Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Bank of New York Mellon Corp | d705859d8k.htm |

ANNUAL MEETING OF STOCKHOLDERS

April 8, 2014

Exhibit 99.1 |

Cautionary Statement

1

A number of statements in our presentations, the accompanying slides and the responses to your

questions are “forward- looking statements.” These statements relate to,

among other things, The Bank of New York Mellon Corporation’s (the

“Corporation”) expectations regarding: Investment Management’s positioning for growth;

the Fed Funds Effective rate and impact of increases on our business; signs of an abatement in

Corporate Trust run-off, and positive growth; our strong capital position and return on

tangible equity; projected margin impacts of investment management initiatives; our ability to

perform well in stress scenarios and maintain our high payout ratios; our 2014 capital plan; expense control plans and

investing for organic growth; strengthening regulatory / compliance and risk management;

cross-business solutions; the benefits to having investment management and investment

services under one company; our business model’s ability to drive shareholder value;

possible gains relating to real estate sales; changes in technology and staffing; our growth

position; and statements regarding the Corporation's aspirations, as well as the Corporation’s

overall plans, strategies, goals, objectives, expectations, estimates, intentions, targets,

opportunities and initiatives. These forward-looking statements are based on assumptions

that involve risks and uncertainties and that are subject to change based on various important

factors (some of which are beyond the Corporation’s control). Actual results may

differ materially from those expressed or implied as a result of the factors described under “Forward

Looking Statements” and “Risk Factors” in the Corporation’s Annual Report on Form

10-K for the year ended December 31, 2013 (the “2013 Annual Report”), and in

other filings of the Corporation with the Securities and Exchange Commission (the

“SEC”). Such forward-looking statements speak only as of April 8, 2014, and the Corporation undertakes no

obligation to update any forward-looking statement to reflect events or circumstances after that

date or to reflect the occurrence of unanticipated events.

Non-GAAP Measures: In this presentation we may discuss some non-GAAP adjusted measures

in detailing the Corporation’s performance. We believe these measures are useful to

the investment community in analyzing the financial results and trends of ongoing

operations. We believe they facilitate comparisons with prior periods and reflect the

principal basis on which our management monitors financial performance. Additional disclosures

relating to non-GAAP adjusted measures are contained in the Corporation’s reports

filed with the SEC, including the 2013 Annual Report, available at

|

2

* Securities transactions are effected, where required, only through registered

broker-dealers. Corporate Trust

Depositary Receipts

Global Markets

Asset Servicing

Global Collateral Services

Pershing

Wealth Management

Investment Management

Wealth Management

Investment Management

Global Collateral Services

Global Markets

Pershing

Corporate Trust

Global Collateral Services

Global Markets

OUR CLIENTS

CREATE

INVESTMENTS

MANAGE

INVESTMENTS

HOLD &

SERVICE

INVESTMENTS

TRADE, CLEAR

& SETTLE

INVESTMENTS *

ENABLE

ACCESS TO

INVESTMENTS

RESTRUCTURE

INVESTMENTS

The Investments Company for the World

Expertise Across the Investment Lifecycle

Broker-Dealer Services

Global Collateral Services

Global Markets

Pershing

Treasury Services |

3

The Investments Company for the World

Global Market Leadership

Corporate

Trust

#1 Global corporate trust service provider

Treasury

Services

Top 5 in U.S.D. payments

Global Markets

Client driven trading

Global Collateral

Services

Leveraging the breadth of Investment

Services

Asset Servicing

Largest global custodian ranked by Assets

Under Custody / Administration

Alternative

Investment Services

#3 fund administrator

Broker-Dealer

Services

#1 (U.S.), growing globally

Pershing

#1 clearing firm U.S., U.K., Ireland, Australia

Depositary

Receipts

#1 in market share (~60%)

Asset

Management

Top 10 global asset manager

Consolidated Revenue of ~$15.0B and Pretax Income of ~$3.7B in 2013*

Investment Management

(46% non-U.S. revenue)

Investment Services

(35% non-U.S. revenue)

Wealth

Management

#7 U.S. wealth manager

Revenue: ~$10.2B

Pretax Income: ~$2.9B

Revenue: ~$4.0B

Pretax Income: ~$1.1B

* Consolidated revenue and pretax income include the Other segment.

Pretax

income

for

Investment

Services

and

Investment

Management

exclude

amortization

of

intangible

assets.

See

Appendix

for

revenue

and

pretax

income

reconciliation.

Rankings reflect BNY Mellon’s size in the markets in which it operates and are based on internal

data as well as BNY Mellon’s knowledge of those markets. For

additional

details

regarding

these

rankings,

see

Appendix

and

/

or

pages

25-26

of

our

Annual

Report

for

the

year

ended

December

31,

2013,

available

at |

Growth

Year-over-Year

Pretax Income

+12%

Net income (16%)

Investment

Management

Fees

1

+7%

AUM +14%

Net AUM inflows of $100 billion

Investment Services Fees

+4%

AUC/A +$1.3 trillion (+5%)

Estimated new AUC/A wins of $639 billion

Net Interest Revenue

+1%

Mix of interest-earning assets, lower funding

costs and higher interest-earning assets offset by

lower yields

Operating Expenses

0%

Lower litigation provision, offset by higher core

expenses in support of fee growth and increasing

regulatory / risk / compliance costs

2013 Highlights

4

2013

Total Shareholder Return

39%

Return on Tangible Common

Equity

2

20%

Share Repurchases

$1B

83% total payout ratio

Repurchased ~3% of shares outstanding

Quarterly Dividend Increase

15%

1

Includes Performance fees.

2

Represents a non-GAAP adjusted measure. See Appendix for reconciliation.

Additional disclosure regarding this measure and other non-GAAP adjusted measures

are

available

in

the

Corporation’s

reports

filed

with

the

SEC,

including

our

2013

Annual

Report,

available

at

+9% (excluding disallowance of certain tax

credits)

2

www.bnymellon.com/investorrelations. |

A

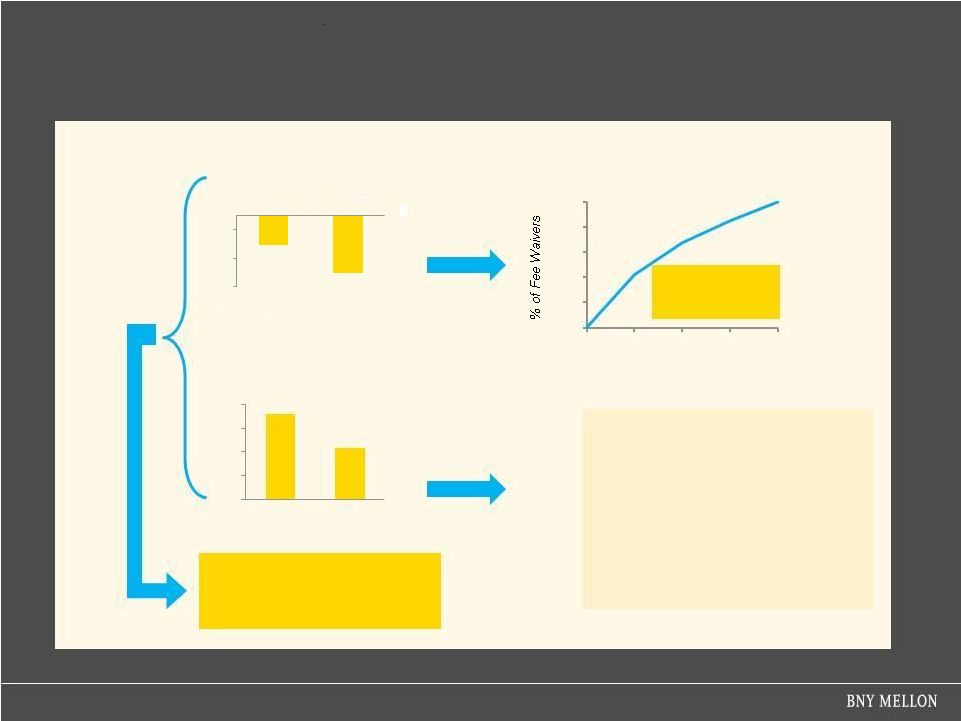

Look at 2013 – Solid Pretax Income Growth Despite Factors Unique to BNY

Mellon Pretax Income +12%

5

Corporate Trust

Pretax Income

($millions)

rates rise by 50 bps²

Rapid Recovery of Fee

Waivers With Rising

Short-Term Interest Rates

Increase in Interest Rates (bps)

•

Pretax decline partially driven by

structured debt run-off

•

Structured debt run-off expected

to abate in the next 18 to 24

months

Combined pretax margin

dilution of ~260 bps from

2009 to 2013

1 Excludes the impact of intangible amortization and money market fee

waivers.

2

Assumes

no

change

in

client

behavior.

$897

$542

0

250

500

750

1,000

2009

2013

0%

20%

40%

60%

80%

100%

0

25

50

75

100

1

~70% of fee waivers

(pretax) recovered if

Money Market

Fee Waivers Pretax Trend

($millions)

($201)

($402)

-500

-300

-100

2009

2013 |

Provides Financial

Flexibility… Strong Capital Position and Returns

(At 12/31/13)

Basel III Tier 1 Common

(Non-GAAP)¹

10.6%

11.3%

6

2011

2012

2013

2014 CCAR

Plan

Share Repurchases²

$873MM or 36MM shares

(3% of shares outstanding)

$1.1B or 51MM shares

(4% of shares outstanding)

$1B or 35MM shares

(3% of shares outstanding)

$1.74B

(4% of shares outstanding) ³

Quarterly Dividend Increase

+44%

+0%

+15%

+13%

Payout Ratio

58%

73%

83%

93%

4

Well Positioned

for Stress Scenarios

Strong Capital Generation Provides Financial Flexibility

1

Represents a non-GAAP adjusted measure. See Appendix for a reconciliation. Additional

disclosure regarding this measure and other non-GAAP adjusted measures are available in

the Corporation’s reports filed with the SEC, including our 2013 Annual Report, available at

www.bnymellon.com/investorrelations.

SOURCE:

Federal

Reserve

–

Dodd-Frank

Act

Stress

Test

(DFAST)

2014:

Supervisory Stress Test Methodology and Results

See Appendix for additional detail.

Least

Impact

Most

Impact

2 Percent of outstanding shares repurchased is based on shares outstanding at the beginning (January

1) of each year, respectively. 3 Assumes shares repurchased at closing stock price of $35.27 (on

4/2/14) and total common shares outstanding of 1,142MM at 1/1/14. 4 Ratio

calculated

using

Full

Year

2014

First

Call

consensus

net

income

estimates

as

a

benchmark.

Advanced

Standardized

20%

0%

2%

4%

6%

8%

HSBC

ZB

SC

BAC

JPM

BMO

BBVA

MTB

STT

RF

ALLY

FITB

PNC

STI

BK

AXP

Impact of DFAST Stress Test

on Basel I Tier 1 Common

Ratio

Return on Tangible Common

Equity

(Non-GAAP)¹ |

Investing in Our Franchise

7

Investing for Organic Growth

Investment Services

•

Outsourcing platform

•

Global Collateral Services

•

Global / Capital Markets expansion

•

Enterprise payment hub

Investment Management

~$73MM increase

in BDS expenses

(2011-2013)

Projected

Margin Impact (%)

0.2

(0.7)

(1.1)

(0.3)

0.5

1.5+

2.0+

Projected Margin Impact of

Investment Management Initiatives

Upside Case

Projected Case

NOTE: Illustrative scenario based on current estimates.

1 Represents increase in the business unit servicing Tri-Party /

Clearance. BDS

=

Broker-Dealer

Services

•

Investing to strengthen regulatory / risk /

compliance / staff and systems

•

Tri-Party Reform

•

Broker-Dealer Clearance

-2.0%

0.0%

2.0%

4.0%

2012

2013

2014

2015

2016

2017

2018

Regulatory / Risk Management

Investment Services

•

Enhanced

distribution to retail investors •

Wealth Management expansion

•

APAC

Strategy

–

developing

local

capabilities

•

Expanding investment offerings

1 |

Investment Management & Investment Services

Benefits of Combination

8

Investment Management

Investment Capabilities

Deepen Client

Relationships

Collaboration Provides

Additional Growth

Opportunities

•

Investment Management has

been a highly successful

contributor to earnings

•

Minimal balance sheet usage

•

Positive to BNY Mellon’s credit

ratings and stress test

performance --

diverse revenue

streams and fee-generating

business

•

Corporate brand and excellent

credit ratings are attractive to

large, sophisticated investors

•

Strong long-term growth

potential

•

Global Partnered Sales

Investment Management &

Investment Services

•

Leverage Pershing platform for

Investment Management product

distribution

Investment Management &

Investment Services

•

Increased money market

distribution

Investment Management &

Investment Services

•

Asia Separately Managed

Accounts platform

Pershing & Investment

Management

•

Brokerage and Bank Services

Pershing & Wealth

Management

•

Intermediary Private Banking

solution

Pershing & Wealth

Management

•

Liability-Driven Investments (LDI)

•

Index and money market products

Net Asset Flows

(2011-2013)

$141B

$57B

$32B

($30B)

$5B

~$205B

Strong financial position of Holding

Company parent is attractive to client

base

Attractive asset classes for Investment

Services’

clients

LDI

Index

Active

Alternative

Money

Market |

Focused on Expense Control and Operating Leverage

9

Bending the Cost Curve

Technology

•

Getting more out of existing spend

Managing

Real Estate

•

Consolidating

our

space

–

net

reduction

of

~700,000 square feet in New York City

Consolidating

Platforms

•

Custody: three platforms to one

•

Fund accounting: five platforms to three

Re-engineering

•

Rationalizing client-coverage teams

•

Insourcing application developers |

Driving Shareholder Value

Actively realigning the business model for the new regulatory

environment

Bending the cost curve and driving positive operating leverage

Generating 20%+ returns on tangible capital, enabling:

Dividend increases

Share repurchases

Investments in our businesses

10

Positioned for Growth |

|

APPENDIX |

Reconciliation Schedule

Business

-

Revenue

and

Pretax

Income

* Totals exclude

the

Other

segment.

Pretax

metrics

exclude

the

impact

of

intangible

amortization.

INVESTMENT SERVICES

INVESTMENT MANAGEMENT

TOTAL

INVESTMENT SERVICES

REVENUE

$ MILLION

INVESTMENT MANAGEMENT

TOTAL

2,515

953

718

1Q13

249

PRETAX INCOME

$ MILLION

2,604

985

778

2Q13

311

2,566

987

800

3Q13

290

2,469

1,061

650

4Q13

292

10,154

3,986

2,946

2013

14,140

1,142

4,088

13 |

14

Reconciliation Schedule

Return on Tangible Common Equity and Net Income

Net Income ($millions)

(Ex. Intangible Amortization)

2013

Net income –

continuing operations

$2,047

Intangible amortization –

after-tax

220

M&I, litigation and restructuring

45

Net charge related to the disallowance of

certain tax credits

593

Adjusted Net Income

1

$2,905

($millions)

Average

Tangible

Common

Shareholders’

Equity

2013

Average

Common

Shareholders’

Equity

$34,832

Average Goodwill

(17,988)

Average Intangible Assets

(4,619)

Deferred

Tax

Liability

–

tax

deductible

goodwill

1,302

Deferred

Tax

Liability

–

non-tax

deductible

intangible assets

1,222

Average

Tangible

Common

Shareholders’

Equity

$14,749

Return

on

Tangible

Common

Equity

1

19.7%

1

Represents a non-GAAP adjusted measure. Additional disclosure regarding this

and other non-GAAP adjusted measures is available in the Corporation’s

reports

filed

with

the

SEC,

including

our

Annual

Report

for

the

year

ended

December

31,

2013,

available

at

www.bnymellon.com/investorrelations.

Net Income ($millions)

2013

2012

Net

income

–

continuing

operations

$2,047

$2,427

Net charge related to the

disallowance of certain tax credits

593

-

Adjusted Net Income

1

$2,640

$2,427

Adjusted Net Income

8.8% |

Dodd-Frank Act Stress Test

Impact on Tier 1 Common Equity Ratio

Bank Holding Company

Ticker/

Identifier

Tier 1 Common Ratio (%)

Stress

Impact

Actual Q3

2013

Ending

Minimum

American Express Company

AXP

12.8

14.0

12.1

0.7

BNY Mellon

BK

14.1

16.1

13.1

1.0

BB&T Corporation

BBT

9.4

8.4

8.4

1.0

SunTrust Banks

STI

9.9

9.0

8.8

1.1

U.S. Bancorp

USB

9.3

8.3

8.2

1.1

PNC Financial Services Group

PNC

10.3

9.0

9.0

1.3

Northern Trust Corporation

NTRS

13.1

11.7

11.7

1.4

Discover Financial Services

DFS

14.7

13.7

13.2

1.5

Fifth Third Bancorp

FITB

9.9

8.4

8.4

1.5

Ally Financial

ALLY

7.9

6.3

6.3

1.6

KeyCorp

KEY

11.2

9.3

9.2

2.0

Regions Financial Corporation

RF

11.0

9.0

8.9

2.1

Comerica Incorporated

COM

10.7

8.6

8.6

2.1

State Street Corporation

STT

15.5

14.7

13.3

2.2

Wells Fargo & Company

WFC

10.6

8.2

8.2

2.4

M&T Bank Corporation

MTB

9.1

6.2

6.2

2.9

UnionBanCal Corporation

UNB

11.1

8.1

8.1

3.0

BBVA Compass Bancshares

BBVA

11.6

8.5

8.5

3.1

RBS Citizens Financial Group

RBS

13.9

10.7

10.7

3.2

BMO Financial Corp.

BMO

10.8

7.6

7.6

3.2

Huntington Bancshares Incorporated

HBAN

10.9

7.4

7.4

3.5

JPMorgan Chase & Co.

JPM

10.5

6.7

6.3

4.2

Capital One Financial Corporation

COF

12.7

7.8

7.8

4.9

Bank of America Corporation

BAC

11.1

6.0

5.9

5.2

Citigroup

C

12.7

7.2

7.2

5.5

Santander Holdings USA

SC

13.7

7.3

7.3

6.4

Morgan Stanley

MS

12.6

7.6

6.1

6.5

Zions Bancorporation

ZB

10.5

3.6

3.6

6.9

Goldman Sachs Group

GS

14.2

9.2

6.9

7.3

HSBC North America Holdings

HSBC

14.7

6.6

6.6

8.1

SOURCE:

Federal

Reserve

–

Dodd-Frank

Act Stress Test (DFAST)

2014: Supervisory Stress Test

Methodology and Results

15 |

Asset Servicing:

Largest global custodian ranked by

Assets Under Custody and / or Administration

Source:

Globalcustody.net,

2013,

data

as

of

June

30,

2013

or

as

otherwise

noted by relevant ranked entity.

Broker-Dealer Services: #1 (U.S.), growing globally

Alternative Investment Services: #3 fund administrator

Based on single manager funds and funds of hedge fund assets under

administration combined.

Corporate Trust: #1 Global Corporate Trust Service Provider

Source:

Thomson Reuters and Dealogic, first quarter, 2013

Depositary Receipts:

#1 in market share (~60%)

Leader in sponsored global depositary receipts programs

Source:

BNY

Mellon.

Data

as

of

December

31,

2013

Pershing: #1 U.S. clearing firm

Pershing LLC., ranked by number of broker-dealer customers

Source: Investment News, 2012

Treasury Services:

Top 5 in USD payments

Fifth largest participant in CHIPS funds transfer volume

Fifth largest Fedwire payment processor

Source:

CHIPS

High

Volume

Customer

Report,

June

2013

and

Fedwire

High

Volume Customer Report, June 2013

Asset Management

Eighth largest global asset manager

Source: Pensions & Investments, November 2013

Wealth Management

Seventh largest U.S. wealth manager

Source: Barron’s, Sept 2013

Disclosures

16

Source:

Federal

Reserve

Bank

of

New

York

-

Fedwire

Securities High Volume Customer Report, March 2013

Leading provider of U.S. Government Securities clearance services

Source:

HFMWeek

20th Biannual AuA Survey -

June 2013 |