Attached files

| file | filename |

|---|---|

| EX-23.1 - EX-23.1 - Zoe's Kitchen, Inc. | a2219585zex-23_1.htm |

| EX-10.11 - EX-10.11 - Zoe's Kitchen, Inc. | a2219585zex-10_11.htm |

As filed with the Securities and Exchange Commission on April 9, 2014

Registration No. 333-194457

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 4

to

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

ZOE'S KITCHEN, INC.

(Exact name of registrant as specified in its charter)

| Delaware (State or other jurisdiction of incorporation or organization) |

5812 (Primary Standard Industrial Classification Code Number) |

51-0653504 (I.R.S. Employer Identification Number) |

5700 Granite Parkway

Granite Park Building #2, Suite 455

Plano, Texas 75024

(205) 414-9920

(Address, including zip code, and telephone number, including area code, of registrant's principal executive offices)

Jason Morgan

Chief Financial Officer

5700 Granite Parkway

Granite Park Building #2, Suite 455

Plano, Texas 75024

(205) 414-9920

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies of all communications, including communications sent to agent for service, should be sent to:

| Joshua N. Korff, Esq. Michael Kim, Esq. Kirkland & Ellis LLP 601 Lexington Avenue New York, New York 10022 (212) 446-4800 |

Marc Jaffe, Esq. Ian Schuman, Esq. Latham & Watkins LLP 885 Third Avenue New York, New York 10022 (212) 906-1200 |

Approximate date of commencement of proposed sale to the public:

As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box: o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer o | Accelerated filer o | Non-accelerated filer ý (Do not check if a smaller reporting company) |

Smaller reporting company o |

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until this Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. The prospectus is not an offer to sell these securities nor a solicitation of an offer to buy these securities in any jurisdiction where the offer and sale is not permitted.

SUBJECT TO COMPLETION DATED APRIL 9, 2014

PRELIMINARY PROSPECTUS

5,833,333 Shares

Zoe's Kitchen, Inc.

Common Stock

We are offering 5,833,333 shares of our common stock. This is our initial public offering and no public market currently exists for our common stock. We expect our initial public offering price to be between $13.00 and $15.00 per share. We have applied to list our common stock on the New York Stock Exchange under the symbol "ZOES."

We are an "emerging growth company" as defined under the federal securities laws and, as such, will be subject to reduced public company reporting requirements. See "Prospectus Summary—Implications of Being an Emerging Growth Company."

Investing in our common stock involves a high degree of risk. Please read "Risk Factors" beginning on page 18 of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| |

PER SHARE | TOTAL | |||||

|---|---|---|---|---|---|---|---|

Public Offering Price |

$ | $ | |||||

Underwriting Discounts(1) |

$ | $ | |||||

Proceeds, before expenses, to us |

$ | $ | |||||

- (1)

- We refer you to "Underwriting" beginning on page 121 of this prospectus for additional information regarding total underwriters compensation.

Delivery of the shares of common stock is expected to be made on or about , 2014. We have granted the underwriters an option for a period of 30 days from the date of this prospectus to purchase an additional 874,999 shares of our common stock. If the underwriters exercise the option in full, the total underwriting discounts payable by us will be $ , and the total proceeds to us, before expenses, will be $ .

| Jefferies | Piper Jaffray | Baird | ||

William Blair |

Stephens Inc. |

Stifel |

Prospectus dated , 2014

TABLE OF CONTENTS

We have not and the underwriters have not authorized anyone to provide you with any information other than that contained in this prospectus or in any free writing prospectus prepared by or on behalf of us or to which we have referred you. We are offering to sell, and seeking offers to buy, shares of our common stock only in jurisdictions where such offers and sales are permitted. The information in this prospectus or any free writing prospectus is accurate only as of its date, regardless of its time of delivery or the time of any sale of shares of our common stock. Our business, financial condition, results of operations and prospects may have changed since that date.

MARKET, RANKING AND OTHER INDUSTRY DATA

This prospectus contains industry and market data, forecasts and projections that are based on internal data and estimates, independent industry publications, reports by market research firms or other published independent sources. In particular, we have obtained information regarding the restaurant industry, including sales and revenue growth in the fast casual segment of the restaurant industry, from Technomic Inc. ("Technomic"), a national consulting market research firm. Other industry and market data included in this prospectus are from internal analyses based upon data available from known sources or other proprietary research and analysis.

We believe these data to be reliable as of the date of this prospectus, but there can be no assurance as to the accuracy or completeness of such information. We have not independently verified the market and industry data obtained from these third-party sources. Our internal data and estimates are based upon information obtained from trade and business organizations, other contacts in the markets in which we operate and our management's understanding of industry conditions. Though we believe this information to be true and accurate, such information has not been verified by any independent sources. You should carefully consider the inherent risks and uncertainties associated with the market and other industry data contained in this prospectus.

We operate on a 52- or 53-week fiscal year that ends on the last Monday of the calendar year. All fiscal years presented herein consist of 52 weeks, with the exception of the fiscal year ended December 31, 2012, which consists of 53 weeks. Our first fiscal quarter consists of 16 weeks and each of our second, third and fourth fiscal quarters consist of 12 weeks, except for a 53-week year when the fourth quarter has 13 weeks. We refer to our fiscal years presented in this prospectus as 2013, 2012, 2011, 2010 and 2009. References to periods in this prospectus refer to a four week reporting period, except for the thirteenth period of a 53-week year, which would contain five weeks. References to comparable restaurant sales in this prospectus refer to comparable restaurant sales in our Company-owned restaurants which have been open for 18 consecutive periods or longer. References to average unit volumes ("AUVs") in this prospectus refer to average unit volumes at our Company-owned restaurants that have been open for a trailing 52-week period or longer. For purposes of both the comparable restaurant sales and AUV calculations the fifty-third week in 2012 has been excluded. References to customer traffic in this prospectus refer to non-catering entrée counts, including non-catering menu items intended for consumption by multiple guests, such as the Company's "Dinner for Four" offerings, which are counted as multiple entrées. References to per customer spend in this prospectus refer to total restaurant sales (excluding all catering related sales) divided by total customer traffic.

TRADEMARKS, SERVICE MARKS AND TRADE NAMES

We own the trademarks, service marks and trade names that we use in connection with the operation of our business, including our corporate names, logos and website names. This prospectus may also contain trademarks, service marks, trade names and copyrights of other companies, which are the property of their respective owners. Solely for convenience, the trademarks, service marks, trade names and copyrights referred to in this prospectus are listed without the TM, SM, © and ® symbols, but we will assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensors, if any, to these trademarks, service marks, trade names and copyrights.

ii

The following summary highlights information appearing elsewhere in this prospectus. This summary does not contain all of the information you should consider before investing in our common stock. You should read this entire prospectus carefully. In particular, you should read the sections entitled "Risk Factors" and "Management's Discussion and Analysis of Financial Condition and Results of Operations" and our consolidated financial statements and the notes relating to those statements included elsewhere in this prospectus. Some of the statements in this prospectus constitute forward-looking statements. See "Forward-Looking Statements."

In this prospectus, unless the context requires otherwise, references to "Zoës Kitchen," "Zoës," the "Company," "we," "our," or "us" refer to Zoe's Kitchen, Inc., the issuer of the common stock offered hereby, and its consolidated subsidiaries.

Our Company

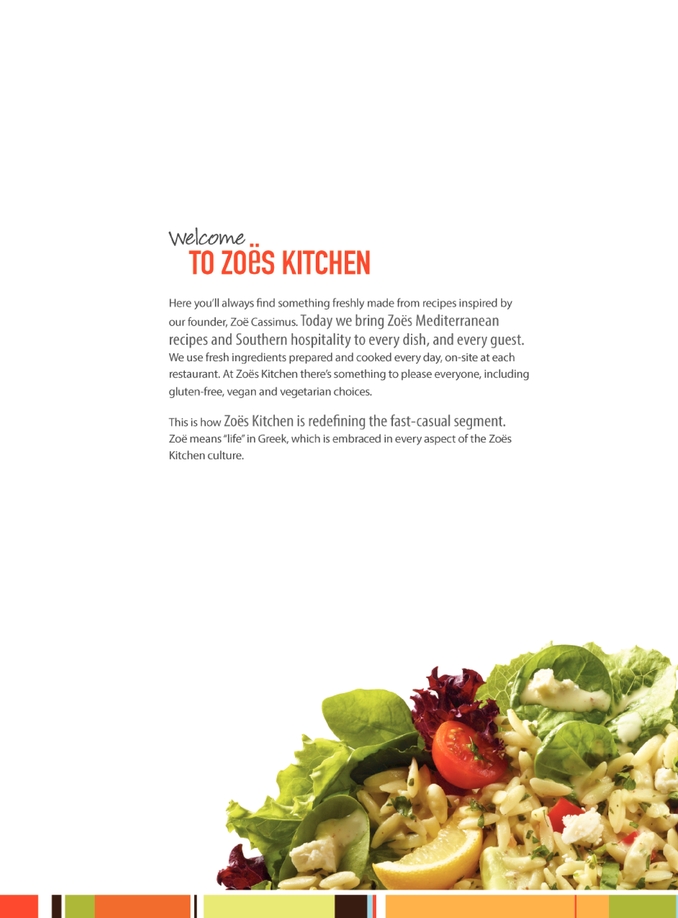

Born in the Mediterranean. Raised in the South. Bringing Mediterranean Mainstream.

Zoës Kitchen is a fast growing, fast casual restaurant concept serving a distinct menu of fresh, wholesome, Mediterranean-inspired dishes delivered with Southern hospitality. Founded in 1995 by Zoë and Marcus Cassimus in Birmingham, Alabama, Zoës Kitchen is a natural extension of Zoë Cassimus' lifetime passion for cooking Mediterranean meals for family and friends. Since opening our first restaurant, we have never wavered from our commitment to make our food fresh daily and to serve our customers in a warm and welcoming environment.

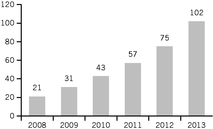

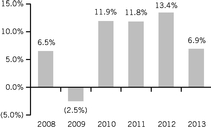

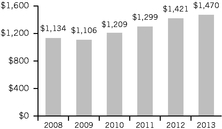

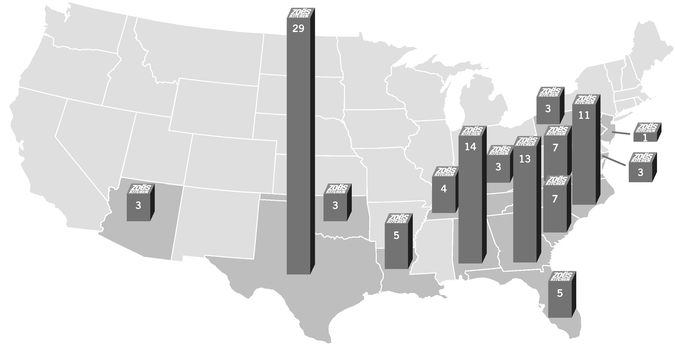

We believe our brand delivers on our customers' desire for freshly-prepared food and convenient, unique and high-quality experiences. As a result, we have delivered strong growth in restaurant count, comparable restaurant sales, AUVs, revenues and Adjusted EBITDA. We have grown from 21 restaurants across seven states, including five franchised locations, in 2008 to 111 restaurants across 15 states, including six franchised locations, as of February 24, 2014, representing a compound annual growth rate ("CAGR") of 38.1%. Our Company-owned restaurants have generated 16 consecutive fiscal quarters of positive comparable restaurant sales growth, due primarily to increases in customer traffic, which we believe demonstrates our growing brand equity. We have grown our Company-owned restaurant AUVs from approximately $1.1 million in 2009 to approximately $1.5 million in 2013, representing an increase of 32.9% over that time period. From 2009 to 2013, our total revenue increased from $20.8 million to $116.4 million and Adjusted EBITDA increased from $0.9 million to $10.9 million. We generated a net loss of $2.8 million and $3.7 million in 2009 and 2013, respectively. For a reconciliation of Adjusted EBITDA, a non-GAAP term, to net income, see "Summary Historical Consolidated Financial and Other Data." Our growth in comparable restaurant sales since 2009 has allowed us to invest significant amounts of capital to drive growth through the opening of new restaurants and the hiring of personnel required to support our growth plans.

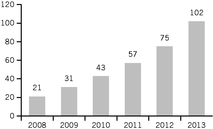

| Total Restaurants at End of Fiscal Year |

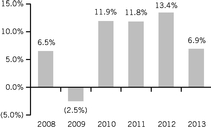

Comparable Restaurant Sales Growth |

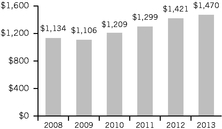

Average Unit Volumes (Dollars in thousands) |

||

|---|---|---|---|---|

|

|

|

1

Our Concept

Delivering Goodness in the Communities We Serve.

The word "zoë," which means "life" in Greek, is embraced in every aspect of the Zoës Kitchen culture and is a key component of our concept. Our mission is to "deliver goodness to our customers, from the inside out" by: (i) offering a differentiated menu of simple, tasty and fresh Mediterranean cuisine complemented with several Southern staples; (ii) extending genuine Southern hospitality with personality, including food delivered to your table; (iii) providing an inviting, cosmopolitan, casual-chic environment in our restaurants; and (iv) delivering an outstanding catering experience for business and social events. Our menu offers meals made generally from scratch using produce, proteins and other ingredients that are predominantly preservative- and additive-free, including our appetizers, soups, salads, and kabobs. We believe our team members are a reflection of our customers-educated, active and passionate-and embrace our culture of providing engaging, attentive service, which we believe helps drive brand advocacy. We believe we deliver a compelling value proposition by offering flavorful food that our customers feel good about eating and providing friendly customer service in an inviting atmosphere, all for an average per customer spend of $9.57 for 2013. Our food, including both hot and cold items, is well suited for catering to a variety of business and social occasions, and we believe our strong catering offering is a significant competitive differentiator that generates consumer trial of our menu and provides additional opportunities for existing customers to enjoy our food off-premise. For 2013, catering represented approximately 17% of our revenue.

We believe we provide an emotional connection to our target customer — educated, affluent women and their families — who represent approximately 70% of our customer visits, based on internal estimates and third-party data. We promote our brand as an extension of our customers' own kitchens by offering meals inspired by family recipes which reminds them of food they may have prepared at home, while allowing them to spend extra time with family and friends to fuel a balanced and active lifestyle. We believe our menu is appealing during both lunch and dinner, resulting in a balanced day-part mix of approximately 60% lunch and 40% dinner (excluding catering) for 2013.

Our Industry

We operate in the fast casual segment of the restaurant industry, which is one of the industry's fastest growing segments. According to Technomic, the fast casual segment generated $31 billion in sales in 2012 and is projected to grow at a CAGR of approximately 10% to $50 billion by 2017. The largest 78 fast casual restaurant concepts grew sales by 13.2% in 2012 to $24.2 billion, compared to growth of 4.9% for the 500 overall largest restaurant chains in the United States. We are the largest U.S.-based fast casual restaurant concept (by number of restaurants) featuring Mediterranean cuisine. Our differentiated menu offering flavorful Mediterranean food delivered to your table at an average per customer spend of $9.57 for 2013 positions us to compete successfully against other fast casual concepts as well as against casual dining restaurants, providing us with a large target market.

Our Strengths

Love Life, Live Zoës!

We believe the following strengths differentiate us and serve as the foundation for our continued growth.

Our Food—Simple. Tasty. Fresh! We believe the Zoës Kitchen experience is driven by providing simple, tasty and fresh Mediterranean food at a compelling value to our customers. High-quality ingredients serve as the foundation of Zoës Kitchen. We prepare our food by utilizing traditional Mediterranean preparation methods such as grilling and baking. Our menu is a reflection of traditional Mediterranean cuisine, offering an abundance of fresh fruits, vegetables and herbs, grains, olive oil and lean proteins. We believe the variety on our menu allows people with different preferences to enjoy a meal together.

- •

- Simple. Our food is simply prepared and made to order in our scratch kitchens. Our cooking philosophy is rooted in rich traditions that celebrate food, rather than in fads or trends. From our

2

- •

- Tasty. True to our heritage, the

flavors in our menu are born in the Mediterranean and raised in the South. Inspired by family recipes and Zoë Cassimus' simple, fresh-from-the-garden sensibility, our menu features

Mediterranean cuisine complemented with several Southern staples. We offer our customers wholesome, flavorful items such as our Mediterranean Tuna sandwich, as well as entrées such as

chicken, steak and salmon kabobs and chicken and spinach roll-ups (tortillas stuffed with feta cheese, grilled chicken, sundried tomatoes and spinach), each of which is served with a choice of a side

item such as braised rosemary white beans, rice pilaf, pasta salad, roasted vegetables or seasonal fruit. Our culinary team delivers flavorful new menu additions with seasonal ingredients allowing our

customers to "Live Mediterranean." One example is our new Mediterranean Quinoa Salad where quinoa is combined with broccoli, tomatoes, onions and feta cheese to deliver a nutritious

entrée packed with flavor. Our commitment to fresh food, combined with our traditional Mediterranean cooking philosophy, results in food options that are full of flavor.

- •

- Fresh. We seek to provide customers with flavorful menu offerings that align with our customers' lifestyles. Fresh ingredients are delivered to our kitchens, and team members wash, cut and prepare food in our kitchens daily. We utilize grilling as the predominant method of cooking our food, and there are no microwaves or fryers in our restaurants. We cater to a variety of dietary needs by offering vegetarian, vegan, gluten-free and our calorie conscious Simply 500TM menu selections. We aim to provide food that makes our customers feel good about themselves and their decision to choose Zoës Kitchen.

hummus, made fresh daily and served with warm pita bread, to our flavorful salads and kabobs, we serve real food. By real food, we mean food made from simple ingredients, such as raw vegetables, fruits and legumes. We serve food the way it was prepared 100 years ago — raw, grilled or baked. Our goodness is created through the careful selection of quality, wholesome ingredients, time-honored preparations inspired by Mediterranean culinary traditions, family recipes that have been passed down for generations and delivering balanced meals.

Differentiated Fast Casual Lifestyle Brand with a Desirable and Loyal Customer Base. We believe the Zoës Kitchen brand reflects our customers' desire for convenient, unique and enjoyable experiences and their commitment to family, friends and enjoying every moment. We seek to deliver on these desires and to provide goodness to both the mind and the body by fueling our customers' active lifestyle with nutritious food that makes them feel great from the inside out. We believe we are an aspirational brand with broad appeal that our customers embrace as a reflection of their desired self-image — active, vibrant, sophisticated, genuine, caring and passionate, which results in customer advocacy and repeat visits. Based on third-party surveys, we estimate that approximately 94% of our surveyed customers intend to recommend Zoës Kitchen. We seek to strengthen our brand through grassroots marketing programs and the use of social media and technology aimed at building long-term relationships with our customers and inspiring lifelong brand advocates.

We provide a welcoming environment, attracting customers from a variety of demographic groups. We believe our combination of menu offerings, ambience and location is designed to appeal to educated and affluent women, who along with their families, represent approximately 70% of our customer visits. Our female customers generally lead active lifestyles, have an average annual household income of over $100,000 and a majority of them are college educated. We believe this demographic represents a highly-desirable customer base with strong influence on a family's mealtime decision-making and are strong brand advocates. We also believe they appreciate the authenticity of our brand and the quality of our menu offerings, admire that we are still cooking meals inspired by family recipes and feel good about the food they provide to themselves and their families when choosing Zoës Kitchen. Additionally, we believe our attractive demographic mix, high repeat visit rate and our ability to draw an average of approximately 2,500 customers to each of our restaurants per week makes us a desirable tenant to landlords and developers of lifestyle centers seeking to drive traffic to complementary retail businesses.

3

Delivering a Contemporary Mediterranean Experience with Southern Hospitality. We strive to provide an inviting and enjoyable customer experience through the atmosphere of our restaurants and the friendliness of our team members. Our restaurants, highlighted by our distinct Zoës Kitchen stripes drawn from the color palette of many seaside Mediterranean neighborhoods, are designed to be warm, welcoming and full of energy. Each of our restaurants has a unique layout to optimize the available space with consistent design cues that strive to balance the richness of dark wood with contemporary, colorful and cosmopolitan casual-chic décor. Our patios, a core feature of our restaurants, are an authentic part of both our Southern and Mediterranean heritage and we believe they provide a relaxing and welcoming dining environment. We invite the community to be a part of each restaurant by showcasing local items such as artwork by the children of our customers. Overall, we seek to create an environment that welcomes casual conversations, family moments or quick exchanges as our customers eat and enjoy a break from their busy schedules.

True to our Southern heritage, we aim to deliver hospitality and attentive service whether our customers choose to dine-in, take-out or host a catered event. Our team members are a reflection of our customers — educated, active and passionate. They are the heart and soul of what we call "Southern hospitality with personality" — making sure our customers feel as welcome as they are well fed. Our team members are trained to deliver personalized service and maintain a clean and inviting atmosphere that fosters a pleasant dining experience. We offer modified table service where, after ordering at the counter, our customers' food is served at their table on china with silverware. Our team members routinely check on them throughout the meal and then bus their table, all without the expectation of receiving a tip. We believe the atmosphere of our restaurants and the dedication of our team members encourages repeat visits, inspires advocacy and drives increased sales.

Diverse Revenue Mix Provides Multiple Levers for Growth. We believe our differentiated menu of both hot and cold food enables our customers to utilize our restaurant for multiple occasions throughout the day. We had a balanced day-part mix of approximately 60% lunch and 40% dinner (excluding catering), and our catering business represented approximately 17% of revenue, in each case, for 2013. We view catering as our third day-part, which helps to increase AUVs and brand awareness by introducing our concept to new customers through trial. We believe we effectively serve both small and large groups in our restaurants, as well as outside of our restaurants with our catering and home meal replacement alternatives, including our Zoës Fresh TakeTM grab-and-go coolers and our family dinner options. In addition, we also serve beer and wine in a majority of our restaurants. We believe the breadth of our offerings provides us multiple levers to continue to drive growth.

Attractive Unit Economic Model with Proven Portability. Our sophisticated, predictive site selection strategy and flexible new restaurant model have resulted in growth in markets of varying sizes as we have expanded our restaurant base utilizing in-line, end-cap and free-standing restaurant formats. We believe our strong performance across a variety of geographic areas and steady AUV growth are validation of our concept's portability. For 2013, our top 20 performing restaurants were spread across seven different states. We have experienced consistent AUV growth across all of our restaurant vintages.

Our restaurant model is designed to generate strong cash flow, attractive restaurant-level financial results and high returns on invested capital. We believe our unit economic model provides a return on investment that is attractive to investors and supports further use of cash flow to grow our restaurant base. Our new restaurant investment model targets an average cash build-out cost of approximately $750,000, net of tenant allowances, AUVs of $1.3 million and cash-on-cash returns in excess of 30% by the end of the third full year of operation. On average, new restaurants opened since the beginning of 2009 have exceeded these AUV and cash-on-cash return targets within the third year of operations. Additionally, since the majority of our restaurant base was built in 2009 or after, we believe our restaurants are well maintained and will likely require minimal additional capital expenditures in the near term, allowing a majority of our cash flow to be available for investment in new restaurant development and other growth initiatives.

4

Experienced Management Team. Our strategic vision and results-driven culture are directed by our senior management team under the leadership of Kevin Miles, who guided the growth of our Company from 22 to 111 restaurants. Mr. Miles joined Zoës Kitchen in 2009 as Executive Vice President of Operations. In 2011, he was promoted to President and Chief Operating Officer, and in 2012, he was promoted to Chief Executive Officer. Mr. Miles is a fast casual industry veteran with over 20 years of relevant experience including leadership roles at La Madeleine French Bakery and Café, Baja Fresh Mexican Grill and Pollo Campero. He directs a team of dedicated and progressive leaders who are focused on executing our business plan and implementing our growth strategy. We believe our experienced management team is a key driver of our restaurant growth and positions us well for long-term growth.

Our Growth Strategies

Bringing Mediterranean Mainstream.

We plan to execute the following strategies to continue to enhance our brand awareness and grow our revenue and achieve profitability.

Grow Our Restaurant Base. We have expanded our restaurant base from 21 restaurants in seven states in 2008 to 111 restaurants in 15 states as of February 24, 2014. We opened 27 restaurants in 2013, and we plan to open 28 to 30 restaurants in 2014. We believe we are in the early stages of our growth story and estimate a long-term total restaurant potential in the United States in excess of 1,600 locations. We utilize a sophisticated site selection process using proprietary methods to identify target markets and expansion opportunities within those markets. Based on this analysis, we believe there is substantial development opportunity in both new and existing markets. We expect to double our restaurant base in approximately four years.

Increase Comparable Restaurant Sales. We have consistently demonstrated strong comparable restaurant sales growth, and we intend to generate future comparable restaurant sales growth with an emphasis on the following goals:

- •

- Heighten brand awareness to drive new customer

traffic. We utilize a marketing strategy founded on inspiring brand advocacy rather than simply capturing customers through traditional

tactics such as limited time offers. Our highly-targeted marketing strategy seeks to generate brand loyalty and promote advocacy by appealing to customers' emotional needs: (i) their passion

for wholesome and flavorful food; (ii) their desire for simple solutions to make life more convenient; (iii) their focus on choices as a reflection of self; and (iv) their desire

to be a guest at their own party. We have a long history of generating new traffic growth at our restaurants through the application of targeted advertising messages, local restaurant-level marketing

and the word-of-mouth of our existing customers to build brand recognition in the markets we serve.

We utilize a variety of channels to communicate brand messaging and build relationships with customers. Our digital strategy includes social media, online influencer programming and blogs hosted on our website and microsite. Our social community, including Facebook, Pinterest, Instagram and Twitter, includes more than 140,000 users combined. In addition, customers can opt into our e-mail marketing program or download our custom mobile LIFE app, which consists of 293,000 unique members combined. These programs enable us to segment and target messaging applicable to each of these members. We also use traditional methods to appeal to customers inside our restaurants, including point of purchase displays and cashier incentive programs. We build brand awareness through partnerships with schools and community partners, as well as complementary businesses that target our core customers. We will continue to leverage our catering business, promotional events and a targeted menu sampling strategy as effective means to introduce customers to the Zoës Kitchen brand. We believe the continued implementation of our highly-targeted marketing strategy, combined with the core strengths of our brand, will increase brand awareness, build long-term customer advocacy and drive incremental sales at our restaurants.

5

- •

- Increase existing customer

frequency. We believe we will be able to continue to increase customer frequency by consistently providing fresh Mediterranean cuisine at

a compelling value. We intend to explore new menu additions by drawing upon the rich heritage and flavors of 21 Mediterranean countries and family recipes to enhance our offerings and encourage

frequency. We will continue to explore ways to increase the number of occasions (lunch, dinner and catering) and the flexibility of dining options (dine-in, to-go/take home, call-in and online) for

our customers to consume our food. We also plan to capitalize on the increasing demand for convenient, high-quality home meal replacement alternatives by expanding the food options in our

Zoës Fresh TakeTM grab-and-go coolers and our family dinner menu offerings, which include a salad, entrée and side items offered for approximately $30 for a

family of four.

- •

- Grow our catering business. Our management team has developed innovative solutions, loyalty programs and a dedicated team of sales professionals to enhance our catering offering, which represented approximately 17% of our revenue for 2013. We believe our strong catering offering is a significant competitive differentiator and generates consumer trial of our brand as well as provides our existing customers additional ways to enjoy our food off-premise. We offer catering solutions for both business and social occasions, and we believe our hot and cold menu offerings differentiate our catering business as our food is portable and conducive to travel. We are focused on making catering easier for our customers, which we believe helps to promote brand advocacy by allowing customers to be a guest at their own party. We offer social catering solutions designed for our core customers' life events, including Zoës Party Packs, which are bundled catering packages for birthday parties, baby and bridal showers, sporting and outdoor events, girls night out and family gatherings.

Improve Margins and Leverage Infrastructure. We have invested in our business, and we believe our corporate infrastructure can support a restaurant base greater than our existing footprint. As we continue to grow, we expect to drive greater efficiencies in our supply chain and leverage our technology and existing support infrastructure. Additionally, we believe we will be able to optimize labor costs at existing restaurants as our restaurant base matures and AUVs increase and leverage corporate costs over time to enhance margins as general and administrative expenses grow at a slower rate than our restaurant base and revenues.

An investment in our common stock involves a high degree of risk. Any of the factors set forth under "Risk Factors" may limit our ability to successfully execute our business strategy. You should carefully consider all of the information set forth in this prospectus and, in particular, should evaluate the specific factors set forth under "Risk Factors" in deciding whether to invest in our common stock. Below is a summary of some of the principal risks we face:

- •

- we may not be able to successfully implement our growth strategy if we are

unable to locate and secure appropriate sites for restaurant locations, obtain favorable lease terms, attract customers to our restaurants or hire and retain personnel;

- •

- challenging economic conditions may affect our business by adversely

impacting numerous items that include, but are not limited to: consumer confidence and discretionary spending, the availability of credit presently arranged from our Credit Facility (as defined

herein), the future cost and availability of credit and the operations of our third-party vendors and other service providers;

- •

- new restaurants may not be profitable, and we may not be able to maintain or

improve levels of our AUVs and comparable restaurant sales;

- •

- we rely heavily on certain vendors, suppliers and distributors, which could

adversely affect our business;

- •

- the restaurant industry is a highly competitive industry with many well-established competitors;

6

- •

- we may face negative publicity or damage to our reputation, which could

arise from concerns regarding food safety and foodborne illness or other matters;

- •

- legislation and regulations, as well as new information or attitudes

regarding diet and health could result in changes in regulations and consumer consumption habits that could adversely affect our business;

- •

- changes in food and supply costs or failure to receive frequent deliveries

of fresh food ingredients and other supplies could adversely affect our business;

- •

- our principal stockholders and their affiliates own a substantial portion of

our outstanding equity, and their interests may not always coincide with the interests of the other stockholders; and

- •

- we will face increased costs as a result of being a public company.

We were incorporated in Delaware in October 2007 and currently exist as a Delaware corporation. Currently, we are a wholly owned subsidiary of Zoe's Investors, LLC, ("Zoe's Investors"). On October 31, 2007 Brentwood Associates and certain of its affiliated entities ("Brentwood") collectively became the majority unitholder of Zoe's Investors.

In connection with this offering, Zoe's Investors will distribute all of our shares of common stock held by it to its existing members in accordance with the units held by each member and pursuant to the terms of Zoe's Investors' Limited Liability Company Agreement, as amended. The distribution of 12,561,414 shares of our common stock held by Zoe's Investors to its members will be conducted in the following manner: (i) 500,000 shares of our common stock to holders of Class C Units in respect of such holders' unreturned capital investment; (ii) 313,970 shares of our common stock to holders of Class C Units in respect of the unpaid yield on such units; (iii) 2,650,658 shares of our common stock to holders of Class A Units in respect of such holders' unreturned capital investment; (iv) 1,765,379 shares of our common stock to holders of Class A Units in respect of the unpaid yield on such units; and (v) 7,331,407 shares of our common stock to holders of Class A Units, Class B Units and Class C Units on a pro rata basis; provided, however, that pursuant to this clause (v), the holders of Class B Units will participate only after a total of 5,230,007 shares of our common stock have been distributed to the holders of Class A Units and Class C Units pursuant to this clause (v). The foregoing distribution is based upon an initial public offering price of $14.00 per share, which is the midpoint of the estimated offering price range set forth on the cover page of this prospectus and gives effect to the 125,614.14-for-1 stock split of our common stock, which will be effected prior to the completion of this offering (the "Stock Split"). The amount of common stock distributed to each member of Zoe's Investors of the total 12,561,414 shares of our common stock held by Zoe's Investors is subject to change based on any changes to the initial public offering price and the date of the pricing of this offering. It is currently contemplated that Zoe's Investors will be dissolved shortly following the distribution and the completion of the offering. The foregoing transactions are herein called the "Distribution Transactions."

Our principal executive offices are located at 5700 Granite Parkway, Granite Park Building #2, Suite 455, Plano, Texas 75024. Our telephone number is (205) 414-9920. The address of our main website is www.zoeskitchen.com. The information contained in or that can be accessed through our website does not constitute a part of, and is not incorporated by reference into, this prospectus.

7

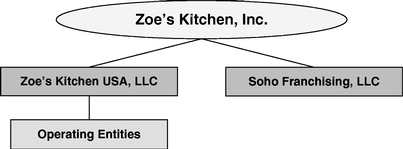

The chart below illustrates our current basic corporate structure and our basic corporate structure upon completion of this offering.

Brentwood is a consumer-focused private equity investment firm with over $800 million of capital under management as of December 30, 2013 and a 30-year history of investing in leading middle-market growth companies. Immediately following the consummation of this offering, Brentwood will own approximately 48% of our common stock, or 45% if the underwriters' option to purchase additional shares of our common stock is exercised in full based on an initial public offering price of $14.00 per share, the midpoint of the estimated offering price range set forth on the cover of this prospectus.

IMPLICATIONS OF BEING AN EMERGING GROWTH COMPANY

We qualify as an emerging growth company as defined in the Jumpstart our Business Startups Act of 2012 (the "JOBS Act"). An emerging growth company may take advantage of specified reduced reporting and other burdens that are otherwise applicable generally to public companies. These provisions include:

- •

- a requirement to have only two years of audited financial statements and

only two years of related selected financial data and management's discussion and analysis of financial condition and results of operations disclosure;

- •

- an exemption from the auditor attestation requirement in the assessment of

our internal control over financial reporting pursuant to the Sarbanes-Oxley Act of 2002 (the "Sarbanes-Oxley Act");

- •

- an exemption from new or revised financial accounting standards until they

would apply to private companies and from compliance with any new requirements adopted by the Public Company Accounting Oversight Board requiring mandatory audit firm rotation;

- •

- reduced disclosure about the emerging growth company's executive

compensation arrangements; and

- •

- no requirement to seek non-binding advisory votes on executive compensation or golden parachute arrangements.

The JOBS Act permits emerging growth companies to take advantage of an extended transition period to comply with new or revised accounting standards applicable to public companies. We are choosing to "opt out" of this provision, and as a result, we plan to comply with new or revised accounting standards as required when they are adopted. This decision to opt out of the extended transition period is irrevocable.

We have elected to adopt certain of the reduced disclosure requirements available to emerging growth companies. As a result of these elections, the information that we provide in this prospectus may be different than the information you may receive from other public companies in which you hold equity interests. In addition, it is possible that some investors will find our common stock less attractive as a

8

result of our elections, which may result in a less active trading market for our common stock and more volatility in our stock price.

We may take advantage of these provisions until we are no longer an emerging growth company. We will remain an emerging growth company until the earlier of (1) the last day of the fiscal year (a) following the fifth anniversary of the completion of this offering, (b) in which we have total annual gross revenue of at least $1.0 billion or (c) in which we are deemed to be a large accelerated filer, which means the market value of our common stock that is held by non-affiliates exceeds $700 million as of the last business day of our prior second fiscal quarter, and (2) the date on which we have issued more than $1.0 billion in non-convertible debt during the prior three-year period. We may choose to take advantage of some but not all of these reduced disclosure requirements.

9

Issuer |

Zoe's Kitchen, Inc. | |

Common stock offered by us |

5,833,333 shares. |

|

Underwriters' option to purchase additional shares |

We have granted the underwriters a 30-day option to purchase up to an additional 874,999 shares of our common stock. |

|

Common stock to be outstanding immediately after completion of this offering |

Immediately following the consummation of this offering, we will have 18,394,747 shares of common stock outstanding, or 19,269,746 shares if the underwriters' option to purchase additional shares of our common stock is exercised in full. |

|

Use of proceeds |

We estimate that the net proceeds to us from this offering, after deducting the underwriting discount and estimated offering expenses payable by us, will be approximately $73.3 million, or $84.7 million if the underwriters' option to purchase additional shares of our common stock is exercised in full, assuming the shares offered by us are sold for $14.00 per share, the midpoint of the estimated offering price range set forth on the cover of this prospectus. |

|

|

We intend to use the net proceeds from the sale of common stock by us in this offering (i) to repay the entire amount of the outstanding borrowings under our Credit Facility, (ii) to continue to support our growth, primarily through opening new restaurants, and (iii) for working capital and general corporate purposes. For additional information, see "Use of Proceeds." |

|

Dividend policy |

We currently intend to retain all available funds and any future earnings to fund the development and growth of our business and to repay indebtedness, and therefore, we do not anticipate paying any cash dividends in the foreseeable future. Any future determination to declare and pay cash dividends will be at the discretion of our Board of Directors and will depend on, among other things, our financial condition, results of operations, cash requirements, contractual restrictions and such other factors as our Board of Directors deems relevant. In addition, our Credit Facility restricts our ability to pay dividends. For additional information, see "Dividend Policy." |

|

Listing |

We have applied to list our common stock on the New York Stock Exchange under the symbol "ZOES." |

|

Risk factors |

Investing in our common stock involves a high degree of risk. See "Risk Factors" beginning on page 18 of this prospectus for a discussion of factors you should carefully consider before investing in our common stock. |

10

Unless otherwise indicated, all information in this prospectus assumes or gives effect to:

- •

- other than historical financial information, the Stock Split, as described

in "—Our Corporate Information;"

- •

- the filing and effectiveness of our amended and restated certificate of

incorporation and amended and restated bylaws, which we will adopt immediately prior to the completion of this offering;

- •

- the Distribution Transactions;

- •

- the exclusion of 1,905,799 shares of our common stock reserved for future

grants under our 2014 Incentive Plan, including 500,000 shares of common stock issuable upon the exercise of stock options with an exercise price equal to the initial public offering price to

be issued to certain officers, directors, employees and consultants, half of such stock options which will vest immediately upon the completion of this offering and the remainder of which will vest in

four equal annual installments following the date of the grant and 7,142 restricted stock units to be issued to certain directors which will vest in three equal annual installments following the date

of the grant;

- •

- no exercise by the underwriters of their option to purchase up to

874,999 additional shares from us; and

- •

- an initial public offering price of $14.00 per share, the midpoint of the estimated offering price range set forth on the cover of this prospectus.

11

SUMMARY HISTORICAL CONSOLIDATED FINANCIAL AND OTHER DATA

The following table presents our summary historical consolidated financial data and certain other financial data. The consolidated statement of operations and consolidated statement of cash flows data for the years ended December 30, 2013, December 31, 2012 and December 26, 2011 have been derived from our historical audited consolidated financial statements, which are included in this prospectus.

We operate on a 52-or 53-week fiscal year that ends on the last Monday of the calendar year. All fiscal years presented herein consist of 52 weeks, with the exception of the fiscal year ended December 31, 2012, which consisted of 53 weeks. Our first fiscal quarter consists of 16 weeks, and each of our second, third and fourth fiscal quarters consist of 12 weeks, except for a 53-week year when the fourth quarter has 13 weeks. We refer to our fiscal years as 2013, 2012 and 2011.

The consolidated financial data and other financial data presented below should be read in conjunction with the sections entitled "Selected Historical Consolidated Financial and Other Data," "Management's Discussion and Analysis of Financial Condition and Results of Operations," and our audited consolidated financial statements and the related notes thereto included elsewhere in this prospectus. Our historical consolidated financial data may not be indicative of our future performance.

12

| |

Fiscal Year Ended | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| |

December 30, 2013 |

December 31, 2012 |

December 26, 2011 |

|||||||

| |

(Dollars in thousands, except per share data) |

|||||||||

Consolidated Statement of Operations Data: |

||||||||||

Revenue: |

||||||||||

Restaurant sales |

$ | 115,748 | $ | 78,966 | $ | 49,193 | ||||

Franchise and royalty fees |

637 | 757 | 984 | |||||||

Total revenue |

116,385 | 79,724 | 50,177 | |||||||

Operating expenses: |

||||||||||

Restaurant operating costs: |

||||||||||

Cost of sales (excluding depreciation and amortization) |

38,063 | 25,845 | 15,756 | |||||||

Labor |

32,810 | 21,567 | 13,424 | |||||||

Store operating expenses |

21,780 | 14,610 | 9,596 | |||||||

General and administrative expenses |

13,172 | 8,969 | 6,384 | |||||||

Depreciation |

5,862 | 3,779 | 2,840 | |||||||

Amortization |

1,601 | 1,091 | 585 | |||||||

Pre-opening costs |

1,938 | 917 | 806 | |||||||

Loss (gain) from disposal of equipment |

175 | 240 | (4 | ) | ||||||

Total operating expenses |

115,401 | 77,018 | 49,387 | |||||||

Income (loss) from operations |

985 | 2,706 | 790 | |||||||

Other expenses: |

||||||||||

Interest expense |

4,019 | 2,337 | 1,248 | |||||||

Loss on interest cap |

25 | — | — | |||||||

Bargain purchase gain from acquisitions |

— | — | (541 | ) | ||||||

Total other expenses |

4,044 | 2,337 | 707 | |||||||

Income (loss) before provision for income taxes |

(3,059 | ) | 369 | 83 | ||||||

Provision for income taxes |

656 | 622 | 110 | |||||||

Net loss |

$ | (3,715 | ) | $ | (253 | ) | $ | (27 | ) | |

Net loss per share: |

||||||||||

Basic |

$ | (37,151 | ) | $ | (2,529 | ) | $ | (269 | ) | |

Diluted |

$ | (37,151 | ) | $ | (2,529 | ) | $ | (269 | ) | |

Weighted average shares outstanding: |

||||||||||

Basic |

100 | 100 | 100 | |||||||

Diluted |

100 | 100 | 100 | |||||||

Adjusted net income (loss) per common share(1): |

||||||||||

Basic |

(0.08 | ) | ||||||||

Diluted |

(0.08 | ) | ||||||||

Adjusted pro forma weighted average number of common shares outstanding(1): |

||||||||||

Basic |

18,394,747 | |||||||||

Diluted |

18,394,747 | |||||||||

Consolidated Statement of Cash Flows Data: |

||||||||||

Net cash provided by operating activities |

$ | 10,924 | $ | 7,796 | $ | 4,764 | ||||

Net cash used in investing activities |

(28,242 | ) | (21,283 | ) | (13,519 | ) | ||||

Net cash provided by financing activities |

16,017 | 15,130 | 7,600 | |||||||

13

| |

As of December 30, 2013 | ||||||

|---|---|---|---|---|---|---|---|

| |

Actual | Pro Forma As Adjusted(2) |

|||||

| |

(Dollars in thousands) |

||||||

Balance Sheet Data: |

|||||||

Cash and cash equivalents |

$ | 1,149 | $ | 27,681 | |||

Property and equipment, net |

78,629 | 78,629 | |||||

Total assets |

119,937 | 145,424 | |||||

Total debt(3) |

61,650 | 20,250 | |||||

Total stockholders' equity |

33,579 | 105,914 | |||||

| |

Fiscal Year Ended | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| |

December 30, 2013 |

December 31, 2012 |

December 26, 2011 |

|||||||

| |

(Dollars in thousands) |

|||||||||

Other Operating Data: |

||||||||||

Company-owned restaurants at end of period |

94 | 67 | 48 | |||||||

Franchise restaurants at end of period |

8 | 8 | 9 | |||||||

Company-owned: |

||||||||||

Average unit volume |

$ | 1,470 | $ | 1,421 | $ | 1,299 | ||||

Comparable restaurant sales growth |

6.9 | % | 13.4 | % | 11.8 | % | ||||

Restaurant contribution(4) |

$ | 23,095 | $ | 16,945 | $ | 10,418 | ||||

as a percentage of restaurant sales |

20.0 | % | 21.5 | % | 21.2 | % | ||||

Adjusted EBITDA(5) |

$ | 10,899 | $ | 9,153 | $ | 5,440 | ||||

as a percentage of revenue |

9.4 | % | 11.5 | % | 10.8 | % | ||||

Capital expenditures |

$ | 28,267 | $ | 15,462 | $ | 10,959 | ||||

- (1)

- Adjusted

net income (loss) per common share reflects: (i) the elimination of the fees paid to Brentwood pursuant to the Corporate

Development and Administrative Services Agreement and fees paid to Greg Dollarhyde pursuant to the Consulting Agreement, each as defined herein, (ii) the net decrease in interest expense

resulting from the repayment of the entire amount of the outstanding borrowings under our Credit Facility with the net proceeds from this offering, as described in "Use of Proceeds," and

(iii) increases in income tax expense due to higher income before income taxes resulting from the elimination of the annual management fee and consulting fee as a result of the termination of

the Corporate Development and Administrative Services Agreement and the Consulting Agreement described in (i) above and a decrease in interest expense as a result of repayments of the entire

amount of the outstanding borrowings under our Credit Facility as described in (ii) above as if each of these events had occurred on January 1, 2013. Adjusted basic net income (loss) per

common share consists of adjusted net income (loss) divided by the adjusted pro forma basic weighted average common stock outstanding. Adjusted diluted net income (loss) per common share consists of

adjusted net income (loss) divided by the adjusted pro forma diluted weighted average common stock outstanding.

Adjusted pro forma per share data gives effect to (i) the Distribution Transactions, as described in "—Our Corporate Information," (ii) the filing and effectiveness of our amended and restated certificate of incorporation and amended and restated bylaws, including the Stock Split, as described in "—Our Corporate Information," which we will adopt prior to the completion of this offering and (iii) the 5,833,333 shares of our common stock issued by us in this offering at an initial public offering price of $14.00 per share, which represents the midpoint of the estimated offering price range set forth on the cover page of this prospectus, as if each of these events had occurred on January 1, 2013.

14

- The

following is a reconciliation of historical net loss to adjusted net income (loss) for 2013:

(Dollars in thousands, except per share data)

|

Year Ended December 30, 2013 |

|||

|---|---|---|---|---|

Net loss, as reported |

$ | (3,715 | ) | |

Management and consulting fees and expenses(a) |

265 | |||

Decrease in interest expense(b) |

1,973 | |||

Increase in income tax expense(c) |

— | |||

Adjusted net income (loss) |

$ | (1,477 | ) | |

Adjusted pro forma weighted average common stock outstanding(d) |

||||

Basic |

18,394,747 | |||

Diluted |

18,394,747 | |||

Adjusted Basic net income (loss) per share |

$ | (0.08 | ) | |

Adjusted Diluted net income (loss) per share |

$ | (0.08 | ) | |

|

|

||||

- (a)

- Management

and consulting fees and expenses represent fees paid to Brentwood pursuant to the Corporate Development and Administrative Services

Agreement and fees paid to Greg Dollarhyde pursuant to the Consulting Agreement. See "Certain Relationships and Related Party Transactions—Corporate Development and Administrative Services

Agreement" and "Certain Relationships and Related Party Transactions—Consulting Agreement."

- (b)

- Reflects

the adjustment to interest expense resulting from the repayment of the entire amount of the outstanding borrowings under our Credit

Facility with the net proceeds of this offering as if these transactions occurred on January 1, 2013 and assumes no additional borrowings under our Credit Facility during the period presented.

This interest adjustment was calculated by reversing the historical interest expense related to borrowings under our Credit Facility.

- (c)

- Reflects

no adjustment to income tax expense as a result of the transactions described in (a) and (b) above because as of December 30,

2013 we had federal net operating loss carryforwards of $15.9 million and state net operating loss carryforwards of $13.5 million that would have offset any increase in income tax

expense as a result of the transactions described in (a) and (b) above.

- (d)

- Reflects the (i) Stock Split, (ii) Distribution Transactions and (iii) issuance of 5,833,333 additional shares of common stock in this offering, as if all these transactions occurred at January 1, 2013 and were outstanding during the entire period presented.

- (2)

- Pro

forma balance sheet data give effect to (i) the Distribution Transactions, (ii) the filing and effectiveness of our amended

and restated certificate of incorporation and amended and restated bylaws, including the Stock Split, as described in "—Our Corporate Information," which we will adopt prior to the

completion of this offering and (iii) this offering and the use of proceeds therefrom as described in "Use of Proceeds," assuming the shares offered by us are sold for $14.00 per share, the

midpoint of the estimated offering price range set forth on the cover page of this prospectus, after deducting the underwriting discounts and estimated offering expenses payable by us.

A $1.00 increase (decrease) in the assumed initial public offering price of $14.00 per share, which is the midpoint of the estimated offering price range set forth on the cover page of this prospectus, would increase (decrease) each of cash and cash equivalents, total assets and total stockholders' equity by $5,425,000, $5,425,000 and $5,425,000, respectively, assuming the number of shares offered by us as stated on the cover page of this prospectus remains unchanged and after deducting the estimated underwriting discounts and estimated offering expenses payable by us. Similarly, a one million share increase (decrease) in the number of shares offered by us, as set forth on the cover page of this prospectus, would increase (decrease) each of cash and cash equivalents, total assets and total stockholders' equity by $13,020,000, $13,020,000 and $13,020,000, respectively, assuming the assumed initial public offering price of $14.00 per share (the midpoint of the price range set forth on the cover page of this prospectus) remains the same, and after deducting the estimated underwriting discounts and estimated offering expenses payable by us.

Assumes our intent to use an additional $5.4 million of the net proceeds we received from this offering to repay additional amounts drawn under our Credit Facility as of February 24, 2014.

- (3)

- Includes

interest-bearing debt, residual value obligations and deemed landlord financing.

- (4)

- Restaurant contribution is defined as restaurant sales less restaurant operating costs, which are cost of sales, labor, and store operating expenses.

15

- (5)

- EBITDA

is defined as net loss before interest, income taxes and depreciation and amortization.

Adjusted EBITDA is defined as EBITDA plus equity-based compensation expense, bargain purchase gain from acquisitions, management and consulting fees, asset disposals, closure costs, loss on interest cap and restaurant impairment and pre-opening costs. Adjusted EBITDA is intended as a supplemental measure of our performance that is not required by, or presented in accordance with, generally accepted accounting principles in the United States ("GAAP"). We believe that EBITDA and Adjusted EBITDA provide useful information to management and investors regarding certain financial and business trends relating to our financial condition and operating results. Our management uses EBITDA and Adjusted EBITDA (i) as a factor in evaluating management's performance when determining incentive compensation and (ii) to evaluate the effectiveness of our business strategies.

We believe that the use of EBITDA and Adjusted EBITDA provides an additional tool for investors to use in evaluating ongoing operating results and trends and in comparing the Company's financial measures with other fast casual restaurants, which may present similar non-GAAP financial measures to investors. In addition, you should be aware when evaluating EBITDA and Adjusted EBITDA that in the future we may incur expenses similar to those excluded when calculating these measures. Our presentation of these measures should not be construed as an inference that our future results will be unaffected by unusual or non-recurring items. Our computation of Adjusted EBITDA may not be comparable to other similarly titled measures computed by other companies, because all companies do not calculate Adjusted EBITDA in the same fashion. Moreover, our definitions of EBITDA and Adjusted EBITDA as presented throughout this prospectus are not the same as these or similar terms in the applicable covenants of our Credit Facility.

Our management does not consider EBITDA or Adjusted EBITDA in isolation or as an alternative to financial measures determined in accordance with GAAP. The principal limitation of EBITDA and Adjusted EBITDA is that they exclude significant expenses and income that are required by GAAP to be recorded in the Company's financial statements. Some of these limitations are:

- •

- Adjusted EBITDA does not reflect our cash expenditures, or

future requirements, for capital expenditures or contractual commitments;

- •

- Adjusted EBITDA does not reflect changes in, or cash

requirements for, our working capital needs;

- •

- Adjusted EBITDA does not reflect the interest expense, or

the cash requirements necessary to service interest or principal payments, on our debts;

- •

- although depreciation and amortization are non-cash charges,

the assets being depreciated and amortized will often have to be replaced in the future, and Adjusted EBITDA does not reflect any cash requirements for such replacements;

- •

- equity-based compensation expense is and will remain a key

element of our overall long-term incentive compensation package, although we exclude it as an expense when evaluating our ongoing operating performance for a particular period;

- •

- Adjusted EBITDA does not reflect the impact of certain cash

charges resulting from matters we consider not to be indicative of our ongoing operations; and

- •

- other companies in our industry may calculate Adjusted

EBITDA differently than we do, limiting its usefulness as a comparative measure.

Because of these limitations, Adjusted EBITDA should not be considered in isolation or as a substitute for performance measures calculated in accordance with GAAP. We compensate for these limitations by relying primarily on our GAAP results and using Adjusted EBITDA only supplementally. You should review the reconciliation of net loss to EBITDA and Adjusted EBITDA below and not rely on any single financial measure to evaluate our business.

16

The following table reconciles net loss to EBITDA and Adjusted EBITDA for 2013, 2012 and 2011:

| |

Fiscal Year Ended | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| |

December 30, 2013 |

December 31, 2012 |

December 26, 2011 |

|||||||

| |

(Dollars in thousands) |

|||||||||

Adjusted EBITDA: |

||||||||||

Net loss, as reported |

$ | (3,715 | ) | $ | (253 | ) | $ | (27 | ) | |

Depreciation and amortization |

7,462 | 4,870 | 3,426 | |||||||

Interest expense |

4,019 | 2,337 | 1,248 | |||||||

Provision for income taxes |

656 | 622 | 110 | |||||||

EBITDA |

8,422 | 7,576 | 4,757 | |||||||

Asset disposals, closure costs, loss on interest cap and restaurant impairment(a) |

200 | 240 | (4 | ) | ||||||

Management and consulting fees(b) |

265 | 294 | 232 | |||||||

Equity-based compensation expense |

73 | 126 | 190 | |||||||

Pre-opening costs(c) |

1,938 | 917 | 806 | |||||||

Bargain purchase gain from acquisitions(d) |

— | — | (541 | ) | ||||||

Adjusted EBITDA |

$ | 10,899 | $ | 9,153 | $ | 5,440 | ||||

- (a)

- Represents

costs related to impairment of long-lived assets, gain or loss on disposal of property and equipment, loss on interest cap and

restaurant closure expenses.

- (b)

- Represents

fees payable to Brentwood pursuant to the Corporate Development and Administrative Services Agreement and fees paid to Greg

Dollarhyde pursuant to the Consulting Agreement. See "Certain Relationships and Related Party Transactions—Corporate Development and Administrative Services Agreement" and "Certain

Relationships and Related Party Transactions—Consulting Agreement."

- (c)

- Represents

expenses directly associated with the opening of new restaurants that are incurred prior to opening, including pre-opening

rent.

- (d)

- Represents the excess of the fair value of net assets acquired over the purchase price related to our acquisitions of the Houston franchise restaurants.

17

Investing in our common stock involves a high degree of risk. Before you purchase our common stock, you should carefully consider the risks described below and the other information contained in this prospectus, including our consolidated financial statements and accompanying notes. If any of the following risks actually occurs, our business, financial condition, results of operations or cash flows could be materially adversely affected. In any such case, the trading price of our common stock could decline, and you could lose all or part of your investment.

Risks Related to Our Business and Industry

Our long-term success is highly dependent on our ability to open new restaurants and is subject to many unpredictable factors.

One of the key means of achieving our growth strategy will be through opening new restaurants and operating those restaurants on a profitable basis. We expect this to be the case for the foreseeable future. In 2013, we opened 27 restaurants and we plan to open 28 to 30 restaurants in 2014. We may not be able to open new restaurants as quickly as planned. In the past, we have experienced delays in opening some restaurants, including due to the landlord's failure to turn over the premises to us on a timely basis. Such delays could happen again in future restaurant openings. Delays or failures in opening new restaurants could materially and adversely affect our growth strategy and our business, financial condition and results of operations. As we operate more restaurants, our rate of expansion relative to the size of our restaurant base will eventually decline.

In addition, one of our biggest challenges is locating and securing an adequate supply of suitable new restaurant sites in our target markets. Competition for those sites is intense, and other restaurant and retail concepts that compete for those sites may have unit economic models that permit them to bid more aggressively for those sites than we can. There is no guarantee that a sufficient number of suitable sites will be available in desirable areas or on terms that are acceptable to us in order to achieve our growth plan. Our ability to open new restaurants also depends on other factors, including:

- •

- negotiating leases with acceptable terms;

- •

- identifying, hiring and training qualified employees in each local market;

- •

- timely delivery of leased premises to us from our landlords and punctual

commencement of our build-out construction activities;

- •

- managing construction and development costs of new restaurants, particularly

in competitive markets;

- •

- obtaining construction materials and labor at acceptable costs, particularly

in urban markets;

- •

- unforeseen engineering or environmental problems with leased premises;

- •

- generating sufficient funds from operations or obtaining acceptable

financing to support our future development;

- •

- securing required governmental approvals, permits and licenses (including

construction permits and liquor licenses) in a timely manner and responding effectively to any changes in local, state or federal laws and regulations that adversely affect our costs or ability to

open new restaurants; and

- •

- avoiding the impact of inclement weather, natural disasters and other calamities.

Our progress in opening new restaurants from quarter to quarter may occur at an uneven rate. If we do not open new restaurants in the future according to our current plans, the delay could materially adversely affect our business, financial condition and results of operations.

We intend to develop new restaurants in our existing markets, expand our footprint into adjacent markets and selectively enter into new markets. However, there are numerous factors involved in identifying and securing an appropriate site, including, but not limited to: identification and availability of suitable

18

locations with the appropriate population demographics, traffic patterns, local retail and business attractions and infrastructure that will drive high levels of customer traffic and sales per restaurant; consumer tastes in new geographic locations and acceptance of our restaurant concept; financial conditions affecting developers and potential landlords, such as the effects of macro-economic conditions and the credit market, which could lead to these parties delaying or canceling development projects (or renovations of existing projects), in turn reducing the number of appropriate locations available; developers and potential landlords obtaining licenses or permits for development projects on a timely basis; anticipated commercial, residential and infrastructure development near our new restaurants; and availability of acceptable lease arrangements.

We may not be able to successfully develop critical market presence for our brand in new geographical markets, as we may be unable to find and secure attractive locations, build name recognition or attract new customers. If we are unable to fully implement our development plan, our business, financial condition and results of operations could be materially adversely affected.

Our expansion into new markets may present increased risks.

We plan to open restaurants in markets where we have little or no operating experience. Restaurants we open in new markets may take longer to reach expected sales and profit levels on a consistent basis and may have higher construction, occupancy or operating costs than restaurants we open in existing markets, thereby affecting our overall profitability. New markets may have competitive conditions, consumer tastes and discretionary spending patterns that are more difficult to predict or satisfy than our existing markets. We may need to make greater investments than we originally planned in advertising and promotional activity in new markets to build brand awareness. We may find it more difficult in new markets to hire, motivate and keep qualified employees who share our vision, passion and culture. We may also incur higher costs from entering new markets if, for example, we assign regional managers to manage comparatively fewer restaurants than in more developed markets. As a result, these new restaurants may be less successful or may achieve target AUVs at a slower rate. If we do not successfully execute our plans to enter new markets, our business, financial condition and results of operations could be materially adversely affected.

Changes in economic conditions and adverse weather and other unforeseen conditions could materially affect our ability to maintain or increase sales at our restaurants or open new restaurants.

The restaurant industry depends on consumer discretionary spending. The United States in general or the specific markets in which we operate may suffer from depressed economic activity, recessionary economic cycles, higher fuel or energy costs, low consumer confidence, high levels of unemployment, reduced home values, increases in home foreclosures, investment losses, personal bankruptcies, reduced access to credit or other economic factors that may affect consumer discretionary spending. Traffic in our restaurants could decline if consumers choose to dine out less frequently or reduce the amount they spend on meals while dining out. Negative economic conditions might cause consumers to make long-term changes to their discretionary spending behavior, including dining out less frequently on a permanent basis. In addition, given our geographic concentrations in the South, South-East and Mid-Atlantic regions of the United States, economic conditions in those particular areas of the country could have a disproportionate impact on our overall results of operations, and regional occurrences such as local strikes, terrorist attacks, increases in energy prices, adverse weather conditions, tornadoes, earthquakes, hurricanes, floods, droughts, fires or other natural or man-made disasters could materially adversely affect our business, financial condition and results of operations. Adverse weather conditions may also impact customer traffic at our restaurants, and, in more severe cases, cause temporary restaurant closures, sometimes for prolonged periods. All of our restaurants have outdoor seating, and the effects of adverse weather may impact the use of these areas and may negatively impact our revenues. If restaurant sales decrease, our profitability could decline as we spread fixed costs across a lower level of sales. Reductions in staff levels, asset impairment charges and potential restaurant closures could result from prolonged negative restaurant sales, which could materially adversely affect our business, financial condition and results of operations.

19

New restaurants, once opened, may not be profitable, and the increases in average restaurant sales and comparable restaurant sales that we have experienced in the past may not be indicative of future results.

Some of our restaurants open with an initial start-up period of higher than normal sales volumes, which subsequently decrease to stabilized levels. Typically, our new restaurants have stabilized sales after approximately 12 to 24 weeks of operation, at which time the restaurant's sales typically begin to grow on a consistent basis. However, we cannot assure you that this will occur for future restaurant openings. In new markets, the length of time before average sales for new restaurants stabilize is less predictable and can be longer as a result of our limited knowledge of these markets and consumers' limited awareness of our brand. New restaurants may not be profitable and their sales performance may not follow historical patterns. In addition, our average restaurant sales and comparable restaurant sales may not increase at the rates achieved over the past several years. Our ability to operate new restaurants profitably and increase average restaurant sales and comparable restaurant sales will depend on many factors, some of which are beyond our control, including:

- •

- consumer awareness and understanding of our brand;

- •

- general economic conditions, which can affect restaurant traffic, local

labor costs and prices we pay for the food products and other supplies we use;

- •

- changes in consumer preferences and discretionary spending;

- •

- competition, either from our competitors in the restaurant industry or our

own restaurants;

- •

- temporary and permanent site characteristics of new restaurants;

- •

- changes in government regulation; and

- •

- other unanticipated increases in costs, any of which could give rise to delays or cost overruns.

If our new restaurants do not perform as planned, our business and future prospects could be harmed. In addition, if we are unable to achieve our expected average restaurant sales, our business, financial condition and results of operations could be adversely affected.

Our sales growth and ability to achieve profitability could be adversely affected if comparable restaurant sales are less than we expect.