Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - POWERSECURE INTERNATIONAL, INC. | d703427d8k.htm |

April 2014

Exhibit 99.1 |

2 | ©

2014 PowerSecure. All rights reserved.

Forward Looking Statements

Safe Harbor

All

forward-looking

statements

made

in

this

presentation

are

made

under

the

safe

harbor

provisions

of

the

Private

Securities

Litigation

Reform

Act

of

1995.

Forward-looking

statements,

which

are

all

statements

other

than

statements

of

historical

facts

and

include

beliefs,

opinions,

estimates,

and

projections

about

future

business

developments

and

opportunities

and

financial

guidance,

are

not

guarantees

of

future

performance

or

events

but

are

subject

to

risks,

uncertainties

and

other

factors

that

could

cause

actual

results

to

differ

materially

from

those

expressed,

projected

or

implied,

including

risks

and

uncertainties

set

forth

in

the

Company's

SEC

filings,

including

but

not

limited

to

the

Company’s

most

recent

Form

10-K

and

subsequent

filings

on

Form

8-K

and

10-Q.

Any

forward-looking

statements

in

this

presentation

speak

only

as

of

the

date

hereof,

and

the

Company

assumes

no

duty

or

obligation

to

update

or

revise

any

forward-looking

statements. |

3 | ©

2014 PowerSecure. All rights reserved.

NYSE:

POWR

PowerSecure: Who We Are Today

Backlog:

$248M

(36% YoY Growth)

>750

Employees

Growing

Operating

Margins,

E.P.S.,

Adjusted EBITDA

Strong

Balance Sheet

TTM Revenues:

$270M

(67% YoY Growth)

Headquarters:

Wake Forest, NC |

PowerSecure: Utility Focused

4 | ©

2014 PowerSecure. All rights reserved.

Distributed

Generation

Systems

Utility

Infrastructure

Solutions

Energy Efficiency

Products/Services

Utilities

and Their

Large

Customers |

FY13

FY12

%

Revenue

Distributed Generation

111.5

76.4

46%

Utility Infrastructure

111.7

60.7

84%

Energy Efficiency

47.0

25.0

89%

Total Revenue

270.2

162.0

67%

GAAP Gross Profit

71.6

51.1

40%

GAAP Gross Profit % Revenue

26.5%

31.5%

-5.0 pp

non-GAAP Gross Profit

75.3

51.1

47%

non-GAAP Gross Profit % Revenue

27.8%

31.5%

-3.7 pp

GAAP Operating Income

8.6

1.9

362%

GAAP Operating Profit % Revenue

3.2%

1.2%

2.0 pp

non-GAAP Operating Income

14.5

4.7

211%

non-GAAP Operating Profit % Revenue

5.4%

2.9%

2.5 pp

GAAP E.P.S.

$0.22

$0.16

38%

Non-GAAP E.P.S.

$0.38

$0.22

73%

Adjusted EBITDA

22.1

11.2

97%

See non-GAAP discussion and reconciliation

5 | ©

2014 PowerSecure. All rights reserved.

FY 2013 Results

(in millions)

Y-O-Y Variance |

4Q 2013

Results (in millions)

4Q13

4Q12

%

Revenue

Distributed Generation

26.4

22.6

16%

Utility Infrastructure

37.5

20.7

82%

Energy Efficiency

9.7

3.4

182%

Total Revenue

73.6

46.8

57%

GAAP Gross Profit

16.5

15.5

7%

GAAP Gross Profit % Revenue

22.4%

33.0%

-10.6 pp

non-GAAP Gross Profit

20.2

15.5

31%

non-GAAP Gross Profit % Revenue

27.4%

33.0%

-5.6 pp

GAAP Operating Income

-1.8

2.0

N/M

GAAP Operating Profit % Revenue

-2.5 %

4.3%

-6.8 pp

non-GAAP Operating Income

3.5

3.1

12%

non-GAAP Operating Profit % Revenue

4.8%

6.7%

-1.9 pp

GAAP E.P.S.

-$0.09

$0.08

N/M

Non-GAAP E.P.S.

$0.13

$0.13

0%

Y-O-Y Variance

See non-GAAP discussion and reconciliation

6 | ©

2014 PowerSecure. All rights reserved. |

7 | ©

2014 PowerSecure. All rights reserved.

•

2013 GAAP EPS of $0.22 (+37.5% y-o-y)

•

2013 non-GAAP EPS of $0.38 (+72.7% y-o-y)

•

2013 operating margins increase

o

+ 2.0 pp on a GAAP basis

o

+ 2.5 pp on a non-GAAP basis

•

2013 Adjusted EBITDA increases 97% to $22.1M

•

Decreasing OpEx as percentage of revenue

•

Increasing scale across all business lines

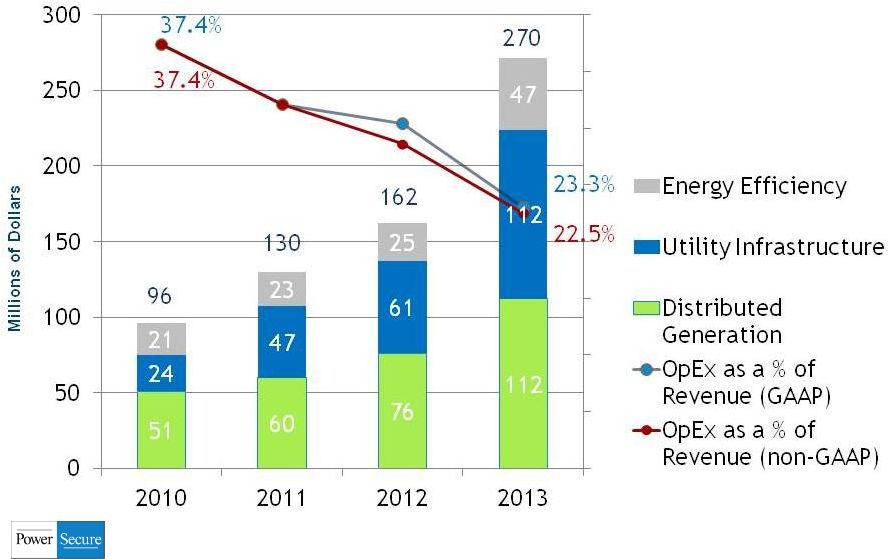

Meaningful Bottom Line Leverage

See non-GAAP discussion and reconciliation |

8 | ©

2013 PowerSecure. All rights reserved.

Revenue Scaling and Diversifying:

Driving OpEx Leverage

See non-GAAP discussion and reconciliation |

9 | ©

2014 PowerSecure. All rights reserved.

2011 Progression

Revenue

E.P.S. --

Non-GAAP

E.P.S. --

GAAP

$0.25 $0.90

$0.05 $0.06 See non-GAAP

discussion and reconciliation |

See non-GAAP discussion and reconciliation

10 | ©

2014 PowerSecure. All rights reserved. |

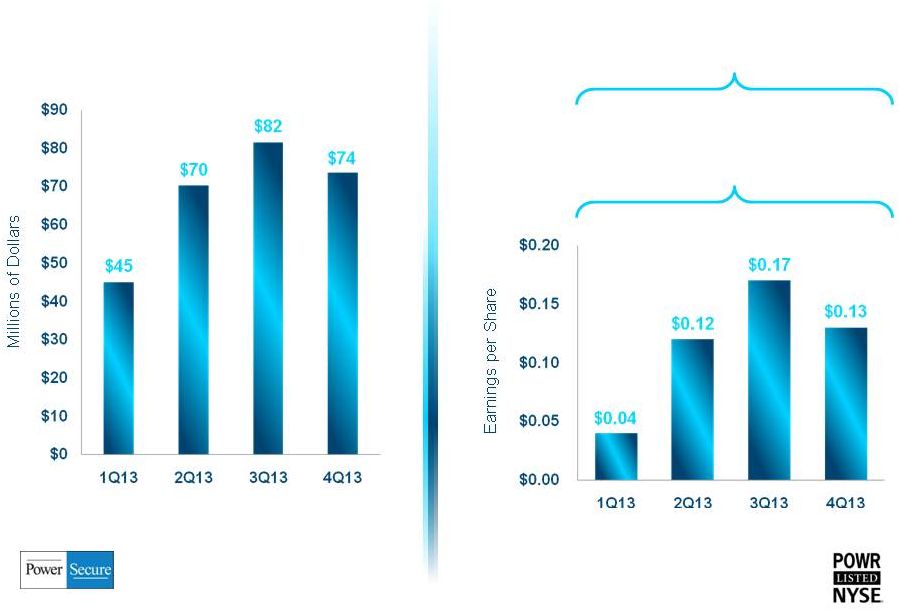

Revenue

2013 Progression

E.P.S. --

Non-GAAP

E.P.S. --

GAAP

See non-GAAP discussion and reconciliation

$0.04

$0.11 $0.17 ($0.09)

11 | ©

2014 PowerSecure. All rights reserved. |

•

At end of Q4 2013:

-

$50.9 M in Cash

-

$27 M term debt (majority hedged at 3.73%)

-

Untapped $20 M revolver

•

Potential uses of capital:

-

Additional investment in company-owned DG projects

-

Potential acquisitions

-

Working capital

-

Equipment to support growth in UI

Robust Balance Sheet

12 | ©

2014 PowerSecure. All rights reserved. |

•

Provides cyber security and NERC-CIP

compliance consulting services to

utility industry

•

Opportunity for PowerSecure to expand

UI service offerings to world-class Encari

customer base

•

PowerSecure can bring Encari’s

expertise to existing UI customers

•

Accretive to UI gross margin

Recent Acquisitions Add Value

Purchased

Encari for $4.8M

October 2013

13 | ©

2014 PowerSecure. All rights reserved. |

Recent

Acquisitions Add Value •

Successful 20-yr old business serving

major ESCOs with lighting, mechanical,

water and building envelope solutions

to deliver energy efficiency savings

•

Significantly expands our Energy

Efficiency offerings

•

Opens new customer channels for

LED lighting and peak shaving

•

Delivered $2.3M in profit in 2013

Purchased

ESCO services

business

for $5.5M

February 2013

14 | ©

2014 PowerSecure. All rights reserved. |

Recent Acquisitions Add Value

•

Solais has significant sourcing and

manufacturing expertise

•

Adds substantial efficiencies to

manufacturing of PowerSecure’s

existing LED solutions

•

Outstanding proprietary portfolio of LED

lamps and fixtures for commercial and

Industrial applications

•

Superior light output, thermal

management, optics, light quality and

aesthetics

Purchased

Solais lighting

business

for $15 M

April 2013

15 | ©

2014 PowerSecure. All rights reserved. |

16 | ©

2014 PowerSecure. All rights reserved.

2014 Goal: >$300M in Revenues

16 | ©

2014 PowerSecure. All rights reserved.

Distributed

Generation

Utility

Infrastructure

Energy

Efficiency |

DG:

Hospital & Data Center Growth Drivers •

Hospital revenues +144% in 2013

•

Data center revenues +86% in 2013

•

Average DG project size up 28%

from 2012 to 2013

•

Focused hospital and data center

sales teams

•

Proprietary PowerBlock solution

drivers higher ROI for customers

•

70% bi-fuel capability delivers

environmental & economic benefits

•

18-24 month sales cycle

17

|

2013

PowerSecure.

All

rights

reserved.

© |

PowerSecure Distributed Generation:

Differentiated Solution=Superior Reliability & ROI

•

24/7 monitoring: standby and peak shaving

•

Proprietary internet-based monitoring, dispatch and control

•

“No Pain”

demand response

•

98.2% reliability

•

Utility tariff and interconnect experts

•

Solar DG capability

Interactive

Distributed

Generation

®

System

Electric

Utility

Customer

Facility

18

|

2014

PowerSecure.

All

rights

reserved.

© |

•

T&D maintenance and construction

•

Substation products and services

•

Advanced metering and lighting

installation

•

Storm repair and restoration

•

Utility engineering and design

•

Regulatory consulting and rate design

Utility Infrastructure:

Direct Service to our Utility Customers

19

|

2014

PowerSecure.

All

rights

reserved.

© |

•

Department store/high-end retail lighting

-

Solais product line adds new customers

•

Utility lighting

•

Grocery, drug, and convenience stores

-

Best-in-class lights for freezer/refrigerated cases

•

Commercial & industrial lighting

-

New targeted/niche product recently launched

Energy Efficiency: LED Solutions

-

Utilities and municipalities

-

Energy and maintenance savings drive payback

-

Opportunity: millions of lights across U.S.

20

|

2014

PowerSecure.

All

rights

reserved.

© |

PowerSecure: Utility Focused

Energy Efficiency

Products/Services

Utility

Infrastructure

Solutions

Distributed

Generation

Systems

Utilities

And Their

Large

Customers

©

21

|

2014

PowerSecure.

All

rights

reserved.

© |

Thank you |

Non-GAAP Financial Measures

23 | ©

2014 PowerSecure. All rights reserved.

Our references to our fourth quarter and full year 2013, and fourth quarter and full year 2012

“non- GAAP pro forma” financial measures of cost of sales, gross margins, gross

margins as a percentage of revenue, operating expenses, operating expenses as a percentage of

revenue, operating income, operating income as a percentage of revenue, net income from

continuing operations, net income, net income attributable to PowerSecure International, Inc.,

diluted E.P.S. from continuing operations, and diluted E.P.S. discussed and shown in this report

constitute non-GAAP financial measures. For the fourth quarter of 2013, our

non-GAAP financial measures refer to our GAAP results, excluding a $4.9 million charge

primarily related to the restructuring of the Company’s Energy Efficiency LED lighting

operations to position its product lines for enhanced future growth and profitability. The

restructuring was implemented to realize the manufacturing and sourcing synergies contemplated

by the Company in its 2013 acquisition of Solais Lighting. The actions taken included

eliminating certain duplicative facilities, resourcing from new lower cost suppliers, reducing

the number of product offerings, and reducing personnel and overhead. $3.7 million of

this charge relates to inventory and was recorded in cost of sales, and $1.2 million relates to

severance, facilities and equipment expenses which was recorded as “restructuring

charge” in operating expense. The Company expects to record an additional charge

related to these actions in the first quarter of 2014 in an amount of $0.3-1.0 million.

Fourth quarter 2013 non-GAAP financial measures also exclude a one-time expense of $0.5

million to upgrade an annuity that underpins the post-retirement compensation of its chief

executive officer to fully guarantee future payments. |

24 | ©

2014 PowerSecure. All rights reserved.

Non-GAAP Financial Measures

For the fourth quarter of 2012, our non-GAAP financial measures refer to our GAAP results,

excluding a $1.1 million pre-tax charge related to a restructuring and cost reduction plan that was

initiated during the third quarter of 2012, and extended into the fourth quarter of 2012, to

position the company to lower its operating expenses as a percentage of revenue in future

periods. For the full year 2013, our non-GAAP financial measures refer to our GAAP results,

excluding a $4.9 million charge primarily related to the restructuring of the Company’s

Energy Efficiency LED lighting operations to position its product lines for enhanced future

growth and profitability. $3.7 million of this charge relates to inventory and was

recorded in cost of sales, and $1.2 million relates to severance, facilities, and equipment

expenses which was recorded as “restructuring charge” in operating expense. Our full

year 2013 non-GAAP financial measures also exclude a one-time expense of $0.5 million

to upgrade an annuity that underpins the post-retirement compensation of its chief executive

officer to fully guarantee future payments, and acquisition expenses of $0.6 million related to

the Solais, ESCO, and PowerLine transactions. For the full year 2012, our non-GAAP financial measures refer to our GAAP results, excluding: 1)

$2.7 million in charges related to restructuring and cost reduction actions taken in 2012, 2)

acquisition expenses of $0.1 million related to the PowerSecure Solar transaction, and 3) gain

on the sale of the company’s WaterSecure investment of $1.4 million. We believe providing

non-GAAP measures which show our pro forma results with these items adjusted is valuable

and useful as it allows our management and our board of directors to measure, monitor and

evaluate our operating performance in 2012, 2013, and in future periods with the same

consistent financial context as the business was managed in those periods. Additionally,

because these items were non-recurring, our non-GAAP pro forma measures are more

comparable to our prior period and future period results. |

25 | ©

2014 PowerSecure. All rights reserved.

Non-GAAP Financial Measures

References to our fourth quarter and full year 2012 and 2013 Adjusted EBITDA, which we define as

our earnings before interest, taxes, depreciation and amortization, as discussed and shown in this

release, constitutes a non-GAAP “pro forma” financial measure.

We believe that Adjusted EBITDA, as a non-GAAP pro forma financial measure, provides

meaningful information to investors in terms of enhancing their understanding of our operating

performance and results, as it allows investors to more easily compare our financial

performance on a consistent basis compared to the prior year periods. This non-GAAP

financial measure also corresponds with the way we expect investment analysts to evaluate and

compare our results. Any non-GAAP pro forma financial measures should be considered

only as supplements to, and not as substitutes for or in isolation from, or superior to, our

other measures of financial information prepared in accordance with GAAP, such as net income

attributable to PowerSecure International, Inc. We define and calculate Adjusted EBITDA as net income attributable to PowerSecure International,

Inc., minus: 1) the gain on the sale of our unconsolidated affiliate, 2) discontinued

operations and 3) interest income and other income, plus: 4) restructuring charges, 5)

acquisition expenses, 6) income tax expense (or minus an income tax benefit), 7) interest

expense, 8) depreciation and amortization and 9) stock compensation expense. We disclose

Adjusted EBITDA because we believe it is a useful metric by which to compare the performance of

our business from period to period. We understand that measures similar to Adjusted

EBITDA are broadly used by analysts, rating agencies, investors and financial institutions in

assessing our performance. Accordingly, we believe that the presentation of Adjusted

EBITDA provides useful information to investors. The table below provides a

reconciliation of Adjusted EBITDA to net income attributable to PowerSecure International, Inc., the

most directly comparable GAAP financial measure. |

26 | ©

2014 PowerSecure. All rights reserved. |

27 | ©

2014 PowerSecure. All rights reserved. |

28 | ©

2014 PowerSecure. All rights reserved. |

29 | ©

2013 PowerSecure. All rights reserved.

Non-GAAP Financial Measures

Our references to our quarterly and full year 2012, and quarterly and full year 2011 “Non-GAAP

Pro forma” financial measures of operating expenses, operating expenses as a percentage of

revenue, operating income, operating income as a percentage of revenue, net income from

continuing operations, net income, net income attributable to PowerSecure International, Inc.,

diluted E.P.S. from continuing operations, and diluted E.P.S. discussed and shown in this

report constitute non- GAAP financial measures. For our quarterly and full year

2012 results, they refer to our GAAP results, adjusted to show them 1) excluding charges

related to our restructuring and cost reduction initiative, 2) gains related to the 2011 sale

of our WaterSecure operations, and 3) results of our discontinued PowerPackages business exited

in 2011. For our fourth quarterly and full year 2011 results, they refer to our GAAP

results, adjusted to show them 1) excluding gains and income related to our WaterSecure

operations, 2) the results of our discontinued PowerPackages business, and 3) gains and income

related to our discontinued Southern Flow business sold in 2011. We believe providing non-GAAP measures which show our pro forma results with these items

adjusted is valuable and useful as it allows our management and our board of directors to measure,

monitor and evaluate our operating performance in 2011, 2012, and in future periods with

the same consistent financial context as the business was managed in those periods.

Additionally, because these items were non-recurring, our non-GAAP pro forma measures

are more comparable to our prior period and future period results. |

30 | ©

2013 PowerSecure. All rights reserved.

Non-GAAP Financial Measures

We believe providing non-GAAP measures which show our pro forma results with these items

adjusted is valuable and useful as it allows our management and our board of directors to measure,

monitor and evaluate our operating performance in 2011, 2012, and in future periods with

the same consistent financial context as the business was managed in those periods.

Additionally, because these items were non-recurring, our non-GAAP pro forma measures

are more comparable to our prior period and future period results.

We believe these Non-GAAP Pro forma measures also provide meaningful information to investors

in terms of enhancing their understanding of our fourth quarter and full year 2012, and fourth

quarter and full year 2011 operating performance and results, as they allow investors to more

easily compare our financial performance on a consistent basis compared to the prior year

periods. These Non-GAAP Pro forma measures also correspond with the way we expect

investment analysts to evaluate and compare our results. Our Non-GAAP Pro forma

measures should be considered only as supplements to, and not as substitutes for or in

isolation from, or superior to, our other measures of financial information prepared in

accordance with GAAP, such as GAAP revenue, operating expenses, operating expenses as a

percentage of revenue, operating income, operating income as a percentage of revenue, net

income from continuing operations, net income, net income attributable to PowerSecure

International, Inc., diluted E.P.S. from continuing operations, diluted E.P.S. from

discontinued operations, and diluted E.P.S.

The following table provides a reconciliation of these non-GAAP financial measures to the most

directly comparable GAAP financial measures. |

Non-GAAP Financial Measures |

32 | ©

2014 PowerSecure. All rights reserved. |