Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Sorrento Therapeutics, Inc. | d656994d8k.htm |

March 2014

Next-Generation

Cancer Therapeutics

Sorrento Therapeutics

Exhibit 99.1 |

| 2

This presentation contains "forward-looking statements" as that term is

defined under the Private Securities Litigation Reform Act of 1995 (PSLRA),

including statements regarding expectations, beliefs or intentions regarding

our business, technologies and products strategies or prospects. Actual

results may differ from those projected due to a number of risks and

uncertainties, including, but not limited to, the possibility that some or all of

the pending matters and transactions being considered by the Company may not

proceed as contemplated, and by

all other matters specified in Company's filings with the Securities and Exchange

Commission, as well as risks inherent in funding, developing and obtaining

regulatory approvals of new, commercially-viable and competitive

products and product candidates. Sufficiency of the data for approval with

respect to Cynviloq™ will be a review issue after NDA filing.

These statements are made based upon current expectations that are subject

to risk and uncertainty and information available to the Company as of the

date of this presentation. The Company does not undertake to update

forward-looking statements in this presentation to reflect actual

results, changes in assumptions or changes in other factors affecting such

forward-looking information. Assumptions and other information that

could cause results to differ from those set forth in the

forward-looking information can be found in the Company's filings with the

Securities and Exchange Commission, including its most recent periodic report. We

intend that all forward-looking statements be subject to the

safe-harbor provisions of the PSLRA. Safe Harbor Statement

NASDAQ: SRNE |

Management Team

Board

of

Directors

William S. Marth -

Chairman

Albany Molecular

(President and CEO)

Teva –

Americas

(former President and CEO)

Mark Durand

Watson,

Teva

–

Americas

(former

CFO)

Cam Gallagher

Nerveda, LLC (Managing Director)

Kim D. Janda, Ph.D.

The Scripps Research Institute (Prof.)

Henry Ji, Ph.D.

Sorrento (CEO)

Daniel Levitt, M.D., Ph.D.

CytRx (EVP & CMO)

Jaisim Shah

PDL (former CBO)

Vuong Trieu, Ph.D.

Sorrento (CSO)

Richard Vincent

Sorrento (CFO)

Henry Ji, Ph.D.

President, CEO &

Director

Inventor

of

G-MAB

®

Technology

President & CEO of Stratagene Genomics

VP of CombiMatrix and Stratagene

Vuong

Trieu, Ph.D.

CSO & Director

Founder and CEO of IgDraSol

Co-inventor

of

IP

covering

Abraxane

®

Instrumental in the approval of Abraxane

Celgene acquired Abaxis Biosciences for > $3B

Amar

Singh

EVP & CBO

Closed major business transactions on oncology products

Led

Novacea

global

transaction

(Arsenal

®

)

with

Schering-

Plough valued at >$500M

Led major deals, including in-licensing of belinostat at

Spectrum Pharmaceuticals

Responsible for building Abraxis commercial organization

George Uy

CCO

CCO of IgDraSol

Directed

the

launches

of

Abraxane,

Xeloda

®

&

Fusilev

®

Built commercial infrastructures and organizations in startup

companies

David Miao, Ph.D.

CTO

President and CSO of Concortis BioSystems

Co-inventor of IP covering ADC technologies

Head of Chemistry at Ambrx

Richard Vincent

EVP, CFO & Director

$430M sale of Elevation to Sunovion-Dainippon

Meritage Pharma option agreement with ViroPharma ($90M

upfront + milestones)

$310M sale of Versus asthma program to AstraZeneca

Elan: various acquisitions and divestitures with aggregate

values more than $300M

3 |

Next-Generation Cancer Therapeutics

TUMOR

Cynviloq

Bioequivalence regulatory pathway

Efficacy demonstrated

US and EU rights

G-MAB

High-diversity human Ab library

Lead mAb programs include

PD-L1, PD-1, and CCR2

4

G-MAB targets toxin to cancer cell

Proprietary toxins and linkers

C-Lock and K-Lock conjugation chemistries |

5

Multiple Commercialization & Partnership Opportunities

* Abraxane orphan drug status (FDA approval, September 2013)

INDICATION > TARGET

Cynviloq

G-MAB

ADC

RTX

Oncology > PD-L1 Oncology/Inflammation >

CCR2, CXCR3 Oncology > VEGFR2, c-Met, CXCR5 Oncology > PD-1

Intractable Cancer Pain

INDICATION

Metastatic Breast Cancer

Non-Small Cell Lung Cancer

Bladder Cancer (sNDA)

Ovarian Cancer (sNDA)

505(b)(2) Bioequivalence

}

Pancreatic Cancer (BE* or sNDA)

PHASE 3

PHASE 2

PHASE 1

PRECLINICAL |

6

Lead Oncology Product Opportunity

Cynviloq

Registration

Trial |

Cynviloq: Next Generation Paclitaxel Therapy

Mean size

~25 nm

Cynviloq

paclitaxel

polymeric micelle

Chemical

polymer:

Poly-lactide and

polyethylene glycol

diblock copolymer

3

rd

>300

mg/m

(up

to

435

mg/m

2

)

Mean size

130 nm

Biological

polymer:

Donor-derived human

serum albumin (HSA)

2

nd

260

mg/m

Taxol

®

paclitaxel

Cremophor EL

excipient:

Polyoxyethylated

castor oil

Formulation

Generation

1

st

175

mg/m

Maximum

Tolerated Dose

Peak

Product Sales

~ $1.6B (WW in 2000)

Est. >$1.7B* (US)

($430M in 2012)

Conversion of

Abraxane sales +

new indications

*Analyst projection; in MBC + NSCLC + PC

7

2

2

2

Abraxane

nab-

paclitaxel |

| 8

Clinical Efficacy & Safety Summary

Total number of patients across all trials: 1,260

Phase 1:

>300 mg/m

2

(q3w) vs. 175 mg/m

2

(Taxol; weekly) and 275 mg/m

2

(Abraxane; q3w)

Phase 2:

Data suggestive of efficacy comparable to historic data for Abraxane and superior to

historic Taxol data or Standard-of-Care

Phase 3:

PM-Safety:

Phase 2b (IIS):

Phase 2 (IIS):

Possible Phase 3 sNDA programs in these tumor types

Ongoing trial for MBC in S. Korea (total n=209; Cynviloq n=105)

GPMBC301. An Open-label, Randomized, Parallel, Phase 3 Trial to Evaluate the

Efficacy and Safety of Cynviloq compared to Genexol

®

(Paclitaxel with Cremophor EL) in Subjects with Recurrent or Metastatic Breast

Cancer)

Interim analysis suggests ORR superior to Taxol and comparable to historic Abraxane

efficacy Efficacy and safety data supportive of 505(b)(2) BE submission

Completed for MBC and NSCLC (total n=502)

Efficacy and safety data supportive of 505(b)(2) BE submission

Chemo-naïve Stage IIIb/IV NSCLC vs Taxol in S. Korea (total n=276; Cynviloq

n=140) 230 mg/m

2

+ cis (q3w) vs. Taxol 175 mg/m

2

+ cis; non-inferiority established

1

st

line treatment of OC vs Taxol in S. Korea (total n=100; Cynviloq n=50)

260 mg/m

2

+ carbo (q3w) vs. Taxol 175 mg/m

2

+ carbo; non-inferiority established

Trials established higher MTD in US - Dana Farber Cancer Inst, Russia, & S. Korea

(total n=80)

Completed trials in MBC, NSCLC, PC, OC, BC; in US - Yale Cancer Center, Russia, S.

Korea (total n=259) |

9

IV bolus at 30 mg/kg; n = 3

Equivalent PK in Mice

Data on file

Cynviloq

Abraxane

Drug

HL (h)

T max (h)

AUCinf

(h*ng/mL)

Vz

(mL/kg)

Cl

(mL/h/kg)

Abraxane

2.99

0.08

61561.33

2103.71

487.32

Cynviloq

2.83

0.08

58151.31

2103.58

515.90 |

10

Abraxane data from: Nuhad K. Ibrahim, Phase I and Pharmacokinetic Study of

ABI-007, a Cremophor-free, Protein-stabilized, Nanoparticle Formulation of

Paclitaxel. Clinical Cancer Research 2002;8:1038-44

Data from 2 separate studies

(3

h

infusion,

135

mg/m

2

dose,

n=3)

Comparable PK in Humans |

11

Bioequivalence = Efficient Pathway to Market

BE registration study in breast cancer patients (2014)

-

Duration = 12 months (including patient recruitment)

-

Direct trial cost ~$5M

Abraxane

(n = 50)

Cynviloq

(n = 50)

Cynviloq

Abraxane

Cycle 1

Cycle 2

*

Based on FDA “Draft Guidance on Paclitaxel”

–

September 2012

Endpoints: AUC and

Cmax (90% CI)

Duration: 3 weeks +

crossover for 3 weeks

Infusion time: 30 min

Dose:

260

mg/m

2

Key Parameters*: |

Potential Cynviloq Advantages

Cynviloq

Abraxane

Taxol

Cynviloq

Advantage

Maximum Tolerated Dose

(mg/m

2

)

>300

260

175

Potential for

higher efficacy

Rapid reconstitution:

no foaming concerns

Convenience for busy

practices and pharmacies

No donor-derived human

serum albumin (HSA)

No viral / prion concerns

Convenient storage

conditions

No requirement for

controlled temp storage

No microbial growth

Chemical polymer

Cremophor-free

Reduced side effects

Dosing

q3w

q3w* &

weekly**

q3w & weekly

Exploits PK advantage

@ higher dose

* = MBC; ** = NSCLC & PC

12 |

13

Next Steps for Cynviloq

BE study initiation: 1Q 2014

NDA filing: 2015

Product launch (MBC and NSCLC): 2016

sNDA planning for label expansion into pancreatic, bladder, and

ovarian cancers

2016

2016

2014

2015

NDA

Filing

FDA

Approval

BE

Study

LAUNCH |

Clinical Stage Pain Management Asset

RTX

Intractable

Cancer

Pain

14 |

15

Two Injection Sites = Two Products for Human Use

Intrathecal

(injection into the

cerebrospinal fluid

space)

(injection into or

nerve the ganglion)

Intraganglionic |

RTX

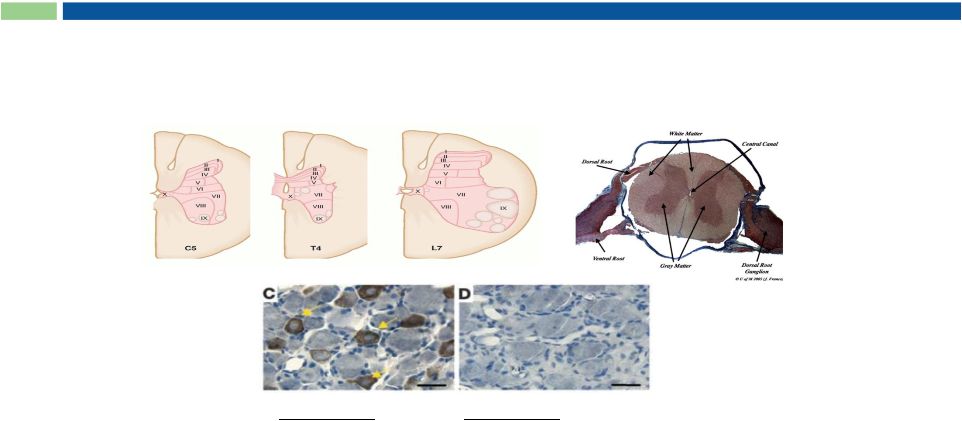

Ablates TRPV1-positive Neurons after Intrathecal Injection

TRPV1

TRPV1

TRPV1

Fore limb

TRPV1 positive

Hind limb

TRPV1 negative

Adapted from Karai et al. 2004

16 |

17

Brown et al, 2005

n=18

n=18

n=8

n=5

n=4

Weeks

(p < 0.0001 for all time points)

100% response rate with single

intrathecal injection

12 dogs reduced or discontinued

analgesics

Dogs passed away due to

underlying osteosarcoma,

not RTX treatment

Permanent analgesic effect

Personality intact

Gait and mood visibly improved

Lack of serious adverse events

No opioid-like side effects

Animal health market represents

separate licensing opportunity

Open-Label Study in Companion Dogs

Intractable pain due to osteosarcoma

0

10

20

30

40

50

60

0

2

6

10

14 |

18

Unilateral Effect Following Trigeminal Injection

Adapted from Tender et al. 2005

Left eye (blue) vs

Right eye (red)

Nociceptive neuron-

mediated neurogenic

inflammation (Evans blue) |

Next

Steps for RTX Development ~3 years for clinical

development

19

Filing for MUMS designation for osteosarcoma in dogs

Intractable cancer pain clinical Phase 1/2 trial (intrathecal injection);

n~40 patients Under Sorrento IND

Phase 1/2 trial for osteosarcoma (intraganglionic injection); n~15

patients Intractable cancer pain clinical Phase 1/2 trial (intrathecal

injection); n~13 patients Under NIH CRADA |

Immunotherapy Programs

G-MAB

& ADC

20

Antibodies

+

Proprietary

Toxins |

G-MAB: Library of Therapeutic Antibodies

High Value Oncology Targets:

Immune modulation:

PD1 and PD-L1

Antibody Drug Conjugates:

VEGFR2 and c-Met

Size of Target Antigen

Proprietary technology:

RNA amplification used for

library generation

Freedom-To-Operate

Very high library diversity:

2.1 x 10

16

distinct antibodies

Fully human antibodies

High successful screening hit rate

Difficult Targets:

Small Peptides

Most Difficult Targets:

G Protein-Coupled Receptors

(GPCRs)

21

No stacking royalties |

Competitor mAb

Sorrento mAb

Anti-PD-L1 mAbs Exhibit Potent Activity

Immune Modulation*

Tumor Mouse Model**

* mAbs @ 0.05 mg/mL

** xenograft model using H1975 human NSCLC cells; % inhibition relative to control

mAb treatment *** p<0.05, mean tumor volumes are significantly reduced in

STI-A1010 group versus control groups as determined by Mann-Whitney u-test

22

Day |

Days After Disease Induction

Sorrento mAb

Untreated

Potent Antibody against Difficult GPCR Target*

mAb

Cell Binding

(EC

50

–

nM)

Sorrento

0.17

Competitor

21

* Sorrento mAb against C-C Chemokine Receptor 2 (CCR2)

** Experimental Auto-immune Encephalomyelitis (EAE) = murine model of Multiple

Sclerosis 23 |

Antibody Drug Conjugates (ADCs)

24

Key Components:

Drug released in CANCER CELL

Target-specific internalizing

antibody

Potent cytotoxic prodrugs

Linker and conjugation

chemistries

1.

2.

3. |

Proprietary High Potency

Duostatin Toxins Duostatins vs. DM1

Duostatins vs. MMAE

Duostatin toxin 1 (K-lock)

>15x higher

potency

Duostatin toxin 2 (K-lock)

DM1 (conventional; NHS)

Duostatin toxin 1 (K-lock)

Duostatin toxin 2 (K-lock)

MMAE (conventional; maleimide)

SKBR3

(Breast Cancer Cell Line)

25 |

2

purified

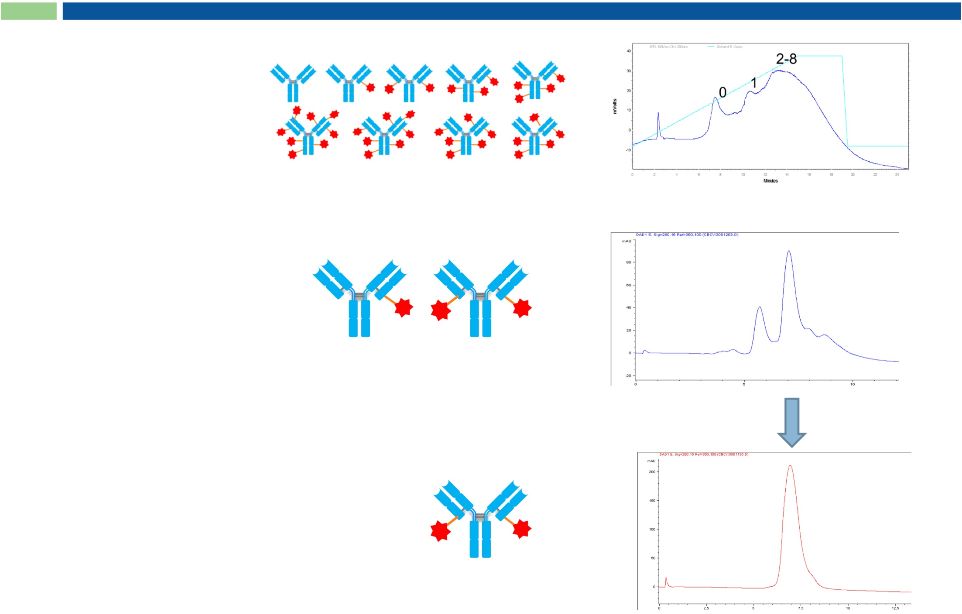

K-Lock Conjugation Enables Homogeneous ADCs

0

1

2

3

Current industry

standard chemistry

Proprietary

K-Lock chemistry

Sorrento’s homogenous ADC

No need for:

non-natural amino acids

genetic re-engineering

enzymatic posttranslational modification

26 |

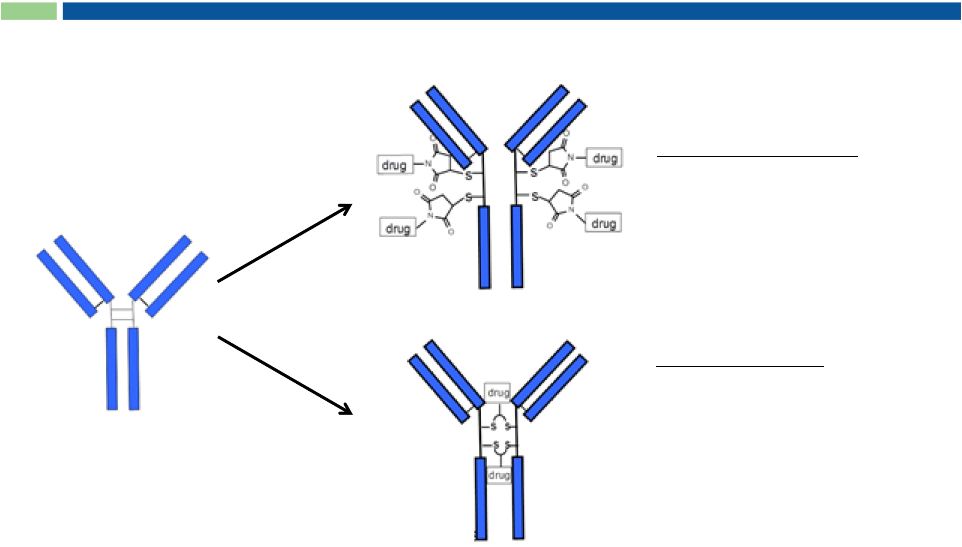

C-Lock Conjugation Stabilizes ADCs

C-lock conjugation

Enhances ADC stability

Prolongs PK profile

Reduced off-target effects

Current industry

standard

Maleimide conjugation

Destabilizes antibody structure

Reduced target specificity

Altered PK profile

Drug-antibody linkage not stable

Off-target drug effects

Sorrento’s

proprietary

C-Lock chemistry

27 |

Proprietary ADC Screening and Optimization Panels

Fast track to IND

Identification of optimal combination of linker, conjugation chemistry and drug

payload essential for efficient and expedited development

28

from target to candidates |

| 29

Investment Highlights

Intractable Cancer Pain Treatment

Ongoing Phase 1/2 study

Orphan drug status received

Three potential drug products from same API

Targeted Cancer Immunotherapeutics

First therapeutic antibody candidate in clinic 1H 2015

Proprietary

linker/conjugation chemistry for homogenous ADC generation

First ADC in clinic 2H 2015

Late-Stage Cancer Drug

Product launch expected in 1H 2016

Addresses multi-billion dollar paclitaxel market

Abbreviated regulatory pathway (“bioequivalence”) for approval

Cynviloq

RTX

G-MAB

& ADC |

30

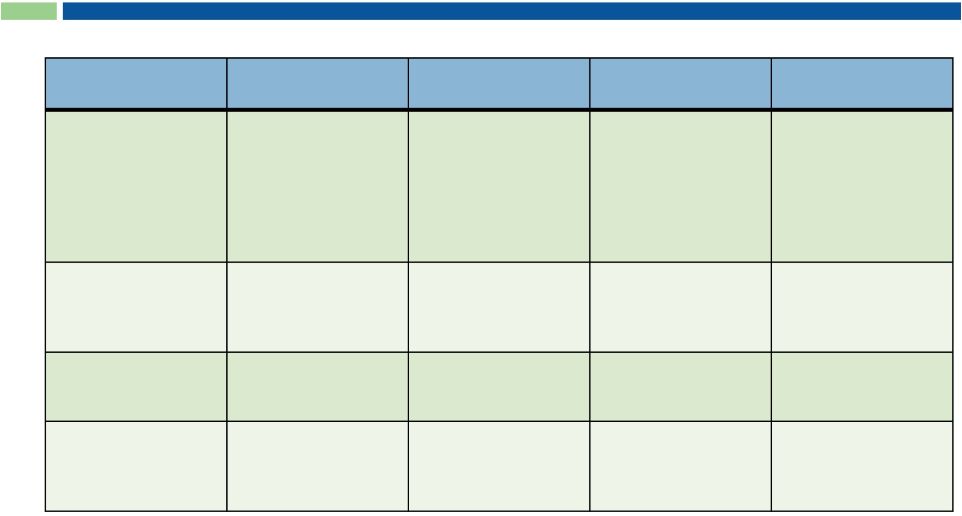

Company Comparables

Company

Small Molecule

Oncology Drug

Antibody

Platform

Targeted

Drug Delivery

Mkt Cap*

Puma:

Pre-revenue

MBC (Phase 3)

~$3.7B

Clovis:

Pre-revenue

NSCLC, MBC (Phase 1)

~$2.9B

MorphoSys:

Pre-revenue

Antibody

Library

~$2.5B

CAT:

Pre-revenue

Antibody

Library

~$1.4B

Domantis:

Pre-revenue

Antibody

Library

~$450M

Seattle Genetics:

Product sales + royalty

ADC

~$6.6B

ImmunoGen:

Royalty only

ADC

~$1.4B

Sorrento: SRNE

NSCLC, MBC

(Ph3/Registration Trial)

Antibody

Library

ADC

~$330M

* based on publicly-available information (03/18/14)

PBYI

CLVS

MOR.DE

Acquired (2006)

Acquired (2007)

SGEN

IMGN |

DEVELOPING THERAPEUTIC SOLUTIONS TO

HELP MAN'S LIFE COMPANIONS

31 |

VET

Indications for Resiniferatoxin/Vaccine Programs Ark-001

(Canine Osteosarcoma)

Ark-002

(Canine Osteoarthritis)

Ark-004

(Idiopathic Cystitis in cats)

Ark-006

(Horse Ocular Pain)

Ark-007

(Horse Laminitis)

Ark-005

(Mastitis in cows)

32 |

33

Disease-Specific Market Factors

Small Animals

*APPA 2012 and Canine Cancer.com

**Veterinary Medicine, Dec 1, 2012

Disease/Drug

Unmet Need

Competition

Prevalence

Level of

Differentiation

Ark-001 (Dogs)

Osteosarcoma/Pain

High

Opiates rare use

Amputation

Alternative

interventions

unsatisfactory

*83 M Pet dogs

1 in 3 have tumors

5% of all tumors=

Osteosarcoma

Approximately 1.35 M

Transformative

Ark-002 (Dogs)

Osteoarthritis/Pain

Moderate to High

NSAIDs

May result in hepatic

and GI toxicity

4 M dogs in active

NSAID treatment

Transformative

Intrathecal inj may

allow for coverage of

all joints

Ark-003 (Dogs)

Recurring

dermatitis/infections

Moderate to High

Antibiotics

Corticosteroids

**MRSA 1.5-2 % of

dogs in community

and Vet hospitals

Moderate to

significant

Ark-004 (Cats)

Interstitial Cystitis

High

Castration/Spaying

Anti-anxiety drugs

Pheromones

Unknown

TBD

May reduce bladder

hyperactivity |

34

Disease/Drug

Unmet Need

Competition

Prevalence

Level of

Differentiation

Ark-005 (Cows)

Mastitis

High

Antibiotics

Mastitis prevention

programs

Approximately 9.2M

cows and 1/3

infected with mastitis

annually

TBD:

Vaccine delivery may

offer high

differentiation

potential

Ark-006 (Horses)

Ocular Pain/Ocular

abrasions

High

Eye drops

Antibacterial

opthalmic ointments

Lidocaine

High

No reliable estimates

Moderate to High:

Desensitization of

nerves may facilitate

abrasion healing

Ark-007 (Horses)

Laminitis

Moderate to High

Pain Killers including

NSAIDs

Peripheral

vasodilators

*9.2 M horses in US

** 15% will suffer

from laminitis in

lifetime

Potentially high

based on limited

results to date

* Making sense of laminitis; Michelle Andersen, Feb 1

2013 ** US Horse Industry

Statistics- The equestrian channel 2013

Disease-Specific Market Factors

Large Animals |

Market Valuation of

Competitor Companies Products on

Market

Products in

development

Disease Area

Focus

Time to market

Market Valuation

ARATANA

(PETX)

None

>15

Pain

Appetite Stimulants

etc

Near Term

$513 M

KINDRED

(KIN)

None

10

Pain

Cancer

GI, Allergy

Inflammation

Autoimmune

Near Term

$405 M

ARK ANIMAL

THERAPEUTICS

None

>10

Pain

Osteoarthritis

Infections

Interstitial Cystitis

Mastitis

Ocular Pain

Laminitis

Near Term

IPO Mid year

35 |

Sorrento Therapeutics

Next-Generation

Cancer Therapeutics

Contact:

Henry Ji

President and CEO

hji@sorrentotherapeutics.com

(858) 668-6923 |