Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ENDURANCE SPECIALTY HOLDINGS LTD | d710842d8k.htm |

| EX-99.2 - EX-99.2 - ENDURANCE SPECIALTY HOLDINGS LTD | d710842dex992.htm |

Endurance and

Aspen: Creating a Global Leader in Specialty Insurance and Reinsurance

April 14, 2014

Exhibit 99.1 |

Cautionary

Note

Regarding

Forward

Looking

Statements

Some of the statements in this presentation may include forward-looking statements which

reflect our current views with respect to future events and financial performance. Such statements may include forward-looking

statements

both

with

respect

to

us

in

general

and

the

insurance

and

reinsurance

sectors

specifically,

both

as

to

underwriting

and

investment

matters.

These

statements

may

also

include

assumptions

about

our

proposed

acquisition

of

Aspen

(including

its

benefits,

results,

effects

and

timing).

Statements

which

include

the

words

"should,"

"would,"

"expect,"

"intend,"

"plan,"

"believe,"

"project,"

"anticipate,"

"seek,"

"will,"

and

similar

statements

of

a

future

or

forward-looking

nature

identify

forward-looking

statements

in

this

presentation

for

purposes

of

the

U.S.

federal

securities

laws

or

otherwise.

We

intend

these

forward-looking

statements

to

be

covered

by

the

safe

harbor

provisions

for

forward-looking

statements

in

the

Private

Securities

Litigation

Reform

Act

of

1995.

All forward-looking statements address matters that involve risks and uncertainties.

Accordingly, there are or may be important factors that could cause actual results to differ materially from those indicated in the forward-

looking

statements.

These

factors

include,

but

are

not

limited

to,

the

effects

of

competitors’

pricing

policies,

greater

frequency

or

severity

of

claims

and

loss

activity,

changes

in

market

conditions

in

the

agriculture

insurance

industry, termination of or changes in the terms of the U.S. multiple peril crop insurance

program, a decreased demand for property and casualty insurance or reinsurance, changes in the availability, cost or quality of reinsurance

or retrocessional coverage, our inability to renew business previously underwritten or

acquired, our inability to maintain our applicable financial strength ratings, our inability to effectively integrate acquired operations,

uncertainties in our reserving process, changes to our tax status, changes in insurance

regulations, reduced acceptance of our existing or new products and services, a loss of business from and credit risk related to our broker

counterparties,

assessments

for

high

risk

or

otherwise

uninsured

individuals,

possible

terrorism

or

the

outbreak

of

war,

a

loss

of

key

personnel,

political

conditions,

changes

in

accounting

policies,

our

investment

performance,

the

valuation of our invested assets, a breach of our investment guidelines, the unavailability of

capital in the future, developments in the world’s financial and capital markets and our access to such markets, government intervention

in the insurance and reinsurance industry, illiquidity in the credit markets, changes in

general economic conditions and other factors described in our Annual Report on Form 10-K for the year ended December 31, 2013. Additional

risks

and

uncertainties

related

to

the

proposed

transaction

include,

among

others,

uncertainty

as

to

whether

Endurance

will

be

able

to

enter

into

or

consummate

the

transaction

on

the

terms

set

forth

in

the

proposal,

the

risk

that

our

or

Aspen’s

shareholders

do

not

approve

the

transaction,

potential

adverse

reactions

or

changes

to

business

relationships

resulting

from

the

announcement

or

completion

of

the

transaction,

uncertainties

as

to

the

timing

of

the

transaction, uncertainty as to the actual premium of the Endurance share component of the

proposal that will be realized by Aspen shareholders in connection with the transaction, competitive responses to the transaction, the

risk

that

regulatory

or

other

approvals

required

for

the

transaction

are

not

obtained

or

are

obtained

subject

to

conditions

that

are

not

anticipated,

the

risk

that

the

conditions

to

the

closing

of

the

transaction

are

not

satisfied,

costs

and difficulties related to the integration of Aspen’s businesses and operations with

Endurance’s businesses and operations, the inability to obtain, or delays in obtaining, cost savings and synergies from the transaction, unexpected

costs, charges or expenses resulting from the transaction, litigation relating to the

transaction, the inability to retain key personnel, and any changes in general economic and/or industry specific conditions.

Forward-looking

statements

speak

only

as

of

the

date

on

which

they

are

made,

and

we

undertake

no

obligation

publicly

to

update

or

revise

any

forward-looking

statement,

whether

as

a

result

of

new

information,

future

developments or otherwise.

Regulation G Disclaimer

In this presentation, management has included and discussed certain non-GAAP

measures. Management believes that these non-GAAP measures, which may be defined differently by other companies, better explain the proposed

transaction in a manner that allows for a more complete understanding. However, these

measures should not be viewed as a substitute for those determined in accordance with GAAP. For a complete description of non-GAAP

measures

and

reconciliations,

please

review

the

Investor

Financial

Supplement

on

our

web

site

at

www.endurance.bm.

The

combined

ratio

is

the

sum

of

the

loss,

acquisition

expense

and

general

and

administrative

expense

ratios.

Endurance

presents

the

combined

ratio

as

a

measure

that

is

commonly

recognized

as

a

standard

of

performance

by

investors,

analysts,

rating

agencies

and

other

users

of

its

financial

information.

The

combined

ratio,

excluding

prior

year

net

loss

reserve

development,

enables

investors,

analysts,

rating

agencies

and

other

users

of

its

financial

information to more easily analyze Endurance’s results of underwriting activities in a

manner similar to how management analyzes Endurance’s underlying business performance. The combined ratio, excluding prior year net loss

reserve development, should not be viewed as a substitute for the combined ratio.

Net premiums written is a non-GAAP internal performance measure used by Endurance in the

management of its operations. Net premiums written represents net premiums written and deposit premiums, which are premiums on

contracts

that

are

deemed

as

either

transferring

only

significant

timing

risk

or

transferring

only

significant

underwriting

risk

and

thus

are

required

to

be

accounted

for

under

GAAP

as

deposits.

Endurance

believes

these

amounts

are

significant to its business and underwriting process and excluding them distorts the analysis

of its premium trends. In addition to presenting gross premiums written determined in accordance with GAAP, Endurance believes that

net premiums written enables investors, analysts, rating agencies and other users of its

financial information to more easily analyze Endurance’s results of underwriting activities in a manner similar to how management analyzes

Endurance’s underlying business performance. Net premiums written should not be

viewed as a substitute for gross premiums written determined in accordance with GAAP.

Return on Equity (ROE) is comprised using the average common equity calculated as the

arithmetic average of the beginning and ending common equity balances for stated periods. The Company presents various measures of

Return on Equity that are commonly recognized as a standard of performance by investors,

analysts, rating agencies and other users of its financial information. Certain

information included in this presentation has been sourced from third parties. Endurance does not make any representations regarding the accuracy, completeness or timeliness of such third party information. Permission

to cite such information has neither been sought nor obtained.

All information in this presentation regarding Aspen, including its businesses, operations and

financial results, was obtained from public sources. While Endurance has no knowledge that any such information is inaccurate or

incomplete, Endurance has not had the opportunity to verify any of that information.

Additional

Information

This

presentation

does

not

constitute

an

offer

to

sell

or

the

solicitation

of

an

offer

to

buy

any

securities

or

a

solicitation

of

any

vote

or

approval.

All

references

in

this

presentation

to

“$”

refer

to

United

States

dollars.

The

contents

of any website referenced in this presentation are not incorporated by reference herein.

Forward looking statements & Regulation G disclaimer

2

Third Party-Sourced Information

|

Endurance

and

Aspen

–

A

Compelling

Combination

Transaction will yield significant value for shareholders and create a company with greater

scale, market presence, diversification and profit potential

3

•

Proposed transaction offers upfront and long-term value for Aspen’s

shareholders –

Substantial premium valuation

–

Opportunity to receive cash and/or Endurance shares

•

The combination of Endurance and Aspen is a unique opportunity to create a global leader in

the specialty insurance and reinsurance sector

–

Over $5 billion of combined annual gross premiums written, diversified across products and

geographies –

Over

$5

billion

of

pro

forma

common

shareholders’

equity

and

$7.6

billion

in

total

capital,

yielding

a

large and strong capital base to compete in the increasingly competitive global market

•

The transaction will create a company with a superior financial profile

–

Increased scale, diversification, market presence and relevance

–

Enhanced profitability driven by:

•

Strong management team comprised of industry-leading talent from both companies

•

World-class underwriting expertise

•

Meaningful synergies from the transaction |

Proposed

Transaction Summary Compelling

value

for

Aspen

shareholders

and

significant

earnings

and

ROE

accretion

for

Endurance

shareholders

4

Notes

1.

Based

on

66.7MM

fully-diluted

Aspen

shares

as

of

2/24/2014

Transaction Proposal

•

Value

•

–

–

Consideration

•

•

Financing

•

•

Endurance CEO

Investment

•

Pro Forma Ownership

•

•

•

Financial Benefits

•

•

Endurance to acquire all of the common shares of Aspen

Aggregate consideration mix of 40% cash and 60% stock

$1.3

billion

of

cash

consideration

to

be

funded

through

Endurance’s

substantial

cash

resources

and

a

new

equity

investment

Endurance

has

received

a

written

commitment

for

the

purchase

of

$1.05

billion

of

newly

issued

common

shares

provided

by

investors

led

by

funds

advised

by

CVC

Capital

Partners

Advisory

(U.S.),

Inc.

and

its

affiliates

John Charman, Endurance’s Chairman and Chief Executive Officer, has committed to

purchase an additional $25 million of Endurance common shares in connection with the

transaction 44%

by Endurance shareholders

35%

by Aspen shareholders

21%

by New Investors

Significant EPS and ROE accretion for Endurance shareholders

Over $100 million of annual synergies

1.16x diluted book value per share at 12/31/2013 and 13.4x 2014 consensus Street earnings

estimates 21% premium to Aspen’s closing share price on 4/11/2014 and 15% premium

to all-time high Proposal

values

Aspen

at

$47.50

per

share

or

$3.2

billion

(1)

Aspen shareholders can elect to receive (i) $47.50 in cash per Aspen share, (ii) 0.8826

Endurance common shares for each Aspen share, or (iii) a combination of cash and

Endurance shares, subject to customary proration |

Combined Company

Will Have Scale to Compete With Market Leaders

5

Notes

1.

As of 12/31/2013, pro forma for transaction, excluding purchase accounting adjustments and

transaction expenses Common Shareholders’

Equity of Peer Companies

As of 12/31/2013

$Bn

(1)

10.0

7.0

5.9

5.4

5.3

5.2

3.7

3.5

3.5

2.7

2.5

1.7

1.6

1.5

0.0

2.0

4.0

6.0

8.0

10.0

12.0

XL

RE

PRE

ENH+AHL

ACGL

AXS

VR

AWH

RNR

AHL

ENH

PTP

AGII

MRH |

Transaction

Creates Company With Improved Market Presence and Diversification

6

Diversified Platform Across Products

and Geographies

Increased Scale and Market Presence

•

Combination creates an enterprise with

over $5 billion of annual gross premiums

written

•

Expanded leadership and underwriting

expertise

•

Increased size allows organization to better

capitalize on distribution relationships

•

Greater scale better positions combined

company to compete with largest players

as competition intensifies

•

Endurance and Aspen share certain

common businesses; however, the relative

weighting of each is quite complementary

•

Aspen’s strength in the Lloyd’s market and

Endurance’s market-leading U.S.

agriculture business are examples of

uncorrelated and diversified businesses

•

The global breadth and diversity of the

combined business will be more relevant

for brokers and customers

•

Aspen’s Lloyd’s platform complements

global insurance and reinsurance footprint

and is highly attractive to Endurance |

Transaction

Creates Company With Stronger Capitalization and Enhanced Profitability

7

Enhanced Profitability

•

With common shareholders’

equity of

$5.4 billion and total capital of $7.6

billion, the combined company will

have scale comparable to many of its

key competitors

(1)

•

Larger, stronger balance sheet will be

better positioned to pursue growth and

withstand volatility

•

Additional capital efficiencies due to

improved business diversification

•

Combined company will be well

positioned to produce an improved ROE

•

Meaningful transaction synergies

through cost savings, underwriting

improvements and capital efficiencies

•

Larger asset base will enable the

combined company to capitalize on

investment opportunities as they arise

Strong Balance Sheet and Capital Position

Notes

1.

Figures as of 12/31/2013, pro forma for transaction, excluding purchase accounting adjustments

and transaction expenses |

Casualty

& Specialty

21%

Combined Business Well Diversified Across Business Lines and Sectors

Geographic and distribution diversification benefits are also achieved

8

Endurance

Aspen

Combined

Property

2%

Agriculture

36%

Professional

Lines

6%

Casualty &

Other Specialty

12%

Property

9%

Casualty &

Other

Specialty

16%

Financial &

Professional

Lines

13%

Marine, Energy

& Transportation

20%

Catastrophe

13%

Property

11%

Casualty &

Specialty

20%

Property

Catastrophe

10%

Other

Property

11%

Casualty &

Specialty

21%

GPW: $2.7Bn

GPW: $2.6Bn

GPW: $5.3Bn

Insurance 55%

Reinsurance 45%

Insurance 57%

Reinsurance 43%

Catastrophe

12%

Insurance 56%

Reinsurance 44%

Agriculture

18%

Property

5%

Casualty &

Other

Specialty

14%

Professional

Lines

9%

Marine, Energy

& Transportation

10%

Property

11%

Notes

1.

Includes Professional Lines reinsurance segment for Endurance

2.

Includes Programs insurance segment for Aspen

(1)

(2)

(1)

(2) |

Proposal Provides

Compelling Value for Aspen Shareholders 9

Notes

1.

For the 30 calendar days ending 4/11/2014

2.

Based on diluted book value per share at 12/31/2013

3.

Based on consensus Street estimates for 2014 EPS as of 4/11/2014

Substantial Premium to Trading Prices

Attractive Valuation Multiples

vs. 5-year Average P/BV

Proposal Price Per Share

$47.50

vs. Diluted BVPS

(2)

$40.90

1.16x

0.79x

+46.8%

vs. 2014E Earnings

(3)

$3.55

13.4x

Proposal Price Per Share

$47.50

vs. Price

as of 4/11/2014

$39.37

+20.7%

vs. 1-month VWAP

(1)

$39.27

+21.0%

vs. All Time High

$41.43

+14.7% |

Proposed

Valuation Well Above Aspen’s Historical Trading Prices 10

1.16x

0.96x

$47.50

$39.37

Aspen

Share

Price

–

Last

5

Years

4/11/2009

–

4/11/2014

Aspen

P/BV

–

Last

5

Years

4/11/2009

–

4/11/2014

5-Yr Average: 0.79x

$20

$30

$40

$50

Apr-09

Apr-10

Apr-11

Apr-12

Apr-13

Historical Share Price

Proposed Purchase Price

0.50x

0.75x

1.00x

1.25x

Apr-09

Apr-10

Apr-11

Apr-12

Apr-13

Historical P/BV

Proposed Purchase Price |

•

Over $100 million of annual synergies, including:

–

Cost savings

–

Underwriting improvements

–

Capital efficiencies

–

Enhanced capital management opportunities

Financially Compelling Transaction

Transaction economics are highly attractive for ongoing Endurance shareholders

11

Notes

1.

As of 12/31/2013, pro forma for transaction, excluding purchase accounting adjustments and

transaction expenses 2.

Excluding integration charges

Key Financial Drivers

Combined Balance Sheet Strength

(1)

Summary of Financial Impact to Endurance

EPS

(2)

•

>10% accretion in 2015

ROE

(2)

•

11 –

13% pro forma ROE in 2015; 100bps

increase vs. standalone Endurance ROE

Book Value Per Share

•

Modest initial dilution to book value per share

Endurance

Pro Forma

Common Shareholders’

Equity

$2.5Bn

$5.4Bn

Cash and Invested Assets

$6.6Bn

$14.6Bn

Total Capital

$3.4Bn

$7.6Bn

Debt / Total Capital

15.5%

14.9% |

Illustrative

Future

Value

of

Aspen

Shares

(1)(2)

•

Based on consensus Street

estimates for Aspen’s ROE

and current trading

multiples, it will take Aspen

over 2 years to surpass the

$47.50 proposed

acquisition price

•

The transaction provides

Aspen shareholders the

ability to achieve values

meaningfully higher than

Aspen’s future value

implied by consensus

Street estimates

Transaction Provides Substantial Premium and Significant

Upside Potential

12

Notes

1.

Assumes Aspen shareholders receive 0.8826 shares of Endurance for each share of Aspen

2.

Assumes Aspen and pro forma dividend yield maintained at current

level as of 4/11/2014 in all scenarios; dividend yield based on

trailing 12-months dividends per share divided by current share price

3.

Assumes P/BV of 1.0x-1.2x for 11-13% ROE

4.

Assumes P/BV of 1.0x; consensus Street estimates for Aspen’s ROE based on median 2014 ROE

estimate of 8.4% for +1 year and median 2015 ROE estimate of 8.6% for +2 years and +3 years; estimates as of 4/11/2014

Historical Aspen

Share Price

Pro forma at

11-13% ROE

(3)

Current

+1 Year

+2 Years

+3 Years

-1 Year

Aspen standalone

at consensus

Street estimates

(4)

$39.37

$43

$46

$50

$61

$47.50

$77

$30

$40

$50

$60

$70

$80 |

Common Equity

Financing Industry-leading investors making substantial investment in the combined

company 13

•

Endurance has received a written commitment for the purchase of $1.05 billion of newly issued

common shares

by

investors

led

by

funds

advised

by

CVC

Capital

Partners

Advisory

(U.S.),

Inc.

and

its

affiliates

–

The investors have already completed due diligence on Endurance and the merits of the

transaction –

The

investment

is

subject

to

customary

due

diligence

of

Aspen

by

the

investors,

in

coordination

with

Endurance, and the closing of the proposed transaction, as well as other customary conditions

to closing •

Key terms of the $1.05 billion investment:

–

Endurance common shares at a pre-negotiated discount to an average market price of

Endurance common shares prior to the announcement of Endurance’s proposal to

acquire Aspen –

Warrants to purchase additional Endurance common shares with an exercise price higher than an

average market price of Endurance common shares prior to the announcement of

Endurance’s proposal to acquire Aspen

–

Customary governance rights for a significant minority investment in a publicly traded

company •

John

Charman

has

committed

to

purchase

an

additional

$25

million

of

Endurance

common

shares

at

an

average market price of Endurance common shares prior to the announcement of Endurance’s

proposal to acquire Aspen

–

No discount

–

No warrants to purchase additional shares

–

This additional investment is subject to the closing of the proposed transaction

|

•

Proposed transaction offers upfront and long-term value for Aspen’s

shareholders –

Substantial premium valuation

–

Opportunity to receive cash and/or Endurance shares

•

The combination of Endurance and Aspen is a unique opportunity to create a global leader in

the specialty insurance and reinsurance sector

–

Over $5 billion of combined annual gross premiums written, diversified across products and

geographies

–

Over

$5

billion

of

pro

forma

common

shareholders’

equity

and

$7.6

billion

in

total

capital,

yielding

a

large and strong capital base to compete in the increasingly competitive global market

•

The transaction will create a company with a superior financial profile

–

Increased scale, diversification, market presence and relevance

–

Enhanced profitability driven by:

•

Strong management team comprised of industry-leading talent from both companies

•

World-class underwriting expertise

•

Meaningful synergies from the transaction

Conclusion

14

Endurance and Aspen: A Global Leader in Specialty Insurance and Reinsurance

|

Additional

Information About Endurance |

•

“A”

ratings from AM Best and S&P

•

$3.4 billion of total capital

•

Conservative, short-duration, AA

rated investment portfolio

•

Prudent reserves

•

Diversified and efficient capital

structure

•

Since inception, returned $2.0

billion to investors through

dividends and share repurchases

Endurance Has Strong Foundation to Build on

Strong balance sheet, diversified portfolio and robust infrastructure

16

Strategic Initiatives

•

Substantially expanded global

underwriting and leadership talent

•

Optimized balance of insurance and

reinsurance portfolios to lower

volatility and improve profitability

•

Streamlined support operations to

generate significant savings to fund

underwriting additions

•

Improved financial results reflect

recent actions

Diversified Portfolio of Businesses

•

Portfolio of approximately $2.7

billion in annual gross premiums

written

•

Book of business diversified

between insurance and reinsurance

as well as short tail and long tail

lines of business

•

Proven leader in U.S. agriculture

insurance business

•

Focus on specialty lines of business,

with industry-leading talent

Strong Balance Sheet and Capital

Strong and seasoned franchise

Inception to date operating ROE of 11.0%

10 year book value per share plus dividends CAGR of 10.6%

Continuous improvement in performance and market positioning |

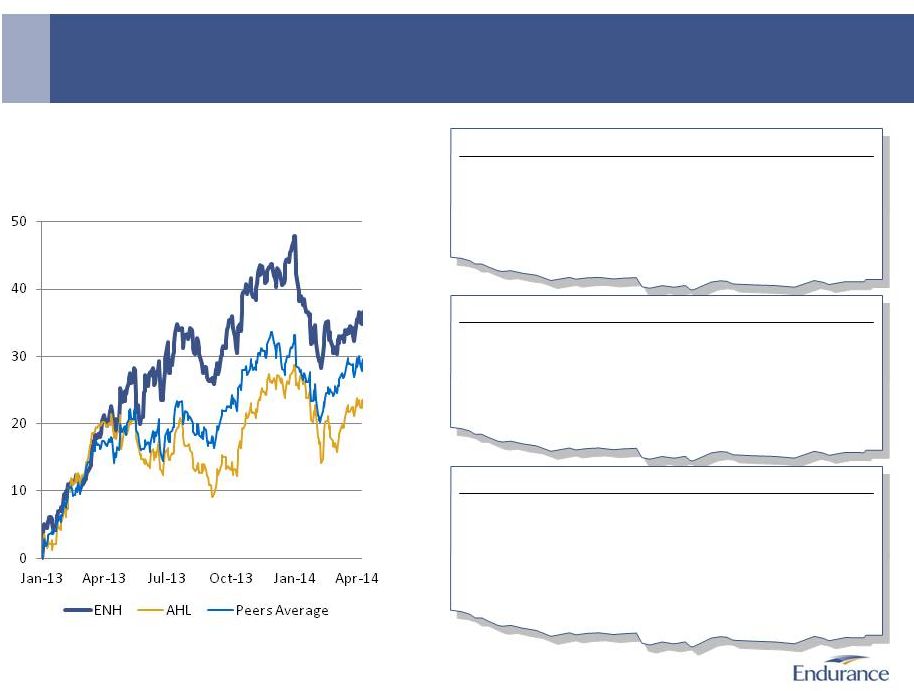

Endurance Share

Price Performance Reflects Investor Confidence Endurance’s strategy has been

strongly supported by the investment community 17

Notes

1.

Peers include ACGL, AGII, AWH, AXS, MRH, PRE, PTP, RE, RNR, VR and XL

Share Price Performance: Endurance vs. Peers

(1)

1/1/2013 –

4/11/2014

%

+29%

+36%

+23%

Equity Research #1

-

February 6, 2014

“The company has laid out a goal to dramatically grow its insurance

premiums

over

the

next

three

years

excluding

its

crop

business.

The

fourth

quarter

already

demonstrated

signs

of

such

growth.

Excluding

crop, the gross insurance premiums grew by 27% in the quarter. As new

teams join the company and Endurance expands its presence in London,

we would expect this double digit [growth] to continue.” “Earlier

this week, we spent a day with recently appointed CEO John Charman visiting with

investors. We walked away from the meetings with increased confidence in

Endurance's long-term prospects, with the company now having the vision and

direction it has long lacked and a plan for growth that we see as largely achievable

over a three-year period.” Equity

Research #2 -

December 6, 2013

Equity Research #3

-

May 28, 2013

“Mr. Charman has an excellent long-term underwriting track

record, particularly in specialty insurance ... Mr. Charman made a name for

himself in the London insurance market. The syndicate he ran

dramatically outperformed the Lloyd’s market over a 13 year period

before

he

left.

...

Axis

performed

well

during

Mr.

Charman’s

time

at

the

helm

with

compound

annual

growth

in

book

value

of

14%

(including

dividends).” |

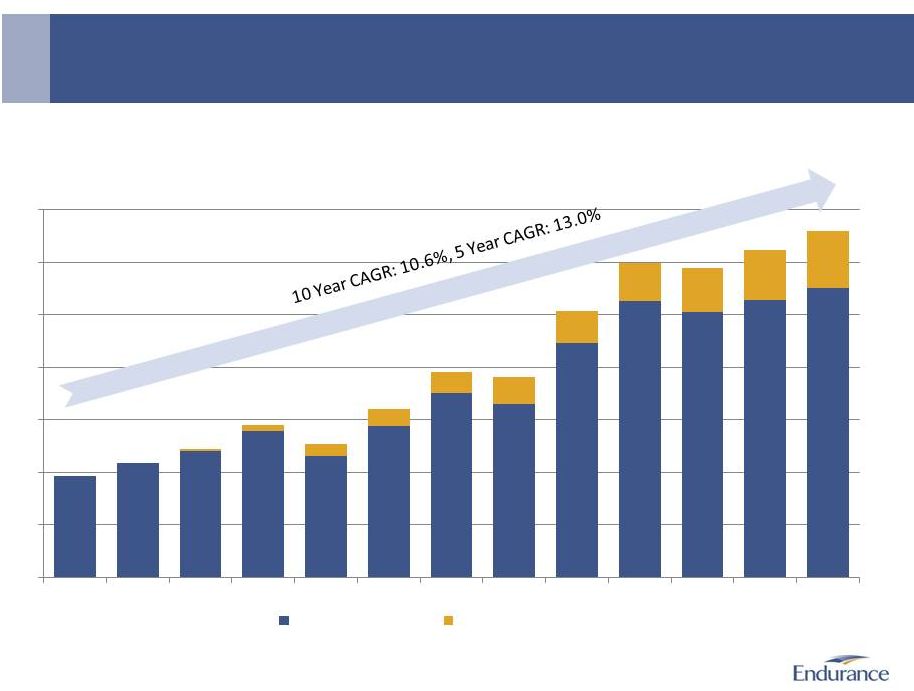

Endurance Has

Delivered Strong Financial Results Since Inception 18

Growth in Diluted Book Value Per Common Share ($)

From December 31, 2001 –

December 31, 2013

19.37

21.73

24.03

27.91

23.17

28.87

35.05

33.06

44.61

52.74

50.56

52.88

55.18

0.32

1.13

4.13

5.13

6.13

7.13

8.33

9.57

10.85

$0

$10

$20

$30

$40

$50

$60

$70

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

Book Value Per Share

Cumulative Dividends

2.13

3.13 |

Specialty

Insurance Strategic Direction Expanding underwriting talent, refocusing underwriting,

rebalancing the portfolio and improving positioning and relevance in the market

19

Initial products include:

•

•

•

•

Misc. commercial

classes

•

Fin. institutions

•

Inland marine

•

Excess casualty (E&S

and retail)

•

Ocean marine

•

Numerous professional

line underwriters

•

Misc.

commercial

classes

•

Financial

institutions

•

Lawyers

•

Commercial

management liability

•

Surety

•

Healthcare

•

Jack Kuhn

CEO , Global Insurance

•

Graham Evans

EVP & Head of

International Insurance

•

Doug Worman

EVP & Head of U.S.

Insurance

•

Richard Allen

EVP & Head of

Professional Lines

•

Richard Housley

EVP & General

Manager of London

Insurance

•

Cliff Easton

EVP & Global Head of

Energy

Energy

Property

Professional Lines

Significantly

enhancing the

leadership team

Increased

Market

Presence

and

Diversity

Opened an insurance office

in London

Meaningfully

expanded

underwriting abilities

in 2013 |

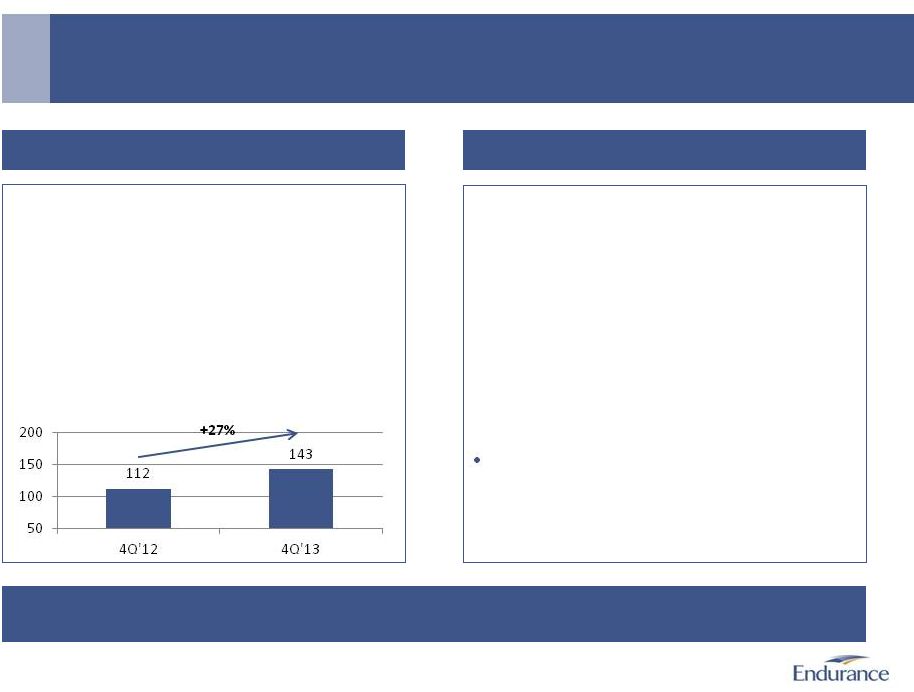

Insurance GPW

(ex. Agriculture) •

Significant and tangible improvements in 2013

to increase market presence and diversity

–

Attracted and retained teams of high

quality underwriters

–

Expanded underwriting and product

capabilities

–

Withdrew from unprofitable lines

Endurance Has an Attractive and Growing Specialty Insurance Franchise

Two pillars of a unique insurance platform with demonstrated improvement across specialty

lines to complement market-leading Agriculture franchise

20

Established Market Leader in Agriculture

•

ARMtech is a top 5 player in the attractive

multi peril crop insurance (MPCI) market

–

Favorable market dynamics with only 17

licensed companies in 2013

–

Federal government sponsored

reinsurance and loss sharing mitigates

downside risk

–

Newly passed Federal Farm Bill provides

stability going forward

–

Not correlated with broader P&C market

–

Historic average combined ratio less than

90%

(1)

–

High risk adjusted returns

Enhanced Specialty Insurance Franchise

$MM

Notes

1.

Historic

average

loss

ratio

post

U.S.

Federal

cessions

has

been

82.9%

(adjusted

for

the

2011

Federal

reinsurance

terms);

current

expense

run

rate

after

A&O

subsidy

is

approximately

6%

-

8%

Insurance Business Has Generated Approximately $200 Million of Underwriting Profits Since

Inception With a Combined Ratio of 97%

Attractive market characteristics |

•

Improve profitability and consistency of results through

enhanced market presence, improved underwriting and

risk selection

Reinsurance Strategic Direction

Enhancing profitability by recruiting top flight underwriting talent, developing strategic

partnerships with key clients and brokers, and improving underwriting and risk

selection Reinsurance Focusing on Growing Profitable Specialty Lines of Business

With Less Volatile Exposures

21

Strategic Priorities for Global Reinsurance

•

Third quarter 2012 additions

–

Engineering Risk Underwriter

–

Trade Credit and Surety Team

–

Global Weather Unit

•

August

2013

–

Hired

Peter

Mills,

Head

of

Global

Specialty

& Europe P&C Reinsurance

•

October

2013

–

Hired

Chris

Donelan,

Head

of

U.S.

Reinsurance and team of underwriters

•

January

2014

–

Hired

Marine

Reinsurance

Team

based

in

Zurich (starting in August 2014)

Recent Key Hires

•

Reinsurance business has a demonstrated track record of profitability

–

Over $1 billion of premiums and combined ratio of 77% in 2013

–

Generated almost $1 billion of underwriting profits with a combined ratio of 92% since

inception Demonstrated Track Record of Profitability

–

Hired Jerome Faure in March 2013 as CEO of Global

Reinsurance

–

Completed the consolidation of European

reinsurance underwriting in Zurich

–

Focus on profitable growth and diversification

through existing and new specialty reinsurance units

•

Manage volatility through improved portfolio management

and opportunistic retro purchases

•

Eliminate substandard businesses with insufficient margins |

22

Endurance and Aspen:

Creating a Global Leader in Specialty

Insurance and Reinsurance |