Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - OMNOVA SOLUTIONS INC | d695894d8k.htm |

March 2014

Exhibit 99

Investor Presentation |

-

2 -

Cautionary

Cautionary

Forward-Looking Statements

Non-GAAP Financial Measures

This presentation includes EBITDA, Adjusted EBITDA and Net Debt which are

non-GAAP financial measures as defined by the Securities and Exchange Commission.

For a reconciliation to the most directly comparable GAAP financial measures, refer

to the presentation Appendix. This presentation and the accompanying oral remarks include

descriptions of our current business, operations, assets and other matters affecting the Company as well as

“forward-looking statements,” as defined by federal securities laws. All

forward-looking statements by the Company, including verbal statements, in connection with this

presentation, are intended to qualify for the protections afforded forward-looking statements

under the Private Securities Litigation Reform Act of 1995. Forward-looking

statements reflect management’s current expectation, judgment, belief, assumption, estimate or

forecast about future events, circumstances or results and may address business conditions and

prospects, strategy, capital structure, debt and cash levels, sales, profits, earnings, markets, products, technology, operations, customers, raw

materials, claims and litigation, financial condition, and accounting policies among other

matters. Words such as, but not limited to, “will,” “may,” “should,” “projects,”

“forecasts,” “seeks,” “believes,” “expects,”

“anticipates,” “estimates,” “intends,” “plans,” “targets,” “optimistic,” “likely,” “would,” “could” and similar expressions or phrases

identify forward-looking statements. All descriptions of our

business, operations and assets, as well as all forward-looking statements involve risks and uncertainties. Many risks and uncertainties are inherent in

business generally and the markets in which the Company operates or proposes to operate. Other

risks and uncertainties are more specific to the Company’s businesses including businesses

the Company acquires. There may be risks and uncertainties not currently known to us. The occurrence of risks and uncertainties and the impact of

such occurrences is often not predictable or within the Company’s control. Such impacts

could adversely effect the Company’s business, operations or assets as well as the

Company’s results and, in some cases, such effect could be material. All written and verbal

descriptions of our business, operations and assets and all forward-looking statements attributable to the Company or any person acting on the

Company’s behalf are expressly qualified in their entirety by the risks, uncertainties and

cautionary statements contained herein.

All such descriptions and forward-looking statements speak only as of the date on which such

description or statement is made, and the Company undertakes no obligation, and specifically

declines any obligation, other than that imposed by law, to publicly update or revise any such descriptions or forward-looking statements whether as a result

of additional information, future events or otherwise. Risks and uncertainties that may

adversely impact our current business, operations, assets, or other matters affecting the Company, and which may cause actual results to

differ materially from expected results include, among others: economic trends and conditions

affecting the economy in general and/or the Company’s end-use markets; prices and

availability of raw materials including styrene, butadiene, vinyl acetate monomer, polyvinyl chloride, acrylonitrile, acrylics and textiles; ability to increase pricing to

offset raw material cost increases; product substitution and/or demand destruction due to product

technology, performance or cost disadvantages; high degree of customer concentration and

potential loss of a significant customer; supplier, customer and/or competitor consolidation; customer credit and bankruptcy risk; failure to successfully

develop and commercialize new products; a decrease in regional customer demand due to reduced

in-region production or increased import competition; risks associated with international

operations including political unrest, fluctuations in exchange rates, and regulatory uncertainty; failure to successfully implement productivity enhancement

and cost reduction initiatives; risks associated with chemical handling and manufacturing and with

acts of war, terrorism, natural disasters or accidents, including fires, floods, explosions and

releases of hazardous substances; unplanned full or partial suspension of plant operations; ability to comply, and cost of compliance with legislative and

regulatory changes, including changes impacting environmental, health and safety compliance and

changes which may restrict or prohibit the Company from using or selling certain products and

raw materials; losses from the Company’s strategic alliance, joint venture, acquisition, integration and operational activities; rapid inflation in health care

costs; loss of key employees and inability to attract and retain new key employees; prolonged work

stoppage resulting from labor disputes with unionized workforce; changes in, and significant

contributions required to meet pension plan funding obligations; attacks on and/or failure of the Company’s information systems; infringement or loss of the

Company’s intellectual property; litigation and claims against the Company related to products,

services, contracts, employment, environmental, safety, intellectual property and other

matters; adverse litigation judgments or settlements; absence of or inadequacy of insurance coverage for litigation judgments, settlements or other losses; higher

than expected capital expenditures; availability of financing at anticipated rates and terms; and loan

covenant default arising from substantial debt and leverage and the inability to service that

debt, including increases in applicable short-term or long-term borrowing rates.

For further information on risks and uncertainties, see the Company’s Form 10-K and Form

10-Q filings with the Securities and Exchange Commission. |

-

3 -

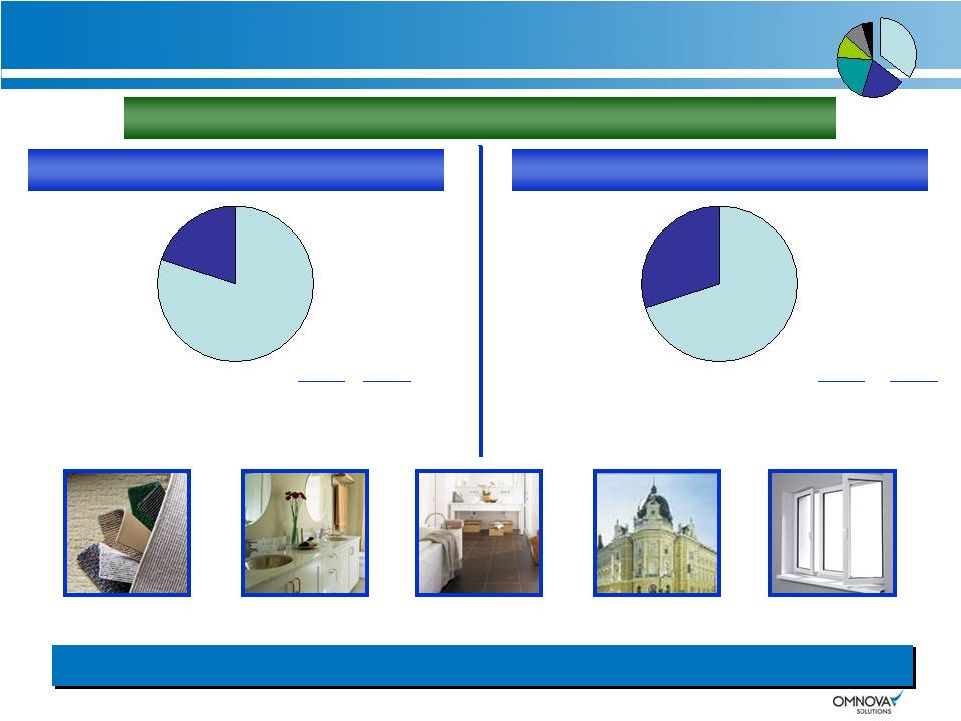

Business Segments At A Glance

Business Segments At A Glance

LTM Sales = $1.0B*

Adj. EBITDA = $97M*

Performance Chemicals

LTM Sales $773M*

Engineered Surfaces

LTM Sales $245M*

Value-added emulsion polymers and

specialty chemicals used in coatings,

adhesives, binders and other

applications

Functional surfaces for

transportation, furnishings, new

construction and refurbishment

A Focused Polymer Company With Market Leadership Positions

A Focused Polymer Company With Market Leadership Positions

A Focused Polymer Company With Market Leadership Positions

* LTM: Last Twelve Months is Through November 30, 2013;

See Appendices 1, 2 and 3 |

-

4 -

Company / Business Model Changes & Highlights

Company / Business Model Changes & Highlights

1.

1. Business Model / Market Position

2. Expanded Global Capability

3. Technology / Differentiation |

-

5 -

1. Business Model / Market Position

•

Leadership

positions

–

Typically

#1

or

#2

in

key

applications

•

Supplier of ingredients or components critical to

performance of finished products, but representing small

fraction of total cost

•

Market position and business model enables effective

margin management through periodic raw material volatility

–

Enhanced global sourcing capabilities

–

Diverse, value-added technology options

–

Responsive pricing mechanisms

Company / Business Model Changes & Highlights

Company / Business Model Changes & Highlights |

-

6 -

1. Business

Model

/

Market

Position

(continued)

•

Strong, growing position in key markets rebounding from last

recession

–

Residential housing and commercial real estate

•

Refurbishment

•

New Construction

–

Transportation

•

Improved profitability of Engineered Surfaces unit

–

Exited commercial wallcovering (N.A. & U.K.)

–

Increased capacity utilization by reducing manufacturing footprint

–

Strong pipeline of new products to enhance value to customers

•

North American asset repurposing in Performance Chemicals

–

Reduces 120 million pounds of SB latex capacity by 2015

–

Improves capacity utilization and profitability

–

Assets converted to diversified capabilities serving higher growth markets

Company / Business Model Changes & Highlights

Company / Business Model Changes & Highlights |

-

7 -

2. Expanded Global Capability

•

Expanded global manufacturing and technology footprint

provides access to fastest growing emerging world markets

(Asia-Pacific, China, India)

•

Global infrastructure improvements drive margins and

strengthen foundation for growth

–

SAP enterprise-wide platform

–

Globally integrated management

–

Global sourcing & logistics

–

Sustainability

–

LEAN SixSigma

Company / Business Model Changes & Highlights

Company / Business Model Changes & Highlights |

-

8 -

3. Technology / Differentiation

•

Focus on value added specialty applications through leading

technologies and deep application knowledge/support

•

Broader / diversified technologies in attractive growth

markets with acquisition of ELIOKEM

–

Specialty coatings

–

Elastomeric modifiers

–

Oilfield chemicals

Company / Business Model Changes & Highlights

Company / Business Model Changes & Highlights

Improved Business Model And Global Position

And Strong Foundation On Which To Build

Improved Business Model And Global Position

Improved Business Model And Global Position

And Strong Foundation On Which To Build

And Strong Foundation On Which To Build |

-

9 -

OMNOVA’s Global Reach

OMNOVA’s Global Reach

100% = $1.0 Billion

Expanding Global Footprint to Meet the

Worldwide Needs of Our Customers

Expanding Global Footprint to Meet the

Worldwide Needs of Our Customers

Asia &

Middle East

20%

USA

59%

Europe &

Africa

21%

Asia

2%

USA

87%

Europe

11%

•

New specialty emulsions plant in Caojing, China supports growth opportunities

•

Specialty

rubber

plant

in

India

—

Global

production

hub

for

tires,

hoses,

belts,

gaskets

•

Low

cost

coated

fabrics

plants

in

China

and

Thailand

for

growing

transportation

position

2002

2002

2013*

2013*

100% = $681 Million

* As of November 30, 2013

Sales by Region

Sales by Region |

-

10 -

OMNOVA Consolidated

OMNOVA Consolidated

Refurbishment & New

Construction

35%

Transportation

21%

Industrial /

Other

10%

Personal

Hygiene

9%

Paper & Packaging

20%

Oilfield

5%

Attractive

Growth

Opportunities

Leveraging

OMNOVA

Technology

And Market Recovery

Attractive

Attractive

Growth

Growth

Opportunities

Opportunities

Leveraging

Leveraging

OMNOVA

OMNOVA

Technology

Technology

And Market Recovery

And Market Recovery

Markets Served -

Markets Served -

Global

Global

•

Strong products / positions to grow as

market recovers

Refurbishment & Construction

Refurbishment & Construction

•

A leading coated paper position in North

America

•

Leverage OMN technology for growth in:

–

N.A. packaging

–

China coated paper & packaging > 2013

Paper & Packaging

Paper & Packaging

•

Well positioned in growing Asian

markets

Transportation

Transportation

•

Oilfield chemicals

•

Personal hygiene

•

China / Asia

High Growth Markets

High Growth Markets

Sales by Market

Sales by Market

LTM: Last Twelve Months is Through November 30, 2013 |

-

11 -

35%

35%

of

of

OMNOVA

OMNOVA

LTM

LTM

Sales

Sales

or

or

~

~

$360

$360

Million

Million

Refurbishment and New Construction

Refurbishment and New Construction

Strong Products / Positions To Grow As Industry Recovers

Strong Products / Positions To Grow As Industry Recovers

Strong Products / Positions To Grow As Industry Recovers

Residential Housing ~ 80%

Residential Housing ~ 80%

Commercial Building ~ 20%

Commercial Building ~ 20%

Refurbishment

80%

New

Construction

20%

Refurbishment

70%

New

Construction

30%

Elastomeric

Modification

2013

2014

New housing starts

921k

1.15M

Source: NAHB, MBA

Architectural

Coatings

Carpet

Latex

Kitchen and

Bath Laminates

2013

2014

Office vacancy rates

15.0%

14.4%

Commercial Real Estate Volume

$300B

$330B

Source: ULI / E&Y

+10%

LTM: Last Twelve Months is Through November 30, 2013

Solid Surface

Flooring Laminates |

-

12 -

Paper and Packaging Chemicals

Paper and Packaging Chemicals

Packaging And China Expected To Drive OMNOVA Growth in This Market

Packaging And China Expected To Drive OMNOVA Growth in This Market

Packaging And China Expected To Drive OMNOVA Growth in This Market

20%

20%

of

of

OMNOVA

OMNOVA

LTM

LTM

Sales

Sales

or

or

~

~

$200

$200

Million

Million

Leverage technology for above

market performance

N. American

N. American

Coated Paper

Coated Paper

N. American

N. American

Packaging

Packaging

China

China

Coated

Coated

Paper & Packaging

Paper & Packaging

OMN focus / technology to drive

share gain

Market

drivers

-

sustainability

focus,

better point of sale promotion

Rapidly growing middle class

drives growth in segment

OMN technology and assets drive

market penetration > 2014

Market

Size

(MM Lbs Emulsion

Polymers 2013)

Forecasted

Per Year Growth

(2014-2015)

OMNOVA Opportunity

900 -3% to

-5% 1,800

+3%

500

+3%

LTM: Last Twelve Months is Through November 30, 2013 |

-

13 -

Transportation

Transportation

Projected Strong Growth In China And Asian Light Vehicle

Sales And Work Tire Demand

Tire Cord Adhesives

-

Global -

Nitrile Rubber

(Belts, Hoses)

-

Asia -

Coated Fabrics

(Vehicle Seating)

-

Asia -

LTM: Last Twelve Months is Through November 30, 2013

Great Wall Motor H6

•

China’s leading SUV

•

2013 win adds to OMNOVA’s

strong position with

Chinese automotive OEMs

Well Positioned In Growing Asian Markets With

China, India, Thailand Manufacturing

Well Positioned In Growing Asian Markets With

Well Positioned In Growing Asian Markets With

China, India, Thailand Manufacturing

China, India, Thailand Manufacturing

21%

21%

of

of

OMNOVA

OMNOVA

LTM

LTM

Sales

Sales

or

or

~

~

$210

$210

Million

Million |

-

14 -

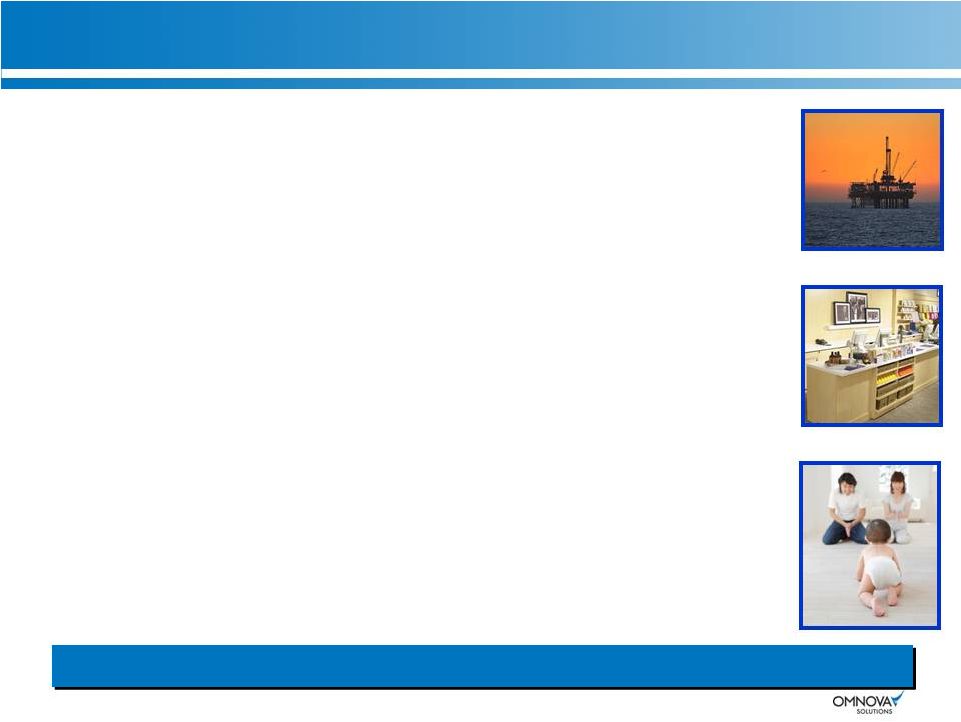

High Growth Markets / Applications

High Growth Markets / Applications

•

Oilfield / gas drilling and cementing chemicals

–

Oilfield

rigs

projected

growth

at

8-10%

per

year

through

2015

–

Opportunity for OMN to grow above market

•

Focus in fast growth high temperature / pressure environments

•

Unique new emulsion and powder products

•

Broader product line offering to accelerate growth

•

Decorative laminates

–

Growing in retail display, luxury flooring, kitchen and bath,

recreational vehicles

–

Cost in-use advantage / superior design aesthetics drives

substitution

•

Personal hygiene products grow in emerging markets

–

Global growth in nonwoven binders

–

New plant in Caojing, China positioned to serve rapidly growing

Asian markets

Unique Technology-Focused

Value Proposition

Drives Growth

Unique Technology-Focused

Unique Technology-Focused

Value Proposition

Value Proposition

Drives Growth

Drives Growth |

-

15 -

Net Debt*

(Net Debt / Adjusted EBITDA)

($ Millions)

*

Change

in

net

debt

–

See

Appendix

5

–

Net

Debt

/

Leverage

LTM: Last Twelve Months is Through November 30, 2013

$111

Leverage*

$68

Significant Cash Flow Generation

Significant Cash Flow Generation

$356

Proven Success At Deleveraging Has Enabled Opportunities

Such As The ELIOKEM Acquisition

Proven Success At Deleveraging Has Enabled Opportunities

Proven Success At Deleveraging Has Enabled Opportunities

Such As The ELIOKEM Acquisition

Such As The ELIOKEM Acquisition

$307

$287

2009

2010

2011

2011

2012

2013

Q1

YE

5.1x

0.9x

1.8x

2.7x

3.1x

2008

2009

2010

2011

2011

2012

2013

Q1

YE

11/30/2013

3.0x

ELIOKEM

Acquisition

ELIOKEM

Acquisition

$376

3.5x

$0

$50

$100

$150

$200

$250

$300

$350

$400

0.0x

1.0x

2.0x

3.0x

4.0x

5.0x

6.0x |

-

16 -

Capital Structure

Capital Structure

$250

$194

$8

Liquidity

Liquidity

Year-End Debt Cost ~ 6.3% / Significant Liquidity And Covenant Cushion

Year-End Debt Cost ~ 6.3% / Significant Liquidity And Covenant Cushion

Year-End Debt Cost ~ 6.3% / Significant Liquidity And Covenant Cushion

Foreign Debt & Other

•

Capital Lease

•

Letters of Credit

Term Loan B

•

2018 Maturity

•

L+300; floor 1.25%

•

Net Sr. Secured leverage

ratio covenant

Senior Notes 7.875%

•

2018 Maturity

•

No financial covenants

Debt

$452 Million

11/30/12

11/30/13

Revolver

$

Balance Drawn

Letters of Credit

0

2

0

2

Remaining Capacity

74

61

Cash

149

165

Total Liquidity

$223M

$226M

Net Sr. Secured Leverage Ratio

Net Sr. Secured Leverage Ratio

2011

2012

2013

2014

Covenant

< 3.00

< 2.75

< 2.50

Actual

0.9

0.5

0.3

EBITDA

Cushion

$84M

$95M

$85M

76

63

$

< 3.25 |

Confidential

Engineered Surfaces

Engineered Surfaces |

-

18 -

Engineered Surfaces –

Segment Overview

Engineered Surfaces –

Segment Overview

*

LTM: Last Twelve Months is Through November 30, 2013;

See Appendix 2 –

Engineered Surfaces

Manufacturing

Process

Functional and

Decorative Surfaces

Customers

•

Durability

•

Stain, scratch resistance, cleanability

•

Attractive designs

•

Critical part of finished product; small part of cost

•

Cost effective substitute for other materials

Key Characteristics:

Key Characteristics:

Laminates

37%

Performance

Films

19%

Coated

Fabrics

44%

A Broad-Based Functional And Decorative Surfaces Business

A Broad-Based Functional And Decorative Surfaces Business

Adj. EBITDA Margin

8.7%

Adj. EBITDA Margin

8.7%

Sales*

$245.1M

Sales*

$245.1M

Adj. EBITDA*

$21.4M

Adj. EBITDA*

$21.4M |

-

19 -

Engineered Surfaces

Engineered Surfaces

•

Kitchen and bath laminates

•

Furniture using coated fabrics

•

Furniture, appliance and flooring laminates

Residential Housing

Residential Housing

Markets Served

Residential

Housing

24%

Transportation

41%

Industrial /

Other

16%

Commercial

Buildings

19%

•

Automotive seating and interior materials

•

Bus / mass transit seating upholstery

•

Recreational vehicle laminates

Transportation

Transportation

•

Store fixture and display laminates

•

Contract furniture upholstery

•

Interior wall partitions

•

Ceiling tile laminates

Commercial Building

Commercial Building

•

Medical application films

•

Tape and labels

Industrial / Other

Industrial / Other

LTM: Last Twelve Months is Through November 30, 2013 |

-

20 -

Major Surface Applications

Major Surface Applications

Automotive

Mass

Transit

Kitchen &

Bath Cabinets

Marine

Contract

Flooring

Digital

Wall Murals

RV/Mfg. Housing

Industrial

Window

Profiles

Retail

Displays

Decking

Healthcare

Upholstery, Laminates and Films Engineered for Functional

Performance with Outstanding Design

Upholstery, Laminates and Films Engineered for Functional

Performance with Outstanding Design |

Confidential

Performance Chemicals

Performance Chemicals |

-

22 -

Performance Chemicals –

Segment Overview

Performance Chemicals –

Segment Overview

*

LTM: Last Twelve Months is Through November 30, 2013;

See Appendix 3 –

Performance Chemicals

•

High performance, globally specified products

•

Many high margin, niche applications

•

High switching costs for customers

•

Solutions provider with value-added technical

service

•

Critical

ingredients

–

Key

to

finished

product

performance; small % of total cost

Key Characteristics:

Key Characteristics:

Emulsion

Polymerization

Process

Customers

Specialty

Chemicals

65%

Performance

Materials

35%

Products

(Wet / Dry)

Raw Materials =

Basic Monomers

Styrene

Styrene

Butadiene

Butadiene

Acrylics

Acrylics

Acrylonitrile

Acrylonitrile

Others

Others

—

—

—

—

—

—

—

—

Providing Value-Added Solutions On A Global Basis

Providing Value-Added Solutions On A Global Basis

Sales*

$773.0M

Sales*

$773.0M

Adj. EBITDA*

$91.5M

Adj. EBITDA*

$91.5M

Adj. EBITDA Margin

11.8%

Adj. EBITDA Margin

11.8% |

-

23 -

Global Chemical Markets

Global Chemical Markets

Personal

Hygiene

Coating

Resins

Tape &

Adhesives

Antioxidants

Oil/Gas

Drilling

Specialty

Rubber &

Reinforcement

Elastomeric

Modifiers

Construction

Floor

Care

Paper/

Packaging

Carpet

Tire

Cord

Numerous Applications Within The Emulsion Polymer Space

Numerous Applications Within The Emulsion Polymer Space

|

-

24 -

OMNOVA Performance Chemicals

OMNOVA Performance Chemicals

Refurbishment &

New Construction

32%

Transportation

15%

Industrial

10%

Personal

Hygiene

11%

Paper &

Packaging

25%

Oilfield

7%

SB Latex

43%

Acrylics &

Vinyl Acetate

25%

Vinyl

Pyridine

Latex

9%

Nitrile

Rubber

8%

Other

Chemicals

4%

Antioxidants

6%

High Styrene

5%

Broad-Based Solutions Provider

Broad-Based Solutions Provider

Broad-Based Solutions Provider

Markets

Markets

Served

Served

–

–

Global

Global

*

*

Chemistries *

Chemistries *

* LTM: Last Twelve Months Through November 30, 2013 |

-

25 -

Key Investment Highlights

Key Investment Highlights

Expanded manufacturing capability in high-growth (Asia and India) emerging

markets Strong global business/supply chain infrastructure on which to

build Improved capacity utilization through repurposing N.A.

assets OMNOVA Is Creating Value Through A Global Enterprise

OMNOVA Is Creating Value Through A Global Enterprise

OMNOVA Is Creating Value Through A Global Enterprise

Typically #1 or #2 –

in key applications provides competitive advantage and

above market growth

Strong technology and new product pipeline further enhanced with

acquisition

Over 1,000 products sold to over 1,500 customers in more than 90

countries

Significant expansion into adjacent markets in the emulsion polymer space through

acquisitions such as ELIOKEM

Improved margins since 2008 (despite sluggish economy and dynamic operating

conditions)

Margin improvement driven by diversification of markets & technologies

Position as a critical ingredients supplier

Strong legacy of cash generation

Maintenance capex generally below D&A

NOL’s shield U.S. cash taxes for several years

Growing Global

Footprint

Growing Global

Footprint

Leading

Market

Positions

Leading

Market

Positions

Diverse

Business

Model

Diverse

Business

Model

Stronger

And

More

Stable

Margins

Stronger

And

More

Stable

Margins

Strong

Free

Cash

Flow

Strong

Free

Cash

Flow |

-

26 -

Company Confidential |

-

27 -

Appendix |

-

28 -

Appendix –

Non-GAAP Financial Measures

Appendix –

Non-GAAP Financial Measures

This presentation includes EBITDA, Adjusted EBITDA and Net Debt which are

Non-GAAP financial measures as defined by the Securities and Exchange

Commission. OMNOVA’s EBITDA is calculated as income (loss) from continuing

operations less interest expense, amortization of deferred financing costs,

income taxes and depreciation and amortization expense. OMNOVA’s Adjusted EBITDA is

calculated as OMNOVA’s EBITDA less restructuring and severance expenses, asset

impairments, non-cash stock compensation and other items. Segment

EBITDA is calculated as segment operating income (loss) less interest expense,

amortization of deferred financing costs, income taxes and depreciation and amortization expense.

Segment Adjusted EBITDA is calculated as Segment EBITDA less restructuring and

severance expenses, asset impairments, non-cash stock compensation and

other items. For purposes of this presentation, Net Debt is calculated

as total debt less cash. ELIOKEM’s EBITDA is calculated as net

income less interest expense, amortization of deferred financing costs, income

taxes and depreciation and amortization expense. ELIOKEM’s Adjusted EBITDA is calculated as ELIOKEM’s

EBITDA less restructuring and severance expenses, asset impairments and other

items. EBITDA, Adjusted EBITDA and Net Debt are not measures of

financial performance under GAAP. EBITDA, Adjusted EBITDA and Net Debt

are not calculated in the same manner by all companies and, accordingly, are

not necessarily comparable to similarly titled measures of other companies and

may not be appropriate measures for comparing performance relative to other

companies. EBITDA, Adjusted EBITDA and Net Debt should not be construed as

indicators of the Company’s operating performance or liquidity and should not be

considered in isolation from or as a substitute for net income (loss), cash

flows from operations or cash flow data, which are all prepared in accordance

with GAAP. EBITDA, Adjusted EBITDA and Net Debt are not intended to represent, and should not be

considered more meaningful than or as an alternative to, measures of operating

performance as determined in accordance with GAAP. Management believes

that presenting this information is useful to investors because these measures

are commonly used as analytical indicators to evaluate performance and by management to allocate

resources. Set forth below are the reconciliations of these non-GAAP

measures to their most directly comparable GAAP financial measure.

All appendix results are pro forma reflecting continuing business (including the

acquisition of ELIOKEM and excluding the sale of global wallcovering

businesses). |

-

29 -

Appendix 1 –

OMNOVA Consolidated

Appendix 1 –

OMNOVA Consolidated

($ Millions)

LTM

OMNOVA Solutions Consolidated

2008

2009

2010

2011

2012

2013

Income (Loss) from Continuing Operations

$

(2.9)

$

27.4

$

117.2

$

16.7

$

25.7

$

20.5

Interest expense

12.3

7.5

8.0

35.3

33.8

29.6

Amortization of deferred financing costs

0.7

0.6

0.7

2.7

2.7

2.3

Income Tax

0.1

1.0

(83.9)

13.4

11.2

6.0

Depreciation and amortization

20.9

20.4

18.7

33.5

32.0

33.6

EBITDA

$

31.1

$

56.9

$

60.7

$

101.6

$

105.4

$

92.0

Restructuring, severance and other

0.6

1.9

0.6

2.2

1.0

5.0

Asset impairments

-

1.1

2.7

3.1

1.0

0.2

Non-cash stock compensation

2.1

2.4

3.2

3.6

4.5

2.2

Other

1.2

(0.5)

11.2

3.7

-

(2.4)

Adjusted EBITDA

$

35.0

$

61.8

$

78.4

$

114.2

$

111.9

$

97.0

Sales

$

766.7

$

625.3

$

781.7

$

1,201.1

$

1,125.5

$

1,018.1

Percentage of Adjusted EBITDA to Sales

4.6%

9.9%

10.0%

9.5%

9.9%

9.5%

LTM

Combined Adjusted EBITDA

2008

2009

2010

2011

2012

2013

OMNOVA Solutions Adjusted EBITDA

$

35.0

$

61.8

$

78.4

$

114.2

$

111.9

$

97.0

ELIOKEM International Adjusted EBITDA

34.6

35.1

48.7

-

-

-

Combined Adjusted EBITDA

$

69.6

$

96.9

$

127.1

$

114.2

$

111.9

$

97.0

Combined Sales

OMNOVA Solutions

$

766.7

$

625.3

$

781.7

$

1201.1

$

1,125.5

$

1,018.1

ELIOKEM International

289.5

229.5

288.4

-

-

-

Combined Sales

$

1,056.2

$

854.8

$

1,070.1

$

1,201.1

$

1,125.5

$

1,018.1

Percentage of Adjusted EBITDA to Sales

6.6%

11.3%

11.9%

9.5%

9.9%

9.5%

LTM: Last Twelve Months Through November 30, 2013 |

-

30 -

Appendix 2 –

Engineered Surfaces

Appendix 2 –

Engineered Surfaces

($ Millions)

LTM

Engineered Surfaces Segment

2008

2009

2010

2011

2012

2013

Segment Operating Profit

$

(7.2)

$

2.2

$

(3.2)

$

(1.3)

$

3.8

$

15.6

Interest expense

-

-

-

-

-

-

Amortization of deferred financing costs

-

-

-

-

-

-

Income Tax

-

-

-

-

-

Depreciation and amortization

9.5

10.2

9.0

8.5

7.6

7.0

EBITDA

$

2.3

$

12.4

$

5.8

$

7.2

$

11.4

$

22.6

Restructuring, severance and other

0.4

1.4

0.1

1.1

1.1

3.7

Asset impairments

-

0.4

2.7

3.1

1.0

(0.2)

Non-cash stock compensation

0.9

0.6

0.5

0.5

0.9

0.2

Other

-

-

4.3

0.4

0.1

(4.9)

Adjusted EBITDA

$

3.6

$

14.8

$

13.4

$

12.3

$

14.5

$

21.4

Sales

$

245.1

$

228.5

$

253.8

$

249.2

$

261.0

$

245.1

Percentage of Adjusted EBITDA to Sales

1.5%

6.5%

5.3%

4.9%

5.6%

8.7%

LTM: Last Twelve Months Through November 30, 2013 |

-

31 -

Appendix 3 –

Performance Chemicals

Appendix 3 –

Performance Chemicals

($ Millions)

LTM

Performance Chemicals

2008

2009

2010

2011

2012

2013

Segment Operating Profit

$

25.2

$

47.9

$

73.3

$

86.5

$

89.6

$

64.1

Interest expense

-

-

-

-

-

-

Amortization of deferred financing costs

-

-

-

-

-

-

Income Tax

-

-

-

-

-

-

Depreciation and amortization

10.9

9.9

9.4

24.6

24.1

25.2

EBITDA

$

36.1

$

57.8

$

82.7

$

111.1

$

113.7

$

89.3

Restructuring, severance and other

0.1

0.2

1.5

1.1

-

1.2

Asset impairments

-

0.7

-

-

-

0.2

Non-cash stock compensation

1.2

0.8

1.2

1.3

1.5

0.4

Other

0.1

0.2

(9.6)

-

(0.2)

0.4

Adjusted EBITDA

$

37.5

$

59.7

$

75.8

$

113.5

$

115.0

$

91.5

Sales

$

521.6

$

396.8

$

527.9

$

951.9

$

864.5

$

773.0

Percentage of Adjusted EBITDA to Sales

7.2%

15.0%

14.4%

11.9%

13.3%

11.8%

LTM

Combined Adjusted EBITDA

2008

2009

2010

2011

2012

2013

Performance Chemicals Adjusted EBITDA

$

37.5

$

59.7

$

75.8

$

113.5

$

115.0

$

91.5

ELIOKEM International Adjusted EBITDA

34.6

35.1

48.7

-

-

-

Combined Adjusted EBITDA

$

72.1

$

94.8

$

124.5

$

113.5

$

115.0

$

91.5

Combined Sales

Performance Chemicals

$

521.6

$

396.8

$

527.9

$

951.9

$

864.5

$

773.0

ELIOKEM International

289.5

229.5

288.4

-

-

-

Combined Sales

$

811.1

$

626.3

$

816.3

$

951.9

$

864.5

$

773.0

Percentage of Combined Adjusted EBITDA

to Combined Sales

8.9%

15.1%

15.3%

11.9%

13.3%

11.8%

LTM: Last Twelve Months Through November 30, 2013 |

-

32 -

Appendix 4 –Pro Forma ELIOKEM

Appendix 4 –Pro Forma ELIOKEM

($ Millions)

ELIOKEM International

2008

2009

2010

Net Income

$

(2.5)

$

1.2

$

0.4

Interest expense

17.5

16.8

16.0

Amortization of deferred financing costs

0.5

0.5

0.4

Income Tax

(3.3)

1.3

2.6

Depreciation and amortization

14.3

13.4

13.2

EBITDA

$

26.5

$

33.2

$

32.6

Restructuring & severance

1.1

3.9

1.1

Asset impairments

-

-

-

Non-cash stock compensation

-

-

-

Other

7.0

(2.0)

15.0

Adjusted EBITDA

$

34.6

$

35.1

$

48.7

Sales

$

289.5

$

229.5

$

288.4

Percentage of Adjusted EBITDA to Sales

12.0%

15.3%

16.9% |

-

33 -

Appendix 5 –

Net Debt / Leverage

Appendix 5 –

Net Debt / Leverage

($ Millions)

Asian Acq

Year-End

Year-End

Year-End

Eliokem

Year-End

Year-End

LTM

OMNOVA Solutions Consolidated

May 31, 2008

2008

2009

2010**

Dec 31, 2010

2011

2012

2013

Total Debt*

$

206.9

$

196.4

$

152.7

$

397.2

$

460.8

$

459.6

$

455.8

$

451.7

Less Cash*

(13.1)

(17.4)

(41.5)

(328.8)

(84.7)

(103.1)

(148.5)

(164.9)

Net Debt*

$

193.8

$

179.0

$

111.2

$

68.4

$

376.1

$

356.5

$

307.3

$

286.8

Adjusted EBITDA (Appendix 1)

$

35.0

$

61.8

$

78.4

$

114.2

$

111.9

$

97.0

Net Debt / Adjusted EBITDA

5.1

X

1.8

X

0.9

X

3.12

X

2.75

X

2.96

X

LTM: Last Twelve Months Through November 30, 2013

* As Defined by the Term Loan B Agreement

** 2010 Total Debt includes $250.0M of Senior Notes held in escrow and 2010 cash

includes restricted cash of $253.1M |

-

34 -

Historical Financial Results

Historical Financial Results

Annual Revenue*

Annual Adjusted EBITDA*

$521.6

$396.8

$527.9

$951.9

$864.5

$773.0

$245.1

$228.5

$253.8

$249.2

$261.0

$245.1

$229.5

$288.4

$289.5

$0

$200

$400

$600

$800

$1,000

$1,200

$1,400

2008

2009

2010

2011

2012

2013

Performance Chemicals

Engineered Surfaces

ELIOKEM

$854.8

$1,056.2

$1,201.1

$1,125.5

Strong

EBITDA

Performance

Across

Varied

Business

Conditions

Strong

Strong

EBITDA

EBITDA

Performance

Performance

Across

Across

Varied

Varied

Business

Business

Conditions

Conditions

$37.5

$59.7

$75.8

$113.5

$115.0

$91.5

$3.6

$14.8

$13.4

$12.3

$21.4

$34.6

$35.1

$48.7

$14.5

9.5%

9.9%

9.5%

11.9%

11.3%

6.6%

$0.0

$20.0

$40.0

$60.0

$80.0

$100.0

$120.0

$140.0

$160.0

$180.0

$200.0

2008

2009

2010

2011

2012

2013

0.0%

2.0%

4.0%

6.0%

8.0%

10.0%

12.0%

Performance Chemicals

Engineered Surfaces

ELIOKEM

OMN Cons. Est.

EBITDA Margin

$96.9

$127.1

$114.2

$111.9

$1,018.1

$97.0

$1,070.1

$69.6

* Pro forma results include ELIOKEM acquisition and exclude divested

commercial wallcovering businesses

Adjusted EBITDA - See Appendices 1, 2, 3, and 4; Annual Adjusted EBITDA includes OMNOVA Corporate

Expense of $6.1M, $12.7M, $10.8M, $11.6M, $17.6M and $15.9M for 2008, 2009, 2010,

2011, 2012 and LTM 2013, respectively. |

Company Confidential |