Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CARBO CERAMICS INC | d698578d8k.htm |

....provides

industry leading technology for Production Enhancement and Environmental Services

Howard Weil 42

nd

Annual Energy Conference

New Orleans, Louisiana

March 25, 2014

Exhibit 99.1 |

The Private

Securities Litigation Reform Act of 1995 provides a "safe harbor" for forward-looking

statements.

Any

written

or

oral

statements

made

by

the

Company

or

on

behalf

of

the

Company

in

conjunction

with this presentation may include forward-looking statements which reflect the Company's

current views with respect to future events and financial performance. These

forward-looking statements are subject to certain risks and uncertainties that

could cause actual results to differ materially from such statements. This document

contains forward-looking statements within the meaning of the Private Securities Litigation Reform

Act of 1995 concerning, among other things, the Company's prospects, developments and business

strategies for its operations, all of which are subject to certain risks, uncertainties

and assumptions. These risks and uncertainties include, but are not limited to, changes

in overall economic conditions, changes in the cost of raw materials and natural gas

used in manufacturing our products, changes in demand and prices charged for our

products, changes in the demand for, or price of, oil and natural gas, risks of increased competition,

technological, manufacturing, distribution and product development risks, loss of key

customers, changes in government regulations, foreign and domestic political and

legislative risks, the risks of war and international and

domestic

terrorism,

risks

associated

with

foreign

operations

and

foreign

currency

exchange

rates

and

controls,

weather-related

risks

and

other

risks

and

uncertainties

described

in

our

publicly

available

filings

with

the

Securities

and

Exchange

Commission.

The

words

"believe,”

"expect,”

"anticipate,”

"project"

and

similar

expressions identify forward-looking statements.

Participants are cautioned not to place undue reliance on these forward-looking

statements, each of which speaks

only

as

of

the

date

the

statement

was

made.

The

Company

undertakes

no

obligation

to

publicly

update

or

revise

any

forward-looking

statements,

whether

as

a

result

of

new

information,

future

events

or

otherwise,

except as required by law.

Forward Looking Statements |

Production

Enhancement Environmental Services

....provides industry leading technology for: |

“We increase

well Production and EUR through our Design, Build, and Optimize the Frac

workflow”

The value we create, is lower F&D costs and a higher

Recovery Factor

Well Cost $

Increased Production & EUR

Lower F&D ($/BOE)

=

TM |

•

Frac Conductivity &

Durability

•

Production Assurance

•

Production Intelligence

•

Flow Enhancement

•

Well Site Supervision

•

Frac Diagnostics & Optimization

•

Field Development Optimization

•

Reservoir & Formation Analysis

•

Frac Design

•

Economic Optimization

•

Reservoir Performance

•

Post Job Analysis

….a leading production enhancement company |

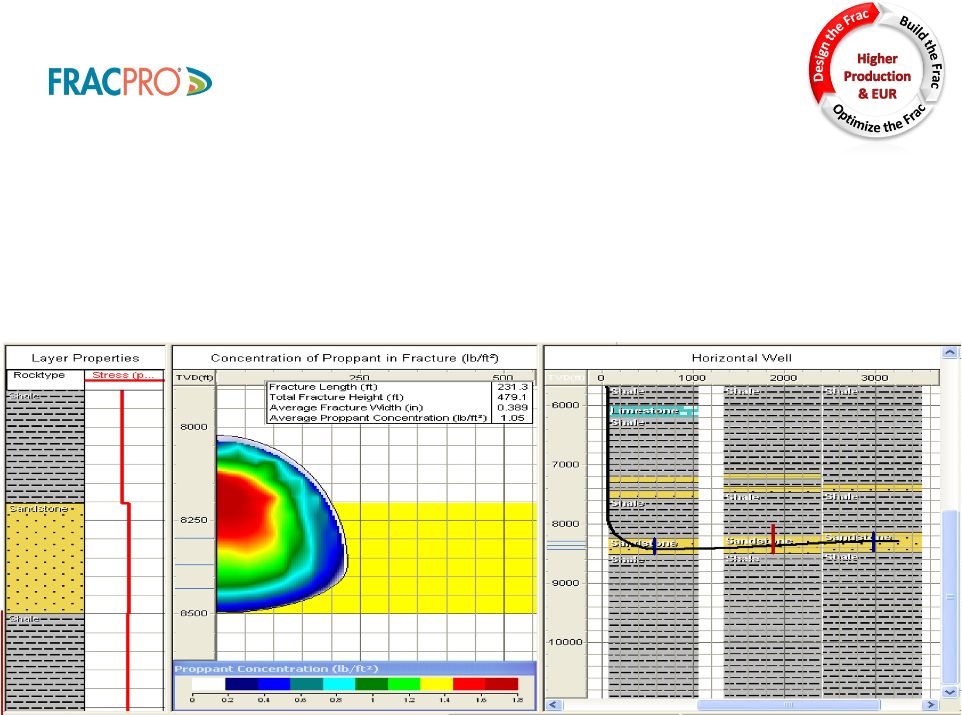

•

Is the industry’s most widely used hydraulic fracturing design software,

clients include E&P Operators, Service Companies, Universities

•

Provides Frac Design, Economic Optimization, Reservoir Performance and

Post

Job

Analysis.

Ties

all

the

information

together

during

the

frac

process. |

Reservoir

Reservoir

Fracture

Fracture

Design

Design

Production

Production

Completion

Completion

Best practices

Best practices

Execution

Execution

•

Experienced, industry experts working

in Unconventional Reservoirs

•

Provide technical consulting from

Well-site to Office to Full Field

Analysis

•

Integrating leading Technology to

increase well Production & EUR |

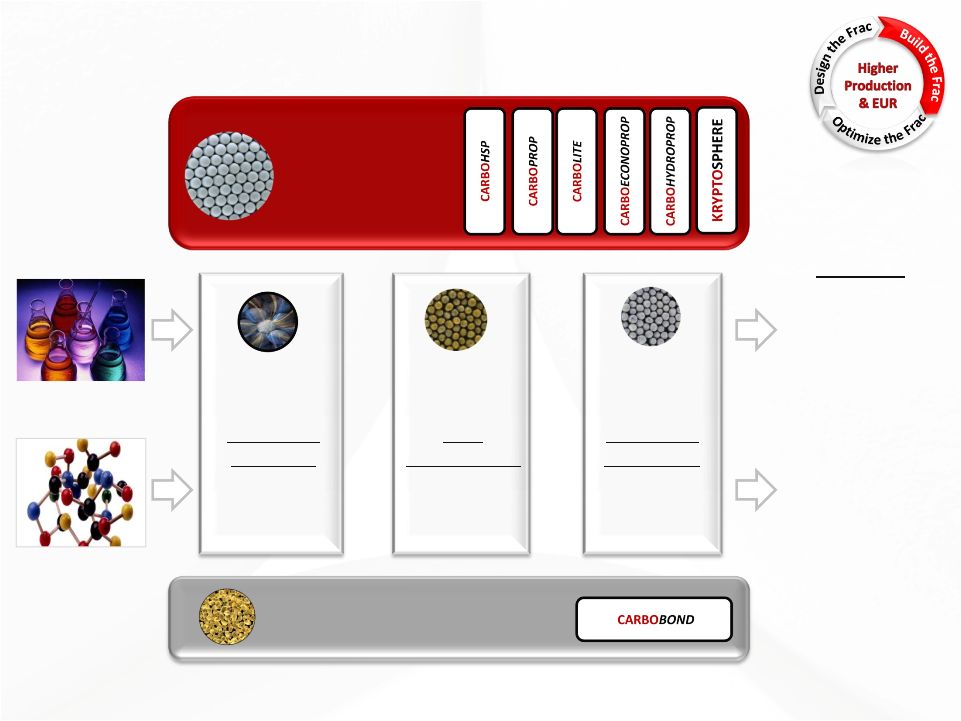

Proppant

Delivered Technology Platforms “More Space to Flow”

Higher

EUR

Production

IRR

Ceramics

Production

Assurance

Flow

Enhancement

Production

Intelligence

Proppant

Delivered

Proppant

Delivered

Proppant

Delivered

Resin Coated Products |

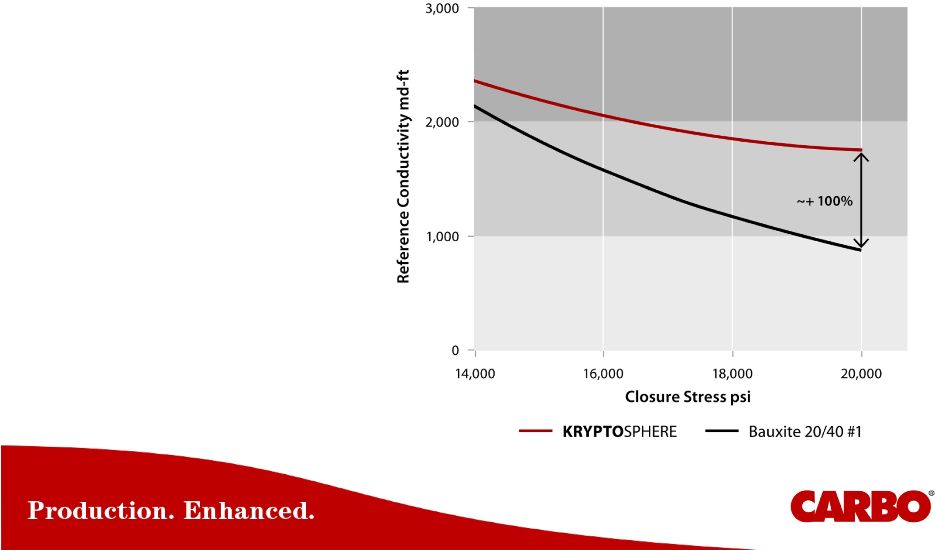

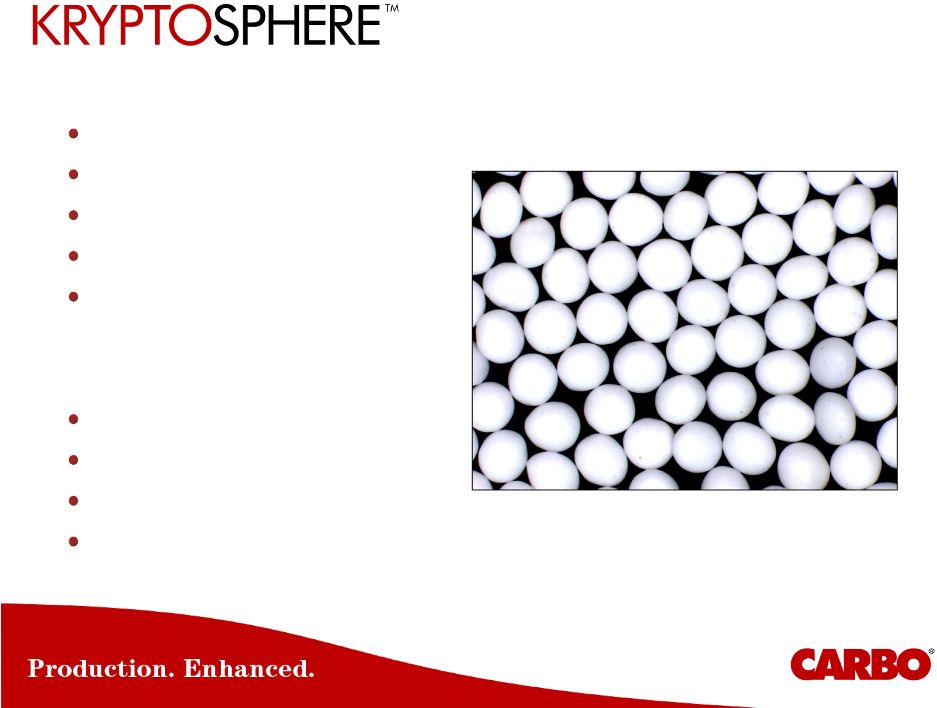

Ultra-conductive ultra-high strength

proppant technology

Developed for deep wells and

ultra-high stress formations |

More

conductivity 100% more baseline

conductivity |

Plant

produced proppant grains Precision-Engineered

More Space to Flow

More strength

More durability

More uniformity

More roundness

More smoothness

More flow space

More uniform flow paths

More long-term conductivity

More production, increased

EUR and superior IRR |

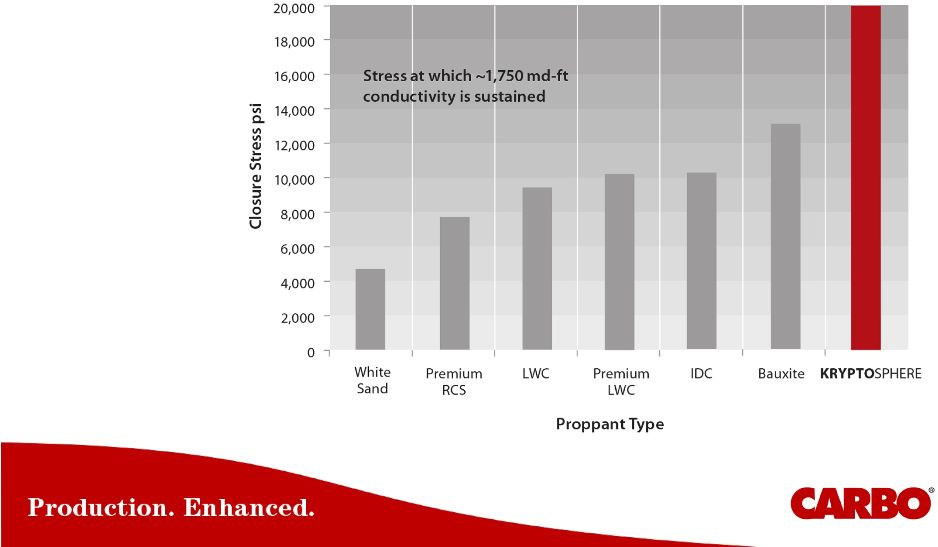

Highest

Conductivity Proppant in the Industry Outstanding

performance

under pressure |

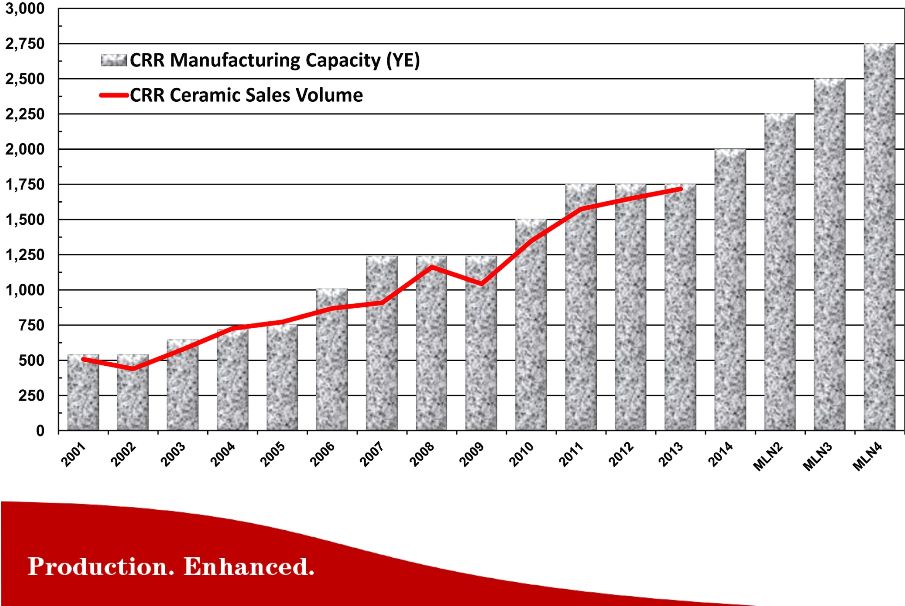

Lbs

(Millions) Millen Line 1 est completion near end of Q2-2014

Millen Line 2 est completion near end of H1-2015

Environmental permits obtained for all 4 Millen lines

Ceramic Proppant Sales vs Capacity |

“Proppant

is one of the biggest factors in determining Production and EUR in fracture

stimulated wells. It is important that E&P

Operators know what Proppant is being used

in their wells. Make sure you are getting the

Conductivity and Quality you are paying for.”

Proppant Conductivity and Quality in the industry |

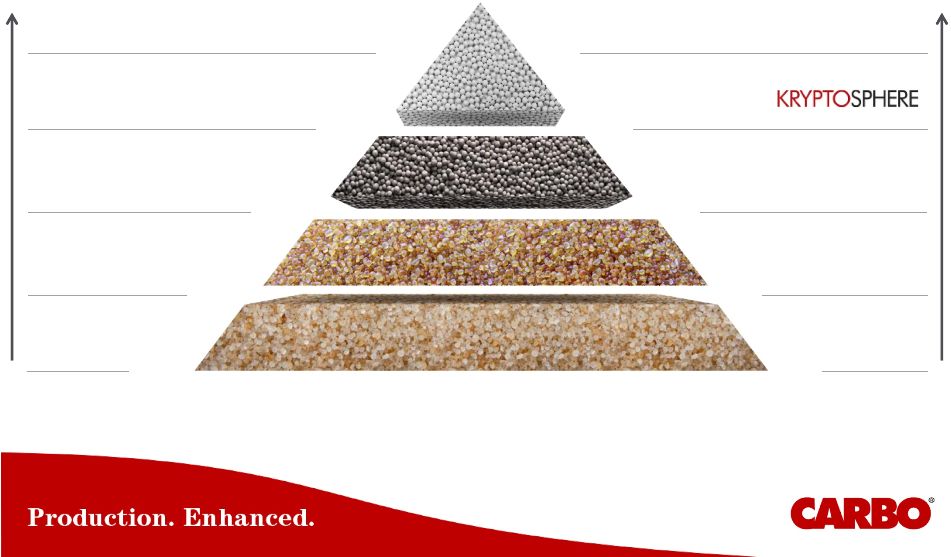

15

Hierarchy of Proppant Conductivity

Highest Conductivity

Highest Production, EUR, ROI

Ceramic -

Engineered product

Ultra-high strength

Mono-size and spherical

High strength

Uniform size and shape

Thermal resistant

Medium strength

Irregular size and shape

Low strength

Irregular size and shape

Sand -

Naturally occurring product

Conductivity

=

Permeability

of

the

frac

x

width

of

the

frac

=

K

x

W

Ultra-conductive Ceramic

Tier 1 –

High conductivity

Ceramic

Tier 2 –

Medium conductivity

Resin-coated Sand

Tier 3 –

Low conductivity

Sand

Chart prepared by and

property of CARBO

frac

frac |

The

Stakeholders -

E&P Operators, Service Companies, Royalty

Owners, State Agencies…..

•

•

Industry Awareness of Low Quality Chinese Ceramics

………are becoming more aware of the losses to well

Production and EUR that can occur when using low quality,

low

conductivity

Chinese

ceramic

proppants,

or

other

low

quality proppants, and the subsequent loss of revenue

………are becoming more aware of the need to test Proppant

and know what they are paying for. CARBO is committed to

quality and testing –

everyday. |

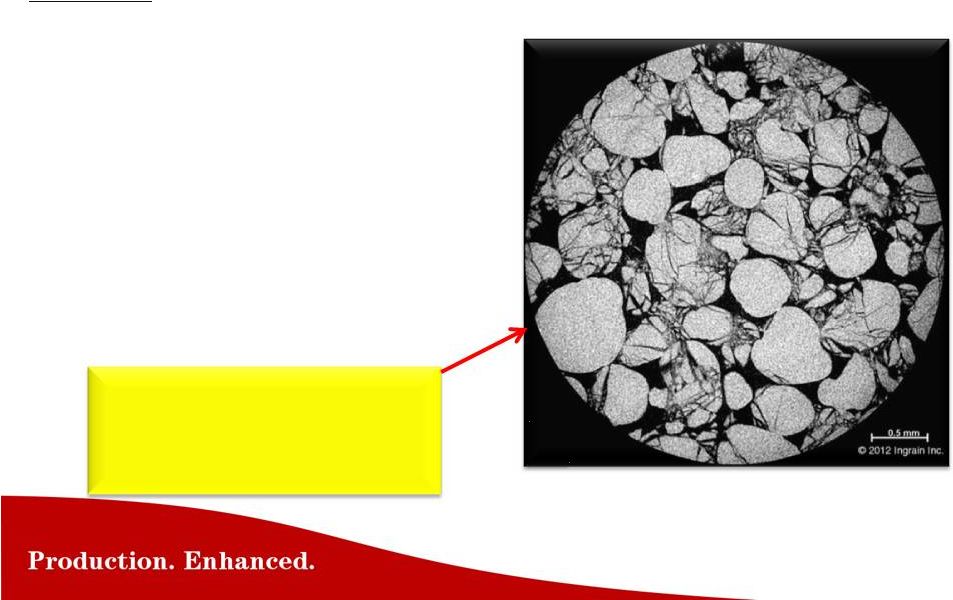

Proppant

Quality Matters in Well Production As

an

E&P

Operator

investing

$4M

–

$12M

on

a

well,

how

much

Production

&

EUR

are

you

sacrificing

by

using

low

quality

Chinese

ceramic

proppant?

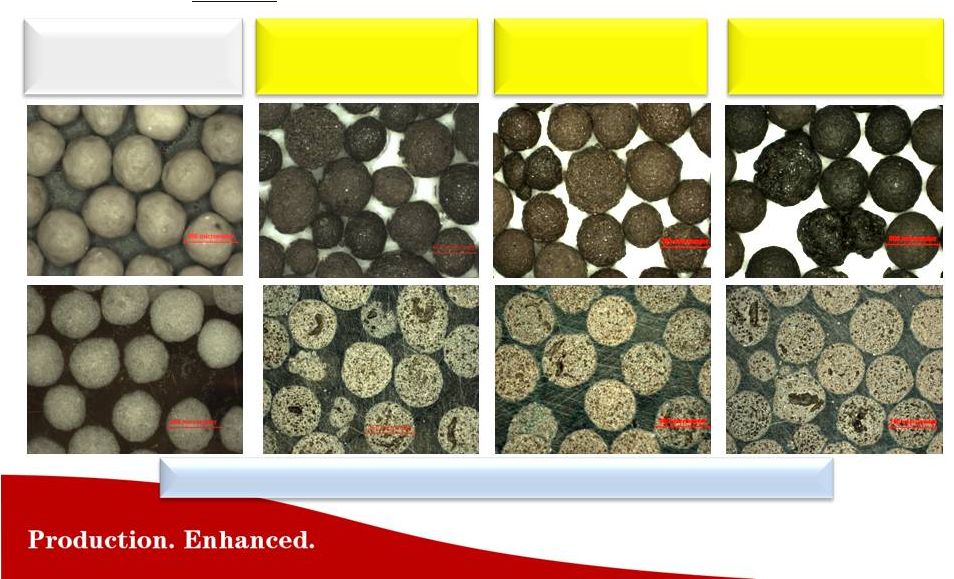

Chinese 20/40

IDC # 1C

Chinese 20/40

IDC # 2C

Chinese 20/40

IDC # 3C

Field Samples #1, #2, #3 taken in North Dakota from 3 Chinese Suppliers

Bottom Row Represents Whole Pellet Cross Sections

Production & EUR Loss

due to Poor Quality:

•

Irregular Size &

Shape reducing

flowrates

•

Rough Surface

reducing flowrates

•

High Internal Porosity

leads to Low

Strength & Crushing

as Closure Stress

Increases

•

All lead to Reduced

Frac Conductivity |

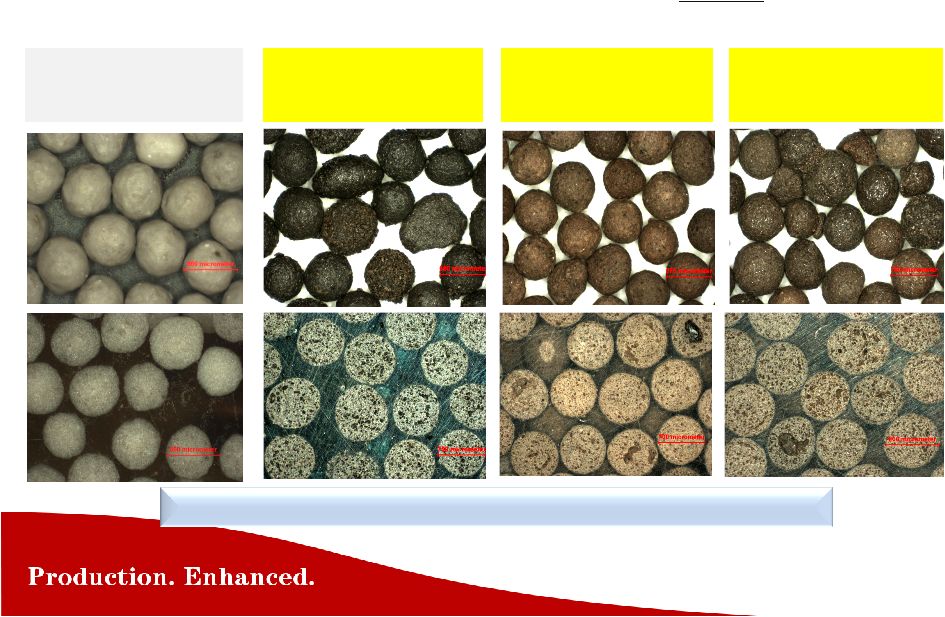

CARBO vs Low

Quality Chinese Ceramic Chinese 20/40

IDC # 1C

CARBOLITE

20/40

Chinese 20/40

IDC # 2C

Chinese 20/40

IDC # 3C

Bottom Row Represents Whole Pellet Cross Sections

Field Samples #1, #2, #3 taken in North Dakota from 3 Chinese Suppliers

Comparison of three field samples from North Dakota from low quality, low

Conductivity

Chinese

ceramic

proppant

suppliers,

compared

to

CARBOLITE

: |

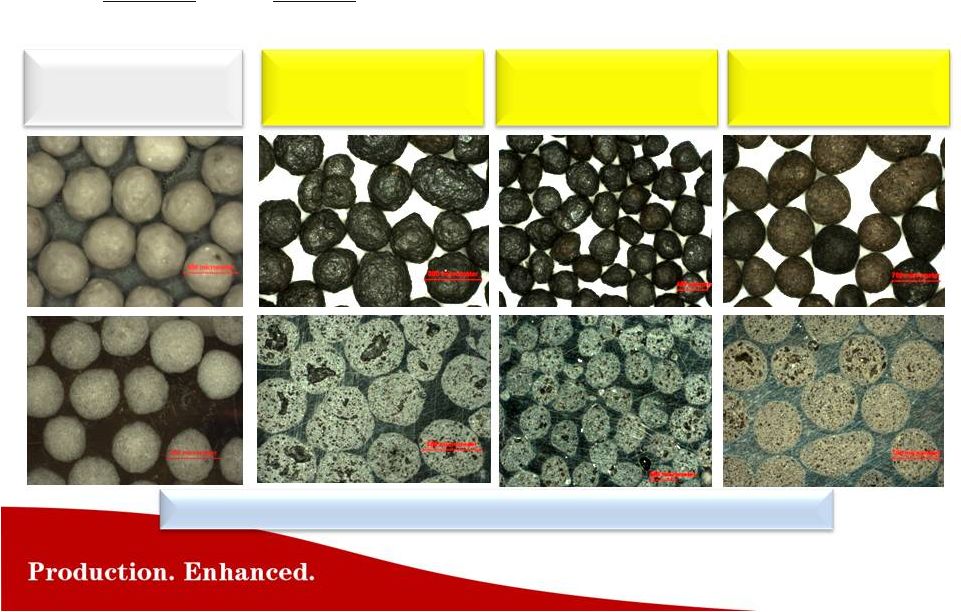

CARBO vs Low

Quality Chinese Ceramic Chinese 20/40

IDC # 4C

CARBOLITE

20/40

Chinese 20/40

IDC # 5C

Chinese 20/40

IDC # 6C

Three

more

field

samples

of

low

quality,

low

Conductivity

Chinese

ceramic

proppant

suppliers,

compared

to

CARBOLITE

:

Bottom Row Represents Whole Pellet Cross Sections

Field Samples #4, #5, #6 taken in North Dakota from 3 more Chinese Suppliers

|

CARBO vs

Brazilian & Russian Ceramic Brazilian 20/40

LDC # B1

CARBOLITE

20/40

Two Brazilian

& one Russian

field samples of low quality, low Conductivity

lightweight

ceramic

proppant

suppliers,

compared

to

CARBOLITE

:

Bottom Row Represents Whole Pellet Cross Sections

Field Samples #B1 taken in South Texas;

#B2, #R1 taken in North Dakota

Brazilian 20/40

LDC # B2

Russian 20/40

LDC # R1 |

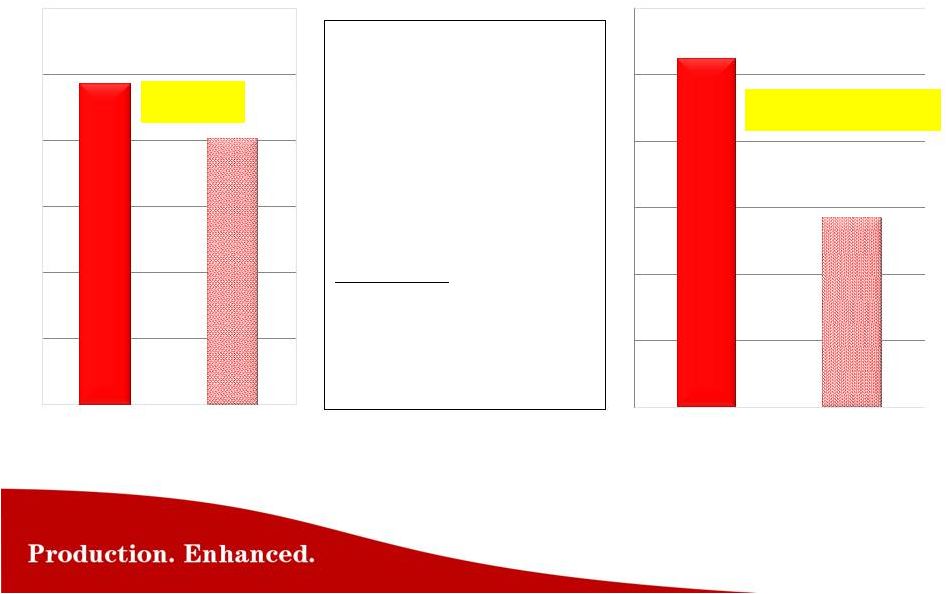

21

+20%

Bakken Operator

CARBO

vs Chinese

+120,000 bbl

30 Day Cum Oil

*EUR

*Operator projected EUR

6 wells with

CARBOECONOPROP low density

ceramic (LDC) 4 wells with Chinese

intermediate density

ceramic (IDC)

Frac Design

(per well)

~ 24 stages

~ 3 million lbs

Average

ECONOPROP

Average

Chinese

IDC

Average

ECONOPROP

Average

Chinese IDC |

Effects of

Pressure and Temperature on Sand

Northern White Sand 20/40

Sand Crushes into fine particles

Conductivity = only 215 md-ft

Conditions:

•

Loss of frac width

•

Particles plug flow channels

•

Leads to loss of Conductivity

•

9,000

psi,

250 F

•

Flowing 2% KCL for 30 days

•

Cross sections of Proppant pack shown

•

At 9,000 psi, the Sand experienced

severe crushing and the conductivity

was only 215 md-ft

x

y |

Effects of

Sand Crushing at Higher Pressure W

frac

Less W

frac

White Sand

@6,000 psi stress

White Sand

@12,000 psi stress

Crushing reduces frac width and the “Space to Flow”

….most wells are conductivity limited with Sand |

Ceramic vs Sand

- Realistic* Conductivity

(20/40 mesh) Bakken Stress

Range Eagle Ford Stress Range

*Reduced

Baseline

conductivity

by

60%

for

the

effects

of

non-darcy flow, multi-phase flow, gel damage, etc.

Md-ft

Md-ft

Closure Stress (psi)

Haynesville Stress Range

0

500

1,000

1,500

2,000

2,500

3,000

3,500

0

500

1,000

1,500

2,000

2,500

3,000

3,500

6,000

8,000

10,000

12,000

14,000

Ceramic -

CARBOLITE

Sand -

White |

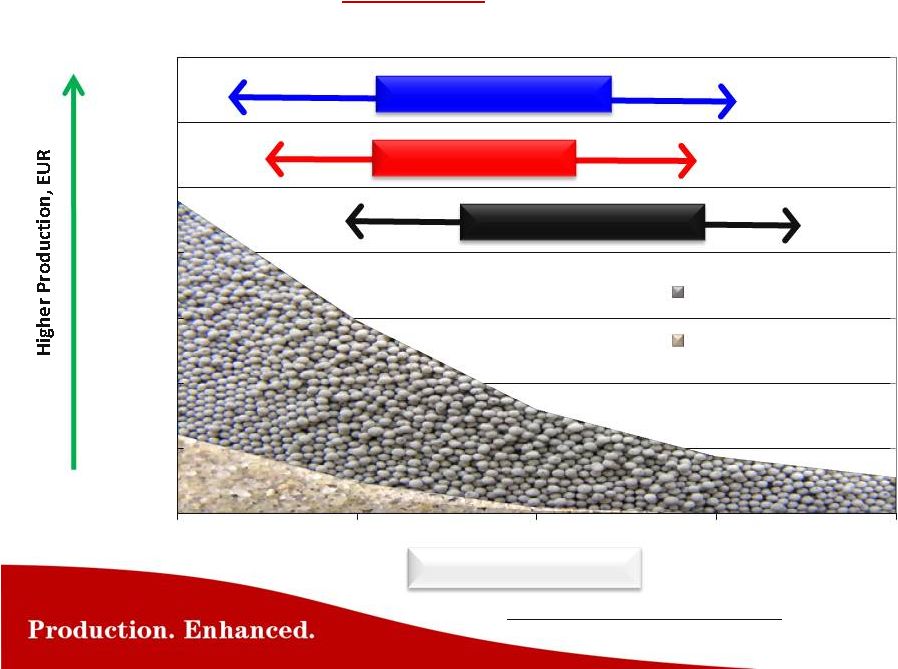

“Over 150

SPE papers have been written documenting the benefits of increased

conductivity on well Production and EUR.

Generally, the payout on the additional

Proppant

investment

is

less

than

2

-

6

months,

and increases Production and EUR in a range of

20% to 100%.”

Case Histories |

Ceramic

Success Grows Into Key Basins |

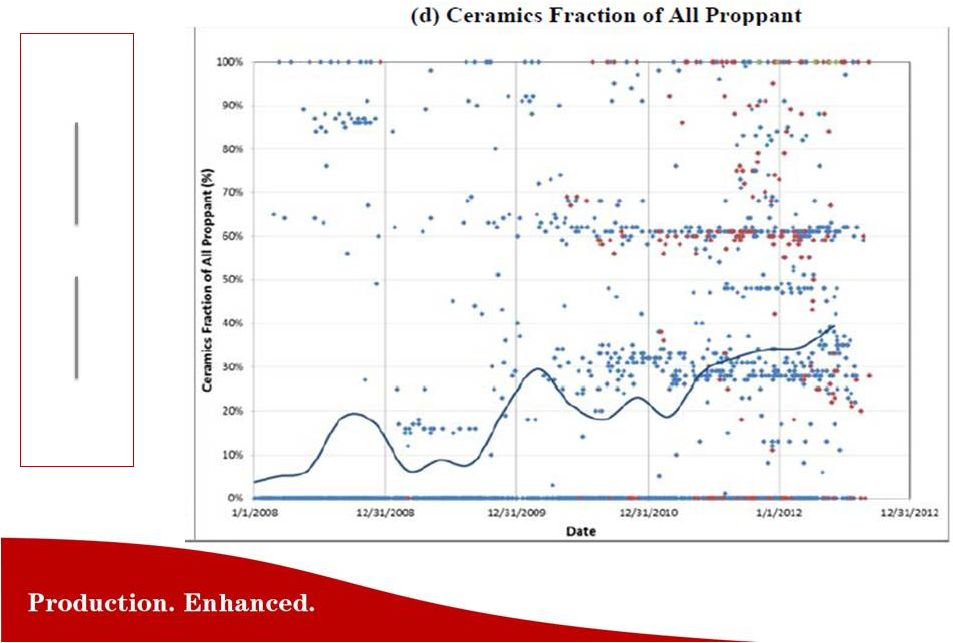

50,000’

view

1,000’

view

Ground view

Bakken

Ceramic

Proppant

Growth

Continues

SPE Paper 163827–

Liberty Resources |

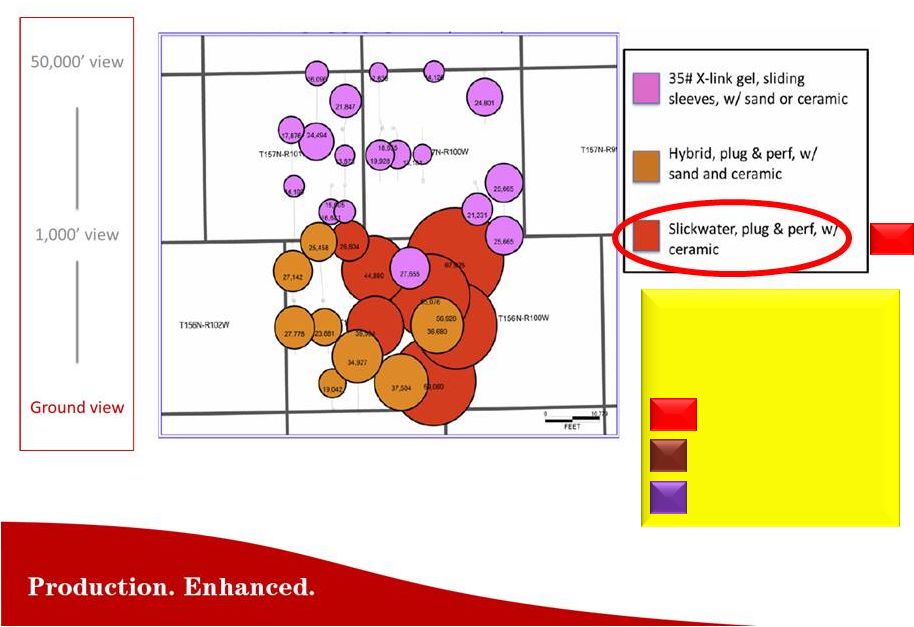

SPE

Paper

163827–

Liberty

Resources

Feb 2013 @ SPE Hydraulic Fracturing Conference by Dr M. Pearson

37 Wells from Williams County

90 Day Production Bubble-Plot

Liberty

Resources

wells

(RED)

49,100 BBLs

29,100 BBLs

19,100 BBls

LR

LR

Bakken ( Liberty Resources )

outperform

offset

wells |

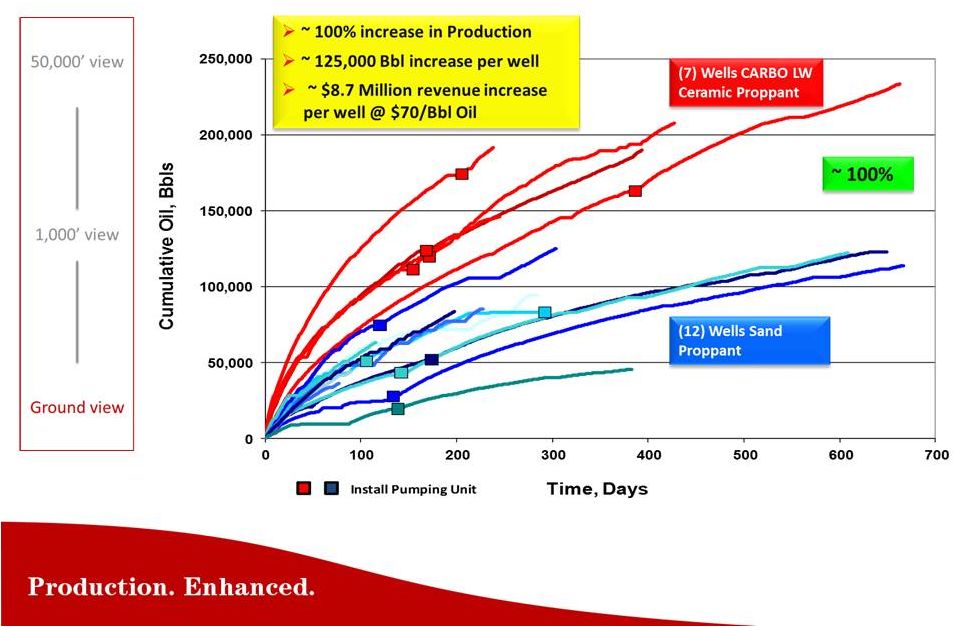

Bakken (

Statoil / Brigham Exploration ) SPE

Paper

134595

&

146376

–

Brigham

Exp/Statoil |

Ceramic

Success Grows Into Key Basins |

50,000’

view

1,000’

view

Ground view

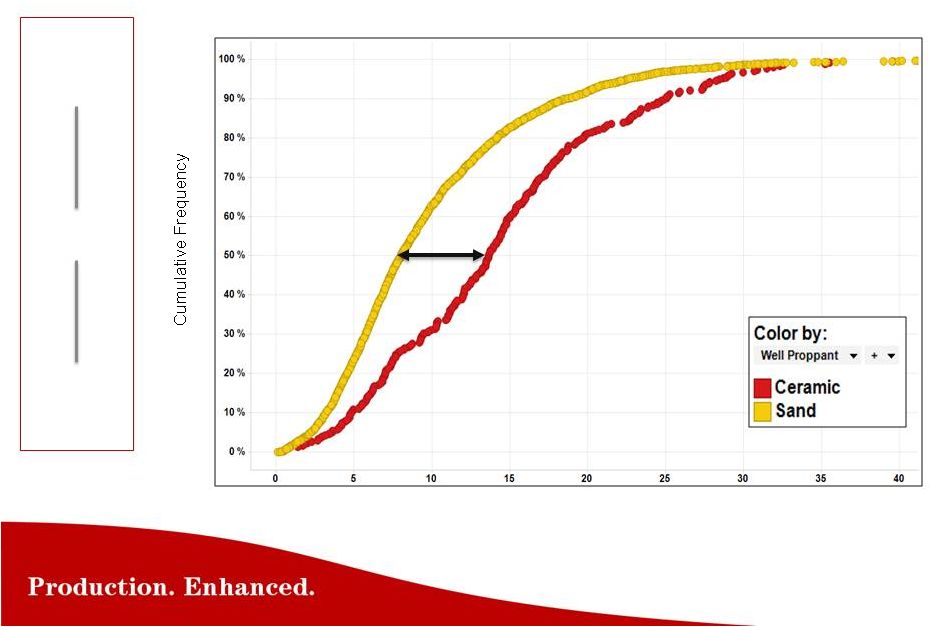

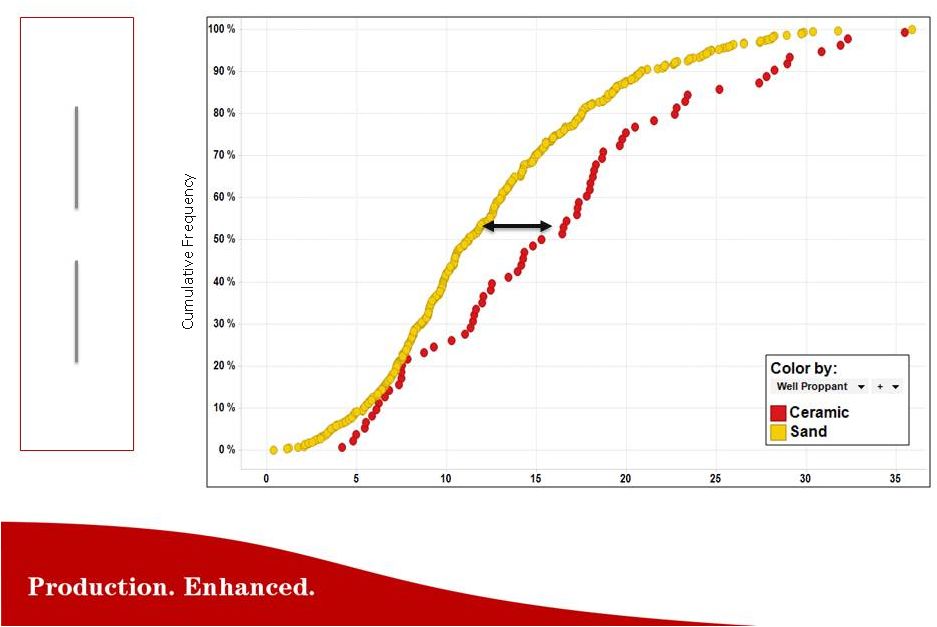

Eagle Ford (4,000 wells*)

* Public data : Unknown proppant type not included

in analysis: Ceramic proppant verified through

internal CARBO data

*NPI = Best 3 Months Production/Perforated Lateral Length = BOE/Ft

(BOE/Ft)

Ceramic completions offer a

20% -

60% improvement

Normalized Production Indicator* |

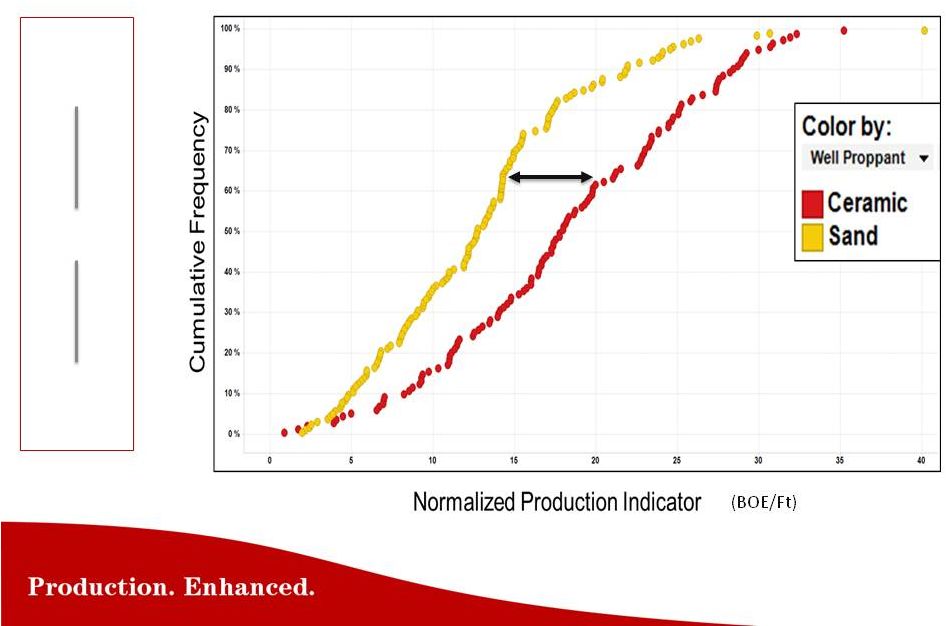

Karnes County

(600 wells*) 50,000’

view

1,000’

view

Ground view

* Public data : Unknown proppant type not

included in analysis: Ceramic proppant verified

through internal CARBO data

Normalized Production Indicator

*NPI = Best 3 Months Production/Perforated Lateral Length = BOE/Ft

(BOE/Ft)

Ceramic completions offer a

20% -

40% improvement |

Karnes County

Operator (300* wells) 50,000’

view

1,000’

view

Ground view

* Public data : Unknown proppant type not included

in analysis: Ceramic proppant verified through

internal CARBO data

*NPI = Best 3 Months Production/Perforated Lateral Length = BOE/Ft

(BOE/Ft)

Ceramic

completions offer

a 30% -

50%

improvement |

Ceramic

Success Grows Into Key Basins |

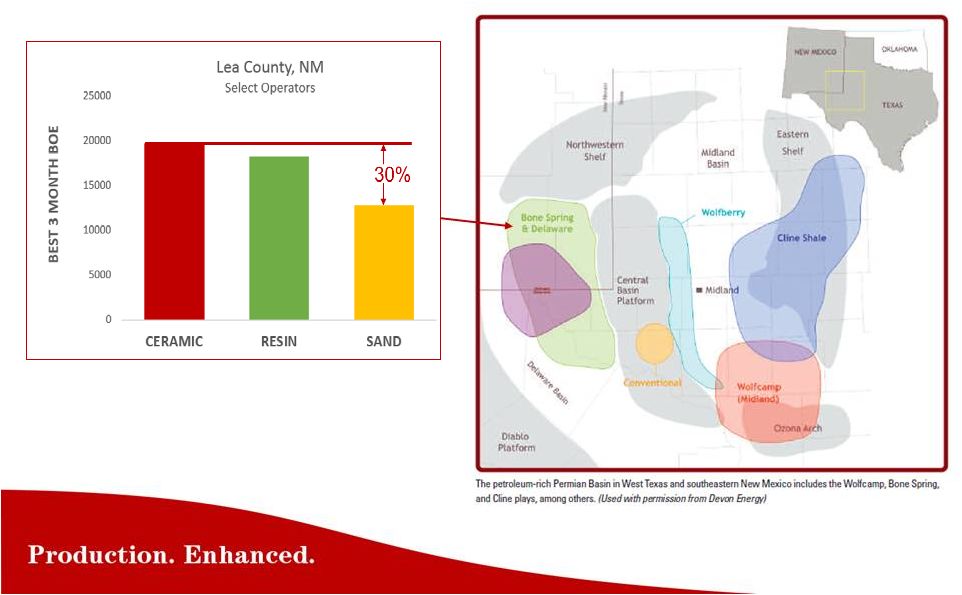

Permian Basin

Bone Spring * Public data : Unknown proppant type not included

in analysis: Ceramic proppant verified through

internal CARBO data |

Ceramic

Success Grows Into Key Basins |

How to

Increase the Recovery Factor •

In horizontal wells in resource plays, there are two critical factors

that determine the level of economic success

1.) Creating large reservoir contact area, through multiple, transverse frac stages

2.) Building

high

conductivity,

durable

fracs

with

a

“life-of-the-well”

flow

channel

•

The majority of fracs today are complex (non-planar), and

conductivity limited……….they need more conductivity

•

Total F&D costs could be reduced by drilling a smaller number of

effectively stimulated wells……….versus drilling more infill wells

on smaller spacing

Proved by well testing, limited effective drainage areas, refracs, lab testing of proppants,

infill drilling

High pressure losses within the frac caused by limited conductivity, constricts

Production |

Page

2-19 |

We take

customers from high risk containments Un-lined,

permeable dirt

berm

Tanks sitting on

pea gravel &

corroding

Un-lined tanks

corroding inside

& outside

High risk for spills

& higher LOE: |

To

industry-leading environmental protection Lined

containment,

impermeable

Tank bases

prevent

corrosion

Lined tanks,

prevents

corrosion

Minimize risk

for spills &

lower LOE:

More than 6,000 installations, with 100% environmental success |

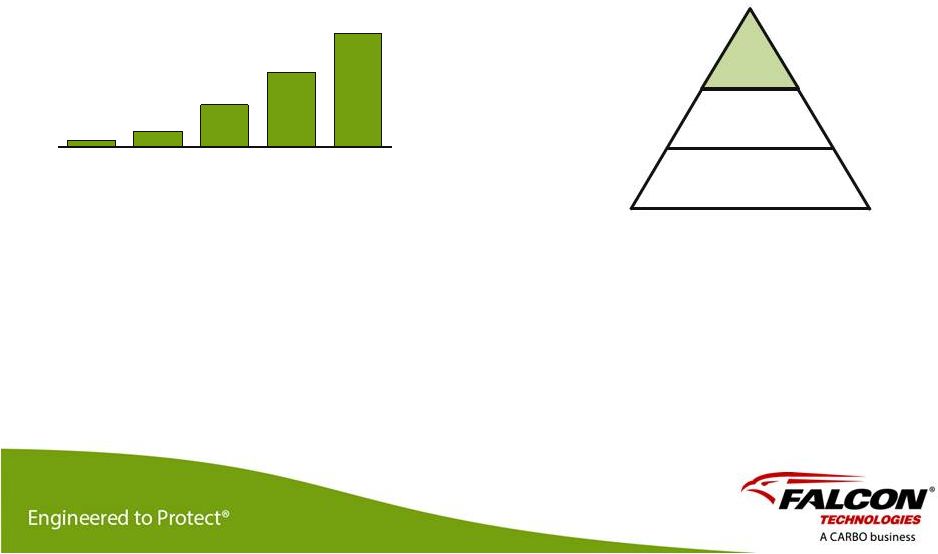

Client Base is

Growing & Market will Change Market Segments

Polymer

Coatings

HDPE

Liners

Dirt Berm

Client Growth, 2009-2013

2010

2012

2011

2009

2013

11

25

68

119

178

We believe the industry and the regulatory

bodies will continue to gain awareness of

the high environmental spill risks associated

with dirt berms and HDPE (plastic)

containments

•

Dirt Berms will likely continue to

be

“regulated”

out

We continue to push growth through:

•

Environmental Stewardship message

•

Business Risk Reduction message

•

Geographic Expansion

•

New Products

Falcon |

Finance

|

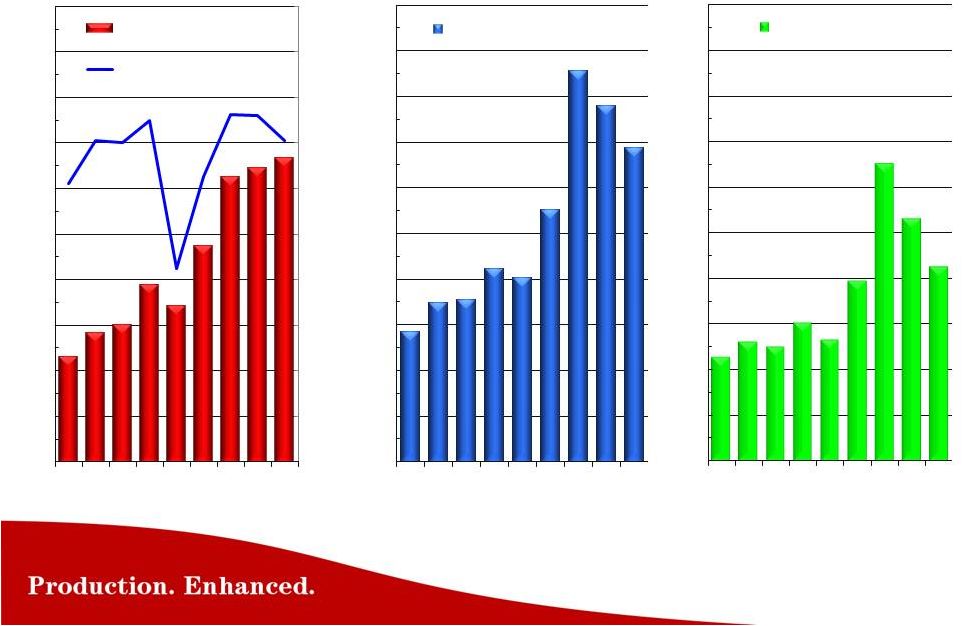

CARBO

Financials * Cash from operations is equal to net

income plus depreciation and

amortization and non-cash stock

compensation

231

284

300

388

342

473

626

646

667

0

300

600

900

1,200

1,500

1,800

2,100

2,400

2,700

3,000

$0

$100

$200

$300

$400

$500

$600

$700

$800

$900

$1,000

05

06

07

08

09

10

11

12

13

Revenue $M

NAM Total Rigcount

57

70

71

84

80

110

171

156

138

$0

$20

$40

$60

$80

$100

$120

$140

$160

$180

$200

05

06

07

08

09

10

11

12

13

Cash From Operations $M

45

52

50

60

53

79

130

106

85

$0

$20

$40

$60

$80

$100

$120

$140

$160

$180

$200

05

06

07

08

09

10

11

12

13

Net Income $M |

CARBO

Financials Cash Flow Per Share = Cash from operations

(= net income plus depreciation and

amortization and non-cash stock based

compensation)/diluted shares

1.88

2.14

2.02

2.46

2.27

3.40

5.62

4.59

3.67

$0.00

$1.00

$2.00

$3.00

$4.00

$5.00

$6.00

$7.00

$8.00

$9.00

05

06

07

08

09

10

11

12

13

Earnings Per Share

231

284

300

388

342

473

626

646

667

$0

$100

$200

$300

$400

$500

$600

$700

$800

$900

05

06

07

08

09

10

11

12

13

Revenue $M

2.33

2.88

2.91

3.57

3.47

4.80

7.43

6.80

6.02

$0.00

$1.00

$2.00

$3.00

$4.00

$5.00

$6.00

$7.00

$8.00

$9.00

05

06

07

08

09

10

11

12

13

Cash Flow Per Share |

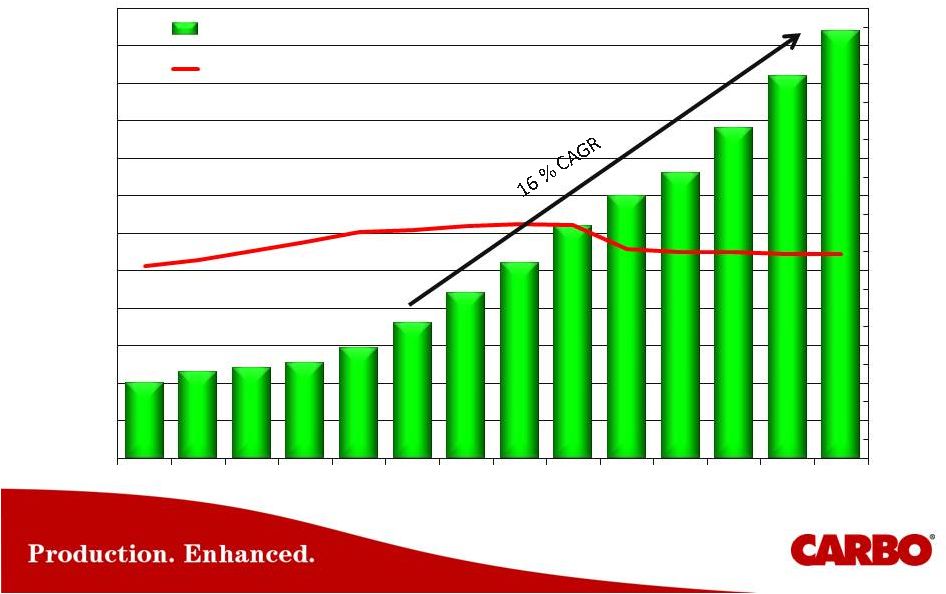

Dividends

Increased - 13 Years

$ Per Share

Shares -

Millions

$0.20

$0.23

$0.24

$0.25

$0.29

$0.36

$0.44

$0.52

$0.62

$0.70

$0.76

$0.88

$1.02

$1.14

12

14

16

18

20

22

24

26

28

30

32

34

36

$0.00

$0.10

$0.20

$0.30

$0.40

$0.50

$0.60

$0.70

$0.80

$0.90

$1.00

$1.10

$1.20

00

01

02

03

04

05

06

07

08

09

10

11

12

13

Dividend Amount Paid Per Share Per Year

Shares Outstanding |

Industry Factors

First Quarter of 2014

Activity quarter-to-date impacted by harsh weather conditions in the Bakken

and northern regions of NAM.

Railroads’

operational

issues

and

congestion

have

severely

impacted

the

distribution of Proppant

Fracturing well-site activity has been negatively impacted by the cold

weather

Anticipate ceramic proppant volumes will be somewhat below fourth

quarter 2013 ceramic proppant volumes

We remain positive on activity levels and our ceramic proppant demand for

Q2 and the balance of the year

Full Year 2014 |

Create value by

lowering E&P Operators F&D costs and increasing the Recovery Factor

Differentiate by continuing to develop industry leading technology

Grow our client’s knowledge of

CARBO

as the leading Production

Enhancement company focused on fracs, with technologies that make oil

& gas wells produce better and increase recovery (EUR)

Stress to E&P the investment benefits of making informed decisions on

Design-Build-Optimize

Fracs,

that

strikes

a

balance

of

EUR

with

AFE

Grow Falcon Technologies through product development to address

industry environmental needs, and geographical expansion.

Continue to grow cashflow and build an enduring Company

Summary |

....provides

industry leading technology for Production Enhancement and Environmental Services

Howard

Weil

42

nd

Annual

Energy

Conference

New Orleans, Louisiana

March 25, 2014 |

Cash Flow

from Operations Reconciliation $ in 000s

Results from Continuing Operations

2005

2006

2007

2008

2009

2010

2011

2012

2013

Net Income

45,463

$

52,245

$

49,641

$

60,405

$

52,810

$

78,716

$

130,136

$

105,933

$

84,886

$

Plus: depreciation and amortization

10,935

15,630

19,895

24,638

24,905

27,728

36,015

44,893

47,472

Plus: non-cash stock compensation

-

2,311

1,709

2,052

2,571

3,812

4,719

5,335

5,837

Cash Flow from Continuing Operations

56,398

$

70,186

$

71,245

$

87,095

$

80,286

$

110,256

$

170,870

$

156,161

$

138,195

$

Weighted Average Shares Oustanding

24,177

24,400

24,451

24,418

23,112

22,977

23,012

22,969

22,957

Cash Flow Per Share

2.33

$

2.88

$

2.91

$

3.57

$

3.47

$

4.80

$

7.43

$

6.80

$

6.02

$

For The Years Ended Dec 31

Cash from operations is equal to net income plus depreciation and amortization and non-cash

stock compensation |