Attached files

| file | filename |

|---|---|

| 8-K - ADK 8-K 032714 - REGIONAL HEALTH PROPERTIES, INC | adk8k032714.htm |

| EX-99.1 - EXHIBIT 99.1 PRESS RELEASE - REGIONAL HEALTH PROPERTIES, INC | exhibit991032714.htm |

Fourth Quarter and Full Year 2013 Conference Call Presentation NYSE MKT: ADK AdCare Health Systems, Inc. “Setting the Standard for Senior Care” ® Exhibit 99.2

The Finest in Senior Living Management NYSE MKT: ADK Forward-Looking Statements Any forward-looking statements made in this presentation are based on management's current expectations, assumptions and beliefs about the Company’s business and the environment in which AdCare operates. These statements are subject to risks and uncertainties that could cause the Company’s actual results to materially differ from those expressed or implied on the call. Readers should not place undue reliance on forward-looking statements and are encouraged to review the Company’s SEC filings for more complete discussion of factors that could impact the Company’s results. Except as required by federal securities laws, AdCare does not undertake to publicly update or revise any forward-looking statements, where changes arise as a result of new information, future events, changing circumstances or for any other reason. In addition, any AdCare facility or business the Company may mention today is operated by a separate independent operating subsidiary that has its own management, employees and assets. References to the consolidated company and its assets and activities, as well as the use of terms like “we,” “us,” “our” and similar verbiage are not meant to imply that AdCare Health Systems, Inc. has direct operating assets, employees or revenue or that any of the operations are operated by the same entity. Also, the Company supplements its GAAP reporting with non-GAAP metrics, such as Adjusted EBITDA and EBITDAR. When viewed together with the Company’s GAAP results, these measures can provide a more complete understanding of its business. They should not be relied upon to the exclusion of GAAP financial measures. A reconciliation of these measures to GAAP is available in the Company’s latest earning release. After management concludes their remarks, they will entertain appropriate questions regarding the presentation. AdCare reserves the right to curtail any questions or statements which are irrelevant to AdCare’s business, related to pending or threatened litigation, derogatory or otherwise not appropriate, unduly prolonged, substantially repetitious of questions or statements made by others, or related to personal grievances. This presentation is copyright 2014 by AdCare Health Systems, Inc. 2

The Finest in Senior Living Management NYSE MKT: ADK Agenda Strategic & Operational Update Q4 & YTD 2013 Financial Results Business Update Corporate Governance Matters 3

The Finest in Senior Living Management NYSE MKT: ADK Strategic Update 4 Multiple channels for future growth Organic growth through improving operating margins within all of our facilities Strategic acquisitions … continual evaluation of numerous opportunities to leverage current infrastructure and extensive industry contacts Facility level improvements Increasing occupancy levels Increasing % of higher margin services Cost containment Improved operational and financial controls provide a stable foundation for growth

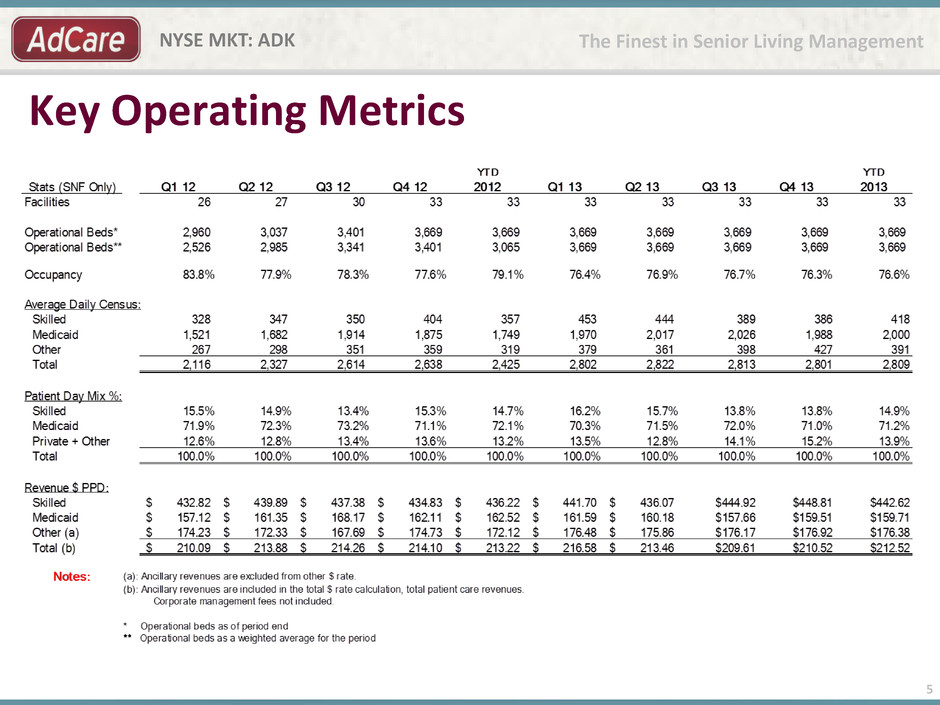

The Finest in Senior Living Management NYSE MKT: ADK Key Operating Metrics 5

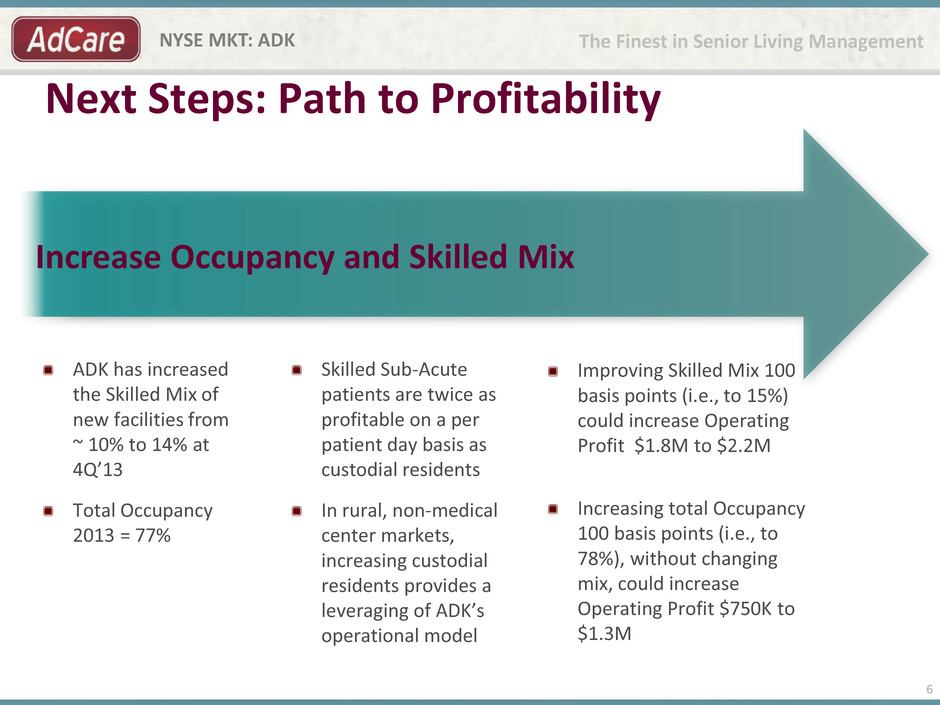

The Finest in Senior Living Management NYSE MKT: ADK Next Steps: Path to Profitability ADK has increased the Skilled Mix of new facilities from ~ 10% to 14% at 4Q’13 Total Occupancy 2013 = 77% 6 Increase Occupancy and Skilled Mix Skilled Sub-Acute patients are twice as profitable on a per patient day basis as custodial residents In rural, non-medical center markets, increasing custodial residents provides a leveraging of ADK’s operational model Improving Skilled Mix 100 basis points (i.e., to 15%) could increase Operating Profit $1.8M to $2.2M Increasing total Occupancy 100 basis points (i.e., to 78%), without changing mix, could increase Operating Profit $750K to $1.3M

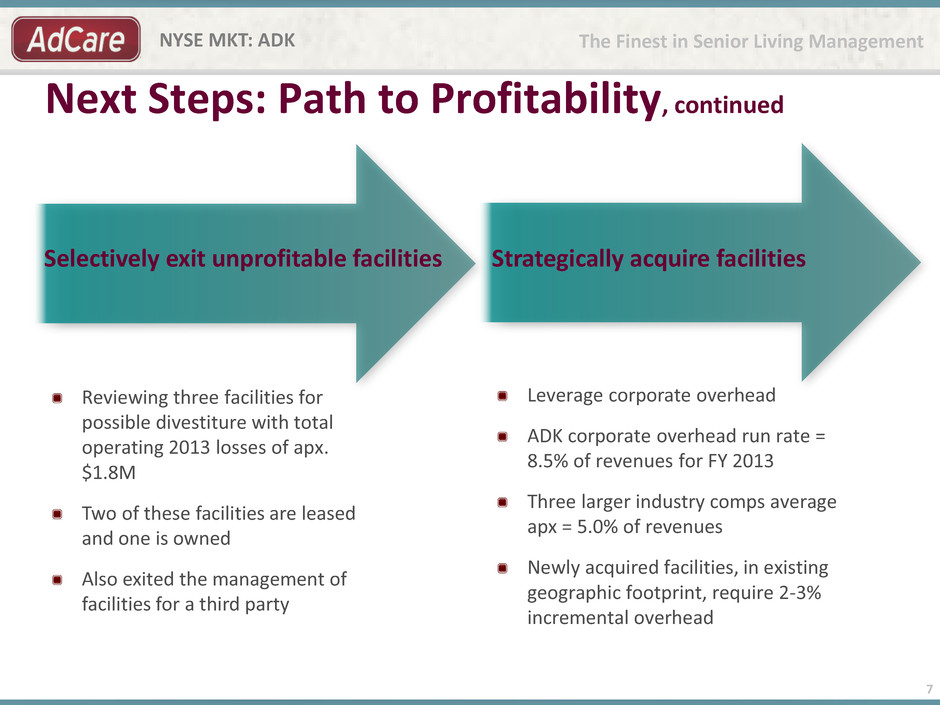

The Finest in Senior Living Management NYSE MKT: ADK Next Steps: Path to Profitability, continued 7 Selectively exit unprofitable facilities Strategically acquire facilities Reviewing three facilities for possible divestiture with total operating 2013 losses of apx. $1.8M Two of these facilities are leased and one is owned Also exited the management of facilities for a third party Leverage corporate overhead ADK corporate overhead run rate = 8.5% of revenues for FY 2013 Three larger industry comps average apx = 5.0% of revenues Newly acquired facilities, in existing geographic footprint, require 2-3% incremental overhead

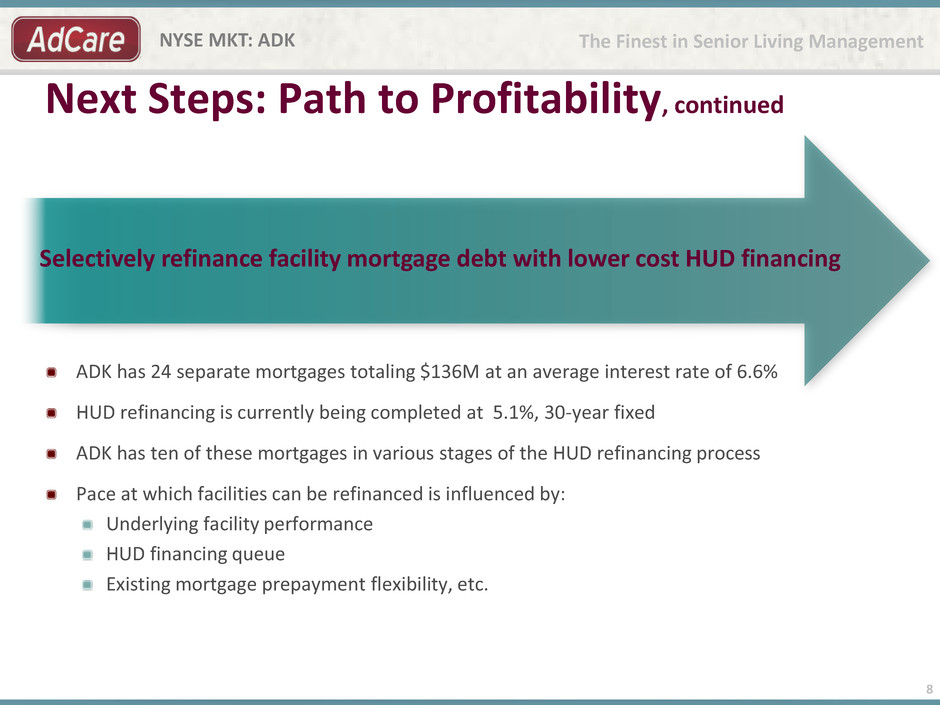

The Finest in Senior Living Management NYSE MKT: ADK Next Steps: Path to Profitability, continued 8 Selectively refinance facility mortgage debt with lower cost HUD financing ADK has 24 separate mortgages totaling $136M at an average interest rate of 6.6% HUD refinancing is currently being completed at 5.1%, 30-year fixed ADK has ten of these mortgages in various stages of the HUD refinancing process Pace at which facilities can be refinanced is influenced by: Underlying facility performance HUD financing queue Existing mortgage prepayment flexibility, etc.

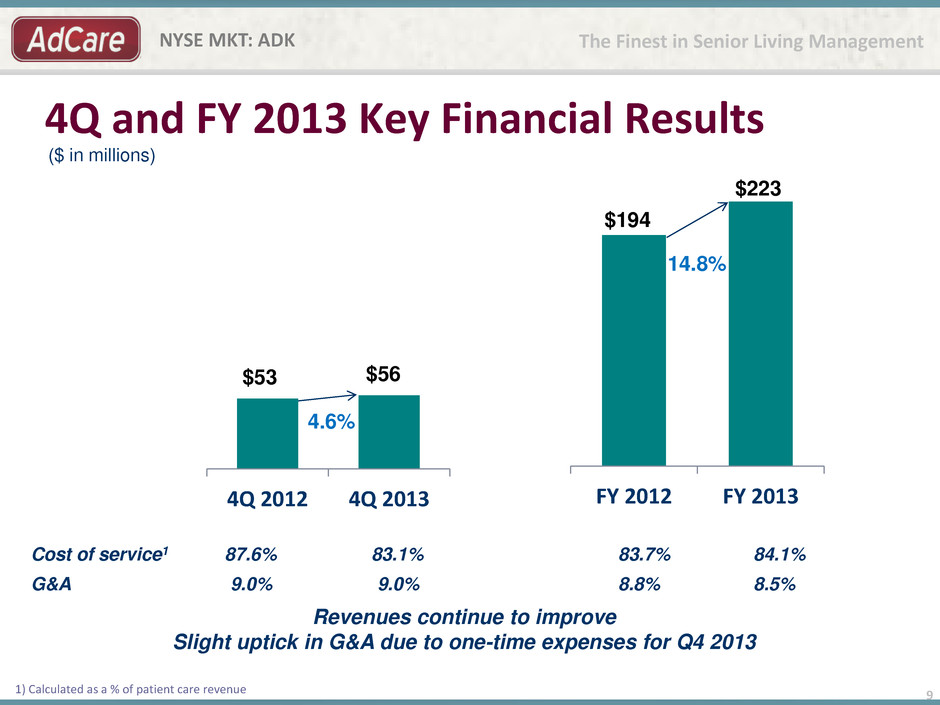

The Finest in Senior Living Management NYSE MKT: ADK 9 1) Calculated as a % of patient care revenue 4Q 2012 4Q 2013 $53 $56 4Q and FY 2013 Key Financial Results FY 2012 FY 2013 $194 $223 Cost of service1 87.6% 83.1% 83.7% 84.1% G&A 9.0% 9.0% 8.8% 8.5% 4.6% 14.8% Revenues continue to improve Slight uptick in G&A due to one-time expenses for Q4 2013 ($ in millions)

The Finest in Senior Living Management NYSE MKT: ADK Annual Performance Expense structure improved; Re-focusing on top-line growth 10 $52.8 $53.1 $55.8 $56.0 $55.5 $55.6 $47.8 $50.5 $51.9 $51.3 $50.1 $50.3 $5.0 $2.6 $3.9 $4.7 $5.4 $5.3 $ m ill io n s Revenue Operating Expenses * Adj. EBITDAR Q3 13 Q2 13 Q1 13 Q4 12 Q3 12 Q4 13 FY 2013 Adjusted EBITDAR $19.3M ($ in millions) * Includes cost of services, general and administrative expenses less amortization of stock based compensation and reincorporation in Georgia expense.

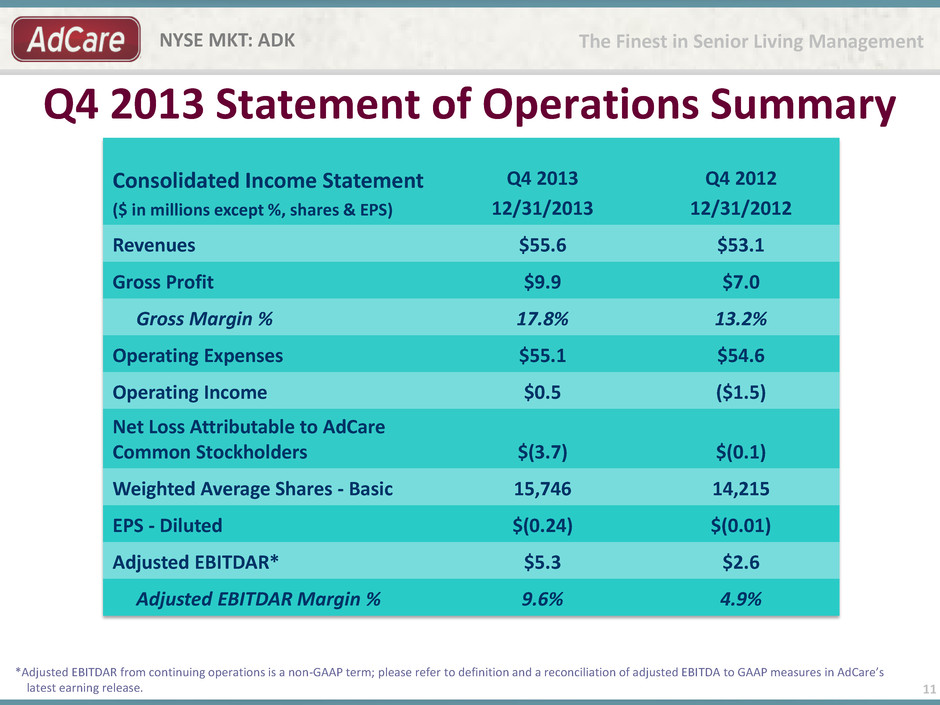

The Finest in Senior Living Management NYSE MKT: ADK Q4 2013 Statement of Operations Summary 11 Consolidated Income Statement ($ in millions except %, shares & EPS) Q4 2013 12/31/2013 Q4 2012 12/31/2012 Revenues $55.6 $53.1 Gross Profit $9.9 $7.0 Gross Margin % 17.8% 13.2% Operating Expenses $55.1 $54.6 Operating Income $0.5 ($1.5) Net Loss Attributable to AdCare Common Stockholders $(3.7) $(0.1) Weighted Average Shares - Basic 15,746 14,215 EPS - Diluted $(0.24) $(0.01) Adjusted EBITDAR* $5.3 $2.6 Adjusted EBITDAR Margin % 9.6% 4.9% *Adjusted EBITDAR from continuing operations is a non-GAAP term; please refer to definition and a reconciliation of adjusted EBITDA to GAAP measures in AdCare’s latest earning release.

The Finest in Senior Living Management NYSE MKT: ADK Full Year 2013 Statement of Operations Summary 12 Consolidated Income Statement ($ in millions except %, shares & EPS) Full Year 2013 Full Year 2012 Revenues $222.8 $194.1 Gross Profit $37.2 $33.4 Gross Margin % 16.7% 17.2% Operating Expenses $222.2 $191.4 Operating Income $0.7 $2.7 Net Loss Attributable to AdCare Common Stockholders ($14.1) ($7.0) Weighted Average Shares - Basic 15,044 14,033 EPS - Diluted $(0.94) $(0.50) Adjusted EBITDAR* $19.4 $17.4 Adjusted EBITDAR Margin % 8.7% 8.9% *Adjusted EBITDAR from continuing operations is a non-GAAP term; please refer to definition and a reconciliation of adjusted EBITDA to GAAP measures in AdCare’s latest earning release.

The Finest in Senior Living Management NYSE MKT: ADK Balance Sheet Summary 13 ($ in Millions) 12/31/2013 12/31/2012 Cash & Cash Equivalents $19.4 $15.9 Accounts Receivable, net $23.6 $26.8 Total Current Assets $53.6 $51.9 Property & Equipment, Net $143.4 $151.0 Total Assets $226.4 $235.2 Total Current Liabilities $69.2 $57.1 Senior Debt (Long-term) $107.9 $112.2 Total Equity $6.9 $15.1 Quarterly cash dividend: $0.68 per share on 10.875% Series A Cumulative Redeemable Preferred Stock. Paid on December 31, 2013 to holders of record at the close of business on December 20, 2013.

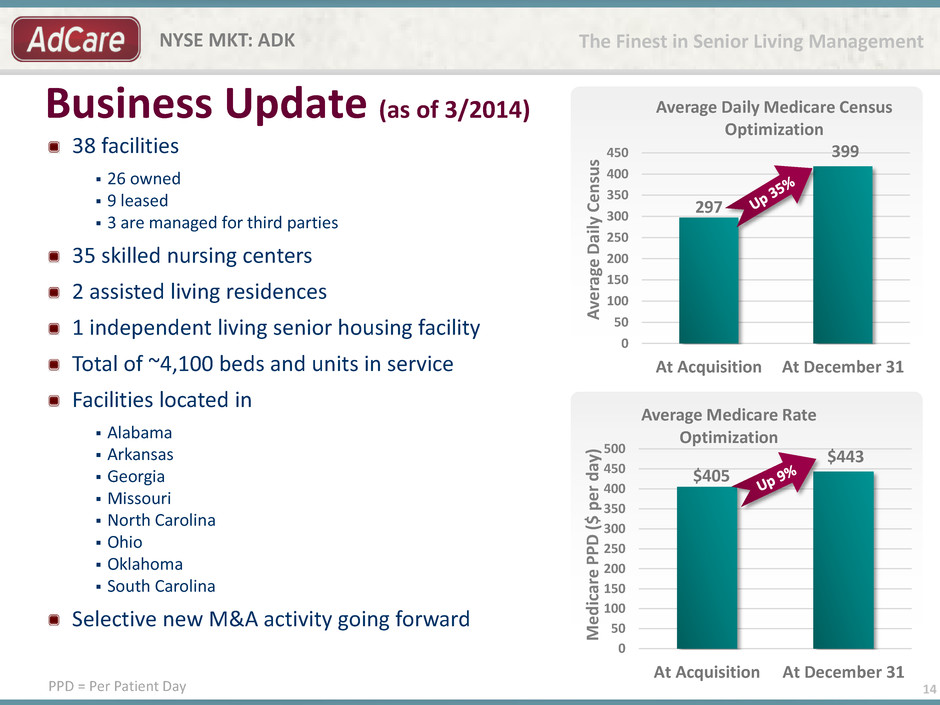

The Finest in Senior Living Management NYSE MKT: ADK 297 399 0 50 100 150 200 250 300 350 400 450 At Acquisition At December 31 A ve ra ge D ai ly Ce n su s Average Daily Medicare Census Optimization Business Update (as of 3/2014) 14 $405 $443 0 50 100 150 200 250 300 350 400 450 500 At Acquisition At December 31 Medi care P P D ($ p e r d ay ) Average Medicare Rate Optimization PPD = Per Patient Day 38 facilities 26 owned 9 leased 3 are managed for third parties 35 skilled nursing centers 2 assisted living residences 1 independent living senior housing facility Total of ~4,100 beds and units in service Facilities located in Alabama Arkansas Georgia Missouri North Carolina Ohio Oklahoma South Carolina Selective new M&A activity going forward

The Finest in Senior Living Management NYSE MKT: ADK Corporate Governance Matters Revised Director and Executive compensation to better align leadership with shareholders Reconstituted and reduced the size of the Board Added Michael Fox as a new Independent Director Added Brent Morrison as a non-voting Observer of the Board Moved Annual Shareholder Meeting to Atlanta 15

The Finest in Senior Living Management NYSE MKT: ADK 2014 Outlook Revenue Expect full-year 2014 revenue of $225M to $250M. Representing 1% to 12% growth compared to fiscal 2013. Reflects lower revenues from exiting non-core facilities which AdCare manages but does not own. Expect year-over-year improvement in: Gross profit Operating income EBITDAR In actual dollars and as a percent of sales 16

The Finest in Senior Living Management NYSE MKT: ADK Q & A Company Contacts Boyd Gentry, CEO Ron Fleming, CFO AdCare Health Systems, Inc., Atlanta, Georgia Tel 678.869.5116 • www.adcarehealth.com Investor Relations Brett Maas, Managing Partner Hayden IR • www.haydenir.com • Tel 646.536.7331 Thank You 17