Attached files

| file | filename |

|---|---|

| 8-K - 8-K - TOYS R US INC | d700659d8k.htm |

March 26,

2014 Exhibit 99.1 |

| Forward-Looking Statements

2

This presentation and the documents incorporated by reference contain

“forward-looking” statements within the meaning of the federal securities

laws, and such statements are intended to be covered by the safe harbors created thereby. These

forward-looking statements reflect our current views with respect to, among other

things, our operations and financial performance. All statements herein or therein that are not historical facts,

including statements about our beliefs or expectations, are forward-looking statements. We

generally identify these statements by words or phrases, such as

“anticipate,” “estimate,” “plan,” “project,” “expect,” “believe,” “intend,” “foresee,” “forecast,” “will,” “may,” “outlook” or

the negative version of these words or other similar words or phrases. These statements

discuss, among other things, our strategy, store openings, integration and remodeling,

the development, implementation and integration of our Internet business, conversion rate improvements, future financial or

operational performance, including future revenue and profits, projected sales or earnings per

share for certain periods, comparable store net sales from one period to another, cost

savings, results of store closings and restructurings, outcome or impact of pending or threatened litigation, domestic

or international developments, amount and allocation of future capital expenditures, growth

initiatives, inventory levels, cost of goods, selection and type of merchandise,

marketing positions, implementation of safety standards, future financings, estimates regarding future effective tax rates, and

other goals and targets and statements of the assumptions underlying or relating to any such

statements. These statements are subject to risks, uncertainties and other factors, including, among

others, the seasonality of our business, competition in the retail industry, changes in

our product distribution mix and distribution channels, general economic factors in the United States and other countries in

which we conduct our business, consumer spending patterns, live birth trends, our ability to

implement our strategy, marketing strategies, the availability of adequate financing,

access to trade credit, changes in consumer preferences, our dependence on key vendors for our merchandise,

political and other developments associated with our international operations, costs of goods

that we sell, labor costs, transportation costs, domestic and international events

affecting the delivery of toys and other products to our stores, product safety issues including product recalls, the existence

of adverse litigation, changes in laws that impact our business, our substantial level of

indebtedness and related debt-service obligations, restrictions imposed by

covenants in our debt agreements and other risks, uncertainties and factors set forth under Item 1A entitled “RISK FACTORS” of

Toys“R”Us, Inc.’s Annual Report on Form 10-K for the fiscal year ended

February 2, 2013 and its other reports and documents filed with the Securities and

Exchange Commission. In addition, we typically earn a disproportionate part of our annual operating earnings in the fourth quarter as a result of

seasonal buying patterns and these buying patterns are difficult to forecast with certainty.

These factors should not be construed as exhaustive and should be read in conjunction

with the other cautionary statements that are included in those reports and documents. We believe that all forward-

looking statements are based on reasonable assumptions when made; however, we caution that it

is impossible to predict actual results or outcomes or the effects of risks,

uncertainties or other factors on anticipated results or outcomes and that, accordingly, one should not place undue reliance on

these statements. Forward-looking statements speak only as of the date they were made, and

we undertake no obligation to update these statements in light of subsequent events or

developments unless required by the Securities and Exchange Commission’s rules and regulations. Actual

results may differ materially from anticipated results or outcomes discussed in any

forward-looking statement. |

1.

Introduction

2.

Diagnosis

3.

TRU Transformation

3 |

Fully

transform the CUSTOMER EXPERIENCE Develop

high

performing

and

highly

focused

TEAMS

Collaborate with BUSINESS PARTNERS to drive

differentiation, innovation and value

Continue to keep kids safe and help them in times of

need in

OUR COMMUNITIES

Position the business for growth and return for

INVESTORS

4

THE TOY AND JUVENILE PRODUCTS AUTHORITY AND

DEFINITIVE DESTINATION FOR KID FUN,

GIFT-GIVING SOLUTIONS AND PARENTING SERVICES |

1.

Introduction

2.

Diagnosis

3.

TRU Transformation

5 |

TOYS“R”US HAS UNIQUE

BRAND STRENGTHS

6 |

TOYS“R”US IS ONE OF THE MOST RECOGNIZED

RETAIL BRANDS IN THE WORLD

Recognized as one of the most valuable global brands¹

Net sales of $12.5 billion (FY ‘13)

Balanced global presence; over 1,700 stores in 36 countries

Broad year-round selection of toy and juvenile items

3,900 active vendor relationships with a growing assortment of exclusive

brands

Leading omnichannel capabilities

Long 65+ year history of serving families = STRONG BRAND

RECOGNITION Japan

1

The Brand Finance Global 500 (2013)

7

China

U.K. |

8

Owned international business accounts for 39%

of total annual sales

STRONG INTERNATIONAL PRESENCE DRIVEN BY

GROWTH IN CHINA

*License

**Joint Venture in which we hold approx. 70% ownership

As of March 5, 2014

TRU Asia JV:

150 Stores |

TOYS“R”US HAS STRONG STORE PROFITABILITY

9

98%

of

862

1

stores

were 4-wall EBITDA

positive during FY2013

•

58% owned or ground leased

94% of 635

1,2

stores

were 4-wall EBITDA

positive during FY2013

•

17% owned or ground leased

International

U.S.

1

Includes Long Term Express and Outlets, excludes stores that were not open during the full

12-month time frame 2

Does not include Licensed Stores |

TOYS“R”US HAS A STRONG AND LOYAL

CUSTOMER BASE

18M

active members and

growing

70%

of sales are done with

these customers

18M

registrants to-date

73%

of all moms surveyed by

TheBump.com register at

Babies“R”Us

Internal Sources

U.S. Programs

Nearly 11 Million Active Members in Similar Loyalty Programs in

Countries Around the World

10 |

TOYS“R”US HAS A BASE OF $1.2 BILLION IN

GLOBAL

INTERNET

SALES

FROM

WHICH

TO

GROW

•

Launched mobile-optimized

websites and dedicated apps for iOS

and Android:

o

Canada

o

China

o

France

o

Germany

o

Spain

o

Japan

o

Australia

o

Portugal

o

Austria

o

Switzerland

o

Netherlands

o

U.K.

o

Poland (2014)

•

Site enhancements made in U.S. in

2013 already benefitting

international markets

Now in 13 Countries

and 8 Languages

$1.2

BILLION

11

5 Year CAGR of 15%

498

578

602

782

1,005

1,129

1,157

2007

2008

2009

2010

2011

2012

2013 |

GLOBAL

e-COMMERCE SALES Leveraging Omnichannel Initiatives Provides Growth

Opportunities and Efficiencies in Cost and Inventory

Omnichannel includes: In-Store Pick Up, Ship to Store, Ship from Store, U.K. Click and

Collect 12

Traditional DC Fulfillment

Omnichannel

Traditional

DC

Fulfillment

Omnichannel

$498

$578

$602

$782

$1,005

$1,129

$1,157

1%

2007

2008

2009

2010

2011

2012

2013

31%

22%

15% |

TOYS“R”US HAS

WELL-ESTABLISHED VENDOR

RELATIONSHIPS

•

Able to provide vendors with a year-round distribution outlet for the

broadest assortment of their products in the U.S. and abroad

13 |

TOYS“R”US BUSINESS

PERFORMANCE IN 2013

WAS DISAPPOINTING

14 |

DIAGNOSIS: MACRO 15 |

RECENT BIRTH RATE DECLINES HAVE IMPACTED BOTH THE TOY AND JUVENILE

BUSINESSES U.S. birth rate has declined significantly since 2007

Source for actuals: CDC/NCHS, National Vital Statistics System

3.1%

1.2%

(1.6%)

(2.8%)

(3.2%)

(1.1%)

(0.0%)

(0.9%)

(4.0%)

(3.0%)

(2.0%)

(1.0%)

0.0%

1.0%

2.0%

3.0%

4.0%

2006

2007

2008

2009

2010

2011

2012

6 Months

June 2013

16 |

U.S. TOY

INDUSTRY SALES HAVE BEEN RELATIVELY FLAT

Source: The NPD Group/ U.S. Toy Consumer Tracking Service as published by the Toy Industry

Association, Inc. Note: Includes Action Figures/Accessories/Role Play, Arts &

Crafts, Building Sets, Dolls, Games/Puzzles, Infant/Preschool, Youth Electronics,

Outdoor & Sports Toys, Plush, Vehicles, All Other Toys 17

$21.6

$22.0

$22.1

$16.0

$17.0

$18.0

$19.0

$20.0

$21.0

$22.0

$23.0

$24.0

2011

2012

2013

+0.3% |

THE RAPID GROWTH OF ONLINE SHOPPING CONTINUES…

Estimated annual U.S. e-commerce retail sales

increased 17% in 2013 vs. 2012

Source: Retail Indicators Branch, U.S. Census Bureau; last revised February 18, 2014.

3Q 2013 is a revised estimate;4Q 2013 is a preliminary estimate.

18

$112

+23.6%

$135

+20.2%

$140

+4.2%

$143

+1.7%

$166

+16.2%

$193

+16.4%

$224

+16.3%

$263

+17.0%

$0

$50

$100

$150

$200

$250

$300

2006

2007

2008

2009

2010

2011

2012

2013E |

DIAGNOSIS: INTERNAL EXECUTION

ISSUES

19 |

Company does

lead competitors on some metrics… 20

Strong

Weak

NEWEST ITEMS

Strong

Weak

“HOT”

TOYS

LEADER

Competitor #3

Competitor #2

Competitor #3

Competitor #1

Strong

Weak

FRIENDLY* EMPLOYEES

LEADER

Competitor #2

*Competitor #3: N/A

LEADER

Competitor #1

Measured U.S. customer perception / Source: Cambridge Group

Competitor #1

and #2

TOYS“R”US HAS BIG OPPORTUNITIES TO IMPROVE CUSTOMER

RELATIONSHIPS

AND

BECOME

A

MORE

CUSTOMER-CENTRIC

BUSINESS |

…but has

much room to improve TOYS“R”US HAS BIG OPPORTUNITIES

TO IMPROVE CUSTOMER RELATIONSHIPS

AND

BECOME

A

MORE

CUSTOMER-CENTRIC

BUSINESS

21

Strong

Weak

FAST CHECKOUT

LEADER

Competitor #1

Competitor #3

Competitor #2

Strong

Weak

ORGANIZED SHELVES*

Strong

Weak

EASY RETURNS

LEADER

LEADER

Competitor #1

Competitor #2

Competitor #3

Competitor #2

Competitor #1

Measured U.S. customer perception / Source: Cambridge Group

*Competitor #3: N/A |

TOYS“R”US HAS NOT MOVED FAST ENOUGH TO MAKE IMPORTANT

INVESTMENTS TO IMPROVE ONLINE SHOPPING OPERATIONS

Measured U.S. customer perception / Source: Cambridge Group

Strong

Weak

LEADER

ASSORTMENT

Strong

Weak

SITE DESIGN / NAVIGATION /

MOBILE APP PERFORMANCE

Strong

Weak

SHIPPING

LEADER

LEADER

Competitor #3

Competitor #2

Competitor #1

Competitor #3

Competitor #2

Competitor #1

Competitor #3

Competitor #2

Competitor #1

22 |

TOYS“R”US HAS A PRICE PERCEPTION CHALLENGE

Measured customer perception of:

Source: Cambridge Group

23

Coupons

Frequent promotions

Sales/discounts

Price Match Guarantee

Fair prices |

TOYS“R”US HAS A BIG OPPORTUNITY TO DELIVER A

BETTER IN-STOCK EXPERIENCE

Strong

Weak

LEADER

ALWAYS IN STOCK

24

Source: Cambridge Group |

U.S. MARGINS

HAVE BEEN PRESSURED DUE TO EXCESSIVE

PROMOTIONAL ACTIVITY AND POOR INVENTORY MANAGEMENT

Note: 2013 excludes the impact of the $51 million domestic reserve

25

34.8%

34.8%

34.3%

35.4%

33.3%

35.9%

36.6%

38.0%

38.3%

38.7%

30.0%

32.0%

34.0%

36.0%

38.0%

40.0%

42.0%

FY2009

FY2010

FY2011

FY2012

FY2013

Domestic

International |

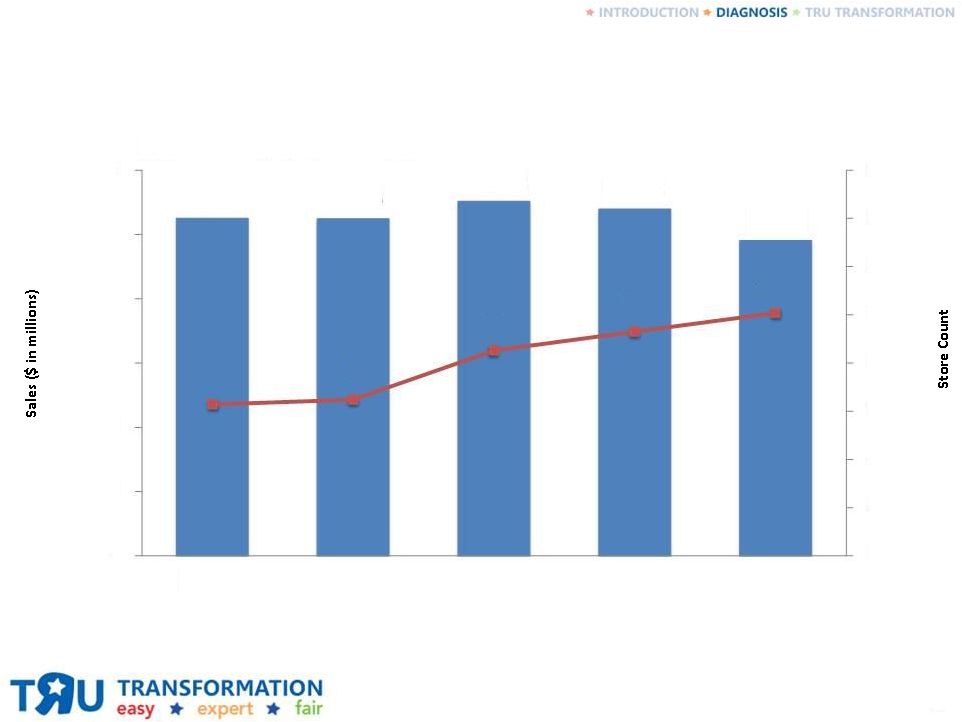

INTERNATIONAL

BUSINESS HAS BEEN SOFT, OFFSET BY STRONG GROWTH IN CHINA

In FY2013, we opened 24 new stores in China, bringing our total store count

to 53. Note: Express stores with a cumulative lease term of at least two years are

included in our overall store count 26

$5,251

$5,243

$5,516

$5,394

$4,905

514

524

626

665

704

200

300

400

500

600

700

800

900

1,000

$-

$1,000

$2,000

$3,000

$4,000

$5,000

$6,000

FY2009

FY2010

FY2011

FY2012

FY2013

In USD$

at each year's actual fx |

GLOBAL SG&A

COST STRUCTURE HAS NOT FLEXED DOWN CONSIDERING DECLINING SALES GROWTH AND COMP

PERFORMANCE Note: SG&A excludes one-time items. See the Appendix for a summary

of the adjustments. 27

$3,699

$3,865

$3,975

$4,003

$3,925

27.3%

27.9%

28.6%

29.6%

31.3%

20.0%

22.0%

24.0%

26.0%

28.0%

30.0%

32.0%

34.0%

36.0%

38.0%

40.0%

FY2009

FY2010

FY2011

FY2012

FY2013

$1,000

$1,500

$2,000

$2,500

$3,000

$3,500

$4,000

$4,500 |

AFTER RECORD

HIGHS, EBITDA HAS DECLINED FOUR YEARS IN A ROW

28

Note: 2005-2013 represents Adjusted EBITDA (Refer to prior SEC filings for the

reconciliation of adjustments); Toys Japan not consolidated prior to 2006, Japan 2005

EBITDA of $35M net of royalties $0

$200

$400

$600

$800

$1,000

$1,200

79

81

83

85

87

89

91

93

95

97

99

01

03

05

07

09

11

13 |

THE COMPANY

HAS NO SIGNIFICANT NEAR-TERM

DEBT

MATURITIES

Other

Excludes North American ABL, European and Australian ABL, Japan Committed Credit Lines, and

Uncommitted Credit Lines related to the Asia JV Other

As of February 1, 2014

Delaware

Term Loan

(B1)

Delaware

HY Notes

Toys“R”

Us, Inc.

Notes

Delaware

Term Loan

(B2 & B3)

Toys“R”

Us, Inc.

Notes

Propco I

Term

Loan

Propco II

Notes

UK Real

Estate

Loans

29

Recently completed the successful refinancing of our $1.85 billion senior secured revolving

credit facility

-

500

1,000

1,500

2014

2015

2016

2017

2018

2019

2020+ |

TO SUM IT UP,

WE HAVE FOUR BIG ISSUES TO

FIX…

•

Customer Experience

•

Price Perception

•

Inventory Management

Disciplines

•

Right-Sized Cost Base

30

…AND THEY ARE IN OUR CONTROL TO FIX

|

1.

Introduction

2.

Diagnosis

3.

TRU Transformation

31 |

MISSION

WE BRING JOY

INTO THE

LIVES OF OUR CUSTOMERS

THE TOY AND JUVENILE PRODUCTS AUTHORITY AND

DEFINITIVE DESTINATION FOR KID FUN, GIFT-GIVING

SOLUTIONS AND PARENTING SERVICES

32 |

GUIDING

PRINCIPLES EASY

EXPERT

FAIR

TO SHOP

IN THE TOY AND

BABY CATEGORIES

PRICES

33 |

The BROADEST SELECTION OF PRODUCTS to help kids and

babies develop, learn, have fun and be safe

The EASIEST PLACE TO RESEARCH AND FIND SOLUTIONS

throughout the journey of parenthood

The BEST RESOURCE FOR

CHILDREN’S GIFT-GIVING

OCCASIONS

FAIR PRICES

EXPERT SERVICE AND UNIQUE SERVICES

The ability to shop WHENEVER, WHEREVER AND HOWEVER

YOU WANT

CUSTOMER PROMISE

34 |

THE 3 PILLARS OF OUR 2014 STRATEGY

35

TRANSFORM THE

CUSTOMER EXPERIENCE

DEVELOP HIGH-PERFORMING,

HIGHLY ENGAGED, DIVERSE TALENT

BECOME FIT FOR GROWTH

2

1

3 |

TRANSFORM THE

IN-STORE SHOPPING EXPERIENCE Put the customer at the

center of decisions; solve

any problems with

immediacy; leverage

consumer insights

Be the true specialist –

add store labor in key

areas to drive sales

and improve service

Improve in-stocks and

speed of checkout

Improve execution

of in-store

initiatives

Better tailor

messaging to

customers to

ensure relevancy

1

2

3

4

5

Reduce clutter and

introduce better

store signage

6

36

Clean up existing stores to

be fit for growth; improve

navigation

7 |

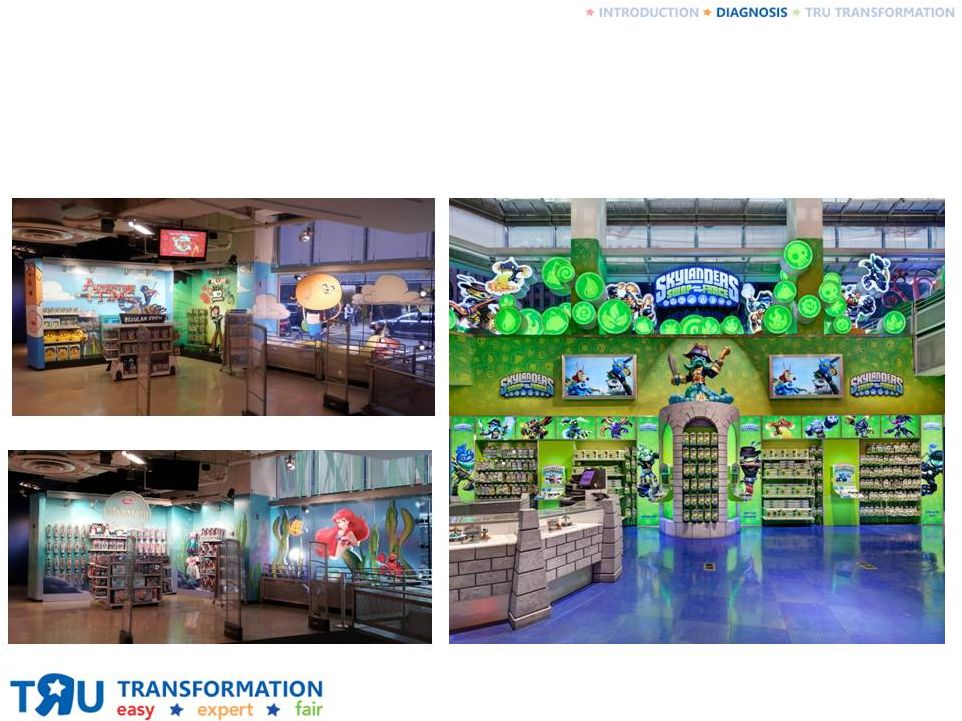

DEVELOP STORE OF

THE FUTURE Slow store growth in the U.S. as work is done to fix current store base

Identify and test

future store

concepts

Deliver fun and

exciting experiences

in stores across the

company

Leverage

Side-by-Side

learnings

1

2

3

37

Reimagine

opportunities for

merchandising,

adjacencies

and space

4 |

OPTIMIZE

e-COMMERCE EXPERIENCE Continue to

improve in-store

pick up

integration

Improve inventory

accuracy and

order status

communication

Reduce load times

online and on

mobile app

Improve

Ship from Store

execution

1

2

3

4

38 |

CREATE

MEANINGFUL CUSTOMER RELATIONSHIPS THROUGH

LOYALTY AND TARGETED MARKETING PROGRAMS

•

Strengthen Rewards“R”Us to build stronger relationships with

loyal customer base and create a more compelling offering

•

Translate program into a true competitive advantage

•

Improve content relevancy to provide targeted messaging based

on purchase history

•

Transition portion of marketing spend to emerging media channels

•

Maintain and accelerate Registry by:

–

Strengthening Registry incentive offering

–

Enhancing digital and omnichannel offerings as they relate to Registry

–

Introducing new services to guide the Registry creation and

maintenance process

39 |

IMPROVE

PRICE PERCEPTION

Source: Cambridge Group

•

SIMPLIFY AND OPTIMIZE PROMOTIONAL ACTIVITY

•

BETTER COMMUNICATE PRICE MATCH GUARANTEE

40

Strong

Weak

LEADER

FAIR PRICES I CAN TRUST

Competitor #2

Competitor #3

Competitor #1

Strong

Weak

LEADER

PRICE MATCHING

Competitor #2

Competitor #3

Competitor #1 |

DEVELOP CLEAR

PRICING STRATEGY AND SIMPLIFY

PROMOTIONAL OFFERS

41

Printed Ad

In-Store |

PUT DISCIPLINES

BACK INTO INVENTORY MANAGEMENT AND INTO GROWING OPERATING MARGINS

42

FY-2006

FY-2007

FY-2008

FY-2009

FY-2010

FY-2011

FY-2012

FY-2013

U.S. Inventory Turnover |

LEVERAGE

BUSINESS PARTNER RELATIONSHIPS TO DRIVE CATEGORY LEADERSHIP

AND TRUE DIFFERENTIATION IN PRODUCTS AND SERVICES

In-Store Events

43

Exclusive Products

Store Services |

DEPLOY CAPITAL

TO DRIVE KEY INITIATIVES U.S. Real Estate Maintenance

International Growth

Global e-Commerce

Supply Chain

44

Global Information Technology |

45

•

Identify substantial cost and working capital savings opportunities through

process and operating model improvements

•

Focus areas include:

•

Supply Chain

•

Marketing

•

Merchandising

•

Store Operations

•

e-Commerce

•

Maintenance

•

Logistics

•

Procurement

•

IT

•

Finance

APPROPRIATELY SCALE COST STRUCTURE AND SG&A THROUGH

EXPENSE CONTROL AND PROCESS IMPROVEMENT |

DEVELOP HIGH-PERFORMING AND HIGHLY

FOCUSED TEAMS

4

5

Culture & Engagement

Create and sustain a culture of high

engagement so we can attract and retain

top talent

1

Organizational Structure

Review organizational structure and roles

and responsibilities within key functions

2

Strengthen Talent

Create infrastructure that will ensure we

consistently assess and develop talent

3

Productivity Tracking

Create and sustain culture of accountability

by establishing a more robust goal-setting

process

46

Training

Drive sales and service training and develop

proper organizational structure to improve

performance and profitability in stores

6

Rewards & Recognition

Enhance our ability to hire and retain great talent

by rewarding those behaviors and results that

truly impact the performance of the business |

Focus for

2014 will be to make changes and strengthen the THIS

WILL TAKE TIME – PROGRESS WILL BE STEADY

47

Execute Flawlessly

Streamline

the

Organization

With

Recalibrated

Performance

Expectations

Right

Size

the

Cost

Structure

Control

Expenses

and

Improve

Processes

Become Easier to Do Business With

Make Progress on FAIR Prices

Improve Store Conditions

Provide a Better Customer Experience

in-store and online and become a

customer-centric company

Focused metrics: Slow Sales Decline; Stabilize Cash Flow; Improve EBITDA

foundation

of

the

company

so

revenue

and

profits

can

grow

in

2015 and beyond

,

, |

48

|

CUSTOMER

PROMISE 49

The BROADEST SELECTION OF PRODUCTS

to help kids and

babies develop, learn, have fun and be safe

The EASIEST PLACE TO RESEARCH AND FIND SOLUTIONS

throughout the journey of parenthood

The BEST RESOURCE FOR

CHILDREN’S GIFT-GIVING

OCCASIONS

FAIR PRICES

EXPERT SERVICE AND UNIQUE SERVICES

The ability to shop WHENEVER, WHEREVER AND HOWEVER

YOU WANT |

APPENDIX

|

RECONCILIATION

FROM REPORTED SG&A TO SG&A EXCLUDING ONE-TIME ITEMS

$ in millions

FY2009

FY2010

FY2011

FY2012

FY2013

Reported SG&A

3,730

$

3,942

$

4,029

$

4,041

$

4,010

$

Litigation expense

-

23

8

1

23

Sponsors’ management and advisory fees

15

20

20

21

22

Prior period adjustments

-

16

-

-

17

Compensation expense

-

6

1

2

7

Restructuring

5

3

3

2

-

Certain legal and accounting transaction costs

-

-

6

6

1

Acquisition costs

-

-

4

-

-

Severance

5

4

7

-

13

Store closure costs

6

5

5

6

2

SG&A excluding one-time items

3,699

$

3,865

$

3,975

$

4,003

$

3,925

$ |

March 26,

2014 |