Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K/A

CURRENT REPORT PURSUANT

TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): December 30, 2013

China Tianfeihong Wine, Inc.

(Exact Name of Registrant as Specified in Its Charter)

Delaware (State or Other Jurisdiction of Incorporation)

|

000-54843

|

98-0360626

|

|

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

1849 Licheng Middle Avenue, Longqiao Street, Chengxiang District

Putian City, Fujian Province, China

(Address of Principal Executive Offices)

(86) 0594-6258386

(Registrant's Telephone Number, Including Area Code)

N/A

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a -12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d -2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e -4(c))

|

Item 1.01

|

Entry into a Material Definitive Agreement

|

|

Item 2.01

|

Completion of Acquisition or Disposition of Assets

|

|

Item 4.01

|

Change in Registrant’s Certifying Accountant

|

|

Item 5.01

|

Changes in Control of Registrant

|

|

Item 5.02

|

Departure of Directors or Principal Officers; Election of Directors; Appointment of Principal Officers; Compensatory Arrangements of Certain Officers

|

|

Item 5.03

|

Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year

|

|

Item 5.06

|

Change in Shell Company Status

|

|

Item 5.07

|

Submission of Matters to a Vote of Security Holders

|

|

Item 9.01

|

Financial Statements and Exhibits

|

1

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This document contains forward-looking statements which reflect our views with respect to future events and financial performance. These forward-looking statements are subject to uncertainties and other factors that could cause actual results to differ materially from the views expressed in these statements. Forward-looking statements are sometimes identified by, among other things, the words "anticipates", "believes", "estimates", "expects", "plans", "projects", "targets" and similar expressions. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date the statement was made. Except to the extent required by applicable securities laws, we undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. These forward-looking statements include, among other things, statements relating to:

|

●

|

our ability to increase our sales and revenue;

|

|

●

|

our ability to contain sourcing and labor costs;

|

|

●

|

our ability to attract and retain key technology and management personnel;

|

|

●

|

our ability to improve our existing technology and remain competitive in the electronics industry;

|

|

●

|

our ability to obtain additional capital in future years to fund our planned expansion; and

|

|

●

|

economic, political, regulatory, legal and foreign exchange risks associated with our operations.

|

USE OF DEFINED TERMS; CONVENTIONS

Except where the context otherwise requires and for the purposes of this report only:

|

●

|

"we," "us," "our company," "our" and “Company” refer to the combined business of China Tianfeihong Wine Inc., and its consolidated subsidiaries and its consolidated affiliate, as the case may be;

|

|

●

|

"Fanwei Hengchang" refers to Fanwei Hengchang Co, Ltd (BVI), our direct, wholly-owned subsidiary, a BVI corporation;

|

|

●

|

"Changshi Tongrong" refers to Changshi Tongrong Limited(Hong Kong), our indirect, wholly-owned subsidiary, a Hong Kong corporation;

|

|

●

|

"Changshitong Consulting " refers to Changshitong Information Consulting (Shenzhen) Co., Ltd., our indirect, wholly-owned subsidiary, a Chinese corporation;

|

|

●

|

“Fujian Tianfeihong” refers to Fujian Tianfeihong Wine Co., Ltd, our indirect, consolidated affiliate, a Chinese corporation;

|

|

●

|

"SEC" refers to the United States Securities and Exchange Commission;

|

2

|

●

|

"China," "Chinese" and "PRC," refer to the People's Republic of China, excluding Hong Kong, Macao and Taiwan;

|

|

●

|

"Renminbi" and "RMB" and “Yuan” refer to the legal currency of China;

|

|

●

|

"U.S. dollars," "dollars" and "$" refer to the legal currency of the United States;

|

|

●

|

"Securities Act" refers to the United States Securities Act of 1933, as amended; and

|

|

●

|

"Exchange Act" refers to the United States Securities Exchange Act of 1934, as amended.

|

Solely for the convenience of the reader, this report contains conversions of certain Renminbi amounts into U.S. dollars at specified rates. No representation is made that the Renminbi or U.S. dollar amounts referred to in this report could have been or could be converted into U.S. dollars or Renminbi, as the case may be, at any particular rate or at all. See “Risk Factors—Risks Related to Our Business— Fluctuations in exchange rates could adversely affect our business and the value of our securities” for a discussion of the effects on the Fujian Tianfeihong fluctuating exchange rates.

In this report we refer to information and statistics regarding our industry and the overall economy in China that we obtained from various government and institute research publications. Much of this information is publicly available and has not been specifically prepared for our use or incorporation in this current report on Form 8-K. We have no reason to believe that the information and statistics that we refer to from such reports is not accurate.

On June 26, 2013, Zenitech Corp. (the “Company”) entered into a Stock Purchase Agreement (the “Agreement”) with Hong Yang (the “Seller”) and Zhiliang Fang (the “Buyer” or “Purchaser”). The closing of the transactions (the “Closing”) contemplated by the Agreement occurred on June 28, 2013.

Pursuant to the Agreement, the Seller sold to the Buyer, and the Buyer purchased from the Seller, 11,500,000 shares of common stock, par value $0.0001 per share (the “Common Stock”) of the Company, constituting approximately 79.97% of the issued and outstanding Common Stock, for an aggregate purchase price of $113,560.

On December 30, 2013,we entered into and closed an exchange agreement with Fanwei Hengchang Co, Ltd (BVI), or “Fanwei Hengchang”, all of the shareholders of Fanwei Hengchang (the “Fanwei Hengchang Shareholders”), and Zhiliang Fang, the majority shareholder of the Company (the "Exchange Agreement"), pursuant to which we acquired all of the outstanding shares of Fanwei Hengchang (the “Fanwei Hengchang Shares”) from the Fanwei Hengchang Shareholders in exchange for an issuance of 32,000,000 shares of our common stock (the “Share Exchange”), representing approximately 93.03% of our outstanding shares of common stock (the “Fanwei Hengchang Acquisition”). We currently have 34,396,680 shares of common stock issued and outstanding.

Pursuant to the Share Exchange Agreement, the Company acquired Fanwei Hengchang and its indirect, controlled affiliate Fujian Tianfeihong, a company that is primarily engaged in distributing all kinds of fruit wine including green plum wine, loquat wine, olive wine, pomegranate wine, etc. On December 30, 2013, pursuant to the terms of the Share Exchange Agreement, the Company acquired all of the outstanding equity securities of Fanwei Hengchang (the “Fanwei Hengchang Shares”) from Fanwei Hengchang Shareholders, and Fanwei Hengchang Shareholders transferred and contributed all of its Fanwei Hengchang Shares to the Company. In addition, we changed our name to China Tianfeihong Wine Inc. on July 8, 2013 and effectuated a 1 for 6 reverse stock split of our shares of common stock to modify the Company’s capital structure to put in place an appropriate capital structure for the Company following the closing of the Share Exchange. The securities issued by us were not registered under the Securities Act. These securities qualified for exemption under Section 4(2) of the Securities Act since the issuance of securities by us did not involve a public offering.

The foregoing description of the terms of the Stock Purchase Agreement and Exchange Agreement does not describe all of the terms and provisions thereof and is qualified in its entirety by reference to the provisions of those documents filed as Exhibits 2.1 and 2.2, to this report, which are incorporated by reference herein.

3

ITEM 2.01 COMPLETION OF ACQUISITION OR DISPOSITION OF ASSETS

On December 30, 2013(the "Closing Date"), we completed the Fanwei Hengchang Acquisition pursuant to the Share Exchange Agreement. Based on the negotiation between the parties, both parties agreed that after the transaction, our former shareholders (other than Zhiliang Fang) shall own 6.97% while the Fanwei Hengchang Shareholders (including Mr. Zhiliang Fang) shall own 93.03% of the capital stock of the Company. Therefore, we issued a total of 32,000,000 shares of our common stock to the Fanwei Hengchang Shareholders for all the shares they held in Fanwei Hengchang. Our board of directors approved the Exchange Agreement on the Closing Date. The Fanwei Hengchang Acquisition was accounted for as a "reverse acquisition" effected as a recapitalization effected by a share exchange, wherein Fanwei Hengchang is considered the acquirer for accounting and financial reporting purposes. The assets and liabilities of the acquired entity have been brought forward at their book value and no goodwill has been recognized.

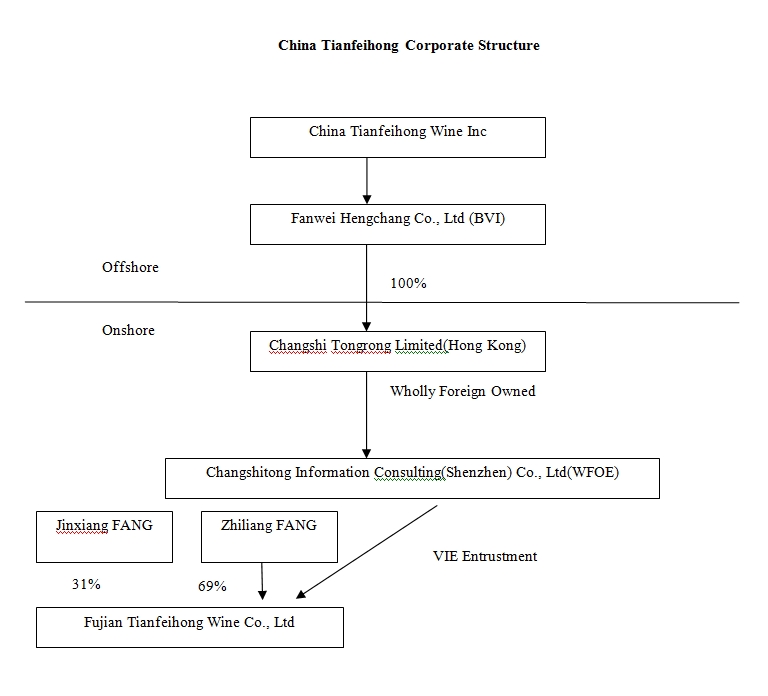

As a result of the Fanwei Hengchang Acquisition, our consolidated subsidiaries include Fanwei Hengchang Co, Ltd (BVI) or “Fanwei Hengchang”, our wholly-owned subsidiary which is incorporated under the laws of the British Virgin Islands, Changshi Tongrong Limited (Hong Kong) or “Changshi Tongrong”, a wholly-owned subsidiary of Fanwei Hengchang which is incorporated under the laws of Hong Kong, Changshitong Information Consulting(Shenzhen) Co., Ltd or “ Changshitong Consulting”, a wholly-owned subsidiary of Changshi Tongrong which is incorporated under the laws of the PRC, and Fujian Tianfeihong Wine Co., Ltd or “Fujian Tianfeihong”, a limited liability company incorporated under the laws of the PRC which is effectively and substantially controlled by Changshitong Consulting through a series of captive agreements, discussed below.

On November 26, 2013, prior to the reverse acquisition transaction, Changshitong Consulting, Fujian Tianfeihong and Fujian Tianfeihong’s shareholders Jinxiang Fang and Zhiliang Fang, owning 31% and 69% of the shares of Fujian Tianfeihong respectively, entered into a series of agreements, including an Exclusive Technical Service and Business Consulting Agreement, a Call Option Agreement, Proxy Agreement and Share Pledge Agreement, collectively referred to in this report as variable interest agreements, or “VIE Agreements,” pursuant to which Fujian Tianfeihong became Changshitong Consulting’s contractually controlled affiliate. As a result of the VIE Agreements described above, we have consolidated Fujian Tianfeihong’s historical financial results in our financial statements as a variable interest entity pursuant to Accounting Principles Generally Accepted in the United States of America following the date of the agreements and combined such results prior to the date of the agreements. The VIE Agreements with our Chinese affiliate and its shareholders, which relate to critical aspects of our operations, may not be as effective in providing operational control as direct ownership. In addition, these arrangements may be difficult and costly to enforce under PRC law. See “Risk Factors - Risks Relating to the VIE Agreements.”

The foregoing descriptions of the VIE Agreements and the transactions contemplated thereby, are subject to the more detailed provisions set forth in the VIE Agreements, which are attached as Exhibits 10.1, 10.2, 10.3, and 10.4 to this Current Report on Form 8-K and which are incorporated herein by reference. Please also see “Related Party Transactions” and “Form 10 Disclosure” for further information on our contractual arrangements with these parties.

We have included the information that would be required if the registrant were filing a general form for registration of securities on Form 10, including a complete description of the business and operations of Changshitong Consulting and its operating subsidiaries in Item 5.06 below, which is incorporated herein by reference.

4

ITEM 4.01 CHANGES IN REGISTRANT’S CERTIFYING ACCOUNTANT

Dismissal of Previous Independent Registered Public Accounting Firm

On October 23, 2013, the Board of Directors of China Tianfeihong Wine, Inc. (the “Company”) approved the dismissal of Malone Bailey LLP (“Malone Bailey”) as our independent certified public accounting firm.

Our financial statements for the years ended December 31, 2010, 2011 and 2012 were audited by Malone Bailey. Malone Bailey’s reports on our financial statements for the three most recent fiscal years did not contain an adverse opinion, a disclaimer of opinion, nor was it qualified or modified as to uncertainty, audit scope or accounting principles, except for the addition of an explanatory paragraph regarding the Company’s ability to continue as a going concern.

During the years ended December 31, 2010, 2011,2012 and the interim period ended June 30, 2013 and through the date of discontinuance of Malone Bailey’s engagement as the Company’s independent accountant, there were no disagreements with Malone Bailey on any matter of accounting principles or practices, financial statement disclosure, auditing scope or procedure, which disagreements, if not resolved to the satisfaction of Malone Bailey, would have caused it to make reference to the subject matter of the disagreement in its reports on our financial statements for such periods.

On March 21, 2014, the Company provided Malone Bailey with a copy of this amendment No. 1 to Form 8-K prior to its filing with the SEC and requested it to furnish a letter addressed to the SEC stating whether it agrees with the statements made above. We have received the requested letter from Malone Bailey and a copy of such letter is filed as Exhibit 16.1 to the Form 8-KA filed with the Commission on March 24, 2014.

Engagement of New Independent Registered Public Accounting Firm

On October 23, 2013, our Board of Directors appointed KCCW Accountancy Corp. (KCCW) as our new independent certified public accounting firm. KCCW is located at 22632 Golden Springs Drive, Suite 230, Diamond Bar, CA 9176, USA.

During the period the Company engaged Malone Bailey as well as through the date KCCW was engaged, neither the Company nor anyone on the Company's behalf consulted with KCCW regarding either (i) the application of accounting principles to a specified transaction, either contemplated or proposed, or the type of audit opinion that might be rendered on the Company's financial statements or (ii) any matter that was either the subject of a disagreement or a reportable event set forth in item 304(a)(2) of Regulation S-K.

ITEM 5.01 CHANGES IN CONTROL OF REGISTRANT

Prior to the Closing, the Seller owned 12,200,000, or approximately 84.84%, of the issued and outstanding shares of Common Stock. Ms. Hong Yang served as the Chief Executive Officer, President and Director (Principal Executive Officer, Principal Financial Officer and Principal Accounting Officer), and Ms. Mo You Yu served as Director of the Company. In connection with the Closing, Ms. Hong Yang resigned from the executive officer positions she held with the Company and Ms. Mo You Yu resigned from the director position she held with the Company on June 28, 2013. The Company appointed Zhiliang Fang as Chief Executive Officer effective as of the Closing, and Chairman of the Company effective from August 12, 2013.

Upon the Closing, the Buyer owned 79.97% of the issued and outstanding Common Stock. In addition, as of the Closing, Ruitao Jiang and ZhuJun Chen have been appointed as the Directors of the Company effective from August 12, 2013. As of the Closing, Lirong Zheng has been appointed as the Chief Financial Officer of the Company effective immediately.

5

The following table sets forth certain information regarding the beneficial ownership of the Common Stock as of immediately following the Closing on June 28, 2013, by (i) each person known by the Company to be the beneficial owner of 5% or more of the outstanding Common Stock, (ii) each executive officer and director of the Company, and (iii) all of the Company’s executive officers and directors as a group.

|

Name of Buyer

|

Number of

Shares (1)

|

Percentage of

Class (2)

|

||||

|

Zhiliang Fang*

No.55, Dingwaikeng, Duli Village, Changtai Town, Chengxiang District, Putian City, Fujian Province

|

11,500,000

|

79.97

|

%

|

|||

|

Ruitao Jiang*

1849 Licheng Middle Avenue, Longqiao Street, Chengxiang District, Putian City, Fujian Province, China

|

0

|

N/A

|

||||

|

Zhujun Chen*

1849 Licheng Middle Avenue, Longqiao Street, Chengxiang District, Putian City, Fujian Province, China

|

0

|

N/A

|

||||

|

Lirong Zheng*

1849 Licheng Middle Avenue, Longqiao Street, Chengxiang District, Putian City, Fujian Province, China

|

0

|

N/A

|

||||

|

All Directors and Officers as a group

1849 Licheng Middle Avenue, Longqiao Street, Chengxiang District, Putian City, Fujian Province, China

|

11,500,000

|

79.97

|

%

|

* Director and/ or executive officer.

On July 8, 2013, our board of directors approved by the unanimous written consent in lieu of a meeting of our Board of Directors and the written consent of Zhiliang Fang, the owner of 11,500,000 shares of our common stock, or approximately 79.97% of our outstanding shares of common stock executed, to effect a one (1) new for six (6) old reverse stock split of our issued. After the reverse split, Mr. Zhiliang Fang held 1,916,666 shares of stock.

On December 30, 2013, we issued a total of 32,000,000 shares of common stock to the former Fanwei Hengchang Shareholders in exchange for all the capital stock the former Fanwei Hengchang Shareholders held in Fanwei Hengchang in connection with the Fanwei Hengchang Acquisition.

6

The following table sets forth certain information regarding the beneficial ownership of the Common Stock as of immediately following the issuance of shares to Fanwei Hengchang shareholders on December 30, 2013, by (i) each person known by the Company to be the beneficial owner of 5% or more of the outstanding Common Stock, (ii) each executive officer and director of the Company, and (iii) all of the Company’s executive officers and directors as a group.

| Name of Buyer |

Number of

Shares (1)

|

Percentage of

Class (2)

|

||||

|

Zhiliang Fang*

No.55, Dingwaikeng, Duli Village, Changtai Town, Chengxiang District, Putian City, Fujian Province

|

3,840,000

|

12

|

%

|

|||

|

Ruitao Jiang*

1849 Licheng Middle Avenue, Longqiao Street, Chengxiang District, Putian City, Fujian Province, China

|

1,568,000

|

4.9%

|

||||

|

Zhujun Chen*

1849 Licheng Middle Avenue, Longqiao Street, Chengxiang District, Putian City, Fujian Province, China

|

1,568,000

|

4.9%

|

||||

|

Lirong Zheng*

1849 Licheng Middle Avenue, Longqiao Street, Chengxiang District, Putian City, Fujian Province, China

|

0

|

N/A

|

||||

|

All Directors and Officers as a group

1849 Licheng Middle Avenue, Longqiao Street, Chengxiang District, Putian City, Fujian Province, China

|

6,976,000

|

21.8

|

%

|

(1) Under Rule 13d-3 of the Exchange Act, a beneficial owner of a security includes any person who, directly or indirectly, through any contract, arrangement, understanding, relationship, or otherwise has or shares: (i) voting power, which includes the power to vote, or to direct the voting of shares; and (ii) investment power, which includes the power to dispose or direct the disposition of shares. Certain shares may be deemed to be beneficially owned by more than one person (if, for example, persons share the power to vote or the power to dispose of the shares). In addition, shares are deemed to be beneficially owned by a person if the person has the right to acquire the shares (for example, upon exercise of an option) within 60 days of the date as of which the information is provided. In computing the percentage ownership of any person, the amount of shares outstanding is deemed to include the amount of shares beneficially owned by such person (and only such person) by reason of these acquisition rights.

(2) Based on 14,380,266 shares of Common Stock issued and outstanding as of the Closing.

The disclosure set forth in Item 1.01 of this Current Report on Form 8-K is incorporated herein by reference.

7

| ITEM 5.02 DEPARTURE OF DIRECTORS OR CERTAIN OFFICERS; ELECTION OF DIRECTORS; APPOINTMENT OF CERTAIN OFFICERS; COMPENSATORY ARRANGEMENTS OF CERTAIN OFFICERS |

Prior to the date of the Closing, our Board of Directors consisted of Ms. Hong Yang and Ms. Mo You Yu. Ms. Hong Yang and Ms. Mo You Yu have submitted letters of resignation on June 28, 2013 and Zhiliang Fang, Ruitao Jiang and ZhuJun Chen have been appointed to our Board of Directors. The appointment of Zhiliang Fang (Chairman), Ruitao Jiang and ZhuJun Chen and the resignation of Ms. Hong Yang and Ms. Mo You Yu is effective on August 12, 2013. In addition, effective on the date of the Closing, Ms. Hong Yang resigned from her officer position with the Company and we appointed Zhiliang Fang as our Chief Executive Officer, appointed Lirong Zheng as our Chief Financial Officer and Secretary. Management stays the same post reverse acquisition transaction.

The following description sets forth the name, age, and position of our officers and directors. Executive officers are elected annually by our Board of Directors. Each executive officer holds his office until he resigns, is removed by the Board, or his successor is elected and qualified.

Mr. Zhiliang Fang, age 55, serves as our Chief Executive Officer and Chairman of the Board. Mr. Fang worked in the business department of Food Bureau in Putian City, Fujian Province from 1982 to 1992. He served as the deputy general manager and sales manager of Fujian Putian Liyuan Machinery Co., Ltd from 1992 to 1995 and manager of Putian Qiusi Fruit Plant from 1995 to 1997. Mr. Fang served as the manager of Changtai Tianbian Fruit Plant in Chengxiang District of Putian City from 1997 to 2005 and vice-president of Putian Loquat Wine Industry Co., Ltd. from 2005 to 2009. Mr. Fang served as the Chairman and Chief Executive Officer of Fujian Tianfeihong Wine Co., Ltd. since 2009 until present. Mr. Fang received associate degree from Fujian Guobo TV University in 1988.

Mr. Ruitao Jiang, age 42, serves as our director. Mr. Jiang served as executive of Xiamen Meilihua Grand Hotel from 1994 to 1996 and served as manager in Fujian branch office of Guizhou Cantonese Cuisine Group from 1997 to 1999. Mr. Jiang served as general manager in Southwest region of Yunnan Branch Office of Fuzhou Shenshi Company from 2000 to 2008 and general manager of Hong Kong Shennuoqi Investment Company from 2009 to 2011. Mr. Jiang served as director of Fujian Tianfeihong Wine Co., Ltd. since 2012 until now. Mr. Jiang received bachelor degree in accounting and finance from accounting school of Fujian Province in 1993.

Mr. Zhujun Chen, age 35, serves as our director. Mr Chen served as executive in Henan Huike Electronics Ltd. from 2001 to 2005 and served as partner of Zhengzhou Zhongcheng Science and Technology Ltd. from 2006 to 2009. Mr. Chen served as director and assistant president of Yongjia Investment Holding (Hong Kong) Ltd. from 2009 to 2011 and served as director of Fujian Tianfeihong Wine Co., Ltd. from 2012 until now. Mr. Chen received degree in computer from Henan College of Information Engineering in 2001.

Ms. Lirong Zheng, age 44, serves as our Chief Financial Officer. Ms. Zheng served as finance Manager of Putian Qiusi Fruit Plant from 1993 to 1997 and finance manager of Changtai Tianbian Fruit Plant in Chengxiang District of Putian City from 1997 to 2005. Ms. Zheng served as accountant of Putian Loquat Wine Industry Co., Ltd. from 2005 to 2009 and served as Chief Financial Officer of Fujian Tianfeihong Wine Co., Ltd. since 2009 until now. Ms. Zheng received bachelor degree in accounting from Putian College in 1993.

8

| ITEM 5.03 AMENDMENTS TO ARTICLES OF INCORPORATION OR BYLAWS; CHANGE IN FISCAL YEAR |

On December 30, 2013, the Board of Directors of the Company approved changing the fiscal year-end of the Company from December 31 to August 31 as a result of the Fanwei Hengchang Acquisition.

On August 1, 2013, the Company filed a Certificate of Amendment to its Articles of Incorporation (the “Amendment”) with the Office of the Secretary of State of Delaware to change its name from “Zenitech Corporation” to “China Tianfeihong Wine Inc.” (the “Name Change”) and to effect a 1 for 6 reverse split of the Company’s outstanding shares of common stock (the “Reverse Split”). Both the Name Change and the Reverse Split were approved by the Financial Industry Regulatory Authority (“FINRA”). Both Name Change and Reverse Split went effective on August 12, 2013.

| ITEM 5.06 CHANGE IN SHELL COMPANY STATUS |

On December 30, 2013, the Company acquired Fanwei Hengchang in a reverse acquisition transaction. Prior to the transactions contemplated by the Exchange Agreement, the Company was a shell company as defined in Rule 12b-2 under the Exchange Act. As a result of the transactions under the Share Exchange Agreement, the Company is no longer a shell company. The information with respect to the transactions set forth in Item 2.01 is incorporated herein by reference.

| ITEM 5.07 SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS |

On July 8, 2013, the Company received a written consent signed by Zhiliang Fang, the record owner of approximately 79.97% of the outstanding shares of common stock approving the Name Change and the Reverse Split. Upon the effectiveness of the Reverse Split, the Company’s outstanding shares of common stock decreased from 14,380,266 to 2,396,680 shares.

9

FORM 10 DISCLOSURE

We are providing below the information that would be included in a Form 10 if we were to file a Form 10. Please note that the information provided below relates to the combined enterprises after the acquisition of Fanwei Hengchang except that information relating to periods prior to the date of the reverse acquisition only relate to Fanwei Hengchang and its subsidiaries and controlled consolidated affiliate unless otherwise specifically indicated.

DESCRIPTION OF BUSINESS

We conduct our operations through our controlled consolidated affiliate Fujian Tianfeihong Wine Co., Ltd (hereinafter referred to as “Fujian Tianfeihong”). Fujian Tianfeihong, founded in April 24, 2009, is primarily engaged in distributing a variety of fruit wine including among others green plum wine, loquat wine, olive wine, and pomegranate wine to supermarkets and liquor stores.

OUR CORPORATE HISTORY AND BACKGROUND

The Company was incorporated in the state of Delaware on July 28, 2005. The Company was initially created to engage in the development, manufacture, distribution and marketing of environmentally friendly floral sleeves and wrappers for the floriculture industry. Since its inception and until the acquisition of Fanwei Hengchang, the Company was a development stage company without significant assets or any revenue.

On August 1, 2013, the Company filed a certificate of amendment to its articles of incorporation to change its name from “Zenitech Corporation” to “China Tianfeihong Wine Inc. ” (the “Name Change”) and to effect a 1 for 6 reverse stock split (the “Reverse Split”) of its outstanding shares of common stock. Both the Name Change and the Reverse Split were approved by the FINRA. The Name Change and the Reserve Split went effective on August 12, 2013. Upon the effectiveness of the Reverse Split, the number of outstanding shares of the Company’s common stock decreases from 14,380,266 to 2,396,680 shares. The number of authorized shares of common stock continues to be 80,000,000 shares.

Acquisition of Fanwei Hengchang

On December 30, 2013, we completed a reverse acquisition transaction through a share exchange with the Fanwei Hengchang Shareholders, whereby we acquired 100% of the outstanding shares of Fanwei Hengchang in exchange for a total of 32,000,000 shares of our common stock, representing 93.03% of our issued and outstanding shares of common stock. As a result of the reverse acquisition, Fanwei Hengchang became our wholly-owned subsidiary and the former Fanwei Hengchang Shareholders became our controlling stockholders. The share exchange transaction was treated as a reverse acquisition, with Fanwei Hengchang as the acquirer and the Company as the acquired party for accounting purposes. Unless the context suggests otherwise, when we refer in this report to business and financial information for periods prior to the consummation of the reverse acquisition, we are referring to the business and financial information of Fanwei Hengchang and its consolidated subsidiaries and variable interest entity.

Immediately prior to the Share Exchange, the common stock of Fanwei Hengchang was owned by the following persons in the indicated percentages: FANG Zhiliang(12%); FANG Jinxiang(10%); FANG Lei(4%); FANG Meichun(4%); FANG Meihua(3%); HUANG Jinlan(3%); JI Meiyu(3%); LIN Xiumei(3%); YANG Yuanchun(3%); ZENG Fan(3%); ZENG Zhan(3%); ZENG Yuanyu(2%); ZHENG Mudan(2%); JIANG Ruitao(4.9%); JIANG Ruipeng(4.9%); LAI Weiyi(4.9%); WANG Dunchang(4.9%); JIANG Lihui(4.9%); TENG Li(4.9%); CHEN Zhujun(4.9%); GUO Xiuli(4.9%); GAO Jian(4.8%); GAO Renlong (1%).

As a result of our acquisition of Fanwei Hengchang, we now own all of the issued and outstanding capital stock of Changshi Tongrong, which in turn owns all of the issued and outstanding capital stock of Changshitong Consulting. In addition, we effectively and substantially control Fujian Tianfeihong through a series of captive agreements with Changshitong Consulting.

10

Subsequent to the closing of the Share Exchange Agreement, we conduct our operations through our controlled consolidated affiliate Fujian Tianfeihong. Fujian Tianfeihong is primarily engaged in distributing all kinds of fruit wine including green plum wine, loquat wine, olive wine, pomegranate wine, etc to supermarkets and liquor stores.

The Company is located in 1849 Licheng Middle Avenue, Longqiao Street, Chengxiang District, Putian City, Fujian Province, China. Our telephone number is (86) 0594-6258386.

Contractual Arrangements with our Controlled Consolidated Affiliate and its Shareholders

On November 26, 2013, prior to the reverse acquisition transaction, Changshitong Consulting and Fujian Tianfeihong and its shareholders Jinxiang Fangand Zhiliang Fang entered into a series of agreements known as variable interest agreements (the “VIE Agreements”) pursuant to which Fujian Tianfeihong became Changshitong Consulting’s contractually controlled affiliate. The VIE Agreements included:

|

(1)

|

an Exclusive Technical Service and Business Consulting Agreement between Changshitong Consulting and Fujian Tianfeihong pursuant to which Changshitong Consulting is to provide technical support and consulting services to Fujian Tianfeihong in exchange for (i) 95% of the total annual net profit of Fujian Tianfeihong plus (ii) RMB10,000 per month (U.S.$1,587).

|

|

|

(2)

|

a Call Option Agreement among Zhiliang Fang and Jinxiang Fang (together referred to as “Fujian Tianfeihong Shareholders”), and Changshitong Consulting under which the Fujian Tianfeihong Shareholders have granted to Changshitong Consulting the irrevocable right and option to acquire all of the equity interests in Fujian Tianfeihong to the extent permitted by PRC law. If PRC law limits the percentage of Fujian Tianfeihong that Changshitong Consulting may purchase at any time, then Changshitong Consulting may repeatedly exercise its option in such increments as may be allowed by PRC law. The exercise price of the option is RMB1.00 ($0.16) or the minimum price regulated by PRC laws if at that time there is any regulatory PRC laws regulating the minimum price. The Fujian Tianfeihong Shareholders agreed to refrain from taking certain actions which might harm the value of Fujian Tianfeihong or Changshitong Consulting’s option;

|

|

|

(3)

|

a Proxy Agreement by Zhiliang Fang, Jinxiang Fang, Changshitong Consulting and Fujian Tianfeihong pursuant to which they each authorize Changshitong Consulting to designate someone to exercise all of their shareholder decision rights with respect to Fujian Tianfeihong; and

|

|

|

(4)

|

a Share Pledge Agreement among Zhiliang Fang and Jinxiang Fang, Fujian Tianfeihong, and Changshitong Consulting under which the Fujian Tianfeihong Shareholders agree to pledge all of their equity in Fujian Tianfeihong to Changshitong Consulting to guarantee Fujian Tianfeihong’s and its shareholders’ performance of their obligations under the Exclusive Technical Service and Business Consulting Agreement, the Call Option Agreement and the Proxy Agreement.

|

The VIE Agreements with our Chinese affiliate and its shareholders, which relate to critical aspects of our operations, may not be as effective in providing operational control as direct ownership. In addition, these arrangements may be difficult and costly to enforce under PRC law. See “Risk Factors - Risks Relating to the VIE Agreements.”

The foregoing description of the terms of the Exclusive Technical Service and Business Consulting Agreement, the Call Option Agreement, the Proxy Agreement and the Share Pledge Agreement is qualified in its entirety by reference to the provisions of the agreements filed as Exhibits 10.1, 10.2, 10.3 and 10.4 to this report, respectively, which are incorporated by reference herein.

See “Related Party Transactions” for further information on our contractual arrangements with these parties.

After the exchange, our current organizational structure after giving effect to the name change is as follows:

11

Fanwei Hengchang was established in the British Virgin Islands on May 29, 2013. The shareholders of Fanfeihengchang before the restructuring are: Zhiliang Fang(12%); Jinxiang Fang(10%); Lei Fang(4%); Meichun Fang(4%); Meihua Fang(3%); Jinlan Huang(3%); Meiyu Ji(3%); Xiumei Lin(3%); Yuanchun Yang(3%); Fan Zeng(3%); Zhan Zeng(3%); Yuanyu Zeng(2%); Mudan Zheng(2%); Ruitao Jiang(4.9%); Ruipeng Jiang(4.9%); Weiyi Lai(4.9%); Dunchang Wang(4.9%); Lihui Jiang(4.9%); Li Teng(4.9%); Zhujun Chen(4.9%); Xiuli Guo(4.9%); Jian Gao(4.8%); Renlong Gao (1%). The shareholder of Fanweihengchang after the restructuring is China Tianfeihong who holds 100% of shares of Fanweihengchang. Mr. Ruitao Jiang is the sole director of Fanwei Hengchang prior to the restructure.

Changshi Tongrong was established in Hong Kong on August 10, 2012 to serve as an intermediate holding company with an authorized shares of 10,000 at HK$ 1.00 per share. Ms. Qiaoli Zhang was the founding director of Changshi Tongrong and was then subsequently replaced by Er Qi Zhang as the sole director of Changshi Tongrong. The sole shareholder of Changshi Tongrong, Mr. Yisha Yang Gao, transferred his 100% owned equity interest in Changshi Tongrong to Fanwei Hengchang on November 22, 2013. The sole shareholder of Changshitongrong after the restructuring is Fanweihengchang who holds 100% of shares of Changshitongrong.

Changshitong Consulting was established by Changshi Tongrong as a wholly foreign owned enterprise (the “WFOE”) in the PRC on September 23, 2013. The shareholder of Changshitong Consulting before the restructuring is Changshitongrong. The shareholder of Changshitong Consulting after the restructuring remains unchanged.

Fujian Tianfeihong, our operating consolidated affiliate, was established in the PRC on April 24, 2009. The local government of the PRC issued a certificate of approval regarding the foreign ownership of Changshitong Consulting by Changshi Tongrong, a Hong Kong entity on September 18, 2013. The shareholders of Fujian Tianfeihong before the restructuring are Zhiliang Fang and Jinxiang Fang who holds 31% and 69% of shares of Fujian Tianfeihong respectively. The shareholders of Fujian Tianfeihong after the restructuring remain the same but the controlling rights and interests transferred to Changshi Tongrong Consulting through VIE agreements.

12

OVERVIEW

Fujian Tianfeihong Wine Co., Ltd (hereinafter referred to as “Fujian Tianfeihong”), founded in April 24, 2009, is primarily engaged in distributing all kinds of fruit wine including green plum wine, loquat wine, olive wine, pomegranate wine, etc to supermarkets and liquor stores.

The Company is located at 1849 Licheng Middle Avenue, Longqiao Street, Chengxiang District, Putian City, Fujian Province, China.

There are two shareholders in Fujian Tianfeihong: 69% of the shares are owned by Zhiliang Fang, and the remaining 31% of the shares are owned by JinxiangFang. Zhiliang Fang and Jinxiang Fang are husband and wife. Zhiliang Fang is the chief executive officer and chairman of the Company and Zhujun Chen and Ruitao Jiang is the director of the Company.

Fujian Tianfeihong is primarily engaged in distributing all kinds of fruit wine including green plum wine, loquat wine, olive wine, pomegranate wine, etc. ,from which the main revenue of Fujian Tianfeihong was generated.

Fujian Tianfeihong entered into agreements with eight major wine manufacturers, whereby Fujian Tianfeihong will purchase the products from these manufacturers based on the demand of its customers during the contract period and Fujian Tianfeihong has the contractual obligation to pay the payments for the purchase orders of last quarter in January, April, July and October each year during the contractual period.

Fujian Tianfeihong has 17 major customers as of today; all these customers were large supermarkets and liquor stores with top sales volumes in their region and they are obligated to pay the sales price on the fifth day of each month for the purchase orders they make in the previous month.

As of today, Fujian Tianfeihong has only one company-owned store and in its early development. It is planning to expand its sales distribution network by opening and operating company-owned stores in order to acquire more market share and generate stable sales revenue.

PRODUCTS AND SUPPLIERS

Fujian Tianfeihong entered into agreements with eight major wine manufacturers, whereby Fujian Tianfeihong will purchase the products from these manufacturers based on the demand of its customers during the contract period and Fujian Tianfeihong has the contractual obligation to pay the payments for the wine supplied of last quarter in January, April, July and October each year during the contractual period.

According to the agreements between Fujian Tianfeihong and its supplier manufacturers, during the three-year contractual period, Fujian Tianfeihong will purchase fruit wine produced or distributed by its suppliers and make payments for the goods ordered in the previous quarter in January, April, July and October and the suppliers are obligated to deliver the products within 5 days upon receipt of the order.

13

Fujian Tianfeihong’s top eight largest suppliers and percentage of supplies offer to Fujian Tianfeihong are listed below:

|

Suppliers

|

Region

|

2013

% of |

2012

% of |

|

|

Anhui Asia-Pacific Pomegranate Wine Co., LTD

|

Huaiyuan County in Anhui Province

|

20.71%

|

18.56%

|

|

|

Fujian Fengda Winery CO.,LTD

|

Fu’an City in Fujian Province

|

31.26%

|

33.27%

|

|

|

Fujian Southland Thorn Wine Co., LTD

|

Economic Development Zone of She Nationality in Fu’an City

|

2.03%

|

1.81%

|

|

|

Fujian Nanhai Foods Co., LTD

|

Zhangzhou City in Fujian Province

|

6.43%

|

6.10%

|

|

|

Fujian Yuanfeng Agricultural Science and Technology Co., LTD

|

Sanming City in Fujian Province

|

1.60%

|

1.21%

|

|

|

Kuangshan Wine Industry Co., LTD of Pucheng County

|

Pucheng County in Fujian Province

|

18.26%

|

17.14%

|

|

|

Zhangzhou Jinshan Wine Industry Co., LTD

|

Zhangzhou City in Fujian Province

|

11.41%

|

12.23%

|

|

|

Zhangzhou Xue Li Xiang Wine Industry Co., LTD

|

Zhao’an County in Fujian Province

|

8.31%

|

9.69%

|

|

|

Total

|

100%

|

100%

|

CUSTOMERS

Fujian Tianfeihong is primarily engaged in distributing all kinds of fruit wine including green plum wine, loquat wine, olive wine, pomegranate wine, etc. to 17 major customers; all these customers were large supermarkets and liquor stores with top sales volumes in their region and they are obligated to pay the sales price on the fifth day of each month for the purchase orders they make in the previous month.

According to the agreements between Fujian Tianfeihong and its customers, Fujian Tianfeihong has the contractual obligation to deliver the goods within three business days and arrange for transportation. The customers will order products from Fujian Tianfeihong, bear the transportation costs and will be entitled to one free unit of corresponding products if the order reaches 15 units of products with a unit price over RMB 400, 10 units of products with a unit price between RMB 200 and RMB 400 and 5 units with a unit price below RMB 200.

14

Fujian Tianfeihong’s top ten customers are listed below:

|

Customers

|

Region

|

2013

% of |

2012

% of |

|

|

Putian Sugar and Wine Non-Stable Food Company in Fujian Province

|

Putian City in Fujian Province

|

7.05%

|

7.33%

|

|

|

Datang Shop in Putian of Fuzhou Carrefour Commercial Co., LTD

|

Putian City in Fujian Province

|

6.53%

|

9.46%

|

|

|

Putian Domestic High-Quality Goods Trading Co., LTD

|

Putian City in Fujian Province

|

7.52%

|

6.92%

|

|

|

Putian Carrefour Industry Co., LTD

|

Putian City in Fujian Province

|

8.94%

|

6.98%

|

|

|

Putian Tairan Centre Mall Co., LTD

|

Putian City in Fujian Province

|

7.07%

|

6.65%

|

|

|

Putian New Hua Du Wanjiahui Shopping Mall Co., LTD

|

Putian City in Fujian Province

|

7.48%

|

7.05%

|

|

|

Datang Shop of Putian New Huadu Domestic Products Shopping Mall Co., LTD

|

Putian City in Fujian Province

|

7.96%

|

8.00%

|

|

|

Quanzhou Jiatai Chinese and Foreign Famous Wine Co., LTD

|

Quanzhou City in Fujian Province

|

6.96%

|

7.18%

|

|

|

Wenxian East Road Shop of Wal-Mart(Fujian) Stores, Inc.

|

Putian City in Fujian Province

|

7.35%

|

8.20%

|

|

|

Great Empire Leisure Co., LTD of Hanjiang District in Putian City

|

Putian City in Fujian Province

|

7.32%

|

5.42%

|

|

|

Total

|

74.19%

|

73.19%

|

15

OUR INDUSTRY

In the description below we rely on certain information and statistics regarding our industry and the economy in China from the reports published by National Bureau of Statistics of China. We have no reason to believe that the information and statistics we cite are not accurate.

Currently, fruit wine accounts for 15-20% of the alcoholic drink worldwide, but only 1% in China. The average yearly consumption of fruit wine per capita China is 0.2-0.3 liter, which is a big difference from the 6 liter of world average, indicating a huge potential in China’s fruit wine market.

According to the public data released by National Bureau Of Statistics in 2012, the total output of China’s liquor making industry in 72, 022,500 kiloliters (including alcoholic drink and fermentation alcohol), 5.67% higher than the total output of 2011; reaching a total industrial production volume of RMB 7,527.02 million, a total industrial sales volume of RMB 7,332.89 million and export volume of RMB 6,200 million, realizing an annual increase of 20.65%, 20.82% and 23.36% respectively. China emerged many fruit wine production bases relying on planting bases, for example, Guangdong province invested and constructed many fruit wine factory using lychee as raw material, Ningbo, Zhejiang Province constructed the production bases of mulberry wine and red bayberry wine, and Putian Fujian constructed fruit wine production bases, etc. In addition, the medlar wine in northwest district and fruit wine in Tianjin have also been going through large scale production and management. Meanwhile, following the growth of people’s living standard and the joint effort from fruit wine producers all around, recent years the development of fruit wine in our country presents a well state. All these show us the fruit wine industry has been in sound development.” Upon the stimulation of the national economic policy, we believe the national consumer demand remains vigorous, the price of major liquor-making raw material remains stable and the supply of the liquor making industry grows rapidly. China has been always the first throughout the world on the yield and area of fruit since the mid-1990s. In 2007, fruit field has reached 104.71 million hectares and 181 million tons, accounting for 19.69% of fruit harvest area of the world. In 2010, there were about 11,543,900 hectares of China orchard area and more than 8 million tons of the annual output of peaches, bananas and grapes. With the increased production, the per capita consumption of fruits also increased. But generally speaking, we believe the growth rate of fruits consumption lagged behind the growth rate of production, which directly resulted in the increase of fruits surplus, hence the raw material for the fruit wine production companies are sufficient and has low price.

In December 2011, National Development and Reform Commission, Ministry of Industry and Information Technology issued the Food Industry “Twelfth Five Year Plan”, which stipulates that by 2015, the liquor-making industry sales revenue will grow to RMB 830 billion at an annual growth rate of over 10%. The annual alcohol product output increase rate will be limited to 5% and the percentage of wine products made from non-grain raw materials(such as grape and other fruits) among the total alcohol product output will be doubled.

In 2012, the China Alcoholic Drinks Industry Association issued Chinese Wine Industry "Twelfth Five-Year" Development Plan, which stipulates that by 2015, the industry will realize total output of 81,200,000 kiloliter (including six sub-industry of alcohol, white spirit, beer, rice wine, grape wine, fruit wine etc), total sales revenue of RMB 830 billion, maintaining an annual average growth rate of 4.6% and 10% respectively and experiencing an increase of 25% and 63% from amount at the end of “Eleventh Five-Year Development Plan”. The output in fruit wine industry in 2015 is expected to reach 500,000 kiloliters and the sales revenue will increase at an annual average rate of 9.3%, gaining a total increase of 56% from the figure at the end of Eleventh Five Year Plan and reaching 22 billion by the end of the Twelfth Five-Year Plan.

Many new technologies are applied in the R&D of fruit wine, such as using ultrasonic wave and infrared ray to accelerate the maturing of fruit wine; using Sugar Palm enzyme to clear the fruit wine; using low temperature fermentation technology to avoid the decrease of vitamin; using “cation exchange” changelogies, agar, and other methods to improve the clarification effect, using spectrophotometry, atomic absorption spectrometry, gas chromatography and other trace measurement techniques and appropriate equipment to detect the physical indicators and other result of fruit wine. With the support of these new technologies, the R&D and manufacturing techniques have reached a higher level and accordingly shortened the R&D time, increased efficiency, lowered cost, improved technology, enhanced product quality, and developed more new species of fruit wine to be distributed into the market.

16

With the improvement of living standards, people are willing to spend more time focusing on their health and pay more attention to the quality and efficacy of wine when they buy alcoholic products. Therefore, medium or low alcohol wine is more suitable for the demand of Chinese customers and consumption market. The fruit wine of high quality contains low-alcohol concentration as well as abundant mineral element, which is very good for the human body, with the effects of enriching the blood, allaying tiredness and improving digestion. Thus over time, people prefer to buy fruit wine products. The fruit wine, with lower alcohol, high-nutrient and being beneficial to brain fitness, can promote blood circulation and body metabolism, control cholesterol levels, improve cardiovascular function, diuretic, stimulate liver function and anti-aging. The various advantages and unique functions of fruit wine have drawn the attention from more and more consumers. In 2004, due to the adjustment in domestic alcohol consumption market layout and optimization of the product structure, non-grain wine proportion increased rapidly, among which, grape wine and beer increased 6%-7%, high spirit white liquor decreased 8%-11%, the market share of fruit wine started to pick up.

COMPETITION

Competitive Advantages

Fujian Tianfeihong purchases a variety of different fruit wine from its suppliers and sells them at a reasonable price. Fruit wine is known for its freshness, convenience, healthiness and fruity flavour. This kind of brewing adopts modern techniques, which has short production cycle and all the raw materials are provided locally and forms a model of “company plus production base plus peasant household”, which has steady supply of fruits, good quality and greatly lower cost as compared with traditional liquor. All the aforesaid reasons enable the company to provide low to moderately priced wines thereby meeting the sales demand of the majority of supermarkets and terminal stores of liquor sales companies. Tianfeihong Wine Company adopts purchase channels of directly join hands with the manufactures and directly distributes products to the terminal stores, which changed the traditional condition of multi-layer wholesale and multi-link allocation of profits, which helps to brings continuing interest for the customers.

Fujian Tianfeihong is operated in a manner of distributing the fruit wine purchased from its manufacturer suppliers through advertising and promotion activities. The company distributes products through advertising and promotion activities. Through advertising, the company can propagandize and describe our products, establish product brand and create brand value. Promotion activities make our products approaching into customers, provide awareness and understanding of our products to customers, thereby attracting customers to buy our products, and further realizing low investment, quick return, and sustainable growth in revenue. Tianfeihong Company spent marketing expenses 10.82 million Yuan and obtained revenue 56.23 million Yuan in 2013 calendar year, spent marketing expenses 8.51 million Yuan and obtained revenue 48.48 million Yuan in 2012 calendar year. The marketing expense of 2013 increased 2.3 million Yuan and revenue increased 7.74 million Yuan as compared with last year. The inventory turnover rate was 8.97 and the inventory turnover days were 40.13 in 2013. Tianfeihong Company is able to place unified orders, make unified distribution in accordance with the demand of the customers and has fast inventory turnover speed, as well as expands the recognition of the products by advantage of advertisement to make profit.

Fujian Tianfeihong’s competitive advantage can be attributed to its products which contain less alcohol than white liquors and are cheaper in price than high-grade wine products, resulting in the Company’s popularity among the consumers. Our competition is mainly influenced by the nature of the products themselves. Current market demand for wine is gradually increasing, and the characteristics of wine products using loquat as raw materials meet the needs of the majority of the audience. With the improvement of living standard, customers tend to pay more attention to the character of the wine products when purchasing. The fruit wine product marketed by Tianfeihong Company contains less alcohol and is healthier for the human body. In addition, the company sells fruit wine at a cheaper price, hence, with the advantages of healthiness and benefits, the products is more competitive than white wine.

While selecting its customers, Fujian Tianfeihong chooses the chain supermarkets with good reputation where the local residents make most of their daily purchases, ensuring the Company’s good reputation in the industry.

17

Competitive Disadvantages

Fujian Tianfeihong is subject to the risk of breach or unilateral termination of the contract by its suppliers due to the fact that it does not manufacture the products as some of its competitors have manufacturing capacity.

Comparing with the competitors who manufacture the products, Fujian Tianfeihong has lower control over the purchase and sales price of the wine products. If the suppliers increase the price during the period when there is usually a price increase such as Middle-Autumn Day and Spring Festival but Fujian Tianfeihong cannot increase sales price correspondingly without decreasing its sales, such price increase will adversely affect the Fujian Tianfeihong’s profit.

OUR GROWTH STRATEGY

The sales in fruit wine market is experiencing fast development at present and the company will seize the opportunity by expanding its sales channel, increasing both the number and scale of the company-owned to acquire more market share, to build a reasonable sales network, to increase its sales and brand recognition and to gain the competitive advantage in the industry.

Fujian Tianfeihong is plan to expand by opening more franchising stores and company owned stores in major cities such as Fuzhou and Shenzhen to build an ideal sales network all over the country. Meanwhile, Fujian Tianfeihong will also introduce more wine products provided by famous wine manufacturers both at home and abroad to enrich its product line and balance its product structure which will help to meet personalized needs of its customers, enhance its ability to generate more revenue and increase its market share.

In terms of Fujian Tianfeihong’s long-term development strategy, the company will take advantage of its availability to locally planted loquat, introduce advanced manufacturing equipment and cooperate with organizations with leading brewing technology to build a manufacturing base with research, manufacturing and processing capacity, to build unique Tianfeihong Brand, and to produce more loquat wine products meeting market demand.

Fujian Tianfeihong aims at building its unique Tianfeihong Brand and will improve the functions of each department, to solve the issues of brand positioning, brand building and brand promotion to reach the goal. The company will also take measures to realize brand subdivision and extension.

Tianfeihong Company currently does not sell any wine products under the Tianfeihong Brand or any other company-owned brands and does not have any manufacturing capability. The location of Tianfeihong Company has natural advantage to plant loquat and there are many fruit wine manufacturing companies in the area. Currently the company does not manufacture products directly, but through cooperating with upstream company to acquire products sources, which results in the decrease in operating cost of the company.

18

MARKETS, SALES AND DISTRIBUTION

Fujian Tianfeihong will enhance its marketing and sales force by opening more company-owned stores and franchising stores in major cities such as Fuzhou and Shenzhen. At present, the company has 17 customers in total which are mainly chain supermarkets and wine terminal stores with good reputation in the region with 2 of them starting to cooperate with Fujian Tianfeihong since April 2013. As of today, the company has one company-owned stores selling products to wine consumers.

INTELLECTUAL PROPERTY

Fujian Tianfeihong does not have intellectual property as of today.

PROPERTIES

In June, 2009, Fujian Tianfeihong signed a lease contract with Tianzhang ZHU, pursuant to which, the company leased 599.26 square meters of the property located at 202, 2nd Floor, Taian Block, Licheng Road, Chengxiang District, Fujian Province for a consideration of $290,433 for a period from July 1, 2009 to June 30, 2017.

In September, 2009, Fujian Tianfeihong signed a lease contract with Fengrong ZHU, pursuant to which, the company leased the property located at 1849 Licheng Middle Avenue, Longqiao Street, Chengxiang District, Putian City, Fujian Province to be used as its principal executive office for a consideration of $71, 883 for a period from April 23, 2009 to April 22, 2014.

In September, 2009, Fujian Tianfeihong signed a lease contract with Zongyuan ZHU, pursuant to which, the company is entitled to use the property located at No. 1600, Tai’an Block, Licheng Road, Chengxiang District, Fujian Province for free during the period of October 18, 2012 to October 17, 2014.

REGULATION

Because our operating affiliate Fujian Tianfeihong is located in the PRC, our business is regulated by the national and local laws of the PRC. We believe our conduct of business complies with existing PRC laws, rules and regulations.

General Regulation of Businesses

We believe we are in material compliance with all applicable labor and safety laws and regulations in the PRC, including the PRC Labor Contract Law, the PRC Production Safety Law, the PRC Regulation for Insurance for Labor Injury, the PRC Unemployment Insurance Law, the PRC Provisional Insurance Measures for Maternity of Employees, PRC Interim Provisions on Registration of Social Insurance, PRC Interim Regulation on the Collection and Payment of Social Insurance Premiums and other related regulations, rules and provisions issued by the relevant governmental authorities from time to time, for our operations in the PRC.

According to the PRC Labor Contract Law, we are required to enter into labor contracts with our employees. We are required to pay no less than local minimum wages to our employees. We are also required to provide employees with labor safety and sanitation conditions meeting PRC government laws and regulations and carry out regular health examinations of our employees engaged in hazardous occupations.

Foreign Currency Exchange

The principal regulation governing foreign currency exchange in China is the Foreign Currency Administration Rules (1996), as amended (2008). Under these Rules, RMB is freely convertible for current account items, such as trade and service-related foreign exchange transactions, but not for capital account items, such as direct investment, loan or investment in securities outside China unless the prior approval of, and/or registration with, the State Administration of Foreign Exchange of the People’s Republic of China, or SAFE, or its local counterparts (as the case may be) is obtained.

19

Pursuant to the Foreign Currency Administration Rules, foreign invested enterprises, or FIEs, in China may purchase foreign currency without the approval of SAFE for trade and service-related foreign exchange transactions by providing commercial documents evidencing these transactions. They may also retain foreign exchange (subject to a cap approved by SAFE) to satisfy foreign exchange liabilities or to pay dividends. In addition, if a foreign company acquires a company in China, the acquired company will also become an FIE. However, the relevant PRC government authorities may limit or eliminate the ability of FIEs to purchase and retain foreign currencies in the future. In addition, foreign exchange transactions for direct investment, loan and investment in securities outside China are still subject to limitations and require approvals from, and/or registration with, SAFE.

Regulation of Income Taxes

On March 16, 2007, the National People’s Congress of China passed the Enterprise Income Tax Law, or the EIT Law, and its implementing rules, both of which became effective on January 1, 2008. The EIT Law and its implementing rules impose a unified EIT rate of 25.0% on all domestic-invested enterprises and FIEs, unless they qualify under certain limited exceptions.

In addition to the changes to the current tax structure, under the EIT Law, an enterprise established outside of China with “de facto management bodies” within China is considered a resident enterprise and will normally be subject to an EIT of 25% on its global income. The implementing rules define the term “de facto management bodies” as “an establishment that exercises, in substance, overall management and control over the production, business, personnel, accounting, etc., of a Chinese enterprise.” If the PRC tax authorities subsequently determine that we should be classified as a resident enterprise, then our organization’s global income will be subject to PRC income tax of 25%. For detailed discussion of PRC tax issues related to resident enterprise status, see “Risk Factors – Risks Related to Our Business – Under the EIT Law, we may be classified as a ‘resident enterprise’ of China. Such classification will likely result in unfavorable tax consequences to us and our non-PRC stockholders.”

Our future effective income tax rate depends on various factors, such as tax legislation, the geographic composition of our pre-tax income and non-tax deductible expenses incurred. Our management carefully monitors these legal developments and will timely adjust our effective income tax rate when necessary.

Dividend Distribution

Under applicable PRC regulations, FIEs in China may pay dividends only out of their accumulated profits, if any, determined in accordance with PRC accounting standards and regulations. In addition, a FIE in China is required to set aside at least 10.0% of its after-tax profit based on PRC accounting standards each year to its general reserves until the cumulative amount of such reserves reach 50.0% of its registered capital. These reserves are not distributable as cash dividends. The board of directors of a FIE has the discretion to allocate a portion of its after-tax profits to staff welfare and bonus funds, which may not be distributed to equity owners except in the event of liquidation.

The EIT Law and its implementing rules generally provide that a 10% withholding tax applies to China-sourced income derived by non-resident enterprises for PRC enterprise income tax purposes unless the jurisdiction of incorporation of such enterprises’ shareholder has a tax treaty with China that provides for a different withholding arrangement. Changshitong Consulting is considered a FIE and is directly held by our subsidiary in Hong Kong, Changshi Tongrong. According to a 2006 tax treaty between the Mainland and Hong Kong, dividends payable by an FIE in China to the company in Hong Kong who directly holds at least 25% of the equity interests in the FIE will be subject to a no more than 5% withholding tax. We expect that such 5% withholding tax will apply to dividends paid to Changshi Tongrong by Changshitong Consulting, but this treatment will depend on our status as a non-resident enterprise.

20

PRC M&A Rule, Circular 75 and Circular 638

On August 8, 2006, six Chinese government agencies, namely, the Ministry of Commerce, or MOFCOM, the State Administration for Industry and Commerce, or SAIC, the China Securities Regulatory Commission, or CSRC, the State Administration of Foreign Exchange, or SAFE, the State Assets Supervision and Administration Commission, or SASAC, and the State Administration for Taxation, or SAT, jointly issued the Regulations on Mergers and Acquisitions of Domestic Enterprises by Foreign Investors, referred to as the “New M&A Rules”, which became effective on September 8, 2006. The New M&A Rules purport, among other things, to require offshore “special purpose vehicles,” that are (1) formed for the purpose of overseas listing of the equity interests of Chinese companies via acquisition and (2) are controlled directly or indirectly by Chinese companies and/or Chinese individuals, to obtain the approval of the CSRC prior to the listing and trading of their securities on overseas stock exchanges. Based on our understanding of current Chinese Laws and pursuant to a legal opinion issued by Jilin Changchun Law Firm, (i) Changshitong Consulting was incorporated by a foreign investor and therefore has no Chinese shareholders; (ii) the share exchange between Fanwei Hengchang and the Company, is between two offshore companies and is not deemed as a transaction to acquire equity or assets of a “Chinese domestic company” as defined under the New M&A Rules and (ii) no provision in the New M&A Rules clearly classifies the contractual arrangements between Changshitong Consulting and Fujian Tianfeihong as a type of transaction falling within the New M&A Rules.

The SAFE issued a public notice in October 2005, or the Circular 75, requiring Chinese residents to register with the local SAFE branch before establishing or controlling any company outside of China for the purpose of capital financing with assets or equities of Chinese companies, referred to in the Circular 75 as special purpose vehicles, or SPVs. Chinese residents who are shareholders of SPVs established before November 1, 2005 were required to register with the local SAFE branch before June 30, 2006. Further, Chinese residents are required to file amendments to their registrations with the local SAFE branch if their SPVs undergo a material event involving changes in capital, such as changes in share capital, mergers and acquisitions, share transfers or exchanges, spin-off transactions or long-term equity or debt investments.

Pursuant to the Circular 698, where a foreign investor transfers the equity interests of a Chinese resident enterprise indirectly via disposing of the equity interests of an overseas holding company, which we refer to as an Indirect Transfer, and such overseas holding company is located in a tax jurisdiction that: (i) has an effective tax rate less than 12.5% or (ii) does not tax foreign income of its residents, the foreign investor shall report such Indirect Transfer to the competent tax authority of the Chinese resident enterprise. The Chinese tax authority will examine the true nature of the Indirect Transfer, and if the tax authority considers that the foreign investor has adopted an abusive arrangement in order to avoid Chinese tax, they will disregard the existence of the overseas holding company and re-characterize the Indirect Transfer and as a result, gains derived from such Indirect Transfer may be subject to Chinese withholding tax at the rate of up to 10%. Circular 698 also provides that, where a non-Chinese resident enterprise transfers its equity interests in a Chinese resident enterprise to its related parties at a price lower than the fair market value, the competent tax authority has the power to make a reasonable adjustment to the taxable income of the transaction.

INSURANCE

Insurance companies in China offer limited business insurance products. While business interruption insurance is available to a limited extent in China, we have determined that the risks of interruption, cost of such insurance and the difficulties associated with acquiring such insurance on commercially reasonable terms make it impractical for us to have such insurance. As a result, we could face liability from the interruption of our business as summarized under “Risk Factors – Risks Related to Our Business – We do not carry business interruption insurance so we could incur unrecoverable losses if our business is interrupted.”

OUR EMPLOYEES

21

RISK FACTORS

An investment in our common stock involves a high degree of risk. You should carefully consider the risks described below, together with all of the other information included in this report, before making an investment decision. If any of the following risks actually occurs, our business, financial condition or results of operations could suffer. In that case, the trading price of our common stock could decline, and you may lose all or part of your investment. You should read the section entitled "Special Notes Regarding Forward-Looking Statements" immediately following these risk factors for a discussion of what types of statements are forward-looking statements, as well as the significance of such statements in the context of this report.

Risks Related to our Business

Our success depends on our management team and other key personnel, the loss of any of whom could disrupt our business operations and have a material adverse effect on our financial condition, operating results and growth prospects.

Our success to date has been largely due to the contributions of our current management team, especially Chairman Zhiliang Fang. The continued success of our business is very much dependent on the experience of the members of our management team and the goodwill that they have developed in the industry to date. As a result, our continued success is dependent, to a large extent, on our ability to retain the services of our management team and key personnel. The loss of the services of any of our management team or key personnel due to resignation, retirement, illness or otherwise without suitable replacement or the inability to attract and retain qualified personnel would have a material adverse effect on our operations and may reduce our profitability and the return on your investment. We do not currently maintain key man insurance covering our key personnel.

Unilateral rescission of agreement by suppliers could have an adverse effect on bur business, financial condition and growth prospects.

Notwithstanding we now retains good partnership with manufacturer suppliers, there is possibility that suppliers will not deliver products on schedule or will terminate the agreement unilaterally, which will cause adverse effect on our business.

Risk of rise in products’ purchasing price could adversely affect our business and the value of our securities.

Recently, due to an increase in the resident disposable income resulting from the fast economic development in the past few years, the overall demand in wine industry is also increasing. Take the white liquor as an example, the average cost price per kiloliter increased by 47.89% during the period of January 2010 and November 2010 and there was a faster increase in some branded and high-ended white liquor. During the festivals such as mid-autumn festival and spring festival, wine producers usually increase its market price, which will directly influence our purchasing price. If Fujian Tianfeihong does not respond to the increasing price by imparting the increased amount to its customers, the increased portion will become cost of sales and thereby reduce Fujian Tianfeihong’s profitability.

Product quality control could adversely affect our relationship with the customers, our business and the value of our securities.

The risks of product quality control are as followings:

Product quality control during production chain. As a distributor, Fujian Tianfeihong cannot control product quality during production chain. If the quality adversely affected by pollution of producer’s goods or flaws incurred during production process damage terminal consumers, the company’s brand reputation and sales amount will be adversely affected.

Product quality control during circulation. This means adulterated wine prevention. Although our company has established a rigorous supply chain and terminal control measures for adulterated wine prevention, due to the present limitation of the company’s informatization, we cannot conduct real time monitoring on the wine products, so there is no exclusion of individuals’ mingling adulterated wine behaviors driven by interests during circulation. The adulterated wine presents during circulation will adversely affect the company’s brand reputation.

22

Depending Upon Consumer Spending and Preferences

The success of the Company’s business depends upon a number of factors related to the level of consumer spending, including the general state of economy and consumer confidence in future economic conditions. Changes in consumer spending can affect both the quality and price level of wines that customers are willing to purchase. Reduced consumer confidence and spending may result in reduced demand for the Company’s proposed products, limitations and its ability to increase prices and increased selling and promotional expenses. A sudden and unexpected shift in consumer preferences for a reduction in sales of wine generally or in wine varieties of types could have a material adverse effect on Company’s proposed business, financial condition and results of proposed operations.

Competition

The wine industry is intensely competitive and highly fragmented. The Company’s intends to expand the market distribution channel, increase the number and scale of boutique store and cover blank market share to bring the established market sales network to a reasonable level and promote the operating performance and brand name in order to form good competitive advantage. The wine industry has also experienced significant consolidation in recent years and many of the Company’s competitors have significantly greater capital resources than the Company. The products distributed by the Company will also compete with popular-priced generic wines and with other alcoholic and nonalcoholic beverages, for shelf space in supermarkets and professional organization of alcohol drinks, many of which carry extensive brand portfolios.

Agricultural Issues

Our main business is distributing all kinds of fruit wine products which purchased from local or surrounding cities’ manufacturers, and then sell those wine products to long-term mass customization wine sales enterprises, supermarkets, hotels and other terminal distribution channels. Wine making and fruit growing are subject to a variety of agricultural risks. Various diseases and pests and extreme weather conditions can materially and adversely affect the quality and quantity of fruits available to the manufacturers, thereby materially adversely affecting the quality and supply of the Company’s proposed wines and consequently, its business, financial condition and results of operations. Future government restrictions regarding the use of certain materials used in the fruit growing and wine manufacturing may have a material adverse effect on costs and productions.

The fruit growing requires adequate water supplies. A substantial loss of fruits or growing fruits caused by inadequate water suppliers would have a material adverse effect on the Company’s proposed business, financial condition and results of operations.

Dependence on Distribution Network

Our wine products are sold to long-term mass customization wine sales enterprises, supermarkets, hotels and other terminal distribution channels. The poor performance of the Company’s major distributors or the Company’s inability to collect amounts receivable from its major distributors could have a material adverse effect on the Company’s proposed business, financial condition and results of operations.

Capital Requirements and Leverage