Attached files

| file | filename |

|---|---|

| 8-K - 8-K - JPMORGAN CHASE & CO | jpmc1q14form8k.htm |

April 11, 2014 F I N A N C I A L R E S U L T S 1Q14

F I N A N C I A L R E S U L T S 1Q14 Financial highlights 1 See note 1 on slide 20 2 Adjusted expense defined as total expense, excluding total legal expense and foreclosure-related matters. See note 2 on slide 20 3 See note 4 on slide 20 4 Estimated 5 Basel III transitional rules became effective for the Firm as of January 1, 2014; Basel III Fully Phased-In refers to the capital rules the Firm will be subject to as of January 1, 2019 6 Subject to the Board’s approval at the customary times those dividends are declared 1Q14 net income of $5.3B and EPS of $1.28 Revenue of $23.9B1, adjusted expense of $14.6B2 and ROTCE of 13%3 The net impact of non-recurring and non-core items was not significant in 1Q14 Fortress balance sheet Basel III Advanced Fully Phased-In Tier 1 common4 of $156B5; ratio of 9.5%5 Firm Supplementary Leverage Ratio (“SLR”)4 over 5%, including the impact of the U.S. NPR announced this week Approval to exit parallel run and CCAR non-objection Intention to increase dividend to $0.40 effective 2Q146 $6.5B gross repurchase authorization 2Q14-1Q15 1

F I N A N C I A L R E S U L T S 1Q14 Financial results1 1 See note 1 on slide 20 2 Actual numbers for all periods, not over/(under) 3 See note 4 on slide 20 $mm, excluding EPS $ O/(U) 1Q14 4Q13 1Q13 Revenue (FTE)1 $23,863 ($249) ($1,985) Credit costs 850 746 233 Expense 14,636 (916) (787) Reported net income/(loss) $5,274 ($4) ($1,255) Net income/(loss) applicable to common stockholders $4,898 ($40) ($1,233) Reported EPS $1.28 ($0.02) ($0.31) ROE2 10% 10% 13% ROTCE2,3 13 14 17 2

F I N A N C I A L R E S U L T S 1Q14 4Q13 1Q13 Basel III Advanced Fully Phased-In2 Tier 1 common capital $156 $151 NA Risk-weighted assets3 1,638 1,591 NA Tier 1 common ratio 9.5% 9.5% NA Firm supplementary leverage ratio ("SLR")4 5.1% 4.6% NA Bank SLR4 5.3 4.6 NA HQLA5 $538 $522 $413 Total assets (EOP) $2,477 $2,416 $2,389 Return on equity 10% 10% 13% Return on tangible common equity 13 14 17 Return on assets 0.89 0.87 1.14 Return on Risk-weighted assets3 1.32 1.33 NA Tangible book value per share $41.73 $40.81 $39.54 $B, except where not d Fortress balance sheet and returns1 Available resources6 represent ~19% of Basel III RWA Compliant with Firm LCR, including the impact of the proposed new rules Repurchased $0.4B of common equity in 1Q14 Firmwide total credit reserves of $16.5B; loan loss coverage ratio of 1.75% Note: Estimated for 1Q14 1 See notes on non-GAAP financial measures on slide 20 2 Basel III Advanced Fully Phased-In refers to the capital rules the Firm will be subject to as of January 1, 2019 3 Reflects calculation under the Basel III Advanced Approach Fully Phased-In 4 1Q14 reflects the U.S. Final Leverage Ratio NPR issued on April 8, 2014; 4Q13 reflects the final supplementary leverage framework issued by the Basel Committee on January 12, 2014 5 High Quality Liquid Assets (“HQLA”) is the estimated amount of assets that qualify for inclusion in the Basel III Liquidity Coverage Ratio (“LCR”) 6 Available resources include Basel III Tier 1 common equity, preferred and trust preferred securities, as well as holding company unsecured long-term debt with remaining maturities greater than 1 year 3 Impact of U.S. Final Leverage Ratio NPR ~15-20 bps

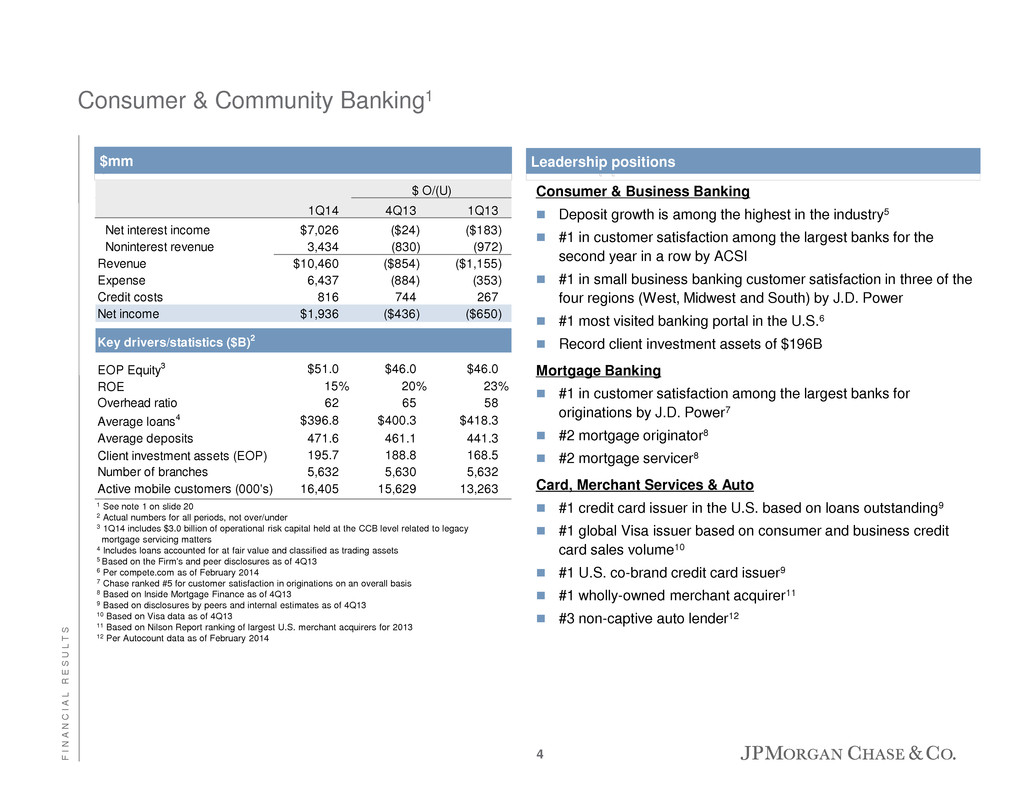

F I N A N C I A L R E S U L T S Consumer & Community Banking1 Consumer & Business Banking Deposit growth is among the highest in the industry5 #1 in customer satisfaction among the largest banks for the second year in a row by ACSI #1 in small business banking customer satisfaction in three of the four regions (West, Midwest and South) by J.D. Power #1 most visited banking portal in the U.S.6 Record client investment assets of $196B Mortgage Banking #1 in customer satisfaction among the largest banks for originations by J.D. Power7 #2 mortgage originator8 #2 mortgage servicer8 Card, Merchant Services & Auto #1 credit card issuer in the U.S. based on loans outstanding9 #1 global Visa issuer based on consumer and business credit card sales volume10 #1 U.S. co-brand credit card issuer9 #1 wholly-owned merchant acquirer11 #3 non-captive auto lender12 Leadership positions 1 See note 1 on slide 20 2 Actual numbers for all periods, not over/under 3 1Q14 includes $3.0 billion of operational risk capital held at the CCB level related to legacy mortgage servicing matters 4 Includes loans accounted for at fair value and classified as trading assets 5 Based on the Firm's and peer disclosures as of 4Q13 6 Per compete.com as of February 2014 7 Chase ranked #5 for customer satisfaction in originations on an overall basis 8 Based on Inside Mortgage Finance as of 4Q13 9 Based on disclosures by peers and internal estimates as of 4Q13 10 Based on Visa data as of 4Q13 11 Based on Nilson Report ranking of largest U.S. merchant acquirers for 2013 12 Per Autocount data as of February 2014 $mm $ O/(U) 1Q14 4Q13 1Q13 Net interest income $7,026 ($24) ($183) Noninterest revenue 3,434 (830) (972) Revenue $10,460 ($854) ($1,155) Expense 6,437 (884) (353) Credit costs 816 744 267 Net income $1,936 ($436) ($650) Key drivers/statistics ($B)2 EOP Equity3 $51.0 $46.0 $46.0 ROE 15% 20% 23% Overhead ratio 62 65 58 Average loans4 $396.8 $400.3 $418.3 Average depo its 471.6 461.1 441.3 Client investme t ass ts (EOP) 195.7 188.8 168.5 Number of bra ches 5,632 5,630 5,632 Active mobile customers (000's) 16,405 15,629 13,263 4

F I N A N C I A L R E S U L T S Consumer & Community Banking Consumer & Business Banking 1 Actual numbers for all periods, not over/(under) 2 See note 11 on slide 20 3 Includes employees and contractors Net income of $740mm, up 15% YoY, but down 5% QoQ Net revenue of $4.4B, up 5% YoY, but down 1% QoQ Expense up 1% YoY and QoQ Average total deposits of $458.5B, up 9% YoY and 3% QoQ Deposit margin of 2.27%, down 9 bps YoY and 2 bps QoQ Households2 up 3% YoY, reflecting strong customer retention Business Banking loan originations up 22% YoY and 16% QoQ Average Business Banking loans up 1% YoY and 2% QoQ Client investment assets up 16% YoY and 4% QoQ Headcount down ~1,500 QoQ3 Financial performance Key drivers $mm $ O/(U) 1Q14 4Q13 1Q13 Net interest income $2,708 $12 $136 Noninterest revenue 1,672 (48) 67 Revenue $4,380 ($36) $203 Expense 3,065 36 24 Credit costs 76 (32) 15 Net income $740 ($40) $99 Key drivers/statistics ($B)1 EOP Equity $11.0 $11.0 $11.0 ROE 27% 28% 24% Average total deposits $458.5 $446.0 $421.1 Deposit margin 2.27% 2.29% 2.36% Households (mm)2 25.2 25.0 24.4 Business Ba king loan originations $1.5 $1.3 $1.2 Business Banking loan balances (Avg) 18.9 18.6 18.7 Net new investm nt assets 4.2 3.6 4.9 Client investm t assets (EOP) 195.7 188.8 168.5 5

F I N A N C I A L R E S U L T S Consumer & Community Banking Mortgage Banking 1 Includes the provision for credit losses 2 Excludes purchased credit-impaired (PCI) write-offs of $61mm and $53mm for 1Q14 and 4Q13, respectively. See note 3 on slide 20 3 Actual numbers for all periods, not over/(under) 4 Firmwide mortgage origination volume was $18.2B, $25.1B and $55.1B, for 1Q14, 4Q13 and 1Q13, respectively 5 Real Estate Portfolios only 6 Excludes the impact of PCI loans acquired as part of the WaMu transaction. The allowance for loan losses was $4.1B, $4.2B and $5.7B for these loans at the end of 1Q14, 4Q13 and 1Q13, respectively 7 Includes employees and contractors; 2013 headcount adjusted for ~1,250 reduction effective January 1, 2014 Financial performance $mm Mortgage Production pretax loss of $58mm, down $485mm YoY Revenue 76% lower YoY, primarily on lower volumes; originations down 68% YoY and 27% QoQ Partially offset by lower expenses and repurchase benefit Mortgage Servicing pretax loss of $270mm, down $169mm YoY Net servicing-related revenue of $713mm, down 8% YoY Mortgage Servicing expense of $582mm, down 21% YoY MSR risk management loss of $401mm vs. $142mm loss in 1Q13 Real Estate Portfolios pretax income of $517mm, down $267mm YoY Total net revenue of $837mm, down 11% YoY Credit cost benefit of $26mm – Net charge-offs of $174mm2 – Reduction in NCI allowance for loan losses of $200mm Headcount down ~14,000, or ~30% since the beginning of 2013, and ~3,000 QoQ7 $ O/(U) 1Q14 4Q13 1Q13 Mortgage Production Production-related revenue, excl. repurchase (losses)/benefits $292 ($202) ($926) Production expense1 478 (511) (232) Income, excl. repurchase (losses)/benefits ($186) $309 ($694) Repurchase (losses)/benefits 128 (93) 209 Income/(loss) before income tax expense/(benefit) ($58) $216 ($485) Mortgage Servicing Net servicing-related revenue $713 $24 ($65) Default servicing expense 364 (110) (133) Core servicing expense1 218 29 (22) Servicing expense $582 ($81) ($155) Income/(loss), excl. MSR risk management 131 105 90 MSR risk management (401) (377) (259) Income/(loss) before income tax expense/(benefit) ($270) ($272) ($169) Real Estate Portfolios Revenue $837 ($13) ($108) Expense 346 (65) (17) Net charge-offs2 174 7 (274) Change in allowance2 (200) 750 450 Credit costs ($26) $757 $176 Income before income tax expense $517 ($705) ($267) Mortgage Banking net income $114 ($448) ($559) Key drivers/statistics ($B)3 EOP Equity $18.0 $19.5 $19.5 ROE 3% 11% 14% Mortgage originations4 $17.0 $23.3 $52.7 EOP third-party mortgage loans serviced 803.1 815.5 849.2 EOP NCI owned portf lio5 115.0 115.0 115.4 ALL/EOP loa s5,6 2.06% 2.23% 3.66% Net charge-off rate2,5,6 0.61 0.57 1.56 6

F I N A N C I A L R E S U L T S Net income of $1.1B, down 15% YoY Net income, excluding the reduction in the allowance for loan losses3, down 4% YoY Revenue of $4.5B, down 4% YoY Credit costs of $763mm, up 11% YoY driven by lower provision release, partially offset by lower net charge-offs $250mm reduction in allowance for loan losses – Card $200mm and Student $50mm Expense of $2.0B, up 1% YoY 1 Actual numbers for all periods, not over/(under) 2 Excludes Commercial Card 3 See note 6 on slide 20 Card Services Average loans of $123.3B, flat YoY and down 1% QoQ Sales volume2 of $104.5B, up 10% YoY and down 7% QoQ Net charge-off rate of 2.93%, down from 3.55% in the prior year and up from 2.86% in the prior quarter Merchant Services Merchant processing volume of $195.4B, up 11% YoY and down 4% QoQ Transaction volume of 9.1B, up 10% YoY and down 5% QoQ Auto Average loans up 5% YoY and 2% QoQ Originations up 3% YoY and 5% QoQ Consumer & Community Banking Card, Merchant Services & Auto $mm Financial performance Key drivers 1Q14 4Q13 1Q13 Revenue $4,511 ($157) ($209) Expense 1,969 (261) 26 Net charge-offs 1,013 (33) (173) Change in allowance (250) 50 250 Credit costs $763 $17 $77 Net income $1,082 $52 ($190) EOP Equity1 $19.0 $15.5 $15.5 ROE1 23% 26% 33% Card Services – Key drivers/statistics ($B)1 Average loans $123.3 $124.1 $123.6 Sales volume2 104.5 112.6 94.7 Net revenue rate 12.22% 12.34% 12.83% Net charge-off rate 2.93 2.86 3.55 30+ day delinquency rate 1.61 1.67 1.94 # of accounts with sales activity (mm)2 31.0 32.3 29.4 % of accounts acquired online2 51% 59% 52% Merchant Services – Key drivers/statistics ($B)1 Merchant processing volume $195.4 $203.4 $175.8 # of total transactions 9.1 9.6 8.3 Auto – Key rivers/statistics ($B)1 Average loans $52.7 $51.8 $50.0 Originations 6.7 6.4 6.5 $ O/(U) 7

F I N A N C I A L R E S U L T S Corporate & Investment Bank1 1 See note 1 on slide 20 2 Lending revenue includes net interest income, fees, gains or losses on loan sale activity, gains or losses on securities received as part of a loan restructuring and the risk management results related to the credit portfolio (excluding trade finance) 3 Primarily credit portfolio credit valuation adjustments (“CVA”), FVA and DVA on OTC derivatives and structured notes, and nonperforming derivative receivable results. Results are presented net of associated hedging activities. 4 Actual numbers for all periods, not over/under 5 Calculated based on average equity; period-end equity and average equity are the same. Return on equity excluding both FVA (effective 4Q13) and DVA, a non-GAAP financial measure, was 15% and 18% for 4Q13 and 1Q13, respectively 6 Overhead ratio excluding FVA (effective 4Q13) and DVA, a non-GAAP financial measure, was 61% and 61% for 4Q13 and 1Q13, respectively 7 Compensation expense as a percentage of total net revenue excluding both FVA (effective 4Q13) and DVA, a non- GAAP financial measure, was 27% and 34% for 4Q13 and 1Q13, respectively 8 ALL/EOP loans as reported was 1.23%, 1.15% and 1.11% for 1Q14, 4Q13 and 1Q13, respectively 9 Pro forma results exclude FVA (effective 4Q13) and DVA in 4Q13 and 1Q13; 2014 reported results include FVA/DVA, net of hedges. See note 8 on slide 20 $mm Financial performance Net income of $2.0B on revenue of $8.6B ROE of 13% compared to 18%, excl. DVA, in 1Q13 Banking revenue IB fees of $1.4B, up 1% from the prior year, driven by higher advisory and equity underwriting fees, predominantly offset by lower debt underwriting fees – Ranked #1 in Global IB fees for 1Q14 Treasury Services revenue of $1.0B, down 3% YoY, primarily driven by lower trade finance and business simplification Lending revenue of $284mm, down 43% YoY on lower gains from securities received from restructured loans Markets & Investor Services revenue Markets revenue of $5.1B, down 17% YoY primarily driven by: Fixed Income Markets of $3.8B, down 21% YoY on weaker performance across most products and lower levels of client activity, compared to a stronger prior year period Equity Markets of $1.3B, down 3% YoY, compared with the prior year on lower derivatives revenue Securities Services revenue of $1.0B, up 4% YoY, driven by higher net interest income and fees on higher balances Credit Adjustments & Other loss of $197mm driven by net CVA losses as well as losses, net of hedges, related to FVA/DVA Expense of $5.6B, down 8% YoY, primarily driven by lower performance-based compensation $ O/(U) 1Q14 4Q13 1Q13 Corporate & Investment Bank revenue $8,606 $2,586 ($1,534) Investment banking fees 1,444 (227) 11 Treasury Services 1,009 22 (35) Lending2 284 (89) (214) Total Banking $2,737 ($294) ($238) Fixed Income Markets 3,760 561 (992) Equity Markets 1,295 422 (45) Securities Services 1,011 (14) 37 Credit Adjustments & Other3 (197) 1,911 (296) Total Markets & Investor Services $5,869 $2,880 ($1,296) Credit costs 49 68 38 Expense 5,604 712 (507) Net income $1,979 $1,121 ($631) Key drivers/statistics ($B)4 EOP equity $61.0 $56.5 $56.5 ROE5 13% 6% 19% Overhead ratio6 65 81 60 Comp/revenue7 33 36 33 EOP loans $104.7 $107.5 $117.5 Average client deposits 412.6 421.6 357.3 Assets under custody ($T) 21.1 20.5 19.3 ALL/EOP loans ex-conduits and trade8 2.18% 2.02% 2.17% Net charge-off/( covery) rate 0.00 (0.04) 0.07 Average VaR ($m ) $42 $42 $62 Pro forma results ($mm)9 $ O/(U) 1Q14 4Q13 1Q13 Corporate & Investment Bank revenue $8, 06 $590 ($1,408) Total Banking 2,737 (294) (238) Total Markets & Investor Services 5,869 884 (1,170) Net income $1,979 ($117) ($553) ROE4 13% 15% 18% Overhead ratio4 65 61 61 Comp/revenue4 33 27 34 8

F I N A N C I A L R E S U L T S Commercial Banking1 Net income of $578mm, down 3% YoY and down 17% QoQ Revenue of $1.7B, down 1% YoY Credit costs of $5mm Net recovery rate of 0.04%; 5th consecutive quarter of net recoveries or single-digit net charge-off rate Excluding recoveries, charge-off rate of 0.01% Expense of $686mm, up 7% YoY, largely reflecting higher control and headcount-related1 expense EOP loan balances up 7% YoY, up 1% QoQ C&I5 loans flat YoY and QoQ Commercial Term Lending loans up 13% YoY Real Estate Banking loans up 29% YoY Average client deposits of $202.9B, up 4% YoY and down 1% QoQ 1 See notes 1 and 9 on slide 20 2 4Q13 included one-time proceeds of $98mm from a lending related workout 3 Actual numbers for all periods, not over/(under) 4 Loans held-for-sale and loans at fair value were excluded when calculating the loan loss coverage ratio and net charge-off/(recovery) rate 5 CB’s C&I (Commercial & Industrial) grouping is defined to include certain client segments (Middle Market, which includes Government, Nonprofit & Healthcare Clients; and CCB) and will not align with regulatory definitions $mm 1Q14 4Q13 1Q13 Revenue $1,651 ($196) ($22) Middle Market Banking 698 (46) (55) Corporate Client Banking 446 (42) 13 Commercial Term Lending 308 10 17 Real Estate Banking2 116 (90) 4 Other 83 (28) (1) Credit costs $5 ($38) ($34) Expense 686 33 42 Net income $578 ($115) ($18) Key drivers/statistics ($B)3 EOP equity $14.0 $13.5 $13.5 ROE 17% 20% 18% Overhead ratio 42 35 38 Average loans $137.7 $135.6 $129.3 EOP loans 138.9 137.1 130.4 Average client deposits 202.9 205.3 196.0 Allowance for loan losses 2.7 2.7 2.7 Nonaccrual loans 0.5 0.5 0.7 Net charge-off/(recovery) rate4 (0.04)% 0.07% (0.02)% ALL/loans4 1.95 1.97 2.05 $ O/(U) Financial performance 9

F I N A N C I A L R E S U L T S Asset Management1 1 See note 1 on slide 20 2 Actual numbers for all periods, not over/(under) 3 See note 10 on slide 20 Net income of $441mm, down 9% YoY Revenue of $2.8B, up 5% YoY Record AUM of $1.6T, up 11% YoY AUM net inflows for the quarter of $14B, driven by net inflows of $20B to long-term products and net outflows of $6B from liquidity products Record client assets of $2.4T, up 10% YoY and 2% QoQ Expense of $2.1B, up 11% YoY Record EOP loan balances of $96.9B, up 19% YoY and 2% QoQ Record average deposit balances of $149.4B, up 7% YoY and 4% QoQ Strong investment performance 67% of mutual fund AUM ranked in the 1st or 2nd quartiles over 5 years $mm 1Q14 4Q13 1Q13 Revenue $2,778 ($401) $125 Private Banking 1,509 (90) 63 Institutional 500 (280) (67) Retail 769 (31) 129 Credit costs ($9) ($30) ($30) Expense 2,075 (170) 199 Net income $441 ($127) ($46) Key drivers/statistics ($B)2 EOP equity $9.0 $9.0 $9.0 ROE 20% 25% 22% Pretax margin3 26 29 29 Assets under management (AUM) $1,648 $1,598 $1,483 Client assets 2,394 2,343 2,171 Average loans 95.7 92.7 80.0 EOP loans 96.9 95.4 81.4 Average dep sits 149.4 144.0 139.4 $ O/(U) Financial performance 10

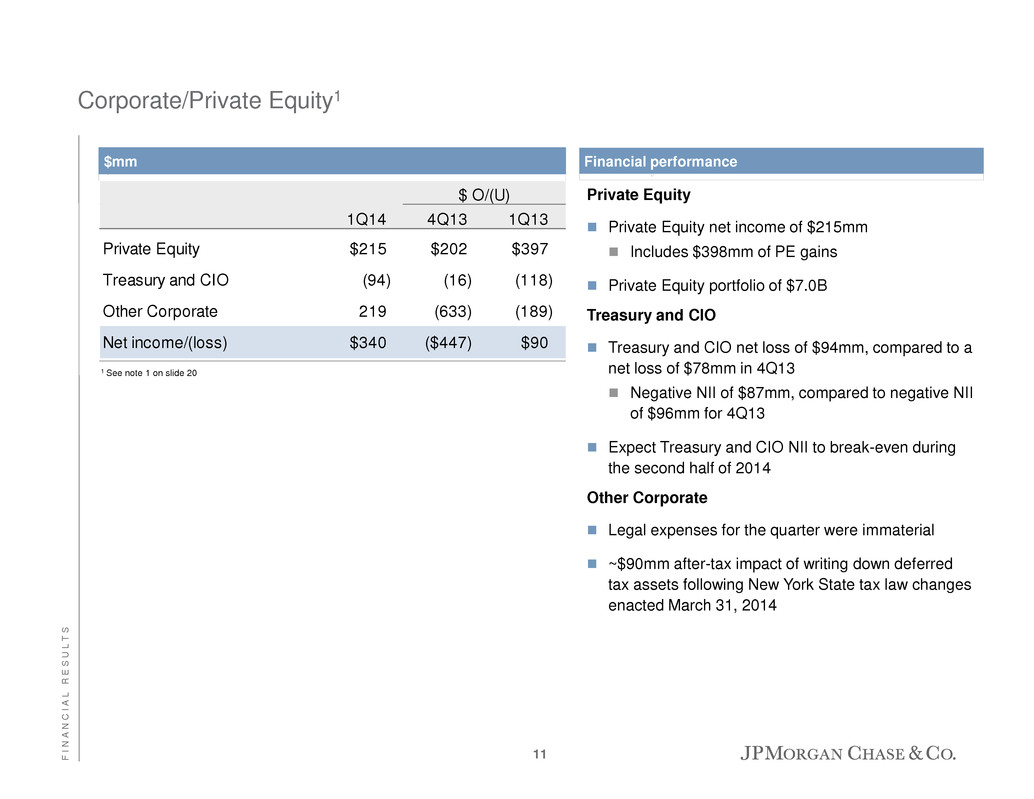

F I N A N C I A L R E S U L T S 1Q14 4Q13 1Q13 Private Equity $215 $202 $397 Treasury and CIO (94) (16) (118) Other Corporate 219 (633) (189) Net income/(loss) $340 ($447) $90 $ O/(U) Private Equity Private Equity net income of $215mm Includes $398mm of PE gains Private Equity portfolio of $7.0B Treasury and CIO Treasury and CIO net loss of $94mm, compared to a net loss of $78mm in 4Q13 Negative NII of $87mm, compared to negative NII of $96mm for 4Q13 Expect Treasury and CIO NII to break-even during the second half of 2014 Other Corporate Legal expenses for the quarter were immaterial ~$90mm after-tax impact of writing down deferred tax assets following New York State tax law changes enacted March 31, 2014 1 See note 1 on slide 20 $mm Corporate/Private Equity1 Financial performance 11

F I N A N C I A L R E S U L T S If delinquencies continue to trend down and macro- economic environment remains stable or improves, potential for further modest mortgage reserve releases over time; however, expect Card releases to be essentially done Expect Mortgage Production pretax income to be a loss of approximately $100-150mm in 2Q14, and pretax income to be negative for the full year 2014 Outlook Consumer & Community Banking Basel III Tier 1 common ratio target of 10%+ Firm SLR target of 5.5%+/- Bank SLR target of 6%+ Capital and leverage Corporate/Private Equity Expect Treasury and CIO NII to break-even during the second half of 2014 Firmwide Expect adjusted expense to be below $59B1 for 2014 1 Adjusted expense defined as total expense, excluding total legal expense and FRM 12

Agenda Page F I N A N C I A L R E S U L T S 13 Appendix 13

A P P E N D I X Core NIM up 2 bps QoQ due to: Higher investment securities yields and lower deposit yields Partially offset by lower loan yields Core net interest margin1 1 See note 7 on slide 20 2 The core and market-based NII presented for FY2010, FY2011 and FY2012 represent their quarterly averages (e.g. total for the year divided by 4); the yield for all periods represent the annualized yield 3.67% 3.29% 2.97% 2.83% 2.60% 2.60% 2.64% 2.66% 1.51% 1.41% 1.16% 1.14% 1.05% 0.89% 0.86% 0.84% 3.06% 2.74% 2.48% 2.37% 2.20% 2.18% 2.20% 2.20% FY2010 FY2011 FY2012 1Q13 2Q13 3Q13 4Q13 1Q14 Core NII Market-based NII Core NIM Market-based NIM JPM NIM Net interest income trend Comments 2 Average balances Deposits with banks $80B $157B $266B $321B $329B $319B $48B 2 $118B 2 14

A P P E N D I X Consumer credit – Delinquency trends1 Note: Prime mortgage excludes held-for-sale, Asset Management and government-insured loans 1 Excluding purchased credit-impaired loans 2 Includes loans held-for-sale Credit card delinquency trend ($mm)2 Prime mortgage delinquency trend ($mm) Home equity delinquency trend ($mm) Subprime mortgage delinquency trend ($mm) $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 $3,500 Jun-10 Nov-10 Apr-11 Sep-11 Feb-12 Jul-12 Dec-12 May-13 Oct-13 Mar-14 $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 $3,500 Jun-10 Nov-10 Apr-11 Sep-11 Feb-12 Jul-12 Dec-12 May-13 Oct-13 Mar-14 30 – 149 day delinquencies 150+ day delinquencies 30 – 149 day delinquencies 150+ day delinquencies $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 $3,500 Jun-10 Nov-10 Apr-11 Sep-11 Feb-12 Jul-12 Dec-12 May-13 Oct-13 Mar-14 30 – 149 day delinquencies 150+ day delinquencies $500 $2,000 $3,500 $5,000 $6,500 $8,000 $9,500 $11,000 Jun-10 Nov-10 Apr-11 Sep-11 Feb-12 Jul-12 Dec-12 May-13 Oct-13 Mar-14 30+ day delinquencies 30-89 day delinquencies 15

A P P E N D I X O/(U) 1Q14 4Q13 1Q13 1Q13 Real Estate Portfolios (NCI) Net charge-offs $174 $167 $448 ($274) NCO rate 0.61% 0.57% 1.56% (95)bps Allowance for loan losses $2,368 $2,568 $4,218 ($1,850) LLR/annualized NCOs1 340% 384% 235% Card Services Net charge-offs $888 $891 $1,082 ($194) NCO rate 2.93% 2.86% 3.55% (62)bps Allowance for loan losses $3,591 $3,795 $4,998 ($1,407) LLR/annualized NCOs1 101% 106% 115% Real Estate Portfolios and Card Services – Coverage ratios Real Estate Portfolios and Card Services credit data ($mm) 1 Net charge-offs annualized (NCOs are multiplied by 4) 2 4Q10 adjusted net charge-offs exclude a one-time $632mm adjustment related to the timing of when the Firm recognizes charge-offs on delinquent loans 3 2Q12 adjusted net charge-offs for Card Services were $1,254mm or 4.03%; excluding the effect of a change in charge-off policy for troubled debt restructurings, 2Q12 reported net charge-offs were $1,345mm or 4.32% 4 3Q12 adjusted net charge-offs and adjusted net charge-off rate for Real Estate Portfolios exclude the effect of an incremental $825mm of net charge-offs based on regulatory guidance 5 4Q12 adjusted net charge-offs and adjusted net charge-off rate reflect a full quarter of normalized Chapter 7 Bankruptcy discharge activity, which exclude one-time adjustments related to the adoption of Chapter 7 Bankruptcy discharge regulatory guidance NCOs ($mm) 2,075 1,372 1,214 1,157 1,076 954 899 876 808 696 595 520 448 288 204 167 174 4,512 3,721 3,133 2,671 2,226 1,810 1,499 1,390 1,386 1,254 1,116 1,097 1,082 1,014 892 891 888 $0 $1,000 $2,000 $3,000 $4,000 $5,000 1Q10 2Q10 3Q10 4Q10 1Q11 2Q11 3Q11 4Q11 1Q12 2Q12 3Q12 4Q12 1Q13 2Q13 3Q13 4Q13 1Q14 Real Estate Portfolios Card Services 2 3 4 5 16

A P P E N D I X Firmwide – Coverage ratios $15.8B of loan loss reserves at March 31, 2014, down ~$5B from $20.8B in 1Q13, reflecting improved portfolio credit quality Loan loss coverage ratio of 1.75%1 1 See note 3 on slide 20 2 NPLs at 1Q14, 4Q13, 3Q13, 2Q13, 1Q13, 4Q12 and 3Q12 include $2.0B, $2.0B, $1.9B, $1.9B, $1.9B, $1.8B and $1.7B, respectively, in accordance with regulatory guidance requiring loans discharged under Chapter 7 bankruptcy and not reaffirmed by the borrower, regardless of their delinquency status to be reported as nonaccrual loans. In addition, the Firm’s policy is generally to exempt credit card loans from being placed on nonaccrual status as permitted by regulatory guidance $mm JPM credit summary 1Q14 4Q13 1Q13 Consumer, ex. credit card LLR/Total loans 1.71% 1.83% 2.56% LLR/NPLs2 55 57 66 Credit Card LLR/Total loans 2.96% 2.98% 4.10% Wholesale LLR/Total loans 1.32% 1.30% 1.33% LLR/NPLs 546 489 332 Firmwide LLR/Total loans 1.75% 1.80% 2.27% LLR /NPLs (ex. credit card)2 100 100 98 LLR /NPLs2 145 146 146 10,391 9,874 11,124 10,609 10,296 9,578 9,027 8,317 8,123 25,871 23,791 22,824 21,936 20,780 19,384 17,571 16,264 15,847 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% 1Q12 2Q12 3Q12 4Q12 1Q13 2Q13 3Q13 4Q13 1Q14 0% 100% 200% 300% 400% 500% Loan loss reserve Nonperforming retained loans Loan loss reserve/Total loans1 Loan loss reserve/NPLs1 2 2 2 2 2 2 2 17

A P P E N D I X Corporate & Investment Bank – Key metrics & leadership positions Comments Corporate & Investment Bank 49% of revenue is international for LTM 1Q14 International deposits increased 23% from FY2011 driven by growth across regions Banking Maintained #1 ranking in Global IB fees #1 in combined Fedwire and CHIPS volume5 LTM 1Q14 total international electronic funds transfer volume up 44% from 1Q13 Markets & Investor Services #1 Fixed income markets revenue share of top 10 investment banks6 International AUC up 35% from FY2011; represents 46% of total AUC at 1Q14 JPM ranked #1 for FY2013/12/11 for both All-America Fixed Income Research and Equity Research Note: LTM rankings included as available. All-America Institutional Investor research rankings are as of October of their respective year 1 Last twelve months 2 International client deposits and other third party liabilities 3 Includes TS product revenue reported in other LOBs related to customers who are also customers of those LOBs 4 International electronic funds transfer represents volume over the period and includes non-U.S. dollar Automated Clearing House ("ACH") and clearing volume 5 4Q13 volume; per Federal Reserve, 2002-2013 6 FY2013 rank of JPM Fixed Income Markets revenue of 10 leading competitors based on reported information, excluding DVA Corporate & Investment Bank Banking Markets & Investor Services International AUC ($T, EOP) $9.6 $9.2 $8.3 $7.1 All-America Institutional I vestor research r nkings NA #1 #1 #1 ($B) LTM1 FY2013 FY2012 FY2011 International revenue $15.9 $16.5 $16.3 $17.1 International dep sits (Avg)2 221.2 213.5 189.6 180.1 International loans (EOP) 61.2 59.9 67.7 67.0 Gross CIB revenue from CB 4.2 4.1 4.0 3.7 lobal IB fees (Dealogic) #1 #1 #1 #1 TS firmwide reve ue3 $6.9 $6.9 $6.9 $6.4 Combined Fedwir /CHIPS volume #1 #1 #1 #1 International electronic funds transfer volume (mm)4 360.1 325.5 304.8 250.5 18

A P P E N D I X Source: Dealogic. Global Investment Banking fees reflects ranking of fees and market share. Remainder of rankings reflects transaction volume rank and market share. Global announced M&A is based on transaction value at announcement; because of joint M&A assignments, M&A market share of all participants will add up to more than 100%. All other transaction volume-based rankings are based on proceeds, with full credit to each book manager/equal if joint 1 Global Investment Banking fees rankings exclude money market, short-term debt and shelf deals 2 Long-term debt rankings include investment-grade, high-yield, supranational, sovereigns, agencies, covered bonds, asset-backed securities (“ABS”) and mortgage-backed securities (“MBS”); and exclude money market, short-term debt and U.S. municipal securities 3 Global Equity and equity-related ranking includes rights offerings and Chinese A-Shares 4 Announced M&A reflects the removal of any withdrawn transactions. U.S. announced M&A represents any U.S. involvement ranking IB League Tables For 1Q14, JPM ranked: #1 in Global IB fees #1 in Global Debt, Equity & Equity-related #1 in Global Long-term Debt #3 in Global Equity & Equity-related #3 in Global M&A Announced #1 in Global Loan Syndications League table results 19

F I N A N C I A L R E S U L T S Notes on non-GAAP financial measures 1. In addition to analyzing the Firm’s results on a reported basis, management reviews the Firm’s results and the results of the lines of business on a “managed” basis, which is a non-GAAP financial measure. The Firm’s definition of managed basis starts with the reported U.S. GAAP results and includes certain reclassifications to present total net revenue for the Firm (and each of the business segments) on a fully taxable-equivalent (“FTE”) basis. Accordingly, revenue from investments that receive tax credits and tax exempt securities is presented in the managed results on a basis comparable to taxable securities and investments. This non-GAAP financial measure allows management to assess the comparability of revenue arising from both taxable and tax-exempt sources. The corresponding income tax impact related to tax-exempt items is recorded within income tax expense. These adjustments have no impact on net income as reported by the Firm as a whole or by the lines of business. 2. Adjusted expense, a non-GAAP financial measure, excludes firmwide legal expense and expense related to foreclosure-related matters (“FRM”). Management believes this information helps investors understand the effect of these items on reported results and provides an alternate presentation of the Firm’s performance. 3. The ratio of the allowance for loan losses to end-of-period loans excludes the following: loans accounted for at fair value and loans held-for-sale; purchased credit-impaired (“PCI”) loans; and the allowance for loan losses related to PCI loans. Additionally, Real Estate Portfolios net charge-offs and net charge-off rates exclude the impact of PCI loans. 4. Tangible common equity (“TCE”), return on tangible common equity (“ROTCE”) and tangible book value per share (“TBVPS”), are each non-GAAP financial measures. TCE represents the Firm’s common stockholders’ equity (i.e., total stockholders’ equity less preferred stock) less goodwill and identifiable intangible assets (other than MSRs), net of related deferred tax liabilities. ROTCE measures the Firm’s earnings as a percentage of TCE. TBVPS represents the Firm’s tangible common equity divided by period-end common shares. TCE, ROTCE, and TBVPS are meaningful to the Firm, as well as analysts and investors in assessing the Firm’s use of equity and are used in facilitating comparisons of the Firm with competitors. 5. Basel III rules under the transitional Standardized Approach became effective on January 1, 2014. The Firm presents the following non-GAAP measures: Tier 1 common capital, risk-weighted assets (“RWA”) and return on RWA, and the Tier 1 common ratio under the Basel III Advanced Fully Phased-In rules, and the supplementary leverage ratio (“SLR”) under Basel III rules. These measures are used by management, bank regulators, investors and analysts to assess and monitor the Firm’s capital position. For additional information on these measures, see Regulatory capital on pages 161-165 of JPMorgan Chase & Co.’s Annual Report on Form 10-K for the year ended December 31, 2013. 6. Within Consumer & Community Banking, Card, Merchant Services and Auto presents its change in net income excluding the change in the allowance for loan losses (assuming a tax rate of 38%). This non-GAAP financial measure is used by management to facilitate a more meaningful comparison with prior periods. 7. In addition to reviewing JPMorgan Chase's net interest income on a managed basis, management also reviews core net interest income to assess the performance of its core lending, investing (including asset-liability management) and deposit-raising activities (which excludes the impact of Corporate & Investment Bank's ("CIB") market-based activities). The core net interest income data presented are non-GAAP financial measures due to the exclusion of CIB’s market-based net interest income and the related assets. Management believes this exclusion provides investors and analysts a more meaningful measure by which to analyze the non-market-related business trends of the Firm and provides a comparable measure to other financial institutions that are primarily focused on core lending, investing and deposit-raising activities. 8. The CIB provides certain non-GAAP financial measures, as such measures are used by management to assess the underlying performance of the business and for comparability with peers: The ratio for the allowance for loan losses to end-of-period loans is calculated excluding the impact of consolidated Firm-administered multi-seller conduits and trade finance loans, to provide a more meaningful assessment of CIB’s allowance coverage ratio. Prior to January 1, 2014, the CIB provided several non-GAAP financial measures excluding the impact of FVA (effective fourth quarter 2013) and DVA on: net revenue, net income, compensation and overhead ratios, and return on equity. Beginning in the first quarter 2014, the Firm does not exclude FVA and DVA from its assessment of business performance; however, the Firm continues to present these non-GAAP measures for the periods prior to January 1, 2014, as they reflected how management assessed the underlying business performance of the CIB in those prior periods. Additional notes on financial measures 9. Headcount-related expense includes salary and benefits (excluding performance-based incentives), and other non-compensation costs related to employees. 10. Pretax margin represents income before income tax expense divided by total net revenue, which is, in management’s view, a comprehensive measure of pretax performance derived by measuring earnings after all costs are taken into consideration; it is, therefore, another basis that management uses to evaluate the performance of AM against the performance of its peers. 11. A household is a collection of individuals or entities aggregated together by name, address, tax identifier and phone. CBB households are households that have a personal or business deposit, personal investment or business credit relationship with Chase. Reported on a one-month lag. Notes 20

F I N A N C I A L R E S U L T S Forward-looking statements This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are based on the current beliefs and expectations of JPMorgan Chase & Co.’s management and are subject to significant risks and uncertainties. Actual results may differ from those set forth in the forward-looking statements. Factors that could cause JPMorgan Chase & Co.’s actual results to differ materially from those described in the forward-looking statements can be found in JPMorgan Chase & Co.’s Annual Report on Form 10-K for the year ended December 31, 2013, which has been filed with the Securities and Exchange Commission and is available on JPMorgan Chase & Co.’s website (http://investor.shareholder.com/jpmorganchase), and on the Securities and Exchange Commission’s website (www.sec.gov). JPMorgan Chase & Co. does not undertake to update the forward- looking statements to reflect the impact of circumstances or events that may arise after the date of the forward-looking statements. 21