of mouth and referrals from other customers. This along with all the individual selling efforts of its staff demonstrates a dynamic way for it to infiltrate the marketplace.

In addition to our efforts to secure prominent featuring or placement for our games, we have also undertaken a number of marketing initiatives designed to acquire customers and increase downloads of our games and increase sales of virtual currency, including:

|

|

•

|

Undertaking extensive outreach efforts with video game websites and related media outlets, such as providing reviewers with access to our games prior to launch;

|

|

|

•

|

Paying third parties, such as Tapjoy, AdMob, iAd or Flurry, to advertise to targeted consumers to download our games through offers or recommendations;

|

|

|

•

|

Using “push” notifications to alert users of sales on virtual currency or items in our games;

|

|

|

•

|

Cross-promoting our games through banner advertisements in our other games, as well as advertising our games in our competitors’ games; and

|

|

|

•

|

Using social networking websites, such as Facebook and Twitter, to build a base of fans and followers to whom we can quickly and easily provide information about our games.

|

The main challenge of today’s game companies is App Store discoverability. Gamzio realizes that in creating strategic partnerships with companies with massive distribution channels, and sources of new players, the discoverability issue may be ameliorated.

Gamzio has teamed up with a number of industry veterans and strategic partners who specialize in app discoverability and distribution. In doing so, Gamzio hopes to expand the distribution of its games and apps worldwide.

Government Regulation

We are subject to a number of domestic and foreign laws and regulations that affect our business. Not only are these laws constantly evolving, which could result in their being interpreted in ways that could harm our business, but legislation is also continually being introduced that may affect both the content of our products and their distribution. In the United States, for example, numerous federal and state laws have been introduced which attempt to restrict the content or distribution of games. Legislation has been adopted in several states, and proposed at the federal level, that prohibits the sale of certain games to minors. In order to address concerns relating to these new laws, we explicitly include in our download page in the Apple iTunes Store the following disclaimer: “This game is for entertainment purposes only, and is not intended for those under 18 year of age, and in some cases, 21 years of age.”

14

We may also be required to modify certain games or alter our marketing strategies to comply with new and possibly inconsistent regulations, which could be costly or delay the release of our games. For example, the United Kingdom’s Office of Fair Trading issued proposed principles in September 2013 relating to in-app purchases in free-to-play games that are directed towards children 16 and under, which principles are expected to become effective in the first quarter of 2014. The Federal Trade Commission has also indicated that it intends to review issues related to in-app purchases, particularly with respect to games that are marketed primarily to minors. In addition, two self-regulatory bodies in the United States (the Entertainment Software Rating Board) and the European Union ( Pan European Game Information) provide consumers with rating information on various products such as entertainment software similar to our products based on the content (for example, violence, sexually explicit content, language). Furthermore, the Chinese government has adopted measures designed to eliminate violent or obscene content in games. In response to these measures, some Chinese telecommunications operators have suspended billing their customers for certain mobile gaming platform services, including those services that do not contain offensive or unauthorized content, which could negatively impact our revenues in China.

Furthermore, the growth and development of free-to-play gaming and the sale of virtual goods may prompt calls for more stringent consumer protection laws that may impose additional burdens on companies such as ours. We anticipate that scrutiny and regulation of our industry will increase and that we will be required to devote legal and other resources to addressing such regulation. For example, existing laws or new laws regarding the regulation of currency and banking institutions may be interpreted to cover virtual currency or goods. If that were to occur we may be required to seek licenses, authorizations or approvals from relevant regulators, the granting of which may depend on us meeting certain capital and other requirements and we may be subject to additional regulation and oversight, all of which could significantly increase our operating costs.

We are also subject to federal, state and foreign laws regarding privacy and the protection of the information that we collect regarding our users, which laws are currently in a state of flux and likely to remain so for the foreseeable future. The U.S. government, including the Federal Trade Commission and the Department of Commerce, is continuing to review the need for greater regulation over collecting information concerning consumer behavior on the Internet and on mobile devices. For example, in December 2012, the Federal Trade Commission adopted amendments to the Children’s Online Privacy Protection Act to strengthen privacy protections for children under age 13, which amendments became effective on July 1, 2013. In addition, the European Union has proposed reforms to its existing data protection legal framework. Various government and consumer agencies have also called for new regulation and changes in industry practices. For example, in February 2012, the California Attorney General announced a deal with Amazon, Apple, Google, Hewlett-Packard, Microsoft and Research in Motion to strengthen privacy protection for users that download third-party apps to smartphones and tablet devices. In response to developments in the interpretation and understanding of regulations such as these and guidance we make our privacy policy readily accessible to players of our games as required by the California Online Privacy Protection Act.

In the area of information security and data protection, we are subject to state laws requiring notification to users when there is a security breach for personal data, such as the 2002 amendment to California’s Information Practices Act, or requiring the adoption of minimum information security standards.

CUSTOMER LOYALTY TECHNOLOGY

We have developed a proprietary technology platform designed to provide merchants with a new method of marketing to existing and loyal customers. We generate revenue primarily through transaction fees associated with the use of our deal management software (“DMS”). The deal management software provides companies of all sizes the ability to create their own electronic discount offers (coupons), make those offers available to targeted customer groups, and send them out through their own distribution channels.

We generate revenues by collecting a small transaction fee for the use of the DMS. Consumers purchase “deal offers” from Gamzio for $1, locking in the merchant’s future discounted deal. When the purchased deal offer is redeemed, the consumer then pays the merchant directly for full cost of the deal. The platform is provided at no cost to the merchant, with the merchant’s customer paying us a $1 fee for the right to the merchant’s deal at a future time.

Our DMS was officially introduced to the golf industry in January 2012 at the PGA Merchandise Show through the website eTeeoff.com, an easy-to-use platform to connect golf merchants to consumers. We signed a Memorandum of Agreement with TapIn Solutions, LLC to make eTeeoff and DMS available to their network of 3,400 golf courses and 450 product distributors across the country.

15

Operations

To date we have not generated any revenue through this business segment.

Since the acquisition of MDT, we have had significant on-going operations, developed proprietary software to use in our products, developed and launched a product, eTeeoff.com, created a marketing plan and sales team, hired contract employees and management and have been actively seeking potential acquisition or development targets, and negotiating and closing transactions with such targets.

Our current and future operations are and will be focused on continuing to carry out our business plan through the marketing and continued development of our deal management software, and our future products, continued software development efforts, the integration of the intellectual property we have acquired through MDT, and the continued evaluation of potential strategic acquisitions and/or partnerships.

Products

Our deal management software (DMS) provides companies of all sizes with the ability to not only enter the e-commerce space, but a clear path of adoption to fast growing mobile-commerce transactions. With this significant cultural and technological shift taking place, we use flexible design to integrate our platform with iPhone, android and even javascript enabled blackberry devices.

Our innovative model involves an intuitive and integrated interface for both web and mobile platforms, and has been designed for the needs of merchants and consumers. Along with high quality professional support, creating and promoting deal offers through our platform is as easy as sending an email. Redeeming a deal is simply a matter of hitting a button on a phone, scanning a QR code, or entering a deal ID.

Strategy

Our customer loyalty technology segment will be an m-Commerce transaction-supported business. We plan to derive most of our revenue in this segment from fees levied on transactions conducted through any one of our m-Commerce platforms. Initially, revenues will be generated from the purchase of a “deal coupon” which guarantees to the consumer a special discount on goods and services from a specific merchant. Deals can be purchased through our mobile applications, as well as through our web-based e-Commerce sites. E-commerce, or electronic commerce, is also known as eCommerce or e-comm. It refers to the buying and selling of products or services over electronic systems such as the Internet.

Pricing

Our strategy will be to derive revenue primarily from a small fee levied on all transactions conducted on any one of our m-Commerce platforms. This transaction fee is based on a sliding scale and varies depending on the full cost of the merchant’s offer, the discounted price of the offer, and the relationship of both of these to the percentage discount being offered. We have established an optimal minimum price of $1 per coupon transaction to cover servicing costs such as: deal assemblage, advertising and promotional costs, platform support, and other related expenses. The intent of this pricing model is to offer excellent deals to customers with as little cost as possible passed onto the merchants, allowing merchants to offer bigger and better deals as often as they wish without sacrificing profits.

Marketing

We develop web and mobile-based e-coupon websites catering to targeted lifestyle demographics. These sites are designed to attract merchants to use our transaction engine. Our management team is particularly experienced in developing joint promotions and partnerships with the dual purpose of expanding both our merchant base and the number of consumers who purchase merchant offers.

Our primary goal is to match merchants and consumers through our transactional m-Commerce applications and software. The Company intends to develop targeted geographic and vertical-specific promotions that appeal to global, national and regional audiences. These promotions will be rolled out strategically to coincide with the growth of each of the Company’s lifestyle vertical properties.

To further grow merchants’ market potential, we intend to allow merchants to easily enter the m-Commerce space by offering easy-to-use coupon apps, or application software, designed specifically for smartphones. To that end, we intend to develop mobile apps for the Apple iPhone, as well as for the Android, RIM and other mobile phone operating systems.

16

Technology

We continue to develop proprietary transactional m-Commerce applications that allow merchants to participate in the online customer loyalty and daily deal promotional market. Designed as a SaaS-based platform, it will allow merchants to easily launch and integrate a daily deal/coupon system into their electronic marketing program.

Smartphones are increasingly being used as a transactional tool and mobile wallet. We intend for our products and services to be at the forefront of this growth. Utilizing our existing in-house expertise we intend to release new versions of our technology platform over the next 12 months to incorporate many of the following tools and applications:

|

·

|

m-Commerce transactional engine;

|

|

·

|

m-Commerce platform to enable merchants to create electronic coupons, promotions and daily deals;

|

|

·

|

Mobile applications to integrate e-coupon applications to the mobile platform;

|

|

·

|

Social media tools and applications; and

|

|

·

|

Detailed reporting and analytics.

|

Industry

Online Commerce

According to eMarketer, in 2011, approximately 179 million consumers ages 14 and older in the United States will research products online and 83% of them will make an online purchase. With the rise of online commerce, the user experience has improved with easy-to-use interfaces, broad selection, enhanced search, rich media and streamlined payment options. Additionally, improved capabilities of inventory management systems, logistics infrastructure and ground and air transportation have provided fast and affordable delivery

of consumer products.

Mobile Commerce

Within the online commerce industry, m-Commerce activity is growing quickly and is predicted to reach $119 billion by 2015. The primary medium for m-Commerce is the smartphone, a device that had garnered 312 million subscribers worldwide by the end of 2010. That number is expected to top 500 million by the end of 2011.

Smartphone owners are increasingly using their phones to shop, browse and research for products. Over a quarter of users now use their smartphone to find product information on a regular basis. Of even greater significance is the fact that half of all smartphone owners have completed a purchase on their phones, while 11% now use it to make a purchase on a weekly basis. The smartphone easily carries coupons, handles a variety of rewards cards and tools and can be used to pay during the check-out process.

In addition to the use of m-Commerce as a retail point of sale, companies have found diverse ways to broaden the use of m-Commerce. Many businesses have developed mobile applications that not only allow customers to purchase products with their mobile device but also spark interest that can generate foot traffic to traditional brick and mortar stores. Other companies use mobile applications not simply to attract customers, but to enhance existing customers’ overall experience or to present unique advertising campaigns.

Top m-Commerce retailers globally include: Taobao, Amazon and eBay. On eBay alone, consumers bought and sold over $2 billion worth of merchandise via mobile in 2010. It is estimated that the US m-Commerce market will be approximately $31 billion by 2016.

17

Competition

Competitors in the online couponing space include Groupon, Living Social and, more recently, Google Offers. These services have increased rapidly of late partly due to the economic downturn; consumers are more interested in searching out the best deals on products. Groupon now has over 50 million subscribers in 35 countries, and the company claims it has saved consumers over a billion dollars and generated hundreds of millions of dollars for businesses.

Most e-couponing services sell a “Deal of the Day”, offering significant savings for local restaurants, service providers, activities and memberships, and generate revenue by taking a commission from the merchant. Often this commission is large and merchants break even at best. For example, Groupon’s revenue is the purchase price paid by the customer for the Groupon. Their gross profit is the amount Groupon retains after paying an agreed-upon percentage of the purchase price to the featured merchant.

Sites like Groupon require a certain number of buy-ins before the deal becomes active. This creates the incentive to share the deal with friends and family, until “the deal is on.” By combining the viral nature of the social web with hard-to-replicate deals, Groupon has created a network-effects business for commerce that makes its model highly attractive. Living Social does not require a minimum number of buy-ins, but strongly encourages customers to share the deal and is extremely active on Facebook and Twitter, engaging customers in an ongoing conversation.

All competitors generally follow the same methods of deal delivery – a daily email, a website, and a mobile site. Email subscribers are offered discounts for goods and services that are targeted to their location and personal preferences. A typical deal might offer a $20 coupon that can be redeemed for $40 in value at a restaurant, spa, yoga studio, car wash or other local merchant.

Government Regulations

Our business will be subject to a number of foreign and domestic laws and regulations that affect companies conducting business on the internet, many of which are still evolving and could be interpreted in ways that could harm our business. These regulations and laws may involve taxation, tariffs, subscriber privacy, data protection, content, copyrights, distribution, electronic contracts and other communications, consumer protection, the provision of online payment services and the characteristics and quality of services. It is not clear how existing laws governing issues such as property ownership, sales and other taxes, libel and personal privacy apply to the internet as the vast majority of these laws were adopted prior to the advent of the internet and do not contemplate or address the unique issues raised by the internet or e-commerce.

In addition, it is possible that governments of one or more countries may seek to censor content available on our websites or may even attempt to completely block access to our websites. Accordingly, adverse legal or regulatory developments could substantially harm our business.

Our e-coupons may be considered gift cards, gift certificates, stored value cards or prepaid cards and therefore governed by, among other laws, the CARD Act and state laws governing gift cards, stored value cards and coupons. Many of these laws contain provisions governing the use of gift cards, gift certificates, stored value cards or prepaid cards, including specific disclosure requirements and prohibitions or limitations on the use of expiration dates and the imposition of certain fees.

In addition, certain states and foreign jurisdictions have requirements for disclosure and product terms and conditions, including expiration dates and permissible fees, which might apply to us. Some states and foreign jurisdictions also include gift cards under their unclaimed and abandoned property laws which require companies to remit to the government the value of the unredeemed balance on the gift cards after a specified period of time (generally between one and five years) and impose certain reporting and recordkeeping obligations.

Many states have passed laws requiring notification to subscribers when there is a security breach of personal data. There are also a number of legislative proposals pending before the U.S. Congress, various state legislative bodies and foreign governments concerning data protection. In addition, data protection laws in Europe and other jurisdictions outside the United States may be more restrictive, and the interpretation and application of these laws are still uncertain and in flux. It is possible that these laws may be interpreted and applied in a manner that is inconsistent with our data practices. If so, in addition to the possibility of fines, this could result in an order requiring that we change our data practices, which could have an adverse effect on our business. Furthermore, the Digital Millennium Copyright Act has provisions that limit, but do not necessarily eliminate, our liability for linking to third-party websites that include materials that infringe copyrights or other rights, so long as we comply with the statutory requirements of this act. Complying with these various laws could cause us to incur substantial costs or require us to change our business practices in a manner adverse to our business

18

Employees

Currently, we have five three time contracted employees which includes our CEO. We have also hired part-time employees to assist in the on-going operations of the Company. Other work, including work relating to our sales efforts, is subcontracted to consultants on an as-needed basis. We intend to grow our employee base based on the demands and requirements of the business.

ITEM 1A— RISK FACTORS

You should carefully consider the risks described below together with all of the other information included in our public filings before making an investment decision with regard to our securities. If any of the following events described in these risk factors actually occurs, our business, financial condition or results of operations could be harmed. In that case, the trading price of our common stock could decline, and you may lose all or part of your investment.

Risks Relating to Our Business and Industry

We have no revenues and have incurred and expect to continue to incur substantial losses.

Since inception through December 31, 2013, we have not generated any revenues and we have generated significant operating losses since our formation and given our recent shift in business focus we expect to incur substantial losses and negative operating cash flows for the foreseeable future. For the year ended December 31, 2013, our net loss was $135,435 and as of December 31, 2013our accumulated deficit, was $332,467. We anticipate that our existing cash and cash equivalents will not be sufficient to fund our short term business needs, and we will need to generate revenue or receive additional investment in the Company to continue operations. In addition, our business operations may prove more expensive than we currently anticipate and we may incur significant additional costs and expenses. We expect that capital outlays and operating expenditures will continue to increase as we attempt to expand our infrastructure and development activities, and we will require significant additional capital in order to implement our business plan and continue our operations.

Our auditors have expressed uncertainty as to our ability to continue as a going concern.

Primarily as a result of our recurring losses and our lack of liquidity, we received a report from our independent auditors that includes an explanatory paragraph describing the substantial uncertainty as to our ability to continue as a going concern as of our fiscal year ended December 31, 2013.

We have a relatively new and evolving business model with a short operating history.

|

|

•

|

we may have difficulty optimizing the monetization of our games due to our relatively limited experience creating games that include micro-transaction capabilities, advertising and offers, as well as our limited experience in offering the features that are often associated with free-to-play games published by games-as-a-service companies, such as tournaments, live events and more frequent content updates;

|

|

|

•

|

we intend to develop our games based upon our own intellectual property, rather than well-known licensed brands, and we may encounter difficulties in generating sufficient consumer interest in and downloads of our games;

|

|

|

•

|

many well-funded public and private companies have released, or plan to release, free-to-play games,, and this competition will make it more difficult for us to differentiate our games and derive significant revenues from them;

|

|

|

•

|

free-to-play games, have a relatively limited history, and it is unclear how popular this style of game will become or remain or its revenue potential;

|

|

|

•

|

our free-to-play strategy assumes that a large number of players will download our games because they are free and that we will then be able to effectively monetize the games; however, players may not widely download our games for a variety of reasons, including poor consumer reviews or other negative publicity, ineffective or insufficient marketing efforts, lack of sufficient community features, lack of prominent storefront featuring and the relatively large file size of some of our games—our thick-client games may utilize a significant amount of the available memory on a user’s device, and due to the inherent limitations of the smartphone platforms and telecommunications networks, which only allow applications that are less than 100 megabytes to be downloaded over a carrier’s wireless network, players must download one of our thick-client games either via a wireless Internet (wifi) connection or initially to their computer and then side-loaded to their device;

|

|

|

•

|

even if our games are widely downloaded, we may fail to retain users or optimize the monetization of these games for a variety of reasons, including poor game design or quality, lack of community features, gameplay issues such as game unavailability, long load times or an unexpected termination of the game due to data server or other technical issues, or our failure to effectively respond and adapt to changing user preferences through game updates;

|

|

|

•

|

we may have difficulty hiring the additional monetization, live operations, server technology, user experience and product management personnel that we require to support our games and incorporating our products;

|

|

|

•

|

we will depend on the proper and continued functioning of our own servers and third-party infrastructure to operate;

|

|

|

•

|

the billing and provisioning capabilities of some smartphones and tablets are currently not optimized to enable users to purchase games or make in-app purchases, which make it difficult for users of these smartphones and tablets to purchase our games or make in-app purchases and could reduce our addressable market, at least in the short term; and

|

|

|

•

|

the Federal Trade Commission has indicated that it intends to review issues related to in-app purchases, particularly with respect to games that are marketed primarily to minors, and the commission might issue rules significantly restricting or even prohibiting in-app purchases or name us as a defendant in a future class-action lawsuit.

|

If we do not achieve a sufficient return on our investment with respect to our free-to-play business model, it will negatively affect our operating results and may require us to formulate a new business strategy.

19

We will derive our revenues from Apple’s App Store, and if we are unable to maintain a good relationship with each of Apple or if the storefront was unavailable for any prolonged period of time, our business will suffer.

The majority of our smartphone revenues will be derived from Apple’s iOS platform. We will generate the majority of these iOS-related revenues from in-app purchases made through the Apple App Store. We believe that we have good relationships with Apple. Accordingly, any change or deterioration in our relationship with Apple could materially harm our business and likely cause our stock price to decline. We also rely on the continued functioning of the Apple App Store. In the past the digital storefront has been unavailable for short periods of time or experienced issues with their in-app purchasing functionality. If either of these events recurs on a prolonged basis or other similar issues arise that impact our ability to generate revenues from these storefronts, it would have a material adverse effect on our revenues and operating results. In addition, if the storefront operators fail to provide high levels of service, our end users’ ability to access our games may be interrupted or end users may not receive the virtual currency or goods for which they have paid, which may adversely affect our brand.

The operators of digital storefronts on which we publish our free-to-play games in many cases have the unilateral ability to change and interpret the terms of our contract with them.

The distribution terms and conditions are often “click through” agreements that we are not able to negotiate with the storefront operator. For example, we are subject to each of Apple’s standard click-through terms and conditions for application developers, which govern the promotion, distribution and operation of applications, including our games, on their storefronts. Apple can unilaterally change their standard terms and conditions with no prior notice to us. In addition, the agreement terms can be vague and subject to changing interpretations by the storefront operator. For example, in the second quarter of 2011, Apple began prohibiting certain types of virtual currency-incented advertising offers in games sold on the Apple App Store. Most recently, Apple informed us early in the fourth quarter of 2012 that we could no longer include links to Tapjoy’s HTML5 website in our games, which has since negatively impacted our ability to generate revenue through incented offers and will likely continue to negatively impact our revenues in future periods. Any similar changes in the future that impact our revenues could materially harm our business, and we may not receive significant or any advance warning of such change. In addition, Apple has the right to prohibit a developer from distributing its applications on its storefront if the developer violates its standard terms and conditions. If Apple or any other storefront operator determines that we are violating its standard terms and conditions, by a new interpretation or otherwise or prohibits us from distributing our games on its storefront, it would materially harm our business and likely cause our stock price to significantly decline.

The markets in which we operate are highly competitive, and many of our competitors have significantly greater resources than we do.

Developing, distributing and selling mobile games is a highly competitive business, characterized by frequent product introductions and rapidly emerging new platforms, technologies and storefronts. For end users, we compete primarily on the basis of game quality, brand and customer reviews. We compete for promotional and storefront placement based on these factors, as well as our relationship with the digital storefront owner, historical performance, perception of sales potential and relationships with licensors of brands and other intellectual property. For content and brand licensors, we compete based on royalty and other economic terms, perceptions of development quality, porting abilities, speed of execution, distribution breadth and relationships with storefront owners or carriers. We also compete for experienced and talented employees.

20

We compete with a continually increasing number of companies, including Gluu Mobile Inc., Zynga, DeNA, Gree, Nexon and many well-funded private companies, including Kabam, King, Rovio, Storm 8/Team Lava and Supercell. We also compete for consumer spending with large companies, such as Activision, Electronic Arts (EA Mobile), Gameloft and Take-Two Interactive, whose games for smartphones and tablets are primarily premium rather than free-to-play. In addition, given the open nature of the development and distribution for smartphones and tablets, we also compete or will compete with a vast number of small companies and individuals who are able to create and launch games and other content for these devices using relatively limited resources and with relatively limited start-up time or expertise. As an example of the competition that we face, it has been estimated that more than 170,000 active games were available on Apple’s App Store as of October 31, 2013. The proliferation of titles in these open developer channels makes it difficult for us to differentiate ourselves from other developers and to compete for end users without substantially increasing our marketing expenses and development costs.

|

|

•

|

significantly greater financial resources;

|

|

|

•

|

greater experience with the free-to-play games and games-as-a-service business model and more effective game monetization;

|

|

|

•

|

stronger brand and consumer recognition regionally or worldwide;

|

|

|

•

|

greater experience integrating community features into their games, operating as a games-as-a-service company and increasing the revenues derived from their users;

|

|

|

•

|

the capacity to leverage their marketing expenditures across a broader portfolio of mobile and non-mobile products;

|

|

|

•

|

larger installed customer bases from related platforms, such as console gaming or social networking websites, to which they can market and sell mobile games;

|

|

|

•

|

more substantial intellectual property of their own from which they can develop games without having to pay royalties;

|

|

|

•

|

lower labor and development costs and better overall economies of scale;

|

|

|

•

|

greater platform-specific focus, experience and expertise; and

|

|

|

•

|

broader global distribution and presence.

|

If we are unable to compete effectively or we are not as successful as our competitors in our target markets, our sales could decline, our margins could decline and we could lose market share, any of which would materially harm our business, operating results and financial condition.

Consumer tastes are continually changing and are often unpredictable, and we compete for consumer discretionary spending against other forms of entertainment; if we fail to develop and publish new mobile games that achieve market acceptance, our sales would suffer.

Our business depends on developing and publishing mobile games that consumers will want to download and spend time and money playing. We must continue to invest significant resources in research and development, analytics and marketing to introduce new games and continue to update our successful free-to-play games, and we often must make decisions about these matters well in advance of product release to timely implement them. Our success depends, in part, on unpredictable and volatile factors beyond our control, including consumer preferences, competing games, new mobile platforms and the availability of other entertainment activities. If our games and related applications do not meet consumer expectations, or they are not brought to market in a timely and effective manner, our business, operating results and financial condition would be harmed. Even if our games are successfully introduced and initially adopted, a failure to continue to update them with compelling content or a subsequent shift in the entertainment preferences of consumers could cause a decline in our games’ popularity that could materially reduce our revenues and harm our business, operating results and financial condition. Furthermore, we compete for the discretionary spending of consumers, who face a vast array of entertainment choices, including games played on personal computers and consoles, television, movies, sports and the Internet. If we are unable to sustain sufficient interest in our games compared to other forms of entertainment, our business and financial results would be seriously harmed.

21

If we do not successfully establish and maintain awareness of our brand and games, if we incur excessive expenses promoting and maintaining our brand or our games or if our games contains defects or objectionable content, our operating results and financial condition could be harmed.

We believe that establishing and maintaining our brand is critical to establishing a direct relationship with end users who purchase our products from direct-to-consumer channels and to maintaining our existing relationships with distributors and content licensors, as well as potentially developing new such relationships. Increasing awareness of our brand and recognition of our games is particularly important in connection with our strategic focus of developing games based on our own intellectual property. Our ability to promote the Gamzio brand and increase recognition of our games depends on our ability to develop high-quality, engaging games. If consumers, Digital Storefront owners and branded content owners do not perceive our existing games as high-quality or if we introduce new games that are not favorably received by them, then we may not succeed in building brand recognition and brand loyalty in the marketplace. In addition, globalizing and extending our brand and recognition of our games is costly and involves extensive management time to execute successfully, particularly as we expand our efforts to increase awareness of our brand and games among international consumers. Even if we significantly increased our sales and marketing expenditures in connection with the launch of our games, these efforts may not succeed in increasing awareness of our brand or the new games. If we fail to increase and maintain brand awareness and consumer recognition of our games, our potential revenues could be limited, our costs could increase and our business, operating results and financial condition could suffer.

In addition, if a game contains objectionable content, we could experience damage to our reputation and brand. In addition, one of our employees or an employee of an outside developer could include hidden features in one of our games without our knowledge, which might contain profanity, graphic violence, sexually explicit or otherwise objectionable material. If consumers believe that a game we published contains objectionable content, it could harm our brand, consumers could refuse to buy it or demand a refund, and could pressure the digital platform operators to no longer allow us to publish the game on their platforms. Similarly, if one of our games is introduced with defects or has playability issues, it could results in negative user reviews and damage our brand. These issues could be exacerbated if we do not timely and adequately address issues that our users have encountered with our games.

We will depend on only one game for a significant portion of our revenues in the near future and if the game does not succeed or we do not release new games that are successful, our business will fail.

In the mobile gaming industry, new games are frequently introduced, but a relatively small number of games account for a significant portion of industry sales. Similarly, we have released just one game, Slots-O-Luck Adventure HD. Our growth depends on our ability to consistently launch new games that generate significant revenues. Developing and launching our games and providing future content updates requires us to invest significant time and resources with no guarantee that our efforts will result in significant revenues. If our new games are not successful or if we are not able to cost-effectively extend the lives of our successful games, our revenues could be limited and our business and operating results would suffer.

We rely on a combination of our own servers and technology and third party infrastructure to operate our games. If we experience any system or network failures, cyber-attacks or any other interruption to our games, it could reduce our sales, increase costs or result in a loss of revenues or end users of our games.

We rely on Digital Storefronts and other third-party networks to deliver games to our customers and on their or other third parties’ billing systems to track and account for our game downloads. We also rely on our own servers and third-party infrastructure to operate, however, we could experience unexpected technical problems. Any technical problem with, cyber-attack on, or loss of access to these third parties’ or our systems, servers or other technologies, could result in the inability of end users to download or play our games, cause interruption to gameplay, prevent the completion of billing for a game or result in the loss of users’ virtual currency or other in-app purchases, interfere with access to some aspects of our games or result in the theft of end-user personal information. In addition, if virtual assets are lost, or if users do not receive their purchased virtual currency, we may be required to issue refunds, we may receive negative publicity and game ratings, we may lose users of our games, and we may become subject to regulatory investigation or class action litigation, any of which would negatively affect our business. Any of these problems could harm our reputation or cause us to lose end users or revenues or incur substantial repair costs and distract management from operating our business.

22

If we fail to maintain and enhance our capabilities for porting games to a broad array of mobile devices, particularly those utilizing the Android operating system, our revenues and financial results could suffer.

We derive all of our revenues from the sale of Slots-O-Luck Adventure HD which is available for smartphones and tablets that utilize Apple’s iOS operating systems. Unlike the Apple ecosystem in which Apple controls both the device (iPhone, iPod Touch and iPad) and the storefront (Apple’s App Store), the Android ecosystem is highly fragmented since a large number of OEMs manufacture and sell Android-based devices that run a variety of versions of the Android operating system, and there are many Android-based storefronts in addition to the Google Play Store. For us to sell our games to the widest possible audience of Android users, we must port our games to a significant portion of the more than 700 Android-based devices that are commercially available, many of which have different technical requirements. Since the number of Android-based smartphones and tablets shipped worldwide is growing significantly, it is important that we maintain and enhance our porting capabilities, which could require us to invest considerable resources in this area. These additional costs could harm our business, operating results and financial condition. In addition, we must continue to increase the efficiency of our porting processes or it may take us longer to port games to an equivalent number of devices, which would negatively impact our margins. If we fail to maintain or enhance our porting capabilities, our revenues and financial results could suffer.

We may need to raise additional capital or borrow funds to grow our business, and we may not be able to raise capital or borrow funds on terms acceptable to us or at all.