Exhibit 99.2

Profile:

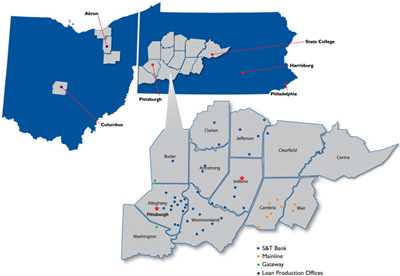

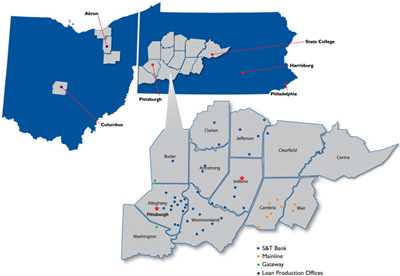

S&T Bancorp, Inc. is a $4.5 billion financial holding company headquartered in Indiana, PA, located about 55 miles northeast of Pittsburgh, PA.

Founded in 1902 with a single location in Indiana, PA, S&T Bancorp, Inc. has grown to 55 branch offices that provide a full range of financial services to

individuals and businesses in Allegheny, Armstrong, Blair, Butler, Cambria, Centre, Clarion, Clearfield, Indiana, Jefferson, Washington and Westmoreland counties. Additionally, S&T has loan production offices in northeast Ohio and central Ohio.

Strategy:

| |

• |

|

Disciplined mergers and acquisitions |

| |

• |

|

Selective Denovo and LPO |

Recent Mergers and Expansions:

March 3, 2014

S&T Bank hires 2 local

community bankers in State College, PA to service central Pennsylvania.

January 21, 2014

S&T Bank loan production office opens in Columbus, OH to service central Ohio.

August 27, 2012

S&T Bank loan production

office opens in Fairlawn, OH to service northeast Ohio.

August 13, 2012

S&T Bank acquired Gateway Bank of PA adding 2 offices in Cranberry Township and McMurray. Gateway had approximately $99

million in loans and $105 million in deposits.

March 9, 2012

S&T Bank acquired Mainline Bancorp adding 8 offices in Blair and Cambria County. Mainline Bancorp had approximately $130

million in loans and $206 million in deposits.

MEMBER FDIC

MEMBER FDIC

Key Statistics:

|

|

|

|

|

|

|

|

|

|

|

| (Data as of 12.31.13) |

|

|

|

|

|

(Data as of 12.31.13) |

|

|

|

|

| Total Assets (in $ millions) |

|

$ |

4,533 |

|

|

Stock Price |

|

$ |

25.31 |

|

| Common BV/Share |

|

$ |

19.21 |

|

|

Market Cap (in $ millions) |

|

$ |

753 |

|

| Tangible BV/Share |

|

$ |

13.17 |

|

|

Dividend Yield (annualized) |

|

|

2.53 |

% |

|

|

|

|

|

|

Price/Earnings (LTM) |

|

|

14.9 |

|

55 Branches in 12 Western Pennsylvania Counties & 2 Loan Production

Offices in Ohio

Total Annualized Shareholder Return

Includes reinvested dividends

(Data as of 12.31.13)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

1 YR |

|

|

3 YR |

|

|

5 YR |

|

|

10 YR |

|

| STBA |

|

|

44.12 |

% |

|

|

7.06 |

% |

|

|

-3.54 |

% |

|

|

1.71 |

% |

| NASDAQ Bank |

|

|

41.72 |

% |

|

|

14.58 |

% |

|

|

7.53 |

% |

|

|

1.34 |

% |

| KRX-Dow Jones KBW Regional Bank |

|

|

46.83 |

% |

|

|

16.37 |

% |

|

|

8.14 |

% |

|

|

NA |

|

| S&P 500 |

|

|

32.38 |

% |

|

|

16.14 |

% |

|

|

17.91 |

% |

|

|

7.39 |

% |

Source: Bloomberg

Senior Management:

Todd D. Brice

President and Chief Executive Officer

Mark Kochvar

Senior Executive Vice President,

Chief Financial Officer

David G. Antolik

Senior Executive Vice President,

Chief Lending Officer

David P. Ruddock

Senior Executive Vice President,

Chief Operating Officer

Investor Relations Contact:

Mark Kochvar

S&T Bancorp, Inc.,

800 Philadelphia Street

Indiana, PA 15701

724.465.4826

mark.kochvar@stbank.net

For more information visit stbancorp.com.

Common stock traded

on the NASDAQ under the symbol STBA

Analyst Coverage:

The following analysts published research about S&T Bancorp, Inc. in 2013.

Boenning & Scattergood

Matthew Schultheis •

610.832.5290

mschultheis@boenninginc.com

Guggenheim

Partners

Taylor Brodarick • 615.208.1222

taylor.brodarick@guggenheimpartners.com

Keefe,

Bruyette & Woods

Collyn Gilbert • 973.549.4092

collyn.gilbert@kbw.com

RBC Capital Markets

Jake Civiello • 617.725.2152

jake.civiello@rbccm.com

Sterne Agee

Matthew Breese • 207.699.5800

mbreese@sterneagee.com

Financial Highlights:

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

4Q13 |

|

|

3Q13 |

|

|

4Q12 |

|

| Net Income (in $ thousands) |

|

$ |

11,859 |

|

|

$ |

12,247 |

|

|

$ |

9,524 |

|

| Diluted Earnings per Share |

|

$ |

0.40 |

|

|

$ |

0.41 |

|

|

$ |

0.32 |

|

| Dividends Declared per Share |

|

$ |

0.16 |

|

|

$ |

0.15 |

|

|

$ |

0.15 |

|

|

|

|

|

| Total Assets (in $ millions) |

|

$ |

4,533 |

|

|

$ |

4,588 |

|

|

$ |

4,527 |

|

| Total Loans (in $ millions) |

|

$ |

3,568 |

|

|

$ |

3,515 |

|

|

$ |

3,369 |

|

| Total Deposits (in $ millions) |

|

$ |

3,672 |

|

|

$ |

3,694 |

|

|

$ |

3,638 |

|

|

|

|

|

| Return on Average Assets (annualized) |

|

|

1.03 |

% |

|

|

1.07 |

% |

|

|

0.86 |

% |

| Return on Average Equity (annualized) |

|

|

8.40 |

% |

|

|

8.86 |

% |

|

|

7.05 |

% |

| Net Interest Margin (FTE) |

|

|

3.52 |

% |

|

|

3.50 |

% |

|

|

3.51 |

% |

|

|

|

|

| Nonperforming Assets/Loans + OREO |

|

|

0.64 |

% |

|

|

1.05 |

% |

|

|

1.66 |

% |

| Allowance for Loan Losses/Total Loans |

|

|

1.30 |

% |

|

|

1.37 |

% |

|

|

1.38 |

% |

| Net Loan Charge-offs (annualized) / Average Loans |

|

|

0.37 |

% |

|

|

0.18 |

% |

|

|

0.49 |

% |

|

|

|

|

| Risk-based Capital - Total |

|

|

14.36 |

% |

|

|

14.27 |

% |

|

|

15.39 |

% |

| Tangible Common Equity/Tangible Assets |

|

|

9.00 |

% |

|

|

8.52 |

% |

|

|

8.20 |

% |

Our Reputation Speaks for Itself...

| |

• |

|

Named to the prestigous Sandler O’Neill Sm-All Stars Class of 2013. |

S&T voted one of the best

employers for workers over 50 years old.

S&T honored twice with

the Pillars of the Community Award.

This document may contain “forward-looking statements” within the meaning of the

Private Securities Litigation Reform Act of 1995. Such statements involve risks and uncertainties that could cause actual results to differ materially from the results discussed in these statements. These risks are detailed in the company’s

latest form 10-Q and 10-K filed with the Securities and Exchange Commission.

This document also contains or references, certain non-GAAP financial

measures, such as net interest margin (FTE). Although S&T believes that these measures enhance investors’ understanding of S&T’s business and performance, these non-GAAP financial measures should not be considered an alternative to

GAAP, and should be read in conjunction with the audited financial statements and analysis as presented in the Annual Report on Form 10-K as well as the unaudited financial statements and analyses as presented in the respective Quarterly Reports on

Forms 10-Q for S&T Bancorp, Inc. and subsidiaries.

MEMBER FDIC

MEMBER FDIC