Attached files

| file | filename |

|---|---|

| EX-31.1 - CERTIFICATION - 5V Inc. | f10q1213ex31i_5vinc.htm |

| EX-32.1 - CERTIFICATION - 5V Inc. | f10q1213ex32i_5vinc.htm |

| EXCEL - IDEA: XBRL DOCUMENT - 5V Inc. | Financial_Report.xls |

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

x QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended December 31, 2013

OR

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ________ to ________

Commission file number 000-54175

5V Inc.

(Exact name of registrant as specified in its charter)

|

Delaware

|

27–3828846

|

|

|

(State or other jurisdiction of

incorporation or organization)

|

(I.R.S. Employer

Identification Number)

|

7th Floor, Tower B, Four Points Sheraton Hotel

Futian, Shenzhen, China

(Address of principal executive offices)

+86-13510608355

(Registrant’s telephone number, including area code)

Not applicable

(Former name, former address and former fiscal year, if changed since last report)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer

|

o

|

Accelerated filer

|

o

|

|

|

Non-accelerated filer

|

o

|

Smaller reporting company

|

x

|

|

|

(Do not check if a smaller reporting company)

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes x No o.

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date: 100,000,000 shares of common stock of the registrant, par value $.0001 per share, were outstanding as of April 9, 2014.

5V INC.

- INDEX -

|

Page

|

||||

|

PART I – FINANCIAL INFORMATION:

|

||||

|

Item 1.

|

Financial Statements:

|

1

|

||

|

Balance Sheets as of December 31, 2013 (Unaudited) and September 30, 2013

|

2

|

|||

|

Statements of Operations (Unaudited) for the Three Months Ended December 31, 2013 and 2012 and the Period from February 19, 2010 (Inception) to December 31, 2013

|

3

|

|||

|

Statements of Cash Flows (Unaudited) for the Three Months Ended December 31, 2013 and 2012 and the Period from February 19, 2010 (Inception) to December 31, 2013

|

4

|

|||

|

Notes to the Financial Statements (Unaudited)

|

5

|

|||

|

Item 2.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

15

|

||

|

Item 3.

|

Quantitative and Qualitative Disclosures About Market Risk

|

17

|

||

|

Item 4.

|

Controls and Procedures

|

17

|

||

|

PART II – OTHER INFORMATION:

|

||||

|

Item 1.

|

Legal Proceedings

|

18

|

||

|

Item 1A.

|

Risk Factors

|

18

|

||

|

Item 2.

|

Unregistered Sales of Equity Securities and Use of Proceeds

|

18

|

||

|

Item 3.

|

Defaults Upon Senior Securities

|

18

|

||

|

Item 4.

|

Mine Safety Disclosures

|

18

|

||

|

Item 5.

|

Other Information

|

18

|

||

|

Item 6.

|

Exhibits

|

19

|

||

|

Signatures

|

20

|

|||

FORWARD-LOOKING STATEMENTS

Certain statements made in this Quarterly Report on Form 10-Q are “forward-looking statements” (within the meaning of the Private Securities Litigation Reform Act of 1995) regarding the plans and objectives of management for future operations. Such statements involve known and unknown risks, uncertainties and other factors that may cause actual results, performance or achievements of 5V, Inc. (the “Company”) to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. The forward-looking statements included herein are based on current expectations that involve numerous risks and uncertainties. The Company's plans and objectives are based, in part, on assumptions involving the continued expansion of business. Assumptions relating to the foregoing involve judgments with respect to, among other things, future economic, competitive and market conditions and future business decisions, all of which are difficult or impossible to predict accurately and many of which are beyond the control of the Company. Although the Company believes its assumptions underlying the forward-looking statements are reasonable, any of the assumptions could prove inaccurate and, therefore, there can be no assurance the forward-looking statements included in this Report will prove to be accurate. In light of the significant uncertainties inherent in the forward-looking statements included herein, the inclusion of such information should not be regarded as a representation by the Company or any other person that the objectives and plans of the Company will be achieved.

PART I – FINANCIAL INFORMATION

|

Item 1.

|

Financial Statements.

|

The accompanying financial statements have been prepared in accordance with generally accepted accounting principles for interim financial information and in accordance with the instructions for Form 10-Q. Accordingly, they do not include all of the information and footnotes required by generally accepted accounting principles for complete financial statements.

In the opinion of management, the financial statements contain all material adjustments, consisting only of normal recurring adjustments necessary to present fairly the financial condition, results of operations, and cash flows of the Company for the interim periods presented.

The results for the period ended December 31, 2013 are not necessarily indicative of the results of operations for the full year. These financial statements and related footnotes should be read in conjunction with the financial statements and footnotes thereto included in the Company’s Form 10-K filed with the Securities and Exchange Commission on January 27, 2014.

1

5V, INC.

(A Development Stage Company)

BALANCE SHEETS

|

December 31,

|

September 30,

|

|||||||

|

2013

|

2013

|

|||||||

|

(unaudited)

|

||||||||

|

ASSETS

|

||||||||

|

Current Assets:

|

||||||||

|

Cash and cash equivalents

|

$ | 1,973 | $ | - | ||||

|

Total Current Assets

|

1,973 | - | ||||||

|

Total Assets

|

$ | 1,973 | $ | - | ||||

|

LIABILITIES AND STOCKHOLDERS' EQUITY (DEFICIENCY)

|

||||||||

|

Current Liabilities:

|

||||||||

|

Accounts payable and accrued expenses (Note 5)

|

3,426 | 8,261 | ||||||

|

Advances from a related party (Note 6)

|

$ | 133,340 | $ | 92,833 | ||||

|

Total Current Liabilities

|

136,766 | 101,094 | ||||||

|

Commitments and Contingencies (Note 10)

|

- | - | ||||||

|

Stockholders' Deficiency

|

||||||||

|

Preferred stock, par value $0.0001, 10,000,000 shares authorized; no shares issued and outstanding as of December 31, 2013 and September 30, 2013

|

- | - | ||||||

|

Common stock, par value $0.0001, 400,000,000 shares authorized; 100,000,000 shares and 7,500,000 shares issued and outstanding as of December 31, 2013 and September 30, 2013

|

10,000 | 750 | ||||||

|

Additional paid-in capital

|

42,037 | - | ||||||

|

Subscription receivable (Note 9)

|

(51,287 | ) | - | |||||

|

Deficit accumulated during the development stage

|

(135,543 | ) | (101,844 | ) | ||||

|

Total Stockholders' Equity (Deficiency)

|

(134,793 | ) | (101,094 | ) | ||||

|

Total Liabilities and Stockholders' Equity (Deficiency)

|

$ | 1,973 | $ | - | ||||

The accompanying notes are an integral part of these financial statements.

2

5V, INC.

(A Development Stage Company)

STATEMENTS OF OPERATIONS

|

For the Period

|

||||||||||||

|

February 19, 2010

|

||||||||||||

|

For the Three Months Ended

|

(inception) through

|

|||||||||||

|

December 31,

|

December 31,

|

|||||||||||

|

2013

|

2012

|

2013

|

||||||||||

|

(unaudited)

|

(unaudited)

|

(unaudited)

|

||||||||||

|

Revenues

|

||||||||||||

|

Sales

|

$ | - | $ | - | $ | - | ||||||

|

Costs of Sales

|

- | - | - | |||||||||

|

Gross Profit

|

- | - | - | |||||||||

|

Operating Expenses

|

||||||||||||

|

Professional fees

|

31,727 | 500 | 106,678 | |||||||||

|

Other general and administrative expenses

|

469 | 438 | 28,865 | |||||||||

|

Total Operating Expenses

|

32,196 | 938 | 135,543 | |||||||||

|

Loss from Operation before Provision for Income Tax

|

(32,196 | ) | (938 | ) | (135,543 | ) | ||||||

|

Provision for Income Tax

|

- | - | - | |||||||||

|

Net Loss

|

$ | (32,196 | ) | $ | (938 | ) | $ | (135,543 | ) | |||

|

Basic and fully diluted loss per share

|

$ | (0.00 | ) | $ | (0.00 | ) | $ | (0.02 | ) | |||

|

Basic and diluted weighted average shares outstanding

|

69,166,667 | 7,500,000 | 7,500,000 | |||||||||

The accompanying notes are an integral part of these financial statements.

3

5V, INC.

(A Development Stage Company)

STATEMENT OF CASH FLOWS

|

For the Period

|

||||||||||||

|

February 19, 2010

|

||||||||||||

|

For the Three Months Ended

|

(inception) through

|

|||||||||||

|

December 31,

|

December 31,

|

|||||||||||

|

2013

|

2012

|

2013

|

||||||||||

|

(unaudited)

|

(unaudited)

|

(unaudited)

|

||||||||||

|

CASH FLOWS FROM OPERATING ACTIVITIES

|

||||||||||||

|

Net loss

|

$ | (32,196 | ) | $ | (938 | ) | $ | (135,543 | ) | |||

|

Adjustments to reconcile net loss to net cash used by operating activities:

|

||||||||||||

|

Company expenses paid by related parties

|

8,539 | 438 | 102,875 | |||||||||

|

Changes in operating assets and liabilities:

|

||||||||||||

|

Increase (decrease) in accounts payable and accrued expenses

|

(4,835 | ) | 500 | 3,426 | ||||||||

|

Net cash used by operating activities

|

(28,492 | ) | - | (29,242 | ) | |||||||

|

CASH FLOWS FROM INVESTING ACTIVITIES

|

||||||||||||

|

Net cash used by investing activities

|

- | - | - | |||||||||

|

CASH FLOWS FROM FINANCING ACTIVITIES

|

||||||||||||

|

Proceeds from issuance of common stocks

|

- | - | 750 | |||||||||

|

Proceeds from related parties

|

- | - | 30,465 | |||||||||

|

Proceeds from acquisition of 5-V Holding Limited

|

30,465 | - | - | |||||||||

|

Net cash provided by financing activities

|

30,465 | - | 31,215 | |||||||||

|

NET INCREASE IN CASH

|

1,973 | - | 1,973 | |||||||||

|

CASH AT BEGINNING OF PERIOD

|

- | - | - | |||||||||

|

CASH AT END OF PERIOD

|

$ | 1,973 | $ | - | $ | 1,973 | ||||||

|

SUPPLEMENTAL DISCLOSURES OF CASH FLOW INFORMATION

|

||||||||||||

|

Cash paid (received) during the period for:

|

||||||||||||

|

Interest

|

$ | - | $ | - | $ | - | ||||||

|

Income taxes

|

$ | - | $ | - | $ | - | ||||||

|

Non-cash financing activities:

|

||||||||||||

|

Accounts payable paid directly by related parties

|

$ | - | $ | 5,000 | $ | 16,534 | ||||||

The accompanying notes are an integral part of these financial statements.

4

5V INC.

(A Development Stage Company)

Notes to Financial Statements

(Unaudited)

NOTE 1 – ORGANIZATION AND NATURE OF BUSINESS

5V Inc. (the “Company”), formerly China Gate Acquisition Corp. 1, was organized on February 19, 2010 as a Delaware corporation with fiscal year ending September 30. This is a shell company with no business activity whose purpose is to seek out and attract partners for possible merger or acquisition.

On April 28, 2011, China Gate Acquisition Corp. 1 incorporated a wholly-owned subsidiary in the name of “5V Inc.” under the laws of the State of Delaware.

On May 3, 2011, China Gate Acquisition Corp. 1 effectuated a merger (the “Merger”) pursuant to which its wholly-owned subsidiary, 5V Inc. (“5V”), merged with and into China Gate Acquisition Corp. 1, with China Gate Acquisition Corp. 1 continuing as the surviving corporation and the officer and directors of the corporation replacing the sole officer and director of 5V. On the same day, China Gate Acquisition Corp. 1 changed its name to “5V Inc.” by filing a Certificate of Ownership and Merger with the Office of Secretary of State of Delaware.

On August 24, 2012, Jun Jiang and Xiong Wu (collectively the “Purchasers”) purchased all of the issued and outstanding shares of common stock of the Company’s existing shareholders (the “Sellers”) for an aggregate purchase price of $250,000. As a result of the consummation of the transaction, the Purchasers collectively own 100% of the Company’s outstanding common stock, resulting in no liability owed to the original shareholders (the “Sellers”) thereafter.

On September 30, 2012, the Company’s Board of Directors and shareholders approved an increase in the authorized shares of common stock from 100,000,000 to 400,000,000. The amendment to the Company’s Certificate of Incorporation was filed with the Secretary of State of Delaware on April 16, 2013.

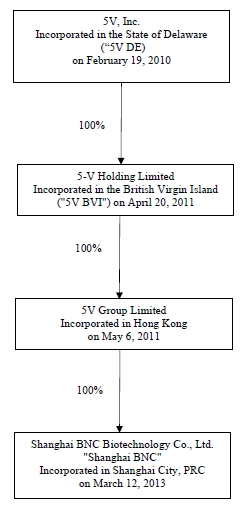

On October 30, 2013, the Company, 5-V Holding Limited, a British Virgin Islands company (“5V BVI”) and the shareholders of 5V BVI (the “5V BVI Shareholders”) entered into a share exchange agreement (the “Share Exchange Agreement”). Pursuant to the Share Exchange Agreement, the Company agreed to acquire 100% of the issued and outstanding shares of 5V BVI from the 5V BVI Shareholders in exchange for the issuance of 92,500,000 shares (the “5V DE Shares”) of the Company’s common stock, par value $0.0001 per share (the “Common Stock”) to 5V BVI Shareholders. The 5V BVI Shareholders agreed to exchange each share of their 5V BVI shares for 2,000 5V DE Shares. The transaction pursuant to the Share Exchange Agreement is hereby referred to as the Share Exchange. The Share Exchange was consummated on October 30, 2013 (the “Closing Date”). As a result of the Share Exchange, 5V BVI became a wholly-owned subsidiary of the Company;

On May 6, 2011, 5V BVI incorporated a wholly-owned subsidiary named “5V Group Limited” in Hong Kong under the Companies Ordinance as a limited liability company. 5V Group Limited is a shell with no business activity and whose purpose is to seek out and attract partners for possible merger or acquisition.

On March 12, 2013, 5V Group Limited established a wholly-owned subsidiary named "Shanghai BNC Biotechnology Co., Ltd." ("Shanghai BNC") in the People's Republic of China ("PRC') as a limited liability company under the Company Laws of PRC. Shanghai BNC plans to engage in the research, sale and after-market service of herb diet nutritional supplement and skin-care product in China.

5

5V INC.

(A Development Stage Company)

Notes to Financial Statements

(Unaudited)

NOTE 1 – ORGANIZATION AND NATURE OF BUSINESS (continued)

5V Inc., 5-V Holding limited, 5V Group Limited, and Shanghai BNC are hereafter referred to as the Company, which structure is summarized in the following chart.

6

5V INC.

(A Development Stage Company)

Notes to Financial Statements

(Unaudited)

NOTE 2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

BASIS OF PRESENTATION

The accompanying unaudited financial statements have been prepared in accordance with generally accepted accounting principles (GAAP) applicable to interim financial information and the requirements of Form 10-Q and Rule 8-03 of Regulation S-X of the Securities and Exchange Commission. Accordingly, they do not include all of the information and disclosure required by accounting principles generally accepted in the United States of America for complete financial statements. Interim results are not necessarily indicative of results for a full year. In the opinion of management, all adjustments considered necessary for a fair presentation of the financial position and the results of operations and cash flows for the interim periods have been included.

Interim Financial Statements

These interim financial statements should be read in conjunction with the audited financial statements for the period from February 19, 2010 (date of inception) through December 31, 2013, as not all disclosures required by generally accepted accounting principles for annual financial statements are presented. The interim financial statements follow the same accounting policies and methods of computations as the audited financial statements for the period from February 19, 2010 (date of inception) through December 31, 2013.

Subsequent Events

In preparing the accompanying financial statements, we evaluated the period from the balance sheet date through the date the financial statements were issued for material subsequent events requiring recognition or disclosure. No such events were identified for this period.

Development Stage Company

The Company is currently a development stage enterprise reporting under the provisions of the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 915. Those standards require the Company to disclose its activities since the date of inception.

7

5V INC.

(A Development Stage Company)

Notes to Financial Statements

(Unaudited)

NOTE 2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Cash and Cash Equivalents

In accordance with FASB ASC Topic 230-10-50-6, “Statement of Cash Flows”, the Company considers all highly liquid debt instruments with a maturity of three months or less when purchased to be cash equivalents.

Property, plant and equipment

Property, plant and equipment, are stated at cost less depreciation and amortization and accumulated impairment loss. Cost represents the purchase price of the asset and other costs incurred to bring the asset into its existing use. Maintenance, repairs and betterments, including replacement of minor items, are charged to expense; major additions to physical properties are capitalized.

Depreciation of property, plant and equipment is calculated based on cost, less their estimated residual value, if any, using the straight-line method over their estimated useful lives.

Upon sale or retirement of property, plant and equipment, the related cost and accumulated depreciation are removed from the accounts and any gain or loss is reflect in operation.

The estimated useful lives of the assets are as follows:

|

Office equipment and furniture

|

3-5 years |

Impairment of Long-life Assets

Long-lived assets and certain identifiable intangibles are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. Recoverability of assets to be held and used is measured by a comparison of the carrying amount of an asset to future net cash flows expected to be generated by the asset. If such assets are considered to be impaired, the impairment to be recognized is measured by the amount by which the carrying amount of the assets exceeds the fair value of the assets. Assets to be disposed of are reported at the lower of the carrying amount or fair value less costs to sell.

Revenue Recognition

The Company recognizes revenue when the earnings process is complete, both significant risks and rewards of ownership are transferred or services have been rendered and accepted, the selling price is fixed or determinable, and collectability is reasonably assured.

8

5V INC.

(A Development Stage Company)

Notes to Financial Statements

(Unaudited)

NOTE 2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

Advertising Costs

The Company expenses advertising costs as incurred or the first time the advertising takes place, whichever is earlier, in accordance with the FASB ASC 720-35. Advertising costs were immaterial for the three months ended December 31, 2013 and 2012, respectively.

Research and Development Costs

The Company charges research and development costs to expense when incurred in accordance with the FASB ASC 730, “Research and Development”. Research and development costs were immaterial for the three months ended December 31, 2013 and 2012, respectively.

Income Taxes

The Company accounts for income taxes in accordance with FASB ASC Topic 740 which requires that deferred tax assets and liabilities be recognized for future tax consequences attributable to differences between financial statement carrying amounts of existing assets and liabilities and their respective tax bases. In Addition, FASB ASC 740 requires recognition of future tax benefits, such as carryforwards, to the extent that realization of such benefits is more likely than not and that a valuation allowance be provided when it is more likely than not that some portion of the deferred tax asset will not be realized.

The Company has accumulated deficiency in its operation. Because there is no certainty that we will realize taxable income in the future, we did no record any deferred tax benefit as a result of these losses.

The Company accounts for income taxes in interim periods in accordance with FASB ASC 740-270, "Interim Reporting". The Company has determined an estimated annual effect tax rate. The rate will be revised, if necessary, as of the end of each successive interim period during the Company’s fiscal year to its best current estimate. The estimated annual effective tax rate is applied to the year-to-date ordinary income (or loss) at the end of the interim period.

FAIR VALUE OF FINANCIAL INSTRUMENTS

The Company adopted the guidance of FASB ASC 820 for fair value measurements which clarifies the definition of fair value, prescribes methods for measuring fair value, and establishes a fair value hierarchy to classify the inputs used in measuring fair value as follows:

Level 1-Inputs are unadjusted quoted prices in active markets for identical assets or liabilities available at the measurement date.

Level 2-Inputs are unadjusted quoted prices for similar assets and liabilities in active markets, quoted prices for identical or similar assets and liabilities in markets that are not active, inputs other then quoted prices that are observable, and inputs derived from or corroborated by observable market data.

Level 3-Inputs are unobservable inputs which reflect the reporting entity’s own assumptions on what assumptions the market participants would use in pricing the asset or liability based on the best available information.

The carrying amounts reported in the balance sheets for cash and accrued expenses approximate their fair market value based on the short-term maturity of these instruments. The Company did not identify any assets or liabilities that are required to be presented on the balance sheets at fair value in accordance with the accounting guidance.

9

5V INC.

(A Development Stage Company)

Notes to Financial Statements

(Unaudited)

NOTE 2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

Basic and Diluted Loss per Share

The Company reports loss per share in accordance with FASB ASC 260 “Earnings per share”. The Company’s basic earnings per share are computed using the weighted average number of shares outstanding for the periods presented. Diluted earnings per share are computed based on the assumption that any dilutive options or warrants were converted or exercised. Dilution is computed by applying the treasury stock method. Under this method, the Company’s outstanding stock warrants are assumed to be exercised, and funds thus obtained were assumed to be used to purchase common stock at the average market price during the period. There were no dilutive instruments outstanding during the three months ended December 31, 2013 and 2012. However, if present, a separate computation of diluted loss per share would not have been presented, as these common stock equivalents would have been anti-dilutive due to the Company's net loss.

Comprehensive Income

FASB ASC 220, “Comprehensive Income", establishes standards for reporting and display of comprehensive income, its components and accumulated balances. Comprehensive income as defined includes all changes in equity during a period from non-owner sources.

Segment Reporting

FASB ASC 820 “Segments Reporting” establishes standards for reporting information about operating segments on a basis consistent with the Company’s internal organization structure as well as information about geographical areas, business segments and major customers in financial statements. The Company currently operates in one principal business segment.

Related Parties

Parties are considered to be related to the Company if the parties, directly or indirectly, through one or more intermediaries, control, are controlled by, or are under common control with the Company. Related parties also include principal owners of the Company, its management, members of the immediate families of principal owners of the Company and its management and other parties with which the Company may deal if one party controls or can significantly influence the management or operating policies of the other to an extent that one of the transacting parties might be prevented from fully pursuing its own separate interests. The Company discloses all related party transactions. All transactions shall be recorded at fair value of the goods or services exchanged. Property purchased from a related party is recorded at the cost to the related party and any payment to or on behalf of the related party in excess of the cost is reflected as a distribution to related party.

In July 2013, the FASB issued ASU 2013-11, “Presentation of an Unrecognized Tax Benefit When a Net Operating Loss Carryforward, a Similar Tax Loss, or a Tax Credit Carryforward Exists.” This standard requires that an unrecognized tax benefits, or a portion of an unrecognized tax benefit be presented on a reduction to a deferred tax asset for an NOL carryforward, a similar tax loss, or a tax credit carryforward with certain exceptions to this rule. If certain exception conditions exists, an entity should present an unrecognized tax benefit in the financial statements as a liability and should not net the unrecognized tax benefit with a deferred tax asset. This standard is effective for fiscal years and interim periods within those years beginning after December 15, 2013. The Company does not expect the adoption of the new provisions to have a material impact on our financial condition or results of operations.

10

5V INC.

(A Development Stage Company)

Notes to Financial Statements

(Unaudited)

NOTE 2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

Recent Accounting Pronouncements (continued)

In March 2013, the FASB issued guidance on when foreign currency translation adjustments should be released to net income. When a parent entity ceases to have a controlling financial interest in a subsidiary or group of assets that is a business within a foreign entity, the parent is required to release any related cumulative translation adjustment into net income. Accordingly, the cumulative translation adjustment should be released into net income only if the sale or transfer results in the complete or substantially complete liquidation of the foreign entity in which the subsidiary or group of assets had resided. The guidance is effective prospectively beginning January 1, 2014. It is not expected to have a material impact in the financial statements.

In February 2013, the FASB issued guidance for the recognition, measurement and disclosure of obligations resulting from joint and several liability arrangements for which the total amount of the obligation within the scope of the guidance is fixed at the reporting date. Examples include debt arrangements, other contractual obligations and settled litigation. The guidance requires an entity to measure such obligations as the sum of the amount that the reporting entity agreed to pay on the basis of its arrangement among its co-obligors plus additional amounts the reporting entity expects to pay on behalf of its co-obligors. The guidance is effective January 1, 2014 and is not expected to have a material impact in the financial statements.

The Company believes that there were no other accounting standards recently issued that had or are expected to have a material impact on our financial position or results of operations.

NOTE 3 – GOING CONCERN

The accompanying financial statements were prepared in conformity with U.S. GAAP, which contemplates continuation of the Company as a going concern and depends upon the Company’s ability to establish itself as a profitable business. The Company is a development stage company and has an accumulated loss of $135,543 since inception, including net operating loss of $32,196 and $938 for the three months ended December 31, 2013 and 2012, respectively. As of December 31, 2013, the Company has a shareholders' deficit of $134,793, and a working capital deficit of $134,793, which is not sufficient to finance its business for the next twelve months. Due to the start-up nature of the Company, the Company expects to incur additional losses in the immediate future. The Company’s ability to continue as a going concern is dependent upon its ability to generate future profitable operations and/or obtain the necessary financing to meet its obligations and repay its liabilities arising from normal business operations when they become due. The financial statements do not include any adjustments that might be necessary if the Company is unable to continue as a going concern. To date, the Company’s cash flow requirements have been primarily met through advances from shareholders.

The Company is planning to obtain financing either through issuance of equity or debt. To the extent that funds generated from any private placements, public offerings and/or bank financing are insufficient, the Company will have to raise additional working capital through other channels.

NOTE 4 – COMMON STOCK AND PREFERRED STOCK

The Company has authority to issue 410,000,000 shares of capital stock. These shares are divided into two classes with four hundred million (400,000,000) shares designated as common stock at $0.0001 par value and ten million (10,000,000) shares designated as preferred stock at $0.0001 par value. As of December 31, 2013, the Company has no preferred stocks issued and outstanding, and has issued and outstanding of 100,000,000 shares of common stock at par value of $0.0001 per share.

11

5V INC.

(A Development Stage Company)

Notes to Financial Statements

(Unaudited)

NOTE 5 –ACCOUNTS PAYABLE AND ACCRUED EXPENSES

Accounts payable and accrued expenses consist of the following:

|

December 31,

|

September 30,

|

|||||||

|

2013

|

2013

|

|||||||

|

(unaudited)

|

||||||||

|

Accrued professional fees

|

$ | 3,000 | $ | 7,000 | ||||

|

Accrued office expenses

|

426 | 1,261 | ||||||

|

Total accounts payable and accrued expenses

|

$ | 3,426 | $ | 8,261 | ||||

NOTE 6 – ADVANCES FROM RELATED PARTY

One of the Company’s stockholders advanced funds to the Company to cover legal, audit, and filing fees, general office administration and other expenses. The advances are unsecured, non interest bearing, and payable upon demand. On August 24, 2012, Jun Jiang and Xiong Wu purchased all of the issued and outstanding shares of common stocks of the Company from the then existing shareholders. Concurrently with the transaction, the Sellers agreed to transfer to the Purchasers all of their claims on advances to the Company.

Advances from related party consist of the following:

|

December 31,

|

September 30,

|

|||||||

|

2013

|

2013

|

|||||||

|

(unaudited)

|

||||||||

|

Jiang, Jun, CEO of the Company

|

$ | 133,340 | $ | 92,833 | ||||

|

Total accounts payable and accrued expenses

|

$ | 133,340 | $ | 92,833 | ||||

Note 7 - OFFICE RENTAL EXPENSE

From time to time, our officers and directors provide office space to us for free. However, we have not reached a formal lease agreement with any officer as of the date of this filing. The office rental expense were $0 and $0 for the three months ended December 31, 2013 and 2012, respectively.

12

5V INC.

(A Development Stage Company)

Notes to Financial Statements

(Unaudited)

Note 8 - INCOME TAX

The Company has operating losses that may be applied against future taxable income. The potential tax benefits arising from these loss carryforwards, which expire beginning the year 2030, are offset by a valuation allowance due to the uncertainty of profitable operations in the future. The cumulative net operating loss carryforward as of December 31, 2013 and September 30, 2013 was $135,543 and $101,844, respectively. The statutory tax rate for fiscal years 2013 and 2012 is 35%. The significant components of the deferred tax assets as of December 31, 2013 and September 30, 2013 are as follows:

|

December 31,

|

September 30,

|

|||||||

|

2013

|

2012

|

|||||||

|

(unaudited)

|

||||||||

|

Deferred tax assetss from losses carryforward

|

$ | 47,440 | $ | 35,645 | ||||

|

Less-Valuation allowance

|

(47,440 | ) | (35,645 | ) | ||||

|

Total net deferred tax assets

|

$ | - | $ | - | ||||

NOTE 9 – LOSS PER SHARE

The Company presents earnings (loss) per share on a basic and diluted basis. Basic earnings (loss) per share are computed by dividing income available to common shareholders by the weighted average number of common shares outstanding. Diluted earnings (loss) per share are computed by dividing income available to common shareholders by the weighted average number of shares outstanding plus the dilutive effect of potential securities.

|

For the three months

|

||||||||

|

Ended December 31,

|

||||||||

|

2013

|

2012

|

|||||||

|

|

|

|||||||

|

Net loss

|

$

|

(32,196

|

)

|

$

|

(938

|

)

|

||

|

Weighted average common shares

|

69,166,667

|

7,500,000

|

||||||

|

(denominator for basic earnings (loss) per share)

|

||||||||

|

Effect of dilutive securities:

|

-

|

-

|

||||||

|

Weighted average common shares

|

69,166,667

|

7,500,000

|

||||||

|

(denominator for diluted earnings (loss) per share)

|

||||||||

|

Basic loss per share

|

$

|

(0.00

|

)

|

$

|

(0.00

|

)

|

||

|

Diluted loss per share

|

$

|

(0.00

|

)

|

$

|

(0.00

|

)

|

||

13

5V INC.

(A Development Stage Company)

Notes to Financial Statements

(Unaudited)

Note 10-STOCKHOLDERS’ EQUITY

Common Stocks of 5V, Inc.

Currently, the Articles of Incorporation authorizes 5V, Inc. to issue 400,000,000 shares of common stock with a par value of $0.0001 per share. Upon formation of the 5V, Inc., 7,500,000 shares of common stock were issued to two founders for $750. On October 30, 2013, 5V, Inc. issued 92,500,000 shares of common stocks to acquire 100% of 5-V BV1 and its subsidiaries.

Issuance of 50,000 shares of common stock to the founders of 5-V Holding Limited

5V BVI’s Articles of Incorporation authorizes 5-V BVI to issue 50,000 shares of common stock with a par value of $1.00 per share. Upon formation of the 5-V BVI, 50,000 shares of common stock were issued for $50,000, which has not been received at the date this report.

Issuance of 10,000 shares of common stock to the funders of 5V Group Limited

The Articles of Incorporation of 5V authorizes 5V Group Limited to issue 10,000 shares of common stock with a par value of HKD$1.00 ($0.1287) per share. Upon formation of the 5V Group Limited, 10,000 shares of common stock were issued for HKD$10,000 ($1,287.00), which has not been received at the date this report.

Capital contribution of Shanghai BNC

In accordance with the Bylaws of Shanghai BNC, the registered capital at the date of incorporation of March 12, 2013 was $100,000, 20% of which must be contributed within three months after the business license is issued, and the balance must be contributed within two years after the business license is issued. The Bylaws of Shanghai BNC also stipulates that the total capital contribution is $140,000.

On May 29, 2013, 5V Group Limited, the sole shareholder, contributed $30,465, or 30.47% of the registered capital toward the registered capital as required by the PRC Company Law. Since 5V Group Limited did not have the funds, 5V Group Limited borrowed the $30,465 from Jun Jiang, CEO of 5V Group Limited.

Note 11-COMMITMENTS AND CONTINGENCIES

Control by principal stockholder/officer

Jun Jiang Chief Executive Officer owns beneficially and in the aggregate, the majority of the voting power of the Company. Accordingly, the chief executive officer has the ability to control the approval of most corporate actions, including approving significant expenses, increasing the authorized capital stock and the dissolution, merger or sale of the Company's assets.

14

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operation.

After the share exchange transaction with 5V BVI on October 30, 2013, we may engage in the research, sale and after-market service of herb diet nutritional supplement and skin-care products in China. There can be no assurance that we will be able to successfully implement our business plan to develop the herb diet nutritional supplement and skin-care product in China as discussed above, and we may, in addition to that business, continue to serve as a vehicle to effect an asset acquisition, merger, exchange of capital stock or other business combination with a domestic or foreign business in the herb nutrition business or other businesses. We have made no efforts to identify such a possible business combination. As a result, the Company has not conducted negotiations or entered into a letter of intent concerning any target business as discussed above. The Company’s principal business objective for the next 12 months and beyond such time will be to achieve long-term growth potential through a combination with a business rather than immediate, short-term earnings. The Company will not restrict its potential candidate target companies to any specific business, industry or geographical location and, thus, may acquire any type of business. There is no assurance that we will be able to identify and acquire any business entity, and even if we successfully acquire a business entity, there is no assurance that we can generate revenue and become profitable.

The Company currently does not engage in any business activities that provide cash flow. During the next twelve months, we may incur costs related to:

(i) filing Exchange Act reports,

(ii) WFOE’S compliance with Chinese laws and regulations,

(iii) research, sale and after-market service of herb diet nutritional supplement and skin-care products in China, and

(iv) investigating, analyzing and consummating an acquisition, whether or not the acquired entity is in a business related to herb nutrition.

We did not decide whether we will spend any funds to develope the herb nutrition business and skin-care product business in China, or to spend funds for expenses related to identifying and consuming an acquisition in the herb nutrition business or other businesses.

We believe we will be able to meet these costs through deferral of fees by certain service providers and through funds, as necessary, to be loaned to or invested in us by our stockholders, management or other investors. As of the date of the period covered by this report, the Company has no assets. There are no assurances that the Company will be able to secure any additional funding as needed. Currently, however, our ability to continue as a going concern is dependent upon our ability to generate future profitable operations and/or to obtain the necessary financing to meet our obligations and repay our liabilities arising from normal business operations when they come due. Our ability to continue as a going concern is also dependent on our ability to find a suitable target company and enter into a possible reverse merger with such company. Management’s plan includes obtaining additional funds by equity financing and/or related party advances, however there is no assurance of additional funding will be available.

The Company may consider acquiring a business which has recently commenced operations, is a developing company in need of additional funds for expansion into new products or markets, is seeking to develop a new product or service, or is an established business which may be experiencing financial or operating difficulties and is in need of additional capital. In the alternative, a business combination may involve the acquisition of, or merger with, a company which does not need substantial additional capital but which desires to establish a public trading market for its shares while avoiding, among other things, the time delays, significant expense, and loss of voting control which may occur in a public offering.

15

Any target business that is selected may be a financially unstable company or an entity in its early stages of development or growth, including entities without established records of sales or earnings. In that event, we will be subject to numerous risks inherent in the business and operations of financially unstable and early stage or potential emerging growth companies. In addition, we may effect a business combination with an entity in an industry characterized by a high level of risk, and, although our management will endeavor to evaluate the risks inherent in a particular target business, there can be no assurance that we will properly ascertain or assess all significant risks. Our management anticipates that it will likely be able to effect only one business combination, due primarily to our limited financing and the dilution of interest for present and prospective stockholders, which is likely to occur as a result of our management’s plan to offer a controlling interest to a target business in order to achieve a tax-free reorganization. This lack of diversification should be considered a substantial risk in investing in us, because it will not permit us to offset potential losses from one venture against gains from another.

The Company anticipates that the selection of a business combination will be complex and extremely risky. Through information obtained from industry publications and professionals, our management believes that there are numerous firms seeking the perceived benefits of becoming a publicly traded corporation. Such perceived benefits of becoming a publicly traded corporation include, among other things, facilitating or improving the terms on which additional equity financing may be obtained, providing liquidity for the principals of and investors in a business, creating a means for providing incentive stock options or similar benefits to key employees, and offering greater flexibility in structuring acquisitions, joint ventures and the like through the issuance of stock. Potentially available business combinations may occur in many different industries and at various stages of development, all of which will make the task of comparative investigation and analysis of such business opportunities extremely difficult and complex. We do not currently intend to retain any entity to act as a “finder” to identify and analyze the merits of potential target businesses.

Liquidity and Capital Resources

As of December 31, 2013 and, the Company had $1,973 in cash, as compared to no assets as of September 30, 2013. As of December 31, 2013, the Company had total liabilities equal to $136,766, comprised of $3,426 in accounts payable and $133,340 in advances from related party. This compares with total liabilities of $101,094, comprised of $8,261 in accounts payable and $92,833 in advances from related party, as of September 30, 2013. The Company can provide no assurance that it can continue to satisfy its cash requirements for at least the next twelve months.

The following is a summary of the Company's cash flows provided by (used in) operating, investing, and financing activities for the Three months ended December 31, 2013 and 2012 and for the cumulative period from February 19, 2010 (Inception) to December 31, 2013:

|

Three Months

Ended

December 31,

2013

|

Three Months

Ended

December 31,

2012

|

For the Cumulative

Period from

February 19, 2010

(Inception) to

December 31,

2013

|

||||||||||

|

Net Cash Provided by (Used in) Operating Activities

|

$

|

(28,492

|

)

|

$

|

-

|

$

|

(29,242

|

)

|

||||

|

Net Cash Provided by (Used in) Investing Activities

|

$

|

-

|

$

|

-

|

$

|

-

|

||||||

|

Net Cash Provided by (Used in) Financing Activities

|

$

|

1,973

|

$

|

-

|

$

|

1,973

|

||||||

|

Net Increase (Decrease) in Cash and Cash Equivalents

|

1,973

|

-

|

1,973

|

|||||||||

The Company has no assets and has generated no revenues since inception. The Company is also dependent upon the receipt of capital investment or other financing to fund its ongoing operations and to execute its business plan of seeking a combination with a private operating company. In addition, the Company is dependent upon certain related parties to provide continued funding and capital resources. If continued funding and capital resources are unavailable at reasonable terms, the Company may not be able to implement its plan of operations.

16

Results of Operations

No revenue has been generated by the Company from February 19, 2010 (Inception) to December 31, 2013. It is unlikely the Company will have any revenues unless it is able to effect an acquisition or merger with an operating company or starts operation of the herbal nutritional supplement and skin-care product business in China, of which there can be no assurance. It is management's assertion that these circumstances may hinder the Company's ability to continue as a going concern. The Company’s plan of operation for the next twelve months shall be to continue its efforts to locate suitable acquisition candidates.

For the three months ended December 31, 2013, the Company had a net loss of $32,196, consisting of legal, accounting, and other professional service fees incurred in relation to the preparation and filing of the Company’s periodic reports.

For the three months ended December 31, 2012, the Company had a net loss of $938, consisting of legal, accounting, and other professional service fees incurred in relation to the preparation and the filing of the Company’s periodic reports.

For the period from February 19, 2010 (Inception) to June 30, 2013, the Company had a net loss of $135,543, comprised exclusively of legal, accounting, audit, and other professional service fees incurred in relation to the formation of the Company, the filing of the Company’s Registration Statement on Form 10 on November 9, 2010, and the filing of the Company’s Exchange Act reports.

Off-Balance Sheet Arrangements

The Company does not have any off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on the Company’s financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that is material to investors.

Item 3. Quantitative and Qualitative Disclosures About Market Risk.

As a “smaller reporting company” as defined by Item 10 of Regulation S-K, the Company is not required to provide information required by this Item.

Item 4. Controls and Procedures.

Evaluation of Disclosure Controls and Procedures

We maintain disclosure controls and procedures that are designed to ensure that information required to be disclosed in our reports filed pursuant to the Exchange Act is recorded, processed, summarized and reported within the time periods specified in the SEC’s rules, regulations and related forms, and that such information is accumulated and communicated to our principal executive officer and principal financial officer, as appropriate, to allow timely decisions regarding required disclosure.

As of December 31, 2013, we carried out an evaluation, under the supervision and with the participation of our principal executive officer and our principal financial officer of the effectiveness of the design and operation of our disclosure controls and procedures. Based on this evaluation, our principal executive officer and our principal financial officer concluded that our disclosure controls and procedures were not effective as of the end of the period covered by this report.

17

Changes in Internal Controls

There were no changes in our internal controls over financial reporting during the quarter ended December 31, 2013 that have materially affected or are reasonably likely to materially affect our internal controls.

PART II — OTHER INFORMATION

There are presently no material pending legal proceedings to which the Company, any of its subsidiaries, any executive officer, any owner of record or beneficially of more than five percent of any class of voting securities is a party or as to which any of its property is subject, and no such proceedings are known to the Registrant to be threatened or contemplated against it.

Item 1A. Risk Factors.

As a “smaller reporting company” as defined by Item 10 of Regulation S-K, the Company is not required to provide information required by this Item.

Item 2. Unregistered Sales of Equity Securities and Use of Proceeds.

None.

Item 3. Defaults Upon Senior Securities.

None.

Item 4. Mine Safety Disclosures.

Not applicable.

Item 5. Other Information.

None.

18

|

Item 6.

|

Exhibits.

|

(a) Exhibits required by Item 601 of Regulation S-K.

|

Exhibit

|

Description

|

|

|

3.1

|

Certificate of Amendment to the Company’s Certificate of Incorporation, as filed with the Secretary of State of Delaware on April 16, 2013 incorporated by reference to Appendix in the Definitive Information Statement filed with the SEC on March 4, 2013

|

|

|

31.1

|

Certification of the Company’s Principal Executive Officer and Principal Financial and Accounting Officer, pursuant to Section 302 of the Sarbanes-Oxley Act of 2002, with respect to the registrant’s Quarterly Report on Form 10-Q for the quarter ended December 31, 2013.

|

|

|

32.1+

|

Certification of the Company’s Principal Executive Officer and Principal Financial and Accounting Officer pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002.

|

|

101.INS*

|

XBRL Instance Document

|

|

|

101.SCH*

|

XBRL Taxonomy Extension Schema Document

|

|

|

101.CAL*

|

XBRL Taxonomy Extension Calculation Linkbase Document.

|

|

|

101.LAB*

|

XBRL Taxonomy Extension Label Linkbase Document.

|

|

|

101.PRE*

|

XBRL Taxonomy Extension Presentation Linkbase Document.

|

|

|

101.DEF*

|

XBRL Taxonomy Extension Definition Linkbase Document.

|

+ In accordance with the SEC Release 33-8238, deemed being furnished and not filed.

* Furnished and not filed or a part of a registration statement or prospectus for purposes of Sections 11 or 12 of the Securities Act of 1933, as amended, deemed not filed for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, and otherwise not subject to liability under these sections.

19

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

5V, INC.

|

|||

|

Dated: April 10, 2014

|

By:

|

/s/ Jun Jiang

|

|

|

Jun Jiang

|

|||

|

President

|

|||

|

(Principal Executive officer, and

Principal Financial and Accounting Officer)

|

|||

20