Attached files

| file | filename |

|---|---|

| 8-K - 8-K - AMAG PHARMACEUTICALS, INC. | a14-10236_18k.htm |

Exhibit 99.1

|

|

AMAG Pharmaceuticals April 2014 AMAG Pharmaceuticals, Inc. 1100 Winter Street Waltham, MA 02451 o 617.498.3300 www.amagpharma.com A SPECIALTY PHARMACEUTICAL COMPANY DEDICATED TO BRINGING TO MARKET THERAPIES THAT IMPROVE PATIENTS’ LIVES. |

|

|

Forward Looking Statements 1 This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and other federal securities laws. Any statements contained herein which do not describe historical facts, including but not limited to, statements regarding: (i) our position and plans for accelerated growth, including with regard to products, Feraheme gross margin, operating expenses and cash flows; (ii) our plans to drive revenue growth by optimizing the performance of Feraheme; (iii) key financial metrics for 2014; (iv) our commercial objectives, including AMAG’s plans to increase share of the current chronic kidney disease (CKD) intravenous (IV) iron market and AMAG’s ability to leverage established infrastructure; (v) call point targets; (vi) our forecast for break-even operating results in 2014; (vii) our strategic plan; (viii) our 2014 financial outlook, including projected sales, cost of goods sold, operating expenses and cash and investments balance; (ix) plans to drive revenue growth of Feraheme in the current indication and possible plans to seek to enhance Feraheme’s label and expand into new markets; (x) commercial opportunities for Feraheme in the current indication; (xi) the possibility and next steps for U.S. label expansion for Feraheme in the broader iron deficiency anemia (IDA) population, including plans to meet with the U.S. Food and Drug Administration (FDA) and expected timing; (xii) plans to gain additional share of the IV iron market if regulatory approval for the broader indication is pursued and received; (xiii) opportunities for growth in the U.S. IV iron market, including potential future call points; (xiv) expectations for Takeda’s Type II Variation and approval of a broad IDA label by the European Medicines Agency (EMA) for Rienso; (xv) the expected timing and magnitude of milestone payments; (xvi) plans to build a profitable, multi-product specialty pharmaceutical company; (xvii) expectations regarding the demand and market opportunity for MuGard and our strategies to increase MuGard’s commercial success; (xviii) our business development goals and opportunities, including our expectations that more than 50% of our revenues will be attributable to new products by 2018 and that we will have added two to three additional products by 2018; (xix) the impact of business development transactions on EBITDA; (xx) our ability to optimize after-tax cash flows with business development transactions; (xxi) our 2014 financial outlook, including projected revenues and expenses, as well as sales, cost of goods sold, operating expenses, net income, adjusted EBITDA and cash and investments balance; (xxii) our 2014 goals and (xxiii) our statement that AMAG is well positioned for success in 2014 and beyond are forward-looking statements which involve risks and uncertainties that could cause actual results to differ materially from those discussed in such forward-looking statements. Such risks and uncertainties include, among others: (1) uncertainties regarding the likelihood and timing of potential approval of AMAG’s supplemental New Drug Application (sNDA) for Feraheme in the U.S. in the broader IDA indication, (2) the possibility that following the FDA’s review of post-marketing safety data, including reports of serious anaphylaxis, cardiovascular events, and death, the FDA will request additional technical or scientific information, new studies or reanalysis of existing data, on-label warnings, post-marketing requirements/commitments or risk evaluation and mitigation strategies (REMS) in the current CKD indication for Feraheme, (3) uncertainties regarding our and Takeda Pharmaceutical’s ability to successfully compete in the IV iron replacement market both in the U.S. and outside the U.S., including the EU, including as a result of limitations, restrictions or warnings in Feraheme’s/Rienso’s current or future label that put Feraheme/Rienso at a competitive disadvantage, (4) uncertainties regarding Takeda’s ability to obtain regulatory approval for Feraheme in Canada, and Rienso in the EU, in the broader IDA patient population, (5) the possibility that significant safety or drug interaction problems could arise with respect to Feraheme/Rienso and in turn affect sales, or our ability to market the product both in the U.S. and outside of the U.S., including the EU, (6) uncertainties regarding the manufacture of Feraheme/Rienso or MuGard, (7) uncertainties relating to our patents and proprietary rights both in the U.S. and outside the U.S., (8) the risk of an Abbreviated New Drug Application (ANDA) filing following the FDA’s recently published draft bioequivalence recommendation for ferumoxytol, (9) uncertainties regarding our ability to compete in the oral mucositis market in the U.S. and (10) other risks identified in our filings with the U.S. Securities and Exchange Commission (SEC), including our Annual Report on Form 10-K for the year ended December 31, 2013 and subsequent filings with the SEC. We caution you not to place undue reliance on any forward-looking statements, which speak only as of the date they are made. We disclaim any obligation to publicly update or revise any such statements to reflect any change in expectations or in events, conditions or circumstances on which any such statements may be based, or that may affect the likelihood that actual results will differ from those set forth in the forward-looking statements. Copyright © 2014 AMAG Pharmaceuticals, Inc. All Rights Reserved. |

|

|

AMAG today: Two revenue-generating commercial products Feraheme® : a differentiated intravenous iron for treatment of iron deficiency anemia (IDA) in adult patients with chronic kidney disease (CKD) MuGard®: prescription oral mucoadhesive rinse for the management of oral mucositis Established commercial and corporate infrastructure capable of supporting incremental products and strategic acquisitions Targeting high-value specialty call points – hospitals, hematologists and oncologists Strategic objective of adding 2-3 additional products by 2018 Domestic or internationally domiciled products with complementary commercial or late-stage clinical development assets Strong financial position, poised to transact ~$400M in cash following recent $200M convertible debt offering Forecasting break-even operating results in 2014 2 AMAG: Building a Multi-Product Specialty Pharmaceutical Company Established Commercial Enterprise Poised for Growth and Portfolio Expansion Copyright © 2014 AMAG Pharmaceuticals, Inc. All Rights Reserved. |

|

|

AMAG: Positioned for Accelerated Growth Past (2010-2011) Present (2012 - 2013) Future Products Single product Two products Diversified Portfolio Low/no growth Double-digit growth Strong CAGR Price deterioration Price appreciation Price optimization Feraheme Gross Margin ~75% ~83% Significant gross margins Operating Expenses >$130 million $80.5 million Continued financial discipline Cash Flows Significant cash burn Minimal cash burn Significant cash generation 3 Management transition * If regulatory approval is pursued and received. Feraheme US, IDA-CKD Feraheme US, IDA Rienso (ex-US) MuGard other products Feraheme US, IDA-CKD Rienso (ex-US) MuGard Feraheme US, IDA-CKD Feraheme US, IDA* Rienso (ex-US) MuGard other products Feraheme US, IDA-CKD Rienso (ex-US) MuGard Copyright © 2014 AMAG Pharmaceuticals, Inc. All Rights Reserved. |

|

|

GROWING Drive revenue growth by optimizing the performance of Feraheme |

|

|

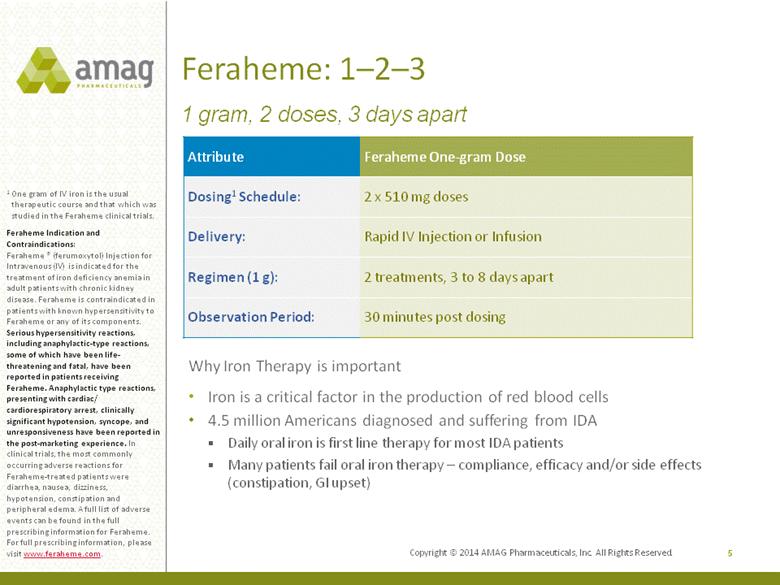

Feraheme: 1–2–3 5 1 One gram of IV iron is the usual therapeutic course and that which was studied in the Feraheme clinical trials. Feraheme Indication and Contraindications: Feraheme ® (ferumoxytol) Injection for Intravenous (IV) is indicated for the treatment of iron deficiency anemia in adult patients with chronic kidney disease. Feraheme is contraindicated in patients with known hypersensitivity to Feraheme or any of its components. Serious hypersensitivity reactions, including anaphylactic-type reactions, some of which have been life-threatening and fatal, have been reported in patients receiving Feraheme. Anaphylactic type reactions, presenting with cardiac/ cardiorespiratory arrest, clinically significant hypotension, syncope, and unresponsiveness have been reported in the post-marketing experience. In clinical trials, the most commonly occurring adverse reactions for Feraheme-treated patients were diarrhea, nausea, dizziness, hypotension, constipation and peripheral edema. A full list of adverse events can be found in the full prescribing information for Feraheme. For full prescribing information, please visit www.feraheme.com. 1 gram, 2 doses, 3 days apart Attribute Feraheme One-gram Dose Dosing1 Schedule: 2 x 510 mg doses Delivery: Rapid IV Injection or Infusion Regimen (1 g): 2 treatments, 3 to 8 days apart Observation Period: 30 minutes post dosing Why Iron Therapy is important Iron is a critical factor in the production of red blood cells 4.5 million Americans diagnosed and suffering from IDA Daily oral iron is first line therapy for most IDA patients Many patients fail oral iron therapy – compliance, efficacy and/or side effects (constipation, GI upset) Copyright © 2014 AMAG Pharmaceuticals, Inc. All Rights Reserved. |

|

|

Feraheme Performance 6 Net ex-factory sales* ($ in millions) 2012 vs 2011 +12% growth (+17% volume, -5% price) * Excludes the impact of changes in estimates made to product returns and Medicaid reserves in 2012 and 2013 Net Sales 2013 vs 2012 +28% growth (+22% volume, +6% price) Copyright © 2014 AMAG Pharmaceuticals, Inc. All Rights Reserved. |

|

|

U.S. IV Iron Market: Competitive Landscape 7 *Aggregate of Ferrlecit Brand + Generic Ferric Gluconate Source: IMS DDD Data thru week ending 12/20/13 2013 Share of ~850,000 Gram Non-dialysis Market Copyright © 2014 AMAG Pharmaceuticals, Inc. All Rights Reserved. |

|

|

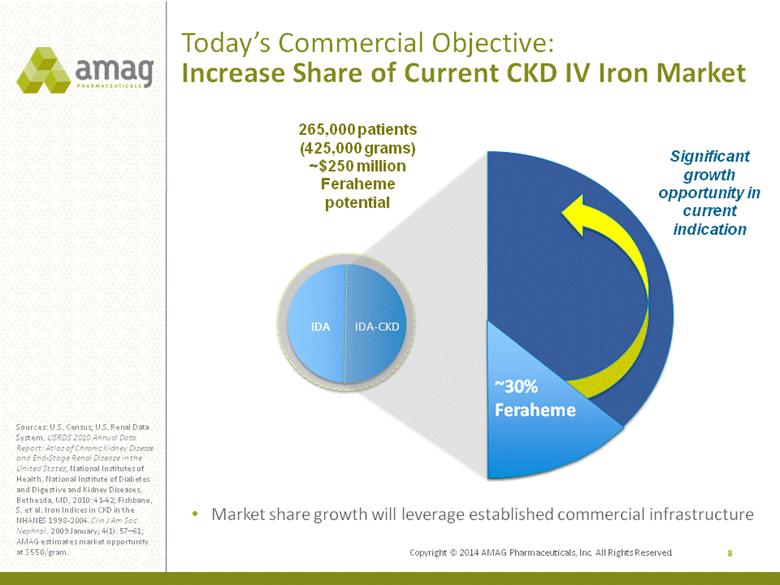

Today’s Commercial Objective: Increase Share of Current CKD IV Iron Market 8 Sources: U.S. Census; U.S. Renal Data System, USRDS 2010 Annual Data Report: Atlas of Chronic Kidney Disease and End-Stage Renal Disease in the United States, National Institutes of Health, National Institute of Diabetes and Digestive and Kidney Diseases, Bethesda, MD, 2010: 41-42; Fishbane, S. et al. Iron Indices in CKD in the NHANES 1998-2004. Clin J Am Soc Nephrol. 2009 January; 4(1): 57–61; AMAG estimates market opportunity at $550/gram. IDA IDA-CKD ~30% Feraheme Significant growth opportunity in current indication 265,000 patients (425,000 grams) ~$250 million Feraheme potential Market share growth will leverage established commercial infrastructure Copyright © 2014 AMAG Pharmaceuticals, Inc. All Rights Reserved. |

|

|

2014: U.S. IDA Label Expansion 9 *If regulatory approval is pursued and received. Complete response letter (CRL) received Evaluate CRL and develop responsive and economically viable proposal Meet with FDA to discuss proposal and other possible approaches to address the points raised in CRL sNDA submitted for all adult patients with IDA who have failed or could not tolerate oral iron treatment Submission based on two Phase 3 trials of 1,400+ patients that achieved primary endpoints, no new safety signals observed Value of IDA in the U.S.* Leverage strong market position in IDA-CKD Five Orange Book listed patents Manufacturing and other proprietary know-how Large market opportunity Copyright © 2014 AMAG Pharmaceuticals, Inc. All Rights Reserved. Final determination on path forward in IDA – multi-pronged approach Initiate plan Dec ‘12 |

|

|

10 Sources: U.S. Census; U.S. Renal Data System, USRDS 2010 Annual Data Report: Atlas of Chronic Kidney Disease and End-Stage Renal Disease in the United States, National Institutes of Health, National Institute of Diabetes and Digestive and Kidney Diseases, Bethesda, MD, 2010: 41-42; Fishbane, S. et al. Iron Indices in CKD in the NHANES 1998-2004. Clin J Am Soc Nephrol. 2009 January; 4(1): 57–61; AMAG estimates market opportunity at $550/gram. 530,000 patients (850,000 grams) ~$500 million Feraheme potential IDA IDA-CKD Label Expansion Opportunity* Same call audience: Hematology/Oncology Expand use to all IDA patients in current accounts Convert single IV iron stockers to Feraheme Hospitals Expand use to all IDA patients in current accounts Continue to gain new accounts Potential IDA Label Expansion*: Gain Additional Share of IV Iron Market *If regulatory approval is pursued and received. Copyright © 2014 AMAG Pharmaceuticals, Inc. All Rights Reserved. |

|

|

Opportunity: Grow U.S. IV Iron Market 11 IV Iron IDA* IV Iron IDA-CKD 4,000,000 patients diagnosed with IDA placed on oral iron therapy IV Iron IDA-CKD IV Iron IDA* Oral Iron IDA* Oral Iron IDA-CKD *If regulatory approval is pursued and received. 4,000,000 patients diagnosed with IDA placed on oral iron therapy Current CKD call points Potential future call points Oncology Nephrology Women’s Health Rheumatology Gastroenterology Copyright © 2014 AMAG Pharmaceuticals, Inc. All Rights Reserved. |

|

|

Takeda’s in Europe 12 Double-digit tiered royalties on Takeda sales Additional potential milestones Ferumoxytol is marketed under the Rienso trade name in EU Copyright © 2014 AMAG Pharmaceuticals, Inc. All Rights Reserved. 2010 $60 million upfront paid for select international markets 2012 $33 million in milestones paid for approval and first sale in IDA CKD in EU and Canada 2013 Rolling launches across Europe in CKD Takeda filed a Type II Variation (sNDA equivalent) with the EMA for label expansion 2014 Potential EMA approval of broad IDA label, triggering a significant milestone |

|

|

BUILDING Build our future by expanding our product portfolio |

|

|

Building a Profitable, Multi-product Specialty Pharmaceutical Company Commercial Infrastructure Focus on Hematology/Oncology, Hospital and Nephrology Strong Balance Sheet Experienced Management Team Feraheme® U.S. CKD Business Feraheme IDA label Expansion* IV Iron Market Expansion Feraheme Geographic Expansion Product #3 14 MuGard® Product #4 *If regulatory approval is pursued and received. Copyright © 2014 AMAG Pharmaceuticals, Inc. All Rights Reserved. |

|

|

MuGard: >$500 Million Market Opportunity In-licensed in 2013; $3.3 million upfront license fee MuGard: the only oral mucositis product that forms a protective coating over the oral mucosa to shield the membranes of the mouth and tongue MuGard $1,500/Rx (50% price increase April 1st) 15 < 5% Currently Prescribed Treatment (2013 TRXs) 400,000 cancer patients with oral mucositis in U.S. annually Copyright © 2014 AMAG Pharmaceuticals, Inc. All Rights Reserved. |

|

|

MuGard’s Road to Success in 2014 16 MuGard is a prescription oral rinse for the management of oral mucositis Copyright © 2014 AMAG Pharmaceuticals, Inc. All Rights Reserved. Strategies for Success in 2014 Differentiate MuGard Distinguish muco-adhesive from oral rinses Physician Targeting Sub-segment of Feraheme prescribers with significant use of chemo products with high risk of oral mucositis Increase emphasis on radiation oncologists Expand Access Expand MuGard payor coverage |

|

|

Targeted Business Development 17 Bulls-Eye Hem/onc or hospital company or product $10 MM–$60 MM/yr. revenue potential IP runway Immediately accretive ~130 branded specialty products with revenues between $10MM and $50MM Fact #1 Copyright © 2014 AMAG Pharmaceuticals, Inc. All Rights Reserved. |

|

|

Targeted Business Development 18 Strategic Opportunities aligned with Feraheme growth strategy Gastroenterology, rheumatology, women’s health ~90 branded specialty products with revenues between $51MM and $100MM Bulls-Eye Hem/onc or hospital company or product $10 MM–$60 MM/yr. revenue potential IP runway Immediately accretive Fact #2 Copyright © 2014 AMAG Pharmaceuticals, Inc. All Rights Reserved. |

|

|

Targeted Business Development 19 Financial Similarly sized specialty company Eliminate overlapping infra- structure and increase EBITDA Examine transactions to optimize after-tax cash flows ~ 75 small private companies with U.S. marketed specialty products Strategic Opportunities aligned with Feraheme growth strategy Gastroenterology, rheumatology, women’s health Bulls-Eye Hem/onc or hospital company or product $10 MM–$60 MM/yr. revenue potential IP runway Immediately accretive Fact #3 Copyright © 2014 AMAG Pharmaceuticals, Inc. All Rights Reserved. |

|

|

Examples of Successfully Executing a Build Strategy 20 Industry peers have utilized business development to broaden their portfolios and reduce dependence on a single commercial product Oritavancin FibroCapsTM IONSYSTM Cangrelor Copyright © 2014 AMAG Pharmaceuticals, Inc. All Rights Reserved. |

|

|

2014 OUTLOOK |

|

|

Key Financial Metrics: Positive Trends 2011 - 2014 22 Revenues ($ in millions) Expenses ($ in millions) Copyright © 2014 AMAG Pharmaceuticals, Inc. All Rights Reserved. |

|

|

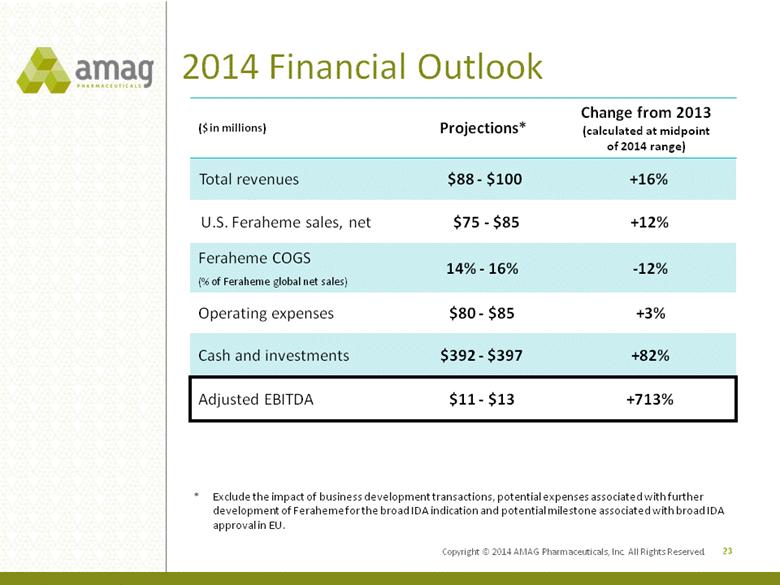

2014 Financial Outlook ($ in millions) Projections* Change from 2013 (calculated at midpoint of 2014 range) Total revenues $88 - $100 +16% U.S. Feraheme sales, net $75 - $85 +12% Feraheme COGS (% of Feraheme global net sales) 14% - 16% -12% Operating expenses $80 - $85 +3% Cash and investments $392 - $397 +82% Adjusted EBITDA $11 - $13 +713% 23 * Exclude the impact of business development transactions, potential expenses associated with further development of Feraheme for the broad IDA indication and potential milestone associated with broad IDA approval in EU. Copyright © 2014 AMAG Pharmaceuticals, Inc. All Rights Reserved. |

|

|

2014 Goals Maximize Feraheme opportunities Drive market share and market growth within current U.S. IDA-CKD indication Optimize net revenue per gram Potential label expansion: IDA (non-CKD) oral iron failures Expected E.U. action – mid-2014; broad IDA approval triggers significant milestone Determine regulatory path forward in U.S. Pursue IV iron market expansion initiatives Drive MuGard growth across oral mucositis patient population Execute additional, quality business development transactions Continue to identify unique in-license/acquisition candidates Leverage balance sheet strength to consummate additional business development deals Continue to operate the business with financial discipline 24 Copyright © 2014 AMAG Pharmaceuticals, Inc. All Rights Reserved. |

|

|

Well positioned for success in 2014. . . and beyond. AMAG Pharmaceuticals, Inc. 1100 Winter Street Waltham, MA 02451 o 617.498.3300 www.amagpharma.com A SPECIALTY PHARMACEUTICAL COMPANY DEDICATED TO BRINGING TO MARKET THERAPIES THAT IMPROVE PATIENTS’ LIVES. |

|

|

Adjusted EBITDA Reconciliation 26 ($ in millions) 2013 2014 (est.) Net loss ($9.6) ($15.7) Interest expenses $5.0 Amortization of debt discount and deferred financing costs $ - $10.7 Sub-total ($9.6) $ - Fair value adjustment to contingent consideration expense $1.1 $2.3 Depreciation & amortization $3.1 $1.2 Interest income ($1.1) ($1.5) EBITDA ($6.5) $2.0 Stock compensation expense $8.0 $10.2 Adjusted EBITDA $1.5 $12.2 Copyright © 2014 AMAG Pharmaceuticals, Inc. All Rights Reserved. |