Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - MEDIFAST INC | v371904_8-k.htm |

Sidoti Conference March 2014

Certain information included in this presentation may constitute forward - looking statements within the meaning of Section 27 A of the Securities Act of 1933 , as amended, Section 21 E of the Securities Exchange Act of 1934 , as amended, and the Private Securities Litigation Reform Act of 1995 . These forward - looking statements generally can be identified by use of phrases or terminology such as "intend" or other similar words or the negative of such terminology . Similarly, descriptions of Medifast's objectives, strategies, plans, goals or targets contained herein are also considered forward - looking statements . Medifast believes this presentation should be read in conjunction with all of its filings with the United States Securities and Exchange Commission and cautions its readers that these forward - looking statements are subject to certain events, risks, uncertainties, and other factors . Some of these factors include, among others, Medifast's inability to attract and retain independent Health Coaches and Members, stability in the pricing of print, TV and Direct Mail marketing initiatives affecting the cost to acquire customers, increases in competition, litigation, regulatory changes, and its planned growth into new domestic and international markets and new channels of distribution . Although Medifast believes that the expectations, statements, and assumptions reflected in these forward - looking statements are reasonable, it cautions readers to always consider all of the risk factors and any other cautionary statements carefully in evaluating each forward - looking statement in this presentation, as well as those set forth in its latest Annual Report on Form 10 - K and Quarterly Report on Form 10 - Q, and other filings filed with the United States Securities and Exchange Commission, including its current reports on Form 8 - K . Safe Harbor Statement 2

Video 3

Medifast Products and Programs Have Been Recommended by over 20,000 Doctors and Used by Over a Million Customers Since 1980 FAST SAFE SIMPLE LONG TERM PORTABLE 4

Vision To create health, hope, and happiness through clinically proven weight - management products, programs, and support Mission To combat the obesity epidemic and improve health in two ways: • Through clinically proven weight - management products & programs • Through multiple, innovative support channels, each of which meets different personal weight management, health, and wellness needs 5

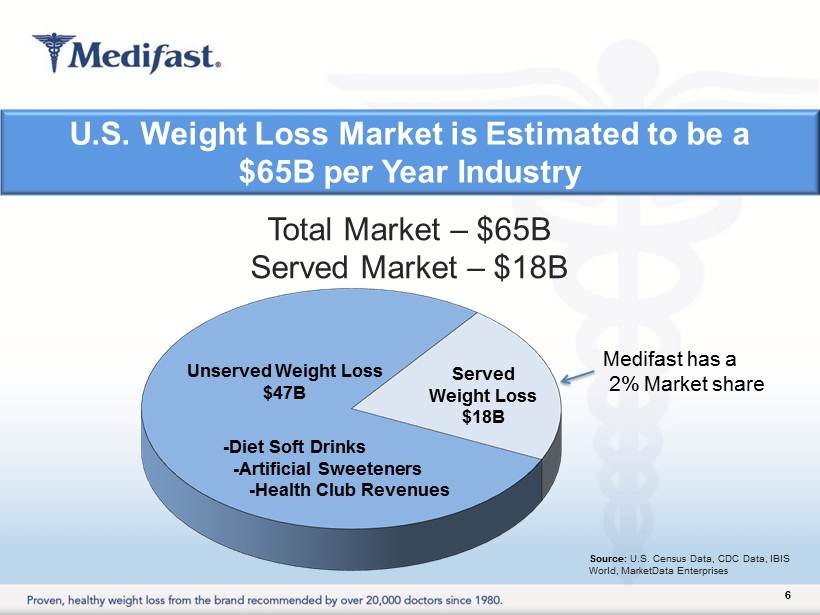

Source: U.S. Census Data, CDC Data, IBIS World, MarketData Enterprises Unserved Weight Loss $47B - Diet Soft Drinks - Artificial Sweeteners - Health Club Revenues Served Weight Loss $18B Total Market – $65B Served Market – $18B U.S. Weight Loss Market is Estimated to be a $65B per Year Industry 6 Medifast has a 2% Market share

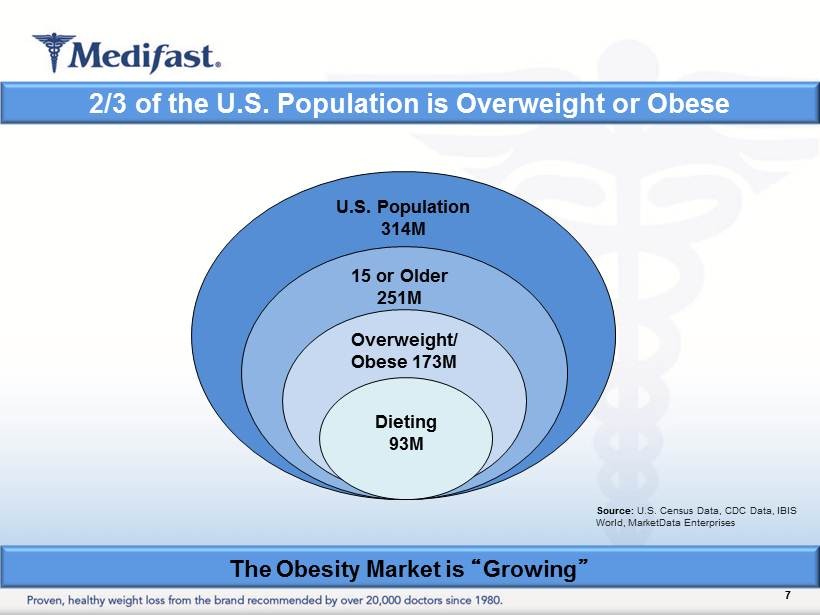

Source: U.S. Census Data, CDC Data, IBIS World, MarketData Enterprises U.S. Population 314M 15 or Older 251M Overweight/ Obese 173M Dieting 93M 2/3 of the U.S. Population is Overweight or Obese The Obesity Market is “ Growing ” 7

8 Obesity officially recognized as a disease in 2013 Obesity on the Rise The CDC reports a significant increase in Obesity levels 8

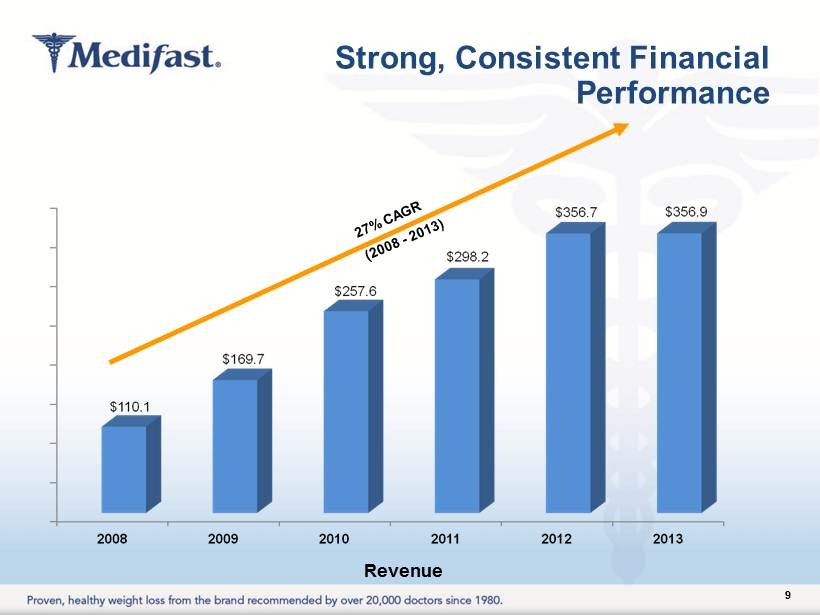

Strong, Consistent Financial Performance Revenue 9

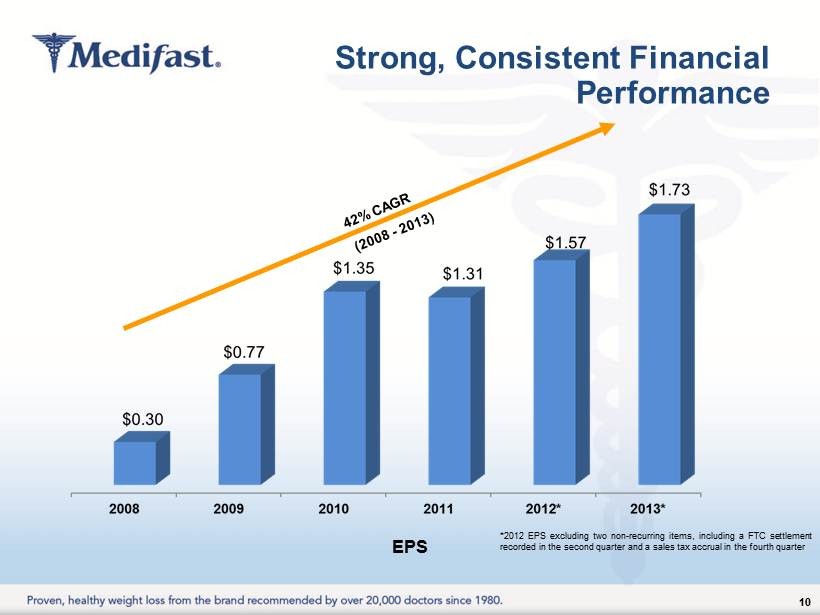

Strong, Consistent Financial Performance EPS 10 * 2012 EPS excluding two non - recurring items, including a FTC settlement recorded in the second quarter and a sales tax accrual in the fourth quarter

• Company - owned state - of - the - art manufacturing and distribution facilities • Help support industry leading gross margins • Capacity in place to drive aggressive growth Manufacturing Owings Mills, MD Distribution Ridgely, MD Manufacturing & Distribution Distribution Dallas, TX 11

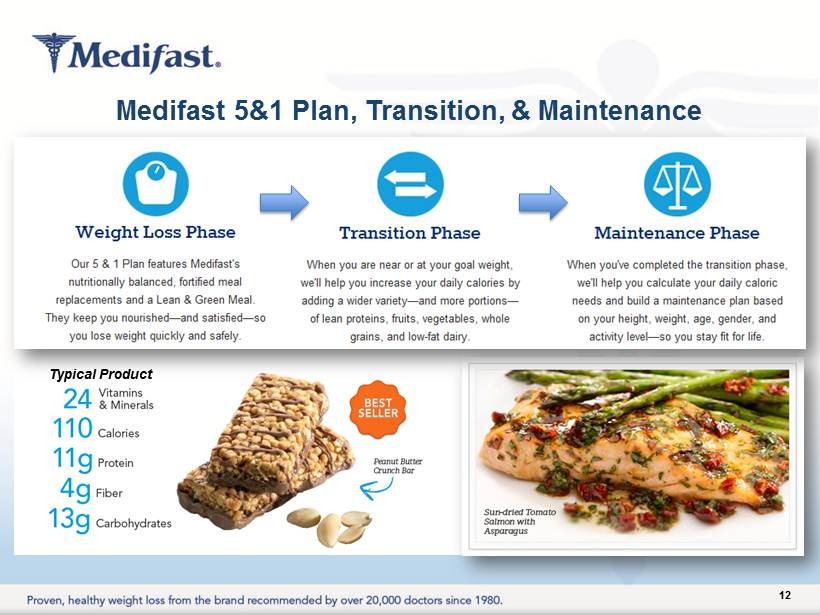

12 Medifast 5&1 Plan, Transition, & Maintenance Typical Product

MacDonald Center for Obesity Prevention & Education Scientific Advisory Board 13 Clinically Proven & Scientifically Based

Strong Executive Leadership Team Addition of Seasoned Executives to Board of Directors 2013 Forbes Magazine America’s Best Small Companies Baltimore Smart CEO Future 50 Companies Meg Sheetz - Daily Record Leading Women 2013 People Magazine – Half Their Size Issue TSFL Ranked one of DSA’s 20 Largest Member Companies 2013 Highlights 14

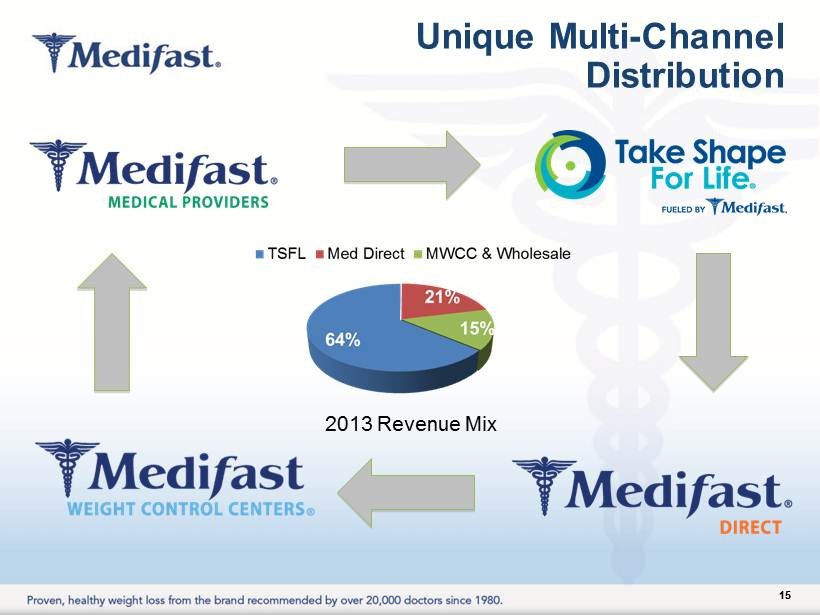

Unique Multi - Channel Distribution 2013 Revenue Mix 15

16 Direct Selling Healthy Living Coaching Division A free personal Health Coach & Mentor to guide Clients through their weight loss and weight management journey.

• US direct selling accounts for $30B – 24% or $7B comes from weight - loss products • 15.6M people engaged in direct sales in the US • U.S. is the #1 direct selling market in the world • TSFL was recently recognized as one of the Top 20 Direct Selling Companies in the U.S. Direct Selling Overview 17

Key attributes of our Direct Selling Model • Health Coaches are required to take competency exam now administered by the Center for Obesity Prevention and Education(COPE) at Villanova University. • Health Coaches do not need to purchase product themselves to receive commission. Sales to Health Coaches for personal consumption are approximately 6% of total revenues. • Health Coaches are not compensated for their own personal orders or for recruitment of clients/health coaches. • Health Coaches do not hold or distribute inventory. Health Coaches direct their clients to Take Shape for Life for all product purchases and direct shipment to the client. 18

Coverage Expansion • Over 10,000 Coaches in the Network and growing • Continued Expansion promoted through key events to motivate Coaches and attract new Coaches to join Take Shape for Life • 5 Super Regional events planned in Q1 with over 1,000 attendees registered at some locations • National Convention 2014 in July with over 1,600 attendees already pre - registered. • Utilize Dr. A’s best selling new Book • Nationwide Transformation Campaign 19

New Integrated Compensation Plan • New Integrated ranks were introduced to motivate Coaches and recognize those who grow their business. • Enhanced incentives reward the dual objectives - developing business structure depth and growing front line order volume. • Increased commission rate upon certification * • Commissions are paid weekly • Reduced expense to Medifast 20 * Administered by the Center for Obesity Prevention & Education at Villanova University This image cannot currently be displayed.

Customer Value Proposition x Self - Guided Weight Management x Online Tools and Call Center Support x Ordering Convenience • On Demand • Auto Ship E - Commerce Model 21

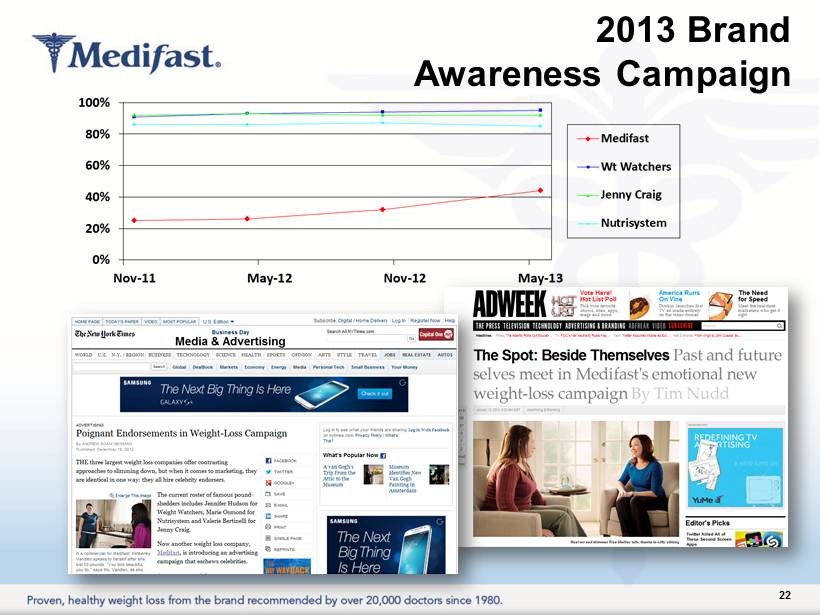

2013 Brand Awareness Campaign 22

• Consistent Mix of Print, Digital, Television, Radio Marketing Efforts • Closely monitoring 2014 Marketing Investments After Reduced Spend in 2013 • Focus on Demand Generation • Mobile Commerce Launched 12/2013 • Simplified Website Design • Tactics to Leverage New & Returning Visitors • Share Value Proposition Value Proposition Comparison to Every Day Options 23

24 Member Value Proposition x Individual Consultation x On - Site Dietician x On - Site Body Gem Technology x On - Site Grocery Store x Supervised, Structured Programs x Weekly Weigh - Ins x Constant Contact “ Care Calls ” Corporate Owned Franchise

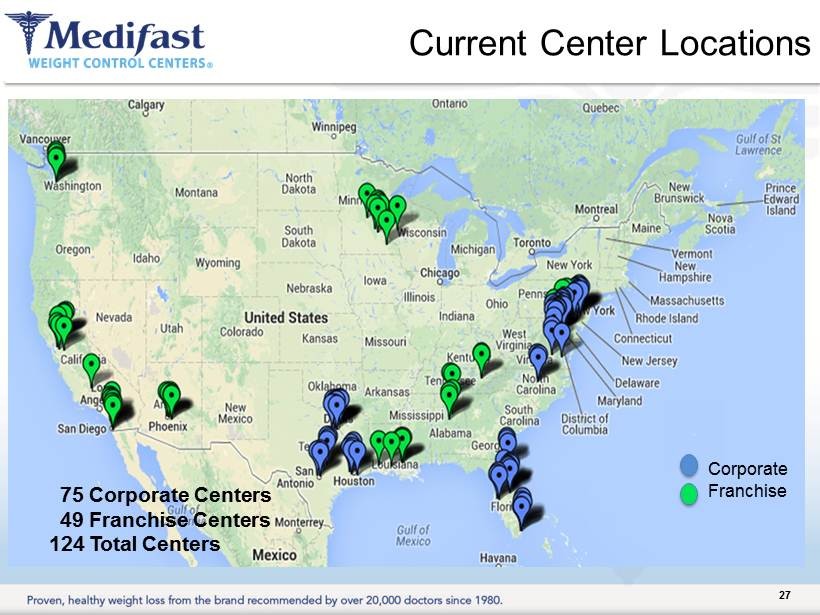

Weight Loss Management Partnership with a Team of Professionals Dedicated to Member Success • Centers offering supervised & structured programs and support • Currently operating 75 company - owned & 49 franchise - owned centers in the U.S. including 8 new centers opened in Q1 2014. 25

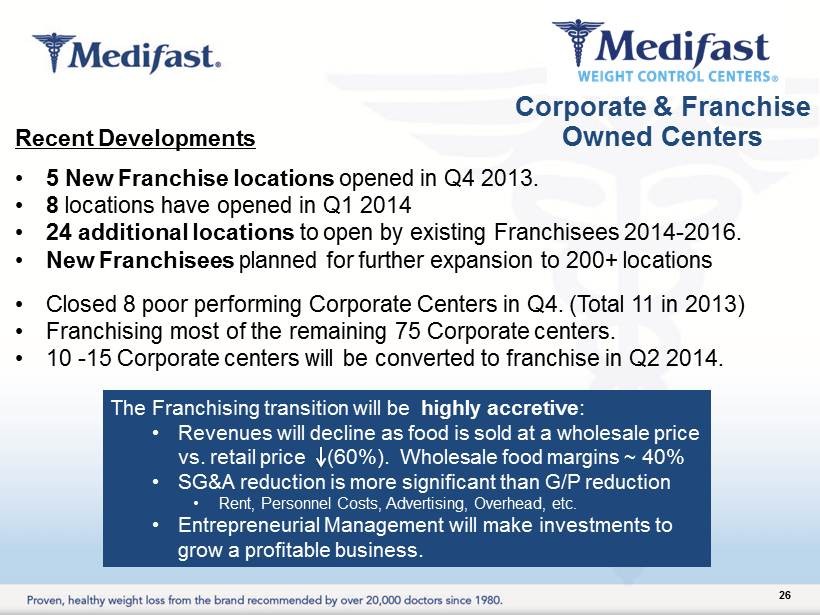

Corporate & Franchise Owned Centers Recent Developments • 5 New Franchise locations opened in Q4 2013. • 8 locations have opened in Q1 2014 • 24 additional locations to open by existing Franchisees 2014 - 2016. • New Franchisees planned for further expansion to 200+ locations • Closed 8 poor performing Corporate Centers in Q4. (Total 11 in 2013) • Franchising most of the remaining 75 Corporate centers. • 10 - 15 Corporate centers will be converted to franchise in Q2 2014. The Franchising transition will be highly accretive : • Revenues will decline as food is sold at a wholesale price vs. retail price (60%). Wholesale food margins ~ 40% • SG&A reduction is more significant than G/P reduction • Rent, Personnel Costs, Advertising, Overhead, etc. • Entrepreneurial Management will make investments to grow a profitable business. 26

75 Corporate Centers 49 Franchise Centers 124 Total Centers Corporate Franchise Current Center Locations 27

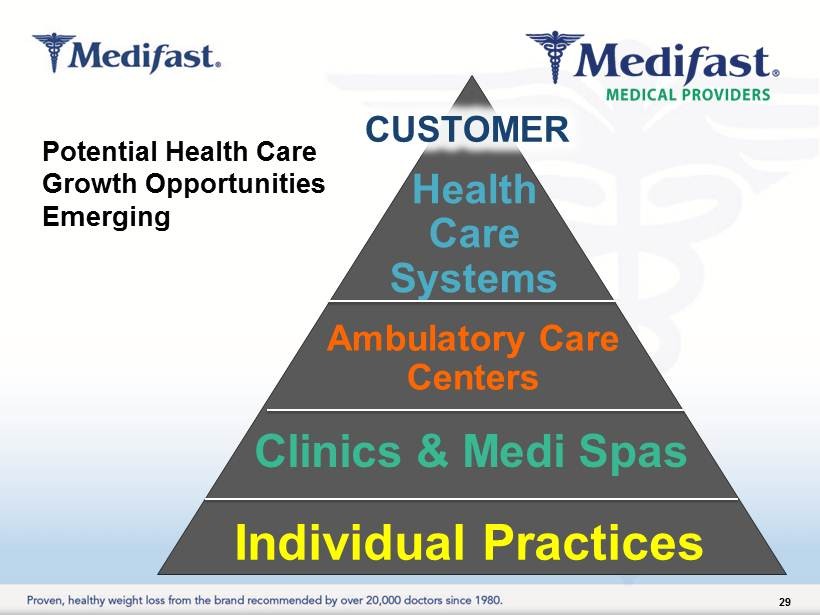

28 Physician directed weight loss and weight management through a Health Care Provider or Non - Retail Medical Center

29 CUSTOMER Health Care Systems Ambulatory Care Centers Clinics & Medi Spas Individual Practices Potential Health Care Growth Opportunities Emerging

Mexico City International Update • Medix opens 4 clinics: • Mexico City, Mexico (2) • Guadalajara, Mexico • Bogota, Columbia • Obesity on the Rise in Mexico (#1) • Medifast Nutrition, Inc . established to begin business in Canada • Medifast product approval underway with Health Canada • Medifast initiated selling in Canada in March 2014: • Med Direct • Medical Providers Bogota, Colombia 30

Product Expansion In addition to ongoing improvements to our current product offerings, Medifast will introduce NEW product categories which will provide incremental revenue opportunities in 2014 and beyond: • Maintenance Products help clients maintain healthy weight and increase Customer Lifetime Value • New Lean & Green microwaveable meal offerings will provide time saving, tasty, convenient options • New Snack choices to help clients stay on plan • Technology integration with Medifast programs • Exploring contract manufacturing opportunities and partnership to utilize excess manufacturing capacity and enter new markets. Snacks Lean & Green Options Maintenance Line 31

Shareholder Return ▪ Medifast is committed to further enhancing shareholder value ▪ November 2013 - repurchased 786,000 common shares under existing share repurchase authorization at an average price of $25.46. ▪ New 1,000,000 share authorization approved in December for a total current authorization of 1,339,000 ▪ Current cash position supports future share repurchases and strategic growth opportunities ▪ Strong Balance Sheet gets stronger with transition of Corporate clinics to Franchisees. 32

Summary x The Medifast Multi - Channel Model uniquely allows us to compete with a broad list of industry competitors x Clinically - proven, effective weight - loss plan x Expanding product categories, embracing technology x Accretive clinic franchising strategy underway x Favorable financial characteristics driving strong cash flows x Very Healthy balance sheet x Experienced management team 33

34 Q & A