Attached files

| file | filename |

|---|---|

| EX-31.4 - EX-31.4 - LKQ CORP | d695430dex314.htm |

| EX-31.3 - EX-31.3 - LKQ CORP | d695430dex313.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K/A

Amendment No. 1

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2013

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number: 000-50404

LKQ CORPORATION

(Exact name of registrant as specified in its charter)

| Delaware | 36-4215970 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification Number) |

| 500 West Madison Street, Suite 2800, Chicago, IL |

60661 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (312) 621-1950

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class |

Name of each exchange on which registered | |

| Common Stock, par value $.01 per share | NASDAQ Global Select Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | x | Accelerated filer | ¨ | |||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

As of June 30, 2013, the aggregate market value of common stock outstanding held by stockholders who were not affiliates (as defined by regulations of the Securities and Exchange Commission) of the registrant was approximately $7.7 billion (based on the closing sale price on the NASDAQ Global Select Market on such date). The number of outstanding shares of the registrant’s common stock as of February 21, 2014 was 301,383,141.

EXPLANATORY NOTE

This Amendment No. 1 on Form 10-K/A is being filed by LKQ Corporation (the “Company”) to amend its Annual Report on Form 10-K for the year ended December 31, 2013, originally filed with the Securities and Exchange Commission on March 3, 2014 (the “Original 10-K”), to set forth all of the information required to be disclosed in Items 10-14, portions of which were incorporated by reference into the Original 10-K from the Company’s proxy statement for its Annual Meeting of Stockholders to be held on May 5, 2014. Accordingly, pursuant to rule 12b-15 under the Securities Exchange Act of 1934, as amended, this Form 10-K/A contains the complete text of Items 10-14 and 15(b), as amended, as well as certain currently dated certifications. Except as indicated above, this Amendment No. 1 does not amend any other information set forth in the Original 10-K, and unaffected items have not been repeated in this Amendment No. 1.

PART III

| ITEM 10. | DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE |

Directors

The members of our Board of Directors, their ages, their positions with us, and their term of office are set forth below.

| Name |

Age | Director Since | Position(s) | |||

| A. Clinton Allen |

70 | May 2003 | Lead Independent Director | |||

| Ronald G. Foster |

72 | October 2007 | Director | |||

| Joseph M. Holsten |

61 | February 1999 | Chairman of the Board | |||

| Blythe J. McGarvie |

57 | March 2012 | Director | |||

| Paul M. Meister |

61 | February 1999 | Director | |||

| John F. O’Brien |

70 | July 2003 | Director | |||

| Guhan Subramanian |

43 | January 2013 | Director | |||

| Robert L. Wagman |

49 | November 2011 |

President and Chief Executive Officer | |||

| William M. Webster, IV |

56 | June 2003 | Director |

Biographical information concerning each of our directors is presented below.

A. Clinton Allen. Mr. Allen currently is Chairman and Chief Executive Officer of A.C. Allen & Company, a holding company. Mr. Allen was Vice Chairman of Psychemedics Corporation, a provider of drug testing services, from October 1989 until March 2002, and Chairman of Psychemedics Corporation from March 2002 until November 2003. Mr. Allen was Vice Chairman and a director of The DeWolfe Companies, Inc., a real estate company, from 1991 until it was acquired by Cendant Corporation in September 2002. He was the founding director of Blockbuster Inc. serving from 1987 until the company was sold to Viacom in 1994. Additionally, he was a director and member of the executive committee of Swiss Army Brands Inc., a worldwide company selling knives, watches and related accessories, from 1995 until it was acquired by Victorinox Corporation in August 2002. Mr. Allen is the non-executive Chairman of Collector’s Universe, Inc., a provider of services and products to dealers and collectors of high-end collectibles; and a director of Brooks Automation, a provider of automation technology to the semiconductor industry. He also served as a director of Avantair, Inc. until 2013. In March 2011, Mr. Allen was elected as our Lead Independent Director. Mr. Allen holds an Executive Masters Professional Director Certification from the American College of Corporate Directors.

The specific experience, qualifications, attributes or skills that led to the conclusion that Mr. Allen should serve as a director of LKQ include his expertise in the areas of corporate governance and responsibility, audit practices and executive compensation. His qualifications in these areas have helped us formulate our corporate governance principles. Mr. Allen also serves on both our Audit Committee and our Governance/Nominating Committee because of his knowledge in these areas. His experience as the Chief Executive Officer of a public company and his knowledge gained serving on the audit committees of public companies qualify him as an audit committee financial expert.

Ronald G. Foster. Mr. Foster was the Chairman of the Board of Keystone Automotive Industries, Inc. from August 2000 until October 2007 when we acquired Keystone. In October 2007, Mr. Foster was elected to our Board of Directors pursuant to a covenant in the Keystone acquisition agreement wherein we committed to add two Keystone directors to our Board of Directors. Mr. Foster has been a consultant since he left the automotive segment of Tenneco, Inc. in October 1993, where he specialized in acquisitions, joint ventures, turnaround situations and quality systems such as QS9000. For the prior 25 years, he held various positions within the automotive segment, most recently as the Senior Vice President of Tenneco Automotive and General Manager of Monroe Auto Equipment Company, the world’s largest manufacturer of ride control systems. Mr. Foster holds a Professional Director Certification from the American College of Corporate Directors.

The specific experience, qualifications, attributes or skills that led to the conclusion that Mr. Foster should serve as a director of LKQ include his extensive experience managing businesses in the automotive parts industry in both the original equipment and replacement part segments, his role as Chairman of the Board of Keystone Automotive Industries, Inc., and his knowledge of SEC and other regulatory requirements for publicly-traded companies.

Joseph M. Holsten. Mr. Holsten has been our Chairman of the Board since November 2011. He joined us in November 1998 as our President and Chief Executive Officer. He was elected to our Board of Directors in February 1999. In November 2010, Mr. Holsten was appointed as Vice Chairman of our Board of Directors. On January 1, 2011, his officer position changed to Co-Chief Executive Officer as part of his transition to retirement. He retired from his officer position in January 2012. Prior to joining us, Mr. Holsten held various positions of increasing responsibility with the North American and International operations of Waste Management, Inc. for approximately 17 years. From February 1997 until July 1998, Mr. Holsten served as Executive Vice President and Chief Operating Officer of Waste Management, Inc. From July 1995 until February 1997, he served as Chief Executive Officer of

1

Waste Management International, plc where his responsibility was to streamline operating activities. Prior to working for Waste Management, Mr. Holsten was a staff auditor at a public accounting firm. Mr. Holsten also has served since May 2009 as a member of the Board of Directors of Covanta Holding Corporation, a company in the energy-from-waste solutions and insurance products business. Mr. Holsten holds a Professional Director Certification from the American College of Corporate Directors.

The specific experience, qualifications, attributes or skills that led to the conclusion that Mr. Holsten should serve as a director of LKQ include primarily his unparalleled knowledge of our business and our industry. Mr. Holsten has been with us almost since our inception and from that time has become intimately familiar with all aspects of our business, including in particular operational and financial matters. His knowledge and experience provide a critical component for the proper functioning of our Board. Mr. Holsten also brings to our Board his significant operational experience from his key positions at Waste Management. He also brings financial accounting skills to our Board through his qualification as a certified public accountant, his attainment of an MBA in finance and accounting, and his prior work at a public accounting firm.

Blythe J. McGarvie. Ms. McGarvie is a member of the faculty of Harvard Business School teaching in the accounting and management unit since July 2012. Prior to joining the Harvard Business School faculty, Ms. McGarvie served for ten years as Chief Executive Officer and Founder of Leadership for International Finance, a global consulting firm specializing in leadership seminars for corporate and academic groups. During this period, she co-founded and served as Senior Fellow for Northwestern University’s Kellogg Innovation Network and was a visiting leader at Shanghai-based CEIBS. Prior to 2003, Ms. McGarvie was Chief Financial Officer for BIC Group, a publicly-traded consumer goods company with operations in 36 countries, based in Paris, France. Prior to moving to Paris, Ms. McGarvie was Chief Financial Officer for Hannaford Bros. Co, a Fortune 500 retailing company, between 1994 and 1999. She serves on the board of directors of Viacom Inc., a global entertainment content company, and currently is the chairperson of the Viacom audit committee. Ms. McGarvie is also a member of the board of directors of Accenture plc, a global management consulting, technology services and outsourcing company, and a member of the board of directors of Sonoco Products Company, a manufacturer of industrial and consumer packaging products. She was a member of the board of directors of the Travelers Company, Inc. from 2003 through May 2011, and a member of the board of directors of The Pepsi Bottling Group, Inc. from March 2002 through February 2010. Ms. McGarvie is a Certified Public Accountant and earned an MBA from Northwestern University’s J.L. Kellogg Graduate School of Management. Ms. McGarvie holds an Advanced Professional Director Certification from the American College of Corporate Directors.

The specific experience, qualifications, attributes or skills that led to the conclusion that Ms. McGarvie should serve as a director of LKQ include her significant experience in the fields of finance and accounting and her international experience. In addition, she has served on publicly-traded companies as a board member since 2001 and has considerable experience with corporate governance matters. Ms. McGarvie’s MBA with a concentration in accounting and marketing, her status as a Certified Public Accountant and her business experience as a Chief Financial Officer qualify her as an audit committee financial expert.

Paul M. Meister. Mr. Meister is Chairman and Chief Executive Officer of inVentiv Health, Inc., a leading global provider of results-driven clinical, consulting and commercial services to the biopharmaceutical and healthcare industries. In addition, Mr. Meister is Chief Executive Officer and Co-Founder of Liberty Lane Partners, LLC, a private investment firm utilizing its broad-based experience in operating and financial management. He formerly was Chairman of the Board of Thermo Fisher Scientific Inc., a provider of products and services to businesses and institutions in the field of science, which was formed by the merger of Fisher Scientific International Inc. and Thermo Electron Corporation in November 2006. Mr. Meister was Vice Chairman of Fisher Scientific International Inc. from 2001 to 2006, and served as its chief financial officer from 1991 to 2001. Fisher Scientific International provided products and services to research, healthcare, industrial, educational and government markets. Mr. Meister is a member of the Board of Directors of Scientific Games Corporation, which provides customized, end-to-end solutions to the gaming industry, and Quanterix Corporation, a developer of ground-breaking tools in high definition diagnostics. Mr. Meister is Co-Chair of the University of Michigan’s Life Sciences Institute External Advisory Board and serves on the Executive Advisory Board of the Chemistry of Life Processes Institute at Northwestern University.

The specific experience, qualifications, attributes or skills that led to the conclusion that Mr. Meister should serve as a director of LKQ include his executive positions with an S&P 500 company, including Chairman of the Board and Chief Financial Officer, and his MBA in Finance and Accounting. Mr. Meister provides sound judgment and discernment to our Board from the experience gained in his key roles with Fisher Scientific International and Thermo Fisher Scientific. His ten years as a Chief Financial Officer and his MBA in Finance and Accounting qualify him as an audit committee financial expert.

John F. O’Brien. Mr. O’Brien retired in 2002 as the Chief Executive Officer of Allmerica Financial Corporation, a public insurance company. In addition to serving on our Board of Directors, he is a director and non-executive chairman of Cabot Corporation, a global specialty chemicals corporation; the Lead Director of The TJX Companies, Inc., an off-price retailer of apparel and home fashions; and a director of a family of registered investment companies managed by BlackRock, an investment management advisory firm. From August 1989 to November 2002, Mr. O’Brien was President and Chief Executive Officer of Allmerica Financial Corporation. From 1968 to 1989, Mr. O’Brien held several positions at Fidelity Investments, including Group Managing Director of FMR Corporation (from 1986 to 1989), Chairman of Institutional Services Company (from 1986 to 1989) and Chairman of Brokerage Services, Inc. (from 1984 to 1989). Mr. O’Brien holds a Masters Professional Director Certification from the American College of Corporate Directors.

2

The specific experience, qualifications, attributes, and skills that led to the conclusion that Mr. O’Brien should serve as a director of LKQ include his tenure as the President and CEO of a Fortune 500 insurance company and over 35 years of experience in the insurance and investment management industries. His insurance and financial experience provide him with skills and knowledge that he is able to contribute to our Board’s oversight with regard to LKQ’s relationship with the insurance industry. Moreover, he is able to provide oversight with regard to budgeting, financial planning, and the appropriate financial strength and capital structure of the Company. Mr. O’Brien’s continuing education regarding corporate governance matters in part led to his election as the chairman of our Governance/Nominating Committee.

Guhan Subramanian. Mr. Subramanian was elected to our board in January 2013. He is currently the Joseph Flom Professor of Law and Business at the Harvard Law School and the H. Douglas Weaver Professor of Business Law at the Harvard Business School. He is the first person in the history of Harvard University to hold tenured appointments at both the Harvard Law School and the Harvard Business School. At the Harvard Law School he teaches courses in negotiations and corporate law. At the Harvard Business School he teaches in several executive education programs including Strategic Negotiations, Changing the Game, and Making Corporate Boards More Effective. He is the faculty chair for the JD/MBA program at Harvard University and the Co-Chair of the Harvard Program on Negotiation. Prior to joining the Harvard faculty in September 1999, Mr. Subramanian spent three years at McKinsey & Company as a consultant in their New York, Boston, and Washington, D.C. offices. He also holds a Masters Professional Director Certification from the American College of Corporate Directors.

The specific experience, qualifications, attributes or skills that led to the conclusion that Mr. Subramanian should serve as a director of LKQ include his extensive knowledge of corporate law, corporate governance and business negotiations. His positions at Harvard Law School and Harvard Business School provide Mr. Subramanian with continuous exposure and insight into the key issues and developments affecting boards of directors and the businesses they oversee. In addition, his role as an instructor in executive education programs allows Mr. Subramanian to exchange ideas and gain knowledge from numerous prominent business leaders.

Robert L. Wagman. Mr. Wagman became our President and Chief Executive Officer on January 1, 2012. He was elected to our Board of Directors in November 2011. Mr. Wagman was our President and Co-Chief Executive Officer from January 1, 2011 to January 1, 2012. Prior thereto, he had been our Senior Vice President of Operations—Wholesale Parts Division, with oversight of our wholesale late model operations, since August 2009. Prior thereto, from October 1998, Mr. Wagman managed our insurance company relationships, and from February 2004, added to his responsibilities the oversight of our aftermarket product operations. He was elected our Vice President of Insurance Services and Aftermarket Operations in August 2005. Before joining us, Mr. Wagman served from April 1995 to October 1998 as the Outside Sales Manager of Triplett Auto Parts, Inc., a recycled auto parts company that we acquired in July 1998. He started in our industry in 1987 as an Account Executive for Copart Auto Auctions, a processor and seller of salvage vehicles through auctions.

The specific experience, qualifications, attributes or skills that led to the conclusion that Mr. Wagman should serve as a director of LKQ include his extensive experience and knowledge regarding the operations of our company and the industry in which we operate. He has been with our company for close to 16 years and has been involved in our industry for almost 27 years. This experience and knowledge makes Mr. Wagman a key contributor to the deliberations of the Board of Directors. In addition, Mr. Wagman is the primary management liaison to the Board of Directors in his position as our Chief Executive Officer.

William M. Webster, IV. Mr. Webster was the co-founder and Chairman of the Board of Directors of Advance America, Cash Advance Centers, Inc., the largest payday advance lender in the United States. He served as the Chairman of the Board of Advance America from January 2009 to April 2012 when Advance America was sold to Group Electra. Prior to founding Advance America in 1997, Mr. Webster was part of the Bush-Clinton transition team and subsequently served the Clinton Administration in various capacities, including Chief of Staff to the Secretary of Education, Richard W. Riley, and as Assistant to the President and Director of Scheduling and Advance in the White House. Mr. Webster is a director and chairman of the Audit Committee of Golub Capital BDC, Inc., an investment company focusing on the middle market. Mr. Webster is the past President and a Founding Board Member of the Community Financial Services Association (CFSA), the national trade association for payday advance lenders. Mr. Webster is also Chairman of the Board of Greenville Health System, the largest employer in South Carolina. Mr. Webster holds a Masters Professional Director Certification from the American College of Corporate Directors.

The specific experience, qualifications, attributes or skills that led to the conclusion that Mr. Webster should serve as a director of LKQ include his experience as Chairman of the Board and Chief Executive Officer of Advance America, Cash Advance Centers, Inc. and his past service as a member of the Board of Advisors of Golub Capital, an affiliate of Golub Capital BDC, LLC and a leading provider of financing solutions for the middle market. These roles give Mr. Webster a unique perspective with respect to financing matters involving LKQ. Mr. Webster also graduated from the University of Virginia Law School, and he brings to our Board of Directors analytical skills developed through his legal education.

3

Executive Officers

Our executive officers, their ages at December 31, 2013, and their positions with us are set forth below. Our executive officers are elected by and serve at the discretion of our Board of Directors.

| Name |

Age | Position | ||

| Robert L. Wagman | 49 | President, Chief Executive Officer and Director | ||

| John S. Quinn | 55 | Executive Vice President and Chief Financial Officer | ||

| Victor M. Casini | 51 | Senior Vice President, General Counsel and Corporate Secretary | ||

| Walter P. Hanley | 47 | Senior Vice President—Development | ||

| Steven Greenspan | 52 | Senior Vice President of Operations—Wholesale Parts Division | ||

| Michael S. Clark | 39 | Vice President—Finance and Controller |

Robert L. Wagman became our President and Chief Executive Officer on January 1, 2012. He was elected to our Board of Directors on November 7, 2011. Mr. Wagman was our President and Co-Chief Executive Officer from January 1, 2011 to January 1, 2012. Prior thereto, he had been our Senior Vice President of Operations—Wholesale Parts Division, with oversight of our wholesale late model operations since August 2009. Prior thereto, from October 1998, Mr. Wagman managed our insurance company relationships, and from February 2004, added to his responsibilities the oversight of our aftermarket product operations. He was elected our Vice President of Insurance Services and Aftermarket Operations in August 2005. Before joining us, Mr. Wagman served from April 1995 to October 1998 as the Outside Sales Manager of Triplett Auto Parts, Inc., a recycled auto parts company that we acquired in July 1998. He started in our industry in 1987 as an Account Executive for Copart Auto Auctions, a processor and seller of salvage vehicles through auctions.

John S. Quinn has been our Executive Vice President and Chief Financial Officer since November 2009. Prior to joining our Company, he was the Senior Vice President, Chief Financial Officer and Treasurer of Casella Waste Systems, Inc., a company in the solid waste management services industry from January 2009. From January 2001 to January 2009 he held various positions of increasing responsibility with Allied Waste Industries, Inc., a company also in the solid waste management services industry, including Senior Vice President of Finance from January 2005 to January 2009, Controller and Chief Accounting Officer from November 2006 to September 2007 and Vice President Financial Analysis and Planning from January 2003 to January 2005. From August 1987 to January 2001, he held various positions with Waste Management Inc.’s foreign subsidiaries, and Waste Management International, plc. in Canada and the United Kingdom. Prior to working for Waste Management, he worked for Ford Glass Ltd., a subsidiary of Ford Motor Company.

Victor M. Casini has been our Vice President, General Counsel and Corporate Secretary from our inception in February 1998. In March 2008, he was elected Senior Vice President. Mr. Casini was a member of our Board of Directors from May 2010 until May 2012. From July 1992 to December 2011, Mr. Casini was the Executive Vice President and General Counsel of Flynn Enterprises, Inc., a venture capital, hedging and consulting firm. Mr. Casini served as Senior Vice President, General Counsel and Corporate Secretary of Discovery Zone, Inc., an operator and franchiser of family entertainment centers, from July 1992 until May 1995. Prior to July 1992, Mr. Casini practiced corporate and securities law with the law firm of Bell, Boyd & Lloyd LLP (now known as K&L Gates LLP) in Chicago, Illinois for more than five years.

Walter P. Hanley joined us in December 2002 as our Vice President of Development, Associate General Counsel and Assistant Secretary. In December 2005, he became our Senior Vice President of Development. Mr. Hanley served as Senior Vice President, General Counsel and Secretary of Emerald Casino, Inc., an owner of a license to operate a riverboat casino in the State of Illinois, from June 1999 until August 2002. Mr. Hanley served as Senior Vice President, General Counsel and Secretary of Blue Chip Casino, Inc., an owner and operator of a riverboat gaming vessel in Michigan City, Indiana, from July 1996 until November 1999. Mr. Hanley served as Vice President and Associate General Counsel of Flynn Enterprises, Inc. from May 1995 until February 1998 and as Associate General Counsel of Discovery Zone, Inc. from March 1993 until May 1995. Prior to March 1993, Mr. Hanley practiced corporate and securities law with the law firm of Bell, Boyd & Lloyd LLP (now known as K&L Gates LLP) in Chicago, Illinois.

Steven Greenspan became our Senior Vice President of Operations—Wholesale Parts Division on January 1, 2012. Mr. Greenspan has been in the recycled automotive parts industry for approximately 30 years. He served as our Regional Vice President—Mid-Atlantic Region from January 2003 to December 2011. He was the Manager of our Atlanta facility from May 1998 until December 2002. Prior thereto, he was the Manager of a company that we acquired in 1998.

Michael S. Clark has been our Vice President—Finance and Controller since February 2011. Prior thereto, he served as our Assistant Controller since May 2008. Prior to joining our Company, he was the SEC Reporting Manager of FMC Technologies, Inc., a global provider of technology solutions for the energy industry, from December 2004 to May 2008. Before joining FMC Technologies, Mr. Clark, a certified public accountant, worked in public accounting for more than eight years, leaving as a Senior Manager in the audit practice of Deloitte & Touche.

4

Code of Ethics

A copy of our Code of Ethics for Financial Officers is available free of charge through our website at www.lkqcorp.com.

Compliance with Section 16(a) of the Exchange Act

Section 16(a) of the Exchange Act requires our executive officers and directors, and any other person who owns more than 10% of our common stock, to file reports with the SEC regarding their ownership of our common stock and changes in such ownership. Based on our review of copies of these reports, we believe that during 2013 such persons have complied with their filing requirements, except the following: (a) gifts by Mr. Allen of a total of 5,698 shares in December 2011 that were reported on February 11, 2014; (b) the exercise of a stock option for 20,000 shares and the sale of such shares by Mr. Greenspan on December 13, 2013 that were reported on December 18, 2013; and (c) the sale of 6,000 shares by Mr. Greenspan on December 13, 2013 that was reported on February 4, 2014.

Audit Committee

Our Board has a standing Audit Committee. The members of the Audit Committee are Ms. McGarvie and Messrs. Allen, Meister, and Subramanian. The Audit Committee’s functions include selecting our independent registered public accounting firm and recommending that firm for ratification by stockholders; reviewing the arrangements for, and scope of, the independent registered public accounting firm’s examination of our financial statements; reviewing the activities of our internal audit department; meeting with the independent registered public accounting firm and certain of our officers to review the adequacy and appropriateness of our system of internal control and reporting, our critical accounting policies, and our public financial disclosures; reviewing compliance with our codes of ethics; and performing any other duties or functions deemed appropriate by the Board of Directors.

All of the Audit Committee members satisfy the independence, financial literacy, and expertise requirements of the rules of NASDAQ. Our Board of Directors has determined that each of Ms. McGarvie, Mr. Allen and Mr. Meister satisfies the requirements to be designated an “audit committee financial expert” under the rules and regulations of the SEC. The Audit Committee operates pursuant to a charter, which is available on our corporate website at www.lkqcorp.com. The Audit Committee met seven times during 2013.

| ITEM 11. | EXECUTIVE COMPENSATION |

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

The Compensation Committee is currently composed of Messrs. Foster, Meister, O’Brien and Webster. It determines the compensation of our executive officers. None of Messrs. Foster, Meister, O’Brien or Webster is or was an officer or employee of the Company nor are they officers of any entity for which one of our executive officers served as a director or makes compensation decisions.

EXECUTIVE COMPENSATION—COMPENSATION DISCUSSION AND ANALYSIS

This section describes the Company’s compensation programs for our executive officers that were in effect for 2013 and the decisions made with respect to these programs. This section contains compensation information for our principal executive officer, our principal financial officer, and our three other most highly compensated executive officers who were serving as executive officers as of December 31, 2013 (referred to as our “named executive officers”).

Executive Summary

Elements of Executive Compensation. Our executive compensation is composed primarily of the following:

| TYPE | METRIC | INCENTIVE-BASED | ||

| Base Salary |

Fixed Periodic Payments | No | ||

| Annual Bonus Awards |

Earnings Per Share | Yes | ||

| Long Term Incentive Awards |

Earnings Per Share, Total Revenue and Return on Equity | Yes | ||

| Equity Incentive Grants |

Stock Price and Earnings Per Share | Yes |

5

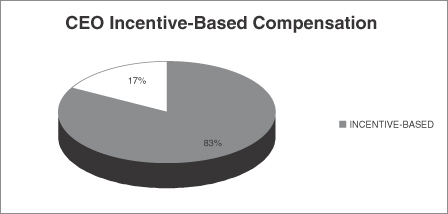

Incentive-Based Compensation. A significant portion of our executive compensation is in the form of incentive-based compensation. We consider our annual bonus awards, long-term incentive awards and equity incentive grants incentive-based compensation because their value depends in whole or in part on the financial performance of the Company. The following chart sets forth the percentage of our Chief Executive Officer’s 2013 compensation that was incentive-based.

Stock Ownership Requirements. Each of our named executive officers is subject to stock ownership requirements set forth below. These requirements are to be satisfied within five years of an individual becoming subject to the requirements. Each of our named executive officers is currently in compliance with the stock ownership requirements. The complete guidelines can be found on our website at www.lkqcorp.com (click the “Governance” link under “Investor Relations”).

| POSITION | MINIMUM NUMBER OF SHARES * |

VALUE OF MINIMUM REQUIRED HOLDINGS** | ||

| Chief Executive Officer |

112,000 | $3,050,880 | ||

| Chief Financial Officer |

52,000 | $1,416,480 | ||

| Other Named Executive Officers |

46,000 | $1,253,040 |

| * | For purposes of our stock ownership requirements, we include the number of shares actually owned by the named executive officer in his or her own name or in the name of an estate planning entity of which the named executive officer is the sole beneficiary. We also include restricted stock and restricted stock units. We exclude any pledged shares and shares of stock that the named executive officer has a right to acquire through the exercise of stock options. |

| ** | Based on closing price per share of LKQ Corporation common stock on March 12, 2014 of $27.24. |

At-Will Employment. We have agreements with each of our named executive officers that provide for a severance payment and other benefits upon a termination of the executive in connection with a change of control of the Company. These agreements are described in more detail under “Potential Payments Upon Termination or Change in Control.” Other than the foregoing, none of our named executive officers has an employment contract, and any of them can be terminated by the Board of Directors at any time.

Insider Trading. We have a comprehensive insider trading policy that is applicable to, among others, our named executive officers. The policy prohibits trading during quarterly “blackout” periods and other periods during which material information about us has not been publicly disclosed.

Hedging/Pledging. The Company’s policies prohibit, among others, our named executive officers from engaging in hedging transactions involving our common stock. In addition, shares that are pledged do not count toward the stock ownership requirements of our named executive officers.

No Material Perquisites. Other than matching contributions under our retirement plan and life insurance and disability insurance premium payments, we do not provide any material perquisites to our named executive officers.

Independent Compensation Committee. The Compensation Committee of our Board of Directors makes the final decisions regarding executive compensation and is composed entirely of independent directors.

Independent Compensation Consultant. Our Compensation Committee periodically engages a compensation consultant to advise it regarding executive compensation. The compensation consultant provides no other services to us and has no affiliation with any of our named executive officers.

6

Executive Compensation Decision-Making

Management provides to the Compensation Committee historical compensation information relating to our executive officers to aid the deliberations of the Compensation Committee regarding executive officer compensation. The information typically includes historical and proposed base salaries, bonuses, long term incentive awards, equity-based awards, and any other material component of compensation or perquisite. The Compensation Committee takes into account the historical trend of each element of compensation and the total of all of the elements for each year in connection with its decisions about proposed compensation amounts. In addition, the Compensation Committee receives recommendations from the Chairman of the Board regarding the compensation of the Chief Executive Officer and receives recommendations from the Chief Executive Officer regarding the compensation of the other executive officers.

The Compensation Committee also considers the limitation imposed by Section 162(m) of the Internal Revenue Code on our deduction for federal income tax purposes when making decisions about compensation. The Compensation Committee uses substantially the same compensation policies and considerations with respect to all of our executive officers.

The Compensation Committee has the authority to procure the services of compensation consultants if it determines that such services are necessary or desirable. In 2010, the Compensation Committee engaged Pearl Meyer & Partners, a compensation consulting firm, to review our executive officer compensation. The Compensation Committee directed Pearl Meyer to prepare a report analyzing the level of our executive officer compensation compared to the compensation of executive officers of similarly-situated companies. Pearl Meyer issued its report in August 2010. The report covered the methodology of Pearl Meyer’s review, comparisons of our executive officer compensation to market data, incentive practices among a peer group, dilution and overhang considerations with respect to equity-based awards, and recommendations regarding executive officer compensation. The Compensation Committee reviewed the report and has taken it into account in connection with the Compensation Committee’s periodic analysis of executive officer compensation. Pearl Meyer did not provide any additional services to the Company during 2011, 2012 or 2013.

In January 2013, the Compensation Committee reviewed the compensation of the executive officers of the peer group listed below (which was the peer group used by Pearl Meyer in its August 2010 report) in connection with its evaluation and determination of the 2013 compensation of our executive officers. However, the Compensation Committee did not set any specific target with regard to setting the compensation of our executive officers in comparison to the executive officers of the peer group.

|

Advance Auto Parts, Inc. |

| Anixter International Inc. |

| Applied Industrial Technologies, Inc. |

| Beacon Roofing Supply Inc. |

| Fastenal Company |

| Interline Brands, Inc. |

| O’Reilly Automotive, Inc. |

| The Pep Boys-Manny, Moe & Jack |

| PSS World Medical, Inc. |

| Schnitzer Steel Industries, Inc. |

| Standard Motor Products, Inc. |

| Steel Dynamics, Inc. |

|

WESCO International, Inc. |

In August 2013, the Compensation Committee engaged Frederic W. Cook & Co., Inc., a compensation consulting firm (“F.W. Cook”), to perform another review of our executive officer compensation. The Compensation Committee directed F.W. Cook to prepare a report analyzing the reasonableness of the compensation of our executive officers and the appropriateness of our compensation program structure and practices in supporting our business objectives. F.W. Cook issued its report in December 2013. The report summarized our current executive compensation program, provided a comparative analysis of our executive compensation program with the executive compensation programs of a peer group of companies, and offered suggestions regarding potential adjustments to our executive compensation program. F.W. Cook compiled a new peer group for purposes of analyzing our executive compensation program. The new peer group is composed of the following companies.

7

| Advance Auto Parts, Inc. |

|

Allison Transmission Holdings, Inc. |

|

American Axle & Manufacturing Holdings, Inc. |

|

Applied Industrial Technologies, Inc. |

|

AutoZone, Inc. |

|

BorgWarner Inc. |

|

Cooper Tire & Rubber Company |

|

Dana Holding Corporation |

|

Fastenal Company |

|

Genuine Parts Company |

|

MSC Industrial Direct Co., Inc. |

|

O’Reilly Automotive, Inc. |

|

Pool Corporation |

|

Republic Services, Inc. |

|

Schnitzer Steel Industries, Inc. |

|

Tenneco Inc. |

|

W.W. Grainger Inc. |

|

Watsco, Inc. |

|

WESCO International, Inc. |

The Compensation Committee reviewed the F.W. Cook report and took it into account in connection with the Compensation Committee’s analysis of 2014 executive officer compensation. Other than services relating to executive officer compensation provided in 2013, F.W. Cook did not provide any additional services to the Company during 2011, 2012 or 2013.

The Compensation Committee has considered the independence of F.W. Cook and determined that its engagement of F.W. Cook & Co. did not raise any conflicts of interest with LKQ or any of our directors or executive officers. All of F.W. Cook’s work was on behalf of the Committee.

Advisory Vote on Executive Compensation

Commencing in 2011, we have submitted to our stockholders on an annual basis a proposal for a (non-binding) advisory vote to approve the compensation of our named executive officers. The table below sets forth the amount of shares that voted to approve our executive compensation as a percentage of shares that voted on the proposal in 2011, 2012, and 2013. In 2011, our Board of Directors recommended, and our stockholders approved, that the advisory vote be held every year.

| YEAR | PERCENTAGE | |

|

2011 |

97.1% | |

|

2012 |

96.5% | |

|

2013 |

97.1% |

The Compensation Committee considered, among other things, the outcome of this vote when evaluating our compensation principles, designs and practices and decided to continue for 2013 our compensation principles, designs and practices largely unchanged compared to 2012 due in part to the level of stockholder support.

Objectives of Our Compensation Programs

Our compensation programs are intended to enable us to attract, motivate, reward and retain the management talent needed to achieve our corporate objectives in a highly competitive industry, and thereby increase stockholder value. It is our policy to provide incentives to the Company’s senior management to achieve both short-term and long-term goals. To attain these goals, our policy is to provide a significant portion of executive compensation in the form of at-risk, incentive-based compensation. We believe that such a policy, which directly aligns the financial interests of management with the financial interests of our stockholders, provides the proper incentives to attract, motivate, reward and retain high quality management.

8

The Compensation Committee has maintained this policy since we became a public company in October 2003 and believes that the policy has been and continues to be appropriate for a growing company like ours. The Compensation Committee will reevaluate this policy in the event that our growth profile changes over time or in the event that the Compensation Committee identifies other reasons that warrant a change of policy.

What Our Compensation Programs are Designed to Reward

Our compensation programs are designed to reward the executive officers for the overall performance of our Company and the individual performance of each executive officer. Specifically, with respect to the overall performance of our Company, we have historically used the growth of the following metrics to measure performance: revenue, consolidated earnings per share, and return on equity. With respect to individual performance of an executive officer, we analyze the growth of the performance metrics that most directly relate to such individual’s area of responsibility and consider certain subjective factors, including the individual’s interpersonal skills, level of motivation, and ability to resolve challenges and to overcome obstacles.

Other than for purposes of determining the appropriate value of equity related awards, stock price performance has not been used as a direct factor in determining executive officer compensation because the price of our common stock is subject to a variety of factors outside of the control of management. Stock price performance, however, ultimately affects the value of equity incentive awards held by executive officers, thus aligning their interests with those of other stockholders.

Elements of Our Compensation Programs, Why We Chose Each Element, and How We Determine the Amount of Each Element

The elements of our compensation programs are base salaries, annual bonus awards, long term incentive awards, and equity incentive grants. We believe that this mix of compensation elements best achieves the objectives of our compensation programs and provides appropriate short-term and long-term motivation to our executive officers.

Base Salaries. Base salaries provide immediate rewards because they are paid periodically throughout the year. The following factors are considered in connection with the base salary of each of the executive officers: base salaries of executive officers in similar positions at comparable companies; the contributions of the executive officers to the Company’s development and growth; and the executive officer’s experience, responsibilities and position within the Company. No specific corporate performance measures are considered with respect to base salaries.

Annual Bonus Awards. We offer annual bonus awards under our Management Incentive Plan (“MIP”) to provide incentives for superior performance over a one-year time horizon. The MIP was approved by our stockholders in May 2011. Under the MIP, each participant (including each of our named executive officers) is eligible to receive a cash payment equal to a percentage of the participant’s base salary. The percentage of base salary ultimately paid is dependent on the achievement of specified levels of financial performance of the Company during a particular fiscal year. In 2013, these percentages ranged from 20% to 150% for our executive officers. In 2013, the bonus payment for our executive officers was based on the Company’s consolidated earnings per share. The target amounts for consolidated earnings per share are determined through our budgeting process that includes growth rates for the Company as a whole and for each region and unit, all as approved by our Board of Directors. In 2013, the earnings per share target was a range of $0.97 (at which the threshold bonus would be earned) to $1.06 (at which the maximum bonus would be earned). Our 2013 earnings per share for purposes of the bonus calculation (which included the cost of paying all 2013 bonuses) resulted in the maximum bonus amounts for our executive officers.

Long Term Incentive Awards. We grant performance awards under our Long Term Incentive Plan (“LTIP”) to certain of our key employees (including our named executive officers). The LTIP was approved by our stockholders in 2006 and re-approved by our stockholders in 2011. Long term incentive awards are designed to reward performance over a three-year period and to create retention incentives. The Compensation Committee administers the LTIP. Performance periods begin on January 1 and end on December 31 of the third calendar year thereafter. Performance awards are equal to the participant’s base salary multiplied by an award percentage. The award percentage is determined by the growth from the year before the commencement of the performance period (base year) to the final year of the performance period of three components: our earnings per share, our total revenue, and our return on equity. We determine for each participant the range of award percentages based on different growth scenarios of the components.

One-half of any performance award achieved is payable promptly after the end of the applicable performance period. A participant must be an employee or other key person of the Company at the end of the performance period to be eligible for the first 50% payment. The other half of the performance award is deferred and payable in three equal installments (plus interest) on each one year anniversary of the end of the performance period over a total of three years. A participant must be an employee or other key person of the Company on each such anniversary date to be eligible for the respective deferred payment, unless the participant is not an employee or key person as a result of death, total disability or normal retirement at age 65, in which case the participant (or his or her estate) will be entitled to all of the deferred payments upon such death, disability or retirement. Interest on the deferred portion of

9

the performance award will accrue at the prime rate and be payable to the participant at the same time as the deferred installments are paid. Upon a change in control, the LTIP provides for acceleration of payments as described below under “Potential Payments Upon Termination or Change in Control.”

A new three-year performance period commenced on January 1, 2012 and will end on December 31, 2014. The performance awards for the current performance period range from 70% to 275% of base salary for our executive officers. The target growth ranges of the three components of these awards for that performance period were 45% to 60% for earnings per share, 30% to 40% for revenue, and 210 basis points to 300 basis points for return on equity. We weighted each of the three components of these awards as follows: 47.5% for earnings per share growth; 47.5% for revenue growth; and 5.0% for return on equity growth. Higher percentages were assigned to earnings per share growth and revenue growth because they were considered relatively more important measures of the success of our Company. The Summary Compensation Table on page 15 sets forth under the column entitled “Non-Equity Incentive Plan Compensation” the amounts recorded by us to the income statement relating to the LTIP for the years presented with respect to our named executive officers.

Equity Incentive Grants. Equity-based awards provide incentives over multi-year time horizons, with vesting schedules of up to five years. Generally, equity-based awards are forfeited upon separation of service, providing an incentive to the employee to remain with the Company. Equity based awards are granted under our 1998 Equity Incentive Plan (the “Equity Incentive Plan”). The Compensation Committee administers the Equity Incentive Plan. Under the Equity Incentive Plan, the Compensation Committee may grant qualified and non-qualified stock options, restricted stock, restricted stock units, stock appreciation rights (“SARs”), performance shares and performance units. During the life of the Equity Incentive Plan, not more than 69,888,834 shares of common stock in the aggregate may be issued under the Equity Incentive Plan. As of March 12, 2014, a total of 13,285,126 shares of our common stock remained available for issuance under the Equity Incentive Plan. Shares subject to awards granted under the Equity Incentive Plan that are returned as payment for the exercise price or tax withholding amount relating to the award or with respect to which awards expire or are forfeited or are paid in cash, would again be available for grant under the Equity Incentive Plan.

The Compensation Committee has the power to set the terms and conditions to which each award is subject, including the times at which it is exercisable. Notwithstanding the foregoing: (i) the exercise price of a stock option or SAR may not be less than the fair market value of our common stock on the date the award is granted; and (ii) the performance period for performance shares and performance units must be a minimum of one year.

Upon a change in control as defined in the plan, awards under the Equity Incentive Plan become immediately exercisable, restrictions thereon lapse, and maximum payout opportunities are deemed earned, as the case may be, as of the effective date of the change in control. The Board of Directors may amend or terminate the Equity Incentive Plan in whole or in part at any time, subject to applicable laws, rules, or regulations; provided, however, that the Board may not, without stockholder approval, (i) materially increase the benefits accruing to participants, (ii) materially increase the number of securities that may be issued under the Equity Incentive Plan, or (iii) materially modify the requirements for participation in the Equity Incentive Plan. No amendment, modification, or termination of the Equity Incentive Plan can adversely affect in any material way any award previously granted, without the written consent of the participant holding such award.

We grant equity awards to named executive officers and other key employees typically upon their commencement of employment, in some cases upon their promotion, and annually near the beginning of each year. The annual grants are made on the second Friday of January each year. When making equity awards, we consider factors specific to each employee such as salary, position and responsibilities. We also consider factors such as the rate of the Company’s development and growth and an estimate of the value of each award. In addition, we determine the amount of dilution that we believe would be generally acceptable to our stockholders and correspondingly limit the aggregate number of awards granted each year. Award grants typically are recommended by management.

In March 2013, the Compensation Committee approved the cancellation of 671,400 unvested RSUs held by our executive officers and approved the issuance of 946,800 RSUs containing both a performance-based vesting condition and a time-based vesting condition. Of the 946,800 RSUs, 671,400 were granted as a replacement of the canceled RSUs and included a performance-based condition that the Company report positive diluted earnings per share, subject to certain adjustments, during the year ending December 31, 2013. In addition, these RSUs retained the same remaining time-based vesting conditions as the canceled RSUs (vesting in equal tranches each six months beginning July 2013 through either January 2016 or January 2017). The remaining 275,400 RSUs granted in March 2013 included a performance-based condition that the Company reports positive diluted earnings per share, subject to certain adjustments, during any fiscal year period within five years following the grant date. In addition, these RSUs included a time-based vesting condition, vesting in equal tranches each six months beginning July 2013 through January 2016. In all cases, both conditions must be met before any RSUs vest. If the applicable performance-based condition of an RSU is not met, the RSU is forfeited. If and when the performance-based condition is met, all applicable RSUs that had previously met the time-based vesting condition will vest immediately and the remaining RSUs will vest according to the remaining schedule of the time-based condition.

The table entitled Grants of Plan-Based Awards for Fiscal Year Ended December 31, 2013 on page 16 sets forth additional information about the grants made in 2013 under the Equity Incentive Plan to our named executive officers.

10

Compensation of Our Chief Executive Officer

Robert L. Wagman has been our President and Chief Executive Officer since January 1, 2012. The annual compensation, including base salary, bonus potential, long term incentive award and equity incentive awards, of Mr. Wagman was determined for 2013 using substantially the same criteria that were used to determine the compensation of other executive officers. Mr. Wagman’s base salary for 2013 was $650,000. Based on the Company’s consolidated earnings per share in 2013, Mr. Wagman received a bonus payment in February 2014 of $975,000.

In March 2009, Mr. Wagman received a performance award under our LTIP for the three-year performance period that ended on December 31, 2011. Based upon the financial performance of the Company during the three-year period ended December 31, 2011, Mr. Wagman earned a cash award under the plan equal to 2.5 times his base salary as of December 31, 2011. We paid 50% of the award in March 2012, and we paid or will pay the remaining 50% in three equal installments (plus interest) in late 2012, 2013 and 2014. Mr. Wagman must be employed by us at the time such payments become payable to receive them (subject to certain exceptions relating to death, disability or normal retirement).

In December 2011, Mr. Wagman received a performance award under our LTIP for the performance period beginning as of January 1, 2012 and ending December 31, 2014. Based upon the financial performance of the Company during the three-year period ending December 31, 2014, Mr. Wagman may be entitled to a cash payment under the LTIP equal to as much as 2.75 times his base salary. Any such payment would be made to Mr. Wagman 50% when the award is determined (in early 2015) and 50% over the succeeding three years in equal installments (plus interest). Mr. Wagman must be employed by us at the time such payments become payable to receive them (subject to certain exceptions relating to death, disability or normal retirement).

Mr. Wagman has been awarded RSUs, restricted shares and stock options under the Equity Incentive Plan. In March 2013, he received a grant under the Equity Incentive Plan of 80,000 new RSUs (258,000 additional RSUs were granted as replacements for an equal number of previously-granted RSUs that were canceled). Of the total RSUs and restricted shares held by Mr. Wagman, 45,000 vested in 2013 with an aggregate value, based on the market value of LKQ common stock on the applicable vest dates, of $1,012,730. As of December 31, 2013, Mr. Wagman held options to purchase a total of 224,000 shares, of which 195,200 were exercisable. The value of the options to purchase the 195,200 shares, measured by the amount that the market value of LKQ common stock on the last trading day in 2013 ($32.90) exceeded each option’s exercise price, was $4,757,645.

In 2013, Mr. Wagman did not receive any material perquisites, any deferred compensation (other than pursuant to our retirement plans), or any reimbursements for the payment of taxes. In our view, Mr. Wagman’s total compensation for 2013 properly reflected the Company’s performance and his performance, and was in proper proportion to the compensation of our other executive officers.

Retirement Plans

We have a 401(k) plan covering substantially all of our employees, including our named executive officers, who have been employed for at least six months. The 401(k) plan allows participants to defer their eligible compensation in amounts up to the statutory limit each year. We currently make matching contributions equal to 50% of the portion of the participant’s contributions that does not exceed 6% of the participant’s eligible compensation. We may, at our sole discretion, make annual profit-sharing contributions on behalf of participants. Each participant is fully vested in such participant’s contributions and any earnings they generate. Each 401(k) participant becomes vested in our matching contributions, and any earnings they generate, in the amounts of 50%, 75% and 100% after two, three and four years of service, respectively. Each participant becomes vested in our profit sharing contributions, if any, and any earnings they generate, in the amounts of 25%, 50%, 75% and 100% after one, two, three and four years of service, respectively.

We also have a plan for highly compensated employees, or HCEs, that supplements the 401(k) plan. All of our named executive officers are HCEs. The tax laws impose a maximum percentage of salary that can be contributed each year by HCEs to our 401(k) plan depending on the participation level of non-HCEs. We adopted the supplemental plan to provide an alternative retirement plan for the HCEs when the participation level of non-HCEs restricts the amount the HCEs would otherwise have been permitted to contribute to the 401(k) plan. The supplemental plan operates similarly to the 401(k) plan except that contributions by HCEs to the supplemental plan are not subject to the statutory maximum percentage, the balance in each HCE’s account in the supplemental plan is a general asset of ours, and in the event of our insolvency, the HCE would be a general, unsecured creditor with respect to such amount.

The terms of the supplemental plan limit the maximum annual contribution by each participant to 100% of the HCE’s salary (including commissions), bonuses and long term incentive awards. In addition, the plan authorizes the Compensation Committee to set an aggregate maximum annual contribution amount. There is no such current aggregate maximum annual contribution. We periodically transfer from the plan to the 401(k) plan, on behalf of each HCE who so elects, the maximum amount (if any) that could have been contributed directly to the 401(k) plan.

11

Potential Payments Upon Termination or Change in Control

Upon a change in control, the terms of our LTIP provide that each performance period that has not ended ends as of the last day of the next calendar quarter, the performance award relating to the shortened performance period is calculated taking into account the shortened performance period, and all unpaid performance awards (relating to the shortened performance period and any other performance periods) become promptly payable. Upon a change in control, the terms of our Equity Incentive Plan provide that equity awards become fully vested.

We have Change of Control Agreements with certain of our employees, including each of our named executive officers. The terms of the agreements as in effect as of December 31, 2013 are described below.

The agreements have an initial term of three years and will automatically renew for a two-year period, unless notice of termination is given by the Company at least 60 days before any such renewal date. The operative provisions of the agreements will apply, however, only if a Change of Control, as defined in the agreements, occurs during the period the agreement is in effect.

If the employee’s employment with the Company is terminated within two years following a Change of Control (or within 12 months prior to a Change of Control in certain circumstances) as a result of an Involuntary Termination (as defined in the agreements), then the employee will be entitled to receive payments and benefits that include the following:

| • | Payment of salary and other compensation accrued through the termination date; |

| • | Payment of a pro rata bonus; |

| • | A severance payment equal to a multiple (two-and-one-half times in the case of Mr. Wagman, two times in the case of Mr. Quinn, Mr. Hanley and Mr. Casini, and one-and-one-half times in the case of Mr. Greenspan) of the sum of the employee’s (a) salary and (b) the greater of the employee’s target bonus or average annual bonus over the preceding three years; |

| • | If applicable, all unreimbursed relocation expenses; |

| • | Continuing coverage of the employee and the employee’s dependents under the Company’s health and dental care plans (for a period of 30 months in the case of Mr. Wagman, 24 months in the case of Mr. Quinn, Mr. Hanley and Mr. Casini, and 18 months in the case of Mr. Greenspan); |

| • | Outplacement services; and |

| • | The employee’s outstanding equity-based compensation awards shall become vested and exercisable. |

If the employee’s employment with the Company is terminated as a result of death or disability, the employee will be entitled to receive salary and other compensation accrued through the termination date and a pro rata bonus. If the employee’s employment with the Company is terminated for Cause or the employee resigns for other than Good Reason (as those terms are defined in the agreement) the employee will be entitled to receive salary and other compensation accrued through the termination date.

The agreement also contains confidentiality obligations on the part of the employee and requires that the employee deliver a release to the Company as a condition to receiving payments of benefits under the agreement. The agreement also provides that in the event of a dispute concerning an agreement, the Company will pay the legal fees of the employee.

Under the agreements, a “Change of Control” would include any of the following events:

| • | any “person,” as defined in the Exchange Act, acquiring 30% or more of our outstanding common stock or combined voting power of our outstanding securities, subject to certain exceptions; |

| • | during a two-year period, our current directors (or new directors approved by them) cease to constitute a majority of our board; and |

| • | a merger, consolidation, share exchange, reorganization or similar transaction involving the Company or any of its subsidiaries, a sale of substantially all the Company’s assets, or the acquisition of assets or stock of another entity by the Company (unless following such business combination transaction a majority of the Company’s directors continue as directors of the resulting entity, the holders of the outstanding voting securities of the Company immediately prior to such an event continue to own shares or other securities that represent more than 50% of the combined voting power of the resulting entity after such event in substantially the same proportions as their ownership prior to such business combination transaction, and no person owns 30% or more of the resulting entity’s common stock or voting securities). |

12

The following table summarizes the value of the termination payments and benefits that our named executive officers would have received if they had terminated employment on December 31, 2013 under the circumstances described above. The table excludes amounts accrued through December 31, 2013 that would be paid in the normal course of continued employment, such as accrued but unpaid salary and earned annual bonus for 2013.

| Robert L. Wagman |

John S. Quinn |

Walter P. Hanley |

Victor M. Casini |

Steven Greenspan |

||||||||||||||||

| Cash severance |

$ | 3,250,000 | $ | 1,691,050 | $ | 1,446,667 | $ | 1,441,111 | $ | 675,000 | ||||||||||

| Long-Term Incentive Compensation |

||||||||||||||||||||

| Unvested and Accelerated Share Based Awards |

11,799,448 | 7,573,460 | 6,521,093 | 6,054,660 | 1,906,840 | |||||||||||||||

| Long-Term Incentive Plan |

1,906,565 | 1,327,208 | 1,126,290 | 1,126,290 | 627,789 | |||||||||||||||

| Benefits and Perquisites (1) |

||||||||||||||||||||

| Medical and Dental Benefits (2) |

48,123 | 58,268 | 58,268 | 58,268 | 43,701 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total |

$ | 17,004,136 | $ | 10,649,986 | $ | 9,152,318 | $ | 8,680,329 | $ | 3,253,330 | ||||||||||

| (1) | In addition to the benefits shown, each named executive officer is entitled to receive outplacement services at the expense of the Company. The amounts to be incurred by the Company for such services would be dependent on the terms and conditions of the services, which would be determined prior to the Change of Control date. |

| (2) | Medical and dental benefits reflect the lump sum payment to each named executive officer in the event that the terms of the Company’s Health Plans (as defined in the agreement) do not allow participation subsequent to a Change of Control. In the event the Health Plans do allow participation, such benefits paid by the Company will be dependent on actual claims incurred due to the self-insured nature of the Company’s plans. Under the terms of the agreements, medical and dental benefits are reduced to the extent that the individual becomes covered under a group health or dental plan providing comparable benefits. |

Other than as described above, we do not have any pension, change in control, severance or other post-termination plans or arrangements applicable to our executive officers.

Indemnification

Each of our named executive officers is a party to an indemnification agreement with us that assures the officer of indemnification and advancement of expenses to the fullest extent permitted by Delaware law and our Certificate of Incorporation.

Impact of Regulatory Requirements

Section 162(m) of the Internal Revenue Code limits the deduction for federal income tax purposes of certain compensation paid in any fiscal year by a publicly-held corporation to its chief executive officer and its three other highest compensated officers (other than its chief financial officer) to $1 million per executive (the “$1 million cap”). The $1 million cap does not apply to “performance-based” compensation as defined under Section 162(m). We believe that annual bonuses paid under our MIP, awards issued under our LTIP, stock options issued under our Equity Incentive Plan, and RSUs issued under our Equity Incentive Plan that include an appropriate performance-based vesting condition qualify as “performance-based” compensation.

The 2013 compensation that was not exempt under Section 162(m) for Mr. Wagman, our Chief Executive Officer at December 31, 2013, exceeded the $1 million cap by $664,421. The compensation that is subject to the $1 million cap paid to our other named executive officers did not exceed the cap in 2013, except in the case of Mr. Hanley whose compensation exceeded the cap by $16,149. We currently believe that the compensation subject to the $1 million cap paid to our named executive officers will not exceed the $1 million cap in 2014. Although the Compensation Committee takes into consideration Section 162(m) when making decisions about executive compensation, there is no formal policy regarding the $1 million cap and the compensation of our named executive officers.

Risks Relating to our Compensation Policies and Practices

We have undertaken an analysis of our compensation policies and practices to assess whether risks arising from such policies and practices are reasonably likely to have a material adverse effect on our company. The analysis was performed by our management with oversight by the Compensation Committee of our Board of Directors. We analyzed risks relating to the different components of our compensation structure, to the time horizons of our compensation components, to the goals and objectives used to determine performance-based compensation, to the disparate treatment, if any, among compensation policies and practices of our business units, and to any contractual obligations by us to accelerate the payment of compensation. Based on that analysis, we have concluded that the risks arising from our compensation policies and practices are not reasonably likely to have a material adverse effect on our company.

13

Compensation Committee Report

We have reviewed and discussed with management the Compensation Discussion and Analysis to be included in Amendment No. 1 on Form 10-K/A (“Amendment No. 1”) to the Company’s Annual Report on Form 10-K for the year ended December 31, 2013 and in the Company’s 2014 Annual Stockholder Meeting Schedule 14A Proxy Statement, to be filed pursuant to Section 14(a) of the Exchange Act (the “Proxy Statement”). Based on the review and discussions referred to above, we recommend to the Board of Directors that the Compensation Discussion and Analysis referred to above be included in Amendment No. 1 and in the Proxy Statement.

Compensation Committee:

Paul M. Meister (Chair)

Ronald G. Foster

John F. O’Brien

William M. Webster, IV

14

EXECUTIVE COMPENSATION—COMPENSATION TABLES

Summary Compensation Table

The following table includes information concerning compensation for the three year period ended December 31, 2013 paid to our Chief Executive Officer, our Chief Financial Officer and our three other highest compensated executive officers (“NEOs”).

| Name and Principal Position |

Year | Salary (1) | Bonus | Stock Awards (2) |

Option Awards (2) |

Non-Equity Incentive Plan Compensation (3) |

All Other Compensation (4) |

Total | ||||||||||||||||||||||||

| Robert L. Wagman |

2013 | $ | 650,000 | — | $ | 1,644,400 | — | $ | 1,725,390 | $ | 21,191 | $ | 4,040,981 | |||||||||||||||||||

| President and Chief Executive Officer |

2012 | $ | 650,000 | — | $ | 2,844,900 | — | $ | 960,188 | $ | 21,090 | $ | 4,476,178 | |||||||||||||||||||

| 2011 | $ | 475,000 | — | $ | 2,235,825 | — | $ | 897,268 | $ | 15,954 | $ | 3,624,047 | ||||||||||||||||||||

| John S. Quinn |

2013 | $ | 500,000 | — | $ | 1,151,080 | — | $ | 972,479 | $ | 22,807 | $ | 2,646,366 | |||||||||||||||||||

| Executive Vice |

2012 | $ | 450,000 | — | $ | 1,501,475 | — | $ | 547,139 | $ | 29,202 | $ | 2,527,816 | |||||||||||||||||||

| 2011 | $ | 425,000 | — | $ | 980,633 | — | $ | 717,628 | $ | 25,451 | $ | 2,148,712 | ||||||||||||||||||||

| Walter P. Hanley |

2013 | $ | 400,000 | — | $ | 1,155,191 | — | $ | 781,792 | $ | 19,091 | $ | 2,356,074 | |||||||||||||||||||

| Senior Vice President - Development |

2012 | $ | 400,000 | — | $ | 1,406,645 | — | $ | 506,958 | $ | 26,891 | $ | 2,340,494 | |||||||||||||||||||

| 2011 | $ | 400,000 | — | $ | 980,633 | — | $ | 737,896 | $ | 24,204 | $ | 2,142,733 | ||||||||||||||||||||

| Victor M. Casini |

2013 | $ | 400,000 | — | $ | 1,052,416 | — | $ | 781,792 | $ | 19,091 | $ | 2,253,299 | |||||||||||||||||||

| Senior Vice President, General Counsel and Corporate Secretary |

2012 | $ | 400,000 | — | $ | 1,406,645 | — | $ | 506,958 | $ | 26,891 | $ | 2,340,494 | |||||||||||||||||||

| 2011 | $ | 400,000 | — | $ | 980,633 | — | $ | 739,738 | $ | 23,953 | $ | 2,144,324 | ||||||||||||||||||||

| Steven Greenspan |

2013 | $ | 300,000 | — | $ | 411,100 | — | $ | 579,888 | $ | 10,662 | $ | 1,301,650 | |||||||||||||||||||

| Senior Vice President Of Operations - Wholesale Parts Division |

2012 | $ | 250,000 | — | $ | 316,100 | — | $ | 259,050 | $ | 7,816 | $ | 832,966 | |||||||||||||||||||

| (1) | The base compensation of our executive officers is discussed beginning on page 9. |

| (2) | The amounts represent the grant date fair value calculated in accordance with Financial Accounting Standards Board Accounting Standards Codification 718, “Compensation-Stock Compensation” (“FASB ASC Topic 718”). See Note 3 of the consolidated financial statements in the Original 10-K regarding assumptions underlying the valuation of equity awards. Our Equity Incentive Plan is discussed beginning on page 10. |

| (3) | Our Non-Equity Incentive Plan Compensation includes amounts related to our LTIP (long-term) and MIP (annual) awards. The amounts for each NEO for each of these award categories are set forth in the table below. The amounts shown for the LTIP are equal to the amount recorded by us to the income statement for accounting purposes in the years presented. The amounts shown for the MIP are equal to the amounts earned and subsequently paid for each annual performance period related to the years presented. Our LTIP and our MIP are discussed beginning on page 9. |

| Name and Principal Position |

Year | LTIP | MIP | |||||||||

| Robert L. Wagman |

2013 | $ | 750,390 | $ | 975,000 | |||||||

| 2012 | $ | 524,688 | $ | 435,500 | ||||||||

| 2011 | $ | 327,268 | $ | 570,000 | ||||||||

| John S. Quinn |

2013 | $ | 422,479 | $ | 550,000 | |||||||

| 2012 | $ | 344,639 | $ | 202,500 | ||||||||

| 2011 | $ | 250,128 | $ | 467,500 | ||||||||

| Walter P. Hanley |

2013 | $ | 341,792 | $ | 440,000 | |||||||

| 2012 | $ | 326,958 | $ | 180,000 | ||||||||

| 2011 | $ | 297,896 | $ | 440,000 | ||||||||

| Victor M. Casini |

2013 | $ | 341,792 | $ | 440,000 | |||||||

| 2012 | $ | 326,958 | $ | 180,000 | ||||||||

| 2011 | $ | 299,738 | $ | 440,000 | ||||||||

| Steve Greenspan |

2013 | $ | 249,888 | $ | 330,000 | |||||||

| 2012 | $ | 146,550 | $ | 112,500 | ||||||||

15

| (4) | The amounts include Company matching contributions under our retirement plans, the amount of life insurance premiums paid by us for the benefit of the NEOs, and the amount we pay to the NEOs as reimbursement for their payment of the premiums for disability insurance. The amounts for each NEO for each such category of compensation are set forth in the table below. |

| Name and Principal Position |

Year | Retirement Plans |

Life Insurance Premiums |

Disability Insurance Premiums |

||||||||||

| Robert L. Wagman |

2013 | $ | 19,500 | $ | 1,260 | $ | 431 | |||||||

| 2012 | $ | 19,399 | $ | 1,260 | $ | 431 | ||||||||

| 2011 | $ | 14,263 | $ | 1,260 | $ | 431 | ||||||||

| John S. Quinn |

2013 | $ | 21,116 | $ | 1,260 | $ | 431 | |||||||

| 2012 | $ | 27,511 | $ | 1,260 | $ | 431 | ||||||||

| 2011 | $ | 23,760 | $ | 1,260 | $ | 431 | ||||||||

| Walter P. Hanley |

2013 | $ | 17,400 | $ | 1,260 | $ | 431 | |||||||

| 2012 | $ | 25,200 | $ | 1,260 | $ | 431 | ||||||||

| 2011 | $ | 22,513 | $ | 1,260 | $ | 431 | ||||||||

| Victor M. Casini |

2013 | $ | 17,400 | $ | 1,260 | $ | 431 | |||||||

| 2012 | $ | 25,200 | $ | 1,260 | $ | 431 | ||||||||

| 2011 | $ | 22,262 | $ | 1,260 | $ | 431 | ||||||||

| Steven Greenspan |

2013 | $ | 8,971 | $ | 1,260 | $ | 431 | |||||||

| 2012 | $ | 6,125 | $ | 1,260 | $ | 431 | ||||||||

Grants of Plan-Based Awards for Fiscal Year Ended December 31, 2013