Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - MOSAIC CO | d707712d8k.htm |

Sulphur World Symposium 2014

Long Beach, CA

April 7-9, 2014

Dr. Michael R. Rahm

Vice President

Market and Strategic Analysis

Phosphate Outlook

Exhibit 99.1 |

Topics

Current Situation and Near Term Outlook

–

The Rally

–

The Sky Really is Falling

–

The Inverse

–

The Fundamentals

Long Term Outlook

–

The Demand Drivers and Forecasts

–

The New Supply Ballgame

–

The Likely Scenario: Positive and More Stable

–

The Key Factors to Watch |

3

Safe Harbor Statement

This presentation contains forward-looking statements within the meaning of the Private Securities

Litigation Reform Act of 1995. Such statements include, but are not limited to, statements

about the acquisition and assumption of certain related liabilities of the Florida phosphate

assets of CF Industries, Inc. (“CF”) and the ammonia supply agreements with CF; the benefits of the transactions with CF;

repurchases of stock; other proposed or pending future transactions or strategic plans and other

statements about future financial and operating results. Such statements are based upon the

current beliefs and expectations of The Mosaic Company’s management and are subject to

significant risks and uncertainties. These risks and uncertainties include but are not limited to risks and uncertainties arising from

difficulties with realization of the benefits of the transactions with CF, including the risks that

the acquired assets may not be integrated successfully or that the cost or capital savings from

the transactions may not be fully realized or may take longer to realize than expected, or the

price of natural gas or ammonia changes to a level at which the natural gas based pricing under one of the long term ammonia supply

agreements with CF becomes disadvantageous to Mosaic; customer defaults; the effects of Mosaic’

decisions to exit business operations or locations; the predictability and volatility of, and

customer expectations about, agriculture, fertilizer, raw material, energy and transportation

markets that are subject to competitive and other pressures and economic and credit market conditions;

the level of inventories in the distribution channels for crop nutrients; changes in foreign

currency and exchange rates; international trade risks and other risks associated with

Mosaic’s international operations and those of joint ventures in which Mosaic participates, including the risk that protests against

natural resource companies in Peru extend to or impact the Miski Mayo mine; changes in government

policy; changes in environmental and other governmental regulation, including greenhouse

gas regulation, implementation of numeric water quality standards for the discharge of

nutrients into Florida waterways or possible efforts to reduce the flow of excess nutrients into the Mississippi River basin or the

Gulf of Mexico; further developments in judicial or administrative proceedings, or complaints that

Mosaic’s operations are adversely impacting nearby farms, business operations or

properties; difficulties or delays in receiving, increased costs of or challenges to necessary

governmental permits or approvals or increased financial assurance requirements; resolution of global

tax audit activity; the effectiveness of the Company’s processes for managing its

strategic priorities; the ability of the Northern Promise joint venture among Mosaic, Ma’aden and

SABIC to obtain project financing in acceptable amounts and upon acceptable terms, the future success

of current plans for the joint venture and any future changes in those plans; adverse

weather conditions affecting operations in Central Florida, the Mississippi River basin

or the Gulf Coast of the United States, and including potential hurricanes, excess rainfall or drought; actual costs of various items

differing from management’s current estimates, including, among others, asset retirement,

environmental remediation, reclamation or other environmental regulation, Canadian resources

taxes and royalties, the liabilities Mosaic is assuming in the proposed phosphate assets

acquisition or the cost of Mosaic’s commitments to repurchase its stock; reduction of

Mosaic’s available cash and liquidity, and increased leverage, due to its use of cash

and/or available debt capacity to fund share repurchases, financial assurance requirements and strategic

investments; brine inflows at Mosaic’s Esterhazy, Saskatchewan, potash mine or other potash shaft

mines; other accidents and disruptions involving Mosaic’s operations, including potential

mine fires, floods, explosions, seismic events or releases of hazardous or volatile

chemicals, as well as other risks and uncertainties reported from time to time in The Mosaic

Company’s reports filed with the Securities and Exchange Commission. Actual results may

differ from those set forth in the forward-looking statements. |

Current Situation and Near Term Outlook:

The Rally |

The Phosphate Market

Catches Fire 5

The price of DAP loaded on a barge in New Orleans (NOLA)

increased from about $330 per ton at the end of November to

about $500 ton at the end of March.

The price of DAP loaded on a vessel in Tampa increased from

about $340 per tonne at the end of November to the $490-500

tonne range at the end of March.

200

300

400

500

600

700

05

06

07

08

09

10

11

12

13

14

$ MT

Weekly DAP Prices

fob Tampa

Source: Fertecon

100

200

300

400

500

600

05

06

07

08

09

10

11

12

13

14

$ ST

Weekly DAP Prices

NOLA Barge

Source: Green Markets |

A

Combination of Factors Fueled the Rally

Continued good end-user demand and lean channel inventories

Several small planned and unplanned production outages

Supply disruptions due to severe logistical problems

Raw materials cost pressure

A rush of purchases once buyers perceived the bottom was in

|

Continued Good End-User Demand

7 |

Lean

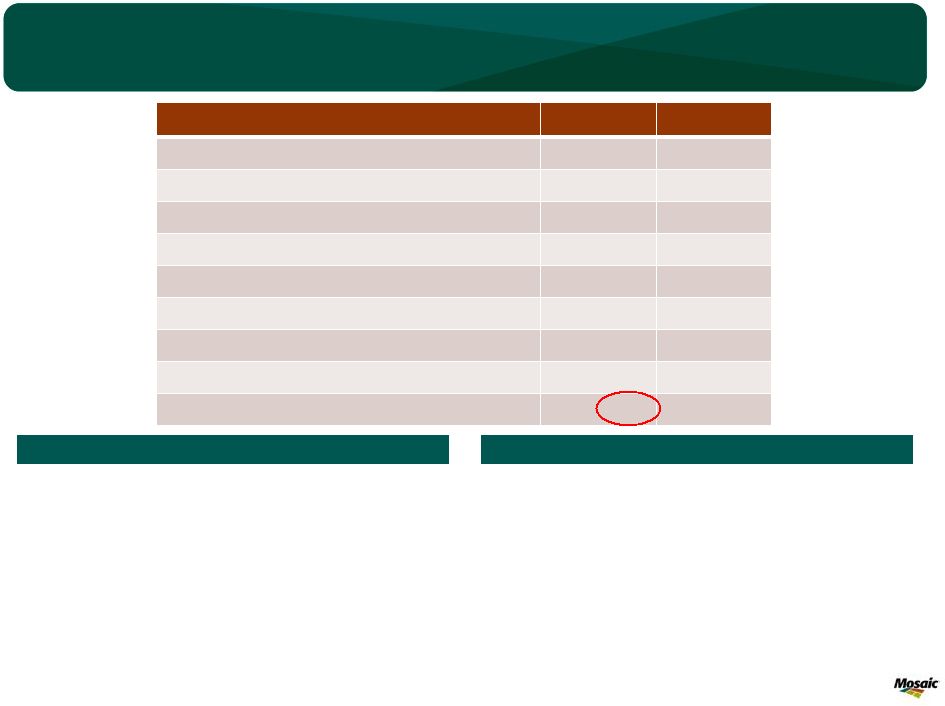

Channel Inventories: India Example 8

Million Tonnes DAP

2013/14E

2014/15F

Producer/Importer Beginning Inventory

1.45

1.60

Production

3.60

3.70

Imports

3.45

5.35

Producer/Importer Sales to Retailer Dealers

6.90

9.20

Retail Dealer Sales to Farmers

9.40

9.60

Retail Inventory Change

-2.50

-0.40

Producer/Importer Ending Inventory

1.60

1.45

Producer/Importer Inventory Change

0.15

-0.15

Total Pipeline Inventory Change

-2.35

-0.55

DAP use by farmers is projected to increase about 2% in 2014/15.

This assumes another good monsoon and continued profitable farm

economics.

Even if channel inventories are drawn down another 550,000 tonnes

and production increases to 3.7 million tonnes, producer/importer

sales to retailers would need to increase 33% to 9.20 million tonnes

and imports would need to increase 55% to 5.35 million tonnes in

order to meet projected demand.

These projections no doubt will change due to several factors such as

the

level

of

phosphoric

acid

prices,

the

quality

of

the

monsoon,

etc.,

but it looks likely that India’s appetite for DAP imports will increase

significantly in 2014/15 with a potential rebound of ~2.0 million

tonnes. 2014/15

2013/14

Our

Delhi

team

estimates

that

DAP

use

by

farmers

remained

strong

in

2013/14 due to an outstanding monsoon, record acreage and

profitable farm economics. The government raised minimum support

prices for major crops, retail urea prices stayed stable at the

extremely low level of $80-$85 per tonne, and retail P&K prices, while

up sharply from pre-reform levels, declined modestly in 2013/14.

As a result, retail dealer sales to farmers are projected to total 9.4

million tonnes for the fertilizer year ending March 31, 2014. Producer

and importer sales to retailer dealers, however, are projected to drop

to 6.9 million tonnes, implying a retail inventory decline of 2.5 million

tonnes. Producer/importer inventories are projected to increase

slightly in 2013/14.

Source: FAI and Mosaic |

Cumulative Impact of Several Production Outages

9

Producer

Estimated Q1 Loss

Notes

OCP

200,000 DAP/MAP

Product loading and raw materials discharge delays

ICL

25,000 TSP

Intermittent labor disputes (a strike began March 13)

GCT

30,000 DAP

Gabes still running at ~50% of capacity

Fauji

75,000 DAP

Re-starts after gas supply shortage

Ma’aden

10,000 DAP

Fire aftermath and heavy rains at mines

Uralchem

50,000 MAP

Rock supply issues from Apatit in Q1 and into Q2

Incitec

20,000 DAP

Running below capacity and 35 day turnaround in Q2

Foskor

15,000 MAP

Technical disruptions for approximately three weeks

Mosaic

150,000 DAP/MAP

Planned Riverview #5 plant conversion

PotashCorp

40,000 DAP

Aurora turnaround in March

MissPhos

15,000 DAP

Conversion from DAP to MAP

Total

~630,000

DAP/MAP/TSP

Significant cumulative impact |

Raw Materials Cost

Pressure 10

Now from ammonia

First from sulphur (especially in China)

0

50

100

150

200

250

300

350

06

07

08

09

10

11

12

13

14

$ MT

Sulphur Prices

c&f China

Source: Fertecon

100

200

300

400

500

600

700

800

05

06

07

08

09

10

11

12

13

14

$ MT

Ammonia Prices

c&f Tampa

Source: Fertecon |

A

Buyers Rush: Picking Up the Knife (and starting a fight)

11

Once distributors perceived that prices had bottomed, or that

knives had hit the floor, they rushed to position product.

Based on the recent spikes in nitrogen and phosphate prices,

distributors not only have picked up the knives, but they have

started a few fights as they compete to position product for the

upcoming application season.

In the case of phosphate, the combination of continued strong

end-user demand, a lean distribution pipeline and the

cumulative impact of several small planned and unplanned

production outages has tightened the global market and

changed sentiment overnight. As a result, phosphate prices

are staging a powerful and earlier-than-expected rally during

what typically is a seasonally slow period.

So, how will this knife fight end? The phosphate market no

doubt is tight due to recent developments, and our

assessment is that there is more upside than downside price

risk in the near term. However, Chinese export economics

likely will set a ceiling later in 2014. In the meantime, a fight

for tonnage rages on.

Available on Mosaicco.com |

Current Situation and Near Term Outlook:

The Sky Really is Falling |

The Sky Really is Falling

The Annual Spring Ritual

–

Warnings of transportation bottlenecks, rail car/truck shortages

and shipping delays

–

Warnings of stock-outs and lost demand

–

But the Sky Never Falls

The Sky Really is Falling this Year

–

Serious disruptions in Q1

–

Morocco –

OCP

•

Flagship

facility

at

Jorf

Lasfar

battered

by

heavy

rain,

high

winds

and

25’

sea

swells

in

Q1

•

Reports of ~40 vessels waiting to unload raw materials or load finished product at

one point •

Long shipping delays to key destinations such as Brazil and USA

–

North America –

The Perfect Storm

•

Lock and dam maintenance at key points on the Mississippi River

(Mel Price L&D at 50% until August) •

Record

NA

harvest

boosts

demand

for

rail

cars,

power

and

crews

(Canada

prioritizing

grain)

•

Heavy demand on rail assets for other commodities as well (e.g.

oil, fracking sand) •

Extreme weather exacerbates the problem (snowed-in trains to a late river open April 15-23)

•

Fall-out and implications |

The

Problem in Pictures 14

0

50,000

100,000

150,000

200,000

250,000

300,000

350,000

400,000

450,000

06

06

06

06

06

06

06

06

06

06

06

06

07

07

07

07

07

07

07

07

07

07

07

07

08

08

08

08

08

08

08

08

08

08

08

08

09

09

09

09

09

09

09

09

09

09

09

09

10

10

10

10

10

10

10

10

10

10

10

10

11

11

11

11

11

11

11

11

11

11

11

11

12

12

12

12

12

12

12

12

12

12

12

12

13

Carloads

Originated Carloads of Crude Oil

on U.S. Class I Railroads

Source: AAR

The Canadian government introduced regulations aimed at easing the grain logistics

bottleneck. These require CN and CP to ship at least 500,000 tonnes

of grains (~5,500 railcars) each week, about double their current

volume. If

the

railways

fail

to

meet

the

minimum

shipments,

they

will

be

charged

C$100,000

each

day

they

are

not

in

compliance

(though

there

is

a

‘catch

up’

period). |

A

Silver Lining - Latitudinal Stratification?

15

A More Normal/Orderly Spring Application Season? |

Current Situation and Near Term Outlook:

The Inverse |

The

Inverse 17

Long List of Reasons for the Large Inverse

Source: Cleartrade Exchange via INTL FCStone

March 31, 2014 DAP SWAPs Bid-Offer Indications

Current Spot Values

NOLA Barge: ~$500 ton (prompt loading)

Tampa Export: ~$490 tonne

Logistical bottlenecks ease

Between seasons in the Americas

Uncertainties about India’s import appetite

China export window opens May 16

Ramp-up of production in key regions

Lower raw materials costs

2014/15 demand uncertainties |

Current Situation and Near Term Outlook:

The Fundamentals |

The Fundamentals

Record Global Shipments and Import Demand

–

Positive demand drivers

–

Lower

channel

inventories

worldwide

–

India

poster

child

–

Continued strong demand in the America

–

Rebound in Indian imports

Ongoing Supply Uncertainties

–

Raw materials costs?

–

How much will China export?

–

When will Ma’aden Phase I ramp up to capacity?

–

How much will OCP produce and export?

–

When will the first Jorf Phosphate Hub come online?

–

How much will Tifert produce and when will Jifco start up?

Most Likely Scenario

–

Balanced during the next six months (average U.S. producer stocks)

–

Tighter situation by September/October (less than average U.S. producer

stocks) |

Record Global

Shipments and Import Demand 20

30

35

40

45

50

55

60

65

70

00

01

02

03

04

05

06

07

08

09

10

11

12

13E

14F

Global Phosphate Shipments

Likely Scenario

MMT Product

DAP/MAP/MES/TSP

Source:

Fertecon

&

Mosaic

0

5

10

15

20

25

00

01

02

03

04

05

06

07

08

09

10

11

12

13E

14F

MMT

Source: CRU/FRC and Mosaic

Global

Phosphate

Import

Demand

Likely

Scenario

excluding

China

Asia and Oceania

Latin America

Europe

Mideast

Africa

North America

FSU |

Positive Demand

Drivers 21

Recent Rally Drivers/Comments

3.50

4.00

4.50

5.00

5.50

6.00

6.50

7.00

7.50

8.00

J

A

S

O

N

D

J

F

M

A

M

J

US$ BU

New Crop Corn Prices

Daily

Close

of

the

New

Crop

Option

(Jul

1

-

Jun

30)

2008

2012

2013

2014

Source: CME

8.0

9.0

10.0

11.0

12.0

13.0

14.0

15.0

16.0

17.0

J

A

S

O

N

D

J

F

M

A

M

J

US$ BU

New Crop Soybean Prices

Daily

Close

of

the

New

Crop

Option

(Jul

1

-

Jun

30)

2008

2012

2013

2014

Source: CME

4.00

5.00

6.00

7.00

8.00

9.00

10.00

11.00

12.00

13.00

J

A

S

O

N

D

J

F

M

A

M

J

US$ BU

New Crop Hard Red Winter Wheat Prices

Daily

Close

of

the

New

Crop

Option

(Jul

1

-

Jun

30)

2008

2012

2013

2014

Source: CME

Wheat: strong demand, severe NA winter and

deteriorating crop conditions, drought in parts of USA,

and recent developments in Ukraine

Corn: strong demand rebound in all major use

categories, smaller second crop in Brazil this year,

and concerns about late planting in NA

Soybeans: strong demand, drought in parts of Brazil

(smaller than expected but still record soybean crop),

and concerns about late planting in NA

Soybean/corn new crop price ratio was 2.38 on

March 31. Will that result in more corn acres than the

Prospective Plantings indication? |

Price Rally Despite a

Blockbuster 2013 Crop 22

The USDA projects that 2013/14 global grain and oilseed

production

will

surge

to

a

record-smashing

2.95

billion

tonnes

due to record harvested area and a record average yield.

Global grain and oilseed use increased at a compound annual

growth rate of 2.4% during the five years prior to 2012. Use

increased just 0.4% in 2012 due to the short crop last year (but

still the second largest ever produced!). USDA projects that

global use will jump 4.5% in 2013 due to ample supplies, more

moderate prices, and an unleashing of pent-up demand.

If current supply and demand projections are on target, global

grain and oilseed stocks will increase significantly this year and

make up all of the declines during the last three years.

Crop prices drop in 2013/14 to

unleash pent up demand, but the

decline is less than expected by

some analysts (i.e. no sub $3 corn)

Crop prices surge in 2012/13 to allocate the

smaller than expected crop to its highest

valued uses, but increases are less than

expected by some analysts (i.e. no $10 corn).

2.0

2.1

2.2

2.3

2.4

2.5

2.6

2.7

2.8

2.9

3.0

00

01

02

03

04

05

06

07

08

09

10

11

12

13E

Bil Tonnes

World Grain and Oilseed Production

Production

Use

Source: USDA

15%

18%

20%

23%

25%

28%

30%

350

400

450

500

550

600

650

00

01

02

03

04

05

06

07

08

09

10

11

12

13E

Percent

Mil Tonnes

World Grain & Oilseed Stocks

Stocks

Percent of Use

Source: USDA

2.40

2.50

2.60

2.70

2.80

2.90

3.00

3.10

3.20

800

820

840

860

880

900

920

940

00

01

02

03

04

05

06

07

08

09

10

11

12

13E

MT Ha

Mil Ha

World Grain and Oilseed Area and Yields

Harvested Area

Yield

Trend

Source: USDA |

Wide Range of Potential Outcomes in 2014/15

23

606

579

494

407

470

463

426

438

514

570

549

536

519

571

350

400

450

500

550

600

650

00

01

02

03

04

05

06

07

08

09

10

11

12

13E

14F

Mil Tonnes

World Grain & Oilseed Stocks

Historical

2014/15 Range

2014/15 Medium Scenario

Source: USDA and Mosaic |

Positive Farm

Economics and Affordable Nutrients 24

0

20

40

60

80

100

120

140

80

83

86

89

92

95

98

01

04

07

10

13F

Bil $

U.S. Net Cash Income

Government Payments

Market

Source: USDA

0.50

0.75

1.00

1.25

1.50

1.75

05

06

07

08

09

10

11

12

13

14

Plant Nutrient Affordability

Plant Nutrient Price Index / Crop Price Index

Affordability Metric

Average

Source:

Weekly

Price

Publications,

CME,

USDA, AAPFCO, Mosaic |

Strong Rebound in

Indian DAP Imports 25

Source: FAI and Mosaic

Million Tonnes

DAP

2013/14E

2014/15F

Producer/Importer

Beginning

Inventory

1.45

1.60

Production

3.60

3.70

Imports

3.45

5.35

Producer/Importer Sales to Retailer Dealers

6.90

9.20

Retail Dealer Sales to Farmers

9.40

9.60

Retail Inventory Change

-2.50

-0.40

Producer/Importer

Ending

Inventory

1.60

1.45

Producer/Importer

Inventory

Change

0.15

0.15

Total

Pipeline

Inventory

Change

-2.35

-0.55

1.2

1.8

1.3

3.3

3.6

5.5

3.8

4.2

2.6

3.3

1.2

1.0

1.5

3.0

2.2

2.1

3.4

1.5

0.9

2.0

0.0

1.0

2.0

3.0

4.0

5.0

6.0

7.0

8.0

06

07

08

09

10

11

12

13

14F

15F

Mil Tonnes

Fertilizer Year Ending March 31

India DAP Imports

Kariff (Apr 1-Sep 30)

Rabi (Oct 1-Mar 31)

Source: FAI and Mosaic India |

Supply Uncertainties

– How Much . . .

26

. . . phosphate will China export?

. . . phosphate will Saudi Arabia export?

Key Issues

Key Issues

0.0

0.5

1.0

1.5

2.0

2.5

3.0

00

01

02

03

04

05

06

07

08

09

10

11

12

13E

14F

Mil Tonnes

DAP

Saudi Arabia Phosphate Exports

Export

Production Capacity

Source: CRU February 2014

0.0

1.0

2.0

3.0

4.0

5.0

6.0

7.0

00

01

02

03

04

05

06

07

08

09

10

11

12

13E

14F

China Phosphate Exports

Source: CRU February 2014

Mil Tonnes

DAP/MAP/TSP

Indian import demand

Domestic off-take

Raw materials costs

Less costly 2014 export tax

Indian import demand

Mine and plant ramp-up |

Long Term Outlook:

The Demand Drivers and Forecasts |

Solid Demand Drivers

– The Food Story

28

Available on Mosaicco.com

1.75

2.00

2.25

2.50

2.75

3.00

3.25

3.50

3.75

775

800

825

850

875

900

925

950

975

80

85

90

95

00

05

10

15

20

25

30

MT Ha

Mil Ha

Source: USDA and Mosaic

World Harvested Area and Average Yield

Actual Area

Forecast Area

Actual Yield

Required Yield

1980-10 Yield Trend

1,000

1,500

2,000

2,500

3,000

3,500

80

85

90

95

00

05

10

20

30

Mil Tonnes

Source: USDA and Mosaic

World Grain and Oilseed Use

Actual for Biofuels

Actual

Forecast for Biofuels

Forecast |

Positive Demand

Outlook 29

Key Assumptions

More moderate but sill elevated crop prices

Profitable farm economics worldwide

More moderate and less volatile phosphate prices

Drive for more balanced nutrient use especially in

China and India

Continued strong growth of phosphate intensive

crops such as soybeans, palm oil and fruits &

vegetables.

20

30

40

50

60

70

80

95

97

99

01

03

05

07

09

11

13E

15F

17F

19F

Mil Tonnes

Global DAP/MAP/TSP Shipment Forecasts

Actual

Low Forecast

High Forecast

Likely Forecast

CRU

-

Feb

2014 |

Key Demand Features

Brazil

–

Continued strong demand prospects

–

Modest increases in domestic production capabilities

–

Still

largely

dependent

on

imports

(~6

million

tonnes

DAP/MAP/MES/TSP

in

2020)

India

–

Demand gets back on track

–

Inevitable changes in subsidy policies

–

DAP shipments of nearly 14 million tonnes by 2020

–

DAP imports of nearly 10 million tonnes by 2020 |

Long Term Outlook:

The New Supply Ballgame |

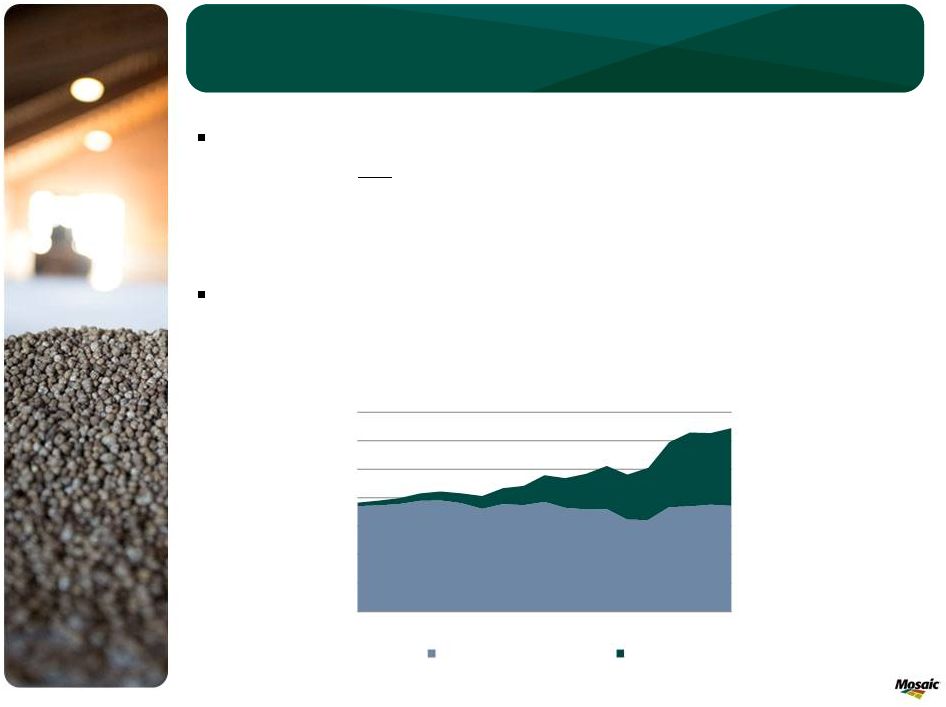

Key Supply

Feature China

–

Accounted

for

ALL

of

the

net

growth

in

phosphate

supply

since

1995

–

Massive 15-year expansion program expected to come to an end

–

Domestic industry consolidation

–

Transition from low-analysis to high-analysis phosphate products

Future Supply Growth Largely from New Low Cost Capacity

–

Morocco

–

Saudi Arabia

0

10

20

30

40

50

60

70

95

97

99

01

03

05

07

09

11

13E

MMT

Global DAP/ MAP/ TSP Production

Rest of World

China

Source: Fertecon, IFA and Mosaic |

Long Term Outlook:

The Likely Scenario: Positive and More Stable |

Positive and More Stable Outlook

34

50%

55%

60%

65%

70%

75%

80%

85%

90%

95%

100%

0

10

20

30

40

50

60

70

80

90

100

2000

2004

2008

2012

2016

2020

Op Rate

MMT

Source: CRU/FRC and Mosaic

Global Phosphate Capacity, Production and Oper Rate

Likely Scenario

Capacity

Production

Acid Op Rate

Based on our likely demand scenario and capacity estimates, global phosphoric acid

operating rates are projected to remain relatively stable at about 85% of

effective capacity from 2014 through 2020. This is in line with the

average since 2000, but projected rates do not exhibit as much volatility as

during the last decade. |

Long Term Outlook:

The Key Factors to Watch |

The Key Factors to Watch

Demand Drivers

–

Macroeconomic

environment

(e.g.

global

growth

and

exchange

rates)

–

Agricultural commodity prices and farm economics

–

Biofuels policies

–

Indian subsidy policies

–

Technological change (e.g. biologicals)

–

Social Change (e.g. dietary habits in both developed and developing countries)

Supply Developments

–

Chinese industrial and export policies

–

Corporate strategies (e.g. Jorf Phosphate Hub developments and Ma’aden expansions)

–

Political developments (e.g. How will the Arab Spring play out)

–

Environmental regulations (right to operate issues worldwide) |

Sulphur World Symposium 2014

Long Beach, CA

April 7-9, 2014

Dr. Michael R. Rahm

Vice President

Market and Strategic Analysis

Phosphate Outlook

Thank You! |