Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ENDEAVOUR INTERNATIONAL CORP | d699961d8k.htm |

Howard Weil

Energy Conference

March 27, 2014

Exhibit 99.1 |

2

This is an oral presentation which is accompanied by slides. Investors are urged

to review our SEC filings. This presentation contains certain

forward-looking statements regarding various oil and gas

discoveries,

oil

and

gas

exploration,

development

and

production

activities,

anticipated

and

potential

production and flow rates; anticipated revenues; the economic potential of

properties and estimated exploration costs. Accuracy of the projections

depends on assumptions about events that change over time and is thus

susceptible to periodic change based on actual experience and new developments.

Endeavour cautions readers that it assumes no obligation to update or publicly

release any revisions to the projections in this presentation and, except

to the extent required by applicable law, does not intend to update or

otherwise revise the projections. Important factors that might cause future results to differ from

these projections include: variations in the market prices of oil and natural gas;

drilling results; access to equipment and oilfield services; unanticipated

fluctuations in flow rates of producing wells related to mechanical,

reservoir

or

facilities

performance;

oil

and

natural

gas

reserves

expectations;

the

ability

to

satisfy future cash obligations and environmental costs; and general exploration

and development risks and hazards.

The Securities and Exchange Commission permits oil and gas companies in their

filings with the SEC to disclose

only

proved

reserves

that

a

company

has

demonstrated

by

actual

production

or

conclusive

formation tests to be economically and legally producible under existing economic

and operating conditions.

SEC

guidelines

prohibit

the

use

in

filings

of

terms

such

as

“probable,”

“possible,”

P2

or

P3

and

“non-proved”

reserves, reserves “potential”

or “upside”

or other descriptions of volumes of reserves

potentially recoverable through additional drilling or recovery techniques.

These estimates are by their nature more speculative than estimates of

proved reserves and accordingly are subject to greater risk of being

actually realized by the company. Certain statements should be regarded as “forward-looking”

statements within the meaning of the securities laws. These statements speak only

as of the date made. Such statements are subject to assumptions, risk and

uncertainty. Actual results or events may vary materially.

The

estimates

of

recoverable

resources

per

well

and

completed

well

costs

included

herein

are

based upon other typical results in these shale plays and may not be indicative of

actual results. |

3

Endeavour at a Glance

Distinctive Portfolio

•

Exceptional operating margins from three core assets

•

Brent crude oil and European natural gas exposure

•

Developing U.S. resource plays at very low cost

Strong Production Growth

•

All three U.K. developments on-line

•

Rochelle

–

Gas

with

associated

condensate

•

Alba

–

Brent

priced

oil

•

Bacchus

–

Brent

priced

oil

•

2013

physical

production

volumes

increased

to

9,922

boepd

–

a

126%

increase

year-over-year

•

2013

Adjusted

EBITDA

increased

to

$203.3

million

–

a

157%

increase

year-over-year

•

4

th

quarter average daily production of 12,422 boepd

2014 Focus

•

Growth in production

•

Maintaining operational margins in existing asset base

•

Reduce G&A

•

Repay debt and reduce cost of capital

•

Accelerate

value

capture

from

existing

portfolio

–

Rossini

in

the

U.K.,

the

Piceance

Basin

and

Pennsylvania Marcellus in the U.S.

Stock Symbol

New York Stock Exchange

END

London Stock Exchange

ENDV

Market Capitalization

$158.3 million

Common Shares Outstanding

50.5 million

Proved & Probable Reserves

40.1 MMBOE

Key Figures |

Endeavour’s Growing Resource Base

Asset base has become

increasingly more oil levered

87% of proved and probable

(2P) gas reserves are in the U.K.

Reserve growth

Production growth

Production has grown over time

with significant contribution

increases from the North Sea

(Mboe/d)

4

(MMboe/d)

2.9

1.1

5.5

8.6

1.2

2.3

2.4

1.3

4.1

3.4

7.9

9.9

2010

2011

2012

2013

6.8

18.2

18.7

22.7

25.7

23.5

61%

Oil

19.3

20.7

25.0

22.3

21.5

16.6

39%

Gas

26.1

38.9

43.7

45.0

47.2

40.1

100%

2008

2009

2010

2011

2012

83% U.K. gas

2013 |

Production Sold Into Higher-Valued European Markets

Crude oil

Natural gas

Average spread over the period: $6.21

5

Average spread over the period: $14.34

$2

$4

$6

$8

$10

$12

$14

$16

Henry Hub

UK NBP

$75

$85

$95

$105

$115

$125

WTI

Brent |

Reserve Valuation

Pro forma net asset valuation

(1)

Excluding monetary production payment of $162 million.

($ in millions)

6

$1,531

$773

$883

(1)

$848

(1)

2P and 3P PV-10

1P PV-10

Total debt

Net debt

$2,309

(as of 12/31/13) |

Production volume up 27% year-over-year

Increasing production in higher valued commodity markets

Brent and U.K. NBP prices have averaged ~$108.46 and ~$10.63, respectively for 2013$$$$ Significant Proved Reserves and Production

2012

Production

Volumes

2013

Production

Volumes

7

Full Year = 7,868

Full Year = 10,017

78%

5%

12%

78%

2%

30%

US Gas

US Oil

UK Gas

UK Oil |

Historical Financials Summary

($ in millions)

($ in millions)

($ in millions)

Average

Daily

Production

(boepd)

Revenue

Adjusted

EBITDAX

Capital

Expenditures

8

$37.6

$25.1

$129.9

$203.3

2010

2011

2012

2013

4,115

3,382

7,868

10,017

2010

2011

2012

2013

$71.7

$60.1

$219.1

$337.7

2010

2011

2012

2013

$92.0

$165.1

$246.9

$223.7

2010

2011

2012

2013 |

Attractive Margins and Expense Structure

9

$106.00

Cash Operating Expense

Operating Cash Flow

$9.00

$97.00

NBP Spot

Cash Operating Expense

Operating Cash Flow

$106.00

Cash Operating Expense

Operating Cash Flow

$20.00

$86.00

Note:

Cash operating expense is midpoint of management estimates.

Brent Spot

Brent Spot

$1.50

$11.00

Alba

Bacchus

Rochelle

$9.50

9

$/boe

$/boe

$/mcfe |

2013

Accomplishments Sale of 50% of upstream and midstream

assets in the Pennsylvania Marcellus and

formed a joint venture with Samson

Exploration, LLC.

•

Partnership plans to complete the three

previously drilled and cased horizontal

Marcellus wells

•

Tied into third-party pipeline that allows

firm capacity of up to 10 Mmcf/d, with

potential for future expansion

JV delivers the capital necessary for the

next phase of development in the core

Daniel Field area in Cameron County

Rochelle field on production

Third Bacchus production well

completed in July

Entered into a monetary production

payment for $125 million in Q1 2013 for a

portion of production from Alba field,

increasing liquidity to fund the

development program

•

Expanded the agreement in August and

December to $175 million

Entered into a forward sale agreement in

February 2013 for $22.5 million fully

delivered in July 2013

•

Entered into a subsequent forward sale

agreement in September 2013 for $22.5

million, which is expected to be fully

delivered in March 2014

Closed the London office and

consolidated technical teams in

Aberdeen, Scotland

•

$15 million to $20 million of annual cash

savings expected

Discovered by Endeavour in 2012

Significant upside and prospectivity in

adjacent Endeavour operated acreage

10

Operations

Samson Joint Venture

Rossini |

Current Assets |

Overview of Endeavour’s U.K. Assets

12

Bacchus

Enoch

Columbus

Bittern

Alba

Rochelle

Current Production

Development Projects |

The

field is a Lower Cretaceous reservoir at 9,900 ft

•

Good quality Britannia Kopervik turbidite sands

•

3-way stratigraphic trap

Flowing gas with associated condensate

•

Both wells have produced at rates of over 70 million

cubic feet of gas per day, with an additional ~ 3,000

boepd of liquids

Production from the wells will exceed the

allocated capacity at the Scott Platform

Rochelle

Jurassic

discovery

–

Rossini

•

P50

reserves

potential

of

35

–

80

MMBOE

Rochelle Overview -

Blocks 15/26b, 15/26c and 15/27

13

Endeavour WI:

44%

Operator:

Nexen (41% WI)

Partner:

Premier Oil (15% WI)

Online:

October 2013

Rossini

Rochelle

Ravel

Mostyn |

Bacchus

-

Block

22/06a

Central

North

Sea

14

Reservoir is formed by shallow marine Fulmar

sandstones of Upper Jurassic age

Current

production

at

~

10,000

bopd*

gross

for

the field

Water injection introduced into the field in

second quarter of 2014

Oil exported to Forties Pipeline System

3-D seismic survey completed to pursue

expansion of the Bacchus area

Endeavour WI:

30%

Operator:

Apache (50% WI)

Partner:

First Oil (20% WI)

Bacchus

Forties

* As of date March 5, 2014 |

Alba

Field Overview - Block 16/26a

Late

Eocene

reservoir

at

~6,200ft

depth

450ft water depth

35 Platform and subsea wells

Oil exported by tanker

Annual infield drilling campaign of

2 -

4 wells

•

First well completed in March and the

second well is expected to be on line in the

summer

15

Endeavour WI:

25.68%

Operator:

Chevron (23.37% WI)

Partners:

Statoil (17% WI)

Mitsui (13% WI)

Centrica (12.65% WI)

Enquest (8% WI)

Discovered/1

st

Production

1984/1994

Alba

Britannia |

High

Quality Exploration in Core Central North Sea Area Net Unrisked Contingent

Prospective Resources: 376 MMboe

28 Licences (12 Endeavour operated)

Own 105 kilometers of 3D seismic in this core area

History of success bidding in the Licensing

Rounds with a focus on high quality acreage close

to infrastructure

•

28

th

Licensing Round in April 2014

Select Prospects:

Rochelle

Jurassic

-

Rossini

•

Oil prospect

Ravel & Mostyn prospects

•

Low risk R-Block area oil prospects

Buffalo prospect

•

Rochelle analogue

Mabry prospect

Exploration Portfolio in Core Central North Sea

Prospects, Discoveries and Licences

16 |

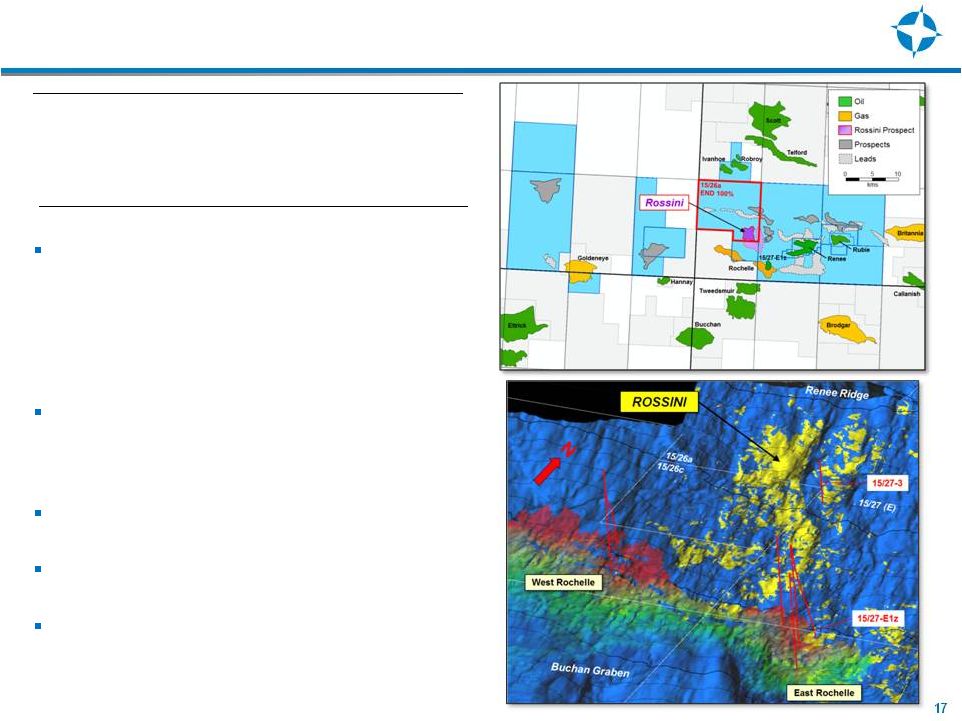

R-Block

Exploration

Opportunities

-

Rossini

Rossini was discovered by Endeavour in 2012

•

A large majority of the prospect sits in block

15/26a, where Endeavour has a 100% working

interest and is the operator

•

P50

reserves

potential

of

35

–

80

MMBOE

Field

lies

close

to

existing

infrastructure

,

but

may be large enough for stand-alone

development

Plan to drill in the first half of 2015

460ft

water

depth

and

normally

pressured

Significant upside and prospectively in

adjacent Endeavour operated acreage

Blocks:

15/26a, 15/26c, 15/27

Reservoir:

Upper Jurassic Galley Sandstone

Expected Fluid Type:

Oil Prone

Working Interest

50%-100%

17 |

US

Onshore Assets 18

Oil

Gas

Mixed

Heath

Marcellus

Building Portfolio

Niobrara/Frontier

Haynesville

US Q4 2013 Totals

442,600 gross / 109,000 net acres

Average of 6 MMCFe/D net production |

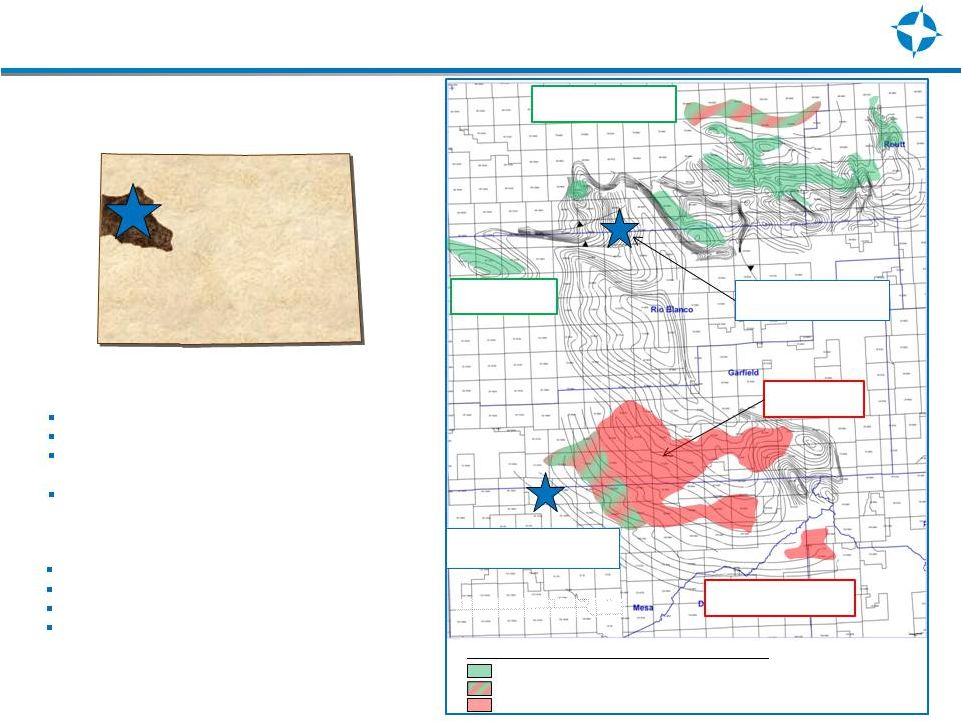

Endeavour -

NW Colorado Niobrara Opportunity

Pursuing liquids-rich, stacked Niobrara/Frontier

plays in the Piceance Basin, NW Colorado

Piceance

Basin

Colorado

Rangely Niobrara

15 mmbo

Buck Peak Niobrara trend

20-30 mmbo

Encana’s Orchard

Niobrara gas development

WPX 16mmcf/d

Niobrara well

Wiley Prospect

Pilot drilled, cored 7/13

Hunter-Garvey Prospect

Cored pilot 9/13

NBRR

Petroleum

System:

Proven

HC

productive

areas

Oil window

Wet gas window

Dry gas window

19

25,000 gross / 17,000 net ac

Gas + liquids play via multi-stage fracs

Identified key wells with volatile oil maturity in brittle,

over-pressured rock

Captured lands just downdip into wet gas window

15,000 gross / 11,000 net ac F/I

Volatile oil play

Targeted structure with open fractures

Frontier Ss ‘carrier bed’

to enhance production

Play 1:

Wiley (3-5N –

97W)

Play 2:

Hunter/Garvey (8S –

100-101W)

Structure on top Rollins Ss, c.i. 500’ |

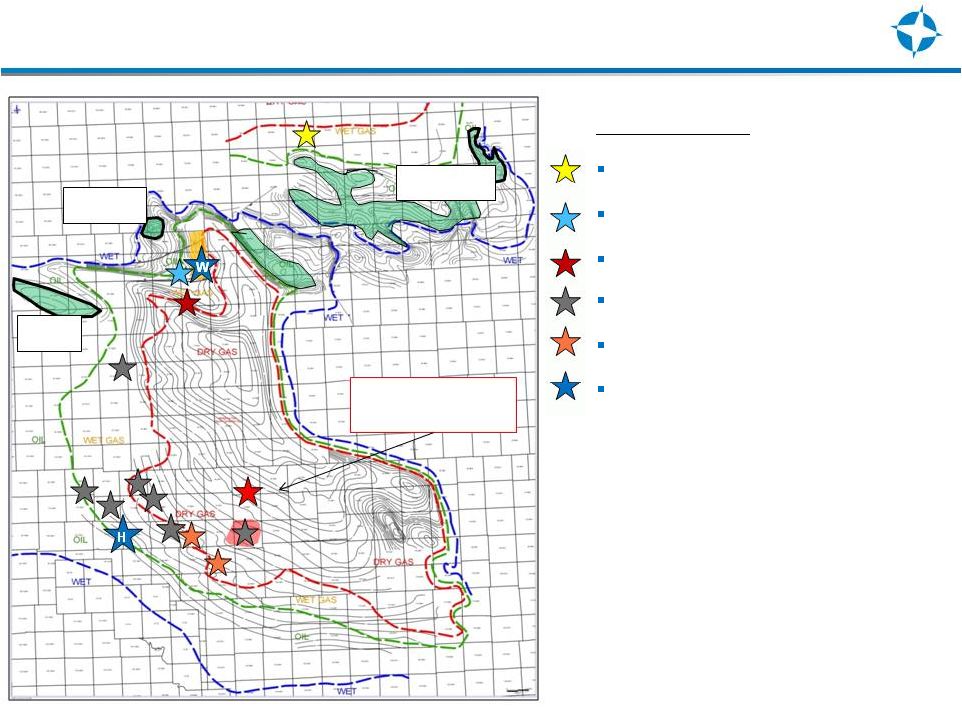

Piceance

Basin

Niobrara

-

Industry

Activity

(Structure on top Rollins Ss, c.i. 500’)

WPX 16 mmcf/d

Niobrara well

20

H

Area Participants

Axia / Oxy

Mesa/WPX

Whiting

Encana

Black Hills

Endeavour Project Areas

•

Wiley (W) and Hunter/Garvey (H)

Buck Peak trend

20-30 mmbo

Winter Valley

80 mbo

Rangely

15 mmbo |

Marcellus Industry Activity in END Play Area

21

Daniel

END

EOG Seneca Ultra

PGE/Exxon

Reported Marcellus EURs 6 –

8+ Bcf

•

Seneca –

N. Cameron County

•

5500’

laterals, 37-stage fracs

•

IP’s 7-

11 mmcf/d

•

EUR’s 6-8 BCF

•

Targeting < $6-7mm CWC’s (full

pad development)

•

EOG/Seneca –

Northern Clearfield Co.

•

Recent IP’s 7-9+ mmcf/d

•

PGE/Exxon –

SE McKean County

•

5000’

–

7600’

laterals

•

IP’s 6-9 mmcf/d

Seneca Geneseo

Seneca Utica well

EOG

PGE long laterals

7000+’

5000+’

Isopach of Marcellus Shale, c.i. = 50’

Seneca 6-8 BCF |

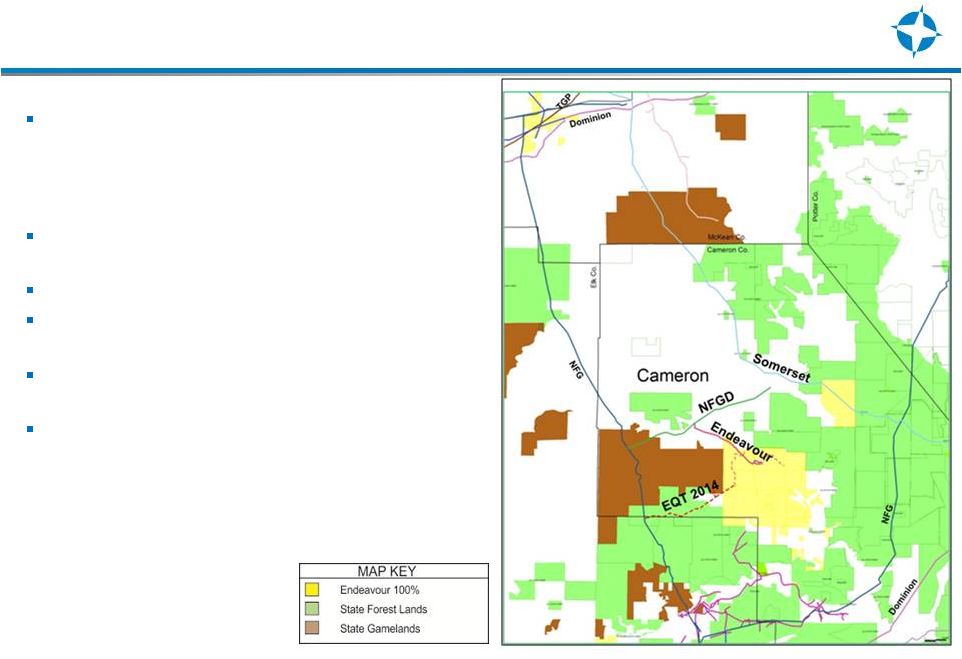

Pennsylvania Marcellus Assets

In October 2013, closed a 50% sale / joint

venture with Samson Exploration, LLC

•

Provides development capital for Daniel

Project ‘proof of concept’

27,000 net acres (majority held by

production), END-operated

400-600+ BCFe net resource potential

1 TCF potential including adjacent state

lands

5 producing wells with 3 horizontal wells

waiting on completion

10 MMCF/D of take-away capacity on the

EQT line available by mid-year

22 |

Financial Overview |

2014

Direct Capital Expenditure Budget 24

U.S.

Other

Colorado

Alba

U.K.

Other

2014

Direct

CapEx

=

$60

million

-

$80

million

•

U.K.

=

$40

million

-

$55

million

•

U.S.

=

$20

million

-

$25

million

Decommissioning costs for IVRR, Renee and Rubie fields = $50 million

|

25

Pro Forma Debt Maturity Schedule

Convertible Notes due 2016 ($18.51 per share conversion price)

Convertible Bonds due 2016 ($16.52 per share conversion price)

Senior Notes due 2018

Senior Secured First Lien Term Loan due 2017

Convertible Notes due 2017 ($4.66 per share conversion price)

$135

$125

$554

$78

$12.5

$0

$100

$200

$300

$400

$500

2014

2015

2016

2017

2018 |

Focus

for 2014 26

Improve and maintain production

Control capex spending

Deleverage

Pursue exploitation of exploration inventory through joint ventures with

like minded partners |

LSE:ENDV

NYSE:END

www.endeavourcorp.com

INVESTOR CONTACT:

Darcey Matthews

Director of Investor Relations

713.307.8711

darcey.matthews@endeavourcorp.com |