Attached files

| file | filename |

|---|---|

| 8-K - 8-K - EMPIRE DISTRICT ELECTRIC CO | a14-9900_18k.htm |

Exhibit 99.1

|

|

Annual 2013 Analyst Presentation 2/21/14 The Empire District Electric Company |

|

|

Forward Looking Statements This presentation discusses various matters that are “forward-looking statements” intended to qualify for the safe harbor from liability established by the Private Securities Litigation Reform Act of 1995. Such statements address or may address future plans, objectives, expectations and events or conditions concerning various matters such as capital expenditures, earnings, pension and other costs, competition, litigation, our construction program, our generation plans, our financing plans, potential acquisitions, rate and other regulatory matters, liquidity and capital resources and accounting matters. Forward-looking statements may contain words like “anticipate”, “believe”, “expect”, “project”, “objective” or similar expressions to identify them as forward-looking statements. Factors that could cause actual results to differ materially from those currently anticipated in such statements include: weather, business and economic conditions and other factors which may impact sales volumes and customer growth; the costs and other impacts resulting from natural disasters, such as tornados and ice storms; the amount, terms and timing of rate relief we seek and related matters; the results of prudency and similar reviews by regulators of costs we incur, including capital expenditures and fuel and purchased power costs, including any regulatory disallowances that could result from prudency reviews; unauthorized physical or virtual access to our facilities and systems and acts of terrorism, including, but not limited to, cyber-terrorism; legislation and regulation, including environmental regulation (such as NOx, SO2, mercury, ash and CO2) and health care regulation; the periodic revision of our construction and capital expenditure plans and cost and timing estimates; costs and activities associated with markets and transmission, including the Southwest Power Pool (SPP) Energy Imbalance Services Market, SPP regional transmission organization (RTO) transmission development, and SPP Day-Ahead Market the impact of energy efficiency and alternative energy sources; electric utility restructuring, including ongoing federal activities and potential state activities; rate regulation, growth rates, discount rates, capital spending rates, terminal value calculations and other factors integral to the calculations utilized to test the impairment of goodwill, in addition to market and economic conditions which could adversely affect the analysis and ultimately negatively impact earnings; volatility in the credit, equity and other financial markets and the resulting impact on our short term debt costs and our ability to issue debt or equity securities, or otherwise secure funds to meet our capital expenditure, dividend and liquidity needs; the effect of changes in our credit ratings on the availability and cost of funds; the performance of our pension assets and other post employment benefit plan assets and the resulting impact on our related funding commitments; our exposure to the credit risk of our hedging counterparties; performance of acquired businesses; the cost and availability of purchased power and fuel, including costs and activities associated with the transition to the SPP Day-Ahead Market, and the results of our activities (such as hedging) to reduce the volatility of such costs; interruptions or changes in our coal delivery, gas transportation or storage agreements or arrangements; operation of our electric generation facilities and electric and gas transmission and distribution systems, including the performance of our joint owners; changes in accounting requirements; costs and effects of legal and administrative proceedings, settlements, investigations and claims; and other circumstances affecting anticipated rates, revenues and costs. All such factors are difficult to predict, contain uncertainties that may materially affect actual results, and may be beyond our control. New factors emerge from time to time and it is not possible for management to predict all such factors or to assess the impact of each such factor on us. Any forward-looking statement speaks only as of the date on which such statement is made, and we do not undertake any obligation to update any forward-looking statement to reflect events or circumstances after the date on which such statement is made. We caution you that any forward-looking statements are not guarantees of future performance and involve known and unknown risk, uncertainties and other factors which may cause our actual results, performance or achievements to differ materially from the facts, results, performance or achievements we have anticipated in such forward-looking statements. |

|

|

Brad Beecher, President & CEO Laurie Delano, Vice President - Finance & CFO Investor Relations Team Jan Watson, Secretary-Treasurer |

|

|

Company Overview NYSE ticker: EDE Market capitalization: $1 Billion on 2/21/2014 Operations in 4 states: MO, KS, OK, AR plus FERC Pure-play utility: vertically integrated electric, gas & water Customers: 217,000 Regulated operations: 100% Who We Are |

|

|

Dividend increased 2% in Q4 2013 – implied annual rate of $1.02 Company Overview Highlights Improved credit ratings – Standard and Poor’s March 2013; Moody’s January 2014 Environmental compliance plan progressing (will spend $195M over next 3 years) MPSC approved $27.5M of the $30.7M revenue increase requested effective 4/1/13 Filed a request with the Arkansas Public Service Commission for a revenue increase of $2.2M SPP Day Ahead Market readiness complete; go live date March 1, 2014 Financings lowered debt costs and replaced 2013 maturity Debt financing expected late 2014 Joplin rebuilding continues 2013 Earnings per share - $1.48 |

|

|

Company Overview Joplin Rebuilding/Redevelopment Mercy Hospital Blue Buffalo Pet Food |

|

|

Joplin Rebuilding/Redevelopment Company Overview Irving Elementary School East Middle School & Soaring Heights Elementary School Joplin High School |

|

|

Core business with rate base infrastructure investment Commitment to renewable energy and reducing emissions Compelling Investment Platform Reliable, diverse, low cost, regulated generating assets Constructive regulatory relationships Experienced management team High quality, pure-play, regulated electric and gas utility EDE Strategy Low-risk growth plan Improved earnings growth profile Regulatory lag managed through ratemaking process and cost-conscious management Investment grade credit ratings Attractive annualized dividend yield of 4.5% on February 21, 2014 Opportunity for earnings and dividend growth Dividend increased 2% in Q4 2013 Strong financial metrics Competitive total return prospects |

|

|

Pure-Play Regulated Electric and Gas Utility |

|

|

Energy Supply Primary Fuel Net Capacity (MW) Status Asbury Coal 189 Owned1 Riverton Natural Gas 279 Owned Iatan Coal 190 Owned State Line Combined Cycle Natural Gas 297 Owned2 State Line Unit 1 Natural Gas 94 Owned Empire Energy Center Natural Gas 262 Owned Ozark Beach Hydro 16 Owned Elk River Windfarm PPA Wind 7 Contracted3 Plum Point Energy Station Coal 50 Owned Plum Point Energy Station PPA Coal 50 Contracted4 Cloud County Windfarm PPA Wind 5 Contracted5 Total 1,439 Notes: Does not include Asbury Unit 2 (14 megawatts) which was retired at the end of 2013 Does not include 40% owned by Westar Elk River contracted through December 2025 Plum Point contracted through December 2036 (option to convert to ownership in 2015) Cloud County contracted through December 2028 Favorable Energy Supply Portfolio Coal-Fired Generation – Environmentally Compliant Iatan 1 12% ownership (85 MW), pulverized coal plant Iatan 2 12% ownership (105 MW), pulverized coal plant Plum Point 7.5% ownership (50 MW), pulverized coal plant 50 MW PPA with option to convert to ownership interest in 2015 Kansas 9 7 Oklahoma Arkansas 8 Missouri 3 6 1 2 4 5 1 2 3 4 5 6 7 9 8 8 Coal Natural Gas Hydro Wind Environmental Upgrade Underway Asbury Scrubber and baghouse construction in process - early 2015 completion SCR completed Retired Asbury Unit 2 December 31, 2013 Riverton Transitioned coal (92 MW) to natural gas September 2012 - Retire Riverton 7, 8, and 9 around 2016 Conversion of Riverton 12 CT to combined cycle – mid 2016 completion Pure-Play Regulated Electric and Gas Utility 4 8 |

|

|

Environmentally compliant Elk River and Meridian Way wind farms allow EDE to meet MO and KS renewable energy standards Scrubber and baghouse in process, to be completed early 2015 Estimated cost: $112 - $130 million ($86.6 million spent as of 12/31/2013) Estimated customer rate impact 3-5% (1) Construction of new ash landfill expected in 2016 Retired Asbury Unit 2 on December 31, 2013 Pure-Play Regulated Electric and Gas Utility Favorable Energy Supply Portfolio - Environmental Compliance Iatan 1, Iatan 2 and Plum Point Asbury Riverton Units 7 and 8 transitioned to natural gas Riverton Unit 12 conversion to Combined Cycle to be completed in mid 2016 and Units 7, 8, & 9 to be retired Estimated cost: $165 - $175 million ($13.6 million spent as of 12/31/2013) Closure of ash pond expected to be completed early 2014 Riverton Wind Farms (1) Assuming all other factors affecting rates remain constant, adding the value of the Asbury environmental project to current rate base could increase retail electric rates by as much as 3-5% above current levels. Any such increase would have to first be reviewed and approved as part of the Company’s next general rate case filings. |

|

|

Pure-Play Regulated Electric and Gas Utility Favorable Energy Supply Portfolio Capacity, Summer Peak Demand & Total System Input |

|

|

Pure-Play Regulated Electric and Gas Utility Constructive Regulatory Relationships 100% regulated electric and gas operations Constructive relationships with state commissions Rate cases managed to reduce regulatory lag Trackers for pension, retiree health, vegetation management, Iatan 2, Iatan common and Plum Point O&M costs in Missouri Fuel recovery mechanisms in place in all four states Missouri Commission Robert S. Kenney (D) – Chairman Daniel Y. Hall (D) 2013 On-System Electric Revenues by Jurisdiction William P. Kenney (R) Stephen M. Stoll (D) Open position |

|

|

Pure-Play Regulated Electric and Gas Utility Constructive Regulatory Relationships – Rate Case Status Missouri MPSC approved $27.5 million annual increase in base rates of requested $30.7 million, effective April 1, 2013 Includes tornado cost recovery Continues fuel recovery mechanism and trackers for Iatan 2, Iatan Common, and Plum Point O & M costs; pension and retiree health care; vegetation management Increased depreciation rates Write off ($3.6 million) for Iatan 2 prudency and reversal of prior period gain Stipulates no general rate increase effective before October 1, 2014 2013 Integrated Resource Plan (IRP) filed with MPSC July 1, 2013 Missouri Energy Efficiency Investment Act (MEEIA) filed with MPSC October 30, 2013 Request for approval to implement portfolio of demand-side management programs in 2014 to help customers use energy more efficiently Inclusion of Demand-Side Investment Mechanism (DSIM) allows for program costs to be added to monthly customer bills if the new programs are approved by the MPSC DSIM charge is designed to offset financial costs associated with the programs On January 14, 2014, the MPSC suspended the procedural schedule to allow more time for analysis Arkansas Filed request of $2.2M on December 3, 2013 FERC Conditional agreement for Transmission Formula Rate in place Generation Formula Rate annual filing in place |

|

|

Low-Risk Growth Plan |

|

|

Low-Risk Growth Plan Build Core Business with Rate Base Infrastructure Total capital expenditures 2014E-2016E of $500 Million Environmental compliance at Asbury Conversion of Riverton 12 to combined cycle Infrastructure hardening Not included: 2015 option to convert to ownership 50 MW Plum Point PPA Capex (actuals include AFUDC, projections exclude AFUDC) |

|

|

Low-Risk Growth Plan Build Core Business with Rate Base Infrastructure CAGR 2014-2018 4% Capex (actuals include AFUDC, projections exclude AFUDC) Capital Expenditures |

|

|

Low-Risk Growth Plan Electric Customer Growth Beyond 2013: Customer and sales growth expected to be less than 1% in near term Build Core Business with Rate Base Infrastructure 4 |

|

|

Below Average Residential Rates Low-Risk Growth Plan 1 EEI preliminary 2 Source: EEI 3 EEI industry average not yet available 2 1 |

|

|

Strong Financial Metrics |

|

|

Strong Financial Metrics 1 Dividend suspended for Q3 and Q4 in 2011 following tornado on May 22, 2011 Improved Earnings Growth Profile 2014 Earnings Guidance - $1.38 to $1.50 Dividend increased 2% in Q4 2013 Target long-term payout commensurate with utility peers |

|

|

Historical Financial Performance * Operating Revenues include revenues for fuel recovery ($ in millions, except EPS) 2013 2012 2011 2010 2009 Operating Revenues* $594.3 $557.1 $576.9 $541.3 $497.2 Operating Margin $393.1 $359.6 $353.9 $315.4 $279.5 Operating Income $99.7 $96.2 $96.9 $80.5 $74.5 Net Income $63.4 $55.7 $55.0 $47.4 $41.3 Earnings per Share $1.48 $1.32 $1.31 $1.17 $1.18 Return on Average Common Equity 8.7% 7.9% 8.2% 7.5% 7.6% EBITDA $206.4 $190.8 $194.5 $169.6 $145.6 Cash from operations $157.5 $159.1 $134.6 $135.9 $129.6 Capital Structure Debt – Short Term $4.3 $24.7 $12.9 $24.8 $101.5 Debt – Long Term $743.4 $691.6 $692.3 $693.1 $640.2 Equity – Retained Earnings $67.6 $47.1 $33.7 $5.5 $10.1 Equity – Other $682.5 $670.7 $660.3 $652.1 $590.1 Total Equity $750.1 $717.8 $694.0 $657.6 $600.2 Book Value $17.43 $16.90 $16.53 $15.82 $15.75 Strong Financial Metrics Other Highlights (as of 02/21/2014) Stock Price $23.89 Actual Shares Outstanding 43.0 million 52 Week High $24.32 Average Volume 154,000 shares |

|

|

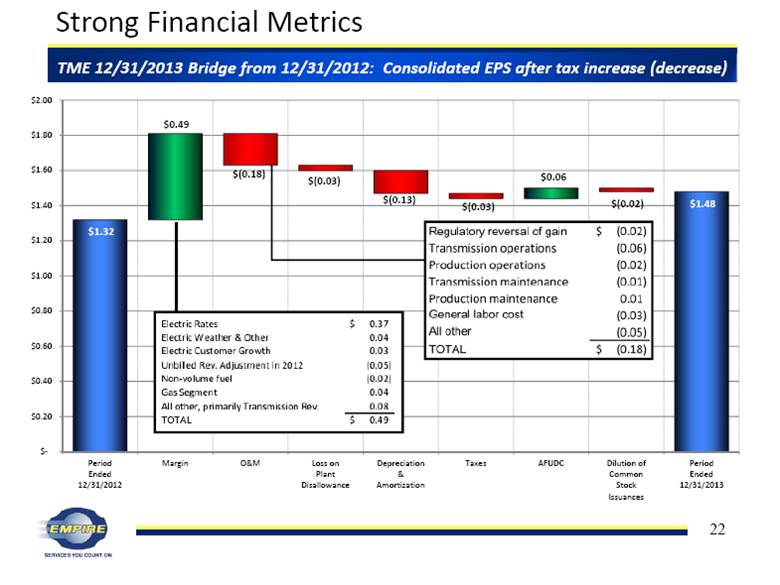

Strong Financial Metrics TME 12/31/2013 Bridge from 12/31/2012: Consolidated EPS after tax increase (decrease) $2.00 $0.49 $1.80 $1.60 $(0.18) $(0.03) $0.06 $(0.13) $(0.02) $1.48 $1.40 $(0.03) $1.32 $1.20 $1.00 $0.80 $0.60 $0.40 $0.20 $- Period Margin O&M Loss on Depreciation Taxes AFUDC Dilution of Period Ended Plant & Common Ended 12/31/2012 Disallowance Amortization Stock 12/31/2013 Issuances 22 |

|

|

Commitment to Credit Quality Strong Financial Metrics Commitment to Credit Quality Target 50/50 capital structure Target strong investment grade ratings January 2014 Moody’s upgrade base on “the company’s constructive regulatory relationships and recently improved cost recovery through general rate case proceedings” (part of an industry wide upgrade in the US utility sector) March 2013 S&P upgrade based on Missouri rate settlement and EDE’s “effective management of regulatory risk” |

|

|

Strong Financial Metrics Financing Outlook and Debt Maturities No near-term maturities and well-spaced debt maturities Debt financing anticipated late 2014: estimate $50M Annual 2013 DRIP $8.0M Empire is positioned with a lower-cost, flexible capital structure |

|

|

Competitive Total Return Prospects |

|

|

Competitive Total Return Prospects Key Earnings Drivers Attractive Dividend CompetitiveTotal Return Net plant growth – 4% CAGR through 2018 Attractive return on equity through constructive regulation Manageable financing requirements Increased dividend 2% in Q4 2013 Attractive yield of 4.5% as of 02/21/2014 |

|

|

Competitive Total Return Prospects Total Return Performance Index 12/21/08 12/31/09 12/31/10 12/31/11 12/31/12 12/31/13 Empire District Electric Company 100.00 114.96 145.53 142.70 144.79 168.77 S&P Electric Utilities index 100.00 103.38 106.93 129.35 128.63 138.66 S&P 500 100.00 126.46 145.51 148.59 172.37 228.19 |

|

|

Summary: Compelling Investment Platform Pure-play regulated utility Low risk growth plan Strong financial metrics Attractive dividend yield and total return prospects |

|

|

Regulated Electric and Gas Utility Data Generation Mix State Commission Profiles Management and Organization Management Biographies Contact Information Supplemental Materials |

|

|

Regulated Electric and Gas Utility Net Plant in Service (at 12/31/13) Oklahoma Revenue Source (LTM 12/31/13) Electric Revenues by Customer (LTM 12/31/13) Gas Revenues by Customer (LTM 12/31/13) |

|

|

Regulated Electric and Gas Utility Diverse Generation/Balanced Mix of Resources 1,377 Net MW Owned Capacity (1) 62 MW Purchased Power Capacity Total: 5,969 GWh (1) Does not include Asbury unit 2 (14 megawatts) which was retired at the end of 2013 2013 Capacity Mix 21% 44% 1% 3% 30% 1% Coal-fired Coal PPA Wind PPA Hydro Gas-fired Simple Cycle Gas-fired Combined Cycle 2013 Energy Mix 22% 15% 52% 8% 1% 2% Coal-fired NCPP Wind PPA Hydro Gas-fired Simple Cycle Gas-fired Combined Cycle |

|

|

State Commission Profiles (1)Regulatory Research Associates |

|

|

Executive Management President & CEO - Bradley P. Beecher VP-Finance & CFO - Laurie A. Delano VP & COO-Electric - Kelly S. Walters VP & COO-Gas - Ronald F. Gatz VP-Transmission Policy & Corporate Services - Michael E. Palmer (Retiring March 2014, duties distributed among current officers) Officers average 15+ years utility experience with Empire Independent Board of Directors Non-executive chairman All directors other than CEO and retired CEO are independent Management and Organization |

|

|

Investor Relations Team Biographies Bradley P. Beecher, President and Chief Executive Officer, joined The Empire District Electric Company in 1988 as a Staff Engineer at the Riverton Power Plant. He was elected Vice President – Energy Supply in 2001 and Vice President and COO – Electric in 2006. He was elected Executive Vice President in February 2010 and became President and CEO on June 1, 2011. A native of northwest Kansas, Mr. Beecher graduated from Kansas State University with a Bachelor of Science degree in Chemical Engineering. He is a registered professional engineer in the State of Kansas. Mr. Beecher serves on the boards of the Joplin Chamber of Commerce, the Boys and Girls Club of Southwest Missouri, and the Kiwanis Club of Joplin. He is also on the boards of Connect2Culture, Joplin Regional Prosperity Initiative, and the Citizens Advisory Recovery Team for the Joplin tornado. He is a graduate of Leadership Missouri. Laurie A. Delano, Vice President - Finance and Chief Financial Officer, first joined the Company in 1979 and served as director of internal auditing from 1983 to 1991. After an eleven-year separation from Empire District, Ms. Delano re-joined the Company in 2002 as director of financial services and assistant controller. She was named to the position of controller, assistant secretary, and assistant treasurer in July 2005. Ms. Delano was named to her current position in July 2011. During the separation in employment, she was an accounting lecturer at Pittsburg State University and held accounting management positions with TAMKO Building Products, Inc. and Lozier Corporation. A native of southwest Missouri, Ms. Delano received an Associate of Arts from Crowder College and a Bachelor of Science in Business Administration from Missouri Southern State University. She also holds a Master of Business Administration from Missouri State University. Ms. Delano is a Certified Public Accountant and Certified Management Accountant. She is a member of the American Institute of Certified Public Accountants and the Institute of Management Accountants. Ms. Delano serves on the board of the Joplin Redevelopment Corporation (JRC) and the Missouri Southern State University School of Business Advisory Council. She has also been active with United Way organizations and agencies, and is a past president of the board of directors of the United Way of Southwest Missouri and the Lafayette House. She currently serves on the Endowment Committee for the Lafayette House. She is a member of the Joplin Daybreak Rotary. |

|

|

Investor Relations Team Biographies Janet S. Watson, Secretary-Treasurer, joined The Empire District Electric Company in 1994 as Accounting Staff Specialist and was elected to her present position in 1995. Prior to joining Empire, Ms. Watson was Accounting Superintendent with Missouri-American Water Company. She was also formerly employed by Freeman Hospital in Joplin as a Cost Analyst and with Teledyne Neosho as a Senior Administrative Accountant. A native of Southwest Missouri, Ms. Watson graduated Summa Cum Laude from Missouri Southern State University with a Bachelor of Business Administration in Accounting with special emphasis in Computer Science. Ms. Watson is a member of the American Society of Corporate Secretaries and Corporate Governance Professionals, the National Investor Relations Institute, and the Risk and Insurance Management Society, Inc. |

|

|

Empire District Electric Company 602 S. Joplin Avenue Joplin, MO 64801 www.empiredistrict.com Jan Watson Office: 417-625-5108 Cell: 417-850-7903 jwatson@empiredistrict.com Laurie Delano Office: 417-625-5127 Cell: 417-291-4397 ldelano@empiredistrict.com Contact Us |

|

|

Making lives better every day with reliable energy and service |