Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Howmet Aerospace Inc. | d708701d8k.htm |

| EX-99.1 - EX-99.1 - Howmet Aerospace Inc. | d708701dex991.htm |

1st Quarter Earnings Conference

1

April 8, 2014

[Alcoa logo]

Exhibit 99.2 |

Cautionary Statement

2

o[Alcoa

logo] This

presentation

contains

statements

that

relate

to

future

events

and

expectations

and

as

such

constitute

forward-looking

statements.

Forward-looking

statements

include

those

containing

such

words

as

“anticipates,”

“estimates,”

“expects,”

“forecasts,”

“intends,”

“outlook,”

“plans,”

“projects,”

“should,”

“targets,”

“will,”

or

other

words

of

similar

meaning.

All

statements

that

reflect

Alcoa’s

expectations,

assumptions,

or

projections

about

the

future

other

than

statements

of

historical

fact

are

forward-looking

statements,

including,

without

limitation,

forecasts

concerning

global

demand

growth

for

aluminum,

end-market

conditions,

supply/demand

balances,

and

growth

opportunities

for

aluminum

in

automotive,

aerospace

and

other

applications,

trend

projections,

targeted

financial

results

or

operating

performance,

and

statements

about

Alcoa’s

strategies,

outlook,

and

business

and

financial

prospects.

Forward-looking

statements

are

subject

to

a

number

of

known

and

unknown

risks,

uncertainties,

and

other

factors

and

are

not

guarantees

of

future

performance.

Important

factors

that

could

cause

actual

results

to

differ

materially

from

those

in

the

forward-looking

statements

include:

(a)

material

adverse

changes

in

aluminum

industry

conditions,

including

global

supply

and

demand

conditions

and

fluctuations

in

London

Metal

Exchange-based

prices

and

premiums,

as

applicable,

for

primary

aluminum,

alumina,

and

other

products,

and

fluctuations

in

indexed-based

and

spot

prices

for

alumina;

(b)

deterioration

in

global

economic

and

financial

market

conditions

generally;

(c)

unfavorable

changes

in

the

markets

served

by

Alcoa,

including

automotive

and

commercial

transportation,

aerospace,

building

and

construction,

packaging,

defense,

and

industrial

gas

turbine;

(d)

the

impact

of

changes

in

foreign

currency

exchange

rates

on

costs

and

results,

particularly

the

Australian

dollar,

Brazilian

real,

Canadian

dollar,

euro,

and

Norwegian

kroner;

(e)

increases

in

energy

costs,

including

electricity,

natural

gas,

and

fuel

oil,

or

the

unavailability

or

interruption

of

energy

supplies;

(f)

increases

in

the

costs

of

other

raw

materials,

including

calcined

petroleum

coke,

caustic

soda,

and

liquid

pitch;

(g)

Alcoa’s

inability

to

achieve

the

level

of

revenue

growth,

cash

generation,

cost

savings,

improvement

in

profitability

and

margins,

fiscal

discipline,

or

strengthening

of

competitiveness

and

operations

(including

moving

its

alumina

refining

and

aluminum

smelting

businesses

down

on

the

industry

cost

curves

and

increasing

revenues

and

improving

margins

in

its

Global

Rolled

Products

and

Engineered

Products

and

Solutions

segments)

anticipated

from

its

restructuring

programs

and

productivity

improvement,

cash

sustainability,

and

other

initiatives;

(h)

Alcoa's

inability

to

realize

expected

benefits,

in

each

case

as

planned

and

by

targeted

completion

dates,

from

sales

of

non-core

assets,

or

from

newly

constructed,

expanded,

or

acquired

facilities,

including

facilities

supplying

auto

sheet

capacity

or

aluminum-lithium

capacity,

or

from

international

joint

ventures,

including

the

joint

venture

in

Saudi

Arabia;

(i)

political,

economic,

and

regulatory

risks

in

the

countries

in

which

Alcoa

operates

or

sells

products,

including

unfavorable

changes

in

laws

and

governmental

policies,

civil

unrest,

imposition

of

sanctions,

expropriation

of

assets,

or

other

events

beyond

Alcoa’s

control;

(j)

the

outcome

of

contingencies,

including

legal

proceedings,

government

investigations,

and

environmental

remediation;

(k)

the

business

or

financial

condition

of

key

customers,

suppliers,

and

business

partners;

(l)

adverse

changes

in

tax

rates

or

benefits;

(m)

adverse

changes

in

discount

rates

or

investment

returns

on

pension

assets;

(n)

the

impact

of

cyber

attacks

and

potential

information

technology

or

data

security

breaches;

and

(o)

the

impact

of

union

disputes,

strikes

or

work

stoppages;

and

(p)

the

other

risk

factors

summarized

in

Alcoa's

Form

10-K

for

the

year

ended

December

31,

2013

and

other

reports

filed

with

the

Securities

and

Exchange

Commission.

Alcoa

disclaims

any

obligation

to

update

publicly

any

forward-looking

statements,

whether

in

response

to

new

information,

future

events

or

otherwise,

except

as

required

by

applicable

law.

Forward-Looking Statements

Non-GAAP Financial Measures

Some

of

the

information

included

in

this

presentation

is

derived

from

Alcoa’s

consolidated

financial

information

but

is

not

presented

in

Alcoa’s

financial

statements

prepared

in

accordance

with

accounting

principles

generally

accepted

in

the

United

States

of

America

(GAAP).

Certain

of

these

data

are

considered

“non-GAAP

financial

measures”

under

SEC

rules.

These

non-

GAAP

financial

measures

supplement

our

GAAP

disclosures

and

should

not

be

considered

an

alternative

to

the

GAAP

measure.

Reconciliations

to

the

most

directly

comparable

GAAP

financial

measures

and

management’s

rationale

for

the

use

of

the

non-GAAP

financial

measures

can

be

found

in

the

Appendix

to

this

presentation

and

on our

website

at

www.alcoa.com

under

the

“Invest”

section.

Any

reference

during

the

discussion

today

to

EBITDA

means

adjusted

EBITDA,

for

which

we

have

provided

calculations

and

reconciliations

in

the

Appendix

and

on

our website. |

3

Solid results in the first quarter –

Transformation accelerates

1) Excludes gain from sale of Suriname gold mine interest

o[Alcoa

logo] Strong

Operational

Performance

Strong

earnings

(excluding

special

items)

increase

sequentially

–

Downstream:

Record

performance

-

ATOI

up

9%

YoY

–

Midstream:

Earnings

rebound

-

ATOI

nearly

triples

QoQ;

record auto revenue

–

Upstream:

Improved

performance

-

10

consecutive

quarters

;

highest

Alumina

1Q

ATOI

1

since

2011

Productivity:

$250

million

across

all

segments

YoY

1Q 2014 Overview

Accelerating

Portfolio

Transformation

Commissioned

$300

million

Davenport

automotive

expansion

Investing

$40

million

in

value-add

specialty

packaging

facility

in

Brazil

Expanding

proprietary

wheel

facility

in

Hungary

Announced

~$300

million

after

-tax

restructuring

Australia,

U.S.

and

Brazil

smelting

capacity

totaling

421

kmt;

can

sheet

rolling

capacity

of

200

kmt |

William Oplinger

Executive Vice President and Chief Financial Officer

4

April 8, 2014

[Alcoa logo] |

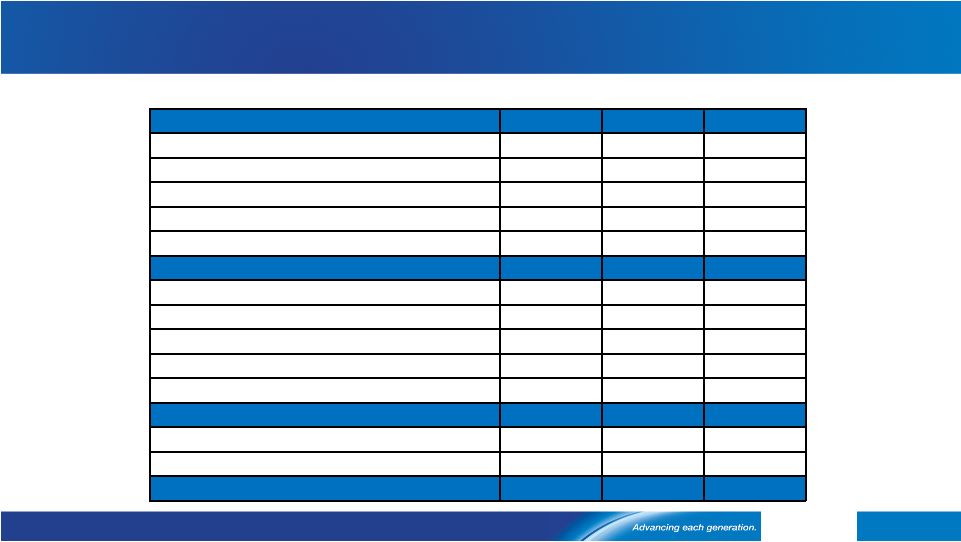

Income Statement Summary

5

See appendix for Adjusted Income reconciliation

o[Alcoa

logo] $ Millions, except aluminum prices and per-share

amounts 1Q13

4Q13

1Q14

Prior Year

Change

Sequential

Change

Realized Aluminum Price ($/MT)

$2,398

$2,157

$2,205

($193)

$48

Revenue

$5,833

$5,585

$5,454

($379)

($131)

Cost of Goods Sold

$4,847

$4,708

$4,495

($352)

($213)

COGS % Revenue

83.1%

84.3%

82.4%

(0.7% pts)

(1.9 % pts.)

Selling,

General

Administrative,

Other

$251

$255

$236

($15)

($19)

SGA % Revenue

4.3%

4.6%

4.3%

0.0

% pts

(0.3 % pts.)

($27)

($10)

$25

$52

$35

Restructuring and Other Charges

$7

$2,111

$461

$454

($1,650)

Effective Tax Rate

27.4%

(15.6%)

28.1%

0.7 % pts

43.7 % pts.

Net Income (Loss)

$149

($2,339)

($178)

($327)

$2,161

Net Income (Loss) Per Diluted Share

$0.13

($2.19)

($0.16)

($0.29)

$2.03

Income

per Diluted

Share excl

Special Items

$0.11

$0.04

$0.09

($0.02)

$0.05

Other (Income) Expense, Net |

Special Items

1) Total restructuring-related charges of $296 million expected to be

approximately 55 percent cash, 45 percent non-cash See appendix for

Adjusted Income reconciliation 6

o[Alcoa

logo] $ Millions, except per-share amounts

4Q13

1Q14

Income Statement

Classification

Segment

Net Loss from Continuing Operations

($2,339)

($178)

Net Loss Per Diluted Share

($2.19)

($0.16)

Restructuring-Related

1

($302)

($296)

Restructuring/COGS/

Other Expenses (Income), Net

Corporate /

Primary Metals/

GRP

Tax Items

($361)

$22

Income Taxes

Corporate

Saudi Arabia Smelter Potline

($9)

($13)

COGS/

Other Expenses (Income), Net

Primary Metals

Massena

Fire

$5

$0

COGS

Primary

Metals/EPS/Corp

Goodwill Impairment

($1,719)

$0

Goodwill Impairment Charge

Corporate

Mark-to-Market Energy Contracts

$7

$0

Other Expenses (Income), Net

Corporate

Surgold

Gain

$0

$11

Other Expenses (Income), Net

Alumina

Special Items

($2,379)

($276)

Net

Income from Continuing Ops excl Special Items

$40

$98

Net Income

per Diluted

Share excl

Special Items

$0.04

$0.09 |

Performance more than offsets cost headwinds and market impacts

7

See appendix for Adjusted Income reconciliation

o[Alcoa

logo] |

LME

drives Y-O-Y earnings decline; net productivity is positive 8

See appendix for Adjusted Income reconciliation

o[Alcoa

logo] |

9

Any reference in our presentations to EBITDA means adjusted EBITDA, for which we have

provided calculations and reconciliations in the appendix. See appendix for

Adjusted EBITDA reconciliation EPS generates record 1Q ATOI and EBITDA Margin

o[Alcoa

logo] Aerospace

market

remains

strong,

but

impacted

by

lower

U.S.

Defense

spare

parts

demand

Gradual

recovery

in

N.A.

Non-Residential

Construction

continues;

European

market

decline

is

slowing

Stronger

N.A.

Heavy

Duty

Truck

build

rates

partially

offset

by

Europe

Share

Gains

through

innovation

and

productivity

continues

across

all

sectors

ATOI

is

expected

to

increase

4-6%

year-over-year;

first-time

+$200M

ATOI

Revenue

up

3%

sequentially

driven

by

share

gains

across

all

markets

Record

1Q

ATOI

and

EBITDA

margin

1Q

EBITDA

margin

at

22.2%,

up

1.3

percentage

points

year-over-year

Quarterly

ATOI

up

9%

year-over-year

to

$189M

driven

by

productivity

and

strong

Aerospace

and

Commercial

Transportation

demand,

offsetting

unfavorable

weather

impacts

in

North

America

1Q 14

$189

Cost Increases

-$7

Productivity

$19

Price / Mix

$2

Volume

$7

4Q 13

$168

1Q 13

4Q 13

1Q 14

3

rd

Party Revenue ($ Millions)

1,423

1,405

1,443

ATOI ($ Millions)

173

168

189

EBITDA Margin

20.9%

20.3%

22.2%

1

st

Quarter Results

1

st

Quarter Business Highlights

1

st

Quarter Performance Bridge

1Q14 Actual and 2Q14 Outlook –

Engineered Products and Solutions

$ Millions

2

nd

Quarter Outlook |

10

GRP nearly triples profitability from productivity and higher mill utilization

See appendix for Adjusted EBITDA reconciliation

o[Alcoa

logo] $ Millions

1Q14 Actual and 2Q14 Outlook –

Global Rolled Products

1

st

Quarter Results

1

st

Quarter Business Highlights

1

st

Quarter Performance Bridge

1Q 14

$59

Portfolio

Actions

-$11

Cost

Decreases

$28

Prod-

uctivity

$6

Price / Mix

-$8

Volume

$6

Currency

$2

Metal

$15

4Q 13

$21

Record

automotive

sheet

revenue

–

continued

high

shipments

Pricing

and

volume

pressures

in

Packaging

Productivity

gains

through

strong

focus

on

cost

reduction

Favorable

fixed

cost

absorption

from

higher

mill

utilization

Costs

associated

with

Australia

portfolio

actions

of

$11M

Auto

demand

expected

to

stay

strong

Continued

pressure on packaging prices and volumes

Unfavorable cost impact from business continuity

preparation

ATOI

is

expected

to

increase

~20%

sequentially,

excluding

FX

and

assuming

no

change

in

metal

price

1Q 13

4Q 13

1Q 14

3

rd

Party Revenue ($ Millions)

1,779

1,645

1,677

ATOI ($ Millions)

81

21

59

Adjusted EBITDA/MT

385

185

315

2

nd

Quarter Outlook

Strengthening

demand

for

Industrial;

pricing

pressures

continue

Industrial

volumes

expected

to

strengthen;

continued

pricing

pressures |

Alumina pricing and productivity drive highest 1Q ATOI since 2011

11

o[Alcoa

logo] $ Millions

1Q14 Actual and 2Q14 Outlook –

Alumina

1

st

Quarter Results

1

st

Quarter Business Highlights

1

st

Quarter Performance Bridge

$18

$8

$37

$9

$92

$70

-$7

1Q 14

Portfolio

Actions

Cost

Inc/RM

Energy

-$4

Prod

-

uctivity

Price

/ Mix

Volume

-$15

Currency

LME

-$24

4Q 13

Sixth

straight

quarter

of

increased

profits;

highest

1Q

ATOI

since

2011,

$74M

before

Surgold

sale

gain

Performance

gains

offset

market

factors

Strong

Alumina

index

(API)

pricing

increases

ATOI

by

$37M

Sale

of

Surgold

generated

$18M

ATOI

65%

of

3

rd

party

shipments

on

spot

or

API

for

2014;

API

pricing

follows

30-day

lag

and

LME

pricing

follows

60-day

lag

Production

decline

due

to

reduction

at

Pocos

refinery

in

Brazil

Gain

from

Surgold

sale

does

not

repeat

Saudi

JV

refinery

pre-operational

costs

increase

$5M

Productivity

gains

will

offset

energy

and

cost

increases,

excluding

Saudi

JV

1Q 13

4Q 13

1Q 14

Production (kmt)

3,994

4,249

4,172

3

rd

Party Shipments (kmt)

2,457

2,578

2,649

3

rd

Party Revenue ($ Millions)

826

832

845

ATOI ($ Millions)

58

70

92

2

nd

Quarter Outlook

-$15

+$19

Market

Performance |

Primary Metals aggressively executing portfolio actions

12

o[Alcoa

logo] Pricing

to

follow

15-day

lag

to

LME

Volumes

impacted

by

Massena

East

and

Brazilian

curtailments

Saudi JV smelter restart completed

Productivity

gains

will

offset

energy

and

cost

increases

Two

fewer

days

in

the

quarter

reduce

volume

by

$8M

sequentially

Regional

premiums,

mix

and

product

pricing

drive

performance

$70M

higher

than

4Q

Energy

improvements

of

$24M

from

lower

Spanish

power

prices,

partially

offset

by

higher

costs

in

other

regions

Combined

portfolio

actions

and

Saudi

JV

smelter

restart

total

$21M

1Q14 Actual and 2Q14 Outlook –

Primary Metals

1

st

Quarter Business Highlights

2

nd

Quarter Outlook

$ Millions

1

st

Quarter Results

1

st

Quarter Performance Bridge

-$15

Portfolio

Actions

-$14

Saudi

JV/

Massena

-$7

Cost

Inc/RM

Currency

$4

LME

-$25

4Q 13

-$35

1Q 14

Price

/Mix &

Vol.

$2

Prod

-

uctivity

$24

Energy

-$26

$62

1Q 13

4Q 13

1Q 14

Production (kmt)

891

866

839

3

rd

Party Shipments (kmt)

705

717

617

3

rd

Party Revenue ($ Millions)

1,758

1,618

1,424

3

rd

Party Price ($/MT)

2,398

2,157

2,205

ATOI ($ Millions)

39

(35)

(15)

Market

Performance

-$21

+$62 |

Two

day year-over-year improvement in average DWC See appendix for days

working capital reconciliation 13

o[Alcoa

logo] Average Days Working Capital since First Quarter 2009

30

28

31

29

32

30

36

35

34

36

40

40

40

37

44

43

42

47

51

55

37

25 days;

$1.6 Billion |

1

st

Quarter Cash Flow Overview

14

See appendix for Free Cash Flow reconciliation

o[Alcoa

logo] ($ Millions)

1Q13

4Q13

1Q14

Net

Income

before

Noncontrolling

Interests

$170

($2,310)

($197)

DD&A

$361

$350

$340

Change in Working Capital

($323)

$522

($687)

Pension Contributions

($83)

($108)

($91)

Other Adjustments

($195)

$2,466

$84

Cash from Operations

($70)

$920

($551)

Dividends to Shareholders

($33)

($33)

($33)

Change in Debt

$90

($14)

($14)

Distributions

to

Noncontrolling

Interests

($25)

($29)

($35)

Contributions

from

Noncontrolling

Interests

$15

$0

$20

Other Financing Activities

$0

$11

$72

Cash from Financing Activities

$47

($65)

$10

Capital Expenditures

($235)

($422)

($209)

Other Investing Activities

($50)

($3)

($31)

Cash from Investing Activities

($285)

($425)

($240)

1Q13, 4Q13 & 1Q14 Cash Flow |

15

See appendix for Net Debt-to-Capital reconciliation

Lowest debt since 3Q 2007; Debt-to-Cap down to target range

762

1,481

1,543

1,939

1,861

1,437

665

1Q14

7,747

7,082

2013

8,319

6,882

2012

8,829

6,968

2011

9,371

7,432

2010

9,165

7,622

2009

9,819

8,338

2008

10,578

9,816

(millions)

Debt to Cap

Net Debt

Cash

38.1%

42.5%

38.7%

34.9%

35.3%

34.8%

35.0%

Debt, Net Debt, and Debt-to-Capital %

o[Alcoa

logo] |

Aggressive targets drive growth and operational performance in 2014

16

o[Alcoa

logo] 2014 Annual Financial Targets

Deliver

Operational

Performance

Drive Productivity Gains of $850M

Process productivity

Procurement savings

Overhead cost reductions

Invest in the

Future; Actively

Manage the

Base

Build Value-Add with Growth Capital of $500M

Invest in Saudi JV of $125M

Manage Sustaining Capital of $750M

Strengthen the

Balance Sheet

Generate Positive Free Cash Flow

Attain 30%-35% Debt

-to-Capital |

Robust demand continues; regional premiums at record levels

17

Global Aluminum Demand Growth at

7%

Aluminum Deficit Emerging

Inventory

is Stable

High Regional Premiums

See appendix for full scale charts

o[Alcoa

logo] |

Klaus Kleinfeld

Chairman and Chief Executive Officer

18

April 8, 2014

[Alcoa logo] |

Source: Alcoa analysis

19

2014 Market Conditions remain solid

o[Alcoa

logo] North America

China

Global

Europe

8%

to

9%

sales growth

2%

to

3%

sales growth

4%

to

6%

sales growth

8%

to

12%

airfoil market

decline

6%

to

10%

prod growth

8%

to

12%

sales growth

7%

to

9%

sales growth

2%

to

3%

sales growth

2%

to

3%

sales decline

0%

to

4%

prod growth

1%

to

5%

prod decline

2%

to

5%

prod growth

1%

to

2%

sales decline

Aerospace

Automotive

Heavy Truck &

Trailer

Beverage Can

Packaging

Commercial Building

and Construction

Industrial Gas

Turbine

5%

to

9%

prod growth

-1%

to

3%

prod flat/growth

3%

to

4%

sales growth

1%

to

4%

prod growth

-1%

to

3%

prod flat/growth

Alcoa End Markets: Current Assessment of 2014 vs. 2013

|

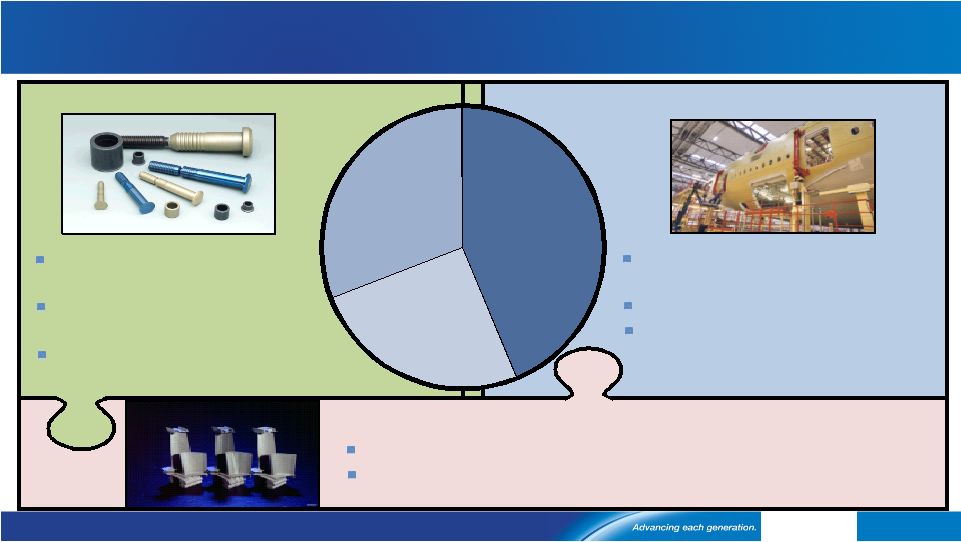

More to Alcoa than meets the eye, exciting Value-Add Portfolio

20

Source: Alcoa analysis

1) Based on dollar value. Global commercial vehicle wheel market includes

trucks, trailers and buses o[Alcoa logo]

2013 Alcoa value-add revenue by market ($B)

0.6

Other

1.5

Commercial

Building and

Construction

1.8

Industrial

Products

3.1

Packaging

1.3

Commercial

Transportation

0.8

Automotive

4.0

Aerospace

Revenues: $13.1B

Aerospace |

Advanced Aerospace Structures

Aluminum

sheet, plate and

extrusions

Aluminum

and

titanium

forgings

Structural castings;

~50%

titanium

, ~30%

aluminum

, and

~20%

nickel alloys

High Performance Engine Investment Castings

Global

leader

in

jet engine airfoils

100%

nickel super alloys

Innovative Fastening Systems

Global

leader

in aerospace

fastening

systems

Both

airframe

and

engine

applications

~40%

titanium

, ~25%

steel

and

~35%

nickel

alloys

43%

$1.74

26%

$1.03

31%

$1.23

$4B Aerospace Portfolio; Multi-material Innovation Leader

21

o[Alcoa

logo] |

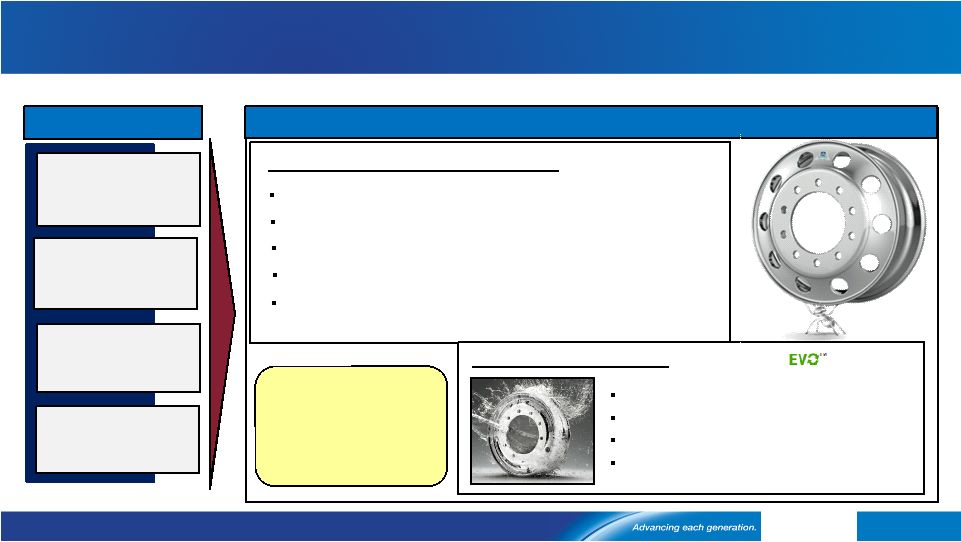

Re-Inventing the Wheel: Lighter & Brighter

22

1) Based on conversion from Standard Steel to Wide-Base Aluminum

o[Alcoa

logo] Most innovative solutions for improved truck fuel efficiency

and lowered maintenance cost

Alcoa’s Innovation Leadership is on a roll

$400

Heavy duty without the “Heavy”

:

Ultra ONE™

New

17% Stronger

Proprietary

MagnaForce™

Alloy

World’s

Lightest

wheel at

40 pounds

47%

Lighter

than

Steel, 18% Lighter

than

avg.

Aluminum

Helps

Save

up to

1,400

pounds

per rig¹

Replacing

18

Steel wheels

with

Aluminum

offsets

Annual

Carbon

Footprint

of average

Family of Four

10x

Improved

Corrosion Resistance

No

Mechanical or Chemical

Cleaning

Looks

New

Longer

Investing

to

double

capacity

in

Europe

67%

of 2013

Alcoa Wheel Sales

driven by Proprietary

Technology

Never loses its Shine:

Dura-Bright

®

Lower GHG

emissions

Reduced

operating cost

Improved

fuel efficiency

Increased payload

Customer needs |

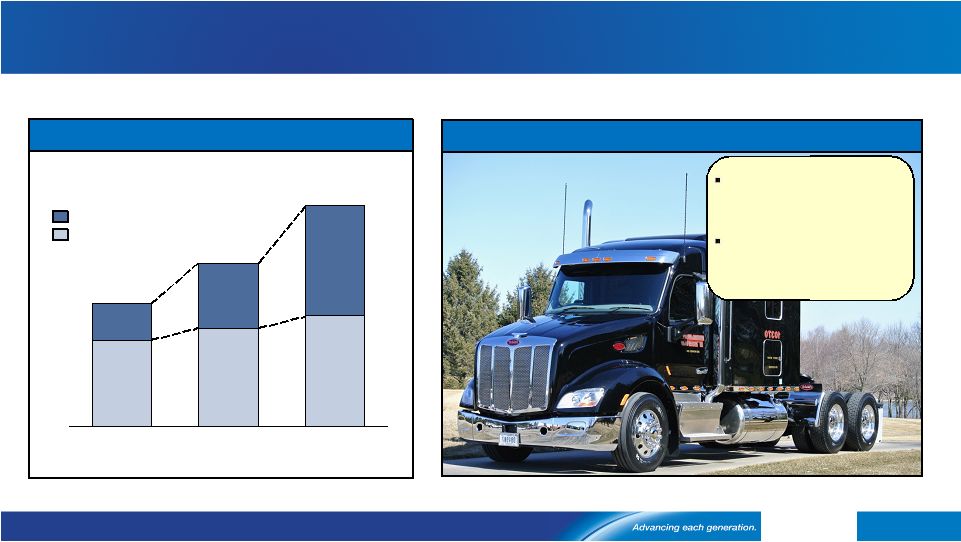

Growth for the long haul, winning out of the gate with Ultra ONE™

23

Source: Alcoa analysis

1) Based on dollar value; Commercial Vehicle Market = Truck, Trailer

& Bus

o[Alcoa

logo] Global commercial vehicle wheel market and customer

conversion to Ultra ONE ™

Undisputed market leader, deep customer reach

Global Commercial Vehicle Wheel Market ($B)

and Penetration Rates¹

Al gaining ground in a growing market

Over

150

fleets

specifying

67,000

Ultra

ONE™

wheels

since introduction

TMC Transportation

converting to

Ultra

ONE™

wheels starting

in 2014

2018

2.7

50%

50%

2014

2.0

60%

40%

2010

1.5

70%

30%

Aluminum

Steel |

Auto going aluminum: From Audi A100 in 1985…

24

1994 to Today:

~700,000

Aluminum Space

Frame Audi’s

Source: Audi

o[Alcoa

logo] |

25

Source: IHS

o[Alcoa

logo] As much as 700 lbs. lighter than its predecessor

Accelerates,

brakes,

tows

and resists corrosion

like never before

Source: Ford Motor Company website

2013:

~700,000

F-150s

Produced

“With my background in aerospace and

commercial airplanes,

aluminum

is

the

material of choice

.”

Alan Mulally, President and CEO

Ford Motor Company

CBS News

“The F

-150

establishes

aluminum

as

a

primary

choice

mainstream

auto

use.”

Automotive News

for

“When we put it all together, to have the

truck do what we wanted,

there was

only

one

answer:

aluminum

Raj Nair, VP Global Product Development

Ford Motor Company

Wall Street Journal

“A stamped

aluminum body

can

equal

or

outperform steel

in

overall

strength

,

dent

resistance and

crash protection

…”

The New York Times

…to 2015: going Mass-Market with the Ford F-150

Military - grade aluminum alloys in body and bed

.” |

*

Total investment relates to rolling mill capability expansion to include auto sheet, building and construction sheet and foil

stock.

Alcoa’s investment portion is

~$95M Capitalizing on our Leading Position as Auto goes Lightweight

26

o[Alcoa

logo] 136

55

14

2012

2025

2015

North America Aluminum Body Sheet

Content Per Vehicle (in lbs)

1,300

580

330

229

166

2018

2015

2014

2013

2012

Projected Alcoa Auto Sheet

Revenues ($M)

Projected aluminum content per vehicle, Alcoa automotive growth projects and Alcoa

auto sheet revenue Increasing Aluminum Intensity

6X Revenue Increase by 2018

~$300M

investment

completed in

4Q 2013

Undergoing

customer

qualifications

~$300M

investment;

completion in

mid-2015

Enables

flexible

production

Positioned to Capture Growth

~$400M

total

investment*; First

auto

coil

by December

2014

to reach over

1MMT by 2025

Source: Ducker Worldwide

~6x

~2.5x

Al

auto

sheet

demand

expected

~10x

~4x |

Re-Packaging Midstream Portfolio: Shifting mix to Grow Value-Add

Source: Alcoa analysis

1) According to the Brazilian Aluminum Association PE =

Polyethylene 27

o[Alcoa

logo] Aluminum

Inner PE coating

Middle PE coating

Paperboard

Outer PE coating

Bud Light re-closable aluminum bottle, investment in aseptic foil packaging and

closure of Australia RM facilities Alcoa puts a cool twist on a cold

one… Uses Alcoa aluminum sheet

Patented

bottle technology

Licensed by

Anheuser-Busch

Suite of

proprietary Alcoa technology

offers premium aluminum packaging options

for brands

Differentiated

Product:

-

Re-Closable

-

84% lighter

than glass bottle

-

Infinitely

Recyclable

U.S. Al bottle growth

expected

to more than double

by

2015

Material

Expertise

Metal-forming

know-how

Closure

of

two

Australia can sheet

Rolling Mills

200 kmt

closed

by year-end 2014

$40

million

Specialty Packaging

investment in

Brazil

All

additional Capacity

has

been

Fully Committed

Most

Highly

Differentiated

type

of container in

Packaging

7%

annual

growth

rate in

Latin

America

over the

next 3 years

1

…While reducing commodity capacity

…And adds more differentiation to the mix… |

Upstream Restructuring advances Transformation

(1)

Operating capacity = Alcoa total base capacity less idled capacity

(2)

Announced but not executed

28

-198

After executing

announcements

-253

2012

+61

2,964

-239

2011

-418

+234

2010

1Q 2014

2009

2008

2013

-344

2007

4,121

Tennessee: -215

Massena East: -125

Other: -113

Portland: -15

Fusina: -12

Mosjoen: +188

Lista: +94

Pt. Henry: -190

(2)

Sao Luis: -85

(2)

Massena East: -84

Pocos: -62

(2)

Other: +3

Baie Comeau: -105

Sao Luis: -97

Massena East: -41

Pocos: -34

Other: -3

Spanish system: +27

Portovesme: -150

Spanish system: -90

Other: +1

Massena East: +125

Intalco: +47

Wenatchee: +43

Other: +19

Rockdale: -267

Baie Comeau: -53

Portland: -15

Other: -9

Fusina: -32

Other: +93

Bridge of Total Smelting Operating Capacity

(1)

2007 to 1Q 2014, kmt

-28%

=1,157kmt

o[Alcoa

logo] |

Saudi Arabia JV Progressing as Planned -

World’s Lowest Cost

29

o[Alcoa

logo] Smelter

Rolling Mill

Mine

Refinery

Phase 1

Phase 2

86%

complete

190 kmt

production in 2013

550 kmt

production in 2014

At

full capacity

in 2014

Lowest cost

smelter

2% point reduction

on the

smelting cost curve

First

hot

coil

in

4Q 2013

First auto

coil in

4Q 2014

First

alumina 4Q 2014

Lowest cost

refinery

2% point reduction

on

the refining cost curve

On track to provide

bauxite in 2014

97%

complete

Saudi Arabia JV construction update

100%

complete

63%

complete |

Alcoa’s Transformation Accelerates

Building out Alcoa’s Value-Add Businesses;

Capturing growing Demand

Lowering Upstream Cost Base

Accelerating launch of Innovative Products;

Applying the Alcoa Advantage

30

o[Alcoa

logo] |

o[Alcoa logo] |

Kelly Pasterick

Director, Investor Relations

Alcoa

390 Park Avenue

New York, NY 10022-4608

Telephone: (212) 836-2674

www.alcoa.com

Additional Information

32

o[Alcoa

logo] |

Annual Sensitivity Summary

33

Currency Annual Net Income Sensitivity

+/-

$100/MT = +/-

$240 million

LME Aluminum Annual Net Income Sensitivity

Australian $

+/-

$11 million

per 0.01 change in USD / AUD

Brazilian

$

+/-

$ 3 million

per 0.01 change in BRL / USD

Euro €

+/-

$ 2 million

per 0.01 change in USD / EUR

Canadian $

+/-

$ 5 million

per 0.01 change in CAD / USD

Norwegian Kroner

+/-

$ 5 million

per 0.10 change in NOK / USD

o[Alcoa

logo] |

Revenue Change by Market

2%

3%

(1%)

7%

11%

(14%)

(0%)

(29%)

2%

(12%)

1%

5%

2%

9%

(6%)

(23%)

(9%)

(5%)

2%

(19%)

19%

4%

7%

6%

8%

2%

12%

1%

15%

26%

Aerospace

Automotive

B&C

Comm. Transport

Industrial Products

IGT

Packaging

Distribution/Other

Alumina

Primary Metals

1Q’14 Third-Party Revenue

Sequential

Change

Year-Over-Year

Change

34

o[Alcoa

logo] |

Special Items

See appendix for Adjusted Income reconciliation.

35

Pre-tax, Before NCI

After-tax, After NCI

$ Millions, except per-share amounts

4Q13

1Q14

4Q13

1Q14

Income Statement

Classification

Segment

Net

Loss from Continuing Operations

($1,998)

($274)

($2,339)

($178)

Net Loss Per Diluted Share

($1.87)

($0.25)

($2.19)

($0.16)

Restructuring-Related

($380)

($499)

($302)

($296)

Restructuring/COGS/

Other Expenses

(Income), Net

Corporate /

Primary Metals/

GRP

Tax Items

$0

$0

($361)

$22

Income Taxes

Corporate

Saudi Arabia Smelter Potline

($10)

($13)

($9)

($13)

COGS/

Other Expenses

(Income), Net

Primary Metals

Massena

Fire

$9

$0

$5

$0

COGS

Primary

Metals/EPS/Corp

Goodwill Impairment

($1,731)

$0

($1,719)

$0

Goodwill

Impairment Charge

Corporate

Mark-to-Market Energy Contracts

$14

$0

$7

$0

Other Expenses

(Income), Net

Corporate

Surgold

Gain

$0

$28

$0

$11

Other Expenses

(Income), Net

Alumina

Special Items

($2,098)

($484)

($2,379)

($276)

Net Income from Continuing Ops excl Special Items

$100

$210

$40

$98

Net

Income

per Diluted

Share excl

Special Items

$0.09

$0.19

$0.04

$0.09

o[Alcoa

logo] |

Composition of Regional Premium Pricing Convention

36

o[Alcoa

logo] 2014E Shipments

Regional Premiums

Estimated Pricing Convention

55%

Midwest

–

Platts

15-day lag

30%

Rotterdam DDP

–

Metal Bulletin

45-day lag

10%

CIF Japan

–

Platts

Month prior to Quarter start

5%

Negotiated

Annual |

Alcoa smelting closures and curtailments when announced actions are complete

37

(1)

Pocos (62 kmt) and Sao Luis (85 kmt) have been announced, but not fully executed

(2)

Announced, but not executed

o[Alcoa

logo] Location

Year

kmt

Baie Comeau

2008

53

Eastalco

2010

195

Badin

2010

60

Warrick

2010

40

Tennessee

2011

215

Rockdale

2011

76

Baie Comeau

2013

105

Fusina

2013

44

Massena East

2013

41

Massena East

2014

84

Point Henry

(2)

2014

190

Total

1,103

Alcoa smelting capacity closures, since Dec 2007

Location

kmt

Rockdale

191

Sao Luis

(1)

182

Portovesme

150

Pocos

(1)

96

Intalco

49

Wenatchee

41

Aviles

35

Portland

30

La Coruna

25

Total

799

Alcoa smelting capacity curtailments |

Reconciliation of ATOI to Consolidated Net Income (Loss)

Attributable to Alcoa

o[Alcoa

logo] 38

(in millions)

1Q13

2Q13

3Q13

4Q13

2013

1Q14

Total segment ATOI

$

351

$

304

$

338

$

224

$

1,217

$

325

Unallocated amounts (net of tax):

Impact of LIFO

(2)

5

9

40

52

(7)

Interest expense

(75)

(76)

(70)

(73)

(294)

(78)

Noncontrolling interests

(21)

29

(20)

(29)

(41)

19

Corporate expense

(67)

(71)

(74)

(72)

(284)

(67)

Impairment of goodwill

–

–

–

(1,731)

(1,731)

–

Restructuring and other charges

(5)

(211)

(108)

(283)

(607)

(321)

Other

(32)

(99)

(51)

(415)

(597)

(49)

Consolidated net income (loss) attributable to

Alcoa

$

149

$

(119)

$

24

$

(2,339)

$

(2,285)

$

(178)

|

Reconciliation of Adjusted Income

39

o[Alcoa

logo] (in millions, except per-

share amounts)

Income (Loss)

Diluted EPS

Quarter ended

Quarter ended

March 31,

December 31,

March 31,

March 31,

December 31,

March 31,

2013

2013

2014

2013

2013

2014

Net income (loss)

attributable to Alcoa

$

149

$

(2,339)

$

(178)

$

0.13

$

(2.19)

$

(0.16)

Restructuring and

other charges

5

302

274

Discrete tax items*

(19)

364

(6)

Other special items**

(14)

1,713

8

Net income

attributable to Alcoa

–

as adjusted

$

121

$

40

$

98

0.11

0.04

0.09

Net income attributable to Alcoa – as adjusted is a non-GAAP financial measure. Management

believes that this measure is meaningful to investors because management reviews the operating results of Alcoa excluding the impacts of

restructuring and other charges, discrete tax items, and other special items (collectively,

“special items”). There can be no assurances that additional special items will not occur in future periods. To compensate for this limitation, management

believes that it is appropriate to consider both Net (loss) income attributable to Alcoa determined

under GAAP as well as Net income attributable to Alcoa – as adjusted. * Discrete tax items include the following:

•

for the quarter ended March 31, 2014, a net benefit for a number of small items ($6);

•

for the quarter ended December 31, 2013, a charge for valuation allowances related to certain Spain and

U.S. deferred tax assets ($372) and a net benefit for other miscellaneous items ($8); and

•

for the quarter ended March 31, 2013, a benefit related to the reinstatement under the American

Taxpayer Relief Act of 2012 of two tax provisions that were applied in 2013 to Alcoa’s U.S. income tax return for calendar year 2012 ($19).

** Other special items include the following:

•

for the quarter ended March 31, 2014, a tax benefit representing the difference between Alcoa’s

consolidated estimated annual effective tax rate and the statutory rates applied to restructuring and other charges ($72), an unfavorable tax

impact related to the interim period treatment of operational losses in certain foreign jurisdictions

for which no tax benefit was recognized ($56), the write-off of inventory related to the permanent closure of a smelter and two rolling mills in

Australia and a smelter in the United States ($20), an unfavorable impact related to the restart of one

potline at the joint venture in Saudi Arabia that was previously shut down due to a period of pot instability ($13), a gain on the sale of a

mining interest in Suriname ($11), and a loss on the writedown of an asset to fair value ($2);

•

for the quarter ended December 31, 2013, an impairment of goodwill ($1,719), an unfavorable impact

related to a temporary shutdown of one of the two smelter potlines at the joint venture in Saudi Arabia due to a period of pot instability

($9), a net favorable change in certain mark-to-market energy derivative contracts ($7), an

insurance recovery related to the March 2012 cast house fire at the Massena, NY location ($5), and a favorable tax impact related to the interim

period treatment of operational losses in certain foreign jurisdictions for which no tax benefit was

recognized during the nine months ended September 30, 2013 ($3); and •

for the quarter ended March 31, 2013, a net favorable change in certain mark-to-market energy

derivative contracts ($9) and a net insurance recovery related to the March 2012 cast house fire at the Massena, NY location ($5). |

($ in millions)

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

1Q13

4Q13

1Q14

Net income (loss)

attributable to

Alcoa

$ 938

$ 1,310

$ 1,233

$ 2,248

$ 2,564

$ (74)

$(1,151)

$ 254

$ 611

$ 191

$(2,285)

$ 149

$(2,339)

$ (178)

Add:

Net income (loss)

attributable to

noncontrolling

interests

212

233

259

436

365

221

61

138

194

(29)

41

21

29

(19)

Cumulative effect

of accounting

changes

47

–

2

–

–

–

–

–

–

–

–

–

–

–

Loss (income)

from

discontinued

operations

–

27

50

(22)

250

303

166

8

3

–

–

–

–

–

Provision (benefit)

for income taxes

367

546

464

853

1,623

342

(574)

148

255

162

428

64

312

(77)

Other (income)

expenses, net

(278)

(266)

(478)

(236)

(1,920)

(59)

(161)

5

(87)

(341)

(25)

(27)

(10)

25

Interest expense

314

271

339

384

401

407

470

494

524

490

453

115

112

120

Restructuring and

other charges

(28)

(29)

266

507

268

939

237

207

281

172

782

7

380

461

Impairment of

goodwill

–

–

–

–

–

–

–

–

–

–

1,731

–

1,731

–

Provision for

depreciation,

depletion, and

amortization

1,110

1,142

1,227

1,252

1,244

1,234

1,311

1,450

1,479

1,460

1,421

361

350

340

Adjusted EBITDA

$ 2,682

$ 3,234

$ 3,362

$ 5,422

$ 4,795

$ 3,313

$ 359

$ 2,704

$ 3,260

$ 2,105

$ 2,546

$ 690

$ 565

$ 672

Sales

$18,879

$21,370

$24,149

$28,950

$29,280

$ 26,901

$18,439

$21,013

$24,951

$23,700

$23,032

$ 5,833

$ 5,585

$ 5,454

Adjusted EBITDA

Margin

14.2%

15.1%

13.9%

18.7%

16.4%

12.3%

1.9%

12.9%

13.1%

8.9%

11.1%

11.8%

10.1%

12.3%

Reconciliation of Alcoa Adjusted EBITDA

40

o[Alcoa

logo] Alcoa’s

definition

of

Adjusted

EBITDA

(Earnings

before

interest,

taxes,

depreciation,

and

amortization)

is

net

margin

plus

an

add-back

for

depreciation,

depletion,

and

amortization.

Net

margin

is

equivalent

to

Sales

minus

the

following

items:

Cost

of

goods

sold;

Selling,

general

administrative,

and

other

expenses;

Research

and

development

expenses;

and

Provision

for

depreciation,

depletion,

and

amortization.

Adjusted

EBITDA

is

a

non-GAAP

financial

measure.

Management

believes

that

this

measure

is

meaningful

to

investors

because

Adjusted

EBITDA

provides

additional

information

with

respect

to

Alcoa’s

operating

performance

and

the

Company’s

ability

to

meet

its

financial

obligations.

The

Adjusted

EBITDA

presented

may

not

be

comparable

to

similarly

titled

measures

of

other

companies. |

Reconciliation of Alumina Adjusted EBITDA

41

o[Alcoa

logo] ($ in millions, except

per metric ton

amounts)

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

1Q13

4Q13

1Q14

After-tax operating

income (ATOI)

$ 415

$ 632

$ 682

$ 1,050

$ 956

$ 727

$ 112

$ 301

$ 607

$ 90

$ 259

$ 58

$ 70

$ 92

Add:

Depreciation,

depletion, and

amortization

147

153

172

192

267

268

292

406

444

455

426

109

102

97

Equity (income) loss

--

(1)

--

2

(1)

(7)

(8)

(10)

(25)

(5)

4

(1)

2

5

Income taxes

161

240

246

428

340

277

(22)

60

179

(27)

66

14

21

40

Other

(55)

(46)

(8)

(6)

2

(26)

(92)

(5)

(44)

(8)

(6)

(3)

(1)

(28)

Adjusted EBITDA

$ 668

$ 978

$ 1,092

$ 1,666

$ 1,564

$ 1,239

$ 282

$ 752

$ 1,161

$ 505

$ 749

$ 177

$ 194

$ 206

Production

(thousand metric

tons) (kmt)

13,841

14,343

14,598

15,128

15,084

15,256

14,265

15,922

16,486

16,342

16,618

3,994

4,249

4,172

Adjusted EBITDA /

Production ($ per

metric ton)

$ 48

$ 68

$ 75

$ 110

$ 104

$ 81

$ 20

$ 47

$ 70

$ 31

$ 45

$ 44

$ 46

$ 49

Alcoa’s definition of Adjusted EBITDA (Earnings before interest, taxes, depreciation, and

amortization) is net margin plus an add-back for depreciation, depletion, and amortization. Net margin is equivalent to Sales minus the following items: Cost of goods sold; Selling, general administrative, and other

expenses; Research and development expenses; and Provision for depreciation, depletion, and

amortization. The Other line in the table above includes gains/losses on asset sales and other nonoperating items. Adjusted EBITDA is a non-GAAP financial measure. Management believes that this measure

is meaningful to investors because Adjusted EBITDA provides additional information with respect to

Alcoa’s operating performance and the Company’s ability to meet its financial obligations. The Adjusted EBITDA presented may not be comparable to similarly titled measures of other companies.

|

($ in millions, except per

metric ton amounts)

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

1Q13

4Q13

1Q14

After-tax operating income

(ATOI)

$

657

$

808

$

822

$

1,760

$

1,445

$

931

$

(612)

$

488

$

481

$

309

$

(20)

$

39

$

(35)

$

(15)

Add:

Depreciation, depletion,

and amortization

310

326

368

395

410

503

560

571

556

532

526

135

128

124

Equity (income) loss

(55)

(58)

12

(82)

(57)

(2)

26

(1)

7

27

51

9

22

28

Income taxes

256

314

307

726

542

172

(365)

96

92

106

(74)

1

(34)

(11)

Other

12

20

(96)

(13)

(27)

(32)

(176)

(7)

2

(422)

(8)

(1)

(6)

–

Adjusted EBITDA

$

1,180

$

1,410

$

1,413

$

2,786

$

2,313

$

1,572

$

(567)

$

1,147

$

1,138

$

552

$

475

$

183

$

75

$

126

Production (thousand

metric tons) (kmt)

3,508

3,376

3,554

3,552

3,693

4,007

3,564

3,586

3,775

3,742

3,550

891

866

839

Adjusted EBITDA /

Production ($ per

metric ton)

$

336

$

418

$

398

$

784

$

626

$

392

$

(159)

$

320

$

301

$

148

$

134

$

205

$

87

$

150

Reconciliation of Primary Metals Adjusted EBITDA

42

o[Alcoa

logo] Alcoa’s

definition

of

Adjusted

EBITDA

(Earnings

before

interest,

taxes,

depreciation,

and

amortization)

is

net

margin

plus

an

add-back

for

depreciation,

depletion,

and

amortization.

Net

margin

is

equivalent

to

Sales

minus

the

following

items:

Cost

of

goods

sold;

Selling,

general

administrative,

and

other

expenses;

Research

and

development

expenses;

and

Provision

for

depreciation,

depletion,

and

amortization.

The

Other

line

in

the

table

above

includes

gains/losses

on

asset

sales

and

other

nonoperating

items.

Adjusted

EBITDA

is

a

non-GAAP

financial

measure.

Management

believes

that

this

measure

is

meaningful

to

investors

because

Adjusted

EBITDA

provides

additional

information

with

respect

to

Alcoa’s

operating

performance

and

the

Company’s

ability

to

meet

its

financial

obligations.

The

Adjusted

EBITDA

presented

may

not

be

comparable

to

similarly

titled

measures

of

other

companies. |

Reconciliation of Global Rolled Products Adjusted EBITDA

43

o[Alcoa

logo] ($ in millions, except

per metric ton

amounts)

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

1Q13

4Q13

1Q14

After-tax operating

income (ATOI)

$ 232

$ 223

$ 232

$ 290

$ 300

$ 317

$ 151

$ (41)

$ (106)

$ 241

$ 260

$ 346

$ 252

$ 81

$ 21

$ 59

Add:

Depreciation,

depletion, and

amortization

167

184

190

200

220

223

227

216

227

238

237

229

226

57

58

58

Equity loss

2

4

1

1

–

2

–

–

–

–

3

6

13

4

4

5

Income taxes

112

90

77

97

135

113

77

14

12

103

98

159

108

39

5

34

Other

(5)

(8)

(5)

1

1

20

1

6

(2)

1

1

(2)

–

(1)

1

(2)

Adjusted EBITDA*

$ 508

$ 493

$ 495

$ 589

$ 656

$ 675

$ 456

$ 195

$ 131

$ 583

$ 599

$ 738

$ 599

$ 89

$ 154

Total shipments

(thousand metric

tons) (kmt)

1,863

1,814

1,893

2,136

2,250

2,376

2,482

2,361

1,888

1,755

1,866

1,943

1,989

468

481

489

Adjusted EBITDA

/ Total shipments

($ per metric ton)*

$ 273

$ 272

$ 261

$ 276

$ 292

$ 284

$ 184

$ 83

$ 69

$ 332

$ 321

$ 380

$ 301

$ 385

$ 185

$ 315

Alcoa’s definition of Adjusted EBITDA (Earnings before interest, taxes, depreciation, and

amortization) is net margin plus an add-back for depreciation, depletion, and amortization. Net margin

is equivalent to Sales minus the following items: Cost of goods sold; Selling, general administrative,

and other expenses; Research and development expenses; and Provision for depreciation,

depletion, and amortization. The Other line in the table above includes gains/losses on asset sales

and other nonoperating items. Adjusted EBITDA is a non-GAAP financial measure. Management

believes that this measure is meaningful to investors because Adjusted EBITDA provides additional information with respect to Alcoa’s operating performance and the Company’s

ability to meet its financial obligations. The Adjusted EBITDA presented may not be comparable to

similarly titled measures of other companies. In 1Q14, the Adjusted EBITDA of Global Rolled

Products includes a $13 charge for the write-off of inventory related to the permanent closure of two rolling mills in Australia. Excluding this

charge, Adjusted EBITDA was $167 and the resulting EBITDA per metric ton was $342 for 1Q14.

* |

Reconciliation of Engineered Products and Solutions

Adjusted EBITDA

44

o[Alcoa

logo] Alcoa’s definition of Adjusted EBITDA (Earnings before interest, taxes,

depreciation, and amortization) is net margin plus an add-back for depreciation, depletion, and amortization. Net margin is equivalent

to Sales minus the following items: Cost of goods sold; Selling, general administrative, and other

expenses; Research and development expenses; and Provision for depreciation, depletion, and

amortization. The Other line in the table above includes gains/losses on asset sales and other

nonoperating items. Adjusted EBITDA is a non-GAAP financial measure. Management believes that this

measure is meaningful to investors because Adjusted EBITDA provides additional information with respect

to Alcoa’s operating performance and the Company’s ability to meet its financial obligations. The

Adjusted EBITDA presented may not be comparable to similarly titled measures of other companies.

($ in millions)

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

1Q13

4Q13

1Q14

After-tax operating

income (ATOI)

$

126

$

161

$

276

$

382

$

423

$

522

$

311

$

419

$

537

$

612

$

726

$

173

$

168

$

189

Add:

Depreciation,

depletion, and

amortization

166

168

160

152

163

165

177

154

158

158

159

40

40

40

Equity loss

(income)

–

–

–

6

–

–

(2)

(2)

(1)

–

–

–

–

–

Income taxes

57

70

120

164

184

215

138

198

258

297

348

84

79

91

Other

11

106

(11)

(2)

(7)

2

1

–

(1)

(9)

(2)

–

(2)

–

Adjusted EBITDA

$

360

$

505

$

545

$

702

$

763

$

904

$

625

$

769

$

951

$

1,058

$

1,231

$

297

$

285

$

320

Third-party sales

$

3,905

$

4,283

$

4,773

$ 5,428

$

5,834

$

6,199

$ 4,689

$

4,584

$ 5,345

$

5,525

$

5,733

$ 1,423

$

1,405

$

1,443

Adjusted EBITDA

Margin

9.2%

11.8%

11.4%

12.9%

13.1%

14.6%

13.3%

16.8%

17.8%

19.1%

21.5%

20.9%

20.3%

22.2%

|

Reconciliation of Free Cash Flow

45

o[Alcoa

logo] Free

Cash

Flow

is

a

non-GAAP

financial

measure.

Management

believes

that

this

measure

is

meaningful

to

investors

because

management

reviews

cash

flows

generated

from

operations

after

taking

into

consideration

capital

expenditures

due

to

the

fact

that

these

expenditures

are

considered

necessary

to

maintain

and

expand

Alcoa’s

asset

base

and

are

expected

to

generate

future

cash

flows

from

operations.

It

is

important

to

note

that

Free

Cash

Flow

does

not

represent

the

residual

cash

flow

available

for

discretionary

expenditures

since

other

non-discretionary

expenditures,

such

as

mandatory

debt

service

requirements,

are

not

deducted

from

the

measure.

(in millions)

Quarter ended

September 30,

2011

December 31,

2011

March 31,

2012

June 30,

2012

September 30,

2012

December 31,

2012

March 31,

2013

June 30,

2013

September 30,

2013

December 31,

2013

March 31,

2014

Cash from

operations

$ 489

$ 1,142

$ (236)

$ 537

$ 263

$ 933

$ (70)

$ 514

$ 214

$ 920

$ (551)

Capital

expenditures

(325)

(486)

(270)

(291)

(302)

(398)

(235)

(286)

(250)

(422)

(209)

Free cash

flow

$ 164

$ 656

$ (506)

$ 246

$ (39)

$ 535

$

(305)

$ 228

$ (36)

$ 498

$ (760)

|

Reconciliation of Free Cash Flow, con’t

46

o[Alcoa

logo] Free

Cash

Flow

is

a

non-GAAP

financial

measure.

Management

believes

that

this

measure

is

meaningful

to

investors

because

management

reviews

cash

flows

generated

from

operations

after

taking

into

consideration

capital

expenditures

due

to

the

fact

that

these

expenditures

are

considered

necessary

to

maintain

and

expand

Alcoa’s

asset

base

and

are

expected

to

generate

future

cash

flows

from

operations.

It

is

important

to

note

that

Free

Cash

Flow

does

not

represent

the

residual

cash

flow

available

for

discretionary

expenditures

since

other

non-discretionary

expenditures,

such

as

mandatory

debt

service

requirements,

are

not

deducted

from

the

measure.

(in millions)

Quarter ended

December 31,

March 31,

June 30,

September 30,

December 31,

March 31,

June 30,

September 30,

December 31,

March 31,

June 30,

2008

2009

2009

2009

2009

2010

2010

2010

2010

2011

2011

Cash from

operations

$

608

$

(271)

$

328

$

184

$

1,124

$

199

$

300

$

392

$

1,370

$

(236)

$

798

Capital

expenditures

(1,017)

(471)

(418)

(370)

(363)

(221)

(213)

(216)

(365)

(204)

(272)

Free cash

flow

$

(409)

$

(742)

$

(90)

$

(186)

$

761

$

(22)

$

87

$

176

$

1,005

$

(440)

$

526

|

Days Working Capital

47

o[Alcoa

logo] Days Working Capital = Working Capital divided by

(Sales/number of days in the quarter). ($ in millions)

Quarter ended

March 31,

June 30,

September 30,

December 31,

March 31,

June 30,

September 30,

December 31,

March 31,

2012

2012

2012

2012

2013

2013

2013

2013

2014

Receivables from customers, less

allowances

$

1,709

$

1,650

$

1,600

$

1,573

$

1,704

$

1,483

$

1,427

$

1,383

$

1,391

Add: Deferred purchase price receivable*

85

144

104

53

50

223

347

339

238

Receivables from customers, less

allowances, as adjusted

1,794

1,794

1,704

1,626

1,754

1,706

1,774

1,722

1,629

Add: Inventories

3,079

3,097

3,051

2,894

2,961

2,949

2,932

2,783

2,974

Less: Accounts payable, trade

2,660

2,594

2,496

2,587

2,656

2,820

2,746

2,816

2,813

Working Capital**

$

2,213

$

2,297

$

2,259

$

1,933

$

2,059

$

1,835

$

1,960

$

1,689

$

1,790

Sales

$

6,006

$

5,963

$

5,833

$

5,898

$

5,833

$

5,849

$

5,765

$

5,585

$

5,454

Days Working Capital

34

35

36

30

32

29

31

28

30

* The deferred purchase price receivable relates to

an arrangement to sell certain customer receivables to several financial institutions on a recurring basis. Alcoa is adding

back this receivable for the purposes of the Days Working Capital

calculation.

** Beginning January 1, 2014, management changed the manner in which Working Capital

is measured by moving from an end of quarter Working Capital to an average quarter

Working Capital. This change will now reflect the

capital tied up during a given quarter. As such, the components of Working Capital for each period presented represent the

average of the ending balances in each of the three months during

the respective quarter. |

Reconciliation of Net Debt

(in millions)

December 31,

March 31,

2008

2009

2010

2011

2012

2013

2014

Short-term borrowings

$ 478

$ 176

$ 92

$ 62

$ 53

$ 57

$ 53

Commercial paper

1,535

–

–

224

–

–

–

Long-term debt due within

one year

56

669

231

445

465

655

85

Long-term debt, less amount

due within one year

8,509

8,974

8,842

8,640

8,311

7,607

7,609

Total debt

10,578

9,819

9,165

9,371

8,829

8,319

7,747

Less: Cash and cash

equivalents

762

1,481

1,543

1,939

1,861

1,437

665

Net debt

$ 9,816

$ 8,338

$ 7,622

$ 7,432

$ 6,968

$ 6,882

$ 7,082

48

o[Alcoa

logo] Net

debt

is

a

non-GAAP

financial

measure.

Management

believes

that

this

measure

is

meaningful

to

investors

because

management

assesses

Alcoa’s

leverage

position

after

factoring

in

available

cash

that

could

be

used

to

repay

outstanding

debt. |

Reconciliation of Net Debt-to-Capital

49

o[Alcoa

logo] Net

debt-to-capital

is

a

non-GAAP

financial

measure.

Management

believes

that

this

measure

is

meaningful

to

investors

because

management

assesses

Alcoa’s

leverage

position

after

factoring

in

available

cash

that

could

be

used

to

repay

outstanding

debt.

($ in millions)

December 31, 2013

March 31, 2014

Debt-to-Capital

Cash and Cash

Net Debt-to-

Debt-to-Capital

Cash and Cash

Net Debt-to-

Equivalents

Capital

Equivalents

Capital

Total Debt

Short-term borrowings

$

57

$

53

Long-term debt due within

one year

655

85

Long-term debt, less amount

due within one year

7,607

7,609

Numerator

$

8,319

$

1,437

$

6,882

$

7,747

$

665

$

7,082

Total Capital

Total debt

$

8,319

$

7,747

Total equity

13,512

14,374

Denominator

$

21,831

$

1,437

$

20,394

$

22,121

$

665

$

21,456

Ratio

38.1

%

33.7

%

35.0

%

33.0

%

|

Composition of Upstream Production Costs

Refining Cost Structure

Smelting Cost Structure

1

Natural gas information corresponds to Point Comfort, as Australia is priced on a

rolling 16 quarter average 50

o[Alcoa

logo] |

2014 global aluminum demand growth continues

51

Source: Alcoa estimates, Brook Hunt, CRU, Harbor

1.0

25.2

6.6

6.4

4.2

2.1

2.0

2.0

1.1

3%

10%

4%

2%

5%

5%

8%

8%

4%

5%

2014E

52.6 mmt

*

Other includes Africa, E.Europe, Latin America ex Brazil, and Oceania

2014 Primary Aluminum Consumption (mmt), Annualized Growth (%)

China

Europe

North America

North Asia

India

SE Asia

MENA

Russia

Brazil

Other *

2.0

2014 demand +7%

World ex China +4%