Attached files

| file | filename |

|---|---|

| EX-23.1 - EX-23.1 - OLD SECOND BANCORP INC | a2218826zex-23_1.htm |

| EX-1.1 - EX-1.1 - OLD SECOND BANCORP INC | a2218826zex-1_1.htm |

Use these links to rapidly review the document

TABLE OF CONTENTS

As filed with the Securities and Exchange Commission on March 26, 2014

Registration No. 333-193424

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 2

to

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

OLD SECOND BANCORP, INC.

(Exact name of registrant as specified in its charter)

| Delaware (State or other jurisdiction of incorporation or organization) |

36-3143493 (I.R.S. Employer Identification Number) |

37 South River Street

Aurora, Illinois 60506

(630) 892-0202

(Address, including zip code and telephone number, including area code, of registrant's principal executive offices)

William B. Skoglund

Chairman and Chief Executive Officer

Old Second Bancorp, Inc.

37 South River Street

Aurora, Illinois 60506

(630) 892-0202

(Name, address, including zip code and telephone number, including area code, of agent for service)

| Copies to: | ||

Robert M. Fleetwood Gregory V. Demo Barack Ferrazzano Kirschbaum & Nagelberg LLP 200 West Madison Street, Suite 3900 Chicago, Illinois 60606 (312) 984-3100 |

Edwin S. del Hierro James S. Rowe Kirkland & Ellis LLP 300 North LaSalle Chicago, Illinois 60654 (312) 862-2000 |

|

Approximate date of commencement of proposed sale to the public: As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"). (Check one):

| Large accelerated filer o | Accelerated filer o | Non-accelerated filer o (Do not check if a smaller reporting company) |

Smaller reporting company ý |

CALCULATION OF REGISTRATION FEE

|

||||||||

| Title of Each Class of Securities to be Registered |

Amount to be Registered |

Proposed Maximum Offering Price Per Share |

Proposed Maximum Aggregate Offering Price(1)(2) |

Amount of Registration Fee(4) |

||||

|---|---|---|---|---|---|---|---|---|

Common Stock, $1.00 par value per share(3) |

NA | NA | $78,000,000 | $10,047 | ||||

|

||||||||

- (1)

- Estimated

solely for the purpose of calculating the registration fee pursuant to Rule 457(o) under the Securities Act.

- (2)

- Includes

offering price of shares that the underwriters have the option to purchase to cover over-allotments, if any.

- (3)

- Each

share of Old Second Bancorp, Inc., common stock has attached thereto the right to purchase one one-thousandth (subject to adjustment) of a share

of Series A Junior Participating Preferred Stock, $1.00 par value per share.

- (4)

- The Registrant previously paid a registration fee of $9,016 for the registration of $70,000,000 worth of Common Stock. As a result of the increase in the proposed maximum offering price, the Registrant will pay an additional registration fee of $1,031.

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not complete this offering and sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities, and it is not soliciting an offer to buy these securities, in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED MARCH 26, 2014

PRELIMINARY PROSPECTUS

13,500,000 Shares

Common Stock

We are offering 13,500,000 shares of our common stock. Our common stock is listed on the Nasdaq Global Select Market under the symbol "OSBC." As of March 25, 2014, the official closing sale price for our common stock on the Nasdaq Global Select Market was $4.67 per share. Please see "Market Price and Dividend Information" on page 39 for more information.

Investing in our common stock involves risks. We encourage you to read and carefully consider this prospectus in its entirety, in particular the risk factors beginning on page 16 as well as other information in any documents we incorporate by reference into this prospectus, for a discussion of factors that you should consider with respect to this offering.

| |

Per Share | Total | |||||

|---|---|---|---|---|---|---|---|

Public offering price |

$ | $ | |||||

Underwriting discounts and commissions(1) |

$ | $ | |||||

Proceeds to us (before expenses) |

$ | $ | |||||

- (1)

- We have agreed to reimburse the underwriters for certain of their expenses as described under "Underwriting."

This is a firm commitment underwriting. The underwriters have the option to purchase additional shares of our common stock up to 2,025,000 shares at the public offering price, less underwriting discounts and commissions, within 30 days of the date of this prospectus solely to cover over-allotments, if any.

The shares of common stock offered are not savings accounts, deposits or other obligations of any of our bank or non-bank subsidiaries and are not insured by the Federal Deposit Insurance Corporation or any other governmental agency.

Neither the Securities and Exchange Commission, any state securities commission, the Federal Deposit Insurance Corporation, the Board of Governors of the Federal Reserve System, nor any other regulatory body has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares of common stock in book-entry form only through the facilities of The Depository Trust Company against payment on or about , 2014, subject to customary closing conditions.

| Keefe, Bruyette & Woods | ||

| A Stifel Company | ||

Sandler O'Neill + Partners, L.P. |

FIG Partners, LLC |

|

The date of this prospectus is , 2014.

You should only rely on the information contained or incorporated by reference in this prospectus and any "free writing prospectus" we authorize to be delivered to you. We have not, and the underwriters have not, authorized anyone to provide you with additional information or information different from that contained or incorporated by reference in this prospectus and any such "free writing prospectus." If anyone provides you with different or inconsistent information, you should not rely on it. We are offering to sell our common stock only in jurisdictions where those sales are permitted. The information contained or incorporated by reference in this prospectus and any such "free writing prospectus" is accurate only as of their respective dates. Our business, financial condition, results of operations and prospects may have changed since those dates.

This prospectus describes the specific details regarding this offering, the terms of the common stock being offered and the risks of investing in our common stock. You should read this prospectus and the additional information about us described in the section entitled "Where You Can Find More Information" before making your investment decision.

As used in this prospectus, the terms "we," "our," "us" and "Old Second" refer to Old Second Bancorp, Inc., and its consolidated subsidiaries unless the context indicates otherwise. When we refer to the "Bank" or "our bank" in this prospectus, we are referring to Old Second National Bank, a national banking association and wholly-owned subsidiary of Old Second.

1

WHERE YOU CAN FIND MORE INFORMATION

This prospectus, which forms a part of a registration statement filed with the Securities and Exchange Commission (the "SEC"), does not contain all of the information set forth in the registration statement. For further information with respect to us and the securities offered, reference is made to the registration statement.

We file annual, quarterly, and current reports, proxy statements and other information with the SEC. You may read and copy any document we file at the SEC's public reference room at 100 F Street, N.E., Washington, D.C. 20549. You can also request copies of the documents, upon payment of a duplicating fee, by writing the Public Reference Section of the SEC. Please call the SEC at 1-800-SEC-0330 for further information on the public reference room. These SEC filings are also available to the public from the SEC's website at www.sec.gov.

When used in this prospectus and the documents incorporated herein the words or phrases "may," "could," "should," "hope," "might," "believe," "expect," "plan," "assume," "intend," "estimate," "anticipate," "project," "likely," or similar expressions are intended to identify "forward-looking statements" within the meaning of such term in the Private Securities Litigation Reform Act of 1995. Such statements are subject to risks and uncertainties, including, without limitation, changes in economic conditions in the market areas of the Bank, changes in policies by regulatory agencies, fluctuations in interest rates, demand for loans in the market areas of the Bank, borrowers defaulting on the repayment of loans and competition. These risks could cause actual results to differ materially from what we have anticipated or projected. These risk factors and uncertainties should be carefully considered by potential investors. See the "Risk Factors" section of this prospectus and Part I, Item 1.A. "Risk Factors" in our Annual Report on Form 10-K for the year ended December 31, 2013, as well as elsewhere in our periodic and current reports filed with the SEC, for discussion relating to risk factors impacting us. Investors should not place undue reliance on any forward-looking statement, which speaks only as of the date on which it was made. The factors described in this prospectus could affect our financial performance and could cause actual results for future periods to differ materially from any opinions or statements expressed with respect to future periods.

Where any such forward-looking statement includes a statement of the assumptions or bases underlying such forward-looking statement, we caution that, while our management believes such assumptions or bases are reasonable and are made in good faith, assumed facts or bases can vary from actual results, and the differences between assumed facts or bases and actual results can be material, depending on the circumstances. Where, in any forward-looking statement, an expectation or belief is expressed as to future results, such expectation or belief is expressed in good faith and believed to have a reasonable basis, but there can be no assurance that the statement of expectation or belief will be achieved or accomplished.

We do not intend to, and specifically disclaim any obligation to, update any forward-looking statements.

2

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

We file annual, quarterly, and current reports, proxy statements and other information with the SEC. The SEC allows us to "incorporate by reference" certain information we file with it. This means we can disclose important information to you by referring you to those documents, which we filed separately with the SEC. The information we incorporate by reference is an important part of this prospectus and should be reviewed by you. We incorporate herein by reference the documents listed below, except to the extent that any information contained in those documents is deemed "furnished" in accordance with SEC rules:

- •

- Annual Report on Form 10-K for the year ended December 31, 2013, filed with the SEC on February 26, 2014;

and

- •

- Current Reports on Form 8-K filed with the SEC on January 15, 2014; and January 23, 2014.

Any statement contained in a document that is incorporated by reference will be modified or superseded for all purposes to the extent that a statement contained in this prospectus modifies or is contrary to that previous statement. Any statement so modified or superseded will not be deemed a part of this prospectus except as so modified or superseded.

Upon request, we will provide to each person, including any beneficial owner, to whom a prospectus is delivered, a copy of any or all of the reports or documents that have been incorporated by reference in the prospectus contained in the registration statement, but not delivered with the prospectus. You may request a copy of any of these filings at no cost, by writing or telephoning us at the following address or telephone number:

Old

Second Bancorp, Inc.

37 South River Street

Aurora, Illinois 60506

(630) 892-0202

Attention: Corporate Secretary

Any report or document incorporated by reference may be accessed on our website at www.oldsecond.com. The information on our corporate website is not part of this prospectus or any free writing prospectus or other offering materials.

The public may read and copy any materials filed with the SEC at the SEC's Public Reference Room at 100 F Street, N.E., Washington, DC 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC also maintains a site, www.sec.gov, where the public may access reports, proxy and information statements and other information regarding Old Second and other issuers that file electronically with the SEC.

3

This summary is not complete and does not contain all of the information that may be important to you or that you should consider before investing in our common stock. This summary is qualified in its entirety by the more detailed information included or incorporated by reference in this prospectus. Before making your investment decision, you should read this entire prospectus, including the "Risk Factors" section and those documents incorporated by reference. Unless otherwise expressly stated or the context otherwise requires, all information in this prospectus assumes that the underwriters do not exercise their option to purchase additional shares of our common stock to cover any over-allotments.

Overview

Old Second Bancorp, Inc., headquartered in Aurora, Illinois is an Illinois-based bank holding company providing commercial banking services to individuals, small to medium-sized businesses, community organizations, and public entities. Our wholly-owned banking subsidiary, Old Second National Bank, was founded in 1871 and conducts its business through 27 branch locations. Through the Bank, we conduct a traditional retail and commercial banking business as well as provide fiduciary and wealth management services. The Bank offers a full complement of electronic banking services, such as online and mobile banking and corporate cash management, including remote deposit capture. The Bank also makes commercial and consumer loans to corporations, partnerships and individuals, primarily on a secured basis. Commercial lending focuses on real estate, business, capital, construction and inventory lending, and installment lending includes direct and indirect loans to consumers and commercial customers. We also originate residential mortgages by offering a wide range of products including conventional, government, and jumbo loans. As of December 31, 2013, we had total assets of $2.0 billion, total deposits of $1.7 billion and total shareholders' equity of $147.7 million.

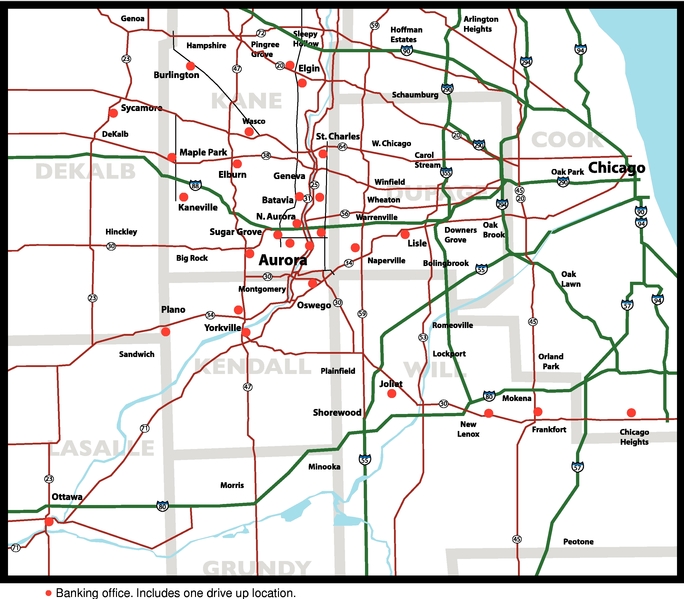

Market Area

Our primary market area is Aurora, Illinois and its surrounding communities. The city of Aurora is located in northeastern Illinois, approximately 40 miles west of Chicago. The Bank operates primarily in Kane, Kendall, DeKalb, DuPage, LaSalle, Will and southwestern Cook Counties in Illinois, and it has developed a strong presence in these counties. Based on 2012 estimates from the United States Census Bureau, these counties, excluding Cook County, represent a market of more than 2.4 million people, and the city of Aurora itself has a population of approximately 200,000 residents. In addition, in 2008, we added an office in southwestern Cook County, which has an estimated population of 5.2 million people. The Bank offers its services to retail, commercial, industrial, and public entity customers in the Aurora, North Aurora, Batavia, Geneva, St. Charles, Burlington, Elburn, Elgin, Maple Park, Kaneville, Sugar Grove, Naperville, Lisle, Joliet, Yorkville, Plano, Wasco, Ottawa, Oswego, Sycamore, New Lenox, Frankfort, and Chicago Heights communities and surrounding areas.

Our Strategic Goals and Recent Accomplishments

Our Bank, like most financial institutions, was adversely affected by the global economic downturn that began in 2007. As a community banking organization, a primary component of our loan portfolio was, and still is, real estate lending, which includes commercial, construction and residential loans, and, because we are located in areas that saw rapid growth over the past two decades, real estate construction and development loans were a significant part of our business prior to the onset of the financial crisis in 2007. Since first incurring losses as a result of the global economic downturn, we determined that our best course of action was to focus on our core business and position the Bank to return to profitability as the economy

4

improved. To facilitate a return to profitability, we have been proactive in addressing the economic challenges facing the Bank and have focused our efforts on achieving four primary goals:

- •

- improving loan quality;

- •

- increasing net earnings;

- •

- strengthening our regulatory capital ratios; and

- •

- stabilizing our loan portfolio and positioning the Bank for loan growth.

As a result of our focus on these four goals our financial condition has steadily improved. We have significantly reduced our problem loans and nonperforming assets. We have also made a concerted effort to reduce operating expenses, including decreasing our expenses related to the valuation and maintenance of our other real estate owned ("OREO"), our legal expenses related to our problem loans and our costs associated with maintaining Federal Deposit Insurance Corporation ("FDIC") insurance on our deposit accounts. As we have focused on reducing our operating expenses, we have been able to maintain our profitable wealth management business and our strong residential real estate business, which contribute to our fee income sources. As set forth in the chart below, because of our efforts, we have achieved consistent profitability in the fiscal year ended December 31, 2013. As a result of achieving six consecutive quarters of consolidated net income and our analysis of other available evidence, both positive and negative, we were able to reverse $70.0 million of the valuation allowance against our deferred tax assets during the quarter ended September 30, 2013. As a result of our success in achieving these goals, in October 2013, the Office of the Comptroller of the Currency (the "OCC") terminated the Stipulation and Consent to the Issuance of a Consent Order (the "Consent Order") originally entered into on May 16, 2011, and, on January 17, 2014, the Federal Reserve Bank of Chicago (the "Federal Reserve Bank") terminated the Written Agreement (the "Written Agreement") between the Federal Reserve Bank and the Company.

| |

As of and For the Year Ended December 31, |

|||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| ($ in thousands) |

2013 | 2012 | 2011 | 2010 | 2009 | |||||||||||

Total assets |

$ | 2,004,034 | $ | 2,045,799 | $ | 1,941,418 | $ | 2,123,921 | $ | 2,596,657 | ||||||

Loans, gross |

1,101,256 | 1,150,050 | 1,368,985 | 1,690,129 | 2,062,826 | |||||||||||

Stockholders' equity |

147,692 | 72,552 | 74,002 | 83,958 | 197,208 | |||||||||||

Net interest and dividend income |

55,254 | 59,346 | 63,950 | 78,613 | 87,137 | |||||||||||

Provision for loan losses |

(8,550 | ) | 6,284 | 8,887 | 89,668 | 96,715 | ||||||||||

Net (loss) income available to common stockholders |

$ | 76,827 | $ | (5,059 | ) | $ | (11,228 | ) | $ | (113,187 | ) | $ | (69,869 | ) | ||

Nonperforming assets to total assets |

4.06 | % | 7.58 | % | 11.96 | % | 14.50 | % | 8.91 | % | ||||||

Nonperforming loans to total loans |

3.61 | % | 7.18 | % | 10.15 | % | 13.54 | % | 9.20 | % | ||||||

Tier 1 leverage ratio |

6.96 | % | 4.85 | % | 4.98 | % | 4.74 | % | 8.48 | % | ||||||

Tier 1 risk-based capital ratio |

10.65 | % | 6.81 | % | 6.21 | % | 6.09 | % | 9.96 | % | ||||||

Total risk-based capital ratio |

15.88 | % | 13.62 | % | 12.38 | % | 11.46 | % | 13.26 | % | ||||||

Over the past few years, we have worked diligently to improve the quality of the loans in our portfolio. While our total loan portfolio has declined, the quality of our loan portfolio has improved for the last 12 consecutive quarters. For example, our nonaccrual loans were down 49.8% to $38.9 million as of December 31, 2013, from $77.5 million at December 31, 2012, and our OREO has declined 42.6% to $41.5 million as of December 31, 2013, from $72.4 million at December 31, 2012.

Since December 31, 2012, our total loans have declined by $48.8 million, or 4.2%, to $1.10 billion as of December 31, 2013; however, the pace of the decline in total loans has generally slowed since 2012, with total loans declining by $58.2 million for the fourth quarter of 2012, $36.7 million for the first quarter of

5

2013, $10.6 million for the second quarter of 2013 and $25.1 million for the third quarter of 2013. Loans increased in the fourth quarter of 2013 by $23.6 million. This is due to our renewed ability to gain new loan relationships, the overall improvement in loan quality and reduced net charge-offs. While loan demand in our market areas remains below historical levels and competition for high quality loans remains intense, we are now positioning ourselves to grow our loan portfolio and have focused on building and improving our loan origination leads. We have hired 11 experienced lending professionals since 2012 and continue to emphasize quality in new loan originations over quantity. We also increased our annual commercial loan originations from $35 million in 2011 to $138 million in 2012 to $199 million in 2013. We believe that, as the economy continues to gradually improve and the real estate market continues to stabilize, our efforts at marketing and increasing our loan pipelines will lead to an increase in the size of our overall loan portfolio.

Our Competitive Strengths

We believe that our following strengths position us well for future growth and profitability:

- •

- Strong and stable market share in growing markets. As of

June 30, 2013, we were ranked first by the FDIC in total dollar deposits in Aurora, Illinois, with approximately 34.67% of the total deposits in that market. As of June 30, 2013, we were

also ranked first in Kendall County and second in Kane County in terms of deposits. Kendall County and Kane County are ranked first and fourth, respectively, in terms of population growth since 2000

relative to the 17 counties in the Chicago metropolitan statistical area ("MSA") according to data from the United States Census Bureau. We are well-positioned to serve those communities as they

continue to grow and expand.

- •

- Our community banking model has built a loyal and long-term customer

base. Our Bank is built on a community bank model, which has allowed us to provide excellent service to our customers and build

long-lasting relationships. Furthermore, our size of approximately $2.0 billion in assets provides us with the financial resources to handle the majority of our customers' banking needs. Our

excellent service and relationship-based approach have led to our customers remaining loyal to us throughout the years. Currently, 57% of all households banking with us have been customers of the Bank

for ten years or more.

- •

- Strong core deposits and limited reliance on brokered deposits and other short-term

funding. As of December 31, 2013, we had $1.7 billion in total deposits, approximately $1.2 billion of which we

classified as "core deposits," which we define as all non-time deposits, and we had no brokered deposits. Our strong and stable deposit base is one of our key attributes, and it was a significant

factor in allowing us to weather the economic downturn and return to profitability.

- •

- Improved credit culture. We have strengthened our credit

practices through the implementation of credit initiatives designed to strengthen our credit oversight and risk management functions, minimize losses from our legacy portfolio and reduce the level of

our nonperforming assets. By strengthening our credit practices, we have achieved a reduction in our classified assets of nearly 78% since December 31, 2010.

- •

- Highly experienced management team with strong community

ties. Our management team has remained loyal and intact through the economic downturn. Its strong and steadfast leadership and ability

to work with and for members of our community has been a key driver in the retention of our customers and other key employees. The members of our executive management team, on average, have been with

Old Second for over 25 years. We believe our management team's experience and strong reputation in the community will assist us as we renew our focus on building our lending origination

business and returning to consistent loan growth.

- •

- Profitable wealth management and residential real estate business. We have a profitable wealth management business with over $1.0 billion in assets under management, and a residential real

6

estate banking group that sold $185.4 million in residential real estate loans for the fiscal year ended December 31, 2013.

We believe that focusing on our four primary goals set forth above, our organization's unique strengths and successfully consummating this offering will enable us to continue as a strong organization and position us to grow as the overall economy and real estate and credit markets continue to improve.

Background to the Offering and Our Capital Structure

In June of 2003, we completed the sale of $27.5 million of cumulative trust preferred securities and sold an additional $4.1 million of cumulative trust preferred securities in July of 2003 through our unconsolidated subsidiary, Old Second Capital Trust I. In addition, in April of 2007, we issued $25.0 million of cumulative trust preferred securities through a private placement completed by an additional, unconsolidated subsidiary, Old Second Capital Trust II (together with the trust preferred securities issued by Old Second Capital Trust I, the "Trust Preferred Securities"). We issued subordinated debentures to Old Second Capital Trust I in the original amount of $32.6 million and subordinated debentures to Old Second Capital Trust II in the amount of $25.8 million in connection with the issuance of the Trust Preferred Securities. As of December 31, 2013, there were a total of $58.4 million of Trust Preferred Securities outstanding and the total accrued but unpaid interest on the Trust Preferred Securities, including compound interest on the deferred payments, totaled $17.0 million.

We also entered into a credit facility in January 2008, which originally included a $30.5 million senior debt facility, including $500,000 in term debt, as well as $45.0 million of subordinated debt. The $30.0 million line of credit portion of the senior debt facility matured in accordance with its terms and has been repaid. However, we still have $500,000 in principal outstanding under the term debt portion of the senior debt facility and $45.0 million in principal outstanding in subordinated debt as of December 31, 2013. The term debt portion of the senior debt facility is secured by the outstanding capital stock of the Bank. The agreement governing the credit facility contains the usual and customary provisions regarding the acceleration of senior debt upon the occurrence of an event of default. As of December 31, 2013, we were out of compliance with one of the financial covenants in the agreement governing the credit facility and, as a result, were in default on the $500,000 in term debt currently outstanding under the senior debt portion of the credit facility. Because the outstanding subordinated debt is treated as Tier 2 capital for regulatory capital purposes, the agreement covering the credit facility does not allow the acceleration of such amount as a result of our failure to comply with a financial covenant.

In January 2009, in connection with the global economic crisis and to strengthen our capital position, we issued and sold (i) 73,000 shares of Series B Fixed Rate Cumulative Perpetual Preferred Stock (the "Series B Preferred Stock") and (ii) a warrant to purchase 815,339 of our common stock at an exercise price of $13.43 per share to the U.S. Department of the Treasury ("Treasury") through the Capital Purchase Program (the "CPP") instituted as part of the Troubled Asset Relief Program. The aggregate purchase price for the Series B Preferred Stock and the warrant was $73.0 million. We carried $72.9 million of Series B Preferred Stock in total shareholders' equity as of December 31, 2013.

Following our participation in the CPP, we experienced substantial losses as a result of the decline in the real estate market caused by the global economic downturn. Because our loan portfolio was heavily invested in real estate lending, including commercial real estate and construction loans, many of our loans were moved to nonperforming status and subsequently charged off. We also posted a net loss for each of 2010, 2011 and 2012 and began to accumulate deferred tax assets as a result of our losses. As a result of these losses, we first established a valuation allowance against our deferred tax assets as of December 31, 2010. On August 31, 2010, we announced that we elected to defer the dividend payments on the Series B

7

Preferred Stock. We also announced that we would begin deferring the regularly scheduled interest payments on the Trust Preferred Securities on August 31, 2010.

On May 16, 2011, the Bank entered into the Consent Order with the OCC, which is the Bank's primary regulator. The Consent Order required the Bank, among other things, to adopt a strategic plan and a capital plan, to maintain heightened regulatory capital ratios, and to receive the approval of the OCC prior to paying any dividends. In October of 2013, the Consent Order with the OCC was terminated.

On July 22, 2011, we entered into the Written Agreement with the Federal Reserve Bank pursuant to the regulations promulgated by the Board of Governors of the Federal Reserve System (the "Board of Governors," and together with the Federal Reserve Bank, the "Federal Reserve"). The Written Agreement was designed to maintain our financial soundness and prohibited the declaration or payment of interest on our Trust Preferred Securities, the payment of any dividend and the repurchase of shares of our capital stock, including the Series B Preferred Stock, among other things, without the prior written consent of the Federal Reserve. The Written Agreement was terminated on January 17, 2014. Although the Written Agreement was terminated, we expect that we will continue to seek approval from the Federal Reserve Bank prior to paying any dividends on our capital stock and incurring any additional indebtedness.

During the fourth quarter of 2012, Treasury announced the continuation of individual auctions of the preferred stock issued through the CPP and informed us that our Series B Preferred Stock would be auctioned. Auctions for our Series B Preferred Stock were held in the first quarter of 2013. As a result of the auctions, all of the shares of our Series B Preferred Stock were sold to third parties, including certain of our directors. The warrant to purchase 815,339 shares of our common stock was also sold to a third party in a separate auction.

Following Treasury's auctions, we stopped accruing the dividend on the Series B Preferred Stock given the discount reflected in the results of the auctions and our belief that we would likely be able to repurchase the Series B Preferred Stock at a price less than the face amount of the preferred stock plus unpaid dividends. Pursuant to the terms of the Series B Preferred Stock, the dividend rate increased from 5% to 9% in February 2014. Although we have stopped accruing the dividend on the Series B Preferred Stock, dividends on the Series B Preferred Stock have continued to accumulate, and, as of December 31, 2013, the accumulated and unpaid dividends on the Series B Preferred Stock totaled $13.3 million.

The Consent Order was terminated in October of 2013. However, the Bank is still subject to the risk-based capital regulatory guidelines, which include the methodology for calculating the risk-weighting of the Bank's assets, developed by the OCC and the other bank regulatory agencies. In addition, our Bank's board of directors implemented a capital plan (the "Capital Plan") in 2010 pursuant to which the Bank was required to maintain certain minimum capital ratios and work to improve its core capital. Following the termination of the Consent Order, the Bank's board of directors updated the Capital Plan to require the Bank to maintain a minimum Tier 1 leverage capital ratio at or above 8% and a total risk-based capital ratio at or above 12%. As of December 31, 2013, the Bank's Tier 1 leverage capital ratio was 10.97% and its total risk-based capital ratio was 18.04%. In addition, the Bank's Tier 1 risk-based capital ratio was 16.78% as of December 31, 2013. The Bank's capital ratios exceed the heightened capital ratios required by the Capital Plan.

Recent Developments

Series B Preferred Stock. We have negotiated and delivered a non-binding letter of understanding to a certain holder of our Series B Preferred Stock regarding the possible repurchase of approximately 33% of the shares of our outstanding Series B Preferred Stock. The letter of understanding currently contemplates that we will repurchase shares of our Series B Preferred Stock at a price equal to 94.75% of their per share

8

liquidation value, provided that the holder of such shares enters into an agreement with us to forbear payment of any declared dividends on the Series B Preferred Stock and, upon payment of the repurchase price, to waive any rights to the accumulated and unpaid dividends on the Series B Preferred Stock. We may pay the repurchase price in cash, using a portion of the net proceeds from this offering, or in a combination of cash and shares of common stock, which will be issued in reliance on exemptions from registration under the Securities Act following the closing of this offering. We will not issue common stock in exchange for our Series B Preferred Stock to such holder in an amount in excess of 4.9% of our outstanding common stock after giving effect to the issuance of shares of common stock in this offering. If we issue our common stock as part of the repurchase price for the Series B Preferred Stock, such common stock will be issued at a price per share equal to the price at which shares of common stock are sold to the public in this offering (before giving effect to the underwriting discount). We are working toward the execution of a definitive agreement with this holder. The closing of the repurchase of Series B Preferred Stock will be contingent on, and is expected to occur as quickly as possible following, the closing of this offering. The closing of this offering is not contingent on the repurchase of the Series B Preferred Stock, and there is no assurance that we will consummate any of the transactions contemplated by the letter of understanding. We may enter into agreements to repurchase Series B Preferred Stock from other holders of Series B Preferred Stock. The Federal Reserve has informed us that it will not object to the repurchase of our Series B Preferred Stock provided that this offering is successful.

The information in this prospectus regarding the proposed repurchase of Series B Preferred Stock is included herein solely for informational purposes. Nothing in this prospectus should be construed as an offer to buy, or the solicitation of an offer to sell, any of shares our Series B Preferred Stock, or an offer to sell, or the solicitation of an offer to buy, any of shares our common stock. See the section entitled "Use of Proceeds" for additional information.

Developments Since December 31, 2013. From December 31, 2013 through February 28, 2014, our asset quality has continued to improve with nonperforming assets down 1.85% to $79.8 million as of February 28, 2014, from $81.3 million as of December 31, 2013. During the two months ended February 28, 2014, the improvement in our OREO balance of $2.3 million from $41.5 million to $39.2 million was slightly offset by an increase in our nonaccrual loans. In addition, our total loans increased by $3.2 million between December 31, 2013 and February 28, 2014. February was also the fourth consecutive month of increasing loan balances. Based on our performance during the first two months of 2014, we currently expect that we will have positive net income available to common stockholders for the first quarter of 2014.

As of February 28, 2014, the Company had a Tier 1 leverage capital ratio of 6.97% and a total risk-based capital ratio of 15.73%. The Company's Tier 1 risk-based capital ratio was 10.56%. In addition, the Bank's Tier 1 leverage capital ratio was 11.00% and its total risk-based capital ratio was 17.92% at February 28, 2014. The Bank also had a Tier 1 risk-based capital ratio of 16.66%.

As of February 28, 2014, the total accrued but unpaid interest on the Trust Preferred Securities, including compound interest on the deferred payments, totaled $18.0 million and the accumulated and unpaid dividends on the Series B Preferred Stock totaled $14.1 million.

The information set forth above regarding developments since December 31, 2013 is preliminary, unaudited and based on estimates of our results. Estimates of results are inherently uncertain and subject to change, and we undertake no obligation to update this information. This information is not a comprehensive statement of our financial results, and our actual results may differ materially from these estimates due to the completion of our financial closing procedures, final adjustments and other developments that may arise between now and the time our financial results for the three months ended March 31, 2014 are finalized. In addition, the information as of and for the two months ended February 28, 2014 is not necessarily indicative of the results to be achieved for the three months ended March 31, 2014

9

or for any future period. See "Risk Factors" and "Forward-Looking Statements" for factors that could impact our future results and financial performance.

Interests of Certain Directors

Certain of our directors beneficially own, in the aggregate, 1,510 shares of our Series B Preferred Stock, representing 2.1% of the outstanding Series B Preferred Stock. These directors purchased the shares in the auctions conducted by Treasury during the first quarter of 2013. Following the offering, we expect to repurchase shares of our Series B Preferred Stock from these directors on substantially the same economic terms as we repurchase shares from other holders of our Series B Preferred Stock, which will be for a price higher than the directors paid for their shares. However, none of our directors would receive shares of our common stock in exchange for their shares of our Series B Preferred Stock. If we do not repurchase our directors' shares of Series B Preferred Stock for any reason, those directors will receive payment of their pro rata share of the accumulated and unpaid dividends on the Series B Preferred Stock. Our board has created a committee of directors who do not own or have an interest in our Series B Preferred Stock to approve the terms of any repurchases.

Corporate Information

Our principal executive offices are located at 37 South River Street, Aurora, Illinois 60506, and our telephone number at that address is (630) 892-0202. We also maintain a website at www.oldsecond.com. The information on our corporate website is not part of this prospectus or any free writing prospectus or other offering materials.

Our common stock trades on The Nasdaq Global Select Market ("NASDAQ") under the ticker symbol "OSBC."

10

Common Stock Offered |

13,500,000 shares (15,525,000 shares if the underwriters exercise their over-allotment option in full) | |

Common Stock Outstanding After the Offering |

27,417,508 shares (29,442,508 shares if the underwriters exercise their over-allotment option in full)(1)(2) |

|

Net Proceeds |

After deducting the underwriting discounts and commissions and other estimated expenses of this offering, our estimated net proceeds from this offering are anticipated to be approximately $ or approximately $ if the underwriters exercise their over-allotment option in full. |

|

Use of Proceeds |

We plan to use the proceeds of this offering to pay the accrued and unpaid interest on the Trust Preferred Securities, pay the unpaid dividends on the Series B Preferred Stock, to the extent necessary, and repurchase a portion of the Series B Preferred Stock from the current holders. We have negotiated and delivered a non-binding letter of understanding to a certain holder of our Series B Preferred Stock regarding the possible repurchase of approximately 33% of the shares of our outstanding Series B Preferred Stock. The letter of understanding currently contemplates that we will repurchase shares of our Series B Preferred Stock at a price equal to 94.75% of their per share liquidation value, provided that the holder of such shares enters into an agreement with us to forbear payment of any declared dividends on the Series B Preferred Stock and, upon payment of the repurchase price, to waive any rights to the accumulated and unpaid dividends on the Series B Preferred Stock. We may pay the repurchase price in cash, using a portion of the net proceeds from this offering or in a combination of cash and shares of common stock, which will be issued in reliance on exemptions from registration under the Securities Act following the closing of this offering. Any remaining net proceeds will be used for general corporate purposes. See "Use of Proceeds." |

|

No Dividends |

We are not currently paying any cash dividends on our common stock and our ability to pay cash dividends in the near term is significantly restricted by the factors described under the section entitled "Dividend Policy" included herein. |

11

Purchases by Directors and Officers |

All of our directors and certain of our officers intend to purchase shares of our common stock in this offering from the underwriters. Based on their indications of interest, these directors and officers intend to subscribe for approximately $1.3 million worth of shares of common stock in this offering. As of December 31, 2013, our directors and executive officers, in the aggregate, beneficially owned approximately 8.3% of our common stock. Following the closing of this offering, assuming that they purchase all $1.3 million worth of shares of common stock, our directors and executive officers, in the aggregate, will beneficially own approximately 5.2% of our common stock. All of the terms and conditions of the purchases by these directors and officers will be the same as any other person in the general offering to the public, including the purchase price, except that the underwriters will reserve these shares specifically for purchase by these officers and directors. See "Underwriting—Purchase by Directors and Officers." |

|

Market Trading |

Our common stock is currently traded on NASDAQ under the symbol "OSBC." The official closing sale price of our common stock on March 25, 2014, was $4.67 per share. |

|

Risk Factors |

See "Risk Factors" and other information included in this prospectus (including information incorporated by reference) for a discussion of factors you should consider before investing in our common stock. |

- (1)

- The

number of our shares outstanding immediately after the closing of this offering is based on 13,917,508 shares of our common stock outstanding as of

March 6, 2014.

- (2)

- Unless otherwise indicated, the number of shares of common stock stated to be outstanding in this prospectus excludes: (a) 325,500 shares of our common stock underlying options issued pursuant to our equity incentive plans; (b) 45,368 shares of our common stock reserved for future issuance under our equity incentive plans; and (c) 160,500 shares reserved for all non-vested restricted stock awards. Additionally, we have also excluded any shares issuable upon exercise of the warrant that was originally issued to Treasury pursuant to the CPP and subsequently sold to an individual investor at public auction.

12

The following tables set forth selected consolidated financial data for us at and for each of the years in the five-year period ended December 31, 2013. The selected financial data as of and for the years ended December 31, 2013 and 2012, has been derived from our audited financial statements included in our Annual Report on Form 10-K for the year ended December 31, 2013. The selected financial data as of and for the years ended December 31, 2011, 2010 and 2009 has been derived from our audited financial statements included in our Annual Reports on Form 10-K for the years ended December 31, 2011 and 2010. In the opinion of our management, these financial statements reflect all necessary adjustments for a fair presentation of the data for those periods. Historical results are not necessarily indicative of future results.

You should read this information in conjunction with our consolidated financial statements and related notes, from which this information is derived. See the section entitled "Incorporation of Certain Information by Reference" included elsewhere herein.

| |

As of and For the Year Ended December 31, |

|||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| ($ in thousands, except per share data) |

2013 | 2012 | 2011 | 2010 | 2009 | |||||||||||

Balance Sheet Items |

||||||||||||||||

Total assets |

$ | 2,004,034 | $ | 2,045,799 | $ | 1,941,418 | $ | 2,123,921 | $ | 2,596,657 | ||||||

Total earning assets |

1,758,582 | 1,834,995 | 1,751,662 | 1,933,296 | 2,359,740 | |||||||||||

Average assets |

1,962,688 | 1,950,625 | 2,015,464 | 2,426,356 | 2,813,221 | |||||||||||

Loans, gross |

1,101,256 | 1,150,050 | 1,368,985 | 1,690,129 | 2,062,826 | |||||||||||

Allowance for loan losses |

27,281 | 38,597 | 51,997 | 76,308 | 64,540 | |||||||||||

Deposits |

1,682,128 | 1,717,219 | 1,740,781 | 1,908,528 | 2,206,277 | |||||||||||

Securities sold under agreement to repurchase |

22,560 | 17,875 | 901 | 2,018 | 18,374 | |||||||||||

Other short-term borrowings |

5,000 | 100,000 | — | 4,141 | 54,998 | |||||||||||

Junior subordinated debentures |

58,378 | 58,378 | 58,378 | 58,378 | 58,378 | |||||||||||

Subordinated debt |

45,000 | 45,000 | 45,000 | 45,000 | 45,000 | |||||||||||

Note payable and other borrowings |

500 | 500 | 500 | 500 | 500 | |||||||||||

Stockholders' equity |

147,692 | 72,552 | 74,002 | 83,958 | 197,208 | |||||||||||

Results of Operations |

||||||||||||||||

Interest and dividend income |

64,040 | 75,081 | 85,423 | 106,681 | 132,650 | |||||||||||

Interest expense |

13,786 | 15,735 | 21,473 | 28,068 | 45,513 | |||||||||||

Net interest and dividend income |

55,254 | 59,346 | 63,950 | 78,613 | 87,137 | |||||||||||

Provision for loan losses |

(8,550 | ) | 6,284 | 8,887 | 89,668 | 96,715 | ||||||||||

Noninterest income |

31,183 | 37,219 | 31,060 | 42,536 | 41,761 | |||||||||||

Noninterest expense |

83,144 | 90,353 | 92,623 | 98,262 | 143,344 | |||||||||||

(Loss) income before taxes |

11,843 | (72 | ) | (6,498 | ) | (66,781 | ) | (111,161 | ) | |||||||

Provision (benefit) for income taxes |

(70,242 | ) | — | — | 41,868 | (45,573 | ) | |||||||||

Net (loss) income |

82,085 | (72 | ) | (6,498 | ) | (108,649 | ) | (65,588 | ) | |||||||

Preferred stock dividends and accretion |

5,258 | 4,987 | 4,730 | 4,538 | 4,281 | |||||||||||

Net (loss) income available to common stockholders |

$ | 76,827 | $ | (5,059 | ) | $ | (11,228 | ) | $ | (113,187 | ) | $ | (69,869 | ) | ||

Loan Quality Ratios |

||||||||||||||||

Allowance for loan losses to total loans at end of year |

2.48 | % | 3.36 | % | 3.80 | % | 4.51 | % | 3.13 | % | ||||||

Provision for loan losses to total loans |

(0.78 | )% | 0.55 | % | 0.65 | % | 5.31 | % | 4.69 | % | ||||||

Net loans charged off to average total loans |

0.25 | % | 1.56 | % | 2.17 | % | 4.10 | % | 3.33 | % | ||||||

Nonaccrual loans to total loans |

3.53 | % | 6.74 | % | 9.26 | % | 12.56 | % | 8.48 | % | ||||||

Nonperforming assets to total assets |

4.06 | % | 7.58 | % | 11.96 | % | 14.50 | % | 8.91 | % | ||||||

Nonperforming loans to total loans |

3.61 | % | 7.18 | % | 10.15 | % | 13.54 | % | 9.20 | % | ||||||

Allowance for loan losses to nonaccrual loans |

70.11 | % | 49.79 | % | 41.01 | % | 35.96 | % | 36.88 | % | ||||||

13

| |

As of and For the Year Ended December 31, |

|||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| ($ in thousands, except per share data) |

2013 | 2012 | 2011 | 2010 | 2009 | |||||||||||

Per Share Data |

||||||||||||||||

Basic (loss) earnings |

$ | 5.45 | $ | (0.36 | ) | $ | (0.79 | ) | $ | (8.03 | ) | $ | (5.04 | ) | ||

Diluted (loss) earnings |

5.45 | (0.36 | ) | (0.79 | ) | (8.03 | ) | (5.04 | ) | |||||||

Dividends declared |

— | — | — | 0.02 | 0.10 | |||||||||||

Common book value |

5.37 | 0.05 | 0.22 | 1.01 | 9.27 | |||||||||||

Weighted average diluted shares outstanding |

14,106,033 | 14,207,252 | 14,220,822 | 14,104,228 | 13,912,916 | |||||||||||

Weighted average basic shares outstanding |

13,939,919 | 14,074,188 | 14,019,920 | 13,918,309 | 13,815,965 | |||||||||||

Shares outstanding at period end |

13,917,108 | 14,084,328 | 14,034,991 | 13,911,475 | 13,823,917 | |||||||||||

Supplementary Data |

||||||||||||||||

Other real estate owned assets |

$ | 41,537 | $ | 72,423 | $ | 93,290 | $ | 75,613 | $ | 40,200 | ||||||

Other real estate owned expense |

10,747 | $ | 18,663 | $ | 19,410 | 24,027 | 7,549 | |||||||||

Residential mortgage revenue |

8,391 | $ | 11,706 | $ | 6,172 | 11,170 | 11,790 | |||||||||

Capital Ratios |

||||||||||||||||

Tangible common equity to tangible assets |

3.67 | % | (0.13 | )% | (0.08 | )% | 0.40 | % | 4.69 | % | ||||||

Tangible common equity to risk-weighted assets |

5.84 | % | (0.19 | )% | (0.10 | )% | 0.48 | % | 5.46 | % | ||||||

Tier 1 common equity to risk-weighted assets |

0.77 | % | (0.12 | )% | (0.05 | )% | 0.52 | % | 4.31 | % | ||||||

Tier 1 leverage ratio |

6.96 | % | 4.85 | % | 4.98 | % | 4.74 | % | 8.48 | % | ||||||

Tier 1 risk-based capital ratio |

10.65 | % | 6.81 | % | 6.21 | % | 6.09 | % | 9.96 | % | ||||||

Total risk-based capital ratio |

15.88 | % | 13.62 | % | 12.38 | % | 11.46 | % | 13.26 | % | ||||||

Non-GAAP Financial Measures

We and investors often use the ratio of tangible common equity to tangible assets and the ratio of tangible common equity to risk-weighted assets to assess capital and the quality of capital. Tier 1 common equity and risk-weighted assets are terms used by banking regulators in assessing our capital adequacy for regulatory purposes. The ratios of tangible common equity to tangible assets and the ratio of tangible common equity to risk-weighted assets are not necessarily comparable to similar capital measures that may be presented by other companies.

The limitations associated with these measures are the risks that persons might disagree as to the appropriateness of items comprising these measures and that different companies might calculate these measures differently. These disclosures should not be considered an alternative to GAAP. The information

14

provided reconciles GAAP measures and the ratios of tangible common equity or Tier 1 common equity, as applicable, to tangible assets or risk-weighted assets, as applicable.

| |

As of and for the Year Ended December 31, |

|||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| ($ in thousands, except per share data) |

2013 | 2012 | 2011 | 2010 | 2009 | |||||||||||

Tier 1 capital |

||||||||||||||||

Total equity |

$ | 147,692 | $ | 72,552 | $ | 74,002 | $ | 83,958 | $ | 197,208 | ||||||

Tier 1 adjustments: |

||||||||||||||||

Trust preferred securities allowed |

51,577 | 24,626 | 25,901 | 29,029 | 56,625 | |||||||||||

Accumulated other comprehensive loss |

7,038 | 1,327 | 3,702 | 3,130 | 1,605 | |||||||||||

Disallowed goodwill and intangible assets |

(1,177 | ) | (3,276 | ) | (4,678 | ) | (5,525 | ) | (6,655 | ) | ||||||

Disallowed deferred tax assets |

(70,350 | ) | — | (2,592 | ) | (2,064 | ) | (27,018 | ) | |||||||

Other |

(581 | ) | (412 | ) | (349 | ) | (390 | ) | (245 | ) | ||||||

Tier 1 Capital |

$ | 134,199 | $ | 94,817 | $ | 95,986 | $ | 108,138 | $ | 221,520 | ||||||

Total capital |

||||||||||||||||

Tier 1 capital |

$ | 134,199 | $ | 94,817 | $ | 95,986 | $ | 108,138 | $ | 221,520 | ||||||

Tier 2 additions: |

||||||||||||||||

Allowable portion of allowance for loan losses |

15,898 | 17,656 | 19,736 | 22,875 | 28,249 | |||||||||||

Additional trust preferred securities disallowed for Tier 1 capital |

5,048 | 31,999 | 30,724 | 27,596 | — | |||||||||||

Subordinated debt |

45,000 | 45,000 | 45,000 | 45,000 | 45,000 | |||||||||||

Tier 2 additions subtotal |

65,946 | 94,655 | 95,460 | 95,471 | 73,249 | |||||||||||

Allowable Tier 2 |

65,946 | 94,655 | 95,460 | 95,471 | 73,249 | |||||||||||

Other Tier 2 capital components |

(6 | ) | (6 | ) | (7 | ) | (7 | ) | (8 | ) | ||||||

Total capital |

$ | 200,139 | $ | 189,466 | $ | 191,439 | $ | 203,602 | $ | 294,761 | ||||||

Tangible common equity |

||||||||||||||||

Total equity |

$ | 147,692 | $ | 72,552 | $ | 74,002 | $ | 83,958 | $ | 197,208 | ||||||

Less: Preferred equity |

72,942 | 71,869 | 70,863 | 69,921 | 69,039 | |||||||||||

Goodwill and intangible assets |

1,177 | 3,276 | 4,678 | 5,525 | 6,655 | |||||||||||

Tangible common equity |

$ | 73,573 | $ | (2,593 | ) | $ | (1,539 | ) | $ | 8,512 | $ | 121,514 | ||||

Tangible book value (per share data) |

$ | 5.29 | $ | (0.18 | ) | $ | (0.11 | ) | $ | 0.61 | $ | 8.79 | ||||

Tier 1 common equity |

||||||||||||||||

Tangible common equity |

$ | 73,573 | $ | (2,593 | ) | $ | (1,539 | ) | $ | 8,512 | $ | 121,514 | ||||

Tier 1 adjustments: |

||||||||||||||||

Accumulated other comprehensive loss |

7,038 | 1,327 | 3,702 | 3,130 | 1,605 | |||||||||||

Deferred tax liabilities on intangible assets |

— | — | — | — | — | |||||||||||

Other |

(70,951 | ) | (412 | ) | (2,941 | ) | (2,454 | ) | (27,263 | ) | ||||||

Tier 1 common equity |

$ | 9,660 | $ | (1,678 | ) | $ | (778 | ) | $ | 9,188 | $ | 95,856 | ||||

Tangible assets |

||||||||||||||||

Total assets |

$ | 2,004,034 | $ | 2,045,799 | $ | 1,941,418 | $ | 2,123,921 | $ | 2,596,657 | ||||||

Less: Goodwill and intangible assets |

1,177 | 3,276 | 4,678 | 5,525 | 6,655 | |||||||||||

Tangible assets |

$ | 2,002,857 | $ | 2,042,523 | $ | 1,936,740 | $ | 2,118,396 | $ | 2,590,002 | ||||||

Total risk-weighted assets |

||||||||||||||||

On balance sheet |

$ | 1,224,438 | $ | 1,356,762 | $ | 1,511,815 | $ | 1,723,519 | $ | 2,128,378 | ||||||

Off balance sheet |

36,023 | 34,804 | 34,824 | 53,051 | 95,220 | |||||||||||

Total risk-weighted assets |

$ | 1,260,461 | $ | 1,391,566 | $ | 1,546,639 | $ | 1,776,570 | $ | 2,223,598 | ||||||

Average assets |

||||||||||||||||

Total average assets for leverage |

$ | 1,927,217 | $ | 1,955,000 | $ | 1,925,953 | $ | 2,279,538 | $ | 2,612,204 | ||||||

15

An investment in our common stock involves risks. Before making an investment decision with respect to our common stock, you should carefully consider the risks described below together with the other information contained or incorporated by reference into this prospectus, including the information contained in the section entitled "Risk Factors" in our Annual Report on Form 10-K for the year ended December 31, 2013, and any risks described in our other filings with the SEC. If any of the following risks actually occur, our financial condition and results of operations could suffer, possibly materially. In that case, the trading price of our common stock may decline, and you may lose all or part of your investment. The risks discussed below also include forward-looking statements, and actual results may differ substantially from those discussed or implied in these forward-looking statements.

RISKS RELATED TO OUR BUSINESS

We have incurred net losses in the past and cannot ensure that we will not incur further net losses in the future.

Although we have reported net income of $82.1 million for the fiscal year ended December 31, 2013, we incurred a net loss of $72,000 for 2012 and $6.5 million for 2011, as well as a net loss of $108.6 million for 2010. Despite a general improvement in the overall economy and the real estate market, the economic environment remains challenging and the stability of the real estate market is uncertain, and we cannot ensure we will not incur future losses. Any future losses may affect our ability to meet our expenses or raise additional capital and may delay the time in which we can resume dividend payments on our common stock. In addition, future losses may cause us to re-establish a valuation allowance against our deferred tax assets. Furthermore, any future losses would likely cause a decline in our holding company regulatory capital ratios, which could materially and adversely affect our financial condition, liquidity and results of operations.

Nonperforming assets take significant time to resolve, adversely affect our results of operations and financial condition and could result in further losses in the future.

At December 31, 2013, our nonperforming loans (which consist of nonaccrual loans and loans past due 90 days or more still accruing interest and restructured loans still accruing interest) and our nonperforming assets (which include nonperforming loans plus OREO) are reflected in the table below (in millions):

| |

12/31/2013 | 12/31/2012 | % Change | |||||||

|---|---|---|---|---|---|---|---|---|---|---|

Nonperforming loans |

$ | 39.8 | $ | 82.6 | (51.8 | )% | ||||

OREO |

41.5 | 72.4 | (42.7 | )% | ||||||

Nonperforming assets |

$ | 81.3 | $ | 155.0 | (47.5 | )% | ||||

Our nonperforming assets adversely affect our net income in various ways. For example, we do not record interest income on nonaccrual loans and OREO may have expenses in excess of lease revenues collected, thereby adversely affecting our income and returns on assets and equity. Our loan administration costs also increase because of our nonperforming assets. The resolution of nonperforming assets requires significant time commitments from management, which can be detrimental to the performance of their other responsibilities. While we have made significant progress in reducing our nonperforming assets, there is no assurance that we will not experience increases in nonperforming assets in the future or that our nonperforming assets will not result in further losses in the future.

16

Our loan portfolio is concentrated heavily in commercial and residential real estate loans which involve risks specific to real estate values and the real estate markets in general, all of which have been experiencing significant weakness.

Our loan portfolio generally reflects the profile of the communities in which we operate. Because we operate in areas that saw rapid growth between 2000 and 2007, real estate lending of all types is a significant portion of our loan portfolio. Total real estate lending, excluding deferred fees, is still $979.8 million, or approximately 89.0% of our December 31, 2013 loan portfolio. Given that the primary (if not only) source of collateral on these loans is real estate, additional adverse developments affecting real estate values in our market area could increase the credit risk associated with our real estate loan portfolio.

The effects of ongoing real estate challenges, combined with the ongoing correction in commercial and residential real estate market prices and reduced levels of home sales, have adversely affected our real estate loan portfolio and have the potential to further adversely affect such portfolio in several ways, each of which could further adversely impact our financial condition and results of operations.

Real estate market volatility and future changes in disposition strategies could result in net proceeds that differ significantly from fair value appraisals of loan collateral and OREO and could negatively impact our operating performance.

Many of our nonperforming real estate loans are collateral-dependent, meaning the repayment of the loan is largely dependent upon the successful operation of the property securing the loan. For collateral-dependent loans, we estimate the value of the loan based on appraised value of the underlying collateral less costs to sell. Our OREO portfolio consists of properties acquired through foreclosure or deed in lieu of foreclosure in partial or total satisfaction of certain loans as a result of borrower defaults. OREO is recorded at the lower of the recorded investment in the loans for which the property served as collateral or estimated fair value, less estimated selling costs. In determining the value of OREO properties and loan collateral, an orderly disposition of the property is generally assumed. Significant judgment is required in estimating the fair value of property and the period of time within which such estimates can be considered current is significantly shortened during periods of market volatility.

A return of recessionary conditions could result in increases in our level of nonperforming loans and/or reduced demand for our products and services, which could lead to lower revenue, higher loan losses and lower earnings.

A return of recessionary conditions and/or continued negative developments in the domestic and international credit markets may significantly affect the markets in which we do business, the value of our loans and investments and our ongoing operations, costs and profitability. Declines in real estate values and sales volumes and increased unemployment or underemployment levels may result in higher than expected loan delinquencies, increases in our levels of nonperforming and classified assets and a decline in demand for our products and services. These negative events may cause us to incur losses and may adversely affect our capital, liquidity and financial condition.

Our allowance for loan losses may be insufficient to absorb potential losses in our loan portfolio.

We maintain an allowance for loan losses at a level we believe adequate to absorb estimated losses inherent in our existing loan portfolio. The level of the allowance reflects management's continuing evaluation of industry concentrations; specific credit risks; credit loss experience; current loan portfolio quality; present economic, political and regulatory conditions; and unidentified losses inherent in the current loan portfolio.

17

Determination of the allowance is inherently subjective since it requires significant estimates and management's judgment of credit risks and future trends, all of which may undergo material changes. For example, the final allowance for December 31, 2013 and December 31, 2012 included an amount reserved for other not specifically identified risk factors. Although improving, continued difficult economic conditions affecting borrowers, new information regarding existing loans, identification of additional problem loans and other factors, both within and outside of our control, may require an increase in the allowance for loan losses. In addition, bank regulatory agencies periodically review our allowance and may require an increase in the provision for loan losses or the recognition of additional loan charge-offs, based on judgments different from those of management. In addition, if charge-offs in future periods exceed the allowance for loan losses, we will need additional provisions to increase the allowance. Any increases in provisions will result in a decrease in net income and capital and may have a material adverse effect on our financial condition and results of operations.

While we had a loan loss reserve release in 2013, our provision for loan losses has been elevated during the last several years and we may be required to make increases in our provision for loan losses and to charge-off additional loans in the future.

For the years ended December 31, 2013 and 2012, we recorded a loan loss reserve release of $8.6 million and a provision for loan losses of $6.3 million, respectively. We also recorded net loan charge-offs of $2.8 million and $19.7 million for the years ended December 31, 2013 and 2012, respectively. Our nonperforming assets totaled $81.3 million, or 4.1% of total assets, at December 31, 2013. Additionally, classified assets were $103.8 million at December 31, 2013. If the economy and/or the real estate market continue to weaken, more of our classified assets may become nonperforming and we may be required to take additional provisions to increase our allowance for loan losses for these assets as the value of the collateral may be insufficient to pay any remaining net loan balance, which could have a negative effect on our results of operations. We maintain an allowance for loan losses to provide for loans in our portfolio that may not be repaid in their entirety. We believe that our allowance for loan losses is maintained at a level adequate to absorb probable losses inherent in our loan portfolio as of the corresponding balance sheet date. However, our allowance for loan losses may not be sufficient to cover actual loan losses and future provisions for loan losses could materially adversely affect our operating results.

The size of our loan portfolio has declined in recent periods, and, if we are unable to return to loan growth, our profitability may be adversely affected.

Since December 31, 2010, our gross loans held for investment have declined by 34.8% while our total assets have declined by 5.6%. During this period, we were managing our balance sheet composition to manage our capital levels and position the Bank to meet and exceed its targeted capital levels. Management's efforts have reduced our nonperforming assets by 73.6% over this same period. Among other things, our current strategic plan calls for continued reductions in the amount of our nonperforming assets and returning to growth in our loan portfolio to improve our net interest margin and profitability. Our ability to increase profitability in accordance with this plan will depend on a variety of factors, including our ability to originate attractive new lending relationships. While we believe we have the management resources and lending staff in place to successfully achieve our strategic plan, if we are unable to increase the size of our loan portfolio, our strategic plan may not be successful and our profitability may be adversely affected.

Our business is concentrated in and dependent upon the welfare of several counties in Illinois specifically and the State of Illinois generally.

Our primary market area is Aurora, Illinois, and the surrounding communities as well as southwestern Cook County. The city of Aurora is located in northeastern Illinois, approximately 40 miles west of

18

Chicago. The Bank operates primarily in Kane, Kendall, DeKalb, DuPage, LaSalle, Will and southwestern Cook counties in Illinois, and, as a result, our financial condition, results of operations and cash flows are subject to changes and fluctuations in the economic conditions in those areas.

The communities that we serve grew rapidly over the past decade. We intend to continue concentrating our business efforts in these communities, and our future success is largely dependent upon the overall economic health of these communities. However, since late 2007, the U.S. economy has generally experienced difficult economic conditions, and the State of Illinois's financial condition continues to be among the most troubled of any state in the United States with both unemployment and foreclosure rates among the ten worst in the United States. Weak economic conditions are characterized by, among other indicators, deflation, unemployment, fluctuations in debt and equity capital markets, increased delinquencies on mortgage, commercial and consumer loans, residential and commercial real estate price declines and lower home sales and commercial activity. All of those factors are generally detrimental to our business. If the overall economic conditions fail to significantly improve or decline further, particularly within our primary market areas, we could experience a lack of demand for our products and services, an increase in loan delinquencies and defaults and high or increased levels of problem assets and foreclosures. Moreover, because of our geographic concentration, we are less able than other regional or national financial institutions to diversify our credit risks across multiple markets.

Similarly, we have credit exposure to entities or in industries that could be impacted by the continued financial difficulties at the state level. Exposure to health care, construction and social services organizations has been reviewed to evaluate credit impact from a possible reorganization of state finances. Credit downgrades, partial charge-offs and specific reserves could develop in this exposure with resulting impact on our financial condition if the State of Illinois encounters more severe payment issuance capabilities.

We operate in a highly competitive industry and market area, and we may not be able to continue to effectively compete.

We face substantial competition in all areas of our operations from a variety of different competitors, many of which are larger and have more financial resources. Our competitors primarily include national and regional banks as well as community banks within the markets we serve. We also face competition from savings and loan associations, credit unions, personal loan and finance companies, retail and discount stockbrokers, investment advisors, mutual funds, insurance companies and other financial intermediaries. For example, in Kane and Kendall Counties, the Bank faced competition from 196 bank branches representing 42 different financial institutions (including us) according to the June 30, 2013, FDIC share of deposit data. The financial services industry could become even more competitive as a result of legislative and regulatory changes. Banks, securities firms and insurance companies can merge under the umbrella of a financial holding company, which can offer the wide spectrum of financial services to many customer segments. Many large scale competitors can leverage economies of scale and be able to offer better pricing for products and services compared to what we can offer.

Our ability to compete successfully depends on developing and maintaining long-term customer relationships, offering community banking services with features and pricing in line with customer interests and expectations, consistently achieving outstanding levels of customer service and adapting to many and frequent changes in banking as well as local or regional economies. Failure to excel in these areas could significantly weaken our competitive position, which could adversely affect our growth and profitability. These weaknesses could have a significant negative impact on our business, financial condition and results of operations.

19

We are a community bank and our ability to maintain our reputation is critical to the success of our business and the failure to do so may materially adversely affect our performance.

We are a community bank, and our reputation is one of the most valuable components of our business. As such, we strive to conduct our business in a manner that enhances our reputation. This is done, in part, by recruiting, hiring and retaining employees who share our core values: being an integral part of the communities we serve; delivering superior service to our customers; and caring about our customers and associates. If our reputation is negatively affected, by the actions of our employees or otherwise, our business and our operating results may be adversely affected.

We are subject to interest rate risk, and a change in interest rates could have a negative effect on our net income.

Our earnings and cash flows are largely dependent upon our net interest income. Interest rates are highly sensitive to many factors that are beyond our control, including general economic conditions, our competition and policies of various governmental and regulatory agencies, particularly the Federal Reserve. Changes in monetary policy, including changes in interest rates, could influence the amount of interest we earn on loans and securities and the amount of interest we incur on deposits and borrowings. Such changes could also affect our ability to originate loans and obtain deposits as well as the average duration of our securities portfolio. If the interest rates paid on deposits and other borrowings increase at a faster rate than the interest rates received on loans and other investments, our net interest income, and therefore earnings, could be adversely affected. Earnings could also be adversely affected if the interest rates received on loans and other investments fall more quickly than the interest rates paid on deposits and other borrowings.

Although management believes it has implemented effective asset and liability management strategies to reduce the potential effects of changes in interest rates on our results of operations, any substantial, unexpected, prolonged change in market interest rates could have a material adverse effect on our financial condition and results of operations.

Monetary policies and regulations of the Federal Reserve could adversely affect our business, financial condition and results of operations.

The policies of the Federal Reserve also have a significant impact on us. Among other things, the Federal Reserve's monetary policies directly and indirectly influence the rate of interest earned on loans and paid on borrowings and interest-bearing deposits and can also affect the value of financial instruments we hold and the ability of borrowers to repay their loans, which could have a material adverse effect on us.

If we fail to maintain sufficient capital, whether due to losses, an inability to raise additional capital or otherwise, our financial condition, liquidity and results of operations, as well as our ability to maintain regulatory compliance, would be adversely affected.