Attached files

| file | filename |

|---|---|

| EX-21 - EX-21 - ECM ENERGY SERVICES INC | d604510dex21.htm |

| EX-3.2 - EX-3.2 - ECM ENERGY SERVICES INC | d604510dex32.htm |

| EX-3.1 - EX-3.1 - ECM ENERGY SERVICES INC | d604510dex31.htm |

| EX-4.3 - EX-4.3 - ECM ENERGY SERVICES INC | d604510dex43.htm |

| EX-4.2 - EX-4.2 - ECM ENERGY SERVICES INC | d604510dex42.htm |

| EX-23.1 - EX-23.1 - ECM ENERGY SERVICES INC | d604510dex231.htm |

| EX-10.2 - EX-10.2 - ECM ENERGY SERVICES INC | d604510dex102.htm |

| EX-10.4 - EX-10.4 - ECM ENERGY SERVICES INC | d604510dex104.htm |

| EX-10.5 - EX-10.5 - ECM ENERGY SERVICES INC | d604510dex105.htm |

| EX-10.1 - EX-10.1 - ECM ENERGY SERVICES INC | d604510dex101.htm |

| EX-10.3 - EX-10.3 - ECM ENERGY SERVICES INC | d604510dex103.htm |

Table of Contents

As filed with the Securities and Exchange Commission on March 28, 2014

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

ECM Energy Services, Inc.

(Exact Name of Registrant as Specified in Its Charter)

| Delaware | 7359 | 46-3275821 | ||

| (State or Other Jurisdiction of Incorporation or Organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

17015 North Scottsdale Road

Suite 210

Scottsdale, Arizona 85255

(888) 523-9095

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Mr. Kevin Groman, Chief Executive Officer

17015 North Scottsdale Road

Suite 210

Scottsdale, Arizona 85255

(888) 523-9095

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent For Service)

Copies to:

| Ralph V. De Martino Cavas S. Pavri Schiff Hardin LLP 901 K Street, Suite 700 Washington, DC 20001 (202) 778-6400 |

Mitchell S. Nussbaum Loeb & Loeb, LLP 345 Park Avenue New York, NY 10154 (212) 407-4000 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Securities Exchange Act of 1934. (Check one):

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | x |

CALCULATION OF REGISTRATION FEE

|

| ||||||||

| Title of each class of securities to be registered |

Amount to be registered |

Proposed maximum offering

price |

Proposed maximum aggregate offering price (1)(2) |

Amount of registration fee | ||||

| Common Stock, par value $0.001 per share |

2,875,000 | $9.00 | $ 25,875,000 | $ 3,332.70 | ||||

| Underwriter warrants (3) |

- | - | - | |||||

| Common Stock issuable upon exercise of Underwriters Warrants |

230,000 | $11.25 | $ 2,587,500 | $ 333.27 | ||||

| Total |

$3,665.97 | |||||||

|

| ||||||||

|

| ||||||||

| (1) | Estimated solely for purposes of computing the amount of the registration fee pursuant to Rule 457(o) under the Securities Act of 1933. |

| (2) | Pursuant to Rule 416 under the Securities Act, the securities being registered hereunder include such indeterminate number of additional shares of common stock as may be issued after the date hereof as a result of stock splits, stock dividends or similar transactions. |

| (3) | No separate fee is required pursuant to Rule 457(g) under the Securities Act of 1933. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell, nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion Dated , 2014.

2,500,000 Shares

ECM Energy Services, Inc.

Common Stock

This is an initial public offering of ECM Energy Services, Inc.

We are offering 2,500,000 shares of common stock in this offering.

Prior to this offering, there has been no public market for our common stock. It is currently estimated that the initial public offering price per share will be between $7.00 and $9.00. We intend to list the common stock on the NYSE MKT under the symbol “ECME”. If our common stock is not approved for listing on the NYSE MKT, we will not consummate this offering.

We are an “emerging growth company” as defined in Section 2(a) of the Securities Act of 1933, as amended, and we have elected to comply with certain reduced public company reporting requirements.

We have granted the underwriters an option for a period of 45 days after the closing of this offering to purchase up to 15% of the total number of shares to be offered by us pursuant to this offering, solely for the purpose of covering over-allotments, at the initial public offering price less the underwriting discount.

An investment in our common stock involves significant risks. You should carefully consider the risk factors beginning on page 12 of this prospectus before you make your decision to invest in our common stock.

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

| Per Share |

Total | |||||||

| Initial public offering price |

$ | $ | ||||||

| Underwriting discount (1) |

$ | $ | ||||||

| Proceeds, before expenses, to us. |

$ | $ | ||||||

| (1) | We have also agreed to issue warrants to the representatives of the underwriters, entitling them to purchase up to 200,000 shares of common stock. Other terms of the warrants are described under the heading “Underwriting.” |

The underwriters expect to deliver the shares on or about , 2014.

Maxim Group LLC

Prospectus dated , 2014.

Table of Contents

ABOUT THIS PROSPECTUS

You should rely only on the information contained in this prospectus related to this offering prepared by us or on our behalf or otherwise authorized by us. We have not authorized anyone to provide you with different information and if anyone provides you with different or inconsistent information, you should not rely on it. We are not making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information contained in this prospectus is accurate only as of the date of this prospectus. Our business, financial condition, results of operations and prospects may have changed since that date.

Before you invest in our common stock, you should read the registration statement (including the exhibits thereto and documents incorporated by reference therein) of which this prospectus forms a part.

For Investors Outside the United States: Neither we nor any of the underwriters have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. You are required to inform yourselves about and to observe any restrictions relating to this offering and the distribution of this prospectus.

Throughout this prospectus, unless otherwise designated, the terms “we,” “us,” “our,” “the Company” and “our company” refer to ECM Energy Services, Inc., a Delaware corporation.

EXPLANATORY NOTE

Market data and certain industry data and forecasts used throughout this prospectus were obtained from internal company surveys, market research, consultant surveys, publicly available information, reports of governmental agencies and industry publications and surveys. Industry surveys, publications, consultant surveys and forecasts generally state that the information contained therein has been obtained from sources believed to be reliable, but that the accuracy and completeness of such information is not guaranteed. We have not independently verified any of the data from third party sources, nor have we ascertained the underlying economic assumptions relied upon therein. Similarly, internal surveys, industry forecasts and market research, which we believe to be reliable based on our management’s knowledge of the industry, have not been independently verified. Forecasts are particularly likely to be inaccurate, especially over long periods of time. In addition, we do not necessarily know what assumptions regarding general economic growth were used in preparing the forecasts we cite. Statements as to our market position are based on the most currently available data. While we are not aware of any misstatements regarding the industry data presented in this prospectus, our estimates involve risks and uncertainties and are subject to change based on various factors, including those discussed under the heading “Risk Factors” in this prospectus.

Table of Contents

| Page | ||||

| 1 | ||||

| 12 | ||||

| 21 | ||||

| 22 | ||||

| 22 | ||||

| 23 | ||||

| 25 | ||||

| 27 | ||||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

33 | |||

| 44 | ||||

| 51 | ||||

| 62 | ||||

| Security Ownership Of Certain Beneficial Owners And Management |

64 | |||

| 66 | ||||

| 70 | ||||

| 72 | ||||

| 76 | ||||

| 76 | ||||

| 76 | ||||

| F-2 | ||||

Through and including , 2014 (the 25th day after the date of this prospectus), all dealers effecting transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to a dealer’s obligation to deliver a prospectus when acting as an underwriter and with respect to unsold allotments or subscriptions.

No dealer, salesperson or other person is authorized to give any information or to represent anything not contained in this prospectus. You must not rely on any unauthorized information or representations. This prospectus is an offer to sell only the shares offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus is current only as of its date.

i

Table of Contents

This summary highlights information contained elsewhere in this prospectus. This summary does not contain all of the information that you should consider before deciding to invest in our common stock. You should read this entire prospectus carefully, including the “Risk Factors” section, our historical consolidated financial statements and the notes thereto, and unaudited pro forma financial information, each included elsewhere in this prospectus.

Overview

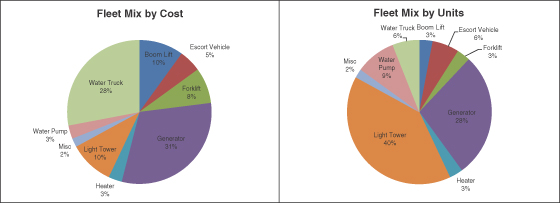

We are an energy services company in the United States focused on natural gas and oil field equipment rentals, water logistics and pilot car services. We are committed to providing our customers with the safest and most dependable solutions in each of the local markets where we operate. Currently, our locations in underserved markets service some of the most prolific oil and natural gas shale areas in the United States, including the Utica shale and Marcellus shale, in Ohio, Pennsylvania, and West Virginia; the Mississippian Lime formation in northern Oklahoma and southern Kansas; the Eagle Ford shale in south Texas, and our newest location opened in February 2014 in the Permian shale basin in New Mexico and North West Texas. We located our branches in the heart of the oil and gas fields, which enables us to provide extremely responsive customer service. Our fleet is tailored for the oil and gas industry and we have $25.2 million of fleet at original equipment cost, with a cost weighted average age of 1.25 years. Oil and gas companies utilize our above the hole equipment in their site preparations, drilling completion and production efforts. The following chart reflects our fleet at December 31, 2013:

Our revenues for the year ended December 31, 2013 were $33.1 million as compared to $15.0 million during the year ended December 31, 2012. Our net loss for the year ended December 31, 2013 was $0.4 million as compared to a net loss of $2.1 million during the year ended December 31, 2012. We are highly leveraged and a substantial portion of our liquidity needs arise from debt service requirements and from funding our costs of operations and capital expenditures. As of December 31, 2013, we had $25.0 million of indebtedness outstanding, including $15.7 million in capital lease obligations and $9.3 million in debt. As of December 31, 2013, we had negative working capital of $4.7 million and our short term liquidity position is dependent on the completion of this offering.

1

Table of Contents

Our Services

We specialize in the deployment of assets for above the hole, natural gas and oil drilling operations and we provide exceptional customer service due in part to our dependable employees and our unique real estate strategy. Our assets include equipment for rent and assets operated by our employees such as water trucks and pilot cars, as well as support vehicles and trailers. Our water hauling logistics services primarily consists of transporting fresh, treated, produced/flowback and disposal water for the onshore oil and gas fracturing shale energy markets in Ohio, West Virginia and Pennsylvania. Our rental equipment increased from $13.7 million as of December 31, 2012 to $28.2 million as of December 31, 2013, and we expanded our water hauling fleet by 14 trucks to a total of 42 trucks due to increased demand for our services in the Marcellus and Utica shale areas.

Our pilot car and traffic control services consist of escorting heavy haul trucks in the rig moving process, and the traffic control activities for drill and hydraulic fracturing sites. We primarily escort heavy haul loads and drilling rig moves throughout Pennsylvania, Ohio and West Virginia.

Our Strategy

With our young and high quality fleet, we deliver safe and dependable customer service and provide equipment and energy services to onshore oil and gas shale customers in North America. We target underserved markets in our locations and our goal is to rapidly expand into the major U.S. shale basins and to be the most dependable provider in each of our local service areas. We believe the following strategies will enable us to achieve this goal:

Safety: We believe safety is of the highest priority to the oil and gas company operators. Our safety records are regularly reviewed and monitored by our customers. We similarly place safety as the highest priority for our operations.

Location: We locate our facilities in underserved markets and in close proximity to the oil and gas field areas in our markets rather than the larger metropolitan areas. This proximity enables us to service our customers’ needs quickly and efficiently and allows us to provide true 24/7 customer service. We believe our customer service reputation has been, and will in the future be, a primary factor in our growth.

Service: We provide 24 hour, seven days per week service and pickup and delivery capabilities. Due to our proximity to our customers, we are able to address our customers’ service issues within two hours of a request. We also provide “on call” fuel delivery for our customers on an agreed upon schedule. To deliver outstanding customer service it is important to hire and retain high quality drivers and field service mechanics as they are the day-to-day customer interfacing roles. We believe the compensation and benefits we provide our drivers is among the highest and best in the industry, which allows us to hire and retain quality drivers. In addition, since our water hauling trucks are relatively new, we believe we have an advantage in hiring and retaining quality drivers, as newer trucks are more desirable to operate.

Age of Equipment: At a 1.25 year cost weighted average age of fleet as of December 31, 2013, our fleet is significantly newer than most major rental companies. We believe the age of our rental equipment gives us an advantage with customers that view new, reliable equipment as having less chance of downtime and is safer for our customers’ employees. A majority of our water hauling trucks and pilot cars were purchased within the last two years. We believe the age of the water hauling trucks and their condition reduces the likelihood of equipment malfunctions, and the associated costs, due to the lesser mileage and wear and tear as compared to older fleets.

2

Table of Contents

Expansion: Our strategy for expansion is focused on building out our footprint to most of the major oil and gas plays in the United States. In each of these areas, we will seek locations that are close to the drilling activity and that are also underserved markets. Once we are able to establish these locations, we intend to expand using satellite locations (generally within 150 miles of the initial location) until they achieve sufficient volumes to become standalone locations. Satellite locations generally are managed by the hub store and operate more synergistically than a typical location.

Previously, our focus was to increase revenues and our geographical footprint often at the expense of operating margin. While we will continue to focus on the increase of revenues in the geographic locations that we service, we also intend to focus on increasing the margins of our existing business and further enhancing profitability.

Our Industry

Oil exploration companies have continued to focus on the resources within the vast shale play in North America utilizing new drilling and completion strategies, including hydraulic fracturing technology. The United States Energy Information Administration in the Annual Energy Outlook 2013 reported: “continued strong growth in domestic crude oil production over the next decade – largely as a result of rising production from tight formations – and increased domestic production of natural gas.” McKinsey Global Institute published in July 2013 the “Game changers: Five Opportunities for US growth and renewal,” which reflected that additional infrastructure investment is needed to fully realize the opportunity the shale play presents, with $1 trillion of this investment needed to support drilling, fracturing, and gathering activity, expecting 30,000 to 40,000 new wells expected to come on line. We believe the industry is staged for significant growth. In addition, we believe that we are benefiting from the continued secular shift toward rental instead of ownership of equipment by our customers.

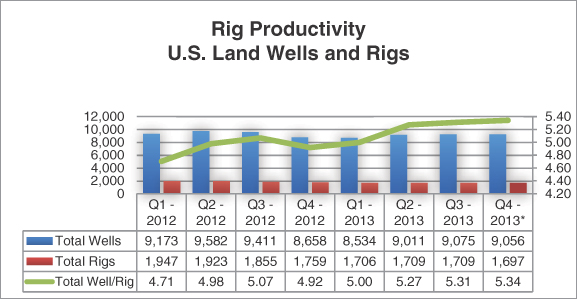

The drilling rig counts are increasing throughout the United States. Drilling permits for U.S. land were at 4,774 in January 2013 increasing to a peak of 7,072 in August 2013 with total permits of 68,624 for 2013, as per RigData. Active rigs on U.S. land totaled 1,759 rigs in January 2013 and increased to 1,862 rigs in December 2013 per RigData. Also oil and gas companies have continued to make improvements in the productivity of the rigs going from 4.71 wells per rig in the first quarter of 2012 to 5.34 in the fourth quarter of 2013, as can be noted in the chart below (Source: Baker Hughes). We believe we are benefiting from this increase in productivity in connection with the increased usage of our equipment at each well site.

3

Table of Contents

Based on industry sources, we estimate the U.S. construction equipment rental industry had rental revenues of approximately $32 billion in 2013. This represents a compound annual growth rate in excess of 6.5% since 1990. We believe that long-term industry growth, apart from reflecting general economic conditions and cyclicality is driven by end-user markets that increasingly recognize the many advantages of renting equipment rather than owning, including:

| • | Avoiding the large capital investment required for equipment purchases; |

| • | Accessing a broad selection of equipment and selecting the equipment that best is suited for each particular job; |

| • | Reducing storage, maintenance and transportation costs; and |

| • | Accessing the latest technology without investing in new equipment. |

Proceeds

With the proceeds from this offering we believe we will be positioned to capitalize on these favorable industry trends and use the net proceeds for the purchase of additional fleet, the potential purchase of new lines of equipment within the shale play and also for complimentary customer adjacencies, the expansion into new markets, for repayment of the remainder of the principal amount of our bridge notes that are not converted into shares of our common stock in connection with this offering and working capital and general corporate purposes.

Risks Associated With Our Business

Our business is subject to numerous risks, as more fully described in the section entitled “Risk factors” immediately following this prospectus summary. You should read these risks before you invest in our common stock. We may be unable, for many reasons, including those that are beyond our control, to implement our business strategy. In particular, risks associated with our business include:

| • | A few of our customers represent a significant source of our revenues. We do not have long-term agreements with customers, and the loss of any such customer would have a significant impact on the revenues generated by that particular business. |

| • | Our business is dependent upon the oil and natural gas industry and particularly on the level of exploration, drilling, development and production of oil and natural gas in the small number of states in which we do business. If there is a downturn in the oil and natural gas activity in these states, our business may suffer. |

| • | A significant portion of our business involves customers conducting hydraulic fracturing. Federal and state legislative and regulatory initiatives limiting hydraulic fracturing or making hydraulic fracturing more costly could adversely affect our business by reducing the business activities of our customers. |

| • | Our business strategy is to expand into underserved markets, which will require us to source real estate in suitable locations and to hire quality personnel. We may have difficulty finding these locations. In addition, as we depend on customer service to differentiate us from our competitors, we will need to attract, hire and retain qualified personnel in these locations, which are generally not located in major metropolitan areas. |

| • | The short-term nature of our equipment rental service agreements exposes us to redeployment risks and means that we could experience rapid fluctuations in revenue in response to market conditions. |

| • | Prolonged periods of severe weather can materially and adversely impact demand for our rental equipment and our water hauling and pilot car services, and increase our costs of operations. |

4

Table of Contents

Recent Developments

We were incorporated in July 2013 to operate our energy service businesses, which have been in operation since July 2010. In July 2013, we acquired all of the membership interests in Energy Construction Management LLC (“ECM LLC”) and Lyco Industries, Inc. (“Lyco”). This acquisition was completed by the equity holders in ECM LLC and Lyco contributing their equity to us in exchange for our shares of common stock.

Prior to our reorganization, Lyco owned a majority of the membership interests in ECM LLC and in Adtrak 360, LLC (“Adtrak”), an entity in the online advertising industry. In July 2013 and prior to our acquisition of Lyco, Lyco distributed all of the equity it held in Adtrak to its shareholders (the “Adtrak distribution”). As a result of the Adtrak distribution, our Media Management operations conducted under the Adtrak name are no longer part of the consolidated group. In accordance with Staff Accounting Bulletin 5:Z.7 we have retroactively reflected the Adtrak distribution as a change in reporting entity as of the beginning of the first period presented and Adtrak’s results are therefore not reflected within our financial statements.

In August and December 2013, we completed a bridge financing pursuant to which we issued an aggregate of $6.0 million in principal amount of convertible notes. In connection with the bridge financing, we agreed to issue the bridge note holders five-year, callable warrants, issuable upon the completion of this offering, to purchase a number of shares of common stock equal to one-quarter of the principal amount of convertible notes acquired by the holders divided by the price per share at which we sell our common stock in this offering at an exercise price equal to 125% of the price per share at which we sell our common stock in this offering. The warrants may be exercised by the holders on a cashless basis and the warrants are callable by us at any such time that the volume weighted average price for our common stock for each of 30 consecutive trading days exceeds 250% of the exercise price of the warrants (subject to adjustment for forward and reverse stock splits, recapitalizations, stock dividends and the like).

Upon completion of this offering, the principal amount of the bridge notes issued in December 2013 will convert into our common stock at a conversion price equal to the price per share of the common stock being sold in this offering. With respect to the bridge notes issued in August 2013, a holder may choose to convert the entire principal amount of bridge notes into our common stock at a conversion price equal to the price per share of the common stock being sold in this offering; provided that if a holder elects not to convert the entire principal amount of the bridge notes into our common stock, then without further action by the holder, upon the closing of this offering 50% of the principal amount of the bridge notes held by such holder shall be converted into shares of common stock at a conversion price equal to the price per share of the common stock being sold in this offering with the remaining 50% of the principal amount of the note being repaid from proceeds received from this offering. Assuming a public offering price of $8.00 per share, which is the midpoint of the offering price range, and assuming the minimum amount of bridge notes converted into shares of our common stock, we would issue 562,500 shares of our common stock upon such conversion. In addition, assuming a public offering price of $8.00 per share, which is the midpoint of the offering price range, we would issue the bridge note holders warrants to purchase an aggregate of 187,500 shares of our common stock at an exercise price of $10.00 per share. The bridge notes bear interest at a rate of 12% per annum and interest is payable in cash on the last day of each calendar month with any remaining unpaid interest to be paid on the conversion of the notes. Upon the conversion or repayment of the notes, which shall occur at the closing of this offering, we will pay any accrued and unpaid interest in cash; provided that if this offering occurs prior to the 12-month anniversary of the issuance of this notes, we will pay interest in amount equal to 12 months of interest (less any interest amounts previously paid).

On March 24, 2014, our board approved a 1-for-2 reverse stock split of our common stock and will submit such reverse stock split for approval of our stockholders at a meeting of stockholders to be held in April 2014. Assuming the approval of the reverse stock split by our stockholders, each share of our common stock outstanding immediately prior to the approval date will be combined, reclassified and changed into one-half of a fully paid and non-assessable share of common stock. All common share and common per share information in this prospectus have been retroactively adjusted to reflect the reverse stock split for all periods presented.

5

Table of Contents

Company Information

We are incorporated in the State of Delaware. Our principal executive offices are located at 17015 North Scottsdale Road, Suite 210, Scottsdale, Arizona, 85255, and our telephone number is (888) 523-9095. Our web site is www.ECMenergy.com. Information contained on our web site is not incorporated by reference into this prospectus. You should not consider information contained on our web site as part of this prospectus.

6

Table of Contents

The Offering

| Issuer |

ECM Energy Services, Inc. |

| Common stock we are offering |

2,500,000 shares |

| Common stock outstanding immediately before this offering |

4,000,056 shares |

| Common stock outstanding immediately after this offering |

6,500,056 shares (excluding shares of common stock to be issued upon conversion of our outstanding bridge notes) |

| Offering price |

$ per share |

| Underwriter’s over-allotment option |

The underwriting agreement provides that we will grant to the underwriter an option, exercisable within 45 days after the closing of this offering, to acquire up to an additional 15% of the total number of shares to be offered by us pursuant to this offering, solely for the purpose of covering over-allotments. |

| Use of proceeds |

We estimate that the net proceeds to us from this offering will be approximately $17.3 million (based on the midpoint of the price range set forth on the cover page of this prospectus), after deducting the underwriting discount payable to the underwriters and our estimated cash offering expenses. We intend to use the net proceeds for the purchase of additional equipment and trucks, the potential purchase of new lines of equipment, the expansion into new markets, for repayment of the remainder of the principal amount of our bridge notes that are not converted into shares of our common stock and working capital and general corporate purposes. |

| Risk Factors |

See “Risk Factors” and other information appearing elsewhere in this prospectus for a discussion of factors you should carefully consider before deciding whether to invest in our common stock. |

| Lock-up |

We, our directors and executive officers, as well as certain of our professional services firms have agreed with the underwriter not to offer, issue, sell, contract to sell, encumber, grant any option for the sale of or otherwise dispose of any of our securities for a period of 12 months following the closing of the offering of the shares. See “Underwriting” for more information. |

| Proposed listing symbol |

“ECME” |

The number of shares of common stock to be outstanding after this offering is based on 4,000,056 shares outstanding as of March 28, 2014, and does not give effect to:

| • | based on an assumed initial public offering price of $8.00 per share, the mid-point of the range set forth on the cover of this prospectus, the issuance of 187,500 shares of common stock upon the conversion of $1.5 million in principal amount of our outstanding bridge notes issued in August 2013, which is the minimum principal amount of bridge notes that will be converted upon completion of this offering; |

7

Table of Contents

| • | based on an assumed initial public offering price of $8.00 per share, the mid-point of the range set forth on the cover of this prospectus, the issuance of 375,000 shares of common stock upon the conversion of $3.0 million in principal amount of our outstanding bridge notes issued in December 2013; |

| • | based on an assumed initial public offering price of $8.00 per share, the mid-point of the range set forth on the cover of this prospectus, 187,500 shares of common stock issuable upon the exercise of warrants issued to holders of our bridge notes issued in August and December 2013; |

| • | 707,000 shares of common stock issuable upon the exercise of outstanding options issued pursuant to ECM Energy Services, Inc. 2013 Stock Plan; |

| • | 693,000 shares of common stock available for issuance under the ECM Energy Services, Inc. 2013 Stock Plan; |

| • | 150,000 shares of common stock issuable upon the exercise of warrants that will be outstanding on the date of the closing of this offering issued to one of our professional services firms; |

| • | 200,000 shares of common stock issuable upon the exercise of the warrants issued to the representatives of the underwriters; |

| • | 375,000 shares of common stock issuable upon exercise of the underwriters’ option to purchase additional shares; and |

| • | 30,000 shares of common stock issuable upon the exercise of the warrants that would be issued to the representatives of the underwriters to the extent the underwriters’ option to purchase additional shares is exercised. |

Unless otherwise indicated, all information in this prospectus assumes a 1-for-2 reverse split of our common stock is effected prior to this offering.

8

Table of Contents

Summary Consolidated Financial Data

The following table summarizes our consolidated financial data. We derived the summary consolidated statement of operations data for the year ended December 31, 2013 and 2012 from our audited consolidated financial statements and related notes appearing elsewhere in this prospectus. The audited consolidated financial statements have been prepared in accordance with U.S. GAAP. The consolidated balance sheet data as of December 31, 2013 and 2012 have been derived from our audited consolidated financial statements included elsewhere in this prospectus and have been prepared on the same basis as the audited consolidated financial statements. In the opinion of management, the unaudited financial information includes all adjustments, consisting of normal recurring adjustments, necessary for the fair presentation of our statement of our financial position and results of operations for these periods. Our historical results for any prior period are not necessarily indicative of the results to be expected in any future period, and our results for any interim period are not necessarily indicative of results to be expected for a full fiscal year. The summary consolidated financial data should be read together with our consolidated financial statements and related notes, as well as our “Management’s discussion and analysis of financial condition and results of operations,” beginning on page 21. Our audited and unaudited consolidated financial statements have been prepared in U.S. dollars in accordance with U.S. GAAP.

The unaudited pro forma consolidated statements of operations data for the fiscal year ended December 31, 2013 present the Company’s consolidated results of operations giving pro forma effect to the Reorganization Transactions, this offering and the use of the estimated net proceeds from this offering as described under “Use of Proceeds,” as if such transactions occurred on January 1, 2013.

The unaudited pro forma consolidated balance sheet data as of December 31, 2013 presents our consolidated financial position giving pro forma effect to this offering and the use of the estimated net proceeds from this offering as described under “Use of Proceeds,” as if such transactions occurred on December 31, 2013.

For purposes of the unaudited pro forma consolidated financial information, we have assumed that upon completion of the offering, the mandatory conversion of 50% of the $3.0 million principal amount of bridge notes issued in August 2013 and the mandatory conversion of 100% of the $3.0 million principal amount of bridge notes issued in December 2013, a total of 7,062,556 shares of common stock will be outstanding, assuming conversion at a price per share equal to the midpoint of the estimated offering price range set forth on the cover of this prospectus. If the underwriters’ over-allotment option is exercised in full, an additional 375,000 shares of common stock would be issued.

The unaudited pro forma consolidated financial information should be read in conjunction with the sections of this prospectus captioned “Use of Proceeds,” “Capitalization,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the audited consolidated financial statements and related notes included elsewhere in this prospectus. All pro forma adjustments and their underlying assumptions are described more fully in the notes to our unaudited pro forma consolidated statements of operations and unaudited pro forma consolidated balance sheet.

The unaudited pro forma consolidated financial information is included for information purposes only and does not purport to reflect the results of operations or financial position of the Company that would have occurred had we operated as a public company during the periods presented. The unaudited pro forma consolidated financial information does not purport to be indicative of our results of operations or financial position had the Reorganization Transaction and this offering occurred on the dates assumed. The unaudited pro forma consolidated financial information also does not project our results of operations of financial position for any future period or date.

9

Table of Contents

Consolidated Statement of Operations

| Pro forma Year Ended December 31, |

For the Years Ended December 31, |

|||||||||||

| 2013 | 2012 | 2013 | ||||||||||

| Total Revenues |

$ | 33,129,443 | $ | 15,033,725 | $ | 33,129,443 | ||||||

| Cost of Revenues |

26,876,316 | 13,210,328 | 26,876,316 | |||||||||

|

|

|

|

|

|

|

|||||||

| Gross Margin |

6,253,127 | 1,823,397 | 6,253,127 | |||||||||

| Selling, general and administrative expenses |

6,220,522 | 3,343,776 | 5,735,341 | |||||||||

|

|

|

|

|

|

|

|||||||

| Operating Income (Loss) |

32,605 | (1,520,379 | ) | 517,786 | ||||||||

| Other Expense |

(789,408 | ) | (591,479 | ) | (893,640 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Net Loss Before Income Taxes |

(756,803 | ) | (2,111,858 | ) | (375,854 | ) | ||||||

| Income Tax Expense (Benefit) |

— | — | — | |||||||||

|

|

|

|

|

|

|

|||||||

| Net Loss |

$ | (756,803 | ) | $ | (2,111,858 | ) | (375,854 | ) | ||||

|

|

|

|

|

|

|

|||||||

| Net Loss Attributable to non-Controlling Interest |

— | (429,491 | ) | — | ||||||||

|

|

|

|

|

|

|

|||||||

| Net Loss Attributable to Common Shareholders |

$ | (756,803 | ) | $ | (1,682,367 | ) | $ | (375,854 | ) | |||

|

|

|

|

|

|

|

|||||||

| Net Loss Per Share Attributable to the Common Shareholders: |

||||||||||||

| Basic and Diluted |

$ | (0.10 | ) | $ | (0.29 | ) | $ | (0.05 | ) | |||

|

|

|

|

|

|

|

|||||||

| Weighted Average Shares Outstanding: |

||||||||||||

| Basic and Diluted |

7,402,897 | 5,893,659 | 6,840,397 | |||||||||

|

|

|

|

|

|

|

|||||||

| Pro Forma Net Loss Per Share Attributable to the Common Shareholders after Reverse Stock Split: |

||||||||||||

| Basic and Diluted |

$ | (0.19 | ) | $ | (0.57 | ) | $ | (0.11 | ) | |||

|

|

|

|

|

|

|

|||||||

| Pro Forma Weighted Average Shares Outstanding after Reverse Stock Split: |

||||||||||||

| Basic and Diluted |

3,982,699 | 2,946,830 | 3,420,199 | |||||||||

|

|

|

|

|

|

|

|||||||

Consolidated Balance Sheet Data

| As of | ||||||||||||

| Pro forma December 31, 2013 |

December 31, 2012 | December 31, 2013 | ||||||||||

| Cash and cash equivalents |

$ | 17,209,088 | $ | 540,178 | $ | 1,409,088 | ||||||

| Net working capital (deficiency) |

11,074,340 | (5,071,083 | ) | (4,725,660 | ) | |||||||

| Total assets |

46,427,308 | 13,045,129 | 30,627,308 | |||||||||

| Long-term liabilities |

10,785,675 | 6,209,285 | 16,785,675 | |||||||||

| Equity Attributable to ECM Energy Services, Inc. (excludes non-controlling interest) |

22,069,340 | 330,534 | 269,340 | |||||||||

| Total stockholders’ equity (includes non- controlling interest) |

$ | 22,069,340 | $ | 278,865 | $ | 269,340 | ||||||

10

Table of Contents

Supplemental Financial Information

| Pro forma Year Ended December 31, 2013 |

For the Years Ended December 31, |

|||||||||||

| 2012 | 2013 | |||||||||||

| Adjusted EBITDA (a) |

$ | 5,592,645 | $ | 569,679 | $ | 5,592,645 | ||||||

| Adjusted EBITDA % (a) |

16.9 | % | 3.8 | % | 16.9 | % | ||||||

| (a) | Adjusted EBITDA is a non-GAAP financial measure used by management as an additional measure of our financial performance. For a full description of Adjusted EBITDA, the reasons management believes an Adjusted EBITDA-based measure is useful to investors and the limitations associated with an EBITDA-based measure, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Supplemental Financial Information”. See the table below for a reconciliation of Adjusted EBITDA to net loss: |

| Pro forma Year Ended December 31, 2013 |

For the Years Ended December 31, |

|||||||||||

| 2012 | 2013 | |||||||||||

| Adjusted EBITDA |

$ | 5,592,645 | $ | 569,679 | $ | 5,592,645 | ||||||

| Interest, taxes, and non-cash items: |

||||||||||||

| Interest (income) expense, net |

(749,914 | ) | (530,695 | ) | (817,682 | ) | ||||||

| Interest expense, related party |

(255,549 | ) | (92,820 | ) | (292,012 | ) | ||||||

| Income tax (provision) benefit |

— | — | — | |||||||||

| Depreciation and amortization |

(4,106,522 | ) | (1,975,522 | ) | (4,106,522 | ) | ||||||

| Non-cash stock-based compensation |

(1,237,463 | ) | (82,500 | ) | (752,283 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Net loss |

$ | (756,803 | ) | $ | (2,111,858 | ) | $ | (375,854 | ) | |||

|

|

|

|

|

|

|

|||||||

11

Table of Contents

Investing in our common stock involves a high degree of risk. You should carefully consider each of the following risks, together with all other information set forth in this prospectus, including the consolidated financial statements and the related notes, before making a decision to buy our common stock. If any of the following risks actually occurs, our business could be harmed. In that case, the trading price of our common stock could decline, and you may lose all or part of your investment.

Risks Relating to Our Business

We commenced operations in July 2010 and have a limited operating history that may not provide an adequate basis to judge our future prospects and results of operations.

We have a limited operating history. Our business operations commenced in July 2010 and we expanded our operations substantially in the last two years. Our activities to date have included, opening rental locations in new areas, acquiring new customers and diversifying markets, as well as cross-selling services to existing customers. There is limited historical financial information related to operations available upon which you may base your evaluation of our business and prospects. During the years ended December 31, 2013 and 2012, we incurred operating losses of $0.4 million and $2.1 million, respectively. Consequently, the long-term revenue and income potential of our business is unproven.

The largest customers in each of our equipment rental, water logistics and pilot car businesses, collectively represent a significant source of our revenues. We do not have long-term agreements with customers, and the loss of any such customer would have a significant impact on the revenues generated by that particular business.

We derive a significant portion of our sales from a few large customers. For the year ended December 31, 2013, two customers represented more than 10% of our revenues, with one at 43% and the other at 13%. Similarly for year ended December 31, 2012, two customers represented more than 10% of our revenues, with one at 26% and the other at 22%. We do not have long-term agreements with our customers, and we can provide no assurance that we could replace the lost revenue from our significant customers if they terminated their arrangements with us. Long-term agreements are not common in the industry in which we operate, and as such we do not expect to enter into long-term agreements in the future.

We may not be able to manage our growth effectively and our growth may slow down in the future.

We have been expanding our business rapidly and expect to continue to do so either through organic growth or through acquisitions. Such expansion may place a significant strain on our managerial, operational and financial resources. We will need to manage our growth effectively, which may entail devising and implementing business plans, training and managing a growing workforce, managing costs and adequately integrating control and reporting systems in a timely manner. There can be no assurance that our personnel, procedures and controls will be managed effectively to support future growth adequately. Failure to manage expansion effectively may affect our success in executing our business plan and may adversely affect our business, financial condition and results of operation. In addition, although we increased our revenues by 120% during the year ended December 31, 2013 as compared to the year ended December 31, 2012, our growth in percentage terms may slow in the future. Accordingly, you should not rely on our historic growth rate as an indicator for our future growth.

12

Table of Contents

Our business is dependent upon the oil and natural gas industry and particularly on the level of exploration, development and production of oil and natural gas in the small number of states in which we do business. Our markets may be adversely affected by industry conditions, including economic and regulatory conditions, that are beyond our control.

We depend on our customers continuing to make capital expenditures to explore, develop and produce oil and natural gas in the United States and specifically in the limited geographic regions in which we currently operate. If these expenditures decline, our business may suffer. Our customers’ willingness to continue such activities depends largely upon prevailing industry conditions that are influenced by numerous factors over which our management and our customers have no control, such as:

| • | the supply of and demand for oil and natural gas; |

| • | the prices, and expectations about future prices, of oil and natural gas; |

| • | the supply of and demand for hydraulic fracturing and other well service equipment in the United States, and particularly in the small number of regions in which we operate; |

| • | public pressure on, and legislative and regulatory interest within, federal, state and local governments to stop, significantly limit or regulate hydraulic fracturing activities; |

| • | regulation of drilling activity; and |

| • | weather conditions that can affect oil and natural gas operations over a wide area. |

The level of activity in the oil and natural gas exploration and production industry in the United States is volatile. Unexpected material declines in oil and natural gas prices, or drilling or completion activity in the United States oil and natural gas shale regions, could have a material adverse effect on our business, financial condition, results of operations and cash flows.

The oil and natural gas industry is cyclical and, as a result, our operating results may fluctuate.

Oil and natural gas prices are volatile. Declines in prices have resulted in, and future fluctuations in such prices may result in, a decrease in the expenditure levels of oil and natural gas companies and drilling contractors. We may experience significant fluctuations in operating results as a result of the reactions of our customers to actual and anticipated changes in oil and natural gas prices.

Regulatory compliance costs and restrictions, as well as delays in obtaining permits by our customers for their operations, such as for hydraulic fracturing, could impair our business.

Our operations and the operations of our customers are subject to or impacted by a wide array of regulations in the jurisdictions in which we and our customers operate. As a result of regulations and laws relating to the oil and natural gas industry, or changes in such regulations or laws, our and our customers’ operations could be disrupted or curtailed by governmental authorities. For example, oil and natural gas exploration and production may become less cost-effective and decline as a result of increasingly stringent environmental requirements (including bans or moratoria on drilling in specific areas, land use policies responsive to environmental concerns and delays or difficulties in obtaining environmental permits). Our customers generally will be required to obtain permits from one or more governmental agencies in order to perform drilling and completion activities, including hydraulic fracturing. Such permits are typically required by state agencies, but can also be required by federal and local governmental authorities. The high cost of compliance with applicable regulations and delays in obtaining required permits may cause our customers to discontinue or limit their operations, and may discourage our customers from continuing exploration and production activities, which could result in a decrease in demand for our services.

13

Table of Contents

Federal and state legislative and regulatory initiatives limiting hydraulic fracturing or making hydraulic fracturing more costly could adversely affect our business.

Our water logistics business primarily consists of the transportation of fresh, treated, produced/flowback and disposal water for our customers utilizing hydraulic fracturing in Ohio, West Virginia and Pennsylvania. Hydraulic fracturing is a practice that is used to stimulate production of natural gas from tight formations, such as shales. The process involves the injection of water, sand and chemicals under pressure into formations to fracture the surrounding rock. This method has been the subject of scrutiny by several states, the Federal government and advocacy groups regarding its impact on the environment. Federal and state legislative and regulatory initiatives relating to hydraulic fracturing could result in increased costs and additional operating restrictions or delays for our customers, which could limit our water management business servicing these operations.

Laws protecting the environment generally have become more stringent over time and are expected to continue to do so. In addition to changes in existing environmental health or safety laws or regulations, various new and more stringent regulatory requirements directed to hydraulic fracturing in particular are being imposed or considered at the federal, state and local levels. The United States Environmental Protection Agency, or EPA, is undertaking a comprehensive research study on the potential adverse impacts that hydraulic fracturing may have on water quality and public health. The first progress report was issued in December 2012 and the final report is expected in 2014. The results of this study could spur further initiatives to regulate hydraulic fracturing. Such measures could lead to material increases in future costs of compliance and remediation for our customers conducting hydraulic fracturing operations. In such an event, the amount of hydraulic fracturing activity may decrease, which could materially, adversely affect our water management business.

Our business strategy is to expand into new markets and such expansion plans involve risks related to the sourcing of real estate and the hiring of quality personnel.

Our business strategy includes the expansion into new markets in emerging shale areas close to the drilling activity in these areas. In order to successfully expand into these markets, we will need to find suitable real estate in these locations, which may not be available to us. In addition, as we depend on customer service to differentiate us from our competitors, we will need to attract, hire and retain qualified personnel in these locations, which are generally not located in major metropolitan areas. If we are unable to find suitable locations to expand or if we are unable to hire and retain qualified personnel in new locations, we may be unsuccessful in expanding our operations.

We depend on the services of our key executives.

Our senior executives are important to our success because they are instrumental in setting our strategic direction, operating our business, identifying, recruiting and training key personnel and identifying expansion opportunities. In addition, much of our business is relationship driven and the loss of our senior executives may damage our relationships with significant customers. Losing the services of any of these individuals could adversely affect our business, operating results and financial condition until a suitable replacement could be found. We have secured key man life insurance on Messrs. Groman, Seifert and Wahl.

If we disrupt our customers’ businesses by failing to meet our delivery deadlines, we may lose customers, and our reputation may be negatively affected.

If we fail to timely provide services under our contracts with our customers, we may disrupt such customers’ businesses, which could result in the termination of the applicable contract and a reduction in our revenues. In addition, such failure or inability to meet a contractual requirement could seriously damage our reputation and affect our ability to attract new business. The termination of a contract based upon our failure to comply, even if such assertions against us are inaccurate could result in reputational harm, which could have a negative impact on our business operations.

14

Table of Contents

If we have any safety or environmental failures, we may lose business with our current customers and we may be prohibited from obtaining business from current and potential new customers.

Our safety profile is a critical element of our ability to maintain our business relationships and to develop new relationships. If we have accidents, including environmental accidents, on our customers’ work sites or while performing work for our customers, regardless of whether such accidents are determined to be our fault, we may lose additional work from such customers for a period of time or indefinitely. Many of our customers have policies not to utilize vendors that have had serious safety or environmental failures.

The utilization of our water hauling services is subject to extreme volatility due to the nature of this market.

For our water hauling services, our customers generally provide us notice regarding the number of trucks needed less than one day prior to the date such trucks are required. As such, we are unable to predict the level of utilization in this area of our business. Furthermore, to the extent we reserve the use of our trucks for our customers and these customers determine not to use our services on a specific day, we have limited time to reallocate our trucks for other customers.

Severe weather can adversely affect our business.

Severe weather materially and adversely impacts demand for our rental equipment and our water hauling and pilot car services, and increases our costs of operations. Our rental equipment is operated outdoors. Equipment is much more susceptible to failure and requires increased maintenance when operated in harsh climactic conditions (during periods of extreme heat, extreme cold, heavy rain, heavy snow or heavy winds). Prolonged periods of severe weather increase our repair and maintenance costs and may cause us to rent replacement equipment from a third party in order to service a client account while our equipment is being repaired, often at substantially higher costs to us. Extreme weather conditions can also cause transportation difficulties that hamper our ability to redeploy our rental equipment inventory and trucks, to access our equipment in service for repair and maintenance, and to timely obtain parts and deliver those parts to the locations at which we require them. Finally, during periods of extreme climactic conditions our customers may reduce or suspend hydraulic fracturing and other drilling activity, adversely impacting demand for our water hauling and pilot services. During the first calendar quarter of 2014, we experienced severe weather conditions in most of our geographic markets, including heavy snow, prolonged periods of extreme cold, ice storms and high winds. Those weather conditions resulted in the realization of significantly lower revenues and increased operating expenses, and will significantly and adversely impact our operating results for that period.

If we are unable to collect on contracts with customers, our operating results would be adversely affected.

One of the reasons some of our customers find it more attractive to rent equipment rather than own equipment is the need to deploy their capital elsewhere. This has been particularly true in industries with high growth rates such as the oil and gas industry. Some of our customers may have liquidity issues and ultimately may not be able to fulfill the terms of their rental agreements with us. If we are unable to manage credit risk issues adequately, or if a large number of customers have financial difficulties at the same time, our credit losses could increase above historical levels and our operating results would be adversely affected. Further, delinquencies and credit losses generally are expected to increase if there is a slowdown in the economic recovery or worsening of economic conditions.

As our rental equipment ages, our servicing costs may increase, our replacement costs may increase and we may be unable to pass along such costs to our customers.

As our rental equipment ages the costs of maintaining such equipment may materially increase in the future. We purchase equipment directly from manufacturers and dealerships for our rental division. Since we do not have long-term supply agreements for new equipment, the cost of new equipment for use in our rental fleet could also increase due to increased material costs for our suppliers or other factors beyond our control. Such increases could materially adversely impact our financial condition and results of operations in future periods. Furthermore, changes in customer demand could cause certain of our existing equipment to become obsolete and requiring us to purchase new equipment at increased costs.

15

Table of Contents

We are exposed to a variety of claims relating to our business, and our insurance may not fully cover them.

We are in the ordinary course exposed to a variety of claims relating to our business. These claims include those relating to:

| • | personal injury or property damage involving equipment rented or sold by us; |

| • | motor vehicle accidents involving our vehicles and our employees; and |

| • | employment-related claims. |

Currently, we carry insurance for the protection of our assets and operations. However, such insurance may not fully cover these claims, as our insurance policies are often subject to significant deductibles. In addition, we do not maintain stand-alone coverage for environmental liability, since we believe the cost for such coverage is high relative to the benefit it provides. Furthermore, certain types of claims, such as claims for punitive damages or for damages arising from intentional misconduct, which are often alleged in third party lawsuits, might not be covered by our insurance.

Our industry is highly competitive and competitive pressures could lead to a decrease in the prices that we can charge.

The industries in which we compete are highly fragmented and competitive. Our competitors in the equipment rental industry include small, independent businesses with one or two rental locations, regional competitors that operate in one or more states, public companies or divisions of public companies, and equipment sellers who both sell and rent equipment directly to customers. Our water logistics business competes with national, regional and local trucking companies as well as pipeline companies and oil company operators. We also compete with companies offering water recycling regarding flow back and produced water. We compete with a number of small operators in the pilot car and traffic control market, as well as a few larger companies that service the markets in which we operate. We may in the future encounter increased competition from our existing competitors or from new competitors. Competitive pressures could adversely affect our revenues and operating results by, among other things, decreasing our volumes, depressing the prices that we can charge or increasing our costs to retain employees.

We may be unable to employ a sufficient number of skilled and qualified workers.

The delivery of our services and products requires personnel with specialized skills and experience who can perform physically demanding work. The demand for skilled workers in our industry is high and the supply is limited.

Potential inability or lack of desire by workers to commute to our facilities and job sites and competition for workers from competitors or other industries are factors that could affect our ability to attract and retain workers. A significant increase in the wages paid by competing employers could result in a reduction of our skilled labor force, increases in the wage rates that we must pay, or both. If either of these events were to occur, our capacity and profitability could be diminished and our growth potential could be impaired.

Our ability to be productive and profitable will depend upon our ability to employ and retain skilled workers and at times of high demand we may not be able to retain, recruit and train an adequate number of workers. In addition, our ability to expand our operations will depend in part on our ability to increase the size of our skilled labor force. Our inability to attract and retain skilled workers in sufficient numbers to satisfy our business needs could materially adversely affect our business, financial condition and results of operations.

The short term nature of our equipment rental service agreements exposes us to redeployment risks and means that we could experience rapid fluctuations in revenue in response to market conditions.

Our rental service agreements are typically short term in nature, with prices quoted on a daily basis, and either party to the agreement is able to terminate upon notice. As a result, our rental income, both in terms of price and quantity, is not fixed for any substantial period of time and may fluctuate quickly in response to changes in market conditions. Changes in general economic conditions, the business environment or weather affecting our customers

16

Table of Contents

may make it difficult for us to find customers to rent our equipment as it comes off of existing rental contracts. This could lead us to lower our rental prices, reduce our overall number of rentals or both, and may increase our operating expenses. Further, because our rental service agreements are short term in nature, these changes to our business and profitability could happen very quickly after the corresponding changes in market conditions.

Fluctuations in fuel costs or reduced supplies of fuel could harm our business.

In connection with our rental and water logistics business, to better serve our customers and limit our capital expenditures, we often move our rental equipment and water supply trucks between our locations. Accordingly, we could be materially adversely affected by significant increases in fuel prices that result in higher costs to us for transporting equipment or moving our water supply trucks. It is unlikely that we would be able to promptly raise our prices to make up for increased fuel costs. A significant or protracted price fluctuation or disruption of fuel supplies could have a material adverse effect on our financial condition and results of operations.

Our expenses could increase if there is an adverse change in our relationships with our equipment suppliers or if our suppliers are unable to provide us with products we rely on to generate revenues.

We purchase our rental equipment from various suppliers and manufacturers. We rely on these suppliers and manufacturers to provide us with equipment which we then rent to our customers. We have not entered into any long-term equipment supply arrangements with manufacturers. To the extent we are unable to rely on these suppliers and manufacturers for any reason due to an adverse change in our relationships with them or if such suppliers or manufacturers are unable to supply us with equipment or needed replacement parts in a timely manner, our business could be adversely affected through higher costs or the resulting potential inability to service our customers. We may experience delays in receiving equipment from some manufacturers due to factors beyond our control, including raw material shortages, and, to the extent that we experience any such delays, our business could be hurt by the resulting inability to service our customers and harm to our reputation.

Risks Relating to this Offering of Our Common Stock

There has been no public market for our common stock and an active market may not develop or be sustained, which could limit your ability to sell shares of our common stock.

There currently is no public market for our common stock, and our common stock will not be traded in the open market prior to this offering. Although we intend to list the common stock on a national securities exchange in connection with this offering, an adequate trading market for the common stock may not develop or be sustained after this offering. The initial public offering price will be determined by negotiations between the underwriters and our board of directors and may not be representative of the market price at which our shares of common stock will trade after this offering. In particular, we cannot assure you that you will be able to resell your shares at or above the initial public offering price.

If securities or industry analysts do not publish research or reports about us, or if they adversely change their recommendations regarding our common stock, then our stock price and trading volume could decline.

The trading market for our common stock will be influenced by the research and reports that industry or securities analysts publish about us, our industry and our market. If no analyst elects to cover us and publish research or reports about us, the market for our common stock could be severely limited and our stock price could be adversely affected. In addition, if one or more analysts ceases coverage of us or fails to regularly publish reports on us, we could lose visibility in the financial markets, which in turn could cause our stock price or trading volume to decline. If one or more analysts who elect to cover us adversely change their recommendations regarding our common stock, our stock price could decline.

17

Table of Contents

Purchasers in this offering will experience immediate and substantial dilution in net tangible book value.

The initial public offering price per share is expected to be substantially higher than the net tangible book value per share of our outstanding common stock. Purchasers of shares in this offering will experience immediate dilution in the net tangible book value of their shares. Based on an assumed initial public offering price of $8.00 per share, the mid-point of the range set forth on the cover of this prospectus, dilution per share in this offering will be $4.88 per share (or 61% of the initial public offering price). See “Dilution.”

Your ownership may be diluted if additional capital stock is issued to raise capital, to finance acquisitions or in connection with strategic transactions.

We may seek to raise additional funds, finance acquisitions or develop strategic relationships by issuing equity or convertible debt securities in addition to the shares issued in this offering, which would reduce the percentage ownership of our existing stockholders. Our board of directors has the authority, without action or vote of the stockholders, to issue all or any part of our authorized but unissued shares of common or preferred stock. Our certificate of incorporation authorizes 50,000,000 shares of common stock and 10,000,000 shares of preferred stock. Future issuances of common or preferred stock would reduce your influence over matters on which stockholders vote and would be dilutive to earnings per share. In addition, any newly issued preferred stock could have rights, preferences and privileges senior to those of the common stock. Those rights, preferences and privileges could include, among other things, the establishment of dividends that must be paid prior to declaring or paying dividends or other distributions to holders of our common stock or providing for preferential liquidation rights. These rights, preferences and privileges could negatively affect the rights of holders of our common stock, and the right to convert such preferred stock into shares of our common stock at a rate or price which would have a dilutive effect on the outstanding shares of our common stock.

Certain provisions in our organizational documents could enable our board of directors to prevent or delay a change of control.

Our organizational documents contain provisions that may have the effect of discouraging, delaying or preventing a change of control of, or unsolicited acquisition proposals, that a stockholder might consider favorable. These include provisions:

| • | prohibiting the stockholders from acting by written by consent; |

| • | requiring advance notice of director nominations and of business to be brought before a meeting of stockholders; |

| • | requiring the vote of 70% of the outstanding shares of common stock to amend the bylaws; and |

| • | limiting the persons who may call special stockholders’ meetings. |

Furthermore, our board of directors has the authority to issue shares of preferred stock in one or more series and to fix the rights and preferences of these shares without stockholder approval. Any series of preferred stock is likely to be senior to our common stock with respect to dividends, liquidation rights and, possibly, voting rights. The ability of our board of directors to issue preferred stock also could have the effect of discouraging unsolicited acquisition proposals, thus adversely affecting the market price of our common stock.

In addition, Delaware law makes it difficult for stockholders that recently have acquired a large interest in a corporation to cause the merger or acquisition of the corporation against the directors’ wishes. Under Section 203 of the Delaware General Corporation Law, a Delaware corporation may not engage in any merger or other business combination with an interested stockholder for a period of three years following the date that the stockholder became an interested stockholder except in limited circumstances, including by approval of the corporation’s board of directors.

18

Table of Contents

We have no intention of declaring dividends in the foreseeable future.

The decision to pay cash dividends on our common stock rests with our board of directors and will depend on our earnings, unencumbered cash, capital requirements and financial condition. We do not anticipate declaring any dividends in the foreseeable future, as we intend to use any excess cash to fund our operations. Investors in our common stock should not expect to receive dividend income on their investment, and investors will be dependent on the appreciation of our common stock to earn a return on their investment.

We will incur increased costs as a result of being a publicly-traded company.

As a company with publicly-traded securities, we will incur additional legal, accounting and other expenses not presently incurred. In addition, the Sarbanes-Oxley Act of 2002 (or SOX), the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, as well as rules promulgated by the SEC and the national securities exchange on which we list, requires us to adopt corporate governance practices applicable to U.S. public companies. These rules and regulations will increase our legal and financial compliance costs.

We may be exposed to risks relating to evaluations of controls required by Sarbanes-Oxley Act of 2002.

Pursuant to Sarbanes-Oxley Act of 2002, our management will be required to report on, and our independent registered public accounting firm may in the future be required to attest to, the effectiveness of our internal control over financial reporting. Although we prepare our financial statements in accordance with accounting principles generally accepted in the United States of America, our internal accounting controls may not meet all standards applicable to companies with publicly traded securities. If we fail to implement any required improvements to our disclosure controls and procedures, we may be obligated to report control deficiencies and our independent registered public accounting firm may not be able to certify the effectiveness of our internal controls over financial reporting. In either case, we could become subject to regulatory sanction or investigation. Further, these outcomes could damage investor confidence in the accuracy and reliability of our financial statements.

We identified a material weakness in our internal control over financial reporting and if the remediation procedures we have undertaken are unable to successfully remediate the existing material weakness, the accuracy and timing of our financial reporting may be adversely affected.

In preparing our consolidated financial statements as of and for the year ended December 31, 2013, we identified control deficiencies in the design and operation of our internal control over financial reporting that together constituted a material weakness in our internal control over financial reporting. A material weakness is a deficiency, or a combination of deficiencies, in internal control over financial reporting such that there is a reasonable possibility that a material misstatement of our financial statements will not be prevented or detected on a timely basis. The material weakness identified was that we did not have sufficient inventory tracking systems, adequate accounting systems, and our accounting staff was inadequate both in terms of the number of personnel and their expertise in U.S. GAAP and SEC rules and regulations. As such, our controls over financial reporting were not designed or operating effectively. We believe we have remediated this material weakness as of the date of this prospectus.

The material weakness in our internal control over financial reporting was attributable to inventory tracking systems, and in adequate accounting systems. In addition, our accounting staff was inadequate both in terms of the number of personnel and their expertise in U.S. GAAP and SEC rules and regulations. In response to this material weakness, at the end of 2013, we implemented and licensed a hosted third party enterprise wide rental information system and general ledger. The system fully integrates all location operations such as rentals, water services, pilot services and cash management, with the corporate activities, including finance, fixed asset and inventory management. In addition, we have hired additional personnel with knowledge of U.S. GAAP and public company financial reporting expertise to enhance our financial management and reporting infrastructure, and further develop and document our accounting policies and financial reporting procedures.