Attached files

| file | filename |

|---|---|

| 8-K - 8-K - AXIALL CORP/DE/ | a14-8140_78k.htm |

Exhibit 99.1

|

|

Goldman Sachs Houston Chemical Intensity Day March 2014 |

|

|

Forward-Looking Statements This presentation contains certain statements relating to future events and our intentions, beliefs, expectations, and predictions for the future. Any such statements other than statements of historical fact are forward-looking statements within the meaning of the Securities Act of 1933 and the Securities Exchange Act of 1934. Words or phrases such as “anticipate,” “believe,” “plan,” “estimate,” “project,” “may,” “will,” “intend,” “target,” “expect,” “would” or “could” (including the negative variations thereof) or similar terminology used in connection with any discussion of future plans, actions or events generally identify forward-looking statements. These statements relate to, among other things: our outlook for future periods, supply and demand, pricing trends and market forces within the chemicals and building industries, cost reduction strategies and their results, integration plans and expected synergies and other statements of expectations concerning matters that are not historical facts. These statements are based on the current expectations of our management. There are a number of risks and uncertainties that could cause our actual results to differ materially from the forward-looking statements included in this press release. These risks and uncertainties include, among other things: (i) a material adverse change, event or occurrence affecting Axiall or the newly acquired chemicals business; (ii) the ability of Axiall to successfully integrate the businesses of the chemicals business formerly owned by PPG with which Axiall has merged, which may result in the combined company not operating as effectively and efficiently as expected; (iii) the possibility that the merger and related transactions may involve other unexpected costs, liabilities or delays; (iv) the possibility that Axiall may not be able to consummate an arrangement for the design and construction of an ethane cracker on commercially reasonable terms, or at all; and (v) uncertainties regarding future prices, industry capacity levels and demand for Axiall’s products, raw materials and energy costs and availability, feedstock availability and prices, changes in governmental and environmental regulations, the adoption of new laws or regulations that may make it more difficult or expensive to operate Axiall’s businesses or manufacture its products, Axiall’s ability to generate sufficient cash flows from its business after the merger, future economic conditions in the specific industries to which its products are sold, and global economic conditions. In light of these risks, uncertainties, assumptions, and factors, the forward-looking events discussed in this presentation may not occur. Other unknown or unpredictable factors could also have a material adverse effect on Axiall’s actual future results, performance, or achievements. For a further discussion of these and other risks and uncertainties applicable to Axiall and its business, see Axiall’s Annual Report on Form 10-K for the fiscal year ended December 31, 2013, and subsequent filings with the SEC. As a result of the foregoing, readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this presentation. Axiall does not undertake, and expressly disclaims, any duty to update any forward-looking statement whether as a result of new information, future events, or changes in its expectations, except as required by law. |

|

|

Agenda Axiall Overview Global Chlor-alkali and Vinyls Summary |

|

|

Axiall Overview |

|

|

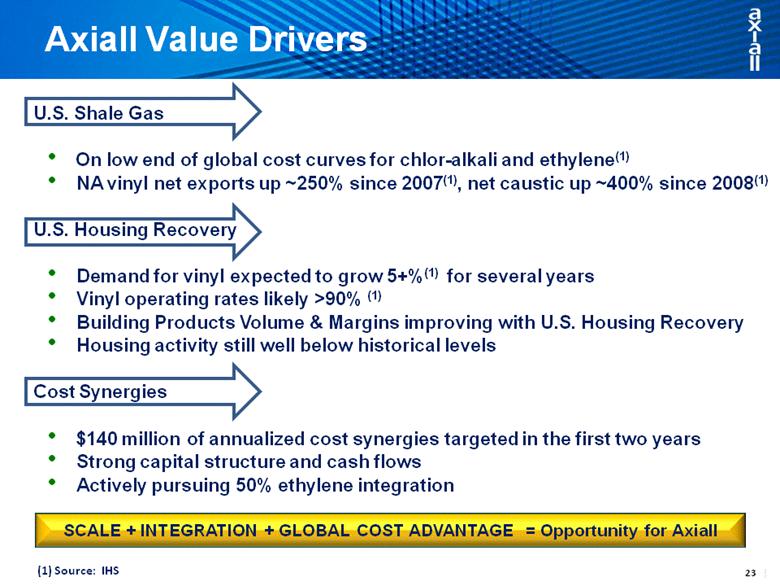

Axiall Value Drivers U.S. Shale Gas On low end of global cost curves for chlor-alkali and ethylene(1) NA vinyl net exports up ~250% since 2007(1), net caustic up ~400% since 2008(1) U.S. Housing Recovery Demand for vinyl expected to grow 5+%(1) for several years Vinyl operating rates likely >90% (1) Building Products Volume & Margins improving with U.S. Housing Recovery Housing activity still well below historical levels Cost Synergies $140 million of annualized cost synergies targeted in the first two years Strong capital structure and cash flows Actively pursuing 50% ethylene integration (1) Source: IHS SCALE + INTEGRATION + GLOBAL COST ADVANTAGE = Opportunity for Axiall |

|

|

Axiall 2013 Sales |

|

|

Building Products Sales Mix & Drivers Key Drivers: Canada - Single Family homes - Repair & Remodel U.S. - NE & Midwest Repair & Remodel - NE & Midwest Single Family homes - Minimal exposure to South & West End Use Mix Sales Geography Source: 2013 AXLL data |

|

|

Accessories Shutters Columns Siding Shakes Soffit Corner Post Shutters Corners Windows Railing Surrounds Decking Mouldings Fascia Building Products Portfolio Pipe & Fittings |

|

|

Chlorine Merchant Resin VCM Electricity Building Products Chlorovinyls – Building Products Integration Merchant Chlorine Merchant Caustic Salt Natural Gas Ethane Derivatives Compounds Caustic Chlor-alkali Ethylene Vinyl Resins Vinyl Compounds Cogen Facilities |

|

|

North American Competitors and Capacity ('000s short tons) ECU 1) VCM (intermediate) Resin (’000s short tons) (’000s short tons) Source: IHS 1) Electrochemical Unit (ECU) defined as 1 ton of chlorine and 1.1 tons of caustic |

|

|

Diverse Product Portfolio Creates Optionality Chlorine Downstream Vinyl Downstream 60% internally consumed by a broad mix of chlorine derivatives Downstream growth opportunities Gulf Coast logistics provide excellent access to export markets Housing recovery = Organic growth expected in Building Products VCM/Vinyl 45% Merchant Up to 40% Derivatives 15% Domestic Merchant 52% Export 15% Compound 16% Building Products 17% Source: Axiall |

|

|

New External Synergy Target: $140 MM Original Targets ~$40 ~$35 ~$115 Procurement & Logistics Operating Rate G&A Reduction ~$40 Total Cost to Achieve ~$55 Annualized Synergy Savings Run Rate $140 MM annualized run rate expected by year end 2014 New Targets ~$50 ~$35 ~$140 ~$55 ~$55 12 |

|

|

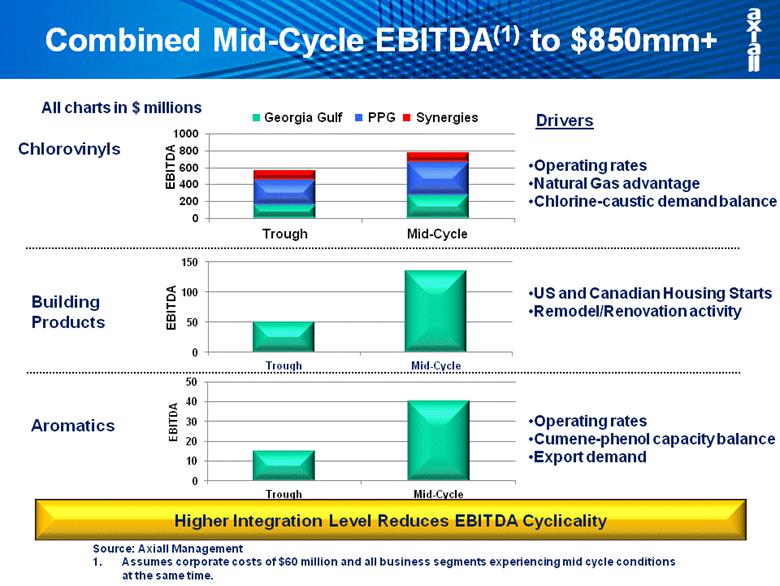

Combined Mid-Cycle EBITDA(1) to $850mm+ Higher Integration Level Reduces EBITDA Cyclicality Source: Axiall Management Assumes corporate costs of $60 million and all business segments experiencing mid cycle conditions at the same time. Chlorovinyls Building Products Aromatics Operating rates Natural Gas advantage Chlorine-caustic demand balance Operating rates Cumene-phenol capacity balance Export demand US and Canadian Housing Starts Remodel/Renovation activity Georgia Gulf PPG Synergies All charts in $ millions Drivers |

|

|

Global Chlor-alkali and Vinyls |

|

|

Global Chlor-alkali Capacity Growth Capacity growth in Northeast Asia slowing dramatically 2013-2018 capacity growth likely well below demand growth Western Europe expected to consolidate capacity, especially mercury Source: IHS |

|

|

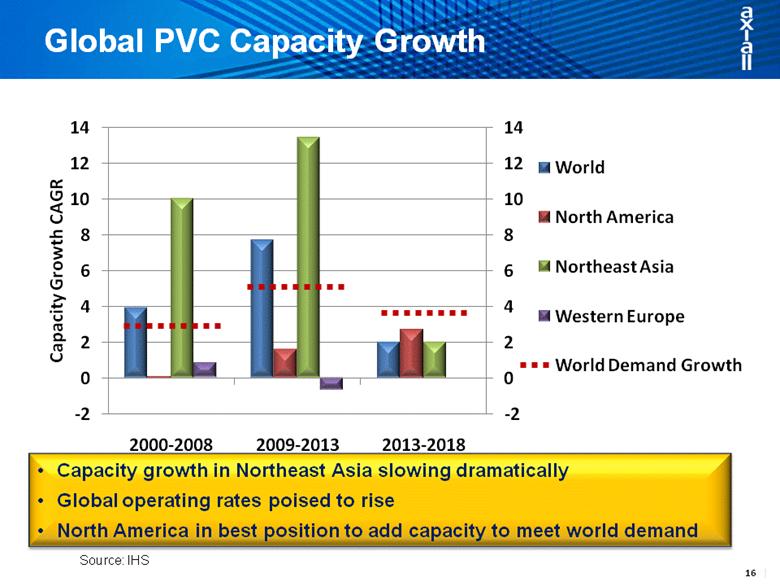

Global PVC Capacity Growth Capacity growth in Northeast Asia slowing dramatically Global operating rates poised to rise North America in best position to add capacity to meet world demand Source: IHS |

|

|

PVC consumption per capita - 2013 10 kg 10 kg 4 kg 1 kg 2 kg 11 kg Source: IHS 3 kg PVC consumption in export markets will grow as they develop water infrastructure |

|

|

Global Chlor-Alkali Manufacturing Costs Source: IHS, Axiall marketing, www.energy.eu, sunsirs.com % Global Capacity 17% 42% 12% 4% US Remains advantaged over other exporting regions |

|

|

North American Net ECU Capacity Additions Sources: Company announcements, PPG estimates 2013 Global Capacity: 89 million ECUs 2013 NA Capacity: 15 million ECUs WLK addition 2.3% of NA Capacity 0.4% Global Capacity Oxy- Limited Impact on supply/demand balance North American additions easily absorbed by global demand growth Source: IHS Sources: Company announcements, PPG estimates |

|

|

North American Chlorine Demand 2012 Demand: 12 million ECUs U.S. Housing Recovery Satisfied by Fewer Exports, not more Chlorine Source: IHS (CMAI), ACC, Axiall marketing |

|

|

U.S. Operating rates Sources: CDI, IHS Adjusted for Dow withdrawal Operating rates moving higher, led by VCM ECU |

|

|

Summary |

|

|

Axiall Value Drivers U.S. Shale Gas On low end of global cost curves for chlor-alkali and ethylene(1) NA vinyl net exports up ~250% since 2007(1), net caustic up ~400% since 2008(1) U.S. Housing Recovery Demand for vinyl expected to grow 5+%(1) for several years Vinyl operating rates likely >90% (1) Building Products Volume & Margins improving with U.S. Housing Recovery Housing activity still well below historical levels Cost Synergies $140 million of annualized cost synergies targeted in the first two years Strong capital structure and cash flows Actively pursuing 50% ethylene integration (1) Source: IHS SCALE + INTEGRATION + GLOBAL COST ADVANTAGE = Opportunity for Axiall |

|

|

Q&A |