Attached files

| file | filename |

|---|---|

| EX-33.1 - EXHBIT 32.L - PURA NATURALS, INC. | ex32_1.htm |

| EX-31.1 - EXHBIT 31.L - PURA NATURALS, INC. | ex31_1.htm |

| EX-31.2 - EXHBIT 31.2 - PURA NATURALS, INC. | ex31_2.htm |

| EXCEL - IDEA: XBRL DOCUMENT - PURA NATURALS, INC. | Financial_Report.xls |

U.S. SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

__________________

FORM 10-K

__________________

(Mark one)

[ X ] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF

1934 FOR THE FISCAL YEAR ENDED DECEMBER 31, 2013

[ ] TRANSITION REPORT UNDER SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF

1934 for the transition period from ________________ to________________________.

Commission File Number 000-52898

YUMMY FLIES, INC.

(Exact name of registrant as specified in its charter)

|

Colorado

|

20-8496798

|

|

|

(State or other jurisdiction of

Incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

1848 South Lamar Ct.

Lakewood, CO 80232

(Address of principal executive offices)

(303) 619-2503

(Issuer’s Telephone Number)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [_] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Securities Act. Yes [_] No [X]

Indicate by check mark whether the issuer (1) filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [_]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [X]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer [_] Accelerated filer [_]

Non-accelerated filer [_] (Do not check if a Smaller reporting company [X]

smaller reporting company)

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes [_] No [X]

The aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, and the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter was $0.

As of April 9, 2014, the Registrant had 10,278,000 shares of Common Stock issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE - None

TABLE OF CONTENTS

|

Page No.

|

||

|

PART I

|

||

|

Item 1.

|

Business

|

4

|

|

Item 1A.

|

Risk Factors

|

12

|

|

Item 1B.

|

Unresolved Staff Comments

|

12

|

|

Item 2

|

Properties

|

13

|

|

Item 3.

|

Legal Proceedings

|

13

|

|

Item 4.

|

Mine Safety Disclosures

|

13

|

|

PART II

|

||

|

Item 5.

|

Market for the Registrant’s Common Equity and Related Stockholder Matters and Issuer Purchases of Equity Securities

|

13

|

|

Item 6.

|

Selected Financial Data

|

14

|

|

Item 7.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

15

|

|

Item 7A.

|

Quantitative and Qualitative Disclosures About Market Risk

|

15

|

|

Item 8.

|

Financial Statements and Supplementary Data

|

18

|

|

Item 9.

|

Changes in and Disagreements on Accounting and Financial Disclosure

|

33

|

|

Item 9A.

|

Controls and Procedures

|

33

|

|

Item 9B.

|

Other Information

|

35

|

|

PART III

|

||

|

Item 10.

|

Directors, Executive Officers and Corporate Governance

|

35

|

|

Item 11.

|

Executive Compensation

|

36

|

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

36

|

|

Item 13.

|

Certain Relationships and Related Transactions, and Director Independence

|

37

|

|

Item 14.

|

Principal Accounting Fees and Services

|

37

|

|

PART IV

|

||

|

Item 15.

|

Exhibits, Financial Statement Schedules

|

38

|

|

Signatures

|

39

|

- 2 -

FORWARD LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Act of 1934. The statements regarding Yummy Flies Inc. contained in this Report that are not historical in nature, particularly those that utilize terminology such as “may,” “will,” “should,” “likely,” “expects,” “anticipates,” “estimates,” “believes” or “plans,” or comparable terminology, are forward-looking statements based on current expectations and assumptions, and entail various risks and uncertainties that could cause actual results to differ materially from those expressed in such forward-looking statements.

Important factors known to us that could cause such material differences are identified in this Report. We undertake no obligation to correct or update any forward-looking statements, whether as a result of new information, future events or otherwise. You are advised, however, to consult any future disclosures we make on related subjects in future reports to the SEC.

- 3 -

PART I

ITEM 1.BUSINESS

History

We were incorporated on December 26, 2005, in the State of Colorado under the name “Yummieflies.com, Inc.” In March 2010 we filed an amendment to our Articles of Incorporation changing our name to “Yummy Flies, Inc.” Since inception we have been engaged in marketing and selling our fly fishing ties that have been developed by our management. The cost of our products is higher than customary due to the amount of time it takes to produce our ties, as well as the quality of raw material utilized. Each of our flies is hand crafted in order to look like the bugs that fish feed upon. Our management believes that customary over the counter flies are mass produced with thread and feathers, fur or hair. Our marketing efforts to date have been limited by our limited available capital.

Our principal marketing efforts have been by word of mouth, including exposure of our products at area fly tying clinics where our management has been and continues to be invited to appear about six times per year, as a cost free featured tier at local fly shops where these shops have promoted their appearance in order to allow them to demonstrate their fly tying abilities. We also have marketed our products through our website and to a limited extent, our participation at various industry shows. Messrs. Okizaki and Coleman, two of our officers and directors, are professional fishing guides and have introduced our flies to their patrons on their fishing excursions. Mr. Yamauchi has given them to friends and acquaintances, including our shareholders that fish. Based upon the response we received initially from the fisherman on these excursions and other friends and family members we decided to attempt to initially market our products on a regional basis throughout the Rocky Mountain area, an established trout fishing region.

The most important attribute of our flies that needed to be initially determined was simply that they had to catch fish regardless of the level of competency of the fisherman. We examined answers to several questions, including (i) were the flies successful in catching trout, our target species, and did they catch fish regardless of who was fishing them, and (ii) more importantly, did the fisherman fishing our fly’s think they were worth the extra cost and would they buy them? We believe the Natural Fly selection was a success for all fishermen under varied weather conditions, water conditions and light. These results are our opinion only and there were no formal independent tests conducted on any of our flies. There are no assurances that future performance will be consistent with the initial results. Even if the fishermen who thought our flies were worth the extra cost and they would purchase our flies, there are no assurances they will actually do so. When we provided samples of our flies to other fisherman and when these ties were used by our management, the Natural Flies caught, on average, more trout than the fisherman who used them had caught on other patterns. In these situations our Yummy Tandem Flies and Canyon Magic caught less fish that when the Natural Fly ties were used, but still caught fish. There can be no assurances that these results will be duplicated in the future.

- 4 -

Our management, especially our President and CEO, Mr. Okizaki, who has been a professional fly fishing guide and instructor for a specialty fly fishing shop (who has represented a fly fishing corporation for the past thirteen years), are all experienced fly fisherman and we were formed to take advantage of this experience in what our management perceives as a growing industry. Mr. Okizaki has developed many long-term relationships in the Colorado fly-fishing industry as well as industry leaders in other parts of the United States and Australia. Since 2001, Mr. Okizaki has been a professional guide and has been involved in pro programs for 11 different companies, including Orvis, Simms and Sage. Management intends to utilize these contacts to take advantage of the opportunities that we believe are available, including acquiring small specialty shops and manufacturers. As of the date of this Report we have engaged in various discussions with other smaller companies like ourselves, but no definitive agreement has been reached for us to acquire any specific company. See "Growth by Acquisition," below.

Our marketing efforts have been limited due to our limited available capital. In 2007 we did an initial capital raise of $26,750. We utilized these funds primarily for the development of our initial DVD’s and for our limited inventory. We estimate that we will require approximately $500,000 in additional capital to fully implement our business plan. See “Management’s Discussion of Financial Condition and Results of Operations – Liquidity and Capital Resources” and “Plan of Operation.” Based upon our discussions with various potential investors we believe that our efforts to raise additional equity capital thus far have been unsuccessful primarily as a result of the lack of liquidity in our securities. The comment we have heard often is that there is no exit strategy for an investor. As such, after careful analysis, our management has elected to cause us to become a reporting company and have our common stock approved for trading in order to provide the potential for liquidity in our securities. While there are no assurances we will be successful in accomplishing these objectives, we believe that if we are successful we will have a better opportunity to raise the additional equity capital we believe we need in order to grow our business. As of the date of this report we have caused to be filed an application to trade our common stock on the OTC-QM. We have advised certain people who have indicated an interest in investing in our business once our common stock is approved for trading. They have indicated an interest in investing provided out common stock is so approved, of which there are no assurances. Further, even if our common stock is approved for trading, there are no assurances such individuals will elect to invest, or invest in an amount that will allow us to expand our existing business.

Our current ties are handcrafted to appear like real bugs which the fish feed upon. As a result of recent enhancements in computer programming and 3D printing capabilities, our management believes that it may be possible to find a manufacturer that can produce unique and realistic fly patterns. We must ascertain whether this is, in fact, feasible, as well as economically viable. If we are able to raise the necessary capital, of which there is no assurance, and we can identify a manufacturer that can mass produce our ties so that they too appear like real bugs which the fish feed upon, we are optimistic that our business will increase significantly. There are no assurances that we will be able to raise the funds necessary to manufacture our ties on a mass production basis, or that if we are so able, that the public will accept our ties.

Our Products

We initially designed and attempted to test market 16 patterns. We are currently marketing a series of fly fishing flies under the titles of “Yummy Tandem Flies,” “Natural Selection” and “Canyon Magic.” We attempt to create our flies with a degree of realism. Specifically, most flies are tied with thread, dubbing and feathers and fur. Our “Natural Selection” flies are tied with latex (to form a smooth, translucent body with realistic wings and legs) and microfibetts (fine, tapered clear or colored stiff nylon used for fly tails). Our Tandem flies are tied with two and even three bodies of nymphs and/or larva flies on the same hook shank. Traditional flies are tied one fly body at a time on the hook. Currently, each series is tied by our management.

- 5 -

We believe our Natural Selection Flies collection are realistic and imitate almost exactly what the real insect (what the food trout eat) look like in nature. Our realistic, custom made flies are tied using latex instead of thread or dubbing (synthetic or animal fur, finely chopped as to form a thin coating on the thread) to form the body of the fly and each fly take an average of 15 minutes or longer to produce.

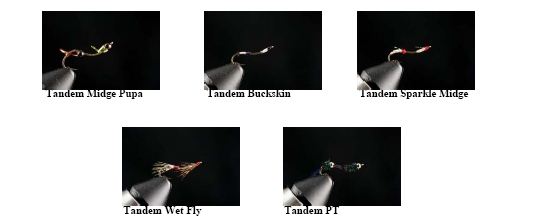

We have also developed a series of flies called “Yummy Tandem Flies” which we characterize as, fished in pairs, they represent behavior drift flies. Our tandem collection is tied to represent two to three flies on the same hook, thus representing a behavioral drift (nymphs moving to a new location) when fished two to three patterns at a time. These flies were developed by Mr. Okizaki, our President and CEO and include:

- 6 -

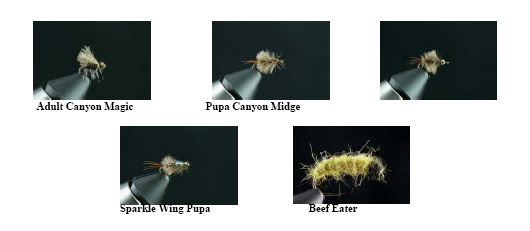

Mr. Coleman has developed flies designed especially for Cheeseman Canyon, Colorado. Cheeseman Canyon is a popular tail water of the South Platte River. His “Canyon Magic Flies” include:

The price point for retail flies generally range from $1.75 to $1.95. The cost of making an individual fly is about $0.45. With the advent of the Internet, Craig’s List and e-bay, individuals (hobbyist) are selling their flies from $.75 to $1.00, which we consider to be lower end product. Management believes that the customer we have earmarked to sell our products to purchase their flies ranging from $2.00 to well over a $100 per fly (a specialty fly that is realistic and presented in a frame) and take 15 minutes to sometimes hours to make per fly. There are no assurances that any potential customer will pay up to $100 for one of our flies. Commercial flies are tied more readily (20 to 50 flies per minute). Our price per fly price is generally $2.50 to $3.50 per fly. Our Tandem Fly series originally sold for $2.50 each. However we have found to be competitive it was necessary to lower our price on the Tandem series to $2.00. Our Canyon Magic Flies sold for $2.25 each and this series is now sold for $1.95, Our Natural Selection Flies are sold for $3.50 each. These prices include shipping, handling, and taxes. New flies have been added to our selections. Two new Natural Flies have been added, a Midge Larva and a Black Fly Larva. They will be sold for $3.00 respectfully. A combination Beetle and Ant will be added to the Tandem series and sell for $2.75. These prices would be considered at the high end of flies sold through the average fly shop. We believe our pricing is a reflection of the time each fly takes to tie and our attention to detail.

In 2006 we began producing a line of instructional fly tying DVDs of Brian Yamauchi’s flies. The first DVD produced was titled “Midge Life Cycle, Volume 1” and featured the recipes on how to tie the midge larva, midge pupa and the midge adult. This DVD, The Midge Life Cycle, Volume I, was produced on a limited run basis to test the viability of marketing a series of Fly Tying DVD’s that showed how to tie our signature patterns. It was first marketed at the International Sportsman Expo in Denver, Colorado in 2006 and the second was at the West Denver Trout Unlimited annual Fly Tying Clinic held in 2007. This DVD was sold at the National Shows but not offered for sale on our web site. It was felt that this could be used as a teaser to promote the buying of our individual fly pattern DVD’s. This was a strategic decision because it was felt that selling the individual patterns would generate more revenues for the Company. This initial video sold for $24.95, but had a limited run. In the winter of 2007 we produced the remainder of our four DVD’s that included the Chironomid Pupa, Mysis Shrimp, Scud, and Midge Pupa patterns. Mr. Yamauchi produced this entire series of DVD’s including the artwork, cover and packaging. These DVD’s were also presented at fly-fishing shows and extended to include area fly tying clinics. It was decided to improve the quality of the DVD’s by buying a new camera lens. It was also agreed to expand the DVD offerings to include four additional patterns with one pattern offered per DVD. The “Life Cycle of a Midge, Volume I” was added in 2010 and currently sells for $39.50, while the single fly patterns, the Chironomid Pupa, Mysis Shrimp, Scud, and Midge Pupa patterns, are offered for $16.50 each and includes shipping and handling. The cost of creating each of our DVD’s is $3.50. Estimated cost for initial distribution is $8,000, which would include (i) advertising in two nationally distributed magazines, “Fly Tying” and “Fly Fisherman;” (ii) the cost of posters to be placed in fly shops; and (iii) the initial run of 500 DVD’s.

During our fiscal year ended December 31, 2013, we developed a series of new Tandem Flies that incorporate terrestrial (ants, beetles and crickets) that are being sold for $2.75 each. An ant - beetle tandem is currently being sold on our website to ascertain customer interest. We expect to utilize both of these new flies during the spring of 2014 to conduct product viability studies.

- 7 -

Current Marketing Efforts

Our current marketing efforts continue to center around our existing realistic fly patterns. We believe that the success of these patterns in catching trout, in terms of market survey group enthusiasm, has been positive. Many of the clients that have bought our patterns have reorder them. Many have referred their associates to us, which has allowed us to expand our client base on a limited basis.. The need to develop a relationship with an existing marketing company to market our products has become apparent to us. We recognize the need to retain a marketing director, as well as to advertise in national fly fishing magazines and press kit/marketing packets will need to be procured and produced. The estimated cost will be $100,000, which would also include the necessary fly tying materials to produce the flies. We have concluded that in order to be successful we must always be creative and expand our existing fly lines. We have procured a number of flies from various fly manufactures and fly shops to determine why certain patterns work and why fisherman buy certain flies and will continue to do so in the future. As a result, we are in the final stages of developing a new series of flies that will be introduced in late 2013 provided we receive additional capital, of which there is no assurance. The estimated cost to bring these flies to market is $35,000.

We believe the development of a relationship with an existing market company that markets to retail fly fishing outlets is important for the creation and development of our wholesale business. Until we are able to establish an inventory of our products this is unrealistic. We believe it is also imperative that we improve our website, where retail shops can order on-line. The cost of this is estimated to be $4,500. A marketing director and marketing kit needs to be in place. Advertising in fly fishing magazines and articles about us and our products are important to generate interest and demand. We also believe that offering products to key, nationally known fly fishermen who can endorse our products is also important. To date, we have not contacted or discussed any relationship with any nationally known fly fishermen and there are no assurances that we will ever develop such a relationship in the future.

We believe that one key to our success is for us to buy in bulk which will occur if we have sufficient capital to pay for this type of manufacturing, which we currently do not have available. This would require that we mass produce our flies. If and when we are successful in raising the funds necessary we intend to explore manufacturing opportunities throughout the world, including China or Taiwan, which we believe are the cheapest venues for producing our flies in bulk. This will also require that the manufacturer we select will have the ability to create injection molding with soft polyurethane plastics and polmers in order to duplicate our custom flies as closely as possible. To date, we have not entered into any agreement with any party to produce our ties in bulk and there are no assurances we will be able to do so in the future. However, if we are able to produce in bulk this would greatly reduce our products cost and enable our pricing to be more competitive. Currently, we have had to tie our flies or produce the DVD’s specific to each order, thus wasting time, energy and greatly increasing the cost.

We have not been able to effectively market our products because of a lack of funding for advertising. In the future and provided that sufficient financing can be obtained, of which there is no assurance, we intended to expand our offered products by both developing new videos that encompass techniques from casting to “how to rig your fly fishing equipment.” We also hope to sign contracts with fly tiers who we consider to be exceptional to exclusively tie for us. We have conducted preliminary discussions with those individuals that our management has identified as up and coming industry innovators. While many have expressed an interest in developing their flies and related products and allowing us to market the same on an exclusive basis, in order to consummate these new relationships it will be necessary for us to have additional capital available for purposes of compensation to these entities and individuals, as well as to market the products they develop. As indicated above, it has been difficult for us to obtain this additional capital. We have conducted discussions with various venture capital, investment banking and private individuals who have indicated that they would be more amenable to investing or raising additional capital for us if there was a market for our securities. As a result, an application has been filed on our behalf to list our Common Stock for trading. However, there can be no assurances that even if our application is approved for trading, that we will be able to raise any additional capital to fully implement our business plan. See “Part II, Item 7, MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS – Liquidity and Capital Resources,” below. As of the date of this Report we lack funding for marketing and can only attend limited fly tackle dealer shows.

- 8 -

In the immediate future we plan to seek other fly tiers to tie proprietary flies for us and broaden our selection of trout flies. We have developed a list of potential fly tiers from the various fly tying clinics and shows where we have participated. Based upon verbal discussions with relevant parties at these clinics, there are a number of tiers who would be willing, for a fee and royalties, or stock in our Company if and when our common stock is approved for trading, of which there is no assurance, to give us proprietary rights to their flies. We estimate that this will cost approximately $2,500 per tier, plus a to be determined royalty. . As of the date of this Report we have entered into a definitive agreement with one of these individuals, Casey Dunnigan, a fly tier and designer for Montana Fly Company, a fly fishing company. This agreement provides for Mr. Dunnigan to be a commercial tier to tie our Natural Selection Flies and provide critical critiques of our fly designs. In exchange we have agreed to pay him 30% of the retail cost of those flies he ties for the retail market and 20% for the wholesale market. To date he has not been paid anything and it is not expected that he will perform any services or otherwise be paid any amounts until we are successful in raising additional funds, of which there can be no assurance. There can also be no assurances we will enter into such additional agreements in the foreseeable future, or at all with any other entity or individual.

Also we will seek to initiate our wholesale business and contact local fly-fishing stores to promote and sell our products. We have been unable to pursue our wholesale business and our lack of inventory has prevented us from any long-term relationships to fly fishing shops because of a lack of funding. We are also planning to develop other videos and include “Nymph Rigging for Effective Fishing,” as well as developing a new pattern, Case Caddis and a DVD on tying. We anticipate that these products will be ready within 3 to 4 month after we receive at least $100,000 in additional capital, of which there is no assurance. We estimate that the cost of producing these DVD’s will be approximately $24,000. The balance of funds will be utilized to produce the flies that are being introduced in these new videos.

We also intend to continue to maintain and promote our web site (www.yummyflies.com), which has been operational since March 2008. To date, fifteen DVD’s have been sold at $12.95 per unit, with three additional sales pending confirmation of funds reflecting our new sales price of $16.50 per unit, including shipping and handling. We need to retain a marketing director/sales person to formalize a marketing plan. As of the date of this Report we do not have the financial ability to retain this position and we have not been able to effectively market our products because of this lack of funding for advertising.

In 2008 two of our principals were asked to submit patterns for a fly pattern book that was being published. Seventeen patterns were submitted and all our patterns were included in the book “Modern Midges” by Rick Takahashi and Jerry Hubka, published in 2010 by Headwater Books and Stackpole Books. This book is widely distributed and sold on Amazon, at Barnes & Noble, The Orvis Catalogue, as well as most fly shops nationally.

In addition a new book, Modern Terrestrials, will be available for sale on Amazon in early September 2014 and Mr. Okizaki has his new tandem terrestrial patterns will be included in this book. The authors of this book, Rick Takahashi and Jerry Hubka, also wrote “Modern Midges.” The authors have asked guides and commercial fly tiers to submit patterns to be included in this new book. Invitations went out to the tiers that participated in the first book. We consider it to be an honor to be included and we received a lot of positive responses from the first book.

- 9 -

As funding permits we plan to hire a marketing/sales representative to initiate our wholesale base and expand our current retail base. The Internet has provided only limited exposure and sales have been disappointing to date. In order for us to realize our objectives we must hire a professional marketer, order enough supplies and materials to create an inventory of flies and DVD’s, and create a publicity/marketing packet. We believe the cost for one year of operation would be approximately $100,000, including $35,000 for a marketer, $1882.56 for latex (enough for 24,000 flies), $40,000 for hooks (24,000 flies times the 16 patterns we are currently tying), $150 for dubbing, $50.00 for thread, $167.88 for feathers, $2850.00 for DVD cases (3,000 cases each for the 5 DVD’s that have already been produced) $4,480 for 16,000 bulk DVD's, and $200 for printer paper for DVD covers. We also estimate it will cost approximately $15,000 to develop a marketing kit.

We are also looking into the possibilities of representing other manufacturers of unique tying materials and selling the same through our on-line catalogue. We have completed our web site which has opened a merchant account to accept all major credit cards and is presently accepting orders. In June 2010 we entered into an agreement to represent NRS, Inc., a leading marketer and manufacturer of paddle sports products, including products for kayaking, rafting and associated outdoor activities, to sell their personal watercraft “the GigBob.” We believe that the GigBob is a unique personal watercraft because it is frameless and most importantly it has a 15-foot platform that can be used for storage or the fisherman can stand on the platform to cast. We also believe that this is a unique and important advantage that other personal watercrafts do not have at this time. We were one of the first Internet company’s’ to offer it for retail sales. Features of the Gigbob include:

|

·

|

It has no frame. It is a personal fishing boat that can be rowed and is rigid without a frame. The patented frameless design means you can fold it up and pack it on your back without having to break down a frame.

|

|

·

|

The drop-stitch construction lets you put 4-6 pounds per square inch of air pressure into the multiple air chambers, to obtain stiff, rigidity.

|

|

·

|

The 15 square feet of flat area on the GigBob deck provides space for all of a fisherman’s tackle, cooler, extra rods and other equipment.

|

|

·

|

The pontoons are wide and flat, which provides stability. We believe a person can stand on the deck without fear of tipping and the flat bottoms provide a very shallow waterline to insure that the craft slips right over rocks that snag a rounded pontoon.

|

|

|

Detachable pontoons with NRS' batten attachment system for an even lighter weight kick boat.

|

|

·

|

The seat and built-in foot pegs give you full support for an all-day fishing expedition.

|

|

·

|

It is sold with an adjustable padded seat, Carlisle 7' two-piece oars with sleeves and oar rights, oar plates, oar mounts, oar locks, springs and split rings, oar rests, two Easy Access Tackle Bags, stripping apron and a carrying backpack to haul it all in.

|

|

·

|

Repair kit included.

|

|

·

|

5 Year warranty

|

The current retail price of a GigBob is $1,595, with price breaks dependent on the number of GigBob’s ordered. Currently, our wholesale price from NRS is 50% below retail. We do not inventory any of the crafts as NRS has agreed to drop ship on our behalf. We are currently marketing the GigBob through our website.

- 10 -

Growth by Acquisitions

We also intend to expand our operations through the acquisition of related businesses that will complement our current business. There are many synergistic small operations which have expressed an interest in being acquired by our Company if and when we become a trading, reporting company. We believe this makes economic sense because we can eliminate duplication of general and administrative expense, provide centralized information marketing and eliminate overlapping of services offered. We are presently evaluating several such businesses in the State of Colorado and elsewhere as potential merger or acquisition candidates, and anticipate expanding this acquisition strategy to metropolitan areas in the states of Arizona, New Mexico and California. However, as of the date of this Report, there are no definitive agreements in place relating to our acquiring any such business and there can be no assurances that such agreements will be executed on favorable terms or at all in the future.

If we are successful, the acquisition of related, complimentary businesses is expected to increase revenues and profits by providing a broader range of services in vertical markets which are consolidated under one parent, thus reducing overhead costs by streamlining operations and eliminating duplicitous efforts and costs. There are no assurances that we will increase profitability if we are successful in acquiring other synergistic companies.

Management will seek out and evaluate related, complimentary businesses for acquisition. The integrity and reputation of any potential acquisition candidate will first be thoroughly reviewed to ensure it meets with management’s standards. Once targeted as a potential acquisition candidate, we will enter into negotiations with the potential candidate and commence due diligence evaluation of each business, including its financial statements, cash flow, debt, location and other material aspects of the candidates’ business. One of the principal reasons for our filing of our registration statement and causing an application to be filed on our behalf to trade our common stock is our intention to utilize the issuance of our securities as part of the consideration that we will pay for these proposed acquisitions. If we are successful in our attempts to acquire similar companies utilizing our securities as part or all of the consideration to be paid, our current shareholders will incur dilution.

In implementing a structure for a particular acquisition, we may become a party to a merger, consolidation, reorganization, joint venture, or licensing agreement with another corporation or entity. We may also acquire stock or assets of an existing business. On the consummation of a transaction, we do not intend that our present management and shareholders will no longer be in control of our Company.

As part of our investigation, our officers and directors will meet personally with management and key personnel, may visit and inspect material facilities, obtain independent analysis of verification of certain information provided, check references of management and key personnel, and take other reasonable investigative measures, to the extent of our limited financial resources and management expertise. The manner in which we participate in an acquisition will depend on the nature of the opportunity, the respective needs and desires of us and other parties, the management of the acquisition candidate and our relative negotiation strength and such other management.

- 11 -

We will participate in an acquisition only after the negotiation and execution of appropriate written agreements. Although the terms of such agreements cannot be predicted, generally such agreements will require some specific representations and warranties by all of the parties thereto, will specify certain events of default, will detail the terms of closing and the conditions which must be satisfied by each of the parties prior to and after such closing, will outline the manner of bearing costs, including costs associated with our attorneys and accountants, will set forth remedies on default and will include miscellaneous other terms.

Depending upon the nature of the acquisition, including the financial condition of the acquisition company, as a reporting company under the 34 Act it may be necessary for such acquisition candidate to provide independent audited financial statements. If so required, we will not acquire any entity which cannot provide independent audited financial statements within a reasonable period of time after closing of the proposed transaction. If such audited financial statements are not available at closing, or within time parameters necessary to insure our compliance with the requirements of the 34 Act, or if the audited financial statements provided do not conform to the representations made by the candidate to be acquired in the closing documents, the closing documents will provide that the proposed transaction will be voidable, at the discretion of our present management. If such transaction is voided, the agreement will also contain a provision providing for the acquisition entity to reimburse us for all costs associated with the proposed transaction.

Competition

We face extreme competition from larger, better-financed and national brands. All of these companies have extensive resources and a world market place for their products. Also, there are local fly shops that are established retail centers that could have an impact on our ability to penetrate the fly tying and fly pattern industry.

Government Regulation

We are not subject to any extraordinary governmental regulations.

Employees

As of the date of this Report we employ three (3) persons, including our members of management. We have consulted with and expect to continue to use the services of independent consultants and contractors with whom our management has a pre-existing relationship to perform various professional services, particularly in the area of sales and marketing consultation. However, no compensation has been paid for these services as of the date of this Report and other than as described above in “Description of Business” concerning our retention of Mr. Dunnigan as a consultant, there is no agreement to pay such compensation in the future. As of the date of this Report Mr. Dunnigan has not provided us with any consulting services but may do so in the future.

None of our employees are members of a union. We consider our employee labor relations to be good.

Trademarks/Trade names/Intellectual Property

We have no registered trademarks or other intellectual property as of the date of this Report, except for our domain name, yummyfiles.com.

ITEM 1A. RISK FACTORS

We are a small business issuer and as such, are not required to include this disclosure in our report. For a description of risk factors relating to our Company please see the relevant disclosure included in our S-1 registration statement previously filed with the SEC.

ITEM 1B. UNRESOLVED STAFF COMMENTS

Not applicable.

- 12 -

ITEM 2. PROPERTIES

We operate from our offices at 1848 South Lamar Ct., Lakewood, CO 80232, telephone (303) 619-2503, which consists of 150 square feet of executive office and manufacturing space. Our President provides this space to us on a rent-free basis. Management believes that this space will meet our needs for the foreseeable future.

ITEM 3. LEGAL PROCEEDINGS

To the best of our management’s knowledge and belief, there are no claims that have been brought against us nor have there been any claims threatened.

ITEM 4. MINE SAFETY DISCLOSURES

Not Applicable.

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Market Information

As of the date of this report there is no market for our Common Stock. We have taken certain steps to cause a licensed market maker to file an application with FINRA to list our Common Stock for trading on the OTCQM. As of the date of this report we have received initial comments from FINRA and have submitted our responses thereto. There can be no assurances that our Common Stock will be approved for listing on the OTCQM, or any other existing U.S. trading market.

Holders

As of the date of this report we had 54 holders of record for our Common Shares.

Dividend Policy

We have not paid any dividends since our incorporation and do not anticipate the payment of dividends in the foreseeable future. At present, our policy is to retain earnings, if any, to develop and market our products. The payment of dividends in the future will depend upon, among other factors, our earnings, capital requirements, and operating financial conditions.

The Securities Enforcement and Penny Stock Reform Act of 1990

The Securities and Exchange Commission has also adopted rules that regulate broker-dealer practices in connection with transactions in penny stocks. Penny stocks are generally equity securities with a price of less than $5.00 (other than securities registered on certain national securities exchanges or quoted on the Nasdaq system, provided that current price and volume information with respect to transactions in such securities is provided by the exchange or system).

As of the date of this Report, our Common Stock is defined as a “penny stock” under the Securities and Exchange Act. It is anticipated that our Common Stock will remain a penny stock for the foreseeable future. The classification of penny stock makes it more difficult for a broker-dealer to sell the stock into a secondary market, which makes it more difficult for a purchaser to liquidate his/her investment. Any broker-dealer engaged by the purchaser for the purpose of selling his or her shares in us will be subject to Rules 15g-1 through 15g-10 of the Securities and Exchange Act. Rather than creating a need to comply with those rules, some broker-dealers will refuse to attempt to sell penny stock.

- 13 -

The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from those rules, to deliver a standardized risk disclosure document prepared by the Commission, which:

|

•

|

contains a description of the nature and level of risk in the market for penny stocks in both public offerings and secondary trading;

|

|

|

•

|

contains a description of the broker's or dealer's duties to the customer and of the rights and remedies available to the customer with respect to a violation to such duties or other requirements of the Securities Act of 1934, as amended;

|

|

|

•

|

contains a brief, clear, narrative description of a dealer market, including "bid" and "ask" prices for penny stocks and the significance of the spread between the bid and ask price;

|

|

|

•

|

contains a toll-free telephone number for inquiries on disciplinary actions;

|

|

|

•

|

defines significant terms in the disclosure document or in the conduct of trading penny stocks; and

|

|

|

•

|

contains such other information and is in such form (including language, type, size and format) as the Securities and Exchange Commission shall require by rule or regulation;

|

The broker-dealer also must provide, prior to effecting any transaction in a penny stock, to the customer:

|

•

|

the bid and offer quotations for the penny stock;

|

|

|

•

|

the compensation of the broker-dealer and its salesperson in the transaction;

|

|

|

•

|

the number of shares to which such bid and ask prices apply, or other comparable information relating to the depth and liquidity of the market for such stock; and

|

|

|

•

|

monthly account statements showing the market value of each penny stock held in the customer's account.

|

In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from those rules; the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser's written acknowledgment of the receipt of a risk disclosure statement, a written agreement to transactions involving penny stocks, and a signed and dated copy of a written suitability statement. These disclosure requirements will have the effect of reducing the trading activity in the secondary market for our stock because it will be subject to these penny stock rules. Therefore, stockholders may have difficulty selling their securities.

Stock Transfer Agent

The stock transfer agent for our securities is VStock Transfer, LLC, 77 Spruce St., Suite 201, Cedarhurst, NY 11516, (646) 536-3179.

ITEM 6. SELECTED FINANCIAL DATA.

We are a small business issuer and as such, are not required to include this disclosure in our report.

.

- 14 -

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion should be read in conjunction with our audited financial statements and notes thereto included herein. In connection with, and because we desire to take advantage of, the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, we caution readers regarding certain forward looking statements in the following discussion and elsewhere in this Report and in any other statement made by, or on our behalf, whether or not in future filings with the Securities and Exchange Commission. Forward looking statements are statements not based on historical information and which relate to future operations, strategies, financial results or other developments. Forward looking statements are necessarily based upon estimates and assumptions that are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond our control and many of which, with respect to future business decisions, are subject to change. These uncertainties and contingencies can affect actual results and could cause actual results to differ materially from those expressed in any forward looking statements made by, or on our behalf. We disclaim any obligation to update forward looking statements.

Overview

Yummy Flies, Inc., (“we,” “our” or the “Company”) was incorporated on December 26, 2005, in the State of Colorado under the name “Yummieflies.com Inc.” In March 2010 we filed an amendment to our Articles of Incorporation changing our name to “Yummy Flies, Inc.” In September 2010, we engaged in a forward split of our issued and outstanding Common Stock whereby nine (9) shares of Common Stock were issued in exchange for every one (1) share then issued and outstanding. All references to our issued and outstanding Common Stock in this Report are presented on a post-forward split basis unless otherwise indicated.

Since inception our business has been to establish an on-line fly fishing company, specializing in marketing trout flies. We also plan to market a series of fly tying DVD’s. Our principal marketing efforts are directed to the post-war “Baby Boomers.”

We have never been subject to any bankruptcy proceeding.

Our executive offices are located at 1848 South Lamar Ct., Lakewood, CO 80232, telephone (303) 619-2503.

Results of Operations

Comparison of Results of Operations for the Fiscal Years Ended December 31, 2013 and 2012

During the year ended December 31, 2013 we generated revenues of $801, compared to no revenues during our fiscal year ended December 31, 2012. We believe that our revenues will remain nominal until we can raise additional equity capital for sales and marketing activities, as well as to commence mass production of our flies. See “Part 1, Item 1, Business.”

Our cost of sales during the fiscal years ended December 31, 2013 and 2012 was $160 and $0, respectively. Consequently, our gross profit for the fiscal years ended December 31, 2013 and 2012 was $641 and $0, respectively.

Our general and administrative expense during our fiscal year ended December 31, 2013 was $23,448, compared to $19,838 during our fiscal year ended December 31, 2012, an increase of $3,610. This increase was primarily as a result of increased accounting fees incurred during 2013.

As a result, we incurred a net loss of $22,807 during the year ended December 31, 2013 (less than $0.01 per share) compared to a net loss of $19,838 during the year ended December 31, 2012.

Because we generated nominal revenues during our most recent fiscal year, following is our Plan of Operation.

- 15 -

Plan of Operation

We are currently marketing a series of fly fishing flies under the titles of “Yummy Tandem Flies,” “Natural Selection” and “Canyon Magic.” We attempt to create our flies with a degree of realism. Specifically, most flies are tied with thread, dubbing and feathers and fur. Our “Natural Selection” flies are tied with latex and microfibetts to form a smooth, translucent body, with realistic wings and legs. The Tandem Flies are tied with two and even three bodies of nymphs and/or larva flies on the same hook shank. Traditional flies are tied one fly body at a time on the hook. Each series is tied by one of our founders. In addition, we have produced a series of five fly tying DVDs entitled “The Natural Selections Series” which demonstrates how to tie our line of realistic midge; mysis shrimp, caddis, baetis, and scud patterns. A DVD was initially produced on a limited run basis by Mr. Yamauchi to test the viability of marketing a series of Fly Tying DVD’s that showed how to tie his signature patterns. This was marketed at the International Sportsman Expo in Denver, Colorado in 2006 and at the West Denver Trout Unlimited annual Fly Tying Clinic held in 2007. We intend to place all of our videos in area fly shops during the second calendar quarter of 2013. However, as of the date of this Report we have no arrangement with any area fly shops to sell our DVD’s.

As stated above, we estimate we will require up to $500,000 in additional capital in order to fully implement our business plan as described in this Report. These funds are proposed to be utilized for our development and expansion from just a retail web based business to a retail and wholesale operation, including the following proposed use of proceeds: (i) approximately $100,000 to purchase raw materials that we utilize in the manufacturing of our flies in bulk, including hooks, latex gloves and other related materials. Included in this category would be the identification of a manufacturer who can produce our custom made ties in bulk by developing and utilizing injection molding with soft polyurethane plastics and polmers, in order to establish an expanded inventory of our ties. We currently do not have the capacity to fill a large order that we might receive from a large retail fishing business; (ii) $50,000 for the development and marketing of additional DVD’s; (iii) approximately $100,000 to increase our inventory of custom ties, including the development of relationships with other established ties designers and retention of additional employees to assist in these expanded operations. It is anticipated that these new employees will have accounting experience, as well as sales and marketing experience; (iv) approximately $25,000 for expansion of our existing website from a retail based marketing vehicle into a retail and wholesale marketing operation; and (v) approximately $100,000 to accomplish the acquisition of related businesses and provide working capital to these business upon acquisition. The balance of funds ($125,000) would be utilized for working capital. If we can raise only between $100,000 and $200,000, we believe we can successfully accomplish the objectives outlined in (i) and (iii) and become profitable. Once profitable, we believe there are opportunities that will arise to expand our business without this additional capital, but over a longer period of time. This includes acquiring competitors in exchange for issuance of our securities. However, there can be no assurances that we will be able to raise the capital required to accomplish these objectives, or if we are so successful in raising such capital, that we will be able to implement our business plan. See “Part I, Item 1, BUSINESS.”

We estimate that it will take approximately 3 years for us to accomplish all of the objectives described in the preceding paragraph, provided that we are able to raise $500,000. We believe the most time consuming aspect of our business plan is the identification of a manufacturing entity, either in the US or overseas, that can develop the molds and then begin manufacturing our ties to our specifications. We estimate that this will take a minimum of two years. Following this development we also estimate that it will take another year in which to develop the sales and marketing to sell these products. As previously stated, there are no assurances that our estimates are accurate, or that we will be able to raise the funds necessary to accomplish these objectives.

Because of our relatively low cost of operations we believe that if we are only able to raise between $100,000 and $200.000, we will continue to be a retail web based business, but we will not be able to afford expanding into the wholesale market. While no assurances can be provided, with an additional $100,000 in equity capital we believe we would be able to successfully increase our inventory of fishing flies and as a result, we believe that the revenues generated from the sale of these flies will be sufficient to allow us to break even or generate nominal profits. There can be no assurances that this will occur.

For a more detailed description of our business and its development, see “Part I, Item 1, BUSINESS,” hereinabove.

- 16 -

Liquidity and Capital Resources

At December 31, 2013, we had $1,257 in cash.

Net cash used in operating activities was $6,939 during the fiscal year ended December 31, 2013, compared to $5,148 during 2012. We anticipate that overhead costs in current operations will increase in the future as a result of our anticipated increased marketing activities.

Cash flows provided or used in investing activities were $0 during the years ended December 31, 2013 and 2012.

Cash flows provided or used by financing activities were $7,742 and $1,500 during 2013 and 2012, respectively, and related to advances we received from one of our shareholders

To date, our operations have been limited and we have only generated nominal revenues. We believe that our principal difficulty has been the lack of available capital to operate and expand our business. We believe we need a minimum of approximately $100,000 in additional working capital to be utilized for marketing and sales of our existing products, including hiring a marketing/sales person, advertising brochures and a presence at fly shows (booth space) (estimated cost of $35,000), generate an inventory of DVD’s and flies ($35,000) and develop a marketing kit for distribution ($20,000, with the balance for working capital and general and administrative expense. As described above under “Plan of Operation” we also believe we will require a total of up to $500,000 in additional capital to fully implement our business plan, as described herein. While no assurances can be provided, we believe that if we are only able to raise $100,000 we should be able to successfully increase our inventory of fishing flies and as a result, we believe that the revenues generated from the sale of these flies will be sufficient to allow us to continue to grow. See “Part I, Item 1, Business.” We lack a market presence that is needed in order for us to succeed. As of the date of this Report we have no commitment from any investor or investment-banking firm to provide us with the necessary funding and there can be no assurances we will obtain such funding in the future. Failure to obtain this additional financing will have a material negative impact on our ability to generate profits in the future.

Inflation

Although our operations are influenced by general economic conditions, we do not believe that inflation had a material effect on our results of operations during the year ended December 31, 2013.

Critical Accounting Policies and Estimates

Critical Accounting Estimates

The discussion and analysis of our financial condition and results of operations are based upon our financial statements, which have been prepared in accordance with accounting principles generally accepted in the United States. The preparation of these financial statements requires us to make estimates and judgments that affect the amounts of assets, liabilities, revenues and expenses, and related disclosure of contingent assets and liabilities. On an on-going basis, we evaluate our estimates based on historical experience and on various other assumptions that are believed to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources. Actual results may differ from these estimates under different assumptions or conditions. The following represents a summary of our critical accounting policies, defined as those policies that we believe are the most important to the portrayal of our financial condition and results of operations and that require management’s most difficult, subjective or complex judgments, often as a result of the need to make estimates about the effects of matters that are inherently uncertain.

Leases – We follow the guidance in SFAS No. 13 “Accounting for Leases,” as amended, which requires us to evaluate the lease agreements we enter into to determine whether they represent operating or capital leases at the inception of the lease.

- 17 -

Recent Accounting Pronouncements

Under the Jumpstart Our Business Startups Act, or the JOBS Act, we meet the definition of an “emerging growth company.” We have irrevocably elected to opt out of the extended transition period for complying with new or revised accounting standards pursuant to Section 107(b) of the JOBS Act. As a result, we will comply with new or revised accounting standards on the relevant dates on which adoption of such standards is required for non- emerging growth companies

Off-Balance Sheet Arrangements

We have not entered into any off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources and would be considered material to investors.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

We are a small business issuer and as such, are not required to include this disclosure in our report.

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

- 18 -

Yummy Flies, Inc.

(A Development Stage Company)

FINANCIAL STATEMENTS

With Independent Accountants' Audit Reports

For the years ended December 31, 2013 and 2012

and

The period from December 26, 2005 (Inception) to December 31, 2013

- 19 -

TABLE OF CONTENTS

|

|

||

|

Page

|

||

|

Independent Accountants' Audit Reports

|

21 - 22

|

|

|

Balance Sheets

|

23

|

|

|

Statements of Operations

|

24

|

|

|

Statements of Cash Flows

|

25

|

|

|

Statements of Changes Stockholders’ Equity (Deficit)

|

26

|

|

|

Notes to Financial Statements

|

27- 32

|

- 20 -

Board of Directors

Yummy Flies, Inc.

Lakewood, Colorado

We have audited the accompanying balance sheet of Yummy Flies, Inc. as of December 31, 2013 and the related statement of operations, changes in stockholders' deficit and cash flows for the year then ended. These financial statements are the responsibility of the Company's management. Our responsibility is to express an opinion on these financial statements based on our audit. The financial statements as of December 31, 2012, the year ended December 31, 2012 and for the period from December 26, 2005 (Inception) to December 31, 2012 were audited by another auditor who expressed an unqualified opinion on April 23, 2013. Our opinion, in so far as it relates to the period from December 26, 2005 (Inception) through December 31, 2012 is based solely on the report of the other auditor.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audit provides a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of Yummy Flies, Inc. as of December 31, 2013, and the results of its operations and its cash flows for the year then ended in conformity with accounting principles generally accepted in the United States of America.

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 2 to the financial statements the Company has suffered losses from operations since Inception (December 26, 2005) and currently does not have sufficient available funding to fully implement its business plan. These factors raise substantial doubt about its ability to continue as a going concern. Management's plans in regard to these matters are also described in Note 2. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

| Arvada, Colorado

April 11, 2014

|

/s/ Cutler & Co., LLC

Cutler & Co., LLC

|

||

- 21 -

RONALD R. CHADWICK, P.C.

Certified Public Accountant

2851 South Parker Road, Suite 720

Aurora, Colorado 80014

Telephone (303)306-1967

Fax (303)306-1944

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Board of Directors

Yummy Flies, Inc.

Lakewood, Colorado

I have audited the accompanying balance sheet of Yummy Flies, Inc. (a development stage company) as of December 31, 2012 and the related statements of operations, stockholders' equity and cash flows for the year then ended, and for the period from December 26, 2005 (inception) through December 31, 2012. These financial statements are the responsibility of the Company's management. My responsibility is to express an opinion on these financial statements based on my audit.

I conducted my audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that I plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. I believe that my audit provides a reasonable basis for my opinion.

In my opinion, the financial statements referred to above present fairly, in all material respects, the financial position of Yummy Flies, Inc. as of December 31, 2012 and the results of its operations and its cash flows for the year the ended, and for the period from December 26, 2005 (inception) through December 31, 2012 in conformity with accounting principles generally accepted in the United States of America.

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 2 to the financial statements the Company has suffered recurring losses from operations that raise substantial doubt about its ability to continue as a going concern. Management's plans in regard to these matters are also described in Note 2. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

|

Aurora, Colorado

|

/s/ Ronald R. Chadwick, P.C.

|

|

April 23, 2013

|

RONALD R. CHADWICK, P.C.

|

- 22 -

|

Yummy Flies, Inc.

|

||||||||

|

(A Development Stage Company)

|

||||||||

|

Balance Sheets

|

||||||||

|

December 31,

|

December 31,

|

|||||||

|

2013

|

2012

|

|||||||

|

ASSETS

|

||||||||

|

Current Assets

|

||||||||

|

Cash & Cash Equivalents

|

$ | 1,257 | $ | 454 | ||||

|

Inventory

|

714 | 238 | ||||||

|

TOTAL CURRENT ASSETS

|

1,971 | 692 | ||||||

|

Property & Equipment

|

||||||||

|

Equipment (net of accumulated depreciation $2,593 and

|

- | 35 | ||||||

|

$2,558 respectively)

|

||||||||

|

TOTAL ASSETS

|

$ | 1,971 | $ | 727 | ||||

|

LIABILITIES AND STOCKHOLDERS' DEFICIT

|

||||||||

|

Current Liabilities

|

||||||||

|

Advances From Shareholders

|

$ | 17,194 | $ | 9,452 | ||||

|

Accounts Payable

|

28,842 | 12,533 | ||||||

|

TOTAL CURRENT LIABILITIES

|

46,036 | 21,985 | ||||||

|

TOTAL LIABILITIES

|

46,036 | 21,985 | ||||||

|

Stockholders' Defcit

|

||||||||

|

Common Stock (par value $0.001; 100,000,000 shares authorized;

|

||||||||

|

10,278,000 issued and outstanding :

|

10,278 | 10,278 | ||||||

|

Additional Paid-in-Capital

|

32,447 | 32,447 | ||||||

|

Deficit Accumulated During the Development Stage

|

(86,790 | ) | (63,983 | ) | ||||

|

TOTAL STOCKHOLDERS' DEFICIT

|

(44,065 | ) | (21,258 | ) | ||||

|

TOTAL LIABILITIES AND STOCKHOLDERS' DEFICIT

|

$ | 1,971 | $ | 727 | ||||

See accompanying notes to financial statements

- 23 -

|

Yummy Flies, Inc.

|

||||||||||||

|

(A Development Stage Company)

|

||||||||||||

|

Statements of Operations

|

||||||||||||

|

December 26,

|

||||||||||||

|

2005 (Inception)

|

||||||||||||

|

Year Ended

|

Year Ended

|

through

|

||||||||||

|

December 31,

|

December 31,

|

December 31,

|

||||||||||

|

2013

|

2012

|

2013

|

||||||||||

|

REVENUES - Sales

|

$ | 801 | $ | - | $ | 2,632 | ||||||

|

COST OF GOODS SOLD

|

160 | - | 962 | |||||||||

|

Gross Profit

|

641 | - | 1,670 | |||||||||

|

GENERAL AND ADMINISTRATIVE EXPENSES

|

||||||||||||

|

Accounting

|

15,350 | 3,250 | 31,995 | |||||||||

|

Depreciation

|

35 | 518 | 2,593 | |||||||||

|

General and administrative

|

3,255 | 1,660 | 12,030 | |||||||||

|

Legal

|

4,808 | 12,533 | 32,369 | |||||||||

|

Writeoffs - Inventory

|

- | 1,877 | 9,473 | |||||||||

|

Total General and Administrative Expenses

|

23,448 | 19,838 | 88,460 | |||||||||

|

Net (Loss) from operations

|

(22,807 | ) | (19,838 | ) | (86,790 | ) | ||||||

|

Provision for taxes

|

- | - | - | |||||||||

|

Net (loss)

|

$ | (22,807 | ) | $ | (19,838 | ) | $ | (86,790 | ) | |||

|

Basic Earnings (Loss) Per Share- Basic and Diluted

|

$ | (0.00 | ) * | $ | (0.00 | ) * | ||||||

|

Weighted average number of common shares outstanding- Basic & Diluted

|

10,278,000 | 10,278,000 | ||||||||||

*denotes a loss of less than $(0.01) per share

See accompanying notes to financial statements

- 24 -

|

Yummy Flies, Inc.

|

||||||||||||

|

(A Development Stage Company)

|

||||||||||||

|

Statements of Cash Flows

|

||||||||||||

|

December 26,

|

||||||||||||

|

2005 (inception)

|

||||||||||||

|

Year Ended

|

Year Ended

|

thorugh

|

||||||||||

|

December 31,

|

December 31,

|

December 31,

|

||||||||||

|

2013

|

2012

|

2013

|

||||||||||

|

Cash flows from operating activities

|

||||||||||||

|

Net (loss) for the period

|

$ | (22,807 | ) | $ | (19,838 | ) | $ | (86,790 | ) | |||

| Adjustments to reconcile decrease in net assets to net cash provided by operating activities: | ||||||||||||

|

Issuance of stock for services

|

- | - | 975 | |||||||||

|

Depreciation expense

|

35 | 519 | 2,593 | |||||||||

|

Changes in operating assets and liabilities:

|

||||||||||||

|

Decrease (increase) in inventory

|

(476 | ) | 1,638 | (714 | ) | |||||||

|

Increase (decrease) in accounts payable

|

16,309 | 12,533 | 28,842 | |||||||||

|

Net cash (used) in operation activities

|

(6,939 | ) | (5,148 | ) | (55,094 | ) | ||||||

|

Cash flows from investing activities

|

||||||||||||

|

Purchase of equipment

|

- | - | (2,593 | ) | ||||||||

|

Net cash provided by (used in) investing activities

|

- | - | (2,593 | ) | ||||||||

|

Cash flows from financing activities

|

||||||||||||

|

Advances from shareholder - borrowings

|

7,742 | 1,500 | 20,504 | |||||||||

|

Advances from shareholder - payments

|

- | - | (3,310 | ) | ||||||||

|

Issuance of common stock

|

- | - | 1,503 | |||||||||

|

Capital paid in excess of par

|

- | - | 40,247 | |||||||||

|

Net cash provided by financing activities

|

7,742 | 1,500 | 58,944 | |||||||||

|

Net increase in cash

|

803 | (3,648 | ) | 1,257 | ||||||||

|

Cash at beginning of period

|

454 | 4,102 | - | |||||||||

|

Cash at end of period

|

$ | 1,257 | $ | 454 | $ | 1,257 | ||||||

|

Supplemental information:

|

||||||||||||

|

Non-cash issuance of common stock

|

$ | - | $ | - | $ | 975 | ||||||

|

Issuance of common stock for debt retirement

|

$ | - | $ | - | $ | 3,500 | ||||||

|

Cash paid for interest

|

$ | - | $ | - | $ | - | ||||||

|

Cash paid for income taxes

|

$ | - | $ | - | $ | - | ||||||

See accompanying notes to financial statements

- 25 -

|

Yummy Flies, Inc.

|

||||||||||||||||||||

|

(A Development Stage Company)

|

||||||||||||||||||||

|

Statements of Changes Shareholders' Equity (Deficit)

|

||||||||||||||||||||

|

Number Of

|

Capital Paid

|

Retained

|

||||||||||||||||||

|

Common

|

Common

|

in Excess

|

Earnings

|

|||||||||||||||||

|

Shares Issued

|

Stock

|

of Par Value

|

(Deficit)

|

Total

|

||||||||||||||||

|

Balance At December 26, 2005

|

- | $ | - | $ | - | $ | - | $ | - | |||||||||||

|

January 1, 2007 common stock issued for services

|

8,775,000 | 8,775 | (7,800 | ) | - | 975 | ||||||||||||||

|

March 2007 common stock issued for cash

|

513,000 | 513 | 13,737 | - | 14,250 | |||||||||||||||

|

April 2007 common stock issued for cash

|

414,000 | 414 | 11,086 | - | 11,500 | |||||||||||||||

|

May 2007 common stock issued for cash

|

36,000 | 36 | 964 | - | 1,000 | |||||||||||||||

|

December 2007 common stock issued for cash

|

126,000 | 126 | 3,374 | - | 3,500 | |||||||||||||||

|

Net (loss)

|

0 | - | - | (14,962 | ) | (14,962 | ) | |||||||||||||

|

Balance at December 31, 2007

|

9,864,000 | 9,864 | 21,361 | (14,962 | ) | 16,263 | ||||||||||||||

|

April 2008 common stock issued for cash

|

351,000 | 351 | 9,399 | - | 9,750 | |||||||||||||||

|

May 2008 common stock issued for cash

|

9,000 | 9 | 241 | - | 250 | |||||||||||||||

|

June 2008 common stock issued for cash

|

18,000 | 18 | 482 | - | 500 | |||||||||||||||

|

August 2008 common stock issued for cash

|

36,000 | 36 | 964 | - | 1,000 | |||||||||||||||

|

Net (loss)

|

- | - | - | (3,628 | ) | (3,628 | ) | |||||||||||||

|

Balance at December 31, 2008

|

10,278,000 | 10,278 | 32,447 | (18,590 | ) | 24,135 | ||||||||||||||

|

Net (loss)

|

- | - | - | (4,289 | ) | (4,289 | ) | |||||||||||||

|

Balance at December 31, 2009

|

10,278,000 | 10,278 | 32,447 | (22,879 | ) | 19,846 | ||||||||||||||

|

Net (loss)

|

- | - | - | (12,169 | ) | (12,169 | ) | |||||||||||||

|

Balance at December 31, 2010

|

10,278,000 | 10,278 | 32,447 | (35,048 | ) | 7,677 | ||||||||||||||

|

Net (loss)

|

- | - | - | (9,097 | ) | (9,097 | ) | |||||||||||||

|

Balance at December 31, 2011

|

10,278,000 | 10,278 | 32,447 | (44,145 | ) | (1,420 | ) | |||||||||||||

|

Net (loss)

|

- | - | - | (19,838 | ) | (19,838 | ) | |||||||||||||

|

Balance at December 31, 2012

|

10,278,000 | 10,278 | 32,447 | (63,983 | ) | (21,258 | ) | |||||||||||||

|

Net (loss)

|

- | - | - | (22,807 | ) | (22,807 | ) | |||||||||||||

|

Balance at December 31, 2013

|

10,278,000 | $ | 10,278 | $ | 32,447 | $ | (86,790 | ) | $ | (44,065 | ) | |||||||||

As retroactivly stated for a 9 to 1 forward stock split effective September 20, 2010 .

See accompanying notes to financial statements

- 26 -

Yummy Flies, Inc.

(A Development Stage Company)

Notes to Financial Statements

For the years ended December 31, 2013 and 2012 and the period from inception (December 26, 2005) to December 31, 2013

Note 1 - Organization and Summary of Significant Accounting Policies

ORGANIZATION

Yummy Flies, Inc., f/k/a Yummyflies.com, Inc. (the “Company”), was incorporated in the State of Colorado on December 26, 2005 (inception). The Company was formed to produce and distribute fishing flies and other fishing supplies, as well as instructional DVD’s. The Company may also engage in any business that is permitted by law, as designated by the board of directors of the Company.

DEPRECIATION AND AMORITIZATION

Furniture, fixtures and equipment are stated at cost and are depreciated over their estimated economic lives ranging from 5 to 7 years. Depreciation is computed using the straight-line method.

USE OF ESTIMATES

The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

CASH AND CASH EQUIVALENTS

The Company considers all highly liquid instruments purchased with an original maturity of three months or less to be cash equivalents.

INVENTORIES

Inventories are stated at the lower of cost or market (first-in, first-out method).

- 27 -

Yummy Flies, Inc.

(A Development Stage Company)

Notes to Financial Statements

For the years ended December 31, 2013 and 2012 and the period from inception (December 26, 2005) to December 31, 2013

Note 1 - Organization and Summary of Significant Accounting Policies (continued)

BASIC (LOSS) EARNINGS PER SHARE